For Audits of Architectural and Engineering

(A/E) Consulting Firms

UNIFORM AUDIT &

ACCOUNTING GUIDE

UNIFORM AUDIT &

ACCOUNTING GUIDE

American Association of State Highway and Transportation Officials t h e v o i c e o f t r a n s p o r tat i o n

2012 Edition

Copyright © 2013, by the American Association of State Highway and Transportation Officials. All Rights Reserved.

This book, or parts thereof, may not be reproduced in any form without written permission of the publisher.

Printed in the United States of America.

AASHTO Uniform Audit & Accounting Guide (2012 Edition) i

AASHTO Uniform Audit & Accounting Guide (2012 Edition) ii

EXECUTIVE COMMITTEE

2012–2013

OFFICERS:

PRESIDENT: Michael P. Lewis, Rhode Island

VICE PRESIDENT: Mike Hancock, Kentucky

SECRETARY-TREASURER: Carlos Braceras, Utah

EXECUTIVE DIRECTOR: John Horsley, Washington, D C

REGIONAL REPRESENTATIVES:

REGION I: James P. Redeker, Connecticut

Chris Clement, New Hampshire

REGION II: Eugene Conti, North Carolina

Sheri LeBas, Louisiana

REGION III: Mark Gottlieb, Wisconsin

Paul Trombino, Iowa

REGION IV: John Cox, Wyoming

John Halikowski, Arizona

IMMEDIATE PAST PRESIDENT:

Kirk Steudle, Michigan

AASHTO Uniform Audit & Accounting Guide (2012 Edition) iii

AASHTO ADMINISTRATIVE SUBCOMMITTEE

ON INTERNAL/EXTERNAL AUDIT

Finance and Administration Subcommittee

Chair Vice Chair

Carri A. Rosti, CPA Judson D. Brown, CPA

Manager, Office of Internal Review Director, External and Construction Audit

Idaho Transportation Department Virginia Department of Transportation

P.O. Box 7129 1401 East Broad Street, 14th Floor, Room 1403

Boise, ID 83707-1129 Richmond, VA 23219

(208) 334-8834 (804) 225-3597

Secretary AASHTO Liaison

Dan Kahnke, CGFM Jenet Adem

Audit Director Director of Finance and Administration

Minnesota Department of Transportation

American Association of State Highway and Transportation Officials

395 John Ireland Blvd. 444 North Capitol Street, N.W. Suite 249

St. Paul, MN 55155 Washington, DC 20001-1539

(651) 366-4140 (202) 624-5816

FHWA Liaison

Dave Bruce

FHWA National Review Team Leader

Federal Highway Administration

Program Management Improvement Team

12300 West Dakota Avenue

Lakewood, CO 80228

(720) 963-3723

AASHTO Uniform Audit & Accounting Guide (2012 Edition) iv

Transportation Internet Links

Alabama http://www.dot.state.al.us Missouri http://www.modot.org

Alaska http://www.dot.state.ak.us Montana http://www.mdt.mt.gov

Arizona http://www.azdot.gov/ Nebraska http://transportation.nebraska.gov

Arkansas http://www.arkansashighways.com Nevada http://www.nevadadot.com

California http://www.dot.ca.gov New Hampshire http://www.state.nh.us/dot

Colorado http://www.dot.state.co.us New Jersey http://www.state.nj.us/transportation

Connecticut http://www.ct.gov/dot New Mexico http://www.nmshtd.state.nm.us

Delaware http://www.deldot.net New York http://www.nysdot.gov

District of Columbia http://ddot.dc.gov/DC/DDOT North Carolina http://www.dot.state.nc.us

Florida http://www.dot.state.fl.us North Dakota http://www.dot.nd.gov

Georgia http://www.dot.state.ga.us Ohio http://www.dot.state.oh.us

Hawaii http://hawaii.gov/dot Oklahoma http://www.okladot.state.ok.us

Idaho http://itd.idaho.gov Oregon http://www.odot.state.or.us

Illinois http://dot.state.il.us Pennsylvania http://www.dot.state.pa.us

Indiana http://www.ai.org/dot Rhode Island http://www.dot.state.ri.us

Iowa http://www.dot.state.ia.us South Carolina http://www.dot.state.sc.us

Kansas http://www.ksdot.org South Dakota http://www.sddot.com

Kentucky http://www.kytc.state.ky.us Tennessee http://www.tdot.state.tn.us

Louisiana http://www.dotd.state.la.us Texas http://www.dot.state.tx.us

Maine http://www.state.me.us Utah http://www.sr.ex.state.ut.us

Maryland http://www.mdot.state.md.us Vermont http://www.aot.state.vt.us

Massachusetts http://www.eot.state.ma.us Virginia http://www.virginiadot.org

Michigan http://www.michigan.gov/mdot Washington http://www.wsdot.wa.gov

Minnesota http://www.dot.state.mn.us West Virginia http://www.wvdot.com

Mississippi http://mdotfcu.com Wisconsin http://www.dot.state.wi.us

Wyoming http://dot.state.wy.us

Federal Highway Administration (FHWA) http://www.fhwa.dot.gov/

AASHTO Uniform Audit & Accounting Guide (2012 Edition) v

ACKNOWLEDGMENTS

Discussions among AASHTO members at the regional level and at annual AASHTO meetings led to the

creation of the first edition of the Uniform Audit & Accounting Guide, as released in March of 2001. The

guide was designed to assist engineering consultants, independent CPAs, and State DOT auditors with

the preparation, and/or auditing, of Statements of Direct Labor, Fringe Benefits, and General Overhead

(indirect cost rate schedules).

Over the years, many people have contributed to the guide by providing input, conducting research,

attending working sessions, facilitating meetings, editing, proofreading, and providing other support. The

participants included representatives from State Departments of Transportation, the FHWA, the ACEC,

public accounting firms, and AASHTO. Their knowledge, time, travel funding, and supplies were greatly

appreciated in the nationwide team effort that led to this 2012 edition of the guide.

Scot P. Gormley, External Audit Manager with the Ohio Department of Transportation, served as the

primary designer and editor of this 2012 Edition of the guide, with additional support and assistance

provided by Dan Purvine of A/E Clarity Consulting and Training, LLC.

AASHTO Uniform Audit & Accounting Guide (2012 Edition) vi

Preface

ABOUT THIS GUIDE

his Uniform Audit and Accounting Guide was developed by the American Association of State

Highway and Transportation Officials (AASHTO) Audit Subcommittee with assistance from

the American Association of State Highway and Transportation Officials, the Federal Highway

Administration (FHWA), and the American Council of Engineering Companies (ACEC). The

AASHTO Audit Subcommittee is comprised of the senior audit representative from each State’s

transportation or highway department. This guide was developed over several years and initially was

approved by AASHTO at the organization’s 2001 annual meeting.

During 2007, the members of the Audit Subcommittee approved the establishment of a Task Force to

update the guide, which resulted in the release of the 2010 Edition. This was necessary to ensure that the

guide was consistent with current auditing standards and procedures, accounting principles, and Federal

regulations. The 2010 update also addressed questions and concerns expressed by various parties,

including the FHWA, State DOT audit agencies, Architectural and Engineering design firms (hereinafter

referred to as “A/E firms” or “engineering consultants”), and public accounting firms. These questions

and concerns were brought about through current practice and, in part, through the findings and

recommendations from an audit performed by the U.S. Department of Transportation’s Office of

Inspector General (OIG).

