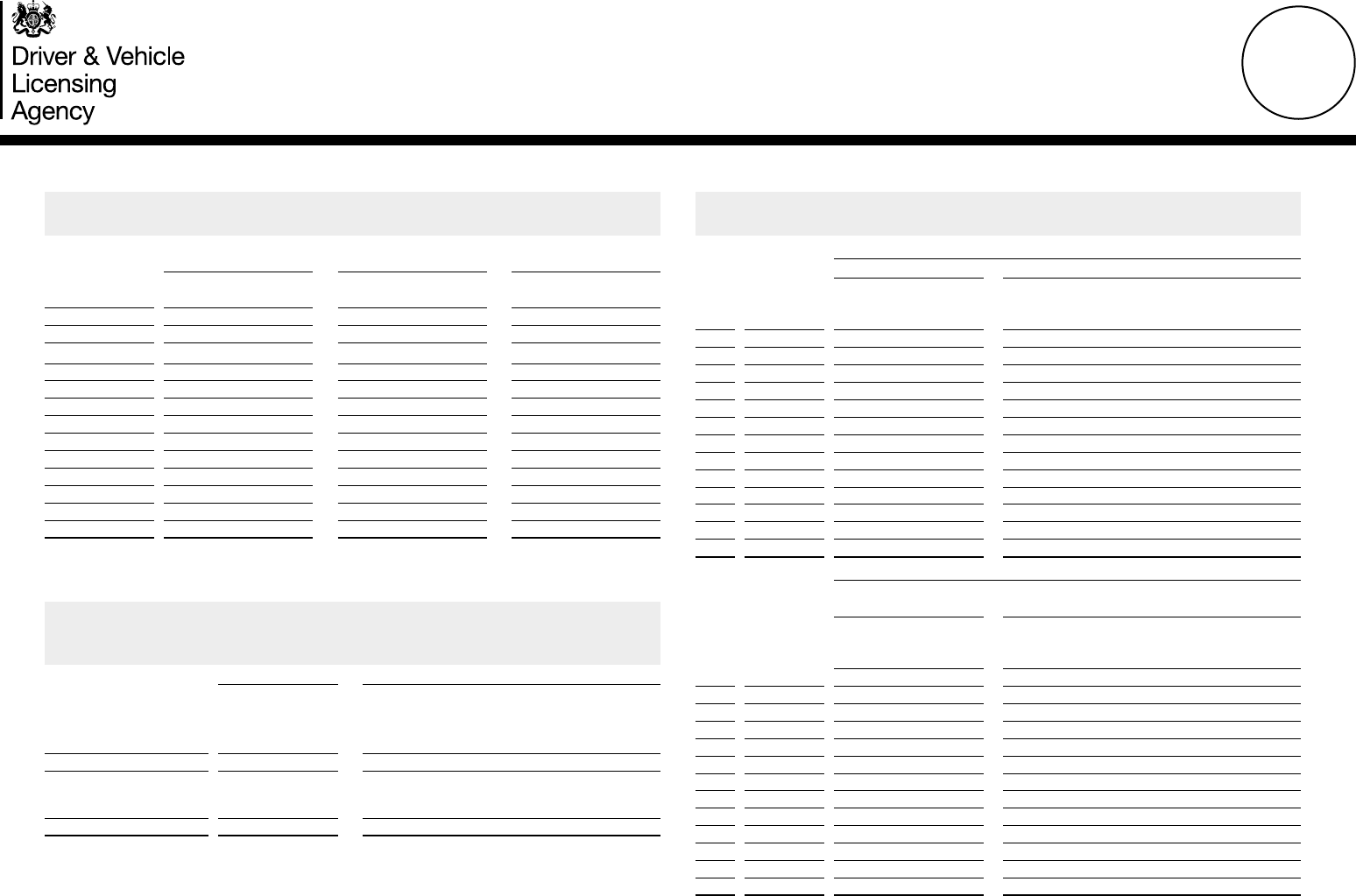

Rates of vehicle tax

for cars, motorcycles, light goods vehicles and private light goods vehicles

V149

The following tables give the rates of vehicle tax that will apply on or after 1 April 2024. Please go to www.gov.uk/check-vehicle-tax for the technical details of your vehicle. Where Direct Debit is

available the rates are shown. Anyone buying a new car will pay a different rate of vehicle tax for the first licence. From the second licence onwards, the standard rate of vehicle tax will apply.

First licence rates for cars registered on or after 01/04/24 based on CO2

emissions and fuel type

CO2

Petrol car/diesel car*

(tax class 48 and 49)

Diesel car**

(tax class 49)

Alternative fuel car

(tax class 59)

12

months

12

months

12

months

0 £0 £0 £0

1 to 50 £10 £30 £0

51 to 75 £30 £135 £20

76 to 90 £135 £175 £125

91 to 100 £175 £195 £165

101 to 110 £195 £220 £185

111 to 130 £220 £270 £210

131 to 150 £270 £680 £260

151 to 170 £680 £1,095 £670

171 to 190 £1,095 £1,650 £1,085

191 to 225 £1,650 £2,340 £1,640

226 to 255 £2,340 £2,745 £2,330

Over 255 £2,745 £2,745 £2,735

* Diesel cars tested to RDE2 standards.

