Multi-Period Portfolio Optimization

∗

Edmond Lezmi

Amundi Quantitative Research

Thierry Roncalli

Amundi Quantitative Research

Jiali Xu

Amundi Quantitative Research

March 2022

Abstract

In this article, we consider a multi-period portfolio optimization problem, which is

an extension of the single-period mean-variance model. We discuss several formulations

of the objective function, constraints and coupling relationships. We then derive three

numerical algorithms that can be used to solve such problems: the alternating direc-

tion method of multipliers, the block coordinate descent algorithm and the augmented

quadratic programming method. We illustrate the differences between single-period

and multi-period solutions by considering three asset allocation problems: transition

management (Rattray, 2003), total variation regularized portfolio (Corsaro et al., 2020)

and trading trajectory modeling (Gˆarleanu and Pedersen, 2013). Finally, we solve the

portfolio alignment problem of Le Guenedal and Roncalli (2022) when the fund man-

ager has to dynamically control the carbon footprint of his investment portfolio by

integrating a carbon reduction scenario. Comparing the single-period and multi-period

solutions shows that the active share between the two portfolios may be greater than

25%. This figure can also reach 40% if we include carbon trends and they are increasing.

Keywords: Multi-period optimization, portfolio allocation, ADMM, block coordinate de-

scent, quadratic programming, coupling variables, transition management, total variation

regularization, optimal trading trajectory problem, portfolio decarbonization, net zero align-

ment.

JEL Classification: C61, G11, Q54.

1 Introduction

Multi-period portfolio optimization is a natural extension of the mean-variance optimization

(MVO) model developed by Harry Markowitz in 1952. The goal is to find the dynamic as-

set allocation policy by considering inter-temporal effects such as rebalancing costs, trading

impacts, time-varying constraints, price trends, etc. Since such models include feedback

features, we might think that they are commonly used by the asset management indus-

∗

The authors are grateful to Mickael Bella¨ıche for his helpful comments.

1

Multi-Period Portfolio Optimization

try. However, while mean-variance optimization was very successful among investors and

portfolio managers, multi-period optimization is mainly an academic research field

1

:

“In practice, multi-period models are seldom used. There are several practical

reasons for that. First, it is often very difficult to accurately estimate return/risk

for multiple periods, let alone for a single period. Second, multi-period models

are in general computationally intensive, especially if the universe of assets con-

sidered is large. Third, the most common existing multi-period models do not

handle real-world constraints. [...] For these reasons, practitioners typically

use single-period models to rebalance the portfolio from one period to another”

(Kolm et al., 2014).

Recently, developments in computing capacity have renewed the interest in such models.

For instance, we can cite the research by Boyd et al. (2017), Calafiore (2009), Corsaro et

al. (2021), Huang et al. (2021), Li et al. (2022), Rosenberg et al. (2016), Skaf and Boyd

(2009) and Wahlberg et al. (2012). Moreover, alongside transition management and trading

trajectory, which are the two most famous multi-period problems

2

, a new problem has

emerged these last two years in climate investing. Indeed, portfolio alignment can be viewed

as the dynamic version of portfolio decarbonization:

“While portfolio decarbonization is a static problem, portfolio alignment involves

a dynamic strategy in order to comply with a given climate policy. Therefore,

the dynamic problem is trickier since it involves several rebalancing decisions and

depends on the future behavior of corporate issuers” (Le Guenedal and Roncalli,

2022).

The primary objective of our study is to solve the multi-period portfolio alignment problem

defined by Le Guenedal and Roncalli (2022, pages 36-37). Indeed, if the investor decar-

bonizes its current portfolio by R and he knows that he will decarbonize it by R + ∆R

during the next period, then it is obvious that the current optimal portfolio is contingent

on the additional reduction ∆R during the next period.

This research project fits into our previous works on portfolio optimization and the devel-

opment of efficient numerical algorithms for solving asset allocation problems. In particular,

we can cite augmented quadratic programming (Bruder et al., 2013; Roncalli, 2013; Bourg-

eron et al., 2018), coordinate descent (Griveau-Billion et al., 2013; Roncalli, 2015; Richard

and Roncalli, 2015, 2019) and alternating direction method of multipliers (Bourgeron et al.,

2018; Chen et al., 2019). These three numerical algorithms are extensively explained in the

survey of Perrin and Roncalli (2020) in the context of portfolio optimization, e.g., risk par-

ity portfolios, strategic asset allocation, smart beta portfolios, minimum-variance strategies,

regularized allocation problems and turnover management. In this work, we show how to ap-

ply these algorithms to multi-period portfolio optimization and solve the portfolio alignment

problem.

This article is organized as follows. In section two, we present the multi-period portfolio

optimization problem. We discuss some special cases of the objective function, constraints

and coupling relationships. We develop numerical algorithms and apply them to three asset

allocation problems. The third section is dedicated to the portfolio decarbonization problem.

Finally, section four offers some concluding remarks.

1

For instance, multi-period portfolio optimization is not available in asset management software such as

MSCI Barra Optimizer or Axioma Portfolio Optimizer.

2

Here, we do not consider Merton-like continuous-time models, whose solution follows a Hamilton-Jacobi-

Bellman equation. Indeed, these models mainly concern two assets, but they are not adapted to deal with

a large universe of assets. Nevertheless, they have been successful in solving liability-driven investment

problems or retirement strategies.

2

Multi-Period Portfolio Optimization

2 Multi-period portfolio optimization

We consider a multi-period optimization problem that we encounter in asset allocation.

After defining the objective problem, we discuss some special cases. Then, we show how we

can solve these multi-period optimization problems using ADMM and QP algorithms.

2.1 General problem with linear and non-linear constraints

Let us consider a universe of n assets. We define the following h-period optimization problem:

x

?

= arg max

x

t+1

,x

t+2

,...

E

U (x

t+1

, . . . , x

t+h

) | F

t

(1)

s.t. x ∈ Ω

where x

t

=

x

1,t

, . . . , x

n,t

is the vector of the portfolio weights at the t

th

period, x =

(x

t+1

, x

t+2

, . . . , x

t+h

) is the vector of the h allocations, U (x

t+1

, . . . , x

t+h

) is the inter-

temporal utility function, F

t

is the filtration associated to the probability space

3

, and x ∈ Ω

is a set of linear and non-linear constraints.

In order to obtain a tractable objective function, we assume that the utility function is

separable in time:

− E

U (x

t+1

, . . . , x

t+h

) | F

t

=

t+h

X

s=t+1

g

s

(x

s

) + h

s

(x

s−1

, x

s

)

(2)

where g

s

and h

s

are two convex functions. While g

s

(x

s

) only depends on the current

portfolio x

s

, h

s

(x

s−1

, x

s

) is a convex function that depends on both the current portfolio x

s

and the previous portfolio x

s−1

. Therefore, g

s

(x

s

) is the static part of the objective function

whereas the dynamic part is modeled by the coupling function h

s

(x

s−1

, x

s

). Similarly, we

split the set of constraints as Ω = Ω

(g)

∩Ω

(h)

where Ω

(g)

=

T

t+h

s=t+1

Ω

s

and Ω

s

corresponds to

the constraints that only relies on x

s

and not on the other variables x

u

(u 6= s). Therefore,

Problem (1) becomes:

x

?

= arg min

x

g (x) + h (x)

(3)

s.t. x ∈ Ω

(g)

∩ Ω

(h)

where g (x) =

P

t+h

s=t+1

g

s

(x

s

), h (x) =

P

t+h

s=t+1

h

s

(x

s−1

, x

s

) and x

?

=

x

?

t+1

, x

?

t+2

, . . . , x

?

t+h

.

Although Problem (3) defines the optimal solution x

?

, we are only interested in x

?

t+1

. In-

deed, since the filtration at time t + 1 will be updated, the optimal solution x

?

t+2

at time

t + 1 is no longer valid. The right formulation of Problem (3) is then:

x

?

t+1

= arg min

x

g (x) + h (x)

(4)

s.t. x ∈ Ω

(g)

∩ Ω

(h)

Remark 1. We could discuss what the goal is when writing the objective function as f (x) =

g (x) + h (x). Indeed, Problem (4) is equivalent to the traditional non-linear optimization

problem x

?

t+1

= arg min f (x) s.t. x ∈ Ω. In fact, the underlying idea is to separate the

coupling and non-coupling parts. Therefore, we notice that Problem (4) is the overlapping

of two problems:

(

x

?

t+1

= arg min g (x) s.t. x ∈ Ω

(g)

x

?

t+1

= arg min h (x) s.t. x ∈ Ω

(h)

(5)

3

The stochastic process will be defined later.

