Actuarial Standard

of Practice

No. 15

Dividends for Individual Participating

Life Insurance, Annuities, and Disability Insurance

Revised Edition

Developed by the

Task Force to Revise ASOP No. 15 of the

Life Committee of the

Actuarial Standards Board

Adopted by the

Actuarial Standards Board

March 2006

Updated for Deviation Language Effective May 1, 2011

(Doc. No. 134)

ASOP No. 15—March 2006

ii

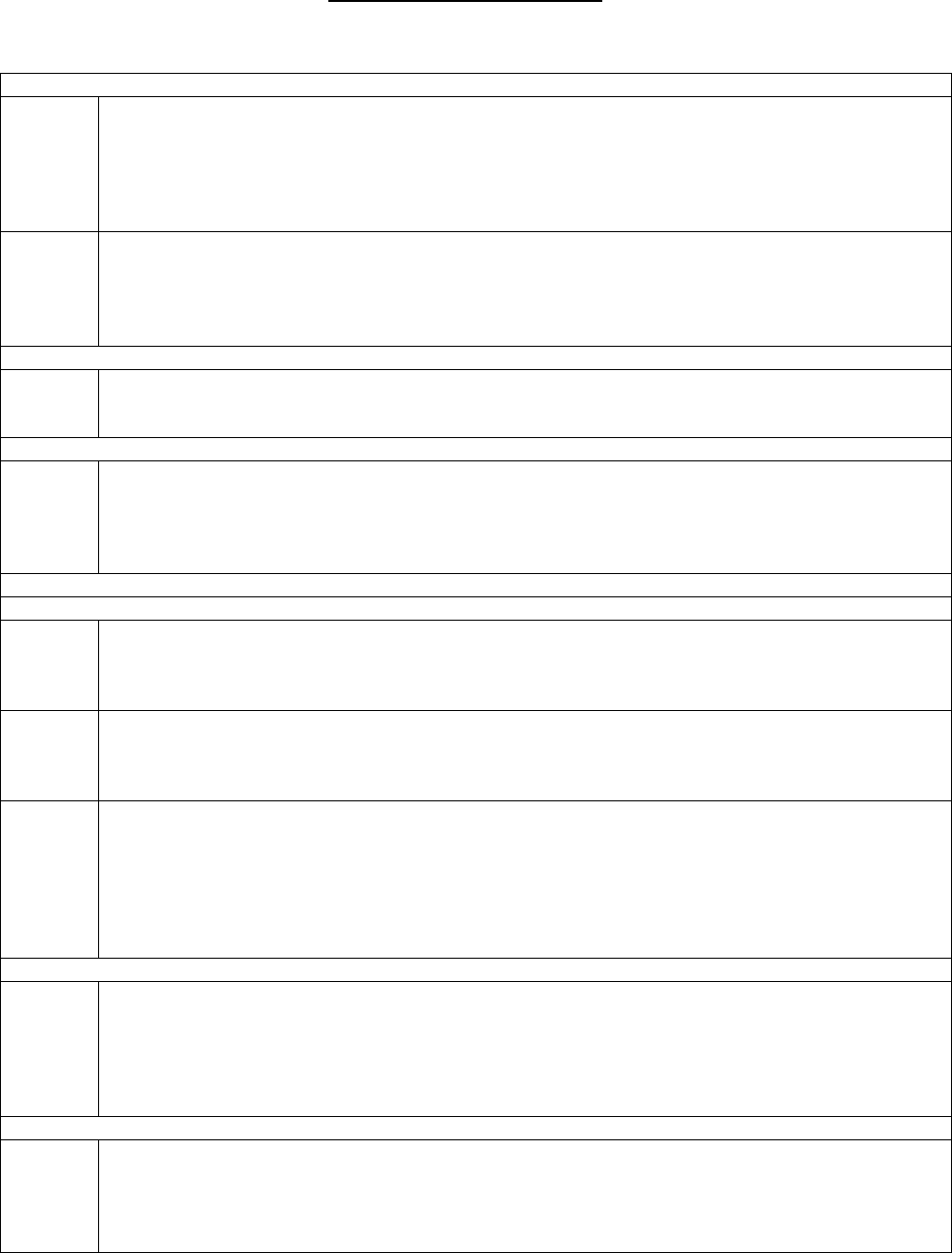

T A B L E O F C O N T E N T S

Transmittal Memorandum iv

STANDARD OF PRACTICE

Section 1. Purpose, Scope, Cross References, and Effective Date 1

1.1 Purpose 1

1.2 Scope 1

1.3 Cross References 1

1.4 Effective Date 1

Section 2. Definitions 2

2.1 Actual Experience 2

2.2 Contribution Principle 2

2.3 Dividend Determination 2

2.4 Dividend Factor 2

2.5 Dividend Factor Class 2

2.6 Dividend Framework 2

2.7 Divisible Surplus 2

2.8 Policies 2

2.9 Policy Factors 2

Section 3. Analysis of Issues and Recommended Practices 3

3.1 Contribution Principle 3

3.2 Dividend Framework 3

3.3 Dividend Factors 3

3.3.1 Projection of Experience 3

3.3.2 Dividend Factor Classes 4

3.3.3 Uniform Criteria 4

3.3.4 Dividend Factors for New Policies 4

3.4 Policy Factors 4

3.5 Mortality, Morbidity, and Policy Termination 4

3.6 Investment Income 5

3.7 Policy Loans 5

3.8 Expense 5

3.9 Reinsurance 5

3.10 Tax 5

3.11 Stockholder Retention on Policies Originally Issued by a Stock Company 5

3.12 Termination Dividends 6

3.13 Illustrated Dividends Not Subject to ASOP No. 24 6

3.14 Documentation 6

3.15 Reliance on Data or Other Information Supplied by Others 6

Section 4. Communications and Disclosures 6

4.1 Actuarial Report 6

4.2 Disclosures Concerning Process of Dividend Determination 6

ASOP No. 15—March 2006

iii

APPENDIXES

Appendix 1—Background and Current Practices 8

Background 8

Current Practicies 9

Appendix 2—Comments on the Exposure Draft and Responses 12

ASOP No. 15—March 2006

iv

March 2006

TO: Members of Actuarial Organizations Governed by the Standards of Practice of the

Actuarial Standards Board and Other Persons Interested in Dividends for

Individual Participating Life Insurance, Annuities, and Disability Insurance

FROM: Actuarial Standards Board (ASB)

SUBJ: Actuarial Standard of Practice (ASOP) No. 15

This booklet contains the final version of the revision of ASOP No. 15, now titled Dividends for

Individual Participating Life Insurance, Annuities, and Disability Insurance.

Background

The ASB adopted the original ASOP No. 15, Dividend Determination for Participating

Individual Life Insurance Policies and Annuity Contracts, in 1990 and revised it in 1997 to

exclude dividend illustrations that are subject to or represented as being in accordance with the

National Association of Insurance Commissioners’ Life Insurance Illustrations Model

Regulation.

This current revision of ASOP No. 15, now titled Dividends for Individual Participating Life

Insurance, Annuities, and Disability Insurance, was prepared by the Task Force to Revise ASOP

No. 15 of the Life Committee of the ASB to be consistent with the current ASOP format, to

bring individual disability insurance into its scope, and to reflect current, generally accepted

