DR-1

R. 01/22

TC 07/23

Rule 12A-1.097, F.A.C.

Effective 01/22

Page 1 of 15

Florida Business Tax Application

Register online at

floridarevenue.com/taxes/registration.

It's fast and secure.

ALL information provided as a part of this application is held confidential by the Florida Department of Revenue. Social security

numbers are used by the Florida Department of Revenue as unique identifiers for the administration of Florida's taxes. Social security

numbers obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not

subject to disclosure as public records. Collection of your social security number is authorized under state and federal law. Visit the

Department's website at floridarevenue.com/privacy for more information regarding the state and federal law governing the

collection, use, or release of social security numbers, including authorized exceptions.

Use Black or Blue Ink to Complete This Application

Business Information

All Applicants -

Identification Numbers

1 . Identification Numbers:

You must provide your FEIN before you can register for Reemployment Tax. If you are not required by the

Internal Revenue Service to obtain an FEIN, you must provide your social security number, unless you are not a

citizen of the United States.

Social Security Number (SSN):

If you are not a citizen of the United States and you do not have a social security number, provide your complete Visa

number.

Visa Number:

Florida Business Partner Number (if registered):

(business partner numbers are 4 to 7 digits in length)

Consolidated Sales and Use Tax Filing Number:

(if you file a consolidated sales and use tax return)

County Control Number:

(if you use this number to report tax for the county where your business is located)

