How-To Guide

SAP Business One 9.3 and SAP Business One 9.3, version

for SAP HANA onwards

Document Version: 6.0 – July 10, 2018

PUBLIC

How to Set Up and Use Serial/Batch Valuation

Method in SAP Business One

2

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Document History

Typographic Conventions

Type Style

Description

Example

Words or characters quoted from the screen. These include field names, screen titles,

pushbuttons labels, menu names, menu paths, and menu options.

Textual cross-references to other documents.

Example Emphasized words or expressions.

EXAMPLE

Technical names of system objects. These include report names, program names,

transaction codes, table names, and key concepts of a programming language when they

are surrounded by body text, for example, SELECT and INCLUDE.

Example

Output on the screen. This includes file and directory names and their paths, messages,

names of variables and parameters, source text, and names of installation, upgrade and

database tools.

Example

Exact user entry. These are words or characters that you enter in the system exactly as

they appear in the documentation.

<Example>

Variable user entry. Angle brackets indicate that you replace these words and characters

with appropriate entries to make entries in the system.

EXAMPLE

Keys on the keyboard, for example,

F2

or

ENTER

.

How to Set Up and Use Serial/Batch Valuation Method

Document History

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

3

Document History

Version

Date

Change

9.1 v3.0 2015-03-26 Document Updated

9.2 v4.1 2017-03-07 Document Updated

9.3 v5.0 2018-05-29 Document Updated

9.3 v6.0 2018-07-10 Document Updated

Glossary of Terms

Terms as used in SAP Business One

o Current Serial/Batch Cost - cost calculated at the serial/batch level.

o Cumulative Qty - the on-hand quantity in inventory,

o Cumulative Value - the on-hand value in inventory.

o Cumulative Purchased Qty - the running total number of physical items purchased for the batch, minus

any returned quantity.

o Cumulative Purchased Amount - the running total amount of purchases in monetary terms for the batch,

minus any returned amount.

o Cumulative Cost - shows a calculated number, dividing Cumulative Purchased Amount by Cumulative

Purchased Qty. This is the cost set in serial/batch details after the posting of transactions. This is the

same as the cost that will be used in the next stock release.

4

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Document History

Table of Contents

Document History ...................................................................................................................................... 3

1 Introduction ................................................................................................................................... 6

2 Prerequisites .................................................................................................................................. 8

3 Initial Settings ............................................................................................................................... 9

3.1 Defining Items Managed by Serial Numbers or Batches ................................................................... 9

3.2 Defining Management of Serial and Batch Cost by Serial/Batch Valuation Method at Company

Level ...................................................................................................................................................... 10

3.3 Defining Serial/Batch Valuation Method at Item Level ..................................................................... 11

3.4 Blocking Multiple Receipts for Same Batch When Valuation Method Is Serial/Batch .................. 12

3.4.1 Blocking Multiple Receipts for the Same Batch at Company Level ................................14

3.4.2 Blocking Multiple Receipts for Same Batch at Item Level................................................ 15

4 Item Management ....................................................................................................................... 16

4.1 Serial Number Details Window ............................................................................................................16

4.2 Batch Details Window ..........................................................................................................................16

4.3 Serial Number Management - Update Window .................................................................................16

4.4 Batch Management - Update Window ................................................................................................ 17

5 Marketing Documents & Valuation, Determining Serial and Batch Item Cost, Exchange

Rates Differences. ....................................................................................................................... 18

5.1 Determining Item Cost of By-Products with Serial/Batch Valuation Method ............................... 20

5.2 Rounding Item Cost for Serial/Batch Valuation Method ................................................................. 20

6 Revaluing Inventory with Serial/Batch Valuation Method .................................................... 21

6.1 Revaluing Inventory by Price Change ................................................................................................ 22

6.2 Revaluing Inventory by Debit/Credit ................................................................................................. 23

7 Updating Valuation Method to Serial/Batch for Selected Items ......................................... 25

8 Gross Profit and Production Cost Recalculation Wizards ..................................................... 27

8.1 Production Cost Recalculation Wizard .............................................................................................. 27

8.2 Gross Profit Recalculation Wizard ...................................................................................................... 31

9 Calculating Costs for Goods Receipt PO Priced at Zero........................................................ 35

10 Examples of Cost Calculation and Postings for Items with Serial/Batch Valuation

Method .......................................................................................................................................... 37

10.1 Purchasing Documents ....................................................................................................................... 37

10.2 Sales Documents ................................................................................................................................. 40

10.3 Production Documents ....................................................................................................................... 43

10.4 Inventory Revaluation ......................................................................................................................... 47

10.5 Rounding Costs for Batch Deliveries ................................................................................................. 48

How to Set Up and Use Serial/Batch Valuation Method

Document History

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

5

11 Generating Batches and Serials Inventory Audit Reports .................................................... 50

6

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Introduction

1 Introduction

In SAP Business One, when running a perpetual inventory, there are four different valuation methods to choose

from to value the items (item master data records) your business deals with. This guide focusses on and explains

how to use the serial/batch valuation method and what it means for the different areas of SAP Business One.

Serial and batch numbers can be used to manage quantities of items. Items valued under the serial/batch

valuation method must have their quantities managed by serial or batch on every transaction. Items valued under

the FIFO, moving average or standard valuation methods can have their quantities managed by serial or batch

number, but it is not mandatory.

Note

The serial/batch valuation method and managing quantities of items by serial/batch are separate and

distinct concepts.

Serial/Batch Valuation

Under the serial/batch valuation method, the valuation of items is linked to a serial number or a batch identifier.

The value of items in a batch is influenced by what happens to all the items in the batch.

o A serial number is a unique identifier for a single unit of an item, applied to a single item master data

record. The unique serial number can only be applied once, to one unit of an item, value is determined

on an individual item serial number basis.

o A batch is a unique identifier for a quantity of an item or different items. Different item master data

records can be identified by the same batch but valuation is separate by item master data record.

Valuation and costs are calculated consistently across the batch for an item master data record.

Item valuation, and so cost, is either maintained on a serial number or a batch basis. Value is dictated by the batch

or serial number and what costs and activities have been recorded against the batch or serial number.

In the serial/batch valuation method, item quantities of the same item master data record can have a different

value determined by their serial/batch association. Two units of the same item (item code) that are held in

different batches have no influence on each other in terms of valuation or cost.

For serial numbered items, the cost used in an outbound transaction is the same as the inbound cost of the item

as determined by its serial number. The cost of the item is managed at the serial number level which can be

adjusted by material revaluation.

For items that are valued by serial/batch and are part of a batch, the cost used in an outbound transaction is

determined by the inbound costs for the whole batch. An inbound transaction affects the cost of the entire batch,

How to Set Up and Use Serial/Batch Valuation Method

Introduction

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

7

no matter whether the quantity of the batch is partially or fully available in a warehouse, or if a batch item has

been sold already. Cost price is always calculated at a company level and so applies consistently across all

relevant warehouses. The cost of an item is managed at the batch level which can be adjusted by material

revaluation affecting the entire batch.

Recommendation

When using the serial/batch valuation method, determine G/L accounts at the company level or use the

same G/L accounts for warehouses containing items from the same batch. This will avoid unbalanced

G/L accounts because of system postings for variable item costs across warehouses containing the same

batch. When using the serial/batch valuation method, costs are always managed at the company level so

the Manage Item Cost per Warehouse option on the Basic Initialization tab of Company Details is

disregarded.

Valuation by serial number is typically used for higher-value individual items (for example, a truck), whereas

valuation by batch is typically used for large volumes of lower-value items (for example, pharmaceuticals).

Note

There is no option to apply a different valuation method within a batch that is valued by serial/batch

valuation method. The serial/batch valuation method is a separate and distinct valuation method with

specific rules as described in this document.

