Federal Trade Commission

E-Cigarette Report

for 2019-2020

ISSUED: 2022

Executive Summary

In 2018, seeing data about the increased popularity of e-cigarette products, particularly

among youth, the Federal Trade Commission (“FTC” or “Commission”) decided to study the e-

cigarette industry’s domestic sales and marketing, as it has for many decades studied the

cigarette and smokeless tobacco industries.

1

In 2019, the FTC issued identical Orders to File Special Reports (“Orders”) under

Section 6(b) of the FTC Act to six of the country’s largest domestic e-cigarette manufacturers,

who together comprised virtually all of the e-cigarette market measured by the Nielsen

Company. The Orders sought information from these companies as to their e-cigarette sales and

advertising and promotional activities for the years 2015, 2016, 2017, and 2018. The

information collected was used to publish the FTC’s first E-Cigarette Report in March 2022.

In 2021, the Commission sent another round of Orders covering the years 2019 and 2020

to those companies among the original recipients who were still marketing e-cigarettes. This

report summarizes the information provided in response to the Commission’s 2021 Orders,

including information gathered through follow-up questions.

Key Findings

In this second E-Cig Report, the Commission observed four important market trends,

related to sales, flavors, discounting, and sampling.

The data we collected revealed that the dramatic growth in e-cigarette sales by the

In 2018, 8.1 million adults in the United States or 3.2% of adults were current e-cigarette

users, while 20.8% of high school students and 4.9% of middle school students were current e-

cigarette users.

1

1

reporting manufacturers continued during 2019, but apparently ceased in 2020. E-cigarette

product sales for the reporting companies, which had increased from $304.2 million in 2015 to

$2.046 billion in 2018, grew to $2.703 billion in 2019 and then declined to $2.224 billion in

2020. It appears that this decline in sales for the reporting companies may not represent that

large a decline in total e-cigarette sales, but rather a shift to products sold by new or growing

market participants. National survey data appears to show national cartridge-based unit sales

declining and disposable product sales increasing in 2020.

2

The Commission hopes to shed light

on this in future reports and is sending its Orders to additional e-cigarette companies to

strengthen the data it collects going forward.

Second, the data show a significant reduction in the sales of “other” flavored cartridges

popular with youth, indicating that the FDA’s 2020 enforcement policy prohibiting the sale of

flavored cartridge-based products other than menthol

3

has been effective in limiting the

availability of these products to youth. “Other” flavored cartridge-based products plummeted

from 42.1% of cartridges sold and given away in 2018 to 0.8% in 2020, but menthol cartridge-

based products surged to 63.5% of cartridges sold and given away. At the same time, publicly

available sources indicate that sales of disposable e-cigarettes, which were exempt from the

2

CDC Foundation, Monitoring U.S. E-Cigarette Sales: National Trends, October 2020,

https://www.cdcfoundation.org/E-cigaretteSalesDataBrief?inline (based upon Information

Resources, Inc. data). Between February 2020, when FDA’s flavor policy became effective, and

October 2020, the market share of cartridges decreased from 81.1% to 67.8% and the market

share of disposables increased from 18.8% to 32.1%.

3

“Enforcement Priorities for Electronic Nicotine Delivery Systems (ENDS) and Other

Deemed Products on the Market Without Premarket Authorization” (January 7, 2020; 85 FR

720) (available at https://www.fda.gov/regulatory-information/search-fda-guidance-

documents/enforcement-priorities-electronic-nicotine-delivery-system-ends-and-other-

deemed-products-market).

2

FDA’s enforcement policy and continue to be available in a wide variety of flavors, have

increased substantially.

4

“Other” flavored disposables made up 77.6% of disposables sold in

December 2020.

5

National survey data indicate a more than 1,000% increase in disposable e-

cigarette use among youth from 2019 to 2020.

6

The national survey data also show that fruit and

mint flavored e-cigarettes continue to be extremely popular with youth, and that menthol and

candy/dessert flavored products were popular among youth.

7

Third, price discounting reached a record high in 2019 ($182.3 million) and, although it

declined somewhat in 2020 ($169.1 million), it was the largest category of advertising

expenditures reported by the recipient companies. Studies indicate that consumers are clearly

responsive to price changes of tobacco products – with youth more responsive to price changes

than adults.

8

In considering the available studies demonstrating that tobacco use among youth is

responsive to price changes, the U.S. Surgeon General concluded that use of price-reducing

4

Hannah Hammond, Disposable E-Cigarette Sales Take Off, CSP Daily News, Feb. 11, 2021,

https://www.cspdailynews.com/tobacco/disposable-e-cigarette-sales-take#page=0.

5

CDC Foundation, Monitoring E-Cigarette Use Among Youth, aggregate data through

10/31/21, https://www.cdcfoundation.org/programs/monitoring-e-cigarette-use-among-youth.

6

Wang TW, Neff LJ, Park-Lee E, et al., “E-Cigarette Use Among Middle School and High

School Students – United States – 2020;” Morbidity and Mortality Weekly, 69(37); 1310-1312

(2020).

7

Id. In 2020, some e-cigarette products were sold in packaging that “imitate[d] packaging for

food products that often are marketed and appeal to youth, such as Cinnamon Toast Crunch

cereal, Twinkies, Cherry Coke and popcorn.” “FDA Notifies Companies, Including Puff Bar, to

Remove Flavored Disposable E-Cigarettes and Youth-Appealing E-Liquids from Market for Not

Having Required Authorization,” (July 20, 2020) (available at https://www.fda.gov/news-

events/press-announcements/fda-notifies-companies-including-puff-bar-remove-flavored-

disposable-e-cigarettes-and-youth).

8

U.S. Department of Health and Human Services, Preventing Tobacco Use Among Youth and

Young Adults. A Report of the Surgeon General (2012), at 524.

3

promotions has led to higher rates of tobacco use among youth.

9

The prevalence of price

discounting for e-cigarettes is therefore concerning.

Fourth, the data revealed that spending on sampling and the distribution of free and

deeply discounted e-cigarette products more than doubled in two years to $140.1 million,

making it the second largest expenditure category in 2020. The FDA prohibited sampling in

2016 to limit youth access to tobacco products.

10

The increased spending occurred because

following the ban on free e-cigarette samples, some companies began offering e-cigarette

products for $1 or a similar highly discounted price in order to evade the spirit, if not the letter,

of the FDA’s sampling ban.

In addition to the four key findings discussed above, the report notes that, due to

volatility in the disposable e-cigarette market, the reporting manufacturers appear to not be

representative of the disposables market as a whole. In particular, only two of the five

manufacturers that received the Commission’s Orders continued to market disposable e-

cigarettes in 2020, and those that did provided more limited offerings. In addition, the 2019-

2020 period saw a number of new market entrants. As a result, although the data collected show

that sales of disposable e-cigarettes declining from $74.7 million in 2018 to $69.3 million in

2019 and then to $59.3 million in 2020, most published data indicate that the market for e-

9

Id. at 530.

10

“Deeming Tobacco Products To Be Subject to the Federal Food, Drug, and Cosmetic Act, as

Amended by the Family Smoking Prevention and Tobacco Control Act; Restrictions on the Sale

and Distribution of Tobacco Products and Required Warning Statements for Tobacco Products”

81 Fed. Reg. 28974, 28986 (May 10, 2016).

4

cigarette disposables grew significantly after 2018.

11

New market entrants most likely account

for this discrepancy.

12

11

See CDC Foundation, Monitoring U.S. E-Cigarette Sales: National Trends, October 2020,

https://www.cdcfoundation.org/E-cigaretteSalesDataBrief?inline (based upon Information

Resources, Inc. data); Hannah Hammond, Disposable E-Cigarette Sales Take Off, CSP Daily

News, Feb. 11, 2021, https://www.cspdailynews.com/tobacco/disposable-e-cigarette-sales-

take#page=0 (based upon Nielsen data).

12

The two most popular brands of disposable devices in April 2021, neither of which was

covered by a Commission 6(b) order, had a combined 75.3% share of the disposable market.

Truth Initiative, E-cigarettes: Facts, stats and regulations, https://truthinitiative.org/research-

resources/emerging-tobacco-products/e-cigarettes-facts-stats-and-regulations.

5

I. INTRODUCTION

This is the Federal Trade Commission’s second report on e-cigarette sales, advertising,

and promotion and it contains data for 2019 and 2020. The prior report presented data for 2015

through 2018.

13

The Commission has published similar reports on cigarette and smokeless tobacco sales

and marketing expenditures since 1967 and 1987, respectively. In February 2019, when it

released its Cigarette Report for 2018 and its Smokeless Tobacco Report for 2018, the FTC

issued a statement that it “lack[ed] similar data about the rapidly growing market for e-cigarettes,

and as a result the FTC’s and the public’s understanding of the overall market for nicotine-based

products [wa]s substantially incomplete.”

In order to assist policymakers, the public, and itself to better understand that market, the

Federal Trade Commission issued compulsory process orders (“Orders”) in October 2019 to six

leading domestic e-cigarette manufacturers (“the manufacturers” or “the companies”) requiring

them to report detailed information on their e-cigarette sales and advertising and promotional

activities for calendar years 2015, 2016, 2017, and 2018.

14

In February 2021, the Commission

13

The first Commission report, Federal Trade Commission E-Cigarette Report for 2015-2018,

issued in March 2022, can be found at: https://www.ftc.gov/reports/e-cigarette-report-2015-

2018.

The data contained in the tables appended to this report are also in an electronic spreadsheet

available at: https://www.ftc.gov/ecigarettedata.

14

A generic version of the Order seeking data for 2015 through 2018 can be found at:

https://www.ftc.gov/system/files/attachments/press-releases/ftc-study-e-cigarette-manufacturers-

sales-advertising-promotional-methods/generic_e-

cigarette_6b_order_to_file_a_special_report_0.pdf.

The owners of one manufacturer did not have data from the period before they acquired the

company and did not report the company’s activities in 2015 or 2016. Therefore, aggregate data

6

issued slightly revised Orders for calendar years 2019 and 2020 to the five original recipients

that were still selling e-cigarette products.

