SBTi CORPORATE

NEAR-TERM CRITERIA

Version 5.2

March 2024

ABOUT SBTi

The Science Based Targets initiative (SBTi) is a corporate climate action organization that

enables companies and financial institutions worldwide to play their part in combating the

climate crisis.

We develop standards, tools and guidance which allow companies to set greenhouse gas

(GHG) emissions reductions targets in line with what is needed to keep global heating below

catastrophic levels and reach net-zero by 2050 at latest.

The SBTi is incorporated as a charity, with a subsidiary which will host our target validation

services. Our partners are CDP, the United Nations Global Compact, the We Mean Business

Coalition, the World Resources Institute (WRI), and the World Wide Fund for Nature (WWF).

Science Based Targets Initiative is a registered charity in England and Wales (1205768) and a limited company registered in England and Wales (14960097). Registered

address: First Floor, 10 Queen Street Place, London, England, EC4R 1BE. SBTI Services Limited is a limited company registered in England and Wales (15181058).

Registered address: First Floor, 10 Queen Street Place, London, England, EC4R 1BE. SBTI Services Limited is a wholly owned subsidiary of Science Based Targets

Initiative. © SBTi 2024

DISCLAIMER

Although reasonable care was taken in the preparation of this document, the Science Based

Targets initiative (SBTi) affirms that the document is provided without warranty, either

expressed or implied, of accuracy, completeness or fitness for purpose. The SBTi hereby

further disclaims any liability, direct or indirect, for damages or loss relating to the use of this

document to the fullest extent permitted by law.

The information (including data) contained in the document is not intended to constitute or

form the basis of any advice (financial or otherwise). The SBTi does not accept any liability

for any claim or loss arising from any use of or reliance on any data or information in the

document.

This document is protected by copyright. Information or material from this document may be

reproduced only in unaltered form for personal, non-commercial use. All other rights are

reserved. Information or material used from this document may be used only for the

purposes of private study, research, criticism, or review permitted under the Copyright

Designs & Patents Act 1988 as amended from time to time ('Copyright Act'). Any

reproduction permitted in accordance with the Copyright Act shall acknowledge this

document as the source of any selected passage, extract, diagram, content or other

information.

The SBTi reserves the right to revise this document according to a set revision schedule or

as advisable to reflect the most recent emissions scenarios, regulatory, legal or scientific

developments, and GHG accounting best practices.

“Science Based Targets initiative” and “SBTi” refer to the Science Based Targets initiative, a

private company registered in England number 14960097 and registered as a UK Charity

number 1205768.

© SBTi 2024

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 3

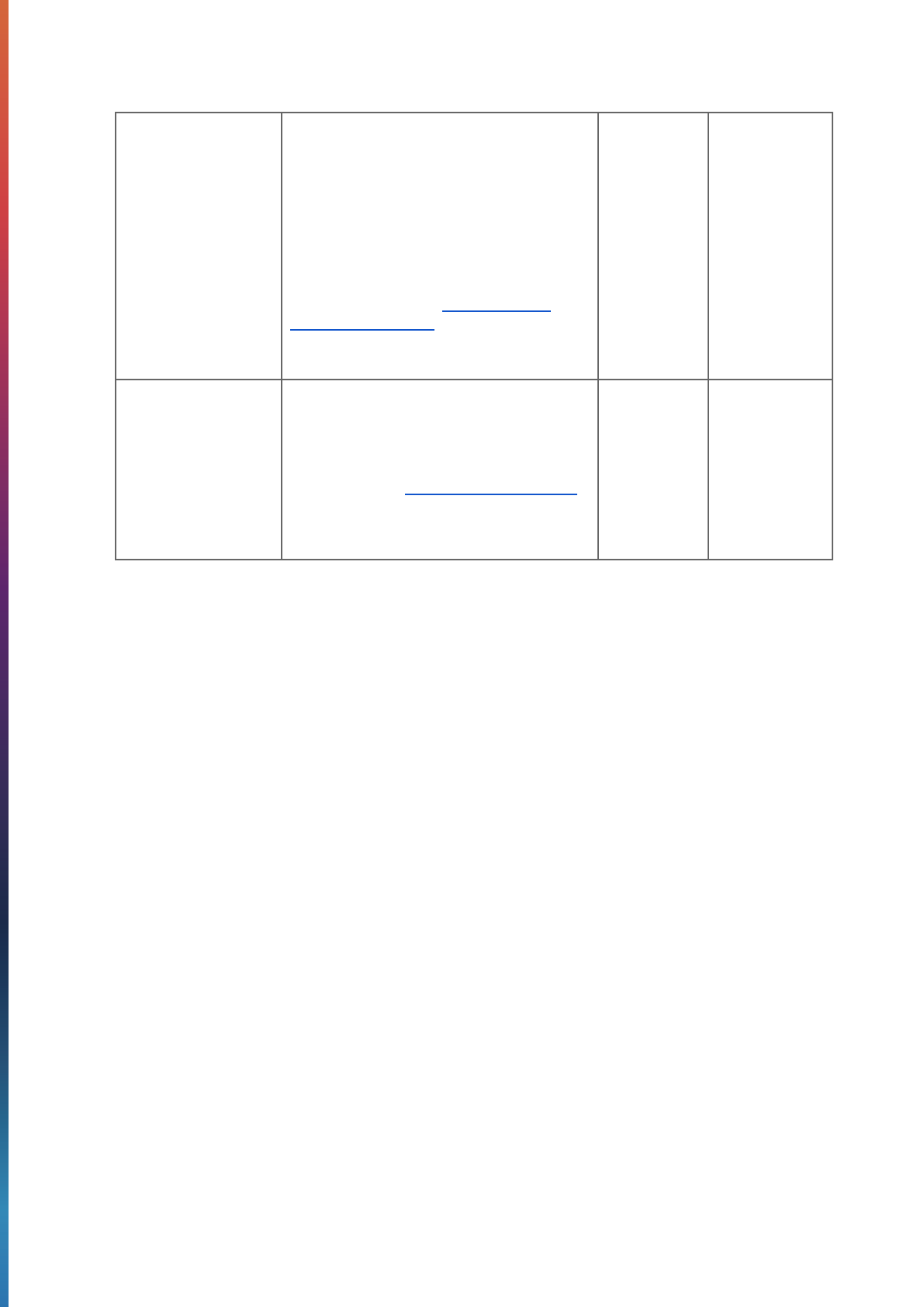

VERSION HISTORY

Version

Update description

Release date

Effective dates

1.0 SBTi Criteria

and

Recommendations

May 2015

May 2015 to

April 16, 2017

2.0 SBTi Criteria

and

Recommendations

Updated version to reflect current best

practice and latest experience.