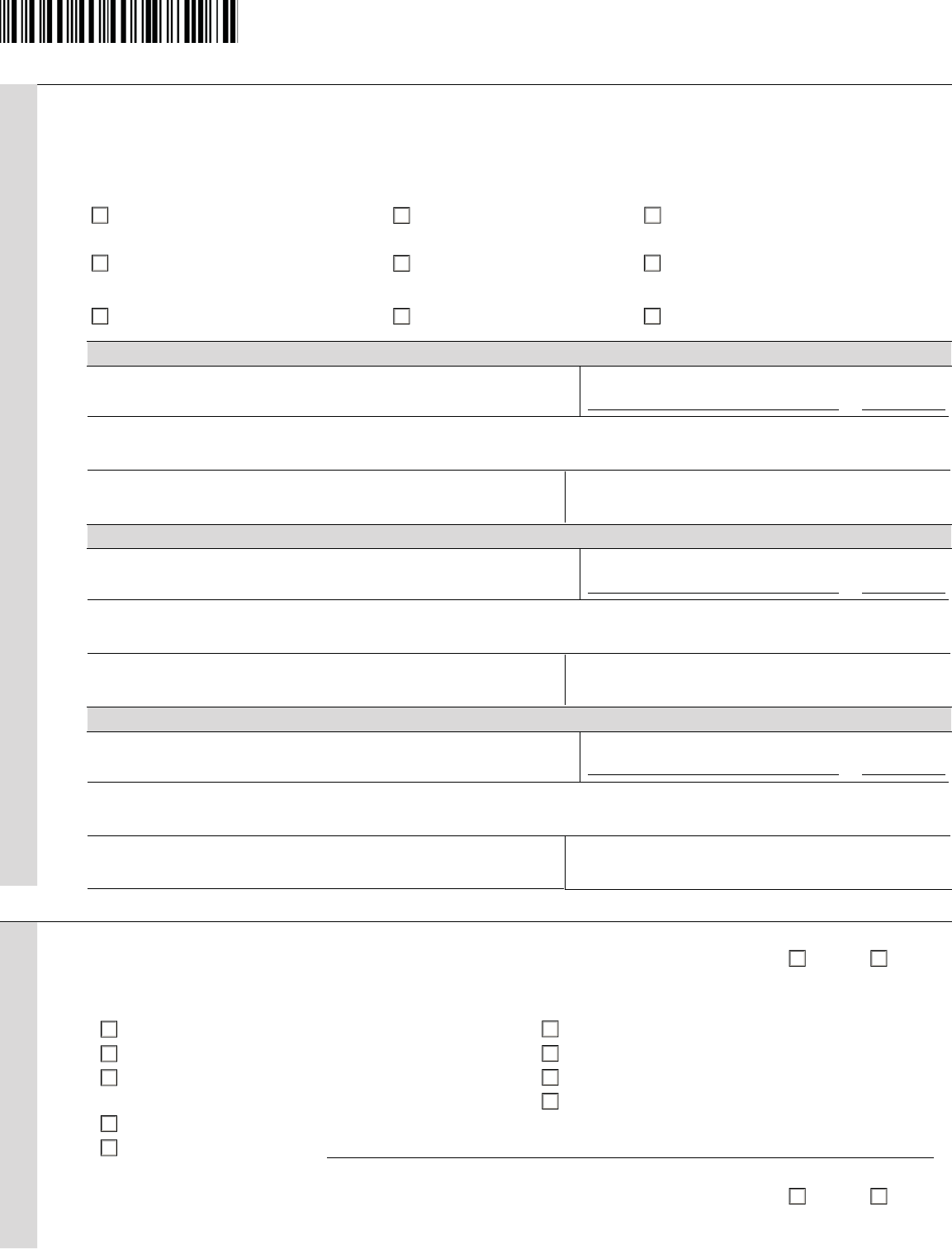

2. Reason for Applying (select only one):

Business entity not currently registered

Date of first Florida taxable activity:

mm dd yyyy

Additional Florida location for Sales and use tax for this location will be reported using my current:

currently registered business (select all that apply)

Date of first taxable activity consolidated return county control reporting number

mm dd yyyy

Additional Florida rental property for Sales and use tax for this location will be reported using my current:

currently registered business (select all that apply)

Date of first taxable activity: consolidated return county control reporting number

mm dd yyyy

Moved registered Florida location to Current sales and use tax certificate number for location

another Florida county -

Effective date: (this number will be cancelled)

mm dd yyyy Sales and use tax for this location will be reported using my current

(select all that apply)

consolidated return county control reporting number

All Applicants -

Reason for Applying

Federal Employer Identification Number (FEIN):

DR-1

R. 01/22

Page 2 of 15

All Applicants -

Reason for Applying

Starting a new taxable activity at a

registered location - Current sales and use tax certificate number for location

Effective date:

mm dd yyyy

Change the form of business

ownership - Effective date:

mm dd yyyy

Acquired existing business -

Effective date:

mm dd yyyy

3. Business Name, Location, and Mailing Address: Others - Use name filed with the Florida Department of State or

Sole proprietors - Use last name, first name, middle initial similar agency in another state

Partnerships - Use partnership name or last name of

general partners

Legal name of business:

Business trade name "doing business as" if you have one:

Physical Address: Provide the street address of the business location or Florida rental property - Do not use PO Box or

Rural Route Numbers.

Street address:

Florida County:

City / State / ZIP:

Mailing Address: Provide the name and mailing address where tax returns and other correspondence for your business

are to be mailed.

Mail to:

Mailing Address (if different than business location address):

City / State / ZIP:

4. Is this business location only open during a portion of a calendar year? Yes No

If yes, provide the:

First calendar month this business location is open: ; and the

Last calendar month this business location is open: .

5. Form of Business Ownership: (select only one form of ownership)

Sole Proprietor (individual owner) Limited liability company (LLC) Estate

Partnership (select one below): (select one below): Trust

Married couple Single member Business

General partnership Multi-member Other

Limited liability partnership (LLP) If single member,select the box that Governmental agency

Limited partnership (LP) applies to how your LLC is treated for

Joint venture federal income tax.

Corporation (select one below): C Corporation

C Corporation S Corporation

S Corporation Disregarded (reported by single member)

Not-for-profit If multi-member, select the box that applies

Foreign corporation to how your LLC is treated for federal

income tax.

Partnership

C Corporation

S Corporation

Seasonal

Business

All Applicants - Business Ownership

ext:

#:

Fax #:

Check if # is outside U.S.

Telephone #:

DR-1

R. 01/22

Page 3 of 15

Business Owners and Managers

6. If your business is a partnership, corporation, limited liability company, or trust, provide the following information:

Date of Florida incorporation or organization,

or date of authorization to conduct business at this location in Florida:

mm dd yyyy

Fiscal year ending date (This date is generally "12/31"; however

a business may elect a different fiscal year):

mm dd

Sole

Proprietors

7. If you are a sole proprietor, provide the following information:

Legal Name (first name, middle initial, last name):

SSN:

Home address:

City / State / ZIP:

8.

If your business is a partnership (including married couples), provide the following information for each general partner:

(Attach additional pages, if needed.)

Name:

Title:

Home address:

SSN:

or Visa #:

City / State / ZIP:

or FEIN:

Name:

Title:

Home address:

SSN:

or FEIN:

or Visa #:

City / State / ZIP:

Name:

Title:

Home address:

SSN:

or Visa #:

or FEIN:

City / State / ZIP:

Name:

Title:

Home address:

SSN:

or Visa #:

City / State / ZIP:

or Visa #:

ext:

Check if # is outside U.S.

