Photo from iStock-627281636

2021 Cost of Wind Energy

Review

Tyler Stehly and Patrick Duffy

National Renewable Energy Laboratory

December 2022

NREL | 2

Acknowledgments

The authors would like to thank Patrick Gilman (U.S. Department of Energy Office of Energy

Efficiency and Renewable Energy Wind Energy Technologies Office [WETO]) for supporting this

research. Thanks also to Gage Reber (contractor to WETO) and Daniel Beals of Allegheny Science

and Technology (contractor to WETO) for reviewing prior versions of this presentation. Thank you

to Ryan Wiser and Mark Bolinger (Lawrence Berkeley National Laboratory) and Alice Orrell (Pacific

Northwest National Laboratory) for their analysis of wind project market data that informed this

analysis and to Parangat Bhaskar (National Renewable Energy Laboratory) for supporting the

techno-economic analysis. Thanks also to Philipp Beiter and Eric Lantz (National Renewable Energy

Laboratory) for their technical guidance and Amy Brice (National Renewable Energy Laboratory) for

editing the presentation. Any remaining errors or omissions are the sole responsibility of the

authors.

NREL | 3

List of Acronyms

AEP annual energy production

ATB Annual Technology Baseline

BOS balance of system

CapEx capital expenditures

CRF capital recovery factor

CSM Cost and Scaling Model

DOE U.S. Department of Energy

DW distributed wind

FCR fixed charge rate

FY fiscal year

GPRA Government Performance and Results Act

GW gigawatt

IEC International Electrotechnical Commission

kW kilowatt

LandBOSSE Land-based Balance of System Systems Engineering

LCOE levelized cost of energy

m meter

m/s meters per second

MACRS Modified Accelerated Cost Recovery System

MW megawatt

MWh megawatt-hour

NCF net capacity factor

NREL National Renewable Energy Laboratory

O&M operations and maintenance

OpEx operational expenditures

ORCA Offshore Wind Regional Cost Analyzer

PTC production tax credit

USD U.S. dollars

WACC weighted-average cost of capital

WETO Wind Energy Technologies Office

yr year

Executive Summary

NREL | 5

Executive Summary

• The 11

th

annual Cost of Wind Energy Review, now presented in slide deck format, uses representative utility-scale and

distributed wind energy projects to estimate the levelized cost of energy (LCOE) for land-based and offshore wind power

plants in the United States.

− Data and results are derived from 2021 commissioned plants, representative industry data, and state-of-the-art

modeling capabilities.

− The goals of this analysis are to provide insight into current component-level costs and give a basis for understanding

the variability in wind energy LCOE across the country.

• The primary elements of this 2021 analysis include:

− Estimated LCOE for (1) a representative land-based wind energy project installed in a moderate wind resource in the

United States, (2) a representative fixed-bottom offshore wind energy project installed in the U.S. North Atlantic, and

(3) a representative floating offshore wind energy project installed off the U.S. Pacific Coast

− Updated LCOE estimates for representative residential-, commercial-, and large-scale distributed wind projects

installed in a moderate wind resource in the United States

− Sensitivity analyses showing the range of effects that basic LCOE variables could have on the cost of wind energy for

land-based and offshore wind projects

− Updated Fiscal Year 2022 values for land-based and offshore wind energy used for Government Performance and

Results Act (GPRA) reporting and illustrated progress toward established GPRA targets.

NREL | 6

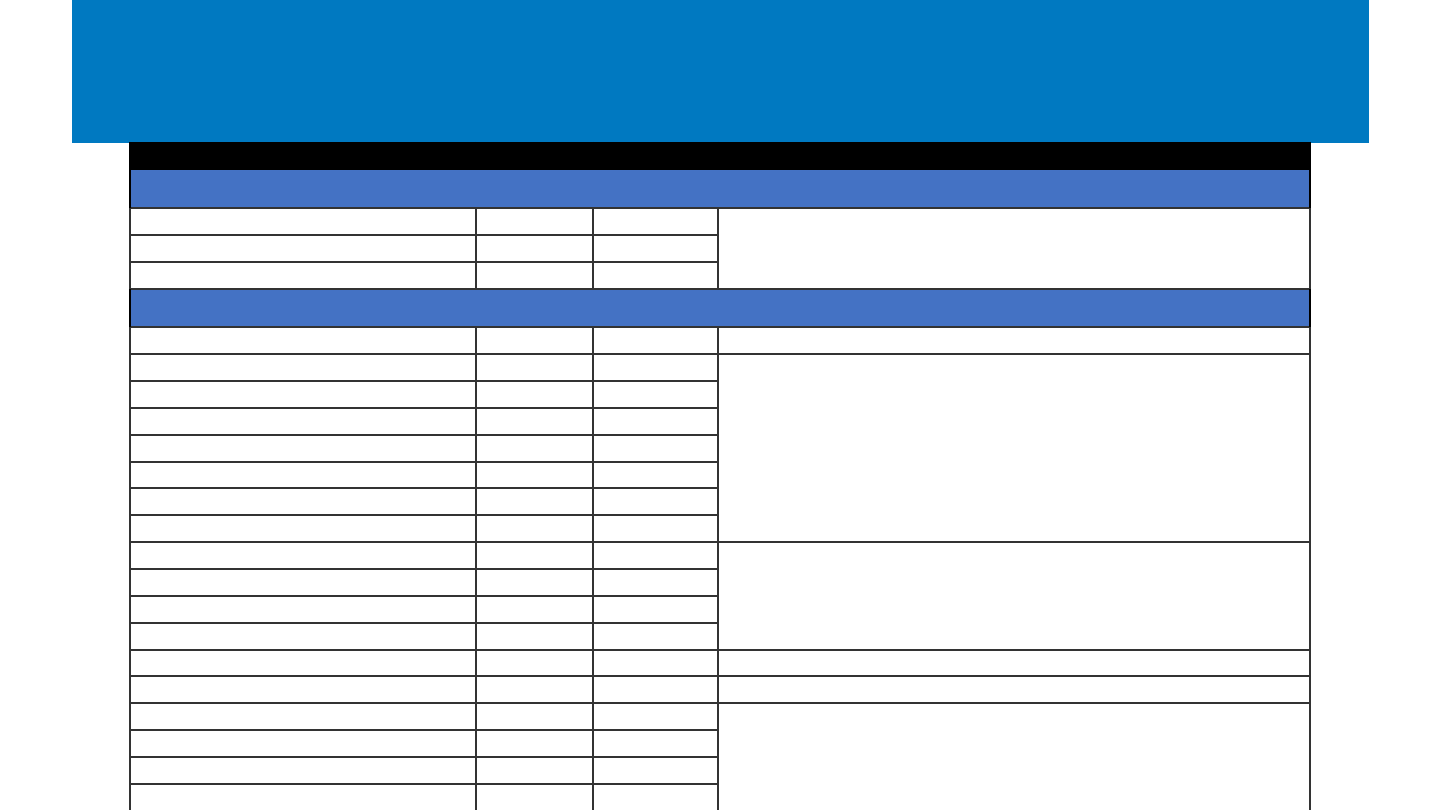

Key Inputs and Levelized Cost of Energy Results

Note: Unless specifically stated, all cost data are reported in 2021 U.S. dollars (USD).

