Charging Fees in Employment

Tribunals and the Employment

Appeal Tribunal

Consultation Paper CP22/2011

Published on 14 December 2011

This consultation will end on 6 March 2012

About this consultation

To:

This consultation is aimed at all stakeholders with

an interest in employment tribunals and

employment matters, or who would be affected by

the introduction of fee charges for employment

claims and appeals to the Employment Appeal

Tribunal.

Duration:

From 14 December 2011 to 6 March 2012

Enquiries (including

requests for the paper in

an alternative format) to:

Doug Easton, on

Tel: 0141 354 8409

Fax: 0141 354 8556

Email: EmploymentFeesConsultation

@hmcts.gsi.

gov.uk

M

inistry of Justice

HQ Civil Family & Tribunals Directorate –

Employment Tribunals Fees Consultation

Level 1 (post point 1.40)

102 Petty France

London SW1H 9AJ

How to respond:

Please send your response by 6 March 2012 to:

Ministry of Justice

HQ Civil Family & Tribunals Directorate –

Employment Tribunals Fees Consultation

Level 1 (post point 1.40)

102 Petty France

London SW1H 9AJ

Tel 0141 354 8409

Email: EmploymentFeesConsultation@

hmcts.gsi.g

ov.uk

Additional w

ays to feed

in your views:

Should you wish to discuss further please use the

‘Enquiries’ contact details.

Response paper:

A response to this consultation exercise is due to

be published three months after the closing of the

consultation at: http://www.justice.gov.uk

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Contents

Foreword 3

Executive summary 5

Introduction 8

Background 11

The Proposals 14

Part 1 – Employment tribunals – Option 1 fee proposals 14

Part 2 – Employment tribunals – Option 2 fee proposals 40

Part 3 – The Employment Appeal Tribunal fee proposals 51

Part 4 – Operational changes to introduce fees 53

Annex A – List of fee levels to which individual complaints are allocated

under Options 1 and 2 55

Annex B – The legislative framework for the remission system 62

Annex C – Remission 3 – Table of Contributions 67

Annex D – Examples of the application of the HM Courts & Tribunals

Service remission system 68

Questionnaire 72

About you 76

Contact details/How to respond 77

The consultation criteria 79

1

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

2

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Foreword

Promoting growth is this government’s number one

priority. At times of economic hardship, it becomes

more important than ever to ensure that public

services are cost effective and efficient, and to

confront the structural barriers that impede

competitiveness, employer confidence and the

creation of jobs.

Accordingly, we need to identify elements within the

operation of the civil justice system that could present

such barriers. A modern justice system should resolve

conflict effectively, efficiently and as early as possible.

Yet, those involved in the current system can find it a

slow, expensive and daunting experience, one that

fosters rather than minimises litigation, and one which weighs heavily on the

public purse.

Employment tribunals and the Employment Appeals Tribunals, the subject of

this consultation, are particularly in need for reform. Bringing a claim or appeal

to these tribunals is currently free for users, with the full £84 million annual

cost of running the tribunals being met by taxpayers, despite the fact that most

of them will never use the service.

It is of course vitally important that employees have meaningful access to

justice. But employers complain that, at its worst, the operation of the current

system can be a one way bet against them, with parties inadequately

incentivised to think through whether a formal claim really needs to be lodged,

or whether it could be settled in other ways such as conciliation, mediation or

informal discussions.

Though the vast majority of awards in employment tribunals are relatively

modest (the median award is £5000) business tells us that the fear of high

awards being made against them creates uncertainty and can put them off

taking on new staff. Litigation lightly entered into is also often not ultimately in

the best interests of claimants, as people can find themselves bogged down in

lengthy and emotionally draining proceedings.

Accordingly, we are seeking to bring in a fee structure in tribunals and the

EAT. This consultation puts forward two sets of proposals that protect access

to justice for those with low income or limited means, but which also ensure

that those who use the system make a financial contribution. Our goal is to

relieve pressure on the taxpayer and encourage parties to think through

whether disputes might be settled earlier and faster by other means.

3

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Losing your job or being subject to discrimination are matters every bit as

serious as the issues arising in the civil courts. These proposals will put users

of employment tribunals and the EAT on broadly the same footing as courts

users who already pay fees. Just like in civil courts the taxpayer will continue

to fund a system of fee remissions (waivers) for those who cannot afford to

pay. In this way these reforms would rebalance the system, without denying

access to justice for those on limited means.

Developing a fee regime that is appropriate, cost effective and ensures that

users contribute towards the cost of running the service is our ambition, and

one that will also support the broader aim of promoting growth. I hope that you

will consider our proposals carefully to help ensure they are sensible and

proportionate, and will make a genuine difference when introduced.

Jonathan Djanogly MP

Parliamentary Under Secretary of State for Justice

4

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Executive summary

At present taking a claim to an employment tribunal or appealing to the

Employment Appeal Tribunal is free of charge to users and entirely funded by

the taxpayer. In the financial year 2010/11, the employment tribunals received

218,100 claims and 2,048 appeals were made to the Employment Appeal

Tribunal at a total cost to the taxpayer of £84.2m.

Parliament has already made provision for the charging of fees in tribunals.

The Lord Chancellor has the power, under section 42 of the Tribunals Courts

and Enforcement Act 2007, to introduce fees in certain tribunals which could

include employment tribunals and the Employment Appeal Tribunal.

The Government announced its intention in early 2011

1

to introduce fee-

charging into these tribunals as part of the wider reforms to support and

encourage early resolution of workplace disputes and in order to transfer

some of the cost burden from the taxpayer to the users of the system.

The policy of introducing fees to contribute to the costs of running employment

tribunals and the Employment Appeal Tribunal is not itself in question in this

consultation. The purpose of this consultation paper is accordingly to seek

views on the proposed fee-charging structure but not the principle of charging

fees in employment tribunals or the Employment Appeal Tribunal.

There are two quite separate schemes for charging fees which we are

consulting on in this paper – Option 1 and Option 2. Because of the significant

differences between these options, respondents are asked to comment on

each one separately. If, following this consultation, the Government decided to

implement Option 1, fees would be introduced in 2013. If Option 2 were

adopted, it would require primary legislation to be implemented in full – we

estimate that could not be achieved until 2014.

There are two alternative fee options proposed within this consultation paper.

The main proposals of Option 1 are:

That fees will be initially set to recover a proportion of the cost of

providing the service;

That for single claims

the level of fees should vary depending on the

nature of the claim made (reflecting the likely level of resources used by

claims of this nature) and the stage reached in the proceedings;

That for multiple claims

the level of fees should vary depending on the

nature of the claim made (reflecting the likely level of resources used by

claims of this nature), the stage reached in the proceedings and

the

number of people in the claim

1

Resolving Workplace Disputes

5

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

That there should be two main charging points for fees – first, on issue

and, for those claims proceeding to hearing, before the hearing.

That fees will be initially payable at the time of lodging the claim by the

party who makes the claim to an employment tribunal or an appeal with

the Employment Appeal Tribunal.