Other valuation method types that are available in SAP Business One, but not covered at length in this guide, are

listed below. These valuation method types are separate and distinct from the serial/batch valuation method.

Moving Average Price (MAP)

The average cost of items is calculated in each sales, purchasing, inventory, and production transaction. An

inbound transaction updates the cost price of inventory that is available as on-hand (in-stock) quantity, either at

the company or warehouse level. Items that have been sold are not impacted by inbound transactions that update

the cost price of on hand inventory.

Standard Price

Valuation is calculated using a fixed standard price, which is used for all transactions.

First In First Out (FIFO)

Goods purchased or produced first are sold first, regardless of the actual goods flow.

o Each inventory receipt transaction creates a layer of quantity linked to cost. A FIFO layer is defined as the

quantity of an item in a warehouse with a particular cost or value.

o Each inventory release transaction uses quantities and their corresponding costs from the first available

open layer or layers.

This document is concerned with how to set up and manage the serial/batch valuation method in SAP Business

One, more information on the other valuation methods can be found in online help for SAP Business One.

8

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Prerequisites

2 Prerequisites

For the serial/batch valuation method to work, you need to be working with a perpetual inventory system in SAP

Business One. To activate or see if you are operating, a perpetual inventory system, follow the path Main Menu →

Modules tab → Administration → System Initialization → Company Details → Basic Initialization tab to access the

Use Perpetual Inventory checkbox.

How to Set Up and Use Serial/Batch Valuation Method

Initial Settings

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

9

3 Initial Settings

To use the serial/batch valuation method, there are settings required at the company and item level in SAP

Business One. This allows for some flexibility in the valuation of different items.

The serial/batch valuation method is applicable only to items that are managed by serial numbers or batches on

every transaction. You need to choose serial/batch management as well as serial/batch valuation for the items

you want to be valued in this way.

3.1 Defining Items Managed by Serial Numbers or Batches

Note

Only the steps relevant to the serial/batch valuation method are described below. For a detailed

description of creating new items, see online help in SAP Business One.

Procedure

1. From the SAP Business One Main Menu, choose Inventory → Item Master Data. The window opens in Find

mode, switch to Add mode by selecting the Add icon in the toolbar.

2. On the General tab of Item Master Data, under the Serial and Batch Numbers section, in the Manage Item By

field, select one of the following options:

o Serial Numbers – to manage the item by serial number.

o Batches – to manage the item by batch.

3. On the General tab of Item Master Data, under the Serial and Batch Numbers section, in the Management

Method field, choose On Every Transaction. Select Update to save your changes.

10

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Initial Settings

Management by batch tracks items that have unique numbers and characteristics but have been combined

into batches or groupings. Management by serial number manages item units on an individual basis.

Note

You can change the way an item is managed by, for example, from Serial Numbers to Batches if the

quantity of the item in stock is zero and the item is not included in any open document. More information

on changing valuation methods can be found in the relevant section of this guide.

3.2 Defining Management of Serial and Batch Cost by

Serial/Batch Valuation Method at Company Level

Management of serial and batch cost can be done by serial/batch valuation method or by items group valuation

method. To initialize the serial/batch valuation method for serial and batch managed items at the company level,

follow the procedure below.

Procedure

1. From the SAP Business One Main Menu, choose Administration → System Initialization → Company Details →

Basic Initialization tab.

2. In the Manage Serial and Batch Cost By section, select the Serial/Batch Valuation Method radio button.

How to Set Up and Use Serial/Batch Valuation Method

Initial Settings

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

11

The system manages the serial/batch valuation method at the company level, not at the warehouse level.

Therefore, the Manage Item Cost per Warehouse checkbox on the Basic Initialization tab has no impact on

items managed by the serial/batch valuation method.

Note

You can change the valuation method by which you manage serial and batch cost, however, the change

always applies only to new item master data records which you create after the change.

3. Choose Update.

3.3 Defining Serial/Batch Valuation Method at Item Level

If you have defined the serial/batch valuation method at the company level as described in Defining Management

of Serial and Batch Cost by Serial/Batch Valuation Method at Company Level, any new item you create and define

as managed by serial/batch automatically has the serial/batch valuation method applied.

If you have chosen a different valuation method for serial/batch managed items at the company level, you can

define the serial/batch valuation method for a specific item.

Procedure

1. From the SAP Business One Main Menu, choose Inventory → Item Master Data.

In the Item No. field enter the desired item.

Note

The item must be managed by serial or batch on every transaction.

2. On the Inventory tab, from the dropdown menu in the Valuation Method field, select Serial/Batch.

12

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Initial Settings

3. Choose Update.

3.4 Blocking Multiple Receipts for Same Batch When Valuation

Method Is Serial/Batch

Receiving inventory into the same batch more than once means that items for the same batch can be received

with different costs. Items received with different costs complicate the tracking of batch costs and cause

revaluations with postings to different accounts depending on outgoing batch transactions. To prevent this issue

and enable easier cost control, you can block multiple receipts to the same batch at the company level or at the

item level. Additional batches can always be established for new receipts.

If multiple receipts for the same batch are blocked, you cannot draw an A/P Reserve Invoice for a batch into a

goods receipt PO more than once.

Note

When you draw an A/P Reserve Invoice into a goods receipt PO, the batch price is based on the A/P

Reserve Invoice. However, due to header freights in a goods receipt PO, the price can change due to the

amount applied to each batch entry.

Recommendation

When using the Multiple Branches feature, it is strongly recommended that you block multiple receipts for

the same batch. This is due to the possibility of different batches being received with different costs to

one branch impacting the costs of other branches.

How to Set Up and Use Serial/Batch Valuation Method

Initial Settings

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

13

For example, items to Batch No. B1_1200 are received to inventory through GRPO1 with the following

data:

o Branch 1

o Warehouse 1

o Quantity 10

o Cost 10

Items to Batch No. B1_1200 are received, through GRPO2, with the following data:

o Branch 2

o Warehouse 2

o Quantity 10

o Cost 12

Since under the serial/batch valuation method the system does not manage batch cost at a warehouse

level, the cost of B1_1200 is calculated as follows: (10*10+10*12)/20=11. That is, the outbound cost from

Branch 1 is impacted by the inbound cost to Branch 2. In such a scenario, the inventory audit report and

the batch and serial audit report cannot differentiate between the inventory value of postings to Branch 1

and the inventory value of postings to Branch 2.

Workaround

When you receive to the same batch more than once, add a prefix or a suffix to the Batch No. For

example, for GRPO2, set Batch No. to B1_1200_1. Although the system will treat it as a new, different

batch, the naming convention will help tracking the physical batch across all branches.

14

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Initial Settings

3.4.1 Blocking Multiple Receipts for the Same Batch at Company

Level

If you block multiple receipts to/for the same batch at the company level, the setting automatically applies to any

new batch items that you create and to any batch item for which you change the valuation method to serial/batch.

You can change the settings at any time. If you select this checkbox after you have received to the same batch

more than once, it has no influence on the existing batches, but blocks any new multiple receipts to single

batches.

Note

This checkbox is selected by default.

Procedure

1. From the SAP Business One Main Menu, choose Administration → System Initialization → General Settings →

Inventory tab → Items subtab.

2. Select the checkbox Block Multiple Receipts for Same Batch with Serial/Batch Valuation Method.

The following system message appears: "Multiple receipt for the same batch are blocked for new batch items

with valuation method "Serial/Batch". Do you want to block multiple receipts for existing items?”

Choose Yes to set the block in Item Master Data of all existing batch managed items with serial/batch

valuation method. Choose No to only set the block in Item Master Data as a default for newly created batch

managed items with serial/batch valuation method or when changing the valuation method of existing items

to serial/batch.