Land-Based Offshore Distributed

Parameter Unit

Utility-Scale

Land-Based

Utility-Scale

(Fixed-Bottom)

Utility-Scale

(Floating)

Single-

Turbine

(Residential)

Single-

Turbine

(Commercial)

Single-

Turbine

(Large)

Wind turbine rating MW 3 8 8 20 (kW) 100 (kW) 1.5

Capital expenditures (CapEx) $/kW 1,501 3,871 5,577 5,675 4,300 3,540

Fixed charge rate (FCR) [real] % 5.88 5.82 5.82 5.88 5.42 5.42

Operational expenditures

(OpEx)

$/kW/yr 40 111 118 35 35 35

Net annual energy production MWh/MW/yr 3,775 4,295 3,336 2,580 2,846 3,326

Levelized Cost of Energy (LCOE) $/MWh 34 78 133 143 94 68

NREL | 7

Levelized Cost Breakdown for

Reference Land-Based Wind Plant

5.0

8.2

3.3

0.4

0.2

1.2

0.6

0.7

2.1

1.4

0.4

10.7

34

$0

$5

$10

$15

$20

$25

$30

$35

$40

Levelized Cost of Energy (2021 $/MWh)

Turbine CapEx (48%) Balance of System CapEx (15%)

Financial

CapEx (5%)

OpEx (32%)

NREL | 8

Levelized Cost Breakdown for

Reference Fixed-Bottom Offshore Wind Plant

17.6

1.2

0.0*

6.7

9.4

5.5

0.5

0.5

1.6

2.1

5.0

2.4

7.1

18.8

78

$0

$20

$40

$60

$80

Levelized Cost of Energy (2021 $/MWh)

OpEx

(33%)

Financial CapEx (14.6%)

Balance of System CapEx

(29.8%)

Turbine

(22.5%)

* Engineering Management cost small, but nonzero

NREL | 9

Levelized Cost Breakdown for

Reference Floating Offshore Wind Plant

22.7

1.5

0.0*

36.5

13.0

5.5

3.1

0.9

1.8

3.9

7.5

0.9

9.1

26.3

133

$0

$20

$40

$60

$80

$100

$120

$140

Levelized Cost of Energy (2021 $/MWh)

* Engineering Management cost small, but nonzero

Balance of System CapEx (45.0%)

Financial CapEx (11.2%)

OpEx

(26.6%)

Turbine

(17.1%)

NREL | 10

Levelized Cost Breakdown for

Reference Distributed Wind Projects

Single-Turbine Residential

(20 kW)

58.6

70.6

13.6

143

$0

$20

$40

$60

$80

$100

$120

$140

$160

Wind

turbine

CapEx

BOS CapEx OpEx LCOE

Levelized Cost of Energy (2021 $/MWh)

48.1

33.7

12.3

94

$0

$20

$40

$60

$80

$100

$120

$140

$160

Wind

turbine

CapEx

BOS CapEx OpEx LCOE

Levelized Cost of Energy (2021 $/MWh)

42.2

15.5

10.5

68

$0

$20

$40

$60

$80

$100

$120

$140

$160

Wind

turbine

CapEx

BOS CapEx OpEx LCOE

Levelized Cost of Energy (2021 $/MWh)

Single-Turbine Commercial

(100 kW)

Single-Turbine Large

(1,500 kW)

NREL | 11

Key Conclusions

• The reference project LCOE for land-based installations is $34/MWh, with a range of land-

based estimates from the single-variable sensitivity analysis covering $28–$70/MWh.

• The fixed-bottom offshore wind estimate is $78/MWh, and the floating substructure

reference project estimate is $133/MWh. These two reference projects give a single-variable

sensitivity range of $53–$179/MWh. This range is primarily caused by the large variation in

CapEx ($1,990–$6,971/kW) and project design life.

• The residential and commercial reference distributed wind system LCOE are estimated at

$143/MWh and $94/MWh, respectively. Single-variable sensitivity analysis for the

representative systems is presented in the 2019 Cost of Wind Energy Review (Stehly, Beiter,

and Duffy 2020). Analysts included the LCOE estimate for a large distributed wind energy

project in this year’s analysis, estimated at $68/MWh.

1

2

3

4

5

6

7

NREL | 12

Background

U.S. Department of Energy Goals and Reporting Requirements

Land-Based Wind

Offshore Wind

Distributed Wind

References

Appendix

Contents

1. Background

NREL | 14

Background

• The 2021 Cost of Wind Energy Review estimates the levelized cost of energy (LCOE) for land-based,

offshore, and distributed wind energy projects in the United States.

− LCOE is a metric used to assess the cost of electricity generation and the total power-plant-level

impact from technology design changes and can be used to compare costs of all types of generation.

− The specific LCOE method applied in this analysis is described in A Manual for the Economic

Evaluation of Energy Efficiency and Renewable Energy Technologies (Short, Packey, and Holt 1995):

=

∗ +

1,000

• LCOE = levelized cost of energy (dollars per megawatt-hour

[$/MWh])

• FCR = fixed charge rate (%)

• CapEx = capital expenditures (dollars per kilowatt [$/kW])

• AEPnet = net average annual energy production (megawatt-hours

per megawatt per year [MWh/MW/yr])

• OpEx = operational expenditures ($/kW/yr).

NREL | 15

Background

• This review also provides an update to the 2020 Cost of Wind Energy Review (Stehly and Duffy 2021) and examines

wind turbine costs, financing, and market conditions. The analysis includes:

− Estimated LCOE for a representative land-based wind energy project installed in a moderate wind resource

(i.e., International Electrotechnical Commission [IEC] wind class IIb [IEC 2020]) in the United States

− Estimated LCOE for representative offshore (fixed-bottom and floating) wind energy projects using National

Renewable Energy Laboratory (NREL) models and databases of globally installed projects; the authors

assessed representative sites on the U.S. North Atlantic Coast (fixed bottom) and Pacific Coast (floating)

using current lease and call information, nominations data from the Bureau of Ocean Energy Management,

and various geospatial data sets

− LCOE estimates for representative residential, commercial, and large distributed wind energy projects in

the United States

− Sensitivity analyses showing the range of effects that basic LCOE variables could have on the cost of wind

energy for land-based and offshore wind power plants

− Updates to the national supply curves for land-based and offshore wind energy based on geographically

specific wind resource conditions paired with approximate wind turbine size characteristics

− Projected land-based and offshore wind cost trajectories from 2021 through 2030 used for U.S. Department

of Energy (DOE) annual wind power LCOE reporting as required by the Government Performance and Results

Act (GPRA).

2. U.S. Department of

Energy Goals and

Reporting Requirements

NREL | 17

DOE Goals and Reporting Requirements

• Every year, the Wind Energy Technologies Office (WETO) reports the LCOE for land-based

wind and fixed-bottom offshore wind to satisfy GPRA reporting requirements.

• The official GPRA LCOE end-point targets presented in this report were set in Fiscal Year (FY)

2016 for land-based wind energy and updated in FY 2019 for fixed-bottom offshore wind

energy.

• Updates to the LCOE targets are periodically implemented to keep performance measures

current with developments in the market and reduce the impact of inflation on LCOE for

land-based and offshore wind energy projects.

• The GPRA targets are based on trajectories for land-based and fixed-bottom offshore wind

projects that span from the current year to FY 2030.

• It is required that each year the actual costs for land-based and fixed-bottom wind LCOE be

reported against the GPRA targets.

• This work provides the cost data to DOE to meet the annual GPRA reporting requirement.

NREL | 18

*The GPRA baseline and target LCOE are reported in 2015 USD for land-based wind energy because WETO will report land-based wind values in 2015 USD.

