Table of Contents

Figures.............................................................................................................................................................................................6

Tables...............................................................................................................................................................................................9

Disclaimers....................................................................................................................................................................................10

Additional Note about Screen Shots...........................................................................................................................................10

What’s New....................................................................................................................................................................................11

1. Introduction.........................................................................................................................................................................12

1.1. About FATCA...............................................................................................................................................12

1.2. Purpose of Guide.........................................................................................................................................12

1.3. Comments....................................................................................................................................................13

1.4. Technical Support .......................................................................................................................................13

2. International Data Exchange Service (IDES)....................................................................................................................13

2.1. About IDES...................................................................................................................................................13

2.2. Before You Begin ........................................................................................................................................14

2.3. Authorized Users.........................................................................................................................................14

2.4. System Availability......................................................................................................................................16

2.5. Data Security................................................................................................................................................17

2.6. File Retention...............................................................................................................................................17

2.7. Requirements...............................................................................................................................................18

2.8. HCTA Username and Password.................................................................................................................18

3. Obtain a Digital Certificate.................................................................................................................................................19

3.1. Purpose of a Digital Certificate ..................................................................................................................19

3.2. IRS Approved Certificate Authorities ........................................................................................................19

3.3. Digital Certificate Format............................................................................................................................19

3.4. Upload a Digital Certificate to IDES ...........................................................................................................20

3.5. Public Key Certificate..................................................................................................................................20

3.6. Certificate Maintenance ..............................................................................................................................20

4. IDES Enrollment .................................................................................................................................................................21

4.1. Overview.......................................................................................................................................................21

4.2. IDES Enrollment Home Page......................................................................................................................21

2

4.3. Enrollment....................................................................................................................................................22

4.4. Knowledge Base..........................................................................................................................................23

4.5. Support.........................................................................................................................................................24

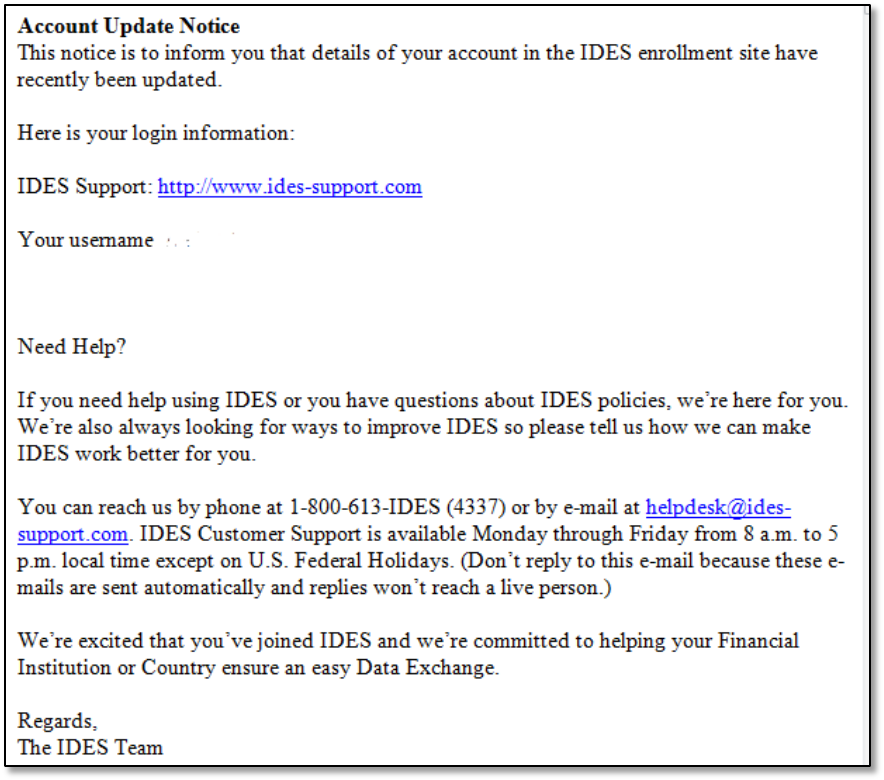

4.6. IRS Public Key .............................................................................................................................................25

4.7. IDES Enrollment User Log In......................................................................................................................26

5. HCTA Administrators......................................................................................................................................................... 26

5.1. Overview.......................................................................................................................................................26

5.2. Begin Enrollment.........................................................................................................................................27

5.3. Create Challenge Questions.......................................................................................................................30

5.4. Create User Profile ......................................................................................................................................31

5.5. Select Alert Preferences .............................................................................................................................32

5.6. Upload Digital Certificate............................................................................................................................33

6. FI Administrators................................................................................................................................................................35

6.1. Overview.......................................................................................................................................................35

6.2. Begin Enrollment.........................................................................................................................................36

6.3. Create Challenge Questions.......................................................................................................................38

6.4. Create User Profile ......................................................................................................................................39

6.5. Select Alert Preferences .............................................................................................................................40

6.6. Upload Digital Certificate............................................................................................................................41

7. Existing Administrators (HCTA and FI)............................................................................................................................ 43

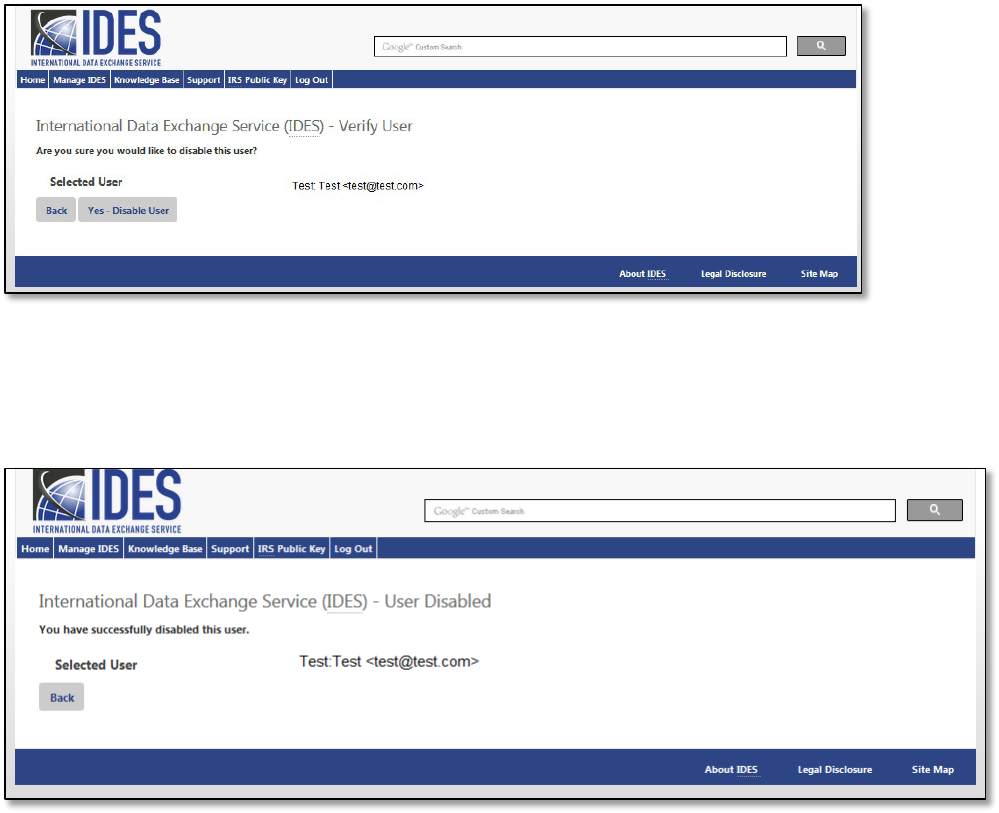

7.1. Add a User....................................................................................................................................................43

