Banco Santander, S.A.

Resolution Plan for U.S. Operations

Public Section

June 30, 2022

[THIS PAGE INTENTIONALLY LEFT BLANK]

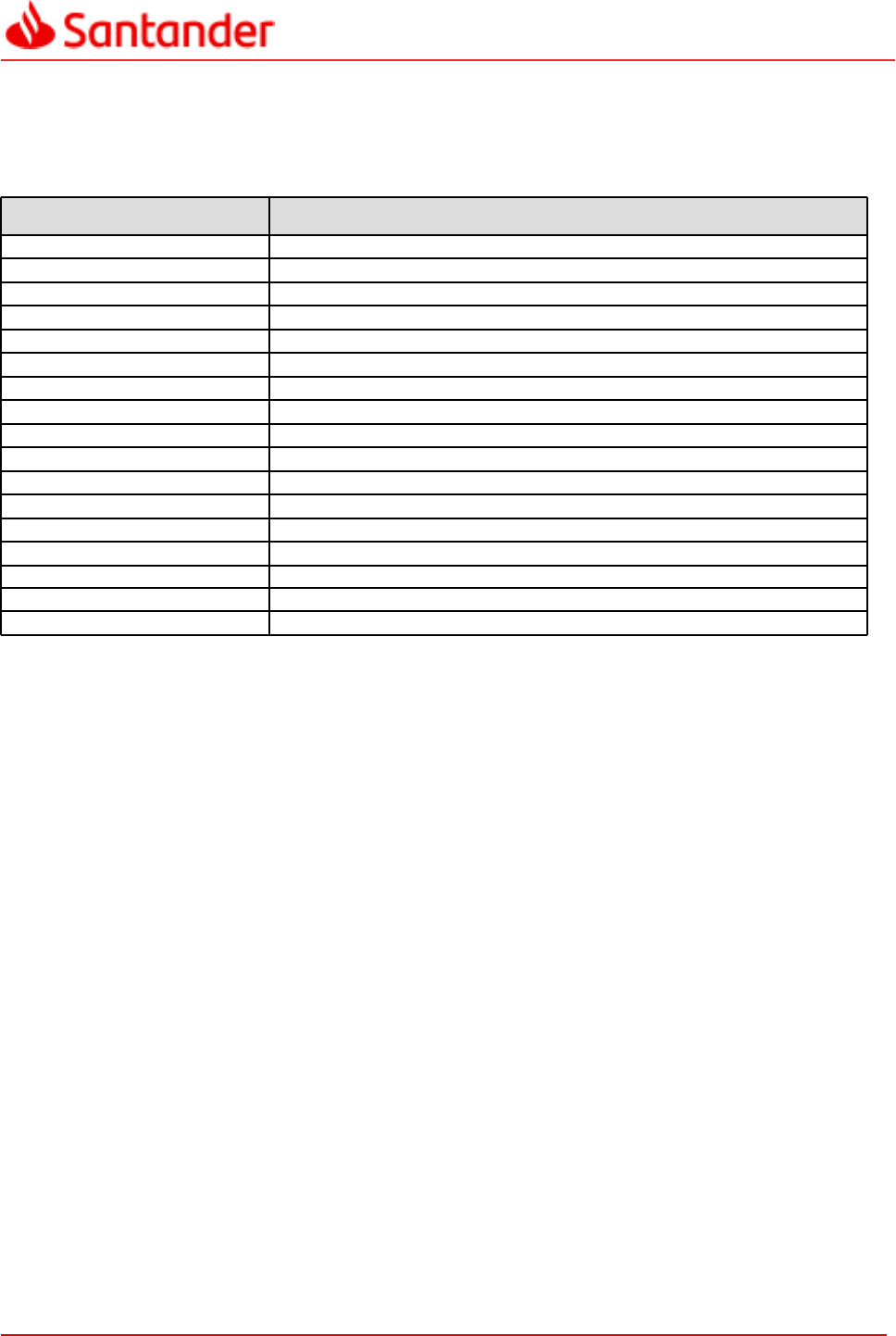

Table of Contents: Public Section

Definition of Entities 4

Executive Summary 5

1.1 Material Entities 9

1.2 Core Business Lines 11

1.3 Material Business Changes 12

1.4 Summary Financial Information 14

1.5 Derivative and Hedging Activities 17

1.6 Memberships in Material Payment, Clearing, and Settlement Systems 18

1.7 Material Supervisory Authorities 19

1.8 Principal Officers 20

1.9 Resolution Planning Corporate Governance 22

1.10 High-Level Description of Resolution Strategy 23

1.11 Acronyms 27

Public Section

Resolution Plan

3

Definition of Entities

The following entities are referred to throughout the document.

Acronym Definition

"Santander" or "Santander Group" or "Group" Includes all Santander operations globally.

"BSSA" or "Parent" Banco Santander, S.A.

"Santander US" Santander Group’s U.S. Operations; includes all Santander operations in the U.S.

"SHUSA IHC" or "U.S. IHC" Santander Holdings USA, Inc. consolidated with all of its subsidiaries.

"SHUSA" Santander Holdings USA, Inc.

"SBNA" or the "Bank" Santander Bank, N.A.

"SC" Santander Consumer USA.

"SGT" Santander Global Technology.

"BSI" Banco Santander International.

"BSNY" or "Branch" Banco Santander, S.A. New York Branch.

"SIS NY" Santander Investment Securities, Inc.

"SSLLC" Santander Securities LLC.

"STUSA" Santander Technology USA, LLC.

"APS" Amherst Pierpont Securities, LLC.

"Factories" BSSA's wholly-owned global shared service entities.

"Aquanima" U.S. Subsidiary of the Aquanima Group is NW Services, Co. referred to as "Aquanima" throughout this Plan.

"Subsidiaries" Santander Holdings USA, Inc. consolidated subsidiaries and branches.

Public Section

Resolution Plan

4

Executive Summary

U.S. Resolution Plan

Banco Santander, S.A. (“BSSA”) has developed this resolution plan (the “Plan” or "Resolution Plan") for

its U.S. operations as required under Title I, Section 165(d) of the Dodd-Frank Wall Street Reform and

Consumer Protection Act (“Dodd-Frank Act”) and the regulations jointly promulgated by the Board of

Governors of the Federal Reserve System (the “FRS”) at 12 C.F.R. Part 243 and the Federal Deposit

Insurance Corporation (“FDIC”) at 12 C.F.R. Part 381 (the Systemically Important Financial Institution

Rule ("SIFI Rule")).

In October 2019, the Federal Reserve Board ("FRB") finalized the tailoring of post-crisis regulatory

framework for large, domestic banking institutions known as Enhanced Prudential Standards ("EPS") in

the U.S. The framework prescribes materially less stringent requirements on firms with less risk, while

maintaining the most stringent requirements for firms that pose the greatest risks to the financial system

and the economy. The final rules tailor the EPS to match the overall risk profiles of large domestic and

foreign banks. The rule is largely consistent with the asset size thresholds laid out in in the Economic

Growth, Regulatory Relief, and Consumer Protection Act ("EGRRCPA"). In a complementary rule making,

the FRB and Federal Deposit Insurance Corporation ("FDIC") also tailored requirements related to

recovery and resolution plans in a similar manner. Under the new framework, SHUSA has been

designated as a Category IV financial institution (lowest risk non-systemic U.S. Intermediate Holding

Company ("IHC") of a non-U.S. Global Systemically Important Bank ("GSIB")) and is accordingly subject

to materially less stringent requirements in the U.S. Under the amended rule, Category IV filers such as

Santander, are required to submit reduced content resolution plans every three years focusing on material

changes since the last submission and the impact of such changes on the orderly resolution of U.S.

based operations.

BSSA, a global banking organization headquartered in Madrid, Spain, is a bank holding company under

the Bank Holding Company Act of 1956 and has elected to be treated as a financial holding company

pursuant to the Gramm-Leach-Bliley Act of 1999. Santander is the “Covered Company” for the purposes

of this Plan. The legal entity structure of Santander in the United States is a reflection of its business

model based on independent subsidiaries, as explained later in this Plan.

