The intelligent tax

function

2020 Global Tax Technology and

Transformation Survey highlights

Contents

1

2

3

4

5

6

8

7

9

Our perspective

Tax authorities are disrupting the

tax function

Focus on data source and

transaction-level information

Improving data quality to

provide tax insights

New skills for the tax function

The intelligent tax function

Transformation insights

A blueprint for action

Conclusion and contacts

About this study

This study includes survey responses from a group of 100 of the largest multinational

companies with median US$12b+ in revenue. The survey was conducted in May 2019 by

the EY Quantitative Economics and Statistics (QUEST) group and Wakeeld Research.

1

Our perspective

Kurt Neidhardt

Global Co-Leader and

Americas Tax Technology

and Transformation Leader

kurt.neidhardt@ey.com

+1 212 773 2283

Albert Lee

Global Co-Leader and

Asia-Pac Tax Technology

and Transformation Leader

[email protected]y.com

+852 2629 3318

Multiple megatrends are disrupting the very nature of global corporate

tax operations. The pace of regulatory change and the digitalization of

tax authorities, demands for transparency, technological advances and

the explosion of data are just a few of the forces redening how tax

functions must operate. Yet the technology, leadership and skills within

many global tax functions have not kept pace.

In the context of this digitally evolving marketplace, EY’s global survey was

conducted to gain insight into the current challenges of the tax function.

Among the varied perspectives we gained, there was one overarching

conclusion: tax functions must close the data and technology gap, and

do so as quickly as possible, if they are to keep pace with today’s rapidly

evolving demands.

This survey helps us paint a picture of what a high-performing tax

function will look like over the next several years, including the

increasingly essential capability to perform more advanced analytics.

The tax function of tomorrow must master data intelligence. That is

the foundation for what we call an “intelligent tax function,” where

every employee performs only the activities matching their skills and

experience, and where they focus more on building value rather than

making xes or wasting time on workarounds.

The path to an intelligent tax function begins with a strategic plan,

one that maps a new way of working, and incorporates new skills

and technology. It uses well-proven solutions to address persisting

issues and leverages the potential of newer technologies to make

a quantum leap in capability to be ready for tomorrow.

What will your journey look like?

13

The intelligent tax function | 2020 Global Tax Technology and Transformation Survey highlights

2

Tax authorities are

disrupting the tax function

4

Tax functions dealing with digital tax

administration (DTA) feel a noticeable

impact and are taking clear action.

They are more aware of the difculty in

monitoring these requirements and asserting

proper governance for government submissions.

of companies surveyed, with

global headquarters in countries

with digital tax administrations,

are organizing their response to

DTAs in a centralized and

globally consistent manner.

Companies surveyed with global headquarters in

countries with digital tax administration are

less condent in their monitoring

of these requirements.

for companies surveyed

that are dealing with

DTAs.

In spite of overall budget constraints, tax

transformation spend, annual technology

budgets and the hiring of data skills each

increase by more than

98%

31%

“

“

Automation and articial intelligence make use of

data, analytics and tools to extend automation and

analytics use cases, and enhance our realized

articial intelligence capabilities.

ATO Corporate Plan 2018-2019

“

We have spent a lot of money on technology at [the]

IRS, but have not spent enough.” [We plan] to bring

[the] IRS into the modern age of technology.”

Steven Mnuchin, United States Secretary of the Treasury –

IRS Strategic Plan 2018-2022

HMRC’s ambition is to become one

of the most digitally advanced tax

administrations in the world.

Making Tax Digital is making

fundamental changes to the way the

tax system works – transforming tax

administration

HMRC Making Tax Digital

“

…to further adapt to the needs of developing the market economy and tax modernization, the Shenzhen

Taxation Bureau has set a goal of ‘Building Smart Tax’ as its goal, and has organized and developed

a pilot for using blockchain to issue ordinary electronic Fa Piao invoices.

State Administration of Taxation Shenzhen Taxation Bureau Announcement 2018 No. 11 2018-08-09)

EY point

of view

Tax authorities are driving changes that are increasingly

impacting corporate taxpayers. These changes require

ling through digital methods, more information, more

real-time ling and the employment of data analytics for

risk proling and auditing.

+40%

Spreadsheets are often the symptom of

multiple data sources and systems not being

set up correctly for Tax.

While the tax function cannot control the number of ERPs,

it can inuence the design and governance of ERPs.

of those surveyed participate in

ERP implementations regularly or

full-time.

efciency

gains.