15

The Orders covering data for 2019 and 2020 were sent to: Fontem US, Inc.; JUUL Labs,

Inc.; Logic Technology Development LLC; NJOY, LLC; and R.J. Reynolds Vapor Company.

Fontem US, Inc., a subsidiary of Imperial Brands plc, markets e-cigarette products under the blu

brand name. JUUL Labs, Inc. markets the JUUL brand e-cigarette products, and currently is the

largest domestic e-cigarette manufacturer in terms of sales. Logic Technology Development

LLC, a subsidiary of Japan Tobacco International, markets e-cigarette products under the Logic

brand name. NJOY, LLC markets the NJOY brand of e-cigarette products, which were among

the first e-cigarette products introduced in the United States. R.J. Reynolds Vapor Company, a

subsidiary of Reynolds American, Inc., markets e-cigarette products under the Vuse brand name.

II. E-CIGARETTE PRODUCT TYPES

E-cigarettes are battery-powered devices that deliver aerosolized e-liquid, usually

containing nicotine, when inhaled.

16

They include vape pens and personal vaporizers. Some e-

from 2015 and 2016 are not strictly comparable to aggregate data from subsequent years.

The sales, advertising, and promotional expenditure figures contained in this report and in the

electronic spreadsheet are in nominal dollars and have not been adjusted for inflation.

15

The Commission also issued an Order for 2015 through 2018 data to Nu Mark LLC, a

subsidiary of Altria Group, Inc. that marketed the MarkTen and GreenSmoke brands of e-

cigarette products through the end of 2018, when it stopped manufacturing and distributing e-

cigarette products.

A generic version of the Order seeking data for 2019 and 2020 can be found at:

https://www.ftc.gov/reports/order-file-special-section-6b-report-e-cigarette-products-calendar-

year-2021-generic-text.

16

Although the Commission’s definition of e-cigarettes could include cannabis vaping devices,

none of the recipients of the Commission’s Orders sold such devices during the period covered

7

cigarette systems have rechargeable batteries and are refillable. Closed refillable systems

(“cartridge systems”) consist of rechargeable devices that use sealed cartridges, pods, or tanks

(“cartridges”) pre-filled with e-liquid that are replaced when the e-liquid is used up. Such pre-

filled cartridges are usually designed to work with one brand’s or one manufacturer’s products.

Closed non-refillable systems (“disposables”) come with pre-filled e-liquid and non-

rechargeable batteries. Open system products are rechargeable devices and have tanks that are

manually filled by the user with e-liquid. Generally, an open system device can be filled with e-

liquid sold by any entity.

III. E-CIGARETTES SOLD AND GIVEN AWAY

As reported in Table 1, total e-cigarette sales of the reporting manufacturers grew from

$2.046 billion

17

in 2018 to $2.703 billion in 2019 and then decreased to $2.224 billion in 2020.

Indirect sales, through retailers, which were 92.1% of total dollar sales in 2018, were 91.6% of

total dollar sales in 2019 and 92.3% in 2020. The companies’ direct sales to consumers

increased from $131.3 million in 2018 to $219.9 million in 2019 and then declined to $157.6

million in 2020. Highly discounted sales of products for $1 or less decreased from $31.3 million

by the Orders, and the data collected by the Commission do not include information about

cannabis vaping devices. As discussed below, the recipients reported selling nicotine-free

products.

The Commission’s e-cigarette definition does not encompass battery-operated devices that

heat, but do not burn, tobacco or the cigarette products used in such devices.

17

All sales figures and advertising and promotion expenditures discussed in the text of this

report that are stated in billions are rounded to the nearest million, those stated in millions are

rounded to the nearest hundred thousand, and those stated in thousands are rounded to the nearest

thousand. The precise, unrounded figures are in the tables at the end of the report.

8

in 2018 to $6.7 million in 2019 and then grew to $13.3 million in 2020.

18

Cartridge-Based Systems

The reporting manufacturers’ best-selling e-cigarette products have been cartridge system

products. Cartridge-based systems can be distributed as individual devices, individual cartridges,

multiple cartridges bundled together, one or more cartridges bundled with one or more devices,

or multiple devices bundled together. As reported in Table 1, sales of cartridge products by the

reporting manufacturers increased from $1.969 billion in 2018 (representing 96.3% of total sales)

to $2.633 billion in 2019 (97.4% of total sales) and then declined to $2.165 billion in 2020

(97.3% of total sales).

As reported in Tables 2A and 2B, sales of one or more cartridges by themselves rose

from $1.560 billion in 2018 to $2.196 billion in 2019 and $2.081 billion in 2020. Sales of

cartridge and device bundles decreased from $240.4 million in 2018 to $132.7 million in 2019

and $2.7 million in 2020. Devices sold by themselves made up 8.5% of cartridge system sales in

2018 ($168.3 million), 11.6% in 2019 ($304.8 million), and 3.8% in 2020 ($81.2 million).

Direct sales of cartridge system products made up 6.2% of their overall dollar sales in

2018, 8.0% in 2019, and 6.8% in 2020. Heavily discounted sales for $1 or less dropped from

1.6% of dollar sales in 2018 to 0.3% in 2019 and then grew to 0.6% in 2020.

Combined sales and giveaways

19

of cartridges grew from 831.3 million cartridges in

18

The Commission’s Order asked the reporting manufacturers to report sales for $1 or less

separately from indirect and direct sales although they could have occurred at retail or directly

through company representatives.

19

The Commission’s definition of E-Cigarette Products given away included all products

distributed for free, whether given for free to retailers or wholesalers for subsequent sale to

consumers, or given for free to retailers, wholesalers, or consumers through sampling, a free

trial promotion, coupons for free product, or otherwise.

9

2018, to 976.7 million in 2019 and then decreased to 943.2 million in 2020. Combined sales and

giveaways of devices increased from 30.5 million devices in 2018 to 33.9 million in 2019 and

then decreased to 21.0 million in 2020. Giveaways of cartridges decreased from 3.1 million

cartridges in 2018 to 189,000 in 2019 and 30,000 in 2020. Giveaways of devices declined from

313,000 in 2018 to 89,000 in 2019 and 5,000 in 2020. At the same time, devices sold for $1 or

less (by themselves or with cartridges) grew from 7.6% of devices sold or given away in 2018

(2.3 million devices) to 23.8% in 2019 (8.1 million devices) and 63.9% in 2020 (13.4 million

devices). Cartridges sold for $1 or less were 0.5% of cartridges sold or given away in 2018,

0.01% in 2019, and 0.0007% in 2020.

Disposable E-Cigarettes

As reported in Table 1, sales of disposable, non-refillable e-cigarette products by the

reporting manufacturers declined from $74.7 million in 2018 (representing 3.7% of total sales) to

$69.3 million in 2019 (2.6% of total sales) and $59.3 million in 2020 (2.7% of total sales). It

appears, however, there were new entrants selling disposable products and that contrary to the

FTC’s data, total sales for e-cigarette disposables have grown significantly.

20

As reported in Table 3, the reporting companies sold or gave away 17.2 million

disposable e-cigarettes to consumers in 2018, 16.1 million in 2019, and 13.3 million in 2020. Of

those sales and giveaways, indirect sales accounted for 89.4% in 2018, 89.4% in 2019, and

88.0% in 2020. Giveaways were 0.5% in 2018, 0.1% in 2019, and 0.07% in 2020. Sales for $1

or less represented 0.1% of disposables sold or given away in 2018 and 2019. In 2020, there

20

Based on Nielsen data, it appears that unit sales of disposable e-cigarettes grew 211.8%

between November 2019 and November 2020, having grown 12.3% the year before. See

Hannah Hammond, Disposable E-Cigarette Sales Take Off, CSP Daily News, Feb. 11, 2021,

https://www.cspdailynews.com/tobacco/disposable-e-cigarette-sales-take#page=0.

10

were virtually no sales of disposables for $1 or less. Again, it appears that the data from the

Order recipients alone paint an incomplete picture of disposable sales.

Open System Products

As reported in Table 1, open system products have represented less than 0.1% of the sales

of the reporting manufacturers since 2018. Open system products tend to be sold at specialized

vape shops and it is likely that the reporting manufacturers account for only a fraction of the

overall sales for such products.

Tables 4A and 4B provide information on the sales of open system products. As

mentioned above, such product sales make up a small portion of sales by the reporting

manufacturers. Therefore, those tables are not discussed in this report beyond noting that by

2020, the reporting manufacturers had apparently abandoned the open system market, with

negative sales.

21

IV. CHARACTERISTICS OF E-CIGARETTE PRODUCTS

Flavors

Tables 5A and 5B report the flavor characteristics of e-cigarette products sold or given

away. The four primary flavor categories reported are tobacco flavors (e.g., absolute tobacco,

classic tobacco, Carolina bold, and sweet original); mint (e.g., wintermint, spearmint, and

wintergreen); menthol flavors (e.g., bold menthol); and “other” flavors. For 2015 through 2018,

the Commission required the companies to report menthol and mint flavors in a single category;

it asked the companies to report menthol and mint separately for 2019 and 2020. The tables

provide breakdowns of the “other” flavors. The subcategories include alcohol flavors (e.g.,

bourbon blend, Havana wine, mimosa, and peach schnapps); beverage flavors (e.g., caramel

21

Negative sales represent returns of products sold in a prior year.

11

cafe, java jolt, chai, and lemon tea); candy or dessert flavors (e.g., mint chocolate, lemon poppy

seed, apple crumble, and chestnut croissant); fruit flavors (e.g., cherry, strawberry, watermelon,

and mixed berry); fruity mint or menthol flavors (e.g. strawberry mint, berry mint, pear mint, and

iced fruit); spice flavors (e.g., vanilla, ginger, cinnamon, and aniseed); and other flavors that do

not fit in any of the above categories.

Several events affected the data on flavors. In November 2018, Juul, the largest e-

cigarette manufacturer, stopped selling flavors other than tobacco, menthol, and mint in retail

locations and, in October 2019, it stopped selling such “other” flavors online.

22

In January 2020,

FDA amended its enforcement policy guidance such that companies that continued to sell

flavored cartridge-based products (other than tobacco and menthol flavored) could face

prosecution for failure to have premarket authorization.

