e-Tutorial

Download Form 16A

Copyright © 2012 Income Tax Department 1

Login to TRACES

Copyright © 2012 Income Tax Department 2

• For first time login to TRACES, migrated user from TIN must enter the User Id and Password for

their TAN Account in TIN

Click on help ion

next to each field

for more details

For more details

on any screen,

click on Help icon

Enter the text as

displayed in

Verification Code

Enter TAN

Enter userid

and password

Copyright © 2012 Income Tax Department 3

Landing page will be

displayed

Landing Page

• Form 16 A downloaded from TRACES are considered as valid TDS certificates, as per

CBDT iula / dated th Apil.

• Form 16 A is generated only for valid PAN. In case of invalid PAN or if the PAN is not

reported in TDS statement, Form 16 A will not be generated.

• TDS certificates downloaded from TRACES are non-editable.

• Password to open Form 16 A is TAN number in Capital letters i.e. ABCD12345E.

Important Notes :

Copyright © 2012 Income Tax Department 4

Copyright © 2012 Income Tax Department 5

Select from Menu

• Download request for Form 16A for a particular FY and Quarter can be submitted

only after Form 26Q or 27Q statement for selected FY and Quarter is filed by

deductor and processed by TDS CPC. Statement filed should not have been

cancelled or NIL Statement.

• Form 16A can be downloaded from FY 2007-08 onwards

• Data in Form 16A will be as per latest statement processed (Form 26Q and 27Q)

for selected FY & Quarter

• For a given FY, Quarter, TAN and PAN, there will be only one Form 16A for all Form

Types and Section Codes

Ude Doloads, lik

o Fo A to plae

download request

For individual PANs, select

Financial Year, Quarter and

Form Type for which Form

16A is required and enter PAN

ad lik o Add

Copyright © 2012 Income Tax Department 6

• Validation screen will be presented on click of Go

• PAN must be present in PAN database and also in the latest Form 26Q / 27Q

statements of selected FY and Quarter

• Form Type field is used to populate validation screen on next step

Enter Search Criteria

Valid PANs will be added to the

list. Select a PAN and click on

‘eoe to eoe it fo the

list.

Click on Help icon

for help text for

this screen

For downloading Form 16A

for all PANs , select Financial

Year, Quarter and Form Type

for which Form 16A is

required and lik o Go

Clik o Go to

proceed with

download request

Copyright © 2012 Income Tax Department 7

Details to be printed on Form 16A

This information will be printed on

Form 16A for each PAN. Details will

be populated from your profile

information in TRACES

Clik o “uit to

submit download

request for Form 16A

Click o Cael ad

go to Pofile section

to update details

Copyright © 2012 Income Tax Department 8

Token Number Details

Enter Authentication Code

if the validation is done

earlier and you have the

Authentication Code

Enter Token Number of only

Regular (Original) Statement

corresponding to the

Financial Year, Quarter and

Form Type displayed above

Copyright © 2012 Income Tax Department 9

Token Number Details (Contd.)

Tick in Check Box for NIL

Challan or Book

Adjustment

Government deductors not

having BIN details tick here and

need not need provide BSR and

Challan Serial Number below

Enter CIN details for a

challan used in the

statement

Click on Guide to select

suitable Challan option

PANs entered must be those

for which payment has been

done using the CIN / BIN

entered on this screen

Tick here if you do not any

Valid PAN corresponding to

above Challan details

Click on Guide to select

suitable PAN amount

Combinations

• Authentication code is generated when you clear validation details for a statement

for certain functionalities such as Download Form 16 / 16A, Download Conso File,

Download Justification Report, etc. Authentication code generated for a particular

statement will be valid for the calendar day (i.e., an authentication code generated

on 10-Dec-2012 can be used only on 10-Dec-2012 to clear validation details for the

same statement. It will not be valid the next day).

• Validation will be bypassed for the same statement within the same session

• Token Number must be of the statement of the FY, Quarter and Form Type displayed

on the screen

• CIN details must be entered for the challan which is deposited and mentioned in the

statement corresponding to the FY, Quarter and Form Type mentioned above

• Transfer Voucher details to be entered for government deductors

• Amount should be entered in two decimal places (e.g., 1234.56)

Notes for Validation Screen

Copyright © 2012 Income Tax Department 10

• Maximum of 3 distinct PANs and corresponding amount must be entered

• If there are more than three such combinations in the challan, user can enter any 3

• If there less than three such combinations in the challan, user must enter all (either

one or two)

