Aetna Student Health

Plan Design and Benefits

Summary

Open Access Elect Choice

EPO

Stanford University

Policy Year: 2023–2024

Policy Number: 198839

https://www.aetnastudenthealth.com

(888) 834-4708

Disclaimer: These rates and benefits are pending approval by the California Department of

Insurance and can change. If they change, we will update this information.

Stanford University 2023-2024 Page 2

This is a brief description of the Student Health Plan. The plan is available for the Stanford University students. The plan

is insured by Aetna Life Insurance Company (Aetna). The exact provisions, including definitions, governing this insurance

are contained in the Certificate available to you and may be viewed online at https://www.aetnastudenthealth.com. If

there is a difference between this Plan Summary and the Certificate, the Certificate will control.

Vaden Health Center

Vaden Health Center is a multidisciplinary outpatient clinic serving registered Stanford students. The staff of over 100

professionals offers primary care medical services, psychiatric and counseling services, confidential support for those

impacted by sexual/relationship abuse, wellness promotion, and health insurance and referral services. Additional

clinical services include radiography, laboratory, injection and immunization, travel medicine, nutrition counseling,

pharmacy, physical therapy, and some specialty care.

For Vaden Health Center’s hours of operation see the website at vaden.stanford.edu.

Who is eligible for Cardinal Care and Dependent Care?

Students, while attending Stanford University, must be covered by health insurance that meets specific

parameters. Cardinal Care, the student health insurance plan, is one such option. Students are automatically enrolled in

Cardinal Care at the start of their entry quarter each year and have until the waiver deadline of their entry quarter to

choose to remain enrolled or waive. Students entering Stanford for the first time who need health insurance coverage

for dependents can enroll them only during a defined period of open enrollment that coincides with their student’s

initial matriculation unless a qualifying life event occurs at a later date.

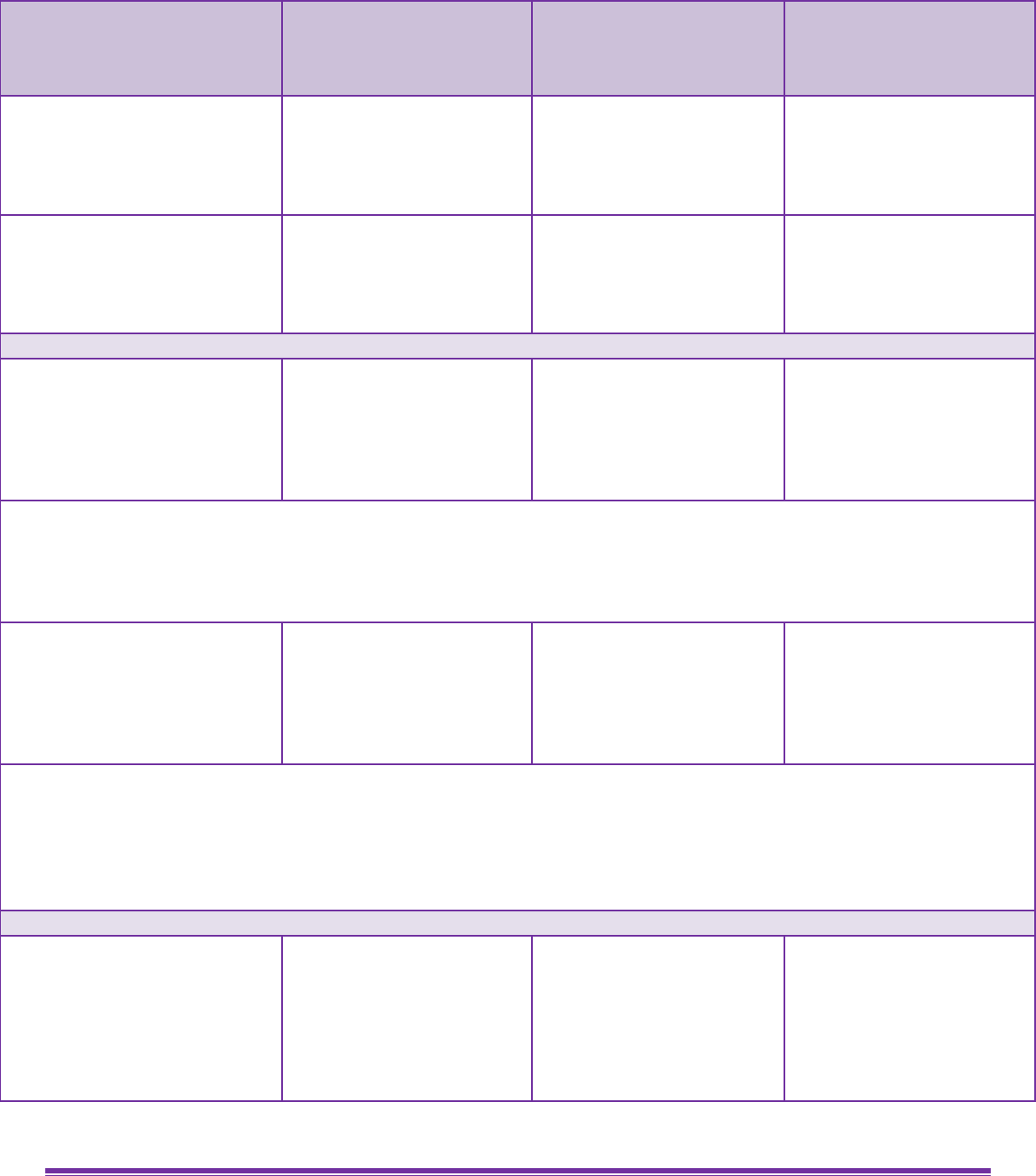

Student Coverage Dates and Rates

Coverage for all enrolled students will become effective at 12:01 AM on the Coverage Start Date indicated below and

will terminate at 11:59 PM on the Coverage End Date indicated.

The rates below include premiums for the Plan underwritten by Aetna Life Insurance Company (Aetna).

Annual

09/01/2023-

08/31/2024

Waiver Deadline:

09/15/2023

Winter

01/01/2024-

08/31/2024

Waiver Deadline:

12/15/2023

Spring

04/01/2024-

08/31/2024

Waiver Deadline:

03/15/2024

Summer

06/01/2024-

08/31/2024

Waiver Deadline:

06/15/2024

Student

$7,128

$4,752

$2,970

$1,782

Dependent Care Eligibility

Students enrolled in Cardinal Care can enroll their spouse, registered domestic partner, and dependent children up to

the age of 26. Students can enroll a dependent in Dependent Care only during a defined period of open enrollment that

coincides with their student’s first 30 days of matriculation unless a qualifying life event occurs at a later date. A

qualifying life event will open a 31-day enrollment period.

Dependent Care Dates and Rates

Coverage for enrolled dependents will become effective at 12:00 AM on the Coverage Start Date indicated below and

will terminate at 11:59 PM on the Coverage End Date indicated. Coverage for insured dependents terminates in

accordance with the Termination Provisions described in the Certificate.

Stanford University 2023-2024 Page 3

The rates below include premiums for Dependent Care underwritten by Aetna Life Insurance Company (Aetna).

Autumn

09/01/2023-

08/31/2024

Enrollment Deadline:

09/30/2023

Winter

01/01/2024-

08/31/2024

Enrollment Deadline:

1/30/2024

Spring

04/01/2024-

08/31/2024

Enrollment Deadline:

04/30/2024

Summer

06/01/2024-

08/31/2024

Enrollment Deadline:

06/30/2024

Monthly Rate

Spouse

$578.00

Child

$300.56

Two or More Children

$541.02

Spouse + Child

$878.56

Spouse + Children

$1119.02

Certificate

Your certificate describes the benefits covered by your Aetna plan. The schedule of benefits in your certificate tells you

how we share expenses for eligible health services and tells you about limits and gives you a summary of how your plan

works.