actuarial practices with respect to dividends for participating individual life insurance policies

and annuity contracts.

Exposure Draft

The exposure draft of this ASOP was issued in March 2005 with a comment deadline of

September 30, 2005. Fourteen comment letters, showing thoughtful insight of the issues, were

received and considered in developing the final ASOP. For a summary of the substantive issues

contained in the exposure draft comment letter and the responses, please see appendix 2.

The most significant changes since the exposure draft were as follows:

1. References to professional services with respect to long-term care insurance were

removed from section 1.2, Scope. References to long-term care were also removed from

the title and other areas of the standard.

2. Several definitions were modified for improved clarity and consistency.

ASOP No. 15—March 2006

v

3. A sentence was added to section 3.1, Contribution Principle, to clarify that the

contribution principle can be applied annually or over an extended period of time.

4. Section 3.3.4, Dividend Factors for New Policies, was changed with respect to setting a

dividend factor that differentiates between old and new policies, dropping the reference

to setting such a factor on a conservative basis.

5. Guidance with respect to reinsurance was added in new section 3.9, Reinsurance.

6. The discussion of the impact of policy loans was moved from section 3.6, Investment

Income, to new section 3.7, Policy Loans.

7. Current practice with respect to disability income insurance in appendix 1 was clarified.

The Life Committee thanks all those who commented on the exposure draft.

The ASB voted in March 2006 to adopt this standard.

Task Force to Revise ASOP No. 15

Thomas A. Phillips, Chairperson

Armand M. dePalo Gary N. Peterson

Phillip J. Grigg Stephen N. Steinig

Dale S. Hagstrom

Life Committee of the ASB

Robert G. Meilander, Chairperson

Charles Carroll Thomas A. Phillips

Michael A. Cioffi Allan W. Ryan

Dale S. Hagstrom Barry L. Shemin

Actuarial Standards Board

Cecil D. Bykerk, Chairperson

William C. Cutlip

Godfrey Perrott

Alan D. Ford William A. Reimert

Robert S. Miccolis Lawrence J. Sher

Lew H. Nathan Karen F. Terry

ASOP No. 15—March 2006

1

ACTUARIAL STANDARD OF PRACTICE NO. 15

DIVIDENDS FOR INDIVIDUAL PARTICIPATING

LIFE INSURANCE, ANNUITIES, AND DISABILITY INSURANCE

STANDARD OF PRACTICE

Section 1. Purpose, Scope, Cross References, and Effective Date

1.1 Purpose—This actuarial standard of practice (ASOP) provides guidance to actuaries

when performing professional services relating to the dividend framework and the

determination and illustration of dividends for individual participating life insurance,

annuities, and disability insurance, whether issued by a stock, fraternal, or mutual insurer.

1.2 Scope—This standard applies to actuaries when performing professional services in

connection with the establishment or modification of the dividend framework and the

determination and illustration of dividends for individual participating life insurance,

annuities, and disability insurance, including any attached participating riders and

agreements.