That the party that lodges a claim with an employment tribunal or an

appeal with the Employment Appeal Tribunal should initially pay the

hearing fee in advance of the claim or appeal being heard;

That the indicative fee levels for single claim

s to employment tribunals are

proposed at the following rates:

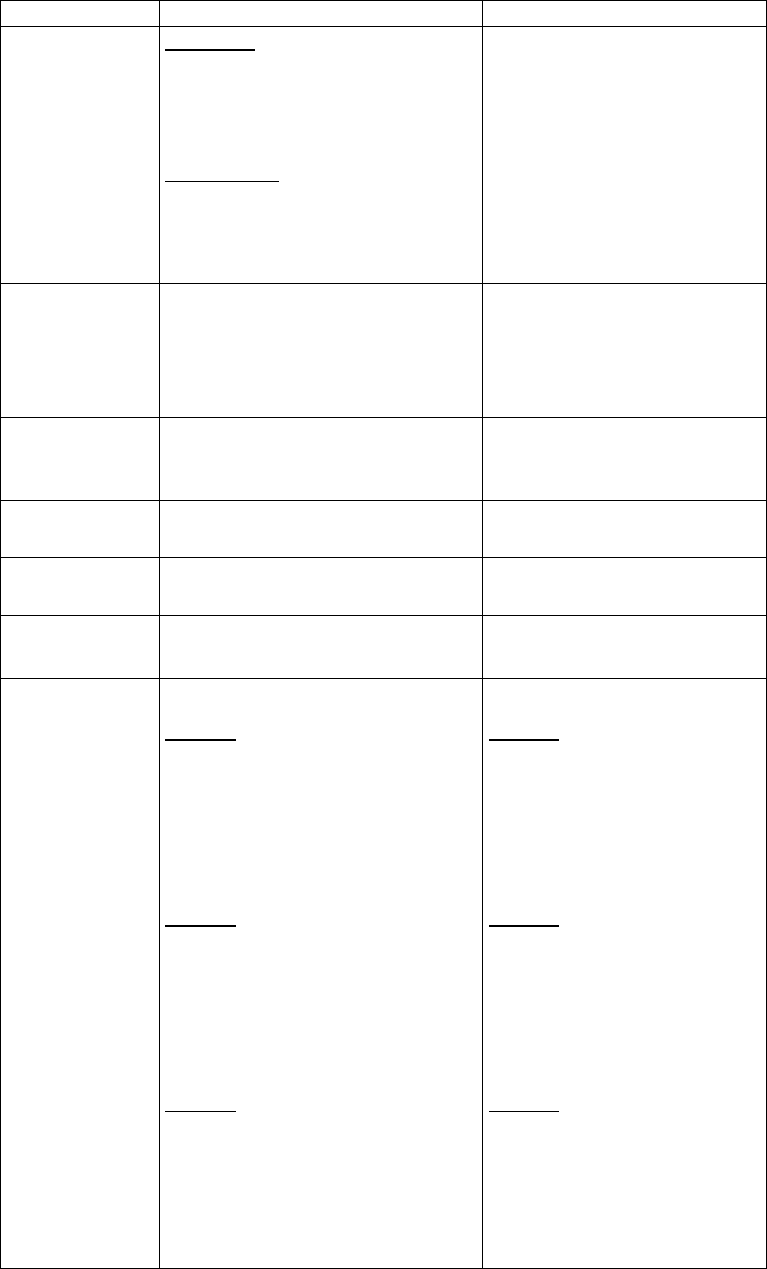

Fee Initially payable by Amounts

Issue fee Claimant Level 1 – £150

Level 2 – £200

Level 3 – £250

Hearing fee Claimant Level 1 – £250

Level 2 – £1000

Level 3 – £1250

That there are 6 further fees for certain specified applications that may be

made after a claim has been accepted, and the indicative fee levels are

proposed at:

Fee Initially payable by Amounts

Request for written reasons Party who applies Level 1 – £100

Level 2 – £250

Level 3 – £250

Review application Party who applies Level 1 – £100

Level 2 – £350

Level 3 – £350

Dismissal of case after

settlement or withdrawal

Respondent £60

Set aside default judgment Respondent £100

Counter-claim Respondent £150

Mediation by judiciary Respondent £750

That the HM Courts & Tribunals Service remission system will be

available for those who need to access the tribunals but cannot afford to

pay the fee; and

That tribunals have power to order that the unsuccessful party reimburse

the fees paid by the successful party so that the cost is ultimately borne

by the party who caused the system to be used.

That the indicative fee levels for the Employment Appeal Tribunal are

proposed at the following rates:

Fee Initially payable by Amounts

Issue fee Appellant £400

Hearing fee Appellant £1200

6

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

The main proposals under Option 2 in this consultation paper are set out

below with the main differences from Option 1 highlighted in bold:

That there should be one main charging point for fees only, at issue

of claim stage, and in employment tribunals six further fees for certain

specified applications that may be made after a claim has been accepted;

That the Level of fees should vary depending on the nature of the claim

made (reflecting the likely level of resources used by claims of this

nature) and the value of the claim, and for multiple claims, the number

of people in the claim.

That if the claimant chooses to seek an award over the threshold of

£30,000 a higher fee is payable (Level 4) irrespective of the nature of the

claim.

That where a claimant seeks an award lower than the threshold of

£30,000 the Tribunal is prohibited from making an award above the

threshold if the claim is successful.

That the fee for high value claims (Level 4) will be initially set to

recover the full cost of providing the service with other fees (Levels 1, 2

and 3) set below full cost recovery;

The indicative fee levels for single claims

in Option 2 are proposed at:

Issue fee Initially payable by Amounts

Level 1 claims (up to an

award of £29,999.99)

Claimant £200

Level 2 claims (up to an

award of £29,999.99)

Claimant £500

Level 3 claims (up to an

award of £29,999.99)

Claimant £600

Level 4 claims – Any type of

claims where the award

sought is unlimited

Claimant £1750

That fees will be initially payable at the time of lodging a claim by the

party who makes the claim to an employment tribunal or an appeal with

the Employment Appeal Tribunal;

That the HM Courts & Tribunals Service remission system will be

available for those who need to access the system but cannot afford to

pay the fee;

That tribunals have power to order that the unsuccessful party reimburse

the fees paid by the successful party so that the cost is ultimately borne

by the party who caused the system to be used.

It should be noted that Option 2 relates only to the employment tribunals and

that only one proposal (described at Part 3) is made in relation to the

Employment Appeal Tribunal.

7

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Introduction

This consultation sets out proposals for introducing fee-charging into

employment tribunals and the Employment Appeal Tribunal. The consultation

is aimed at employers, employees, trade unions, employer organisations,

representatives and other interested parties in Great Britain.

It is being conducted in line with the Code of Practice on Consultation issued

by the Cabinet Office and falls within the scope of the Code. The consultation

criteria, which are set out on page 4 of the Code

2

have been followed.

At the time of publication options continue to be developed and discussed in

relation to devolving the administration of tribunals in Scotland. However, no

decisions have yet been made. To that end and for the purposes of this

consultation, the fee proposals cover the whole of the current jurisdiction of

employment tribunals in England, Wales and Scotland, (Northern Ireland has

its own separate employment tribunal and does not form part of this

consultation).

It has been announced

3

that Government intends to consider whether and

how to introduce a “Rapid Resolution” scheme to provide quicker, cheaper

determinations in low value, straightforward claims (such as holiday pay), as

an alternative to the current employment tribunals process. Any such scheme

may remove some types of claims from the jurisdiction of the employment

tribunals. Proposals will take time to develop, and will be subject to full

consultation.