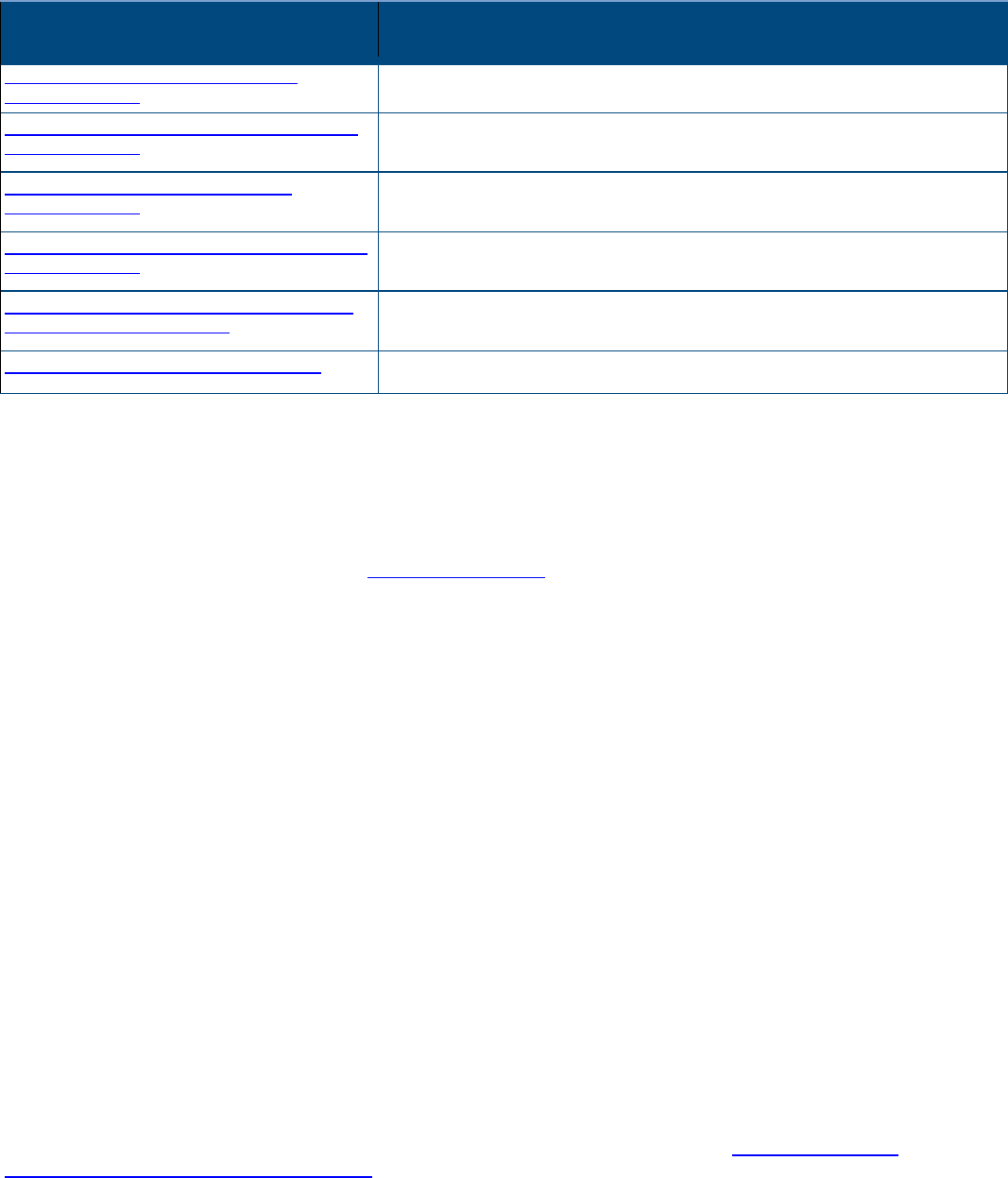

7.2. Disable a User..............................................................................................................................................46

7.3. Enable a User...............................................................................................................................................49

7.4. Update the Certificate..................................................................................................................................52

7.5. Update Alert Preferences............................................................................................................................54

7.6. Create a Metadata File.................................................................................................................................57

7.7. Reset Password...........................................................................................................................................60

7.8. Edit User Role ..............................................................................................................................................61

7.9. Download the IRS Public Key.....................................................................................................................63

8. End Users............................................................................................................................................................................ 64

8.1. Create an Account.......................................................................................................................................64

3

8.2. Create Challenge Questions.......................................................................................................................65

8.4. Select Alert Preferences

.............................................................................................................................67

8.5. IDES Enrollment User Log In......................................................................................................................69

8.6. Create a Metadata File.................................................................................................................................72

8.7. Update Alert Preferences............................................................................................................................72

8.8. Reset Password...........................................................................................................................................73

8.9. Forgot Username.........................................................................................................................................74

8.10. Forgot Password .........................................................................................................................................77

9. Data Preparation for FATCA XML Report.........................................................................................................................80

9.1. Overview.......................................................................................................................................................80

9.2. Prepare the FATCA XML File......................................................................................................................80

9.3. Receive an IRS Notification ........................................................................................................................89

10. Access the IDES Gateway .................................................................................................................................................90

10.1. Overview.......................................................................................................................................................90

10.2. Reset Password...........................................................................................................................................91

10.3. Session Timeout..........................................................................................................................................91

10.4. User Interface Overview..............................................................................................................................92

10.5. Preferences..................................................................................................................................................94

11. Transmit a FATCA Report..................................................................................................................................................95

11.1. IDES Transmission Archive........................................................................................................................95

11.2. IDES Transmission ID .................................................................................................................................96

11.3. Retransmissions..........................................................................................................................................96

11.4. Folder Structure...........................................................................................................................................96

11.5. Transmit a File Using Web UI .....................................................................................................................97

11.6. Model 1, Option 2 HCTA............................................................................................................................100

11.7. Transmit a File Using SFTP ......................................................................................................................103

11.8. Connect to IDES SFTP using Windows Secure Copy (WinSCP):..........................................................103

12. Alerts .................................................................................................................................................................................106

12.1. Overview.....................................................................................................................................................106

12.2. Receive Alerts............................................................................................................................................107

13. IDES Reports..................................................................................................................................................................... 108

4

13.1. IDES Sentinel Overview ............................................................................................................................108

13.2. System Timeout.........................................................................................................................................108

13.3 Connect to IDES Sentinel Web Dashboard using web browser............................................................109

13.4 Understanding Web Dashboard interface...............................................................................................110

13.5 Search Transmission and Alert History ..................................................................................................119

13.6 View Search Results..................................................................................................................................119

13.7 IDES Visibility- Transmission Overview..................................................................................................120

13.7.1 List of All Report Alerts ......................................................................................................................120

13.7.2 List of Failed Transmissions..............................................................................................................121

13.7.3 Examples of Transmission Alerts......................................................................................................124

13.7.4 Examples of Transmission Alerts

- Model 1 Option 2......................................................................126

Appendix A: Acronyms............................................................................................................................................................................................................ 130

Appendix B: File Naming Convention ..................................................................................................................................................................................... 131

Appendix C: Certificate Upload Error Messages .................................................................................................................................................................... 132

Appendix D: HCTA FATCA Entity ID Composition................................................................................................................................................................. 133

Appendix E: IDES Alert Codes................................................................................................................................................................................................ 134

Appendix F: Data Preparation User Tips ................................................................................................................................................................................ 139

Appendix G: IDES Gateway UI Accessibility .......................................................................................................................................................................... 144

Appendix H: IDES Communication Types.............................................................................................................................................................................. 151

5

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

25

30

35

40

45

50

55

Figures

FIGURE – IDES PROCESS OVERVIEW. .................................................................................................................................14

F

IGURE – FILE RETENTION FLOW. ......................................................................................................................................17

F

IGURE – ACCESS THE IRS PUBLIC KEY................................................................................................................................

