REAL ESTATE ISSUES

24

Volume 36, Number 1, 2011

INTRODUCTION

THE MARKET FOR WAREHOUSE AND DISTRIBUTION CENTER

(W/DC) space is the least discussed property type in the

academic and professional literature. Yet the demand for

W/DC space is important for developers and investors to

understand. The underlying determinants of W/DC

demand are complex, have changed over time and show

signs of continued change in the future.

Both the theory of and the investigation into the determi-

nants of W/DC space demand evolved from office and

retail space demand models that focus on employment

and population. Prior to 1990, W/DC demand was the

poor cousin to the other commercial property market

studies. From 1990–1995, W/DC analysis came into its

own. This article presents a brief review of this “indus-

trial” space literature that, heretofore, included W/DC

space as an undifferentiated property type. It also

expresses current thinking, hints at potential new devel-

opments that may cause the current models to come into

question, and concludes with suggestions for further

research into W/DC demand.

To set the stage for a discussion of the demand for W/DC

space, it is important to realize that W/DC space consists

of different forms of warehousing. The general definition

of a warehouse is “a structure or room for storage for

merchandise or commodities.”

1

Also, “Warehouse applies

to unrefrigerated or refrigerated buildings that are used to

store goods, manufactured products, merchandise or raw

materials.”

2

However, within the real estate industry, storage space is

used for different purposes:

I Bulk: Containers or pallets enter the structure in one

truck and are routed to two or more trucks for distri-

bution to users of the products (cross docking of pallet

loads);

I Fulfillment: Containers or pallets enter the structure,

the pallets are disassembled and routed by individual

parcel to other trucks for distribution to users of the

product (cross docking of disassembled parcels from

incoming pallets);

I Distribution: Individual items enter the structure and

are routed by individual parcel to other trucks for

distribution to users of the product;

FEATURE

Demand for Warehouse and

Distribution Center Space

BY JOSEPH S. RABIANSKI, PH.D.; AND PHILIP A. SEAGRAVES, MSRE

About the Authors

Joseph S. Rabianski, Ph.D., teaches

graduate and undergraduate courses in real estate

market analysis, finance, investment, real

property principles, and appraisal at J. Mack

Robinson College of Business, Georgia State

University. He received a both a doctorate and a

master’s degree from the University of Illinois, and

a bachelor’s degree from DePaul University. He is

the author of numerous textbooks and articles on real estate, including

articles published in Appraisal Journal. Rabianski serves as a

consultant and expert witness in real estate market analysis in the retail,

office and hotel/motel property markets.

Philip A. Seagraves, M.B.A., MSRE,

Ph.D. candidate, is a researcher and instructor in

the Real Estate Department at Georgia State

University. Seagraves‘ background also includes

roles in several real estate firms and a variety of

executive level corporate positions in strategic

planning, marketing and product management.

24933_CRE.qxd 5/23/11 12:10 PM Page 24

REAL ESTATE ISSUES

25

Volume 36, Number 1, 2011

FEATURE

Demand for Warehouse and Distribution Center Space

I Intermodal: Shipments come to the facility by one

transportation mode and depart via another. The

transfer of containers from ship to truck or rail is an

example of this activity. The transfer from rail to truck

is another example.

A schematic of this article appears below:

W/DC DEMAND FACTORS

The foundation of the W/DC demand determinant litera-

ture was laid from 1990–1994. During this time, most of

the academic studies took a broad perspective, researching

“industrial” demand that includes W/DC but also other

property types such as manufacturing (both heavy and

light), R&D and general flex space. The important demand

factors we extracted from these studies are as follows:

3

I Physical factors such as structural attributes are impor-

tant determinants of demand. Age, condition, ceiling

heights, structure size, column span, number of dock

doors, number of drive-in doors, sprinklers, building

age, parking area, truck service area, presence of a

railroad siding and presence of office space in the

structure are important factors.

4, 5

I Location variables such as access to thoroughfares and

location in a city or metro area are important consider-

ations in determining warehouse demand.

6

I Factors that extend the scope beyond the physical

characteristics of the structure include the revenue

potential of the property, the per capita income of the

market area, change in the population of the market

area and access to major highways.

7

I Demand for warehouse space is a function of physical

features (size, percent of office space, ceiling height,

dock doors, and age but not rail siding); financial factors

(industrial cap rate and prime rate but not an index of

local economic activity); location (county and distance

to airport); and type of tenant (single or multi-tenant).

8

I Demand for warehouse space is a function of the labor

force and the population of the economy, public infra-

structure and services, and international issues such as

currency exchange rates and trade barriers/restrictions.

Transportation is of particular note since it is the one

factor most aligned with the demand for warehouse

space. The author contends this to be the case when

transportation access including highways, rail and deep

water are advantages of a region.

9

I Demand for W/DC space increases as firms relocate

their operations from cheap office space (Class B and

C space) to W/DC space in business and industrial

parks typically in the suburbs.

10

I Demand decreases as firms get better at managing

inventories with modern computer systems and inven-

tory handling equipment.

11

I Increased warehouse technology (in the form of

racking systems and forklifts) reduce demand for

warehouse space property.

12

I Industrial property demand (like other asset classes) is

affected by lags related to the desire of organizations to

purchase and deploy new capital and also in the risk

mitigation approach of taking up only a portion of new

capital in each of several successive years or investment

periods.

I Warehouse employment is a cleaner proxy for

warehouse demand as this figure tracks inventory

levels very closely.