Request to Waive

Students are automatically enrolled in Cardinal Care, at the start of their entry quarter each year. The plan year begins

on September 1

st

and ends on August 31

st

. If you opt to use alternative health insurance coverage, you must

formally request to waive Cardinal Care by the end of the applicable deadline below, or you will remain enrolled

from your quarter of entry until the end of the plan year (August 31) and will be responsible for paying the

corresponding costs which can be significant.

Review your policy carefully before deciding to request a waiver from Cardinal Care

coverage. If you are approved for

a waiver, you will not

be eligible for Cardinal Care

for the remainder of the plan year unless

you have a pre-defined

qualifying life event.

Students who initially opt to waive Cardinal Care, who then lose health insurance coverage or age out of a parent’s

health insurance plan at age 26, and who wish to have coverage through Cardinal Care, have

31 days

to apply at

stanford.mycare26.com/cardinalcare. In most instances, coverage will commence at the start of the next month.

Similarly, students whose dependents lose health insurance coverage and who wish to enroll their dependent(s) in

the Stanford Dependent Health Insurance Plan, Dependent Care, have

31 days

to apply at

stanford.mycare26.com/cardinalcare.

Note that students must be enrolled in Cardinal Care

to enroll dependents in

the Stanford Dependent Care Plan.

Stanford University 2023-2024 Page 4

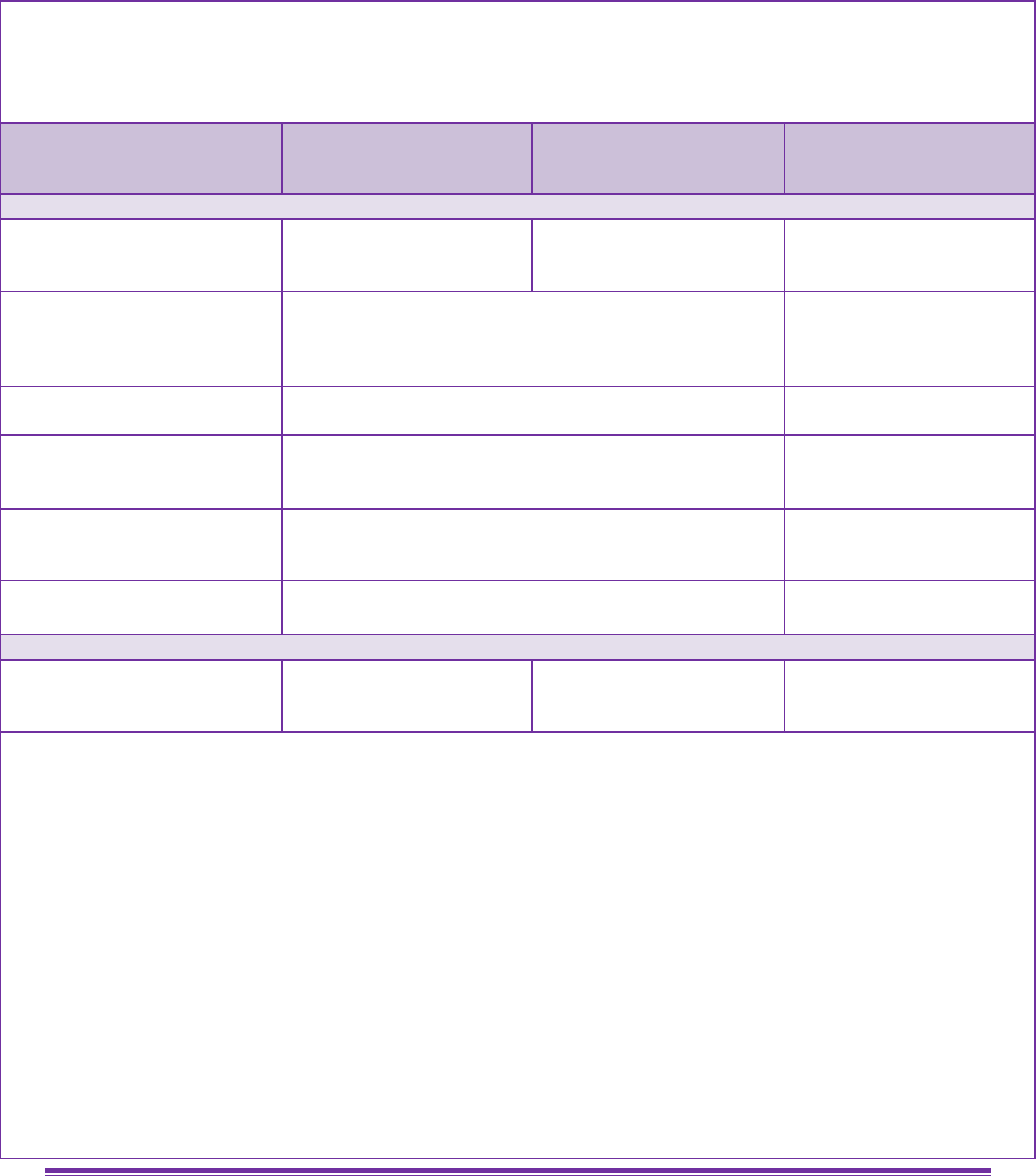

YOU MUST MAKE YOUR HEALTH INSURANCE DECISION EVERY YEAR

If you choose not to have health insurance coverage through Cardinal Care, you will need to

waive EACH academic year by the applicable

deadline. A decision made in one plan

year does not

carry over to the next.

Quarter entering Stanford

Deadline to Convey Your Health Insurance Decision

(Stay Enrolled in Cardinal Care or Waive Coverage)

Autumn Quarter

September 15

Winter Quarter

December 15

Spring Quarter

March 15

Summer Quarter

June 15

Your Alternative Health Care Plan Must Have Comparable Benefits

In order to be approved for a waiver from Cardinal Care coverage, you must have health insurance coverage that

meets or exceeds Stanford’s minimum standards. These requirements ensure that your health care needs will be

adequately covered while you are at Stanford.

Your alternative health insurance policy must meet

or exceed the following minimum standards:

• Covers the entire academic year (September 1 through August 31). Gaps in coverage are not allowed.

•

Covers inpatient and outpatient medical care in the San Francisco Bay Area (with

strong preference for

access to providers

at Stanford University Medical Center and/or the Sutter Health Providers).

•

Coverage for inpatient and outpatient mental health care in the San Francisco Bay Area (with

strong

preference for access to providers

at Stanford University Medical Center and/or the Sutter Health

Providers).

• Has an annual deductible $1,000 USD or less (some employer plans may be exempted from this requirement).

• Has an annual out of pocket maximum of $9,100 USD or less (some employer plans may be exempted from this

requirement).

• Provides the Essential Minimum Benefits require by the Patient Protection and Affordable Care Act (PPACA)

with no annual or lifetime maximums.

• Covers 100% of Preventative Care as defined by the PPACA.

• Contains no exclusions for pre-existing conditions.

• Offers prescription drug coverage.

•

Offers coverage for non-emergency as well as emergency care.

• Has lifetime aggregate maximum benefit of at least $2,000,000 USD OR a maximum per condition/per lifetime

benefit of $500,000 USD.

Dependent Care Enrollment

To enroll the dependent(s) of a Cardinal Care student, please log on to stanford.mycare26.com/cardinalcare. Dependent

Care online application will not be accepted after the enrollment period deadline, unless there is a qualifying life event

that directly affects their insurance coverage. (Examples of a qualifying life event would be loss of health coverage under

another health plan, marriage, birth of a child.)

Stanford University 2023-2024 Page 5

Important note regarding coverage for a newborn infant or newly adopted child:

• A newborn child - Your newborn child is covered on your Cardinal Care health insurance plan for the first 31 days

from the moment of birth.