3

Multi-Period Portfolio Optimization

The first problem is static and corresponds to a traditional single-period optimization problem

since it is equivalent to:

x

?

t+1

= arg min g

t+1

(x

t+1

) s.t. x

t+1

∈ Ω

(g)

t+1

(6)

The second problem is a dynamic feedback problem. Knowing the optimal solution at time

t+2, it modifies the solution at time t+1 because of the feedback effects. In asset allocation,

h (x) is generally a penalty function and not really an objective function. In what follows,

we extensively use the previous breakdown to find the numerical solution.

2.2 Some special cases

In this section, we discuss some special cases. First, we consider different objective functions

that are used in portfolio management. Second, we specify some penalty functions. Finally,

we list the main constraints that are specified when we perform portfolio optimization.

2.2.1 Objective function

Single-period optimization problem When h is equal to 1, the problem reduces to:

x

?

t+1

= arg min

x

g

t+1

(x

t+1

) + h

t+1

(x

t

, x

t+1

)

(7)

s.t. x

t+1

∈ Ω

Mean-variance optimization In the mean-variance optimization problem, the objective

function g

s

(x

s

) is equal to (Roncalli, 2013, Section 1.1.1, page 7):

g

s

(x

s

) =

1

2

x

>

s

Σ

s

x

s

− γx

>

s

µ

s

(8)

where Σ

s

is the covariance matrix and µ

s

is the vector of expected returns. The parameter γ

is a coefficient that controls the trade-off between the portfolio’s volatility and its expected

return. Let R

s

=

R

1,s

, . . . , R

n,s

be the vector of asset returns at time s. Since we have:

E

R

s

| F

t

= E

R

t

| F

t

= µ

t

for s ≥ t (9)

and:

var

R

s

| F

t

= var

R

t

| F

t

= Σ

t

for s ≥ t (10)

we obtain:

g (x) =

t+h

X

s=t+1

1

2

x

>

s

Σ

t

x

s

− γx

>

s

µ

t

(11)

Tracking-error minimization We recall that the tracking error variance of the portfolio

x

s

with respect to the benchmark b

s

is equal to:

σ

2

x

s

| b

s

= (x

s

− b

s

)

>

Σ

s

(x

s

− b

s

) (12)

Therefore, we can show that the objective function g

s

(x

s

) is equal to (Roncalli, 2013, Section

1.2.4, page 60):

g

s

(x

s

) =

1

2

x

>

s

Σ

s

x

s

− x

>

s

Σ

s

b

s

(13)

4

Multi-Period Portfolio Optimization

Finally, we obtain:

g (x) =

t+h

X

s=t+1

1

2

x

>

s

Σ

t

x

s

− x

>

s

Σ

t

b

s

(14)

If we assume that we do not know the future composition of the benchmark at time s > t,

Equation (14) becomes:

g (x) =

t+h

X

s=t+1

1

2

x

>

s

Σ

t

x

s

− x

>

s

Σ

t

b

t

(15)

Portfolio optimization with a benchmark We can mix the two approaches. In this

case, the investor would like to maximize the expected excess return of the portfolio with

respect to the benchmark and control the level of the tracking error volatility. The multi-

period objective function becomes (Roncalli, 2013, Section 1.1.4, page 19):

g (x) =

t+h

X

s=t+1

1

2

x

>

s

Σ

t

x

s

− x

>

s

(Σ

t

b

t

+ γµ

t

)

(16)

Remark 2. We notice that mean-variance, tracking-error and benchmark optimization prob-

lems can be cast into a quadratic programming problem:

g

s

(x

s

) =

1

2

x

>

s

Q

s

x

s

− x

>

s

R

s

(17)

where Q

s

= Σ

s

and R

s

is respectively equal to γµ

s

, Σ

s

b

s

and Σ

s

b

s

+ γµ

s

. In what follows,

we use this notation and the term ‘mean-variance’ to name these three problems.

Other objective functions Perrin and Roncalli (2020, Table 1, page 29) reviewed the

different objective functions used in portfolio optimization. It includes minimum variance,

most diversified, risk budgeting or Kullback-Leibler portfolios.

2.2.2 Penalty function

Perrin and Roncalli (2020) observed that four regularization penalties are mainly used in

portfolio management: ridge, lasso, log-barrier and entropy.

Ridge penalization In the case of the ridge penalty, we have:

h

s

(x

s−1

, x

s

) =

λ

s

2

kx

s

− x

s−1

k

2

2

(18)

where λ

s

is the scalar penalty value. Gˆarleanu and Pedersen (2013) used quadratic trans-

action costs:

h

s

(x

s−1

, x

s

) =

1

2

(x

s

− x

s−1

)

>

Λ

s

(x

s

− x

s−1

) (19)

where Λ

s

is the Kyle’s matrix for temporary price impact. We notice that the penalization

with quadratic transaction costs generalizes the ridge penalty where Λ

s

= λ

s

I

n

.

Lasso penalization Instead of using the `

2

-norm, we can use the `

1

-norm:

h

s

(x

s−1

, x

s

) = λ

s

kx

s

− x

s−1

k

1

(20)

This regularization can be viewed as a turnover penalization problem.

5

Multi-Period Portfolio Optimization

2.2.3 Portfolio constraints

Linear constraints If the constraints are linear, we have:

x ∈ Ω ⇔

Ax = B

Cx ≤ D

x ≤ x ≤ x

(21)

It follows that Ω = Ω

(h)

and Ω

(g)

=

x ∈ R

nh

. In the case where constraints are separable,

we obtain Ω = Ω

(g)

where:

x

s

∈ Ω

s

⇔

A

s

x

s

= B

s

C

s

x

s

≤ D

s

x

s

≤ x

s

≤ x

s

(22)

Turnover constraint The turnover constraint is defined as:

Ω

(h)

=

∀s = t + 1, . . . , t + h

:

kx

s

− x

s−1

k

1

≤ τ

s

(23)

where τ

s

is the turnover limit at time s. In the single-period optimization problem, impos-

ing a turnover constraint is equivalent to add a lasso penalization. Therefore, we have a

relationship between τ

s

and λ

s

. In the multi-period optimization problem, we lose the strict

equivalence.

Other constraints We can specify other constraints such as asset class limits, sector

limits, number of active bets, etc. (Perrin and Roncalli, 2020, Table 3, page 30).

2.3 Numerical algorithms

2.3.1 ADMM approach

Derivation of the algorithm Following Perrin and Roncalli (2020), we use the alternat-

ing direction method of multipliers (ADMM) introduced by Gabay and Mercier (1976) to

propose a numerical solution. We note:

1

Ω

(x) =

0 if x ∈ Ω

+∞ if x /∈ Ω

(24)

Then, we can rewrite the optimization problem as follows:

x

?

t+1

= arg min

x

g (x) + 1

Ω

(g)

(x) + h (x) + 1

Ω

(h)

(x)

(25)

Using the first and third tricks given by Perrin and Roncalli (2020), the equivalent ADMM

form is:

{x

?

, y

?

} = arg min

(x,y)

f

x

(x) + f

y

(y)

(26)

s.t.

x = y

f

x

(x) = g (x) + 1

Ω

(g)

(x)

f

y

(y) = h (y) + 1

Ω

(h)

(y)

Boyd et al. (2010) showed that the associated ADMM algorithm consists of the following

three steps:

6

Multi-Period Portfolio Optimization

1. The x-update is:

x

(k+1)

= arg min

x

f

(k+1)

x

(x) = f

x

(x) +

ϕ

2

x − y

(k)

+ u

(k)

2

2

(27)

2. The y-update is:

y

(k+1)

= arg min

y

f

(k+1)

y

(y) = f

y

(y) +

ϕ

2

x

(k+1)

− y + u

(k)

2

2

(28)

3. The u-update is:

u

(k+1)

= u

(k)

+

x

(k+1)

− y

(k+1)

(29)

In this approach, u

(k)

is the dual variable of the primal residual r = x−y and ϕ is the `

2

-norm

penalty variable. The parameter ϕ can be constant or may change at each iteration. The

ADMM algorithm benefits from the dual ascent principle and the method of multipliers. The

difference with the latter is that the x- and y-updates are performed in an alternating way.