13

I Changes in output (or employment) and movements in

the after-tax cost of corporate capital are associated

with industry property completions.

14

I Increases in manufacturing output that result primarily

from technological improvements and capital intensifi-

cation rather than increased employment affect indus-

trial space demand.

15

I Considering employment as the major driver of

commercial real estate demand, the author introduces

economic development factors into the analysis. These

additional factors are the employment growth rate, the

instability of employment, the industry mix (the indus-

trial structure of the local economy as revealed in one-

digit SIC codes), a measure of industrial diversity (as

measured by the Theil Entropy Index), educational

attainment, percentage of young firms (five years old

or less) and the percent of locally owned firms.

16

I Location, even small geographic differences in

location, can affect demand for warehouse facilities.

Also, the land-to-building ratio can affect demand.

17

I Replacement demand due to functional and locational

(external) obsolescence of existing facilities affects total

1990–94

W/DC Demand

Factors

The Brainstorming

Era for W/DC

Markets

Critique of Employment-Based Studies

Studies Supporting the Variables from

the 1990–94 Era

Evaluation of the Demand Factors

Port City W/DC Space: A New Perspective

Information from Current Interviews

Future Possibilities Affecting the W/DC Market

24933_CRE.qxd 5/23/11 12:10 PM Page 25

REAL ESTATE ISSUES

26

Volume 36, Number 1, 2011

FEATURE

Demand for Warehouse and Distribution Center Space

demand for new W/DC space.

18

Properties suffering

from obsolescence face a declining demand.

I Focusing on the price per square foot of industrial

properties as the dependent variable, price per square

foot in earlier periods, recent construction, a “monetary

base” (undefined in the article) and a variable created as

the difference between the long-term Treasury bond

and the Moody’s Baa corporate bond rate.

19

I The “path of goods movement” (POGM) theory

proposes that land for warehouses gravitates to trans-

portation corridors and hubs with favorable access to

seaports, rail, air and truck transportation between

major import sites and consumption centers

throughout the nation. Figure 1 displays a map of the

U.S. with the major highway transport routes. Rather

than locating warehouses near the large manufacturing

centers as had been the custom in past development

cycles, warehouse space demand will more closely

follow population centers where manufacturers and

importers can position their product for quick consoli-

dation, packing and distribution to the key retail and

consumption markets in large population centers.

Markets on this path of goods movement will see more

warehouse space than other markets controlling for

industrial and manufacturing activity.

20

Summarizing the 1990–94 literature research into W/DC

demand identified a wide array of substantive variables.

They included physical attributes of the site and the struc-

ture; locational characteristics; inventory management

techniques such as Just-in-Time inventory (JIT); techno-

logical improvements in W/DC equipment; the price of

capital goods (W/DC space and equipment); the cost of

capital; replacement demand due to functional and

locational obsolescence; economies of scale; path of goods

movement; and industrial employment level changes.

CRITICISM OF INDUSTRIAL

EMPLOYMENT-BASED MODELS

Starting in 1997 the “industrial space” demand literature

branched in two directions from the 1990–94 literature.

The first was the criticism of industrial employment-

based demand models. The basic element of this criticism

contends that the industrial space demand model and the

analysis of the industrial space market are not variants of

the office demand model and market analysis.

21

The

determining factor in office demand models is employ-

ment with a more specific definition of office-based

employment across SIC codes (NAICS codes today).

22

Some office studies used total employment in SIC codes

that had a high percentage of office-based employment

such as the finance, insurance and real estate SIC code

(FIRE) and the services code.

The task of estimating office-based employment is diffi-

cult, but estimating “warehouse-based employment” is

even more difficult. Manufacturing, wholesale and trans-

portation sector employment are not easily segmented

into employment in W/DC facilities. The manufacturing

sector includes employment in both production and

warehousing facilities, very often without specific distinc-

tion. Many workers in wholesale and transportation do

not work in W/DC facilities. Many workers in the retail

industry are W/DC employees but counted as retail

workers; consider the big box retailers that use W/DC

type facilities with high ceilings for their retail stores and

use the upper racks for storage.

23

“The demand for warehouse space originates more from

the volume of inventories stored, rather than from the

workers used to move this material around.”

24

The volume

of freight shipments was used as a proxy for warehouse

inventory.

25

SUPPORT FOR THE ORIGINAL DISCOVERIES

As stated above, starting in 1997 the “industrial space”

demand literature took one of two branches from the

Figure 1

Path of Goods Movement

Truck Movements

Train/Intermodal Movements

Source: Adapted from U.S. Department of Transportation, 1987 data.

Source: Adapted from U.S. Department of Transportation, 1990 data.

24933_CRE.qxd 5/23/11 12:10 PM Page 26

REAL ESTATE ISSUES

27

Volume 36, Number 1, 2011

FEATURE

Demand for Warehouse and Distribution Center Space

1990–94 literature. The second branch presents empirical

support for the original discoveries made in the 1990–94

literature. The empirical results generated the following

conclusions:

I Focusing on W/DC properties, ceiling height, age of

the structure, number of ground level doors (not dock

high doors), the change in net employment, and

location in a metropolitan area (e.g., Dallas/Fort

Worth) are statistically significant.

26

I Focusing on W/DC properties and using a survey, a

majority of respondents (62 percent) indicate that they

expect their square footage needs to increase in five

years; they are satisfied with the current number of

doors and believe their future need for dock doors will

remain unchanged (60 percent); their need for ceiling

height will not change in five years (79 percent).

