FY 2023-24

JOINT BUDGET COMMITTEE MEMBERS AND STAFF

JOINT BUDGET COMMITTEE MEMBERS

Senator Rachel Zenzinger, Chair

Senator Jeff Bridges

Senator Barbara Kirkmeyer

Representative Shannon Bird, Vice Chair

Representative Emily Sirota

Representative Rod Bockenfeld

JOINT BUDGET COMMITTEE STAFF

OFFICE ADMINISTRATION

Carolyn Kampman, Staff Director

Jessi Neuberg, Administrator IV

Diva Mardones, Administrative Assistant III

CHIEF LEGISLATIVE BUDGET AND POLICY ANALYSTS

Amanda Bickel

Craig Harper

Alfredo Kemm

Eric Kurtz

PRINCIPAL LEGISLATIVE BUDGET AND POLICY ANALYSTS

Tom Dermody

Scott Thompson

SENIOR LEGISLATIVE BUDGET AND POLICY ANALYSTS

Justin Brakke

Mitch Burmeister

Andrew Forbes

Emily Hansen

Andrea Uhl

LEGISLATIVE BUDGET AND POLICY ANALYSTS

Jon Catlett

Abby Magnus

Matthew Valeta

Legislative Services Building

200 East 14th Avenue, 3rd Floor

Denver, CO 80203

JBC Main: 303-866-2061

http://leg.colorado.gov/content/budget

THE LONG BILL NARRATIVE SUMMARIZES THE LONG BILL PACKAGE

AS INTRODUCED

AND DOES NOT REFLECT FINAL ACTION

TABLE OF CONTENTS

SECTION 1- BUDGET PACKAGE OVERVIEW

Budget Package Overview .................................................................................................................... 1

Budget Balancing Summary Tables ..................................................................................................... 7

Budget Package: Appropriation Summary by Department and Bill ............................................... 8

SECTION 2 - LONG BILL NARRATIVE – S.B. 23-214

DEPARTMENT SUMMARIES: LONG BILL PAGE NARRATIVE PAGE

Long Bill Narrative – S.B. 23-214 (Summary) .......... n/a ............................................................... 14

Agriculture .........................................................................10 ............................................................... 15

Corrections ........................................................................23 ............................................................... 21

Early Childhood ...............................................................53 ............................................................... 30

Education ..........................................................................66 ............................................................... 37

Governor ........................................................................ 109 ............................................................... 50

Health Care Policy and Financing .............................. 127 ............................................................... 58

Higher Education .......................................................... 160 ............................................................... 78

Human Services ............................................................. 195 ............................................................... 95

Judicial ............................................................................. 268 ............................................................. 108

Labor and Employment ............................................... 296 ............................................................. 118

Law .................................................................................. 315 ............................................................. 125

Legislative ....................................................................... 328 ............................................................. 133

Local Affairs................................................................... 330 ............................................................. 135

Military and Veterans Affairs....................................... 356 ............................................................. 141

Natural Resources ......................................................... 365 ............................................................. 145

Personnel ........................................................................ 391 ............................................................. 154

Public Health and Environment ................................. 415 ............................................................. 162

Public Safety ................................................................... 476 ............................................................. 176

Regulatory Agencies...................................................... 511 ............................................................. 185

Revenue .......................................................................... 528 ............................................................. 192

State ................................................................................. 550 ............................................................. 198

Transportation ............................................................... 557 ............................................................. 203

Treasury .......................................................................... 563 ............................................................. 210

Capital Construction ..................................................... 573 ............................................................. 215

Information Technology Projects ............................... 612 ............................................................. 218

SECTION 3 -SUMMARY OF COMPANION BILLS TO THE LONG BILL

Summary of Long Bill Package Bills and Bills Included for Balancing ...................................... 222

SECTION 4 - APPENDICES

Appendix A - Summary of Long Bill Sections ................ ............................................................. 271

Appendix B - General Policies ........................................... ............................................................. 272

Appendix C - Highway Users Tax Fund Appropriation Comparison ....................................... 276

Appendix D - General Fund Appropriations Exempt from Certain Restrictions ................... 277

Appendix E - JBC Staff Assignments ............................... ............................................................. 280

OVERVIEW OF THIS PUBLICATION

Joint Budget Committee (JBC) staff prepare this publication for the purpose of describing the JBC’s budget proposal

for the next state fiscal year that begins July 1, 2023. The JBC’s budget proposal is the culmination of five months of

analyses, consultation, and deliberation.

The budget proposal includes the following:

• The annual general appropriation bill, which is referred to as the “Long Bill” and includes most appropriations

for the expenses of the executive, legislative, and judicial departments based on current law;

• Several JBC-sponsored bills that make statutory changes related to the budget proposal and are introduced as part

of a package of bills with the Long Bill; and

• Assumptions concerning the budget impacts of other legislation that has been or will be considered by the General

Assembly.

This publication is organized into four sections:

Section 1:

• Describes the JBC budget deliberation process;

• Provides a high level overview of the JBC budget proposal that focuses on general tax revenues; and

• Includes several detailed tables that allow the reader to identify components of the budget that affect

appropriations for specific departments.

Section 2 focuses on the portion of the budget proposal that is reflected in the Long Bill, with a subsection for each

department that describes the proposed incremental changes from the state fiscal year that begins July 1, 2022 (FY

2022-23) to the state fiscal year that begins July 1, 2023 (FY 2023-24).

Section 3 focuses on the components of the budget proposal that are not in the Long Bill, including:

• A summary of each of the 31 budget package bills;

• A summary of assumptions that are included in the budget proposal related to other bills that have been or will

be considered by the General Assembly.

Section 4 includes appendices that provide reference material related to the following topics:

• The organization of the Long Bill by section;

• Descriptions of general policies that have been applied to calculate certain types of appropriations;

• A summary of appropriations from the Highway Users Tax Fund to the Colorado State Patrol;

• A summary of appropriations from the General Fund that are categorized as exempt from certain statutory or

constitutional provisions; and

• A JBC staff assignment list.

Section 1

Budget Package

Overview

BUDGET PACKAGE OVERVIEW

JOINT BUDGET COMMITTEE DELIBERATION PROCESS

S

UBMISSION OF ANNUAL BUDGET REQUESTS

On November 1, 2022, the Governor submitted his FY 2023-24 budget request. The Governor’s annual request is a

comprehensive plan that is comprised of several elements:

• Amounts requested by Executive Branch agencies for ongoing operations, to be appropriated through the annual

general appropriation act (the “Long Bill”);

• Placeholders for amounts that will be appropriated for ongoing operations of the Legislative Branch, the Judicial

Branch, and those Executive Branch agencies that operate under another elected official;

• Amounts the Governor is requesting to fund state facilities and infrastructure;

• Amounts that will be distributed or transferred pursuant to existing constitutional or statutory requirements; and

• Placeholders for amounts that the Governor proposes including in separate legislation.

Each of the Judicial Branch agencies, the Attorney General, the Secretary of State, and the State Treasurer all submit

their own budget requests for the ongoing operations of their respective agencies. These requests are not reviewed

by OSPB, and they typically differ from the placeholder amounts that are included in the Governor’s budget request.

In January 2023, the Governor, Judicial Branch agencies, and independent elected officials submitted amendments to

their initial budget requests for FY 2023-24. The Governor’s amended budget request was predicated on the

December 2022 revenue forecast prepared by the Office of State Planning and Budgeting (OSPB).

JBC STAFF BRIEFINGS AND AGENCY BUDGET HEARINGS

The Joint Budget Committee (JBC) began meeting on November 14, 2022, to review the FY 2023-24 budget requests.

For two months the Committee heard presentations from JBC Staff detailing the budget requests, and held a hearing

with each Executive and Judicial agency to discuss their budget and policy priorities.

JBC MEETINGS WITH COMMITTEES OF REFERENCE

During the first month of the 2023 legislative session, the JBC met with each committee of reference as required by

Joint Rule 25(d) to discuss budget requests submitted by those agencies for which each committee has oversight. The

JBC asked for input concerning specific budget requests.

P

UBLIC TESTIMONY AND CRAFTING THE FY 2023-24 BUDGET PROPOSAL

On February 1, 2023, the JBC met to hear public testimony concerning the FY 2023-24 state budget. From January

27 through March 10, the Committee reviewed every agency’s budget request and voted on appropriations to include

in the FY 2023-2 Long Bill. The Committee also established common policies related to state employee salaries and

benefits and rates paid to community-based service providers. The JBC requested bill drafts from the Office of

Legislative Legal Services for budget actions that require a statutory change. Only those bill drafts that were

unanimously approved by the JBC are included the Budget Package as JBC-sponsored bills.

On March 16, 2023, the Legislative Council Staff (LCS) and OSPB presented their quarterly economic and revenue

forecasts. The JBC continued to meet through March 20 to consider additional actions to finalize their balanced

budget proposal for the General Assembly. This publication summarizes that proposal.

Long Bill Budget Package

1

March 27, 2023

OVERVIEW OF JBC BUDGET PACKAGE

R

EVENUE FORECASTS

The JBC selected the OSPB March 2023 revenue forecast as the basis for its FY 2023-24 Budget Package.

Compared to the Legislative Council Staff (LCS) March 2023 forecast, the OSPB forecast anticipates $1,043.1 million

less General Fund revenue to be collected in FY 2023-24. However, the OSPB forecast also anticipates a Taxpayer’s

Bill of Rights (TABOR) refund obligation in FY 2023-24 that is $1,302.9 million lower than the LCS forecast. Overall,

due to these two factors as well as other minor differences related to other projected General Fund obligations, the

OSPB forecast projects that $228.1 million more General Fund will be available in FY 2023-24 compared to LCS.

A

PPROPRIATION ADJUSTMENTS FOR FY 2022-23

General Fund appropriations for FY 2022-23 currently total $13.7 billion. Sections 5 through 22 of the 2023 Long

Bill (S.B. 23-214) amend several existing appropriations, decreasing FY 2022-23 General Fund

appropriations by a total of $189.4 million. This is primarily due to a $201.0 million decrease in appropriations to

the Department of Health Care Policy and Financing (HCPF) based on more recent projections of Medicaid

enrollment and expenditures and the extension of an enhanced federal match rate. Table 1 details the recommended

mid-year adjustments affecting five departments. Section 2 of this document details all mid-year appropriation adjustments.