- You must still enroll the child within 31 days of birth even when coverage does not require payment of

an additional premium contribution for the newborn.

- If you miss this deadline, your newborn will not have health benefits after the first 31 days.

- If your coverage ends during this 31 day period, then your newborn coverage will end on the same date

as your coverage. This applies even if the 31 day period has not ended.

• An adopted child or a child legally placed with you for adoption - A child that you, or that you and your spouse,

civil union partner or domestic partner adopts or is placed with you for adoption, is covered on your plan for the

first 31 days after the adoption or the placement is complete.

- You must still enroll the child within 31 days of the adoption or placement for adoption even when

coverage does not require payment of an additional premium contribution for the child.

- If you miss this deadline, your adopted child or child placed with you for adoption will not have health

benefits after the first 31 days.

- If your coverage ends during this 31 day period, then coverage for your adopted child or child placed

with you for adoption will end on the same date as your coverage. This applies even if the 31 day period

has not ended.

If you need information or have questions on dependent enrollment, call our enrollment partner Academic Health Plans

at 855-343-8387

Cardinal Care and Leaves of Absence

If you are covered by Cardinal Care and contemplate taking a leave of absence at any point in your academic career,

be sure to contact Vaden Health Center’s Insurance and

Referral Office for guidance about coverage,

in advance, if

possible. As you’ll see below,

timing can be a driver as to whether coverage

will be preserved.

A student who is granted a Leave of Absence in Autumn Quarter for which the effective date of the leave is prior to the

first day of class will not be charged tuition or any associated fees for the quarter. Upon reversal of the tuition, the

student’s eligibility for enrollment in Cardinal Care will be canceled retroactive to September 1. (The student’s eligibility for

enrollment in Cardinal Care will resume upon return to the university and reinstatement of tuition.)

A student who is granted a Leave of Absence in

Autumn Quarter for which the effective date of the leave is on or after the

first day of class

but before the term withdrawal deadline will

be charged (prorated) tuition and associated fees for the

quarter after confirmation of attendance in classes or participation in units by the Office of the University Registrar. If

enrolled in Cardinal Care, the student will remain enrolled through the end of the plan

year (August 31) and applicable

fees will apply.

A student who is enrolled in Cardinal Care as of Autumn Quarter, and who is granted a Leave of Absence for a subsequent

quarter (i.e., Winter Quarter, Spring Quarter, or Summer Quarter) will remain enrolled in and covered by Cardinal Care

through the end of the plan year (August 31) and applicable fees will apply.

A student who returns to the university in Winter Quarter or Spring Quarter, and who is subsequently granted a

Leave of Absence, i.e., if the effective date of the leave is prior to the first day of class, tuition and any associate

fees for the quarter will be reversed. Upon reversal of the tuition, the student’s eligibility for enrollment in Cardinal

Care will be cancelled retroactively to the start of the applicable coverage period (January 1 for Winter Quarter

entry student and April 1 for Spring Quarter entry students) the effective date of the leave is on or after the first

day of class but before the respective term withdrawal deadline, the student will be charged (prorated) tuition and

associated fees for the quarter after confirmation of attendance in classes, or participation in units, by the Office

of the University Registrar. If enrolled in Cardinal Care, the student will remain enrolled through the end of the plan

year (August 31) and applicable fees will apply.

Stanford University 2023-2024 Page 6

Service area

Your plan generally pays for eligible health services only within a specific geographic area, called a service area. There

are some exceptions, such as for Tier 2, emergency services, urgent care and transplants.

Medicare Eligibility Notice

You are not eligible to enroll in the student health plan if you have Medicare at the time of enrollment in this student

plan. The plan does not provide coverage for people who have Medicare.

Precertification (Prior Authorization)

You do not need to obtain precertification for any services. However, your provider is required to obtain precertification

for certain Preferred Care services. Refer to the Precertification provisions in the Coverage section of the Certificate for a

complete description of the precertification programs including the types of services, treatments, procedures, visits or

supplies that require precertification. No penalty will be applied to you for a Preferred Care service that was not pre-

certified.

Coordination of Benefits (COB)

Some people have health coverage under more than one health plan. If you do, we will work together with your other

plan(s) to decide how much each plan pays. This is called coordination of benefits (COB). A complete description of the

Coordination of Benefits provision is contained in the Certificate available to you.

Stanford University 2023-2024 Page 7

Plan Design and Benefits Summary

The Plan excludes coverage for certain services and has limitations on the amounts it will pay. While this Plan Summary

document will tell you about some of the important features of the Plan, other features that may be important to you

are defined in the Certificate. To look at the full Plan description, which is contained in the Certificate available to you,

go to https://www.aetnastudenthealth.com.

This Plan will pay benefits in accordance with any applicable California Insurance Law(s).

Tier 1 (Stanford Health

Care, Menlo Medical

Clinic, Sutter Health) In-

network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Policy year deductibles

You have to meet your policy year deductible before this plan pays for benefits.

Student

$100 per policy year

$500 per policy year

Not Applicable

Spouse

$100 per policy year

$500 per policy year

Not Applicable

Each child

$100 per policy year

$500 per policy year

Not Applicable

Family

$300 per policy year

$1,500 per policy year

Not Applicable

Policy year deductible waiver

The policy year deductible is waived for all of the following eligible health services:

•

Tier 2 in-network care for Preventive care and wellness,

•

Tier 2 in-network care for Pediatric Dental Care type A services,

•

Tier 2 in-network care for Pediatric Vision Care Services and Supplies,

•

Tier 2 in-network care for Physicians, Specialists and consults office visits,

•

Tier 2 in-network care for first postnatal visit,

•

Tier 2 in-network care for Well Newborn Nursery Care,

•

Tier 2 in-network care for Walk-in clinic visits,

•

Tier 2 in-network care for Hospital emergency room,

•

Tier 2 in-network care for Urgent care,

•

Tier 2 in-network care outpatient mental health and substance abuse office visits,

•

Tier 2 in-network care Ambulance services,

•

Tier 2 in-network care for hearing aid exams,

•

Tier 2 in-network care for routine adult vision exams,

•

Tier 2 in-network care for Outpatient Prescription Drugs.

The Tier 1 in-network care policy year deductible applies to the following eligible health services:

•

Inpatient hospital (room and board)

•

Outpatient surgery (facility charges)

•

Treatment of infertility

Individual

This is the amount you owe for select care and in-network eligible health services each policy year before the plan

begins to pay for eligible health services. After the amount you pay for eligible health services reaches the policy year

deductible, this plan will begin to pay for eligible health services for the rest of the policy year.

Stanford University 2023-2024 Page 8

Tier 1 (Stanford Health

Care, Menlo Medical

Clinic, Sutter Health) In-

network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Maximum out-of-pocket limits

Student

$2,000 per policy year

$4,000 per policy year

Not Applicable

Spouse

$2,000 per policy year

$4,000 per policy year

Not Applicable

Each child

$2,000 per policy year

$4,000 per policy year

Not Applicable

Family

$6,000 per policy year

$12,000 per policy year

Not Applicable

Eligible health services

Tier 1 (Stanford Health Care,

Menlo Medical Clinic, Sutter

Health) In-network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Routine physical exams

Performed at a physician’s office

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

Not covered

Maximum age and visit limits per

policy year through age 21

Subject to any age and visit limits provided for in the

comprehensive guidelines supported by the American

Academy of Pediatrics/Bright Futures//Health Resources and

Services Administration guidelines for children and

adolescents.