27

The

survey was performed in 1998 and may not have

current relevance.

I Focusing on “industrial” property, the demand for

industrial space is a function of employment, invest-

ment and technology.

28

NEW DETERMINANTS

Focusing attention on the determinants of NOI in W/DC

properties in three metropolitan markets, significant

relationships for several different variables were discov-

ered. In Chicago, the change in exports, the change in

gross domestic product (GDP) and the W/DC vacancy

rate were found to be significant. In Dallas, the change in

exports and inventories as well as building “starts” (a ratio

of new construction to the stock of W/DC space in the

metro area) were found to be significant. In Los Angeles,

the change in imports and manufacturing productivity

were found to be significant. Previous period NOI was

also found to be significant in each metro area.

29

Focusing on the “industrial” property market, previous

period rent, current period vacancy, current period GDP

and the latest period change in GDP are statistically

significant determinants of W/DC demand.

30

EVALUATION OF SUPPORTING VARIABLES

The previous sections of this article chronicle the W/DC

market determinants discussed in the literature specifi-

cally starting with 1990. However, there are market

factors not fully discussed in the literature.

Gross Domestic Product

The role of GDP in W/DC models focused on the U.S.

needs examination. First, GDP numbers do not exist for

small geographic areas such as local market areas defined

as counties or metropolitan areas. So, GDP-based models

use national values in local market models; these GDP

values are a proxy for local market vitality. The accuracy

of this proxy relationship is questionable.

GDP is the total dollar value of all new goods and

services produced in the U.S. in a specific year. Relating

GDP to W/DC, consider the following ideas:

1. The newly produced goods may require W/DC space

but the services do not. So, GDP measures more value

than what goes into W/DC space.

2. Imports, which are not produced in the U.S., are a big

factor in W/DC demand.

31

Population or Employment

Population or employment: Which is the conceptually

correct W/DC demand side variable? Population and

employment numbers in a geographic area are related in

the “labor force participation” rate. The rate is stated as

the civilian labor force (employed plus unemployed

workers) divided by the population in that area. For the

majority of geographic areas, the labor force participation

rate is typically in the 55–70 percent range. To develop

the demand for W/DC space either of these concepts can

be used. But which is most conceptually correct? It is

population because retail expenditures are related to

population more directly than to employment.

Employment by NAICS codes in the study area is concep-

tually less appropriate because employment data does not

include children or senior citizens who are retired. These

are two large population groups.

Consumer Disposable Income

An author made the following statement: “… high levels

of disposable income in the region… draw warehouse

developers there.”

32

W/DC space holds inventories of

retail goods distributed to retail stores for purchase by

people who have disposable income. Two geographic

areas with the same population but with different

incomes will exhibit different demand levels for retail

goods. The appropriate income measure to use with

population figures is the per capita income of the popula-

tion in the market area. If households are the measure of

people in the area, the mean household income is the

appropriate measure. However, many data sources

provide only the median income figure of households in

the market area.

33

24933_CRE.qxd 5/23/11 12:10 PM Page 27

REAL ESTATE ISSUES

28

Volume 36, Number 1, 2011

FEATURE

Demand for Warehouse and Distribution Center Space

Levels of Location

W/DC space is located on specific sites in the local

economic area and this W/DC space serves at least two

related but distinct geographic market areas. The local

market area consists of the counties that comprise a

metropolitan area. Some portion of the local W/DC space

serves the needs of the local residents in the metro area,

and it serves the needs of manufacturers that provide

goods to both the local residents and to those residing

outside of the local market area.

The regional market area that surrounds the metro area is

the other geographic area. The other portion of the local

W/DC space serves the needs of the consumers,

manufacturers and the importers in this regional

geographic area.

The geographic extent of these exurban areas reflects

federal government regulation that sets restrictions on the

truck transport industry. These restrictions are the topic

of the next subsection.

Drive Time Regulation

On the demand side, the important linkage for W/DC

facilities is population. A key to the demand for W/DC

space is “the percentage of population within one day’s

drive of the port.”

34

A W/DC facility can serve at least two

different population bases. It can serve the needs of the

population in the local economic area, and it can serve

the needs of a population external to the local economic

area—the regional market area. The ability to serve these

populations depends in large part on the regulations

governing the truck drivers’ hours of service. The regula-

tions are below:

Commercial truckers transporting property (the rules for

passenger trucks are a bit different) are subject to daily

and weekly limits on the number of hours they are

permitted to work. Generally, drivers are permitted to work

no more than 14 consecutive hours. Of that time, only

11 hours may be devoted to driving. (The remaining time

may be devoted to paperwork, loading and unloading,

etc.). After exhausting these limits, drivers are required to

spend a minimum of 10 consecutive hours off duty. (At this

time a secondary source states that the 11 hours of

driving time is being reduced to 10 hours but we have

been unable to confirm this point.)

Drivers are subject to weekly limits as well. Federal

regulations prohibit driving after the driver has been on

duty 60 hours in seven consecutive days, or 70 hours in

eight consecutive days. Drivers may restart the 60- or

70-hour clock by taking no less than 34 consecutive

hours off duty.

The local population can be served by “short haul”

truckers who leave a trucking facility, deliver the products

and return to the facility within the 11-hour driving time

and 14-hour maximum limits and generally confine the

trips to the local economic market area—the metro area.