23

The amended policy does not apply to

disposable or open system products, which may have led to the surge in sales of disposables

described below, particularly those that were “other” flavored.

In 2018, the most popular flavor category of e-cigarette cartridges was the “other”

category, representing 42.1% of all cartridges sold or given away. The popularity of “other”

flavored cartridges dropped to 14.3% of cartridges in 2019 and to 0.8% in 2020. The most

popular subcategory of the “other” flavor category was fruit-flavored, which represented 29.7%

22

See, e.g., Matthew Perrone, Juul halts sales of fruit, dessert flavors for e-cigarettes,

Associated Press, Oct. 17, 2019,

https://apnews.com/article/d3beff8e79934a828edf35de0ba4c2a3.

23

“Enforcement Priorities for Electronic Nicotine Delivery Systems (ENDS) and Other

Deemed Products on the Market Without Premarket Authorization” (January 7, 2020; 85 FR

720) (available at https://www.fda.gov/regulatory-information/search-fda-guidance-

documents/enforcement-priorities-electronic-nicotine-delivery-system-ends-and-other-

deemed-products-market).

12

of cartridges sold or given away in 2018, 11.5% in 2019, and 0.8% in 2020. The popularity of

mint and menthol-flavored cartridges combined grew from 36.9% in 2018, to 60.8% in 2019, and

63.5% in 2020. Mint accounted for 44.1% of cartridges sold or given away in 2019 and -.06% in

2020. Menthol accounted for 16.7% of cartridges in 2019 and 63.5% in 2020. The percentage

of tobacco-flavored cartridge products sold or given away grew from 21.0% in 2018, to 24.9% in

2019, and 35.7% in 2020.

For completeness, the Commission is providing summaries of the data it received from

the reporting manufacturers about disposable e-cigarettes, but as described above, disposables

made up only a small percentage of the products sold by those manufacturers during this period

and appear to not accurately represent the market for such products. According to the data

collected from reporting manufacturers, the most popular flavor category of disposables in 2018

was the “other” flavor category, representing 37.4% of all devices sold or given away. The

popularity of “other” flavored devices increased to 39.3% in 2019 and then decreased to 23.5%

in 2020. The most popular subcategory of the “other” flavor category was fruit-flavored, which

represented 33.2% of disposable devices sold or given away in 2018, 35.2% in 2019, and 18.4%

in 2020. The popularity of mint and menthol-flavored disposables combined increased from

27.2% in 2018 to 29.7% in 2019 and 36.9% in 2020. Mint accounted for 7.4% of disposables in

2019 and 9.6% in 2020. Menthol accounted for 22.3% of disposables in 2019 and 27.3% in

2020. The percentage of tobacco flavored products decreased from 35.4% in 2018 to 31.0% in

2019, and then increased to 39.6% in 2020.

In contrast, information collected for the CDC Foundation by Information Resources,

Inc. showed that, in December 2020, “other” flavored disposables made up 77.6% of disposables

13

sold, mint made up 8.6%, menthol 6.2%, and tobacco only 7.6%.

24

New market entrants and

reduced disposable offerings from the reporting manufacturers likely account for this

discrepancy.

Nicotine Concentrations

The Commission asked the reporting companies to provide the nicotine concentrations of

each of their products as measured in milligrams of nicotine per milliliter (“mg/ml”) of e-liquid.

Tables 6A and 6B report nicotine concentration in ranges and averages. For cartridge products,

the average nicotine concentration increased from 49.4 mg/ml in 2018 to 52.3 mg/ml in 2019 and

then decreased to 51.2 mg/ml in 2020.

Bundling

Tables 7A and 7B provide details with respect to the bundling of cartridge system

products. In 2018, 97.7% of cartridges were distributed separately from a cartridge system

device. This percentage grew to 99.1% in 2019, and over 99.9% in 2020. In 2018, 26.1% of

cartridges sold or given away were distributed in bundles containing two cartridges, which

increased to 31.4% in 2019 and 43.8% in 2020. In 2018, 56.3% of cartridges were sold or given

away together in bundles containing four cartridges. That increased to 63.2% in 2019 and then

decreased to 55.1% in 2020. Few bundles contained more than four cartridges; only 0.007% in

2019 and 0% in 2020 of cartridges were sold or given away in bundles of five or more, down

from 1.1% in 2018.

The proportion of devices sold or given away together with cartridges declined from 63%

in 2018 to 26.9% in 2019 and to 2.6% in 2020. Almost no cartridge system devices sold or given

24

CDC Foundation, Monitoring E-Cigarette Use Among Youth, aggregate data through

10/31/21, https://www.cdcfoundation.org/programs/monitoring-e-cigarette-use-among-youth.

14

away in 2019 were bundled together with other such devices and none were in 2020.

Table 8 provides details with respect to the bundling of disposable e-cigarette products.

In 2019 and 2020, 2.1% and 1.2%, respectively, of disposable e-cigarettes were sold or given

away in bundles of five or more and the rest were distributed individually. In 2018, 3.7% of

disposables were sold or given away in bundles of five or more.

V. ADVERTISING AND PROMOTIONAL EXPENDITURES BY CATEGORY

Tables 9A and 9B show the annual expenditures of the reporting manufacturers on

e-cigarette advertising and promotion.

25

The tables list the amounts spent on the different types

of media advertising (e.g., magazines) and sales promotion activities (e.g., distribution of

coupons).

26

The reporting manufacturers spent $1.033 billion on e-cigarette advertising and

promotion in 2019, up from $643.5 million in 2018.

27

Total advertising and promotion then

declined to $719.9 million in 2020.

Spending on television advertising, which was $7.6 million in 2018, increased to $93.8

million in 2019. This category includes advertising on broadcast, cable, and satellite television

25

The reported figures include all advertising and promotional expenditures related to e-

cigarettes, regardless of whether such expenditures would constitute “commercial speech” or

would be protected from law enforcement action under the First Amendment. They do not

include the costs of employing full-time company employees or any overhead expenses

attributable to the activities of such company employees. They do not include advertising that

will only be seen or heard by the trade.

26

Numerous expenditures could have been reported in more than one expenditure category.

The Orders instructed the manufacturers in which category to report an expenditure when it

fell in multiple categories, but often told them to do so “to the extent practicable.” The Orders

also said that expenditures should be included in only one category to the extent practicable.

27

Definitions of the advertising and promotional expenditure categories appear in the

Appendix to this report.

15

channels, Internet television (e.g., Hulu, Netflix, Amazon Prime), and webisodes, but does not

include product placement. The Commission is not reporting the amount spent on television

advertising in 2020 because only one company reported spending in that category.

28

As in prior years, no company reported advertising e-cigarettes before or during movies

in 2019 or 2020.

The Commission asked about radio advertising, including Internet radio, audio streaming

services (e.g., Pandora and Spotify), and podcasts. The manufacturers reported spending $54.2

million on radio advertising for e-cigarettes in 2019, up from $4.5 million in 2018. Radio

advertising expenditures then decreased to $10.2 million in 2020.

The Commission is not reporting the amount spent on other audio-visual advertising in

2019 or 2020, as was the case with respect to 2018. The Commission defined other audio-visual

advertising as audio and/or visual advertising other than TV, movie, or radio advertising, product

placement, social media, endorsements, or transit advertising. It could include advertising on

screens or monitors in commercial establishments, such as video arcades or retail shops, and

video games.

In 2019 and 2020, the manufacturers reported spending nothing on product placement in

the creative content of any program or performance. The Commission did not report product

28

If only one company reported spending money on a particular type of advertising or

promotion in a year, the Commission is not reporting that expenditure in order to avoid potential

disclosure of individual company data. For this reason, the Commission is not separately

reporting the amount(s) spent in 2019, 2020, or either year on television advertising, “other

audio-visual” advertising, endorsements, newspaper advertising, transit advertising, retail-value-

added promotions involving free e-cigarette products, retail-value-added promotions involving

free items other than e-cigarette products, non-branded specialty item distribution, consumer

engagement that took place outside of adult-only facilities, and sponsorship.

In Table 9, “NA” appears where the Commission is not reporting the expenditure in a

category for this reason. The unreported expenditures are included in the “Other” category.

16

placement expenditures in 2018.

Spending on company websites directed to persons located in the United States decreased

from $11.6 million in 2018 to $8 million in 2019 and $4.7 million in 2020.

The Commission inquired about advertising on company-controlled social media

accounts or channels (e.g., Facebook, Twitter, Instagram, Snapchat, Reddit, and YouTube)

directed to persons located in the United States, including company-authored posts and replies,

and re-posts of other users’ content. The category excludes expenses related to celebrities, social

media influencers, or other endorsers. Expenditures in this category increased from $577,000 in

2018 to $1.4 million in 2019, and then decreased to $1.3 million in 2020.

The reporting category “other Internet and digital advertising” could include, among

other things, banner, display, pop-up, and native advertising on third-party Internet sites, search

advertising, sponsored digital content, advertising using a short message service (SMS text),

multimedia messaging (MMS), instant messaging (IM), and direct messaging (DM), and

advertising viewed in apps or video games. Spending on other Internet and digital advertising

increased from $22.3 million in 2018 to $79.2 million in 2019 and then decreased to $36.6

million in 2020.

The reporting companies spent $6.8 million in 2019 to procure endorsements of e-

cigarette products by celebrities, social media influencers, brand ambassadors, or other

endorsers, up from $4.3 million in 2018. The companies reported that they made no

expenditures on endorsements in 2020.

The reporting manufacturers spent $16.1 million on direct mail marketing in 2019, which

decreased to $11.1 million in 2020. The companies had spent $4.3 million on direct mail

marketing in 2018. Email marketing expenditures for e-cigarettes increased from $430,000 in

17

2018 to $630,000 in 2019 and then decreased to $165,000 in 2020.

The companies reported spending $57.7 million on newspaper advertising in 2019. Only

one of them had newspaper advertising expenditures in 2018 or 2020, so the Commission is not

reporting those expenditures.

The amount reported on magazine advertising of e-cigarettes rose from $5.2 million in

2018 to $13 million in 2019 and then declined to $2.7 million in 2020. This category includes

advertising appearing in digital editions of magazines that are nearly identical to print editions.