Not Applicable

Covered persons age 22 and

over: Maximum visits per policy

year

1 visit

Not Applicable

Preventive care immunizations

Performed in a facility or at a

physician's office

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

Not covered

Maximums

Subject to any age limits provided for in the comprehensive

guidelines supported by Advisory Committee on

Immunization Practices of the Centers for Disease Control and

Prevention

Not Applicable

Routine gynecological exams (including Pap smears and cytology tests)

Performed at a physician’s,

obstetrician (OB), gynecologist

(GYN) or OB/GYN office

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

Not covered

Maximum visits per policy year

1 visit

Not Applicable

Stanford University 2023-2024 Page 9

Eligible health services

Tier 1 (Stanford Health Care,

Menlo Medical Clinic, Sutter

Health) In-network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Preventive screening and counseling services

Preventive screening and

counseling services for Obesity

and/or healthy diet counseling,

Misuse of alcohol & drugs,

Tobacco Products, Depression

Screening, Sexually transmitted

infection counseling & Genetic

risk counseling for breast and

ovarian cancer

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

Not covered

Stress management counseling

office visits

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

Not covered

Chronic condition counseling

office visits

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

Not covered

Routine cancer screenings

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

Not covered

Maximum:

Subject to any age; family history; and frequency guidelines

as set forth in the most current:

•

Evidence-based items that have in effect a rating of A or B

in the current recommendations of the United States

Preventive Services Task Force; and

•

The comprehensive guidelines supported by the Health

Resources and Services Administration.

Not Applicable

Lung cancer screening maximums

1 screening every 12 months*

Not Applicable

Prenatal and postpartum care

services -Preventive care services

only (includes participation in the

California Prenatal Screening

Program)

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

Not covered

Lactation support and counseling

services

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

Not covered

Stanford University 2023-2024 Page 10

Eligible health services

Tier 1 (Stanford Health Care,

Menlo Medical Clinic, Sutter

Health) In-network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Breast pump supplies and

accessories

100% (of the negotiated

charge) per item

No copayment or policy year

deductible applies

100% (of the negotiated

charge) per item

No copayment or policy year

deductible applies

Not covered

Family planning services – female contraceptives

Female contraceptive counseling

services

office visit

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

100% (of the negotiated

charge) per visit

No copayment or policy year

deductible applies

Not covered

Female contraceptive

prescription drugs and devices

provided, administered, or

removed, by a provider during an

office visit

For each 30 day supply or 12

month supply

100% (of the negotiated

charge) per item

No copayment or policy year

deductible applies

100% (of the negotiated

charge) per item

No copayment or policy year

deductible applies

Not covered

Female Voluntary sterilization-

Inpatient & Outpatient provider

services

100% (of the negotiated

charge)

No copayment or policy year

deductible applies

100% (of the negotiated

charge)

No copayment or policy year

deductible applies

Not covered

The following are not covered under this benefit:

•

Any contraceptive methods that are only "reviewed" by the FDA and not "approved" by the FDA

Physicians and other health professionals

Physician, specialist including

Consultants Office visits (non-

surgical/non-preventive care by a

physician and specialist) includes

telemedicine consultations)

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit

No policy year deductible

applies

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit

No policy year deductible

applies

Not covered

Allergy testing and treatment

Allergy testing performed at a

physician or specialist office

100% (of the negotiated

charge)

No policy year deductible

applies

70% (of the negotiated

charge)

Not covered

Stanford University 2023-2024 Page 11

Eligible health services

Tier 1 (Stanford Health

Care, Menlo Medical Clinic,

Sutter Health) In-network

coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Allergy injections treatment

performed at a physician’s, or

specialist office [when you see

the physician]

100% (of the negotiated

charge)

No policy year deductible

applies

70% (of the negotiated

charge)

Not covered

Allergy sera and extracts

administered via injection at a

physician’s or specialist’s office

100% (of the negotiated

charge)

No policy year deductible

applies

70% (of the negotiated

charge)

Not covered

Physician and specialist surgical services

Inpatient surgery performed

during your stay in a hospital or

birthing center by a surgeon

(includes anesthetist and surgical

assistant expenses)

100% (of the negotiated

charge)

No policy year deductible

applies

70% (of the negotiated

charge)

Not covered

The following are not covered under this benefit:

•

The services of any other physician who helps the operating physician

•

A stay in a hospital (Hospital stays are covered in the Eligible health services and exclusions – Hospital and other facility

care section)

•

Services of another physician for the administration of a local anesthetic

Outpatient surgery performed at

a physician’s or specialist’s office

or outpatient department of a

hospital or surgery center by a

surgeon (includes anesthetist and

surgical assistant expenses)

100% (of the negotiated

charge) per visit

No policy year deductible

applies

70% (of the negotiated

charge) per visit

Not covered

The following are not covered under this benefit:

•

The services of any other physician who helps the operating physician

•

A stay in a hospital (Hospital stays are covered in the Eligible health services and exclusions – Hospital and other facility

care section)

•

A separate facility charge for surgery performed in a physician’s office

•

Services of another physician for the administration of a local anesthetic

Alternatives to physician office visits

Walk-in clinic visits

(non-emergency visit)

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit thereafter

No policy year deductible

applies

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit thereafter

No policy year deductible

applies

Not covered

Stanford University 2023-2024 Page 12

Eligible health services

Tier 1 (Stanford Health

Care, Menlo Medical Clinic,

Sutter Health) In-network

coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Hospital and other facility care

Inpatient hospital (room and

board) and other

miscellaneous services and

supplies)

Includes birthing center facility

charges

$500 copayment then the

plan pays 100% (of the

balance of the negotiated

charge) per admission

70% (of the negotiated

charge) per admission

Not covered

Preadmission testing

Covered according to the type of benefit and the place

where the service is received.

Not covered

In-hospital non-surgical physician

services

100% (of the negotiated

charge) per visit

No policy year deductible

applies

70% (of the negotiated

charge) per visit

Not covered

Alternatives to hospital stays

Outpatient surgery (facility

charges) performed in the

outpatient department of a

hospital or surgery center

$250 copayment then the

plan pays 100% (of the

balance of the negotiated

charge)

70% (of the negotiated

charge)

Not covered

The following are not covered under this benefit:

•

The services of any other physician who helps the operating physician

•

A stay in a hospital (See the Hospital care – facility charges benefit in this section)

•

A separate facility charge for surgery performed in a physician’s office

•

Services of another physician for the administration of a local anesthetic

Home health Care

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit thereafter

No policy year deductible

applies

70% (of the negotiated

charge) per visit

Not covered

Maximum visits per policy year

100

Not applicable

The following are not covered under this benefit:

•

Nursing and home health aide services or therapeutic support services provided outside of the home (such as in

conjunction with school, vacation, work or recreational activities)

•

Transportation

•

Services or supplies provided to a minor or dependent adult when a family member or caregiver is not present

•

Homemaker or housekeeper services

•

Food or home delivered services

•

Maintenance therapy

Stanford University 2023-2024 Page 13

Eligible health services

Tier 1 (Stanford Health

Care, Menlo Medical Clinic,

Sutter Health) In-network

coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Hospice-Inpatient

100% (of the negotiated

charge) per admission

No policy year deductible

applies

70% (of the negotiated

charge) per admission

Not covered

Hospice-Outpatient

100% (of the negotiated

charge) per visit

No policy year deductible

applies

70% (of the negotiated

charge) per visit

Not covered

The following are not covered under this benefit:

•

Funeral arrangements

•

Financial or legal counseling which includes estate planning and the drafting of a will

•

Homemaker or caretaker services that are services which are not solely related to your care and may include:

-

Sitter or companion services for either you or other family members

-

Transportation

-

Maintenance of the house

Skilled nursing facility-

Inpatient

$500 copayment then the

plan pays 100% (of the

balance of the negotiated

charge)

70% (of the negotiated

charge)

Not covered

Maximum days of

confinement per policy year

unlimited

Not covered

Hospital emergency room

$100 copayment then the

plan pays 100% (of the

balance of the negotiated

charge) per visit

No policy year deductible

applies

$100 copayment then the

plan pays 100% (of the

balance of the negotiated

charge) per visit

No policy year deductible

applies

Paid the same as Tier 1 in-

network coverage

Non-emergency care in a hospital

emergency room

Not covered

Not covered

Not covered

Important note:

•

As out-of-network providers do not have a contract with us the provider may not accept payment of your cost share,

(copayment/coinsurance), as payment in full. You may receive a bill for the difference between the amount billed by the

provider and the amount paid by this plan. If the provider bills you for an amount above your cost share, you are not

responsible for paying that amount. You should send the bill to the address listed on the back of your ID card, and we will

resolve any payment dispute with the provider over that amount. Make sure the ID card number is on the bill.