The population in the regional market can be served by

“long haul trucking” which is also determined by these

regulations. These long haul day trips involve a departure

and return within the 11-hour driving time and 14-hour

maximum limitation. On the condition that the truck

can average 55 miles per hour, the total driving time sets

out a total distance of 550 miles and a one-way distance

of 275 miles.

Points of Entry/Egress

The points of entry are the facilities along the three coasts

of the U.S. (the East, West and the Gulf coasts) and the

border crossings with Canada and Mexico. Figure 1

displays the 10 major ports and the 10 top border cross-

ings with Canada and Mexico.

Path of Goods Movement Theory

The POGM model is still theory; it suggests a strong

association between truck traffic, W/DC locations and

population. An inspection of the POGM routes reveals a

strong relationship to the Interstate Highway System.

Larger W/DC nodes tend to occur at major intersections

in this system along routes to and near large population

bases. A port is the end point of the POGM system. Over

time, the container volume has grown at these major

ports and the square footage of warehouse space per

person in the major nodes of the POGM system has

grown.

35

Logistics and Supply Chain Management

Logistics has many definitions that may be of interest to

the reader. We provide the following from a Google

search of the term. Notice that both of these definitions

link a process to a warehouse.

I The detailed coordination of a complex operation

involving many people, facilities or supplies;

I The management and control of the flow of goods

and services from the source of production to the

market. It involves knowledge, communication, trans-

port and warehousing.

24933_CRE.qxd 5/23/11 12:10 PM Page 28

REAL ESTATE ISSUES

29

Volume 36, Number 1, 2011

FEATURE

Demand for Warehouse and Distribution Center Space

Supply chain management (SCM) is also defined as a

process that is linked to a warehouse. Here is an appro-

priate definition taken from a Google search:

I SCM is the organization of the overall business

processes to enable the profitable transformation of

raw materials or products (inputs) into finished goods

and their timely distribution to meet customer

demand.

As logistics and SCM improve the efficiency of business

operations within a company and between/among

companies, the demand for W/DC space will decline.

Here the efficiencies created would be quicker processing

of products through a distribution center and the

minimization of storage time in the facility. A point to

remember is that technological change is not always

technological improvement; resources could be reorgan-

ized in such a way that productivity declines. Logistical

processes could also lead to a decrease in efficiency.

PORT CITY W/DC: A NEW PERSPECTIVE

“Freight movements are an increasingly important deter-

minant of warehousing/distribution space demand. In

particular, the rising use of marine container terminals in

the global movement of goods is a major contributor to

demand (for W/DC space) in the United States.”

36

The

growth of global trade volume and the demand for

additional W/DC space will be determined by many

factors, chief among them being the following factors that

involve the accommodation of container ships of

increasing size.

37

Panamax and Post-Panamax Ships

The size of oceangoing container ships is limited by the

capacity of the Panama Canal. A Panamax ship can pass

through the Panama Canal but it is at the upper limit for

size. The Panamax ship cannot exceed 951 feet in length,

106 feet in width and a “draft” not exceeding 39.4 feet.

The ship can carry a maximum of 4,500 containers

known as TEUs (twenty-foot equivalent units). Each TEU

is 20 feet long by eight feet wide and eight feet high. This

limitation affects shipping between Southeast Asia

(China, Japan, Taiwan, Korea, etc.) and the ports on the

East Coast of the U.S.

These limitations do not affect shipping through the Suez

Canal, which can handle larger ships (Post-Panamax)

because it is wider. This extra width affects the shipping

routes from Southeast Asia to the East Coast ports of the

U.S. for the Post-Panamax ships. However, the transit time

for ships taking the Suez Canal route instead of the Pacific

Ocean route grows from 11 days to 30 days. The Panama

Canal Authority announced plans in 2006 to expand its

facilities to handle larger ships. According to their plan,

38

the new facilities will be open in 2014 or 2015. As of 2003,

ocean freight carriers were ordering ships of larger size—

the Post-Panamax ships. These ships are longer (approxi-

mately 1,100 feet), wider (140 feet) and have a greater

draft (48 feet); they also carry 8,000 to 12,000 TEUs.

“A Post-Panamax container ship of 366 meters (1,200´)

length, 49 meters (160´) width and maximum 15 meters

(50´) draft was used as the reference for establishing the

ideal lock chamber sizes. This vessel has been identified

as the largest type of vessel that carriers in the routes

with the greatest frequency, volume and intensity would

regularly deploy in transiting the Canal. It accommo-

dates up to 19 container rows through its width and has

a nominal cargo capacity of up to 12,000 TEU. The

proposed lock dimensions will also allow handling of

Capesize dry-bulk vessels and Suezmax tankers

displacing 150,000 to 170,000 tons.”

39

The obvious conclusion is the port cities that will experi-

ence an increase in demand for W/DC space will be the

ports that can handle the Post-Panamax ships.

Port Infrastructure

In order to accommodate the Post-Panamax ships, port

cities must:

I Complete and maintain necessary dredging;

I Lengthen the dock facilities;

I Invest in new overhead cranes that can span up to 22

containers (existing cranes can span 18 containers);

I Provide land to expand the size of dock space;

I Provide land to expand the W/DC facilities;

I Provide skilled labor to expand the docks and build the

new space;

I Redesign the dock facilities to efficiently handle the

expanded volume of containers;

I Change time of operation of the docks. Many current

docks operate only from 8 A.M.–5 P.M. In order to

handle the expanded volume of containers, these hours

will need to be expanded. 24/7 might be the ultimate

time schedule for these expanded ports.