In practice, ADMM may be slow to converge with high accuracy, but is fast to converge if

we consider modest accuracy. This is why ADMM is a good candidate for solving large-scale

optimization problems, where high accuracy does not necessarily lead to a better solution.

We notice that:

f

x

(x) =

t+h

X

s=t+1

g

s

(x

s

) +

t+h

X

s=t+1

1

Ω

s

(x

s

)

=

t+h

X

s=t+1

f

s

(x

s

) (30)

where:

f

s

(x

s

) = g

s

(x

s

) + 1

Ω

s

(x

s

) (31)

Using the same partition for y and u than for x, we have:

y = (y

t+1

, y

t+2

, . . . , y

t+h

) (32)

and:

u = (u

t+1

, u

t+2

, . . . , u

t+h

) (33)

We deduce that:

x − y

(k)

+ u

(k)

2

2

=

x − y

(k)

+ u

(k)

>

x − y

(k)

+ u

(k)

=

t+h

X

s=t+1

x

s

− y

(k)

s

+ u

(k)

s

>

x

s

− y

(k)

s

+ u

(k)

s

It follows that the solution x

(k+1)

is equal to:

x

(k+1)

=

x

(k+1)

t+1

.

.

.

x

(k+1)

t+h

(34)

7

Multi-Period Portfolio Optimization

where:

x

(k+1)

s

= arg min

x

s

g

s

(x

s

) + 1

Ω

s

(x

s

) +

ϕ

2

x

s

− y

(k)

s

+ u

(k)

s

2

2

(35)

Here, we exploit the separability property of f

x

(x). Instead of solving a problem of di-

mension nh, we solve h problems of dimension n. We conclude that the ADMM algorithm

becomes:

1. The x-update is:

x

(k+1)

s

= arg min

x

s

g

s

(x

s

) + 1

Ω

s

(x

s

) +

ϕ

2

x

s

− y

(k)

s

+ u

(k)

s

2

2

(36)

where s = t + 1, t + 2, . . . , t + h.

2. The y-update is:

y

(k+1)

= arg min

y

f

(k+1)

y

(y) = f

y

(y) +

ϕ

2

x

(k+1)

− y + u

(k)

2

2

(37)

3. The u-update is:

u

(k+1)

= u

(k)

+

x

(k+1)

− y

(k+1)

(38)

The case f

s

(x

s

) is a QP problem f

s

(x

s

) is a QP problem when the objective function

g

s

(x

s

) =

1

2

x

>

s

Q

s

x

s

− x

>

s

R

s

is quadratic and the constraints x

s

∈ Ω

s

are linear. This is for

example the case when we perform mean-variance or tracking-error optimization

4

. It follows

that the x-update reduces to solve a standard QP problem:

x

(k+1)

s

= arg min

x

s

(

1

2

x

>

s

(Q

s

+ ϕI

n

) x

s

− x

>

s

R

s

+ ϕ

y

(k)

s

− u

(k)

s

)

(39)

s.t.

A

s

x

s

= B

s

C

s

x

s

≤ D

s

x

s

≤ x

s

≤ x

s

The case 1

Ω

(h)

(x) = 0 Since there is no coupling constraint, the function f

y

(y) reduces

to h (y) and we have:

f

(k+1)

y

(y) = h (y) +

ϕ

2

x

(k+1)

− y + u

(k)

2

2

= h (y) +

ϕ

2

y − v

(k+1)

2

2

(40)

where v

(k+1)

= x

(k+1)

+ u

(k)

. We deduce that:

y

(k+1)

= arg min

y

ϕ

−1

h (y) +

1

2

y − v

(k+1)

2

2

= prox

ϕ

−1

h

v

(k+1)

(41)

4

In what follows, we only consider this specification because it corresponds to the standard approach of

portfolio allocation.

8

Multi-Period Portfolio Optimization

where prox

f

(v) is the proximal operator of the function f at the point v (Perrin and

Roncalli, 2020).

We consider the ridge penalization h

s

(y

s−1

, y

s

) =

1

2

(y

s

− y

s−1

)

>

Λ

s

(y

s

− y

s−1

). We

have:

f

(k+1)

y

(y) =

1

2

t+h

X

s=t+1

(y

s

− y

s−1

)

>

Λ

s

(y

s

− y

s−1

) + ϕ

y

s

− v

(k+1)

s

2

2

The first-order condition is:

∂ f

(k+1)

y

(y)

∂ y

s

= Λ

s

(y

s

− y

s−1

) − Λ

s+1

(y

s+1

− y

s

) + ϕ

y

s

− v

(k+1)

s

= 0

n

(42)

with the convention Λ

t+h+1

= 0

n,n

. We deduce that:

α

s

y

s−1

+ β

s

y

s

+ γ

s

y

s+1

= ϕv

(k+1)

s

(43)

where α

s

= −Λ

s

, β

s

= Λ

s

+ Λ

s+1

+ ϕ and γ

s

= −Λ

s+1

. We obtain a block-tridiagonal

system:

β

t+1

γ

t+1

0

n,n

· · · 0

n,n

α

t+2

β

t+2

γ

t+2

.

.

.

0

n,n

· · · 0

n,n

α

t+h

β

t+h

y

t+1

y

t+2

.

.

.

y

t+h

=

δ

t+1

δ

t+2

.

.

.

δ

t+h

(44)

where δ

s

= ϕv

(k+1)

s

+ 1 {s = t + 1} · Λ

t+1

y

t

. We can easily solve Equation (44) by using the

recurrence algorithm of block-Gaussian elimination.

Remark 3. In the case where the matrices Λ

s

are diagonal, we can exploit their structure

to obtain a better efficient algorithm. Indeed, we notice that f

(k+1)

y

(y) becomes separable:

f

(k+1)

y

(y) =

1

2

n

X

i=1

t+h

X

s=t+1

λ

i,s

y

i,s

− y

i,s−1

2

+ ϕ

y

i,s

− v

(k+1)

i,s

2

where λ

i,s

is the i

th

element of the diagonal matrix Λ

s

. Using the same analysis as previously,

we obtain a tridiagonal system:

β

i,t+1

γ

i,t+1

0 · · · 0

α

i,t+2

β

i,t+2

γ

i,t+2

.

.

.

0 · · · 0 α

i,t+h

β

i,t+h

y

i,t+1

y

i,t+2

.

.

.

y

i,t+h

=

δ

i,t+1

δ

i,t+2

δ

i,t+h

(45)

where α

i,s

= −λ

i,s

, β

i,s

= λ

i,s

+λ

i,s+1

+ϕ, γ

i,s

= −λ

i,s+1

and δ

i,s

= ϕv

(k+1)

i,s

+1 {s = t + 1}·

λ

i,t+1

y

i,t

.

The case h (y) is an additively separable function If we assume that:

h

s

(y

s−1

, y

s

) =

n

X

i=1

h

s

y

i,s−1

, y

i,s

(46)

9

Multi-Period Portfolio Optimization

we deduce that:

f

(k+1)

y

(y) =

n

X

i=1

t+h

X

s=t+1

h

s

y

i,s−1

, y

i,s

+

ϕ

2

y

i,s

− v

(k+1)

i,s

2

(47)

Let y

(i)

=

y

i,t+1

, . . . , y

i,t+h

be the h × 1 vector that collects the weights of asset i. The

first-order condition is:

∂ f

(k+1)

y

(y)

∂ y

(i)

=

∂ h

s

y

i,s−1

, y

i,s

∂ y

(i)

+ ϕ

y

(i)

− v

(k+1)

(i)

= 0

h

(48)

Therefore, we have to solve n problems of dimension h instead of one problem of dimension

nh.

For instance, the lasso penalization h

s

(y

s−1

, y

s

) = λ

s

ky

s

− y

s−1

k

1

is an additively sep-

arable function:

h

s

(y

s−1

, y

s

) =

n

X

i=1

λ

s

y

i,s

− y

i,s−1

(49)

We deduce that:

h (y) =

t+h

X

s=t+1

n

X

i=1

λ

s

y

i,s

− y

i,s−1

=

n

X

i=1

t+h

X

s=t+1

λ

s

y

i,s

− y

i,s−1

=

n

X

i=1

D (λ) y

(i)

− λ

t+1

e

1

y

i,t

1

(50)

where e

1

= (1, 0, . . . , 0) and D (λ) is a h × h matrix with diagonal and sub-diagonal entries:

D (λ) =

λ

t+1

−λ

t+2

λ

t+2

.

.

.