F

IGURE – CREATE IDES CHALLENGE QUESTIONS.................................................................................................................

F

IGURE – ENROLLMENT CONFIRMED................................................................................................................................

F

IGURE – SELECT IDES ALERT PREFERENCES......................................................................................................................

F

IGURE – SEND AN ENROLLMENT INVITATION. ...................................................................................................................

F

IGURE – SELECT A USER TO ENABLE. ...............................................................................................................................

F

IGURE – SELECT NEW ALERT PREFERENCES.......................................................................................................................

F

IGURE – IDES ENROLLMENT HOME PAGE. .........................................................................................................................21

F

IGURE – IDES OVERVIEW AND ENROLLMENT TOOL PAGE......................................................................................................22

F

IGURE – IDES KNOWLEDGE BASE PAGE.............................................................................................................................23

F

IGURE – IDES SUPPORT PAGE.........................................................................................................................................24

F

IGURE – IRS PUBLIC KEY CERTIFICATE INFORMATION. ..........................................................................................................25

F

IGURE – IDES ENROLLMENT USER LOG IN..........................................................................................................................26

F

IGURE – ACCESS IDES ENROLLMENT..............................................................................................................................27

F

IGURE – BEGIN THE ENROLLMENT PROCESS. ....................................................................................................................28

F

IGURE – LOG IN AS AN HCTA ADMINISTRATOR. ...............................................................................................................29

F

IGURE – IDES GIIN FOUND PAGE..................................................................................................................................29

F

IGURE – SUBMIT USER PROFILE INFORMATION. ................................................................................................................31

F

IGURE – SELECT IDES ALERT PREFERENCES......................................................................................................................32

F

IGURE – UPLOAD A DIGITAL CERTIFICATE.........................................................................................................................34

F

IGURE – SELECT A DIGITAL CERTIFICATE...........................................................................................................................34

F

IGURE – ACCESS IDES ENROLLMENT..............................................................................................................................36

F

IGURE – BEGIN THE ENROLLMENT PROCESS. ....................................................................................................................36

F

IGURE – LOG IN AS AN FI ADMINISTRATOR. .....................................................................................................................37

F

IGURE – IDES GIIN VERIFICATION PAGE. ........................................................................................................................37

F

IGURE – CREATE IDES CHALLENGE QUESTIONS.................................................................................................................38

F

IGURE – SUBMIT USER PROFILE INFORMATION. ................................................................................................................39

F

IGURE – UPLOAD A DIGITAL CERTIFICATE.........................................................................................................................41

F

IGURE – SELECT A DIGITAL CERTIFICATE...........................................................................................................................42

F

IGURE – ENROLLMENT CONFIRMED................................................................................................................................42

F

IGURE – ADD AN END USER. .........................................................................................................................................44

F

IGURE – NEW USER ADDED. .........................................................................................................................................45

F

IGURE – IDES WELCOME EMAIL. ...................................................................................................................................46

F

IGURE – DISABLE A USER..............................................................................................................................................47

F

IGURE – SELECT A USER TO DISABLE. ..............................................................................................................................47

F

IGURE – VERIFY USER TO DISABLE. .................................................................................................................................48

F

IGURE – USER DISABLED CONFIRMATION.........................................................................................................................48

F

IGURE – ENABLE A USER. .............................................................................................................................................49

F

IGURE – VERIFY THE USER TO ENABLE.............................................................................................................................51

F

IGURE – USER ENABLED CONFIRMATION. ........................................................................................................................51

F

IGURE – UPDATE A USER CERTIFICATE.............................................................................................................................52

F

IGURE – UPLOAD A DIGITAL CERTIFICATE.........................................................................................................................52

F

IGURE – SELECT A DIGITAL CERTIFICATE...........................................................................................................................53

F

IGURE –UPDATED DIGITAL CERTIFICATE CONFIRMATION.....................................................................................................53

F

IGURE – UPDATE ALERT PREFERENCES. ...........................................................................................................................54

F

IGURE – SELECT THE USER PROFILE TO UPDATE.................................................................................................................54

F

IGURE – USER ALERT PREFERENCES UPDATED...................................................................................................................55

F

IGURE – EMAIL CONFIRMATION FOR UPDATED USER ALERT PREFERENCE ................................................................................56

6

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

FIGURE – CREATE A METADATA FILE. ...............................................................................................................................57

F

IGURE – ENTER METADATA FILE INFORMATION.................................................................................................................58

F

IGURE – METADATA SAMPLE IMAGE ..............................................................................................................................59

F

IGURE – RESET A PASSWORD. .......................................................................................................................................60

F

IGURE – SELECT THE USER TO UPDATE. ...........................................................................................................................60

F

IGURE – CREATE A NEW PASSWORD FOR THE SELECTED USER. .............................................................................................61

F

IGURE – EDIT USER ROLE..............................................................................................................................................61

F

IGURE – SELECT USER TO UPDATE ..................................................................................................................................62

F

IGURE – SELECT NEW ROLE FOR USER .............................................................................................................................62

F

IGURE – DOWNLOAD THE IRS PUBLIC KEY .......................................................................................................................63

F

IGURE – GENERAL CERTIFICATE INFORMATION. ................................................................................................................63

F

IGURE – IDES NEW END USER WELCOME EMAIL. ..............................................................................................................64

F

IGURE – CREATE IDES CHALLENGE QUESTIONS.................................................................................................................65

F

IGURE – SUBMIT USER PROFILE INFORMATION. ................................................................................................................66

F

IGURE – SELECT IDES ALERT PREFERENCES......................................................................................................................67

F

IGURE – ENROLLMENT CONFIRMATION...........................................................................................................................69

F

IGURE – IDES ENROLLMENT USER LOG IN PAGE................................................................................................................69

F

IGURE – LOG IN TO THE IDES ENROLLMENT SITE...............................................................................................................70

F

IGURE – MANAGE AN IDES USER ACCOUNT. ...................................................................................................................70

F

IGURE – CREATE A METADATA FILE ................................................................................................................................72

F

IGURE – UPDATE IDES ALERT PREFERENCES. ...................................................................................................................72

F

IGURE – SELECTING NEW ALERT PREFERENCES..................................................................................................................73

F

IGURE – RESET A PASSWORD. .......................................................................................................................................73

F

IGURE – CREATE A NEW PASSWORD. ..............................................................................................................................74

F

IGURE – REQUEST A USERNAME REMINDER EMAIL. ...........................................................................................................75