#:

Telephone #:

ext:

Check if # is outside U.S.

#:

Telephone #:

ext:

Check if # is outside U.S.

#:

Telephone #:

ext:

Check if # is outside U.S.

#:

Telephone #:

ext:

Check if # is outside U.S.

#:

Telephone #:

or FEIN:

DR-1

R. 01/22

Page 4 of 15

Business Owners and Managers

9. If your business is a corporation, limited liability company, or trust, provide the following information for each director, officer, managing

member, grantor, personal representative, or trustee of the business entity:

(Attach additional pages, if needed.)

Name:

Title:

Home address:

Last 4 Digits of Social Security Number:

or Visa #:

or FEIN:

City / State / ZIP:

Name:

Title:

Home address:

Last 4 Digits of Social Security Number:

or Visa #:

or FEIN:

City / State / ZIP:

All Applicants -

Business Activities

10. Background:

Has your business ever been known Name:

by another name? Yes No

Was that business issued a Florida certificate Number:

of registration or tax account number? Yes No

11. Business Activities: Primary code

Enter the six-digit North American Industry Classification

System (NAICS) code(s) that best describes your

business activities at this location. Enter your primary

code first. (Enter at least one.)

If you do not know your NAICS code(s), go to census.gov/naics. Enter a keyword to

search the most recent NAICS list.

Applicants -

Background

Name:

Title:

Home address:

Last 4 Digits of Social Security Number:

or Visa #:

or FEIN:

City / State / ZIP:

Name:

Title:

Home address:

Last 4 Digits of Social Security Number:

City / State / ZIP:

or Visa #:

or FEIN:

ext:

Check if # is outside U.S.

#:

Telephone #:

ext:

Check if # is outside U.S.

#:

Telephone #:

ext:

Check if # is outside U.S.

Telephone #:

#:

ext:

Check if # is outside U.S.

Telephone #:

#:

DR-1

R. 01/22

Page 5 of 15

All Applicants -

Business Activities

Describe the primary nature of your business and type(s) of products or services to be sold.

12. Change in Form of Business Ownership or Acquired Business

If your form of business ownership has changed (e.g., sole proprietorship to a corporation or partnership to a limited liability

company), or you acquired an existing business, provide the following for your prior form of ownership or for the

acquired business:

Name:

FEIN:

Address:

Florida certificate or tax account number:

City / State / ZIP:

If acquired, portion acquired:

All Part Unknown

Did your business share any common ownership, management, or

control with the acquired business at the time of acquisition?

Yes No

Did the previous legal entity or acquired business have employees

at the time of the change or acquisition?

Yes No

Were employees transferred to the new legal entity or new

business?

Yes No

mm dd yyyy

Business Changes and Acquisitions

You must also submit a completed Report to Determine Succession and Application for Transfer of Experience Rating Records

(Form RTS-1S) within 90 days after the date of transfer when:

You acquired an existing business in whole or in part, and

There was no common ownership, management or control between your business and the acquired business at the time of transfer.

Sales and Use Tax

13. For each of the business activities below, select all that apply to this location:

Sales, Rentals, or Repairs of Products

Sell products at retail (to consumers)

Sell products at wholesale (to registered dealers who will sell to consumers)

Sell products or goods from nonpermanent locations (such as flea markets or craft shows)

Sell products or goods by mail using catalogs or the internet

Sell, serve, or prepare food products or drinks for immediate consumption on your premises, or that you package or

wrap for take-out or to go, from a temporary or permanent location

Repair or alter consumer products or equipment

Rent equipment or other property or goods to individuals or businesses

Charge admissions or membership fees

Property Rentals, Leases, or Licenses

Rent or lease commercial real property to individuals or businesses

Manage commercial real property for individuals or businesses

Rent or lease living or sleeping accommodations to others for periods of six months or less

Manage the rental or leasing of living or sleeping accommodations belonging to others

Rent or lease parking or storage spaces for motor vehicles in parking lots or garages

Rent or lease docking or storage spaces for boats in boat docks or marinas

Rent or lease tie-down or storage spaces for aircraft at airports

Sales and Use Tax

Date transferred:

DR-1

R. 01/22

Page 6 of 15

Sales and Use Tax (continued)

Real Property Contractors

Improve real property as a contractor

Sell products at retail (to consumers)

