Barclays PLC

Results Announcement

31 December 2018

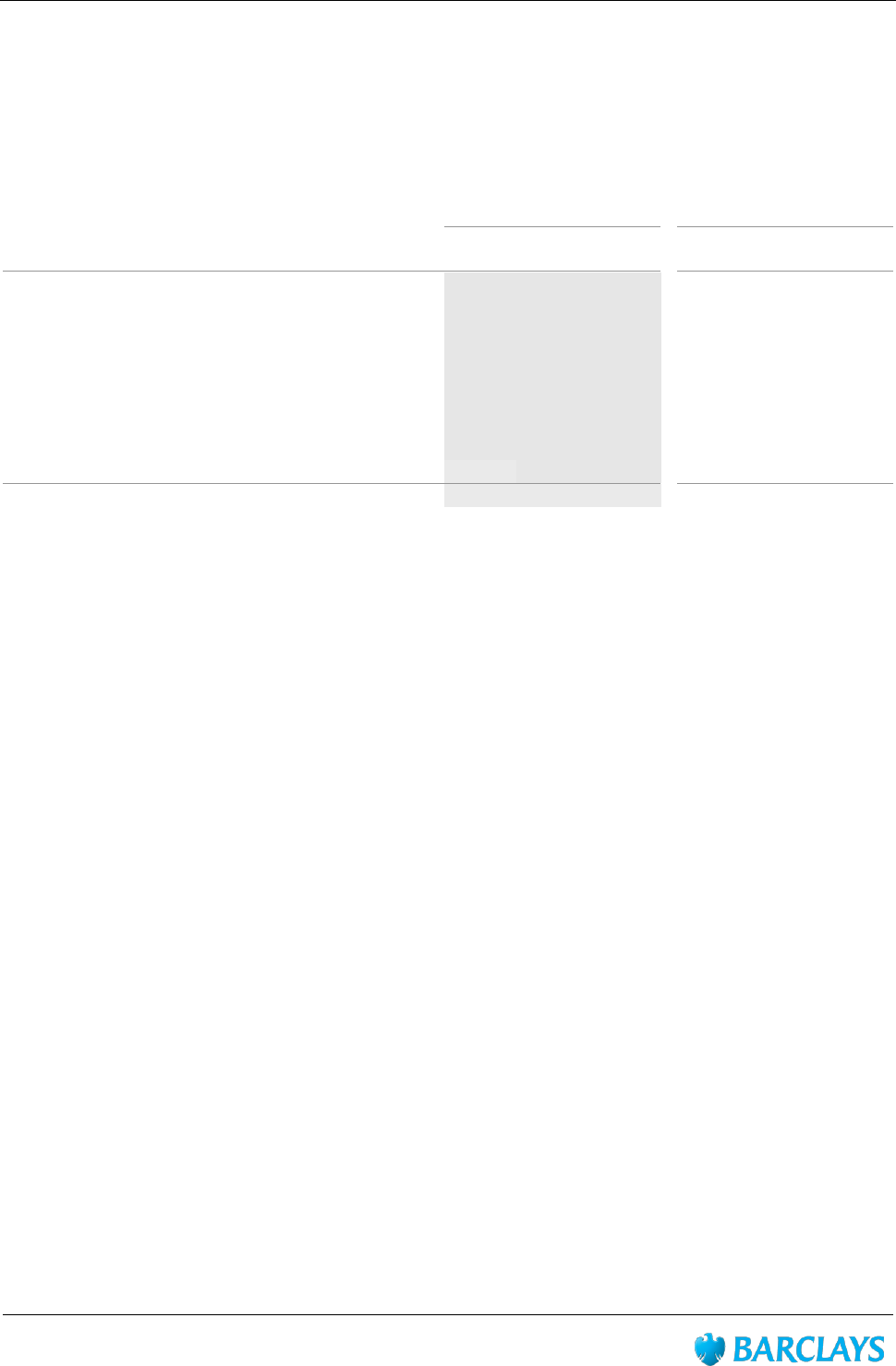

Barclays PLC

Table of Contents

Results Announcement

Page

Notes

1

Performance Highlights

2-3

Group Chief Executive Officer’s Review

4

Group Finance Director’s Review

5-7

Results by Business

Barclays UK

8-10

Barclays International

11-14

Head Office

15

Quarterly Results Summary

16

Quarterly Results by Business

17-22

Barclays Non-Core Results

23

Discontinued Operation Results

24

Performance Management

Margins and Balances

25

Remuneration

26-27

Risk Management

Risk Management and Principal Risks

28

Credit Risk

29-40

Market Risk

41

Treasury and Capital Risk

42-51

Statement of Directors’ Responsibilities

52

Condensed Consolidated Financial Statements

53-57

Financial Statement Notes

58-63

Appendix: Non-IFRS Performance Measures

64-72

Shareholder Information

73

BARCLAYS PLC, 1 CHURCHILL PLACE, LONDON, E14 5HP, UNITED KINGDOM. TELEPHONE: +44 (0) 20 7116 1000. COMPANY NO. 48839.

Notes

Barclays PLC

1

The terms Barclays or Barclays Group refer to Barclays PLC together with its subsidiaries. Unless otherwise stated, the income statement analysis

compares the year ended 31 December 2018 to the corresponding twelve months of 2017 and balance sheet analysis as at 31 December 2018 with

comparatives relating to 31 December 2017. The abbreviations ‘£m’ and ‘£bn’ represent millions and thousands of millions of Pounds Sterling

respectively; the abbreviations ‘$m’ and ‘$bn’ represent millions and thousands of millions of US Dollars respectively; the abbreviations ‘€m’ and ‘€bn’

represent millions and thousands of millions of Euros respectively.

There are a number of key judgement areas, for example impairment calculations, which are based on models and which are subject to ongoing

adjustment and modifications. Reported numbers reflect best estimates and judgements at the given point in time.

Relevant terms that are used in this document but are not defined under applicable regulatory guidance or International Financial Reporting Standards

(IFRS) are explained in the results glossary that can be accessed at home.barclays/investor-relations/reports-and-events/annual-reports.

The information in this announcement, which was approved by the Board of Directors on 20 February 2019, does not comprise statutory accounts

within the meaning of Section 434 of the Companies Act 2006. Statutory accounts for the year ended 31 December 2018, which contain an unqualified

audit report under Section 495 of the Companies Act 2006 (which does not make any statements under Section 498 of the Companies Act 2006) will

be delivered to the Registrar of Companies in accordance with Section 441 of the Companies Act 2006.

These results will be furnished as a Form 6-K to the SEC as soon as practicable following their publication. Once furnished with the SEC, copies of

these results will also be available from the Barclays Investor Relations website at home.barclays/investor-relations/reports-and-events/annual-

reports and from the SEC’s website at www.sec.gov.

Barclays is a frequent issuer in the debt capital markets and regularly meets with investors via formal road-shows and other ad hoc meetings.

Consistent with its usual practice, Barclays expects that from time to time over the coming quarter it will meet with investors globally to discuss these

results and other matters relating to the Barclays Group.

Non-IFRS performance measures

Barclays’ management believes that the non-IFRS performance measures included in this document provide valuable information to the readers of

the financial statements as they enable the reader to identify a more consistent basis for comparing the businesses’ performance between financial

periods and provide more detail concerning the elements of performance which the managers of these businesses are most directly able to influence

or are relevant for an assessment of the Barclays Group. They also reflect an important aspect of the way in which operating targets are defined and

performance is monitored by Barclays’ management. However, any non-IFRS performance measures in this document are not a substitute for IFRS

measures and readers should consider the IFRS measures as well. Refer to the appendix on pages 64 to 72 for further information and calculations of

non-IFRS performance measures included throughout this document, and the most directly comparable IFRS measures.

Forward-looking statements

This document contains certain forward-looking statements within the meaning of Section 21E of the US Securities Exchange Act of 1934, as amended,

and Section 27A of the US Securities Act of 1933, as amended, with respect to the Barclays Group. Barclays cautions readers that no forward-looking

statement is a guarantee of future performance and that actual results or other financial condition or performance measures could differ materially

from those contained in the forward-looking statements. These forward-looking statements can be identified by the fact that they do not relate only

to historical or current facts. Forward-looking statements sometimes use words such as ‘may’, ‘will’, ‘seek’, ‘continue’, ‘aim’, ‘anticipate’, ‘target’,

‘projected’, ‘expect’, ‘estimate’, ‘intend’, ‘plan’, ‘goal’, ‘believe’, ‘achieve’ or other words of similar meaning. Examples of forward-looking statements

include, among others, statements or guidance regarding or relating to the Barclays Group’s future financial position, income growth, assets,

impairment charges, provisions, business strategy, capital, leverage and other regulatory ratios, payment of dividends (including dividend payout ratios

and expected payment strategies), projected levels of growth in the banking and financial markets, projected costs or savings, any commitments and

targets, estimates of capital expenditures, plans and objectives for future operations, projected employee numbers, IFRS 9 impacts and other

statements that are not historical fact. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events

and circumstances. These may be affected by changes in legislation, the development of standards and interpretations under International Financial

Reporting Standards including the continuing impact of IFRS 9 implementation, evolving practices with regard to the interpretation and application of

accounting and regulatory standards, the outcome of current and future legal proceedings and regulatory investigations, future levels of conduct

provisions, the policies and actions of governmental and regulatory authorities, geopolitical risks and the impact of competition. In addition, factors

including (but not limited to) the following may have an effect: capital, leverage and other regulatory rules applicable to past, current and future

periods; UK, US, Eurozone and global macroeconomic and business conditions; the effects of any volatility in credit markets; market related risks such

as changes in interest rates and foreign exchange rates; effects of changes in valuation of credit market exposures; changes in valuation of issued

securities; volatility in capital markets; changes in credit ratings of any entities within the Barclays Group or any securities issued by such entities; the

potential for one or more countries exiting the Eurozone; instability as a result of the exit by the United Kingdom from the European Union and the

disruption that may subsequently result in the UK and globally; and the success of future acquisitions, disposals and other strategic transactions. A

number of these influences and factors are beyond the Barclays Group’s control. As a result, the Barclays Group’s actual future results, dividend

payments, and capital and leverage ratios may differ materially from the plans, goals, expectations and guidance set forth in the Barclays Group’s

forward-looking statements. Additional risks and factors which may impact the Barclays Group’s future financial condition and performance are

identified in our filings with the SEC (including, without limitation, our Annual Report on Form 20-F for the fiscal year ended 31 December 2018),

which are available on the SEC’s website at www.sec.gov.