Consistent with the SIFI Rule, this Plan addresses Santander Group's U.S. operations ("Santander US"),

which are conducted primarily through the Material Entities ("MEs") set forth and described in Section 1.1,

and the Core Business Lines ("CBLs") described in Section 1.2.

This Resolution Plan identifies and evaluates the CBLs and MEs of Santander's U.S. operations and

presents strategies for their rapid and orderly resolution. None of Santander's U.S. business activities

meets the standard of a "Critical Operation” (“CO”) as defined in the SIFI Rule, nor do any of these

business activities dominate their respective markets; an interruption or termination of these activities

would not materially disrupt these markets. Therefore, a resolution of Santander US's operations would

not pose any systemic risk to the U.S. financial system or economy.

In addition to the MEs identified in Section 1.1, Santander owns, directly or indirectly, the following

subsidiaries or branches: Santander Investment Securities Inc. ("SIS NY"), a New York broker-dealer

regulated by the Securities and Exchange Commission ("SEC") and the Financial Industry Regulatory

Authority (“FINRA”) that is subject to resolution as a member of the Securities Investor Protection

Corporation ("SIPC"); Banco Santander International ("BSI"), an Edge corporation based in Miami,

Florida, subject to supervision by the FRB; and Santander Securities, LLC ("SSLLC"), a broker-dealer

subject to SEC and FINRA supervision and a member of the SIPC.

Santander's U.S. operations do not have any foreign subsidiaries or offices and no material components

of Santander’s U.S. operations are based outside the United States.

Public Section

Resolution Plan

5

In accordance with the SIFI Rule, this Plan does not address resolution strategies for entities not

identified as MEs or subject to U.S. resolution regimes. Information in this Plan is as of December 31,

2021, unless otherwise indicated.

Santander Group

The structure of the Santander Group in the United States is a reflection of its business model of

autonomous and globally-diversified subsidiaries.

• The Group’s activities are divided first by geographic areas, in such a way that each major local

market comprises a business unit (e.g., the U.S., Brazil, the United Kingdom ("U.K."), Portugal,

and Poland).

• Legally, the geographic business units are arranged within separate sub-groups of subsidiaries.

In some of the most relevant financial markets (e.g., New York and London), local branches of

business units from other geographic areas may also exist.

• This structure of subsidiaries that are legally independent is essential to fully identify and

appropriately separate the different relationships, with respect to, for example, capital, financing,

lending, servicing, and custody within the Group.

• Financially, each local sub-group is required to measure, control, and manage its capital and

liquidity needs commensurate with its activities and local regulatory expectations and without

regular reliance on other Santander affiliates or BSSA.

• From a technological and operational view, each local sub-group uses its own resources,

contracts with third parties, and/or obtains these services from the Group’s "Factories." Factories

are affiliates that provide certain core services such as software programming and network

infrastructure.

This business model provides necessary financial and legal segregation of assets and services,

encourages disciplined management responsive to local regulation and customer expectations, and

promotes financial flexibility for the Group through globally diversified income streams. This model also

acts as a firewall in preventing the spread of financial issues in one jurisdiction to the other jurisdictions

within the Group.

Accordingly, the Group’s organizational structure permits clear and precise distinction between the main

business units. This also makes it possible to separate particular units from the rest of the Group if the

intention was to dispose of any particular unit or should it be necessary to isolate any unit in the case of a

resolution scenario according to the Multiple Points of Entry ("MPE") model in resolution terms. In this

sense, the structure of the Group mitigates the potential for financial contagion among the Group's

globally-dispersed banking units and reduces the potential for systemic risk.

This structure makes the MPE approach the most appropriate resolution strategy for the Santander

Group. Under this approach, separate resolution actions may be taken at Santander's operating

subsidiaries that would be coordinated by the Crisis Management Group ("CMG"). The CMG would

include the appropriate supervisors, central banks, resolution authorities, finance ministries, and public

authorities in jurisdictions that are home or host to entities that are material to Santander Group’s

resolution. This would allow for the orderly resolution of each of the subsidiaries under applicable national

laws and regulations with cross-border cooperation but would limit the risk of jurisdictional conflict. The

CMG meets annually to discuss resolution considerations for the Group and its global affiliates and

includes participants from regulatory agencies of each jurisdiction in which Santander operates.

Public Section

Resolution Plan

6

Santander Group Business Model

The Santander Group is primarily a retail and commercial banking group based in Spain, with a presence

in core markets including: Spain, the U.K., Germany, Poland, Portugal, U.S., Brazil, Mexico, Argentina,

Uruguay and Chile. Santander had EUR 1,595bn in assets, 153mm customers, 10,000 branches, and

197 thousand employees as of December 2021.

The operating business units of the Santander Group are structured in two levels:

• Principal (or geographic) level: Geographic areas segment the activity of the Group’s operating

units. This coincides with the Group’s first level of management and reflects Santander Group’s

positioning in three of the world’s main currency areas (euro, sterling, and dollar). These

segments are:

◦ Continental Europe: This includes all retail banking business, wholesale banking, and asset

management and insurance conducted in this region.

◦ U.S.: This includes the businesses of Santander Bank N.A. ("SBNA"), Santander Consumer

USA, Inc. ("SC") and all other businesses in the U.S.

◦ U.K.: This includes retail and wholesale banking as well as asset management and insurance

conducted by the various units and branches of the Group in the U.K.

◦ Latin America: This includes all of the Group’s financial activities conducted through several

banks and other subsidiaries in the region.

• Secondary (or business) level: This categorizes the activity of the operating units by type of

business. The segments are retail banking, wholesale banking, and asset management and

insurance.

◦ Retail Banking: This includes all consumer banking businesses, including private banking

(global corporate banking, which is coordinated through the Santander Group’s global

customer relationship model, is excluded).

◦ Global Wholesale Banking: This business reflects revenues from global corporate banking,

investment banking, and markets worldwide, including all treasuries managed globally (both

trading and distribution to customers), as well as the equities business.

◦ Asset Management and Insurance: This includes the contribution of the various units to the

Group in the design and management of mutual and pension funds and insurance. The

Group uses, and remunerates through agreements, the retail networks that place these

products.

Corporate-Level Resolution Planning

Santander’s planning for resolution is subject to the overarching framework of the European Union's Bank

Recovery and Resolution Directive ("BRRD"), published on May 15, 2014.

The BRRD establishes a European Union-wide crisis management framework for 28 jurisdictions which

provides for preparatory and preventive measures, early intervention procedures, and resolution

procedures and tools. In this respect, the BRRD constitutes a key element of the EU resolution

architecture, together with Regulation (EU) No 806/2014, which established the Single Resolution

Mechanism ("SRM"). The SRM is made up of the Single Resolution Board ("SRB") and the Single

Resolution Fund ("SRF").

Public Section

Resolution Plan

7

Spanish Law, in alignment with the BRRD, envisions cooperation with third-country authorities through so-

called "resolution colleges", both in the phases leading up to resolution and in the event of resolution. In

addition, the Spanish Law assigns the roles of national supervisor and national preventive resolution

authority (i.e., development of resolution plans) to the Bank of Spain, while the Fund for Orderly Bank

Restructuring (“FROB”) assumes the role of national executive resolution authority (i.e., execution of the

resolution plan). Both the Bank of Spain and the FROB take part in the SRB to coordinate the resolution

procedures with member-state authorities and third-country authorities through resolution colleges.

In addition to general coordination in the event of resolution, the value of Santander and each of its

Factories is dependent upon the continuation of services provided by the Factories to SBNA and other

banks within the Santander Group. Revenues from SBNA and numerous other businesses in the Group

are a material source of value for the Factories. The value of Santander’s ownership interest in SBNA is

enhanced by the continuation of the services provided by the Factories. Accordingly, it is in the best

interests of the FROB as administrator, both in terms of economic benefit to Santander and in the

interests of avoiding disruptions and limiting contagion to other financial institutions, to take steps to

assure the continuation of those services.