Construct, assemble, or fabricate building components at your plant or shop away from a project site that are used in

your real property improvement projects

Purchase products or supplies from vendors located outside Florida for use in Florida real property improvement

projects

Services

Pest control services for nonresidential buildings

Interior cleaning services for nonresidential buildings

Detective services

Protection services

Security alarm system monitoring services

Fuel

Sell tax paid gasoline, diesel fuel, or aviation fuel to retail dealers or end users in Florida (select all that apply below):

Gas station only

Gas station and convenience store

Truck stop

Marine fueling

Aircraft fueling

Reseller of fuel in bulk quantities

Purchase dyed diesel fuel for off-road purposes

Secondhand Goods or Scrap Metal

Purchase, consign, trade, or sell secondhand goods

Purchase, gather, obtain, or sell salvage or scrap metal to be recycled or convert ferrous or nonferrous metals into raw

material products

If you select either of these activities, you must also submit a Registration Application for Secondhand

Dealers and Secondary Metals Recyclers (Form DR-1S).

Coin-Operated Amusement Machines

Place and operate coin-operated amusement machines at locations belonging to others

Operate coin-operated amusement machines at this location (select all that apply below):

Self-operate some or all the amusement machines at this location (no other machine operator used)

Have entered into a written agreement with the following person or business to operate some or all the

machines at this location.

Sales and Use Tax

Name:

Mailing address:

City / State / ZIP:

If you operate amusement machines at your location or at locations belonging to others, you must also submit an Application for

Amusement Machine Certificate (Form DR-18) to obtain an annual Amusement Machine Certificate for each location where you

operate amusement machines.

Vending Machines

(select all that apply below)

Place and operate vending machines at locations belonging to others:

(Select the type or types of vending machines you operate.)

Food or beverage vending machines

Nonfood or nonbeverage vending machines

Operate vending machines at this location:

(Select the type or types of vending machines you operate.)

Food or beverage vending machines

Nonfood or nonbeverage vending machines

ext:

Check if # is outside U.S.

Telephone #:

#:

DR-1

R. 01/22

Page 7 of 15

Sales and Use Tax (continued)

Purchases

Purchase items to use in my business without paying Florida sales tax to the seller at the time of purchase (such

as from a seller located outside Florida)

Applying for a direct pay permit to self-accrue and remit use tax directly to the Department

To apply for a permit, submit an Application for Self-Accrual Authority/Direct Pay Permit Sales and Use Tax

(Form DR-16A).

Applying for authority to remit sales tax to the Department for independent sellers or distributors (see Rule

12A-1.0911, Florida Administrative Code, for more information)

This business does not conduct activities at this location subject to Florida sales and use tax

Sales and Use Tax

Prepaid Wireless Fee

Prepaid

Wireless Fee

14. Do you sell prepaid phones, phone cards, or calling arrangements at this location? Yes No

If yes, select the box that describes your sales:

Domestic or international long distance calling or phone cards (non-wireless)

Prepaid wireless services (cards, plans, devices) that provide access to wireless networks and interaction with

911 emergency services

Solid Waste - New Tire Fee, Lead-Acid Battery Fee, and Rental Car Surcharge

Solid Waste Fees

and Surcharge

15. Do you sell (at retail) new tires for motorized vehicles at this location that are sold separately or as Yes No

part of a vehicle?

16. Do you sell (at retail) new or remanufactured lead-acid batteries at this location that are sold separately

or as a component part of another product such as new automobiles, golf carts, or boats? Yes No

17. Do you operate a car-sharing service, a peer-to-peer car sharing program, or motor vehicle rental

company at this location that provides motor vehicles that transport fewer than nine passengers? Yes No

Gross Receipts Tax on Dry-cleaning

Dry-Cleaning

Tax

18. Do you own or operate a dry-cleaning plant or dry drop-off facility in Florida? Yes No

If yes, and you import or produce perchloroethylene or other dry-cleaning solvents, you must also complete a

Registration Package (GT-400401) for fuels and pollutants.

Reemployment Tax

Reemployment Tax

For purposes of reemployment tax, employees include officers of a corporation and members of a limited liability

company classified as a corporation for federal tax purposes who perform services for the corporation or limited liability

company and receive payment for such services (salary or distributions).

In addition to registering for Reemployment Tax:

New Florida employers must register with the Florida New Hire Reporting Center to report newly hired and re-hired

employees in Florida at servicesforemployers.floridarevenue.com.