•

A separate hospital emergency room copayment/coinsurance will apply for each visit to an emergency room. If you are

admitted to a hospital as an inpatient right after a visit to an emergency room, your emergency room

copayment/coinsurance will be waived and your inpatient copayment/coinsurance will apply.

•

Covered benefits that are applied to the hospital emergency room copayment/coinsurance cannot be applied to any other

copayment/coinsurance under the plan. Likewise, a copayment/coinsurance that applies to other covered benefits under

the plan cannot be applied to the hospital emergency room copayment/coinsurance.

Stanford University 2023-2024 Page 14

•

Separate copayment/coinsurance amounts may apply for certain services given to you in the hospital emergency room

that are not part of the hospital emergency room benefit. These copayment/coinsurance amounts may be different from

the hospital emergency room copayment/coinsurance. They are based on the specific service given to you.

•

Services given to you in the hospital emergency room that are not part of the hospital emergency room benefit may be

subject to copayment/coinsurance amounts that are different from the hospital emergency room copayment/coinsurance

amounts.

The following are not covered under this benefit:

•

Non-emergency services in a hospital emergency room facility, freestanding emergency medical care facility or

comparable emergency facility

Eligible health services

Tier 1 (Stanford Health Care,

Menlo Medical Clinic, Sutter

Health) In-network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Urgent care

$50 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit thereafter

No policy year deductible

applies

$50 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit thereafter

No policy year deductible

applies

$50 copayment then the plan

pays 100% (of the balance of

the recognized charge) per

visit thereafter

No policy year deductible

applies

Non-urgent use of an urgent care

provider

Not covered

Not covered

Not covered

The following is not covered under this benefit:

•

Non-urgent care in an urgent care facility (at a non-hospital freestanding facility)

Pediatric dental care (Limited to covered persons through the end of the month in which the person turns age 19.

Type A services

Tier 1 providers do not

provide dental services

100% (of the negotiated

charge) per visit

No copayment or deductible

applies

Not covered

Type B services

Tier 1 providers do not

provide dental services

80% (of the negotiated

charge) per visit

No copayment or deductible

applies

Not covered

Type C services

Tier 1 providers do not

provide dental services

50% (of the negotiated

charge) per visit

No copayment or deductible

applies

Not covered

Orthodontic services

Tier 1 providers do not

provide dental services

50% (of the negotiated

charge) per visit

No copayment or deductible

applies

Not covered

Dental emergency services

Tier 1 providers do not

provide dental services

Covered according to the

type of benefit and the place

where the service is received.

Not covered

Stanford University 2023-2024 Page 15

Pediatric dental care exclusion

The following are not covered under this benefit:

•

Asynchronous dental treatment

•

Cosmetic services and supplies including plastic surgery, reconstructive surgery, cosmetic surgery, personalization or

characterization of dentures or other services and supplies which improve alter or enhance appearance, augmentation

and vestibuloplasty, and other substances to protect, clean, whiten bleach or alter the appearance of teeth; whether or

not for psychological or emotional reasons. Facings on molar crowns and pontics will always be considered cosmetic.

•

Crown, inlays, onlays, and veneers unless:

-

It is treatment for decay or traumatic injury and teeth cannot be restored with a filling material or

-

The tooth is an abutment to a covered partial denture or fixed bridge

•

Dental implants (that are determined not to be medically necessary mouth guards, and other devices to protect, replace

or reposition teeth

•

Dentures, crowns, inlays, onlays, bridges, or other appliances or services used:

-

For splinting

-

To alter vertical dimension

-

To restore occlusion

-

For correcting attrition, abrasion, abfraction or erosion

•

Treatment of any jaw joint disorder and treatments to alter bite or the alignment or operation of the jaw, including

temporomandibular joint dysfunction disorder (TMJ) and craniomandibular joint dysfunction disorder (CMJ) treatment,

orthognathic surgery, and treatment of malocclusion or devices to alter bite or alignment, except as covered in the

Eligible health services and exclusions – Specific conditions section

•

General anesthesia and intravenous sedation, unless specifically covered and only when done in connection with another

eligible health service

•

Mail order and at-home kits for orthodontic treatment

•

Orthodontic treatment except as covered in this section

•

Pontics, crowns, cast or processed restorations made with high noble metals (gold)

•

Prescribed drugs

•

Replacement of teeth beyond the normal complement of 32

•

Services and supplies:

-

Done where there is no evidence of pathology, dysfunction, or disease other than covered preventive services

-

Provided for your personal comfort or convenience or the convenience of another person, including a provider

-

Provided in connection with treatment or care that is not covered under your policy

•

Surgical removal of impacted wisdom teeth only for orthodontic reasons, except as medically necessary

•

Treatment by other than a dental provider

Eligible health services

Tier 1 (Stanford Health Care,

Menlo Medical Clinic, Sutter

Health) In-network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Diabetic services and supplies

(including equipment and

training)

Covered according to the

type of benefit and the place

where the service is received.

Covered according to the

type of benefit and the place

where the service is received.

Not covered

Podiatric (foot care) treatment

Physician and specialist non-

routine foot care treatment

Covered according to the

type of benefit and the place

where the service is received.

Covered according to the

type of benefit and the place

where the service is

received.

Not covered

The following are not covered under this benefit:

•

Services and supplies for:

-

The treatment of calluses, bunions, toenails, flat feet, hammertoes, fallen arches

-

The treatment of weak feet, chronic foot pain or conditions caused by routine activities, such as walking, running,

Stanford University 2023-2024 Page 16

working or wearing shoes

-

Supplies (including orthopedic shoes), foot orthotics, arch supports, shoe inserts, ankle braces, guards, protectors,

creams, ointments and other equipment, devices and supplies

-

Routine pedicure services, such as cutting of nails, corns and calluses when there is no illness or injury of the feet

Eligible health services

Tier 1 (Stanford Health

Care, Menlo Medical Clinic,

Sutter Health) In-network

coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Accidental injury to sound

natural teeth

100% (of the negotiated

charge)

No policy year deductible

applies

70% (of the negotiated

charge)

Not covered

The following are not covered under this benefit:

•

The care, filling, removal or replacement of teeth and treatment of diseases of the teeth

•

Dental services related to the gums

•

Apicoectomy (dental root resection)

•

Orthodontics

•

Root canal treatment

•

Soft tissue impactions

•

Bony impacted teeth

•

Alveolectomy

•

Augmentation and vestibuloplasty treatment of periodontal disease

•

False teeth

•

Prosthetic restoration of dental implants

•

Dental implants

Temporomandibular joint

dysfunction (TMJ) and

craniomandibular joint

dysfunction (CMJ) treatment

Covered according to the

type of benefit and the place

where the service is received.

Covered according to the

type of benefit and the place

where the service is received.

Not covered

The following are not covered under this benefit:

•

Dental implants

Blood and body fluid exposure

Covered according to the

type of benefit and the place

where the service is

received.

Covered according to the

type of benefit and the place

where the service is

received.

Not covered

The following are not covered under this benefit:

•

Services and supplies provided for the treatment of an illness that results from your clinical related injury as these are

covered elsewhere in the student policy

Clinical trial (routine patient

costs)

Covered according to the

type of benefit and the place

where the service is

received.