An Impact Assessment has been completed and provides preliminary

estimates given the state of knowledge at the time of writing. The Impact

Assessment indicates that under our proposals overall, employment tribunal

claimants would tend to be worse off while respondents, taxpayers and HM

Courts & Tribunals Service would be better off.

A separate Equality Impact Assessment for our fee proposals has also been

prepared and published. The overall assessment in the Equality Impact

Assessment is that there are some implications of the proposals on Equality

Act 2010 protected characteristics groups in seeking access to justice; these

will impact on different equality groups differently insofar as they have varying

income profiles. Based on the limited information available, the initial

assessment in the Equality Impact Assessment is that the proposals do not

amount to direct discrimination and is unlikely to amount to indirect

2

http://www.bis.gov.uk/files/file47158.pdf

3

Department for Business, Innovation & Skills, ‘Resolving workplace disputes:

Government Response to Consultation’, published in November 2011.

http://www.bis.gov.uk/Consultations/resolving-workplace-

disputes?cat=closedwithresponse

8

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

discrimination under the Equality Act 2010. This is because the Government

considers that the proposals, if implemented, would be likely to be a

proportionate means of achieving the legitimate aim of transferring a

proportion of the cost of running the tribunals from the taxpayer to those who

use the service and can afford to pay.

Comments on the Impact Assessment and in particular the specific questions

within the Equality Impact Assessment are particularly welcome.

The Impact Assessment and Equality Impact Assessment use the 2009/10

cost and caseload to assess the impacts of proposals because at the time of

development this was the latest available information. However, given its

subsequent availability this consultation paper refers to 2010/11 outturn costs

and caseload. When the Government publishes its response to consultation,

the Impact Assessment and Equality Impact Assessment will be updated with

the 2010/11 data.

Copies of the consultation paper are being sent to:

Administrative Justice and Tribunals Council

Advisory, Conciliation and Arbitration Service

Age & Employment Network

Association of British Insurers

Association of Chief Executives of Voluntary Organisations

Association of Recruitment Consultancies

British Chambers of Commerce

Chartered Institute of Personnel Development

Confederation of British Industry

Citizen’s Advice

Citizen’s Advice Scotland

Discrimination Law Association

Employment Bar Association

Employment Law Group

Employment Lawyers Association

Engineering Employers Federation

Entrepreneurs’ Forum

Equality and Diversity Forum

Equality and Human Rights Commission

Federation of Small Businesses

Forum of Private Business

9

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Free Representation Unit

GMB

Institute of Directors

Institute of Employment Rights

Joint Industry Board for the Electrical Contracting Industry

Judge D J Latham. President Employment Tribunals (England and

Wales)

Judge S Simon. President Employment Tribunals (Scotland)

Law Society

Law Society of Scotland

Legal Action Group

Lord Justice Carnwath, Senior President of Tribunals

Mr Justice Underhill, President, Employment Appeal Tribunal

National Association of Citizens Advice Bureaux

Public and Commercial Services Union (PCS)

Scottish Trades Union Congress

Scottish Discrimination Law Association

Trades Union Congress

Unison

Unite.

However, this list is not meant to be exhaustive or exclusive and responses

are welcomed from anyone with an interest in or views on the subject covered

by this paper.

10

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Background

Employment tribunals were initially created by the Industrial Training Act 1964

to hear appeals against training levy assessments imposed by industrial

training boards. This remains one of their functions today, but the jurisdiction

has since expanded to embrace a large number of different types of claim

arising from employment situations. There are, in employment tribunals,

separate jurisdictions for England & Wales and Scotland. The Employment

Appeal Tribunal generally hears appeals from all the employment tribunals on

points of law.

The employment tribunals and Employment Appeal Tribunal are administered

by HM Courts & Tribunals Service. The cost of running the tribunals is met

through the allocation of funds provided to the Ministry of Justice (MoJ) from

HM Treasury and ultimately provided by the taxpayer. In 2010/11 the cost of

running the employment tribunals was £81.8m and the cost of running the

Employment Appeal Tribunal was £2.4m.

There are clear reasons why fees should be introduced into the employment

tribunals and the Employment Appeal Tribunal. First, these tribunals are

similar to civil courts as they act as independent adjudicators with the power to

make legally binding decisions in a dispute between two parties. Indeed there

are claims that can be made in either the civil courts or the employment

tribunals.

4

Users in the civil courts in England & Wales and the separate

Scottish civil courts have been charged fees for many years and introducing

fees will place employment tribunal users on the same footing. As provided by

HM Treasury

5

guidance: “It is Government policy to charge for many publicly

provided goods and services. This approach helps allocate use of goods or

services in a rational way because it prevents waste through excessive or

badly targeted consumption.”

This policy does not underestimate the seriousness of claims that deal with

the loss of a job or being discriminated against, or the level of impact that

these events can have. Rather it recognises that such claims are equal to

those in the civil courts where issues of medical negligence, personal injury, or

even family law matters all attract fees. Employment tribunal users, potentially

vulnerable though they may be, have no more reason not to pay fees than

those seeking to gain access to their children.

4

A claim for breach of contract (wrongful dismissal) may be made to an employment

tribunal or to a county or sheriff court. If the sum claimed is £25,000 or less the

claim should be made to the employment tribunal. If the sum claimed exceeds

£25,000 the claim must be made in the county or sheriff court.

5

Section 6.1.1, “Managing Public Money” (http://www.hm-

treasury.gov.uk/psr_managingpublicmoney_publication.htm)

11

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Secondly, a significant majority of the population will never use employment

tribunals but all taxpayers are being asked to provide financial support for

parties who settle a workplace dispute in this way. Moreover, the taxpayer fully

funds conciliation offered by Acas for those involved in employment disputes

which can be accessed before or after the making of a claim. This currently

offers users two different forms of dispute resolution without being required to

make any financial contribution towards the cost of providing either service. At

a time of tight financial pressures, it is not possible to sustain this and

introducing fees in employment tribunals will reduce the financial burden on

the taxpayer as well as bringing the tribunals into line with Government policy

on fee-charging generally.

Thirdly, as set out in the Resolving Workplace Disputes

6

consultation, it is

recognised that fees can influence the behaviour of those who might become

involved in employment tribunal proceedings by encouraging them to resolve

their dispute by other means (e.g. within the workplace, via mediation or

conciliation) or, if a claim is made, earlier in the tribunal proceedings. Ensuring

that tribunals, along with courts, are seen as an option of last resort is

essential to improving the way disputes are resolved and encouraging

reasonable behaviour. Consequently, we believe it is right that fees are

charged for using these tribunals.

However, our fee proposals will mean that taxpayers continue to subsidise

part of the cost of administering employment tribunals and the Employment

Appeal Tribunal. Under the proposals contained within this consultation paper

it is intended that (at commencement) most fees will be set below the full cost

i.e. the fee charged will not cover the actual cost of running the tribunals. In

addition it is an integral part of our proposals that the taxpayer will fund the

employment tribunals for any individual who cannot afford to pay the fee via

the remission system which offers full or part fee waiver. It is important when

considering our proposals that the fee proposals and remissions are

considered together as part of the overall package of measures.

Developing a cost-effective fee structure which obtains a reasonable financial

contribution from users but does not act as a barrier to justice is a challenging

task. As a starting point initial views have been sought from external groups

during the Resolving Workplace Disputes stakeholder engagement, as well as

from the senior judiciary and HM Courts & Tribunals Service operational staff.