This standard does not apply to actuaries when performing professional services with

respect to illustrations of dividends subject to ASOP No. 24, Compliance with the NAIC

Life Insurance Illustrations Model Regulation.

This standard does not apply to the establishment of the aggregate amount available to be

distributed to policyholders as dividends (i.e., divisible surplus).

If the actuary departs from the guidance set forth in this standard in order to comply with

applicable law (statutes, regulations, and other legally binding authority), or for any other

reason the actuary deems appropriate, the actuary should refer to section 4.

1.3 Cross References

—When this standard refers to the provisions of other documents, the

reference includes the referenced documents as they may be amended or restated in the

future, and any successor to them, by whatever name called. If any amended or restated

document differs materially from the originally referenced document, the actuary should

consider the guidance in this standard to the extent it is applicable and appropriate.

1.4 Effective Date—This standard is effective for actuarial services performed on or after

August 1, 2006.

ASOP No. 15—March 2006

2

Section 2. Definitions

The terms below are defined for use in this actuarial standard of practice.

2.1 Actual Experience—Historical results within a dividend factor class and trends in those

results.

2.2 Contribution Principle—The concept that aggregate divisible surplus is allocated to

policies to reflect the proportion that the policies, as part of their dividend factor classes,

are considered to have contributed to divisible surplus.

2.3 Dividend Determination—Given the dividend framework, the process by which the

divisible surplus is allocated to policies including the determination of dividend factors.

2.4 Dividend Factor—A value or set of values, other than the policy factors, used in the

determination of the dividend on a particular policy. A dividend factor reflects the

experience of the dividend factor class of policies to which the particular policy belongs.

Examples of dividend factors include those related to mortality, morbidity, expense,

investment income, policy termination, tax, and experience premiums.

2.5 Dividend Factor Class—A group of policies for which dividends are determined by using

the same value or set of values for a particular dividend factor.

2.6 Dividend Framework—The structure by which the insurer allocates divisible surplus

among participating policies. This includes the assignment of policies to dividend factor

classes, the method of allocating income and costs, and the structure of the formulas or

other methods of using dividend factors.

2.7 Divisible Surplus—The aggregate amount available to be distributed to policyholders as

dividends.

2.8 Policies

—Individual participating policies and contracts for life insurance, disability

insurance and annuities, and group certificates for these same types of business that

operate in substantially the same manner as individual participating policies and

contracts.

2.9 Policy Factors

—Financial components of a policy based on the guarantees or actuarial

components underlying the policy. Examples of policy factors include cash values,

reserves and their associated net premiums, gross premiums, policy loan interest rates,

and the rates of interest, mortality, and morbidity used in calculating cash values or

reserves.

ASOP No. 15—March 2006

3

Section 3. Analysis of Issues and Recommended Practices

3.1 Contribution Principle—The actuary should use the contribution principle in determining

dividends unless, in the actuary’s professional judgment, a different basis is preferable,

reasonable, and appropriate. The actuary may apply the contribution principle annually or

over an extended period of time. Limitations of the dividend determination process

require that practical considerations be reflected in applying the contribution principle,

and the actuary may recognize such considerations in applying the contribution principle.

The actuary may use approximations, simplified processes, or other adjustments

considering relevant conditions and circumstances such as the size of a particular group

of policies, the costs and practical difficulties of making a dividend scale change, and the

effect of the scale change on individual dividends.

3.2 Dividend Framework

—When advising the insurer with respect to the dividend

framework, the actuary should consider the following: (a) treatment of policies within

the line of business that, in the actuary’s professional judgment, is equitable; (b) the

insurer’s marketing, financial, and other objectives; (c) materiality; (d) relevant policy

provisions; and (e) practical limitations.

3.3 Dividend Factors

—The actuary should determine dividend factors that allocate the

divisible surplus within the insurer’s dividend framework. The actuary should develop

dividend factors based on an analysis of policy factors and actual experience of the

participating block for which dividends are being determined. However, when actual

experience is not determinable, available, or credible, the actuary should consider the

experience and trends in experience of similar classes of business either from the same

insurer, from industry sources, or from other non-industry sources, in that order of

preference. Dividend factors may differ from actual experience, as the actuary may adjust

the factors to reflect the insurer’s financial objectives, to reflect practical limitations, and

to result in an estimated aggregate dividend payout equal to divisible surplus.

The actuary should consider materiality and practical limitations in determining the

policy and dividend factors that are to appear in the dividend formula or other method of

using dividend factors. Thus, the analysis underlying dividend determination may involve

the use a variety of policy factors and actual experience measures, but the actuary need

not include all of these factors.

When developing new dividend factors for all policies is not practical, the actuary may

recommend the continuation of a dividend scale, continuation of certain dividend factors,

or the use of approximations or simplified processes or formulas.

3.3.1 Projection of Experience

—If any projection of experience is made in determining

the dividend factor of any dividend factor class, the actuary should project

experience for all classes of that dividend factor for a line of business to the same

point in time. The actuary should limit such projections to a relatively short time

frame (for example, the period for which a dividend scale is likely to remain

ASOP No. 15—March 2006

4

appropriate) and should develop projections consistently for dividends on both

policies in force and new business.

