COMPANY DRY DOCKS GENOA

Business Plan

18/01/2012 12:27:53(GMT)

Executive Summary.....................................................................................................3

Business Overview......................................................................................................4

Products and Services................................................................................................5

Sales Forecast...............................................................................................................6

Marketing Strategy.......................................................................................................7

Management and Staffing.........................................................................................7

Implementation Plan....................................................................................................9

Overhead and Investments.........................................................................................9

Financing..................................................................................................................... 10

Financial Projections................................................................................................. 11

Risk Analysis................................................................................................................ 16

3

Get started with your business plan – www.iplanner.net

Executive Summary

The contest in which the Dry Docks Genoa develops its business is located in the ships

repair area situated in the eastern part of Genoa port. This company offers a lot of

services for ships that are under repair. The Dry Docks can supply large docks that can be

utilized to accomodate boats of different sizes. Instruments of raising as quay-cranes,

compressed air and gas tools (used for cutting and welding plates steel) and logistic

supports towards crews (mainly during the periods in which the ships are under repair)

are only a few of the services that “Ente Bacini Genova” offers to its clients. Facilities

consist of five dry docks and one thousand and five hundred meters utilized by ships that

are waiting for their reparation-phase. The entire equipment is under concession from

the Port Authority of Genoa.

Main financial measures

2012 2013 2014

Cash 753,400

1,179,643

1,989,272

Sales revenue 6,400,000

11,000,000

14,000,000

Net profit for financial year -479,318

1,938,965

2,854,629

Operating margin -7.49%

17.6%

20.4%

Owners' equity 1,020,682

2,959,647

4,629,276

Return on equity (per year) -47.0%

65.5%

61.7%

Dry docks Genoa3

4

Dry docks Genoa2

Business Overview

The market taken in consideration is that one of international naval repairing. The largest

harbours are equipped with different-size dry docks; dimensions are required to the last

generation of ship constructions and the type of work they need. In fact, nowadays

vessels as container ships (whose weight can be close to 14000 tons and whose length

could be around 360 meters with breadth of 55 meters) and cruisers (able to

accommodate 4000 passengers with a crew composed by almost 2000 members) needed

good and innovative structures and modern ports have to be in the position to supply this

kind of services. Therefore the winning elements of a naval repairing area are extremely

linked with large harbour infrastructures, logistic availability of the city considered

(airports, hotels and institutional seats), with the quality of operating companies, and of

course with the typical weather that marks the above-mentioned city (fundamental

parameter that has to be considered before starting with the necessary operations).

Obviously such kind of activity suffers the international variations of raw materials’ costs

like oil and steel. These costs affect (influence) deeply the prices that firms offer for their

5

services. Another important issue is the national stability of the country considered. Well-

organized and operative trade-union relationships between workers, firms and

government are essential elements for having success in the shipping business.

Products and Services

The main goal of Dry Docks of Genoa is to improve the quality of its services and its

offers. Nowadays the company is missing some points connected with environment and

security at work. There is also a lack of a large dock that could permit to host bigger

ships. The management and shareholders of the company are strongly engaged in trying

to trace the necessary instruments to achieve what was above-mentioned. The examined

company (Ente Bacini Genova) is a S.R.L. (Private Limited Company). It has a fully pay-

up share capital that comes to 300.000 Euro and a mixed stock consisting of Port

Authority (56%) and Private Naval Repairers (44%). The main goal of the company, as

already claimed in other sections of this business plan, is that one to supply shipyards and

naval workshop with the suitable equipment for working on different-sizes ships.

Recently a technical due diligence has laid bare several sensitive matters. Firstly we can

notice the old age of some parts of the structure, for example three of five dry docks have

been built in 1903, so it’s evident that they need fast interventions for innovating and

consolidating their conditions. The company has entered a budget of fifteen-twenty

millions of Euro for realizing these maintenances in 3/5 years. The availability of funds

has to be researched in the State and local authorities, though interventions of private

capital within administration and organization. The Italian market competitors with the

same characteristics are only located in the port of Napoli. In the other calls the presence

of dry docks and relative services are directly managed by the shipyard that has the

concession for it. In these cases there is no possibility to offer a public service, thing that

instead happens in the port of Genoa.