3. Choose Update.

How to Set Up and Use Serial/Batch Valuation Method

Initial Settings

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

15

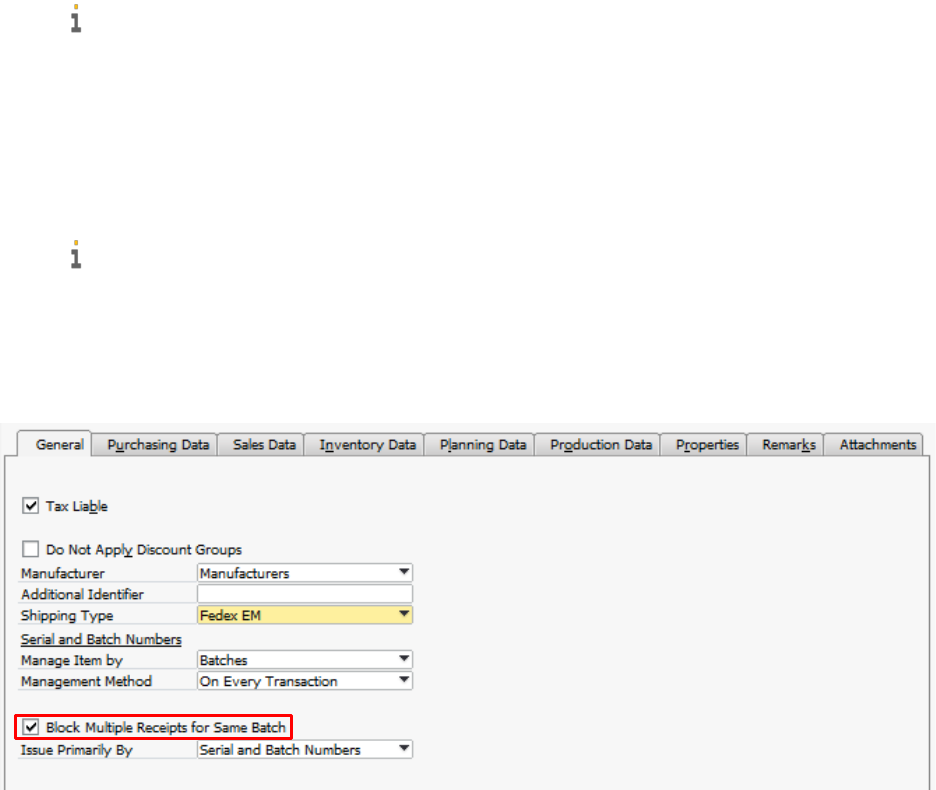

3.4.2 Blocking Multiple Receipts for Same Batch at Item Level

You can block multiple receipts to/for the same batch at the item level regardless of whether multiple receipts for

the same batch are blocked at the company level.

Note

You can change this setting, even if a batch item already had multiple receipts for the same batch.

Procedure

1. From the SAP Business One Main Menu, choose Inventory → Item Master Data.

In the Item No. field, enter the desired item.

Note

The item must be managed by batches.

2. On the General tab, select the checkbox Block Multiple Receipts for Same Batch.

When you change the item valuation method to one other than serial/batch, this checkbox is deselected and

not visible.

3. Choose Update.

16

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Item Management

4 Item Management

Information about batch and serial number items and the management of them is available on the following

windows:

• Serial Number Details

• Batch Details

• Serial Number Management - Update

• Batch Management - Update

4.1 Serial Number Details Window

To access the Serial Number Details window, do the following:

1. From the SAP Business One Main Menu, choose Inventory → Item Management → Item Serial Numbers →

Serial Number Details. The window opens in Find mode.

2. In the Item Number field, enter the item number or use (Previous Record) (Next Record) in the toolbar to

browse through the serial number items.

The current cost of the serial number item is displayed in the Cost field.

4.2 Batch Details Window

To access the Batch Number Details window, do the following:

1. From the SAP Business One Main Menu, choose Inventory → Item Management → Batches → Batch Details.

The window opens in Find mode.

2. In the Item Number field, enter the item number or use (Previous Record) (Next Record) in the toolbar to

browse through the batch items.

The current unit batch cost of the item is displayed in the Cost field.

4.3 Serial Number Management - Update Window

To access the Serial Number Management - Update window, do the following:

1. From the SAP Business One Main Menu, choose Inventory → Item Management → Item Serial Numbers →

Serial Number Management. The window Serial Numbers Management - Selection Criteria appears.

2. In the Operation field, select Update.

How to Set Up and Use Serial/Batch Valuation Method

Item Management

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

17

3. Define the remaining selection criteria for the range of the items for which you want to update the serial

numbers and choose OK. The Serial Number Management - Update window appears.

In the Cost column, you can view the current cost of the item serial numbers displayed.

4.4 Batch Management - Update Window

To access the Batch Management - Update window, proceed as follows:

1. From the SAP Business One Main Menu, choose Inventory → Item Management → Batches → Batch

Management. The Batch Management - Selection Criteria window appears.

2. In the Operation field, select Update.

3. Define the remaining selection criteria for the range of batches you want to update and choose OK. The Batch

Management - Update window appears.

In the Cost column, you can view the current cost of the item serial numbers displayed.

18

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Marketing Documents & Valuation, Determining Serial and Batch Item Cost, Exchange Rates

Differences.

5 Marketing Documents & Valuation,

Determining Serial and Batch Item Cost,

Exchange Rates Differences.

Marketing Document Impact on Valuation

All marketing documents that impact costs within a batch affect all the relevant batch items under the

serial/batch valuation method. Marketing documents that impact batch costs do not only affect on-hand items

that are in inventory, they also affect sold items; this behavior is different from how other valuation methods work.

Every marketing document that changes batch costs effectively causes a revaluation of the whole batch.

If some batch items have been sold and some batch items are on-hand in inventory, then a marketing document

that impacts costs will generate postings against inventory and price difference accounts. For details of what the

postings look like, see section 11 Examples of Cost Calculation and Postings for Items with Serial/Batch Valuation

Method.

A/P Invoices that are not based on other documents can receive items to batches with costs that are different to

those already established for the batch. If there already were inbound and outbound transactions for the batch to

which the A/P Invoice was received, then the A/P Invoice will cause a change in costs and so postings to price

difference accounts as well as inventory accounts.

Exchange Rate Differences

Inventory costs and values are maintained in the local system currency for your system. When items costed in

foreign currency are received to inventory, their local currency costs are calculated by using the prevailing

exchange rate set in the system.

Recommendation

To maintain cost consistency in batches, use the same exchange rate or date for the same batches that

appear in different marketing documents.

Revaluations can occur under the serial/batch valuation method if changes in exchange rates impact the batch

valuation. If a Goods Receipt PO is created at a different exchange rate to a subsequent, related A/P Invoice based

on the original Goods Receipt PO, then there is an exchange rate difference.

• Postings are made to exchange rate difference accounts for any batch quantity already delivered in local

currency

• Postings are made to inventory accounts for any items still on hand and in inventory

The postings will be made representing the full exchange rate change impact, at the point of the A/P Invoice.

How to Set Up and Use Serial/Batch Valuation Method

Marketing Documents & Valuation, Determining Serial and Batch Item Cost, Exchange Rates

Differences.

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

19

Determining Serial and Batch Item Cost

The cost of a serial or batch item is determined by the following documents:

• Receipts to stock

o A/P documents

o Goods receipt POs

o A/P invoices

o Inventory Transactions

o Goods receipts

o Positive entries from the inventory opening balance

o Positive entries from the inventory posting

o Receipts from production

o A/R returns, A/R credit memos and A/R correction invoices that are not based on other documents

Note

If the return cost is not set in the document, the serial/batch cost is calculated by the current cost. If the

return cost is set in the document, the serial/batch cost is calculated by the return cost.