Covered according to the

type of benefit and the place

where the service is

received.

Not covered

The following are not covered under this benefit:

•

Services and supplies related to data collection and record-keeping that is solely needed due to the clinical trial (i.e.

protocol-induced costs)

•

Services and supplies provided by the trial sponsor without charge to you

•

The experimental intervention itself (except medically necessary Category B investigational devices and promising

Stanford University 2023-2024 Page 17

experimental and investigational interventions for terminal illnesses in certain clinical trials in accordance with Aetna’s

claim policies)

Eligible health services

Tier 1 (Stanford Health Care,

Menlo Medical Clinic, Sutter

Health) In-network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Dermatological treatment

Covered according to the

type of benefit and the place

where the service is received.

Covered according to the

type of benefit and the place

where the service is received.

Not covered

The following are not covered under this benefit:

•

Cosmetic treatment and procedures

Obesity bariatric Surgery and

services

Covered according to the

type of benefit and the place

where the service is

received.

Covered according to the

type of benefit and the place

where the service is

received.

Not covered

Obesity surgery-travel and lodging

Maximum benefit payable for

travel expenses for each round

trip – three round trips covered

(one pre-surgical visit, the

surgery and one follow-up visit)

$130

Not applicable

Maximum benefit payable for

travel expenses per companion

for each round trip – two round

trips covered (the surgery and

one follow-up visit)

$130

Not applicable

Maximum benefit payable for

lodging expenses per patient and

companion for the pre-surgical

and follow-up visits

$100 per day, up to two days

Not applicable

Maximum benefit payable for

lodging expenses per companion

for surgery stay

$100 per day, up to four days

Not applicable

The following are not covered under this benefit:

•

Weight management treatment or drugs intended to decrease or increase body weight, control weight or treat obesity,

including morbid obesity except as described above and in the Eligible health services and exclusions – Preventive care and

wellness section, including preventive services for obesity screening and weight management interventions. This is

regardless of the existence of other medical conditions. Examples of these are:

-

Drugs, stimulants, preparations, foods or diet supplements, dietary regimens and supplements, food supplements,

appetite suppressants and other medications

-

Hypnosis or other forms of therapy

-

Exercise programs, exercise equipment, membership to health or fitness clubs, recreational therapy or other forms of

activity or activity enhancement

Stanford University 2023-2024 Page 18

Eligible health services

Tier 1 (Stanford Health Care,

Menlo Medical Clinic, Sutter

Health) In-network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Maternity care that is not

considered preventive care

(includes delivery and postpartum

care services in a hospital or

birthing center)

Covered according to the

type of benefit and the place

where the service is received.

Covered according to the

type of benefit and the place

where the service is received.

Not covered

The following are not covered under this benefit:

•

Any services and supplies related to births that take place in the home or in any other place not licensed to perform

deliveries

Well newborn nursery

care in a hospital or

birthing center

100% (of the negotiated

charge) per visit

No policy year deductible

applies

70% (of the negotiated

charge) per visit

No policy year deductible

applies

Not covered

Family planning services – other

Voluntary sterilization

for males-inpatient surgical

services

$50 copayment then the plan

pays 100% (of the negotiated

charge)

No policy year deductible

applies

$100 copayment then the plan

pays 100% (of the negotiated

charge)

Not covered

Voluntary sterilization

for males-outpatient surgical

services

$50 copayment then the plan

pays 100% (of the negotiated

charge)

No policy year deductible

applies

$100 copayment then the plan

pays 100% (of the negotiated

charge)

Not covered

Abortion

Inpatient physician or specialist

surgical services

100% (of the negotiated

charge)

No policy year deductible

applies

100% (of the negotiated

charge)

No policy year deductible

applies

Not covered

Outpatient physician or

specialist surgical services

100% (of the negotiated

charge)

No policy year deductible

applies

100% (of the negotiated

charge)

No policy year deductible

applies

Not covered

Reversal of voluntary sterilization

Inpatient physician or specialist

surgical services

100% (of the negotiated

charge)

No policy year deductible

applies

70% (of the negotiated

charge)

Not covered

Stanford University 2023-2024 Page 19

Eligible health services

Tier 1 (Stanford Health Care,

Menlo Medical Clinic, Sutter

Health) In-network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Outpatient physician or

specialist surgical services

100% (of the negotiated

charge)

No policy year deductible

applies

70% (of the negotiated

charge)

Not covered

Gender affirming treatment

Surgical, hormone replacement

therapy, and counseling

treatment

Covered according to the

Behavioral health section

Covered according to the

Behavioral health section

Not covered

Mental Health & Substance related disorders treatment

Coverage provided under the same terms, conditions as any other illness.

Inpatient hospital

(room and board and other

miscellaneous hospital

services and supplies)

$500 copayment then the

plan pays 100% (of the

negotiated charge) per

admission

100% (of the negotiated

charge) per admission

Not covered

Outpatient office visits

(includes telemedicine

consultations)

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit thereafter

No policy year deductible

applies

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit thereafter

No policy year deductible

applies

Not covered

Other outpatient treatment

(includes skilled behavioral

health services in the home)

100% (of the negotiated

charge) per visit

No policy year deductible

applies

100% (of the negotiated

charge) per visit

No policy year deductible

applies

Not covered

Transplant services

Inpatient and outpatient

transplant facility services

Covered according to the

type of benefit and the place

where the service is received.

Covered according to the

type of benefit and the place

where the service is received.

Not covered

Inpatient and outpatient

transplant physician and

specialist services

Covered according to the

type of benefit and the place

where the service is received.

Covered according to the

type of benefit and the place

where the service is received.

Not covered

Transplant services-travel and

lodging

Covered

Covered

Not applicable

Lifetime Maximum payable for

Travel and Lodging Expenses for

any one transplant, including

tandem transplants

$10,000

$10,000

Not applicable

Maximum payable for Lodging

Expenses per IOE patient

$50 per night

$50 per night

Not applicable

Maximum payable for Lodging

Expenses per companion

$50 per night

$50 per night

Not applicable

Stanford University 2023-2024 Page 20

The following are not covered under this benefit:

•

Services and supplies furnished to a donor when the recipient is not a covered person

•

Harvesting and storage of organs, without intending to use them for immediate transplantation for your existing illness

•

Harvesting and/or storage of bone marrow, hematopoietic stem cells, or other blood cells without intending to use them

for transplantation within 12 months from harvesting, for an existing illness

Eligible health services

Tier 1 (Stanford Health Care,

Menlo Medical Clinic, Sutter

Health) In-network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Treatment of infertility

Basic infertility services Inpatient

and outpatient care - basic

infertility

Covered according to the

type of benefit and the place

where the service is received.

Covered according to the

type of benefit and the place

where the service is received.

Not covered

Comprehensive infertility

services. Inpatient and

outpatient care

50% (of the negotiated charge)

Not covered

Artificial insemination maximum

per policy year

6 attempts

Not applicable

Maximum number of

intrauterine insemination cycles

per policy year

6 attempts

Not applicable

Advanced reproductive

technology (ART) services.

Inpatient and outpatient care

50% (of the negotiated charge)

Not covered

Maximum number of cycles per

policy year

1 course of treatment

Not applicable

Fertility preservation services

Fertility preservation

Covered according to the

type of benefit and the place

where the service is received.

Covered according to the

type of benefit and the place

where the service is received.

Not covered

The following are not covered services under the infertility treatment benefit:

•

Injectable infertility medication, including but not limited to menotropins, hCG, and GnRH agonists.