Subject to our obligations under the applicable laws and regulations of the United Kingdom and the United States in relation to disclosure and ongoing

information, we undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future

events or otherwise.

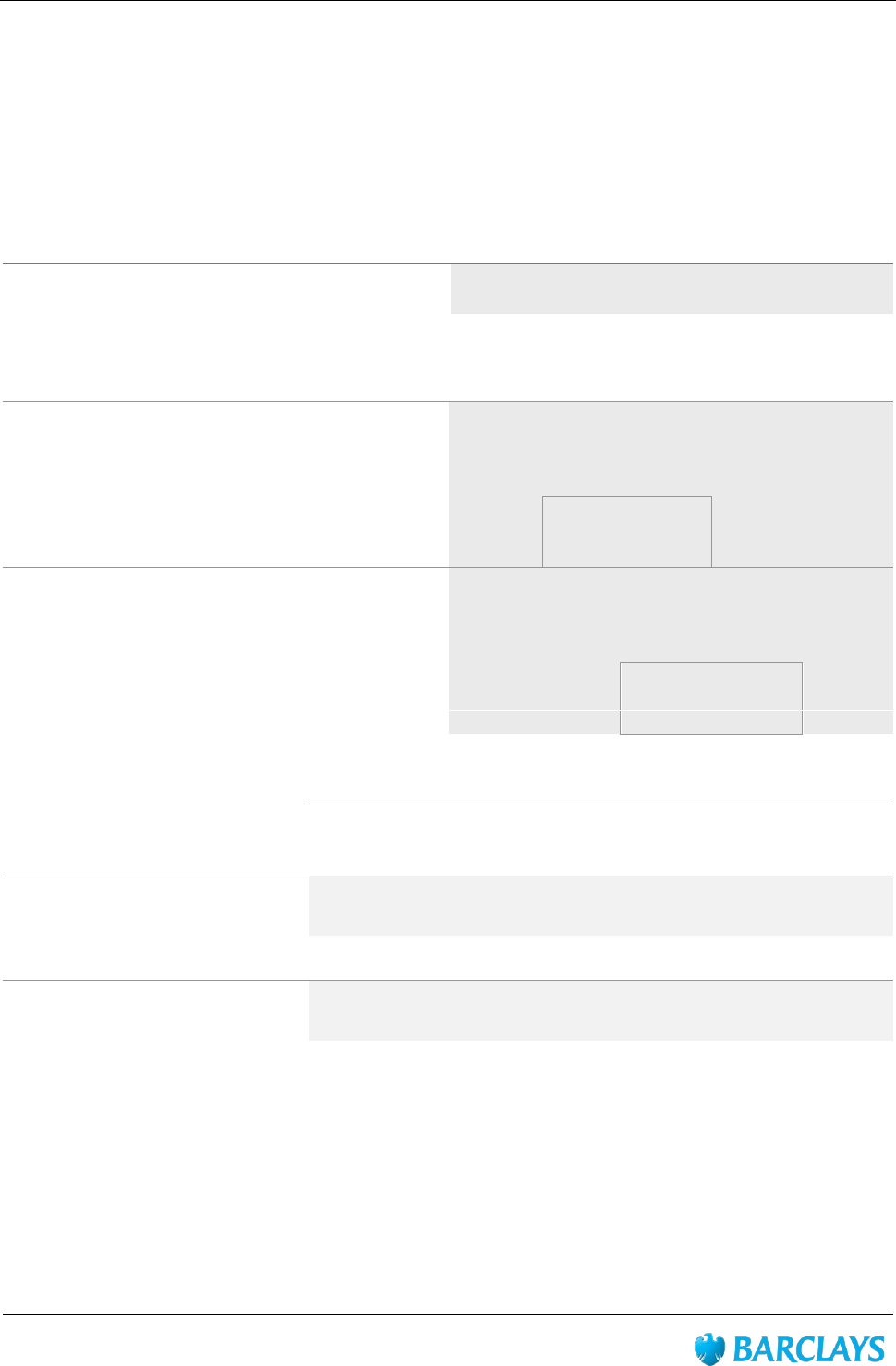

Performance Highlights

Barclays PLC

2

Improved financial performance with Group return on tangible equity of 8.5%

and earnings per share of 21.9p

1

Delivering improving earnings for shareholders

Improving operating leverage and investing in medium term growth initiatives with a particular focus on capital light activities

with attractive returns

Common equity tier 1 (CET1) ratio of 13.2% is at the end-state target of c.13%, with future profit generation supporting both

investment and cash returns to shareholders

Returns

1

Group RoTE targets of >9% in

2019 and >10% in 2020

Earnings per share (EPS) of 21.9p (2017: negative 3.5p) and Group return on tangible equity

(RoTE) of 8.5% (2017: negative 1.2%), with profit before tax (PBT) up 20% to £5.7bn

Barclays UK RoTE of 16.7% (2017: 17.8%), as PBT decreased 3% to £2.4bn

Barclays International RoTE of 8.7% (2017: 4.4%), as PBT increased 10% to £3.9bn

Cost efficiency

Group cost guidance of

£13.6-13.9bn

1

in 2019, and

cost: income ratio of <60%

over time

Group operating expenses decreased 2% to £13.9bn in line with guidance after excluding a

charge for Guaranteed Minimum Pensions (GMP)

The cost: income ratio, excluding litigation and conduct charges, improved to 66% (2017:

68%)

Creating capacity within the cost base through elimination of legacy costs and productivity

savings via Barclays Execution Services (BX) to improve operating leverage and investment

in medium term growth initiatives, while delivering a reduction in absolute costs in 2018

Capital and dividends

At end-state CET1 ratio

target of c.13%

6.5p total dividend

for 2018

Generated 140bps of capital from profits, more than offset by 71bps impact from litigation

and conduct charges, 53bps from ordinary dividends and Additional Tier 1 (AT1) coupons

paid and foreseen, and 33bps from the decision to redeem Preference Shares and Additional

Tier 1 (AT1) securities in December 2018

Capital returns policy updated – progressive ordinary dividend, supplemented by share

buybacks as and when appropriate

Barclays Group profit before tax was £3.5bn (2017: £3.5bn) which included litigation and conduct charges of £2.2bn (2017:

£1.2bn) principally related to a £1.4bn settlement with the US Department of Justice (DoJ) with regard to Residential Mortgage-

Backed Securities (RMBS) and charges of £0.4bn (2017: £0.7bn) due to Payment Protection Insurance (PPI) in Q118

Excluding litigation and conduct charges, Group profit before tax increased 20% to £5.7bn despite the adverse effect of the

3% depreciation of average USD against GBP. Income was stable and operating expenses reduced 2%. The cost: income ratio

improved to 66% (2017: 68%) which included a £140m charge to reflect the estimated increase in pension obligations due to

GMP. Credit impairment charges reduced 37% to £1.5bn including updates for consensus-based macroeconomic forecasts in

the UK and US during the year and the prudent management of credit risk. This improvement was partially offset by a Q418

£150m specific charge for the impact of the anticipated economic uncertainty in the UK

Barclays UK profit before tax increased to £2.0bn (2017: £1.7bn). Excluding litigation and conduct, profit before tax decreased

3% to £2.4bn reflecting a 5% increase in impairment charges, due to a £100m charge for the anticipated economic uncertainty

in the UK. Income was stable as lower interest margins were offset by strong balance sheet growth. Expenses increased 1%

reflecting continued investment to grow the business and improve future operating efficiency. RoTE excluding litigation and

conduct was 16.7% (2017: 17.8%)

Barclays International profit before tax increased to £3.8bn (2017: £3.3bn). Income growth in Markets and the Consumer,

Cards and Payments business was offset by the non-recurrence of prior year one-offs, from a US asset card sale and a valuation

gain on Barclays’ preference shares in Visa Inc, and lower Banking income. Credit impairment charges decreased 56% primarily

due to single name recoveries, updates for consensus-based macroeconomic forecasts in the UK and US, non-recurrence of

single name charges in 2017 and the repositioning of the US cards portfolio towards a lower risk mix. Total operating

expenses decreased 2% as continued investments in business growth, talent and technology were offset by lower costs for

restructuring and structural reform. RoTE excluding litigation and conduct was 8.7% (2017: 4.4%), with the Corporate and