• Purchase returns - cost is calculated by the current serial/batch cost.

• Revaluation postings

o A/P invoices based on goods receipt POs with price and exchange rate changes

o Landed costs

o Material revaluations

o A/P correction invoices with price changes

o A/P correction reversals with price changes

o A/P credit memos without quantity postings

The following documents are posted by the current serial/batch cost:

• Issues from stock (all types of documents)

• A/R deliveries, A/R returns with negative quantities

• Goods receipts, A/P cancellations, A/P documents with negative quantity

• A/R corrections, reversals with entry to stock

• Returns of components

• A disassembly in an issue for production

• Inventory postings (exit: counted quantity is smaller than the quantity in inventory)

• Negative inventory opening balances

• Inventory transfers

20

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Marketing Documents & Valuation, Determining Serial and Batch Item Cost, Exchange Rates

Differences.

5.1 Determining Item Cost of By-Products with Serial/Batch

Valuation Method

In SAP Business One, the Issue Method of a by-product item can be set to Manual. As a result, a by-product item

can use the serial/batch valuation method. The cost of such item is determined by the value that you enter in the

Unit Price field in the receipt from production document as displayed below.

5.2 Rounding Item Cost for Serial/Batch Valuation Method

Rounding settings influence transaction and invoice values where a total batch value cannot be divided evenly

amongst the batch quantity. The system will consider previous transactions affecting the batch to calculate the

next transaction value, this may result in different costs per item.

How to Set Up and Use Serial/Batch Valuation Method

Revaluing Inventory with Serial/Batch Valuation Method

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

21

6 Revaluing Inventory with Serial/Batch

Valuation Method

Items under the serial/batch valuation method can be revalued using inventory revaluation functionality. For

batches, the revaluation process applies to an entire batch, not just the on-hand quantity that is in inventory. This

means that if some items from a batch have been sold, the revaluation will apply to the sold items with the

relevant accounting impact, just like for on-hand items still in inventory. Revaluations are carried out at a company

level, even if a batch is allocated to several different warehouses.

You can revalue items by two types of method:

• Price Change – Changes the selected item's cost price for all quantities in a specific batch or with a serial

number. The price change applies to all items related to the batch. Inventory value is recalculated according

to the updated cost, sold items not in inventory are updated as well. It is not possible to update the cost of

only some items in one batch, the entered New Cost is consistent for all item quantities in a batch.

• Inventory Debit/Credit – Changes the selected item's cost value for all items in a specific batch or with a serial

number. The cost change represents an increase or decrease to the original cost for all items related to a

batch. Inventory value is recalculated according to the updated cost, sold items not in inventory are updated

as well. It is not possible to update the cost of only some items in one batch, the cost change is consistent for

all items in a batch. The system recalculates cost prices according to the total value debited or credited in

relation to what costs were before the Inventory Revaluation. A negative value can be entered for Debit/Credit.

The two Inventory Revaluation types, Price Change and Inventory Debit/Credit, work in a similar way by crediting

and debiting the same types of account.

• Price Change type Inventory Revaluations calculate the amount to credit or debit by multiplying the batch or

serial total quantity by the difference (delta) between the previous cost and New Cost.

• Inventory Debit/Credit type Inventory Revaluations apply the Debit/Credit amount.

• For on-hand items in inventory, inventory and G/L increase or G/L decrease accounts are credited or debited

depending on whether the cost has increased or decreased.

• For items that have been issued from inventory, price difference and G/L increase or G/L decrease accounts

are credited or debited depending on whether the cost has increased or decreased.

• In both Price Change and Inventory Debit/Credit type Inventory Revaluations, the value is applied consistently

to all quantities (Cumulative Purchased Qty) of an item associated with a batch.

• Debit/Credit amounts are added to the Cumulative Purchased Amount. New batch cost (Cumulative Cost) is

calculated by dividing the new Cumulative Purchased Amount by the Cumulative Purchased Qty. The Trans.

Value posted to the inventory account by the Inventory Revaluation is calculated by multiplying the available

batch quantity by the difference between the new and the previous Cumulative Cost. The remaining

Debit/Credit amount is posted to a price difference account.

22

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Revaluing Inventory with Serial/Batch Valuation Method

6.1 Revaluing Inventory by Price Change

Procedure

1. From the SAP Business One Main Menu choose Inventory → Inventory Transactions → Inventory Revaluation.

The Inventory Revaluation window appears.

2. In the Revaluation Type field, select Price Change.

3. In the Item No. column, select the item for which you want to update prices. All available batches or serial

numbers for the item are listed in the lower table. To display issued batches or serial numbers, select the

checkbox Display Issued Serials/Batches.

o Filtered By is active only for serial number managed items.

4. In the lower table, enter the new required value in the field New Cost for the desired batch or serial number.

5. Choose Add.

Note

You can press CTRL to select desired items in the lower table, and update the price in the Set Value for

Selection field located between the two tables.

How to Set Up and Use Serial/Batch Valuation Method

Revaluing Inventory with Serial/Batch Valuation Method

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

23

Example

o Batch BB500 exists for item Batch1.

o For all the items in batch BB500 the Current Cost unit cost is USD 12.

o As there are 20 items in batch BB500, the Total Cost is USD 240.

o An Inventory Revaluation is created for item Batch1, selecting Price Change as the Revaluation Type.

o In the lower table of the Inventory Revaluation, entering a value into the New Cost field for S/B No.

batch BB500 row will adjust the value for every Batch1 item in Batch BB500. A value of USD 14 is

entered in New Cost to revalue every item at USD 14.

o Selecting Add finalizes the Inventory Revaluation so making the relevant journal entry postings. The

difference between the previous and new cost is USD 2 per unit, so USD 40 in total, for the 20 units in

the batch. As all items are in inventory, USD 40 is posted to the inventory account and to the G/L

increase account.

6.2 Revaluing Inventory by Debit/Credit

Procedure

1. From the SAP Business One Main Menu, choose Inventory → Inventory Transactions → Inventory Revaluation.

The Inventory Revaluation window appears.

2. In the Revaluation Type field, select Inventory Debit/Credit.

3. In the Item No. column, select the item for which you want to update costs. All available batches or serial

numbers for the item are listed in the lower table.

4. In the lower table, enter a value in the field Debit/Credit representing the amount you want to debit or credit

for the relevant batch or serial number. A positive or negative value can be entered for Debit/Credit.

5. Choose Add.

Example

o Batch BB500 exists for item Batch1.

o For all the items in batch BB500, the Current Cost unit cost is USD 12 per item.

o As there are 20 items in batch BB500, the Total Cost is USD 240.

o An Inventory Revaluation is created for item Batch1, selecting Inventory Debit/Credit as the

Revaluation Type.

o Entering a value of USD 40 into the Debit/Credit field for Batch BB500 row will spread a total USD 40

value across every item in Batch BB500. The value of USD 40 across every item in the batch applies

USD 2 of value to each item, revaluing each item at USD 14 from USD 12.

o Selecting Add finalizes the Inventory Revaluation so making the relevant journal entry postings. The

additional cost is USD 40 in total, for the 20 units in the batch. As all items are in inventory, USD 40 is

posted to the inventory account and to the G/L increase account.

24

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Revaluing Inventory with Serial/Batch Valuation Method

Caution

When changing the valuation method to Serial/Batch, you will not be able to carry out any Inventory

Revaluations for transactions under the previous valuation method.