Florida employers are required to obtain appropriate workers' compensation insurance coverage for their employees.

Visit www.myfloridacfo.com/division/wc/.

19. Do you have or will you have, employees in Florida? Yes No

20. Do you, or will you, lease workers from an employee leasing company to work in Florida? Yes No

If yes, provide the following:

Name of leasing company:

FEIN:

Department of Business and Professional Regulation license number:

Portion of workforce that is leased:

All Part

Date of leasing agreement for workers in Florida:

mm dd yyyy

DR-1

R. 01/22

Page 8 of 15

Reemployment Tax (continued)

Reemployment Tax

21. Do you use the services of persons in Florida whom you consider to be self-employed, independent contractors other

than those engaged in a distinct business, occupation, or profession that serves the general public (e.g., plumber,

general contractor, or certified public accountant)? Yes No

If yes, you must also submit a completed Independent Contractor Analysis (Form RTS-6061).

If you answered No to questions 19, 20, and 21, proceed to the Communications Services Tax section.

If you answered Yes, continue to the next question.

22. Is your business registered for reemployment tax? Yes No

If yes, provide your RT account number:

Are you currently reporting wages to the Florida Department of Revenue? Yes No

Are you reactivating your reemployment tax account? Yes No

23. On what date did you, or will you, first have an employee in Florida?

mm dd yyyy

24. Employment Type (select only one employment type):

Regular employer

Nonprofit organization [must hold a

501(c)(3) determination letter from the

Internal Revenue Service]

Domestic employer [employer of

persons performing only domestic

(household) services (e.g., maid or

cook)]

Indian tribe or Tribal unit

Governmental entity

Agricultural (noncitrus) employer

Agricultural (citrus) employer

Agricultural crew chief

25. Select one category for your employment:

Regular, Indian tribe or Tribal unit, or Governmental employer

Have you or will you pay gross wages of at least $1,500 within a calendar quarter? Yes No

If yes, provide the date you reached or will reach $1,500 gross wages.

Have you or will you have one or more employees for a day (or portion of a day) during 20 or more

weeks in a calendar year? Yes No

If yes, provide the last day of the 20th week.

Nonprofit organization

Have you or will you employ four or more workers for a day (or portion of a day) during 20 or more Yes No

weeks in a calendar year?

If yes, provide the last day of the 20th week.

Domestic employer (Employer whose employees only perform domestic services.)

Have you or will you pay gross wages of at least $1,000 within a calendar quarter? Yes No

If yes, provide the date you reached or will reach $1,000 gross wages.

mm dd yyyy

mm dd yyyy

mm dd yyyy

mm dd yyyy

DR-1

R. 01/22

Page 9 of 15

Reemployment Tax (continued)

Reemployment Tax

Agricultural (noncitrus, citrus, or crew chief) employer

Have you or will you pay gross wages of at least $10,000 within a calendar quarter? Yes No

If yes, provide the date you reached or will reach $10,000 gross wages.

Have you or will you have five or more employees for a day (or portion of a day) during 20 or more

weeks in a calendar year? Yes No

If yes, provide the last day of the 20th week.

26. List all Florida locations where you have employees.

(Attach a separate sheet, if needed.)

mm dd yyyy

City / State / ZIP:

Address:

City / State / ZIP:

Number of employees:

Principal products or services:

If services, indicate if:

Administrative Research Other

Address:

City / State / ZIP:

Number of employees:

Principal products or services:

If services, indicate if:

Administrative Research Other

Address:

City / State / ZIP:

Number of employees:

Principal products or services:

If services, indicate if:

Administrative Research Other

Address:

City / State / ZIP:

Number of employees:

Principal products or services:

If services, indicate if:

Administrative Research Other

27. Payroll Agent Information. If you will use a payroll agent (such as an accountant or bookkeeper) or firm that will maintain your payroll

information, provide the following:

Name of payroll agent or firm:

Mailing address:

mm dd yyyy

DR-1

R. 01/22

Page 10 of 15

Reemployment Tax (continued)

Reemployment Tax

28. Mailing Addresses for Reemployment Tax. To receive correspondence about reemployment tax reporting, tax rates, and benefits

paid, select the appropriate mailing address for each type of correspondence below.