3.3.2 Dividend Factor Classes

—When providing advice with respect to creating,

changing, or combining dividend factor classes, the actuary should consider

characteristics such as the following:

a. the similarity of the policy types;

b. the structure of the policy factors;

c. the similarity of the actual experience;

d. the time period over which the policies were issued; and

e. the underwriting and marketing of the policies.

The actuary may use the same dividend factor class for policies with different

actual experience when this difference is charged for elsewhere. For example, the

dividend factor related to mortality used for permanent policies resulting from

term conversion may be the same as that for regularly underwritten policies, even

though the actual experience is different, provided that the appropriate charges for

material differences in mortality experience, net of expense savings, are charged

to the term policies.

3.3.3 Uniform Criteria

—In placing policies in their respective dividend factor classes,

the actuary should base placement on uniformly applied criteria such as criteria

designed to group similar experience. The actual occurrence or absence of a claim

on a particular policy should not be a criterion for placement of that policy in a

particular dividend factor class.

3.3.4 Dividend Factors for New Policies

—Dividend factors for new policies or

products commonly differ from those of older, otherwise similar policies. When

setting dividend factors that differ for otherwise similar old and new policies, the

actuary should consider (a) actual experience, if available, and (b) assumptions

that are reasonable and methods that are equitable, in the actuary’s professional

judgment.

3.4 Policy Factors—In the calculation of dividends for a particular policy, the actuary may

use the actual policy factors for that policy or approximations to the actual policy factors

that the actuary judges appropriate.

3.5 Mortality, Morbidity, and Policy Termination

—The actuary may base the dividend

factors related to mortality, morbidity, or policy termination on a variety of

characteristics or a combination thereof. Examples of such characteristics include, but are

ASOP No. 15—March 2006

5

not limited to, age, gender, duration, geographic location, marketing method, plan, size of

policy, and risk class.

3.6 Investment Income

—The actuary should reflect the investment experience of the line of

business for which dividends are being determined in setting a dividend factor related to

investment income. The dividend factor related to investment income may reflect

investment experience net of investment expenses or, alternatively, investment expenses

may be treated separately as expenses. The actuary should consider the treatment of

capital gains and losses and taxes in setting the factor. The actuary should use a

reasonable basis for allocating investment income to policies, whether using portfolio,

segmentation, investment generation, or any other methods.

3.7 Policy Loans

—The actuary may reflect the effect of policy loans in setting a dividend

factor related to investment income. In determining the effect of policy loans, the actuary

should consider the policy loan interest rate, the treatment of policy loan expenses, and

whether policy loan interest is aggregated with other investment income recognizing the

utilization rate of loanable funds or whether policy loan interest is passed through directly

to borrowing policyholders.

3.8 Expense—The actuary should consider expense experience in setting a dividend factor

related to expenses. In considering expense experience, the actuary should allocate direct

costs (those that can be related to a specific group of policies) to the policies generating

those costs. The actuary should reasonably allocate indirect costs, such as overhead. The

actuary should develop dividend factor classes and dividend factors related to expenses

such that total expenses charged to each class are reasonable.

3.9 Reinsurance—The actuary should review the nature of any applicable reinsurance

arrangement and determine the allocation, if any, of the impact (positive or negative) of

reinsurance to specific blocks of business. If a reinsurance agreement is reflected in the

determination of dividends, the actuary may reflect its impact in the dividend factors such

as those related to expenses or mortality, or elsewhere in the dividend framework.

3.10 Tax—The actuary may determine a dividend factor related to taxes without reflecting

modest variations in taxes among jurisdictions. The actuary should consider material

variations in applicable laws in determining a dividend factor related to taxes, consistent

with the analyses underlying other experience.

3.11 Stockholder Retention on Policies Originally Issued by a Stock Company—The actuary

should consider applicable state law with respect to stockholder retention charges on

participating policies. The actuary should not ordinarily change the dividend factors for

stockholder retention from those in the scale used in the original dividend illustrations. If

the factors are to be changed from the scale used in the original dividend illustrations, the

actuary should make corresponding changes to all participating policies in force.

ASOP No. 15—March 2006

6

3.12 Termination Dividends—In establishing or changing termination dividends (dividends

that may be provided upon events such as death, maturity or surrender), the actuary

should consider the insurer’s intent as represented to the actuary by the insurer for the

block of business, if available, and develop termination dividends that are consistent with

that intent and supportable within the divisible surplus of the insurer. The actuary should

consider applicable state law with respect to termination dividends.

3.13 Illustrated Dividends Not Subject to ASOP No. 24—The actuary should determine

dividends to be used in illustrations not subject to ASOP No. 24 so that they reasonably

relate to actual dividends recently determined for payment on policies in force.

The actuary should consider whether illustrated dividends can be supported by recent

experience. If not, the actuary should disclose this and consider the appropriateness of

recommending a reduced scale for illustrations.

3.14 Documentation—The actuary should prepare and retain documentation in compliance

with the requirements of ASOP No. 41, Actuarial Communications. The actuary should

also prepare and retain documentation to demonstrate compliance with the disclosure

requirements of section 4.2.