February 24,

2017

24 February,

2017 to 22

May, 2018

3.0 SBTi Criteria

and

Recommendations

Updated version to provide greater clarity

and reflect current best practices.

23 May, 2018

23 May 2018 to

14 October

2019

Guidance for 3.0

Supplementary guidance and clarifications

to V3.0.

28 February

2019

23 May 2018 to

14 October

2019

4.0 SBTi Criteria

and

Recommendations

Updated version to reflect current

developments of climate science and best

practices. This version integrates

clarifications to relevant criteria included in

Guidance for 3.0.

17 April 2019

15 October

2019 to 14 July

2020

4.1 SBTi Criteria

and

Recommendations

Updated version to provide greater clarity

and reflect current best practices.

15 April 2020

15 July 2020 to

14 April 2021

4.2 SBTi Criteria

and

Recommendations

Updated version that includes minor

wording changes to improve clarity in C4,

C16-18, C23, and R10. No changes or

updates to criteria content have been

made.

Additionally, the section on annual timeline

of updates was removed as it was out of

date, and sections 3 and 4 have been

added from other SBTi resources to

provide the information directly in this

criteria document.

15 April 2021

15 April 2021

to 14 July 2022

5.0 SBTi Criteria

and

Recommendations

Updated version that reflects current

developments in climate science and best

practices. This version integrates changes

in alignment with SBTi’s new strategy,

including the integration of the SBTi

Corporate Net-Zero Standard.

27 October

2021

15 July 2022 to

10 April 2023

5.1 SBTi Criteria

and

Recommendations

for Near-term

Targets

Non-substantive revision to provide further

clarification and context to existing criteria,

recommendations and use of terminology

(criterion 4, 5, 6, 10, 13,19, 26 and 27 and

recommendation 5 and 8). This version

11 April 2023

11 April 2023 to

12 March 2024

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 4

also clarifies that allowable years for a

recent year inventory for submissions in

2023 must be no earlier than 2021

(criterion 14), and that scope 3 physical

intensity targets (criterion 18) only need to

meet the 7% compounded emissions

intensity reduction (and can lead to

absolute emissions increase). In this

version criteria 22 and 23 are aligned to the

revised version of the SBTi’s policy on

fossil fuel companies, and the most up to

date information on sector developments

and sector-specific criteria are included.

5.2 SBTi Corporate

Near-term Criteria

Non-substantive revision to correspond

with the V1.2 update of the SBTi Corporate

Net-Zero Standard. For a detailed list of

revisions made in V5.2 of the SBTi

Corporate Near-term Criteria, please refer

to Table 1 of the Main Changes document

for V1.2 of the SBTi Corporate Net-Zero

Standard.

From 13

March 2024

From 13 March

2024

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 5

CONTENTS

DISCLAIMER...........................................................................................................................3

CONTENTS............................................................................................................................. 6

INTRODUCTION......................................................................................................................7

Terminology........................................................................................................................7

Effective dates of updated criteria...................................................................................... 7

Near-term science-based targets and net-zero targets......................................................8

CRITERIA AND RECOMMENDATIONS FOR NEAR-TERM TARGETS................................ 8

General criteria...................................................................................................................8

Target boundary........................................................................................................... 8

Organizational boundary........................................................................................ 8

GHG coverage........................................................................................................8

Scope coverage......................................................................................................8

Emissions coverage............................................................................................... 9

Method validity (near-term targets).............................................................................. 9

Emissions accounting requirements.............................................................................9

Timeframe...................................................................................................................11

Ambition..................................................................................................................... 12

Scope 1 and 2 (near-term targets)....................................................................... 12

Scope 3 (near-term targets)................................................................................. 12

Combined targets (near-term targets).................................................................. 13

Renewable electricity targets (near- and long-term targets).................................13

Sector-specific guidance.................................................................................................. 14

Fossil fuel sales, distribution, and other business...................................................... 14

Sector-specific guidance............................................................................................ 14

Reporting, recalculation and target validity...................................................................... 14

Reporting....................................................................................................................14

Recalculation and target validity.................................................................................15

SECTOR-SPECIFIC REQUIREMENTS.................................................................................16

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 6

INTRODUCTION

This document includes all criteria that must be met for near-term target(s) to be validated by

the Science Based Targets initiative (SBTi) as well as recommendations which are important

for transparency and best practice. It is important to note that criteria and recommendations

are subject to change and may be updated.

Although this document contains all criteria for setting near-term science-based targets,

companies should refer to the SBTi Corporate Net-Zero Standard V1.2 if they wish to set

science-based net-zero targets.

These criteria apply to companies not classified as financial institutions or small and

medium-sized enterprises (SMEs). Financial institutions must set targets using the Financial

Sector Science-based Targets Guidance. SMEs may use the SME validation route or the

regular validation route to set targets.

Companies must follow the GHG Protocol Corporate Standard, Scope 2 Guidance, and

Corporate Value Chain (Scope 3) Accounting and Reporting Standard.

The SBTi Corporate Near-term Criteria V5.2 should be read in conjunction with the SBTi

Corporate Net-Zero Standard V1.2, which includes informative guidance on near-term and

net-zero targets, the Procedure for Validation of SBTi Targets, which describes the

underlying process followed to assess targets, the Criteria Assessment Indicators for

near-term targets that detail the indicators used to determine conformance and

non-conformance with criteria, and the SBTi Glossary, which lists the terms, definitions, and

acronyms used in this document.

Terminology

This document explains the near-term criteria, which are requirements that companies

must follow, and recommendations, which companies should follow, to align with the SBTi

Corporate Near-term Criteria. Unless otherwise stated (including specific sections), all

criteria apply to scopes 1, 2, and 3.

This document uses precise language to indicate requirements, recommendations, and

allowable options that companies may choose to follow.

● The terms “shall” or “must” are used throughout this document to indicate what is

required for targets to be in conformance with the criteria.

● The term “should” is used to indicate a recommendation, but not a requirement.

● The term “may” is used to indicate an option that is permissible or allowable.

The terms “required” or “must” are used in the guidance to refer to requirements. “Can” and

“is encouraged” may be used to provide recommendations on implementing a requirement

or “cannot” may be used to indicate when an action is not possible.

The letter “C” preceding a number indicates a criterion and the letter “R” preceding a

number indicates a recommendation.

Effective dates of updated criteria

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 7

The SBTi Corporate Near-term Criteria version 5.2 will be in effect as of 13 March 2024.