Investment Bank (CIB) and Consumer, Cards and Payments delivering 7.1% and 17.3% (2017: 2.2% and 16.8%) respectively

Attributable profit was £1.4bn (2017: loss of £1.9bn). This reflected the non-recurrence of a £2.5bn loss related to the sell

down of Barclays Africa Group Limited (BAGL) and a tax charge of £1.1bn compared to a 2017 charge of £2.2bn which included

a one-off net charge of £0.9bn due to the re-measurement of US deferred tax assets (DTAs). Basic earnings per share was 9.4p

(2017: loss per share of 10.3p) and excluding litigation and conduct was 21.9p (2017: loss per share of 3.5p)

Tangible net asset value (TNAV) per share was 262p (December 2017: 276p) as 21.9p of earnings per share, excluding

litigation and conduct, was more than offset by the implementation of IFRS 9, impact of litigation and conduct charges,

the redemption of Preference Shares and AT1 securities, as well as dividend payments. In Q418 TNAV increased by 2p, the third

consecutive quarter of TNAV accretion

1 Excluding litigation and conduct, with returns targets based on a Barclays Group CET1 ratio of c.13%.

Performance Highlights

Barclays PLC

3

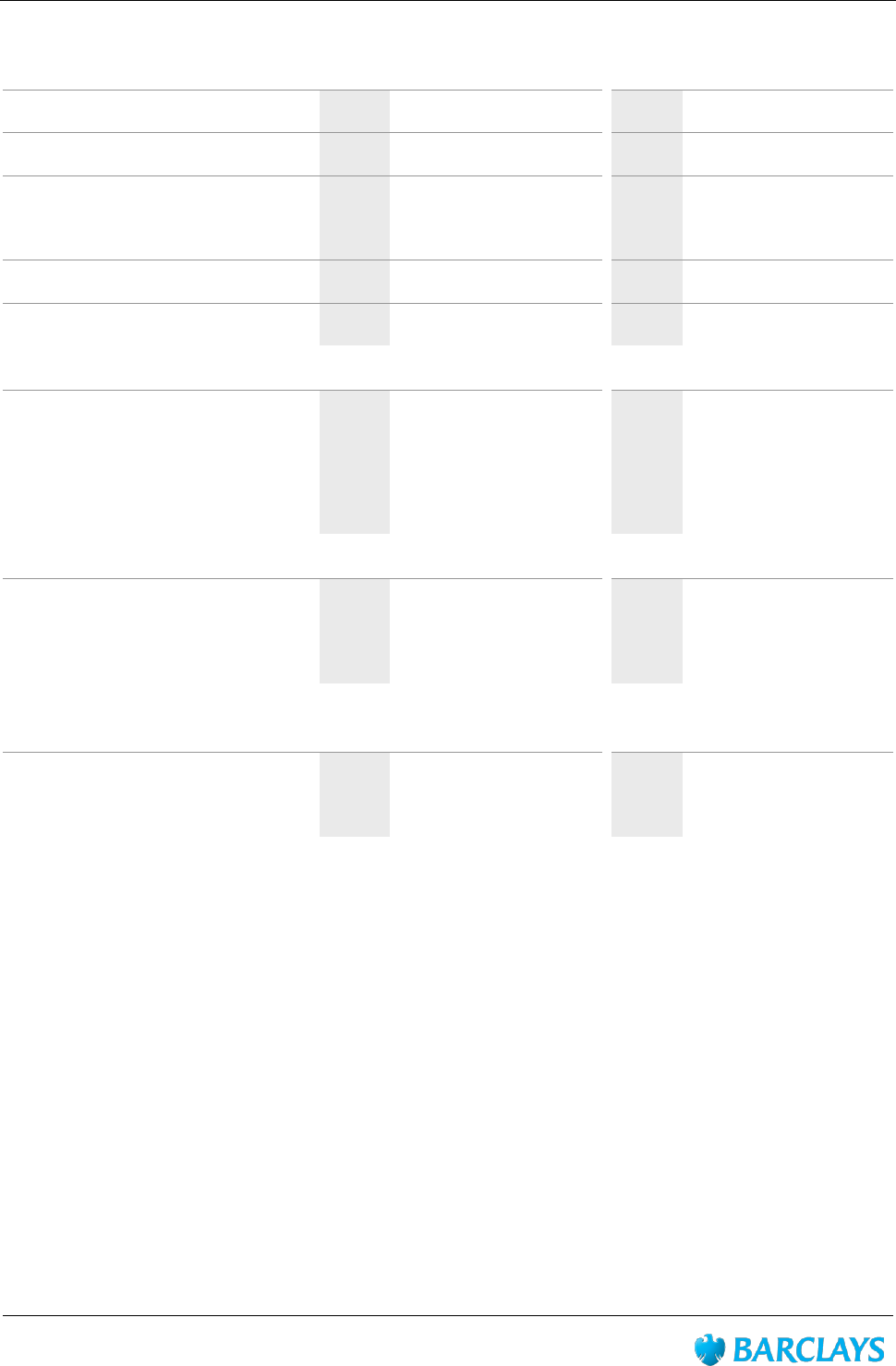

Barclays Group results

for the year ended

31.12.18

31.12.17

£m

£m

% Change

Total income

21,136

21,076

-

Credit impairment charges and other provisions

(1,468)

(2,336)

37

Net operating income

19,668

18,740

5

Operating costs

(13,627)

(13,884)

2

UK bank levy

(269)

(365)

26

Operating expenses

(13,896)

(14,249)

2

GMP charge

(140)

-

Litigation and conduct

(2,207)

(1,207)

(83)

Total operating expenses

(16,243)

(15,456)

(5)

Other net income

69

257

(73)

Profit before tax

3,494

3,541

(1)

Tax charge

(1,122)

(2,240)

50

Profit after tax in respect of continuing operations

2,372

1,301

82

Loss after tax in respect of discontinued operation

-

(2,195)

Non-controlling interests in respect of continuing operations

(226)

(249)

9

Non-controlling interests in respect of discontinued operation

-

(140)

Other equity instrument holders

1

(752)

(639)

(18)

Attributable profit/(loss)

1,394

(1,922)

Performance measures

Return on average tangible shareholders' equity

1

3.6%

(3.6%)

Average tangible shareholders' equity (£bn)

44.1

48.9

Cost: income ratio

77%

73%

Loan loss rate (bps)

2

44

57

Basic earnings/(loss) per share

1

9.4p

(10.3p)

Dividend per share

6.5p

3.0p

Performance measures excluding litigation and conduct

3

Profit before tax

5,701

4,748

20

Attributable profit/(loss)

3,530

(772)

Return on average tangible shareholders' equity

1

8.5%

(1.2%)

Cost: income ratio

66%

68%

Basic earnings/(loss) per share

1

21.9p

(3.5p)

Balance sheet and capital management

4

£bn

£bn

Tangible net asset value per share

262p

276p

Common equity tier 1 ratio

13.2%

13.3%

Common equity tier 1 capital

41.1

41.6

Risk weighted assets

311.9

313.0

UK leverage ratio

5.1%

5.1%

UK leverage exposure

999

985

Average UK leverage ratio

5

4.5%

4.9%

Average UK leverage exposure

5

1,110

1,045

Funding and liquidity

Group liquidity pool (£bn)

227

220

Liquidity coverage ratio

169%

154%

Loan: deposit ratio

83%

81%

1 The profit after tax attributable to other equity instrument holders of £752m (2017: £639m) is offset by a tax credit recorded in reserves of £203m (2017:

£174m). The net amount of £549m (2017: £465m), along with non-controlling interests, is deducted from profit after tax in order to calculate earnings per

share and return on average tangible shareholders’ equity.

2 Comparatives calculated based on gross loans and advances at amortised cost prior to the balance sheet presentation change and IAS 39 impairment

charge.

3 Refer to pages 64 to 72 for further information and calculations of performance measures excluding litigation and conduct.

4 Capital, RWAs and leverage measures are calculated applying the transitional arrangements of the Capital Requirements Regulation (CRR). This includes

IFRS 9 transitional arrangements.

5 The average UK leverage ratio and exposure are for Q4, refer to page 49 for details on the averaging methodology for both 2018 and 2017.

6 The fully loaded CET1 ratio was 12.8%, with £39.8bn of CET1 capital and £311.8bn of Risk Weights Assets (RWA), calculated without applying the transitional

arrangements of the CRR.

Group Chief Executive Officer’s Review

Barclays PLC

4

“2018 represented a very significant period for Barclays.

In the course of the year, having resolved major legacy issues and reduced the drag from low returning businesses, we started

to see the earnings potential of the bank, as the strategy we have implemented began to deliver.

This was evident in the improved performance across the Group compared to 2017.

Excluding litigation and conduct, profits before tax were up by 20% to £5,701m and our Group Return on Tangible Equity was

8.5% for the year – close to our 2019 financial target of greater than 9%.

Earnings per share excluding litigation and conduct for the full year was 21.9p. Our CET1 capital ratio of 13.2% is at our target

of around 13%, and we have grown tangible book value for three quarters in a row.

The progress made on these key measures demonstrates that our plan is working and we have a strong foundation on which

to achieve our returns targets for this year and next.