Banco Santander Resolution

Santander Group's model of independent affiliates makes the likelihood of Santander going into resolution

remote. Pursuant to the Spanish Law, in the event that early intervention measures prove insufficient to

limit any significant financial distress experienced by the institution and Santander were to enter

resolution simultaneously with Santander US, the European Central Bank ("ECB") in prior consultation

with the Bank of Spain (in its role as preventive resolution authority) would determine whether the

conditions for resolution have been met. The results of this assessment would be communicated without

delay to the SRB and the FROB. Notwithstanding this procedure, the SRB can also, on its own initiative,

require the ECB to issue an assessment within a period of three days after the petition is made.

Once it has been determined that an institution meets the conditions for resolution, the SRB would

develop a resolution scheme containing the procedures and resolution tools, including any resources to

the Single Resolution Fund that would be executed by the FROB. This resolution scheme would be

derived from the resolution plan but tailored to the specific circumstances of the institution entering into

resolution. In accordance with the Spanish Law, it can be expected that during a resolution action, the

Board of Directors or equivalent body of Santander could be replaced and the FROB would be designated

as the administrator of the institution. The FROB would, in turn, appoint the individuals who, on its behalf,

would exercise the functions and powers necessary for day-to-day operations of the institution, including

all of the powers inherent in the Board of Directors and at the shareholders’ meeting.

The SRB's preferred resolution strategy for the Group contemplates multiple points of entry for the

resolution of the entire Santander Group. Given the potential adverse effects the liquidation of the Group's

European-based banks could have on the real economies in which it operates, a bail-in resolution is

expected, thus allowing operating entities to continue business activities. Outside of Europe, the SRB

defers identification of an appropriate resolution strategy to each of the relevant resolution authorities in

their respective jurisdictions. This includes Santander's U.S. operations which would be resolved under

U.S Bankruptcy Code (SHUSA and SC) and by the FDIC (SBNA).

Public Section

Resolution Plan

8

1.1 Material Entities

For U.S. resolution planning purposes, Santander has identified the following entities as MEs, which are

defined under the SIFI Rule as "a subsidiary or foreign office of the Covered Company that is significant

to the activities of a critical operation or core business line." The identified MEs are listed below.

Santander Holdings USA, Inc. ("SHUSA")

SHUSA is a wholly-owned subsidiary of Santander and the U.S. intermediate holding company ("IHC") for

Santander's U.S. subsidiary activities. In order to comply with the U.S. Enhanced Prudential Standards

("EPS") for Foreign Banking Organizations ("FBOs"), Santander restructured the ownership of its U.S.

domiciled subsidiaries and elected SHUSA to become its U.S. IHC. In conjunction with this conversion,

most of Santander's U.S. legal entities were realigned under SHUSA. SHUSA’s principal executive offices

are located at 75 State Street, Boston, Massachusetts.

Santander Bank, N.A.

SBNA is a national banking association with its home office in Wilmington, DE and its headquarters in

Boston, MA, with a primary presence in the U.S. Northeast region. SBNA is focused on providing banking

products and services to consumers, businesses, large corporations, and institutions.

SBNA's primary business consists of attracting deposits from its network of retail branches and originating

small business, middle market, large and global commercial loans, multifamily loans, and auto and other

consumer loans in the communities served by those offices. As of December 31, 2021, SBNA had

approximately $102bn in deposits and more than $53bn in loans and leases.

Santander Consumer USA Inc.

SC is a specialized consumer finance company headquartered in Dallas, Texas, and engages in the

purchase, securitization, and servicing of Retail Installment Contracts ("RICs") originated by automobile

dealers and direct origination of retail installment contracts. SC is a subsidiary of SHUSA, which

maintains 100% ownership.

Santander Technology USA, LLC ("STUSA")

During 2017, BSSA implemented a new IT operating model in which it transitioned the responsibility for

procuring and providing certain IT services to the various Santander Group entities. In support of this new

model, in Q1 2018, a new SBNA subsidiary, STUSA, was established to house the local U.S. technology

assets, employees, and third-party contracts that were transferred from Isban and Produban. Local assets

were classified as those for which there were no identified synergies between two or more banks of

Santander Group. In contrast, global assets were identified as those that are strategic for Santander

Group or assets for whom synergies between two or more banks of the Group were identified.

BSSA NY Branch

As part of the Santander US strategy to develop its market position with global corporate clients, since

2018 U.S. Corporate and Investment Banking ("CIB") has undergone a transformation wherein BSNY

materially supports CIB's activities in the U.S. BSNY has increased its capabilities for repo activity,

commercial paper and transaction banking products to support the growth strategy for CIB in the U.S.

BSNY conducts market activities related to rates and currency derivatives with clients, and lending, trade

and cash management activities with the CIB U.S. client base (predominantly investment grade corporate

clients).

Public Section

Resolution Plan

9

Amherst Pierpont Securities, LLC ("APS")

APS is an independent broker dealer and investment bank operating predominantly in the fixed income

capital markets. APS provides institutional and middle market clients with access to a broad range of fixed

income products including mortgage products, investment grade credit, U.S. Government and federal

agency securities and structured products banking and advisory services. APS is a registered broker-

dealer under the Securities Exchange Act of 1934 and is a member of the FINRA and is also registered as

an introducing broker with the Commodity Futures Trading Commission and a member of the National

Futures Association.

As of May of 2019, the Federal Reserve Bank of New York ("FRBNY") has designated APS as one of 24

Primary Dealers acting as a direct trading counterparty to the FRBNY.

The Factories

The following two entities, the "Factories," are affiliates of Santander that provide a core set of services to

Santander's global banking subsidiaries. The Factories are legally independent of any bank within the

Group, have their own capital, are self-financed through income received primarily from internal bank

customers, and provide services under detailed, arm's-length contracts for each service provided. The

resolution strategies for SBNA and SHUSA consider, as a key element, the continuity of the services

provided by the Factories.

Santander Global Technology ("SGT")

SGT is organized as a centralized, wholly-owned operational subsidiary of Santander, headquartered in

Madrid, Spain, with the support of localized branches and/or subsidiaries across the primary geographies

in which Santander conducts business.

SGT provides software related services and the management of systems, infrastructure and other type of

hardware. It is responsible for the development and implementation of proprietary software, integration of

third-party solutions and maintenance of applications that ensure the proper operations of the Groups’

banks and businesses, as well as providing standardized management of software production and IT

infrastructure (i.e.: data centers).

NW Services, Co. ("Aquanima")

Aquanima focuses its business activities on the provision of services as a central buying entity and on the

negotiation of service and supply agreements for its customers. Aquanima provides contract

management, vendor onboarding and tactical procurement support within the U.S.

Public Section

Resolution Plan

10

1.2 Core Business Lines

The SIFI Rule defines CBLs as those "business lines of a Covered Company, including associated

operations, services, functions, and support that, in the view of the Covered Company, upon failure would

result in a material loss of revenue, profit, or franchise value.”

Based on these criteria, Santander identified five CBLs in the U.S.: Consumer and Business Banking

("CBB"), Corporate and Commercial Banking ("CCB"), Commercial Real Estate and Vehicle Finance

("CREVF"), CIB, and SC Vehicle Finance.

• Consumer and Business Banking: CBB is primarily comprised of SBNA's branch locations. The

branch locations offer a wide range of products and services to customers, and attract deposits

by offering a variety of deposit instruments, including demand and interest-bearing demand

deposit accounts, money market and savings accounts, CDs, and retirement savings products.

The branch locations also offer consumer loans, such as credit cards, as well as business

banking and small business loans to individuals. CBB also includes investment services and

provides annuities, mutual funds, managed monies, and insurance products, and acts as an

investment brokerage agent to customers.

• Corporate and Commercial Banking: CCB offers commercial loans and related commercial

deposits. This CBL also provides financing and deposits for government entities.