Spending on outdoor advertising rose from $1.0 million in 2018 to $19.1 million in 2019,

then declined to $7.2 million in 2020. Outdoor advertising includes billboards; signs and

placards in arenas, stadiums, and shopping malls, whether they are open-air or enclosed; and any

other advertising placed outdoors.

The manufacturers reported no spending in 2020 on transit advertising, that is advertising

on or in private or public vehicles and ads placed at, on, or in any bus stop, taxi stand,

transportation waiting area, subway or train station, airport, or any other transportation facility.

Transit advertising expenditures were $667,000 in 2018. The Commission is not reporting

transit advertising expenditures in 2019.

Spending on point-of-sale advertising advertising displayed or distributed at a physical

retail location went up from $45.9 million in 2018 to $85.7 million in 2019, then declined to

$61.8 million in 2020.

The largest promotions spending category in 2018, 2019, and 2020 was price discounts

paid to cigarette product retailers or wholesalers to reduce the price of e-cigarette products to

consumers. The manufacturers reported spending $182.3 million on price discounts in 2019 and

$169.1 million in 2020, up from $155.1 million in 2018.

18

Promotional allowances paid to wholesalers declined from $141.4 million in 2018 to

$126.8 million in 2019, when it was the second largest expenditure category, and $113.6 million

in 2020, when it was the third largest expenditure category. Examples of promotional

allowances paid to wholesalers might include payments for volume rebates, incentive payments,

value-added services, promotional execution, and satisfaction of reporting requirements.

Promotional allowances paid to retailers also declined from $73.9 million in 2018 to

$51.2 million in 2019, before ticking back up to $56.8 million in 2020. Examples of promotional

allowances paid to retailers might include payments for stocking, shelving, displaying, and

merchandising brands, slotting fees, volume rebates, incentive payments, and the cost of e-

cigarette products given to retailers for free for subsequent resale to consumers.

Price discounts and promotional allowances together represent 34.9% of advertising and

promotional expenditures in 2019 and 47.2% in 2020, down from 57.5% in 2018.

The reporting manufacturers spent $44.2 million in 2019 on coupons to reduce the retail

cost of e-cigarette products, up from $36.5 million in 2018. Spending then declined to $19.3

million in 2020.

The Commission asked the companies about retail-value-added expenditures

promotions involving free products given to consumers at the point of sale, including online, in

connection with a purchase of e-cigarette products. Some such promotions involve free e-

cigarette products (e.g., buy two, get one free or buy a device and get a free e-liquid) while

others involve other free products (e.g., buy two, get a free t-shirt). Because only one company

reported spending in this category, the Commission is not reporting the expenditures in 2019 or

2020 on retail-value-added promotions involving free e-cigarette products. The manufacturers

reported spending $11.3 million in 2018 on such promotions. The companies reported spending

19

$3.1 million in 2020 on retail-value-added promotions involving items other than free e-cigarette

products. The Commission is not reporting the expenditures on such promotions in 2018 or

2019.

The manufacturers reported that they spent nothing in 2019 or 2020 on branded specialty

item distribution — that is, the selling or giving consumers items such as t-shirts, caps,

sunglasses, key chains, or sporting goods bearing the brand name of an e-cigarette product. They

spent $212,000 in 2018 distributing such items. The companies also reported that, as in 2018,

they made no expenditures in 2020 on specialty item distribution involving products not bearing

an e-cigarette product brand name. The Commission is not reporting the expenditures on the

distribution of such items in 2019 because only one company reported spending in this category.

When the distribution of items, whether branded or non-branded, is combined with the sale of e-

cigarettes, the associated expenditures are reported as retail-value-added expenditures.

Sampling includes the distribution of free e-cigarette products and the distribution of

e-cigarette products sold at a price of $1 or less.

29

Sampling includes the costs of the products

themselves and all costs of organizing and conducting the sampling. The companies reported

sampling spending of $111.9 million in 2019 (the third largest expenditure category) and $140.1

million in 2020 (the second largest expenditure category), up from $58.1 million in 2018.

The Commission inquired about expenditures for public entertainment events (e.g.,

29

Highly discounted sales became more popular following the 2016 effective date of FDA’s

Deeming Regulation, which asserted jurisdiction over all tobacco products and, among other

things, prohibited free sampling of tobacco products. See Deeming Tobacco Products To Be

Subject to the Federal Food, Drug, and Cosmetic Act, as Amended by the Family Smoking

Prevention and Tobacco Control Act; Restrictions on the Sale and Distribution of Tobacco

Products and Required Warning Statements for Tobacco Products, 81 Fed. Reg. 28974 (May 10,

2016).

20

concerts or sporting events) that take place in adult-only facilities and that promote e-cigarette

products. Expenditures in connection with such events grew from $2.3 million in 2018 to $4.3

million in 2019 and $10.1 million in 2020. As in prior years, the companies did not report any

expenditures in 2019 or 2020 on public entertainment events promoting e-cigarette products that

took place outside of adult-only facilities.

30

The manufacturers reported spending $16.1 million in 2019 on consumer engagement

(not involving the distribution of free e-cigarette products) that took place inside adult-only

facilities, up from $12.8 million in 2018. The companies reported spending nothing in this

category in 2020. The Commission is not reporting expenditures in 2019 or 2020 on consumer

engagement that took place outside of adult-only facilities, because, as in all prior years, only

one company reported such expenditures.

Because only one company reported spending in this area, the Commission is not

reporting expenditures in 2019 or 2020 on sponsoring sports teams or individual athletes. The

companies reported that they did not sponsor sports teams or individual athletes in 2018.

Finally, the Commission inquired about expenditures related to advertising or promotion

through college campus programs including the use of brand ambassadors, campus

representatives, or on campus or off campus events or promotions. This category is duplicative

of expenditures for other categories. For all reporting years, the manufacturers stated that they

spent nothing on such college campus programs.

30

Some expenses related to public entertainment events could have been reported under the

sampling category.

21

VI. PRODUCT PLACEMENT

31

The Commission asked the e-cigarette manufacturers whether, in 2019 or 2020, they or

their agents: compensated anyone engaged in product placement in motion pictures, television

shows, video games, magazines, or other publications (“in creative content”); solicited the

appearance of e-cigarettes in creative content, or paid money or other compensation (including

free product) in connection with the appearance of any e-cigarette product brand imagery in

creative content; or granted approval for the appearance of an e-cigarette product in creative

content. All of the reporting companies said they had not engaged in any of those activities.

VII. AGE VERIFICATION

All of the reporting companies maintained websites to advertise and sell their e-cigarette

brands. The Commission inquired about any mechanisms used to deter entry onto those websites

by underage persons. The companies used self-certification in 2019 and 2020, asking website

visitors to confirm that they were either 18 or 21 years of age.

32

Three of the companies required

throughout the time period that individuals attest they were 21 years or older; in early 2019, one

company switched from requiring visitors to be 18 years of age to requiring them to be 21; and

one company simply stated that it required visitors to certify they were “of legal age.”

During 2019 and 2020, all of the reporting manufacturers used third-party age

verification services before allowing customers to purchase e-cigarette products directly on their

31

See Federal Trade Commission E-Cigarette Report for 2015-2018 for discussions of the

e-cigarette manufacturers’ activities in prior years with respect to: product placement; age

verification; social media accounts; affiliates; and celebrities, influencers, and endorsers.

32

In 2019, amendments to the Food, Drug, and Cosmetics Act raised the nationwide minimum

legal sales age for tobacco products from 18 years to 21 years. See 21 U.S.C. § 906(d)(5).

22

websites.

33

They collected information including name, date of birth, and address and/or

telephone number and matched it to information in databases in order to verify that prospective

customers were at least 21 years of age. The nature of age verification varied between the

companies and over time. One company allowed the submission and matching of the last four

digits of a consumer’s Social Security number (“SSN digits”) or the uploading of government-

issued identification (“ID”) when a more general verification failed, but started, in 2020, to

require all potential customers under 27 years of age to upload an ID. A second company

required the submission and matching of SSN digits or the uploading of an ID together with a

matching “selfie.” A third company required the submission and matching of SSN digits or the

completion of a knowledge-based authentication employing a series of multiple-choice questions

referencing then-current and historical data derived primarily from government sources. The

other two companies required matching of SSN digits, one throughout the time period and the

other starting in January 2020. Two of the companies also noted that they used two-factor

authentication, one starting in January 2019 and the other in August 2019. One company noted

that its system locked the consumer’s age-verified name, so a consumer could not use a different

name in the credit card, billing address, or shipping address sections.

All of the companies reported that in 2019 and 2020 they followed state laws with respect

to obtaining an adult signature upon delivery. One company stated that starting in February

33

In March 2021, the Preventing Online Sales of E-Cigarettes to Children Act took effect,

prohibiting the United States Postal Service from shipping e-cigarette products and requiring

online e-cigarette sellers to verify the age of consumers through commercially available (or

similar) databases and obtain proof of age from persons accepting delivery. As reported, other

carriers such as DHL, FedEx and the United Parcel Service (“UPS”) have also implemented bans

on shipping e-cigarette products. Therefore, direct sales are likely to significantly decline in

2021.

23

2020, UPS required adult signatures for all e-cigarette product deliveries and that because of the

extent of its use of UPS, almost all deliveries from that point on required adult signature.

Another company reported that beginning in stages between April and October 2019, it also

required adult signature for the first completed purchase on an account and any time there was a

mismatch between the billing and shipping address on an order.

The Commission asked the manufacturers about their mechanisms to prevent underage

individuals from joining their mailing lists and loyalty programs in 2019 and 2020. All the

companies required consumers to be 21 years old to join their mailing lists or loyalty programs.

To be on their mailing lists, three of the companies required third-party age verification, one

required self-certification, and one relied on self-certification until March 2019, when it switched

to third-party age verification.

Two companies said they had loyalty programs and a third said that it offered a non-

traditional program through which participants could obtain discounts on up to two replacement

devices per year. All three companies stated that they required third-party age verification in

order to enroll in those programs.