F

IGURE – ENTER AN EMAIL ADDRESS FOR A USERNAME REMINDER MESSAGE. ..........................................................................75

F

IGURE – REMINDER EMAIL SENT CONFIRMATION. .............................................................................................................76

F

IGURE – IDES USERNAME REMINDER EMAIL. ...................................................................................................................76

F

IGURE –USER EMAIL ADDRESS NOT RECOGNIZED ERROR MESSAGE........................................................................................77

F

IGURE – FORGOT PASSWORD RESET PAGE. ......................................................................................................................77

F

IGURE – ENTER A USERNAME TO RESET A PASSWORD.........................................................................................................78

F

IGURE – EMAIL SENT TO USERS TO RESET A PASSWORD. .....................................................................................................78

F

IGURE – CREATE A NEW PASSWORD. ..............................................................................................................................79

F

IGURE – DATA PREPARATION OVERVIEW.........................................................................................................................81

F

IGURE - IDES GATEWAY ACCEPT SCREEN. .......................................................................................................................90

F

IGURE – IDES GATEWAY LOG IN SCREEN.........................................................................................................................91

F

IGURE – IDES ABOUT TO EXPIRE SESSION MESSAGE...........................................................................................................92

F

IGURE – IDES SESSION TIMEOUT MESSAGE......................................................................................................................92

F

IGURE - IDES GATEWAY HOME SCREEN. .........................................................................................................................92

F

IGURE – IDES GATEWAY ACCOUNT HOME. .....................................................................................................................93

F

IGURE – SELECT PREFERENCES.......................................................................................................................................94

F

IGURE – SELECT AND UPLOAD FILES................................................................................................................................97

F

IGURE – VIEW FILE TRANSFER STATUS IN UPLOADS MONITOR. .............................................................................................97

F

IGURE – FILE TRANSFER STATUS.....................................................................................................................................98

F

IGURE – IDES FILE DOWNLOAD SCREEN..........................................................................................................................98

F

IGURE – SAVE A FILE. ..................................................................................................................................................99

F

IGURE – MODEL 1 OPTION 2 FOLDER STRUCTURE. ..........................................................................................................100

F

IGURE – IDES PENDING STATUS FOLDER.......................................................................................................................101

F

IGURE – IDES FILE OPTIONS. ......................................................................................................................................101

F

IGURE – IDES MOVE FILE OPTIONS. ...........................................................................................................................102

F

IGURE – SAMPLE SFTP CONNECTION. ........................................................................................................................103

F

IGURE – SSH AUTHENTICATION DISCLAIMER................................................................................................................104

F

IGURE – SFTP WARNING DIALOG. .............................................................................................................................104

7

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

FIGURE – SFTP CONNECTION. ...................................................................................................................................105

F

IGURE – IDES ALERT FLOW CHART FOR TRANSMISSION UPLOADS. ....................................................................................106

F

IGURE – SAMPLE IDES ALERT E-MAIL MESSAGE............................................................................................................107

F

IGURE – SENTINEL DISCLAIMER BANNER......................................................................................................................109

F

IGURE - SENTINEL WEB DASHBOARD LOGIN PAGE.........................................................................................................109

F

IGURE - SENTINEL WEB DASHBOARD HOME PAGE.........................................................................................................110

F

IGURE – WEB DASHBOARD TITLE BAR.........................................................................................................................110

F

IGURE – WEB DASHBOARD FLOATING MENU ...............................................................................................................111

F

IGURE – ADJUSTING WEB DASHBOARD MENU .............................................................................................................111

F

IGURE - MAIN DASHBOARD MENU .............................................................................................................................112

F

IGURE – SELECT A DASHBOARD .................................................................................................................................112

F

IGURE - DASHBOARD RESULT ....................................................................................................................................112

F

IGURE - DASHBOARD TRANSMISSION DETAILS LINK ........................................................................................................113

F

IGURE – SELECTED TRANSMISSION DETAILS..................................................................................................................113

F

IGURE – TRANSMISSION DETAILS MINIMIZED VIEW........................................................................................................113

F

IGURE – TRANSMISSION DETAILS EXTENDED VIEW .........................................................................................................114

F

IGURE - DASHBOARD FILTER ICON ..............................................................................................................................114

F

IGURE – FILTER IN DASHBOARD VIEW .........................................................................................................................114

F

IGURE – DASHBOARD FILTER MENU ...........................................................................................................................115

F

IGURE – DASHBOARD DATE AND TIME FILTER ...............................................................................................................115

F

IGURE – DASHBOARD LIST FILTER...............................................................................................................................116

F

IGURE - DASHBOARD DROP DOWN FILTER LIST..............................................................................................................116

F

IGURE - DASHBOARD TEXT FILTER ..............................................................................................................................116

F

IGURE – DASHBOARD NAVIGATION FROM DETAILED VIEW ..............................................................................................117

F

IGURE – DASHBOARD MAIN RESULT VIEW ...................................................................................................................117

F

IGURE – DASHBOARD REFRESH ICON ..........................................................................................................................117

F

IGURE – REFRESH ICON IN DASHBOARD VIEW ...............................................................................................................118

F

IGURE – RESULT EXPORT FROM DASHBOARD VIEW ........................................................................................................118

F

IGURE – DASHBOARD PDF EXPORT............................................................................................................................119

F

IGURE – DASHBOARD EXCEL EXPORT..........................................................................................................................119

8

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

Tables

TABLE – FATCA RELATED DOCUMENTS.............................................................................................................................13

T

ABLE – VALID USER TYPES AND FEATURES. .......................................................................................................................15

T

ABLE – SYSTEM REQUIREMENTS......................................................................................................................................16

T

ABLE - IDES ENROLLMENT REQUIREMENTS.......................................................................................................................18

T

ABLE – IRS-APPROVED CERTIFICATE AUTHORITIES..............................................................................................................19

T

ABLE – HCTA IDES ALERT PREFERENCES. ........................................................................................................................33

T

ABLE – FI IDES ALERT PREFERENCES. ..............................................................................................................................41

T

ABLE – METADATA FILE TYPE AND BINARY ENCODING TYPE PAIRING. ....................................................................................59

T

ABLE – IDES ALERT PREFERENCES...................................................................................................................................68

T

ABLE – OVERVIEW PROCESS TO PREPARE AND SEND A FILE..................................................................................................80

T

ABLE – PROCESS TO DIGITALLY SIGN A FILE.......................................................................................................................82

T

ABLE – RECOMMENDED COMPRESSION TOOLS BASED ON COMPRESSION TESTING AND SUPPORTED ALGORITHMS. .........................83

T

ABLE – PROCESS TO COMPRESS A FILE. ...........................................................................................................................83

T

ABLE – PROCESS TO ENCRYPT AN XML FILE WITH AN AES KEY. ...........................................................................................84

T

ABLE – PROCESS TO ENCRYPT AN AES KEY WITH A PUBLIC KEY.............................................................................................85

T

ABLE – PROCESS FOR A MODEL 1 OPTION 2 FI TO ENCRYPT AN AES KEY. .............................................................................86

T

ABLE – SENDER METADATA SCHEMA SUMMARIZES EACH ELEMENT......................................................................................87

T

ABLE – FILES CONTAINED IN A TRANSMISSION ARCHIVE OR DATA PACKET ...............................................................................88

