The Digitization of the World

From Edge to Core

David Reinsel – John Gantz – John Rydning

An IDC White Paper – #US44413318, Sponsored by

November 2018

ANALYZE THE FUTURE

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 2

Executive Summary

This process of digitization is often referred to

as digital transformation, and it is profoundly

changing the shape of business today,

impacting companies in every industry and

consumers around the world. Digital

transformation is not about the evolution of

devices (though they will evolve), it is about

the integration of intelligent data into

everything that we do.

The data-driven world will be always on,

always tracking, always monitoring, always

listening, and always watching – because it will

be always learning. What we perceive to be

randomness will be bounded into patterns of

normality by sophisticated artificial intelligence

algorithms that will deliver the future in new

and personalized ways. Artificial intelligence

will drive even more automation into

businesses and feed processes and

engagements that will deliver new levels of

eciency and products that are tailored to

business outcomes and individual customer

preferences.

Traditional paradigms will be redefined

(like vehicle or white goods ownership) and

ethical, moral and societal norms will be

challenged as genomics and advanced DNA

profiling influence healthcare directives,

insurance premiums, and spousal choices.

Entertainment will literally be transformed

before our eyes as virtual reality technologies

transport us into new digital realities and

augmented reality will dramatically change

the service industry as we know it today.

Mankind is on a quest to

digitize the world

The data-driven world will be always on,

always tracking, always monitoring, always listening and

always watching – because it will be always learning.

The focus of this digitization is anything and everything that intersects our

business workflows and personal streams of life.

IDC predicts that

the Global Datasphere

will grow from

175 Zettabytes

by 2025

in 2018 to

33 Zettabytes

Cloud is the new core

One of the key drivers of growth in the core is

the shift to the cloud from traditional

datacenters. As companies continue to pursue

the cloud (both public and private) for data

processing needs, cloud datacenters are

becoming the new enterprise data repository.

In essence, the cloud is becoming the new core.

In 2025 IDC predicts that 49% of the world’s

stored data will reside in public cloud

environments.

Introducing the world's first data

readiness condition (DATCON) index

Not all industries are prepared for their

digitally transformed future. So, to help

companies understand their level of data

readiness, IDC developed a DATCON (DATa

readiness CONdition) index, designed to

analyze various industries regarding their own

Datasphere, level of data management, usage,

leadership, and monetization capabilities. IDC

examined four industries as part of its DATCON

analysis: financial services, manufacturing,

healthcare, and media and entertainment.

Manufacturing’s Datasphere is by far the

largest given its maturity, investment in IoT,

and 24x7 operations, and we found that

manufacturing and financial services are the

leading industries in terms of maturity, with

media and entertainment most in need of a

jump start.

China's Datasphere on pace to

becoming the largest in the world

Every geographic region has its own

Datasphere size and trajectories that are

impacted by population, digital

transformation progress, IT spend and

maturity, and many other metrics. For

example, China’s Datasphere is expected to

grow 30% on average over the next 7 years

and will be the largest Datasphere of all

regions by 2025 (compared to EMEA, APJxC,

U.S., and Rest of World) as its connected

population grows and its video surveillance

infrastructure proliferates. (APJxC includes

Asia-Pacific countries, including Japan, but

not China.)

Consumers are addicted to data,

and more of it in real-time

As companies increase the digitization of their

business and drive consistent and better

customer experiences, consumers are

embracing these personalized real-time

Data is at the heart of digital transformation,

the lifeblood of this digitization process.

Today, companies are leveraging data to

improve customer experiences, open new

markets, make employees and processes more

productive, and create new sources of

competitive advantage – working toward the

future of tomorrow.

Global Datasphere expansion is

never-ending

IDC has defined three primary locations where

digitization is happening and where digital

content is created: the core (traditional and

cloud datacenters), the edge

(enterprise-hardened infrastructure like cell

towers and branch oces), and the endpoints

(PCs, smart phones, and IoT devices). The

summation of all this data, whether it is

created, captured, or replicated, is called the

Global Datasphere, and it is experiencing

tremendous growth. IDC predicts that the

Global Datasphere will grow from 33

Zettabytes (ZB) in 2018 to 175 ZB by 2025.

To keep up with the storage demands

stemming from all this data creation, IDC

forecasts that over 22 ZB of storage capacity

must ship across all media types from 2018 to

2025, with nearly 59% of that capacity

supplied from the HDD industry.

An enterprise renaissance is on the

horizon

The enterprise is fast becoming the world's

data steward…again. In the recent past,

consumers were responsible for much of their

own data, but their reliance on and trust of

today’s cloud services, especially from

connectivity, performance, and convenience

perspectives, continues to increase while the

need to store and manage data locally

continues to decrease. Moreover, businesses

are looking to centralize data management

and delivery (e.g., online video streaming,

data analytics, data security, and privacy) as

well as to leverage data to control their

businesses and the user experience

(e.g., machine-to-machine communication,

IoT, persistent personalization profiling). The

responsibility to maintain and manage all this

consumer and business data supports the

growth in cloud provider datacenters. As a

result, the enterprise’s role as a data steward

continues to grow, and consumers are not

just allowing this, but expecting it. Beginning

in 2019, more data will be stored in the

enterprise core than in all the world's

existing endpoints.

engagements and resetting their expectations

for data delivery. As their digital world

overlaps with their physical realities, they

expect to access products and services

wherever they are, over whatever connection

they have, and on any device. They want data

in the moment, on the go, and personalized.

This places greater demand on both the edge

and the core to be able to produce the

precise data consumers require, often in

real-time. IDC predicts that due to the infusion

of data into our business workflows and

personal streams of life, that nearly 30% of

the Global Datasphere will be real-time by

2025. Enterprises looking to provide superior

customer experience and grow share must

have data infrastructures that can meet this

growth in real-time data.

Today, more than 5 billion consumers interact

with data every day – by 2025, that number

will be 6 billion, or 75% of the world's

population. In 2025, each connected person

will have at least one data interaction every

18 seconds. Many of these interactions are

because of the billions of IoT devices

connected across the globe, which are

expected to create over 90ZB of data in 2025.

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 3

Cloud is the new core

One of the key drivers of growth in the core is

the shift to the cloud from traditional

datacenters. As companies continue to pursue

the cloud (both public and private) for data

processing needs, cloud datacenters are

becoming the new enterprise data repository.

In essence, the cloud is becoming the new core.

In 2025 IDC predicts that 49% of the world’s

stored data will reside in public cloud

environments.

Introducing the world's first data

readiness condition (DATCON) index

Not all industries are prepared for their

digitally transformed future. So, to help

companies understand their level of data

readiness, IDC developed a DATCON (DATa

readiness CONdition) index, designed to

analyze various industries regarding their own

Datasphere, level of data management, usage,

leadership, and monetization capabilities. IDC

examined four industries as part of its DATCON

analysis: financial services, manufacturing,

healthcare, and media and entertainment.