3.15 Reliance on Data or Other Information Supplied by Others—When relying on data or

other information supplied by others, the actuary should refer to ASOP No. 23, Data

Quality, for guidance.

Section 4. Communications and Disclosures

4.1 Actuarial Report—When advising an insurer on dividends subject to this standard of

practice, or on the dividend framework, the actuary should issue an actuarial report in

accordance with ASOP No. 41 to the insurer stating the actuary’s advice, unless another

actuary advising the same insurer is issuing such an actuarial report that incorporates

such advice.

4.2 Disclosures Concerning Process of Dividend Determination

—The actuary should

disclose the following items in appropriate detail in the actuarial report:

a. a description of the process and dividend framework used to determine dividends,

the manner in which the policy and dividend factors were reflected in that

process, and any material change in process or dividend framework since the last

dividend scale;

b. whether the contribution principle has been followed and, if not, the basis used for

dividend allocation;

c. if the contribution principle is being applied to divisible surplus for a period other

than the current year, the procedures used for such application;

ASOP No. 15—March 2006

7

d. a description of the use of any significant approximations, simplified procedures,

and practical adjustments to dividends, and the rationale for that usage;

e. a description of the dividend factor classes used and any material changes in such

classes or in placement of policies within them;

f. a description of the policy factors and any material change in practice with respect

to their determination or use;

g. a description of the dividend factor values used and any material changes in such

values, including an identification of dividend factors with more than one

dividend factor class. If a projection of experience has been used in setting a

dividend factor, the type and extent of usage should be stated;

h. a description of the approach used for allocating investment income to the policies

covered by the report. If the approach for a given group of policies has changed,

or if a previously unused approach is to be introduced for a new group of policies,

the report should identify the approach and include a full description of the nature,

rationale, and effect of such approach;

i. for the dividend factors related to stockholder retention, a description of the

method, the actual factors, and any material changes in values of these factors

since the last dividend scale change;

j. if the insurer provides for termination dividends, a description of the processes

used to determine termination dividends and any material changes in practice with

respect to the determination of termination dividends since the last report;

k. for illustrations that are not included in the scope of ASOP No. 24, a description

of the methods used to determine illustrated dividends;

l. a description of any illustrated dividends that cannot be supported by recent

experience;

m. the disclosure in ASOP No. 41, section 4.2, if any material assumption or method

was prescribed by applicable law (statutes, regulations, and other legally binding

authority);

n. the disclosure in ASOP No. 41, section 4.3, if the actuary states reliance on other

sources and thereby disclaims responsibility for any material assumption or

method selected by a party other than the actuary; and

o. the disclosure in ASOP No. 41, section 4.4, if, in the actuary’s professional

judgment, the actuary has otherwise deviated materially from the guidance of this

ASOP.

ASOP No. 15—March 2006

8

Appendix 1

Background and Current Practices

Note: This appendix is provided for informational purposes but is not part of the standard of

practice.

Background

The determination of dividends on participating life insurance policies was a fundamental part of

actuarial practice in the United States before the founding of actuarial organizations. Principles

were defined early and have not changed. Practices have changed. Broad averaging of

experience was generally used until the early 1970s. Because of newly emerging products with

differentiated pricing, newly emerging differences in experience factors, and increased computer

speed and capacity, dividend practices shifted toward more refined reflections of cost and

income.

There have been no fundamental changes in life insurance dividend practices since the 1980s.

The general trend in practice has been to develop refinements in classes of business. This has

paralleled the development of dividend frameworks that are more refined and computer systems

that are capable of handling the additional refinements.

The determination of dividends for disability insurance policies has a shorter history than that for

life insurance, but the principles are similar.

One trend of the 1990s was the development of closed blocks of participating business, usually

as a result of the demutualization of mutual life insurance companies. These closed blocks,

according to their operating rules, are self-supporting and preserve the reasonable dividend

expectations of their policyholders. The determination of dividends for policies in closed blocks

follows the principles outlined in this ASOP. The divisible surplus for the closed block is set so

as to exhaust the assets when the last policy terminates, while avoiding the creation of a tontine.

Some insurers have sold blocks of participating individual policies to a reinsurer. In such a

situation, the guidance provided by this standard applies to any actuaries providing professional

services, as defined in this standard, to an insurer with respect to those policies.

In 1976, the Society of Actuaries appointed a Committee on Dividend Philosophy to consider

this subject. Building on the work and recommendations of that committee, the American

Academy of Actuaries’ (Academy) Committee on Dividend Principles and Practices formulated

a set of Recommendations for the participating individual life insurance business of mutual

companies that was adopted by the Board of Directors of the Academy in 1980. In 1985, the

Academy board adopted a revised set of Recommendations that covered participating individual

life insurance and participating annuity contracts of both mutual and stock companies. The

original ASOP No. 15, Dividend Determination for Participating Individual Life Insurance

Policies and Annuity Contracts, was a reformatted version of those Recommendations. This

ASOP No. 15—March 2006

9

revision has been updated to reflect current dividend determination practices and to add

individual disability insurance to its scope.

Current Practices

The actuary may provide professional services in two principal areas with respect to dividends.