−λ

t+h

λ

t+h

(51)

Therefore, we split the y-update problem and the solution for y

(k+1)

(i)

is given by the following

optimization problem:

y

(k+1)

(i)

= arg min

y

(i)

D (λ) y

(i)

− λ

t+1

e

1

y

i,t

1

+

ϕ

2

y

(i)

− v

(k+1)

(i)

2

2

= prox

ζ

ϕ

(

y

(i)

;y

i,t

,λ

)

v

(k+1)

(i)

(52)

where the function ζ

ϕ

(x; x

0

, λ) is defined as:

ζ

ϕ

(x; x

0

, λ)

:

= ϕ

−1

D (λ) x − λ

1

e

1

x

0

1

(53)

This proximal solution can be found by using the augmented QP problem or other algorithms

(see Appendix C.1 on page 42).

10

Multi-Period Portfolio Optimization

2.3.2 Block coordinate descent

Definition The goal of the coordinate descent algorithm is to find the solution x

?

=

arg min f (x) by using a series of optimization problems that are more simple to solve. For

that, we choose a coordinate i ∈ {1, n}, we solve the uni-dimensional problem:

x

(k+1)

i

= arg min

x

i

f

x

(k)

1

, . . . , x

(k)

i−1

, x

i

, x

(k)

i+1

, . . . , x

(k)

n

(54)

we update the solution such that x

(k+1)

j

← x

(k)

j

if j 6= i and we iterate the algorithm until

convergence. Coordinate descent is then a variant of the gradient descent and minimizes

the function along one coordinate at each step. The simplest way to choose the coordinate

is to consider cyclic coordinates. In this case, we have:

x

(k+1)

i

= arg min

x

i

f

x

(k+1)

1

, . . . , x

(k+1)

i−1

, x

i

, x

(k)

i+1

, . . . , x

(k)

n

(55)

The previous algorithm can be extended to the case where x

i

is not a scalar, but a block

of coordinates. In this case, we solve the minimization problem with respect to x

1

by

considering the blocks x

2

, . . . , x

n

as given. Then, we update the solution x

1

and we solve

the minimization problem with respect to x

2

by considering the blocks x

1

, x

3

, . . . , x

n

as

given. Since each iteration involves a block of coordinates, this algorithm is called “block

coordinate descent” (BCD).

Application to the multi-period optimization problem The function to minimize is

equal to:

f (x

t+1

, . . . , x

t+h

) =

t+h

X

s=t+1

g

s

(x

s

) + h

s

(x

s−1

, x

s

)

+ 1

Ω

(x

t+1

, . . . , x

t+h

) (56)

We consider each vector x

s

as a block of coordinates. We deduce that the BCD algorithm

consists in the following iterations:

x

(k+1)

s

= arg min

x

s

f (x

t+1

, . . . , x

s−1

, x

s

, x

s+1

, . . . , x

t+h

)

= arg min f

s

x

s

| x

(−s)

(57)

where x

(−s)

= (x

t+1

, . . . , x

s−1

, x

s+1

, . . . , x

t+h

) and

5

:

f

s

x

s

| x

(−s)

= g

s

(x

s

) + h

s

(x

s−1

, x

s

) + h

s+1

(x

s

, x

s+1

) +

1

Ω

s

(x

s

) + 1

Ω

(h)

(x

t+1

, . . . , x

t+h

) (58)

In the case where 1

Ω

(h)

(x) = 0, the function f

s

x

s

| x

(−s)

reduces to f

s

x

s

| x

s−1

, x

s+1

:

f

s

x

s

| x

s−1

, x

s+1

= g

s

(x

s

) + h

s

(x

s−1

, x

s

) + h

s+1

(x

s

, x

s+1

) + 1

Ω

s

(x

s

) (59)

Therefore, the case 1

Ω

(h)

(x) = 0 is appealing since it can be considered as a single-period reg-

ularized optimization problem with two penalty functions

6

h

s

(x

s−1

, x

s

) and h

s+1

(x

s

, x

s+1

).

5

Because we have Ω = Ω

(g)

∩ Ω

(h)

and Ω

(g)

=

T

t+h

s=t+1

Ω

s

.

6

If s = t + h, the function h

s+1

(x

s

, x

s+1

) is set to 0 and we have only one penalty function.

11

Multi-Period Portfolio Optimization

The mean-variance-ridge problem We formulate the function g

s

(x

s

) as follows:

g

s

(x

s

) =

1

2

x

>

s

Q

s

x

s

− x

>

s

R

s

(60)

This general formulation encompasses the mean-variance optimization problem, the tracking-

error minimization problem and the portfolio optimization with a benchmark. We have:

f

s

x

s

| x

s−1

, x

s+1

=

1

2

x

>

s

Q

s

x

s

− x

>

s

R

s

+ 1

Ω

s

(x

s

)

1

2

(x

s

− x

s−1

)

>

Λ

s

(x

s

− x

s−1

) +

1

2

(x

s+1

− x

s

)

>

Λ

s+1

(x

s+1

− x

s

)

=

1

2

x

>

s

(Q

s

+ Λ

s

+ Λ

s+1

) x

s

− x

>

s

(R

s

+ Λ

s

x

s−1

+ Λ

s+1

x

s+1

) +

1

Ω

s

(x

s

) +

1

2

x

>

s−1

Λ

s

x

s−1

+

1

2

x

>

s+1

Λ

s+1

x

s+1

(61)

We deduce that:

x

(k+1)

s

= arg min

x

s

1

2

x

>

s

(Q

s

+ Λ

s

+ Λ

s+1

) x

s

− x

>

s

(R

s

+ Λ

s

x

s−1

+ Λ

s+1

x

s+1

) + 1

Ω

s

(x

s

)

(62)

If the constraints x

s

∈ Ω

s

are linear, we obtain a QP problem. The BCD algorithm consists

then in solving a series of QP problems. While the dimension of the original problem is nh,

the dimension of the BCD algorithm reduces to n.

The mean-variance-lasso problem In this case, we have:

x

(k+1)

s

= arg min

x

s

1

2

x

>

s

Q

s

x

s

− x

>

s

R

s

+ λ

s

kx

s

− x

s−1

k

1

+ λ

s+1

kx

s+1

− x

s

k

1

+ 1

Ω

s

(x

s

)

(63)

If the constraints x

s

∈ Ω

s

are linear, we can transform this optimization problem into an

augmented QP problem (see Appendix C.4 on page 51).

2.3.3 Quadratic programming

If g (x) + h (x) can be written as a quadratic function and if the constraints x ∈ Ω are linear,

we obtain a quadratic programming problem:

x

?

= arg min

x

1

2

x

>

Qx − x

>

R

(64)

s.t.

Ax = B

Cx ≤ D

x ≤ x ≤ x

This is for example the case of the multi-period mean-variance-ridge problem. For this

problem, the matrices Q and R are given in Appendix C.5 on page 53. If the constraints are

separable with respect to time s, we obtain block linear equality and inequality constraints

(see Appendix C.6 on page 54).

The multi-period mean-variance-lasso problem is not a QP problem since we have:

h (x) =

t+h

X

s=t+1

h

s

(x

s−1

, x

s

) =

t+h

X

s=t+1

λ

s

kx

s

− x

s−1

k

1

(65)

12

Multi-Period Portfolio Optimization

Nevertheless, we can use the trick of augmented variables:

x

s

= x

s−1

− x

−

s

+ x

+

s

(66)

in order to transform the multi-period mean-variance-lasso problem into an augmented QP

problem. The details are given in Appendix C.7 on page 55.

2.4 Convergence and efficiency of the algorithms

The choice of an algorithm depends on the problem specification and the efficiency of the

algorithm. For instance, in the case where g

s

(x

s

) is a mean-variance function, h

s

(x

s−1

, x

s

)

is a ridge penalty and the constraints Ω are linear, the QP algorithm is certainly the best

choice. Nevertheless, the dimension of this problem is equal to nh where n is the number

of assets and h is the number of periods. For instance, if n = 200 and h = 5, the Q matrix

of the QP algorithm has a dimension 1 000 × 1 000. If the investment universe corresponds

to the MSCI world index, n is greater than 1 500, and the dimension of the QP problem

is larger than 7 500. However, most of QP algorithms are valid for a dimension lower than

2 000. Therefore, we need to use sparse QP algorithms, which are not always implemented

in programming languages. The alternative solution is to use the block coordinate descent

algorithm. For instance, in the case of the mean-variance-ridge problem, it consists in solving

a series of QP problems, whose dimension is equal to n whatever the value of h. From a

theoretical point of view, we can show that this algorithm will converge (Tseng, 2001; Xu

and Yin, 2013).