T

ABLE - PROCESS TO OPEN A NOTIFICATION MESSAGE ARCHIVE.............................................................................................89

T

ABLE – IDES USER INTERFACE OVERVIEW.......................................................................................................................93

T

ABLE – IDES GATEWAY FOLDERS AND SUBDIRECTORIES. ....................................................................................................96

T

ABLE – SUMMARY DESCRIPTION OF IDES REPORTING PROCESS FOR MODEL 1 OPTION 2 HCTAS. ...........................................102

T

ABLE - SUMMARY OF SENTINEL AVAILABLE REPORTS........................................................................................................108

T

ABLE - SENTINEL COLOR-CODED TRANSMISSION EVENTS. ................................................................................................119

T

ABLE - SENTINEL REPORT RETURN CODES. ....................................................................................................................120

T

ABLE – LIST OF ALERT CODES FOR FAILED TRANSMISSIONS...............................................................................................123

T

ABLE – SUCCESSFUL TRANSMISSION UPLOAD.................................................................................................................124

T

ABLE - CERTIFICATE FAILURE.......................................................................................................................................125

T

ABLE - EXPIRED TRANSMISSIONS NOT DOWNLOADED BY IRS............................................................................................125

T

ABLE – MODEL 1 OPTION 2 APPROVED UPLOAD. ..........................................................................................................126

T

ABLE – MODEL 1 OPTION 2 TRANSMISSION FILE REJECTED..............................................................................................127

T

ABLE – EXPIRED UPLOAD: NO ACTION FROM HCTA. ......................................................................................................128

T

ABLE – EXPIRED UPLOAD: NO ACTION FROM IRS...........................................................................................................129

T

ABLE – TABLE OF ACRONYMS USED IN THIS DOCUMENT....................................................................................................130

T

ABLE – IDES FILE NAMING CONVENTIONS. ....................................................................................................................131

T

ABLE – IDES CERTIFICATE UPLOAD ERROR MESSAGES. ...................................................................................................132

T

ABLE – IDES HCTA FATCA ENTITY ID COMPOSITION. ...................................................................................................133

T

ABLE – DATA PACKAGING TIPS. ..................................................................................................................................140

T

ABLE – APPLICATION KEYBOARD SHORTCUTS.................................................................................................................148

T

ABLE – GO TO KEYBOARD SHORTCUTS. ........................................................................................................................148

T

ABLE – SELECTION KEYBOARD SHORTCUTS....................................................................................................................148

T

ABLE – FILES AND FOLDERS KEYBOARD SHORTCUTS. .......................................................................................................149

T

ABLE – TRANSFER QUEUE KEYBOARD SHORTCUTS. .........................................................................................................149

T

ABLE – IDES COMMUNICATION TYPES.........................................................................................................................151

9

Disclaimers

This document is provided to the public for information purposes only. Information in this

document is indicative and is subject to change without notice. Unless otherwise noted, the

companies, organizations, products, domain names, e-mail addresses, logos, people, places,

and events depicted in examples herein are fictitious. No association with any real company,

organization, product, domain name, e-mail address, logo, person, place, or event is intended or

should be inferred. Complying with all applicable copyright laws is the responsibility of the user.

Without limiting the rights under copyright, no part of this document may be reproduced, for any

purpose, without the express written of permission the IRS. For more information, contact the

IRS SPEC Office of Products, Systems & Analysis.

Additional Note about Screen Shots

Screen shots are intended for illustrative purposes only and may not match the IDES

Enrollment and IDES Gateway sites exactly. The FATCA IDES team will continue to update

screen shots in future versions of the guide.

10

What’s New

This section summarizes updates since the last publication of the IDES User Guide (July 2020):

Section Description

System Availability (2.4) Updated supported browser section

IDES Reports (Sections 13.1 - 13.6) Updated items

Examples of Transmission Alerts (13.7.4)

Updated Model 1 Option 2, RC030 from rename to move

IDES Testing Window (Appendix F) One annual testing window per year

.

11

1. Introduction

1.1. About FATCA

The Foreign Account Tax Compliance Act (FATCA) was enacted as part of the Hiring Incentives to Restore

Employment (HIRE) Act in March 2010. FATCA was created to improve transparency and address tax non-reporting of

income related to foreign financial accounts held by U.S. taxpayers.

FATCA requires certain foreign financial institutions (FFIs) to report certain information about its U.S. accounts (including

U.S. owned foreign entities), accounts held by owner-documented FFIs (ODFFI), and certain aggregate

information concerning account holders that are recalcitrant account holders and, for a transitional period, accounts held

by nonparticipating FFIs. Generally, FFIs will commit to these reporting requirements by registering with the IRS and

signing an agreement with the IRS; however, the FFI agreement does not apply to FFIs under a Model 1

Intergovernmental Agreement (IGA). In most cases, FFIs that do not register with the IRS will be subject to 30%

withholding on certain U.S. source payments (unless an exception applies). Chapter 4 of the FATCA regulations also

generally requires a withholding agent to deduct and withhold tax equal to 30 percent of a withholdable payment made

to a passive non-financial foreign entity (NFFE), unless the passive NFFE certifies to the withholding agent that it does

not have any substantial U.S. owners, or provides certain identifying information with respect to its substantial U.S.

owners. Payments to NFFEs that report their substantial U.S. owners directly to the IRS (direct reporting NFFEs) are

accepted from withholding and reporting by the withholding agent.

An approved financial institution (FI) (other than a limited FFI or a limited branch), direct reporting NFFE, or sponsoring

entity that registers with the IRS under FATCA will receive a global intermediary identification number (GIIN) and appear

on the published FFI list. The FFI List Search and Download tool allows users to search entities by GIIN, financial

institution name, or country/jurisdiction of the FFI or branch.

There are certain entities, such as U.S. withholding agents (USWA), territory financial institutions (TFI), third party

preparers, and independent software vendors that do not need to have a GIIN (non-GIIN filers) but need to file FATCA

reports through the International Data Exchange Service (IDES). A non-GIIN filer has to get a FATCA identification

number (FIN) in order to enroll in and report through IDES. Publication of a FIN on the FFI list does not change the filer’s

status for FATCA purposes, as it does not subject the filer to the requirements applicable to an FFI and does not serve

any function related to withholding tax on payments under FATCA or reporting such tax. A FIN will be accompanied by a

generic name (e.g., “U.S. Withholding Agent 1”) on the FFI List. For more information on FINs, visit the

FATCA

Identification Number (FIN) Enrollment Process page.

An FFI could have two or more GIINs on the FFI list in a given month. This may occur when an FI obtains one GIIN for its

own reporting and another GIIN to report on behalf of another entity (such as a sponsoring entity reporting on behalf of a

sponsored entity or a trustee reporting on behalf of a trustee-documented trust). This may also occur when an FI is in the

process of transferring into an expanded affiliated group or changing its FI type; in such a case, please note the

following:

If the FI’s FATCA account is in approved status, a new GIIN will be issued. The old GIIN will remain on the

published FFI list for 90 days to allow the GIIN holder enough time to distribute its new GIIN

All approved branches will also be issued new GIINs. The old branch GIINs will also remain on the published FFI list

for 90 days

1.2. Purpose of Guide

This guide is intended to serve as a tool for FIs, direct reporting NFFEs, sponsoring entities, non-GIIN filers, and Host

Country Tax Authorities (HCTAs) who transmit data through the International Data Exchange Service (IDES). The

document assumes that the reader is familiar with the FATCA regulations and is experienced with extensible markup

language (XML) and schema technology. For the purpose of this document, direct reporting NFFEs, sponsoring entities,

non-GIIN filers and trustees of trustee-documented trusts should follow the instructions set forth for FIs. Additionally, the

term “U.S. withholding agent” includes

a territory FI treated as a U.S. person.