You can revalue serial numbers/batches that existed before a valuation method change provided they

have serial/batch valued transactions in the past. For example, an item had serial/batch valuation

method, then changed to moving average, then changed again to serial/batch valuation method. In all

three periods transactions exist. The batches/serial numbers created in the first period can be revalued in

the third period. If the same batch/serial number is repeatedly used in all periods, transactions from the

second (moving average ) period have no effect on the batch/serial number's Cumulative Cost,

Cumulative Purchased Qty and Cumulative Purchased Amount.

How to Set Up and Use Serial/Batch Valuation Method

Updating Valuation Method to Serial/Batch for Selected Items

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

25

7 Updating Valuation Method to

Serial/Batch for Selected Items

You can update the valuation method to serial/batch for a range of items managed by serial numbers or batches.

This is possible even if transactions have involved the item you want to change the valuation method for, provided

certain prerequisites are satisfied.

Prerequisites

• The In Stock quantity is zero, in all warehouses, for the items whose valuation method is to be changed.

• The item is not drawn into any inventory-related open documents, including:

o Open Deliveries not copied to Returns or Invoice

o Open Sales Returns not based on Deliveries

o Goods Receipt POs not copied to Goods Returns or Invoice

o Open Goods Returns not based on Goods Receipt POs

o Goods Returns or Sales Returns not copied to a Credit Note

Note

The Inventory Valuation Method does not take into consideration open Invoices, Credit Notes, or

Production Orders. This means that Invoices that have not been copied to Credit Memos or Payments are

not considered to be open inventory documents because the main inventory relevant process was closed

when the Invoice was created.

• The item is not issued or received by an Issue for Production or Receipt from Production linked to an open

Production Order. The following query can be run to detect open Production Orders, where XXX represents

the required Item Code:

o SELECT * FROM OWOR T0 INNER JOIN IGN1 T1 ON T1."BaseEntry" = T0."DocEntry" AND T1."BaseType"

= 202 WHERE T0."ItemCode" = ('XXX') AND T0."Status"= ('R');

o SELECT * FROM OWOR T0 INNER JOIN IGE1 T1 ON T1."BaseEntry" = T0."DocEntry" AND T1."BaseType"

= 202 WHERE T0."ItemCode" = ('XXX') AND T0."Status"= ('R');

Recommendation

Establish a new item with the required valuation method instead of changing valuation methods. Check

with your accountant before changing an item's valuation method, changing an item valuation method

can lead to accounting discrepancies.

26

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Updating Valuation Method to Serial/Batch for Selected Items

Procedure

The valuation method can be changed in Item Master Data, or by the following steps.

1. From the SAP Business One Main Menu, choose Inventory → Item Management → Inventory Valuation

Method.

2. In the Item No. From… To fields, define the range of items for which you want to update the valuation method

to Serial/Batch.

3. In the Default Valuation Method field, select Serial/Batch.

4. Choose OK.

The Update Valuation Method window appears.

5. In the Approved column, all checkboxes are selected. If you want to exclude any of the items from the update,

deselect the appropriate checkbox.

6. In the New Method column, select Serial/Batch for those items for which you want to update the valuation

method.

7. Choose the Update button.

Caution

When changing the valuation method to Serial/Batch, you will not be able to carry out any Inventory

Revaluations based on transactions under the previous valuation method.

How to Set Up and Use Serial/Batch Valuation Method

Gross Profit and Production Cost Recalculation Wizards

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

27

8 Gross Profit and Production Cost

Recalculation Wizards

The Production Cost Recalculation Wizard allows you to recalculate production costs while the Gross Profit

Recalculation Wizard allows you to recalculate production costs, cost of goods sold, and profit, when you have

implemented the serial/batch valuation method. The wizards identify where transactions have influenced cost or

profit and interpret this through a recalculation, or revaluation, process. The wizards guide you through the

process, find the relevant documents for your product items and provide descriptions of the various stages.

Items managed by the serial/batch valuation method can be produced or sold before final costs are known.

Production costs and gross profit are determined by current costs, but costs can change over time. These

changes can be managed through the wizards.

• Purchased serial/batch items might be sold before related costs are fully recorded and posted. Gross profit

calculations need to be updated to reflect changed costs of items already sold.

• Produced serial/batch items might be made before item component costs are fully recorded and posted.

Production cost calculations need to be updated to reflect changed costs.

The Production Cost Recalculation Wizard recalculates production costs using the current serial/batch

component cost as a base. The Gross Profit Recalculation Wizard performs the same steps as the Production Cost

Recalculation Wizard for production costs, the Gross Profit Recalculation Wizard also recalculates sales document

cost of goods sold (COGS) and gross profit using the current serial/batch cost as a base.

8.1 Production Cost Recalculation Wizard

The Production Cost Recalculation Wizard allows you to recalculate item production costs based on updated

component or bill of material costs, where the component makes up part of the item. The wizard identifies when

costs have changed and interprets this through a revaluation process by Inventory Revaluation documents for

production items.

Prerequisites

• The product item you want to recalculate costs for is managed by the serial/batch valuation method.

• At least one of the components that makes up the product is managed by the serial/batch valuation method.

• Any production order for the product item, that forms the basis of the receipt from production, is closed.

• The component cost has been impacted by a change in costs, therefore the wizard should be used.

• The product item is the parent item in an existing BOM of the production type.

28

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Gross Profit and Production Cost Recalculation Wizards

Before running the Production Cost Recalculation Wizard, there needs to be a series of activities to establish initial

production costs. Changes then need to occur to affect the established production cost. Only then will the

Production Cost Recalculation Wizard be useful.

Access the Production Cost Recalculation Wizard by following the Main Menu in SAP Business One then choosing

Production → Production Cost Recalculation Wizard. As with other wizards, the Production Cost Recalculation

Wizard guides you through the process in a series of steps with accompanying explanations.

The following example with serial/batch valuated items shows the various steps that would occur before needing

the Production Cost Recalculation Wizard and then how the Production Cost Recalculation Wizard deals with the

scenario.

Example

1. A production Bill of Materials is created for an Item named Product, specifying that two of a Component

named Component make up the Product.

2. A Goods Receipt PO (GRPO) is created for the Component, where the quantity of the Component is 10 and

the unit price is GBP 10, a related Batch named C01 is created showing a cost of GBP 10 per unit.

3. A Production Order is created and released for a planned quantity of 3 Products and so a planned quantity

of 6 Components.

4. An Issue for Production is created to issue all 6 of the Components using Batch C01.

5. A Receipt from Production is created for 3 of the Products, created under related Batch P01 that shows a

cost of GBP 20 per unit.

6. The Production Order from step 3 is closed. The Production Order must be closed, otherwise the wizard

will not make any suggested changes.

7. An A/R Invoice is created for 1 Product from Batch P01, with a unit sales price of GBP 30.

o This gives a gross profit of GBP 10, or 50%, for the Product that has a base price of GBP 20.

o This step is not mandatory for the Production Cost Recalculation Wizard to make suggestions for cost

recalculation. The Gross Profit Recalculation Wizard will make suggestions due to this step.

8. The Goods Receipt PO from step 2 is copied to create a Landed Costs document with a unit cost of GBP 5.

o The unit cost of GBP 5 is applied to all 10 units of the Component that appeared in the original Goods

Receipt PO.

o The Landed Costs have an effect of increasing the cost of Batch C01 to GBP 15 per unit.

9. At this point, the Production Cost Recalculation Wizard is run to recalculate production costs resulting

from the Landed Costs. The wizard guides you through the process of recalculation, in a series of different

steps:

o A new wizard run is chosen.

o The Product is searched for and selected in the Wizard Parameters window.

o The wizard finds the relevant documents for the Product in Batch P01 under the Production Order

created in step 3 and shows the document details on the Recommendations window. The wizard

identifies that the component cost inputs for the Product in Batch P01 have changed due to the

Landed Costs.