Any proposed fee structure should comply with HM Treasury policy on

charging fees.

7

A further key contextual component is the administration of the

fee structure by HM Courts & Tribunals Service, which already charges fees

for the services provided and proceedings issued in the civil courts in England

and Wales. Given that considerable savings could be made by adopting or

6

http://www.bis.gov.uk/assets/biscore/employment-matters/docs/r/11-511-resolving-

workplace-disputes-consultation.pdf

7

See chapter 6 of HMT’s “Managing Public Money” (http://www.hm-

treasury.gov.uk/psr_managingpublicmoney_publication.htm)

12

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

adapting current processes or systems, it is important to make the best use of

existing resources and staff expertise where possible.

Format of the consultation paper

Two alternative fee structures are proposed within this consultation. Both

structures seek to transfer part of the cost of running the tribunals from the

taxpayer to the user, and have some features in common, e.g. they both

propose that the unsuccessful party pays the fees. However, there are

significant differences between them as the two options have different aims

and are seeking to achieve different outcomes. Only one proposal is made in

relation to the Employment Appeal Tribunal.

Developing a fee structure is complicated and requires the appreciation of a

large range of factors and underlying requirements. Option 1 is worked

through in detail in Part 1. To support policy development of Option 1 a cost

model has also been developed to ensure the proposals are equitable, in

terms of ensuring proportionate contribution to costs is sought across fees

types. The model is discussed in more detail in the impact assessment and

will be reviewed and updated during the consultation period.

Option 2 is summarised in Part 2 and is a high level option where all the

underlying cost implications have yet to be fully considered. Depending on the

responses to the consultation and the Government’s decision on what fee

structure should be introduced, we will ensure that the response to this

consultation contains the full underlying detail of our proposals. Part 2 also

offers a comparison between Options 1 and 2.

Many forms of fee structures exist so further alternative options that were

considered but not proposed have been included throughout this consultation

document. Whilst these do not form a comprehensive list of all the alternatives

considered, these summaries should help respondents to assess the

suitability of the proposed structures.

Part 3 considers a fee structure for the Employment Appeal Tribunal where

only one type of fee structure is proposed. Finally, Part 4 seeks views on the

operational implications of introducing fees into the employment tribunals and

the Employment Appeal Tribunal.

13

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

The Proposals

Part 1 – Employment tribunals – Option 1 fee proposals

Section 1 – Developing a fee structure

1. Developing a fee structure that is suitable for employment tribunals and

the Employment Appeal Tribunal presents a number of issues. There are

many inter-dependencies to consider, questions to resolve such as when

to charge and what to charge for as well as what is fair for users and what

is the likely impact of introducing a fee charging system. All of this is set

in the context of tribunals with particular characteristics and ways of

working that have become established without fees being in place.

2. Recognising this, there is a need to ensure that the key issues are

identified and used to help shape suitable proposals for consultation. This

section explains the criteria that are considered important for success and

provides the basis for the fee structure outlined in this consultation.

3. The starting point is to acknowledge that the purpose of a fee structure is

to act as the method of achieving the transfer of part of the cost burden

from the taxpayer to the users of the service and under our proposed

Option 1 this is adopted as its objective. However, fees must not prevent

claims from being brought by making it unaffordable for those with limited

means. Therefore, a fee remission system will be a key component of the

fee structure and one that is integral to the fee proposals.

4. A fee structure that is simple to understand and administer brings benefits

for users as well as HM Courts & Tribunals Service, who administer the

employment tribunals. For users a simple fee structure makes it easier to

understand and ensures that the decision to bring a claim is made in the

knowledge of the potential fee. For HM Courts & Tribunals Service the

greater the number and range of fees the more expensive the system will

be to implement and subsequently administer. Any additional cost will

ultimately be borne by users through fees and the taxpayer through HM

Treasury funding.

5. The decision to charge fees sits within the wider proposals on reform of

the employment landscape. It is important to recognise the impact that

fees can have on resolving disputes early and encouraging parties to

think more carefully about alternative options before making a claim or

14

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

taking a case to final hearing. Unmeritorious claims

8

consume valuable

administrative and judicial resources before they are disposed of;

resources that would otherwise be available to deal with meritorious

cases. Whilst there is considerable disagreement about the number of

weak and vexatious claims that are made,

9

it is expected that the

introduction of fees will encourage parties to resolve disputes earlier and

to think more carefully about alternative options before making a claim or

taking a case to final hearing.

6. With these issues in mind the purpose and success criteria for the Option

1 fee structure are:

Purpose:

To transfer part of the cost burden from taxpayers to users of the

employment tribunals and the Employment Appeal Tribunal.

Criteria:

Recover a contribution towards the costs from users which will be

used to support and fund the system.

Develop a simple, easy to understand and cost-effective fee structure.

Maintain access to justice for those on limited means.

Contribute to improving the effectiveness and efficiency of the system

by encouraging users to resolve issues as early as possible.

7. It should be noted that Option 2 has wider policy aims, although the same

criteria for success have been adopted. The Option 2 fee structure is

discussed in Part 2.

Question 1 – Are these the correct success criteria for developing the

fee structure? If not, please explain why.

8

In the civil courts, while the matter is within the court’s discretion, the normal rule is

that the successful party is awarded costs against the unsuccessful party. Different

considerations generally apply in employment tribunal proceedings. The underlying

concept in relation to costs (in Scotland, expenses) in the employment tribunal has

always been that a person who, in good faith, considers that s/he has a good cause

of action or ground of defence, should not be inhibited from taking or defending

proceedings before a tribunal for fear of liability for costs, which can provide a

deterrent to civil litigation in the courts, and therefore as a general rule tribunals do

not normally award costs or expenses.

9

For example, the Institute of Directors 2010 Manifesto for Business said: “Too many

weak claims are being made by employees because there is no incentive for

employees and their lawyers not to bring weak cases to tribunals.’ Conversely, in

their response to the BIS Resolving Workplace Disputes consultation the TUC said

there is no ‘empirical evidence that a substantial proportion of employees currently

use the Tribunal system to pursue unmerited cases’.

15

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Section 2 – The cost of employment tribunals

8. Section 1 set out the purpose for a fee structure in employment tribunals

for the Option 1 proposal and the criteria to assess the options. However,

fees for public sector services are charged in accordance with HM

Treasury guidelines

10

which state that users should be charged no more

than it costs to provide that service unless there are strong public policy

reasons to do so. This section provides a summary of the cost of

administering employment tribunals and considers what cost recovery

levels are appropriate to seek from users when introducing fees for the

first time. The Employment Appeal Tribunal is considered separately in

Part 3.

9. In the financial year 2010/11

11

employment tribunals received

approximately 218,000 claims. The budget for dealing with employment

tribunals in 2010/11 was £81.8m. The break-down of costs is set out in

the pie chart below which shows that the largest single component was

judicial cost, (mostly related to judges’ salaries, fees and expenses).

ET total cost in 2010/11 = £81.8m

Judicial fees

19%

Court costs

2%

Judicial expenses

2%

Overheads

12%

Other admin

3%

Staff admin

18%

Estates

16%

Judicial salaries

28%

Judicial

51%

Employment tribunals expenditure in 2010/11

Judicial Salaries £23.0m

Judicial fees and expenses £16.9m

Administrative staffing £14.7m

10

Managing Public Money – HM Treasury.