Manufacturing’s Datasphere is by far the

largest given its maturity, investment in IoT,

and 24x7 operations, and we found that

manufacturing and financial services are the

leading industries in terms of maturity, with

media and entertainment most in need of a

jump start.

China's Datasphere on pace to

becoming the largest in the world

Every geographic region has its own

Datasphere size and trajectories that are

impacted by population, digital

transformation progress, IT spend and

maturity, and many other metrics. For

example, China’s Datasphere is expected to

grow 30% on average over the next 7 years

and will be the largest Datasphere of all

regions by 2025 (compared to EMEA, APJxC,

U.S., and Rest of World) as its connected

population grows and its video surveillance

infrastructure proliferates. (APJxC includes

Asia-Pacific countries, including Japan, but

not China.)

Consumers are addicted to data,

and more of it in real-time

As companies increase the digitization of their

business and drive consistent and better

customer experiences, consumers are

embracing these personalized real-time

Data is at the heart of digital transformation,

the lifeblood of this digitization process.

Today, companies are leveraging data to

improve customer experiences, open new

markets, make employees and processes more

productive, and create new sources of

competitive advantage – working toward the

future of tomorrow.

Global Datasphere expansion is

never-ending

IDC has defined three primary locations where

digitization is happening and where digital

content is created: the core (traditional and

cloud datacenters), the edge

(enterprise-hardened infrastructure like cell

towers and branch oces), and the endpoints

(PCs, smart phones, and IoT devices). The

summation of all this data, whether it is

created, captured, or replicated, is called the

Global Datasphere, and it is experiencing

tremendous growth. IDC predicts that the

Global Datasphere will grow from 33

Zettabytes (ZB) in 2018 to 175 ZB by 2025.

To keep up with the storage demands

stemming from all this data creation, IDC

forecasts that over 22 ZB of storage capacity

must ship across all media types from 2018 to

2025, with nearly 59% of that capacity

supplied from the HDD industry.

An enterprise renaissance is on the

horizon

The enterprise is fast becoming the world's

data steward…again. In the recent past,

consumers were responsible for much of their

own data, but their reliance on and trust of

today’s cloud services, especially from

connectivity, performance, and convenience

perspectives, continues to increase while the

need to store and manage data locally

continues to decrease. Moreover, businesses

are looking to centralize data management

and delivery (e.g., online video streaming,

data analytics, data security, and privacy) as

well as to leverage data to control their

businesses and the user experience

(e.g., machine-to-machine communication,

IoT, persistent personalization profiling). The

responsibility to maintain and manage all this

consumer and business data supports the

growth in cloud provider datacenters. As a

result, the enterprise’s role as a data steward

continues to grow, and consumers are not

just allowing this, but expecting it. Beginning

in 2019, more data will be stored in the

enterprise core than in all the world's

existing endpoints.

engagements and resetting their expectations

for data delivery. As their digital world

overlaps with their physical realities, they

expect to access products and services

wherever they are, over whatever connection

they have, and on any device. They want data

in the moment, on the go, and personalized.

This places greater demand on both the edge

and the core to be able to produce the

precise data consumers require, often in

real-time. IDC predicts that due to the infusion

of data into our business workflows and

personal streams of life, that nearly 30% of

the Global Datasphere will be real-time by

2025. Enterprises looking to provide superior

customer experience and grow share must

have data infrastructures that can meet this

growth in real-time data.

Today, more than 5 billion consumers interact

with data every day – by 2025, that number

will be 6 billion, or 75% of the world's

population. In 2025, each connected person

will have at least one data interaction every

18 seconds. Many of these interactions are

because of the billions of IoT devices

connected across the globe, which are

expected to create over 90ZB of data in 2025.

In 2025

IDC predicts

that

of the world’s stored

data will reside in public

cloud environments

49

%

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 4

Cloud is the new core

One of the key drivers of growth in the core is

the shift to the cloud from traditional

datacenters. As companies continue to pursue

the cloud (both public and private) for data

processing needs, cloud datacenters are

becoming the new enterprise data repository.

In essence, the cloud is becoming the new core.

In 2025 IDC predicts that 49% of the world’s

stored data will reside in public cloud

environments.

Introducing the world's first data

readiness condition (DATCON) index

Not all industries are prepared for their

digitally transformed future. So, to help

companies understand their level of data

readiness, IDC developed a DATCON (DATa

readiness CONdition) index, designed to

analyze various industries regarding their own

Datasphere, level of data management, usage,

leadership, and monetization capabilities. IDC

examined four industries as part of its DATCON

analysis: financial services, manufacturing,

healthcare, and media and entertainment.

Manufacturing’s Datasphere is by far the

largest given its maturity, investment in IoT,

and 24x7 operations, and we found that

manufacturing and financial services are the

leading industries in terms of maturity, with

media and entertainment most in need of a

jump start.

China's Datasphere on pace to

becoming the largest in the world

Every geographic region has its own

Datasphere size and trajectories that are

impacted by population, digital

transformation progress, IT spend and

maturity, and many other metrics. For

example, China’s Datasphere is expected to

grow 30% on average over the next 7 years

and will be the largest Datasphere of all

regions by 2025 (compared to EMEA, APJxC,

U.S., and Rest of World) as its connected

population grows and its video surveillance

infrastructure proliferates. (APJxC includes

Asia-Pacific countries, including Japan, but

not China.)

Consumers are addicted to data,

and more of it in real-time

As companies increase the digitization of their

business and drive consistent and better

customer experiences, consumers are

embracing these personalized real-time

Data is at the heart of digital transformation,

the lifeblood of this digitization process.

Today, companies are leveraging data to

improve customer experiences, open new

markets, make employees and processes more

productive, and create new sources of

competitive advantage – working toward the

future of tomorrow.

Global Datasphere expansion is

never-ending

IDC has defined three primary locations where

digitization is happening and where digital

content is created: the core (traditional and

cloud datacenters), the edge

(enterprise-hardened infrastructure like cell

towers and branch oces), and the endpoints

(PCs, smart phones, and IoT devices). The

summation of all this data, whether it is

created, captured, or replicated, is called the

Global Datasphere, and it is experiencing

tremendous growth. IDC predicts that the

Global Datasphere will grow from 33

Zettabytes (ZB) in 2018 to 175 ZB by 2025.

To keep up with the storage demands

stemming from all this data creation, IDC

forecasts that over 22 ZB of storage capacity

must ship across all media types from 2018 to

2025, with nearly 59% of that capacity

supplied from the HDD industry.

An enterprise renaissance is on the

horizon

The enterprise is fast becoming the world's

data steward…again. In the recent past,

consumers were responsible for much of their

own data, but their reliance on and trust of

today’s cloud services, especially from

connectivity, performance, and convenience

perspectives, continues to increase while the

need to store and manage data locally

continues to decrease. Moreover, businesses

are looking to centralize data management

and delivery (e.g., online video streaming,

data analytics, data security, and privacy) as

well as to leverage data to control their

businesses and the user experience

(e.g., machine-to-machine communication,

IoT, persistent personalization profiling). The

responsibility to maintain and manage all this

consumer and business data supports the

growth in cloud provider datacenters. As a

result, the enterprise’s role as a data steward

continues to grow, and consumers are not

just allowing this, but expecting it. Beginning

in 2019, more data will be stored in the

enterprise core than in all the world's

existing endpoints.