Government Performance and Results Act Cost Reduction

Pathway From 2016 to 2030 for Land-Based Wind

• The land-based wind GPRA baseline value starts at $56/MWh (in 2015 USD) set in FY 2016, using the 2015 reference project data presented in Moné et al. (2017).

• The land-based wind GPRA target is $23/MWh by 2030 (in 2015 USD) and is derived from the analysis conducted in Enabling the SMART Wind Power Plant of the

Future Through Science-Based Innovation (Dykes et al. 2017).

56

23

-8

-20

-4

-1

$0

$10

$20

$30

$40

$50

$60

FY 2016 GPRA CapEx AEP OpEx Financing FY 2030 Target

LCOE (2015 $/MWh)*

Net 31% CapEx

reduction

through wind

plant economies

of scale, turbine

scaling with less

material use, and

efficient

manufacturing

Net 57% increase in

energy production

through turbine

scaling, enhanced

control strategies,

and reducing wind

plant losses

Net 41% OpEx

reduction from

advanced

operations and

maintenance

(O&M) strategies

Net 6% cost of

capital reduction

from increased

certainty of future

plant performance

and reduced risk

NREL | 19

Government Performance and Results Act Cost Reduction

Pathway From 2018 to 2030 for Fixed-Bottom Offshore Wind

• The GPRA baseline value starts at $89/MWh (in 2018 USD) set in FY 2019 using 2018 reference project data reported in Stehly and Beiter (2019).

• The GPRA target is $51/MWh by 2030 (in 2018 USD) and is derived for a fixed-bottom wind plant with 15 MW at the reference site based on cost

reductions informed by technology innovations considered in the spatial economic analysis by Beiter et al. (2016).

Net 22% CapEx

reduction through wind

plant economies of

scale, turbine scaling,

export/array cables

with less material use,

and optimized

foundation design

Net 19% increase in AEP

through turbine scaling,

enhanced control

strategies, reduced wind

plant losses, and higher

availability due to

improved vessel access

Net 54% OpEx reduction

from advanced O&M

strategies, improved

vessel accessibility, and

remote maintenance

strategies

NREL | 20

Modeled Cost Reduction Pathway From 2018 to 2030

for Floating Offshore Wind Energy

Net 53% OpEx reduction

from advanced O&M

strategies, improved

vessel accessibility, and

remote maintenance

strategies

Net 36% CapEx reduction

through wind plant

economies of scale, turbine

scaling and export/array

cables with less material

use, and optimized

foundation design

Net 28% increase in energy

production through turbine

scaling, enhanced control

strategies, reduced wind

plant losses, and higher

availability due to improved

vessel access

• DOE had no official GPRA reporting requirement for floating offshore wind energy costs.

• Projected floating offshore wind cost reductions are mapped to $60/MWh in 2030 using similar methodology as fixed-bottom offshore wind.

• DOE has established a Floating Offshore Wind Shot

target of $45/MWh by 2035 for a different reference site using a different set of assumptions.

NREL | 21

GPRA Cost Reduction Pathway and Historical Cost Data From

2016 to 2030 for Land-Based Wind Energy

• The current and historical LCOE values (labeled as “Actuals”) are tracked against the GPRA trajectory.

• The GPRA trajectory and LCOE values are reported in 2015 USD since WETO will report land-based wind energy values in 2015 USD.

• The FY 2022 LCOE is reported as $29/MWh instead of $34/MWh, as it was converted from 2021 USD to 2015 USD assuming a −12.5%

cumulative rate of inflation from the Bureau of Labor and Statistics (undated), to compare against the GPRA trajectory.

23

56

52

48

40

34

31

29

0

10

20

30

40

50

60

2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

LCOE (2015 $/MWh)

Fiscal Year

GPRA Trajectory Actuals

NREL | 22

GPRA Cost Reduction Pathway and Historical Cost Data From

2016 to 2030 for Fixed-Bottom Offshore Wind Energy

• The current and historical LCOE values (labeled as “Actuals”) are tracked against the GPRA trajectory.

• The GPRA trajectory and LCOE values are reported in 2018 USD per WETO’s congressional reporting requirements.

• The FY 2022 LCOE is $73/MWh (2018 USD) after being converted from 2021 USD to compare against the GPRA

trajectory.

3. Land-Based Wind Energy

NREL | 24

Land-Based Wind Turbine Average Nameplate Capacity, Hub

Height, Rotor Diameter, and Assumed Representative Wind Plant

Parameter Value

Wind turbine rating 3.0 MW

Rotor diameter 127 m

Hub height 95 m

Specific power 237 W/m

2

Wind plant capacity 200 MW

Number of turbines 67

Source: Wiser and Bolinger (2022)

Power curve data available on

https://github.com/NREL/turbine-

models.

2021 average wind turbine

characteristics

NREL | 25

Reference Land-Based Wind Site Characteristics and

Performance

Parameter Value

Annual average wind speed

at 50 m above surface level

7.25 m/s

Annual average wind speed

at hub height

7.95 m/s

Weibull k 2.0 (factor)

Shear exponent 0.14

Gross energy capture 4,395

MWh/MW/yr

Gross capacity factor 50.2%

Losses 15%

Availability 98%

Total losses 16.7%

Net energy capture 3,661

MWh/MW/yr

Net capacity factor 41.8%

Wind resource of the United States, annual average wind speed at 100 m above surface level.

Source: NREL (2017)

NREL | 26

Rotor

Nacelle

Tower

Development

Engineering and

Management

Foundation

Site Access and Staging

Assembly and

Installation

Electrical Infrastructure

Contingency

Construction Finance

21.4%

35.0%

14.0%

1.6%

0.7%

5.2%

2.8%

2.8%

9.0%

6.0%

1.5%

Turbine

70.4%

Balance of

System

22.0%

Financial

7.5%

Land-Based Wind Project

Component Cost Breakdown

Parameter Value

($/kW)

Wind Turbine CapEx 1,030

Rotor $313

Nacelle 512

Tower 204

BOS CapEx 322

Engineering 23

Project management 10

Foundation 75

Site access, staging, and facilities 40

Assembly and installation 41

Electrical infrastructure 132

Financial CapEx 113

Construction finance 23

Contingency 90

Total CapEx 1,501

• Turbine component cost estimates are derived from the 2015 Cost and Scaling Model, used as an internal reference and not publicly available.

• BOS component cost estimates are obtained from the Land-based Balance of System Systems Engineering (LandBOSSE) model (Eberle et al. 2019).

• Construction financing was estimated assuming a 3-year construction duration and distributing the capital and interest over the 3 years.

• Project contingency assumes 6% of total CapEx.

• Total installed project CapEx for U.S. projects in 2021 averaged $1,501/kW (Wiser and Bolinger 2022).

All costs reported in 2021 USD

NREL | 27

Land-Based Wind Plant Operational Expenditures

Estimate and Historical Data

Parameter Value

Estimated OpEx $40/kW-yr

• Source: Wiser and Bolinger (2022)

• Sample is limited; few projects in sample have complete records of OpEx from 2000 to 2020; OpEx reported here do not include all operating costs.

• Data from “Assessing Wind Power Operating Costs in the United States: Results From a Survey of Wind Industry Experts” (Wiser, Bolinger, and Lantz 2019) are used to

estimate all-in project OpEx for a representative project commissioned in 2021.