•

All charges associated with:

-

Surrogacy for you or the surrogate. A surrogate is a female carrying her own genetically related child where the child

is conceived with the intention of turning the child over to be raised by others, including the biological father

-

Thawing of cryopreserved (frozen) eggs, embryos or sperm

-

The care of the donor in a donor egg cycle which includes, but is not limited to, any payments to the donor, donor

screening fees, fees for lab tests, and any charges associated with care of the donor required for donor egg retrievals

or transfers

-

The use of a gestational carrier for the female acting as the gestational carrier. A gestational carrier is a female

carrying an embryo to which the person is not genetically related

-

Obtaining sperm from a person not covered under this plan for ART services

-

Home ovulation prediction kits or home pregnancy tests

-

The purchase of donor embryos, donor oocytes, or donor sperm

-

Reversal of voluntary sterilizations, including follow-up care

•

Ovulation induction with menotropins, Intrauterine insemination and any related services, products or procedures

•

In vitro fertilization (IVF), Zygote intrafallopian transfer (ZIFT), Gamete intrafallopian transfer (GIFT),

Cryopreserved embryo transfers and any related services, products or procedures (such as Intracytoplasmic

Stanford University 2023-2024 Page 21

sperm injection (ICSI) or ovum microsurgery)

•

ART services are not provided for out-of-network care

Eligible health services

Tier 1 (Stanford Health Care,

Menlo Medical Clinic, Sutter

Health) In-network coverage

Tier 2 Aetna In-network

coverage

(IOE facility)

Out-of-network coverage

Specific therapies and tests

Diagnostic complex imaging

services performed in the

outpatient department of a

hospital or other facility

$100 copayment then the

plan pays 100% (of the

negotiated charge) per visit

No policy year deductible

applies

70% (of the negotiated

charge) per visit

Not covered

Diagnostic lab work and

radiological services performed

in a physician’s office, the

outpatient department of a

hospital or other facility

100% (of the negotiated

charge) per visit

No policy year deductible

applies

70% (of the negotiated

charge) per visit

Not covered

Outpatient Chemotherapy,

Radiation & Respiratory Therapy

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit

No policy year deductible

applies

70% (of the negotiated

charge) per visit

Not covered

Outpatient infusion therapy

performed in a covered person’s

home, physician’s office,

outpatient department of a

hospital or other facility

Covered according to the

type of benefit and the place

where the service is received.

Covered according to the

type of benefit and the place

where the service is

received.

Not covered

The following are not covered under this benefit:

•

Enteral nutrition

•

Blood transfusions and blood products

Outpatient Cardiac and

Pulmonary Therapy

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit

No policy year deductible

applies

$40 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit

Not covered

Outpatient physical,

occupational, speech, and

cognitive therapies

Combined for short-term

rehabilitation services and

habilitation therapy services

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit

No policy year deductible

applies

$40 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit

Not covered

Stanford University 2023-2024 Page 22

Eligible health services

Tier 1 (Stanford Health Care,

Menlo Medical Clinic, Sutter

Health) In-network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Acupuncture therapy

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit

No policy year deductible

applies

70% (of the negotiated

charge) per visit, after policy

year deductible

Not covered

The following are not covered under this benefit:

•

Acupressure

Chiropractic services

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit

No policy year deductible

applies

70% (of the negotiated

charge) per visit, after policy

year deductible

Not covered

Maximum visits per policy year

15 visits

Not applicable

Specialty prescription drugs

purchased and injected or

infused by your provider in an

outpatient setting

Covered according to the

type of benefit or the place

where the service is received.

Covered according to the

type of benefit or the place

where the service is received.

Not covered

Other services and supplies

Emergency ground, air, and

water ambulance

(includes non-emergency

ambulance)

100% (of the negotiated

charge) per trip

No policy year deductible

applies

100% (of the negotiated

charge) per trip

No policy year deductible

applies

Paid the same in-network

coverage

Durable medical and surgical

equipment

100% (of the negotiated

charge) per item

No policy year deductible

applies

70% (of the negotiated

charge) per item

Not covered

The following are not covered under this benefit:

•

Whirlpools

•

Portable whirlpool pumps

•

Sauna baths

•

Massage devices

•

Over bed tables

•

Elevators

•

Communication aids

•

Vision aids

•

Telephone alert systems

•

Personal hygiene and convenience items such as air conditioners, humidifiers, hot tubs, or physical exercise

equipment even if they are prescribed by a physician

Stanford University 2023-2024 Page 23

Eligible health services

Tier 1 (Stanford Health Care,

Menlo Medical Clinic, Sutter

Health) In-network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Nutritional support

Covered according to the

type of benefit and the place

where the service is

received.

Covered according to the

type of benefit and the place

where the service is

received.

Not covered

The following are not covered under this benefit:

•

Any food item, including infant formulas, nutritional supplements, vitamins, plus prescription vitamins, medical foods and

other nutritional items, even if it is the sole source of nutrition

Cochlear implants

100% (of the negotiated

charge) per item

No policy year deductible

applies

70% (of the negotiated

charge) per item

Not covered

Prosthetic devices including

contact lenses for aniridia &

Orthotics

100% (of the negotiated

charge) per item

No policy year deductible

applies

70% (of the negotiated

charge) per item

Not covered

The following are not covered under this benefit:

•

Services covered under any other benefit

•

Orthopedic shoes, therapeutic shoes, foot orthotics, or other devices to support the feet, unless required for the

treatment of or to prevent complications of diabetes, or if the orthopedic shoe is an integral part of a covered leg brace

•

Trusses, corsets, and other support items

•

Repair and replacement due to loss or misuse

•

Communication aids

Hearing Exams

Hearing exam

100% (of the negotiated

charge) per visit

No policy year deductible

applies

100% (of the negotiated

charge) per visit

No policy year deductible

applies

Not covered

The following are not covered under this benefit:

•

Hearing exams given during a stay in a hospital or other facility, except those provided to newborns as part of the overall

hospital stay

Pediatric vision care (Limited to covered persons through the end of the month in which the person turns age 19)

Performed by a legally qualified

ophthalmologist or optometrist

(includes comprehensive low

vision evaluations)

100% (of the negotiated

charge) per visit

No policy year deductible

applies

100% (of the negotiated

charge) per visit

No policy year deductible

applies

Not covered

Low vision Maximum

One comprehensive low vision evaluation every five years

Fitting of contact Maximum

1 visit

Not applicable

Stanford University 2023-2024 Page 24

Eligible health services

Tier 1 (Stanford Health Care,

Menlo Medical Clinic, Sutter

Health) In-network coverage

Tier 2 Aetna In-network

coverage

Out-of-network coverage

Pediatric vision care services &

supplies-Eyeglass frames,

prescription lenses or

prescription contact lenses

100% (of the negotiated

charge) per item

No policy year deductible

applies

100% (of the negotiated

charge) per item

No policy year deductible

applies

Not covered

Maximum number Per year:

Eyeglass frames

One set of eyeglass frames

Prescription lenses

One pair of prescription lenses

Contact lenses (includes non-

conventional prescription contact

lenses & aphakic lenses

prescribed after cataract surgery)

Daily disposables: one-year supply

Extended wear disposable: one-year supply

Non-disposable lenses: one-year supply

Not applicable

Optical devices

Covered according to the type of benefit and the place where

the service is received.

Not applicable

Maximum number of optical

devices per policy year

One optical device

Not applicable

*Important note: Refer to the Vision care section in the Certificate for the explanation of these vision care supplies. As to

coverage for prescription lenses in a policy year, this benefit will cover either prescription lenses for eyeglass frames or

prescription contact lenses, but not both.