Revised criteria and recommendations are marked with an asterisk (*).

Near-term science-based targets and net-zero targets

Companies wishing to seek validation for near-term targets

1

only may still do so, but the

SBTi encourages companies contemplating setting net-zero targets in the future to consider

the implications of the formulation of their near-term targets for long-term target setting.

CRITERIA AND RECOMMENDATIONS FOR

NEAR-TERM TARGETS

General criteria

Target boundary

Organizational boundary

*C1 – Organizational boundary: Companies should submit targets only at the parent- or

group level, not the subsidiary level. Parent companies shall include the emissions of all

subsidiaries in their target submission, in accordance with the boundary criteria.

2

In cases

where both parent companies and subsidiaries submit targets, the parent company’s target

must also include the emissions of the subsidiary if it falls within the parent company’s

emissions boundary given the chosen inventory consolidation approach.

3, 4

*R1 – Setting organizational boundaries: The SBTi strongly recommends that a company's

organizational boundary, as defined by the GHG Protocol Corporate Standard, is consistent

with the organizational boundary used in the company’s financial accounting and reporting

procedures. Companies should use the same organizational boundary year-on-year. If a

company’s organizational boundary changes, they should refer to C27 of this standard.

GHG coverage

*C2 – Greenhouse gasses: The targets shall cover all relevant emissions of the seven GHGs

as required by the GHG Protocol Corporate Standard.

5

Scope coverage

*C3 – Scope 1 and scope 2: The targets shall cover company-wide scope 1 and scope 2

emissions, as defined by the GHG Protocol Corporate Standard.

6

6

* GHG accounting that is not proven to adhere to the GHG Protocol accounting standard and the SBTi criteria

assessment indicators will not be accepted by the SBTi.

5

* The seven GHGs are carbon dioxide (CO

2

), methane (CH

4

), nitrous oxide (N

2

O), hydrofluorocarbons (HFCs),

perfluorocarbons (PFCs), sulfur hexafluoride (SF

6

), and nitrogen trifluoride (NF

3

).

4

* Companies must integrate emissions from their structural changes into their GHG inventory within a

reasonable timeframe.

3

* Brands, licensees, and/or specific regions or business divisions of a company will not be accepted as separate

targets, unless they fall outside of a parent company’s chosen consolidation approach.

2

* As outlined in C2 to C6.

1

Near-term targets were previously termed short-term targets.

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 8

*C4 – Scope 3: If a company’s relevant scope 3 emissions are 40% or more of total scope 1,

2, and 3 emissions, they shall be included in near-term science-based targets. All companies

involved in the sale or distribution of natural gas and/or other fossil fuels shall set separate

scope 3 targets for the use of sold products, irrespective of the share of these emissions

compared to the total scope 1, 2 and 3 emissions of the company.

Emissions coverage

*C5 – Scope 1, 2 and 3 allowable exclusions: Companies shall not exclude more than 5% of

total combined scope 1 and scope 2 emissions from either the boundary of the GHG

inventory or the target boundary.

7, 8

Companies shall not exclude more than 5% of emissions

from their total scope 3 GHG inventory.

9

Scope 3 target boundary requirements are outlined

in C6.

*C6 – Scope 3 emissions coverage for near-term targets: Companies shall set one or more

emission reduction near-term targets and/or supplier or customer engagement targets that

collectively cover(s) at least 67% of total reported and excluded scope 3 emissions

considering the minimum boundary of each scope 3 category in conformance with the GHG

Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard.

10

*R2 – Targets covering optional scope 3 emissions: Targets to reduce scope 3 emissions

that fall outside the minimum boundary of scope 3 categories are not required but are

nevertheless encouraged when these emissions are significant. Companies may cover these

emissions with a scope 3 target, but such targets cannot count towards the threshold defined

in C6 for scope 3 emissions (i.e., these targets are in addition to the company’s required

scope 3 targets). For a definition of optional emissions for each scope 3 category, please

see Table 5.4 (page 34) of the GHG Protocol Corporate Value Chain (Scope 3) Accounting

and Reporting Standard.

Method validity (near-term targets)

C7 – Method validity: Targets must be modeled using the latest version of methods and tools

approved by the SBTi. Targets modeled using previous versions of the tools or methods can

only be submitted to the SBTi for validation within 6 months of the publication of the revised

method or sector-specific tools.

Emissions accounting requirements

10

* GHG accounting that is not proven to adhere to the GHG Protocol minimum boundaries and the SBTi criteria

assessment indicators will not be accepted by the SBTi.

9

* The SBTi does not recognize emissions perceived to be “negligible” as a rationale for not reporting them. Even

if emissions from certain activities or operations are perceived to be negligible, these emissions still must be

quantified and reported in the reporting company’s GHG inventory or disclosed as an exclusion.

8

* Where a company’s scope 1 or 2 emissions are deemed immaterial (i.e., under 5% of total combined scope 1

and 2 emissions), companies may set their SBT solely on the scope (either scope 1 or scope 2) that covers more

than 95% of the total scope 1 and 2 emissions. The company shall continue to report on both scopes and adjust

their targets as needed, according to the GHG Protocol’s principle of completeness, and as per C26 and C27.

7

* The total targeted scope 1 and 2 emissions shall be greater than or equal to 95% of total (reported +

excluded) scope 1 and 2 emissions. This means that a company shall not exclude 5% from the inventory

boundary and then also exclude a further 5% from the target boundary.

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 9

C8 – Scope 2 accounting approach: Companies shall disclose whether they are using a

location- or market-based accounting approach as per the GHG Protocol Scope 2 Guidance

to calculate base year emissions and to track performance against a science-based target.

The GHG Protocol requires measuring and reporting scope 2 emissions using both

approaches. However, a single and consistent approach must be used for setting and

tracking progress toward a SBT (e.g., using location-based approach for both target setting

and progress tracking).

*C9 – Scope 3 inventory: Companies shall complete a scope 3 inventory covering gross

scope 3 emissions for all its relevant emissions sources according to the GHG Protocol

Corporate Value Chain (Scope 3) Accounting and Reporting Standard.

11, 12

*C10 – Bioenergy accounting: CO

2

emissions from the combustion, processing and

distribution phase of bioenergy – as well as the land-based emissions and removals

associated with bioenergy feedstocks – shall be reported alongside a company’s GHG

inventory.

13

Furthermore, these emissions shall be included in the target boundary when

setting a science-based target (in scopes 1, 2 and/or 3, as required) and when reporting

progress against that target.