Those surveyed who participate in the ERP

implementation on average experience

45%

17%

3

Companies need to focus on data

sources and transaction-level

information

5

The intelligent tax function | 2020 Global Tax Technology and Transformation Survey highlights

of companies surveyed are dealing

with multiple ERP systems.

more time on data collection,

cleansing and manipulation.

Companies surveyed with 6+ ERPs spend at least

% time spent on data collection,

cleansing and manipulation

1

2-5

6-12

13-24

25+

7%

20%

44%

50%

55%

93%

6X

Number of ERPs

Only

EY point

of view

With Tax becoming more real-time and transaction-based,

tax functions should actively participate in the design and

governance of nancial systems to help ensure data quality

via correct processing at the time of transaction.

4

Improving data quality is the

key to providing tax insight

6

EY point

of view

The intelligent tax function thinks strategically about

the tax data supply chain and employs articial

intelligence-driven data intelligence and insights to

improve data quality, accuracy and efciency.

Clean data is required for all tax activities. Data quality is

dependent on the information accessible by Tax, whether

it’s accurate and sufcient to answer the most relevant

questions or just the basis for estimates.

When using data to drive insight, detail becomes even more crucial. As for the

promise of emerging technology, the simple truth is that even articial intelligence

and machine learning cannot analyze unavailable data any more than humans can.