• Commercial Real Estate and Vehicle Finance: CREVF primarily offers commercial real estate

loans and multifamily loans. CREVF also finances commercial vehicles with equipment owned or

operated by a city or county.

• Corporate and Investment Banking: CIB serves the needs of global commercial and institutional

customers by leveraging the international footprint of Santander to provide financing and banking

services to corporates and institutional clients. CIB's offerings and strategy are based on

Santander's local and global capabilities in wholesale banking.

• SC Vehicle Finance: SC Vehicle Finance is a full-service specialized consumer finance company

focused on vehicle finance and third-party servicing. SC's primary business is the indirect

origination and servicing of RICs and leases, principally through manufacturer-franchised dealers

in connection with their sale of new and used vehicles to retail consumers. Santander Auto

Finance ("SAF") is SC’s primary vehicle financing brand, and is available as a finance option for

automotive dealers across the United States. Since May 2013, under the master private-label

financing agreement ("MPLFA") with Stellantis, SC has operated as Stellantis's preferred provider

for consumer loans, leases, and dealer loans and provides services to Stellantis customers and

dealers under the Chrysler Capital ("CCAP") brand. These products and services include

consumer RICs and leases, as well as dealer loans for inventory, construction, real estate,

working capital and revolving lines of credit.

Public Section

Resolution Plan

11

1.3 Material Business Changes

This section discusses material business changes at Santander US since the 2018 Resolution Plan

submission.

Sale of Santander Banco Puerto Rico ("BSPR") Business

On September 1, 2020, SHUSA completed the sale of SBC (the holding company that included BSPR) to

FirstBank Puerto Rico. FirstBank did not acquire Santander Financial Services (“SFS”) and Santander

Securities (“SSLLC”), both subsidiaries of SHUSA, nor Santander Asset Management (“SAM”) (a

subsidiary of SFS). In addition, FirstBank did not acquire nonperforming assets in BSPR and therefore

these were sold to SFS prior to closing.

Exit from Bluestem Personal Lending

During Q1 2021, SC completed the sale of the Bluestem personal lending portfolio to a third party. In

addition, SC executed a forward flow sale agreement with a third party to purchase new advances of all

personal lending receivables that SC purchases from Bluestem through the term of the agreement with

Bluestem.

Crédit Agricole Corporate and Investment Bank, S.A. Acquisition

In March of 2021, SHUSA (through its BSI subsidiary) announced that it has reached an agreement with

Crédit Agricole Corporate and Investment Bank, S.A. to take over management of up to $4.3bn in global

wealth management client assets and liabilities. The transaction closed in Q2 2021.

SC Buyout of Minority Interest

In December 31, 2021, SC was approximately 80.2% owned by SHUSA and 19.8% by other

shareholders. In August 2021, SHUSA entered into a definitive agreement to acquire all of the outstanding

shares of SC common stock not already owned by SHUSA via an all-cash tender offer. The transaction

was completed on January 31, 2022, at which time SHUSA acquired the remaining non-controlling

interest in SC and SC became a wholly-owned subsidiary of SHUSA.

OneAuto

The privatization of SC advanced SHUSA's strategic plan to become a full spectrum Auto Finance

business in the U.S. ("OneAuto"). The OneAuto strategy will provide operational efficiencies between SC

and SBNA existing auto business. Once fully implemented, the OneAuto strategy will leverage SC’s auto

expertise and scale with SBNA’s low-cost deposit funding to develop a comprehensive, market

competitive auto platform. The net impact is improved profitability with a larger auto balance sheet at

SBNA while constraining balance sheet growth at SC.

Exit from Residential Mortgage Business

As of February 2022, SBNA discontinued new mortgage and home equity originations, exiting the

business.

Purchase of APS

SHUSA acquired APS on April 11, 2022. APS will be a part of the CIB business that will transform CIB's

structuring and distribution capabilities in fixed income capital markets and securitized products.

Completion of the acquisition will significantly enhance CIB’s infrastructure and capabilities in market

making of U.S. fixed income capital markets, provide a platform for self-clearing of fixed income

securities, grows institutional client footprint, and expand structuring and advisory capabilities for asset

originators in the real estate and specialty finance markets. The acquisition creates a comprehensive

Public Section

Resolution Plan

12

suite of fixed income and debt products and services. Eventually, in the later stages of integration, SIS

and APS would be merged into a single broker-dealer supporting the CIB business.

Stellantis

Since May 2013, under the Master Private Label Financing Agreement ("MPLFA") with Stellantis, SC

operated as Stellantis's preferred provider for consumer loans, leases, and dealer loans and provides

services to Stellantis customers and dealers under the CCAP brand. These products and services include

consumer retail installment contracts and leases, as well as dealer loans for inventory, construction, real

estate, working capital and revolving lines of credit. In June 2019, SC entered into an amendment to the

MPLFA which modified that agreement to, among other things, adjust certain performance metrics,

exclusivity commitments and payment provisions. The amended contract establishes an operating

framework for the remainder of its 2023 term. Further in April 2022, both parties agreed to extend the

MPLFA through 2025.

Public Section

Resolution Plan

13

1.4 Summary Financial Information

For purposes of resolution planning, Santander has created consolidated financial information for

Santander US. Accordingly, financial information may not wholly correspond with Santander's public

financial reporting because Santander publicly reports information of its legally consolidated entities. In

addition, the financial information may not wholly correspond to the reports that Santander has provided

to the FRB because certain Santander subsidiaries that are engaged in activities in the U.S. are exempt

from such filings.

The financial information representing the consolidated balance sheet for Santander US, is included

below.