6

Dry docks Genoa

Sales Forecast

During the last five years the earning reports have been slow but steadily growing. This

happened because presently ships are still considered the best instrument to transport of

goods worldwide. Globalization has allowed to new huge markets, as the Chinese one, to

enter overbearingly in the international sphere.

Therefore the worldwide fleet has considered important to start up orders to build

innovative vessels and making safe the ships already working/sailing.

As far as the field of services is concerned, the company has already received

applications for using its dry docks until the first semester of 2012. However it is

necessary to remember that some negative matters can be the cause to cancel a dry

dock reservation. Among them we can mention for example the international instability

(like 11 September or other terroristic attacks), the sudden closing of the Suez Canal, the

price of oil, etc.

7

Sales revenue (EUR)

Products and services 2012 2013 2014

Dry Docks Service 3,650,000

7,000,000

8,000,000

Other Services 2,750,000

4,000,000

6,000,000

6,400,000

11,000,000

14,000,000

Marketing Strategy

Ente Bacini Genoa gets a monopolistic position in the national contest. In fact it cannot

have the same economic behavior of the other Italian private companies, that, having to

face up to the market competition, can decide to offer their dry docks free of charge (in

relation with the number of services that they are required to offer). Considering instead

the other European ports (especially those located in the north), we have to effect a

different interpretation. Rotterdam, Amsterdam and Hamburg are in the technological

forefront and they hold an unreachable position for the Dry Docks of Genoa. Marseille,

Barcelona and Malta live contradictions so similar to Genoa’s ones. The challenge is

played mainly on the due delivery’s trustworthiness of the final product.

Important additional services that can be required to a Dry Docks company are the

possibility of satisfying the crew’s requests (in fact the crew live on board of the ship

during the works) and to grant security safety towards people and things. Another

essential issue is represented by the capability of working respecting the main standard

characters given by international organisms of control. Other interesting parameters are

the capability of the company in not loosing time (in fact the ships are profitable when

they can sail); so companies don’t have to waste time due to spare parts delay or

for instruments of work that have limited capabilities.

Management and Staffing

The organization chart of the company consists of a management that is characterized by

an administrator (or General Manager) and an administrative office where five office-

workers and a director of operations. Then there is a technical office made of two heads

of team, eleven electricians, three boatswains (personnel managers), twenty between

sailors, crane operators and carpenters, and one maintenance-team that includes five

authorized staff.

If the company will be able to build a new dry dock (characterized by important

dimensions) during next years, then it should expand its staff at least of eight members.

The features of these new specialists will be chosen considering the necessities connected

with the building of the innovative facility.

Within a company that provides services, the cost of the work is definitely high and

during the last years it has represented at least 35% of whole turnover. To work out the

salaries the firm relies upon the Italian national contract for engineering workers,

enriched by an integrative internal contract that improves considerably the wages. In fact

this type of agreement pays remarkably the overtime for all workers.