Reporting Forms and Information Tax Rate Information Benefits Paid Information

Employer's Quarterly Reports, Certifications, Tax Rate Notices Notice of Benefits Paid

Reporting-related Correspondence: Related Correspondence: Related Correspondence:

Business Information (address in the Business Information (address Business Information (address in the

the first section of this application) in the first section of this application) first section of this application)

Payroll Agent Information (address Payroll Agent Information Payroll Agent Information (address

in Question 27) (address in Question 27) in Question 27)

Other (enter below) Other (enter below) Other (enter below)

Other Address for Reporting Forms and Information

Name:

Telephone #:

Ext:

Mailing address:

City / State / ZIP:

Email address:

Other Address for Tax Rate Information

Name:

Telephone #:

Ext:

Mailing address:

City / State / ZIP:

Email address:

Other Address for Benefits Paid Information

Name:

Telephone #:

Ext:

Mailing address:

City / State / ZIP:

Email address:

Communications Services Tax

Communications Services Tax

29. Do you sell communications services; purchase communications services to integrate into prepaid calling arrangements;

or are you applying for a direct pay permit for communications services tax? Yes No

If yes, select each service you sell.

Telephone service (e.g., local, long distance, wireless, or VOIP) Video service (e.g., television programming or streaming)

Paging service Direct-to-home satellite service

Facsimile (fax) service (not when providing advertising or Pay telephone service

professional services) Purchase services to integrate into prepaid calling arrangements

Reseller (only sales for resale; no sales to retail customers)

Other services; please describe:

30. Are you applying for a direct pay permit for communications services tax? Yes No

If yes, you must also submit an Application for Self-Accrual Authority/Direct Pay Permit (Form DR-700030).

DR-1

R. 01/22

Page 11 of 15

Communications Services Tax (continued)

Communications Services Tax

If you answered No to questions 29 and 30, proceed to the Documentary Stamp Tax section.

If you answered Yes, continue.

If you are a reseller only, sell only pay telephone or direct-to-home satellite services, or

only purchase services to integrate into prepaid calling arrangements, go to question 34.

31. To charge the correct amount of tax, you must know the taxing jurisdiction (county and municipality) in which your customers

are located. How will you verify the assignment of customer location to the correct taxing jurisdictions? If you use multiple

methods, select all that apply.

An electronic database provided by the Department of Revenue

Your own database that will be certified by the Department of Revenue

To apply for certification, you must submit an Application for Certification of Communications Services

Database (Form DR-700012).

A database supplied by a vendor. Provide the name of the vendor and product:

Vendor: Product:

ZIP + 4 and a methodology for assignment when the ZIP codes overlap jurisdictions

ZIP + 4 that does not overlap jurisdictions (e.g., a hotel located in one jurisdiction)

None of the above.

The method you use to verify the assignment of a customer location to the correct taxing jurisdictions (county and municipality) for purposes

of collecting local communications services tax determines the collection allowance rate that will be assigned to your business. If you change

your method of assigning a customer's location to the correct taxing jurisdictions, you must submit a Notification of Method Employed to

Determine Taxing Jurisdiction (Form DR-700020) indicating the new method(s). For more information, visit floridarevenue.com/taxes/cst.

32. If you use multiple assignment methods, you may need to file two separate returns to maximize your collection allowances. If you will file

separate returns for each assignment method, check the box below.

I will file two separate communications services tax returns, one for each type of assignment method.

33. Name and contact information of the person who can answer questions about communications services tax returns filed with the Department:

Name:

Telephone #:

Ext:

Email address:

Documentary Stamp Tax

34. Do you enter into written obligations to pay money with customers at this location that are not recorded with the

Clerk of the Court or County Comptroller (e.g., financing agreements, title loans, pay-day loans, liens, promissory

notes, or similar documents)? Yes No

If yes, do you anticipate executing five or more written obligations to pay money subject to documentary

stamp tax per month? Yes No

Documentary

Stamp Tax

Gross Receipts Tax on Electrical Power and Gas

Gross Receipts

Tax

35. Do you own or operate an electric or natural or manufactured gas (LP gas is excluded) utility distribution

facility in Florida? Yes No

If yes, select the type of utility facility:

Electric Natural or manufactured gas

36. Do you import natural or manufactured gas (LP gas is excluded) into Florida for your own use? Yes No

DR-1

R. 01/22

Page 12 of 15

Severance Taxes and Miami-Dade County Lake Belt Fees

Severance Taxes

37. Do you extract oil, gas, sulfur, solid minerals, phosphate rock, lime rock, sand, or heavy minerals from the

soils or waters of Florida? Yes No

If yes, select each extraction activity that you will engage in:

Extracting oil for sale, transport, storage, profit, or commercial use

Extracting gas for sale, transport, profit, or commercial use

Extracting sulfur for sale, transport, storage, profit, or commercial use

Extracting solid minerals, phosphate rock, or heavy minerals from the soil or water for commercial use

Extracting lime rock or sand from within the Miami-Dade County Lake Belt Area (see section 373.4149, Florida Statutes, for

boundary description)

Enrollment to File and Pay Tax Electronically

File and Pay Electronically

Filing and paying electronically is quick, easy, and secure at floridarevenue.com/taxes/eservices. You can electronically file and pay most

taxes, fees and surcharges.