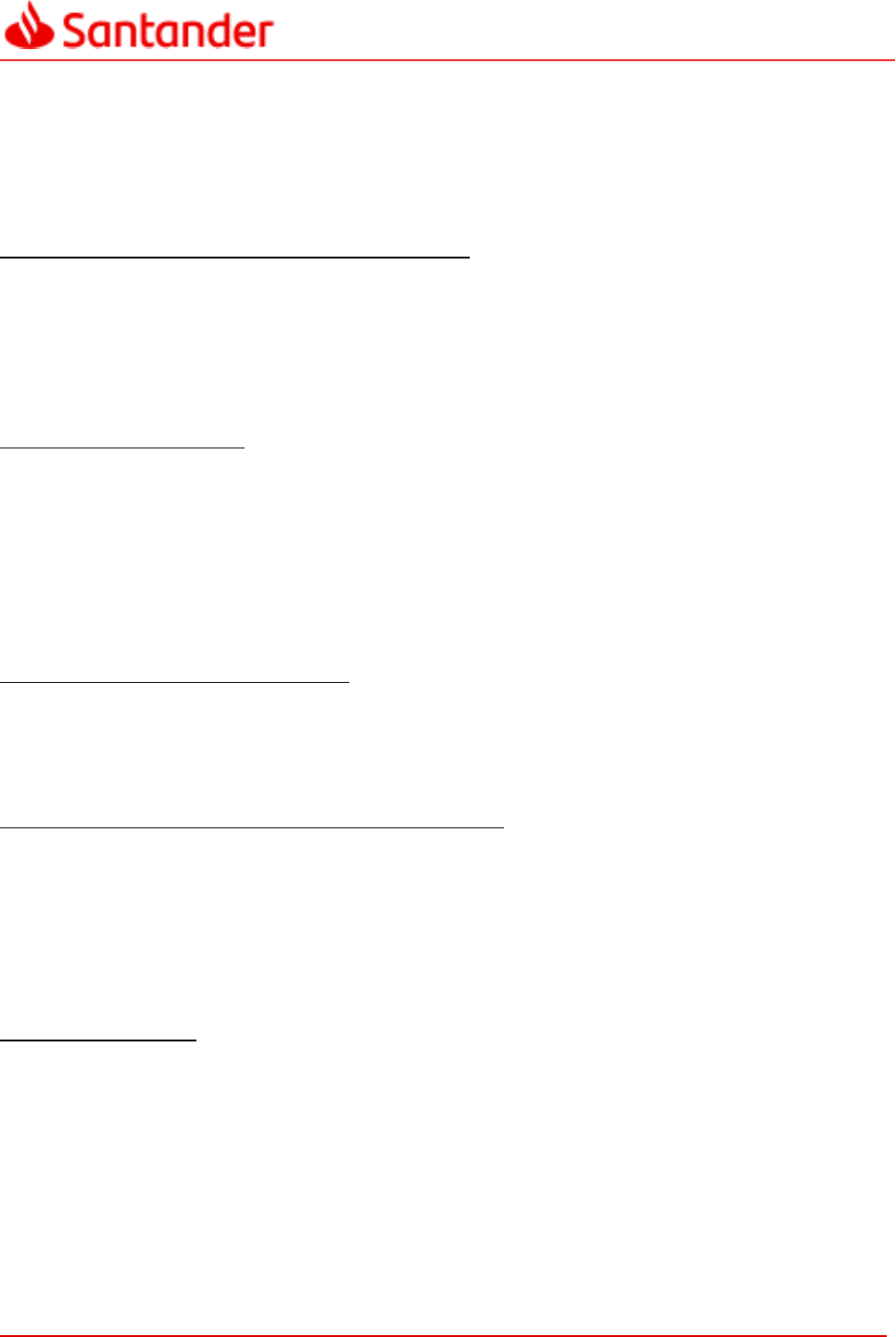

Exhibit 1.1 Santander US Consolidated Balance Sheet as of December 31, 2021

Cash and Cash Equivalents 27,792

Federal Funds Sold and Securities Purchased Under Agreements to Resell 5,346

Investment Securities 19,252

Loans Held-for-Investment 103,249

Allowance for Loan and Lease Losses (6,483)

Loans Held-for-Sale 255

Premises and Equipment, Net 856

Operating Leases, Net 15,406

Accrued Interest Receivable 482

Equity Method Investments 260

Goodwill 2,596

Other Assets 17,934

Total Assets 186,945

Accrued Expenses and Payables 1,015

Deposits and Other Customer Accounts 104,188

Federal Funds Purchased and Securities Sold Under Repurchase Agreements 5,259

Borrowings and Other Debt Obligations 42,905

Advance Payments by Borrowers for Taxes and Insurance 143

Deferred Tax Liabilities, Net 771

Other Liabilities 7,439

Total Liabilities 161,720

Preferred Stock —

Common Stock and Paid-In Capital 17,876

Accumulated Other Comprehensive Gain (Loss) (188)

Retained Earnings 5,584

Total SHUSA Stockholder's Equity 23,272

Non-controlling Interest 1,953

Total Stockholder's Equity 25,225

Total Liabilities & Stockholder's Equity 186,945

Balance Sheet (Santander US Consolidated) ($mm)

Production of financial statement information for purposes of resolution planning involves consolidating

financial information on entities that are part of Santander US. Consolidation activities are based on the

aggregation of asset and liability values in addition to the removal of related intercompany transactions.

To arrive at values for Santander US, consolidation activities occur across all of the entities that operate

within the U.S.

Public Section

Resolution Plan

14

Capital

Capital is held within SHUSA, SBNA and SC, the primary legal entities discussed in the Resolution Plan.

SHUSA is the intermediate holding company for Santander's U.S. operations and, under the FRB

regulations, is required to prepare an annual Capital Plan. SHUSA is required to maintain prescribed

regulatory capital ratios in accordance with FRB requirements.

SHUSA maintains capital levels to ensure the safety and soundness of the institution, support its business

plans, anticipate the impact of adverse economic conditions, and meet current and anticipated regulatory

requirements. Capital expectations are set for capital ratios that are based on SHUSA's risk-weighted

assets and average assets.

The following exhibit shows SHUSA's consolidated capital ratios as of December 31, 2021.

Exhibit 1.2 SHUSA Consolidated Capital Ratios as of December 31, 2021

Capital Type ($bn)

Common Equity Tier 1 Capital 21

Tier 1 Capital 23

Tier 2 Capital 25

Total Risk Based Capital 49

Total Risk Weighted Assets 112

Ratios (%)

Common Equity Tier 1 ("CET1") Ratio 18.8 %

Tier 1 Capital ("T1C") Ratio 20.7 %

Total Capital ("TC") Ratio 22.7 %

Tier 1 Leverage ("T1L") Ratio 15.0 %

SHUSA maintains “well capitalized” capital ratios under the FRB’s requirements. SHUSA’s Tier 1 common

ratio is well above the regulatory minimum. SHUSA and its subsidiaries maintain internal capital targets

that are well above applicable regulatory minimums.

SHUSA's primary sources of funding are debt issuances, capital distributions and dividends from SBNA,

SC, and BSI, respectively, capital contributions from Santander from time to time, and borrowings.

The following exhibit shows SHUSA’s consolidated borrowings and debt obligations profile as of

December 31, 2021.

Public Section

Resolution Plan

15

Exhibit 1.3 SHUSA and Other Subsidiaries' Debt Obligations Breakdown as of December 31, 2021

Balance (in thousands) Effective Rate

Parent Company

4.45% Senior Notes due December 2021 0 — %

3.70% Senior Notes due March 2022 706,819 3.67 %

Senior Notes due June 2022 0 — %

Senior Notes due January 2023 720,947 1.28 %

3.40% Senior Notes due January 2023 998,599 3.54 %

5.83% Senior Notes due March 2023 0 — %

3.50% Senior Notes due April 2023 447,107 3.52 %

Senior Notes due July 2023 439,085 1.29 %

2.88% Senior Notes due January 2024 750,000 2.88 %

3.50% Senior Notes due June 2024 997,610 3.60 %

3.45% Senior Notes due June 2025 995,983 3.58 %

4.50% Senior Notes due July 2025 1,097,667 4.56 %

3.24% Senior Notes due November 2026 918,851 3.97 %

4.40% Senior Notes due July 2027 1,049,565 4.40 %

2.88% Subordinate Note, due November 2031 500,000 2.88 %

Short-term borrowing due within one year, with an affiliate 0 — %

Subsidiaries

2.00% Subordinated Debt Maturing through 2040 11 2.00 %

Short-term Borrowing with an affiliate, maturing January 2021 0 — %

Short-term Borrowing due within one year, maturing January 2022 57,365 0.05 %

Total Parent Company and Subsidiaries' Borrowings and Other Debt Obligations 9,679,609 3.44 %

The table below reflects SHUSA's debt maturity structure as of December 31, 2021.

Exhibit 1.4 SHUSA Consolidated Debt Schedule as of December 31, 2021

Debt Schedule ($mm)

2022 1,191

2023 8,422

2024 10,698

2025 8,767

2026 5,137

Thereafter 6,918

Total Long-Term Debt 41,133

Public Section

Resolution Plan

16

1.5 Derivative and Hedging Activities

In the United States, Santander US MEs engage in derivatives activities for balance sheet-related interest

rate risk hedging purposes and to meet customer needs. None of Santander US MEs is a market maker

in derivative products nor do any Santander US ME use derivatives for speculative purposes.

As part of their overall risk hedging strategies, Santander US MEs use derivative contracts as hedges to

help manage exposure to interest rate, foreign exchange, equity and credit risk, as well as to reduce the

effects that changes in interest rates may have on net income, the fair value of assets and liabilities, and

cash flows.

The majority of derivatives that are not designated as accounting hedges under Generally Accepted

Accounting Principles ("GAAP") are customer-related derivatives relating to foreign exchange and lending

arrangements, as well as derivatives to hedge interest rate risk on SC's secured structured financings and

the borrowings under its revolving credit facilities.

SBNA offers derivative products to its customers based on each customer’s needs. When a customer

request for a derivative product is received, SBNA executes the transaction with the customer, if

appropriate. In addition, SBNA enters into an offsetting derivative transaction with the market to

immediately eliminate the risk of the position on the Bank’s balance sheet.