14

Land-based emissions accounting shall include CO

2

emissions from direct land use change

(LUC) and non-LUC emissions, inclusive of N

2

O and CH

4

emissions from land use

management. Including emissions associated with indirect LUC is optional.

Companies are expected to adhere to any additional GHG Protocol Guidance on bioenergy

accounting when released in order to maintain conformity with C10.

C11 – Carbon credits: The use of carbon credits must not be counted as emission reductions

toward the progress of companies’ near-term science-based targets. Carbon credits may

only be considered to be an option for neutralizing residual emissions (see the SBTi

Corporate Net-Zero Standard Criteria C28) or to finance additional climate mitigation beyond

their science-based emission reduction targets (see the SBTi Corporate Net-Zero Standard

Criteria R9).

14

* Please note that companies that use/produce or have bioenergy within their value chain or intend to account

for bioenergy as a decarbonization lever over the lifetime of their target must include the following bioenergy

footnote in their target language: “*The target boundary includes land-related emissions and removals from

bioenergy feedstocks”.

13

* Negative emissions due to biogenic removals shall not be accounted for in a company’s target formulation or

as progress towards SBTs. In addition, removals that are not directly associated with bioenergy feedstock

production are not accepted to count as progress towards SBTs or to net emissions in a company’s GHG

inventory.

12

* Companies may use the Partnership for Carbon Accounting Financials (PCAF) Global GHG Accounting and

Reporting Standard for the Financial Industry to calculate financed emissions. However, emissions beyond the

minimum requirements of the Greenhouse Gas Protocol for Scope 3 Category 15 Investments as per Table 5.9

(page 52) of the GHG Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard shall not

count towards the mandatory boundary for scope 3 targets (see C6 and C7). Companies may, however, set

optional targets on these emissions (see R2).

11

* To determine relevance of scope 3 activities for inclusion in the target boundary, companies will be assessed

against minimum boundary in Table 5.4 and using the criteria in Table 6.1 of the GHG Protocol Corporate Value

Chain (Scope 3) Accounting and Reporting Standard. Please note that, although beyond the minimum boundary,

all transport-related emissions across all sectors must be reported on a well-to-wheel (WTW) basis in companies’

GHG inventories (well-to-wake for aviation and maritime transport). All use-phase emissions from third-party

distributed fossil fuels must be reported in scope 3 category 11 for all companies engaged in this type of

distribution activity.

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 10

C12 – Avoided emissions: Avoided emissions fall under a separate accounting system from

corporate inventories and do not count toward near-term science-based emission reduction

targets.

R3 – Biofuel certification: The SBTi recommends that companies using or producing

biofuel(s) for transport should support their bioenergy GHG accounting with recognized

biofuels certification(s) to disclose that the data on land-related emissions and removals

represents the relevant biofuel feedstock production.

*R4 – Bioenergy data reporting: The SBTi recommends that companies report direct

biogenic CO

2

emissions and removals from bioenergy separately. Emissions and removals

of CO

2

associated with bioenergy shall be reported as net emissions according to C10, at a

minimum. However, companies are encouraged to report gross emissions and gross

removals from bioenergy feedstocks.

Timeframe

*C13 – Base and target years: Absolute and intensity-based emission reduction near-term

targets must cover a minimum of 5 years and a maximum of 10 years from the date the

target is submitted to the SBTi for validation.

15

The choice of base year must be no earlier

than 2015. Scope 1 and scope 2 targets must use the same base year.

16

The SBTi does not

accept multi-year average base years, unless this is specified in the sector-guidance

relevant to the company.

*C14 – Progress to date: The minimum forward-looking ambition of near-term targets

covering scope 1 and/or scope 2 emissions is consistent with reaching net-zero by 2050 at

the latest, assuming a linear absolute reduction, linear intensity reduction, or intensity

convergence between the most recent year and 2050 (not increasing absolute emissions or

intensity).

17, 18

R5 – Long-term targets: Targets that cover more than 10 years from the date of submission

are considered long-term targets. Long-term targets can only be validated in accordance

with the SBTi Corporate Net-Zero Standard Criteria.

R6 – Consistency: It is recommended that companies use the same base years for all

near-term targets.

18

* Companies shall provide all the relevant GHG inventory data including a most recent year GHG inventory. For

submissions in 2024, the most recent inventory shall be no earlier than 2022 i.e. allowable most recent years are

2022 and 2023. Companies should also note that using proxy data (i.e., applying one reporting year's data to

another reporting year) is not permitted. For example, a company may not apply base year emissions to the most

recent year.

17

* The most recent year used for scope 1 and scope 2 emissions shall be the same year. The most recent year

used for scope 3 emissions is recommended to be the same year as scope 1 and scope 2.

16

* Scope 3 targets are recommended but not required to use the same base year as scope 1 and scope 2

targets. Base years across different scope 3 targets must be the same.

15

* For targets submitted for validation in the first half of 2024 (until June, 30), valid target years are 2028-2033

inclusive. For targets submitted in the second half of 2024 (from July,1), valid target years are between 2029 and

2034 inclusive.

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 11

Ambition

Scope 1 and 2 (near-term targets)

*C15 – Level of ambition for scope 1 and 2 targets: At a minimum, scope 1 and scope 2

near-term targets shall be consistent with the level of decarbonization required to keep

global temperature increase to 1.5°C compared to pre-industrial temperatures.

19

C16 – Absolute targets: Absolute reduction targets for scope 1 and scope 2 are eligible

when they are at least as ambitious as the minimum of the approved range of emissions

scenarios consistent with the 1.5°C goal.

C17 – Intensity targets: Intensity targets for scope 1 and scope 2 emissions are only eligible

when they are modeled using an approved 1.5°C sector pathway applicable to companies’

business activities.

R7 – Choosing an approach: The SBTi recommends using the most ambitious

decarbonization scenarios that lead to the earliest reductions and the least cumulative

emissions.

Scope 3 (near-term targets)

*C18 – Level of ambition for scope 3 emissions reductions targets: At a minimum, near-term

scope 3 targets (covering total required scope 3 emissions or individual scope 3 categories)

shall be aligned with methods consistent with the level of decarbonization required to keep

global temperature increase well-below 2°C compared to pre-industrial temperatures.

20

*C19 – Supplier or customer engagement targets: Near-term targets to drive the adoption of

science-based emission reduction targets by their corporate suppliers and/or customers

shall meet the following requirements:

● Boundary: Companies may set engagement targets across upstream or

downstream scope 3 categories.