The fundamental strength of our Group rests on a diversified, though connected, portfolio of businesses. Barclays is well

diversified by geography, by product and by currency between our consumer and wholesale businesses, designed to produce

consistent and attractive returns through the economic cycle. The results for 2018 demonstrate this.

Our overriding priority for 2019 and 2020 is the attainment of our returns targets. Beyond those we are also focusing on

medium term revenue growth opportunities – opportunities which rely on technology rather than capital. Such investment

and focus beyond the immediate was simply not a viable option during the many years of reshaping this company. The

efficiencies we have driven have created the capacity to invest to strengthen and grow our business within our cost guidance

of £13.6-13.9bn for 2019, although we have the ability to flex that investment to a degree to support our RoTE targets if the

environment requires us to do so.

In 2018, based on our strong capital generation, Barclays restored the dividend to 6.5p and redeemed expensive preference

shares dating from the financial crisis. This is excellent progress, but not sufficient.

Going forward the principal calls on future earnings should now be returns to shareholders and investing to grow the business.

We will use the strong capital generation of the bank to return a greater proportion of those earnings to shareholders by way

of dividends and to supplement those dividends with additional returns, including share buybacks. I am optimistic for our

prospects to do more in 2019 and beyond.”

James E Staley, Group Chief Executive Officer

Group Finance Director’s Review

Barclays PLC

5

Results for the year reflected good progress against our strategy. Excluding litigation and conduct charges, the Group return

on tangible equity was 8.5% with earnings per share of 21.9p. Stable income and a reduction in operating expenses drove

positive jaws and an improved cost: income ratio of 66%, with a 37% improvement in credit impairment charges resulting in

a 20% increase in profit before tax despite the 3% depreciation of average USD against GBP.

The CET1 ratio of 13.2% is at the end-state target, and Barclays declares a total dividend of 6.5p for 2018.

Group performance

Profit before tax was £3,494m (2017: £3,541m). Excluding litigation and conduct charges, profit before tax increased

20% to £5,701m driven by an improvement in credit impairment charges and a reduction in operating expenses. The 3%

depreciation of average USD against GBP adversely impacted profits

Total income was £21,136m (2017: £21,076m). Barclays UK income was stable as lower interest margins were offset by

strong balance sheet growth. Barclays International income growth in Markets, which increased 9%, was offset by lower

Banking income, primarily from a 20% decrease in Corporate lending income reflecting the strategy of redeploying Risk

Weighted Assets (RWAs) to higher returning businesses. Consumer, Cards and Payments income growth was offset by

the non-recurrence of prior year one-offs, from a US asset card sale and a valuation gain on Barclays’ preference shares

in Visa Inc. Head Office income was a net expense of £273m (2017: £159m), and the Group benefited from the non-

recurrence of negative income associated with the former Non-Core division, which was closed on 1 July 2017

Credit impairment charges decreased 37% to £1,468m primarily driven by single name recoveries, updates to consensus-

based macroeconomic forecasts in the UK and US during the year, the non-recurrence of single name charges in 2017,

portfolio adjustments as IFRS 9 has continued to embed and the prudent management of credit risk, including the impact

of repositioning the US cards portfolio towards a lower risk mix. This decrease was partially offset by a Q418 £150m

specific charge for the impact of the anticipated economic uncertainty in the UK. The Barclays Group loan loss rate was

44bps (2017: 57bps)

Operating expenses of £13,896m (2017: £14,249m) reduced 2% as continued investment to grow the business and

improve future operating efficiency was more than offset by elimination of legacy costs, productivity savings and a lower

bank levy charge due to a reduction in the levy rate and the impact of prior year adjustments. The cost: income ratio,

excluding litigation and conduct, reduced to 66% (2017: 68%)

Total operating expenses of £16,243m (2017: £15,456m) included litigation and conduct charges of £2,207m (2017:

£1,207m) and a £140m charge for GMP in relation to the equalisation of obligations for members of the Barclays Bank

UK Retirement Fund (UKRF). There was no capital impact of the GMP charge as, at 31 December 2018, the UKRF remained

in accounting surplus

Other net income declined to £69m (2017: £257m) primarily reflecting the non-recurrence of gains on the sales of

Barclays’ share in VocaLink and a joint venture in Japan in Q217

The Group’s effective tax rate reduced to 32.1% (2017: 63.3%). The 2017 rate included a one-off net charge due to the

re-measurement of DTAs as a result of the reduction in the US federal corporate income tax rate. The underlying effective

tax rate was 20.9% (2017: 29.4%), due to the lower US federal corporate income tax rate and the beneficial impact of

adjustments to prior periods recognised in 2018

The Group's underlying effective tax rate for future periods is expected to be in the low-to mid-20 percents, excluding the

impact of the future accounting change that will require tax relief on payments in relation to AT1 instruments to be

recognised in the income statement, as opposed to retained earnings

Attributable profit was £1,394m (2017: loss of £1,922m). This reflected the non-recurrence of a £2.5bn loss related to

the sell down of BAGL and a tax charge of £1,122m compared to a 2017 charge of £2,240m which included a one-off net

charge of £0.9bn due to the re-measurement of US DTAs

RoTE was 8.5% (2017: negative 1.2%) and earnings per share was 21.9p (2017: loss per share of 3.5p), excluding litigation

and conduct. Statutory RoTE was 3.6% (2017: negative 3.6%) and basic earnings per share was 9.4p (2017: loss per share

10.3p)

TNAV per share was 262p (December 2017: 276p) as 21.9p of earnings per share, excluding litigation and conduct, was

more than offset by the implementation of IFRS 9, impact of litigation and conduct charges, the redemption of Preference

Shares and AT1 securities, as well as dividend payments. In Q418 TNAV increased by 2p, the third consecutive quarter of

TNAV accretion

Group Finance Director’s Review

Barclays PLC

6

Group capital and leverage

Barclays’ CET1 ratio ended the year at 13.2% (December 2017: 13.3%), at our end-state target of c.13%

CET1 capital decreased £0.5bn to £41.1bn as underlying profit generation of £4.2bn, was more than offset by £2.1bn of

litigation and conduct charges, as the bank resolved major legacy matters, £1.7bn for ordinary dividends and AT1

coupons paid and foreseen, and £1.0bn from the redemption of capital instruments

RWAs remained broadly stable at £311.9bn (December 2017: £313.0bn). The Group continued to actively manage capital

allocation to businesses during the year, including the redeployment of RWAs within CIB to higher returning businesses,

while targeting growth in selected consumer businesses in Barclays UK and Consumer, Cards and Payments. Within

Barclays UK, the increase in RWAs included the impact of a change in the regulatory methodology for the Education,

Social Housing and Local Authority (ESHLA) portfolio which was partly offset by a reduction in Head Office due to the

regulatory deconsolidation of BAGL

The UK leverage ratio remained flat at 5.1% (December 2017: 5.1%). The UK leverage exposure increased marginally to

£999bn (December 2017: £985bn) including securities financing transactions (SFTs), due to the CIB utilising leverage

balance sheet more efficiently within high returning financing businesses. The average UK leverage ratio decreased to

4.5% (December 2017: 4.9%)

Group funding and liquidity

The liquidity pool increased to £227bn (December 2017: £220bn) driven largely by net deposit growth across businesses.

The liquidity coverage ratio (LCR) increased to 169% (December 2017: 154%), equivalent to a surplus of £90bn

(December 2017: £75bn) to the 100% regulatory requirement. Barclays Group also continued to maintain surpluses to

its internal liquidity requirements. The strong liquidity position reflects the Barclays Group’s prudent approach given the

continued macroeconomic uncertainty

Barclays Group issued £12.2bn of minimum requirement for own funds and eligible liabilities (MREL) instruments from

Barclays PLC (the Parent company) in a range of tenors and currencies. Barclays Group is well advanced in its MREL

issuance plans, with a Barclays PLC MREL ratio of 28.1% as at 31 December 2018 relative to an estimated requirement

including requisite buffers of 30.0% by 1 January 2022

Barclays Bank PLC continued to issue in the shorter-term markets and Barclays Bank UK PLC issued in the shorter-term

and secured markets, helping to maintain their stable and diversified funding bases

The overall funding structure has improved further – Barclays Group has continued to reduce its reliance on short-term

wholesale funding, where the proportion maturing in less than 1 year fell to 30% (December 2017: 31%)

Other matters

In Q118 Barclays reached a settlement with the US DoJ to resolve the civil complaint brought by the DoJ in December

2016 relating to RMBS sold by Barclays between 2005 and 2007. Barclays paid a civil monetary penalty of $2.0bn (£1.4bn)

In May 2018 Barclays announced that the Crown Court had dismissed all of the charges that had been brought by the

Serious Fraud Office (SFO) against Barclays PLC and Barclays Bank PLC regarding matters which arose in the context of

Barclays’ capital raisings in 2008. In October 2018, the High Court denied the SFO’s application to reinstate the charges,

which were consequently dismissed

Additional charges of £0.4bn (2017: £0.7bn) relating to PPI were recognised in Q118. The remaining PPI provision as at