If we consider that g

s

(x

s

) is a mean-variance function, h

s

(x

s−1

, x

s

) is a lasso penalty and

the constraints Ω are linear, the best choice is the augmented QP algorithm. Nevertheless,

the dimension of the problem is now equal to 3nh. If we consider an investment universe

of 200 assets and 5 periods, the Q matrix of the augmented QP algorithm has a dimension

3 000 × 3 000. Therefore, it is better to use the block coordinate descent algorithm, because

the dimension of each iterated problem is equal to 600. Nevertheless, we are not sure that

the algorithm will converge (Tseng, 2001). An alternative solution is to use the ADMM

algorithm. Again, the convergence of the algorithm is not guaranteed. Moreover, the con-

vergence depends on the algorithm used for solving the y-step. This can also be the case for

non-linear problems (objective function and/or constraints), which require to use Dykstra

algorithms (Dykstra, 1983; Bauschke and Borwein, 1994; Perrin and Roncalli, 2020).

In this context, we must be careful with the solutions obtained by those algorithms. We

must test several starting values and several algorithms when it is possible before deciding

whether or not the numerical solution is acceptable. In all cases, we must consider how

small changes of the problem impact the numerical solution. Moreover, it is also important

to test the algorithm in degenerate and simplified cases in order to understand its behavior.

2.5 Some examples

2.5.1 Transition management

Example 1. We consider a strategic asset allocation problem. The investment universe

is made up of seven asset classes: three fixed-income classes, three equity classes and one

commodity class. The parameters are given in Appendix A.1 on page 30. The current

portfolio is equal to x

t

=

20%, 10%, 15%, 20%, 10%, 15%, 10%

.

Using the expected returns µ

t

and the covariance matrix Σ

t

defined on page 30, we

compute the long-only mean-variance portfolio: x

?

= arg min

1

2

x

>

Σ

t

x−γx

>

µ

t

with γ = 1%.

13

Multi-Period Portfolio Optimization

The solution is x

?

=

46.21%, 38.21%, 0%, 4.09%, 4.09%, 7.11%, 0.30%

. Since we notice

that the turnover τ (x

t

, x

?

) = kx

?

− x

t

k

1

is equal to 108.82%, it is not possible to directly

implement this strategic asset allocation policy. Indeed, there is a large discrepancy between

the current portfolio x

t

and the target portfolio x

?

. Therefore, we generally consider a

transition management approach, whose goal is to change the assets of the portfolio by

minimizing the transaction costs and mitigating the market risks associated with these

changes (Rattray, 2003).

Let us assume that the transition management process consists in changing the compo-

sition of the portfolio in h periods and limiting the turnover at each rebalancing date. We

can proceed in an iterative way and solve the following mean-variance problem:

x

?

s

= arg min

1

2

x

>

s

Σ

t

x

s

− γx

>

s

µ

t

for s = t + 1, . . . , t + h (67)

s.t.

1

>

n

x

s

= 1

x

s

− x

?

s−1

1

≤ τ

s

x

s

≥ 0

n

where x

?

t

= x

t

and τ

s

is the maximum turnover at time s. For instance, in the previous

example, we had τ (x

t

, x

?

) = 108.82%, implying that we can impose τ

s

= 25% if we consider

h = 5 rebalancing periods. Results are given in Table 1. We verify that the optimal solution

at time t + 5 is equal to the mean-variance portfolio.

Table 1: Iterative solution in % (transition management)

s t t + 1 t + 2 t + 3 t + 4 t + 5

x

1,s

20.00 20.00 20.04 27.25 39.74 46.21

x

2,s

10.00 22.50 34.96 40.25 40.26 38.21

x

3,s

15.00 15.00 15.00 15.00 3.92 0.00

x

4,s

20.00 20.00 11.62 5.65 5.57 4.09

x

5,s

10.00 10.00 9.99 5.65 4.70 4.09

x

6,s

15.00 7.77 5.56 5.16 5.16 7.11

x

7,s

10.00 4.74 2.82 1.04 0.64 0.30

τ

s

25.00 25.00 25.00 25.00 16.83

Another method is to consider the multi-period mean-variance-lasso optimization prob-

lem, which is described on page 58. We have:

x

?

t+1

, . . . , x

?

t+h

= arg min

t+h

X

s=t+1

1

2

x

>

s

Σ

t

x

s

− γx

>

s

µ

t

(68)

s.t.

1

>

n

x

s

= 1

x

s

− x

?

s−1

1

≤ τ

s

x

s

≥ 0

n

x

?

t

= x

t

for s = t + 1, . . . , t + h

Using the augmented QP (or a-QP) algorithm and the block coordinate descent method

7

(or BCD), we obtain the results given in Tables 2 and 3.

We notice that we obtain the same solution for x

?

t+5

, but the path

x

?

t+1

, . . . , x

?

t+h

is

not the same if we compare the iterative, a-QP and BCD solutions. Moreover, the total

7

The BCD algorithm is initialized with x

(0)

= (x

t

, . . . , x

t

).

14

Multi-Period Portfolio Optimization

Table 2: Augmented QP solution in % (transition management)

s t t + 1 t + 2 t + 3 t + 4 t + 5

x

1,s

20.00 20.00 20.10 28.05 40.52 46.21

x

2,s

10.00 22.50 34.90 39.45 39.48 38.21

x

3,s

15.00 15.00 15.00 15.00 3.83 0.00

x

4,s

20.00 20.00 11.43 5.17 5.10 4.09

x

5,s

10.00 10.00 10.00 5.57 4.70 4.09

x

6,s

15.00 7.76 5.78 5.78 5.78 7.11

x

7,s

10.00 4.74 2.80 0.98 0.59 0.30

τ

s

25.00 25.00 25.00 25.00 14.02

Table 3: Block CD solution in % (transition management)

s t t + 1 t + 2 t + 3 t + 4 t + 5

x

1,s

20.00 20.00 20.05 27.72 40.18 46.21

x

2,s

10.00 22.50 34.95 39.78 39.82 38.21

x

3,s

15.00 15.00 15.00 15.00 3.90 0.00

x

4,s

20.00 20.00 11.61 5.54 5.37 4.09

x

5,s

10.00 10.00 10.00 5.61 4.77 4.09

x

6,s

15.00 7.76 5.56 5.33 5.33 7.11

x

7,s

10.00 4.74 2.82 1.03 0.63 0.30

τ

s

25.00 25.00 25.00 25.00 16.52

turnover

P

t+h

s=t+1

x

s

− x

?

s−1

1

is respectively equal to 116.83%, 114.02% and 116.52%. It is

therefore larger than the figure 108.82% computed previously. This is because we can buy

more than the target at a rebalancing date s and then sell a part at the next rebalancing

date s + 1. As a result, the total turnover may be greater than 108.82%. In order to find

an optimal path, we can introduce transaction costs. For instance, if we consider quadratic

transaction costs, the objective function becomes:

f

s

(x

s

) =

1

2

x

>

s

Σ

t

x

s

− γx

>

s

µ

t

+

1

2

(x

s

− x

s−1

)

>

Λ

s

(x

s

− x

s−1

) (69)

Nevertheless, by modifying the mean-variance function, we are not certain to obtain the

right solution. In particular, we can face the following two extreme situations:

1. If the matrix Λ

s

is too small, we obtain the previous solutions because the penalization

is too low;

2. If the matrix Λ

s

is too big, we obtain a solution which is far from optimal. In fact,

the risk is that the solution sticks to the current allocation (x

?

t+1

= . . . = x

?

t+h

= x

t

)

because the penalization is too prohibitive.

Let x

t

and x

?

be the current and target portfolios. A transition management process requires

that the allocation to an asset can only be increasing or decreasing:

x

?

i

≥ x

i,t

⇒ x

i,s

≥ x

i,s−1

x

?

i

≤ x

i,t

⇒ x

i,s

≤ x

i,s−1

(70)

This means that we cannot decrease the allocation to asset i at a given rebalancing date

s if its weight in the target portfolio is larger than its weight in the current portfolio. In

15

Multi-Period Portfolio Optimization

Appendix C.8 on page 60, we show how to translate the monotonic property into inequality

constraints. We report the results in Tables 11, 12 and 13 on page 31. In this case, we

obtain similar results with each of the three methods.