Local Infrastructure

Even if the port facility significantly upgrades its infra-

structure in order to handle the expanded container

volume, it will not be successful if the containers cannot

24933_CRE.qxd 5/23/11 12:10 PM Page 29

REAL ESTATE ISSUES

30

Volume 36, Number 1, 2011

FEATURE

Demand for Warehouse and Distribution Center Space

be efficiently transported away from the docks. The local

economy’s infrastructure must facilitate this next leg of

transportation. The local economy must:

I Provide streets and highways to facilitate the expanded

shipments (expanding the number of lanes, dedicating

truck lanes, etc.);

I Provide intermodal facilities to handle the expanded

shipments;

I Eliminate impediments to traffic flows such as at grade

rail crossings and street intersections that cause traffic

backups.

Transit Times

Both producers and retailers want to minimize transit time

between the factory and the W/DC that ultimately serves

the retailer and its consumers. Transit time has three

components—ocean transport, transshipment and land

transport. Transshipment involves the removal of the cargo

from the ocean carrier and placing it on a land carrier, a

process often requiring two to three days. Transshipment

may also include the time it takes to cross dock the cargo

in a port city W/DC to get the shipments on the road to

the ultimate destinations. “The shorter the transit time, the

more inventory turns can be accomplished and the greater

the flexibility to meet changes in consumer demand or

respond to other special circumstances.”

40

INFORMATION FROM CURRENT INTERVIEWS

As a point of interest for the authors, a convenience sample

was generated and 10 designees from the S

OCIETY OF

INDUSTRIAL AND OFFICE REALTORS® were asked several

questions. One question was: “Please list as many

warehouse space requirements as possible from the point

of view of a W/DC space tenant.” The items topping their

lists largely coincided with the determinants identified in

the 1990–94 studies. The rank order of their responses was:

location, access to interstates, building size, access to good

labor, and building characteristics. When building charac-

teristics were listed, the respondents took the time to

identify a series of the physical attributes studied in the

academic literature. They also identified several character-

istics that have not appeared in the literature. These

include: floor flatness and load bearing capacity; insulation

rating; electrical power capacity; air circulation; sprinkler

system rating; and dock equipment.

In addition, the respondents identified several non-

physical determinants not mentioned in the literature.

These include: the ability of the facility to expand; the

nature and extent of publicly provided infrastructure; the

provision of locational incentives; image of the facility;

the nature and quality of neighborhood and the general

area; and the safety/security aspects for the facility.

WHAT THE FUTURE MAY HOLD

Future events and trends will have either a positive or a

negative effect on W/DC space in the U.S. These “favor-

able” or “unfavorable” effects on W/DC space may

emerge slowly over time or may not become evident until

an unpredictable, critical threshold is reached.

Energy Costs

A reasonable expectation is increasing energy costs. This

increase in fuel cost will raise transportation costs on

land, sea and air. Focusing on ocean transport and inter-

national air transit, as transport costs increase to a high

enough level, they will reduce the advantage of overseas

production that uses lower wage labor. This will reduce

demand for W/DC in port cities and increase the need

for W/DC space near inland metro areas as production of

previously imported items shifts to lower wage areas in

Mexico, Canada and the U.S.

Foreign Wage Structure and Standard of Living

As the Asian and Indonesian economies grow, the result

will be a rising wage structure and standard of living in

that area of the world. To the extent these economies

outpace the U.S., this will narrow the current wage gap

between the U.S. and the Asian and Indonesian economies.

Their costs of production will rise, reducing the current

advantage of offshore production. Offshore wages will also

increase as labor productivity in these countries increases.

Terrorist Attacks

Terrorist attacks on the Panama Canal and Suez Canal

facilities would result in canal closures. Such disruptions

to shipping routes would greatly lengthen shipping days

and increase transportation costs. Terrorist attacks on the

major port facilities in China, India and Indonesia would

stop a high percentage of ocean cargo, raise transport

costs and create an environment of uncertainty regarding

the economics of offshore production.

Relative Wage Rates

A decline in the U.S. real wage structure relative to world

wages will reduce our relative production costs and

thereby increase our exports. At the same time, imports

in general, and higher priced imports in particular, will

become more expensive. The exact impact on the demand

for W/DC space depends on the relative change in

imports versus exports.

24933_CRE.qxd 5/23/11 12:10 PM Page 30

REAL ESTATE ISSUES

31

Volume 36, Number 1, 2011

FEATURE

Demand for Warehouse and Distribution Center Space

Value of the Dollar

A decline in the value of the dollar, relative to other key

currencies, will reduce our imports and increase our

exports. Even if our exports increase, the combined effect

of these two changes will be a reduction in the volume of

traffic through U.S. ports.

U.S. Government Regulation

Unproductive regulation that unduly limits transport

options for the trucking industry will negatively affect

procurement and distribution costs. Limiting driving

time for drivers shrinks the travel zones and increases the

need for overnight delivery patterns.

Currency Exchange Rates

As the exchange rate of the U.S. dollar changes relative to

foreign currencies, export and import levels in the U.S.

will change. If the U.S. dollar falls relative to those foreign

currencies, imports become more expensive and exports

become cheaper. This situation will narrow the balance of

trade deficit but more than likely will not turn it positive.

The major effect could be a differential effect on the

volume of traffic through specific ports. The ports nearest

the export firms may experience an increase in the

demand for W/DC space while most firms should experi-

ence a decrease in demand from a reduction in imports.