The actuary is normally involved in the determination of dividends, using the dividend

framework of the insurer. In addition, the actuary may be involved in advising the insurer with

respect to the dividend framework. In providing such services, current practices, such as the

following, provide a background for dividend determination.

For typical insurers, management recommends an aggregate amount available to be distributed to

policyholders as dividends (i.e., divisible surplus), actuaries recommend an allocation of that

amount to individual policies, and the board approves the entire process. Divisible surplus may

be determined for the organization as a whole or may be determined for specific lines of business

within the organization, including closed blocks or participating lines of business operated by

stock life insurers. Also, some insurers have developed policies that are participating but upon

which dividends are not anticipated to be paid. For these policies, the insurer determines whether

there is any divisible surplus to be allocated to the policies in the line of business.

Dividends may be calculated for a company as a whole but it is more common that dividends are

calculated on a “line of business” basis. For this purpose, “line of business” varies by company.

Some companies may view the entire individual life block as a single line of business while

others may break that down into two or more separate lines. For dividend purposes, disability

insurance is often treated as a separate line. Annuity business is also often separated from other

lines for dividend purposes.

The use of the contribution principle in determining dividends is generally accepted practice in

the United States. Methods of applying the contribution principle in dividend determination

described in actuarial literature include the following:

1. the contribution or source of earnings method;

2. the asset share method;

3. the fund method;

4. the experience premium method;

5. the percentage of premium method; and

6. the reversionary bonus method.

Some of these methods, such as the percentage of premium method, refer primarily to the

formula used to calculate dividends. Other methods, such as the asset share method, refer

ASOP No. 15—March 2006

10

primarily to the process used. Much of the standard is implicitly written in terms of the

contribution method, but the standard should be understood in terms of analogous effects under

the other methods.

It is the application of a particular method, by means of the dividend factors, that determines

whether or not it follows the contribution principle, not the method itself. Also, it may be that a

particular method, which does not of itself satisfy the contribution principle, will do so when

termination dividends (see section 3.12) are taken into account.

Frequently the calculation of dividend factors takes place at two levels. At the detail level (policy

form, issue age, issue year, gender, etc.) the actuary seeks a formula that is simple to administer

while producing equitable dividends. A very common formula is the three-factor dividend

formula with a dividend factor related to investment, a dividend factor related to mortality, and a

dividend factor for all other sources (primarily expenses). After the actuary has selected a

formula that the actuary thinks is appropriate, the actuary tests it at a model level (quinquennial

issue ages, major policy forms, selected issue years, etc.), using assets share calculations with a

complete set of assumptions. The testing determines whether the selected scale is (in the

actuary’s professional judgment) reasonable and equitable. The dividend factors may reflect

experience directly in one or more of the three factors, but more often experience is reflected in

the asset share assumptions.

A simplified approach to the determination of dividends for disability policies is common for

several reasons. It is more difficult to know claim costs with certainty because of the volatility of

morbidity results. The product offerings in these areas tend to be quite complex, with many

potential dividend factor classes. An approach for these products may include a simplified

formula for paying dividends, such as a percentage of premium or an experience premium

determined from underlying experience, and a broad application of the definition of dividend

factor class.

As stated in section 3.2 of the standard, practical limitations are part of the dividend framework.

In determining dividends, actuaries commonly make adjustments to dividends for a variety of

reasons, such as the following:

1. to reflect unusual gains or losses on certain supplementary benefit riders;

2. to reflect losses from the presence of settlement option guarantees;

3. to smooth the transition from one dividend scale to another;

4. to provide consistency in quantity discounts made to varying degrees in the gross

premium structure;

5. to serve as a balancing item so that aggregate dividends equal aggregate divisible

surplus;

ASOP No. 15—March 2006

11

6. to distribute gains from extraneous sources such as nonparticipating benefits or lines of

business; and

7. to smooth the incidence of dividends within a dividend scale by policy duration.

Determination of dividends requires analysis of the actual experience of the participating block

for which the dividends are being determined. Maintaining distinct accounting for participating

business and for nonparticipating business and by line within each of these businesses may be

helpful for this purpose.

In allocating divisible surplus to policies, a wide variety of acceptable practice exists in the

determination of dividend factors and the treatment of dividend factors in the dividend

framework. The actual experience upon which dividend factors are based commonly varies by

several characteristics. For example, expenses may vary by plan, size of policy, marketing

method, level of policyholder service, and other items. Also, details of taxation vary widely,

depending on applicable laws in various jurisdictions. Differences in dividend frameworks are

also common among insurers. Dividends may be calculated on a pre-tax basis or the dividend

framework may include a dividend factor related to taxes. Some products of some insurers

provide for termination dividends and there is a wide variety of practices with respect to

termination dividends.

Where an insurer is operating a closed block of participating policies under operating rules

developed in a demutualization, the insurer continues to set the divisible surplus for the partici-

pating policies, while the actuary continues to use the dividend framework to determine

dividends for the policies based on the contribution principle, as defined in the standard.