1

This 2012 Edition of the guide incorporates several updates, refinements, and clarifications necessary to

reflect changes in the statutory and regulatory framework applicable to A/E contracts that have occurred

since the publication of the 2010 update. This 2012 guide should be used as a tool by State DOT auditors,

A/E firms, and public accounting firms that perform audits and attestations of A/E firms. The techniques

presented herein primarily focus on examination, auditing, and reporting procedures to be applied to

costs that are incurred by A/E firms for engineering and design related services performed on various

Federal, State, and Local transportation projects. These costs normally are billed to applicable agencies

through their State DOTs.

The techniques discussed in this guide were designed to be applied to audit and attestation engagements

performed in connection with engineering consultants’ Statements of Direct Labor, Fringe Benefits, and

General Overhead (hereinafter referred to as “indirect cost rate schedules”), as well as the related

accounting systems, job-costing systems, and labor-charging systems that serve as the basis for the

indirect cost rate schedules.

This guide is not intended to be a comprehensive auditing procedures manual but is instead a guide to

assist users in understanding terminology, policies, procedures and audit techniques, and sources for

applicable Federal Regulations. This guide provides only general guidance and is not meant to, and

cannot, supersede either the Federal Acquisition Regulation (FAR) or any related laws or regulations.

2

Users should be aware that the FAR Cost Principles change frequently; accordingly, please review the

1

See “Oversight of Design and Engineering Firms’ Indirect Costs Claimed on Federal-Aid Grants” (Report Number:

ZA-2009-033), issued February 5, 2009.

2

Although use of this guide is not required by Federal law or regulation, most State DOTs expect engineering

consultants, external CPAs, and other involved parties to comply with the minimum procedures and techniques

illustrated and discussed herein. As recommended by the FHWA, most State DOTs have adopted risk assessment

procedures to help determine engineering consultants’ compliance with FAR Part 31 and related laws and

regulations. Consistency with this guide may be a key factor in assessing risk, and departures from the procedures

recommended herein, lacking adequate justification, may lead to additional scrutiny by a reviewing State DOT.

Accordingly, engineering consultants are strongly encouraged to adopt the uniform reporting procedures illustrated

herein, including, but not limited to, labor charging practices, cost accumulation and reporting processes, and the

format and content of indirect cost schedules (including the recommended standard disclosures). Engineering

consultants should contact their respective cognizant State DOTs for further details and clarifications regarding risk

assessment and application of this guide.

T

AASHTO Uniform Audit & Accounting Guide (2012 Edition) vii

applicable FAR version in conjunction with this guide. Likewise, illustrations and sample reports

included in the guide used various sources and information current at the time it was published. Due to

periodic changes in Generally Accepted Accounting Principles (GAAP), Generally Accepted Auditing

Standards (GAAS), and Government Auditing Standards (GAGAS or the “Yellow Book”), users should

refer to the more current guidance/standards and modify the sample reports accordingly.

Note:PleaseseetheAASHTOwebsiteforcontactinformationforallStatetransportationagencies.

An electronic version of this guide is available on the AASHTO home page: www.transportation.org.

AASHTO Uniform Audit & Accounting Guide (2012 Edition) viii

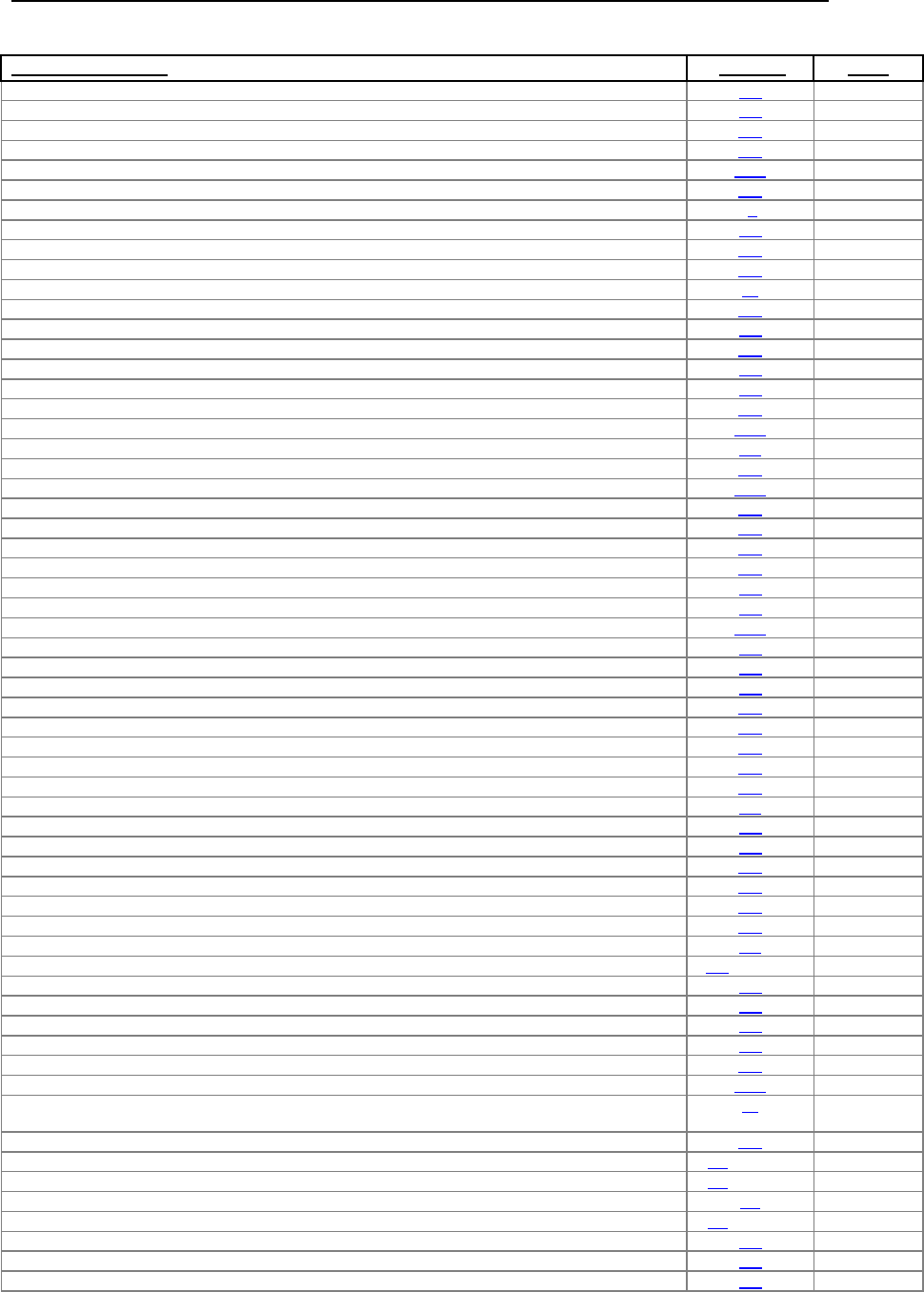

CONTENTS

CHAPTER 1—ORGANIZATION OF THIS GUIDE AND DEFINED TERMS ....................................... 1

1.1—ORGANIZATION OF THIS GUIDE ....................................................................................................... 1