12

Document Description

FATCA Online Registration User Guide

(Publication 5118)

Provides instructions for the online system to complete an electronic

Form 8957, FATCA Registration

FFI List Search and Download Tool User Guide

(Publication 5147)

Provides instructions on how to use the FFI List Search and Download

Tool to search for an approved GIIN

FATCA XML Schema v1.1 User Guide

(Publication 5124)

Explains the information required to be included in each data element of

the schema

FATCA Metadata XML Schema v1.2 User Guide

(Publication 5188)

Explains the schema and elements of a FATCA metadata file

FATCA Reports Notification XML Schema v2.0

User Guide (Publication 5189)

Explains the schema and elements of FATCA notifications

Instructions for Form 8966, FATCA Report Provides instructions for the paper Form 8966, FATCA Report

Table 1 – FATCA Related Documents.

1.3. Comments

We appreciate your feedback on the quality and usefulness of this publication. Please send comments, with a reference

to chapter, section, and page number(s), to lbi.fatca.ide[email protected].

1.4. Technical Support

IDES technical assistance is available Monday through Friday, 24 hours a day, except for U.S. federal holidays, through

the IDES Customer Service Help Desk. IDES customer support will send a system alert from the help desk portal for

planned outages and scheduled maintenance.

2. International Data Exchange Service (IDES)

2.1. About IDES

IDES is a secure managed file transfer service that is available to FIs and HCTAs to facilitate FATCA reporting. This

reporting is provided for under U.S. Treasury Regulations, the FFI agreement, Tax Information Exchange Agreements

(TIEAs), Intergovernmental Agreements (IGAs), and other guidance issued by the Treasury Department and the IRS.

The data collected through IDES will be incorporated into IRS compliance operations.

IDES is accessible to enrolled users over the Internet via Hypertext Transfer Protocol Secure (HTTPS) or Secure File

Transfer Protocol (SFTP). IDES provides for an end-to-end controlled file transfer with enhanced monitoring and

security features. The system only accepts encrypted electronic submissions, and will allow for the transmission of

FATCA reporting in the approved FATCA XML Schema v1.1 (FATCA XML). For more information on FATCA

regulations, Form 8966 and instructions, FATCA XML, and other related topics, visit the FATCA Home Page

and

FATCA Frequently Asked Questions (FAQs).

The main function of IDES is to provide authorized users with secure exchange services for FATCA data transmissions,

with the additional protection of a Public Key Infrastructure (PKI). The primary features of IDES are:

13

Enrollment

Certificate Management

Account Management

Secure Data Transmission

Status of Data Transmission (Alerts and Notifications)

Figure 1 – IDES process overview.

2.2. Before You Begin

This material is intended to supplement the contents of IDES online help and is not intended to replace technical

documentation to establish and test SFTP connections. Examples shown in this document are based upon a Windows

environment and may differ if using other operating systems.

2.3. Authorized Users

Authorized IDES users are FIs, direct reporting NFFEs, sponsoring entities, trustees of trustee-documented trusts, U.S.

withholding agents, and HCTAs. Each authorized user has limited access to the system based on the data flow model

described in their agreement with the United States (for example, an IGA or an FFI agreement) or in Treasury

regulations. Note that for many IDES users, the IRS is the only valid recipient for files. The table below provides

additional information regarding user access based on agreement types.

Type of Agreement

User

Type

Access Description

Model 1B IGA (Non-Reciprocal)

FFI transmits data directly to its HCTA then

the HCTA transmits data to the IRS

FFI No Access

HCTA On behalf of FI under the HCTA jurisdiction:

Upload FATCA reporting for direct transfer to

IRS

Download alerts generated by IDES

Download notifications and Competent

Authority Requests (CARs) submitted by IRS

14

Type of Agreement User

Type

Access Description

Model 1A IGA (Reciprocal)

FFI transmits data directly to its HCTA then

the HCTA transmits data to the IRS. This is a

reciprocal model with two-way transmission

between the HCTA and the IRS

FFI No Access

HCTA On behalf of FI under the HCTA jurisdiction:

Upload FATCA reporting for direct transfer to

IRS

Download alerts generated by IDES

Download notifications and CARs submitted by

IRS

Reciprocal data will be exchanged with HCTA

Model 1 Option 2

FFI transmits data directly to its HCTA via

IDES. The HCTA approves or rejects the

FATCA reporting data. If approved, IDES

releases the data to the IRS.

FFI Upload FATCA reporting to IDES for review by

HCTA

Download alerts generated by IDES

Download notifications submitted by IRS (subject to

the terms of the country’s IGA)

HCTA Upload approved or rejected FATCA reporting for

direct transfer to IRS

Download alerts generated by IDES

Download notifications and CARs submitted by IRS

Model 2 IGA and FFI agreement

FFI transmits data regarding:

Consenting accountholders directly to the

IRS

Aggregate information on non-consenting

accountholders and non-consenting, non-

participating FFIs directly to IRS

Specific information on non-consenting

accountholders and non-consenting, non-

participating FFIs directly to HCTA.

HCTA may deliver data to IRS after a

treaty request

FFI Upload FATCA reporting for direct transfer to IRS

Download alerts generated by IDES

Download notifications submitted by IRS (subject to

the terms of the country’s IGA)

HCTA Upload FATCA reporting regarding non-consenting

accountholders and non-consenting, non-

participating FFIs for direct transfer to IRS (after

treaty request)

Download alerts generated by IDES

Download notifications and CARs submitted by IRS

Non-IGA (FFI agreement)

FFI transmits data directly to the IRS

FFI Upload FATCA reporting for direct transfer to IRS

Download alerts generated by IDES

Download notifications submitted by IRS

HCTA No Access

Non-IGA (no FFI agreement)

Direct Reporting

NFFE, U.S.

Withholding Agent

(USWA),

Sponsoring Entity,

or Trustee of

Trustee-

Documented Trust

Upload FATCA reporting for direct transfer to IRS

Download alerts generated by IDES

Download notifications submitted by IRS

Table 2 – Valid User Types and Features.

15

2.4. System Availability

IDES requires a username and password, which can be obtained through the IDES enrollment process. The system will

be available 24 hours a day, with the exception of U.S. holidays and regularly scheduled system maintenance periods.

All users will be notified of planned outages, as well as unplanned outages that are expected to last more than 8 hours.

IDES works with all major browsers and can be accessed using different SSH clients for Secure File Transfer Protocol

(SFTP).

Items Technical Specifications

Browsers for HTTPS

Apple Safari – only on macOS

Google Chrome

Microsoft Edge

Mozilla Firefox

SSH clients

Any client that complies with RFCs 4251-4254

File Size

File uploads and downloads are limited to a size of 200 MB compressed.

File Naming Conventions See Appendix B for file naming conventions.

Only file extension .zip are authorized for file uploads to IDES in the user Outbox folders

File names are case insensitive

Do not use illegal characters in the name of files, such as colon, backslash, question mark or

space

Table 3 – System Requirements.