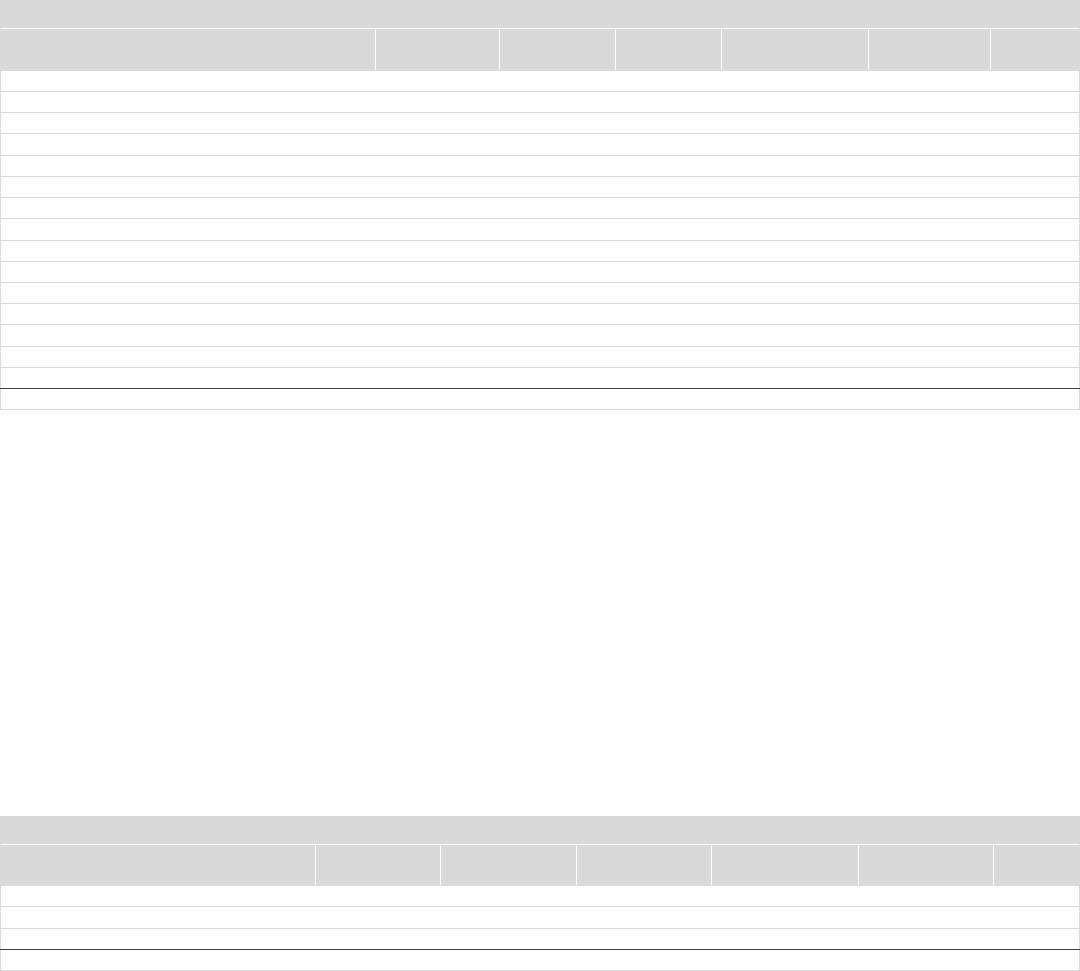

T

ABLE

1

GENERAL FUND OPERATING APPROPRIATIONS FOR FY 2022-23 AND

RECOMMENDED MID-YEAR CHANGES

D

EPARTMENT

C

URRENT

A

PPROPRIATION

C

HANGES

I

NCLUDED IN

2023

L

ONG

B

ILL

A

DJUSTED

A

PPROPRIATION

P

ERCENTAGE

C

HANGE

Agriculture

$14,787,857

$0

$14,787,857

0.0%

Corrections

919,931,039

4,233,045

924,164,084

0.5%

Early Childhood

110,769,874

0

110,769,874

0.0%

Education

4,500,428,610

0

4,500,428,610

0.0%

Governor

57,157,966

0

57,157,966

0.0%

Health Care Policy and Financing

3,853,083,776

(200,964,886)

3,652,118,890

(5.2%)

Higher Education

1,362,586,612

0

1,362,586,612

0.0%

Human Services

1,074,002,731

5,002,231

1,079,004,962

0.5%

Judicial

669,766,534

909,163

670,675,697

0.1%

Labor and Employment

31,508,365

0

31,508,365

0.0%

Law

20,622,725

0

20,622,725

0.0%

Legislature

66,732,424

0

66,732,424

0.0%

Local Affairs

55,351,984

0

55,351,984

0.0%

Military and Veterans Affairs

12,680,614

0

12,680,614

0.0%

Natural Resources

39,072,874

0

39,072,874

0.0%

Personnel

28,788,405

0

28,788,405

0.0%

Public Health and Environment

203,182,871

1,381,438

204,564,309

0.7%

Public Safety

242,152,457

0

242,152,457

0.0%

Regulatory Agencies

3,715,753

0

3,715,753

0.0%

Revenue

143,404,525

0

143,404,525

0.0%

State

1,151,651

0

1,151,651

0.0%

Transportation

0

0

0

n/a

Treasury

302,753,525

0

302,753,525

0.0%

TOTAL

$13,713,633,172

($189,439,009)

$13,524,194,163

(1.4%)

Long Bill Budget Package

2

March 27, 2023

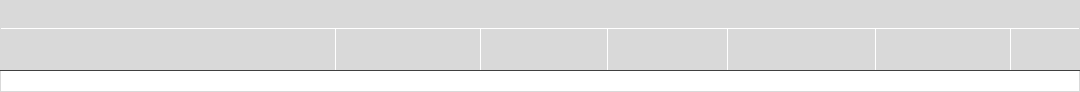

APPROPRIATIONS FOR FY 2023-24

Table 2 compares operating appropriations for FY 2022-23 and FY 2023-24. Figures for FY 2022-23 include existing

appropriations, plus mid-year adjustments recommended by the JBC. Figures for FY 2023-24 include recommended

Long Bill appropriations, plus the placeholders for General Fund appropriations that are included in the annual

legislative appropriation bill (SB 23-197). This provides comparable operating appropriations for all departments,

including the Legislature. Shading in the table highlights the most significant annual changes.

The Long Bill and the legislative appropriation bill provide increases in General Fund appropriations for

most departments, with an overall increase of $1,203.2 million (8.9 percent). Section 2 of this document details the

Long Bill appropriation adjustments for each department.

T

ABLE

2

GENERAL FUND OPERATING APPROPRIATIONS FOR FY 2023-24

D

EPARTMENT

FY

2022-23

INCLUDING

RECOMMENDED

A

DJUSTMENTS

D

OLLAR

C

HANGE

FY

2023-24

L

ONG

B

ILL

RECOMMENDATIONS AND

LEGISLATIVE APPROPRIATION

B

ILL

P

LACEHOLDER

1

PERCENTAGE

C

HANGE

Agriculture

$14,787,857

$2,270,188

$17,058,045

15.4%

Corrections

924,164,084

64,503,410

988,667,494

7.0%

Early Childhood

110,769,874

192,225,314

302,995,188

173.5%

Education

4,500,428,610

11,849,974

4,512,278,584

0.3%

Governor

57,157,966

(8,837,430)

48,320,536

(15.5%)

Health Care Policy and Financing

3,652,118,890

838,369,687

4,490,488,577

23.0%

Higher Education

1,362,586,612

137,300,132

1,499,886,744

10.1%

Human Services

1,079,004,962

(83,294,571)

995,710,391

(7.7%)

Judicial

670,675,697

78,030,724

748,706,421

11.6%

Labor and Employment

31,508,365

346,046

31,854,411

1.1%

Law

20,622,725

3,629,869

24,252,594

17.6%

Legislature

1

66,732,424

5,191,566

71,923,990

7.8%

Local Affairs

55,351,984

(2,459,701)

52,892,283

(4.4%)

Military and Veterans Affairs

12,680,614

1,361,603

14,042,217

10.7%

Natural Resources

39,072,874

3,293,649

42,366,523

8.4%

Personnel

28,788,405

14,427,112

43,215,517

50.1%

Public Health and Environment

204,564,309

(93,185,304)

111,379,005

(45.6%)

Public Safety

242,152,457

11,384,786

253,537,243

4.7%

Regulatory Agencies

3,715,753

(928,381)

2,787,372

(25.0%)

Revenue

143,404,525

5,109,714

148,514,239

3.6%

State

1,151,651

11,683,927

12,835,578

1014.5%

Transportation

0

0

0

n/a

Treasury

302,753,525

10,939,394

313,692,919

3.6%

TOTAL

$13,524,194,163

$1,203,211,708

$14,727,405,871

8.9%

1

Figure for FY 2023-24 includes $65,192,117 placeholder for the annual legislative appropriation bill.

The Budget Package includes $642.5 million in placeholders for 2023 legislation. This amount includes three

categories of placeholders, discussed on the next page. Section 3 of this document includes descriptions of JBC Budget

Package bills and placeholders for other 2023 legislation.

Long Bill Budget Package

3

March 27, 2023

First, the Budget Package includes $15.9 million General Fund for FY 2023-24 appropriations that are

included in several JBC-sponsored bills. Table 3 lists each of these bills and the corresponding appropriation

amounts.

T

ABLE

3

G

ENERAL

F

UND

A

PPROPRIATIONS IN

JBC-

SPONSORED

B

ILLS

DESCRIPTION

FY 2023-24

Bills Introduced With Long Bill

SB 23-217 Separating Fees in Records & Reports Cash Fund

$1,341,564

SB 23-218: Repeal School Transformation Grant Prog Admin Cap

115,785

SB 23-221: Healthy School Meals for All Program Fund

*

SB 23-222: Medicaid Pharmacy & Outpatient Services Copayment

1,439,499

SB 23-228: Office of Admin Serv for Indep Agencies

508,289

SB 23-229: Statewide Behavioral Health Court Liaison Office

2,478,982

SB 23-230: County Assistance for 23rd Judicial District

668,600

SB 23-232: Unempl Ins Premiums Allocation Fed Law Compliance

(899,537)

SB 23-241: Creation of Office of School Safety

9,401,600

SB 23-242: Community Corrections Financial Audit

100,000

Bills Introduced Separately From Long Bill

Medicaid Continuous Coverage Feasibility Study

335,253

Review of HCPF Medicaid Recovery

400,000

Total: JBC-sponsored Bills

$15,890,035

* This bill includes an appropriation of $115.3 million, but the source is General Fund revenue that must be used for the Health School Meals for All

Program. Table 8 excludes this revenue source from available General Fund revenues, so the related appropriation is also excluded from this table.