This study is based on IDC’s ongoing Global

DataSphere research and market sizing models.

Industry and specific geographic Datasphere

research was conducted in September 2018 by

IDC. In addition, 2,400 enterprise decision

makers were surveyed, and in-depth interviews

were conducted with senior IT executives at a

variety of industries to inform this study. The

survey was with decision makers who had

responsibility for or knowledge of their

organization’s use, management, and storage of

data leveraging advanced technologies including

Internet of Things, real-time analytics, and

AI/machine learning. The survey spanned several

countries and regions including the United

States, China, EMEA, APJxC, and others.

About this study

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 5

engagements and resetting their expectations

for data delivery. As their digital world

overlaps with their physical realities, they

expect to access products and services

wherever they are, over whatever connection

they have, and on any device. They want data

in the moment, on the go, and personalized.

This places greater demand on both the edge

and the core to be able to produce the

precise data consumers require, often in

real-time. IDC predicts that due to the infusion

of data into our business workflows and

personal streams of life, that nearly 30% of

the Global Datasphere will be real-time by

2025. Enterprises looking to provide superior

customer experience and grow share must

have data infrastructures that can meet this

growth in real-time data.

Today, more than 5 billion consumers interact

with data every day – by 2025, that number

will be 6 billion, or 75% of the world's

population. In 2025, each connected person

will have at least one data interaction every

18 seconds. Many of these interactions are

because of the billions of IoT devices

connected across the globe, which are

expected to create over 90ZB of data in 2025.

The use of data today is transforming the way we

live, work, and play. Businesses in industries

around the world are using data to transform

themselves to become more agile, improve

customer experience, introduce new business

models, and develop new sources of competitive

advantage. Consumers are living in an

increasingly digital world, depending on online

and mobile channels to connect with friends and

family, access goods and services, and run nearly

every aspect of their lives, even while asleep.

Much of today’s economy relies on data, and this

reliance will only increase in the future as

companies capture, catalog, and cash in on data

in every step of their supply chain; enterprises

collect vast sums of customer data to provide

greater levels of personalization; and consumers

integrate social media, entertainment, cloud

storage, and real-time personalized services into

their streams of life.

The consequence of this increasing reliance on

data will be a never-ending expansion in the size

of the Global Datasphere. Estimated to be 33 ZB

in 2018, IDC forecasts the Global Datasphere to

grow to 175 ZB by 2025. (Figure 1). See Appendix

for methodology and data/device categories.

Global Datasphere Expansion

is Never-ending

Chapter 1 Characterizing the Global Datasphere

Figure 1 – Annual Size of the Global Datasphere

Annual Size of the Global Datasphere

MRI image creation is driving storage requirements significantly.

The trend is more images with thinner slices and 3D capability.

We've gone from 2,000 images to over 20,000 for an MRI of a

human head, and stronger magnets and higher resolution

pictures means more data stored.

– Senior Director in IT, Major Healthcare Provider

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

Source: Data Age 2025, sponsored by Seagate with data from IDC Global DataSphere, Nov 2018

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 6

180

160

140

120

100

80

60

40

20

0

Zetabytes

175 ZB

Sometimes it can be

dicult to get our minds

around such a large number.

Here are some illustrations of

just how large 175ZB is.

How big is 175ZB?

The Core is the Heart of the Datasphere

1.

One zettabyte is equivalent to a trillion gigabytes

If you were able to store the entire Global Datasphere on

DVDs, then you would have a stack of DVDs that could

get you to the moon 23 times or circle Earth 222 times.

If you could download the entire 2025 Global Datasphere

at an average of 25 Mb/s, today's average connection

speed across the United States, then it would take one

person 1.8 billion years to do it, or if every person in the

world could help and never rest, then you could get it

done in 81 days.

In this study we isolated three primary data location categories that make up the Datasphere:

This consists of designated computing datacenters in the enterprise and cloud providers. It

includes all varieties of cloud computing, including public, private, and hybrid cloud. It also

includes enterprise operational datacenters, such as those running the electric grid and

telephone networks.

Edge refers to enterprise-hardened servers and appliances that are not in core datacenters. This

includes server rooms, servers in the field, cell towers, and smaller datacenters located regionally

and remotely for faster response times.

Endpoints include all devices on the edge of the network, including PCs, phones, industrial

sensors, connected cars, and wearables.

A key aspect characterizing the Datasphere today is the increasingly critical role of the endpoints

and edge – which is where all the digital data about us or for us is delivered to us to help inform

real-time decisions, personalized services, or other latency-sensitive actions. Data gathered from

endpoints is collected at the edge, which is an important location for delivering the intelligence

and analytics necessary to provide faster response and better end-user experience, as well as to

accelerate and bring new levels of eciency and quality to business.

Use cases at the edge and core that illustrate their criticality are growing aggressively, with entire

categories yet to have even crossed our minds. One increasingly critical engagement between

edge and endpoint is the connected car. Driven largely by the video captured and analyzed by

numerous cameras integrated into the vehicle, IDC estimates that an autonomous vehicle can

create over 3TB of data per hour, and this doesn't include infotainment and GPS data. This data

creation will continue to increase as vehicle-to-vehicle communication becomes commonplace,

and as machine learning and AI continuously update pattern recognition integrated into vehicles’

intelligent driving algorithms.

Core

Edge

Endpoint

2.

3.

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 7

– CISO/CFO, Leading Manufacturing Firm

We’ll have more intelligence and more activity at the edge

on data coming from the generators that we build and the

IoT devices we have deployed…raw data will be analyzed

on the edge first, and then the results will be sent back to

the core for deeper analysis.

Figure 2

Data propagation from endpoints to core and back

Source: IDC’s Data Age 2025 study, sponsored by Seagate

Manufacturers have long sensed and actuated

on real-time data feeds within controlled

manufacturing environments. This has led to

better quality products at significantly lower

prices. Companies are now looking to sense and

actuate on data collected outside the factory

walls, while products are being used.

Manufacturers can extend product life and

reduce product failures by understanding

product performance in random environments

used by customers with a multitude of behavior

profiles. This is now possible with sensors that

are embedded and connected in the everyday

products that we use.

But the heart of the Datasphere is the

core. The core plays a critical role by

providing centralized storage and

archiving, service delivery, deeper-level

analytics, command and control, and

regulatory compliance. As a result, data

flows in a constant stream from endpoints

and the edge to the core and back out to

the edge and endpoints, with each location

playing an important part in the overall

Datasphere. This propagation of data drives data

growth in the core and has ramifications for analytics

and intelligence throughout the network,

powering internal and external processes, as

well as intelligent and predictive engagements

between businesses and individuals across

entire ecosystems (Figure 2). The net eect is

the continued importance and growth in

enterprise storage.