Marketplace providers and persons making a substantial number of remote sales (total of taxable remote sales in the previous calendar year

exceeds $100,000) must file and remit tax electronically.

You may choose to enroll to file or pay tax electronically. Enrolling allows you to view your payment history, reprint your payment information,

and view bills posted to your account. Your bank account and contact information are saved for future transactions.

If you enroll using this application, you will receive a user ID and password for each tax account created based on the information you

provide. Each account will have the same contact, banking, and payment method. After you receive your user ID and password, you may log

into each tax account and change the contact, banking, and method of payment information.

If you choose not to file returns or pay tax electronically, proceed to the

Authorization for Email Communication section.

38. Do you wish to: (select only one)

Enroll for both filing returns and paying tax electronically?

Enroll only to pay tax electronically?

File returns and pay tax electronically without enrolling?

39. If you are enrolling, select only one electronic payment method.

ACH-Debit (e-check) – The Department's bank withdraws a payment from your bank account when you authorize the payment.

ACH-Credit – Your bank transfers a payment to the Department's bank account when you authorize the bank to make the

payment. This is not a credit card payment. You are responsible for any costs charged by your bank to use this payment

method.

40. Contact Person for Electronic Payments:

Name: Telephone #:

Ext: Fax #:

Mailing address:

City / State / ZIP: Email address:

A company employee A non-related tax preparer

Payroll agent

Federal Preparer Tax Identification Number (PTIN):

DR-1

R. 01/22

Page 13 of 15

Enrollment to File and Pay Tax Electronically (continued)

File and Pay Electronically

41. Contact Person for Electronic Return Filing (If different than contact person for electronic payments.)

Name: Telephone #: Ext:

Fax #:

Mailing address:

City / State / ZIP: Email address:

A company employee A non-related tax preparer

Payroll agent

42. Banking Information (not required for ACH-Credit payment method):

Bank / financial institution name:

Account type: Business Checking

Personal Savings

Note: Due to federal security requirements, we cannot process international ACH transactions. If any funding for payments comes from

financial institutions located outside the US or its territories, please contact us to make other payment arrangements. If you are unsure, please

contact your financial institution.

43. Enrollee Authorization and Agreement:

This is an Agreement between the Florida Department of Revenue, hereinafter "the Department," and the business entity named herein,

hereinafter "the Enrollee," entered into according to the provisions of the Florida Statutes and the Florida Administrative Code.

By completing this agreement and submitting this enrollment request, the Enrollee applies and is hereby authorized by the Department

to file tax returns and reports, make tax and fee payments, and transmit remittances to the Department electronically. This agreement

represents the entire understanding of the parties in relation to the electronic filing of returns, reports, and remittances.

The same statute and rule sections that pertain to all paper documents filed or payments made by the Enrollee also govern an

electronic return, or payment initiated electronically according to this agreement.

I certify that I am authorized to sign on behalf of the business entity identified herein, and that all information provided in this section

has been personally reviewed by me and the facts stated in it are true. According to the payment method selected above, I hereby

authorize the Department to present debit entries into the bank account referenced above at the depository designated herein

(ACH-Debit), or I am authorized to register for the ACH-Credit payment privilege and accept all responsibility for the filing of payments

through the ACH-Credit method.

Signature: ___________________________________

Signature: ___________________________________

(If account requires two signatures)

Printed name:

Title:

Date:

Printed name:

Title:

Date:

Bank account number:

Bank Routing Number:

|: :|

Federal Preparer Tax Identification Number (PTIN):

DR-1

R. 01/22

Page 14 of 15

Authorization for Email Communication

Email Communication

Your privacy is important to the Department of Revenue. The Department will mail information regarding this application to you. If you wish to

receive the information in an email, a written request from you is required. This request allows the Department to send information using its

secure email software. This software requires additional steps before you can access the information.

Complete this section to receive information about this application by secure email.