VIII. SOCIAL MEDIA ACCOUNTS

Two of the five companies said that in 2019 and 2020 they only used social media

accounts for non-promotional communications, e.g., customer service. Three of the companies

used social media accounts to promote their e-cigarette products in 2019 or 2020. Two

companies said they maintained Twitter, Instagram, and Facebook accounts to advertise their e-

cigarette products, and one of them also used a YouTube account until December 2020.

34

The

34

Twitter, Facebook/Instagram, and YouTube do not themselves sell e-cigarette or tobacco

advertising.

24

final company used a YouTube account to advertise e-cigarette products and also used Facebook

and Instagram accounts between July 2019 and September 2020.

The companies that used social media accounts reported that they used tools made

available by the social media platforms, which permit account holders to designate age

restrictions. Before allowing an individual to access a company account, the platforms confirm

that the individual meets the designated age – based either on the age the individual reported

when creating a personal account for the platform or on an affirmation that the user was of a

certain required legal age in response to a challenge question. One of the e-cigarette

manufacturers reported that it hired a third party to manually review its social media followers

and remove fraudulent profiles and those that appeared to be under 21 years of age.

IX. AFFILIATES

Three of the five manufacturers said that they did not use online affiliate programs to

market their e-cigarette products in 2019 or 2020. One company had an affiliate program that

primarily partnered with deal websites such as Groupon or Slick Deals, but also used vaping blog

affiliates. Another company had a limited affiliate program for four months during 2019 for the

publication of promotional codes to be used for making purchases from its website.

X. CELEBRITIES, INFLUENCERS, AND ENDORSERS

The FTC asked the companies whether they engaged in marketing using celebrities,

social media influencers, or other endorsers (collectively “influencers”) during 2019 or 2020.

Two companies said that they did not use influencers. One said that it engaged influencers to

publish product reviews online between January and March 2019. Another company utilized

social media influencers and other adult endorsers until October 2019 to create content on the

influencers’ social media pages and on the company’s websites and social media accounts. The

25

final company ran consumer testimonials in 2019, hired radio personalities to share their

switching stories, and until September 2019, had an endorsement arrangement with a talk show

host. None of the companies reported using influencers in 2020.

One company said that it reviewed all paid influencer social media posts before and after

they were posted. A second company said its legal department was involved in reviewing and

overseeing certain influencer messaging and content prior to publication. A third company said

it reviewed all influencer scripts.

26

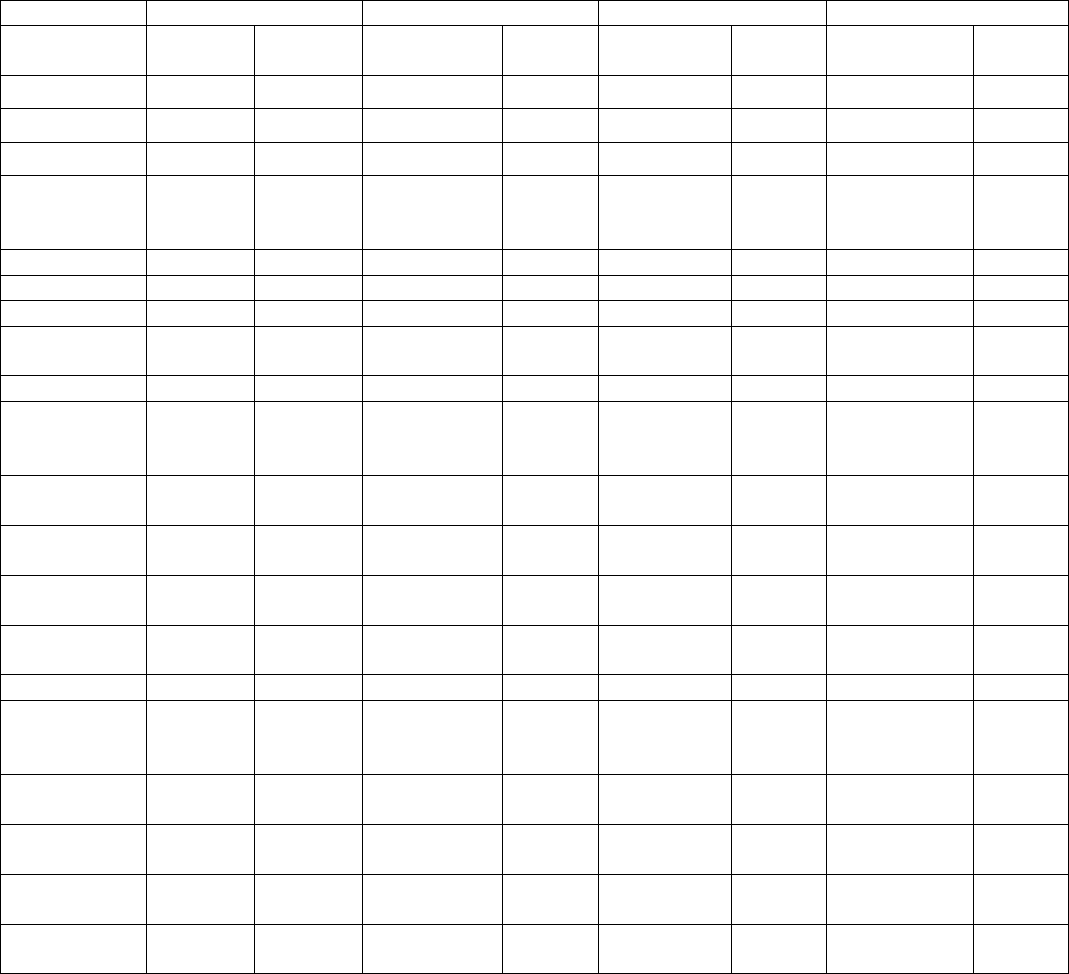

Table 1

Total Product Sales and Percentages of Total Sales

(2015-2020)

2015 2016 2017 2018

Total sales $304,170,139 $487,791,646 $782,269,969 $2,045,622,966

Cartridge systems $259,984,551 85.47% $417,302,598 85.55% $707,415,500 90.43% $1,969,019,051 96.26%

Disposables $44,185,495 14.53% $68,404,886 14.02% $72,420,899 9.26% $74,683,954 3.65%

Open systems $92 0.00% $2,084,163 0.43% $2,427,812 0.31% $1,535,492 0.08%

Indirect sales $268,574,337 88.30% $436,160,722 89.42% $690,224,679 88.23% $1,883,091,677 92.05%

Direct sales $35,480,901 11.66% $50,047,078 10.26% $90,605,887 11.58% $131,274,855 6.42%

Sales for $1 or

less

$114,901 0.04% $1,583,847 0.32% $1,439,403 0.18% $31,256,434 1.53%

2019 2020

Total sales $2,702,811,187 $2,223,795,406

Cartridge

systems

$2,633,333,620 97.43% $2,164,546,108 97.34%

Disposables $69,274,687 2.56% $59,250,133 2.66%

Open systems $193,583 0.01% ‐$834 0.00%

Indirect sales $2,476,210,392 91.62% $2,052,886,910 92.31%

Direct sales $219,856,446 8.13% $157,595,133 7.09%

Sales for $1 or

less

$6,744,349 0.25% $13,313,364 0.60%

Table 2A

Cartridge System Sales and Giveaways and Percentages of Total Sales

(2015-2018)

2015 2016 2017 2018

Cartridge system

sales

$259,984,551 $417,302,598 $707,415,500 $1,969,019,051

Cartridge sales $197,187,253 75.85% $338,234,357 81.05% $567,174,474 80.18% $1,560,395,293 79.24%

Device sales $649,055 0.25% $3,810,583 0.91% $23,614,906 3.34% $168,305,746 8.55%

Cartridge & device

bundle sales

$62,148,238 23.90% $75,257,657 18.03% $116,626,415 16.49% $240,318,013 12.21%

Indirect sales $225,163,505 86.61% $367,124,417 87.98% $622,341,019 87.97% $1,816,012,985 92.23%

Direct sales $34,706,146 13.35% $48,594,334 11.64% $83,635,077 11.82% $121,830,755 6.19%

$1 sales $114,901 0.04% $1,583,847 0.38% $1,439,403 0.20% $31,175,312 1.58%

Total cartridges

sold & given away

169,281,616 211,062,325 313,626,942 831,349,329

Cartridges sold

indirectly

152,178,291 88.99% 190,647,050 90.33% 286,283,022 91.28% 790,440,407 95.08%

Cartridges sold

directly

12,225,256 7.22% 15,839,150 7.50% 22,703,264 7.24% 33,502,457 4.03%

Cartridges sold for

$1 or less

272,420 0.16% 2,878,860 1.36% 2,766,371 0.88% 4,338,265 0.52%

Cartridges given

away

4,605,649 2.72% 1,697,265 0.80% 1,874,285 0.60% 3,068,201 0.37%

Total devices

sold & given away

7,814,159 8,849,196 11,824,626 30,466,903

Devices sold

indirectly

6,953,901 88.99% 7,866,147 88.89% 11,004,545 93.06% 26,993,075 88.60%

Devices sold

directly

100,612 1.29% 173,633 1.96% 442,840 3.75% 850,367 2.79%

Devices sold for $1

or less

28,278 0.36% 328,816 3.72% 177,280

1.50% 2,310,951 7.59%

Devices given away 731,368 9.36% 480,600 5.43% 199,961 1.69% 312,510 1.03%

Table 2B

Cartridge System Sales and Giveaways and Percentages of Total Sales

(2019-2020)

2019 2020

Cartridge

system sales

$2,633,333,620 $2,164,546,108

Cartridge sales $2,195,797,626 83.38% $2,080,565,721 96.12%

Device sales $304,839,736 11.58% $81,203,408 3.75%

Cartridge &

device bundle

sales

$132,696,259 5.04% $2,729,832 0.13%

Indirect sales $2,415,511,724 91.73% $2,003,415,959 92.56%

Direct sales $211,101,250 8.02% $147,816,787 6.83%

$1 sales $6,720,647 0.26% $13,313,362 0.62%

Total cartridges

sold & given

away

976,656,877 943,180,991

Cartridges sold

indirectly

919,757,576 94.17% 901,905,290 95.62%

Cartridges sold

directly

56,601,584 5.80% 41,239,688 4.37%

Cartridges sold

for $1 or less

109,205 0.01% 6,333 0.00%

Cartridges given

away

188,512 0.02% 29,680 0.00%

Total devices

sold & given

away

33,851,529 21,042,495

Devices sold

indirectly

25,010,441 73.88% 7,234,693 34.38%

Devices sold

directly

684,560 2.02% 355,837 1.69%

Devices sold for

$1 or less

8,067,283 23.83% 13,447,132 63.90%

Devices given

away

89,245 0.26% 4,833 0.02%

Table 3

Disposable Sales and Giveaways and Percentages of Total Sales

(2015-2020)