Ship Size

The size of the fleet of transoceanic ships will continue to

increase with more and bigger ships. This trend will not

affect deep water ports but will affect the shallow harbor

ports that will have to forgo servicing the big ships or

incur greatly expanded costs of operation because of the

need to dredge. Also, the Post-Panamax ships are wider,

so the cranes will have to be upgraded as existing,

narrower crane operations become functionally obsolete.

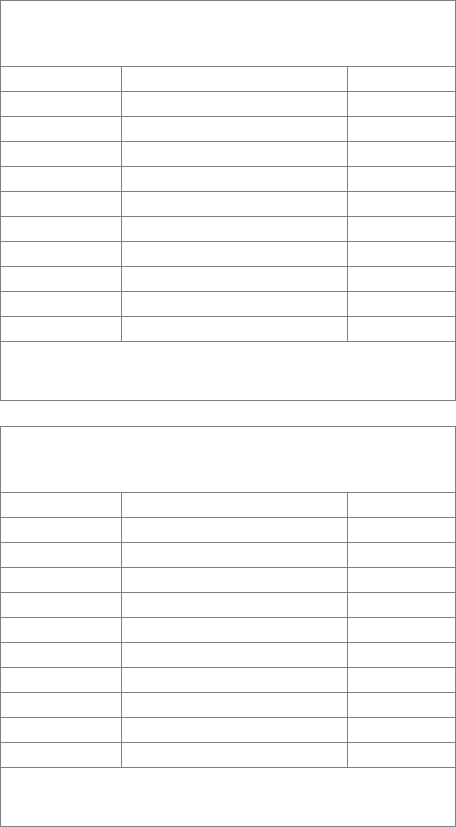

INTERESTING STATISTICS

The demand for and regional structure of the W/DC

space market are largely driven by the top ocean ports,

border crossings and airports along the path of goods

movement. Analysis of these factors presented in Figure 2

reveals several points of interest about export/import

truck traffic. First, the top border crossing is U.S./Mexico

but the next three top crossing points are along the

U.S./Canada border. Second, these border crossings are

not in major metro areas but may require an extra

amount of W/DC space—more than needed by their local

population. Figure 3 reveals similar information about the

top ten railroad crossings: Seven of the ten crossings are

located at the U.S./Canada border.

Figure 3

Top 10 Border Crossings By Train

State Crossing # Trains

Minnesota International Falls 3286

Michigan Port Huron 2846

Texas Laredo 2479

New York Buffalo/Niagara Falls 2120

Minnesota Warroad 2097

Michigan Detroit 1895

North Dakota Portal 1739

Texas Eagle Pass 1555

Texas El Paso 1424

Washington Blaine 1219

Source: U.S. Department of Transportation, Research and Innovative

Technology Administration, Bureau of Transportation Statistics

Figure 2

Top 10 Border Crossings By Truck

State Crossing # Containers

Texas Laredo 1,382,319

Michigan Detroit 1,197,967

New York Buffalo/Niagara Falls 846,114

Califonia Otay Mesa/San Ysidro 684,425

Texas El Paso 644,272

Michigan Port Huron 625,642

Texas Hidalgo 419,426

Washington Blaine 310,075

New York Champlain/Rouses Point 294,970

Arizona Nogales 276,877

Source: U.S. Department of Transportation, Research and Innovative

Technology Administration, Bureau of Transportation Statistics

24933_CRE.qxd 5/23/11 12:10 PM Page 31

REAL ESTATE ISSUES

32

Volume 36, Number 1, 2011

FEATURE

Demand for Warehouse and Distribution Center Space

Figure 4 displays the top fifteen ocean ports and Figure 5

displays the top ten U.S. airports for shipping products.

Figure 6 shows a different data set for volume of cargo in

the top 30 international airports. Notice that Memphis, the

FedEx hub, shows up as number one in cargo followed by

the airport in Louisville (UPS hub), number two in the

U.S. These airport facilities have a significant impact on

the W/DC space demand in their local market areas and

on specific locations in those local market areas.

Figure 5

Top 10 Airports by Total Value in 2008

Airport Value ($ millions)

J. F. Kennedy, NY $167,966

Chicago, IL $97,180

Los Angeles, CA $78,292

San Francisco, CA $52,756

New Orleans, LA $49,585

Anchorage, AL $41,443

Miami, FL $40,036

Dallas/Ft. Worth, TX $39,488

Atlanta, GA $32,335

Cleveland, OH $30,812

Source: U.S. Department of Commerce, U.S. Census Bureau,

Foreign Trade Division, 2009

Figure 4

Top 15 Ports by Total Value in 2008

Port Value ($ millions)