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 8

E

N

D

P

O

I

N

T

P

e

o

p

l

e

M

o

b

i

l

e

C

o

m

p

u

t

e

r

s

B

O

T

I

o

T

V

e

h

i

c

l

e

s

A

R

/

V

R

C

o

n

n

e

c

t

e

d

A

P

I

A

s

s

e

t

s

P

r

o

c

e

s

s

e

s

G

a

t

e

w

a

y

s

E

D

G

E

B

r

a

n

c

h

O

c

e

s

C

e

l

l

T

o

w

e

r

s

C

O

R

E

Large

Datacenters

including

Private & Public

Cloud

Data Created (Datasphere) is dierent than Data Stored

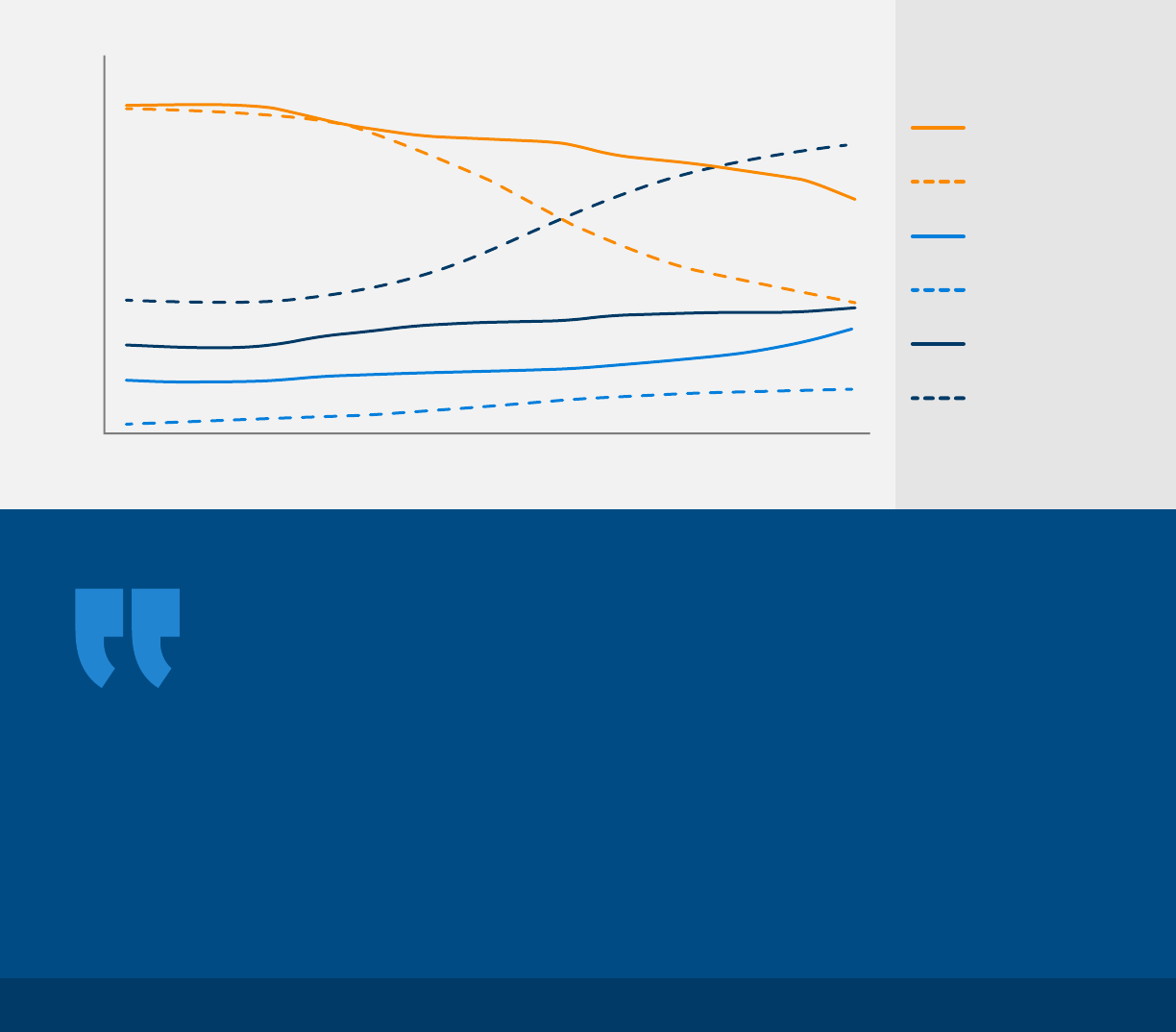

From a data creation perspective (solid lines in

Figure 3), endpoints are declining as a percent

while the core and edge continue to produce

more. From a data storage perspective

(dotted lines in Figure 3), the amount of data

being stored in endpoints will plummet as the

core becomes the repository of choice for data

of all types. By 2024, we expect data stored in

the core to be more than double the data

stored in the endpoint, completely reversing

the dynamic from 2015. Edge storage will also

see significant growth as latency-sensitive

services and applications proliferate

throughout our world.

Figure 3 – Where data is created and stored

– CISO/CFO, Leading Manufacturing Firm

We are beginning to understand the value of data

mining and being able to bring together disparate

data and systems that create that data. We don’t

understand well enough how to do this in an ecient,

cost-eective way. Right now, each system primarily

creates its own data; each system manages its own

data environment.

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

80%

70%

60%

50%

40%

30%

20%

10%

0%

Creating and Storing Data by Core/Edge/Endpoint

Endpoint-Create

Endpoint-Store

Edge-Create

Edge-Store

Core-Create

Core-Store

Source: Data Age 2025, sponsored by Seagate with data from IDC Global DataSphere, Nov 2018

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 9

Figure 4 – Where is the data stored?