2015 2016 2017 2018

Disposable

sales

$44,185,495 $68,404,886 $72,420,899 $74,683,954

Indirect

sales

$43,410,770 98.25% $67,178,662 98.21% $66,396,135 91.68% $66,058,562 88.45%

Direct sales $774,726 1.75% $1,226,224 1.79% $6,024,764 8.32% $8,544,270 11.44%

Sales for $1

or less

$0 0.00% $0 0.00% $0 0.00% $81,123 0.11%

Total sold

& given

away

7,802,219 12,879,262 15,838,443 17,226,341

Indirect

sales

7,727,777 99.05% 12,635,814 98.11% 14,609,115 92.24% 15,402,865 89.41%

Direct sales 58,144 0.75% 157,888 1.23% 1,221,223 7.24% 1,706,549 9.91%

Sales for $1

or less

0 0.00% 0 0.00% 0 0.00% 22,752 0.13%

Given away 16,298 0.21% 85,560 0.66% 8,105 0.05% 94,175 0.55%

2019 2020

Disposable

sales

$69,274,687 $59,250,133

Indirect

sales

$60,574,533 87.44% $49,474,662 83.50%

Direct sales $8,676,452 12.52% $9,775,469 16.50%

Sales for $1

or less

$23,702 0.03% $2 0.00%

Total sold

& given

away

16,072,942 13,270,159

Indirect

sales

14,366,110 89.38% 11,679,252 88.01%

Direct sales 1,662,942 10.35% 1,581,200 11.92%

Sales for $1

or less

23,956 0.15% 2 0.00%

Given away 19,934 0.12% 9,705 0.07%

Table 4A

Open System Sales and Giveaways and Percentages of Total Sales

(2015-2018)

2015 2016 2017 2018

Open system

sales

$92 $2,084,163 $2,427,812 $1,535,492

E‐liquid sales $57 65.52% $815,107 39.14% $1,347,033 55.46% $1,147,756 74.75%

Device sales $0 0.00% $1,182,794 56.80% $951,038 39.16% $314,167 20.46%

E‐liquid &

device bundle

sales

$30 34.48% $84,427 4.05% $130,800 5.39% $73,586 4.79%

Indirect sales $62 67.39% $1,857,643 89.13% $1,487,524 61.27% $1,020,130 66.44%

Direct sales $30 32.61% $226,519 10.87% $940,288 38.73% $515,362 33.56%

Sales for $1 or

less

$0 0.00% $0 0.00% $0 0.00% $0 0.00%

Total e‐liquids

sold & given

away

1,135 200,543 261,665 193,862

E‐liquids

indirect sales

1,134 99.91% 157,439 78.51% 171,184 65.37% 121,526 62.69%

E‐liquids direct

sales

1 0.09% 43,091 21.49% 89,526 34.27% 54,632 28.18%

E‐liquids sold

for $1 or less

0 0.00% 0 0.00% 0 0.00% 0 0.00%

E‐liquids given

away

0 0.00% 13 0.01% 955 0.36% 17,704 9.13%

Total devices

sold & given

away

1 197,368 112,573 40,664

Devices

indirect sales

0 0.00% 177,778 90.07% 82,128 72.96% 23,980 58.97%

Devices direct

sales

1 100.00% 19,589 9.93% 30,292 26.91% 16,682 41.02%

Devices sold

for $1 or less

0 0.00% 0 0.00% 0

0.00% 0 0.00%

Devices given

away

0 0.00% 1 0.00% 153 0.14% 2 0.00%

Table 4B

Open System Sales and Giveaways and Percentages of Total Sales

(2019-2020)

2019 2020

Open system

sales

$193,583 ‐$834

E‐liquid sales $144,259 91.70% ‐$2,185 261.78%

Device sales ‐$8,915 ‐5.67% ‐$1,527 182.99%

E‐liquid &

device bundle

sales

$21,966 13.96% $2,877 ‐344.77%

Indirect sales $124,135 64.12% ‐$3,712 444.77%

Direct sales $69,448 35.88% $2,877 ‐344.77%

Total e‐liquids

sold & given

away

15,653 ‐63

E‐liquids

indirect sales

13,422 85.75% ‐205 324.92%

E‐liquids direct

sales

2,231 14.25% 142 ‐224.92%

Total devices

sold & given

away

778 24

Devices

indirect sales

‐553 ‐71.00% ‐118 ‐485.44%

Devices direct

sales

1,331 171.00% 142 585.44%

* Negative sales represent returns of products sold in a prior year.

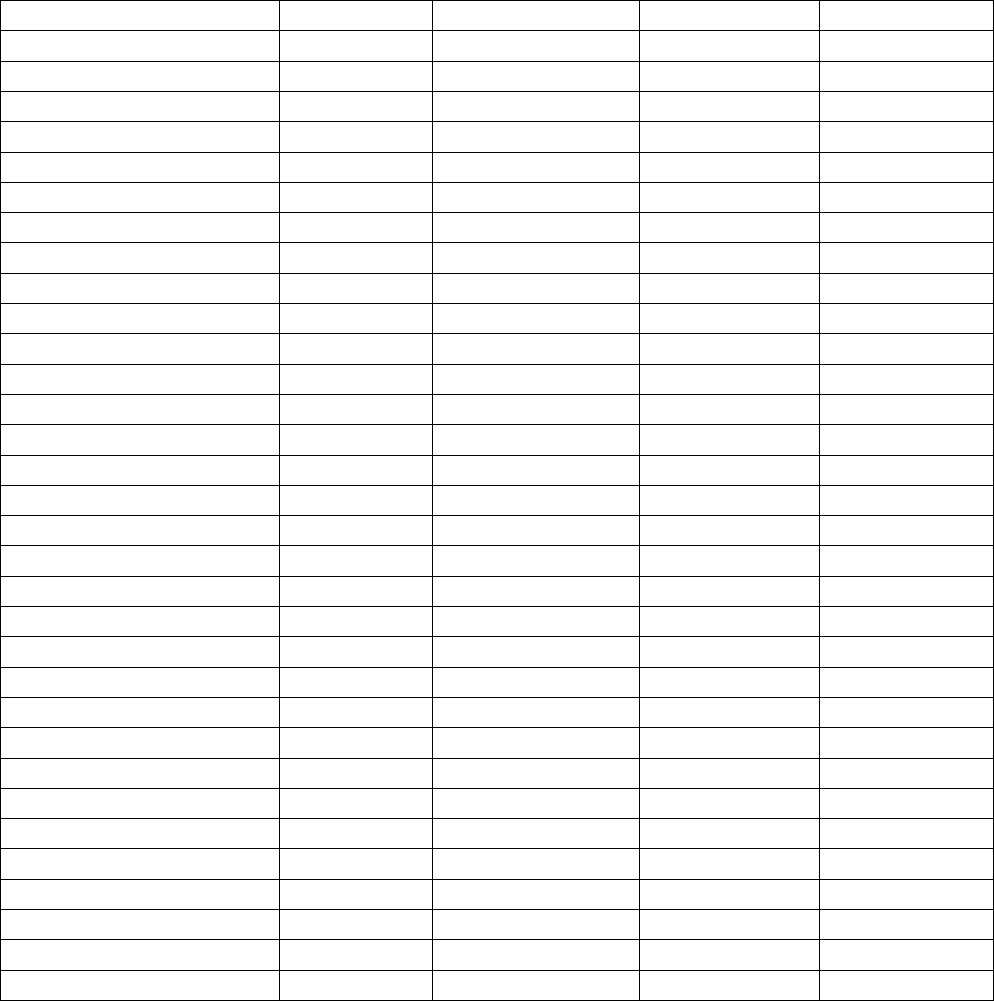

Table 5A

Percentages of Cartridges, Disposables, and E‐Liquid Containers with Various Flavors

(2015‐2018)

2015 2016 2017 2018

Cartridge flavors

Tobacco 47.24% 39.80% 34.26% 20.96%

Menthol or Mint 39.00% 38.04% 36.26% 36.90%

All other 13.76% 22.16% 29.47% 42.14%

‐Alcohol 0.11% 0.14% 0.04% 0.03%

‐Beverage 3.56% 4.07% 5.37% 3.47%

‐Candy/Dessert 4.47% 7.26% 6.67% 4.38%

‐Fruit 4.72% 8.95% 15.27% 29.70%

‐Fruit & Menthol/Mint 0.00% 0.02% 0.19% 0.09%

‐Spice 0.90% 1.72% 1.04% 0.50%

‐Other 0.00% 0.00% 0.88% 3.96%

Disposable flavors

Tobacco 52.05% 45.64% 38.52% 35.44%

Menthol or Mint 25.95% 22.42% 25.72% 27.16%

All other 22.00% 31.94% 35.76% 37.40%

‐Candy/Dessert 0.00% 0.00% 0.07% 0.12%

‐Fruit 22.00% 26.81% 31.96% 33.16%

‐Spice 0.00% 0.00% 3.73% 4.12%

E‐liquid bottle flavors

Tobacco 12.78% 35.07% 32.97% 27.94%

Menthol or Mint 14.45% 30.15% 36.12% 28.04%

All other 72.78% 34.78% 30.91% 44.02%

‐Alcohol 8.46% 0.18% 0.26% 0.12%

‐Beverage 0.00% 0.69% 1.62% 15.27%

‐Candy/Dessert 30.66% 1.97% 4.68% 2.32%

‐Fruit 27.31% 28.52% 18.10% 21.47%

‐Fruit & Menthol/Mint 0.00% 2.09% 3.20% 1.10%

‐Spice 3.17% 1.31% 3.06% 3.74%

‐Other 3.17% 0.03% 0.00% 0.00%

Table 5B

Percentages of Cartridges, Disposables, and E‐Liquid Containers with Various Flavors