1.2—GENERAL TERMS ............................................................................................................................. 1

1.3—OTHER DEFINED TERMS .................................................................................................................. 3

CHAPTER 2—ADEQUACY OF ACCOUNTING RECORDS ................................................................ 11

2.1—INDIRECT COST RATE SCHEDULE .................................................................................................. 11

A. Generally ................................................................................................................................. 11

B. Facilities Capital Cost of Money and Other Items .................................................................. 12

C. Disclosure of Field Office Rates ............................................................................................. 12

D. Accounting Period: Application of Submitted Indirect Cost Rates ......................................... 13

2.2—UNALLOWABLE COSTS .................................................................................................................. 13

A. Generally ................................................................................................................................. 13

B. Directly Associated Costs ........................................................................................................ 13

2.3—FINANCIAL STATEMENTS ............................................................................................................... 14

2.4—MANAGEMENT REPRESENTATIONS ................................................................................................ 14

2.5—MANAGEMENT AND CPA’S ROLES AND RESPONSIBILITIES ........................................................... 14

A. Management Responsibilities .................................................................................................. 14

B. The CPA Auditor’s Responsibilities ....................................................................................... 15

1. Generally ............................................................................................................................ 15

2. The CPA’s Responsibilities for Fraud Detection ............................................................... 16

C. Selection of CPA Firm as Overhead Auditor .......................................................................... 17

CHAPTER 3—STANDARDS FOR ATTESTATIONS AND AUDITS .................................................. 19

3.1—BACKGROUND ............................................................................................................................... 19

3.2—ENGAGEMENT TYPES ..................................................................................................................... 19

A. Review of Indirect Cost Rates for Costs Incurred ................................................................... 19

B. Indirect Cost Rate (Forward Pricing) Review ......................................................................... 20

C. Contract Pre-Award Review .................................................................................................... 20

D. Contract Cost Review.............................................................................................................. 20

3.3—AUDITING STANDARDS .................................................................................................................. 20

A. Government Auditing Standards (“Yellow Book” or “GAGAS” Standards) ......................... 20

B. GAGAS Engagement Types .................................................................................................... 21

1. Financial Audits ................................................................................................................. 21

2. Attestation Engagements .................................................................................................... 21

3. Performance Audits ............................................................................................................ 21

3.4—OPINION ON INTERNAL CONTROL .................................................................................................. 21

CHAPTER 4—COST PRINCIPLES ......................................................................................................... 23

4.1—OVERVIEW OF FEDERAL ACQUISITION REGULATION, PART 31 ...................................................... 23

4.2—ALLOWABILITY, INCLUDING REASONABLENESS ............................................................................ 24

A. Generally ................................................................................................................................. 24

B. Requirements of FAR 31.201-2 and FAR 31.201-3 ................................................................ 24

C. Methodologies for Applying FAR 31.201-3 ........................................................................... 25

1. Using Quantitative Analysis to Determine Ordinary Cost ................................................. 25

2. Determining Reasonableness: Common Cost Categories .................................................. 25

4.3—ALLOCABILITY .............................................................................................................................. 25

4.4—UNALLOWABLE COSTS .................................................................................................................. 26

4.5—DIRECT AND INDIRECT COSTS ....................................................................................................... 26

4.6—APPLICABILITY OF COST ACCOUNTING STANDARDS ..................................................................... 26

4.7—ALLOCATION BASES FOR INDIRECT COSTS .................................................................................... 27

CONTENTS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) ix

CHAPTER 5—COST ACCOUNTING ..................................................................................................... 29

5.1—ALLOCATION BASES, GENERALLY ................................................................................................. 29

A. Direct Labor Cost .................................................................................................................... 29

B. Direct Labor Hours .................................................................................................................. 29

C. Total Labor Hours (Total Hours Worked)............................................................................... 29

D. Total Cost Input ....................................................................................................................... 29

E. Total Cost Value Added .......................................................................................................... 29

F. Consumption/Usage ................................................................................................................. 29

5.2—ACCOUNTING FOR UNALLOWABLE COSTS IN ALLOCATION BASES ................................................ 30

5.3—COST CENTERS .............................................................................................................................. 30

A. Functional Cost Centers .......................................................................................................... 31

B. Subsidiaries, Affiliates, Divisions, and Geographic Locations ............................................... 31

5.4—ALLOCATED COSTS ....................................................................................................................... 31

A. Generally ................................................................................................................................. 31

B. Fringe Benefits ........................................................................................................................ 31

C. Overhead ................................................................................................................................. 31

D. General and Administrative (G&A) ........................................................................................ 31

E. Internally-Allocated Costs (Company-Owned Assets) ............................................................ 32

1. Computer/CADD Costs ...................................................................................................... 32

2. Fleet or Company Vehicles ................................................................................................ 32

3. Equipment .......................................................................................................................... 32

4. Printing/Copying/Plan Reproduction ................................................................................. 32

F. Internal Labor Costs ................................................................................................................. 32

1. Direct Labor ....................................................................................................................... 32

2. Uncompensated Overtime for Salaried Employees ............................................................ 33

3. Overtime Premium ............................................................................................................. 35

4. Other Considerations Regarding Internal Labor Costs....................................................... 35

5. Potential Areas of Risk Regarding Internal Labor ............................................................. 36

6. Sole Proprietors’ and Partners’ Salaries ............................................................................. 36

G. Contract Labor/ Purchased Labor ........................................................................................... 36

5.5—OTHER DIRECT COSTS-OUTSIDE VENDORS/EMPLOYEE EXPENSE REPORTS .................................. 37

5.6—FIELD OFFICE RATES ..................................................................................................................... 37

A. Generally ................................................................................................................................. 37

B. Types of Field Offices ............................................................................................................. 38

C. Cost Accounting Considerations ............................................................................................. 38

1. Field Office Direct Labor ................................................................................................... 38

2. Field Office Indirect Costs ................................................................................................. 38

3. Other Considerations Regarding Indirect Cost Allocations ............................................... 39

CHAPTER 6—LABOR-CHARGING SYSTEMS AND OTHER CONSIDERATIONS ......................... 45

6.1—BACKGROUND ............................................................................................................................... 45

6.2—LABOR COSTS, GENERALLY .......................................................................................................... 45

6.3—ALLOWABILITY AND REASONABLENESS OF INDIRECT LABOR ....................................................... 45

A. Bid and Proposal Costs (B&P) ................................................................................................ 46

1. Definition ........................................................................................................................... 46

2. Identification and Accumulation of B&P ........................................................................... 46

3. Efforts Sponsored by Grant or Required by Contract ........................................................ 46

B. Selling Effort and Activities .................................................................................................... 47

1. Direct Selling ...................................................................................................................... 47

2. Brokerage Fees, Commissions, and Similar Costs ............................................................. 47

3. Other Cost Principles Related to Selling Efforts ................................................................ 47

4. Recordkeeping Requirements ............................................................................................. 48

CONTENTS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) x

6.4—DCAA ACCOUNTING GUIDE ......................................................................................................... 48

A. Accounting System Internal Control ....................................................................................... 48

B. Labor Charging System Internal Control ................................................................................ 49

1. Generally ............................................................................................................................ 49

2. Timecard Preparation ......................................................................................................... 49

3. Timekeeping Policy ............................................................................................................ 50

6.5—COMPLIANCE AND REVIEW ............................................................................................................ 51