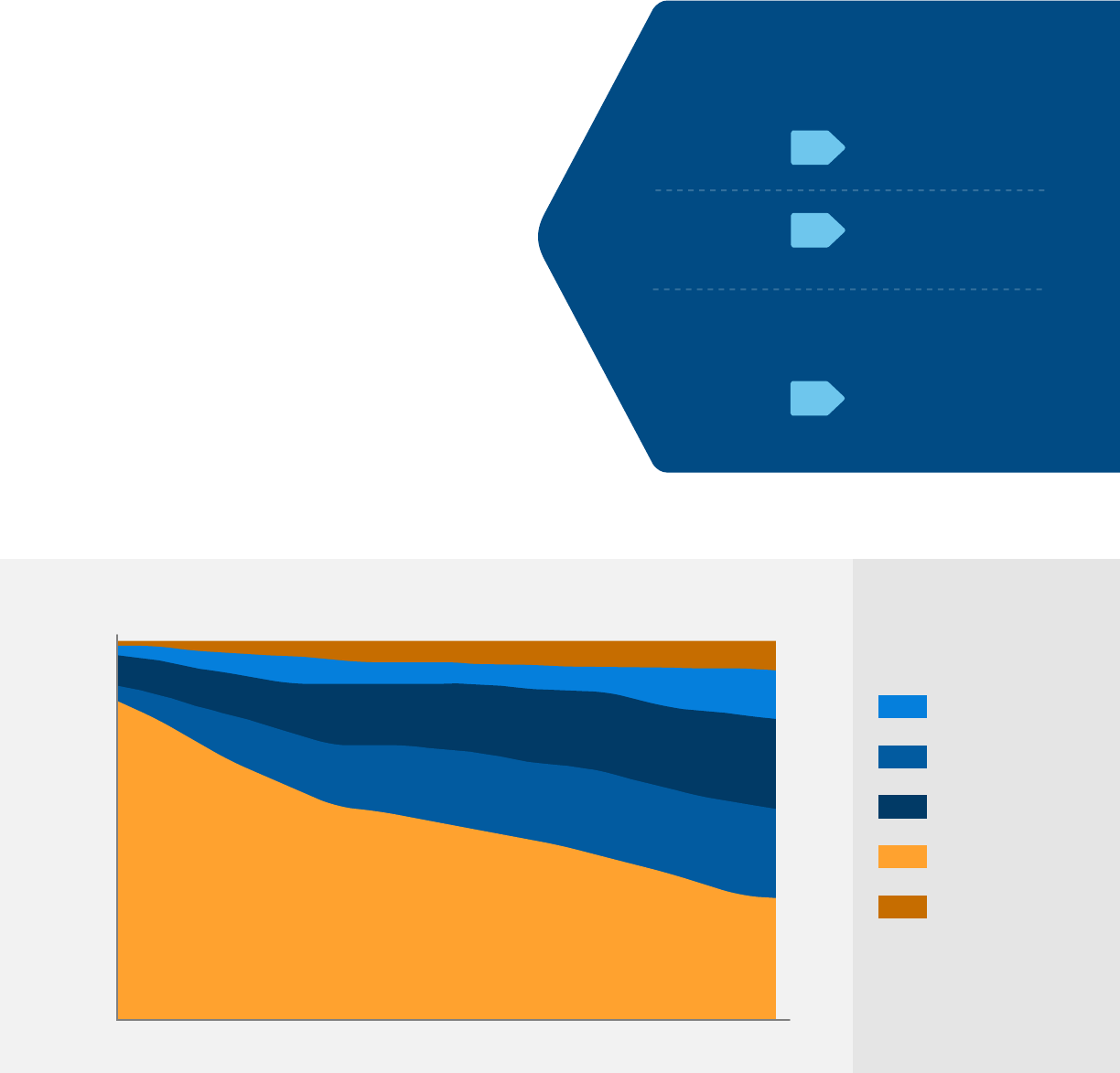

Cloud is the New Core…and Much of it is Additive

Today, as greater numbers of devices with greater

levels of intelligence are connected to various

networks, businesses and consumers are finding

the cloud to be an increasingly attractive option

that enables fast, ubiquitous access to their data.

Increasingly, consumers are fine with lower

storage capacity on endpoint devices in favor of

using the cloud. By 2020, we believe that more

bytes will be stored in the public cloud than in

consumer devices (Figure 4), and by 2021, there

will be more data stored in the public cloud than

in traditional datacenters (Figure 5).

– VP of IT, Fortune 50 Financial Services Firm

There is definitely interest in an increase in utilization of

public cloud for data stores as long as we’re good with

governance and identify suitable candidates. It’s still not

going to be customer data for the foreseeable future, but

there are candidates…It’s fair to say that public cloud

utilization is going to double.

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

70%

60%

50%

40%

30%

20%

10%

0%

Where is the data stored?

Consumer %

Enterprise %

Public Cloud %

Source: Data Age 2025, sponsored by Seagate with data from IDC Global DataSphere, Nov 2018

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 10

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Data Stored in Public Clouds vs. Traditional Datacenters

Enterprise Datacenters

Public Cloud

Source: Data Age 2025, sponsored by Seagate with data from IDC Global DataSphere, Nov 2018

Figure 5 – Data Stored in Public Clouds Versus Traditional Datacenters

Business models and the location of data

management may be changing, but the technical

requirements and challenges remain. Data must

be archived and stored in ways that provide

appropriate levels of performance and enable

analytics and intelligence to be applied to them,

but it must be done cost-eectively and securely.

This is not necessarily an easy task given that

some industries still have data in silos within the

corporate walls, as well as outside the corporate

walls residing in branch oces, contractor sites,

or some other location where the data is not

generally accessible.

– CIO and SVP of Corporate IT, Major Media Firm

There is a lot of data that has been done by third parties,

and there’s a lot of data we own but it sits out with other

people. A big part is trying to figure out how we might

bring back that data and store it. We may not even know

what we need it for, but we need it stored in one place so

that others, like data scientists, can have access.

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 11

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

The Enterprise vs. Consumer Datasphere

Installed Base of Bytes by Owner

Enterprise

Consumer

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Enterprise

Source: Data Age 2025, sponsored by Seagate with data from IDC Global DataSphere, Nov 2018

Consumer

Figure 6 and 7 – The Enterprise Datasphere Continues to Expand

The Enterprise Datasphere and Stewardship is Vital to Our Future

The enterprise continues to see its share of

Datasphere stewardship grow, with consumers’

share of data generated dropping from 47% in

2017 to 36% by 2025. This shift is largely driven

by the increasingly always-on and “sensorized”

world that is capturing and analyzing our

environments and creating data 24x7. In the

past, consumers were responsible for much of

their own data, but as data becomes

increasingly centralized across enterprise core

and edge infrastructure, the responsibility to

maintain and manage it is shifting to

enterprise/cloud provider datacenters. The

enterprise is already the primary source and

steward of data creation and storage, and the

trend continues to amplify these responsibilities

(Figures 6 and 7).

– VP of IT, Fortune 50 Financial Services Firm

We have initiatives partnering with facility management,

micro payments, and car manufacturers. We currently have

25 properties, so we leverage IoT to have ecient

optimization around datacenter and portfolio management.

All of those are big sources of data ingest.

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 12

The installed bytes across the enterprise is expected to grow to 13.6ZB, representing

over 80% of the worldwide installed bytes in 2025.

% of Global

Datasphere

Real-Time Data

60

50

40

30

20

10

0

35%

30%

25%

20%

15%

10%

5%

0%

Zetabytes

Source: Data Age 2025, sponsored by Seagate with data from IDC Global DataSphere, Nov 2018

Source: Data Age 2025, sponsored by Seagate with data from IDC Global DataSphere, Nov 2018

Figure 8 - Real-Time Data

How Much of Global Datasphere is Real-Time?

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

Real-Time Data Demand is Driving the Edge

IDC forecasts that more than 150B devices will

be connected across the globe by 2025, most

of which will be creating data in real time. For

example, automated machines on a

manufacturing floor rely on real-time data for

process control and improvement. Real-time

data represents 15% of the Datasphere in 2017,

and nearly 30% by 2025 (Figure 8).