11

For the purposes of policy development and impact assessing the policy proposals

a cost model was developed using the most up to date information available at the

time; i.e. the 2009/10 ET and EAT financial outturn and statistical information.

16

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Estates £13.m

Overheads

12

£10.2m

Other Administrative costs £2.4m

Court costs £1.3m

10. Good management of public services requires continuous improvement

and review of operational costs. HM Courts & Tribunals Service are

already undertaking efficiency savings in employment tribunals, which will

continue in the future.

13

However, as long as claims are brought to

employment tribunals, a cost of processing them will occur and be

required to be met.

11. The cost of administering the employment tribunals arises first from

providing the processes needed to deal with the claims, as well as the

costs that arise from the need to support the processes such as buildings,

equipment, IT systems, staff and the judiciary. In processing claims,

employment tribunals incur administrative costs in the receipt and service

of claims, the receipt and service of responses, dealing with pre-hearing

issues, responding to enquiries, arranging and holding hearings and

providing notification of judicial decisions.

12. There are also many judicial decisions needed to consider claims and

responses, including the holding of case management discussions and

pre-hearing reviews, identifying and narrowing the key issues of dispute,

dealing with correspondence and conducting hearings. Two non-legal

members, drawn from both sides of industry

14

sit with a qualified judge in

12

Overheads consist of MoJ Estate costs, the costs of services centrally provided by

MoJ (such as HR and Payroll), and internal HM Courts & Tribunal costs arising from

support directorates.

13

Various innovations have been introduced over the last 18 months in the

employment tribunals in England & Wales and Scotland and that process

continues. These innovations include evening sittings, case management pilots with

ACAS officers being present, digital recording of proceedings, variations in listing

processes, changes in case management procedure (source: Senior President of

Tribunals Annual Report 2011 – http://www.judiciary.gov.uk/Resources/JCO/

Do

cuments/Report

s/spt-annual-report-2011.pdf).

14

Lay members are appointed by the Secretary of State after consultation with

organisations of employees and employers (Reg 8(3)(b) & (c) of the Employment

Tribunals (Co

nstitution and Rules of Procedure) Regulations 2004). The members

have knowled

ge and experience in commerce and industry and bring this practical

experience to bear in their judicial role.

17

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

nearly all hearings

15

to ensure that a balanced judgement is reached.

There are also indirect costs of providing the service such as line

management, payroll and IT. It is all these costs of providing the

employment tribunals that form the basis for the level of fees.

13. In order to allocate costs across the process a cost model was developed

for the Option 1 fee structure that combined three sets of management

information namely:

2009/10 financial outturn data including overheads;

A list of case events showing the stages cases may go through during

their lifecycle together with the volume of 2009/10 cases where each

event occurred; and

The amount of judicial and administrative effort that is involved for

each stage/case event.

14. HM Treasury policy requires every fee-charging statutory service to have

a financial objective for the level of cost recovery agreed between the

responsible Minister and Treasury. The default position is that fees should

be set, so far as possible, at levels that reflect the full cost

16

(but no

more),

of the process involved. Consequently, the highest fee levels that

could be set would reflect the full cost of providing employment tribunals

services. Lower targets can be agreed where there is a sound policy

justification.

15. The civil courts in England and Wales aim to attain 100% of cost from

users net of the remission system, by 2014/15.

17

Under the Option 1 fee

structure we propose setting fee recovery rates lower than this when

introducing fees into employment tribunals.

15

Section 4 of the Employment Tribunals Act s.4(2) – Employment Tribunals Act 1996

– provides that certain proceedings are, unless an Employment Judge decides

otherwise, to be heard by an Employment Judge sitting alone. These proceedings

include failure to pay guarantee, redundancy and insolvency payments, breach of

contract claims and unlawful deductions from wages. The question of whether

claims for unfair dismissal should be heard by an employment Judge alone was

raised in the Resolving Workplace Disputes and the position announced in the

Government response.

16

See chapter 6 of HMT’s “Managing Public Money” (http://www.hm-

treasury.gov.uk/psr_managingpublicmoney_publication.htm). Although the term full

cost is used, the target is no

t literally full cost recovery as the taxpayer makes and

will continue to make a significant contribution to employment tribunals. A better

way of describing the policy is full cost pricing. In other words, fees should be set at

levels calculated to cover the cost of the system if paid in full in every case.

17

The cost of running the civil and family courts in England and Wales is currently

some £619m a year and 82% is funded through court fees. In Scotland 76% of the

cost is recovered. To ensure access to justice is protected, both jurisdictions

operate their own remissions systems which are funded by the taxpayer.

18

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

16. Other things being equal, charging fees will tend to have an impact on the

number of claims made because parties will have another factor to take

into account when deciding whether to make a claim. However, the

impact is extremely hard to forecast as there is currently no research that

provides a reliable assessment of the impacts of charging fees

specifically on employment tribunal users. However, a similar exercise

has in the past been undertaken for the civil courts.

18

To the extent that

the experience of civil court fee-charging is a guide, this MoJ research

suggests that Tribunal users required to pay a fee would not be especially

price sensitive and that other factors will be more influential in the

decision to make a claim than a fee.

17. There is no reason to assume that similarly wide-ranging motivations will

not apply in the employment tribunals. However, given that civil court fees

are long established, introducing fees where none have previously

existed means that impacts could be greater and are harder to predict.

19

18. Under Option 1 initial fee levels are proposed at a much lower level than

would be required to achieve full cost recovery. The indicative fee levels

for Option 1 are set out in section 9. Assumptions regarding the sensitivity

of users to fee charging are outlined in the accompanying impact

assessment.

Charging for all types of claims

19. There are over 60 different types of claims that can be made to

employment tribunals which include discrimination, equal pay and unfair

dismissal. We propose that all types of claims and appeals are subject to

a fee. With appropriate safeguards to protect access to justice this is fair

because:

The cost of the service is borne across all users;

It will allow all users to make informed decisions when deciding

whether to make a legal claim or use an informal route to resolve their

dispute; and

It reflects the long-standing approach taken in the civil courts (where

all types of claims and appeals attract a fee).

Alternative options

20. The vast majority of claims dealt with by the employment tribunals are

‘party versus party’ disputes in which neither party is representing the

State. However, there are a small number of claims per year where an

employer or an individual appeals against a decision of a Government

18

“What’s cost got to do with it? The impact of changing court fees on users”,

MoJ Research Series 4/07, June 2007

(http://www.justice.gov.uk/publication

s/do

cs/changing-court-fees.pdf).

19

For further information on impacts see the impact assessment.

19

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

body.

20

These include appeals against a prohibition or improvement

notice issued by the Health and Safety Executive and appeals against a

decision of the Secretary of State not to make an insolvency payment in

lieu of wages and/or a redundancy payment.

21. In the civil courts, appeals against decisions of the State are subject to

fees and we see no reason to exclude these types of appeal in the

employment tribunal fee structure. Those who appeal a decision of the

State should be encouraged to consider carefully the consequences of

taking formal legal action as should others making a claim in the

employment tribunals. Our proposals mean that such appeals will attract

the lowest level of fees and individual appellants will be able to apply for

remission of the fee if they cannot afford it (see section 5).