Second, the Budget Package includes $127.6 million General Fund for FY 2023-24 appropriations that are

included in several pending bills or other bills concerning specific topics. Table 4 lists each of these bills and

the corresponding appropriation amounts.

T

ABLE

4

GENERAL FUND APPROPRIATION PLACEHOLDERS FOR SPECIFIED 2023 LEGISLATION

DESCRIPTION

FY 2023-24

SB 23-013 Fire Investigations

$3,243,155

SB 23-082 CO Fostering Success Voucher Program

2,783,111

SB 23-197 Legislative Appropriation Bill

65,192,117

HB 23-1194 Closed Landfills Remediation Local Govs Grants

15,000,000

HB 23-1228 Nursing Facility Reimbursement Rate Setting

30,509,457

Auto Theft Prevention

5,000,000

Increase Juvenile Detention Bed Caps

3,340,119

Universal Preschool Provider Bonuses

2,500,000

Total: Other Specified Bills

$127,567,959

Third, the Budget Package includes General Fund placeholders totaling $499.0 million for other 2023

legislation. These placeholders are listed in Table 5.

T

ABLE

5

GENERAL FUND APPROPRIATION PLACEHOLDERS FOR OTHER 2023 LEGISLATION

DESCRIPTION

FY 2023-24

Legislation with Ongoing Fiscal Impacts

$30,000,000

Legislation with One-Time Fiscal Impacts:

Workforce-related legislation, including free credentials, math, scholarships, adult education, and concurrent enrollment

103,000,000

Housing-related legislation, including property tax relief, land use, and public-private partnerships

221,000,000

Legislation related to topics other than workforce and housing, including rural opportunity, line of duty loss, and Proposition 122

implementation

145,000,000

Subtotal

469,000,000

TOTAL

$499,000,000

Long Bill Budget Package

4

March 27, 2023

TRANSFERS AND OTHER CHANGES AFFECTING AVAILABLE GENERAL FUND

The Budget Package includes four bills that are anticipated to affect the State’s TABOR refund obligation,

increasing General Fund available for other purposes by $55.3 million over two fiscal years. These impacts are

listed in Table 6.

T

ABLE

6

JBC-SPONSORED BILLS AFFECTING TABOR REFUND

FY 2022-23

FY 2023-24

SB 23-214: Higher Education Indirect Cost Collections

1

($4,059,676)

($4,901,811)

SB 23-217: Separating Fees in Records & Reports Cash Fund

0

(1,471,257)

SB 23-232: Unempl Ins Premiums Allocation Fed Law Compliance

0

(45,270,419)

SB 23-240: CDPHE Dairy Plant Fees

0

450,000

TOTAL

($4,059,676)

($51,193,487)

Senate Bill 23-243 transfers a total of $294.2 million from the General Fund for capital construction,

information technology, and transportation projects that are included in the 2023 Long Bill. A summary of this

bill is included in Section 3 of this document.

Finally, the Budget Package includes transfers into and out of the General Fund, resulting in a net decrease

of $132.1 million General Fund. These transfers are listed in Table 7.

T

ABLE

7

PLACEHOLDERS FOR 2023 LEGISLATION AFFECTING AVAILABLE GENERAL FUND REVENUES

FY 2022-23

FY 2023-24

TRANSFERS INTO GENERAL FUND:

JBC-Sponsored Bills

SB 23-215: State Employee Reserve Fund Gen Fund Transfer

$0

$4,913,753

TOTAL: Transfers into General Fund

$0

$4,913,753

TRANSFERS OUT OF GENERAL FUND

JBC-Sponsored Bills

SB 23-246: State Emergency Reserve

$20,000,000

$0

Placeholders for Other Bills

General Fund Transfer to IIJA Cash Fund

0

91,000,000

Firehawk Purchase

26,000,000

0

TOTAL: Transfers Out of General Fund

$46,000,000

$91,000,000

GENERAL FUND OVERVIEW

Table 8 provides an overview of the General Fund impact of the Budget Package, including:

• Available General Fund revenue [rows 1 through 6];

• General Fund obligations [rows 7 through 21];

• Reversions and Accounting Adjustments [row 22]; and

• The fiscal year-end General Fund reserve [rows 23 through 26].

The discretionary elements of the Budget Plan are shaded in Table 8, and are thus referenced in the above discussion.

Specifically:

• Table1: The $189.4 million midyear adjustment to FY 2022-23 appropriations is reflected in row 8.

• Table 2: The FY 2023-24 appropriations are reflected in row 7 ($14,662.2 million in the Long Bill) and in row 9

($65.2 million in the legislative appropriation bill).

1

Starting in FY 2022-23, appropriations to the Department of Higher Education related to indirect cost collections have been modified to

eliminate a double-count of state revenue that is subject to the TABOR limit. For more information, see page 6 of this JBC Staff document:

http://leg.colorado.gov/sites/default/files/cy23_hedsup.pdf.

Long Bill Budget Package

5

March 27, 2023

• Table 3: The $15.9 million for FY 2023-24 appropriations included in JBC-sponsored bills is reflected in row 9.

• Table 4: The $127.6 million for FY 2023-24 appropriations that are included in several pending bills or other bills

concerning specific topics is reflected in row 9.

• Table 5: The General Fund placeholders for other 2023 legislation are included in row 9.

• Table 6: Adjustments to the State’s TABOR refund obligation are reflected in row 14.

• Capital-related transfers are included in row 17.

• Table 7: Transfers into the General Fund are reflected in row 5, and transfers out of the General Fund are reflected

in row 19.

As indicated in row 26 of Table 8, the $19.0 billion General Fund projected to be available in FY 2023-24 would

be sufficient to cover Budget Package obligations of $16.7 billion and the required 15.0 percent statutory

reserve.

T

ABLE

8

GENERAL FUND OVERVIEW

BASED ON THE OFFICE OF STATE PLANNING AND BUDGETING MARCH 2023 FORECAST

($ MILLIONS)

FY 2022-23

FY 2023-24

GENERAL FUND AVAILABLE

1

Beginning Reserve

$3,201.9

$2,356.5

2

Gross General Fund Revenue

16,972.6

16,695.8

3

Revenues related to Proposition FF (not available for other purposes)

(48.9)

(98.5)

4

Transfers In (existing law reflected in forecast)

24.1

26.2

5

JBC-sponsored Bills (SB 23-215)

n/a

4.9

6

Total General Fund Available

$20,149.7

$18,984.9

LESS: GENERAL FUND OBLIGATIONS

7

Appropriations FY 2022-23: Current Law; FY 2023-24: Long Bill (SB 23-214)

$13,713.6

$14,662.2

8

Mid-year adjustments included in Long Bill (SB 23-214)

(189.4)

n/a

9

Placeholders for 2023 legislation

n/a

642.5

10

LESS: Appropriations for rebates and expenditures

(229.4)

(226.1)

11

Subtotal: Appropriations subject to statutory reserve requirement

$13,294.7

$15,078.6

12

Rebates and Expenditures (reflected in forecast)

147.1

151.4

TABOR Refund [Article X, Section 20 (7)(d)]

13

Current year revenue above Referendum C Cap (refunded in following fiscal year)

2,657.7

720.9

14

Adjustments to TABOR Refund (SB 23-214, SB 23-232)

(4.1)

(51.2)

Transfers Out and Other Diversions

15

Transportation (existing law reflected in forecast)

88.0

0.0

16

Capital/IT projects (existing law reflected in forecast)

488.3

20.0

17

Transfers for controlled maintenance and new capital projects (SB 23-243)

n/a

294.2

18

Other Transfers and Diversions (existing law reflected in forecast)

1,226.7

418.0

19

Other transfers (SB 23-246 and other placeholders for 2023 legislation)

46.0

91.0

20

Subtotal: Other Obligations

$4,649.8

$1,644.3

21

Total General Fund Obligations

$17,944.54

$16,722.9

22

PLUS: REVERSIONS AND ACCOUNTING ADJUSTMENTS

$151.35

n/a

RESERVE

23

Fiscal Year-end General Fund Reserve

$2,356.5

$2,262.0

24

Statutorily Required Reserve Percent

15.0%

15.0%

25

Required Reserve Amount

$1,994.2

$2,261.8

26

Year-end Reserve Above/(Below) Requirement

$362.3

$0.2

Totals may not sum due to rounding.