However, as described in ASOP No. 33, Actuarial Responsibilities with Respect to Closed

Blocks in Mutual Life Insurance Company Conversions, aggregate dividends in a closed block

are to be managed so as to exhaust the assets when the last policy terminates, while avoiding the

creation of a tontine. In such situations, actuaries commonly include in dividend work an

evaluation of the financial position of the closed block relative to the principle of exhausting the

assets while avoiding a tontine. Also, as the operating rules for the closed block may refer to one

or more dividend factors, actuaries commonly refer to the operating rules for the closed block in

setting the dividend factors.

The actuary may have responsibilities in addition to the requirements of this ASOP. For

example, the Exhibit 5 Interrogatories of the National Association of Insurance Commissioners’

current annual statement address additional issues with respect to the determination of dividends

(see section 3.13 of this standard).

ASOP No. 15—March 2006

12

Appendix 2

Comments on the Exposure Draft and Responses

The exposure draft of this actuarial standard of practice (ASOP), then titled Dividends for

Individual Participating Life Insurance, Annuities, Disability Insurance, and Long-Term Care

Insurance, was issued in March 2005, with a comment deadline of September 30, 2005. Fourteen

comment letters were received, some of which were submitted on behalf of multiple comment-

ators, such as by firms or committees. For purposes of this appendix, the term “commentator”

may refer to more than one person associated with a particular comment letter. The Task Force

to Revise ASOP No. 15 carefully considered all comments received, and the Life Committee and

the ASB reviewed (and modified, where appropriate) the proposed changes to the ASOP.

Summarized below are the significant issues and questions contained in the comment letters and

responses to each. The term “reviewers” includes the task force, the Life Committee, and the

ASB. Unless otherwise noted, the section numbers and titles used below refer to those in the

exposure draft.

GENERAL COMMENTS

Comment

Response

Several commentators suggested various editorial changes in addition to those addressed specifically

below.

The reviewers implemented such changes if they enhanced clarity and did not alter the intent of the

section.

Comment

Response

One commentator noted that if interest earned is less than required, there may be yearly dividend decreases

and policyholder complaints. The commentator suggested that it may be better to level scales, build

surplus, and develop dividends with an increasing pattern.

The reviewers noted that the development of such scales is a determination of divisible surplus, which is a

decision by the insurer and not within the scope of the standard.

Comment

Response

Two commentators suggested that the cost of reinsurance might be taken into account in the distribution of

costs among policyholders.

The reviewers agreed and created new section 3.9, Reinsurance.

Comment

Response

Some disability income policies have been issued as participating but where no dividend is anticipated to

be paid. One commentator suggested the standard address (a) whether it is appropriate to offer such

policies under the contribution principle, and (b) how the actuary is to determine dividends.

The reviewers believed determining the appropriateness of policy offerings was beyond the scope of this

standard. The reviewers disagreed with the commentator’s request that the standard discuss how to

determine dividends.

Comment

Response

One commentator noted that some blocks of individual participating insurance have been sold to a

reinsurer and asked about the scope of the standard in such a situation.

The reviewers noted that the standard applies to actuaries providing professional services on dividends

whether working for a direct insurer or a reinsurer.

ASOP No. 15—March 2006

13

Comment

Response

One commentator noted that, in the case of a closed block of participating policies, one or more dividend

factors, such as the factor related to expenses, may be specifically addressed in a plan of reorganization.

The commentator suggested the standard should provide guidance in this situation.

The reviewers noted that the scope of the standard recognized that the actuary should satisfy the

requirements of “other legally binding authority” in performing professional services.

Comment

Response

Several commentators believed that the distinction in guidance for paid dividends and illustrated dividends

was unclear.

The reviewers assessed the scopes of ASOP Nos. 15 and 24 and believed they were clear.

Comment

Response

Two commentators made comments that can be summarized in three general areas:

1. The standard should provide more guidance to actuaries in the area of the actuary’s responsibility to act

in the beneficial interest of the policyholder in determining dividends and the latitude the actuary may

have in following the contribution principle.

2. The standard did not provide sufficient detail in the level of guidance for performing professional

services, both in the dividend framework and determining dividend factors.

3. The standard should address the role of the actuary, the insurer, and the policyholder in determining

divisible surplus.

1. The reviewers assessed the standard with respect to the actuary’s responsibility to act in the beneficial

interest of the policyholder and the latitude the actuary may exercise in following the contribution

principle and believed the standard provided appropriate guidance and reflected accepted practice.

2. The reviewers assessed the level of detail and made appropriate revisions.

3. The reviewers noted that determining divisible surplus was

outside the scope of the standard.

Comment

Response

Several commentators stated that the determination of dividends for participating long-term care policies

does not yet have generally accepted practices and should be outside the scope of this standard.

The reviewers agreed and removed references to long-term care policies.

SECTION 1. PURPOSE, SCOPE, CROSS REFENCES, AND EFFECTIVE DATE

Section 1.1, Purpose

Comment

Response

One commentator suggested that the standard should clearly state that it covers policyholder dividends

whether the policy is issued by a stock, fraternal, or mutual insurer.

The reviewers agreed and revised the language in this section to include these entities.

Section 1.2, Scope

Comment

Response

One commentator asserted that the actual payment of future dividend scales should be tightly and

permanently linked to those illustrated at issue.