NREL | 28

Land-Based Wind Project Financial Assumptions

Parameter Nominal Value Real Value

Weighted-average cost of capital 5.37% 2.8%

Capital recovery factor 7.36% 5.62%

Fixed charge rate 7.7% 5.88%

• The economic evaluation of wind energy investments in this analysis uses the fixed charge rate (FCR) method

from NREL’s Annual Technology Baseline and Standard Scenarios web page: atb.nrel.gov

.

• The FCR represents the amount of annual revenue required to pay the carrying charge as applied to the

CapEx on that investment during the expected project economic life and is based on the capital recovery

factor (CRF) but also reflects corporate income taxes and depreciation.

• The analysis assumes the reference project operates for 25 years, a 5-year MACRS depreciation schedule,

and an inflation rate of 2.5%.

• Additional financial assumption details are displayed in the Appendix.

NREL | 29

LCOE for Representative Land-Based Wind Plant

and Historical Data

Source: Wiser and Bolinger (2022)

Note: Yearly estimates reflect variations in installed cost, capacity factors, operational costs, cost of financing, and project life; includes accelerated depreciation but excludes

production tax credit.

Parameter Value

Wind turbine rating 3 MW

Capital expenditures $1,501/kW

Fixed charge rate (real) 5.88%

Operational expenditures $40/kW/yr

Net annual energy production 3,775

MWh/MW/yr

Calculated levelized cost of energy $34/MWh

NREL | 30

LCOE Breakdown for

Reference Land-Based Wind Plant

5.0

8.2

3.3

0.4

0.2

1.2

0.6

0.7

2.1

1.4

0.4

10.7

34

$0

$5

$10

$15

$20

$25

$30

$35

$40

Levelized Cost of Energy (2021 $/MWh)

Turbine CapEx (48%) Balance of System CapEx (15%)

Financial

CapEx (5%)

OpEx (32%)

NREL | 31

Range of LCOE Parameters for Land-Based Wind

Note: The reference LCOE reflects a representative industry LCOE. Changes in LCOE for a single variable can be understood by moving to the left or right along a specific variable.

Values on the x-axis indicate how the LCOE will change as a given variable is altered and all others are assumed constant (i.e., remain reflective of the reference project).

$20 $25 $30 $35 $40 $45 $50 $55 $60 $65 $70 $75

Project Design Life (years)

Discount Rate (nominal) [%]

Net Capacity Factor (%)

OpEx ($/kW/year)

CapEx ($/kW)

LCOE ($/MWh)

Key Parameters for LCOE Sensitivity Analysis

2,000

1,501 (reference)

1,350

40

60

30

43.1

2152

5.37 (reference)

6.34.46

1535 25

Reference LCOE = $34/MWh

4. Offshore Wind Energy

NREL | 33

2021 Market Average Offshore Wind Turbine and

Representative Wind Plant

Parameter Value

Wind turbine rating 8.0 MW

Rotor diameter 159 m

Hub height 102 m

Specific power 403 W/m

2

Wind plant capacity 600 MW

Number of turbines 75

• Global capacity-weighted-average turbine rating

in 2021 was 7.4 MW, down slightly from 7.6 MW

in 2020 (Musial et al. 2022).

• Representative wind plant parameters are held

constant with respect to 2020 Cost of Wind

Energy Review (Stehly and Duffy 2022).

Global capacity-weighted-average turbine rating, hub height, and rotor diameter for

offshore wind projects in 2021. Source: Offshore Wind Market Report: 2022 Edition

(Musial et al. 2022)

Representative turbine parameters and power curves

available on GitHub

NREL | 34

Offshore Wind Reference Wind Sites

and Wind Plant Performance

Parameter Fixed-

bottom

Floating Units

Water depth 34 739 m

Export cable length 50 36 km

Annual average wind

speed at 50 meters

8.43 7.67 m/s

Annual average wind

speed at hub height

9.05 8.24 m/s

Weibull k 2.1 2.1 factor

Shear exponent 0.1 0.1 #

Gross energy capture 5,081 4,205 MWh/MW

/yr

Gross capacity factor 58.0 48.0 %

Total losses 15.5 20.7 %

Net energy capture 4,295 3,336 MWh/MW

/yr

Net capacity factor 49.0 38.1 %

Wind resource of the United States, annual average wind speed at 100 meters above surface

level. Source: NREL (2017)

• The fixed-bottom offshore wind reference project

represents near-term development in the U.S. Northeast.

• The floating offshore wind reference site represents the

first leases in California.

NREL | 35

Turbine

Development and

Project Management

Substructure & Foundation

Electrical Infrastructure

Assembly and

Installation

Lease Price

Plant Commissioning

Decommissioning

Contingency

Construction Finance

Insurance During

Construction

33.6%

2.3%

12.8%

17.9%

10.5%

4.6%

0.9%

3.0%

9.5%

3.9%

0.9%

Turbine

33.6%

Balance of

System

48.2%

Soft Costs

18.2%

Fixed-bottom Offshore Wind System CapEx

Component Cost Breakdown

Parameter Value ($/kW)

Turbine

1,301

BOS

1,866

Development and project

management

91

Substructure and foundation

496

Electrical infrastructure

693

Assembly and installation

408

Lease price

178

Soft Costs

704

Plant commissioning

34

Decommissioning

117

Contingency

366

Construction finance

152

Insurance during construction

34

Total CapEx

3,871

NREL | 36

Turbine

Development and

Project Management

Substructure &

Foundation

Electrical Infrastructure

Assembly and

Installation

Lease Price

Plant Commissioning

Decommissioning

Contingency

Construction Finance

Insurance During

Construction

23.3%

1.6%

37.5%

13.4%

5.7%

3.2%

0.9%

1.8%

7.7%

4.0%

0.9%

Turbine

23.3%

Balance of

System

61.4%

Soft Costs

15.3%

Floating Offshore Wind System CapEx

Component Cost Breakdown

Parameter Value

($/kW)

Turbine

1,301

BOS

3,422

Development and project

management

91

Substructure and foundation

2,089

Electrical infrastructure

747

Assembly and installation

316

Lease price

178

Soft Costs

854

Plant commissioning

52

Decommissioning

101

Contingency

428

Construction finance

221

Insurance during construction

52

Total CapEx

5,577

NREL | 37

Fixed-Bottom and Floating Offshore Wind

OpEx Estimates

• Public OpEx data are scarce, and estimates

vary among existing projects in Europe and

Asia.

• Estimated fixed-bottom and floating OpEx

values are calculated with NREL’s Offshore

Regional Cost Analyzer (ORCA) model

(Beiter et al. 2016) which varies in the

definition of OpEx scope when compared

with more recent trends and analyses.

• Continued work to develop and validate

the open-source offshore OpEx model

Windfarm Operations & Maintenance cost-

Benefit Analysis Tool (WOMBAT) is

expected to improve current OpEx

estimating capabilities.

(follow model development on GitHub)

Parameter Fixed Value Floating Value

OpEx

($/kW-yr)

111 118

Projected U.S. offshore wind plant OpEx costs between 2021 and 2035. Source: Musial et al. (2022)

NREL | 38

Fixed-Bottom and Floating Offshore Wind

Project Financial Assumptions

• The data used to calculate the weighted-average cost of capital (WACC) are collected by NREL based on

conversations with project developers and industry financiers and provides a basis for WACC assumptions for

the representative wind project in 2021.

• The WACC, CRF, and FCR are given in nominal and real terms using the after-tax WACC discount rate of 5.29%

and 2.72%, respectively, a project design lifetime of 25 years, and a net present value depreciation factor of

86.9% (assuming a 5-year MACRS depreciation schedule).

• Detailed financial assumptions are displayed in the Appendix.