Long Bill Budget Package

6

March 27, 2023

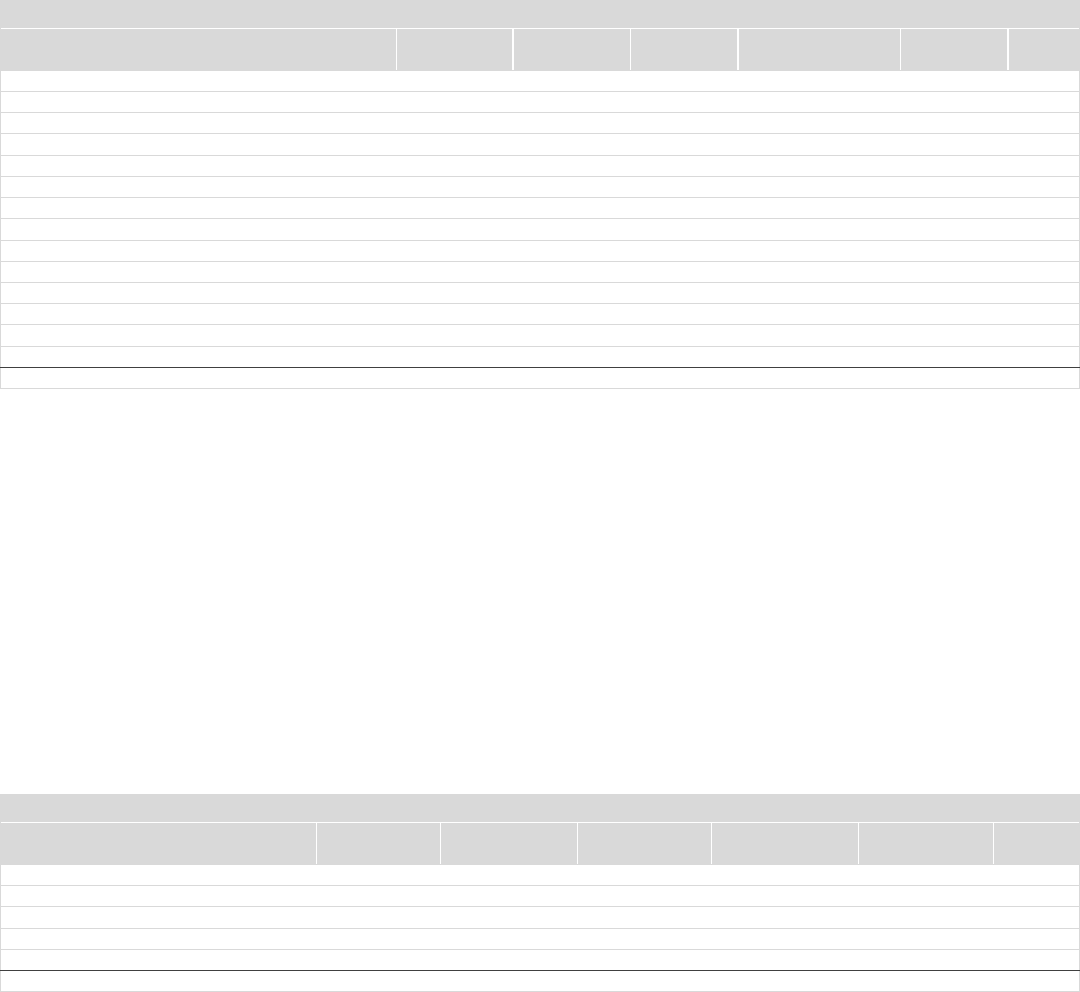

TOTAL

FUNDS

GENERAL

FUND

CASH

FUNDS

REAPPROPRIATED

FUNDS

FEDERAL

FUNDS

F T E

FY 2022-23 Appropriation $39,488,688,670 $13,713,633,172 $11,012,681,221 $2,473,001,802 $12,289,372,475 63,279.7

S.B. 23-214 - Long Bill Supplemental 260,736,324 (189,439,009) 74,294,389 (618,772) 376,499,716 5.4

Other Legislation for Balancing (FY 2022-23) 0 0 0 0 0 0.0

FY 2022-23 Adjusted Appropriation $39,749,424,994 $13,524,194,163 $11,086,975,610 $2,472,383,030 $12,665,872,191 63,285.1

S.B. 23-214 - Long Bill Total $40,498,289,342 $14,662,213,754 $10,504,317,065 $2,603,141,391 $12,728,617,132 64,247.8

Other Legislation for Balancing (FY 2023-24) 905,585,642 757,797,101 46,312,892 3,811,699 97,663,950 565.3

Proposed FY 2023-24 Appropriation $41,403,874,984 $15,420,010,855 $10,550,629,957 $2,606,953,090 $12,826,281,082 64,813.1

$ Change from prior year $1,654,449,990 $1,895,816,692 ($536,345,653) $134,570,060 $160,408,891 1,528.0

% Change from prior year

4.2% 14.0% (4.8%) 5.4% 1.3% 2.4%

DEPARTMENT

TOTAL

FUNDS

GENERAL

FUND

CASH

FUNDS

REAPPROP.

FUNDS

FEDERAL

FUNDS

F T E

Early Childhood $2,500,000 $2,500,000 $0 $0 $0 0.0

Education 41,261,786 0 41,261,786 0 0 0.0

Health Care Policy and Finance 63,334,703 31,244,710 0 0 32,089,993 5.0

Human Services 6,123,230 6,123,230 0 0 0 41.0

Legislative 66,922,023 65,192,117 90,000 1,639,906 0 440.9

Public Health and Environment 15,000,000 15,000,000 0 0 0 0.0

Public Safety 11,486,310 8,243,155 0 3,243,155 0 20.2

Statewide 499,000,000 499,000,000 0 0 0 0.0

$705,628,052 $627,303,212 $41,351,786 $4,883,061 $32,089,993 507.1

DEPARTMENT/ITEM

TOTAL

FUNDS

GENERAL

FUND

CASH

FUNDS

REAPPROP.

FU

NDS

FEDERAL

FUNDS

F T E

Corrections $0 $0 $0 $0 $0 0.0

Early Childhood (1,070,429) 1,341,564 (1,341,564) (1,070,429) 0 0.0

Education 108,738,927 115,454,892 (6,514,126) (201,839) 0 4.1

Governor 0 0 0 0 0 0.0

Health Care Policy and Financing 7,345,507 1,439,499 446,651 0 5,459,357 0.0

Higher Education 0 0 0 0 0 0.0

Human Services 0 0 0 0 0 0.0

Judicial 3,856,777 3,655,871 0 200,906 0 36.7

Labor and Employment 12,657 (899,537) 912,194 0 0 0.2

Law 0 0 0 0 0 0.0

Military and Veterans Affairs 50,000 0 50,000 0 0 0.0

Public Health and Environment 66,126,060 0 6,011,460 0 60,114,600 0.0

Public Safety 14,898,091 9,501,600 5,396,491 0 0 17.2

Statewide 0 0 0 0 0 0.0

TOTAL 199,957,590 130,493,889 4,961,106 (1,071,362) 65,573,957 58.2

1

Departments not included in this table do not have companion bills or placeholders as identified by the JBC for budget balancing purposes.

OTHER LEGISLATION FOR BALANCING: APPROPRIATIONS FOR

SELECT NON-BUDGET PACKAGE LEGISLATION

1

OTHER LEGISLATION FOR BALANCING: APPROPRIATIONS FOR BUDGET PACKAGE LEGISLATION

1

JOINT BUDGET COMMITTEE FY 2023-24 BUDGET PACKAGE BALANCING

BUDGET PACKAGE: OPERATING APPROPRIATION SUMMARY TABLE

1

Departments not included in this table do not have companion bills or placeholders as identified by the JBC for budget balancing purposes.

Long Bill Budget Package

7

March 27, 2023

DEPARTMENT/ITEM

TOTAL

FUNDS

GENERAL

FUND

CASH

FUNDS

REAPPROPRIATED

FUNDS

FEDERAL

FUNDS

F T E

AGRICULTURE

FY 2022-23 Appropriation $71,530,898 $14,787,857 $50,172,615 $2,623,496 $3,946,930 310.7

S.B. 23-214 - Long Bill Total

$66,625,053 $17,058,045 $42,931,530 $2,714,972 $3,920,506 314.2

Proposed FY 2023-24 Appropriation $66,625,053 $17,058,045 $42,931,530 $2,714,972 $3,920,506 314.2

$ Change from prior year

($4,905,845) $2,270,188 ($7,241,085) $91,476 ($26,424) 3.5

% Change from prior year

(6.9%) 15.4% (14.4%) 3.5% (0.7%) 1.1%

CORRECTIONS

FY 2022-23 Appropriation $1,015,787,232 $919,931,039 $48,450,773 $44,473,298 $2,932,122 6,317.0

S.B. 23-214 - Long Bill Total 4,416,740 4,233,045 183,695 0 0 0.0

FY 2022-23 Adjusted Appropriation $1,020,203,972 $924,164,084 $48,634,468 $44,473,298 $2,932,122 6,317.0

S.B. 23-214 - Long Bill Total $1,082,512,096 $988,667,494 $45,669,318 $44,928,789 $3,246,495 6,343.1

SB 23-215 State Employee Reserve Fund Gen Fund Transfer 0 0 0 0 0 0.0

Proposed FY 2023-24 Appropriation

$1,082,512,096 $988,667,494 $45,669,318 $44,928,789 $3,246,495 6,343.1

$ Change from prior year

$66,724,864 $68,736,455 ($2,781,455) $455,491 $314,373 26.1

% Change from prior year

6.6% 7.5% (5.7%) 1.0% 10.7% 0.4%

EARLY CHILDHOOD

FY 2022-23 Appropriation $537,352,015 $110,769,874 $108,699,670 $12,129,913 $305,752,558 208.0

S.B. 23-214 - Long Bill Total

0 0 0 0 0 0.0

FY 2022-23 Adjusted Appropriation $537,352,015 $110,769,874 $108,699,670 $12,129,913 $305,752,558 208.0

S.B. 23-214 - Long Bill Total

$791,008,286 $302,995,188 $212,983,095 $13,954,712 $261,075,291 229.7

SB 23-216 Colorado Universal Preschool Program Funding

0 0 0 0 0 0.0

SB 23-217 Separating Fees in Records & Reports Cash Fund

-1,070,429 1,341,564 -1,341,564 -1,070,429 0 0.0

Universal Preschool Provider Bonuses (Placeholder)

2,500,000 2,500,000 0 0 0 0.0

Proposed FY 2023-24 Appropriation

$792,437,857 $306,836,752 $211,641,531 $12,884,283 $261,075,291 229.7

$ Change from prior year

$255,085,842 $196,066,878 $102,941,861 $754,370 ($44,677,267) 21.7

% Change from prior year

47.5% 177.0% 94.7% 6.2% (14.6%) 10.4%

EDUCATION

FY 2022-23 Appropriation

$7,138,403,069 $4,500,428,610 $1,517,239,273 $72,285,315 $1,048,449,871 638.3

S.B. 23-214 - Long Bill Total

0 0 0 0 0 0.0

FY 2022-23 Adjusted Appropriation

$7,138,403,069 $4,500,428,610 $1,517,239,273 $72,285,315 $1,048,449,871 638.3

S.B. 23-214 - Long Bill Total

$7,003,972,046 $4,512,278,584 $1,361,942,038 $79,976,873 $1,049,774,551 636.5

SB 23-219 Supports to Students & Facility Schools

18,564,029 0 18,780,654 (216,625) 0 0.0

SB 23-220 Public School Capital Constr Assistance Grants

(25,294,780) 0 (25,294,780) 0 0 0.0

SB 23-221 Healthy School Meals for All Program Fund

115,353,893 115,339,107 0 14,786 0 3.2

SB 23-218 Repeal School Transformation Grant Prog Admin Cap

115,785 115,785 0 0 0 0.9

Categorical Programs Inflation Increase (Placeholder)