Los Angeles, CA $243,910

New York/New Jersey $185,385

Houston, TX $147,695

Long Beach, CA $91,537

Charleston, SC $62,332

Savannah, GA $58,987

Norfolk, VA $53,950

New Orleans, LA $49,765

Baltimore, MD $45,312

Philadelphia, PA $43,176

Seattle, WA $39,989

Oakland, CA $38,698

Morgan City, LA $38,503

Tacoma, WA $35,322

Corpus Christi, TX $29,685

Source: U.S. Department of Transportation, Research and Innovative

Technology Administration, Bureau of Transportation Statistics

Figure 6

Cargo Traffic 2009

Last update: August 5 2010

Rank City (Airport) Total Cargo % Change

1 MEMPHIS TN, US (MEM) 3,697,054 0.0

2 HONG KONG, HK (HKG) 3,385,313 (7.5)

3 SHANGHAI, CN (PVG) 2,543,394 (2.3)

4 INCHEON, KR (ICN) 2,313,001 (4.6)

5 PARIS, FR (CDG) 2,054,515 (9.9)

6 ANCHORAGE AK, US (ANC)* 1,994,629 (15.0)

7 LOUISVILLE KY, US (SDF) 1,949,528 (1.3)

8 DUBAI, AE (DXB) 1,927,520 5.6

9 FRANKFURT, DE (FRA) 1,887,686 (10.6)

10 TOKYO, JP (NRT) 1,851,972 (11.8)

11 SINGAPORE, SG (SIN) 1,660,724 (11.9)

12 MIAMI FL, US (MIA) 1,557,401 (13.8)

13 LOS ANGELES CA, US (LAX) 1,509,236 (7.4)

14 BEIJING, CN (PEK) 1,475,649 8.1

15 TAIPEI, TW (TPE) 1,358,304 (9.0)

16 LONDON, GB (LHR) 1,349 571 (9.2)

17 AMSTERDAM, NL (AMS) 1,317,120 (17.8)

18 NEW YORK NY, US (JFK) 1,144,894 (21.2)

19 CHICAGO IL, US (ORD) 1,047,917 (17.1)

20 BANGKOK, TH (BKK) 1,045,194 (10.9)

21 GUANGZHOU, CN (CAN) 955,270 39.3

22 INDIANAPOLIS IN, US (IND) 944,805 (9.2)

23 NEWARK NJ, US (EWR) 779,642 (12.1)

24 TOKYO, JP (HND) 779,118 (8.3)

25 LUXEMBOURG, LU (LUX) 628,667 (20.2)

26 OSAKA, JP (KIX) 608,876 (28.0)

27 SHENZHEN, CN (SZX) 605,469 1.2

28 KUALA LUMPUR, MY (KUL) 601,620 (9.9)

29

DALLAS/FT WORTH TX, US (DFW)

578,906 (11.3)

30 MUMBAI, IN (BOM) 566,368 1.3

Airports participating in the ACI Annual Traffic Statistics Collection.

Total Cargo: loaded and unloaded freight and mail in metric tonnes.

*ANC data includes transit freight.

Source: Airports Council International (ACI) at www.airports.org

24933_CRE.qxd 5/23/11 12:10 PM Page 32

REAL ESTATE ISSUES

33

Volume 36, Number 1, 2011

FEATURE

Demand for Warehouse and Distribution Center Space

SUMMARY AND CONCLUSION

Today, research into the demand for W/DC space must

investigate the flow of goods and technological factors for

answers to the pressing questions concerning both

industry and academia. Early research focusing on the

flow or path of goods transport began when U.S.

manufacturing shifted first to Mexico and later to Asia,

and increasingly to China. In the years since the intro-

duction of the path of goods model, China has emerged

as the dominant source for consumer goods shipped via

larger and larger container ships to ports on both the East

and West coasts of the U.S.

As the need for W/DC space grew in port cities, the

demand for W/DC space in general was reduced by

concurrent shifts in retail distribution activity in the U.S.

As large retailers such as Walmart, Target, Costco, etc.

grew, they sought to reduce costs and improve the speed

and flexibility with which they move product to their

stores. This motivation led to the creation of large W/DC

structures placed along the pathways—interstate

highways—to key markets. This trend reduced the

demand for W/DC space in many older geographic

markets. So demand grew in port cities and key inland

sites along major truck transport routes while demand fell

in other market areas. In more recent years, the W/DC

space placed in the key markets, port cities and metro

areas with major interstate interchanges was large square

footage under a single roof—750,000 or more square feet.

Real estate developers building W/DC space should now

consider the projections of port growth, import/export

activity, and the transport pathways to major markets

rather than the traditional industrial or manufacturing

employment projections when making decisions on the

amount of space and the best locations for new construc-

tion of speculative W/DC projects.

W/DC demand literature presents an orderly progression

from employment and population demand models to

current analytical methods tailored to the dynamics in

the W/DC economic activity and spatial markets.

ENDNOTES

1. Webster’s New Collegiate Dictionary.

2. Space Type Definitions – Warehouse at http://www.energystar.gov/

ia/business/tools_resources/target_finder/help/Space_Type_

Definitions_-_Warehouse.htm.

3. Many of the studies referenced in this article focus on “industrial”

properties. W/DC space is combined with manufacturing (usually

light manufacturing). Also, some of the studies focus on a single set

of factors such as structural items while other studies combine sets of

factors such as structural and locational. For this reason the

categories presented are the authors’ choice; for other authors the

categories could be specified differently. Finally, this literature search

focused on concepts and ideas affecting the demand for W/DC space

so statistical results appearing in the articles were ignored.

4. Ambrose, Brent W., “Analysis of the Factors Affecting Light

Industrial Property Valuation,” The Journal of Real Estate Research,

Fall 1990, pp. 355–370; D. H. Treadwell, “Intricacies of the Cost

Approach in the Appraisal of Major Industrial Properties,” Appraisal

Journal, 1988, pp. 70–79.

5. Graham, Marshall F. and Douglas S. Bible, “Classifications for

Commercial Real Estate,” Appraisal Journal, April 1992, pp. 237–246.

6. Ibid.

7. Miles, Mike, Rebel Cole and David Guilkey, "A Different Look at

Commercial Real Estate Returns," AREUEA Journal, Vol. 18, No.4,

1990, pp. 403–430.