● Formulation: Companies shall provide information in the target language on what

percentage of emissions from relevant upstream and/or downstream categories is

covered by the engagement target or, if that information is not available, what

percentage of annual procurement spend is covered by the target.

21

21

If measuring coverage by spend, the company shall provide an estimate of the emissions coverage associated

with that spend for validation purposes to demonstrate that criterion C6 has been met, by the supplier or

customer target alone or together with other scope 3 target(s).

20

* When a company uses fiscal years in its GHG accounting, the SBTi assesses minimum ambition based on

the calendar year (CY) where the majority of the months occur. E.g. FY2022 with a date range of April 2021 -

March 2022 it would be assessed as CY2021. In the case where a FY is evenly split across a CY (i.e., a FY ends

on June, 30), ambition is assessed using the later year in the date range. This approach is applicable to all

targets.

19

* When a company uses fiscal years in its GHG accounting, the SBTi assesses minimum ambition based on

the calendar year (CY) where the majority of the months occur. E.g. FY2022 with a date range of April 2021 -

March 2022 it would be assessed as CY2021. In the case where a FY is evenly split across a CY (i.e., a FY ends

on June, 30), ambition is assessed using the later year in the date range. This approach is applicable to all

targets.

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 12

● Timeframe: Engagement targets shall be fulfilled within a maximum of 5 years from

the date the company’s target is submitted to the SBTi for a validation.

22

● Ambition level: The company’s suppliers/customers shall have science-based

emission reduction targets in line with the latest version of the SBTi Corporate

Near-Term Criteria.

*R8 – Supplier engagement: Companies should recommend that their suppliers use the

SBTi guidance and tools available to set science-based targets. SBTi validation of supplier

science-based targets is recommended but not required.

Combined targets (near-term targets)

*C20 – Combined scope targets: Targets that combine scopes (e.g., 1+2 or 1+2+3) are

permitted if the SBTi can review the ambition of the individual target components and

confirm each meets the relevant ambition criteria.

23

Renewable electricity targets (near- and long-term targets)

*C21 – Renewable electricity (scope 2 only): Targets to actively source renewable electricity

at a rate consistent with 1.5°C scenarios are an acceptable alternative to scope 2 emission

reduction targets over emissions from the generation of procured electricity.

24

The SBTi has

identified 80% renewable electricity procurement by 2025 and 100% by 2030 as thresholds

(portion of renewable electricity over total electricity use) for this approach, in line with the

recommendations of RE100.

25

Companies that already source electricity at or above these

thresholds shall maintain or increase their use of renewable electricity to qualify. For

long-term targets, companies shall maintain 100% renewable electricity procurement beyond

2030.

*R9 – Purchased heat and steam: When modeling targets using the Sectoral

Decarbonization Approach (SDA), companies should model purchased heat and steam

related emissions as if they were part of their direct emissions, i.e., scope 1.

R10 – Efficiency considerations for target modeling: If companies are using a method that

does not already embed efficiency gains for the specific sector, market – and the

decarbonization projected for the power sector is based on a 1.5°C scenario – these factors

should be considered when modeling electricity-related scope 2 targets.

25

RE100 guidance states that setting a 100% renewable electricity target by 2030 at the latest shows a strong

level of leadership.

24

* Companies reporting scope 2 emissions using location-based methods can still set a renewable electricity

target provided they have the capacity to demonstrate active sourcing of renewable electricity through market

instruments.

23

* When submitting combined near-term targets, the scope 1+2 portion must be in line with at least a 1.5°C

scenario and the scope 3 portion of the target must be in line with at least a well-below 2°C scenario. For sectors

where minimum target ambition is further specified for companies’ scope 3 activities, C24 supersedes C20.

22

For targets submitted for validation in the first half of 2024 (until June, 30), valid target years are up to 2028

inclusive. For targets submitted in the second half of 2024 (from July, 1), valid target years are up to 2029

inclusive.

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 13

Sector-specific guidance

Fossil fuel sales, distribution, and other business

*C22 – Sale, transmission, distribution of oil, natural gas, coal as well as other fossil fuels:

Companies that sell, transmit, or distribute natural gas (or other fossil fuel products) shall set

separate emission reduction targets for scope 3 category 11 “use of sold products” -

covering emissions from the combustion of the sold, transmitted, or distributed fossil fuels -

that are at a minimum consistent with the level of decarbonization required to keep global

temperature increase to 1.5°C compared to pre-industrial temperatures, irrespective of the

share of these emissions compared to the total scope 1, 2, and 3 emissions of the company,

company's sector classification, or whether fossil fuel sale/distribution is the company's

primary business. In order to meet the 67% near-term scope 3 coverage, companies may

need to set additional targets covering other scope 3 categories. Customer engagement

targets are not eligible for this criterion.

*C23 – Companies in the fossil fuel production business or with significant revenue from

fossil fuel business lines: The SBTi will not currently validate targets for:

● Companies with any level of direct involvement in exploration, extraction, mining

and/or production of oil, natural gas, coal or other fossil fuels, irrespective of

percentage revenue generated by these activities.

● Companies that derive 50% or more of their revenue from the sale, transmission and

distribution of fossil fuels, or by providing equipment or services to fossil fuel

companies.

● Companies with more than 5% revenue from fossil fuel assets (e.g., coal mine, lignite

mine, etc.) for extraction activities with commercial purposes.

These companies must follow the applicable sector standards if available.

Sector-specific guidance

*C24 — Requirements from sector-specific guidance: Companies must follow requirements

for target setting and minimum ambition levels as indicated in relevant sector-specific

methods and guidance – at the latest, 6 months after the sector guidance publication. A list

of the sector-specific guidance and requirements is available below (Table 4 of the Corporate

Net-Zero Standard).

26

Reporting, recalculation and target validity

Reporting

C25 – Frequency: The company shall publicly report its company-wide GHG emissions

inventory and progress against published targets on an annual basis.

26

* The Corporate Net-Zero Standard and the Near-Term Criteria should be complemented with SBTi

sector-specific guidance whenever the sector and/or activity covered by the sector guidance is relevant to the

company seeking SBTi validation, e.g. a company with aviation, maritime, and financial services activities is

encouraged to set separate sector-specific targets for each of the activities relevant to them based on SBTi

sector guidance. Please note that the target boundary coverage is to be met at the company wide-level, not at

target level, unless otherwise stated.

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 14

*R11 – Where to disclose: There are no specific requirements regarding where the inventory

and progress against published targets should be disclosed, as long as it is publicly

available. The SBTi recommends disclosure through standardized, comparable data

platforms such as CDP’s climate change annual questionnaire. Annual reports, sustainability

reports and the company’s website are also acceptable platforms.