16

2.5. Data Security

IDES provides secure file data transfers and uses encryption standards established by the United States National

Institute of Standards and Technology (NIST). When a supported web browser connects to IDES via HTTPS, the

Transport Layer Security (TLS) cryptographic protocol provides communication security over the Internet and the

session is encrypted for data confidentiality.

2.6. File Retention

IDES provides secured data transmissions and prohibits long term data storage. Data packets that contain errors, such

as files with an unencrypted payload or virus, will be automatically deleted. Generally, each file transmitted from the

U.S. to a receiver remains available for download for a limited number of days, based on the date the file was created.

After a user transmits a data packet, the user receives an IDES Alert or Notification that the transmission is available for

download. The file will remain available for download in the receiver’s account inbox for 7 days. An inbox folder may

contain several different transmitted files at the same time, each with a different payload. For the purpose of this

document, the term payload will be used to describe the body of the data packet (e.g. a FATCA XML document) that

serves as the fundamental purpose of the data transmission.

If the receiver does not download the file within a specified period, the files expires and will be automatically deleted.

After a file is deleted, it cannot be retrieved, downloaded or restored. If the receiver initiates the file download within 7

days, the file should be downloaded within 24 hours from the time the download is initiated. After 24 hours, the file

expires and will be automatically deleted.

The file retention times vary slightly based on model types. Also refer to 11.6 for more details on file retention times for

files sent under Model 1 Option 2.

IDES

File: <IDESTransmissionID>.zip download initiated

File deleted

File: <IDESTransmissionID>.zip available for download

in account Inbox (or Pending) folder

Start of the 7 day expiration clock

(based on file CreationTime)

End of the 7 day expiration clock

Start of the 24 hour expiration clock

End of the 24 hour expiration clock

File not

downloadable

End of the 7 day expiration clock

File deleted

File not

downloadable

Continue the 7 day expiration clock

Or until file moved into /Approved or /Rejected folder

Model 1 Option 2 ?

NO

(Inbox\xxx folder)

YES

(Pending folder)

Figure 2 – File retention flow.

17

2.7. Requirements

Certain requirements are needed to create a new account on the IDES Enrollment site. Requirements differ for HCTA and FI users.

Valid User Type

Requirements HCTA FI

Registered GIIN and non-GIIN filers

See IRS FFI List for more information

N/A X

HCTA FATCA Entity ID

See Appendix D: for more information

The IRS provided

usernames to your

Competent Authority.

Contact the IRS for more

information

N/A

Valid certificate issued by an IRS

approved certificate authority (CA)

See Obtaining a Certificate

for more

information

X X

Public and Private Key

X X

Email address of additional users

X X

Table 4 - IDES Enrollment Requirements.

Note: Users that do not have a requirement to obtain a GIIN but are required to report using the FATCA XML (non-GIIN

filers), must get a FIN in order to enroll in and report through IDES. For information on how to obtain a FIN, refer to the

FATCA Identification Number (FIN) Enrollment Process page.

2.8. HCTA Username and Password

All countries under Model 1 IGAs have a pre-assigned username and HCTA FATCA Entity ID. Each HCTA FATCA

Entity ID is in the format: 000000.00000.TA.<ISO>. ISO is the ISO 3166-1 numeric standard country code. Please refer

to Appendix D:

for more information.

The first time a user logs on to IDES, the user is required to change its assigned username and create a password. A

letter containing information on the username and enrollment instructions will be sent to an appropriate contact from

each country based on their agreement with the United States. For additional information, contact the IDES help desk

.

IDES Users can change their contact information through the Registration Portal. The Registration Portal is found at

https://www.irs.gov/businesses/corporations/fatca-foreign-financial-institution-registration-system.

18

3. Obtain a Digital Certificate

3.1. Purpose of a Digital Certificate

Certificates and their related private keys are used to sign and decrypt messages between the sending party and the

IRS. A digital certificate binds an identity to a public key. A certificate authority (CA) issues a certificate after an identity

proofing process to verify the certificate owner. The individual identified in the certificate has possession and control

over the private key associated with the public key found in the certificate.

3.2. IRS Approved Certificate Authorities

The IRS only accepts certificates issued by approved CAs. A published list of certificate authorities and acceptable

digital certificate products is available on IRS.gov.

Certificate Authority Type of Certificate External Website Links

Sectigo (formerly Comodo) EV SSL https://ssl.comodo.com/ev-ssl-

certificates.php?track=11003&af=11003&s_track=7639#_

ga=2.257816459.1630310083.1528894756-

1943831559.1528894756

Digicert

®

Standard SSL

EV SSL

https://www.digicert.com/welcome/ssl-plus.htm

Entrust

®

Standard SSL

EV Multi-Domain SSL

http://www.entrust.net/ssl-certificates/standard.htm

®

GlobalSign

Organization SSL

Extended SSL

https://www.globalsign.com/ssl/organization-ssl/

Go Daddy

EV SSL https://www.godaddy.com/web-security/ev-ssl-certificate

IdenTrust Standard Server SSL http://www.identrust.com/irs/fatca/index.html

FATCA Organization

Certificate

http://www.identrust.com/irs/fatca/index.html

Table 5 – IRS-approved Certificate Authorities.

3.3. Digital Certificate Format

Before you begin the IDES enrollment process, each entity should obtain one valid digital certificate issued by

an approved certificate authority (CA). Certificates in other formats, such as wildcards will be rejected. IDES will only

accept digital certificates issued by an approved CA.

Supported formats for the digital certificates are:

Distinguished Encoding Rules (DER) binary X.509

Privacy Enhanced eMail (PEM) ASCII (Base-64) encoded X.509

19

IDES will convert digital certificates received in DER format to Base64 for storage and retrieval.

If a digital certificate is not in DER or PEM format, use Windows to convert your digital certificate to DER or PEM as

follows:

Open the digital certificate with a .CRT filename extension

Select the Details tab

Select the “Copy to File…” button

In the Certificate Export Wizard, select the format you want to use as either “DER encoded binary X.509 (.CER)” or

“Base-64 encoded X.509 (.CER)”.

3.4. Upload a Digital Certificate to IDES

Only an IDES administrator can upload a digital certificate. After an FI or HCTA administrator obtains a digital certificate,

the administrator will provide the certificate to IDES during the enrollment process. After upload, the certificate is

validated with the Certificate Authority (CA) that issued the certificate.

It is the responsibility of IDES users to verify that the certificate is valid at the time they attempt to use it. Please refer

to 5.6

for more information on how to upload a digital certificate to an IDES account.

3.5. Public Key Certificate

A public key certificate, also known as a digital certificate, is an electronic document used to prove ownership of a public

key. The IRS public key certificate can be downloaded during IDES enrollment. The IDES administrator will upload the

digital certificate for its FI or HCTA during enrollment.

3.6. Certificate Maintenance

IDES uses a Public Key Infrastructure (PKI) to manage and revoke digital certificates. The CA sets the lifetime of each

digital certificate, typically up to one year. IDES requires one digital certificate per FI or HCTA.

A Certificate Revocation List (CRL) is a list of digital certificates that have been revoked, meaning that they are not

trustworthy, and should not be used. CRLs are always issued by the trusted CA and are publicly available. IDES

validates all digital certificates against the most current CRL published from each trusted CA to identify any revoked

digital certificates. A revoked digital certificate will be deleted from IDES, along with the associated public key contained

in the digital certificate. IDES will immediately deactivate the user account associated with a revoked digital certificate.