Public Section

Resolution Plan

17

1.6 Memberships in Material Payment, Clearing, and

Settlement Systems

Santander US MEs maintain membership in various Financial Market Utilities ("FMUs"), or access them

through Financial Intermediaries ("FIs"), in order to facilitate payment, clearing, and settlement activities.

FMUs allow SHUSA, SBNA and SC to conduct financial transactions, provide payment services, perform

derivatives transactions as needed to manage risk, and meet the needs of customers and clients.

SHUSA does not maintain membership in FMUs or directly engage FIs for access to FMUs. Instead,

SBNA, through its FMU and FI relationships provides these services to SHUSA when necessary. SHUSA

utilizes Deutsche Bank as a FI for its debt servicing requirements.

SBNA leverages the Federal Reserve's suite of financial services for all payment activity, including

Fedwire payments, check clearing, and ACH network payments. SBNA maintains a relationship with Bank

of New York Mellon ("BoNY Mellon") which provides settlement and custody services for the Bank’s

securities transactions as well as a relationship with UBS Securities for the clearance of interest rate

derivative transactions.

SC maintains operating account relationship with Santander Bank And JPMorgan Chase. These banks

provide access to Fedwire, ACH, and CHIPS for the wiring of payments related to daily operations and

loan fundings. SC also has a relationship with BoNY Mellon which provides post-trade clearance,

settlement of securities transactions, and serves as securities intermediary concerning derivative initial

margin.

BSNY maintains a relationship with BoNY Mellon which provides settlement and custody services for the

securities transactions. Additionally, BSNY is a member of the DTCC and FICC. BSNY maintains a

relationship with Bank of America for the clearance of interest rate derivative transactions.

Public Section

Resolution Plan

18

1.7 Material Supervisory Authorities

As a Spanish financial services company, Santander is subject to prudential supervision by the Bank of

Spain. If Santander were to be resolved or taken over in the event of a failure the Bank of Spain, in

coordination with the SRB, would designate the FROB as a “special manager” to assume control of

Santander and its domestic subsidiaries. Santander’s foreign subsidiaries, including those based in the

U.S., are also subject to local laws, regulations, and supervision administered by the regulators in those

countries. Santander’s U.S. operations are subject to the extensive regulatory framework applicable to

bank holding companies, banks, and U.S. branches of foreign banks.

Since Santander is a financial holding company with subsidiaries located in the U.S., its U.S. operations

are subject to the supervision and regulation of the FRB, as is SHUSA, the intermediate holding company

of Santander's U.S. operations. As a SEC registrant, SHUSA is also subject to applicable SEC regulations

and financial reporting and filing requirements.

As a national bank, SBNA is subject to primary regulation, supervision and examination by the Officer of

the Comptroller of the Currency ("OCC"), and to additional banking regulation by the FDIC and the FRB.

In addition, the Consumer Financial Protection Bureau (“CFPB”) regulates SBNA's consumer financial

products and services.

SC is subject to supervision by the FRB, the CFPB, and the Federal Trade Commission.

BSNY is subject to the supervision of the FRB and the New York Department of Financial Services.

APS is subject to regulation and supervision by the SEC and FINRA with respect to their securities

activities.

Santander’s other U.S. subsidiaries are also subject to various laws and regulations, as well as

supervision and examination by other regulators, all of which directly or indirectly affect its operations and

management and its ability to make distributions to stockholders. Additional relevant information can be

found in SHUSA’s Annual Report on Form 10-K for 2021 filed with the SEC.

Public Section

Resolution Plan

19

1.8 Principal Officers

The key individuals who comprise SHUSA’s management and are responsible for its activities and

direction as of April 30, 2022, are reflected in the exhibit below:

Exhibit 1.5 SHUSA Principal Officers as of April 30, 2022

Name Title Legal Entity Employer

Timothy Wennes* Country Head, President and Chief Executive Officer ("CEO") SHUSA

Ashwani Aggarwal* Chief Risk Officer ("CRO") SHUSA

Juan Carlos Alvarez de Soto* Chief Financial Officer ("CFO") SHUSA

Brian Yoshida* Chief Legal Officer / General Secretary SHUSA

Rosilyn Houston* Chief Human Resources Officer SHUSA

Dan Griffiths* Chief Technology Officer SHUSA

Daniel Budington* Chief Strategy Officer SHUSA

*Dual hatted employee with SBNA

The key individuals who comprise SBNA’s management and are responsible for its activities and direction

as of April 30, 2022, are reflected in the exhibit below:

Exhibit 1.6 SBNA Principal Officers as of April 30, 2022

Name Title Legal Entity Employer

Timothy Wennes* Country Head, President and CEO

SHUSA

Pierre Habis Chief Consumer and Digital Banking Transformation Officer

SBNA

Joseph Abruzzo Jr Head of Commercial Banking

SBNA

Michael Lee Head of Commercial Real Estate

SBNA

Marco Achon Head of CIB

BSSA

Mahesh Aditya** Head of Auto

SC

*Dual hatted employee with SHUSA

**Dual hatted employee with SC

The key individuals who comprise SC's management and are responsible for its activities and direction as

of April 30, 2022, are reflected in the exhibit below.

Exhibit 1.7 SC Principal Officers as of April 30, 2022

Name Title Legal Entity Employer

Mahesh Aditya* President and CEO SC

Fahmi Karam* Chief Financial Officer SC

Sandra Rosa Chief Human Resources Officer SC

Donald Smith Chief Technology Officer SC

Christopher Pfirrman* Chief Legal Officer SC

Lakshmana (RL) Prasad Ramamurthy* Chief Risk Officer SC

Bruce Jackson* President, Chrysler Capital SC

Konrad Benginow* Head of Pricing and Strategy SC

Marc Womack* Head of Operations SC

*Dual hatted employee with SBNA

Public Section

Resolution Plan

20

The key individuals who comprise APS's management and are responsible for its activities and direction

as of April 30, 2022, are reflected in the exhibit below.

Exhibit 1.8 APS Principal Officers as of April 30, 2022

Name Title Legal Entity Employer

Joe Walsh CEO APS

Ryan Mullaney President APS

Mike Santangelo CFO APS

Paul Nicholson CRO APS

Darla Bartkowiak Chief Communications Officer APS

Tim Dooley President AP Asset Acquisition, LLC ("APAC")

Scott Pierce Managing Director APS

Alex Fischer General Counsel APS

The key individuals who comprise BSNY’s management and are responsible for its activities and direction

as of June 24, 2022, are reflected in the exhibit below:

Exhibit 1.9 BSNY Principal Officers as of June 24, 2022

Name Title Legal Entity Employer*

Marco Achon Head of Santander CIB BSNY

Pablo Urgoiti Head of Global Debt Finance BSNY

Antonius Arts Head of Global Transaction Banking SBNA

Sergio Lew Head of Banking & Corporate Finance BSNY

Juan Minuesa Head of Markets SIS

Xavier Ruiz Sena Head of CIB Business Management SBNA

Felix Munoz Elorza Head of Finance - CIB BSNY

Jonathan Gottlieb Chief Compliance Officer - CIB BSNY

Carlos Manteiga Bautista Chief Operations Officer - CIB BSNY

Balkrishna Mehra Chief Technology Officer - CIB BSNY

Manuel Rodriguez San Pedro CRO - CIB BSNY

Elizabeth Mannion USA, Sr. Deputy General Counsel SBNA

Christina Yahn Director, Human Resources Business Partner SBNA

*Employees that are employed by BSNY or SIS are dual-hatted with SBNA (and SBNA employees are dual-hatted with BSNY/SIS).

Public Section

Resolution Plan

21

1.9 Resolution Planning Corporate Governance

Governance of this Resolution Plan integrates oversight by key stakeholders and senior executives from

Santander US MEs, CBLs and Shared Services with review and recommendation for approval from

management committees.