Parameter Nominal Value Real Value

Weighted-average cost of capital 5.29% 2.72%

Capital recovery factor 7.30% 5.60%

Fixed charge rate 7.64% 5.82%

Note: The calculated weighted-average cost of capital for land-based wind is higher than offshore wind because it considers the influences of the production tax

credit and assumes a lower debt fraction.

NREL | 39

2021 Offshore Wind Reference Plant

LCOE Estimates

• The LCOE values for the 2021 representative fixed-bottom and floating offshore

wind plants are estimated at $78/MWh and $133/MWh, respectively.

• Calculated with the formulation presented in NREL’s Annual Technology Baseline and

presented in Appendix.

Parameter Fixed-bottom 8.0-MW

Offshore Wind Turbine

Floating 8.0-MW

Offshore Wind Turbine

Units

Capital expenditures 3,871 5,577 $/kW

Fixed charge rate (real) 5.82 5.82 %

Operational expenditures 111 118 $/kW/yr

Net annual energy

production

4,295 3,336 MWh/MW/yr

Total LCOE 78 133 $/MWh

NREL | 40

Fixed-Bottom Offshore Wind Reference Plant

LCOE Component Cost Breakdown

17.6

1.2

0.0*

6.7

9.4

5.5

0.5

0.5

1.6

2.1

5.0

2.4

7.1

18.8

78

$0

$20

$40

$60

$80

Levelized Cost of Energy (2021 $/MWh)

OpEx

(33%)

Financial CapEx (14.6%)

Balance of System CapEx

(29.8%)

Turbine

(22.5%)

* Engineering Management cost small, but nonzero

NREL | 41

Floating Offshore Wind Reference Plant

LCOE Component Cost Breakdown

22.7

1.5

0.0*

36.5

13.0

5.5

3.1

0.9

1.8

3.9

7.5

0.9

9.1

26.3

133

$0

$20

$40

$60

$80

$100

$120

$140

Levelized Cost of Energy (2021 $/MWh)

* Engineering Management cost small, but nonzero

Balance of System CapEx (45.0%)

Financial CapEx (11.2%)

OpEx

(26.6%)

Turbine

(17.1%)

NREL | 42

$50 $60 $70 $80 $90 $100 $110 $120 $130 $140 $150 $160 $170 $180

Project Design Life (years)

Discount Rate (nominal) [%]

Net Capacity Factor (%)

OpEx ($/kW/year)

CapEx ($/kW)

Key Parameters for LCOE Sensitivity Analysis

Reference LCOE = $78/MWh

3,871

25

15

35

5.29

3.97

6.61

49.0

5,740

50.0

35.0

111

56

167

6,380

1,990

Range of LCOE Parameters for

Fixed-Bottom Offshore Wind Platform

Note: The reference LCOE reflects a representative industry LCOE. Changes in LCOE for a single variable can be understood by moving to the left or right along a

specific variable. Values on the x-axis indicate how the LCOE will change as a given variable is altered and all others are assumed constant (i.e., remain reflective of

the reference project).

NREL | 43

$50 $60 $70 $80 $90 $100 $110 $120 $130 $140 $150 $160 $170 $180

Project Design Life (years)

Discount Rate (nominal) [%]

Net Capacity Factor (%)

OpEx ($/kW/year)

CapEx ($/kW)

Key Parameters for LCOE Sensitivity Analysis

Reference LCOE = $133/MWh

15

5,351

35

25

5.29

6.61

3.97

38.0

50.0

35.0

118

59

177

6,971

4,183

Range of LCOE Parameters for

Floating Offshore Wind Platform

Note: The reference LCOE reflects a representative industry LCOE. Changes in LCOE for a single variable can be understood by moving to the left or right along a

specific variable. Values on the x-axis indicate how the LCOE will change as a given variable is altered and all others are assumed constant (i.e., remain reflective of

the reference project).

5. Distributed Wind Energy

NREL | 45

Distributed Wind Turbine Characteristics for

Residential, Commercial, and Large-Scale Projects

Parameter

Wind Turbine Class

UnitsResidential Commercial Large

Wind turbine rating 20 100 1,500 kW

Rotor diameter 12.4 27.6 77 m

Hub height 30 40 80 m

Specific power 166 167 322 W/m

2

Number of wind

turbines 1 1 1 #

Wind turbine classes are aligned with the Distributed Wind Energy Futures Study (McCabe et al. 2022).

NREL | 46

Distributed Wind Site Characteristics

and Performance

Parameter

Wind Turbine Class

UnitsResidential Commercial Large

Annual average wind speed at 50 m above surface

level

6 6 6 m/s

Annual average wind speed at hub height 5.58 5.81 6.42 m/s

Weibull k 2.0 2.0 2.0 factor

Shear exponent 0.14 0.14 0.14 #

Gross energy capture 2,916 3,217 3,759 MWh/MW/yr

Gross capacity factor 33.3 36.7 42.9 %

Losses 6.9 6.9 6.9 %

Availability 95 95 95 %

Total losses 11.5 11.5 11.5 %

Net energy capture 2,580 2,846 3,326 MWh/MW/yr

Net capacity factor 29.5 32.5 38 %

Residential and commercial wind turbines assume stall-regulated power curves; the large wind turbine assumes pitch-regulated power curve.

Power curve data available on https://github.com/NREL/turbine-models.

NREL | 47

Distributed Wind Project Component Cost Breakdown

and Estimated Operational Expenditures

Residential (20 kW) Commercial (100 kW) Large (1,500 kW)

Parameter

Wind Turbine Class

UnitsResidential Commercial Large

Wind turbine CapEx 2,575 2,530 2,589 $/kW

BOS CapEx 3,100 1,770 951 $/kW

Total CapEx 5,675 4,300 3,540 $/kW

OpEx 35 35 35 $/kW/yr

• Turbine component cost estimates are derived from the Distributed Wind Market Report: 2022 Edition (Orrell et al. 2022).

• BOS component cost estimates are obtained from the Land-based Balance of System Systems Engineering (LandBOSSE) model (Eberle et al. 2019) and presented in Bhaskar and Stehly (2021).

• Because CapEx data are scarce for distributed wind projects, further cost details on the individual system components are not presented.

• OpEx market data are not widely available for distributed wind projects; therefore, $35/kW/yr are assumed for each wind class.

58.8%

41.2%

Turbine

Balance of

System

45.4%

54.6%

Turbine

Balance of

System

73.1%

26.9%

Turbine

Balance of

System

NREL | 48

Distributed Wind Project Financial Assumptions

Parameter

Wind Turbine Class

Residential Commercial Large

Nominal Real Nominal Real Nominal Real

Weighted-average cost of capital (%) 4.69 2.13 4.69 2.13 4.69 2.13

Capital recovery factor (%) 6.87 5.2 6.87 5.2 6.87 5.2

Fixed charge rate (%) 7.76 5.88 7.16 5.42 7.16 5.42

• The economic evaluation of wind energy investments in this analysis uses the fixed charge rate (FCR) method used in NREL’s Annual

Technology Baseline and Standard Scenarios web page: atb.nrel.gov.

• The FCR represents the amount of annual revenue required to pay the carrying charge as applied to the CapEx on that investment during

the expected project economic life and is based on the capital recovery factor (CRF) but also reflects corporate income taxes and

depreciation.

• The analysis assumes the reference projects operate for 25 years; residential host-owned assumes a 20-year straight-line depreciation

schedule, and the commercial/industrial host-owned project assumes a 5-year MACRS depreciation schedule.