- The Issue for Production from step 4, shows a Delta Cost of GBP 30 for Component.

- The Receipt from Production from step 5, shows a Variance of GBP 30 for Product.

How to Set Up and Use Serial/Batch Valuation Method

Gross Profit and Production Cost Recalculation Wizards

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

29

- Costs for each Component are GBP 5 higher than before due to the Landed Costs. This translates

into a cost increase of GBP 10 for each Product. As only 3 Products were in the Production Order, the

total cost increase, variance, or delta, is USD 30.

o The wizard generates a suggestion in the Material Revaluation Details window based on the changes

in cost for the Receipt from Production:

- The suggestion is to apply a GBP 30 journal entry for the Product in Batch P01 by posting to the

relevant accounts.

30

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Gross Profit and Production Cost Recalculation Wizards

o Choosing the Execute option in the Save and Execute Options window and accepting the System

Message creates the Inventory Revaluation document:

- The product cost of Product in Batch P01 is revalued at GBP 30 from GBP 20 due to the Inventory

Revaluation.

o The Summary window states that product cost has been adjusted and a MRV (Inventory Revaluation)

has been created. For more information on how Inventory Revaluations work, see the Inventory

Revaluation section in this guide.

The different steps of the above example are represented in the following grid:

Document

Item or

Component

Item

Quantity

Unit

Price

Batch

Batch

Quantity

Accumulated

Value

Accumulated

Quantity

Unit

Cost

Goods

Receipt PO

Component 10 10 C01 10 100 10 10

Production

Order

Product

3

Planned

Issue for

Production

Component 6 10 C01 6 100 10 10

Receipt

from

Production

Product 3 - P01 3 60 3 20

How to Set Up and Use Serial/Batch Valuation Method

Gross Profit and Production Cost Recalculation Wizards

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

31

Document

Item or

Component

Item

Quantity

Unit

Price

Batch

Batch

Quantity

Accumulated

Value

Accumulated

Quantity

Unit

Cost

A/R Invoice Product 1 30 P01 3 60 3 20

Landed

Costs

Component 10 15 C01 10 150 10 15

MRV by

Wizard

Product 3 - P01 3 90 3 30

The Inventory Revaluation document for the Product created by the wizard can be viewed, the Remarks state

Production Cost Recalculation Wizard. The Batch Details for Batch P01 show that Cost has changed to GBP 30.

8.2 Gross Profit Recalculation Wizard

The Gross Profit Recalculation Wizard allows you to recalculate the cost of goods sold and the gross profit of items

based on updated costs, where items are managed by the serial/batch valuation method. The wizard identifies

when costs and profit for sales documents have changed and interprets this through a revaluation by journal

entries and updating gross profit for marketing documents.

The Gross Profit Recalculation Wizard performs the same steps as the Production Cost Recalculation Wizard for

production costs or bill of material costs. Gross profit and cost of goods sold are also updated for sales

documents, reflecting updated costs.

Prerequisites

• The product item you want to recalculate costs and profit for is managed by the serial/batch valuation

method. The item can be produced according to a bill of materials or can be a standard purchased item.

• The Calculate Gross Profit setting must be selected (follow path Main Menu → Modules tab → Administration

→ System Initialization → Document Settings → General tab) and the Base Price Origin must be selected as

Item Cost.

• In A/R sales documents Gross Profit settings, the Base Price By setting must be Item Cost.

• The same prerequisites as for the Production Cost Recalculation Wizard apply for production costs.

o Any production order for the product item, that forms the basis of the receipt from production, is closed.

• The costs and profit have been impacted by a change, therefore the wizard should be used.

Before running the Gross Profit Recalculation Wizard, there needs to be a series of activities to establish initial

production costs and gross profit. Changes then need to occur to affect the established production cost and gross

profit. Only then will the Gross Profit Recalculation Wizard be useful.

Access the Gross Profit Recalculation Wizard by following the Main Menu in SAP Business One then choosing

Sales - A/R → Gross Profit Recalculation Wizard.

32

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Gross Profit and Production Cost Recalculation Wizards

Example

Following on from the example in section 8.1 Production Cost Recalculation Wizard, the Gross Profit Recalculation

Wizard can be run to recalculate gross profit and cost of goods sold, specifically for the A/R Invoice in step 7.

As the Gross Profit Recalculation Wizard performs the same steps as the Production Cost Recalculation Wizard,

those steps already performed by the Production Cost Recalculation Wizard do not need to be repeated.

10. The Gross Profit Recalculation Wizard is run to recalculate gross profit. The wizard guides you through the

process of recalculation, in a series of different steps:

o A new wizard run is chosen.

o Product is searched for and selected in the Wizard Parameters window.

o The wizard finds the relevant sales documents for the Product in the Sales Document Selection

window. Documents are found where the base price used to calculate gross profit differs from the

current serial/batch cost. Documents can be selected for inclusion in the recalculation process

through the check-box at line level.

- The A/R Invoice from step 7 with a COGS Amount of GBP 20, Sales Price of GBP 30 and Gross Profit

of GBP 10 is found by the wizard.

o As the production costs were already calculated by the Production Cost Recalculation Wizard, no

details show in the Recalculation of Product Cost window.

o The Recommendations window shows the cost of goods sold (COGS) and gross profit calculations for

the original sales document as well as updated, current COGS and current gross profit calculations.

Proceeding with the recommendations implements the calculations based on current costs.

- The recommendation is to apply a GBP 10 increase to COGS for Product and reduce gross profit to

GBP 0.

How to Set Up and Use Serial/Batch Valuation Method

Gross Profit and Production Cost Recalculation Wizards

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

33

o As the material revaluation was already completed by the Production Cost Recalculation Wizard, no

details show in the Material Revaluation Details window.

o The wizard shows where and which journal entries will be made to reflect the change in COGS and

adjust the gross profit calculation for the sales document. Choosing the Automatic Posting check-box

(in step 7 of the wizard - Journal Entry Details) will implement the updated values.

- The COGS Account is debited by GBP 10 (1 item multiplied by GBP 10).

- The Price Difference Account is credited by GBP 10 (1 item multiplied by GBP 10).

- The Base Price for the Gross Profit of Outgoing Invoice is updated to GBP 30.

- The Gross Profit for the Gross Profit of Outgoing Invoice is updated to GBP 0.

Ne

w Gross Profit =

Sales Price – Cost

30-30=0

Old Gross Profit =

Sales Price – Cost

30-20=10

34

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Gross Profit and Production Cost Recalculation Wizards

o Choosing the Execute option in the Save and Execute Options window and accepting the System

Message creates Journal Entries and adjusts gross profit, finalizing the recommendations of the

wizard.

o The Summary window states that gross profit has been adjusted and journal entries have been

created.

The Journal Entry created by the wizard can be viewed, showing Remarks of Gross Profit Recalculation Wizard.

The Gross Profit of the Outgoing Invoice can be viewed for the A/R Invoice, showing a Base Price of GBP 30 and a

Gross Profit of 0.

The Gross Profit Recalculation Wizard creates journal entries and adjusts gross profit if there is an increase or

decrease in item cost.

• Item cost increases are expressed by debiting COGS accounts and crediting price difference accounts

• Item cost decreases are expressed by crediting COGS accounts and debiting price difference accounts with

negative values.

Note

The journal entry amount applied is the cost difference multiplied by the number of items sold.

How to Set Up and Use Serial/Batch Valuation Method

Calculating Costs for Goods Receipt PO Priced at Zero

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

35

9 Calculating Costs for Goods Receipt PO

Priced at Zero

Under the serial/batch valuation method, the following example demonstrates what results should be expected

for a Goods Receipt PO priced at zero.