8

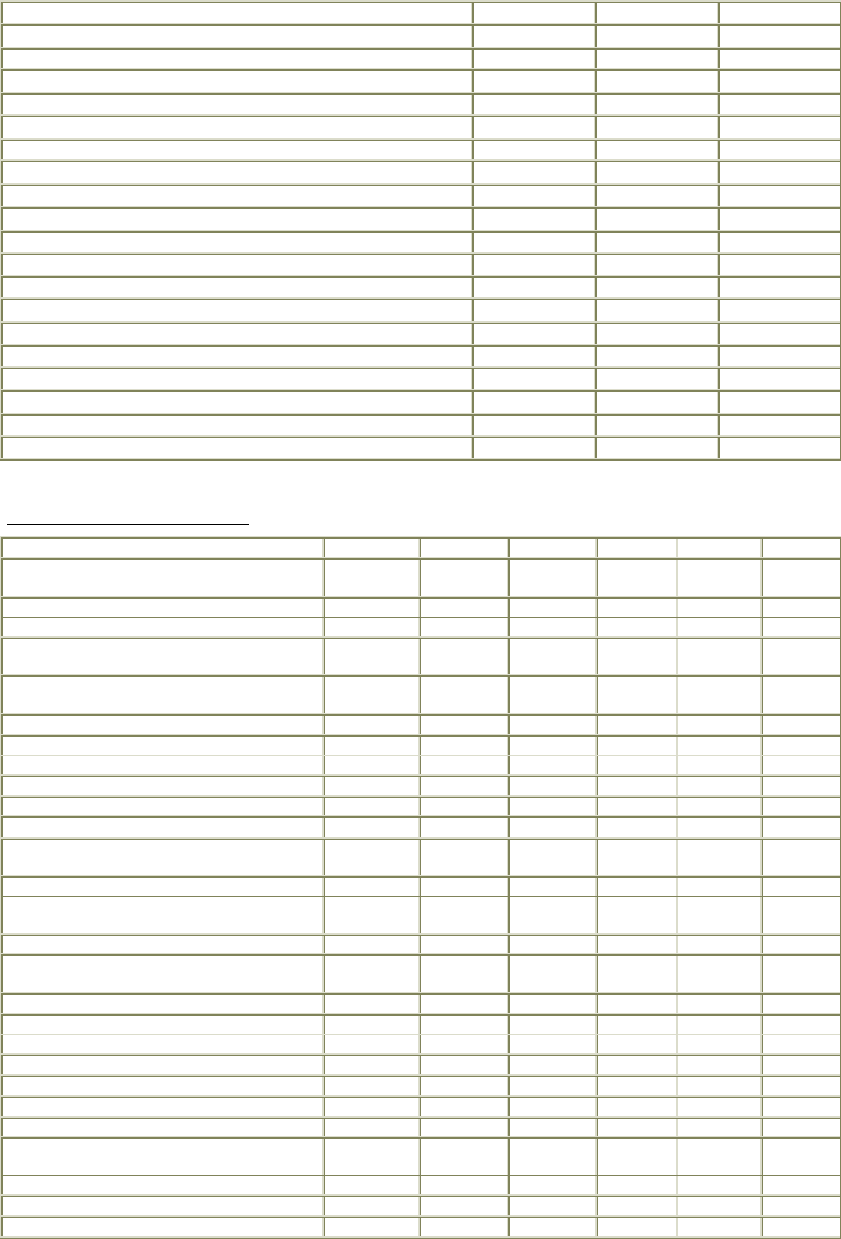

Status (professional qualification) Time of work Firm's cost per month Wage per month

Manager 8-18+ext. time

9.800,00 euro 3.000,00 euro

Technician 8-18+ext. time

6.700,00 euro 2.400,00 euro

Office-worker 8-17 5.500,00 euro 1.700,00 euro

Team's head 8-18+ext. time

5.500,00 euro 1.900,00 euro

Electrician (shift worker) 8 hours 4.700,00 euro 1.550,00 euro

Crane operator (shift worker) 8 hours 4.700,00 euro 1.550,00 euro

Worker 8 hours 4.450,00 euro 1.400,00 euro

Beginner (worker) 8 hours 1.900,00 euro 980,00 euro

Headcount

Personnel 2012 2013 2014

Manager 1

1

1

Team's head 5

5

5

Office-worker 4

4

4

Electrician 14

16

18

Crane operator 18

20

22

Carpenter 6

8

10

Worker 2

4

6

50

58

66

Monthly salary (EUR)

Personnel 2012 2013 2014

Manager 9,800

9,800

9,800

Team's head 5,500

5,500

5,500

Office-worker 5,500

5,500

5,500

Electrician 4,700

4,700

4,700

Crane operator 4,700

4,700

4,700

Carpenter 4,700

4,700

4,700

Worker 4,450

4,450

4,450

Labor cost (EUR)

2012 2013 2014

Wages and salaries 2,961,600

3,406,800

3,852,000

Social security costs 0

0

0

Labor cost 2,961,600

3,406,800

3,852,000

REVENUES 6,400,000

11,000,000

14,000,000

Labor cost to revenues 46.3%

31.0%

27.5%

9

Implementation Plan

The company has troubles in trying to stand comparison with other international

shipyards, as those situated in the north of Europe or in South Korea and China. The main

causes of this backwardness have to be researched in the lack of technological innovation

that is necessary for a such important plant engineering. The productive process of the