2.5.2 Total variation regularized portfolio

Example 2. We consider an investment universe of 7 stocks. The values of their idiosyn-

cratic risk ˜σ

i

and beta β

i

are equal to:

Stock i 1 2 3 4 5 6 7

˜σ

i

3% 5% 15% 16% 10% 8% 10%

β

i

−0.50 −0.50 0.00 0.50 1.00 1.75 2.00

We also assume that the market risk volatility σ

m

is equal to 20%. The current portfolio cor-

responds to the global minimum variance (GMV) portfolio

8

: x

t

= (54.15%, 19.50%, 2.30%,

2.14%, 5.78%, 9.74%, 6.39%).

We consider the following `

1

-regularization problem

9

:

x

?

t+1

= arg min

t+h

X

s=t+1

1

2

x

>

s

Σx

s

+ λ

s

kx

s

− x

s−1

k

1

(72)

s.t.

(

1

>

n

x

s

= 1

β (x

s

) ≥ β

−

s

where Σ = ββ

>

σ

2

m

+ diag

˜σ

2

1

, . . . , ˜σ

2

n

is the one-factor covariance matrix, λ

s

is the penal-

ization factor at time s, β (x

s

) is the beta of the portfolio x

s

and β

−

s

is the minimum beta

at time s. Since we have β (x

s

) =

P

n

i=1

x

i,s

β

i

= x

>

s

β, the beta constraint is equivalent to

the system C

s

x

s

≤ D

s

where C

s

= −β

>

and D

s

= −β

−

s

. Problem (72) can be solved using

the ADMM algorithm where the x-update corresponds to a series of QP problems and the

y-update is the proximal operator of the function ζ

ϕ

(x; x

t

, λ).

Let us assume that β

−

s

= β

0

·

s − (t + 1)

and λ

s

= λ

0

· (s − t). We solve Problem (72)

when β

0

= 0.125 and λ

0

takes different values (1%, 2%, 3%, 4%). Moreover, we study the

impact of the time horizon h on the solution. The optimal weights x

?

i,t+1

are reported in

Figure 1 for the first, second, sixth and seventh assets. If λ

0

is equal to zero, we can verify

that the optimal solution x

?

t+1

does not depend on the time horizon h because this is not

a coupling problem

10

. If λ

0

> 0, the optimal solution x

?

t+1

depends on the time horizon h.

For instance, the weight of the seventh stock increases when h is small and then decreases

when h is high. The weight of the sixth stock does not change and then increases whereas

the weight of the first stock decreases initially and then reaches a floor.

8

The GMV portfolio is given by minimizing the portfolio variance without any constraints:

x

t

= arg min

1

2

x

>

Σx

(71)

s.t. 1

>

n

x = 1

where Σ = ββ

>

σ

2

m

+ diag

˜σ

2

1

, . . . , ˜σ

2

n

is the one-factor covariance matrix.

9

This is a special case of total variation regularization problems (Corsaro et al., 2020, 2021).

10

Indeed, Problem (72) reduces to h problems:

x

?

s

= arg min

1

2

x

>

s

Σx

s

(73)

s.t.

(

1

>

n

x

s

= 1

β (x

s

) ≥ β

−

s

when λ

s

= 0.

16

Multi-Period Portfolio Optimization

Figure 1: Regularized minimum variance portfolio x

?

t+1

in % (β

0

= 0.125)

0 2 4 6 8 10

20

30

40

50

60

0 2 4 6 8 10

0

5

10

15

20

0 2 4 6 8 10

5

10

15

20

25

0 2 4 6 8 10

0

10

20

30

2.5.3 Trading trajectory problem

We consider the trading trajectory problem, which consists in finding the optimal trading

strategy while considering trading costs. If we use a mean-variance framework, the objective

function becomes:

f

s

(x

s

) =

1

2

x

>

s

Σ

s

x

s

− x

>

s

γµ

s

+

TC

s

(x

s−1

, x

s

) + PI

s

(x

s−1

, x

s

) (74)

where TC

s

(x

s−1

, x

s

) and PI

s

(x

s−1

, x

s

) are the transaction costs and price impacts. Follow-

ing Gˆarleanu and Pedersen (2013, page 2320), we have:

TC

s

(x

s−1

, x

s

) =

1

2

(x

s

− x

s−1

)

>

Λ

s

(x

s

− x

s−1

) (75)

and:

PI

s

(x

s−1

, x

s

) = φx

>

s

Γ

s

(x

s

− x

s−1

) − x

>

s−1

Γ

s

(x

s

− x

s−1

) −

1

2

(x

s

− x

s−1

)

>

Γ

s

(x

s

− x

s−1

) (76)

where φ is the mean-reversion parameter of the price distortion, Λ

s

and Γ

s

are Kyle’s

matrices for temporary trading costs and permanent price impacts.

Remark 4. To understand the previous formula, we assume that the number n of assets

is equal to one and a linear price impact model (Roncalli et al., 2021). If we continuously

sell or buy the security between s − 1 and s, the average change is equal to

1

2

∆x

s

. The unit

17

Multi-Period Portfolio Optimization

transaction cost is then equal to c

s

=

1

2

λ

s

∆x

s

whereas the total transaction cost is:

TC

s

(x

s−1

, x

s

) = c

s

· ∆x

s

=

1

2

λ

s

(∆x

s

)

2

(77)

At the same time, we observe a price distortion during the period [s − 1, s + 1]. If ∆x

s

> 0,

this implies that the price increases between s − 1 and s. By assuming that the return

increases by ∆µ

s

= γ

s

∆x

s

, we obtain the following potential gain:

G

s

(x

s−1

, x

s

) = ∆µ

s

·

x

s−1

+

1

2

∆x

s

= γ

s

x

s−1

∆x

s

+

1

2

γ

s

(∆x

s

)

2

(78)

Nevertheless, the price distortion can mean-revert, implying a potential loss between s and

s + 1:

L

s

(x

s−1

, x

s

) = −∆µ

s+1

· x

s

= φ∆µ

s

· x

s

= φγ

s

x

s

∆x

s

(79)

Finally, we obtain:

PI

s

(x

s−1

, x

s

) = L

s

(x

s−1

, x

s

) − G

s

(x

s−1

, x

s

)

= φγ

s

x

s

∆x

s

− γ

s

x

s−1

∆x

s

−

1

2

γ

s

(∆x

s

)

2

(80)

Formula (76) is a generalization of this equation in the multi-dimensional case.

Rosenberg et al. (2016) proposed another formulation

11

:

f

s

(x

s

) =

1

2

x

>

s

Σ

s

x

s

− x

>

s

γµ

s

+

(x

s

− x

s−1

)

>

Λ

0

s

(x

s

− x

s−1

) − x

>

s

Γ

0

s

(x

s

− x

s−1

) (81)

The transaction costs and the price impacts differ slightly. Indeed, the authors did not

breakdown the effects between s−1 and s+1, assumed discrete trading instead of continuous

trading

12

and used a net impact

13

. The two formulations can be cast into the following

function:

f

s

(x

s

) =

1

2

x

>

s

Σ

s

x

s

− x

>

s

(γµ

s

− φΓ

s

∆x

s

) +

1

2

∆x

>

s

Λ

s

∆x

s

− ε

x

>

s−1

Γ

s

∆x

s

+

1

2

∆x

>

s

Γ

s

∆x

s

(83)

The formulation of Gˆarleanu and Pedersen (2013) is obtained with ε = 1 whereas the

formulation of Rosenberg et al. (2016) corresponds to φ = −1, ε = 0, Λ

s

= 2Λ

0

s

and

Γ

s

= Γ

0

s

.

11

Steinhauer et al. (2020) used an optimization procedure based on simulated bifurcation to solve this

problem, which can be an alternative approach to the quantum annealer suggested by Rosenberg et al.

(2016).

12

This explains that the factor

1

/2 vanishes.

13

We have:

PI

s

(x

s−1

, x

s

) = φx

>

s

Γ

s

∆x

s

− x

>

s−1

Γ

s

∆x

s

− ∆x

>

s

Γ

s

∆x

s

= φx

>

s

Γ

s

∆x

s

− x

>

s

Γ

s

∆x

s

= − (1 − φ) x

>

s

Γ

s

∆x

s

= −x

>

s

Γ

0

s

∆x

s

(82)

where Γ

0

s

= (1 − φ) Γ

s

is the Kyle’s matrix for net price impacts, (1 − φ) is the net factor and Γ

s

is the

Kyle’s matrix for gross price impacts.