• PAN mentioned must be that for which payment has been done using the challan /

Transfer Voucher mentioned on this screen

Notes for Validation Screen

Copyright © 2012 Income Tax Department 11

Copyright © 2012 Income Tax Department 12

Authentication Code Screen

Authentication Code

will be available here

Copyright © 2012 Income Tax Department 13

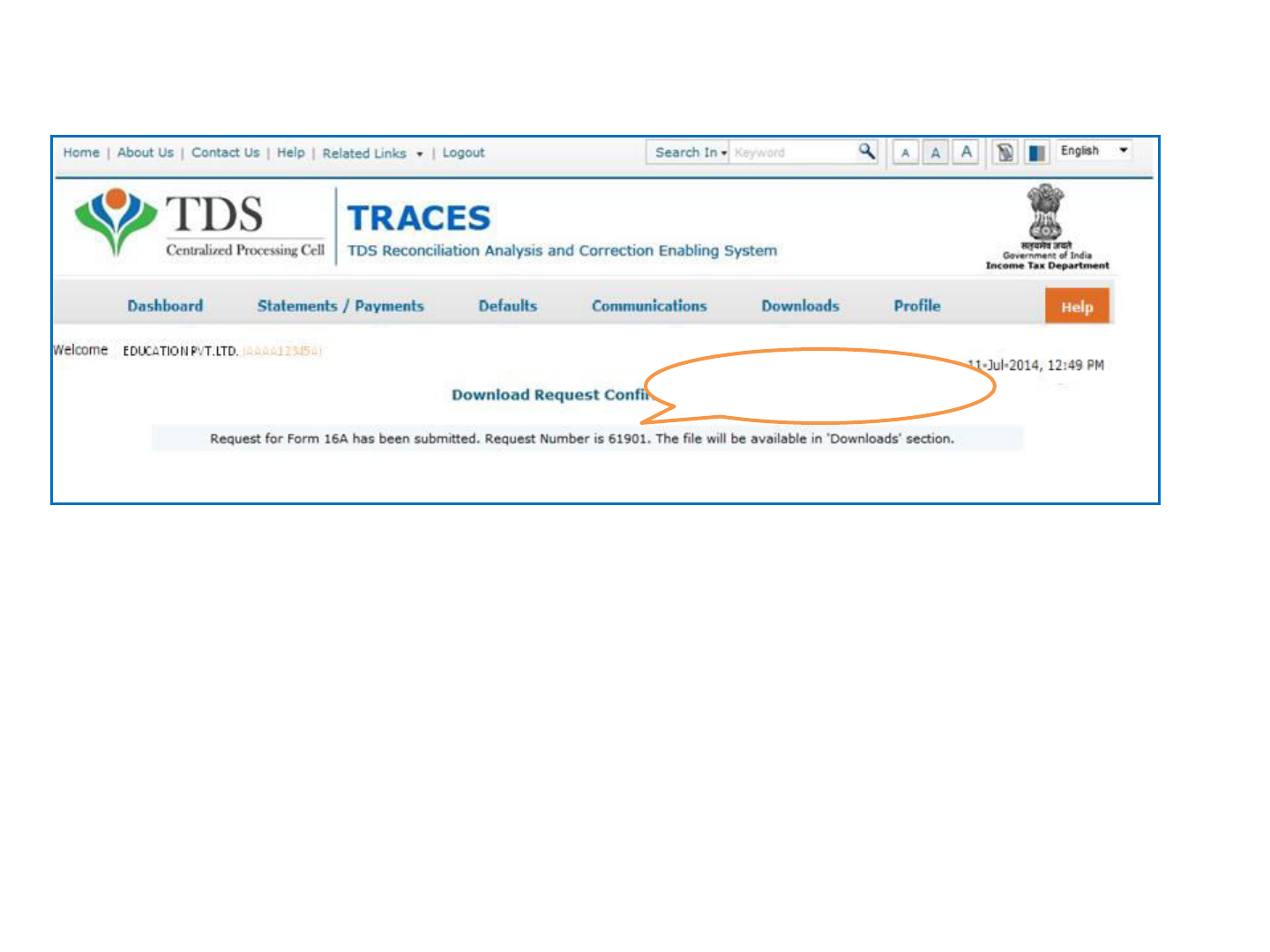

Request Number Screen

Request Number will be

available here

Copyright © 2012 Income Tax Department 14

Downloading Form 16A

• File will be available in ‘euested Doloads

Clik o ‘euested

Doloads ude

Doloads

Copyright © 2012 Income Tax Department 15

Downloading Form 16A (contd.)

Enter Request Number (Search

Option 1) or Request Date

(Search Option 2 or option 3

Vie All to ie the doload

request

Clik o T‘ACE“ PDF Geeatio

Utility to stat the doload

If PDS Utility is already downloaded, mentioned the request options and proceed

further.

If Utility is not Downloaded earlier then follow the procedure from slide 19 onwards

Copyright © 2012 Income Tax Department 16

Search Results

Click on a row to select it

Copyright © 2012 Income Tax Department 17

Search Results (contd.)