41,261,786 0 41,261,786 0 0 0.0

Proposed FY 2023-24 Appropriation

$7,153,972,759 $4,627,733,476 $1,396,689,698 $79,775,034 $1,049,774,551 640.6

$ Change from prior year

$15,569,690 $127,304,866 ($120,549,575) $7,489,719 $1,324,680 2.3

% Change from prior year

0.2% 2.8% (7.9%) 10.4% 0.1% 0.4%

BUDGET PACKAGE BALANCING: OPERATING APPROPRIATION

SUMMARY BY DEPARTMENT AND BILL

Long Bill Budget Package

8

March 27, 2023

DEPARTMENT/ITEM

TOTAL

FUNDS

GENERAL

FUND

CASH

FUNDS

REAPPROPRIATED

FUNDS

FEDERAL

FUNDS

F T E

BUDGET PACKAGE BALANCING: OPERATING APPROPRIATION

SUMMARY BY DEPARTMENT AND BILL

FY 2022-23 Appropriation

$486,529,300 $57,157,966 $94,591,666 $327,993,055 $6,786,613 1,286.2

S.B. 23-214 - Long Bill Total

0

0 0 0 0 0.0

FY 2022-23 Adjusted Appropriation

$486,529,300 $57,157,966 $94,591,666 $327,993,055 $6,786,613 1,286.2

S.B. 23-214 - Long Bill Total

$520,236,969 $48,320,536 $95,040,576 $369,056,086 $7,819,771 1,312.7

General Fund Transfer to IIJA Cash Fund (Placeholder)

0 0 0 0 0 0.0

Proposed FY 2023-24 Appropriation

$520,236,969 $48,320,536 $95,040,576 $369,056,086 $7,819,771 1,312.7

$ Change from prior year

$33,707,669 ($8,837,430) $448,910 $41,063,031 $1,033,158 26.5

% Change from prior year

6.9% (15.5%) 0.5% 12.5% 15.2% 2.1%

HEALTH CARE POLICY AND FINANCING

FY 2022-23 Appropriation

$14,431,200,758 $3,853,083,776 $1,797,935,515 $95,031,721 $8,685,149,746 741.8

S.B. 23-214 - Long Bill Total

228,359,061 (200,964,886) 59,779,845 0 369,544,102 3.2

FY 2022-23 Adjusted Appropriation

$14,659,559,819 $3,652,118,890 $1,857,715,360 $95,031,721 $9,054,693,848 745.0

S.B. 23-214 - Long Bill Total $15,433,373,544 $4,490,488,577 $1,768,567,113 $105,145,754 $9,069,172,100 776.4

SB 23-222 Medicaid Pharmacy & Outpatient Services Copayment 7,345,507 1,439,499 446,651 0 5,459,357 0.0

SB 23-223 Medicaid provider rate review process 0 0 0 0 0 0.0

Continuous Coverage Feasibility Study (Placeholder) 670,506 335,253 0 0 335,253 5.0

Review of HCPF Medicaid Recovery (Placeholder) 400,000 400,000 0 0 0 0.0

HB 23-1228 Nursing Facility Reimbursement Rate Setting

(Placeholder)

62,264,197 30,509,457 0 0 31,754,740 0.0

Proposed FY 2023-24 Appropriation

$15,504,053,754 $4,523,172,786 $1,769,013,764 $105,145,754 $9,106,721,450 781.4

$ Change from prior year $844,493,935 $871,053,896 ($88,701,596) $10,114,033 $52,027,602 36.4

% Change from prior year 5.8% 23.9% (4.8%) 10.6% 0.6% 4.9%

HIGHER EDUCATION

FY 2022-23 Appropriation

$5,501,896,712 $1,362,586,612 $3,043,010,760 $1,070,449,520 $25,849,820 26,489.2

S.B. 23-214 - Long Bill Total

10,996,028 0 10,996,028 0 0 0.0

FY 2022-23 Adjusted Appropriation $5,512,892,740 $1,362,586,612 $3,054,006,788 $1,070,449,520 $25,849,820 26,489.2

S.B. 23-214 - Long Bill Total

$5,796,479,118 $1,499,886,744 $3,082,301,297 $1,187,840,403 $26,450,674 26,753.9

SB 23-224 CO Commn Policies Postgraduate Student Exch Prog

0 0 0 0 0 0.0

SB 23-225 Specialty Ed CSU Medical School Partnership

0 0 0 0 0 0.0

Proposed FY 2023-24 Appropriation

$5,796,479,118 $1,499,886,744 $3,082,301,297 $1,187,840,403 $26,450,674 26,753.9

$ Change from prior year

$283,586,378 $137,300,132 $28,294,509 $117,390,883 $600,854 264.7

% Change from prior year

5.1% 10.1% 0.9% 11.0% 2.3% 1.0%

HUMAN SERVICES

FY 2022-23 Appropriation

$2,573,846,841 $1,074,002,731 $726,218,593 $218,629,040 $554,996,477 5,241.7

S.B. 23-214 - Long Bill Total

16,674,104 5,002,231 3,334,821 0 8,337,052 0.0

FY 2022-23 Adjusted Appropriation

$2,590,520,945 $1,079,004,962 $729,553,414 $218,629,040 $563,333,529 5,241.7

S.B. 23-214 - Long Bill Total

$2,345,920,362 $995,710,391 $557,393,208 $219,355,902 $573,460,861 5,320.3

SB 23-226 Extending Transitional Jobs Program

0 0 0 0 0 0.0

Increase Juvenile Detention Bed Caps (Placeholder)

3,340,119 3,340,119 0 0 0 38.0

SB 23-082 CO Fostering Success Voucher Program (Placeholder)

2,783,111 2,783,111 0 0 0 3.0

Proposed FY 2023-24 Appropriation

$2,352,043,592 $1,001,833,621 $557,393,208 $219,355,902 $573,460,861 5,361.3

$ Change from prior year

($238,477,353) ($77,171,341) ($172,160,206) $726,862 $10,127,332 119.6

% Change from prior year (9.2%) (7.2%) (23.6%) 0.3% 1.8% 2.3%

GOVERNOR - LIEUTENANT GOVERNOR - STATE PLANNING AND BUDGETING

Long Bill Budget Package

9

March 27, 2023

DEPARTMENT/ITEM

TOTAL

FUNDS

GENERAL

FUND

CASH

FUNDS

REAPPROPRIATED

FUNDS

FEDERAL

FUNDS

F T E

BUDGET PACKAGE BALANCING: OPERATING APPROPRIATION

SUMMARY BY DEPARTMENT AND BILL

JUDICIAL

FY 2022-23 Appropriation

$917,728,394 $669,766,534 $185,322,748 $58,214,112 $4,425,000 5,175.7

S.B. 23-214 - Long Bill Total

290,391

909,163 0 (618,772) 0 2.2

FY 2022-23 Adjusted Appropriation

$918,018,785 $670,675,697 $185,322,748 $57,595,340 $4,425,000 5,177.9

S.B. 23-214 - Long Bill Total

$1,001,777,098 $748,706,421 $191,476,126 $57,169,551 $4,425,000 5,322.6

SB 23-227 State Agency Attorney Hourly Rate

0

0 0 0 0 0.0

SB 23-228 Office of Admin Serv for Indep Agencies

608,742 508,289 0 100,453 0 2.5

SB 23-229 Statewide Behavioral Health Court Liaison Office

2,579,435 2,478,982 0 100,453 0 34.2

SB 23-230 County Assistance for 23rd Judicial District 668,600 668,600 0 0 0 0.0

Proposed FY 2023-24 Appropriation

$1,005,633,875 $752,362,292 $191,476,126 $57,370,457 $4,425,000 5,359.3

$ Change from prior year

$87,905,481 $82,595,758 $6,153,378 ($843,655) $0 183.6

% Change from prior year

9.6% 12.3% 3.3% (1.4%) 0.0% 3.5%

LABOR AND EMPLOYMENT

FY 2022-23 Appropriation

$335,385,251 $31,508,365 $111,762,752 $7,107,350 $185,006,784 $1,344

S.B. 23-214 - Long Bill Total

$404,056,083 $31,854,411 $152,198,025 $24,238,463 $195,765,184 1,705.2

SB 23-231 Amend Fund to Allow Payment Overdue Wage Claims

12,657 0 12,657 0 0 0.2

SB 23-232 Unempl Ins Premiums Allocation Fed Law Compliance 0 (899,537) 899,537 0 0 0.0

SB 23-233 Employment Services Funded By Wagner-Peyser Act 0 0 0 0 0 0.0

SB 23-234 State Employee Insurance Premiums

0 0 0 0 0 0.0

Proposed FY 2023-24 Appropriation

$404,068,740 $30,954,874 $153,110,219 $24,238,463 $195,765,184 1,705.4

$ Change from prior year

$68,683,489 ($553,491) $41,347,467 $17,131,113 $10,758,400 361.4

% Change from prior year

20.5% (1.8%) 37.0% 241.0% 5.8% 26.9%

LAW

FY 2022-23 Appropriation $114,564,354 $20,622,725 $20,511,859 $70,201,573 $3,228,197 593.2

S.B. 23-214 - Long Bill Total

$130,064,513 $24,252,594 $23,670,454 $78,347,293 $3,794,172 616.1

SB 23-235 DOL Funds for Unanticipated State Legal Needs

0 0 0 0 0 0.0

Proposed FY 2023-24 Appropriation

$130,064,513 $24,252,594 $23,670,454 $78,347,293 $3,794,172 616.1

$ Change from prior year

$15,500,159 $3,629,869 $3,158,595 $8,145,720 $565,975 22.9

% Change from prior year

13.5% 17.6% 15.4% 11.6% 17.5% 3.9%

LEGISLATIVE

FY 2022-23 Appropriation $68,357,755 $66,732,424 $90,000 $1,535,331 $0 429.1

S.B. 23-214 - Long Bill Total

$7,001,874 $6,731,874 $0 $270,000 $0 0.0

SB 23-197 Legislative Appropriation Bill (Placeholder)

66,922,023 65,192,117 90,000 1,639,906 0 440.9

Proposed FY 2023-24 Appropriation

$73,923,897 $71,923,991 $90,000 $1,909,906 $0 440.9

$ Change from prior year

$5,566,142 $5,191,567 $0 $374,575 $0 11.8

% Change from prior year

8.1% 7.8% 0.0% 24.4% n/a 2.7%

LOCAL AFFAIRS

FY 2022-23 Appropriation

$450,114,237 $55,351,984 $289,810,561 $22,370,987 $82,580,705 221.9

S.B. 23-214 - Long Bill Total 0 0 0 0 0 0.0

FY 2022-23 Adjusted Appropriation

$450,114,237 $55,351,984 $289,810,561 $22,370,987 $82,580,705 221.9

S.B. 23-214 - Long Bill Total

$377,813,556 $52,892,283 $184,795,741 $15,109,746 $125,015,786 233.2

Proposed FY 2023-24 Appropriation

$377,813,556 $52,892,283 $184,795,741 $15,109,746 $125,015,786 233.2

$ Change from prior year

($72,300,681) ($2,459,701) ($105,014,820) ($7,261,241) $42,435,081 11.3

% Change from prior year

(16.1%) (4.4%) (36.2%) (32.5%) 51.4% 5.1%

Long Bill Budget Package

10

March 27, 2023

DEPARTMENT/ITEM

TOTAL

FUNDS

GENERAL

FUND

CASH

FUNDS

REAPPROPRIATED

FUNDS

FEDERAL

FUNDS

F T E

BUDGET PACKAGE BALANCING: OPERATING APPROPRIATION

SUMMARY BY DEPARTMENT AND BILL

MILITARY AND VETERANS AFFAIRS

FY 2022-23 Appropriation $143,057,108 $12,680,614 $1,571,906 $80,305 $128,724,283 2,513.9