18

Multi-Period Portfolio Optimization

In Appendix C.9 on page 61, we show that:

f

s

(x

s

) =

1

2

x

>

s

Q

0,0

s

x

s

− x

>

s

Q

0,1

s

x

s−1

+

1

2

x

>

s−1

Q

1,1

s

x

s−1

− x

>

s

R

s

(84)

where Q

0,0

s

= Q

s

+ Λ

s

+ (2φ − ε) Γ

s

, Q

0,1

s

= Λ

s

+ φΓ

s

, Q

1,1

s

= Λ

s

+ εΓ

s

and R

s

= γ

s

µ

s

.

To solve the trading trajectory problem, we can use the block coordinate descent. Let us

introduce the notation f

s

(x

s−1

, x

s

)

:

= f

s

(x

s

). A first idea is to consider the following

iterative step:

x

(k+1)

s

= arg min

x

s

f

s

x

(k+1)

s−1

, x

s

(85)

Nevertheless, the cyclical BCD algorithm stops after the first cycle and does not converge

because the coupling is between x

s−1

and x

s

, implying that the new coordinate x

(k+1)

s

has no impact on the previous coordinates x

(k+1)

u

for u < s. Empirical experiments show

that this issue remains if we use the random BCD algorithm. Let us consider the function

f

s

(x

s−1

, x

s

, x

s+1

), whose coupling concerns x

s−1

, x

s

and x

s+1

:

f

s

(x

s−1

, x

s

, x

s+1

)

:

=

1

2

x

>

s

Q

0,0

s

x

s

− x

>

s

Q

0,1

s

x

s−1

+

1

2

x

>

s−1

Q

1,1

s

x

s−1

− x

>

s

R

s

+

1

2

x

>

s+1

Q

0,0

s+1

x

s+1

− x

>

s+1

Q

0,1

s+1

x

s

+

1

2

x

>

s

Q

1,1

s+1

x

s

− x

>

s+1

R

s+1

(86)

The iterative step becomes:

x

(k+1)

s

= arg min

x

s

f

s

x

(k+1)

s−1

, x

s

, x

(k)

s+1

= arg min

x

s

f

?

s

x

(k+1)

s−1

, x

s

, x

(k)

s+1

(87)

where:

f

?

s

x

(k+1)

s−1

, x

s

, x

(k)

s+1

=

1

2

x

>

s

Q

0,0

s

+ Q

1,1

s+1

x

s

− x

>

s

R

s

+ Q

0,1

s

x

(k+1)

s−1

+ Q

0,1

s+1

x

(k)

s+1

(88)

If the constraints are linear, x

(k+1)

s

is the solution of a QP problem. Concerning the ADMM

algorithm, this approach is not really appropriate because the objective function is not

separable

14

. Finally, we can also use the QP problem if the constraints are linear

15

.

Example 3. We consider a universe of four assets. Their expected returns are equal to

5%, 6%, 7% and 8% while their volatilities are equal to 15%, 20%, 25% and 30%. The

correlation matrix of asset returns is given by the following matrix:

C =

1.00

0.10 1.00

0.40 0.70 1.00

0.50 0.40 0.40 1.00

14

Indeed, we have:

f

x

(x) =

t+h

X

s=t+1

1

2

x

>

s

Q

0,0

s

x

s

− x

>

s

R

s

(89)

and:

f

y

(y) =

t+h

X

s=t+1

1

2

y

>

s−1

Q

1,1

s

y

s−1

− y

>

s

Q

0,1

s

y

s−1

(90)

f

x

(x) is separable, but not f

y

(y).

15

The derivation of the QP problem is given on page 61.

19

Multi-Period Portfolio Optimization

In what follows, we use the model of Gˆarleanu and Pedersen (2013). We assume

that the transaction costs and price impacts are proportional to asset volatilities. We

consider the stationary model: Σ

s

= Σ, µ

s

= µ, γ = 1, Λ

s

= %

Λ

S and Γ

s

= %

Γ

S,

where S = diag (σ

1

, . . . , σ

4

) is the diagonal matrix of volatilities. We estimate the op-

timal trading trajectory

n

x

∗

t+1

, . . . , x

∗

t+h

o

by considering that the current portfolio x

t

is

the equally-weighted portfolio. The mean-variance optimized portfolio is equal to x

mvo

=

20.39%, 23.11%, 24.74%, 31.76%

. If we set %

Λ

= %

Γ

= 0, we obtain x

∗

t+1

= . . . = x

∗

t+h

=

x

mvo

. If %

Λ

= ∞, we verify that x

∗

t+1

= . . . = x

∗

t+h

= x

t

. In Table 4, we report the opti-

mal trajectory for %

Λ

= 5% and two values of %

Γ

. Moreover, we consider three values of the

mean-reversion parameter φ: 0%, 50% and 100%. It is interesting to notice that the solution

at time t+1 is largely the same, but the solution at time t+5 is very different. In particular,

we notice that the turnover is a decreasing function of the mean-reversion parameter φ and

an increasing function of the price impact parameter %

Γ

. The mean-reversion effect disap-

pears when φ = 0, implying that the trader can create a “momentum ignition”. This is why

we observe a monotonic allocation increase in the third and fourth assets between t + 1 and

t + 5. This momentum pattern also depends on the price impact magnitude, which explains

why it is stronger for %

Γ

= 10% than for %

Γ

= 1%. When φ = 1, the price momentum at

time s is offset by the price reversal at time s + 1. Therefore, the trading gains are limited

and the turnover is reduced.

Table 4: Optimal trading trajectory in % (γ = 1, %

Λ

= 5%)

φ s

%

Γ

= 1% %

Γ

= 10%

x

?

1,s

x

?

2,s

x

?

3,s

x

?

4,s

x

?

1,s

x

?

2,s

x

?

3,s

x

?

4,s

t + 1 21.48 23.60 24.53 30.40 21.40 23.34 24.81 30.46

t + 2 20.63 23.24 24.64 31.48 20.32 22.38 25.58 31.73

0% t + 3 20.40 23.11 24.75 31.74 19.20 20.48 27.66 32.66

t + 4 20.20 22.97 24.91 31.92 15.45 15.18 33.77 35.60

t + 5 19.48 22.69 25.26 32.56 0.00 0.00 52.13 47.87

t + 1 21.54 23.62 24.52 30.31 21.93 23.69 24.63 29.75

t + 2 20.67 23.27 24.62 31.44 20.74 23.12 24.86 31.28

50% t + 3 20.44 23.14 24.72 31.71 20.00 22.62 25.35 32.03

t + 4 20.30 23.06 24.81 31.83 18.77 21.85 26.26 33.12

t + 5 19.96 22.92 24.97 32.14 15.45 20.36 28.07 36.11

t + 1 21.61 23.65 24.52 30.23 22.31 23.92 24.52 29.25

t + 2 20.71 23.29 24.60 31.40 21.19 23.49 24.51 30.81

100% t + 3 20.47 23.18 24.68 31.67 20.72 23.30 24.58 31.39

t + 4 20.41 23.14 24.71 31.73 20.54 23.22 24.63 31.61

t + 5 20.40 23.12 24.73 31.75 20.47 23.19 24.66 31.68

Remark 5. We notice that the momentum ignition implies an arbitrage opportunity in the

last period when φ < 1. Indeed, the multi-period optimization does not consider profits and

losses after the period t + h. In order to eliminate this free lunch, we can impose solving

the problem by considering the extended period [t + 1, t + h + 1] and imposing the constraint

x

t+h

= x

t+h+1

. This last restriction means that trading is stopped after s > t + h. Since

we include the period s = t + h + 1 in the multi-period optimization problem, the objective

function takes into account profits and losses after the period t +h. This boundary condition

is particularly relevant when the mean-reversion parameter φ is close to zero. Let us consider

the previous example. Results obtained with the boundary condition are reported in Table

14 on page 32. A comparison of the two approaches is provided in Table 5 for the case

20

Multi-Period Portfolio Optimization

%

Γ

= 10% and φ = 0. Whereas the solution x

?

t+5

is equal to

0%, 0%, 52.13%, 47.87%

without the boundary condition, it becomes

12.82%, 16.81%, 32.08.13%, 38.29%

when the

correction is implemented. The two solutions are very different, because the performance of

the trader is not impacted by the P&L in the period t + 6 in the first approach.