31 December 2018 was £0.9bn (December 2017: £1.6bn) to cover claims through to the deadline of 29 August 2019.

Management views its current PPI provision as appropriate, but will continue to closely monitor complaint trends and the

associated provision adequacy

On 1 April 2018 Barclays successfully established its ring-fenced bank, Barclays Bank UK PLC, after receiving approval

from the Prudential Regulation Authority (PRA) and the High Court of Justice of England and Wales to implement the

ring-fencing transfer scheme under Part VII of the Financial Services Markets Act 2000

In Q418 Barclays Bank Ireland PLC (BBI) received confirmation of its extended banking licence as part of Barclays’ plans

to expand BBI in anticipation of the UK’s departure from the EU in March 2019. On 29 January 2019 Barclays received

approval from the High Court of Justice of England and Wales for its banking business transfer scheme application under

Part VII of the Financial Services and Markets Act 2000

Group Finance Director’s Review

Barclays PLC

7

Dividends

A half year dividend of 2.5p per share was paid on 17 September 2018. Barclays declares a full year dividend of 4.0p per

share, resulting in a total dividend of 6.5p per share for 2018

Barclays understands the importance of delivering attractive cash returns to shareholders. Barclays is therefore committed

to maintaining an appropriate balance between total cash returns to shareholders, investment in the business and

maintaining a strong capital position. Going forward, Barclays intends to pay a progressive ordinary dividend, taking into

account these objectives and the earnings outlook of the Group. It is also the Board’s intention to supplement the ordinary

dividends with additional cash returns, including share buybacks, to shareholders as and when appropriate

Outlook and guidance

Barclays is on track in the execution of its strategy and continues to target a RoTE

1

of greater than 9% for 2019 and greater

than 10% for 2020 and operating expenses

1

guidance in the range of £13.6–13.9bn for 2019. The Group’s 2018 results

reflect good progress towards these targets

Tushar Morzaria, Group Finance Director

1 Excluding litigation and conduct, with returns targets based on a Barclays Group CET1 ratio of c.13%.

Results by Business

Barclays PLC

8

Barclays UK

Year ended

Year ended

31.12.18

31.12.17

Income statement information

£m

£m

% Change

Net interest income

6,028

6,086

(1)

Net fee, commission and other income

1,355

1,297

4

Total income

7,383

7,383

-

Credit impairment charges and other provisions

(826)

(783)

(5)

Net operating income

6,557

6,600

(1)

Operating costs

(4,075)

(4,030)

(1)

UK bank levy

(46)

(59)

22

Litigation and conduct

(483)

(759)

36

Total operating expenses

(4,604)

(4,848)

5

Other net income/(expenses)

3

(5)

Profit before tax

1,956

1,747

12

Attributable profit

1,158

853

36

Balance sheet information

£bn

£bn

Loans and advances to customers at amortised cost

187.6

183.8

Total assets

249.7

237.4

Customer deposits at amortised cost

197.3

193.4

Loan: deposit ratio

96%

95%

Risk weighted assets

75.2

70.9

Period end allocated tangible equity

10.2

9.6

Key facts

Average loan to value of mortgage portfolio

48%

48%

Average loan to value of new mortgage lending

65%

64%

Number of branches

1,058

1,208

Mobile banking active customers

7.3m

6.4m

30 day arrears rate - Barclaycard Consumer UK

1.8%

1.8%

Performance measures

Return on average allocated tangible equity

11.9%

9.8%

Average allocated tangible equity (£bn)

10.0

9.1

Cost: income ratio

62%

66%

Loan loss rate (bps)

1

43

42

Net interest margin

3.23%

3.49%

Performance measures excluding litigation and conduct

2

£m

£m

Profit before tax

2,439

2,506

(3)

Attributable profit

1,630

1,586

3

Return on average allocated tangible equity

16.7%

17.8%

Cost: income ratio

56%

55%

1 Comparatives calculated based on gross loans and advances at amortised cost prior to the balance sheet presentation change and IAS 39 impairment

charge.

2 Refer to pages 64 to 72 for further information and calculations of performance measures excluding litigation and conduct.

Results by Business

Barclays PLC

9

Analysis of Barclays UK

Year ended

Year ended

31.12.18

31.12.17

Analysis of total income

£m

£m

% Change

Personal Banking

1

4,006

4,214

(5)

Barclaycard Consumer UK

2,104

1,977

6

Business Banking

1

1,273

1,192

7

Total income

7,383

7,383

-

Analysis of credit impairment charges and other provisions

Personal Banking

1

(173)

(221)

22

Barclaycard Consumer UK

(590)

(541)

(9)

Business Banking

1

(63)

(21)

Total credit impairment charges and other provisions

(826)

(783)

(5)

Analysis of loans and advances to customers at amortised cost

£bn

£bn

Personal Banking

1

146.0

141.3

Barclaycard Consumer UK

15.3

16.4

Business Banking

1

26.3

26.1

Total loans and advances to customers at amortised cost

187.6

183.8

Analysis of customer deposits at amortised cost

Personal Banking

1

154.0

153.1

Barclaycard Consumer UK

-

-

Business Banking

1

43.3

40.3

Total customer deposits at amortised cost

197.3

193.4

1 In Q218, Wealth was reclassified from Wealth, Entrepreneurs & Business Banking (now named Business Banking) to Personal Banking. Comparatives have

been restated.

Results by Business

Barclays PLC

10

In 2018, Barclays officially stood up Barclays Bank UK PLC as part of structural reform, being the first bank in the UK to become

legally ring-fenced. Throughout 2018, Barclays UK has maintained its position in the market as a leader in innovation,

investing to transform customer interactions. Building long term, meaningful customer and client relationships continues to

deliver sustainable balance sheet growth and returns, within a prudent risk appetite. This is further enhanced by investment

to automate and digitise the provision of tailored products and services, meeting customers’ needs on their terms.

2018 compared to 2017

Income statement

RoTE excluding litigation and conduct was 16.7% (2017: 17.8%) reflecting the continuing strength of Barclays UK

business. Including litigation and conduct charges of £483m (2017: £759m), RoTE increased to 11.9% (2017: 9.8%)

Total income was stable at £7,383m (2017: £7,383m) as lower interest margins were offset by strong balance sheet

growth in secured lending and customer deposits

– Personal Banking income decreased 5% to £4,006m as continued momentum in mortgage lending and growth in

customer deposits was more than offset by the non-recurrence of an update to effective interest rate modelling in

Q417, a valuation gain on Barclays’ preference shares in Visa Inc. in Q117 and the realignment of clients from Barclays

UK to Barclays International as part of structural reform

– Barclaycard Consumer UK income increased 6% to £2,104m reflecting a focus on sustainable growth and the non-

recurrence of remediation provisioning in H217

– Business Banking income increased 7% to £1,273m driven by strong deposit growth and the realignment of clients

from Barclays International to Barclays UK as part of structural reform

– Net interest margin decreased 26bps to 3.23% reflecting growth in secured lending at lower margins and the

integration of the ESHLA portfolio

Credit impairment charges increased 5% to £826m primarily due to a Q418 £100m specific charge for the impact of the

anticipated economic uncertainty in the UK. This was partially offset by improved consensus-based macroeconomic

forecasts during the year and the continued prudent management of credit risk reflected in the broadly stable 30 and 90

day arrears rates in UK cards of 1.8% (2017: 1.8%) and 0.9% (2017: 0.8%) respectively

Operating expenses excluding litigation and conduct increased 1% to £4,121m as continued investment to grow the

business, including digitisation of the bank and improvements to future operating efficiency, were partially offset by cost

efficiencies and lower costs of setting up the ring-fenced bank. The cost: income ratio excluding litigation and conduct

was 56% (2017: 55%)

Balance sheet

Loans and advances to customers at amortised cost increased 2% to £187.6bn reflecting £4.6bn of mortgage growth

Total assets increased 5% to £249.7bn reflecting increases in the liquidity pool including the transfer of treasury assets

from Head Office and loans and advances to customers

Customer deposits at amortised cost increased 2% to £197.3bn as strong deposit growth was partially offset by the net

realignment of clients between Barclays UK and Barclays International as part of structural reform

RWAs increased to £75.2bn (December 2017: £70.9bn) primarily due to growth in mortgages and UK cards, and

regulatory methodology changes for the ESHLA portfolio

Results by Business

Barclays PLC

11

Barclays International

Year ended

Year ended

31.12.18

31.12.17

Income statement information

£m

£m

% Change

Net interest income

3,815

4,307

(11)

Net trading income

4,450

3,971

12

Net fee, commission and other income

5,761

6,104

(6)

Total income

14,026

14,382

(2)

Credit impairment charges and other provisions

(658)

(1,506)

56

Net operating income

13,368

12,876

4

Operating costs

(9,324)

(9,321)

-

UK bank levy

(210)

(265)

21

Litigation and conduct

(127)

(269)

53

Total operating expenses

(9,661)

(9,855)

2

Other net income

68

254

(73)

Profit before tax

3,775

3,275

15

Attributable profit

2,441

847

Balance sheet information

£bn

£bn

Loans and advances at amortised cost

127.2

126.8

Trading portfolio assets

104.0

113.0

Derivative financial instrument assets

222.1

236.2

Derivative financial instrument liabilities

219.6

237.8

Financial assets at fair value through the income statement

144.7

104.1

Total assets

862.1

856.1

Deposits at amortised cost

197.2

187.3

Loan: deposit ratio

65%

68%

Risk weighted assets

210.7

210.3

Period end allocated tangible equity

29.9

27.5

Performance measures

Return on average allocated tangible equity

8.4%

3.4%

Average allocated tangible equity (£bn)

31.0

28.1

Cost: income ratio

69%

69%

Loan loss rate (bps)

1

50

75

Net interest margin

4.11%

4.16%

Performance measures excluding litigation and conduct

2

£m

£m

Profit before tax

3,902

3,544

10

Attributable profit

2,547

1,107

Return on average allocated tangible equity

8.7%

4.4%

Cost: income ratio

68%

67%

1 Comparatives calculated based on gross loans and advances at amortised cost prior to the balance sheet presentation change and IAS 39 impairment

charge.