• Additional financial assumption details are displayed in the Appendix.

NREL | 49

LCOE Breakdown for Reference

Distributed Wind Projects

Single-Turbine Residential

(20 kW)

Single-Turbine Commercial

(100 kW)

Single-Turbine Large

(1,500 kW)

58.6

70.6

13.6

143

$0

$20

$40

$60

$80

$100

$120

$140

$160

Wind

turbine

CapEx

BOS CapEx OpEx LCOE

Levelized Cost of Energy (2021 $/MWh)

48.1

33.7

12.3

94

$0

$20

$40

$60

$80

$100

$120

$140

$160

Wind

turbine

CapEx

BOS CapEx OpEx LCOE

Levelized Cost of Energy (2021 $/MWh)

42.2

15.5

10.5

68

$0

$20

$40

$60

$80

$100

$120

$140

$160

Wind

turbine

CapEx

BOS CapEx OpEx LCOE

Levelized Cost of Energy (2021 $/MWh)

6. References

NREL | 51

References

Beiter, P., W. Musial, A. Smith, L. Kilcher, R. Damiani, M. Maness, et al. 2016. A Spatial-Economic Cost Reduction Pathway Analysis for U.S. Offshore Wind Energy Development from 2015-2030.

Golden, CO: National Renewable Energy Laboratory. NREL/TP6A20-66579. https://www.nrel.gov/docs/fy16osti/66579.pdf

.

Bhaskar, Parangat, and Tyler Stehly. 2021. Technology Innovation Pathways for Distributed Wind Balance-of-System Cost Reduction. Golden, CO: National Renewable Energy Laboratory. NREL/TP-

5000-77452. https://www.nrel.gov/docs/fy21osti/77452.pdf

.

Bureau of Labor and Statistics. Undated. “CPI Inflation Calculator.” Accessed September 2022. https://www.bls.gov/data/#calculators

.

Dykes, K., M. Hand, T. Stehly, P. Veers, M. Robinson, E. Lantz. 2017. Enabling the SMART Wind Power Plant of the Future Through Science-Based Innovation. Golden, CO: National Renewable

Energy Laboratory. NREL/TP-5000-68123. https://www.nrel.gov/docs/fy17osti/68123.pdf

.

Eberle, Annika, Owen Roberts, Alicia Key, Parangat Bhaskar, and Katherine Dykes. 2019. NREL’s Balance-of-System Cost Model for Land-Based Wind. Golden, CO: National Renewable Energy

Laboratory. NREL/TP-6A20-72201. https://www.nrel.gov/docs/fy19osti/72201.pdf

.

Feldman, D., M. Bolinger, and P. Schwabe. 2020. Current and Future Costs of Renewable Energy Project Finance Across Technologies. Golden, CO: National Renewable Energy Laboratory. NREL/TP-

6A20-76881. https://www.nrel.gov/docs/fy20osti/76881.pdf

.

McCabe, Kevin, Ashreeta Prasanna, Jane Lockshin, Parangat Bhaskar, Thomas Bowen, Ruth Baranowski, Ben Sigrin, Eric Lantz. 2022. Distributed Wind Energy Futures Study. Golden, CO: National

Renewable Energy Laboratory. NREL/TP-7A40-82519. https://www.nrel.gov/docs/fy22osti/82519.pdf

.

Moné, C., M. Hand, M. Bolinger, J. Rand, D. Heimiller, J. Ho. 2017. 2015 Cost of Wind Energy Review. Golden, CO: National Renewable Energy Laboratory. NREL/TP-6A20-66861.

https://www.nrel.gov/docs/fy17osti/66861.pdf

.

Musial, W., P. Spitsen, P. Duffy, P. Beiter, M. Marquis, R. Hammond, and M. Shields. 2022. Offshore Wind Market Report: 2022 Edition. Washington, D.C.: U.S. Department of Energy. DOE/GO-

102022-5765.

https://www.energy.gov/sites/default/files/2022-09/offshore-wind-market-report-2022-v2.pdf.

National Renewable Energy Laboratory (NREL). 2017. “Wind Resource Maps and Data.”

https://www.nrel.gov/gis/wind-resource-maps.html.

National Renewable Energy Laboratory (NREL). (n.d.). “Annual Technology Baseline.” Accessed September 2022. https://atb.nrel.gov/

.

Orrell, A., K. Kazimierczuk, L. Sheridan. 2022. Distributed Wind Market Report: 2022 Edition. Washington, D.C.: U.S. Department of Energy. DOE/GO-102022-5764.

https://www.energy.gov/sites/default/files/2022-08/distributed_wind_market_report_2022.pdf.

NREL | 52

References

Short, W., D. J. Packey, and T. Holt. 1995. A Manual for the Economic Evaluation of Energy Efficiency and Renewable Energy Technologies. Golden, CO: National Renewable Energy Laboratory.

NREL/TP-462-5176. http://www.nrel.gov/docs/legosti/old/5173.pdf

.

Stehly, Tyler and Patrick Duffy. 2022. 2020 Cost of Wind Energy Review. Golden, CO: National Renewable Energy Laboratory. NREL/TP-5000-81209. https://www.nrel.gov/docs/fy22osti/81209.pdf

.

Stehly, T., P. Beiter, P. Duffy. 2020. 2019 Cost of Wind Energy Review. Golden, CO: National Renewable Energy Laboratory. NREL/TP-5000-78471. https://www.nrel.gov/docs/fy21osti/78471.pdf

.

Stehly, Tyler, and Philipp Beiter. 2019. 2018 Cost of Wind Energy Review. Golden, CO: National Renewable Energy Laboratory. NREL/TP-5000-74598.

https://www.nrel.gov/docs/fy20osti/74598.pdf

.

UL Solutions. Undated. “Wind Farm Design Software Developed on More Than 30 Years of Expertise.”

https://aws-dewi.ul.com/software/openwind/.

Wiser, R. and M. Bolinger. 2022. Land-Based Wind Market Report: 2022 Edition. Washington, D.C.: U.S. Department of Energy. DOE/GO-102022-5763.

https://www.energy.gov/sites/default/files/2022-08/land_based_wind_market_report_2202.pdf.

Wiser, R., M. Bolinger, and E. Lantz. 2019. “Assessing Wind Power Operating Costs in the United States: Results From a Survey of Wind Industry Experts.” Renewable Energy Focus 30: 46–57.

https://doi.org/10.1016/j.ref.2019.05.003

.