But it's not just machines that are driving

real-time data. IDC estimates that by 2025,

every connected person in the world on

average will have a digital data engagement

over 4,900 times per day – that's about 1 digital

interaction every 18 seconds (Figure 9).

6,000

5,000

4,000

3,000

2,000

1,000

0

Figure 9 - Data Interactions per Connected Person Per Day

The Number of Interactions/Capita/Day

298

584

1,426

4,909

2010 2015 2020 2025

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 13

The Demand for Storage Remains Strong

The amount of data created in the Global

Datasphere is, of course, the target for the

storage industry. Even with the amount of data

created that is discarded, overwritten, or sensed,

but never stored longer than milliseconds, there

still exists a growing demand for storage

capacity across industries, governments,

enterprises, and consumers.

To live in a digitized world where artificial

intelligence drives business processes, customer

engagements, and autonomous infrastructure or

where consumers' lives are hyper-personalized in

nearly every aspect of behavior – including what

time we'll be awakened based on the previous

day's activities, overnight sleep patterns, and the

next day's calendar – will require creating and

storing more data than ever before.

IDC currently calculates Data Age 2025 storage

capacity shipments across all media types (HDD,

SSD, NVM-flash/other, tape, and optical) over the

next 4 years (2018–2021) will need to exceed the

6.9ZB shipped across all media types over the

past 20 years. IDC forecasts that over 22ZB of

storage capacity must ship across all media

types from 2018 to 2025 to keep up with storage

demands. Around 59% of the capacity will need

to come from the HDD industry and 26% from

flash technology over that same time frame, with

optical storage the only medium to show signs

of fatigue as consumers continue to abandon

DVDs in favor of streaming video and audio

(Figure 10).

HDD

SSD

NVM-NAND

NVM-Other

Optical

Tape

5.0

4.5

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0

Source: Data Age 2025, sponsored by Seagate with data from IDC Global DataSphere, Nov 2018

Zetabytes

Figure 10 - Worldwide Byte Shipments by Storage Media Type

Worldwide Byte Shipments by Storage Media Type

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 14

The growth in endpoint and edge storage will

favor solid state, while the core continues to

have a voracious appetite for the economical

bytes that hard disk drives and tape provide.

Enterprises will use a mix of disk drives, SSDs,

flash, and tape to satisfy the performance,

management, and archive demands being

placed on them. By the end of 2025, over 80%

of the enterprise bytes shipped into the core

and edge will continue to be HDD bytes when

compared to SSDs and other NVM

technologies (Figure 11).

HDD

SSD

NVM-NAND

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Source: Data Age 2025, sponsored by Seagate with data from IDC Global DataSphere, Nov 2018

Figure 11 - Share Worldwide Byte Shipments into the Enterprise Core and Edge by Storage Media Type

Share Worldwide Byte Shipments into the Enterprise

Core and Edge by Storage Media Type

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

By the

end of 2025,

over

of the enterprise bytes shipped

into the core and edge will

continue to be HDD bytes.

80

%

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 15

Whether population driven, application driven

(e.g., video surveillance), or digital

transformation maturity driven, any given

country or region will have a dierent

Datasphere growth profile. Note that the

calculations in regional Dataspheres are based on

where the devices are located from a regional

perspective, as opposed to who may actually own

them. For example, if providers in the U.S. own and

operate datacenters in EMEA, the data created

and stored are part of the EMEA Datasphere.

Regional Dataspheres have their

own unique growth profile

Chapter 2 A Regional Perspective on the Global Datasphere

China has the fastest growing Datasphere of all the regions forecast in this study. The rapid

deployment of video surveillance in China has catapulted the country’s use of enterprise storage,

as well as a large share of endpoint data creation. China is also one of the fastest growing regions

when it comes to the deployment of cloud.

Much of the growth in the EMEA Datasphere is a result of a massive population with associated

endpoint devices used to create and consume massive amounts of data, an already established

base of video surveillance infrastructure, and the initial impact of General Data Protection

Regulation (GDPR) legislation that likely will result in a temporary increase of data until formal

data management practices are implemented fully.

While the U.S. Datasphere continues to grow, it cedes share to the other regions due to its more

mature state in cloud infrastructure and highly penetrated population from an endpoint perspective.

The Asia-Pacific region including Japan, but excluding China, has the second strongest

Datasphere growth with respect to geographies analyzed in this study. Countries like Japan are

spending aggressively on smart city initiatives, which are data-creation intense.

China

EMEA

U.S.A.

APJxC

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 16

Figure 12 looks at the absolute size of each

regional Datasphere while Figure 13 represents

the Datasphere share of the U.S., EMEA,

APJxC, China, and ROW in terms of the share

of bytes generated.

China

EMEA

APJxC

US

ROW

200

180

160

140

120

100

80

60

40

20

0

Source: IDC’s Data Age 2025 study, sponsored by Seagate

Zetabytes

Figure 12 - Size and Growth of the Global Datasphere by Region

Global Datasphere by Region

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

Figure 13 – Global Datasphere Share by Region

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

35%

30%

25%

20%

15%

10%

5%

0%

Global Datasphere Share by Region

Source: IDC’s Data Age 2025 study, sponsored by Seagate

China

EMEA

APJxC

US

ROW

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 17

Cloud Growth Explodes Outside the United States

China

EMEA

APJxC

US

ROW

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Source: IDC’s Data Age 2025 study, sponsored by Seagate

Figure 14 - Cloud Storage Growth and Share by Region

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

US – 33

%

EMEA – 46

%

APJxC – 47

%

China – 50

%

ROW – 50

%

The U.S. share of public cloud

storage will drop precipitously

31

while China’s share will more

than double

in

2025

%

13

%

6

to

%

51

in

2017

%

As the headquarters region for the leading global

cloud providers, the United States has traditionally

had the lion’s share of cloud storage, followed by

EMEA and APJxC. And while cloud storage in the

United States will continue to grow, cloud

storage in other regions will grow even faster,

fueled both by the desire to reduce latency

by locating data closer to the end

consumer, as well as corporate and regulatory

mandates requiring data to be housed locally

within dierent regions. The U.S. share of public

cloud storage will drop precipitously from 51% in

2017 to 31% by 2025, while China’s share will more

than double from 6% to 13% (Figure 14).

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 18

Cloud Storage Growth and Share by Region

2015-2025 CAGR

IDC’s global survey in support of this project

indicates that other regions are beginning to

eclipse the U.S. in certain measures of data

maturity. In particular, China and APJ show

better metrics in several areas.

China and APJ are more likely to have

corporate-driven digital transformation

initiatives, to be able to quantify the value of

their data, and to increase their usage of edge

computing (Figure 15). This is helped in

emerging markets by a lower level of

investment in older legacy IT.

Do you expect your organization's utilization of edge

computing to increase in the next 2 years?