Recalculation and target validity

*C26 – Mandatory target review: Companies shall review all active targets, at a minimum,

every 5 years to ensure consistency with the latest SBTi criteria.

27

If targets do not meet SBTi

criteria, then they shall be updated and revalidated. Companies with targets approved in

2020 or earlier shall review all active targets by 2025. Companies shall follow the most

recent applicable criteria at the time of resubmission.

*C27 – Triggered target recalculation: Targets shall be recalculated and revalidated when

significant changes occur that could compromise the existing target. The following changes

shall trigger a target recalculation:

● Scope 3 emissions become 40% or more of aggregated scope 1, 2 and 3

emissions.

● Changes in the consolidation approach chosen for the GHG inventory.

● Emissions of exclusions in the inventory or target boundary change significantly.

● Significant changes in company structure and activities (e.g., acquisition,

divestiture, merger, insourcing or outsourcing, shifts in goods or service offerings).

28

● Adjustments to data sources or calculation methodologies resulting in significant

changes to an organization’s total base year emissions or the target boundary base

year emissions (e.g., discovery of significant errors or a number of cumulative errors

that are collectively significant).

● Other significant changes to projections/assumptions used in setting the

science-based targets.

29

Companies shall apply a significance threshold of 5% or less. For base year emissions, a

change of 5% in an organization's total base year emissions would trigger a base year

emissions recalculation. A change of 5% or more in the base year emissions covered within

a target boundary would trigger a target recalculation.

30

30

* Please note that the significance threshold for target recalculation is relative to the scopes covered by the

target. For example, if a company has a validated scope 1+2 target and their scope 1+2 base year emissions

change by 5% or more, this triggers a target recalculation. Similarly, if a company has a validated scope 1+2+3

target and their scope 1+2+3 base year emissions change by 5% or more, this triggers a target recalculation.

29

* For example, for intensity targets, changes in growth projections.

28

* For example, a target recalculation may be triggered if a shift of goods and service offerings results in a shift

of emissions between scopes of already validated targets (e.g., if a company has a scope 1+2 target separate

from a scope 3 target, and emissions that were first in scope 3 are shifted to scope 1 or scope 2 because of a

change in the company's offering). A target recalculation may also be triggered if a company's current targets use

a metric that becomes irrelevant after a shift in goods or service offerings (e.g., if a car manufacturer stopped

selling passenger cars and pivoted to freight trucks, their use of sold products target would no longer be

appropriate to model with the sold vehicle pathway and “passenger-kilometers” would no longer be an

appropriate metric).

27

* Please note that the beginning of the review period for all active targets corresponds to the date of initial

validation of the oldest currently active target or the most recent target validation date of each target where all the

company targets were updated.

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 15

If a significant change occurs and the company’s target(s) no longer meet SBTi criteria, then

only the affected target(s) shall be recalculated and revalidated. Companies shall follow the

most recent applicable criteria at the time of resubmission.

C28 – Target validity: Companies with approved targets must announce their target publicly

on the SBTi website within 6 months of the approval date. Targets unannounced after 6

months must go through the approval process again unless a different publication time frame

has been agreed in writing with the SBTi.

R12 – Validity of target projections: The SBTi recommends that companies check the validity

of target-related projections on an annual basis. The company should notify the SBTi of any

significant changes and report these major changes publicly, as relevant.

SECTOR-SPECIFIC REQUIREMENTS

Sector-specific guidance and methods are currently available for many sectors. All new,

sector-specific guidance that becomes available will be uploaded to the sector guidance

page on the SBTi website. The SBTi has sector-specific requirements related to the use of

target-setting methodologies and minimum ambition levels (please see table below

31

).

32

*Table 4. Eligible pathways, methods, and tools for all sectors and activities

Sector/activity

Eligible pathways, methods, tools

Guidance and further notes

Companies not

covered by any

SBTi sector

guidance

● Cross-sector pathway with absolute

reduction method for near-, and

long-term targets. See Corporate

Near-term Tool and Corporate

Net-Zero Tool.

Please note that companies in certain

sectors (e.g., oil & gas) cannot

currently set targets with the SBTi.

Aluminum

● Cross-sector pathway with absolute

reduction method for near-, and

long-term targets. See Corporate

Near-term Tool and Corporate

Net-Zero Tool.

Apparel

● Cross-sector pathway with absolute

reduction method for near-, and

long-term targets. See Corporate

Near-term Tool and Corporate

Net-Zero Tool.

Optional guidance is available for

companies in the apparel and footwear

sector.

Air transport

Options:

● Aviation pathway with intensity

convergence method (i.e., SDA) for

near-, and long-term targets on

well-to-wake (WTW) emissions,

recommended for all companies

For all transport-related emissions

across all sectors, companies shall set

targets over these emissions on a

well-to-wheel (WTW) basis in their

GHG inventory (well-to-wake for

aviation and maritime transport).

32

Please note that in case of inconsistencies between Table 4 and sector-specific guidance, the latest published

information applies.

31

This table can also be found in the Corporate Net-Zero Standard V1.2 (Table 4).

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 16

providing air transport services. See

the Aviation tool.

● Cross-sector pathway with absolute

reduction method for near-, and

long-term targets on WTW. See

Corporate Near-term Tool and

Corporate Net-Zero Tool.

Please note that whichever pathway is

chosen, the target boundary must

cover WTW, as specified in the SBTi

Aviation Guidance.

Aviation target formulation and

communication must explicitly state

that targets are exclusive of non-CO₂

factors. Targets must include a footnote

stating that non-CO₂ factors which may

also contribute to aviation-induced

warming are not included in this target

and whether the company has publicly

reported or commits to publicly report

its non-CO

2

impacts.

All companies using the Aviation tool

must not choose 2020, 2021 or 2022

as the base year. The years 2020-2022

are anomalous for the industry due to

the COVID-19 pandemic.

Buildings

Options:

● Residential buildings or service

building pathway with intensity

convergence method (i.e., SDA) for

near-, and long-term targets. See

Corporate Near-term Tool and

Corporate Net-Zero Tool.

● Please note that these pathways

address only emissions from energy

use of the buildings.

● Sector-specific absolute reduction

method for long-term targets. See

Corporate Net-Zero Tool.

● Cross-sector pathway with absolute

reduction method for near-, and

long-term targets. See Corporate

Near-term Tool and Corporate

Net-Zero Tool.