S.B. 23-214 - Long Bill Total

$148,071,038 $14,042,217 $1,961,125 $65,557 $132,002,139 2,490.0

SB 23-236 Electric Vehicle Service Equipment Fund

50,000 0 50,000 0 0 0.0

Proposed FY 2023-24 Appropriation

$148,121,038 $14,042,217 $2,011,125 $65,557 $132,002,139 2,490.0

$ Change from prior year

$5,063,930 $1,361,603 $439,219 ($14,748) $3,277,856 (23.9)

% Change from prior year

3.5% 10.7% 27.9% (18.4%) 2.5% (1.0%)

NATURAL RESOURCES

FY 2022-23 Appropriation

$518,225,793 $39,072,874 $385,158,144 $67,928,561 $26,066,214 1,562.0

SB 23-237 Transfer to Water Plan Implementation Cash Fund

0 0 0 0 0 0.0

FY 2022-23 Adjusted Appropriation

$518,225,793 $39,072,874 $385,158,144 $67,928,561 $26,066,214 1,562.0

S.B. 23-214 - Long Bill Total

$407,821,389 $42,366,523 $319,830,780 $8,351,203 $37,272,883 1,650.9

Proposed FY 2023-24 Appropriation

$407,821,389 $42,366,523 $319,830,780 $8,351,203 $37,272,883 1,650.9

$ Change from prior year

($110,404,404) $3,293,649 ($65,327,364) ($59,577,358) $11,206,669 88.9

% Change from prior year

(21.3%) 8.4% (17.0%) (87.7%) 43.0% 5.7%

PERSONNEL

FY 2022-23 Appropriation

$243,018,509 $28,788,405 $12,208,090 $202,022,014 $0 452.0

S.B. 23-214 - Long Bill Total

$270,682,213 $43,215,517 $17,518,235 $209,948,461 $0 521.5

Proposed FY 2023-24 Appropriation

$270,682,213 $43,215,517 $17,518,235 $209,948,461 $0 521.5

$ Change from prior year

$27,663,704 $14,427,112 $5,310,145 $7,926,447 $0 69.5

% Change from prior year

11.4% 50.1% 43.5% 3.9% n/a 15.4%

PUBLIC HEALTH AND ENVIRONMENT

FY 2022-23 Appropriation $915,919,362 $203,182,871 $311,690,039 $76,603,566 $324,442,886 1,732.4

S.B. 23-214 - Long Bill Total

0 1,381,438 0 0 (1,381,438) 0.0

FY 2022-23 Adjusted Appropriation

$915,919,362 $204,564,309 $311,690,039 $76,603,566 $323,061,448 1,732.4

S.B. 23-214 - Long Bill Total

$803,508,100 $111,379,005 $295,300,422 $66,298,363 $330,530,310 1,848.6

SB 23-238 Small Communities Water and Wastewater Grant Fund

66,126,060 0 6,011,460 0 60,114,600 0.0

SB 23-239 Hazardous Site Response Fund Transfer

0 0 0 0 0 0.0

SB 23-240 CDPHE Dairy Plant Fees

0 0 0 0 0 0.0

HB 23-1194 Closed Landfills Remediation Local Govs Grants

Placeholder

15,000,000 15,000,000 0 0 0 0.0

Proposed FY 2023-24 Appropriation

$884,634,160 $126,379,005 $301,311,882 $66,298,363 $390,644,910 1,848.6

$ Change from prior year

($31,285,202) ($76,803,866) ($10,378,157) ($10,305,203) $66,202,024 116.2

% Change from prior year

(3.4%) (37.8%) (3.3%) (13.5%) 20.4% 6.7%

Long Bill Budget Package

11

March 27, 2023

DEPARTMENT/ITEM

TOTAL

FUNDS

GENERAL

FUND

CASH

FUNDS

REAPPROPRIATED

FUNDS

FEDERAL

FUNDS

F T E

BUDGET PACKAGE BALANCING: OPERATING APPROPRIATION

SUMMARY BY DEPARTMENT AND BILL

PUBLIC SAFETY

FY 2022-23 Appropriation

$624,350,673 $242,152,457 $259,548,535 $53,612,551 $69,037,130 2,123.1

Firehawk Purchase (Placeholder)

0 0 0 0 0 0.0

FY 2022-23 Adjusted Appropriation

$624,350,673 $242,152,457 $259,548,535 $53,612,551 $69,037,130 2,123.1

S.B. 23-214 - Long Bill Total

$656,121,638 $253,537,243 $265,718,100 $68,113,327 $68,752,968 2,273.3

SB 23-242 Community Corrections Financial Audit

100,000 100,000 0 0 0 0.0

SB 23-241 Creation of Office of School Safety

14,798,091 9,401,600 5,396,491 0 0 17.2

Auto Theft Prevention (Placeholder)

5,000,000 5,000,000 0 0 0 10.1

SB 23-013 Fire Investigations (Placeholder)

6,486,310 3,243,155 0 3,243,155 0 10.1

Proposed FY 2023-24 Appropriation

$682,506,039 $271,281,998 $271,114,591 $71,356,482 $68,752,968 2,310.7

$ Change from prior year

$58,155,366 $29,129,541 $11,566,056 $17,743,931 ($284,162) 187.6

% Change from prior year

9.3% 12.0% 4.5% 33.1% (0.4%) 8.8%

REGULATORY AGENCIES

FY 2022-23 Appropriation

$121,882,627 $3,715,753 $110,264,924 $6,306,416 $1,595,534 668.9

S.B. 23-214 - Long Bill Total

$128,584,338 $2,787,372 $116,965,541 $7,090,380 $1,741,045 678.2

Proposed FY 2023-24 Appropriation

$128,584,338 $2,787,372 $116,965,541 $7,090,380 $1,741,045 678.2

$ Change from prior year $6,701,711 ($928,381) $6,700,617 $783,964 $145,511 9.3

% Change from prior year

5.5% (25.0%) 6.1% 12.4% 9.1% 1.4%

REVENUE

FY 2022-23 Appropriation

$470,580,844 $143,404,525 $317,263,756 $8,752,841 $1,159,722 1,691.6

S.B. 23-214 - Long Bill Total

$494,194,408 $148,514,239 $336,350,158 $7,882,293 $1,447,718 1,701.7

Proposed FY 2023-24 Appropriation

$494,194,408 $148,514,239 $336,350,158 $7,882,293 $1,447,718 1,701.7

$ Change from prior year

$23,613,564 $5,109,714 $19,086,402 ($870,548) $287,996 10.1

% Change from prior year

5.0% 3.6% 6.0% (9.9%) 24.8% 0.6%

STATE

FY 2022-23 Appropriation

$35,562,683 $1,151,651 $33,953,683 $457,349 $0 147.2

S.B. 23-214 - Long Bill Total

$50,135,121 $12,835,578 $36,507,770 $791,773 $0 149.5

Proposed FY 2023-24 Appropriation

$50,135,121 $12,835,578 $36,507,770 $791,773 $0 149.5

$ Change from prior year

$14,572,438 $11,683,927 $2,554,087 $334,424 $0 2.3

% Change from prior year

41.0% 1,014.5% 7.5% 73.1% n/a 1.6%

TRANSPORTATION

FY 2022-23 Appropriation

$1,790,022,188 $0 $955,302,209 $5,478,096 $829,241,883 3,327.0

S.B. 23-214 - Long Bill Total

$1,797,035,671 $0 $958,557,897 $5,528,096 $832,949,678 3,327.0

Proposed FY 2023-24 Appropriation

$1,797,035,671 $0 $958,557,897 $5,528,096 $832,949,678 3,327.0

$ Change from prior year

$7,013,483 $0 $3,255,688 $50,000 $3,707,795 0.0

% Change from prior year

0.4% n/a 0.3% 0.9% 0.4% 0.0%

TREASURY

FY 2022-23 Appropriation

$983,372,067 $302,753,525 $631,903,150 $48,715,392 $0 64.8

S.B. 23-214 - Long Bill Total

$781,399,404 $313,692,919 $436,638,516 $31,067,969 $0 55.0

Proposed FY 2023-24 Appropriation

$781,399,404 $313,692,919 $436,638,516 $31,067,969 $0 55.0

$ Change from prior year

($201,972,663) $10,939,394 ($195,264,634) ($17,647,423) $0 (9.8)

% Change from prior year

(20.5%) 3.6% (30.9%) (36.2%) n/a (15.1%)

Long Bill Budget Package

12

March 27, 2023

DEPARTMENT/ITEM

TOTAL

FUNDS

GENERAL

FUND

CASH

FUNDS

REAPPROPRIATED

FUNDS

FEDERAL

FUNDS

F T E

BUDGET PACKAGE BALANCING: OPERATING APPROPRIATION

SUMMARY BY DEPARTMENT AND BILL

STATEWIDE

FY 2022-23

SB 23-246 State Emergency Reserve

$0

$0 $0 $0 $0 0.0

FY 2023-24

SB 23-245 Transfer to Revenue Loss Restoration Cash Fund

0 0 0 0 0 0.0

Set aside for legislation - ongoing impacts (Placeholder)

30,000,000 30,000,000 0 0 0 0.0

Set aside for legislation - one time impacts (Placeholder)

469,000,000

469,000,000 0 0 0 0.0

SB 23-244 Technology Accessibility Cleanup

0 0 0 0 0 0.0

FY 2023-24 Statewide Appropriation Adjustments

$499,000,000 $499,000,000 $0 $0 $0 0.0

TOTAL

FUNDS

GENERAL

FUND

CASH

FUNDS

REAPPROPRIATED

FUNDS

FEDERAL

FUNDS

F T E

FY 2022-23 Appropriation

$39,488,688,670 $13,713,633,172 $11,012,681,221 $2,473,001,802 $12,289,372,475 63,279.7

S.B. 23-214 - Long Bill Total

260,736,324 (189,439,009) 74,294,389 (618,772) 376,499,716 5.4

Other Legislation for Balancing (FY 2021-22)

0 0 0 0 0 0.0

FY 2022-23 Adjusted Appropriation

$39,749,424,994 $13,524,194,163 $11,086,975,610 $2,472,383,030 $12,665,872,191 63,285.1

S.B. 23-214 - Long Bill Total

$40,498,289,342 $14,662,213,754 $10,504,317,065 $2,603,141,391 $12,728,617,132 64,247.8

Other Legislation for Balancing (FY 2022-23)

905,585,642 757,797,101 46,312,892 3,811,699 97,663,950 56

5.3

Proposed FY 2023-24 Appropriation

$41,403,874,984 15,420,010,855 $10,550,629,957 $2,606,953,090 $12,826,281,082 64,813.1

$ Change from prior year

$1,654,449,990 $1,895,816,692 ($536,345,653) $134,570,060 $160,408,891 1,528.0

% Change from prior year

4.2% 14.0% (4.8%) 5.4% 1.3% 2.4%

BUDGET PACKAGE BALANCING: APPROPRIATION SUMMARY TABLE

Long Bill Budget Package

13

March 27, 2023

Section 2

Long Bill Narrative

S.B. 23-214

LONG BILL NARRATIVE – S.B. 23-214

This Section 2 focuses on the portion of the budget proposal that is reflected in the Long Bill (S.B. 23-214). The

proposed Long Bill includes a total of $40.5 billion for State operations and $577.2 million for capital construction

and information technology projects for FY 2023-24.