(2019‐2020)

2019 2020

Cartridge flavors

Tobacco 24.93% 35.70%

Menthol 16.67% 63.53%

Mint 44.13% ‐0.06%

All other 14.27% 0.83%

‐Alcohol 0.00% 0.00%

‐Beverage 1.11% 0.03%

‐Candy/Dessert 0.74% 0.00%

‐Fruit 11.53% 0.79%

‐Fruit &Menthol/Mint 0.34% 0.00%

‐Spice 0.31% 0.02%

‐Other 0.23% 0.00%

Disposable flavors

Tobacco 31.04% 39.62%

Menthol 22.30% 27.29%

Mint 7.37% 9.59%

All other 39.29% 23.49%

‐Candy/Dessert 0.02% 0.00%

‐Fruit 35.25% 18.45%

‐Spice 4.03% 5.04%

E‐liquid bottle flavors

Tobacco 21.67% ‐122.10%

Menthol 20.64% 138.58%

Mint 0.06% 0.00%

All other 57.62% 83.52%

‐Alcohol ‐0.15% ‐7.81%

‐Beverage 29.38% ‐98.43%

‐Candy/Dessert ‐0.41% 21.90%

‐Fruit 10.71% 121.44%

‐Fruit & Menthol/Mint 0.00% 0.00%

‐Spice 2.91% 30.79%

‐Other 15.18% 0.00%

* Negative sales represent returns of products sold in a prior year.

Table 6A

Percentages of Cartridges, Disposables, and E‐Liquid Containers

Within Various Nicotine Concentration Ranges and Their Average Nicotine Concentrations

Measured in Milligrams of Nicotine per Milliliter of E‐liquid

(2015‐2018)

2015 2016 2017 2018

Cartridges‐ nicotine concentration

0 0.21% 0.18% 0.03% 0.02%

1‐10.99 0.58% 0.46% 0.01% 0.01%

11‐20.99 11.42% 6.75% 8.21% 13.07%

21‐30.99 15.52% 16.05% 10.67% 5.65%

31‐40.99 0.82% 10.72% 20.62% 9.21%

41‐50.99 0.00% 0.18% 1.33% 0.91%

51‐60.99 71.44% 65.66% 59.13% 71.13%

Average 47.46 47.23 46.79 49.41

Disposables‐ nicotine concentration

0 ‐0.06% 0.13% 0.00% 0.00%

11‐20.99 28.72% 7.17% 1.93% 0.00%

21‐30.99 71.34% 92.57% 68.91% 55.07%

31‐40.99 0.00% 0.00% 1.20% 2.35%

41‐50.99 0.00% 0.01% 7.16% 4.37%

51‐60.99 0.00% 0.11% 18.49% 28.25%

61‐70.99 0.00% 0.00% 2.31% 9.95%

Average 25.04 27.06 34.53 39.53

E‐liquid Bottle‐ nicotine concentration

0 0.00% 1.06% 1.06% 1.62%

1‐10.99 27.22% 89.37% 53.36% 35.19%

11‐20.99 13.13% 2.83% 32.60% 11.49%

21‐30.99 0.00% 6.30% 12.98% 30.77%

31‐40.99 29.60% 0.23% 0.00% 0.00%

41‐50.99 0.00% 0.00% 0.00% 20.94%

51‐60.99 30.04% 0.22% 0.00% 0.00%

Average 32.35 7.75 11.84 21.83

Table 6B

Percentages of Cartridges, Disposables, and E‐Liquid Containers

Within Various Nicotine Concentration Ranges and Their Average Nicotine Concentrations

Measured in Milligrams of Nicotine per Milliliter of E‐liquid

(2019‐2020)

2019 2020

Cartridges‐ nicotine concentration

0 0.02% 0.01%

1‐10.99 0.01% 0.00%

11‐20.99 4.82% 5.49%

21‐30.99 5.51% 10.60%

31‐40.99 11.77% 9.24%

41‐50.99 0.01% 0.00%

51‐60.99 77.86% 74.66%

Average 52.31 51.22

Disposables‐ nicotine concentration

0 0.00% 0.00%

11‐20.99 0.00% 0.00%

21‐30.99 49.13% 54.65%

31‐40.99 2.14% ‐0.20%

41‐50.99 6.42% 1.67%

51‐60.99 27.97% 23.30%

61‐70.99 14.35% 20.58%

Average 41.74 41.90

E‐liquid Bottle‐ nicotine concentration

0 7.06% 1.08%

1‐10.99 ‐5.99% 316.18%

11‐20.99 ‐5.33% 292.76%

21‐30.99 42.16% ‐224.92%

31‐40.99 0.00% 0.00%

41‐50.99 62.10% ‐285.10%

Average 38.81 ‐124.79

* Negative sales represent returns of products sold in a prior year.

Table 7A

Bundling of Cartridge System Components

(2015‐2018)

2015 2016 2017 2018

% Devices

bundled with

cartridges

97.10% 95.40% 88.12% 63.03%

% Devices not

bundled with

cartridges

2.90% 4.60% 11.88% 36.97%

% Cartridges

bundled with

devices

4.88% 4.13% 3.33% 2.31%

% Cartridges not

bundled with

devices

95.12% 95.87% 96.67% 97.69%

# of devices

bundled together

1 device 100.01% 100.00% 99.98% 100.00%

2 or more devices ‐0.01% 0.00% 0.02% 0.00%

# of cartridges

bundled together

1 cartridge 4.50% 4.30% 5.05% 4.88%

2 cartridges 71.77% 69.16% 58.42% 26.06%

3 cartridges 3.58% 14.83% 11.41% 11.64%

4 cartridges 1.31% 4.27% 22.05% 56.33%

5 cartridges 18.84% 7.44% 0.09% 0.02%

6 or more

cartridges

0.00% 0.00% 2.98% 1.06%

Table 7B

Bundling of Cartridge System Components

(2019‐2020)

2019 2020

% Devices

bundled with

cartridges

26.90% 2.55%

% Devices not

bundled with

cartridges

73.10% 97.45%

% Cartridges

bundled with

devices

0.93% 0.03%

% Cartridges not

bundled with

devices

99.07% 99.97%

# of devices

bundled together

1 device 100.00% 100.00%

2 or more devices 0.00% 0.00%

# of cartridges

bundled together

1 cartridge 1.63% 0.66%

2 cartridges 31.41% 43.83%

3 cartridges 3.73% 0.44%

4 cartridges 63.23% 55.07%

5 cartridges 0.00% 0.00%

6 or more

cartridges

0.00% 0.00%

Table 8

Percentages of Disposables Sold or Given Away Individually or in Bundles

(2015‐2020)

2015 2016 2017 2018

1 100.00% 100.00% 92.29% 96.30%

5 0.00% 0.00% 2.70% 3.70%

20 0.00% 0.00% 2.06% 0.00%

100 0.00% 0.00% 2.95% 0.00%

2019 2020

1 97.91% 98.81%

5 1.89% 0.72%

20 0.20% 0.47%

100 0.00% 0.00%

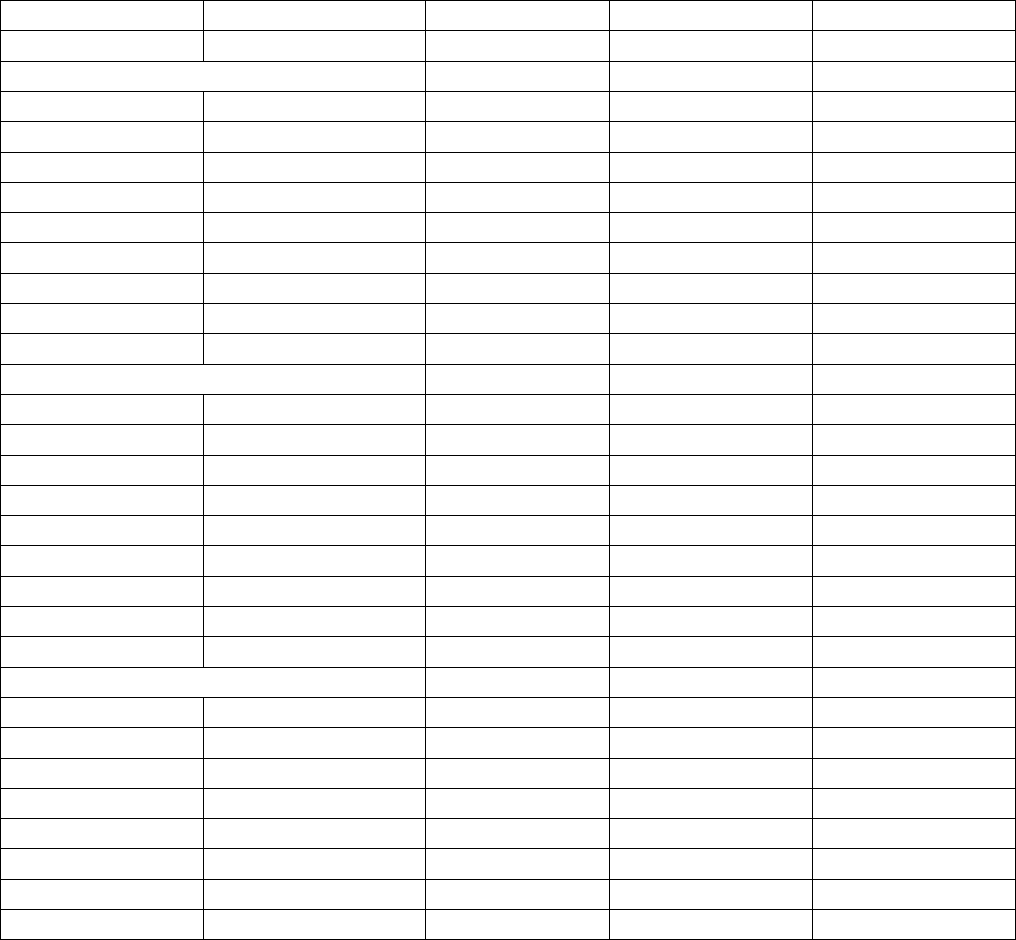

Table 9A

Advertising and Promotional Expenditures

(2015‐2018)