22. Another option is to exclude some party versus party claims from fees,

either on the basis of the type of claim or on the basis of low value of

claim. However this option is not proposed because:

It is common in employment tribunals for claims to contain several

types of jurisdictional complaint and exempting one type of claim may

encourage users to seek redress under an exempt route which will in

turn perversely increase demand for it;

Establishing a robust definition for the types of claim that should be

excluded is not possible without creating unfairness for some users;

and

Cost is incurred irrespective of the type of claim or whether the claim

is for a small or non-monetary value so such claims should not be

exempt from fees or consideration of the consequences of taking legal

action.

Question 2 – Do you agree that all types of claims should attract fees? If

not, please explain why.

Section 3 – Fee types – issue and hearing fees

23. The above sections set out the background and general cost recovery

approach. This section outlines the types of fees we propose and the

basis for fee charging in employment tribunals under Option 1. The

proposed fee structure for the Employment Appeal Tribunal is set out in

Part 3.

24. Introducing a charging regime means setting fees at levels that reflect the

cost of the services provided. The cost of a claim in employment tribunals

20

In 2010–11 there were 508 appeals against the decision of the State.

20

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

depends on how much administrative and judicial resources a case

uses.

21

This in turn depends on;

The stage in the process i.e. the earlier stages consume less resource

than the later stages; and

The complexity of the issues to be resolved i.e. the nature of the

claim.

25. It is proposed that these two factors are used to develop a simple fee

structure that ensures that the fee is reasonably representative of the cost

and ensures that the costs of administering the fees structure are kept to

a minimum.

The stage in the process

26. The cost of dealing with a claim in employment tribunals increases the

further a claim progresses. This is because at hearing it is normally a

judge and two lay members who deal with the case. In pre-hearing work it

is the judge alone who considers and deals with the parties, supported by

administrative staff. To reflect this increasing cost and the fact that around

80% of jurisdictional complaints do not require a hearing, it is proposed

that, under Option 1, fees are charged at two stages in the process

namely:

At the point of making a claim (the issue fee); and

Before the case is heard (the hearing fee).

27. The advantages of adopting this approach are:

It is simple to understand;

Keeps down the costs of administration; and

Encourages users to consider settlement before and during the

tribunal process.

28. However, fees at two points in the process mean that users will not know

at the start of the process whether they will need to pay a second fee

because payment will only be due if the case requires a hearing. Other

disadvantages are that:

The total fee payable in those cases which require a hearing is higher

than under Option 2; and

It is more complex and expensive for HM Courts & Tribunals Service

to implement and administer than a single flat fee.

21

‘For further detail on the cost of claims see sections 1.27–1.30 of the Impact

assessment.

21

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Alternative options

29. A further option would be to charge a fee once the case has concluded

when an accurate calculation of the cost of the case could be calculated.

However, this option is not proposed because:

It would require extra expenditure to create a system capable of

calculating the exact cost in every case

Payment after the case is concluded offers no direct incentive to users

to consider alternative methods of dispute resolution; and

It would take considerable resource to develop processes for the

tribunal to ensure that payment after the event was secured.

30. Another option is to charge fees at more stages in the process, for

example, for pre-hearings or at every time an application is made, and is

the approach used in the civil courts. In light of the informal nature of

employment tribunals, which allows for frequent direct contact between

the parties and the judiciary, this is not proposed because:

It would require extra payment each time an application was made

which could slow the process;

The fee charging system would need to account for those types of

claims that do not have pre-hearing work (i.e. not charge a fee);

It could change the informal nature of employment tribunals; and

Initial estimates suggested that the introduction of a third charging

point would cost in the region of 50% more to administer than the 2

charging point approach.

31. In part 2 we consider the option of charging one fee only at the start of the

process. With this in mind please consider the following question.

Question 3 – Do you believe that two charging points proposed under

Option 1 are appropriate? If not, please explain why.

The complexity of the case

32. The second factor that impacts on the cost of the case is the complexity

of the issues it raises. Where claims raise difficult legal issues and/or

where the facts are complex, the cost will increase. Conversely, there are

claims made to the employment tribunals which require a purely factual

decision.

22

33. HM Courts & Tribunals Service already allocates claims into 3 categories

for the purposes of administration and listing cases. These are:

22

For example, complaints of failure by the employer to provide a guarantee payment

or make a redundancy payment are routinely listed for a 1 hour hearing.

22

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Level 1 – generally claims for sums due on termination of employment

e.g. unpaid wages, payment in lieu of notice, redundancy payments.

Level 2 – generally claims relating to unfair dismissal.

Level 3 – all discrimination complaints, equal pay claims and claims

arising under the Public Information Disclosure Act.

34. The levels into which claims are allocated are determined by the

administrative and judicial resource that the claims within each Level are

likely to use given the complexity of the issues that are likely to arise. In

general, more cost is incurred to deal with Level 2 and 3 cases because

on average these types of cases require more judicial case management,

more pre-hearings and longer final hearings (for further information see

the Impact Assessment).

35. Cases within Level 1 generally consume smaller amounts of

administrative and judicial resources because they raise factual issues

that are straightforward to determine. Currently they are automatically

listed at receipt of claim for a short hearing (1 hour) 9 weeks hence.

These claims would therefore attract the lowest fees and our analysis

suggests that Level 1 claims are likely to be those that are of small value.

In 2010/11 62% of the jurisdictional complaints accepted by employment

tribunals fell into this category.

36. As the cost incurred differs between the categories, it is proposed that all

claim types are allocated to one of the three levels for the purposes of

setting fee levels. The full list of claim types and their suggested

allocation to the three fee levels are provided in Annex A.

37.

It is common for claimants to send in their claims

with more than one type

of jurisdictional complaint. It is not proposed that each and every

complaint made on a claim form should attract a separate fee as this

could require a range of fees that will add to the complexity and cost of

the system. Instead it is proposed that the fee payable will be that which

relates to the highest Level claim. For example:

A claim with unpaid wages (Level 1) as well as unfair dismissal (Level

2) would pay the Level 2 fee only.

38. We recognise that basing the fee on the amount of resource that the

claim consumes from both an administrative and judicial perspective

means that the fees payable in Level 3 cases, e.g. those containing either

a claim of discrimination or a ‘whistleblowing’ claim, are higher than those

payable in other types of claim. However, we believe it is right that all

users contribute towards the cost of the tribunals and that higher fees

should be payable by cases that use the greatest level of administrative

and judicial resources. We also believe that the remission system we

propose to introduce will ensure that access to justice will be protected for

those seeking to bring such complaints (see section 5).

23

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Question 4 – Do you agree that the claims are allocated correctly to the

three levels (see Annex A)? If not, please identify which claims should

be allocated differently

and explain

your reasons.

Alternative options

39. There are over 60 types of claim that can be made to employment

tribunals and an alternative approach would be to set a different fee for

each specific claim type. This could enable fee levels to reflect more

accurately the cost of dealing with each specific type of claim. But as

each claim type is processed in a similar way, the cost of processing most

types of claim is largely the same. Allocating each individual claim type a

different fee would be overly complex and as differences in cost are

reflected in the allocation of fees to the three levels outlined above, this

option is not proposed.

Conclusion

40. It is never possible to predict with complete accuracy how much resource

a claim will use, which means that fees can only ever reflect a

representative amount of the actual cost. Under Option 1 we believe our

proposal to combine a two stage approach with three levels of fees, offers

users a reasonably representative cost that ensures that cases more

likely to use resources are charged a higher fee, without being overly

complex for either users or administrators.