2 Refer to pages 64 to 72 for further information and calculations of performance measures excluding litigation and conduct.

Results by Business

Barclays PLC

12

Analysis of Barclays International

Corporate and Investment Bank

Year ended

Year ended

31.12.18

31.12.17

Income statement information

£m

£m

% Change

FICC

1

2,863

2,875

-

Equities

2,037

1,629

25

Markets

4,900

4,504

9

Banking fees

2,531

2,612

(3)

Corporate lending

878

1,093

(20)

Transaction banking

1,627

1,629

-

Banking

5,036

5,334

(6)

Other

(171)

40

Total income

9,765

9,878

(1)

Credit impairment releases/(charges) and other provisions

150

(213)

Net operating income

9,915

9,665

3

Operating expenses

(7,281)

(7,475)

3

Litigation and conduct

(68)

(267)

75

Total operating expenses

(7,349)

(7,742)

5

Other net income

27

133

(80)

Profit before tax

2,593

2,056

26

Balance sheet information

£bn

£bn

Loans and advances at amortised cost

86.4

88.2

Deposits at amortised cost

136.3

128.0

Risk weighted assets

170.9

176.2

Performance measures

Return on average allocated tangible equity

6.9%

1.1%

Average allocated tangible equity (£bn)

26.0

24.0

Performance measures excluding litigation and conduct

2

£m

£m

Profit before tax

2,661

2,323

15

Return on average allocated tangible equity

7.1%

2.2%

1 Fixed income, currencies and commodities (FICC) is composed of Credit and Macro income.

2 Refer to pages 64 to 72 for more information and calculations of performance measures excluding litigation and conduct.

Results by Business

Barclays PLC

13

Analysis of Barclays International

Consumer, Cards and Payments

Year ended

Year ended

31.12.18

31.12.17

Income statement information

£m

£m

% Change

Total income

4,261

4,504

(5)

Credit impairment charges and other provisions

(808)

(1,293)

38

Net operating income

3,453

3,211

8

Operating expenses

(2,253)

(2,111)

(7)

Litigation and conduct

(59)

(2)

Total operating expenses

(2,312)

(2,113)

(9)

Other net income

41

121

(66)

Profit before tax

1,182

1,219

(3)

Balance sheet information

£bn

£bn

Loans and advances at amortised cost

40.8

38.6

Deposits at amortised cost

60.9

59.3

Risk weighted assets

39.8

34.1

Key facts

30 day arrears rate – Barclaycard US

2.7%

2.6%

Total number of Barclaycard business clients

374,000

366,000

Value of payments processed (£bn)

344

322

Performance measures

Return on average allocated tangible equity

16.5%

16.7%

Average allocated tangible equity (£bn)

5.0

4.2

Performance measures excluding litigation and conduct

1

£m

£m

Profit before tax

1,241

1,221

2

Return on average allocated tangible equity

17.3%

16.8%

1 Refer to pages 64 to 72 for more information and calculations of performance measures excluding litigation and conduct.

Results by Business

Barclays PLC

14

In 2018, Barclays International made good progress on executing our strategy and improving returns, delivering underlying growth

in Consumer, Cards & Payments; a strong performance in Markets, where the global ranking improved one place; and a record year

for Advisory within Banking. This progress gives confidence that by continuing to build out the businesses through targeted

deployment of financial resources and investments in talent and technology, growth can be accelerated towards achieving increased

returns.

2018 compared to 2017

Income statement

Profit before tax increased 10% to £3,902m achieving a RoTE of 8.7% (2017: 4.4%), reflecting improved returns in both CIB of

7.1% (2017: 2.2%) and Consumer, Cards and Payments of 17.3% (2017: 16.8%) excluding litigation and conduct

The 3% depreciation of average USD against GBP adversely impacted profits and income, and positively impacted credit

impairment charges and operating expenses

Total income was £14,026m (2017: £14,382m)

– CIB income of £9,765m decreased 1% as Markets income increased 9% to £4,900m, reflecting gains in market share

1

, offset

by a decrease in Banking income of 6% to £5,036m

– FICC income was stable at £2,863m (2017: £2,875m) with significant share gains despite a challenging environment

– Equities income increased 25% to £2,037m becoming one of the highest growing Equities franchises relative to peers,

substantially improving our global ranking. This was driven by strength in derivatives and continued growth in the equity

financing franchise through increased client balances, together with technology investment, which resulted in higher

electronic revenues

– Banking fee income decreased 3% to £2,531m as Barclays maintained its highest rank and global fee share in 4 years,

including a record year in Advisory, which was more than offset by debt and equity underwriting fees being down across

the industry

– Corporate lending income reduced 20% to £878m reflecting the strategy of redeploying RWAs within the CIB towards

higher returning business and the transfer of clients between Barclays UK and Barclays International as part of structural

reform

– Transaction banking income was stable at £1,627m (2017: £1,629m) as strong and targeted growth in deposits was

offset by the transfer of clients between Barclays UK and Barclays International as part of structural reform

– Consumer, Cards and Payments income decreased 5% to £4,261m. Excluding material one-off items in both 2017 and 2018,

related to US cards portfolio sales and revaluation of Barclays preference shares in Visa Inc, underlying income increased due

to growth in US cards

Credit impairment charges decreased 56% to £658m

– CIB credit impairment charges decreased to a release of £150m (2017: charge of £213m) primarily due to single name

recoveries, improved consensus-based macroeconomic forecasts during the year, the non-recurrence of single name

charges in 2017 and the prudent management of credit risk, partially offset by a Q418 £50m specific charge for the

anticipated economic uncertainty in the UK

– Consumer, Cards and Payments credit impairment charges decreased 38% to £808m reflecting the non-recurrence of a

£168m charge in Q317 relating to deferred consideration from the Q117 asset sale in US cards, improved consensus-based

macroeconomic forecasts in the US and the impact of repositioning the US cards portfolio towards a lower risk mix

Total operating expenses decreased 2% to £9,661m as continued investments in business growth, talent and technology were

offset by lower restructuring and structural reform costs, and a reduced impact from the change in compensation awards

introduced in Q416

Other net income decreased to £68m (2017: £254m) due to the non-recurrence of a gain of £109m on the sale of Barclays’ share

in VocaLink to MasterCard and a gain of £76m on the sale of a joint venture in Japan in Q217

Attributable profit increased to £2,441m (2017: £847m) as 2017 was impacted by the one-off tax charge due to the re-

measurement of US DTAs

Balance sheet

Loans and advances at amortised cost remained broadly flat at £127.2bn (December 2017: £126.8bn)

Derivative financial instrument assets and liabilities decreased £14.1bn to £222.1bn and £18.2bn to £219.6bn respectively, due

to a decrease in interest rate derivatives, driven by an increase in major interest rate forward curves, and the adoption of daily

settlement under the London Clearing House (LCH) rules, partially offset by increased foreign exchange and equity derivative

volumes

Financial assets at fair value through the income statement increased £40.6bn to £144.7bn primarily due to the impact of the

transition to IFRS 9 and increased reverse repurchase agreements activity

Total assets increased £6.0bn to £862.1bn including the transfer of treasury assets from Head Office

Deposits at amortised cost increased £9.9bn to £197.2bn, due to the integration of treasury liabilities from Head Office and a

strong and targeted increase in deposits

RWAs were in line at £210.7bn (December 2017: £210.3bn) as reductions in CIB were offset by increased lending in Consumer,

Cards & Payments

1 All Markets ranks and shares: Coalition, FY18 Preliminary Competitor Analysis based on the Coalition Index and Barclays’ internal business structure.

Results by Business

Barclays PLC

15

Head Office

Year ended

Year ended

31.12.18

31.12.17

Income statement information

£m

£m

% Change

Net interest income

(781)

(435)

(80)

Net fee, commission and other income

508

276

84

Total income

(273)

(159)

(72)

Credit impairment releases/(charges) and other provisions

16

(17)

Net operating income

(257)

(176)

(46)

Operating costs

(228)

(277)

18

UK bank levy

(13)

(41)

68

GMP charge

(140)

-

Litigation and conduct

(1,597)

(151)

Total operating expenses

(1,978)

(469)

Other net expenses

(2)

(189)

99

Loss before tax

(2,237)

(834)

Attributable loss

(2,205)

(868)

Balance sheet information

£bn

£bn

Total assets

21.5

39.7

Risk weighted assets

26.0

31.8

Period end allocated tangible equity

4.9

10.0

Performance measures

Average allocated tangible equity (£bn)

3.1

9.3

Performance measures excluding litigation and conduct

1

£m

£m

Loss before tax

(640)

(683)

6

Attributable loss

(647)

(731)

11

1 Refer to pages 64 to 72 for further information and calculations of performance measures excluding litigation and conduct.