8. Fehriback, Frank A., Ronald C. Rutherford and Mark E. Eakin, “An

Analysis of the Determinants of Industrial Property Values,” Journal

of Real Estate Economics, Vol. 8, 1997, p. 3.

9. Hughes, William T. Jr., “Determinants of Demand for Industrial

Property,” Appraisal Journal, April 1994, pp. 303–309.

10. Bruce, Robert, “Industrial Goes Upscale,” Journal of Property

Management, May/June 1994, pp. 14–17.

11. Christensen, M. F., B. Wisener and D.J. Campos, “Attributes of

Tomorrow's Warehouse Structures,” Real Estate Review, 27(3), 1997,

p. 5; and Robert Bruce, “Industrial Goes Upscale,” Journal of

Property Management, May/June 1994, pp. 14–17.

12. Ibid.

13. Wheaton, W. C., & Torto, R. G., “An Investment Model of the

Demand and Supply for Industrial Real Estate,” Journal of the

American Real Estate & Urban Economics Association, 1990, 18,

pp. 530–547.

14. Ibid.

15. Ibid.

16. Malizia, E. E., “Forecasting Demand for Commercial Real Estate

Based on the Economic Fundamentals of U.S. Metro Markets,”

Journal of Real Estate Research, 6, 1991, p. 251.

17. Zimmer, D. W., “Avoiding Traps When Using Sales Comparison to

Value Storage and Distribution Facilities,” Appraisal Journal, 59(3),

1991, p. 390.

18. Ibid.

19. Atteberry, William and Ronald C. Rutherford, “Industrial Real

Estate Prices and Market Efficiency,” Journal of Real Estate Research,

Vol. 8, 3, pp. 377–385.

20. Mueller, G. R. and Laposa, Steven P., “The Path of Goods

Movement,” Real Estate Finance, 1994, 11(2), pp. 42, 45–46.

24933_CRE.qxd 5/23/11 12:10 PM Page 33

REAL ESTATE ISSUES

34

Volume 36, Number 1, 2011

FEATURE

Demand for Warehouse and Distribution Center Space

21. Rabianski, Joseph and Roy T. Black, “Why Analysts Often Make

Wrong Estimates About the Demand for Industrial Space,” Real

Estate Review, Vol. 27, Issue 1, Spring 1997, pp. 68–72.

22. For a more detailed discussion of the office demand model see

Joseph Rabianski and Karen Gibler, “Office Demand Analysis

Analytical Techniques,” Journal of Real Estate Literature, Vol. 15,

No.1, 2007.

23. Rabianski and Black, op. cit.

24. Mansour, Asieh and Marvin C. Christensen, “An Alternative

Determinant of Warehouse Space Demand: A Case Study,” Journal

of Real Estate Research, Vol. 21, Issues 1 and 2, 2001, pp. 77–88.

25. Ibid.

26. Buttimer Jr., R. J., R.C. Rutherford and R. Witten, “Industrial

Warehouse Rent Determinants in the Dallas/Fort Worth Area,”

Journal of Real Estate Research, 13, p. 47.

27. Christensen, M. F., B. Wisener and D.J. Campos, “Attributes of

Tomorrow's Warehouse Structures,” Real Estate Review, 27(3), 1997,

p. 51.

28. AMB Property Corporation, “Determinants of Industrial Real

Estate Demand,” Real Estate Review, Summer 2002, pp. 57–61.

29. Chai, Young W., “Determinants of NOI for Warehouse Properties,”

Real Estate Finance, Vol. 14, Summer 1997, p. 2.

30. Thompson, R., and S. Tsolacos, “Projections in the Industrial

Property Market using a Simultaneous Equation System,” Journal of

Real Estate Research, 19(2), pp. 165–188.

31. In macroeconomic theory, Gross Domestic Product (GDP) = C + I

+ G + X – M.

C = Consumption (a measure of all retail goods and many services

bought by consumers)

I = Investment in new capital goods such as industrial building,

fixed equipment, inventories and capital goods (manufactured

goods that are used in the production process but not directly sold

to consumers)

G = Government spending on goods and services

X= Exports

M = Imports (a negative entity in the GDP calculation but a

positive entity in the use of W/DC space)

32. Choi, Amy, “Despite Soft Market in Boston, Industrial Developers

Forge On,” Commercial Property News, Vol. 18, Issue 15, September

2004.

33. The mean and median are the same value only in a normal distri-

bution—the bell shaped curve. When the mean is greater than the

median the income distribution is skewed to the higher income

categories. Using the median income in this situation underesti-

mates the consumer purchasing power in the market.

34. Biederman, David, “A Developing Situation,” The Journal of

Commerce, Sept. 24, 2007, pp. 46–7.

35. Mueller, Glenn R. and Andres G. Mueller, “Warehouse Demand and

the Path of Goods Movement,” Journal of Real Estate Portfolio

Management, Vol. 13, 1, 2007, pp. 45–55.

36. McGowan, Michael, “The Impact of Shifting Container Cargo Flows

on Regional Demand for U.S. Warehouse Space,” Journal of Real

Estate Portfolio Management, 11, 2; May/August 2005, pp. 167–185.

37. The following discussion is based on information taken from

McGowan. Parts of that discussion are supplemented by the

authors.

38. Available at http://www.pancanal.com/eng/plan/

documentos/propuesta/acp-expansion-proposal.pdf.

39. See endnote 31.

40. McGowan, op. cit.

24933_CRE.qxd 5/23/11 12:10 PM Page 34