I authorize the Department to send information regarding this Application using the Florida Department

of Revenue's secure email. I understand that this method requires additional steps to view the information provided.

Provide the name and contact information of the person who can respond to questions about this Application.

Name:

Email address:

Applicant Declaration and Signature

I understand that any person who is required to collect, truthfully account for, and pay any tax, fee, or surcharge, and willfully fails to do so, or any

officer or director of a corporation who directs any employee of the corporation to do so, is personally liable for the tax, fee, or surcharge evaded,

not accounted for, or paid to the Florida Department of Revenue, plus a penalty equal to twice the amount of the tax, fee, or surcharge due that is

evaded, not accounted for, or paid. (Section 213.29, Florida Statutes.)

I understand that, in addition to any other civil penalties provided by law, it is a criminal offense to fail or refuse to collect a required tax, fee, or

surcharge; to fail to timely file a tax, fee, or surcharge return; to underreport a tax, fee, or surcharge liability on a return; or to give a worthless check,

draft, debit card order, or other order on a bank to transfer funds to the Florida Department of Revenue.

I understand that I must notify the Florida Department of Revenue of any change in the form of ownership of this business or a change in business

activities, location, mailing address, or contact information for this business.

I certify that I am authorized by _________________________________ (Officer/Director) to execute this application. I understand that I

will be creating a tax account that may result in the responsibility to file returns and to pay a tax, surtax, fee, or surcharge to the Florida

Department of Revenue.

Under penalties of perjury, I declare that I have read the foregoing Application and that the facts stated in it are true.

Signature:________________________________________________________

Printed name:

Title:

Date:

Applicant Declaration and Signature

Before you submit your completed application

Have you:

Provided your business identification numbers?

Completed all sections of this application?

Signed and dated this application?

Included all additional applications, if required?

Mail to: Account Management MS 1-5730

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0160

ext:

Check if # is outside U.S.

Telephone #:

#:

DR-1

R. 01/22

Page 15 of 15

Contact Us

You may also bring your completed application to your

nearest taxpayer service center. To find a taxpayer service

center near you, visit floridarevenue.com/taxes/servicecenters.

Information, forms, and tutorials are available on the Department's

website at floridarevenue.com.

For written replies to tax questions, write to:

Taxpayer Services MS 3-2000

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0112

To speak with a Department representative, call Taxpayer Services at

850-488-6800, Monday through Friday, excluding holidays.

Subscribe to Receive Updates by Email

Visit floridarevenue.com/dor/subscribe to sign up to receive an email

when the Department posts:

• Tax Information Publications (TIPs)

• Proposed rules, including notices of rule development workshops

and emergency rulemaking

• Due date reminders for reemployment tax and sales and use tax

References

The following documents were mentioned in this form and are incorporated by reference in the rules indicated below.

The forms are available online at floridarevenue.com/forms.

Form RTS-1S Report to Determine Succession and Application For Transfer of Rule 73B-10.037, F.A.C.

Experience Rating Records

Form DR-1S Registration Application for Secondhand Dealers and Secondary Rule 12A-17.005, F.A.C.

Metals Recyclers

Form DR-18 Application for Amusement Machine Certificate Rule 12A-1.097, F.A.C.

Form DR-16A Application for Self-Accrual Authority/Direct Pay Permit Sales Rule 12A-1.097, F.A.C.

and Use Tax

GT-400401 Registration Package for Motor Fuel and/or Pollutants,

includes the following forms:

Form DR-156 Florida Fuel or Pollutants Tax Application Rule 12B-5.150, F.A.C.

Form DR-600 Enrollment and Authorization for e-Services Rule 12-24.011, F.A.C.

Form DR-157W Bond Worksheet Instructions Rule 12B-5.150, F.A.C.

Form DR-157 Fuel or Pollutants Tax Surety Bond Rule 12B-5.150, F.A.C.

Form DR-157A Assignment of Time Deposit Rule 12B-5.150, F.A.C.

Form DR-157B Fuel or Pollutants Tax Cash Bond Rule 12B-5.150, F.A.C.

Form RTS-6061 Independent Contractor Analysis Rule 73B-10.037, F.A.C.

Form DR-700030 Application for Self-Accrual Authority/Direct Pay Permit Rule 12A-19.100, F.A.C.

Form DR-700012 Application for Certification of Communications Services Database Rule 12A-19.100, F.A.C.

Form DR-700020 Notification of Method Employed to Determine Taxing Jurisdiction Rule 12A-19.100, F.A.C.