Dry Docks Genoa consists of receiving different-dimensions ships and, after that the

boats have been docked, offers the necessary services for permitting other companies of

effecting the requested interventions (following important parameters and standards set

by international bodies like Boureau Veritas, RINA, LLoydd Register, ABB, etc...). The

skill of the management consists in researching structural and engineering critical states

and investing in the appropriate way for increasing technology and organization. In order

to clarify this concept, we can proceed reporting an example that considers the closing’s

system of dry docks (this is fundamental for proceeding with emptying of the same dry

docks). The dry docks of Ente Bacini utilize doors to close the gates (this is the most

famous system used all over in the world). Such gate is sunk at the entrance of the dry

dock. Four hours are usually necessary for emptying a medium-size dry dock (250 met. x

40 met.). However floating dock needs two hours.

Within shipping world time is money, so those firms who are able to safe time warranting

security and quality of services, are for sure winning. The same considerations have to be

done with cranes, short power supply and compressed air, as well as for hot works

equipment used for steel repair.

Overhead and Investments

The shareholders’ meeting has recently approved a new investment plan. It establishes

interventions of refit concerning the eleven cranes (around two millions of Euro) whose

Ente Bacini can arrange, the making safe of the gates of each dry dock (200.000 Euro)

and the complete renovation of one door (650.000 Euro). Then the company, utilizing the

financial resources coming directly from the Italian government through the Port

Authority, will realize the so-called “Cold Iron” (that is a mechanism of supplying for

giving energy straight from shore power lines) , an important instrument necessary for

closing the on board generators, reducing in this way atmospheric emissions and

consequently pollution (around 14 million of Euro). Furthermore nine million of Euro

have been entered for reducing pollution caused by the two dry docks closer to the city

centre (house settlements).

ISP-Code systems, utilizing for controls against terroristic actions, have already been

realized.

Good's name Unit cost Time of realisation

Crane 150.000 euro 90 days per crane

Door 650.000 euro 300 days

Access staircases 40.000 euro 365 days

10

Cold Iron 14 millions of euro 3 years

Telescopic covering 9 millions of euro 2 years

Other operating expenses (EUR)

Other operating expenses 2012 2013 2014

Raw materials and goods 1,300,000

1,500,000

1,800,000

Services and Overhead 2,000,000

2,200,000

2,500,000

3,300,000

3,700,000

4,300,000

Assets purchase value (EUR)

Fixed assets 2012 2013 2014

Immaterial assets 1,000,000

500,000

200,000

Material fixed assets 250,000

100,000

100,000

1,250,000

600,000

300,000

Financing

The company’s resources on one hand are distributed among the shareholders (Port

Authority and other private companies) and on the other hand they are directly property

of the Port Authority who got them through public state act. Ente Bacini, to face the

forecast interventions and investments, will have to increase its capital stock and all

tariffs connected with its offered services (always considering the market demand and the

actual period of world economic crisis). The forecast capital increase is equal to 700.000

euro that has to be added to the current 300.000 euro. So the total amount is one million

of euro and it has to be entirely endorsed. The rate increase will have to be less than 10%

to preserve the client base and not drive it towards other dry docks.

After one year the economic resources will be about two millions of euro and around

900.000 for all next years. This opportunity permits the company of getting the necessary

resources to solve the above-mentioned structural problems (utilizing loans and financial

plans as well).

Capital structure (EUR)

2012 2013 2014

Current assets 1,364,015

1,790,759

2,767,055

Fixed assets 1,200,000

1,730,000

1,940,000

Current liabilities 1,043,333

561,112

77,778

Long-term liabilities 500,000

0

0

Owners' equity 1,020,682

2,959,647

4,629,276

11

Financial Projections

Performance measures (EUR)