Question

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

298

584

1,426

China APJxC U.S. EMEA

YES

99

%

YES

91

%

YES

88

%

YES

82

%

Figure 15 – Increased Use of Edge Computing

Source: IDC’s Data Age 2025 study, sponsored by Seagate, n=959

China and Asia Pacific/Japan Have Edge in Data Maturity

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 19

Source: IDC’s Data Age 2025 study, sponsored by Seagate

Introducing the DATa Readiness CONdition Index

Digital transformation and the

resulting growth in data

Chapter 3 Industry Perspective on the Global Datasphere

Growth in data is happening across all industries

and geographies, but not all businesses are

impacted in the same way. Some rely more on the

cloud, while others continue to rely more on their

own datacenters, sometimes very massive ones.

Industries are in various states of readiness and

need to take action to prepare for and capitalize on

a new era of data growth.

To characterize dierences by dierent industries, IDC

created the DATCON (DATa Readiness CONdition)

index, the first index of its kind to evaluate how

prepared various industries are for managing,

analyzing, and storing data. It also identifies gaps that

need to be addressed and the most pressing

initiatives businesses must consider. The DATCON

index is a scale from 1 to 5, where 5 represents an

industry that is completely optimized and where 1

represents an industry in critical condition with

respect to its readiness to manage and fully monetize

the data it creates, captures, stores, and analyzes.

5

DATCON Index

4

3

2

1

Optimized

Advanced

Average

Needful

Critical

Industry is

leading in DX

Industry leading

in some areas of

digital

transformation

Industry on

par with the

average

Industry is in

catch-up mode

Industry

disarray

Suppliers are

synced and

healthy

Vibrant

ecosystem

Decent

ecosystem with

similar visions

Limited vision,

though there

are pockets of

action

Disaggregated

ecosystem

A DX culture is

driven throughout

from the top

Many DX initiatives

owned and

budgeted at the

highest level

Some C-level

commitment

There may be

some 3

rd

-platform

initiatives, but

limited

No vision for

3

rd

-platform

technologies

A skilled workforce

is executing

advanced initiatives

Data management

well under

control

Corporate-owned

visions and

initiatives in place

No C-level

commitment,

often a LOB

initiative

No leadership

within companies

A strong vision

exists on what data

is needed, leveraged,

and monetized

Good pulse on

leveraging data

to fullest extent

Usually strong

in one area of

3

rd

-platform

technologies

Most data never

monetized

An impending

data tsunami with

no survival plans

Figure 16 – Data Readiness Condition (DATCON) Levels

Figure 16 illustrates the 1 to 5 DATCON index with descriptions that provide further characterization of each level.

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 20

The DATCON index is a calculated score that is

synthesized across six assessment vectors and

numerous associated metrics informed

through global surveys, ongoing IDC research,

expert analysis, and proprietary modeling

techniques.

Data growth and investment

Digital transformation

competency

IT structural assessment

C-level involvement

Data value competency

Leadership self-score

Financial services

Manufacturing

Healthcare

Media and entertainment

These assessment vectors include:

For this study, IDC focused on four industries to develop the DATCON index:

DATCON Industries Comprise Nearly

Half of the Enterprise Datasphere

48

%

of the Enterprise

Datasphere

The four DATCON industries chosen in this

study (financial services, manufacturing,

healthcare, and media and entertainment)

comprise 48% of the Enterprise

Datasphere, with manufacturing

responsible for the largest share of data,

followed by financial services and media and

entertainment (Figure 17).

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 21

For additional information about the DATCON index methodology and

detailed findings by industry, Click here

Figure 18 – Comparing Industry Datasphere Growth Rates

Source: IDC’s Data Age 2025 study, sponsored by Seagate

While healthcare is the smallest of the four

industry Dataspheres in this study, it is primed

to grow faster than the rest given the

advancements in healthcare analytics,

increasing frequency and resolution of MRIs,

and other image and video-related data being

captured in today’s advanced modes of

medical care. IDC compares growth of various

industry Dataspheres to the overall Global

Datasphere growth through 2025 in Figure 18.

Source: Data Age 2025, sponsored by Seagate, Nov 2018

2018-2025 CAGR

Global Datasphere Healthcare Manufacturing Financial Services

Media and Entertainment

26

%

27

%

36

%

30

%

25

%

4,500

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

0

2018 Enterprise Datasphere by Industry (EB)

4,239

280

717

1,555

2,212

1,296

1,218

3,584

2,074

Financial Services

Manufacturing

Healthcare

Retail/WH

Infrastructure

1

Transportation

Resource

2

Other

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 22

Figure 17 - 2018 Enterprise Datasphere by Industry

Media and

Entertainment

1

Infrastructure includes Utilities, Telecommunications

2

Resource includes Oil and Gas (Mining), Transportation of oil & gas through pipelines or shipping, Resource industries, Petroleum and coal

_manufacturing/refining

Source: Data Age 2025, sponsored by Seagate, Nov 2018, n=1,081

The Interplay Between Core, Edge, and Endpoint is Key in All Industries

While all industries have examples of waves of

data traversing the core, edge, and endpoints, in

which data collected at the endpoints is

processed at the edge, propagated at the core,

then distributed back out to the endpoints, the

greatest use of edge computing in the four

industries in the DATCON index is found in

manufacturing and financial services (Figure 19).

Does your organization utilize edge computing?

Question

Financial Services Manufacturing Healthcare

Media and Entertainment

YES

62

%

No

33

%

No

38

%

No

45

%

No

62

%

YES

58

%

YES

48

%

YES

34

%

Figure 19 – Use of Edge Computing

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Don’t know Don’t know Don’t know Don’t know

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 23

IDC came across multiple examples of this data flow across the core, edge, and endpoints in its

interviews for this project. Some of them include the following:

Manufacturers have multiple use cases such as

factory automation and control, but a

particularly notable one mentioned by a

manufacturer had to do with IoT data from

engines it builds and sells. It collects telemetry

and other operating data which it then pulls

back into the core to perform advanced

analytics to tweak manufacturing processes,

but which it also shares with its dealers and

distributors, so they can be more responsive to

customers’ needs.

Firms circulate data between core, edge, and

endpoint for a variety of use cases including

analytics and branch operations. Fraud

detection on the edge is a growing use case

for banks and other financial firms given its

immediate impact on the balance sheet. ATM

machines are being outfitted with analytics

engines to authenticate would-be ATM

customers looking to withdraw funds.

Complex algorithms that capture various

forms of personal biometric data and

behavior are coalesced into a unique

identifier that authenticates identity as

customers approach the ATM – all the while

creating data at the edge.

Providers are taking advantage of greater

intelligence being built into diagnostic

equipment and patient devices that can collect

patient data, upload it to the cloud or a

centralized datacenter for analysis or diagnosis,

and then receive instructions or

recommendations based on the patient’s

specific needs. In the future, in-home robotic

healthcare assistants will monitor elderly

patients and provide notification if an individual

requires assistance, ensure medication is taken,

and even perform simple tasks.

Companies interviewed by IDC spoke of

ongoing eorts to repatriate data, pulling

digitized data from marketing groups, third

parties, and other sources back to the core

where it can be repurposed, re-used, and

analyzed. Based on the results of that analysis

the appropriate data is then repropagated back

to the end users and devices that require it. In

the future, entertainment content might be

tailored in real time based on a consumer’s

responses and biometric reactions. Intensity of

eects could be increased or decreased

appropriately to ensure the best experience in

augmented or virtual realities.