The Online Certificate Status Protocol (OCSP) is an Internet protocol designed for real-time verification of digital

certificates against a database of revoked digital certificates. IDES tests all digital certificates using the OCSP to verify

whether the digital certificates are valid. For example, when a transmission uses an expired digital certificate, IDES tests

the certificate using the OCSP, confirms the certificate is revoked, and deletes the transmitted file. Users are not able to

transmit the file until a valid digital certificate is resubmitted.

20

4. IDES Enrollment

4.1. Overview

IDES Enrollment is required for FIs and HCTAs to access the IDES environment. Users must enter a valid GIIN and

certificate to enroll. FIs or HCTAs with invalid or expired certificates cannot enroll. Users with a FIN must select the FI

button to enroll. The IDES Enrollment site can be accessed at https://www.ides-support.com/

IDES Enrollment Options:

Add and Update a User

Update Certificate

Disable/Enable a User

Select Alert Preferences

Create Metadata File

4.2. IDES Enrollment Home Page

The IDES Enrollment site can be accessed through:

IDES Enrollment Web User Interface

Secure File Transfer Protocol (SFTP)

The IDES Enrollment site contains links to various IDES resources and includes five main tabs in addition to the Home

tab:

Enrollment

Knowledge Base

Support

IRS Public Key

IDES Enrollment User Log In

Figure 3 – IDES enrollment home page.

21

4.3. Enrollment

The Enrollment tab describes the IDES enrollment process and provides users with access to create an IDES account.

The Enrollment tab also links to the IDES Gateway, a web application that allows enrolled HCTAs and FIs to securely

upload and download FATCA data over the Internet using both HTTPS and SFTP protocols.

Figure 4 – IDES overview and enrollment tool page.

22

4.4. Knowledge Base

The Knowledge Base tab directs users to important IDES documentation such as user guides and an interactive

knowledge base.

Users can access the following resources from the Knowledge Base tab:

Interactive IDES Knowledge Base

IDES User Guides

IDES Frequently Asked Questions (FAQs)

Figure 5 – IDES knowledge base page.

23

4.5. Support

The IDES help desk is available to assist users with log in problems, error messages, and other technical issues. The

Support tab provides contact information for the help desk and hours of operation. The help desk can be contacted by

phone or via an online form which allows users to submit technical system problems. The click to call feature allows

users to dial the help desk directly from the internet browser. Please note that the help desk is available in English only.

Users can access the following resources from the Support tab:

Email Support

Phone Support

Help Desk Hours of Operation

Submit Technical System Problems

Figure 6 – IDES support page.

24

4.6. IRS Public Key

The IRS Public Key is a certificate that can be downloaded from the IDES Enrollment site. This certificate should be

included in the FATCA transmission archive transmitted to the IRS.

Figure 7 – Access the IRS public key.

1. From the IDES Support home page, click the IRS Public Key tab.

Figure 8 – IRS public key certificate information.

25

2. Download and save the IRS Public Key Certificate to your computer.

3. The certificate should be included in the transmission archive .zip file transmitted to the IRS via the IDES Gateway.

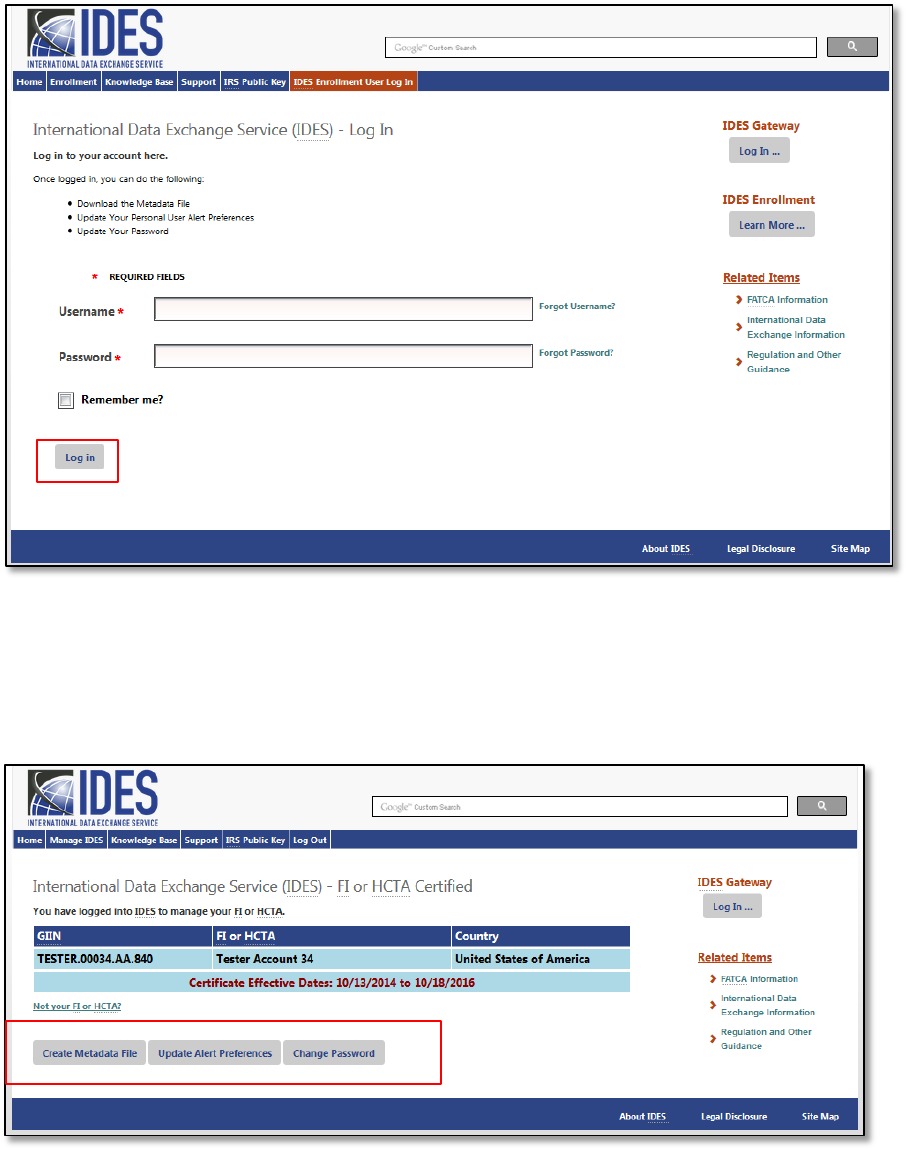

4.7. IDES Enrollment User Log In

The IDES Enrollment User Log In tab allows returning users to access the IDES Enrollment site. HCTA administrators,

FI administrators, and end users are able to log in after they have created an IDES account.

Figure 9 – IDES enrollment user log in.

5. HCTA Administrators

5.1. Overview

HCTA administrators have the following roles under the IGAs:

Model 1 IGA HCTA: The partner jurisdiction agrees to report to the IRS specified information about the U.S.

accounts maintained by all relevant FIs located in the jurisdiction.

Model 2 IGA HCTA: The partner jurisdiction agrees to direct and enable all relevant FIs located in the

jurisdiction to report specified information about their U.S. accounts directly to the IRS.

HCTAs will need their IRS assigned username in order to create an IDES account. The first user that registers for an IDES