Example

1. Create an item "BV" managed by batch on every transaction and with serial/batch valuation. Do not block

multiple receipts for the same batch.

2. Create a Goods Receipt PO for batch "X01" of item BV for quantity of 10 and price 10. The cost calculation

can be observed in the Batches and Serials Inventory Audit Report as follows:

o Receipt value (Trans. Value) = 100.

o Total receipt value (Cumulative Purchased Amount) = 100.

o Total receipt quantity (Cumulative Purchased Qty) = 10.

o New cost per unit (Cumulative Cost) = 10.

3. Create a Goods Issue for BV for a quantity of 5 for batch X01. The same cost of 10, as in step 2, is applied.

4. Create a Goods Receipt PO for batch X01 of item BV for quantity of 10 and price 0. The cost calculation

can be observed in the Batches and Serials Inventory Audit Report as follows:

o Receipt value (Trans. Value) = 25.

o Total receipt value (Cumulative Purchased Amount) = 100.

o Total receipt quantity (Cumulative Purchased Qty) = 20.

o New cost per unit (Cumulative Cost) = 5.

The batch cost price per unit (5) calculated in step 4 will not be used in the goods receipt PO created in step 4, but

will be used in the next issuing transaction.

The cost calculation in step 4 for the goods receipt PO with zero price uses the following method, using the terms

from the Batches and Serials Inventory Audit Report as below:

• First calculate the new Cumulative Cost as the new Cumulative Purchased Amount divided by the new

Cumulative Purchased Qty: 100 / 20 = 5

• Then calculate the new Cumulative Value as the new Cumulative Cost multiplied by the new Cumulative

Qty: 5 * 15 = 75

• The difference between the new and previous Cumulative Value is the Transaction Value posted to the

inventory account: 75 – 50 = 25

• The amount posted to the price difference account is the difference between the line total from the receipt

document and the Transaction Value: 0 – 25 = -25

36

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Calculating Costs for Goods Receipt PO Priced at Zero

• The amount posted to the price difference account can also be calculated as cost change multiplied by

cumulative issued quantity of the batch: -25 = -5 * 5

• Cost change equals the new Cumulative Cost after the receipt minus the old Cumulative Cost before the

receipt: 5 – 10 = -5

How to Set Up and Use Serial/Batch Valuation Method

Examples of Cost Calculation and Postings for Items with Serial/Batch Valuation Method

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

37

10 Examples of Cost Calculation and Postings

for Items with Serial/Batch Valuation

Method

As a precondition for all examples, the option Block Multiple Receipts for Same Batch is not selected in Item

Master Data.

10.1 Purchasing Documents

Goods Receipt PO (GRPO)

Example 1 - A newly received quantity for the same batch number with a price that is different from the

current cost triggers a cost recalculation.

Batch1

(B1)

Qty

Price

Total

Cost Price per

Unit

JE Debit

JE Credit

Batch Value

Balance

GRPO1-B1 10 10 100 10 Inventory 100

Allocation 100

100

GRPO2-B1 10 30 300 20* Inventory 300

Allocation 300

400

Delivery1-

B1

-5

Not

relev

ant

20 COGS 100 Inventory 100 300

GRPO3- B1 5 50 250 26**

Inventory 220

Price Diff. 30

Allocation 250

520

* Total receipts value (100+300) / Total receipts quantity (10+10) = 20

** Total receipts value (100+300+250) / Total receipts quantity (10+10+5) = 26

Example 2 - The cost of a serial number item is set by the price in the receipt to stock.

Serial S100

Qty

Price

Qty Balance

Cost

JE Debit

JE Credit

GRPO1 1 10 1 10 Inventory 10 Allocation 10

Delivery1 -1 - 0 10 COGS 10 Inventory 10

GRPO2 1 13 1 13 Inventory 13 Allocation 13

38

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Examples of Cost Calculation and Postings for Items with Serial/Batch Valuation Method

Serial S100

Qty

Price

Qty Balance

Cost

JE Debit

JE Credit

Delivery2 -1 - 0 13 COGS 13 Inventory 13

Goods Return or Cancellation of GRPO

Example 1 - After issuing a based goods return or a cancellation of a GRPO, the current cost is recalculated.

If the system identifies that all purchased quantities has been returned, the batch cost is set to zero.

Scenario 1 - Some batch items have been returned

Batch1

Qty

Price

Total

Cost per Unit

JE Debit

JE Credit

Batch Value

Balance

GRPO1 10 10 10 10 (100/10) Inventory 100 Allocation 100 100

A/R

Delivery1

-4 10 COGS 40 Inventory 40 60

A/R

Return

Based on

Delivery1

1 10 Inventory 10 COGS 10 70

Goods

Return

based on

GRPO1

-2 10 Allocation 20 Inventory 20 50

Scenario 2 - All batch items have been returned and the current cost is set to zero

Batch1

Qty

Price

Total

Cost per Unit

JE Debit

JE Credit

Batch Value

Balance

GRPO1 10 10 100 10 (100/10) Inventory 100 Allocation 100 100

A/R

Delivery1

-4 10 COSG 40 Inventory 40 60

A/R Return1

Based on

Delivery1

4 10 Inventory 40 COGS 40 100

Goods

Return

based on or

Cancellation

of GRPO1

-10 10

Allocation 100 Inventory 100 0*

How to Set Up and Use Serial/Batch Valuation Method

Examples of Cost Calculation and Postings for Items with Serial/Batch Valuation Method

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

39

Batch1

Qty

Price

Total

Cost per Unit

JE Debit

JE Credit

Batch Value

Balance

A/R Return 10

Return

price

not set

0 0 0 0

* The current cost is set to zero because all the purchased quantity has been returned. The next A/R return is

posted with zero cost because it does not have a set return price and the system uses the current cost.

Example 2 - Based goods return when the current cost is different to the one in the base document.

Batch1

Qty

Price

Total

Cost per Unit

JE Debit

JE Credit

Batch Value

Balance

GRPO1 10 10 100 10 (100/10)

Inventory

100

Allocation

100

100

A/R

Delivery

-4 10 COGS 40 Inventory 40 60

Non-

Based A/R

Return

4

Return cost set

to 13.5

11

(100+13.5*4)/1

4

Inventory 50

Price Diff. 4

COGS 54 110

Goods

Return

Based on

GRPO1

-2 20 11

(100+54-

2*11)/(10+4-2)

Allocation

20

Price Diff. 2

Inventory 22 88

Due to the need to balance the allocation amount (20) and the inventory amount (22), the amount 2 is posted to

the price difference account.

Example 3 - Non-based goods return when the current cost is different from the one in the GRPO document

Batch1

Qty

Price

Total

Cost per Unit

JE Debit

JE Credit

Batch Value

Balance

GRPO1 10 10 100 10 (100/10) Inventory 100 Allocation 100 100

A/R

Delivery

-4 10 COGS 40 Inventory 40 60

Non-

Based

A/R

Return

4

Return

cost

set to

13.5

11 (100+13.5*4)/14 Inventory 50

Price Diff. 4

COGS 54 110

Non-

Based

Goods

Return

-2 20 11

(100+54-2*11)/(10+4-2)

Allocation 22 Inventory 22 88

The price in the goods return is ignored and there is no posting to the price difference account.

40

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Examples of Cost Calculation and Postings for Items with Serial/Batch Valuation Method

10.2 Sales Documents

A/R Return and A/R Credit Memo

Example 1 - Non-based A/R return without a set return cost does not influence the current cost calculation.