The operating budget includes $2.6 billion in “reappropriated funds,” which are duplicated amounts that appear more

than once within the budget. The Long Bill operating budget without duplicated amounts totals $37.9 billion. This

includes $14.7 billion in general tax revenues that are credited to the General Fund, $10.5 billion in various State cash

fund revenues that are earmarked for certain purposes, and $12.7 billion in anticipated federal funds.

The following table summarizes the appropriations and informational amounts that are included in the introduced

Long Bill for FY 2023-24. The subsections that follow for each department include tables that detail FY 2022-23

appropriations (including any additional mid-year proposed adjustments) and proposed appropriations for FY 2023-

24. The summary table for each department is followed by descriptions of each proposed incremental change from

FY 2022-23 to FY 2023-24.

SUMMARY OF PROPOSED LONG BILL (S.B. 23-214) APPROPRIATIONS FOR FY 2023-24

O

PERATING

A

PPROPRIATIONS

,

BY DEPARTMENT

T

OTAL

FUNDS

G

ENERAL

FUND

C

ASH

FUNDS

R

EAPPROPRIATED

FUNDS

F

EDERAL

FUNDS

Agriculture

$66,625,053

$17,058,045

$42,931,530

$2,714,972

$3,920,506

Corrections

1,082,512,096

988,667,494

45,669,318

44,928,789

3,246,495

Early Childhood

791,008,286

302,995,188

212,983,095

13,954,712

261,075,291

Education

7,003,972,046

4,512,278,584

1,361,942,038

79,976,873

1,049,774,551

Governor

520,236,969

48,320,536

95,040,576

369,056,086

7,819,771

Health Care Policy and Financing

15,433,373,544

4,490,488,577

1,768,567,113

105,145,754

9,069,172,100

Higher Education

5,796,479,118

1,499,886,744

3,082,301,297

1,187,840,403

26,450,674

Human Services

2,345,920,362

995,710,391

557,393,208

219,355,902

573,460,861

Judicial

1,001,777,098

748,706,421

191,476,126

57,169,551

4,425,000

Labor and Employment

404,056,083

31,854,411

152,198,025

24,238,463

195,765,184

Law

130,064,513

24,252,594

23,670,454

78,347,293

3,794,172

Legislature

7,001,874

6,731,874

0

270,000

0

Local Affairs

377,813,556

52,892,283

184,795,741

15,109,746

125,015,786

Military and Veterans Affairs

148,071,038

14,042,217

1,961,125

65,557

132,002,139

Natural Resources

407,821,389

42,366,523

319,830,780

8,351,203

37,272,883

Personnel

270,682,213

43,215,517

17,518,235

209,948,461

0

Public Health and Environment

803,508,100

111,379,005

295,300,422

66,298,363

330,530,310

Public Safety

656,121,638

253,537,243

265,718,100

68,113,327

68,752,968

Regulatory Agencies

128,584,338

2,787,372

116,965,541

7,090,380

1,741,045

Revenue

494,194,408

148,514,239

336,350,158

7,882,293

1,447,718

State

50,135,121

12,835,578

36,507,770

791,773

0

Transportation

1,797,035,671

0

958,557,897

5,528,096

832,949,678

Treasury

781,399,404

313,692,919

436,638,516

31,067,969

0

Long Bill Operating Total

$40,498,393,918

$14,662,213,755

$10,504,317,065

$2,603,245,966

$12,728,617,132

LESS:

Amount Exempt from Statutory Limit

n/a

$226,068,385

n/a

n/a

n/a

Grand Total Subject to Statutory Limit

on General Fund Appropriations

n/a

$14,436,145,370

n/a

n/a

n/a

C

APITAL

C

ONSTRUCTION AND

INFORMATION TECHNOLOGY PROJECT

APPROPRIATIONS

TOTAL

C

APITAL

CONSTRUCTION

FUNDS EXEMPT

CASH FUNDS

REAPPROPRIATED

FUNDS

FEDERAL FUNDS

Capital Construction Projects

$456,541,848

$241,750,932

$212,411,819

$0

$2,379,097

Information Technology Projects

120,656,327

61,285,415

8,184,071

996,386

50,190,455

Long Bill Capital Total

$577,198,175

$303,036,347

$220,595,890

$996,386

$52,569,552

Long Bill Budget Package

14

March 27, 2023

DEPARTMENT OF AGRICULTURE

Description: The Department of Agriculture regulates, promotes, and supports various agricultural activities

throughout Colorado through a wide range of services including: regulation and certification of the livestock industry;

regulation of the use of pesticides and pesticide applicators; administration of Inspection and Consumer Services

Programs; brand inspections; oversight of conservation services throughout the state; promotion of Colorado's

agricultural industries; and administration of the State Fair and fairgrounds.

DEPARTMENT OF AGRICULTURE

T

OTAL

FUNDS

G

ENERAL

FUND

C

ASH

FUNDS

R

EAPPROPRIATED

FUNDS

F

EDERAL

FUNDS

FTE

FY 2022-23 Appropriation

$71,530,898

$14,787,857

$50,172,615

$2,623,496

$3,946,930

310.7

CHANGES FROM FY 2022-23 APPROPRIATION

Centrally appropriated line items

$3,196,939

$2,208,768

$991,206

($2,855)

($180)

0.0

Animal health and welfare

238,505

238,505

0

0

0

1.0

Climate drought-smart agriculture

marketing specialist

232,544

232,544

0

0

0

0.9

Agricultural water advisor

187,455

187,455

0

0

0

0.9

Commissioner's office support

156,849

78,424

0

78,425

0

0.9

Insectary lab technician

115,822

0

115,822

0

0

0.9

Impacts driver by other agencies

34,102

22,098

12,004

0

0

0.0

Fruit and vegetable fund adjustments

10,000

10,000

0

0

0

0.0

Inspection and consumer services fund

adjustments

0

(300,000)

300,000

0

0

0.0

Annualize prior year legislation

(8,196,934)

(196,934)

(8,000,000)

0

0

0.3

Annualize prior year budget actions

(591,327)

(210,672)

(382,373)

1,718

0

0.4

Indirect cost assessment

(289,800)

0

(277,744)

14,188

(26,244)

0.0

TOTAL FY 2023-24 LONG BILL

$66,625,053

$17,058,045

$42,931,530

$2,714,972

$3,920,506

316.0

APPROPRIATION

$ Change from prior year

($4,905,845)

$2,270,188

($7,241,085)

$91,476

($26,424)

5.3

% Change from prior year

(6.9%)

15.4%

(14.4%)

3.5%

(0.7%)

1.7%

DESCRIPTION OF INCREMENTAL CHANGES

CENTRALLY APPROPRIATED LINE ITEMS: The bill includes adjustments to the following centrally appropriated line

items: state contributions for health, life, and dental benefits; short-term disability; supplemental state contributions

to the Public Employees' Retirement Association (PERA) pension fund; shift differential; salary survey; workers'

compensation; legal services; administrative law judges; payment to risk management and property funds; vehicle lease

payments; payments to the Governor’s Office of Information Technology (OIT); and CORE operations.

ANIMAL HEALTH AND WELFARE: The bill includes an increase of $238,505 General Fund and 1.0 FTE for a Western

Slope Investigator and a mental health contractor for the Bureau of Animal Protection and additional operational

funding for the Animal Health Division.

CLIMATE DROUGHT-SMART AGRICULTURAL MARKETING SPECIALIST: The bill includes an increase of $232,544

General Fund and 0.9 FTE to hire a Marketing and Communications Specialist to create and amplify market

opportunities for Colorado producers who grow climate and drought-smart commodities.

AGRICULTURAL WATER ADVISOR: The bill includes increase of $187,445 General Fund and 0.9 FTE to hire an

Agricultural Water Advisor to support communication and outreach to the agricultural community on water supply

issues and to purchase an electric state fleet vehicle.

Long Bill Budget Package

15

March 27, 2023

COMMISSIONER’S OFFICE SUPPORT: The bill includes an increase of $156,849 total funds and 0.9 FTE, including

$78,424 General Fund and $78,425 reappropriated funds funded through indirect costs charged to the Department’s

divisions, to fund the Deputy Commissioner of Operations position in the Commissioner’s office.

INSECTARY LAB TECHNICIAN: The bill includes an increase of $115,822 cash funds from the Plant Health, Pest

Control, and Environmental Protection Cash Fund and 0.9 FTE to hire a Lab Technician at the Palisade Insectary’s

Request-a-Bug service to use natural techniques to mitigate invasive pests’ spread in the community and agriculture

industry and for an additional vehicle.

IMPACTS DRIVEN BY OTHER AGENCIES: The bill includes an increase of $34,102 total funds, including $22,098

General Fund for decision items originating in the Governor's Office of Information Technology to pay for included

budget changes. More information can be found in the Office of the Governor department summary.