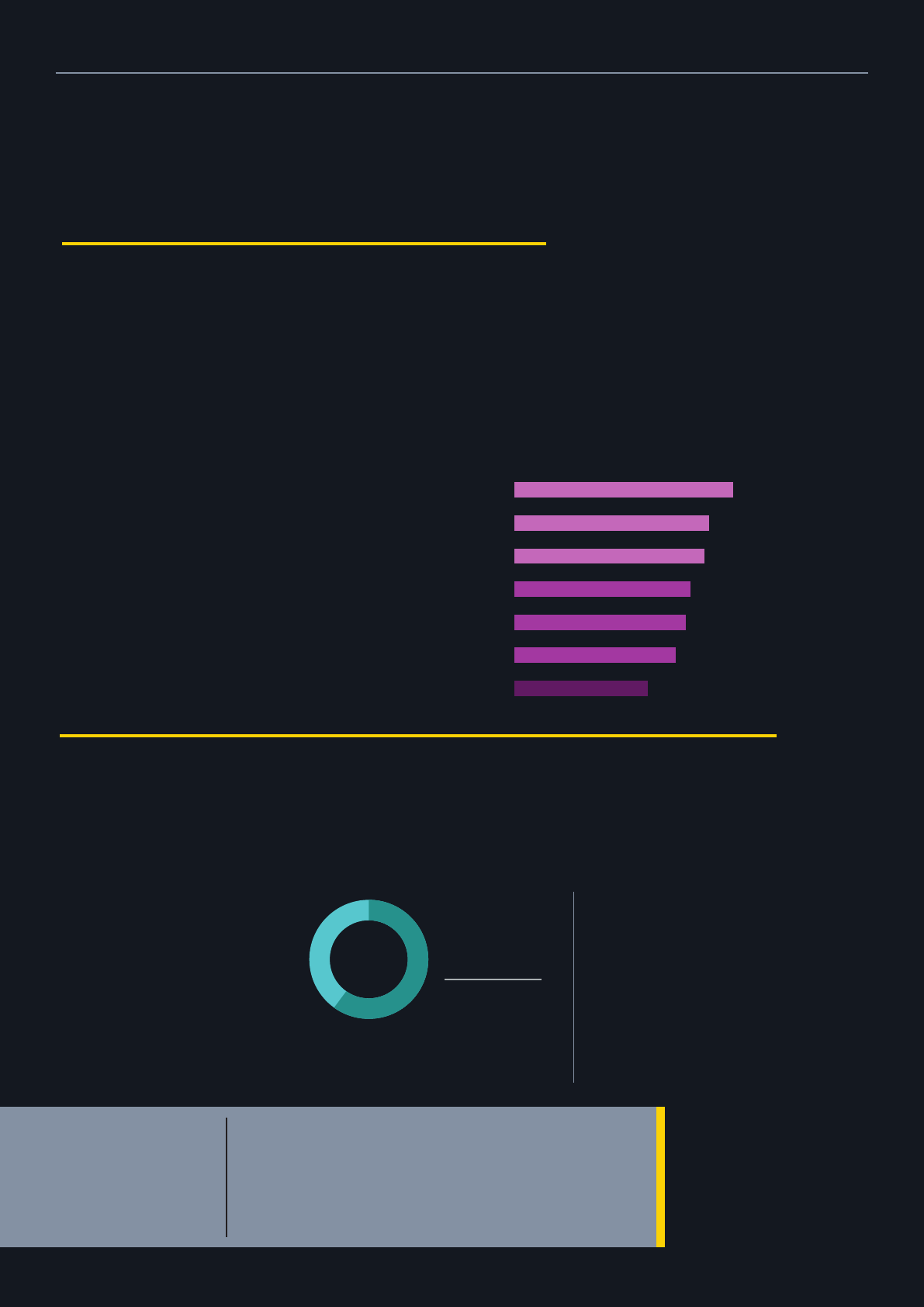

What exactly is consuming all that time?

Data cleansing can broadly represent a wide variety of activities, most of which are symptoms of

people, process and technology gaps that exist prior to Tax receiving the data.

The level of data detail available is most inuenced by the primary source.

The majority of companies

surveyed still spend

of their time on data cleansing.

Seven of the most common activities:

Time spent

40%-70%

1 | Splitting accounts, cost centers or prot centers

2 | Making group-to-local GAAP adjustments

3 | Splitting data into correct locations or jurisdictions

4 | Splitting data into correct legal entities

5 | Reclassifying transactions

6 | Mapping

7 | Splitting or assigning correct trading partners

40% of the companies surveyed

are using a tax reporting package,

consolidations ledger or

disconnected spreadsheets as

their primary source for tax data.

60%

ERP systems or

Finance/Tax data

warehouse

40%

Spreadsheets, data

collect package,

consolidations

ledger

40%

efciency gains

are realized by companies surveyed

with multiple ERPs that build a tax

data warehouse as their primary

data source to reduce collection,

cleansing and manipulation time.

The tax function should seek maximum

leverage from the nancial reporting

technology investments made by the

enterprise while also using specialized

tax technology.

The survey results show that companies have a large appetite for increasingly

complex analytics, even when they can’t adequately perform the basics.

7

The intelligent tax function | 2020 Global Tax Technology and Transformation Survey highlights

EY point

of view

One of the critical goals of a tax function is to add

value by providing insights. Once data is harnessed and

managed, tax professionals can focus on adding value.

more efcient.

The companies that do are

Technology in use by tax end users

% adopted

Desktop

DB

End-user

cleansing

Enterprise

reporting

Visualization

57% 57%

51%

70%

50%

of companies surveyed do not use

commercial tax accounting software.

41%

of companies,

struggle with basic analytical

reporting capabilities…

are striving to incorporate

more advanced analytics

into key activities.

but

newer end-user data-cleansing tools have

already been adopted by

70%

51%

50% 68%

While decades-old technology such as

business intelligence tools have only been

adopted by

5

The tax function needs new

types of skills

8

EY point

of view

The tax functions that will be most successful in the

future are those that adapt to the way authorities are

administering tax. In addition to having traditional

technical tax and nance skills, tax functions will also

need to have technology and data skills.

The time has come for the tax technology function to become the

tax data function. Data sits at the intersection of process and

technology and touches every part of Tax.

Individuals with data and analytics skills as their core skill set will

comprise a larger portion of tomorrow’s intelligent tax function.

Today’s tax technology function can mean very

different things from one organization to another.

Maintain tax software

Process change

Tax data collection

Data cleansing

Report development

Maintain tax data warehouse

Microsoft ofce/ tax software

user support

The tax technology functions that act as

the interpreter between tax personnel and

incoming data — ensuring that data is t for

tax use — will be the most successful.

Tax software

maintenance

Intelligent data

management

Process change

Process change

Tax data

collection

Report

development

Today's

Tax function

Tomorrow's

Intelligent tax function

Top 3 activities

1 1

2 2

3 3

of companies surveyed plan to

increase tax headcount with

people with data and tech

management skills.

of companies surveyed report that

they need more skills with tools

their company already licenses.

When considering the abilities of existing staff,

73%

+60%

6

Transformation insights

9

The tax functions that will succeed in the next wave of transformation must get involved, taking

an active part in the transformation plan, strategy and execution.

Making meaningful change can be difcult without appropriate

planning and resources.