The following are not covered under this benefit:

•

Eyeglass frames, non-prescription lenses and non-prescription contact lenses that are for cosmetic purposes

Adult vision care Limited to covered persons age 19 and over

Adult routine vision exams

(including refraction) Performed

by a legally qualified

ophthalmologist or therapeutic

optometrist, or any other

providers acting within the scope

of their license

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit

No policy year deductible

applies

$25 copayment then the plan

pays 100% (of the balance of

the negotiated charge) per

visit

No policy year deductible

applies

Not covered

Maximum visits per policy year

1 visit

Not applicable

The following are not covered under this benefit:

Adult vision care

•

Office visits to an ophthalmologist, optometrist or optician related to the fitting of prescription contact lenses

•

Eyeglass frames, non-prescription lenses and non-prescription contact lenses that are for cosmetic purposes

Adult vision care services and supplies

•

Special supplies such as non-prescription sunglasses

•

Special vision procedures, such as orthoptics or vision therapy

•

Eye exams during your stay in a hospital or other facility for health care

•

Eye exams for contact lenses or their fitting

•

Eyeglasses or duplicate or spare eyeglasses or lenses or frames

•

Replacement of lenses or frames that are lost or stolen or broken

•

Acuity tests

•

Eye surgery for the correction of vision, including radial keratotomy, LASIK and similar procedures

•

Services to treat errors of refraction

Stanford University 2023-2024 Page 25

Eligible health services

In-network coverage

Out-of-network coverage

Outpatient prescription drugs

Outpatient prescription drug copayment/coinsurance waiver for risk reducing breast cancer

The per prescription copayment/coinsurance will not apply to risk reducing breast cancer prescription drugs when obtained at a

retail in-network, pharmacy. This means that such risk reducing breast cancer prescription drugs are paid at 100%.

Outpatient prescription drug copayment waiver for tobacco cessation prescription and over-the-counter drugs

The outpatient prescription drug copayment will not apply to treatment regimens per policy year for tobacco cessation

prescription drugs and OTC drugs when obtained at an in-network pharmacy. This means that such prescription drugs and

OTC drugs are paid at 100%.

Outpatient prescription drug copayment waiver for contraceptives

The outpatient prescription drug copayment will not apply to female contraceptive methods when obtained at an in-network

pharmacy.

This means that such contraceptive methods are paid at 100% for:

•

All FDA approved contraceptive prescription drugs and devices, including over-the-counter (OTC) contraceptive prescription

drugs and devices. Related services and supplies needed to administer covered devices will also be paid at 100%.

•

A therapeutic equivalent prescription drug or device when a prescription drug or device is not available or is deemed

medically inadvisable by your provider when you are granted a medical exception.

The Certificate explains how to get a medical exception.

Eligible health services

In-network coverage

Out-of-network coverage

Preferred generic prescription drugs

For each fill up to a 30 day supply

filled at a retail pharmacy

$10 copayment per supply then the plan

pays 100% (of the negotiated charge)

No policy year deductible applies

Not covered

Preferred brand-name prescription drugs

For each fill up to a 30 day supply

filled at a retail pharmacy

$35 copayment per supply then the plan

pays 100% (of the negotiated charge)

No policy year deductible applies

Not covered

Non-preferred generic prescription drugs

For each fill up to a 30 day supply

filled at a retail pharmacy

$50 copayment per supply then the plan

pays 100% (of the negotiated charge)

No policy year deductible applies

Not covered

Non-preferred brand-name prescription drugs

For each fill up to a 30 day supply

filled at a retail pharmacy

$50 copayment per supply then the plan

pays 100% (of the negotiated charge)

No policy year deductible applies

Not covered

Specialty prescription drugs

For each fill up to a 30- day supply

filled at a specialty pharmacy or a

retail pharmacy

$50 copayment per supply then the plan

pays 100% (of the negotiated charge)

No policy year deductible applies

Not covered

Stanford University 2023-2024 Page 26

Eligible health services

In-network coverage

Out-of-network coverage

Contraceptives (birth control)

For each fill up to a 12 month

supply of generic and OTC drugs

and devices filled at a retail

pharmacy

100% (of the negotiated charge)

No policy year deductible applies

Not covered

For each fill up to a 12 month

supply of brand name prescription

drugs and devices filled at a retail

pharmacy

Paid according to the type of drug per the

schedule of benefits, above

A brand name contraceptive is 100% (of

the negotiated charge), No policy year

deductible if there are no generic

therapeutic equivalents.

Not covered

Orally administered anti-cancer

prescription drugs- For each fill up

to a 30 day supply filled at a retail

pharmacy

100% (of the negotiated charge)

No policy year deductible applies

Not covered

Preventive care drugs and

supplements filled at a retail

pharmacy

For each 30 day supply

100% (of the negotiated charge per

prescription or refill

No copayment or policy year deductible

applies

Not covered

Risk reducing breast cancer

prescription drugs filled at a

pharmacy

For each 30 day supply

100% (of the negotiated charge) per

prescription or refill

No copayment or policy year deductible

applies

Not covered

Maximums:

Coverage will be subject to any sex, age,

medical condition, family history, and

frequency guidelines in the

recommendations of the United States

Preventive Services Task Force.

Not applicable

Sexual enhancement or

dysfunction prescription drugs-Up

to 8 pills for each 30 day supply

filled at a retail pharmacy

Paid according to the tier of drug in the

schedule of benefits above

Not covered

Sexual enhancement or

dysfunction prescription drugsUp

to 27 pills for all fills greater than a

30 day supply but no more than a

90 day supply filled at a mail order

pharmacy

Paid according to the tier of drug in the

schedule of benefits above

Not covered

Stanford University 2023-2024 Page 27

Eligible health services

In-network coverage

Out-of-network coverage

Tobacco cessation prescription

and over-the-counter drugs

(Preventive care)-Tobacco

cessation prescription drugs and

OTC drugs filled at a pharmacy

For each 30 day supply

100% (of the negotiated charge per

prescription or refill

No copayment or policy year deductible

applies

Not covered

Maximums:

Coverage will be subject to any sex, age,

medical condition, family history, and

frequency guidelines in the

recommendations of the United States

Preventive Services Task Force.

Not applicable

Outpatient prescription drugs exclusions

The following are not covered under the outpatient prescription drugs benefit:

•

Biological sera unless specified on the preferred drug guide

•

Compounded prescriptions containing bulk chemicals not approved by the U.S. Food and Drug Administration (FDA)

including compounded bioidentical hormones

•

Cosmetic drugs including medications and preparations used for cosmetic purposes

•

Devices, products and appliances, except those that are specially covered

•

Dietary supplements

•

Drugs or medications

-

Which do not, by federal or state law, require a prescription order i.e. over-the-counter (OTC) drugs, even if a

prescription is written except as specifically provided above

-

Not approved by the FDA or not proven safe or effective

-

Provided under your medical plan while an inpatient of a healthcare facility

-

Recently approved by the U.S. Food and Drug Administration (FDA), but which have not yet been reviewed by our

Pharmacy and Therapeutics Committee, unless we have approved a medical exception

-

That include vitamins and minerals unless recommended by the United States Preventive Services Task Force

(USPSTF)

-

For which the cost is covered by a federal, state, or government agency (for example: Medicaid or Veterans

Administration)

-

That are used to treat increase sexual desire, including drugs, implants, devices or preparations to correct or

enhance erectile function, enhance sensitivity, or alter the shape or appearance of a sex organ

-

That are used for the purpose of weight gain or reduction, including but not limited to stimulants, preparations,

foods or diet supplements, dietary regimens and supplements, food or food supplements, appetite suppressants

or other medications

-

That are drugs or growth hormones used to stimulate growth and treat idiopathic short stature unless there is

evidence that the covered person meets one or more clinical criteria detailed in our [precertification] and clinical

policies]

•

Duplicative drug therapy (e.g. two antihistamine drugs)

•

Immunizations related to travel or work

•

Infertility

-

Injectable prescription drugs used primarily for the treatment of infertility

•

Injectables

-

Any charges for the administration or injection of prescription drugs or injectable insulin and other injectable

drugs covered by us.

-

Needles and syringes, except for those used for insulin administration.

-