7. Appendix

NREL | 54

Land-Based Wind Reference Project Details

Parameter Units Value Notes

Wind plant and reference site characteristics

Wind plant capacity

MW 200

Representative of commercial-scale projects

Number of turbines

67

Turbine rating

MW 3

"Land-Based Wind Market Report: 2022 Edition" (Wiser and Bolinger 2022)Rotor diameter

m 127

Hub height

m 95

Specific power

W/m2 237 Calculation

Cut-in wind speed

m/s 3

Typical turbine characteristics

Cut-out wind speed

m/s 25

Annual average wind speed at 50 meters

m/s 7.25 Reference site wind speed

Annual average wind speed at hub height

m/s 7.95

Between International Electrotechnical Class (IEC) class III (7.5 m/s) and IEC class II (8.5

m/s)

Weibull k factor

2.0

Shear exponent

0.143 Shear for neutral stability conditions

Altitude above mean sea level

m 450 Altitude at turbine foundation

Losses

% 15%

"Wind Vision" (U.S. Department of Energy 2015)

Availability

% 98%

Net energy capture

MWh/MW/yr 3,775

System Advisor Model (SAM) calculation

Net capacity factor

% 43.1%

NREL | 55

Land-Based Wind System CapEx Breakdown

CapEx

Total CapEx $/kW 1,501 "Land-Based Wind Market Report: 2022 Edition" (Wiser and Bolinger 2022)

Turbine $/kW 1,057

2015 Cost and Scaling Model

Rotor module $/kW 322

Blades $/kW 208

Pitch assembly $/kW 65

Hub assembly $/kW 49

Nacelle module $/kW 526

Nacelle structural assembly $/kW 106

Drivetrain assembly $/kW 210

Nacelle electrical assembly $/kW 170

Yaw assembly $/kW 39

Tower module $/kW 210

Balance of system $/kW 331

Land-based Balance of System Systems Engineering [LandBOSSE] (Eberle

et. al. 2019)

Development $/kW 24

Engineering and project

management

$/kW 10

Foundation $/kW 77

Site access and staging $/kW 41

Assembly and installation $/kW 42

Electrical infrastructure $/kW 136

Soft costs $/kW 113

Construction finance $/kW 23 Project construction over 3 years

Contingency $/kW 90 6% of total CapEx

Parameter Units Value Notes

NREL | 56

Land-Based Wind OpEx and Financing Terms

OpEx

Total OpEx $/kW/year 40 Assessing Wind Power Operating Costs in the United States (Wiser et al. 2019)

Financials

Project design life Years 25 Project life for Government Performance and Reporting Act (GPRA) reporting

Tax Rate (combined state and federal) % 25.7%

2022 Annual Technology Baseline (NREL’s Annual Technology Baseline and

Standard Scenarios web page: atb.nrel.gov)

Inflation rate % 2.5%

Interest during construction (nominal) % 3.11%

Land-Based Wind Market Report: 2022 Edition (Wiser and Bolinger 2022)

Construction finance factor % 102%

Calculation

Debt fraction % 48.5%

Lawrence Berkeley National Laboratory 2021 financial analysis

Debt interest rate (nominal) % 3.11%

Return on equity (nominal) % 8.25%

Weighted-average cost of capital [WACC] (nominal;

after-tax) % 5.37%

Calculation

WACC (real; after-tax) % 2.80%

Capital recovery factor (nominal; after-tax) % 7.36%

Capital recovery factor (real; after-tax) % 5.62%

Depreciable basis % 100% Simplified depreciation schedule

Depreciation schedule 5-year MACRS

Modified Accelerated Cost Recovery System (MACRS) is standard for U.S. wind

projects

Depreciation adjustment (NPV) % 86.6%

Calculation

Project finance factor % 105%

FCR (nominal) % 7.70%

FCR (real) % 5.88%

Levelized cost of energy $/MWh 34 Calculation

Parameter Units Value Notes

NREL | 57

Fixed-Bottom Offshore Wind

Reference Project Details

Parameter Units Value Notes

Wind plant and reference site characteristics

Wind plant capacity

MW 600

Representative of commercial-scale projects

Number of turbines

Number 75

Calculation

Turbine rating

MW 8

Informed by Offshore Wind Market Report: 2022 Edition (Musial et al. 2022)Rotor diameter

m 159

Hub height

m 102.1

Specific power

W/m2 403

Calculation

Water depth

m 34

Representative fixed-bottom offshore site for COE Review

Substructure type

Monopile

Distance from shore

km 50

Cut-in wind speed

m/s 3

Cut-out wind speed

m/s 25

Average annual wind speed at 50 m

m/s 8.4

Average annual wind speed at hub height

m/s 9.0

Shear exponent

0.10

Weibull k

2.1

Total system losses

% 15.5%

Offshore Regional Cost Analyzer (ORCA) (based on Beiter et al. 2016)

Gross energy capture

MWh/MW/year 5,081

Calculation

Net energy capture

MWh/MW/year 4,295

Gross capacity factor

% 58.0%

Offshore Regional Cost Analyzer (ORCA) (based on Beiter et al. 2016)

Net capacity factor

% 49.0%

NREL | 58

Fixed-Bottom Offshore Wind

System CapEx Breakdown

Parameter Units Value Notes

CapEx

Total CapEx

$/kW 3,871

Turbine

$/kW 1,301

Informed by Offshore Wind Market Report: 2022 Edition (Musial et al. 2022)Rotor nacelle assembly

$/kW 1,119

Tower

$/kW 182

Balance of System

$/kW 1,866

BOS Costs computed with ORBIT (Nunemaker et al. 2020)

Development

$/kW 89

Project management

$/kW 2

Substructure and foundation

$/kW 496

Substructure

$/kW 194

Foundation

$/kW 302

Port and staging, logistics, transportation

$/kW 0

Electrical infrastructure

$/kW 693

Array cable system

$/kW 117

Export cable system

$/kW 387

Grid connection

$/kW 188

Assembly and installation

$/kW 408

Turbine installation

$/kW 222

Substructure and foundation installation

$/kW 186

Soft Costs

$/kW 704

Soft Costs computed using same methodology as ORCA (Beiter et al. 2016)

Insurance during construction

$/kW 34

Decommissioning bond

$/kW 117

Construction finance

$/kW 152

Sponsor contingency

$/kW 366

Procurement contingency

$/kW 133

Installation contingency

$/kW 233

Project completions / commissioning

$/kW 34

NREL | 59

Fixed-Bottom Offshore Wind

OpEx and Financing Terms

Parameter Units Value Notes

OpEx

Total OpEx $/kW/year 111

Offshore Regional Cost Analyzer (ORCA) (based on Beiter et al. 2016)

Operations (pretax) $/kW/year 30

Maintenance $/kW/year 81

Financials

Project design life Years 25 Offshore wind project life for GPRA reporting

Tax Rate (combined state and federal) % 26%

Feldman et al. 2020 and NREL's Annual Technology Baseline, updated with data from

industry partners

Inflation rate % 2.5%

Debt fraction % 67%

Debt interest rate (nominal) % 4.0%

Return on equity (nominal) % 10.0%

WACC (nominal; after-tax) % 5.3%

Calculation

WACC (real; after-tax) % 2.7%

Capital recovery factor (nominal; after-tax) % 7.3%

Capital recovery factor (real; after-tax) % 5.6%

Depreciable basis % 100% Simplified depreciation schedule

Depreciation schedule 5-year MACRS Standard for U.S. wind projects

Depreciation adjustment (NPV) % 86.8%

Calculation

Project finance factor % 105%

FCR (nominal) % 7.6%

FCR (real) % 5.8%

NREL | 60

Floating Offshore Wind Reference Project Details

Parameter Units Value Notes

Wind plant and reference site characteristics

Wind plant capacity

MW 600

Representative of commercial-scale projects

Number of turbines

Number 75

Calculation

Turbine rating

MW 8

Informed by Offshore Wind Market Report: 2022 Edition (Musial et al. 2022)Rotor diameter

m 159

Hub height

m 102.1

Specific power

W/m2 403

Calculation

Water depth

m 739

Representative Floating site for Cost of Wind Energy Review

Substructure type

Semisubmersible

Distance from shore

km 36

Cut-in wind speed

m/s 3

Cut-out wind speed

m/s 25

Average annual wind speed at 50 m

m/s 7.7

Average annual wind speed at hub height

m/s 8.2

Shear exponent

0.10

Weibull k

2.1

Total system losses

% 20.7%

Offshore Regional Cost Analyzer (ORCA) (based on Beiter et al. 2016)