Once the Buildings guidance becomes

effective, companies in the Built

Environment will be required to use

the sector-specific intensity

convergence method (i.e., SDA) for

in-use operational emissions using the

new SBTi-CRREM (carbon risk real

estate monitor) pathways. See the

Buildings Target-Setting Tool.

To model upfront embodied emissions,

companies will be able to either use

the SBTi cross-sector methods, or the

intensity convergence method (i.e.,

SDA) or the sector-specific absolute

reduction method. See the SBTi

Buildings Target-Setting Tool for

sector-specific methods.

Real estate investment trusts (REITs)

wishing to set targets must specify if

they are a mortgage-based or

equity-based REIT. Equity REITs must

pursue the regular target validation

route for companies. Mortgage REITs

must instead utilize the Financial

Institutions guidance for setting

science-based targets.

The SBTi is developing guidance for

companies operating in the built

environment. Once the final resources

are published, they will become

mandatory for intended user types with

a usual six month grace period. The

upcoming sector-specific resources will

include:

● Guidance for GHG accounting and

target-setting for both in-use

operational and upfront embodied

emissions.

● Standalone buildings target-setting

tool with two sets of pathways:

granular in-use operational

emissions and upfront embodied

emissions pathways.

Cement

Options:

● Sector-specific intensity

The SBTi has released guidance to aid

companies in the cement industry in

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 17

convergence method (i.e., SDA) for

near-, and long-term targets. See

Corporate Near-term Tool and

Corporate Net-Zero Tool.

● Sector-specific absolute reduction

method for long-term targets. See

Corporate Net-Zero Tool.

● Cross-sector pathway with absolute

reduction method for near-, and

long-term targets. See Corporate

Near-term Tool and Corporate

Net-Zero Tool.

setting science-based targets.

Regardless of the pathway chosen,

near-term science-based targets for

cement activities shall include a scope

3 target which includes the emissions

from purchased cement and clinker

(under scope 3 category 1 “purchased

goods and services”), irrespective of

the share of these emissions compared

to the total scope 1, 2 and 3 emissions

of the company.

Chemicals

See “all other sectors”.

The SBTi is developing guidance for

companies in the chemicals sector.

Financial

institutions

Options:

● Absolute reduction method or

sector-specific intensity

convergence (i.e., SDA) for

near-term targets on scope 1 and 2

emissions. See Corporate

Near-term Tool.

● Sector-specific intensity

convergence method (i.e., SDA) for

near-term targets on scope 3

category 15 “investments’

emissions. See Corporate

Near-term Tool and other

sector-specific tools. Based on this

method, only financing within the

same sector is aggregated to

produce a portfolio level intensity.

● Portfolio Coverage method for

near-term targets on scope 3

category 15 “investments”

emissions. See SBTi Finance

Portfolio Coverage tool. Based on

this method, financial institutions

increase the percentage of portfolio

companies that have validated

science-based targets until all

portfolio companies have validated

science-based targets by 2040.

● Temperature Rating method for

near-term targets on scope 3

category 15 “investments”

emissions. See SBTi Finance

Temperature Scoring tool. Based on

this method, financial institutions

increase the percentage of portfolio

companies that have ambitious

targets that meet certain ambition

levels (but not necessarily validated

by the SBTi).

The SBTi is developing a Net-Zero

The SBTi defines a financial institution

as an entity that generates 5% or more

of its revenue from investment, lending,

or insurance activities. This includes

but is not limited to banks, asset

managers and private equity firms,

asset owners and insurance

companies, and mortgage real estate

investment trusts (REITs). Real

economy companies that have more

than 5% of revenue from financial

activities are encouraged to use SBTi

to set targets on those activities in

addition to their corporate targets.

Currently, public financial institutions

are not covered within the SBTi

framework.

Please see the Finance sector

guidance for further details.

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 18

Standard for financial institutions and

cannot validate net-zero targets for this

sector before its release.

Forest, land

and agriculture

(FLAG)

Companies with significant FLAG

emissions are required to set FLAG

targets (see criteria in the column to

the right). FLAG targets are

complementary and separate from

science-based targets that cover

energy/industry (non-FLAG) emissions.

Options:

● Sector-specific absolute reduction

method for near-term targets. See

FLAG tool.

● Sector-specific absolute reduction

method for long-term targets

covering agriculture only. See

Corporate Net-Zero Tool.

● Commodity pathways for near-term

intensity targets. See FLAG tool.

Commodity pathways are available

for 10 agricultural commodities:

beef, chicken, dairy, leather, maize,

palm oil, pork, rice, soy, wheat.

Companies with emissions

associated with one or more of the

available agricultural commodity

pathways that account for 10% or

more of a company's total (gross)

FLAG emissions for each of those

commodities may use the

commodity pathway for that

commodity (but are not required to

do so).

Companies in the forest products

sector or with emissions related to

timber & wood fiber accounting for

10% or more of their FLAG emissions

are required to use the commodity

pathway for timber and wood fiber.

The following companies are required

to set FLAG targets:

1. Companies with FLAG emissions

that total 20% or more of overall

emissions across scopes; and

2. Companies in the following sectors:

● Forest and Paper Products -

Forestry, Timber, Pulp and

Paper, Rubber

● Food Production - Agricultural

Production

● Food Production - Animal

Source

● Food and Beverage Processing

● Food and Staples Retailing

● Tobacco

Please note that FLAG near-term

targets must cover at least 95% of

FLAG-related scope 1 and 2 emissions

and at least 67% of FLAG-related

scope 3 emissions.

Please see the FLAG Guidance for

further details.

Please note that there is currently no

long-term pathway available for timber

and wood fiber. Targets from

companies operating in the forest and

paper products sector shall include a

footnote stating that timber and wood

fiber emissions are not included in the

long-term target. These companies

must (re)submit their long-term FLAG

target covering these emissions within

six months of the release of the

long-term pathway for timber and wood

fiber.

Fossil fuel sale/

transmission/

distribution

Companies that sell, transmit, and/or

distribute fossil fuels (and that derive

less than 50% of revenue from these

activities) are required to set targets

for scope 3 category 11 “use of sold

products” emissions, irrespective of the

share of these emissions compared to

the total scope 1, 2 and 3 emissions of

the company. Separate and additional

scope 3 targets may need to be set.

This requirement is applicable to

companies that derive less than 50% of

revenue from the sale, transmission

and distribution of fossil fuels.

For companies receiving 50% or more

of their revenue from these activities,

please refer to the Oil and Gas section.