2012 2013 2014

Sales revenue 6,400,000

11,000,000

14,000,000

Export sales 730,000

1,400,000

1,600,000

Cost of sales 640,000

1,100,000

1,400,000

Gross profit 5,760,000

9,900,000

12,600,000

Other operating revenue and expenses 0

0

0

Other operating expenses 3,300,000

3,700,000

4,300,000

Labor cost 2,961,600

3,406,800

3,852,000

Depreciation of fixed assets 50,000

70,000

90,000

Operating profit -551,600

2,723,200

4,358,000

EBITDA -501,600

2,793,200

4,448,000

Financial income and expenses -105,000

-67,083

-16,042

Profit before income tax -656,600

2,656,117

4,341,958

Income tax expense -177,282

717,151

1,487,329

Profit -479,318

1,938,965

2,854,629

Operating margin -7.49%

17.6%

20.4%

Gross margin 90%

90%

90%

Sales per employee 128,000

189,655

212,121

Value added 2,460,000

6,200,000

8,300,000

Value added per employee 49,200

106,897

125,758

Return on equity (per year) -47.0%

65.5%

61.7%

Quick ratio 1.31

3.19

35.6

Current ratio 1.31

3.19

35.6

ISCR -4.78

41.6

277

DSCR 0

2.62

8.62

Debt to equity ratio 1.47

0.17

0

Debt to capital ratio 59.5%

14.5%

0%

12

Receivables collection period, days 24.4

20.0

20.0

Payable period, days 24.4

20.0

20.0

Inventory period, days 0

0

0

Income statement (EUR)

2012 2013 2014

Sales revenue 6,400,000

11,000,000

14,000,000

Export sales 730,000

1,400,000

1,600,000

Other operating revenue 0

0

0

Cost of sales 640,000

1,100,000

1,400,000

Other operating expenses 3,300,000

3,700,000

4,300,000

Labor cost

Wages and salaries 2,961,600

3,406,800

3,852,000

Social security costs 0

0

0

Total labor cost 2,961,600

3,406,800

3,852,000

Depreciation of fixed assets 50,000

70,000

90,000

Operating profit -551,600

2,723,200

4,358,000

Financial expenses

Interest expense 105,000

67,083

16,042

Total financial expenses 105,000

67,083

16,042

Profit before income tax -656,600

2,656,117

4,341,958

Income tax expense -177,282

717,151

1,487,329

Net profit for financial year -479,318

1,938,965

2,854,629

Balance sheet (EUR)

2012 2013 2014

ASSETS

Current assets

Cash 753,400

1,179,643

1,989,272

Receivables and prepayments

Trade receivables 433,333

611,116

777,783

Prepaid and deferred taxes 177,282

0

0

Other short-term receivables 0

0

0

Inventories

Inventories 0

0

0

Total current assets 1,364,015

1,790,759

2,767,055

Fixed assets

Tangible assets

Machineny and equipment 1,250,000

1,850,000

2,150,000

Less: Accumulated depreciation -50,000

-120,000

-210,000

Total 1,200,000

1,730,000

1,940,000

Total fixed assets 1,200,000

1,730,000

1,940,000

Total assets 2,564,015

3,520,759

4,707,055

LIABILITIES and OWNERS' EQUITY

Liabilities

Current liabilities

Loan liabilities

Short-term loans and notes 0

0

0

Current portion of long-term loan liabilities 1,000,000

500,000

0

Total 1,000,000

500,000

0

13

Debts and prepayments

Trade creditors, goods 43,333

61,112

77,778

Trade creditors, other 0

0

0

Employee-related liabilities 0

0

0

VAT (GST) 0

0

0

Total 43,333

61,112

77,778

Total current liabilities 1,043,333

561,112

77,778

Long-term liabilities

Long-term loan liabilities

Loans, notes and financial lease payables 500,000

0

0

Deferred grant revenue 0

0

0

Total long-term liabilities 500,000

0

0

Total liabilities 1,543,333

561,112

77,778

Owners' equity

Share capital in nominal value 1,500,000

1,500,000

1,500,000

Share premium 0

0

0

Retained profit/loss 0

-479,318

274,647

Current year profit -479,318

1,938,965

2,854,629

Total owners' equity 1,020,682

2,959,647

4,629,276

Total liabilities and owners' equity 2,564,015

3,520,759

4,707,055

Cash flow statement (EUR)