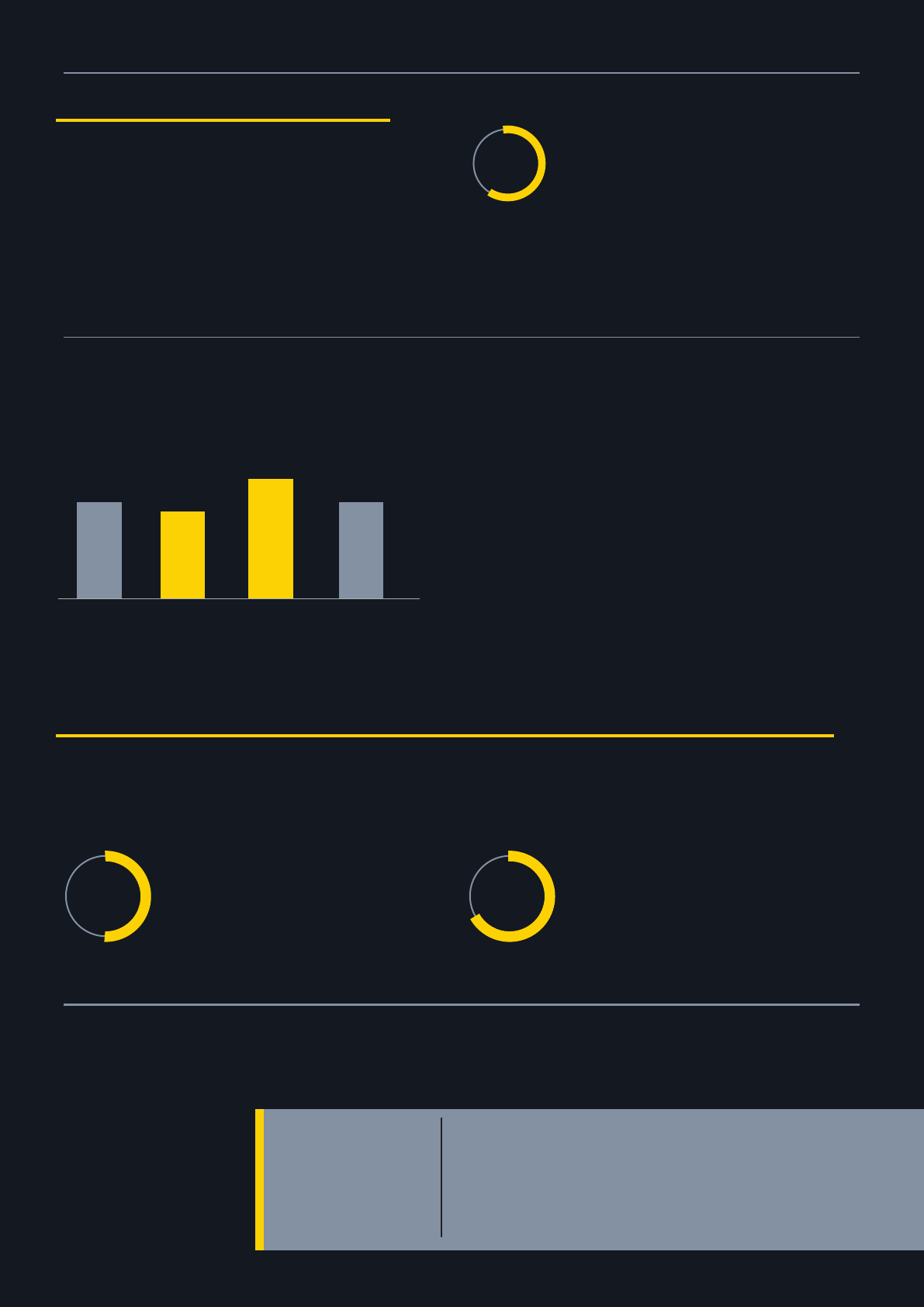

of tax transformations performed

by the companies surveyed do not

meet all of their objectives.

EY point

of view

Transformation needs to be approached strategically

and with focus. Tax leaders need to set a clear vision,

dene the business case to support the journey, commit

and obtain appropriate resources, and enlist sponsorship

from a range of stakeholders.

75%

Only 30% of tax transformations performed

by the companies surveyed are driven by Tax.

Only 49% of the companies surveyed

have a plan beyond the current year.