Santander has delegated authority for oversight and approval of the Plan to Timothy Wennes, the

Santander US Country Head and CEO of SHUSA. In order to obtain approval from the Santander US

Country Head and CEO of SHUSA, SHUSA's CFO and SHUSA ALCO provides recommendation for

approval of the Plan. Prior to review by the SHUSA ALCO, the Balance Sheet Working Group - USRRP

("BSWG-USRRP") provides oversight and governance.

The BSWG-USRRP and the SHUSA ALCO are the immediate governing bodies for this Plan, and

collectively, they guide the development and provide oversight for the resolution planning process. The

BSWG-USRRP is an ALCO Working Group comprising of senior level subject-matter experts across the

organization. ALCO members include: SHUSA CFO (Chair), SHUSA CEO, SHUSA CRO, SHUSA

Treasurer, SHUSA Chief Market Risk Officer, SC CFO, SIS CFO, and APS CFO.

In addition, the Head of Capital Management and USRRP, and members of the USRRP team regularly

engage senior executives across the organization, as necessary, to facilitate key decisions with respect to

the Resolution Plan and supporting processes. The USRRP team is responsible for day-to-day project

management, coordination of key stakeholders across the MEs, CBLs, and shared services, and

managing timelines for the preparation of this Plan.

Public Section

Resolution Plan

22

1.10 High-Level Description of Resolution Strategy

As required by the SIFI Rule, this Plan assumes that a series of idiosyncratic events causes the failure of

the Covered Company and its U.S. MEs.

This Plan describes a strategy for resolving Santander’s U.S. operations, including its U.S. MEs and the

five CBLs that operate within those MEs, in a manner that would substantially mitigate the risk that the

resolutions would have serious adverse effects on U.S. or global financial stability.

This Plan includes strategies designed to ensure continuity of the CBLs during the hypothetical resolution

of the MEs. The strategies incorporate the importance of continued access to critical services including,

but not limited to, technology, employees, facilities, and supplier relationships.

Under the Plan’s hypothetical resolutions of MEs, SBNA and STUSA would be placed into FDIC

receivership, SHUSA and Aquanima would be placed into bankruptcy under Chapter 7 of the U.S.

Bankruptcy Code, SC would be placed into bankruptcy under Chapter 11 of the U.S. Bankruptcy Code,

BSNY's resolution would be subject to oversight by the Superintendent of the New York State Department

of Financial Services ("NYSDFS"), and APS would be resolved under SIPC receivership or Chapter 11

bankruptcy.

Resolution of SHUSA

In a scenario where SBNA and SC were in resolution, SHUSA would file a voluntary petition under

Chapter 7 of the Bankruptcy Code due to the de minimis value of SHUSA following the appointment of the

FDIC as receiver of SBNA and the filing by SC of a voluntary petition under Chapter 11 of the Bankruptcy

Code. This would result in the appointment of a trustee, who would sell SHUSA's assets, pursue any

avoidance actions permitted under the Bankruptcy Code, and distribute the proceeds derived from the

liquidation to the holders of claims and interests in the priority specified in the Bankruptcy Code.

Resolution of SBNA

SBNA offers a plain-vanilla suite of banking products generally also offered by its competitors within the

footprint it serves as well as by most other regional and national banks. None of SBNA's product offerings

or services dominate the footprint in which SBNA operates. An interruption or termination of the provision

of its products or services would not materially disrupt those markets.

For this Plan, Santander analyzed four resolution strategies for SBNA: an Immediate Whole Bank Sale, a

Delayed Whole Bank Sale, a Multiple Acquirer Strategy ("MAS"), and a Liquidation. In each of these

resolution strategies, the OCC would close SBNA and place it into FDIC receivership at the close of

business on Friday afternoon at the end of idiosyncratic events and a "Runway Period" that occurs over

30 days.

In a resolution scenario, the FDIC would likely determine that the preferred resolution strategy is the

Immediate Whole Bank Sale. The Immediate Whole Bank Sale minimizes execution risk by having assets

and insured deposits immediately transfer to a qualified financial institution with minimal management by

the FDIC. This strategy would also have the quickest final distribution of proceeds to claimants. For a

description of the different resolution strategies, see below.

Immediate Whole Bank Sale

Under the Immediate Whole Bank Sale, FDIC as receiver would enter into a whole-bank purchase and

assumption transaction (“P&A Transaction”) with a qualified financial institution ("Acquiring Institution" or

"AI") over the Resolution Weekend. In this strategy, whole bank bid packages would be prepared during

the Runway Period requesting bids on all of SBNA's assets on an “as is” discounted basis (i.e., no

guarantees). This strategy would benefit the FDIC because the FDIC would have no further financial

Public Section

Resolution Plan

23

obligation to the qualified AI, and it would reduce the amount of assets held by the FDIC for liquidation in

the receivership.

Over the Resolution Weekend, the FDIC would then take the final steps to consummate the P&A

Transaction with the successful bidder and work with the AI’s management and staff to prepare for a

Monday opening so depositors would have access to deposits and a smooth transition would be

completed. The AI would open SBNA's former branches for business on the Monday morning following

the Resolution Weekend and continue to operate the CBLs.

This strategy is achievable in part because there are several potential purchasers with the ability and

strategic rationale to purchase SBNA. The most suitable potential purchasers are banks that have greater

than $100bn in assets, strong capital adequacy, similar business models that would minimize integration

costs, and overlapping or adjacent geographic markets. However, the preferred potential purchasers

could not be so large that the acquisition of SBNA would cause a violation of deposit caps or any other

market concentration limits. As a result, Global Systemically Important Financial Institutions ("G-SIFIs")

were not considered.

Delayed Whole Bank Sale

If SBNA’s sale to a single qualified AI could not be completed over the Resolution Weekend, the strategy

the FDIC would likely determine to be the second preferred strategy is the Delayed Whole Bank Sale.

Under this strategy, the FDIC would establish a bridge depository institution ("Bridge Bank") under Section

11(n) of the FDIA and, as receiver, enter into a P&A transaction with the Bridge Bank over the Resolution

Weekend in anticipation of a subsequent whole bank sale to a qualified AI. In this strategy, the FDIC

would open the Bridge Bank on the Monday following the Resolution Weekend in order for insured

depositors to access their deposits and to operate the Bridge Bank before consummating a sale to a third

party in approximately ninety days.

Because of the similarities between an Immediate Whole Bank Sale and a Delayed Whole Bank Sale, the

potential purchasers for this strategy would have a profile similar to the purchaser profiles described

above.

Multiple Acquirer Strategy

The MAS presents an alternative method of resolving SBNA in resolution. Based on guidance published

by the FDIC in December 2014, SBNA analyzed a MAS whereby the Bridge Bank would divest or unwind

a sizable portion of its operations and would execute an IPO for the remaining entity.

The MAS contemplated by this Plan would be accomplished through the establishment of a Bridge Bank

that would acquire, in a whole-bank P&A Transaction, all of the assets of SBNA remaining at the end of

the Runway Period but only the insured deposits. The size of the Bridge Bank would be reduced through

the sale and runoff of certain lines of business. The proceeds from these actions would be distributed to

the receivership as long as the Bridge Bank maintained healthy capital and liquidity levels. If a distribution

would cause the capital or liquidity to fall below a healthy level, the cash would remain on the Bridge

Bank's balance sheet.

After these sales, the Bridge Bank would operate as a retail and commercial bank that would be

sufficiently capitalized. This retail and commercial bank would then go through the IPO process. At the

culmination of the IPO process, the FDIC would issue ownership interest in the Bridge Bank through a

stock sale to the public.

The profile of potential purchasers of assets and businesses from the Bridge Bank prior to the IPO is

similar to that for the Whole Bank sales. However, the list of potential purchasers is larger than for a

Whole Bank Sale because regulatory issues and business model issues are reduced when buying assets

and lines of business since there are no deposits being assumed.