Jan-2012 Feb-2012

Mar-2012

Apr-2012

May-2012

Jun-

2012

CASH FLOWS FROM OPERATING

ACTIVITIES

Inflows

Payments from customers 111,111

333,332

333,333

388,891

500,000

500,000

Receipt of grant financing (operating

expenses)

0

0

0

0

0

0

Receipt of grant financing (personnel

expenses)

0

0

0

0

0

0

Receipt of other operating revenue

0

0

0

0

0

0

Total 111,111

333,332

333,333

388,891

500,000

500,000

Outflows

Payments to vendors (goods) 11,111

33,333

33,333

38,889

50,000

50,000

Payment of salaries and wages 246,800

246,800

246,800

246,800

246,800

246,800

Social security costs 0

0

0

0

0

0

Payments to vendors (operating

expenses)

274,999

274,999

274,999

274,999

274,999

274,999

Total 532,910

555,132

555,132

560,688

571,799

571,799

Net cash flow from operating

activities

-421,799

-221,800

-221,799

-171,797

-71,799

-71,799

CASH FLOWS FROM INVESTING

ACTIVITIES

Receipt of grant financing (assets) 0

0

0

0

0

0

Total 0

0

0

0

0

0

Outflows

Payments to vendors (assets) 1,250,000

0

0

0

0

0

Total 1,250,000

0

0

0

0

0

Net cash flow from investing activities

-1,250,000

0

0

0

0

0

CASH FLOWS FROM FINANCING

ACTIVITIES

Inflows

Inflows of nominal value 1,500,000

0

0

0

0

0

Inflows of share premium 0

0

0

0

0

0

14

Loan amounts received 1,500,000

0

0

0

0

0

Total 3,000,000

0

0

0

0

0

Outflows

Principal repayments 0

0

0

0

0

0

Interest expense 8,750

8,750

8,750

8,750

8,750

8,750

Dividends (net to shareholders) 0

0

0

0

0

0

Payment of corporate income tax

0

0

0

0

0

0

Corporate income tax on dividends

0

0

0

0

0

0

VAT Return 0

0

0

0

0

0

Total 8,750

8,750

8,750

8,750

8,750

8,750

Net cash flow from financing activities

2,991,250

-8,750

-8,750

-8,750

-8,750

-8,750

Net change in cash and cash

equivalents

1,319,451

-230,550

-230,549

-180,547

-80,549

-80,549

Cash and cash equivalents at the

beginning

0

1,319,451

1,088,900

858,351

677,804

597,255

Cash and cash equivalents at the end 1,319,451

1,088,900

858,351

677,804

597,255

516,706

Cash flow statement (EUR)

Q3-2012 Q4-2012 Q1-2013 Q2-2013

CASH FLOWS FROM OPERATING ACTIVITIES

Inflows

Payments from customers 1,850,000

1,950,000

2,572,221

2,749,998

Receipt of grant financing (operating expenses) 0

0

0

0

Receipt of grant financing (personnel expenses) 0

0

0

0

Receipt of other operating revenue 0

0

0

0

Total 1,850,000

1,950,000

2,572,221

2,749,998

Outflows

Payments to vendors (goods) 185,000

195,000

257,222

275,000

Payment of salaries and wages 740,400

740,400

851,700

851,700

Social security costs 0

0

0

0

Payments to vendors (operating expenses) 824,997

825,009

924,999

924,999

Total 1,750,397

1,760,409

2,033,921

2,051,699

Net cash flow from operating activities 99,603

189,591

538,300

698,299

CASH FLOWS FROM INVESTING ACTIVITIES

Receipt of grant financing (assets) 0

0

0

0

Total 0

0

0

0

Outflows

Payments to vendors (assets) 0

0

600,000

0

Total 0

0

600,000

0

Net cash flow from investing activities 0

0

-600,000

0

CASH FLOWS FROM FINANCING ACTIVITIES

Inflows

Inflows of nominal value 0

0

0

0

Inflows of share premium 0

0

0

0

Loan amounts received 0

0

0

0

Total 0

0

0

0

Outflows

Principal repayments 0

0

249,999

249,999

Interest expense 26,250

26,250

23,333

18,958

Dividends (net to shareholders) 0

0

0

0

Payment of corporate income tax 0

0

134,967

134,967

Corporate income tax on dividends 0

0

0

0

VAT Return 0

0

0

0

Total 26,250

26,250

408,300

403,925

Net cash flow from financing activities -26,250

-26,250

-408,300

-403,925

15

Net change in cash and cash equivalents 73,353

163,341

-470,000

294,374

Cash and cash equivalents at the beginning 516,706

590,059

753,400

283,400

Cash and cash equivalents at the end 590,059

753,400

283,400

577,774

Cash flow statement (EUR)