Information and

communication

technology

● Cross-sector absolute reduction

method for near-, and long-term

targets. See Corporate Near-term

Optional guidance is available for ICT

companies including mobile networks

operators, fixed networks operators,

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 19

(ICT) providers

Tool and Corporate Net-Zero Tool.

and data centers operators.

Iron and steel

Options:

● Sector-specific intensity

convergence method (i.e., SDA) for

near-, and long-term targets. See

Steel SDA tool and Corporate

Net-Zero Tool respectively.

● Sector-specific absolute reduction

method for long-term targets. See

Corporate Net-Zero Tool.

● Cross-sector absolute reduction

method for near-, and long-term

targets. See Corporate Near-term

Tool and Corporate Net-Zero Tool.

Please note that regardless of the

pathway chosen, the iron & steel core

boundary must be applied to all

near-term targets.

The SBTi has released guidance to aid

companies in the steel industry in

setting science-based targets.

Near-term iron and steelmakers

science-based targets shall include a

scope 3 target that covers all scope 3

category 3 “Fuel- and energy-related

emissions not included in scope 1 or

scope 2” emissions according to the

GHG Protocol.

Maritime

Transport

Options:

● Maritime pathway with intensity

convergence method (i.e., SDA) for

near-, and long-term targets on

well-to-wake (WTW) is available for

all companies providing applicable

maritime transport services. See

Maritime Tool. When using the

maritime pathway, near-term targets

can be no earlier than 2030 and

long-term targets must be no later

than 2040.

● Cross-sector pathway with absolute

reduction method for near-, and

long-term targets on WTW. See

Corporate Near-term Tool and

Corporate Net-Zero Tool. When

using the cross-sector pathway,

near-term targets must follow the

5-10 year timeframe, and long-term

targets must be no later than 2050.

Companies using the maritime

pathway to set near-term targets

science-based targets covering

emissions from own operations (e.g.,

vessel owners or operators) are

required to also submit long-term

science-based targets modeled with

the maritime pathway along with their

near-term target submission. Please

note that in this case, the long-term

target year is 2040.

Companies using the maritime

guidance to set near-term

science-based targets covering scope

3 emissions from subcontracted

maritime transport operations (e.g.,

cargo owners or shippers) are not

required to submit long-term

science-based targets.

For all transport-related emissions

across all sectors, companies shall set

targets over these emissions on a

well-to-wheel (WTW) basis in their

GHG inventory (well-to-wake for

aviation and maritime transport).

Please see the transport sector page

for the Maritime Transport

Guidance and the Maritime Transport

Target Setting Tool.

Oil & gas

The SBTi is developing a new standard

for companies in the oil and gas sector

to set science-based targets. Currently,

the SBTi is unable to accept

commitments or validate targets for

companies in the oil and gas or fossil

Companies in this sector include – but

are not limited to - integrated oil and

gas companies, integrated gas

companies, exploration and production

pure players, refining and marketing

pure players, oil products distributors,

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 20

fuels sectors.

Companies that have dormant or active

fossil fuel assets (e.g., coal mine,

lignite mine, etc.) for extraction

activities with commercial purposes

(meaning sales), cannot validate

targets at this stage, until further

specific methods and guidance are

developed.

Please see our policy for further

information.

The SBTi will assess companies on a

case-by-case basis to determine sector

classification and reserves the right to

not move forward with a company’s

validation, until methods/guidance

have been developed/completed.

and traditional oil and gas service

companies. Please see the Oil and

Gas sector page on our website for

more information.

Fossil fuel service companies need to

account for the indirect emissions

related to the fossil fuels directly or

indirectly managed by the company.

The SBTi defines fossil fuel service

companies as businesses that support

exploration, extraction, mining or

production of fossil fuels, and other

significant activities along the fossil

fuels value chain, not covered by sale,

transportation or distribution category.

The SBTi recommends companies to

decommission fossil fuel assets,

instead of divesting, as this approach

better reflects the need to phase-out

fossil fuels in our global economy, as

science indicates is necessary. If a

company completely

decommissions/divests from fossil fuel

assets, they will no longer be

considered under these rules, and can

submit targets as per standard route.

The SBTi recommends companies to

follow the GHG Protocol for base year

recalculations.

Electric Utilities

& power

generation

Companies in the power sector are

required to set targets using the

power sector pathway for near-, and

long-term targets (intensity

convergence method only (i.e., SDA)

within the Corporate Near-term Tool

and Corporate Net-Zero Tool).

Please note that the long-term target

shall be no later than 2040.

Companies in the power sector with

scope 3 emissions representing 40%

or more of overall emissions must set

at least two targets:

● An intensity target covering all sold

electricity (including purchased and

resold electricity in scope 3

category 3 “fuel- and energy-related

emissions not included in scope 1

or scope 2” emissions)

● An intensity target covering all

electricity generation in scope 1

expressed in terms of MWh

(megawatt hour) energy generated.

For power generation companies that

distribute and sell fossil fuels, a third

target shall be set covering 100% of

emissions from downstream use of

fossil fuels. This should be an absolute

target that aligns with a 1.5°C

mitigation pathway. In order to meet

the 67% scope 3 coverage threshold,

power companies may need to set a

target over other scope 3 categories as

well.

Please see the Electric utilities/Power

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 21

Guidance for further details.

Land

Transport:

Road and rail

Options:

● Cross-sector pathway with absolute

reduction method for near-, and

long-term targets. See Corporate

Near-term Tool and Corporate

Net-Zero Tool.

● Companies that subcontract

transport services can use the

cross-sector pathway or use the

legacy Transport Tool with the

WB2C (well-below 2°C) pathway.

No 1.5ºC sector intensity pathway is

currently available.

For all transport-related emissions

across all sectors, companies shall set

targets over these emissions on a

well-to-wheel (WTW) basis in their

GHG inventory (well-to-wake for

aviation and maritime transport).

Land

Transport:

Transport

OEMs/Automa

kers

● Cross-sector pathway with absolute

reduction method for near-, and

long-term targets over use of sold

products emissions. See Corporate

Near-term Tool and Corporate

Net-Zero Tool. This is applicable

once the interim 1.5ºC target setting

approach for automakers is

published.

The SBTi will review and update the

passenger, freight and OEM (original

equipment manufacturer) sector

target-setting guidance through a

formal sector development process.

The SBTi Interim 1.5°C Approach for

Automakers will be reviewed and

superseded upon the completion of this

sector guidance update process. Until

the Interim 1.5°C target setting

pathway for automakers is published,

near- and long-term target validations

and target updates for automakers are

paused - as outlined in this policy.

SBTi Corporate Near-Term Criteria V5.2 March 2024 | 22