** Diesel cars tested to RDE standards.

Cars registered on or after 01/04/17 – Standard rate (£)

Note: Cars with a list price of over £40,000 at first registration will pay the

additional rate for 5 years from the start of the second licence

Tax class

Non Direct Debit Direct Debit

12

months

6

months

Single

12 month

payment

Total payable

by 12 monthly

installments

Single

6 month

payment

Petrol/diesel car £190 £104.50 £190 £199.50 £99.75

Alternative fuel car £180 £99 £180 £189 £94.50

Total including the £410 additional rate

Petrol/diesel car £600 £330 £600 £630 £315

Alternative fuel car £590 £324.50 £590 £619.50 £309.75

Cars registered on or after 01/03/01 and before 01/04/17 based

on CO2 emissions and fuel type

Band

CO2

emission

figure (g/km)

Petrol car (tax class 48) and diesel car (tax class 49)

Non Direct Debit Direct Debit

12

months

6

months

Single

12 month

payment

Total payable

by 12 monthly

installments

Single

6 month

payment

A Up to 100 £0 - £0 - -

B 101 to 110 £20 - £20 £21 -

C 111 to 120 £35 - £35 £36.75 -

D 121 to 130 £160 £88 £160 £168 £84

E 131 to 140 £190 £104.50 £190 £199.50 £99.75

F 141 to 150 £210 £115.50 £210 £220.50 £110.25

G 151 to 165 £255 £140.25 £255 £267.75 £133.88

H 166 to 175 £305 £167.75 £305 £320.25 £160.13

I 176 to 185 £335 £184.25 £335 £351.75 £175.88

J 186 to 200 £385 £211.75 £385 £404.25 £202.13

K* 201 to 225 £415 £228.25 £415 £435.75 £217.88

L 226 to 255 £710 £390.50 £710 £745.50 £372.75

M Over 255 £735 £404.25 £735 £771.75 £385.88

Alternative fuel car (tax class 59)

Alternative fuels

non Direct Debit Alternative fuels Direct Debit

12

months

6

months

Single

12 month

payment

Total payable

by 12 monthly

installments

Single

6 month

payment

A Up to 100 £0 - - - -

B 101 to 110 £10 - £10 £10.50 -

C 111 to 120 £25 - £25 £26.25 -

D 121 to 130 £150 £82.50 £150 £157.50 £78.75

E 131 to 140 £180 £99 £180 £189 £94.50

F 141 to 150 £200 £110 £200 £210 £105

G 151 to 165 £245 £134.75 £245 £257.25 £128.63

H 166 to 175 £295 £162.25 £295 £309.75 £154.88

I 176 to 185 £325 £178.75 £325 £341.25 £170.63

J 186 to 200 £375 £206.25 £375 £393.75 £196.88

K* 201 to 225 £405 £222.75 £405 £425.25 £212.63

L 226 to 255 £700 £385 £700 £735 £367.50

M Over 255 £725 £398.75 £725 £761.25 £380.63

* Band K includes cars that have a CO2 emission figure over 225g/km but were registered before 23 March 2006.

2/24

Private/light goods vehicle (tax class 11) weighing no more than 3,500kg

Non Direct Debit Direct Debit

12

months

6

months

Single

12 month

payment

Total payable

by 12 monthly

installments

Single

6 month

payment

Not over 1549cc £210 £115.50 £210 £220.50 £110.25

Over 1549cc £345 £189.75 £345 £362.25 £181.13

Euro 4 light goods vehicles (tax class 36) weighing no more than 3,500kg

Non Direct Debit Direct Debit

12

months

6

months

Single

12 month

payment

Total payable

by 12 monthly

installments

Single

6 month

payment

Vehicles registered between

1 March 2003 and

31 December 2006 and which

are Euro 4 compliant £140 £77 £140 £147 £73.50

Motorcycles and Tricycles (weighing no more than 450kg)

CC

Non Direct Debit Direct Debit

12

months

6

months

Single

12 month

payment

Total payable

by 12 monthly

installments

Single

6 month

payment

Tax class 17 Motorcycles

(with or without a sidecar)

Not over 150cc £25 - £25 £26.25 -

151 to 400cc £55 £30.25 £55 £57.75 £28.88

401 to 600cc £84 £46.20 £84 £88.20 £44.10

Over 600cc £117 £64.35 £117 £122.85 £61.43

Tax class 50 Tricycles

(with or without

a sidecar)

Not over 150cc £25 - £25 £26.25 -

All other

tricycles £117 £64.35 £117 £122.85 £61.43

Motorcycles and Tricycles over 450kg must be taxed in the PLG tax class

Light goods vehicle (tax class 39) weighing no more than 3,500kg

Non Direct Debit Direct Debit

12

months

6

months

Single

12 month

payment

Total payable

by 12 monthly

installments

Single

6 month

payment

Vehicles registered on or

after 1 March 2001 £335 £184.25 £335 £351.75 £175.88

Euro 5 light goods vehicles (tax class 36) weighing no more than 3,500kg

Non Direct Debit Direct Debit

12

months

6

months

Single

12 month

payment

Total payable

by 12 monthly

installments

Single

6 month

payment

Vehicles registered between

1 January 2009 and

31 December 2010 and which

are Euro 5 compliant £140 £77 £140 £147 £73.50

Trade licences

12

months

6

months

11

months

10

months

9

months

8

months

7

months

Trade licences available

for all vehicles £165 £90.75 £165 £151.25 £136.10 £121 £105.85

Motorcycles (weighing

no more than 450kg

without a sidecar) £117 £64.35 £117 £107.25 £96.50 £85.80 £75.05

Tricycles (weighing no

more than 450kg

without a sidecar) £117 £64.35 £117 £107.25 £96.50 £85.80 £75.05

To calculate your tax please visit www.gov.uk/calculate-vehicle-tax-rates

Find out about DVLA’s online services. Go to www.gov.uk/browse/driving

Tax it or lose it

We can always

spot an untaxed car.

Tax now at gov.uk/vehicletax