41. However, in part 2 we explore the option of charging one fee at the start

of the process and basing fees more closely on the value of the claim –

i.e. giving individuals submitting a claim the choice of paying a lower fee

for lower value claims – up to a certain threshold. Individuals could

choose to submit a claim for an amount above the threshold (i.e. £30,000

or more) and would then pay a higher fee.

Question 5 – Do you think that charging three levels of fees payable at

two stages proposed under Option 1 is a reasonable approach? If not,

please explain why.

Section 4 – Who pays the fees

42. In section 3 it was proposed that fees reflect the nature of the claim and

be paid at two stages in the process, namely at issue and at hearing, to

reflect the relative cost at each stage. This section considers who should

pay the fee and outlines 6 further application specific fees.

43. Unlike alternative forms of dispute resolution, employment tribunals

determine which party is at fault. The party at fault or the unsuccessful

party can be considered to have given rise to the cost of the tribunal

proceedings, either by requiring someone to bring an action to enforce

their rights or by having brought an action which was found to be without

merit.

24

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

44. Given the party versus party nature of the proceedings, it seems

appropriate that the unsuccessful party should bear the cost of the fees

where the tribunal so orders. If the claimant is successful, they were

proved right to bring the claim and if the respondent is successful, they

were proved right to defend the claim.

45. It is of course open to parties to reach a settlement at any time. The

employment tribunals do not currently intervene in the details of private

settlements reached and it is not proposed that fees should alter this

approach. Therefore, parties will need to take account of any fees paid as

part of their settlement negotiations.

46. In order to make an order that the fees paid are to be reimbursed by the

unsuccessful party, tribunals will require the power to do so under their

rules of procedure.

23

If the respondent is successful and incurs a fee the

same rule will apply. However, it is proposed that tribunals will have the

power not to order reimbursement in any case where it considers that it is

not appropriate given the circumstances.

47. This proposal is not intended to change the cost awards made in

employment tribunals, where generally parties pay their own costs (e.g.

lawyers’ fees and expenses). The tribunal’s existing power to order one

party to the proceedings to meet in whole or in part the costs (in Scotland,

expenses) incurred by another party will also remain unchanged.

24

The

proposals in this consultation only relate to the reimbursement of any

tribunal fees paid.

48. Both Option 1 and Option 2 make the same proposal as to who initially

pays the fees. With this in mind please consider the following question.

Question 6 – Do you agree that it is right that the unsuccessful party

should bear the fees paid by the successful party? If not, please explain

why.

23

The Employment Tribunals (Constitution and Rules of Procedure) Regulations 2004

(as amended) regulate all employment tribunal proceedings and set out the

Tribunals’ main objectives and procedures, and matters such as time limits for

making a claim, and dealing with requests for reviews.

24

An employment tribunal may:

award costs/expenses in favour of a legally represented party where in the

opinion of the tribunal or employment judge a party or their representative has, in

bringing or conducting the proceedings acted vexatiously, disruptively or

otherwise unreasonably, or the bringing or conducting of proceedings has been

‘misconceived.’ In 2010/11 cost orders were made in 489 cases, with 133 to the

claimant and 356 to the respondent.

make a preparation time order in favour of a party who is not legally represented

at the Hearing but who has spent time preparing the case. No records are kept of

the number of awards made.

make a ‘wasted costs order’ against a party’s representative as consequence of

the representative’s conduct. No records are kept of the number of awards made.

25

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Payment of the issue and hearing fees

49. It is proposed that the unsuccessful party bears the cost of the fee.

However, when a claim commences it can only be the claimant who

initially pays the fee. The employment tribunals incur cost as soon as the

claim form is submitted. The respondent is not formally aware of the

proceedings until the tribunal sends notification and therefore cannot be

asked to pay the initial fee. A claim received without the correct fee, (or

proof of eligibility for a remission considered in section 5), will not be

properly made and will not be accepted.

50. It is also proposed that the hearing fee is initially paid by the claimant. If

the fee is not paid by the due date in advance of the hearing, (or proof of

eligibility for a remission is not provided), it is proposed that tribunals will

have power to strike out the case.

51. An alternative option is that the hearing fee could be sought from both

parties. This could directly encourage both sides to consider settling, and

might encourage more cases to settle early. However, we do not propose

this because:

Respondents would be asked to pay to defend themselves from an

allegation that is not proven until the tribunal determines it is;

Seeking a fee from both parties increases the complexity of the fee

system and the cost of its administration. If the cost of the

administration increases that will be passed on to users and the

taxpayer and result in higher fees being charged overall; and

Only one side may pay leading to further administrative work to

pursue the fee.

52. Both Options 1 and 2 propose that the claimant should initially pay the

issue fees and, in the case of Option 1, the hearing fee. With this in mind,

please consider the following question.

Question 7 – Do you agree that it is the claimant who should pay the

issue fee and, (under Option 1), the hearing fee in order to be able to

initiate each stage of the proceedings? If not, please explain why.

Payment of application specific fees

53. There are some applications to employment tribunals that are made by

respondents and it is they who will gain the benefit if their application is

successful. We propose that for such applications it is appropriate that the

respondent should pay the fee. The applications are:

A counter-claim in a breach of contract case.

Application to set aside a default judgement.

Application for dismissal following settlement or withdrawal.

26

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

54. Each of these applications costs a different amount to deal with and so

will attract a different fee level. However, as the cost does not generally

differ with the type of claim being made, it is proposed that these types of

applications will have a single fixed fee for the application.

55. There are also circumstances where either party can make the

application. We propose that the party who makes the application pays

the fee in the following applications:

Request for written reasons after the judgment where reasons have

been issued orally.

Application for a review of the tribunal’s judgment or decision.

56. Initial modelling suggests that the cost of these applications varies

depending on the type of claim so it is proposed that the fee will vary

depending on the type of claim, reflecting this difference in the cost.

57. All these fees will be payable at the time of the application and a failure to

pay, (or provide proof of eligibility for a remission), will mean the

application will not be properly made and will not be processed.

58. Both Options 1 and 2 make the same proposal for application specific

fees. With this in mind, please consider the following question.

Question 8 – Do you agree that these applications should have separate

fees? If not please explain why.

59. There is one further process undertaken by employment tribunals for

which a separate fee is proposed. In employment tribunals mediation by

the judiciary is available in some discrimination claims.

25

In employment

disputes the cost of mediation, if provided externally, is normally borne by

the respondent so it is proposed that this approach is also followed in the

employment tribunals. As the proposed fee for mediation by the judiciary

is less expensive than a hearing fee, this approach still provides an

incentive to consider mediation. If the respondent fails to pay, mediation

will not take place.

60. Both Options 1 and 2 make the same proposal for a fee for mediation by

the judiciary. With this in mind, please consider the following question.

Question 9 – Do you agree that mediation by the judiciary should attract

a separate fee that is paid by the respondent? If not, please explain why.

25

Currently to be considered for mediation by the judiciary a case must include a

discrimination complaint and have an estimated hearing duration of 3 days or more.

27

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

Section 5 – When someone cannot afford to pay

61. We want to make sure that the introduction of fees does not deny access

to the employment tribunals for those who cannot afford to pay them. This

section proposes that the HM Courts & Tribunals Service remission

system that is currently applied in the civil courts in England and Wales

should be extended to the proposed fee structure in employment tribunals

across Great Britain.