Manufacturing Healthcare

Financial Services

Media and Entertainment

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 24

For additional information on each the four industries profiled in the

DATCON index, Click here

As data is shifting from a consumer-centric

model to an enterprise-centric model, this

increases the burden on enterprises to provide

an excellent experience. Enterprises are

responsible for providing correct insights and

excellent customer experience, even storing

customers’ digital lives. Ensure your data model

provides secure, ubiquitous, real-time access to

services and data. As consumers become more

demanding of the experience in their digital lives,

companies must ensure that they are providing

data and services that are real-time, on the go

via any network, and are personalized.

Cloud providers have emerged as a serious

contender for enterprise data storage and

services. The largest providers have resources,

scale, security, and performance that few

enterprises can match. Their global reach

enables businesses to provide services to global

geographies, and their centralized access

enables company resources to tap into all of a

company's data to drive analytics today and

artificial intelligence in the future.

It is increasingly important for companies to take

a global approach to their data to provide

low-latency, better customer experience and to

address regulatory and compliance pressures

requiring operators to locate data in regions in

which customers are located. Whether in their

own datacenters or via cloud providers,

companies need to consider which data needs to

be located as close as possible to their customers

and where in the network it should be located

(core vs. edge, cloud vs. own datacenters).

Intelligent data is being sought to drive our

businesses and lives in real time and on-the-go.

Many times, data has no time to travel from an

endpoint to the core and back when informing

real-time decisions. The enterprise edge helps

to bridge this gap. Whether taking on data

analytics or simply storing analyzed and

intelligent data, the edge will play an increasing

role in enabling a real-time world.

IDC developed the DATCON index to characterize

the readiness level of dierent industries, and to

enable individual companies to assess their level of

readiness across a number of metrics. When it comes

to improving data readiness, it is important for

executives to lead corporate initiatives, make certain

that budgets exist, and ensure that data-savvy

workers are hired and empowered to execute.

Organizations born of the days when IT

departments dealt with back oce file-and-record

processing are now facing a deluge of real-time,

interrupt-driven bits and bytes from field

organizations. Many IT organizations are finding

themselves being given responsibility for physical

security as well as data security, for operational

data that was once sequestered on the factory

floor, the grid, or the operating room, and for

integrating data repositories previously kept in

separate silos. Dealing with digital transformation

will require not just new technology, but also new

skills, political savvy, and relationships with top

management.

IDC Guidance

Chapter 4

Enterprises must rise to the data

guardianship challenge

Take a global approach to your data

Cloud migration is strategic

Invest in the edge

Ensure your organization is

data-ready

Ready your IT organization for

digital transformation

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 25

Data is

helping us reach

new markets, better

serve existing customers,

streamline operations, and

monetize raw and

analyzed data.

As consumers, data is helping us build more

and deeper connections, and to access

products and services more quickly and easily,

at the time and place of our choosing. We can

now walk into a store and walk out with our

purchases, leaving our transaction record (and

perhaps facial image) as a digital trail, but never

having to pull out a credit card or cash.

As businesses, data is helping us reach new

markets, better serve existing customers,

streamline operations, and monetize raw and

analyzed data. If reported global intangible

assets of companies are more than $200 trillion

dollars*, what must – and will – the value of

unreported data assets be? Data is an

intangible asset and underpins most other

intangible assets like patents and goodwill.

Bytes can be made more valuable by

surrounding them with security, leveraging

them in AI, or using them to cure diseases.

Nevertheless, there is a cost associated with

data: purchasing, maintaining, and protecting

storage, as well as the cost of losing data or

having sensitive data fall into the hands of a

competitor or hacker. The real value of data is

out there, and companies are just finding out

that data has real worth. Those businesses first

through the gateway of digital transformation

will be the first to find out just how valuable

their data is.

The Global Datasphere is large and complex,

with key interdependencies between core, edge,

and endpoints. While the edge and endpoints

will continue to play a critical role as the place

where the Datasphere meets the physical world,

the core remains the heart of the Datasphere

gathering data from the edges and endpoints,

processing and archiving it, and promulgating it

back for consumption by end users, including

machines and things – and the cloud is a vital

part of this core.

Companies looking to be relevant between now

and 2025 will need to understand the role data

plays in their organization and how the

Datasphere will evolve during that period. They

will need to embrace their role as data

guardians, leverage the cloud, and take a global

approach to their data. Dierent industries have

dierent levels of data maturity, so companies

should review the IDC DATCON index reports to

learn where they stand relative to their industry

index and what they need to do to not just

survive – but more importantly to thrive – in

their own Datasphere.

Data is Changing the World

Chapter 5 Conclusion

* Source: IDC’s Intangible Asset Market Value Study, 2018

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 26

The Measure of the Global

Datasphere

Methodology

The Global Datasphere is a measure of all new data

that is captured, created, and replicated in any given

year across the globe.

An installed base of over 70 categories of

content creation/capture devices, including

embedded systems in devices like

automobiles, gasoline pumps, vending

machines, and kiosks, were sized by

geography and industry. Content creation and

capture and replication and consumption

calculations were applied to this installed base

of devices.

The broad category of devices includes:

The aggregation of all these calculations is called

our Global Datasphere.

1

2

3

4

Non-entertainment imaging

Entertainment

Productivity

Voice

e.g., medical imaging, MFPs, surveillance cameras, etc.

e.g., digital TV/radio, movies, video games, etc.

e.g. PCs, servers, supercomputers, metadata, embedded systems

e.g. mobile phones, VoIP, etc.

IDC White Paper I Doc# US44413318 I November 2018

The Digitization of the World – From Edge to Core I 27

About IDC

Global

Headquarters

International Data Corporation (IDC) is the

premier global provider of market intelligence,

advisory services, and events for the

information technology, telecommunications

and consumer technology markets. IDC helps

IT professionals, business executives, and the

investment community make fact-based

decisions on technology purchases and

business strategy. More than 1,100 IDC analysts

provide global, regional, and local expertise on

technology and industry opportunities and

trends in over 110 countries worldwide. For 50

years, IDC has provided strategic insights to

help our clients achieve their key business

objectives. IDC is a subsidiary of IDG, the

world's leading technology media, research,

and events company.

5 Speen Street

Framingham, MA 01701

USA

508.872.8200

Twitter: @IDC

www.idc-community.com

www.idc.com

Copyright 2018 IDC. Reproduction without written permission is completely forbidden.

Copyright Notice

External Publication of IDC Information and Data – Any IDC information that is to be used in advertising,

press releases, or promotional materials requires prior written approval from the appropriate IDC Vice

President or Country Manager. A draft of the proposed document should accompany any such request.

IDC reserves the right to deny approval of external usage for any reason.

ANALYZE THE FUTURE

More than 1,100 IDC analysts provide global, regional,

and local expertise on technology and industry opportunities

and trends in over 110 countries worldwide.