2012 2013 2014

CASH FLOWS FROM OPERATING ACTIVITIES

Inflows

Payments from customers 5,966,667

10,822,217

13,833,333

Receipt of grant financing (operating expenses) 0

0

0

Receipt of grant financing (personnel expenses) 0

0

0

Receipt of other operating revenue 0

0

0

Total 5,966,667

10,822,217

13,833,333

Outflows

Payments to vendors (goods) 596,667

1,082,222

1,383,333

Payment of salaries and wages 2,961,600

3,406,800

3,852,000

Social security costs 0

0

0

Payments to vendors (operating expenses) 3,300,000

3,700,000

4,300,000

Total 6,858,267

8,189,022

9,535,333

Net cash flow from operating activities -891,600

2,633,196

4,298,000

CASH FLOWS FROM INVESTING ACTIVITIES

Receipt of grant financing (assets) 0

0

0

Total 0

0

0

Outflows

Payments to vendors (assets) 1,250,000

600,000

300,000

Total 1,250,000

600,000

300,000

Net cash flow from investing activities -1,250,000

-600,000

-300,000

CASH FLOWS FROM FINANCING ACTIVITIES

Inflows

Inflows of nominal value 1,500,000

0

0

Inflows of share premium 0

0

0

Loan amounts received 1,500,000

0

0

Total 3,000,000

0

0

Outflows

Principal repayments 0

1,000,000

500,000

Interest expense 105,000

67,083

16,042

Dividends (net to shareholders) 0

0

1,185,000

Payment of corporate income tax 0

539,869

1,172,329

Corporate income tax on dividends 0

0

315,000

VAT Return 0

0

0

Total 105,000

1,606,953

3,188,371

Net cash flow from financing activities 2,895,000

-1,606,953

-3,188,371

Net change in cash and cash equivalents 753,400

426,243

809,629

Cash and cash equivalents at the beginning 0

753,400

1,179,643

Cash and cash equivalents at the end 753,400

1,179,643

1,989,272

16

Risk Analysis

The elements that could endanger the Ente Bacini’s business plan are hard to identify. In

fact, the services towards productive activities follow the market fluctuations and then, in

presence of economic crises, either the same services or the power of the company

decrease. Besides there are critical situations that can be identified both the trade-union

problem and the lack of innovative technologies regarding the plant engineering (the

latter really concerns the Dry Docks of Genoa).

Therefore for getting round this, a social peace is necessary and work contracts have to be

appealing. Besides during the most prosperous moments the company has to be able to

set aside economic resources to be used later for ordinary and extraordinary maintenance.

However the company has to entertain good relationships with the Port Authority and

with Ministry of Public Works and Transport. This is indispensable because the

economic strategy of ports is not merely a local problem, but nowadays it concerns the

entire country and actually the whole of Europe. (The railway network, that connects

from one side to the other all European ports, can be considered as an example regarding

what above-mentioned).

Break-even analysis (EUR)

2012 2013 2014

Sales revenue 6,400,000

11,000,000

14,000,000

Cost of sales 640,000

1,100,000

1,400,000

Variable expenses, total 640,000

1,100,000

1,400,000

Labor cost 2,961,600

3,406,800

3,852,000

Other operating expenses 3,300,000

3,700,000

4,300,000

Depreciation of fixed assets 50,000

70,000

90,000

Financial expenses 105,000

67,083

16,042

Fixed expenses, total 6,416,600

7,243,883

8,258,042

Gross margin 90%

90%

90%

Break-even sales revenue 7,129,556

8,048,759

9,175,602

Sales revenue above break-even 0

2,951,241

4,824,398

Get started with your business plan – www.iplanner.net