CHAPTER 7—COMPENSATION............................................................................................................ 53

7.1—GENERAL PRINCIPLES .................................................................................................................... 53

7.2—ALLOWABILITY OF COMPENSATION .............................................................................................. 53

7.3—REASONABLENESS OF COMPENSATION .......................................................................................... 54

7.4—STATUTORY COMPENSATION LIMIT: THE BENCHMARK COMPENSATION AMOUNT (BCA) ............ 55

7.5—DETERMINING THE REASONABLENESS OF EXECUTIVE COMPENSATION ......................................... 55

A. Generally ................................................................................................................................. 55

B. Procedures for Determining Reasonableness .......................................................................... 56

C. Performing a Compensation Analysis in Compliance with FAR 31.205-6, Techplan, and

Information Systems ..................................................................................................................... 56

7.6—CRITERIA FOR DEMONSTRATING SUPERIOR PERFORMANCE .......................................................... 58

A. Generally ................................................................................................................................. 58

B. Procedure for Establishing Compensation Amounts in Excess of Survey Medians ............... 59

7.7—STATE DOT OVERSIGHT: REVIEW OF EXECUTIVE COMPENSATION ............................................... 60

A. Reviewing the Engineering Consultant’s Compensation Analysis ......................................... 60

B. Using the National Compensation Matrix (NCM) to Evaluate Executive Compensation ...... 60

7.8—EXECUTIVE COMPENSATION—REQUIRED SUPPORTING DOCUMENTATION ................................... 61

7.9—ADDITIONAL PROCEDURES—RELATED PARTIES ........................................................................... 61

7.10—SPECIAL CONSIDERATION FOR CLOSELY-HELD FIRMS ................................................................ 62

7.11—BONUS AND INCENTIVE PAY PLANS ............................................................................................ 63

A. Bonus Plans ............................................................................................................................. 63

B. Profit-Distribution Plans .......................................................................................................... 63

C. Documentation of Bonus and Profit-Distribution Plans .......................................................... 63

7.12—FRINGE BENEFITS ........................................................................................................................ 64

A. Deferred Compensation, Generally ......................................................................................... 64

B. Pension Plans ........................................................................................................................... 64

C. Employee Stock Ownership Plans (ESOPs) ............................................................................ 65

D. Severance Pay ......................................................................................................................... 66

7.13—SUPPLEMENTAL BENEFITS ........................................................................................................... 67

A. Supplemental Executive Retirement Plans (SERPs) ............................................................... 67

B. Long-Term Incentive (LTI) Plans ........................................................................................... 67

C. Executive Severance ................................................................................................................ 67

D. Golden Parachutes ................................................................................................................... 67

E. Golden Handcuffs .................................................................................................................... 67

CHAPTER 8—SELECTED AREAS OF COST........................................................................................ 69

8.1—BACKGROUND ............................................................................................................................... 69

A. Directly-Associated Costs ....................................................................................................... 69

B. Burden of Proof ....................................................................................................................... 69

C. Determining Reasonableness ................................................................................................... 70

D. Direct Costs ............................................................................................................................. 70

8.2—ADVERTISING AND PUBLIC RELATIONS ......................................................................................... 70

A. Advertising Costs .................................................................................................................... 70

B. Trade Show Expenses and Labor ............................................................................................ 70

C. Public Relations Costs ............................................................................................................. 71

D. Bad Debts and Collection Costs .............................................................................................. 71

8.3—COMPENSATION ............................................................................................................................. 71

CONTENTS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) xi

8.4—PERSONAL USE OF COMPANY VEHICLES ....................................................................................... 71

8.5—CONTRIBUTIONS OR DONATIONS ................................................................................................... 71

8.6—FACILITIES CAPITAL COST OF MONEY (FCCM) ............................................................................ 72

8.7—DEPRECIATION .............................................................................................................................. 72

A. Depreciation Expense Presented Is Same for Both Financial and Income Tax Purposes ....... 73

B. Depreciation Expense Presented for Financial Purposes Differs from Income Tax Purposes ............... 73

8.8—EMPLOYEE MORALE, HEALTH, AND WELFARE .............................................................................. 73

8.9—ENTERTAINMENT ........................................................................................................................... 74

8.10—FINES AND PENALTIES ................................................................................................................. 74

8.11—GAINS AND LOSSES ON DEPRECIABLE PROPERTY ........................................................................ 74

8.12—IDLE FACILITIES AND IDLE CAPACITY COSTS .............................................................................. 75

8.13—BID AND PROPOSAL COSTS .......................................................................................................... 75

8.14—PRECONTRACT COSTS .................................................................................................................. 75

8.15—INSURANCE .................................................................................................................................. 76

A. Insurance on Lives of Key Personnel ...................................................................................... 76

B. Professional Liability Insurance .............................................................................................. 76

C. Losses and Insurance Deductibles ........................................................................................... 76

D. Self Insurance .......................................................................................................................... 76

8.16—INTEREST COSTS .......................................................................................................................... 77

8.17—LOBBYING COSTS ........................................................................................................................ 77

8.18—LOSSES ON OTHER CONTRACTS ................................................................................................... 77

8.19—ORGANIZATION AND REORGANIZATION COSTS ........................................................................... 77

8.20—PATENT COSTS ............................................................................................................................ 77

8.21—RETAINER AGREEMENTS ............................................................................................................. 77

8.22—RELOCATION COSTS .................................................................................................................... 78

8.23—RENT/LEASE ................................................................................................................................ 79

A. Capital Leases ......................................................................................................................... 79

B. Common Control and Cost of Ownership ............................................................................... 79

8.24—SELLING COSTS ........................................................................................................................... 80

8.25—TAXES ......................................................................................................................................... 81

8.26 —TRAVEL EXPENSES ..................................................................................................................... 81

A. Generally ................................................................................................................................. 81

B. Substantiation of Travel Costs ................................................................................................. 82

C. Aircraft Costs .......................................................................................................................... 82

D. Vehicle Costs .......................................................................................................................... 82

8.27—LEGAL COSTS .............................................................................................................................. 82

8.28—GOODWILL AND BUSINESS COMBINATION COSTS ........................................................................ 82

8.29—ALCOHOLIC BEVERAGES ............................................................................................................. 83

8.30—LISTING OF COMMON UNALLOWABLE COSTS .............................................................................. 83

CHAPTER 9 – GENERAL AUDIT CONSIDERATIONS ....................................................................... 85

9.1—BACKGROUND ............................................................................................................................... 85

9.2—COMPLIANCE REQUIREMENTS ....................................................................................................... 85

9.3—INTERNAL CONTROL ...................................................................................................................... 86

A. Generally ................................................................................................................................. 86

B. COSO Internal Control Framework ........................................................................................ 86

1. Control Environment .......................................................................................................... 86

2. Risk Assessment ................................................................................................................. 86

3. Control Activities ............................................................................................................... 87

4. Information and Communication ....................................................................................... 87

5. Monitoring .......................................................................................................................... 87

9.4—ESTIMATING AND PROPOSAL SYSTEMS .......................................................................................... 87

9.5—COST ACCOUNTING SYSTEMS ........................................................................................................ 87

A. Generally ................................................................................................................................. 87

B. Labor Tracking ........................................................................................................................ 87

C. Other Considerations ............................................................................................................... 88