Public Section

Resolution Plan

24

Liquidation

If SBNA could not be resolved by the FDIC in an Immediate Whole Bank Sale, Delayed Whole Bank Sale,

or through a MAS, the FDIC could close SBNA over Resolution Weekend and pay depositors the amount

of their insured deposits immediately following Resolution Weekend. In its receivership capacity, the FDIC

could liquidate all of its assets to pay claims against the receivership.

The profile of potential purchasers for SBNA's lines of business or portfolios under the Liquidation

strategy is similar to that for the Whole Bank Sales. However, the list of potential purchasers for the

Liquidation strategy is larger than for a Whole Bank Sale for the same reasons as are described in the

MAS.

Resolution of SC

The preferred resolution for SC and its CBL would be a sale of all of its assets as a going concern to a

single buyer. Chapter 11 of the Bankruptcy Code would be used as a vehicle to facilitate the sale because

of the ability of a debtor under Chapter 11 to sell its assets free and clear of all other interests, and

because a competitive sales process, using a “stalking horse” buyer (the first prospective buyer to enter

into a binding agreement to purchase the material assets of a company through the bankruptcy process)

identified prior to filing the Chapter 11 petition would be the most likely way of generating the highest

sales price for the business.

If a sale of SC's assets as a going concern could not be consummated, SC would engage in an orderly

wind down of its business. First, using the power to reject executory contracts granted under Section 365

of the Bankruptcy Code, SC would transition its servicing business to new servicers in cooperation with its

servicing contract counterparties. Thereafter, SC would file a liquidating plan and a disclosure statement

with the bankruptcy court, solicit acceptances and rejections of the plan, seek confirmation of the plan,

and, if an order of confirmation were entered, consummate the plan by transferring its remaining assets

and its Avoidance Actions to a liquidating trustee to complete the asset liquidation and to distribute the

proceeds of the liquidation to creditors in the order of priority specified in the Bankruptcy Code.

As an ongoing entity, SC could receive interest from bank holding companies or other large financial

services firms like insurers and large alternative asset managers. Banks that would be potential

purchasers would include those with a significant auto business that would allow them to achieve

economies of scale. These banks would also have to have the capacity to purchase SC. Certain private

equity firms could each purchase SC independently or as part of a coalition with other PE firms. There are

several private equity firms that have historically shown a strong interest in the returns and margins of

auto lending that have the capacity to invest in SC.

Resolution of STUSA

Being a wholly-owned subsidiary of SBNA, upon appointment of FDIC as the receiver for SBNA, STUSA

will also be under FDIC receivership. Hence, during resolution, actions at STUSA will follow those taken

at SBNA.

Resolution of Aquanima

The preferred resolution for Aquanima would be to file a voluntary petition under Chapter 7 of the U.S.

Bankruptcy Code seeking the appointment of a trustee, the liquidation of its assets, and the distribution of

the proceeds to creditors under the applicable provisions of the U.S. Bankruptcy Code.

Public Section

Resolution Plan

25

Following the filing of the Chapter 7 petition, an independent trustee would be appointed to carry out all

other responsibilities associated with the marshaling and liquidation of assets and the distribution of the

proceeds to creditors and, potentially, other stakeholders. Although Aquanima provides services in terms

of management of contract metadata, the contractual agreements themselves are stored in a shared drive

that SBNA employees have access to. Hence, because of Aquanima's limited business operations that

impact SBNA, no steps would be taken to maintain its operations or funding.

Resolution of BSNY

In resolution, BSNY would be subject to resolution process initiated under the New York State Banking

Law (“NYSBL”) by the Superintendent of the NYSDFS. Such a proceeding can be initiated if the

Superintendent finds that one or more of the statutory grounds for the Superintendent to take possession

of the property and business of a foreign bank in New York exist

1

.

Given the Superintendent's statutory mandate to protect the interests of the preferred creditors, it is highly

likely that upon seizure of BSNY, the Superintendent would take possession of assets necessary to pay

the preferred creditors of BSNY. The NYSBL generally includes ring-fencing that would effectively

segregate BSNY and treat it as a separate entity from SHUSA.

Resolution of APS

As a SEC-registered broker-dealer, APS would be resolved under the Securities Investor Protection Act

("SIPA") framework in a liquidation proceeding. Upon the commencement of the SIPA proceedings, the

SIPC would appoint a trustee to oversee the receivership. APS does not hold any customer assets and is

more active in trading and distribution business. Under SIPA, SIPC may decline to commence an action,

and instead direct the resolution of a broker-dealer to bankruptcy court, if the broker-dealer has no

customers and/or holds no customer funds or securities. Given that APS does not hold customer funds or

securities (except when the same are in transit), it is possible that APS would be resolved in bankruptcy

court.

Public Section

Resolution Plan

26

1

If the Superintendent exercises his authority under NYSBL to take possession of Santander's NY Branch, from a Spanish law

perspective, the Branch would be considered subject to the Spanish resolution and insolvency regime. See Ley 11/2015, de

Recuperación y Resolución de Entidades Crédito y Empresas de Servicios de Inversión, BOE-A-2015-6789 (June 19, 2015).

However, it should be noted that Article 58 of this legal regime requires the resolution authority to collaborate with the foreign

authorities entrusted with functions relating to the supervision, restructuring or resolution of financial institutions. For that purpose the

resolution authority may enter into the appropriate collaboration agreements with such authorities and exchange any information that

may be needed for the exercise of their powers relating to the planning and implementation of early intervention, restructuring or

resolution measures.

1.11 Acronyms

ALCO Asset Liability Committee

APS Amherst Pierpont Securities, LLC

BRRD Bank Recovery and Resolution Directive

BSI Banco Santander International

BSNY Banco Santander New York Branch

BSPR Banco Santander Puerto Rico

BSSA Banco Santander, S.A.

BSWG-USRRP Balance Sheet Working Group – USRRP

CBB Consumer and Business Banking

CBL Core Business Lines

CCAP Chrysler Capital

CCB Corporate and Commercial Banking

CEO Chief Executive Officer

CET1 Common Equity Tier 1

CFO Chief Financial Officer

CFPB Consumer Financial Protection Bureau

CIB Corporate and Investment Banking

CMG Crisis Management Group

CO Critical Operation

CREVF Commercial Real Estate and Vehicle Finance

CRO Chief Risk Officer

ECB European Central Bank

EGRRPA Economic Growth, Regulatory Relief, and Consumer Protection

EPS Enhanced Prudential Standards

FDIC Federal Deposit Insurance Corporation

FI Financial Intermediaries

FINRA Financial Industry Regulatory Authority

FMU Financial Market Utilities

FRB Federal Reserve Board

FRBNY Federal Reserve Bank of New York

FROB Fund for Orderly Bank Restructuring

FRS Federal Reserve System

FSB Financial Stability Board

G-SIFI Global Systemically Important Financial Institution

G-SIB Global Systemically Important Bank

GAAP Generally Accepted Accounting Principles

IHC Intermediate Housing Company

MAS Multiple Acquirer Strategy

ME Material Entity

Public Section

Resolution Plan

27

MPLFA Master Private-Label Financing Agreement

NYSBL New York State Banking Law

NYSDFS New York State Department of Financial Services

OCC Office of the Comptroller of the Currency

RIC Retail Installment Contract

SAF Santander Auto Finance

SAM Santander Asset Management

SBC Santander BanCorp

SBNA Santander Bank, N.A.

SC Santander Consumer USA, Inc.

SEC Securities and Exchange Commission

SFS Santander Financial Services

SGT Santander Global Technology

SHUSA Santander Holdings USA, Inc.

SIFI Systemically Important Financial Institution

SIPA Securities Investor Protection Act

SIPC Securities Investor Protection Corporation

SIS NY Santander Investment Securities, Inc.

SRB Single Resolution Board

SRF Single Resolution Fund

SRM Single Resolution Mechanism

SSLLC Santander Securities, LLC

STUSA Santander Technology USA, LLC

T1C Tier 1 Capital

T1L Tier 1 Leverage

TC Total Capital

U.K. United Kingdom

U.S. United States

Public Section

Resolution Plan

28