2015 2016 2017 2018

TV advertising $18,765,588 $13,706,190 $5,994,063 $7,590,297

Movie advertising $0 $0 $0 $0

Radio advertising $1,949,099 $1,519,965 $1,308,292 $4,505,002

Other audio‐visual advertising $0 $0 N/A N/A

Product placement N/A $113,012 N/A N/A

Company Internet sites $5,171,616 $7,888,889 $8,888,138 $11,616,875

Social media N/A N/A $779,291 $577,285

Other Internet and digital advertising $6,389,902 $8,908,004 $12,392,570 $22,315,874

Endorsements $287,950 $104,381 $4,431,029 $4,287,431

Direct mail marketing N/A N/A $1,249,778 $4,325,312

Email marketing $66,648 $225,703 $152,984 $430,359

Newspaper advertising $0 $0 $0 N/A

Magazine advertising $2,451,090 $7,072,483 $4,884,538 $5,240,440

Outdoor advertising $969,603 $2,815,302 $2,854,201 $1,028,472

Transit advertising N/A $3,453,245 $2,319,535 $666,682

Point‐of‐sale advertising $13,365,702 $26,462,177 $21,445,036 $45,872,667

Price discounts $11,184,584 $33,709,537 $33,648,290 $155,124,847

Promotional allowances paid to retailers $28,430,304 $36,305,608 $40,944,305 $73,852,950

Promotional allowances paid to wholesalers

$21,072,195 $29,273,783 $52,326,119 $141,375,232

Coupons for reduction of purchase price $22,788,155 $20,395,598 $27,154,852 $36,461,104

Retail‐value‐added‐ free e‐cigarette products

$60,115 $5,616,750 $10,586,295 $11,311,627

Retail‐value‐added‐ free items other than e‐

cigarette Products

N/A N/A $0 N/A

Specialty item distribution‐ branded N/A N/A N/A $211,770

Specialty item distribution‐ not branded $0 $0 $0 $0

Sampling $22,962,323 $32,439,417 $14,153,277 $58,083,793

Public entertainment‐ adult‐only facilities N/A $3,024,758 N/A

$2,303,716

Public entertainment‐ not adult‐only facilities $0 $0 $0 $0

Consumer engagement‐ adult‐only facilities $1,613,769 $8,537,860 $1,701,784 $12,771,648

Consumer engagement‐ not adult‐only facilities N/A N/A N/A N/A

Sponsorship $0 $0 $0 $0

All other $40,280,324 $29,401,798 $31,341,033 $43,587,550

Total reportable expenditures $197,808,967 $270,974,462 $278,555,410 $643,540,932

Campus promotion $0 $0 $0 $0

Table 9B

Advertising and Promotional Expenditures

(2019‐2020)

2019 2020

TV advertising $93,786,067 N/A

Movie advertising $0 $0

Radio advertising $54,182,097 $10,243,086

Other audio‐visual advertising N/A N/A

Product placement $0 $0

Company Internet sites $7,972,951 $4,720,225

Social media $1,370,151 $1,255,990

Other Internet and digital advertising $79,185,896 $36,632,537

Endorsements $6,792,765 $0

Direct mail marketing $16,112,008 $11,148,762

Email marketing $630,821 $164,761

Newspaper advertising $57,746,568 N/A

Magazine advertising $12,967,789 $2,744,355

Outdoor advertising $19,076,783 $7,196,454

Transit advertising N/A $0

Point‐of‐sale advertising $85,709,226 $61,769,932

Price discounts $182,269,887 $169,074,590

Promotional allowances paid to retailers $51,163,171 $56,780,807

Promotional allowances paid to wholesalers

$126,783,783 $113,626,836

Coupons for reduction of purchase price $44,154,292 $19,283,623

Retail‐value‐added‐ free e‐cigarette products

N/A N/A

Retail‐value‐added‐ free items other than e‐

cigarette Products

N/A $3,070,220

Specialty item distribution‐ branded $0 $0

Specialty item distribution‐ not branded N/A $0

Sampling $111,860,067 $140,074,983

Public entertainment‐ adult‐only facilities

$4,265,926 $10,052,027

Public entertainment‐ not adult‐only facilities

$0 $0

Consumer engagement‐ adult‐only facilities

$16,134,780 $0

Consumer engagement‐ not adult‐only facilities

N/A N/A

Sponsorship N/A N/A

All other $60,847,782 $75,178,082

Total reportable expenditures $1,033,012,809 $719,947,048

Campus promotion $0 $0

APPENDIX

Advertising and Promotional Expenditure Categories for 2019 and 2020

TV Advertising: Advertising on broadcast, cable, and satellite television channels, Internet

television (e.g., Hulu, Netflix, Amazon Prime), and webisodes (e.g., web shows on

YouTube), including spot ads, long-form commercials, and sponsored programming; but

excluding, to the extent practicable, expenditures in connection with Product Placement,

Social Media, Endorsements, or Public Entertainment (Adult-Only and Not Adult-Only).

Movie Advertising: Advertising spots before or during movies, including in movie theaters,

on DVDs, and streamed movies (e.g., a movie streamed on Hulu); but excluding, to the

extent practicable, expenditures in connection with TV Advertising, Product Placement, or

Endorsements.

Radio Advertising: Advertising on broadcast, satellite, Internet radio, audio streaming

services (e.g., Pandora and Spotify), and podcasts, including spot ads, long-form

commercials, and sponsored programming; but excluding, to the extent practicable,

expenditures in connection with Product Placement, Social Media, or Endorsements.

Other Audio-Visual Advertising: Audio, audio-visual, and video advertising not covered

by TV Advertising, Movie Advertising, Radio Advertising, Product Placement, Social

Media, Endorsements, or Transit Advertising, including advertising on screens or monitors in

commercial establishments, such as video arcades or retail shops, and video games.

Product Placement: All expenditures for product placement in the creative content of any

program or performance (e.g., movies, television shows, Internet series, video games, and

other broadcast and digital media).

Company Internet Sites: All expenditures for any Company-owned or -operated Internet

site, or any site operated on its behalf, that contains information about the Company’s

e-cigarette products, and that is directed to persons located in the United States; but

excluding, to the extent practicable, expenditures in connection with Email Marketing,

Coupons for Reduction of Purchase Price, Public Entertainment – Not Adult-Only Facilities,

or Sponsorship.

Social Media: Advertising on any Company-controlled social media account or channel

(e.g., Facebook, Twitter, Instagram, Snapchat, Reddit, YouTube) that is directed to persons

located in the United States, including Company-authored posts and replies, and re-posts of

other users’ content on Company-controlled accounts or channels; but excluding expenses

related to celebrities, social media influencers, brand ambassadors, or other endorsers

endorsing e-cigarette products, which should be reported as Endorsements.

Other Internet and Digital Advertising: All expenditures for Internet or digital advertising

directed to persons located in the United States that are not covered by TV Advertising,

Movie Advertising, Radio Advertising, Other Audio-Visual Advertising, Product Placement,

Social Media, Endorsements, or Email Marketing, including banner, display, pop-up, and

native advertising on third-party Internet sites, search advertising, sponsored digital content,

advertising using a short message service (SMS text), multimedia (MMS) messaging, instant

messaging (IM), and direct messaging (DM), and advertising viewed in apps or video games;

but excluding, to the extent practicable, expenditures in connection with Coupons, Retail-

Value-Added (Free E-Cigarette Products and Other Free Items), Specialty Item Distribution

(Branded and Not Branded), Sampling, Public Entertainment (Adult-Only and Not Adult-

Only), Consumer Engagement (Adult-Only and Not Adult-Only), or Sponsorship.

Endorsements: All expenditures to procure the mention or use of e-cigarette products by a

celebrity, social media influencer, or other endorser, in any situation; but excluding

expenditures related to an actor mentioning or using an e-cigarette product when assuming

the role of a character, which should be reported as Product Placements.

Direct Mail Marketing: Direct mail marketing; but excluding, to the extent practicable,

expenditures in connection with Endorsements, Email Marketing, Coupons, Retail-Value-

Added (Free E-Cigarette Products and Other Free Items), Specialty Item Distribution

(Branded and Not Branded), Sampling, Public Entertainment (Adult-Only and Not Adult-

Only), Consumer Engagement (Adult-Only and Not Adult-Only), or Sponsorship.

Newspaper Advertising: Newspaper advertising, including print advertising and native

advertising; but excluding, to the extent practicable, expenditures in connection with

Endorsements, Coupons, Retail-Value-Added (Free E-Cigarette Products and Other Free

Items), Specialty Item Distribution (Branded and Not Branded), Sampling, Public

Entertainment (Adult-Only and Not Adult-Only), Consumer Engagement (Adult-Only and

Not Adult-Only), or Sponsorship. To the extent that advertising appearing in print editions

of newspapers also appears in nearly identical digital editions of the newspapers, such

expenditures should be reported here, but other advertising on a newspaper website should be

reported in Other Internet and Digital Advertising.

Magazine Advertising: Magazine advertising, including print advertising and native

advertising; but excluding, to the extent practicable, expenditures in connection with

Endorsements, Coupons, Retail-Value-Added (Free E-Cigarette Products and Other Free

Items), Specialty Item Distribution (Branded and Not Branded), Sampling, Public

Entertainment (Adult-Only and Not Adult-Only), Consumer Engagement (Adult-Only and

Not Adult-Only), or Sponsorship. To the extent that advertising appearing in print editions

of magazines also appears in nearly identical digital editions of the magazines, such

expenditures should be reported here, but other advertising on a magazine website should be

reported in Other Internet and Digital Advertising.

Outdoor Advertising: Billboards; signs and placards in arenas, stadiums, and shopping

malls, whether any of the foregoing are open-air or enclosed; and any other advertising

placed outdoors, regardless of their size; but excluding, to the extent practicable,

expenditures in connection with Endorsements, Transit Advertising, Point-of-Sale

Advertising, Coupons, Retail-Value-Added (Free E-Cigarette Products and Other Free

Items), Specialty Item Distribution (Branded and Not Branded), Sampling, Public