CONTENTS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) xii

9.6—UNDERSTANDING THE ENGINEERING CONSULTANT’S BUSINESS ................................................... 88

A. Risk Assessment ...................................................................................................................... 88

B. Types of Audit Risk ................................................................................................................ 88

9.7—OTHER AUDITS AS A RESOURCE .................................................................................................... 89

9.8—COMPUTERIZED ACCOUNTING INFORMATION SYSTEMS ................................................................ 89

9.9—AUDIT RISK AND MATERIALITY .................................................................................................... 89

A. Audit Risk ............................................................................................................................... 89

B. Materiality ............................................................................................................................... 90

9.10—TYPE AND VOLUME OF CONTRACTS ............................................................................................ 90

CHAPTER 10—GUIDANCE FOR DEVELOPING AUDIT PROCEDURES ......................................... 93

10.1—PLANNING AND GENERAL PROCEDURES ...................................................................................... 93

10.2—AUDIT SAMPLING ........................................................................................................................ 95

A. Audit Objectives and Sampling Methods ................................................................................ 95

B. Sampling for Attributes and Sampling for Variables .............................................................. 96

C. Determining Sample Size ........................................................................................................ 97

10.3—TESTING LABOR COSTS ............................................................................................................... 98

A. Generally ................................................................................................................................. 98

B. Recommended Testing Procedures ......................................................................................... 98

10.4—TESTING INDIRECT COSTS ........................................................................................................... 99

A. Generally ................................................................................................................................. 99

B. Baseline for Determining Risk .............................................................................................. 100

10.5—ALLOCATED COSTS ................................................................................................................... 101

10.6—OTHER DIRECT COSTS (ODCS) ................................................................................................. 102

10.7—FAILURE TO MEET MINIMUM AUDIT PROCEDURES.................................................................... 102

CHAPTER 11—AUDIT REPORTS AND MINIMUM DISCLOSURES .............................................. 105

11.1—GENERALLY .............................................................................................................................. 105

11.2—SAMPLE AUDIT REPORT ON INDIRECT COST RATE SCHEDULE .................................................... 105

11.3 – SAMPLE REPORT ON INTERNAL CONTROL AND COMPLIANCE .................................................... 108

11.4—MINIMUM AUDIT REPORT DISCLOSURES ................................................................................... 109

A. Description of the Company ................................................................................................. 109

B. Basis of Accounting .............................................................................................................. 109

C. Description of Accounting Policies ....................................................................................... 109

D. Description of Overhead Rate Structure ............................................................................... 109

E. Description of Labor-Related Costs ...................................................................................... 110

F. Description of Depreciation and Leasing Policies ................................................................. 111

G. Description of Related-Party Transactions ............................................................................ 111

H. Facilities Capital Cost of Money (FCCM) ............................................................................ 112

I. List of Other Direct Cost Accounts and Charge Rates ........................................................... 112

J. Management’s Evaluation of Subsequent Events ................................................................... 112

CHAPTER 12—COGNIZANCE AND OVERSIGHT ............................................................................ 113

12.1—NATIONAL HIGHWAY SYSTEM DESIGNATION ACT SECTION 307 ............................................... 113

12.2—SECTION 174 OF THE 2006 TRANSPORTATION APPROPRIATIONS ACT ....................................... 114

12.3—WHAT IS A COGNIZANT AGENCY? ............................................................................................. 114

12.4—HOW IS A COGNIZANT APPROVED INDIRECT COST RATE ESTABLISHED? .................................. 115

12.5—GUIDELINES FOR REVIEWING CPA INDIRECT COST AUDITS ...................................................... 115

12.6—ATTESTATIONS ENGAGEMENTS ................................................................................................. 115

12.7—RISK ANALYSIS: ACCEPTING OVERHEAD RATES WITHOUT A WORKPAPER REVIEW ................. 115

12.8—FHWA GUIDANCE: QUESTIONS AND ANSWERS REGARDING COGNIZANCE .............................. 116

CONTENTS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) xiii

APPENDICES

APPENDIX A: Review Program for CPA Audits of Consulting Engineers’ Indirect Cost Rates

APPENDIX B: Internal Control Questionnaire for Consulting Engineers

APPENDIX C: Keyword Index to Federal Acquisition Regulation Part 31

APPENDIX D: Listing of Resource Materials

APPENDIX E: Sample Management Representation Letters

APPENDIX F: FHWA ORDER 4470.1A (Cost Certification)

CONTENTS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) xiv

AASHTO Uniform Audit & Accounting Guide (2012 Edition) 1 | Page

Chapter 1—Organization of this Guide and Defined Terms

1.1—Organization of This Guide

This Uniform Auditing and Accounting Guide is organized in chapters. Chapters are subdivided into

sections, subsections, and paragraphs. For the sake of brevity, internal references to this guide most

commonly follow the “short reference” format as illustrated in the following examples:

Short Reference

Full Reference

Section 2.4 Chapter 2, section 4

Section 3.2.D Chapter 3, section 2, subsection D

Section 5.6.A.2 Chapter 5, section 6, subsection A, paragraph 2

1.2—General Terms

In this guide, words not defined shall be given their plain meaning. The following defined words and

terms are used throughout this guide—

“AASHTO” refers to the American Association of State Highway and Transportation Officials.

The terms “A/E firm,” “engineering consultant,” “consultant,” “contractor,” or “firm” refer to

Architectural and Engineering design companies that perform work on Government contracts.

“AICPA” refers to the American Institute of Certified Public Accountants, the national,

professional organization for all Certified Public Accountants.

The terms “the CPA auditor,” or “the CPA” refer to independent CPA firms that perform audits,

reviews, or other types of attestation engagements for A/E firms.

The “Code of Federal Regulations” (CFR) is the codification of the general and permanent rules

published in the Federal Register by the executive departments and agencies of the Federal

Government. The CFR is divided into 50 titles that represent broad areas subject to Federal

regulation. 48 CFR Chapter 12 sets forth the general guidelines used by State DOTs.

The “Cost Accounting Standards,” or “CAS,” are issued by the Cost Accounting Standards Board

(CASB), a section of the Office of Federal Procurement Policy within the U.S. Office of

Management and Budget. The CASB has the exclusive authority to issue and amend cost

accounting standards and interpretations designed to achieve uniformity and consistency in the cost

accounting practices governing the measurement, assignment, and allocation of costs to contracts

that involve Federal funds. The CAS are codified at 48 CFR Chapter 99. Certain CAS provisions

are incorporated into FAR Part 31 and therefore apply to most Federal-aid highway program

(FAHP) projects, while other provisions apply only to large contracts.

1

C HAPTER 1/ORGANIZATION OF THIS G UIDE AND D EFINED T ERMS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) 2 | Page

The “DCAA Contract Audit Manual” (CAM or DCAA Manual 7640.1) is an official publication of

the Defense Contract Audit Agency (DCAA). The CAM prescribes auditing policies and

procedures and furnishes guidance in auditing techniques for personnel engaged in performing

audits in compliance with FAR Part 31 and related laws and regulations. The CAM is published

semiannually by the DCAA.

The “Federal Acquisition Regulation, Part 31” (FAR). The FAR is codified at 48 CFR Part 31. The

FAR is the primary regulation governing the acquisition of supplies and services with Federal

funds. 48 CFR Part 31 sets the criteria for determining costs eligible for reimbursement on

Federally- funded agreements and may be used to determine allowable costs for contracts funded

solely by State funds.