46%

37%

31%

32%

49%

1%

50%

24%

30%

Enterprise/

nance-driven

Improved risk

management

Improved M&A

integration

Business model

support

none

2+ years

1 year

M&A-driven

Tax-driven

Top 3 most commonly realized benets from

tax transformation

The intelligent tax function | 2020 Global Tax Technology and Transformation Survey highlights

7

8

The intelligent tax function

Blueprint for success

A blueprint for action

Today’s working world demands an intelligent tax function, with a new way of obtaining, processing and

using data, bolstered by a new mix of talent, training and technology — all working together to create

sustainable, long-term value.

New tax operating models will need to be in place within the next few years. This intelligent tax function

will also be more tightly integrated with the rest of the business from an operational perspective, and will

leverage data and technology to deliver value to the business.

This tax function has the potential to be a very different place from the one we know today. Articial

intelligence will increase the opportunities for applying human intelligence. Tax professionals will be able

to analyze data, adding another skill to their tax resumes. The data aptitude gap that exists in today’s tax

function will close rapidly over the next ve years as companies hire more technologists and data scientists,

and supplement tax technical training with training on data management and analysis.

This combination of higher data quality, automation, new skill sets and realigned responsibilities creates

the best chance for tax functions to achieve the aspirational yet elusive mode of focusing on high-value

activities to create the intelligent tax function.

Intelligent

tax function

Talent

Begin to upskill your people in such key

technology areas as database concepts,

desktop data management and analytic tools

Tax technology

Continue to evolve your

internal tax technology

function from its roots to

become more engaged and

accountable for tax data tools

and relevant IT governance.

Data control

Some of the most signicant challenges across

the tax data life cycle are ERP proliferation,

data fragmentation and inadequate use of

nance or tax data warehouses/lakes. Champion

investments here to drive improvements in your

overall tax operating model.

Transformation approach

Establish a seat at the enterprise

transformation table and make

sure your tax function needs are

adequately addressed.

Enterprise systems

Leverage the system of original

entry – the ERP – and other data

repositories and be a part of

their governance and processes.

103

9

Conclusion

Contacts

How can you transform into an

intelligent tax function?

Stand back and assess the landscape of

goals and reporting requirements

Set a vision and strategy, and then execute

Understand your end-to-end tax data

supply chain

Invest in technology skills

Get data correct at the source by setting

up your enterprise systems appropriately

for tax

Focus and dedicate resources to

transformation

Change is always unsettling, but this is also

a time to be excited.

The best days to be a tax professional are

ahead — including the enticing possibility of

spending the majority of time doing the tax

work that adds value.

Learn more at:

ey.com/taxtechtransform

Kurt Neidhardt

Global Co-Leader and Americas Tax

Technology and Transformation Leader

kurt.neidhardt@ey.com

+1 212 773 2283

Ralph Doll

EMEIA Tax Technology and Transformation

Leader

ralph.doll@de.ey.com

+49 221 2779 25678

Albert Lee

Global Co-Leader and Asia-Pac Tax

Technology and Transformation Leader

[email protected]y.com

+852 2629 3318

The intelligent tax function | 2020 Global Tax Technology and Transformation Survey highlights

11

EY | Assurance | Tax | Transactions | Advisory

About EY

EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality

services we deliver help build trust and condence in the capital markets and in economies the

world over. We develop outstanding leaders who team to deliver on our promises to all of our

stakeholders. In so doing, we play a critical role in building a better working world for our people,

for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the member rms of Ernst &

Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK

company limited by guarantee, does not provide services to clients. Information

about how EY collects and uses personal data and a description of the rights individuals

have under data protection legislation are available via ey.com/privacy. For more

information about our organization, please visit ey.com. For more information about our

organization, please visit ey.com

About EY’s Tax Technology and Transformation Services

EY’s Tax Technology and Transformation (TTT) is a global practice that brings together

transformation strategists and technology professionals dedicated to helping organizations

redene the tax function to meet the demands of the digital age: from rapid business

model change and global transparency, to expanding digital tax administrations, escalating

reporting requirements and cloud-based solutions. Our objective is to help each client

transform the traditional tax function into a connected intelligent tax function, with an

operating model that thinks about data differently — one that’s integrated and addin

g value across the enterprise, embraces innovation, and is open to adopting advanced and

emerging technologies to fuel continuous transformation.

©2020 EYGM Limited. All Rights Reserved. EYG No. 005155-19Gbl. ED None

This material has been prepared for general informational purposes only and is not intended to be

relied upon as accounting, tax or other professional advice. Please refer to your advisors for

specic advice.

The views of third parties set out in this publication are not necessarily the views of the global EY

organization or its member rms. Moreover, they should be seen in the context of the time they

were made.

ey.com