Table 5: Impact of the boundary condition on the optimal solution (γ = 1, %

Λ

= 5%,

%

Γ

= 10%, φ = 0)

s

Without the boundary condition With the boundary condition

x

?

1,s

x

?

2,s

x

?

3,s

x

?

4,s

x

?

1,s

x

?

2,s

x

?

3,s

x

?

4,s

t + 1 21.40 23.34 24.81 30.46 21.45 23.53 24.60 30.42

t + 2 20.32 22.38 25.58 31.73 20.53 23.01 24.89 31.56

t + 3 19.20 20.48 27.66 32.66 20.01 22.42 25.52 32.05

t + 4 15.45 15.18 33.77 35.60 18.61 20.95 27.21 33.23

t + 5 0.00 0.00 52.13 47.87 12.82 16.81 32.08 38.29

Remark 6. In practice, the mean-reversion parameter φ is stochastic because we do not

really know how the market will react. Moreover, φ also depends on the size of the trade.

Therefore, it is better to consider several values of φ in order to analyze the several trading

scenarios and the different possible outcomes.

3 Application to portfolio decarbonization

The aim of portfolio decarbonization is to construct an investment portfolio that tracks

a benchmark portfolio but with a lower carbon risk metric, which is generally the carbon

intensity (Le Guenedal and Roncalli, 2022). The concept of portfolio decarbonization has

been extended by taking into account a carbon trajectory (Le Guenedal et al., 2022). While

portfolio decarbonization is a static problem, portfolio alignment implies a dynamic approach

in order to comply with a given climate policy (e.g. Paris-based benchmark approach or

net zero carbon objective approach). Therefore, the portfolio construction becomes a multi-

period portfolio optimization problem with time-varying constraints. The constraints impose

both a decarbonization path for the dynamic portfolio and a minimum financing level for

sectors that are essential to the transition to a low-carbon economy. Nevertheless, these

constraints are not always coherent since we know that there is a negative correlation between

carbon intensities and green revenues for instance. Therefore, the dynamic portfolio may

involve rebalancing allocations that are not always optimal. For example, the weight of

an asset may increase in a first period and then decrease in a second period because one

constraint becomes tighter with time.

3.1 Definition of the optimization problem

Le Guenedal and Roncalli (2022) consider the following optimization problem:

x

?

t+1

= arg min

t+h

X

s=t+1

e

−%

1

(s−t−1)

1

2

σ

2

x

s

| b

s

+ λ

s

e

−%

2

(s−t−1)

τ (x

s−1

, x

s

)

(91)

s.t.

1

>

n

x

s

= 1

x

s

≥ 0

n

CI (x

s

) ≤

1 − R (t, s)

· CI (b

t

)

CIS

High

(x

s

) ≥ ϕ

CIS

· CIS

High

(b

t

)

21

Multi-Period Portfolio Optimization

where %

1

and %

2

are the discount rates, σ

2

x

s

| b

s

is the tracking error variance of the

investment portfolio x

s

with respect to the investment benchmark b

s

:

σ

2

x

s

| b

s

= (x

s

− b

s

)

>

Σ

s

(x

s

− b

s

) (92)

and τ (x

s−1

, x

s

) is the turnover ratio between s − 1 and s:

τ (x

s−1

, x

s

) = kx

s

− x

s−1

k

1

(93)

The objective function defines a classical tracking problem where we would like to minimize

the tracking risk and limit the turnover. However, Problem (91) has two “climate investing”

constraints. The first one imposes that the carbon intensity CI (x

s

) of the portfolio at time

s > t is less than the carbon intensity CI (b

t

) of the benchmark and the reduction between

t and s is denoted by R (t, s). This constraint defines a decarbonization pathway and we

have:

R (t, t + 1) < R (t, t + 2) < · · · < R (t, t + h) (94)

This implies that the carbon intensity of Portfolio x

s

must decrease with the time. The

second constraint imposes that the portfolio has a minimum exposure on high climate impact

sectors (CIS).

3.2 Numerical solution of the optimization problem

The decarbonization and CIS constraints can be written as:

n

X

i=1

CI

i

· x

i,s

≤

1 − R (t, s)

· CI (b

t

) (95)

and:

n

X

i=1

1

i ∈ CIS

High

· x

i,s

≥ ϕ

CIS

· CIS

High

(b

t

) (96)

Let ξ

i

= 1

i ∈ CIS

High

be the indicator function which is equal to 1 if the asset i belongs

the high CIS class or 0 otherwise. We can combine the two constraints in order to obtain

the inequality system C

s

x

s

≤ D

s

where:

C

s

=

CI

1

CI

2

· · · CI

n

−ξ

1

−ξ

2

· · · −ξ

n

(97)

and:

D

s

=

1 − R (t, s)

· CI (b

t

)

−ϕ

CIS

· CIS

High

(b

t

)

!

(98)

Problem (91) becomes

16

:

x

?

t+1

= arg min

t+h

X

s=t+1

g

s

(x

s

) + h

s

(x

s−1

, x

s

)

(99)

s.t.

A

s

x

s

= B

s

C

s

x

s

≤ D

s

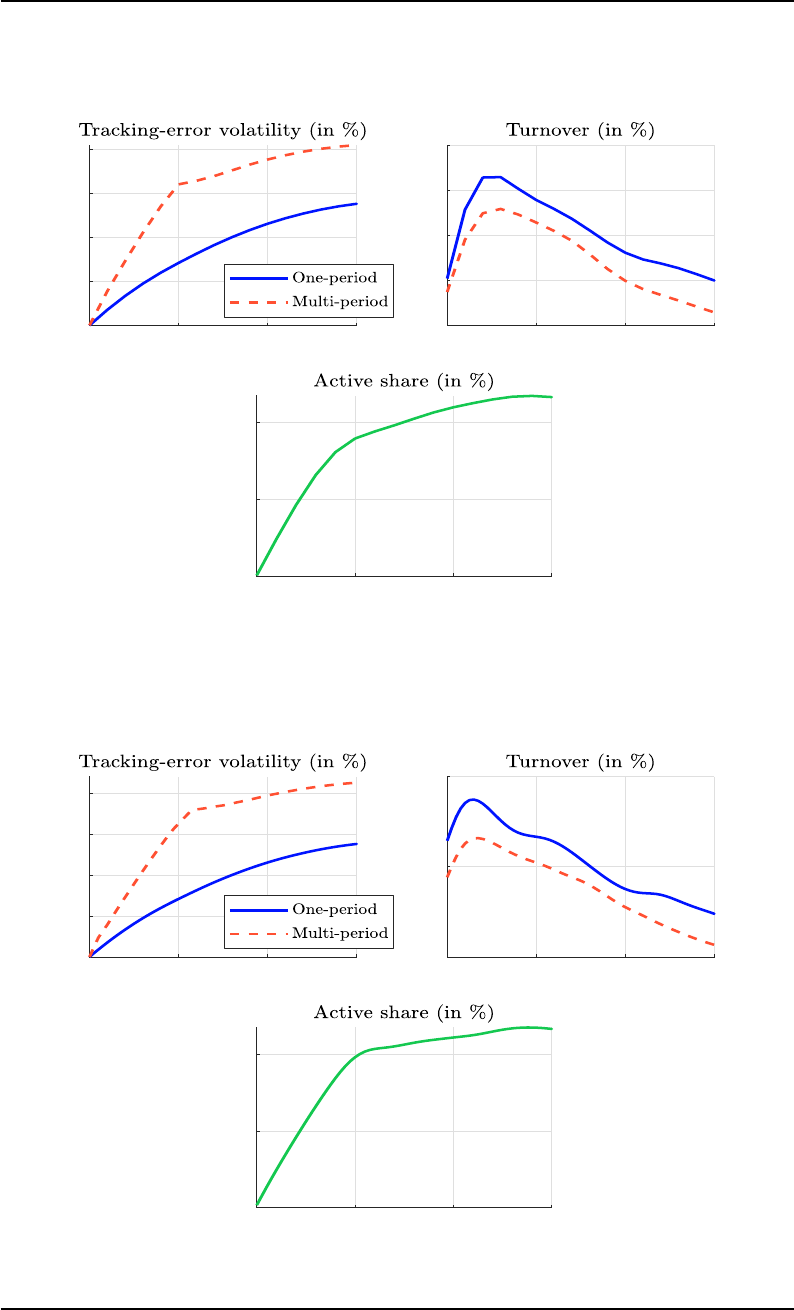

0