2018 compared to 2017

Income statement

Loss before tax excluding litigation and conduct was £640m (2017: £683m). Including litigation and conduct charges of

£1,597m (2017: £151m) primarily related to the £1,420m settlement with the US DoJ relating to RMBS, loss before tax

was £2,237m (2017: £834m)

Total income was an expense of £273m (2017: £159m) reflecting legacy capital instrument funding costs of £351m and

hedge accounting expenses. This was partially offset by a one-off gain of £155m from the settlement of receivables

relating to the Lehman Brothers acquisition in Q218, lower net expenses from treasury operations, higher Absa Group

Limited dividend income and mark-to-market gains on legacy investments

Operating expenses excluding litigation and conduct and a GMP charge, reduced to £241m (2017: £318m) driven by

lower costs associated with legacy Non-Core assets and businesses, and reduced bank levy. Total operating expenses of

£1,978m (2017: £469m) included litigation and conduct charges of £1,597m (2017: £151m) and a £140m charge for

GMP in relation to the equalisation of obligations for members of the Barclays Bank UKRF

Other net expenses were £2m (2017: £189m) due to non-recurrence of a £180m expense in Q217 on the recycling of the

currency translation reserve to the income statement on the sale of Barclays Bank Egypt

Balance sheet

Total assets decreased to £21.5bn (December 2017: £39.7bn) reflecting the transfer of treasury assets to Barclays UK and

Barclays International as part of structural reform

RWAs decreased to £26.0bn (December 2017: £31.8bn) reflecting the net reduction due to BAGL regulatory

deconsolidation

Quarterly Results Summary

Barclays PLC

16

Barclays Group

Q418

Q318

Q218

Q118

Q417

Q317

Q217

1

Q117

1

Income statement information

£m

£m

£m

£m

£m

£m

£m

£m

Net interest income

2,296

2,388

2,190

2,188

2,272

2,475

2,579

2,519

Net fee, commission and other income

2,777

2,741

3,386

3,170

2,750

2,698

2,479

3,304

Total income

5,073

5,129

5,576

5,358

5,022

5,173

5,058

5,823

Credit impairment charges and other

provisions

(643)

(254)

(283)

(288)

(573)

(709)

(527)

(527)

Net operating income

4,430

4,875

5,293

5,070

4,449

4,464

4,531

5,296

Operating costs

(3,624)

(3,329)

(3,310)

(3,364)

(3,621)

(3,274)

(3,398)

(3,591)

UK bank levy

(269)

-

-

-

(365)

-

-

-

Operating expenses

(3,893)

(3,329)

(3,310)

(3,364)

(3,986)

(3,274)

(3,398)

(3,591)

GMP charge

(140)

-

-

-

-

-

-

-

Litigation and conduct

(60)

(105)

(81)

(1,961)

(383)

(81)

(715)

(28)

Total operating expenses

(4,093)

(3,434)

(3,391)

(5,325)

(4,369)

(3,355)

(4,113)

(3,619)

Other net income/(expenses)

37

20

(7)

19

13

(2)

241

5

Profit/(loss) before tax

374

1,461

1,895

(236)

93

1,107

659

1,682

Tax charge

(145)

(240)

(433)

(304)

(1,138)

(324)

(305)

(473)

Profit/(loss) after tax in respect of

continuing operations

229

1,221

1,462

(540)

(1,045)

783

354

1,209

Loss after tax in respect of discontinued

operation

-

-

-

-

-

-

(1,537)

(658)

Attributable to:

Ordinary equity holders of the parent

(76)

1,002

1,232

(764)

(1,294)

583

(1,401)

190

Other equity instrument holders

230

176

175

171

181

157

162

139

Non-controlling interests in respect of

continuing operations

75

43

55

53

68

43

59

79

Non-controlling interests in respect of

discontinued operation

-

-

-

-

-

-

(3)

143

Balance sheet information

£bn

£bn

£bn

£bn

£bn

£bn

£bn

£bn

Total assets

1,133.3

1,170.8

1,149.6

1,142.2

1,133.2

1,149.3

1,135.3

1,203.8

Tangible net asset value per share

262p

260p

259p

251p

276p

281p

284p

292p

Risk weighted assets

311.9

316.2

319.3

317.9

313.0

324.3

327.4

360.9

Average UK leverage exposure

1,110.0

1,119.0

1,081.8

1,089.9

1,044.6

1,035.1

1,092.2

1,130.4

Performance measures

Return on average tangible shareholders'

equity

(0.1%)

9.4%

11.8%

(6.5%)

(10.3%)

5.1%

(11.0%)

1.8%

Average tangible shareholders' equity (£bn)

44.3

44.6

43.5

44.2

48.1

48.9

49.3

49.4

Cost: income ratio

81%

67%

61%

99%

87%

65%

81%

62%

Loan loss rate (bps)

2

77

30

35

36

56

66

49

47

Basic (loss)/earnings per share

(0.1p)

6.1p

7.5p

(4.2p)

(7.3p)

3.7p

(8.0p)

1.3p

Performance measures excluding

litigation and conduct

3

£m

£m

£m

£m

£m

£m

£m

£m

Profit before tax

434

1,566

1,976

1,725

476

1,188

1,374

1,710

Attributable (loss)/profit

(14)

1,087

1,291

1,166

(943)

660

(698)

209

Return on average tangible shareholders'

equity

0.4%

10.2%

12.3%

11.0%

(7.4%)

5.7%

(5.3%)

2.0%

Cost: income ratio

79%

65%

59%

63%

79%

63%

67%

62%

Basic earnings/(loss) per share

0.3p

6.6p

7.8p

7.1p

(5.3p)

4.1p

(3.8p)

1.5p

1 Results included Barclays Non-Core and the Africa Banking discontinued operation; refer to pages 23 to 24 for further detail.

2 Comparatives calculated based on gross loans and advances at amortised cost prior to the balance sheet presentation change and IAS 39 impairment

charge.

3 Refer to pages 64 to 72 for further information and calculations of performance measures excluding litigation and conduct.

Quarterly Results by Business

Barclays PLC

17

Barclays UK

Q418

Q318

Q218

Q118

Q417

Q317

Q217

Q117

Income statement information

£m

£m

£m

£m

£m

£m

£m

£m

Net interest income

1,513

1,529

1,493

1,493

1,540

1,501

1,534

1,511

Net fee, commission and other income

350

367

343

295

330

351

286

330

Total income

1,863

1,896

1,836

1,788

1,870

1,852

1,820

1,841

Credit impairment charges and other provisions

(296)

(115)

(214)

(201)

(184)

(201)

(220)

(178)

Net operating income

1,567

1,781

1,622

1,587

1,686

1,651

1,600

1,663

Operating costs

(1,114)

(988)

(968)

(1,005)

(1,117)

(980)

(974)

(959)

UK bank levy

(46)

-

-

-

(59)

-

-

-

Litigation and conduct

(15)

(54)

(3)

(411)

(53)

(11)

(699)

4

Total operating expenses

(1,175)

(1,042)

(971)

(1,416)

(1,229)

(991)

(1,673)

(955)

Other net (expenses)/income

(2)

1

5

(1)

(5)

1

(1)

-

Profit/(loss) before tax

390

740

656

170

452

661

(74)

708

Attributable profit/(loss)

232

500

464

(38)

245

423

(285)

470

Balance sheet information

£bn

£bn

£bn

£bn

£bn

£bn

£bn

£bn

Loans and advances to customers at amortised

cost

187.6

186.7

185.3

184.3

183.8

182.2

166.6

164.5

Total assets

249.7

252.0

245.9

235.2

237.4

230.4

203.4

203.0

Customer deposits at amortised cost

197.3

195.8

194.3

192.0

193.4

189.3

187.4

184.4

Loan: deposit ratio

96%

96%

96%

96%

95%

97%

89%

90%

Risk weighted assets

75.2

74.8

75.0

72.5

70.9

70.0

66.1

66.3

Period end allocated tangible equity

10.2

10.1

10.2

9.8

9.6

9.5

8.6

8.8

Performance measures

Return on average allocated tangible equity

9.6%

20.1%

18.8%

(1.1%)

10.7%

18.4%

(12.7%)

21.6%

Average allocated tangible equity (£bn)

10.1

10.1

10.1

9.8

9.6

9.4

8.7

8.9

Cost: income ratio

63%

55%

53%

79%

66%

54%

92%

52%

Loan loss rate (bps)

1

61

24

45

43

39

43

52

43

Net interest margin

3.20%

3.22%

3.22%

3.27%

3.32%

3.28%

3.70%

3.69%

Performance measures excluding

litigation and conduct

2

£m

£m

£m

£m

£m

£m

£m

£m

Profit before tax

405

794

659

581

505

672

625

704

Attributable profit

244

548

465

373

282

431

406

467

Return on average allocated tangible equity

10.1%

22.0%

18.8%

15.7%

12.3%

18.7%

19.1%

21.5%

Cost: income ratio

62%

52%

53%

56%

63%

53%

54%

52%

1 Comparatives calculated based on gross loans and advances at amortised cost prior to the balance sheet presentation change and IAS 39 impairment

charge.

2 Refer to pages 64 to 72 for further information and calculations of performance measures excluding litigation and conduct.