“FAR-Compliant Audit” refers to a formal audit or examination of the indirect cost rate schedule

and associated notes, to obtain reasonable assurance that the costs presented in the schedule

substantially comply with the Cost Principles of FAR Subpart 31.2. When performing FAR-

compliant audits, auditors must apply the standards applicable to financial audits or examination-

level attestation engagements as contained in the Government Auditing Standards issued by the

Comptroller General of the United States.

The “Federal Travel Regulation” (FTR) is contained in 41 CFR Chapters 300 through 304. The

FTR implements policies for travel by Federal civilian employees and others authorized to travel at

the Federal Government’s expense. The FAR incorporates certain FTR provisions for use in

determining the allowability of contract costs incurred by engineering consultants.

“GAAP” refers to the Generally Accepted Accounting Principles, a widely accepted set of rules,

conventions, standards, and procedures for reporting financial information, as established by the

Financial Accounting Standards Board (FASB).

“Generally Accepted Auditing Standards” (GAAS) are published by the American Institute of

Certified Public Accountants (AICPA). GAAS apply to financial statement audits and contain

guidance regarding auditors’ professional qualifications, the quality of audit effort, and the

characteristics of professional and meaningful audit reports.

The “Government Auditing Standards,” also known as “Generally Accepted Government Auditing

Standards” (GAGAS) or “Yellow Book” standards, are issued by the U.S. Government

Accountability Office (GAO).

3

GAGAS prescribe general procedures and professional standards

that examiners must apply when performing audits or attestation engagements of firms that conduct

business with governmental entities. GAGAS standards also incorporate the Generally Accepted

Auditing Standards specific to financial-related audits.

“Indirect cost rate schedule” refers to the primary document used by engineering consultants to

compute indirect cost rates (overhead rates) used for billings on Government projects. An indirect

cost rate schedule is based on amounts obtained from the engineering consultant’s general ledger

(after the adjusting entries have been posted to the accounts), as well as from amounts in the

engineering consultant’s cost accounting system. This schedule must be in agreement with, or must

be reconciled to, amounts from the engineering consultant’s general ledger or post-closing trial

balance. An indirect cost rate schedule also is commonly referred as an “overhead schedule,”

“schedule of indirect costs” or “Statement of Direct Labor, Fringe Benefits, and General

Overhead.”

“Management” refers to A/E firm owners, officers, and/or others responsible for the formulation

and execution of the firm’s policies and procedures, including, but not limited to, internal controls,

personnel policies, compensation policies, and labor-charging practices.

“Overhead” or “indirect cost” refers to any cost that is not directly identified with a single final cost

objective, but is identified with two or more final cost objectives or with at least one intermediate

cost objective. Engineering consultants charge their indirect costs by applying an overhead rate to

an allocation base (e.g., direct labor cost).

3

Government Auditing Standards, GAO-12-331G (Washington, D.C.: December 2011 Revision).

C HAPTER 1/ORGANIZATION OF THIS G UIDE AND D EFINED T ERMS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) 3 | Page

“Overhead rate” or “indirect cost rate” refer to a factor/ratio computed by adding together all of a

firm’s costs that cannot be associated with a single cost objective (e.g., general and administrative

costs and fringe benefit costs), then dividing by a base value (usually direct labor cost) to determine

a rate. This rate is applied to direct labor, as incurred on projects, to allow a firm to recover the

appropriate share of indirect costs allowable per the terms of specific agreements. In this guide, the

terms “indirect cost rate” and “overhead rate” are used synonymously.

“State DOT” or “DOT” refers to a State department of transportation or other State transportation

agency.

“Statements on Auditing Standards” or “SASs” are interpretations of U.S. Generally Accepted

Auditing Standards as issued by the Auditing Standards Board (ASB), the senior technical

committee of the AICPA designated to issue auditing, attestation, and quality control standards and

guidance.

1.3—Other Defined Terms

Actual Costs

Amounts determined based on costs incurred. Actual costs are supported by original source

documentation, such as invoices, receipts, and cancelled checks. Actual costs generally are not

determined based on forecasts or historical averages.

Actual Cost Agreement

Costs reimbursed under an Actual Cost Agreement are limited to the specified criteria (actual allowable

costs) described in the agreement. These limitations are based on the Cost Principles found in FAR

Subpart 31.2 and may include additional restrictions mandated by the laws of specific State DOTs. Direct

and indirect costs billed against Actual Cost Agreements must exclude all unallowable costs, including

certain costs that may be fully or partially deductible for the purpose of computing income taxes (e.g.,

interest, entertainment, and bad debts).

Advance Agreement

Contract language that specifies the treatment of special or unusual costs. For example, the use of

statistical sampling methods for identifying and segregating unallowable costs should be the subject of an

advance agreement under the provisions of FAR 31.109 between the engineering consultant and the

cognizant audit agency. The advance agreement should specify the basic characteristics of the sampling

process. FAR 31.109 provides that advance agreements must be “in writing, executed by both the

contracting parties, and incorporated into applicable current and future contracts. An advance agreement

shall contain a statement of its applicability and duration.”

Agreement

A contract between a State DOT and an A/E firm. An Agreement is a binding, legal document that

identifies the deliverable goods/services to be provided, under what conditions, and the method of

reimbursement for such goods/services. An Agreement may include both Federal and State requirements

that must be met by the State DOT and the engineering consultant. Agreements usually indicate start and

finish dates, record retention requirements, and other pertinent information relative to the work to be

performed.

All-Inclusive Hourly Rate Agreement

A contract using a provisional hourly billing rate based on a firm’s estimated direct labor and overhead

costs, plus a negotiated profit margin. Generally, provisional hourly rates are temporary and are adjusted

during the audit process. Negotiated hourly rates may be used for the life of an Agreement or instead may

be adjusted periodically based on the provisions of the agreement.

C HAPTER 1/ORGANIZATION OF THIS G UIDE AND D EFINED T ERMS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) 4 | Page

Allocable Cost

FAR 31.201-4 provides that a cost is allocable to a Government contract if the cost—

(a) Is incurred specifically for the contract;

(b) Benefits both the contract and other work, and can be distributed to them in

reasonable proportion to the benefits received; or

(c) Is necessary to the overall operation of the business, although a direct relationship to

any particular cost objective cannot be shown.

Allowable Cost

Depending on the nature of specific cost items, allowable costs may either be billed directly to contracts

or included as overhead costs; however, FAR 31.201-2 provides that a cost is an allowable charge to a

Government contract only if the cost is—

reasonable in amount,

allocable to Government contracts,

compliant with Generally Accepted Accounting Principles and standards promulgated by the

Cost Accounting Standards Board (when applicable),

compliant with the terms of the contract, and

not prohibited by any of the FAR Subpart 31.2 cost principles.

Audit

A formal examination, in accordance with professional standards, of accounting systems, incurred cost

records, and other cost presentations to verify their reasonableness, allowability, and allocability for

negotiating agreement fees and for determining allowable costs to be charged to Government contracts.

Audits include an evaluation of an engineering consultant’s policies, procedures, controls, and actual

performance. Audit objectives include the identification and evaluation of all activities that contribute to,

or have an impact on, proposed or incurred costs related to Government contracts.