HM Courts & Tribunals Service remission system

62. HM Courts & Tribunals Service provides a fee remission system for users

of the English and Wales civil and family courts. A system of fee waivers

is available to those who would have difficulty paying a court fee and

meet the appropriate criteria. An individual may be eligible for a full

remission, where no fee is payable, or a partial remission, where a

contribution towards the fee is required. Anyone who seeks a remission

from paying a fee either in full or in part, must apply to do so at the time of

making the application or at any time when a fee is due and provide

documentary proof of their financial eligibility. There are three types of

remissions.

63. Remission 1 – currently provides a full remission (i.e. no fee is payable)

if the applicant is in receipt of one of the following stated benefits:

Income Support

Income-based Jobseeker’s Allowance

Pension Credit guarantee credit

Income-related Employment and Support Allowance

Working Tax Credit but not also receiving Child Tax Credit

64. Remission 2 currently provides a full remission (i.e. no fee is payable) if

the applicant’ s gross annual income (and that of their partner if they are a

couple), is calculated to be not more than the amounts shown in the table

below:

Gross annual income with: Single Couple

No children £13,000 £18,000

1 child £15,930 £20,930

2 children £18,860 £23,860

If the party paying the fee has more than 2 children then the relevant

amount of gross annual income is the amount specified in the table for 2

children plus the sum of £2,930 for each additional child

65. Remission 3 – currently provides a full or partial remission (i.e. either no

fee or a contribution towards the fee is payable) based on an income and

expenditure means test to calculate their (and if applicable their partner’s)

monthly disposable income:

28

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

No fee payable if monthly disposable income is £50 or less;

If monthly disposable income is more than £50 but does not exceed

£210, an amount equal to one-quarter of every £10 of the party’s

monthly disposable monthly income up to a maximum of £50;

If monthly disposable income is more than £250, an amount equal to

£50 plus one-half of every £10 over £200 of the party’s monthly

disposable income.

66. There are also 3 fixed allowances permitted as part of the means test for

this criterion:

Partner £159

26

a month

Dependant Children £244* a month per child

General Living Expenses £315* a month

67. For example, a person’s monthly disposable income is calculated

between £50 and £59.99 they will contribute £12.50 on each occasion

that a fee requires to be paid; where the disposable income is calculated

between £340 and £349.99, the contribution will be £120. To assist users

a table setting out the contributions payable has been created and is

provided in Annex C.

68.

Other aspects of the HM Courts & Tribunals Service remission system

are:

The remission system is only available to individuals; it does not apply

to companies, partnerships or charities.

Remissions can be granted without proof of evidence in emergency

situations where an undertaking is given to either provide proof of

eligibility for remission or pay the full fee within 5 working days.

Individuals can apply for a refund (known as a retrospective remission

application) if they have paid a court fee within 6 months and have

evidence to prove that they would have been eligible for a remission

at the time they paid the fee.

There is a clearly defined appeal process available to individuals who

have been refused a remission but believe that they are eligible.

Those determined by a court to be a vexatious litigant, or bound by a

civil restraint order, cannot apply for a fee remission until permission

to issue has been granted (for which a fee is payable). If the

application for permission is successful, the person can apply for a

refund (retrospective remission), of the fee within 6 months from the

date of payment.

26

The amounts contained in this table for an individual (and couple) are based on the

‘Monthly Disposable Income’ bands which are used by the Legal Services

Commission to calculate how much someone would pay towards their case when

assessing Legal Aid.

29

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

69. In addition, there is a discretionary power for the Lord Chancellor to be

able to reduce or remit a fee where owing to the exceptional

circumstances of a particular case, the individual will suffer undue

financial hardship.

70. Full details of the remission system, the application forms and evidence

required are set out in the leaflet (EX160A) Court fees – Do I have to pay

them?

27

Annex B provides the legislative framework for the remission

system as currently provided to users of the English and Wales civil

courts.

Suitability of HM Courts & Tribunals Service remission system

71. We believe that the HM Courts & Tribunals Service remission system will

ensure that access to the employment tribunals is available to those

individuals who are less well off.

72. The remission system means that anyone who comes before the tribunals

after losing their employment will not pay a fee if they are in receipt of one

of the specified benefits. It also protects access to employment tribunals

for those earning low wages because some of the benefits are available

for those in low income employment. For those who would otherwise find

the full fee unaffordable, remission 3 ensures that only a contribution to

the fee will be payable out of net disposable monthly income.

73. The HM Courts & Tribunals Service remission system can be used by

everyone irrespective of type of income they receive. Therefore, whilst the

demography of claimants in employment tribunals may not be the same

as the courts, the HM Courts & Tribunals Service remission system is

suitable given that the types of income they receive is the same.

74. Our current analysis (see paragraph 4.7–4.15 of the Impact Assessment

which supports this consultation paper) suggests that approximately 10%

of employment tribunal claimants will be eligible for Remission 1 and

approximately 17% be eligible for Remission 2, both of which provide a

full fee remission. Moreover, around 50% of additional claimants would

pay only a proportion of the two highest proposed fees (and around 55%

of claimants would pay a proportion of the highest fee of £1250). Some

examples showing what fee remission an applicant would receive under

this system are provided in Annex D.

75.

One of the criteria for the fee structu

re was for a cost-effective system.

HM Courts & Tribunals Service administers civil courts, employment

tribunals and the Employment Appeal Tribunal and many other courts and

Tribunals. Utilising one remission system across the organisation and all

of Great Britain is more cost effective, simpler for a wide range of users

and their advisers to understand and removes anomalies between

jurisdictions. It is also a well established system that has in place clear

27

http://www.hmcourtsservice.gov.uk/courtfinder/forms/ex160a_web_1010.pdf

30

Charging Fees in Employment Tribunals and the Employment Appeal Tribunal

Consultation Paper

appeal routes, eligibility requirements and provides for exceptional

situations. If any changes are made to the HM Courts & Tribunals Service

remission system, they will apply to all users, including those using

employment tribunals. As the remission system is in legislation, any

changes will be made after consultation.

76. However, it would be possible to consider using an amended HM Courts

& Tribunals Service remission system for Employment Tribunals and we

would welcome your views on whether any changes are required to

better meet the needs of users in employment tribunals.

Alternative options for remission

77. The Scottish civil courts have different financial eligibility criteria for those

seeking remission.

28

Users are eligible for remission if they are in receipt

of legal aid, certain state benefits or are in receipt of a low income which

mirrors Remissions 1 and 2 of the HM Courts & Tribunals Service system.

As there is no equivalent Remission 3 and no partial remissions available

under this system it is concluded that adoption of the Scottish civil courts

approach to remission throughout the whole of the employment tribunals’

jurisdiction would offer less opportunity for individuals to apply for a fee

remission.

78. Both Options 1 and 2 make the same proposal for adopting the HM

Courts & Tribunals Service remission system. With this in mind, please

consider the following questions.

Question 10 – Do you agree that the HM Courts & Tribunals Service

remission system should be adopted for employment tribunal fees

across Great Britain? If not, please explain why.

Question 11 – Are there any changes to the HM Courts & Tribunals

Service remission system that you believe would deliver a fairer

outcome in employment tribunals?

Household Insurance