FRUIT AND VEGETABLE FUND ADJUSTMENT: The bill includes an increase of $10,000 General Fund to the Fruit

and Vegetable Program. The increase in funding would restore the Fruit and Vegetable Program’s pre-pandemic total

appropriation of $200,000 General Fund and allow the CDA’s Fruit and Vegetable Program inspectors to attend

annual required trainings provided by the United States Department of Agriculture.

INSPECTION AND CONSUMER SERVICES FUND ADJUSTMENT: The bill includes an increase of $300,000 in cash fund

spending authority and a $300,000 reduction in General Fund from the Inspection and Consumer Services Division.

ANNUALIZE PRIOR YEAR LEGISLATION: The bill includes adjustments for out-year impacts of prior year legislation.

ANNUALIZE PRIOR YEAR LEGISLATION

T

OTAL

F

UNDS

G

ENERAL

F

UND

C

ASH

F

UNDS

R

EAPPROPRIATED

F

UNDS

F

EDERAL

F

UNDS

FTE

SB 22-206 Disaster preparedness

$1,472

$1,472

$0

$0

$0

0.1

HB 22-1353 Public Safety Comms Transfer

0

0

0

0

0

0.0

ARPA Funds Small Food Business

Recovery and Resilience Grant

(7,000,000)

0

(7,000,000)

0

0

0.0

ARPA Funding Community Food Access

(1,000,000)

0

(1,000,000)

0

0

0.0

AG leadership program

(75,000)

(75,000)

0

0

0

0.0

HB22-1053 Blockchain agriculture

(66,568)

(66,568)

0

0

0

0.0

HB22-1308 Agriculture workforce

(52,314)

(52,314)

0

0

0

0.0

HB 21-1181 Soil health program

(3,260)

(3,260)

0

0

0

0.1

SB 22-209 Meat processing grant

(1,264)

(1,264)

0

0

0

0.1

TOTAL

($8,196,934)

($196,934)

($8,000,000)

$0

$0

0.3

ANNUALIZE PRIOR YEAR BUDGET ACTIONS: The bill includes adjustments for out-year impacts of prior budget

actions.

ANNUALIZE PRIOR YEAR BUDGET ACTIONS

T

OTAL

FUNDS

G

ENERAL

FUND

C

ASH

FUNDS

R

EAPPROPRIATED

FUNDS

F

EDERAL

FUNDS

FTE

FY 22-23 Ag Emergency Coordinator

$3,190

($246)

$1,718

$1,718

$0

0.1

FY 22-23 Improve pest response

909

0

909

0

0

0.1

FY 22-23 Salary survey

0

0

0

0

0

0.0

FY 22-23 San Luis Valley well monitoring

(385,000)

0

(385,000)

0

0

0.0

FY 22-23 Rural Mental Health Programs

(200,000)

(200,000)

0

0

0

0.0

FY 22-23 Enhancing resources for bureau

(10,426)

(10,426)

0

0

0

0.2

TOTAL

($591,327)

($210,672)

($382,373)

$1,718

$0

0.4

INDIRECT COST ASSESSMENT: The bill includes a net decrease in the Department’s indirect cost assessment.

Long Bill Budget Package

16

March 27, 2023

SUMMARY OF CHANGES BY LONG BILL DIVISION

SUMMARY TABLE FOR DEPARTMENT OF AGRICULTURE

T

OTAL

FUNDS

G

ENERAL

FUND

C

ASH

FUNDS

R

EAPPROPRIATED

FUNDS

F

EDERAL

FUNDS

FTE

FY 2022-23 Appropriation

$71,530,898

$14,787,857

$50,172,615

$2,623,496

$3,946,930

310.7

CHANGES FROM FY 2022-23 BY LONG BILL DIVISION

Commissioner's Office and

Administrative Services

$2,592,735

$1,941,005

$560,434

$91,476

($180)

1.1

Agricultural Services

281,937

244,449

62,316

0

(24,828)

3.2

Agricultural Markets Division

(7,908,578)

69,985

(7,977,147)

0

(1,416)

1.0

Brand Board

81,100

0

81,100

0

0

0.0

Colorado State Fair

32,212

0

32,212

0

0

0.0

Conservation Board

14,749

14,749

0

0

0

0.0

TOTAL FY 2023-24 LONG BILL

$66,625,053

$17,058,045

$42,931,530

$2,714,972

$3,920,506

316.0

APPROPRIATION

$ Change from prior year

($4,905,845)

$2,270,188

($7,241,085)

$91,476

($26,424)

5.3

% Change from prior year

(6.9%)

15.4%

(14.4%)

3.5%

(0.7%)

1.7%

APPROPRIATION DETAIL BY LONG BILL DIVISION

COMMISSIONER'S OFFICE AND ADMINISTRATIVE SERVICES: The Commissioner's Office, in conjunction with the

Colorado Agricultural Commission, is responsible for the development and implementation of agricultural policies

throughout the state. The Administrative Services section provides administrative and technical support for

Department programs, including accounting, budgeting, and human resources. The funding sources for this division

are General Fund, various cash funds, and federal grants. Reappropriated funds are received from various cash funds

within the Department for centrally appropriated line items.

COMMISSIONER'S OFFICE AND ADMINISTRATIVE SERVICES

T

OTAL

FUNDS

G

ENERAL

FUND

C

ASH

FUNDS

R

EAPPROPRIATED

FUNDS

F

EDERAL

FUNDS

FTE

FY 2022-23 Appropriation

$17,835,384

$5,547,191

$10,326,048

$1,839,496

$122,649

21.0

CHANGES FROM FY 2022-23 APPROPRIATION

Centrally appropriated line items

$3,196,939

$2,208,768

$991,206

($2,855)

($180)

0.0

Commissioner's office support

156,849

78,424

0

78,425

0

0.9

Impacts driver by other agencies

34,102

22,098

12,004

0

0

0.0

Animal health and welfare

15,730

15,730

0

0

0

0.0

Annualize prior year legislation

1,204

1,204

0

0

0

0.1

Climate drought-smart agriculture

marketing specialist

0

0

0

0

0

0.0

Agricultural Water Advisor

0

0

0

0

0

0.0

Insectary lab technician

0

0

0

0

0

0.0

Annualize prior year budget actions

(800,444)

(385,219)

(416,943)

1,718

0

0.1

Indirect cost assessment

(11,645)

0

(25,833)

14,188

0

0.0

TOTAL FY 2023-24 LONG BILL

$20,428,119

$7,488,196

$10,886,482

$1,930,972

$122,469

22.1

APPROPRIATION

$ Change from prior year

$2,592,735

$1,941,005

$560,434

$91,476

($180)

1.1

% Change from prior year

14.5%

35.0%

5.4%

5.0%

(0.1%)

5.2%

Long Bill Budget Package

17

March 27, 2023

AGRICULTURAL SERVICES: These divisions administer the four major Department program areas listed below. The

primary source of funding is from two cash funds: the Plant Health, Pest Control, and Environmental Protection

Fund and the Inspection and Consumer Services Cash Fund.

ANIMAL INDUSTRY DIVISION: Monitors the health of livestock and other animals used in various fields of agriculture;

prevents and controls livestock disease; licenses and inspects pet animal facilities; implements programs for pest

control; and investigates animal cruelty claims.

INSPECTION AND CONSUMER SERVICES DIVISION: Ensures compliance with product quality standards through

licensing and inspection; certifies commercial (large and small) weights and measurement devices; and analyzes

fertilizer and animal feed for chemical contaminants or adulterants.

PLANT INDUSTRY DIVISION: Manages statewide pest control programs; registers pesticides and pesticide applicators;

inspects plants and plant byproducts intended for domestic or international export; oversees the organic certification

program; and inspects nursery stock for quality and health.

CONSERVATION SERVICES DIVISION: Provides technical and financial support, leadership, statewide coordination,

and regulatory oversight to public and private landowners statewide on an array of natural resource management

challenges including noxious weed management and biological pest control.

A

GRICULTURAL

S

ERVICES

T

OTAL

FUNDS

G

ENERAL

FUND

C

ASH

FUNDS

R

EAPPROPRIATED

FUNDS

F

EDERAL

FUNDS

FTE

FY 2022-23 Appropriation

$21,685,761

$5,630,163

$12,896,797

$784,000

$2,374,801

154.2

CHANGES FROM FY 2022-23 APPROPRIATION

Animal health and welfare

$222,775

$222,775

$0

$0

$0

1.0

Agricultural Water Advisor

187,455

187,455

0

0

0

0.9

Insectary lab technician

115,822

0

115,822

0

0

0.9

Inspection & consumer services funds

adjustments

0

(300,000)

300,000

0

0

0.0

Indirect cost assessment

(196,901)

0

(172,073)

0

(24,828)

0.0

Annualize prior year budget actions

(44,222)

137,211

(181,433)

0

0

0.3

Annualize prior year legislation

(2,992)

(2,992)

0

0

0

0.1

TOTAL FY 2023-24 LONG BILL

$21,967,698

$5,874,612

$12,959,113

$784,000

$2,349,973

157.4

APPROPRIATION

$ Change from prior year

$281,937

$244,449

$62,316

$0

($24,828)

3.2

% Change from prior year

1.3%

4.3%

0.5%

n/a

(1.0%)

2.1%

AGRICULTURAL MARKETS DIVISION: This division is organized into two subdivisions:

AGRICULTURAL MARKETS provides marketing assistance and related support to Colorado agricultural-based

businesses competing in local, national, and international arenas through coordination of various market orders,

promotion of Colorado agricultural products, and assistance to start-up or expand food processing companies within

the state.

AGRICULTURAL PRODUCTS INSPECTION administers the agricultural products inspection program, which performs

mandatory and non-mandatory inspections to determine grade, size, and quality of fruits and vegetables.

Long Bill Budget Package

18

March 27, 2023

A

GRICULTURAL

M

ARKETS

D

IVISION

T

OTAL

FUNDS

G

ENERAL

FUND

C

ASH

FUNDS

R

EAPPROPRIATED

FUNDS

F

EDERAL

FUNDS

FTE

FY 2022-23 Appropriation

$13,555,550

$1,390,234

$11,222,617

$0

$942,699

44.4

CHANGES FROM FY 2022-23 APPROPRIATION

Climate drought-smart agriculture

marketing specialist

$232,544

$232,544

$0

$0

$0

0.9

Annualize prior year budget actions

68,870

22,587

46,283

0

0

0.0

Fruit & vegetable fund adjustments

10,000

10,000

0

0

0

0.0

Annualize prior year legislation

(8,195,146)

(195,146)

(8,000,000)

0

0

0.1

Indirect cost assessment

(24,846)

0

(23,430)

0

(1,416)

0.0