Audit Cycle

The series of steps that auditors perform in completing an audit engagement. The procedures performed

may vary somewhat, but the Audit Cycle generally includes audit planning, review of the auditee’s

permanent file, preliminary analytical review, audit fieldwork (including entrance and exit conferences),

submittal of the draft audit report to the auditee for review and comment, and the issuance of the final

audit report.

Audit Resolution Process

The process that State DOTs and the auditee engage in to resolve audit findings. This process may

include the negotiation of a settlement and/or may involve legal counsel and court procedures.

Audit Trail

A record of transactions in an accounting system that provides verification of the activity of the system.

A complete audit trail allows auditors to trace transactions in a firm’s accounting records from original

source documents into subsidiary ledgers through the general ledger and into general-purpose financial

statements and billings/invoices prepared and submitted by the engineering consultant.

Billing Rates (Hourly Labor Rates)

Generally refers to the hourly labor rates invoiced by an engineering consultant for work performed on

an agreement. For a cost plus fixed fee agreement (the most common type of agreement), billing rates are

determined based on employees’ actual payroll rates. By contrast, for an all-inclusive hourly rate

agreement, billing rates are determined based on actual payroll rates with additional amounts included for

overhead and net fee (profit).

C HAPTER 1/ORGANIZATION OF THIS G UIDE AND D EFINED T ERMS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) 5 | Page

Contracting Officer

A position title used in FAR Part 31 to identify a person with the authority to bind a State or Federal

agency to a contract. Within State DOTs, contracting officers are the individuals who enter into,

administer, and/or terminate contracts and make related determinations and findings. In State DOTs,

auditors generally act at the request of, and on behalf of, contracting officers.

Corporation

A business structure where stock is issued and sold to shareholders. A corporation typically has a

president, numerous vice presidents, a chief financial officer and/or treasurer, and a secretary. Corporate

employees usually are paid based on an hourly wage rate or annual salary. The liability of individual

stockholders (owners) is limited to their investments in the corporation’s stock.

Depending on how a corporation is formed, it will be taxed under either Subchapter C or Subchapter S of

Chapter 1 of the Internal Revenue Code. A C-Corporation is taxed on its income at the corporate level,

and stockholders pay a second layer of tax on the dividends they receive from the corporation. By

contrast, S-Corporations are not taxed at the corporate level; instead, the S-Corporation’s income or

losses are passed through to its shareholders, who then report the income or loss on their individual tax

returns.

Cost Center

A non-revenue-producing element of a business organization. Cost centers are used to accumulate and

segregate costs.

Cost Objective

An agreement/contract, function or organizational subdivision, or other work unit for which the costs of

processes, products, jobs, or projects are accumulated and measured. An “intermediate cost objective” is

a cost objective used to accumulate costs that are subsequently allocated to one or more indirect cost

pools and/or final cost objectives.

Cognizant Audit

This concept was developed to assign primary responsibility for an audit to a single entity (the “cognizant

agency”) to avoid the duplication of audit work performed in accordance with Government Auditing

Standards to obtain reasonable assurance that claimed costs are accordance with the FAR Subpart 31.2

cost principles. Such audit work may be performed by home-State auditors, a Federal audit agency, a

CPA firm, or a non-home State auditor designated by the home-State auditor.

Common Control

Exists in related-party transactions when business is conducted at less than arm’s length between

businesses and/or persons that have a family or business relationship. Examples are transactions between

family members, transactions between subsidiaries of the same parent company, or transactions between

companies owned by the same person or persons. Common control exists when a related party has

effective control over the operating and financial policies of the related entity. Effective control may exist

even if the related party owns less than 50 percent of the related entity. (For further discussion, see

Section 8.23.B and Section 11.4.G.1, Example 11-8.)

Cost Plus Fixed Fee Agreement

An agreement in which all the cost factors, except the fixed fee, are based on the engineering consultant’s

actual allowable costs. The fixed fee is a specific, predetermined amount, as identified in the agreement.

C HAPTER 1/ORGANIZATION OF THIS G UIDE AND D EFINED T ERMS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) 6 | Page

Facilities Capital Cost of Money (FCCM)

Although interest costs associated with the financing of capital are unallowable, some costs associated

with the engineering consultant’s investment in fixed assets are allowable. Specifically, Facilities Capital

Cost of Money (FCCM) is an imputed cost determined by applying a charge rate to the engineering

consultant’s fixed assets used in contract performance. FCCM is not required to be recorded in the

engineering consultant’s formal accounting records; instead, FCCM is computed as a charge rate based

on the following factors:

The average annual net book value of the engineering consultant’s investments in the fixed assets

used for allowable business activities (in accordance with the cost principles of FAR Subpart

31.2),

The prorated average Prompt Payment Act Interest Rate

4

determined by the U.S. Secretary of the

Treasury for the accounting period in question, and

The engineering consultant’s direct labor base used to determine overhead rates.

(See Section 8.6 for further discussion regarding FCCM.)

Cost Principles of FAR Subpart 31.2

These principles establish the framework for determining allowable and unallowable charges against

Federal-aid highway program (FAHP) contracts. FAR Subpart 31.2 lists expressly unallowable costs and

establishes criteria for determining the allocability and reasonableness of cost items.

Directly Associated Cost

Refers to a cost generated solely as a result of the incurrence of another cost, and which would not have

been incurred had the other cost not also been incurred (see FAR 31.001 and FAR 31.201-6(a)). If a cost

is determined to be unallowable, then its directly associated costs also must be disallowed.

Direct Cost

Any cost that is identified specifically with a particular final cost objective. Direct costs are not limited to

items that are incorporated in the end product as material or labor. Costs identified specifically with a

contract are direct costs of that contract. All costs identified specifically with other final cost objectives

of the contractor are direct costs of those cost objectives.

Direct costs include labor, materials, and reimbursable expenses incurred specifically for an agreement.

All direct labor costs allocable to design and engineering contracts (regardless of the contract type, e.g.,

lump-sum versus actual cost) must be included in the direct labor base regardless of whether the costs are

billable to a client.

Entrance Conference

A meeting between the auditor and the auditee during which the purpose and scope of the audit are

discussed.

Exit Conference

A meeting held after the completion of audit field work. The exit conference generally focuses on a

discussion of the preliminary audit findings, which are subject to change based on further audit testing,

supervisory review, and additional information submitted by the auditee.

Federal-Aid Highway Program (FAHP) Contracts

Refers to agreements for the acquisition of supplies and services that are partially- or fully-funded from

Federal sources. “Government contracts” is a more encompassing term, as it includes FAHP contracts

and all other contracts with governmental entities, including contracts that are fully funded by State or

municipal governments.

4

Current Treasury rates are available at: http://www.treasurydirect.gov/govt/rates/tcir/tcir_opdprmt2.htm.

C HAPTER 1/ORGANIZATION OF THIS G UIDE AND D EFINED T ERMS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) 7 | Page

Field Office

A field office is a facility that the engineering consultant specifically establishes, or has furnished to it, at

or near the project site. The field office must be used exclusively for project purposes. The use of a field

office allows for the computation of a field office overhead rate, which is designed to reimburse the

engineering consultant for the fringe benefits of the field personnel and associated home office support.

Field offices may exist in several forms. For example, an engineering consultant’s employees may work

for a period of time in an on-site office maintained by a State DOT. Since the engineering consultant’s

employees do not work out of their own offices and do not receive office support in their daily activities,

the hours billed for these employees may not qualify for the engineering consultant’s full overhead rate.