Quarterly Results by Business

Barclays PLC

18

Analysis of Barclays UK

Q418

Q318

Q218

Q118

Q417

Q317

Q217

Q117

Analysis of total income

£m

£m

£m

£m

£m

£m

£m

£m

Personal Banking

1

998

1,021

1,015

972

1,116

1,022

1,033

1,043

Barclaycard Consumer UK

522

551

504

527

445

539

495

498

Business Banking

1

343

324

317

289

309

291

292

300

Total income

1,863

1,896

1,836

1,788

1,870

1,852

1,820

1,841

Analysis of credit impairment

(charges)/releases and other provisions

Personal Banking

1

(44)

(8)

(49)

(72)

(56)

(57)

(60)

(48)

Barclaycard Consumer UK

(250)

(88)

(139)

(113)

(124)

(145)

(149)

(123)

Business Banking

1

(2)

(19)

(26)

(16)

(4)

1

(11)

(7)

Total credit impairment charges and other

provisions

(296)

(115)

(214)

(201)

(184)

(201)

(220)

(178)

Analysis of loans and advances to customers

at amortised cost

£bn

£bn

£bn

£bn

£bn

£bn

£bn

£bn

Personal Banking

1

146.0

145.4

143.6

142.1

141.3

140.4

138.6

136.6

Barclaycard Consumer UK

15.3

15.3

15.2

15.2

16.4

16.3

16.2

16.1

Business Banking

1

26.3

26.0

26.5

27.0

26.1

25.5

11.8

11.8

Total loans and advances to customers at

amortised cost

187.6

186.7

185.3

184.3

183.8

182.2

166.6

164.5

Analysis of customer deposits at amortised

cost

Personal Banking

1

154.0

153.4

152.9

151.9

153.1

152.1

151.1

149.2

Barclaycard Consumer UK

-

-

-

-

-

-

-

-

Business Banking

1

43.3

42.4

41.4

40.1

40.3

37.2

36.3

35.2

Total customer deposits at amortised cost

197.3

195.8

194.3

192.0

193.4

189.3

187.4

184.4

1 In Q218, Wealth was reclassified from Wealth, Entrepreneurs & Business Banking (now named Business Banking) to Personal Banking. Comparatives have

been restated.

Quarterly Results by Business

Barclays PLC

19

Barclays International

Q418

Q318

Q218

Q118

Q417

Q317

Q217

Q117

Income statement information

£m

£m

£m

£m

£m

£m

£m

£m

Net interest income

984

965

853

1,013

987

1,148

1,060

1,112

Net trading income

837

1,103

1,094

1,416

935

815

1,039

1,182

Net fee, commission and other income

1,400

1,222

1,760

1,379

1,397

1,352

1,511

1,844

Total income

3,221

3,290

3,707

3,808

3,319

3,315

3,610

4,138

Credit impairment charges and other provisions

(354)

(143)

(68)

(93)

(386)

(495)

(279)

(346)

Net operating income

2,867

3,147

3,639

3,715

2,933

2,820

3,331

3,792

Operating costs

(2,441)

(2,277)

(2,306)

(2,300)

(2,428)

(2,182)

(2,276)

(2,435)

UK bank levy

(210)

-

-

-

(265)

-

-

-

Litigation and conduct

(33)

(32)

(47)

(15)

(255)

(5)

4

(13)

Total operating expenses

(2,684)

(2,309)

(2,353)

(2,315)

(2,948)

(2,187)

(2,272)

(2,448)

Other net income

32

12

11

13

21

19

202

12

Profit before tax

215

850

1,297

1,413

6

652

1,261

1,356

Attributable (loss)/profit

(72)

650

890

973

(1,168)

359

819

837

Balance sheet information

£bn

£bn

£bn

£bn

£bn

£bn

£bn

£bn

Loans and advances at amortised cost

127.2

132.4

125.5

117.5

126.8

134.4

135.2

145.5

Trading portfolio assets

104.0

124.6

116.5

114.9

113.0

91.2

83.3

83.0

Derivative financial instrument assets

222.1

214.8

228.2

214.1

236.2

242.8

108.4

105.3

Derivative financial instrument liabilities

219.6

213.7

224.9

210.8

237.8

242.9

116.8

112.8

Financial assets at fair value through the income

statement

144.7

147.8

141.2

150.6

104.1

103.7

94.1

81.3

Total assets

862.1

900.2

886.5

866.6

856.1

867.1

681.6

677.2

Deposits at amortised cost

197.2

200.3

191.0

167.2

187.3

191.9

192.0

189.4

Loan: deposit ratio

65%

66%

66%

70%

68%

70%

70%

77%

Risk weighted assets

210.7

214.6

218.0

214.2

210.3

218.2

212.2

214.3

Period end allocated tangible equity

29.9

30.2

30.5

30.0

27.5

28.0

26.8

27.1

Performance measures

Return on average allocated tangible equity

(0.3%)

8.8%

11.8%

13.4%

(15.9%)

5.4%

12.4%

12.5%

Average allocated tangible equity (£bn)

31.3

31.1

31.4

30.1

28.5

28.9

27.4

27.7

Cost: income ratio

83%

70%

63%

61%

89%

66%

63%

59%

Loan loss rate (bps)

1

107

41

22

31

76

88

54

62

Net interest margin

3.98%

3.87%

4.03%

4.57%

4.31%

4.21%

4.07%

4.06%

Performance measures excluding

litigation and conduct

2

£m

£m

£m

£m

£m

£m

£m

£m

Profit before tax

248

882

1,344

1,428

261

657

1,257

1,369

Attributable (loss)/profit

(38)

676

924

985

(918)

363

816

846

Return on average allocated tangible equity

0.2%

9.2%

12.2%

13.6%

(12.4%)

5.5%

12.3%

12.6%

Cost: income ratio

82%

69%

62%

60%

81%

66%

63%

59%

1 Comparatives calculated based on gross loans and advances at amortised cost prior to the balance sheet presentation change and IAS 39 impairment

charge.

2 Refer to pages 64 to 72 for further information and calculations of performance measures excluding litigation and conduct.

Quarterly Results by Business

Barclays PLC

20

Analysis of Barclays International

Corporate and Investment Bank

Q418

Q318

Q218

Q118

Q417

Q317

Q217

Q117

Income statement information

£m

£m

£m

£m

£m

£m

£m

£m

FICC

570

688

736

869

607

627

752

889

Equities

375

471

601

590

362

350

455

462

Markets

945

1,159

1,337

1,459

969

977

1,207

1,351

Banking fees

625

519

704

683

605

607

674

726

Corporate lending

243

197

198

240

269

277

278

269

Transaction banking

412

416

385

414

408

419

404

398

Banking

1,280

1,132

1,287

1,337

1,282

1,303

1,356

1,393

Other

(74)

(56)

(44)

3

1

-

1

38

Total income

2,151

2,235

2,580

2,799

2,252

2,280

2,564

2,782

Credit impairment (charges)/releases and other

provisions

(35)

3

23

159

(127)

(36)

1

(51)

Net operating income

2,116

2,238

2,603

2,958

2,125

2,244

2,565

2,731

Operating expenses

(2,023)

(1,712)

(1,773)

(1,773)

(2,129)

(1,656)

(1,760)

(1,930)

Litigation and conduct

(23)

(32)

-

(13)

(255)

(5)

4

(11)

Total operating expenses

(2,046)

(1,744)

(1,773)

(1,786)

(2,384)

(1,661)

(1,756)

(1,941)

Other net income

15

4

5

3

7

10

116

-

Profit/(loss) before tax

85

498

835

1,175

(252)

593

925

790

Balance sheet information

£bn

£bn

£bn

£bn

£bn

£bn

£bn

£bn

Loans and advances at amortised cost

86.4

93.3

87.8

81.3

88.2

95.4

96.7

106.8

Deposits at amortised cost

136.3

137.6

130.3

107.6

128.0

133.4

134.1

131.0

Risk weighted assets

170.9

175.9

180.4

181.3

176.2

185.2

178.9

180.6

Performance measures

Return on average allocated tangible equity

(1.3%)

6.6%

9.1%

13.0%

(20.2%)

5.9%

11.1%

8.2%

Average allocated tangible equity (£bn)

26.0

25.9

26.4

25.6

24.3

24.8

23.3

23.5

Performance measures excluding

litigation and conduct

1

£m

£m

£m

£m

£m

£m

£m

£m

Profit before tax

108

530

835

1,188

3

598

921

801

Return on average allocated tangible equity

(0.9%)

7.0%

9.1%

13.2%

(16.1%)

6.0%

11.1%

8.3%

1 Refer to pages 64 to 72 for further information and calculations of performance measures excluding litigation and conduct.

Quarterly Results by Business

Barclays PLC

21

Analysis of Barclays International

Consumer, Cards and Payments

Q418

Q318

Q218

Q118

Q417

Q317

Q217

Q117

Income statement information

£m

£m

£m

£m

£m

£m

£m

£m

Total income

1,070

1,055

1,127

1,009

1,067

1,035

1,046

1,356

Credit impairment charges and other provisions

(319)

(146)

(91)

(252)

(259)

(459)

(280)

(295)

Net operating income

751

909

1,036

757

808

576

766

1,061

Operating expenses

(628)

(565)

(533)

(527)

(564)

(526)

(516)

(505)

Litigation and conduct

(10)

-