The reviewers believed that the standard adequately addressed the dividend allocation process and that the

insurer may change the dividend allocation process, working through the dividend framework, dividend

factors, and divisible surplus, resulting in dividend scales that may differ markedly from those originally

illustrated.

SECTION 2. DEFINITIONS

Comment

Response

A few commentators asked for more clarity in the definitions of 2.3, Dividend Determination; 2.4,

Dividend Factor; 2.6, Dividend Framework; and 2.8, Policy Factors (now 2.9).

The reviewers agreed and amended the definitions.

ASOP No. 15—March 2006

14

Section 2.2, Contribution Principle

Comment

Response

Some commentators suggested that the definition of contribution principle should clarify the point that

policies are grouped into dividend factor classes for the purpose of determining dividends and that the

distribution of surplus among policies is based on such factor classes.

The reviewers agreed that such clarity is important and changed the definition of the contribution

principle.

Comment

Response

One commentator asked for clarification of the change in the definition of “contribution principle” because

the commentator believed this suggested no difference from current practice.

The reviewers added the word “reflects” to acknowledge the impossibility of distributing divisible surplus

to policies literally in exact proportion to the contribution to divisible surplus.

Section 2.4, Dividend Factor

Comment

Response

One commentator suggested that the definition be clarified to reflect experience.

The reviewers agreed and modified the definition.

Section 2.7, Policies

Comment

Response

One commentator suggested that the definition of “policy” with respect to group certificates should be

clarified to cover group certificates that include dividend provisions similar to individual participating

policies.

The reviewers agreed and changed the definition to better reflect that concept.

SECTION 3. ANALYSIS OF ISSUES AND RECOMMENDED PRACTICES

Section 3.1, Contribution Principle

Comment

Response

One commentator suggested that the reference to the contribution principle being applied over an extended

period of time be transferred from the appendix to section 3.1, where it was in the previous standard.

The reviewers agreed and restored this reference to section 3.1.

Comment

Response

One commentator suggested that the contribution principle should include smoothing out and leveling

variations in factors, such as mortality, to avoid anomalies in the progression of dividends by duration.

The reviewers agreed but believed that the standard adequately covered this.

Comment

Response

One commentator noted that some dividend frameworks may provide for a step-up in premium that may

be offset by a dividend. The commentator asked whether the contribution principle is being followed in

that situation.

The reviewers noted that the standard provides for approximations, simplified processes, or other

adjustments considering relevant conditions and circumstances. Such latitude is intended to allow for a

variety of reasonable practices in following the contribution principle.

Section 3.3, Dividend Factors

Comment

Response

One commentator suggested that the list of reasons for making adjustments to dividends or dividend

factors, which was in appendix 1 of the exposure draft, be moved to the end of this section or be cross

referenced.

The reviewers believed the list of reasons represented current practice and was more appropriate in the

appendix as education. The reviewers changed the wording of the appendix to refer to section 3.2.

Section 3.3.2, Differences between Dividend Factor Classes (now Dividend Factor Classes)

Comment

Response

One commentator suggested that the characteristics to be considered in defining dividend factor classes be

expanded, by making clear that those in the standard are examples, not an exclusive list.

The reviewers agreed but believed that the existing language allowed consideration of other

characteristics.

ASOP No. 15—March 2006

15

Section 3.3.3, Uniform Criteria

Comment

Response

One commentator suggested a slight editing of the statement in the draft concerning uniform criteria.

The reviewers agreed and revised the language.

Section 3.3.4, Dividend Factors for New Policies

Comment

Response

One commentator suggested that, when setting a dividend factor that differentiates between old and new

policies, it may not be appropriate to set that dividend factor on a conservative basis given a fixed

distributable surplus.

The reviewers agreed and revised section 3.3.4.

Section 3.5, Mortality, Morbidity, and Policy Termination

Comment

Response

One commentator suggested it be made clearer that the list of examples in this section is not exclusive.

The reviewers agreed and added the appropriate wording.

Section 3.8, Tax (now section 3.10)

Comment

Response

One commentator suggested that generally accepted practice allows dividend formulas determined on a

pre-tax basis with no deduction for taxes and that the standard should make that clear.

The reviewers agreed but believed the standard adequately covered this.

Section 3.9, Stockholder Retention on Policies Originally Issued by a Stock Company (now section 3.11)

Comment

Response

One commentator suggested that determination of shareholder retention as discussed in this section is a

part of the determination of divisible surplus and therefore not covered by this standard.

The reviewers believed that shareholder retention charges, as they relate to the dividend framework, were

appropriately addressed in the revised standard.

Section 3.11, Illustrated Dividends Not Subject to ASOP No. 24 (now section 3.13)

Comment

Response

One commentator suggested that the standard clarify that illustrated dividends not covered by ASOP

No. 24 should reasonably relate to recent paid dividends, not all past dividends paid.

The reviewers agreed and amended this section to reflect that.

APPENDIX (now Appendix 1)

Comment

Response

One commentator took exception to including experience premium method and percentage of premium

method as involving simplified formulas.

The reviewers made a clarifying revision to the sentence to address the commentator’s concern.