Instead, a field rate may need to be established to allocate a reasonable portion of the engineering

consultant’s indirect costs to a field office.

Financial Statements

Financial statements are formal records that summarize a firm’s business activities. Financial statements

usually are compiled on a quarterly and annual basis. In this guide, the term “General Purpose Financial

Statements” is used to refer to the basic financial statements, which include an Income Statement,

Balance Sheet, and Statement of Cash Flows. This guide also makes reference to an indirect cost rate

schedule, which is a Special Purpose Financial Statement used to report specific financial information to

governmental agencies such as State Departments of Transportation and the U.S. Department of Defense.

Finding (Audit Finding)

An audit finding may result from an engineering consultant’s deficiencies in internal control, fraud,

illegal acts, the violation of contract or grant provisions, and/or abuse. When auditors identify

deficiencies, they should plan and perform procedures to develop the elements of the findings that are

relevant and necessary to achieve the audit objectives. In accordance with GAGAS, when documenting a

finding, the auditor should include the condition, criteria, cause, effect, and a recommendation for

correction. See GAGAS Chapters 4.10 to 4.14 for more details. Attestation engagements are discussed in

GAGAS Chapters 5.11 to 5.15.

General and Administrative (G&A) Expenses

Costs of operating a company that are incurred by, or allocated to, a business unit and are not directly

linked to the company’s products or services.

Interim Audit

An audit conducted during the life of an agreement and designed to determine the actual allowable costs

as of the audit date, including costs billed by the prime engineering consultant and any subconsultants.

During an interim audit, auditors typically adjust the engineering consultant’s billed costs (including

direct labor, overhead, and other direct costs) to the allowable costs actually incurred. Interim audits

generally involve the use of a standard audit program, although the procedures used may vary somewhat

depending on the agency performing the audit.

Internal Controls

Include the plan of organization and the methods and procedures adopted by management to ensure that

the firm’s goals and objectives are met; that resources are used consistent with laws, regulations, and

policies; that resources are safeguarded against waste, loss, and misuse; and that reliable data are

obtained, maintained, and fairly disclosed in reports.

Limited Liability Companies (LLCs) and Limited Liability Partnerships (LLPs)

Business entities in which the members (owners) generally are liable only to the extent of their invested

capital. LLCs and LLPs usually are taxed as partnerships (no taxation at the corporate level); although

some LLCs elect to be taxed like C-Corporations (taxation applies at the corporate level, before the

distribution of dividends).

C HAPTER 1/ORGANIZATION OF THIS G UIDE AND D EFINED T ERMS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) 8 | Page

Lump Sum (Fixed Price) Agreement

An agreement in which the method of payment for delivered goods and/or services is a fixed amount that

includes salaries, overhead, and profit. Once the lump-sum amount is determined, the goods and/or

services must be provided regardless of the engineering consultant’s actual costs. No adjustments are

permitted to compensate the engineering consultant for costs in excess of the contract’s fixed amount

unless there is a significant change in the scope of work that results in an approved change order.

Negotiated Hourly Rate Agreement

An agreement in which hourly billing rates (including labor, overhead, and net fee) are negotiated in

advance and are listed for a period of one year or more.

Overtime Compensation

Generally, this is compensation paid to employees who work more than 40 hours per week or 80 hours in

a pay period. Overtime pay rates may be based on employees’ normal hourly rates or may include

“premium overtime” such as time and a half or double time. In accordance with the Fair Labor Standards

Act (FLSA), premium overtime pay generally is required for hourly workers but is optional for certain

salaried employees (exempt employees).

Partnership

A business with two or more co-owners, who may or may not have established salaries. Generally,

partners are jointly responsible for the firm’s debts and other liabilities, and this liability exposure is not

limited to the partners’ individual investments in the firm. When establishing hourly pay rates that may

be billed to Government contracts, partners may be treated the same as sole proprietors.

Post Audit (Project Close-Out Audit)

An audit done after an engineering consultant completes all scheduled work on a project. The scope of a

post audit may include all costs billed to the project, including direct costs, overhead costs, and costs for

subconsultants. Post audits generally involve the use of a standard audit program, although the

procedures used may vary somewhat depending on the agency performing the audit.

Pre-Award Review

An examination conducted by, or on behalf of, a State DOT to verify financial information supplied by

an engineering consultant. The examination may involve a desk review performed at the audit office

and/or fieldwork at the engineering consultant’s place of business. Upon completion, the audit results are

provided to the State DOT contracting officer for use during contract negotiations.

Provisional Hourly Rate Agreement

An agreement in which hourly billing rates, including labor, overhead, and net fee, are negotiated in

advance but are subject to adjustment after actual labor and overhead costs are determined through an

audit.

Reasonable Cost

A cost is reasonable, if, in its nature and amount, it does not exceed that which would be incurred by a

prudent person in the conduct of competitive business. See Section 4.2 for additional discussion.

Sole Proprietorship

A business with only one owner. Sole proprietors commonly do not have established salaries, but instead

may rely on draws from the firm’s profits to obtain payment for their services.

Source Documents

Original documents that support the costs recorded in an engineering consultant’s accounting records,

including general and subsidiary ledgers. Source documents include, but are not limited to: time sheets,

payroll registers, invoices, hotel receipts, rental slips, gasoline tickets, cancelled checks, tax returns,

insurance policies, and minutes of corporate meetings.

C HAPTER 1/ORGANIZATION OF THIS G UIDE AND D EFINED T ERMS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) 9 | Page

Task Assignment (Task Order) Agreement

An agreement that specifies a time period for performance but does not include a complete description of

all the work to be completed under the agreement. Tasks that require the engineering consultant’s

expertise are assigned as needed, and each task has its own maximum payable amount. The total amount

paid on all the tasks may not exceed the total amount of the agreement.

Total-Hour Accounting System

A total-hour accounting system records all hours worked by all employees, regardless of whether the

employees are exempt from overtime pay or whether all direct labor hours are billed to specific contracts.

All engineering consultants that receive compensation under actual cost agreements must maintain a

total-hour accounting system. See DCAAP 7641.90 Chapter 2-302.1(5) for details. DCAAP 7641.90 is

available at www.dcaa.mil/chap6.pdf.

Unallowable (Cost)

An item of cost that is ineligible for cost reimbursement. Unallowable costs must not be billed to

Government contracts either directly or through the application of an overhead rate. When an

unallowable cost is incurred, its directly associated costs also are unallowable.

Uncompensated Overtime

FAR 52.237-10 defines uncompensated overtime as “hours worked without additional compensation in

excess of an average of 40 hours per week by direct charge employees who are exempt from the Fair

Labor Standards Act. Compensated personal absences such as holidays, vacations, and sick leave must be

included in the normal work week for purposes of computing uncompensated overtime hours.”

C HAPTER 1/ORGANIZATION OF THIS G UIDE AND D EFINED T ERMS

AASHTO Uniform Audit & Accounting Guide (2012 Edition) 10 | Page

AASHTO Uniform Audit & Accounting Guide (2012 Edition) 11 | Page

Chapter 2—Adequacy of Accounting Records

Management must maintain accurate financial information and must submit timely financial reports to

governmental agencies, including Federal agencies, State DOTs, and/or municipal entities. These

financial reports include general-purpose financial statements, indirect cost rate schedules, and other