Batch1

Qty

Price

Total

Cost per Unit

JE Debit

JE Credit

Batch Value

Balance

GRPO1 10 10 100 10 (100/10) Inventory 100 Allocation 100 100

A/R Delivery -4 10 COSG 40 Inventory 40 60

A/R Delivery

Cancellation

4 10 Inventory 40 COGS 40 100

Goods Return -10 10 10 Allocation 100 Inventory 100 0*

A/R Return 1

Return

cost

not set

0** Inventory 0 COGS 0 0

*The batch has been returned, the current cost is set to zero.

**The system uses the current cost which in this case is zero.

Example 2 - Non-based A/R return with a set return cost influences cost calculation.

Batch1

Qty

Price

Total

Cost per Unit

JE Debit

JE Credit

Batch Value

Balance

GRPO1 10 10 100 10 (100/10) Inventory 100 Allocation 100 100

A/R Delivery -4 10 COGS 40 Inventory 40 60

A/R Delivery

Cancellation

4 10 Inventory 40 COGS 40 100

Goods Return -10 10 10 Allocation 100 Inventory 100 0

A/R Return 1

Return

cost

not set

0 Inventory 0 COGS 0 0

Non-Based

A/R Return or

A/R Credit

Memo or A/R

Correction

Invoice

1 15

Return

cost

set

7.5

Inventory 15 COGS 15 15

How to Set Up and Use Serial/Batch Valuation Method

Examples of Cost Calculation and Postings for Items with Serial/Batch Valuation Method

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

41

Example 4 - A cancellation of a non-based A/R return is considered as a purchasing cancellation or purchase

return.

*Purchased quantity

**Based on purchases and purchase cancellations

***Based on sold quantity and based returns

**** Accumulated Out Qty * Delta Unit Cost

Example 6 - A/R credit memo or A/R return (based or non-based) after a serial number item has been issued

uses the current cost of the serial number item.

Serial S100

Qty

Price

Qty

Balance

Cost

JE Debit

JE Credit

GRPO1 1 10 1 10

Inventory

10

Allocation

10

Delivery1 -1 - 0 10 COGS 10

Inventory

10

Batch1

Qt

y

Pri

ce

Unit Cost

(Accum. Value /

Accum. Qty)

Accu

m.

Qty*

Accum.

Value **

Accu

m.

Out

Qty

***

Pri

ce

Diff

.

Am

t

***

*

JE

Debit

JE

Credit

Qt

y

Ba

l.

Bat

ch

Val

ue

Bal.

GRPO1 10 10 10 10 100 0 -

Invent

ory

100

Allocat

ion

100

10 100

A/R

Delivery

1

-

10

10 10 100 10 -

COGS

100

Invent

ory

100

0 0

Non-

Based

A/R

Return1

3

10

(10*10+3*10)/(10+3)

13 130 10

Invent

ory 30

COGS

30

3 30

GRPO2 2 25

12

(10*10+3*10+2*25)/

(10+3+2)

15 180 10 20

Invent

ory

30

Price

Diff.

20

Allocat

ion 50

5 60

Cancella

tion of

A/R

Return1

-3 12 12

144

(100+30

+50-36)

10 6

COGS

30

Price

Diff. 6

Invent

ory 36

2 24

42

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Examples of Cost Calculation and Postings for Items with Serial/Batch Valuation Method

Serial S100

Qty

Price

Qty

Balance

Cost

JE Debit

JE Credit

A/R Credit Memo or A/R Return (Based on

Delivery1 or Non-based and the Return Cost Not

Set in A/R Return)

1 - 1 10

Inventory

10

Allocation

10

A/P Invoice

Example 1 - A based A/P invoice with a price change influences the current cost calculation.

Batch1

Qty

Price

Total

Cost per Unit

JE Debit

JE Credit

Batch Value

Balance

GRPO1 10 10 100 10 (100/10)

Inventory

100

Allocation

100

100

A/R Delivery1 -3 10 -30 10 COGS 30

Inventory

30

70

A/P Invoice Based on

GRPO1

8 15 40

14

((100+40)/10)

Allocation

80

Inventory

28

Price Diff.

12

BP 120 98

Example 2 - Price change in A/P invoice when there is zero batch quantity

Batch1

Qty

Price

Total

Cost per

Unit

JE Debit

JE Credit

Batch Value

Balance

GRPO1-B1 1 10 10 10

Inventory

10

Allocation

10

10

Delivery-B1 -1 - -10 10 COGS 10

Inventory

10

0

A/P Invoice Based on

GRPO1-B1

- - 2 12

Allocation

10

Inventory

0

Price Diff.

2

BP 12 0

Landed Costs

Example 1 - Landed costs value influences the current cost calculation.

How to Set Up and Use Serial/Batch Valuation Method

Examples of Cost Calculation and Postings for Items with Serial/Batch Valuation Method

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

43

Batch1

Qty

Price

Total

Cost per Unit

JE Debit

JE Credit

Batch

Value

Balance

GRPO1 10 10 100 10 (100/10) Inventory 100

Allocation

100

100

A/R Delivery1 -3 10 -30 10 COGS 30 Inventory 30 70

A/P Invoice Based

on GRPO1

8 15 40

14

((100+40)/10)

Allocation 80

Inventory 28

Price Diff. 12

BP 120 98

Delivery2 -3

Not

relevant

14

COGS 42 Inventory 42 56

Landed Costs for

GRPO1

- 20

16

(100+40+20)/10

Inventory 8

Price Diff. 12

Allocation 20 64

10.3 Production Documents

Issue from Production

Example 1 - An issue from production based on a disassembly order is considered as purchase cancellation.

Batch1

Qty

Price

Unit

Cost

(Accum.

Value /

Accum.

Qty)

Accum.

Qty *

Accum.

Value

**

Accum.

Out Qty

***

Price

Diff.

Amt

****

JE Debit

JE Credit

Qty

Bal.

Batch

Value

Bal.

Production

Order of

Standard or

Special Type

2 0 0 0 0 - 0 0 0 0

Components are issued for

production

Total components cost is 1000

Receipt from

Production

No. 1

2 500 2 1000 0 -

Inventory

1000

COGS

1000

2 1000

A/R

Delivery1

-2 500 2 1000 2 -

COGS

1000

Inventory

1000

0 0

44

CUSTOMER

© 201

8 SAP SE. All rights reserved.

How to Set Up and Use Serial/Batch Valuation Method

Examples of Cost Calculation and Postings for Items with Serial/Batch Valuation Method

Batch1

Qty

Price

Unit

Cost

(Accum.

Value /

Accum.

Qty)

Accum.

Qty *

Accum.

Value

**

Accum.

Out Qty

***

Price

Diff.

Amt

****

JE Debit

JE Credit

Qty

Bal.

Batch

Value

Bal.

A/R Return1

Based on

Delivery1

2 500 2 1000 0 -

Inventory

1000

COGS

1000

2 1000

Production

Order No. 2

of

Disassembly

Type

2 500 2 1000 0 - 0 0 0 1000

Issue from

Production

No. 4

(Disassembly

Order No. 2)

-2 500 0 0 0 -

Inventory

WIP

Account

1000

Inventory

1000

2 0

Non-Based

A/R Return

1 0 1 0 0 -

Inventory

0

COGS 0 1 0

*Purchased quantity

**Based on purchases and purchase cancellations

***Based on sold quantity and based returns

**** Accumulated Out Qty * Delta Unit Cost

How to Set Up and Use Serial/Batch Valuation Method

Examples of Cost Calculation and Postings for Items with Serial/Batch Valuation Method

CUSTOMER

© 2018 SAP SE. All rights reserv

ed.

45

Example 2 - An issue from production based on a disassembly order is considered as purchase cancellation

even if the production BOM was not received from a receipt from production (for example, the product BOM

was received from A/R / A/P / Inventory).

The system uses the current cost, which in this case is zero.

*Purchased quantity

**Based on purchases and purchase cancellations