Gross energy capture

MWh/MW/year 4,205

Calculation

Net energy capture

MWh/MW/year 3,336

Gross capacity factor

% 48.0%

Offshore Regional Cost Analyzer (ORCA) (based on Beiter et al. 2016)

Net capacity factor

% 38.1%

NREL | 61

Floating Offshore Wind System CapEx Breakdown

Parameter Units Value Notes

CapEx

Total CapEx

$/kW 5,577

Turbine

$/kW 1,301

Informed by Offshore Wind Market Report: 2022 Edition (Musial et al. 2022)Rotor nacelle assembly

$/kW 1,119

Tower

$/kW 182

Balance of System

$/kW 3,422

BOS Costs computed with ORBIT (Nunemaker et al. 2020)

Development

$/kW 89

Project management

$/kW 2

Substructure and foundation

$/kW 2,089

Substructure

$/kW 1,353

Foundation

$/kW 736

Port and staging, logistics, transportation

$/kW 0

Electrical infrastructure

$/kW 747

Array cable system

$/kW 218

Export cable system

$/kW 339

Grid connection

$/kW 191

Assembly and installation

$/kW 316

Turbine installation

$/kW 0

Substructure and foundation installation

$/kW 0

Lease price

$/kW 178

Soft Costs

$/kW 854

Soft Costs computed using same methodology as ORCA (Beiter et al. 2016)

Insurance during construction

$/kW 52

Decommissioning bond

$/kW 101

Construction finance

$/kW 221

Sponsor contingency

$/kW 428

Procurement contingency

$/kW 225

Installation contingency

$/kW 203

Project completions / commissioning

$/kW 52

NREL | 62

Floating Offshore Wind OpEx and Financing Terms

Parameter Units Value Notes

OpEx

Total OpEx $/kW/year 118

Offshore Regional Cost Analyzer (ORCA) (based on Beiter et al. 2016)

Operations (pretax) $/kW/year 30

Maintenance $/kW/year 87

Financials

Project design life Years 25 Offshore wind roject life for GPRA reporting

Tax Rate (combined state and federal) % 26%

Feldman et al. 2020 and NREL's Annual Technology Baseline, updated with

data from industry partners

Federal % 21%

State % 4.7%

Inflation rate % 2.5%

Debt fraction % 67%

Debt interest rate (nominal) % 4.0%

Return on equity (nominal) % 10.0%

WACC (nominal; after-tax) % 5.3%

Calculation

WACC (real; after-tax) % 2.7%

Capital recovery factor (nominal; after-tax) % 7.3%

Capital recovery factor (real; after-tax) % 5.6%

Depreciable basis % 100% Simplified depreciation schedule

Depreciation schedule 5 year MACRS Standard for U.S. wind projects

Depreciation adjustment (NPV) % 86.8%

Calculation

Project finance factor % 105%

FCR (nominal) % 7.6%

FCR (real) % 5.8%

NREL | 63

Distributed Wind Reference Project Details

Parameter Units

20-kW

Value

100-kW

Value

1,500-kW

Value

Notes

Wind plant characteristics

Wind plant capacity

kW 20 100 1500

Representative of residential distributed wind project

Number of turbines

1 1 1

Turbine rating

kW 20 100 1500

"Assessing the Future of Distributed Wind: Opportunities for Behind-the Meter Projects."

(Lantz et. al., 2016)

Rotor diameter

m 12.4 27.6 77

Hub height

m 30 40 80

Specific power

W/m2 166 167 322 Calculation

Cut-in wind speed

m/s 3 3 3

Typical turbine characteristics

Cut-out wind speed

m/s 20 25 25

Annual average wind speed at 50

meters

m/s 6.00 6.00 6.00 Reference site wind speed

Annual average wind speed at

hub height

m/s 5.58 5.81 6.42 International Electrotechnical Commission (IEC) class IV

Weibull k factor

N/a 2.0 2.0 2.0

Shear exponent

N/a 0.143 0.143 0.143 Shear for neutral stability conditions

Altitude above mean sea level

m 0 0 0 Altitude at turbine foundation

Losses

% 7% 7% 7%

Informed by "Competitiveness Improvement Project"

(https://www.nrel.gov/wind/competitiveness-improvement-project.html)

Availability

% 95% 95% 95%

Net energy capture

kWh/kW/yr 2,580 2,846 3,326

Calculation in Openwind (UL website (undated): https://aws-

dewi.ul.com/software/openwind/)

Net capacity factor

% 29.5% 32.5% 38.0%

NREL | 64

Distributed Wind System

CapEx, OpEx, and Financials Breakdown

CapEx

Total CapEx $/kW 5,675 4,300 3,540

Turbine $/kW 2,575 2,530 2,589

"2019 Distributed Wind Data Summary" (Orrell et. al., 2020)

Balance of system $/kW 3,100 1,770 951

"NREL’s Balance-of-System Cost Model for Land-Based Wind" (Eberle et. al., 2019)

OpEx

Total OpEx $/kW/year 35 35 35 "Assessing the Future of Distributed Wind: Opportunities for Behind-the Meter Projects" (Lantz et. al., 2016)

Financials

Project design life Years 25 25 25 Project life for Government Performance and Reporting Act (GPRA) reporting

Tax Rate (combined state and federal) % 25.7% 25.7% 25.7%

2021 Annual Technology Baseline (NREL’s Annual Technology Baseline and Standard Scenarios web page:

atb.nrel.gov)

Inflation rate % 2.5% 2.5% 2.5%

Debt fraction % 60% 60% 60%

"Assessing the Future of Distributed Wind: Opportunities for Behind-the Meter Projects" (Lantz et. al., 2016)

Debt interest rate (nominal) % 3.11% 3.11% 3.11%

Lawrence Berkeley National Laboratory 2021 financial analysis

Return on equity (nominal) % 8.25% 8.25% 8.25%

WACC (nominal; after-tax) % 4.69% 4.69% 4.69%

Calculation

WACC (real; after-tax) % 2.13% 2.13% 2.13%

Capital recovery factor (nominal; after-

tax) % 6.87% 6.87% 6.87%

Capital recovery factor (real; after-tax) % 5.20% 5.20% 5.20%

Depreciable basis % 100% 100% 100% Simplified depreciation schedule

Depreciation schedule N/a

20-year

straight line 5-year MACRS 5-year MACRS

Depreciation adjustment (NPV) % 62.6% 88.2% 88.2%

Calculation

Project finance factor % 113% 104% 104%

FCR (nominal) % 7.76% 7.16% 7.16%

FCR (real) % 5.88% 5.42% 5.42%

Levelized cost of energy $/MWh 143 94 68 Calculation

Parameter Units 20-kW Value 100-kW Value

1,500-kW

Value

Notes

www.nrel.gov

Photo from iStock-627281636

Thank You

This work was authored by the National Renewable Energy Laboratory, operated by Alliance for

Sustainable Energy, LLC, for the U.S. Department of Energy (DOE) under Contract No. DE-AC36-

08GO28308. Funding provided by U.S. Department of Energy Office of Energy Efficiency and Renewable

Energy Wind Energy Technologies Office. The views expressed in the article do not necessarily represent

the views of the DOE or the U.S. Government. The U.S. Government retains and the publisher, by

accepting the article for publication, acknowledges that the U.S. Government retains a nonexclusive,

paid-up, irrevocable, worldwide license to publish or reproduce the published form of this work, or

allow others to do so, for U.S. Government purposes.