Click on the buttons to

download file

• HTTP Download is useful to download small files. It will directly download file for the

user

• Download Manager is useful to download large files and where internet bandwidth

is slow. This will launch a window, which will download an applet. The Applet is a

large file, hence first time download might take time. But for subsequent requests, it

should load immediately. User can use this tool to download file. This tool has the

ability to resume download in case of failure

Copyright © 2012 Income Tax Department 18

Downloading Form 16 A

Select Form 16\16A

Zip Files, enter

Password as your

TAN and select

destination folder to

save PDF files.

Select digital certificate to

digitally sign the PDF files.

This is not Mandatory.

Certificate details will

be displayed here.

Clik o Poeed to

continue with

generation of PDF files.

Copyright © 2012 Income Tax Department 19

Convert .ZIP File into PDF

• .Zip file will contain Form 16A details for all requested PANs

• Download T‘ACE“ PDF Generation Utility from the website and install it on your

desktop

• Pass the ZIP file through the utility to convert it into individual PDF files for each PAN

• User can opt to digitally sign the Form 16As during conversion

• Deductor can also opt to manually sign the PDF files after printing.

Form 16A will be generated and

will be saved in the

destination folder selected

by you

Step to Download Traces PDF

Converter V1.3L Light Version

Copyright © 2012 Income Tax Department 20

All content in this e-tutorial are purely for information purpose. All names may be trademarks of their respective owners.

Copyright © 2012 Income Tax Department 21

Downloading PDF Utility Conversion (contd.)

Clik o T‘ACE“ PDF Geeatio

Utility to stat the doload

Copyright © 2012 Income Tax Department 22

Downloading PDF Utility Conversion (contd.)

For more

details on any

screen, click on

Help icon

Enter the text as

displayed in

Verification Code

Click on

Submit

Downloading PDF Utility Conversion (contd.)

Copyright © 2012 Income Tax Department 23

For more details on

any screen, click on

Help icon

Clik o T‘ACE“ PDF Utility

Coete

Copyright © 2012 Income Tax Department 24

Downloading Traces PDF Converter V1.3L Light Version

• Extract TRACES-PDF-CONVERTERV1.3L.zip file in a folder on your system.

• If WinZIP is not already installed on your system ,download it from

www.winzip.com and install it.

• After extraction you will have Run.bat file and TRACES-PDF-ConverterV1.3L.jar in

a same folder.

• To run this Utility, JRE version 1.6 or above is needed. Get the same from

www.java.com and install (Steps are given in pages 10 to 22).

Oracle and Java are registered trademarks of Oracle and/or its affiliates. Other names may be trademarks of their

respective owners

25

Go to www.java.com

Java Installation Steps

Clik o Fee Jaa

Doload utto

Oracle and Java are registered trademarks of Oracle and/or its affiliates. Other names may be trademarks of their

respective owners

26

Click on Agee

and Start Free

Doload

Java Installation Steps (contd.)

If you want to know how to

install Java, please click on

Istallatio Istutios lik.

Oracle and Java are registered trademarks of Oracle and/or its affiliates. Other names may be trademarks of their

respective owners

Copyright © 2012 Income Tax Department 27

Setting Java Path in Environment Variable

Copyright © 2012 Income Tax Department 28

Setting Java Path in Environment Variable(contd.)

Copyright © 2012 Income Tax Department 29

Setting Java Path in Environment Variable(contd.)

Copyright © 2012 Income Tax Department 30

Setting Java Path in Environment Variable(contd.)

Copyright © 2012 Income Tax Department 31

Setting Java Path in Environment Variable(contd.)

The sree ay ary if Widos ersio is other tha 7. Please look for Adaed Syste

Settigs optio i the sree if it is differet the hat is sho aoe.

Copyright © 2012 Income Tax Department 32

Setting Java Path in Environment Variable(contd.)

Copyright © 2012 Income Tax Department 33

Setting Java Path in Environment Variable(contd.)

Copyright © 2012 Income Tax Department 34

Setting Java Path in Environment Variable(contd.)

Copyright © 2012 Income Tax Department 35

Setting Java Path in Environment Variable(contd.)

Copyright © 2012 Income Tax Department 36

Setting Java Path in Environment Variable(contd.)

Copyright © 2012 Income Tax Department 37

Setting Java Path in Environment Variable(contd.)

Copyright © 2012 Income Tax Department 38

Launching TRACES PDF Converter V1.3L

Select Run

File

Copyright © 2012 Income Tax Department 39

Double Click Run.Bat file, which will launch User Interface

Select Form 16\16A

Zip Files, enter

Password as your

TAN and select

destination folder to

save PDF files.

Select digital certificate to

digitally sign the PDF files.

This is not Mandatory.

Certificate details will

be displayed here.

Clik o Poeed to

continue with

generation of PDF files.

Copyright © 2012 Income Tax Department 40

PDF Files

• Separate PDF files will be generated for each PAN and will be saved in the destination

folder selected by you

• User can opt to manually sign Form 16 / 16A PDFs after printing them