Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 1

Medicaid Expansion and the Louisiana Economy

Prepared for

Louisiana Department of Health*

Prepared by

James A. Richardson

Jared J. Llorens

Roy L. Heidelberg

All Professors in the Public Administration Institute at Louisiana State University

March 2018

*This study was funded by a grant from the Louisiana Department of Health in conjunction with the LSU Health

Science Center.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 2

Executive Summary

Medicaid Expansion and the Louisiana Economy

Medicaid expansion provides health insurance for non-elderly adults with income less than 138%

of the Federal Poverty Level. It provides for a 97.5% federal contribution for state fiscal year 2017,

a 94% federal contribution in calendar year 2018, a 93% federal contribution in calendar year

2019, and a 90% federal contribution from calendar year 2020 and beyond, assuming no further

changes in Medicaid at the federal level. This large federal contribution represents an infusion

of federal spending in Louisiana that would not have occurred if the state had not accepted

Medicaid expansion as created in the Patient Responsibility and Affordable Care Act passed by

the U.S. Congress in 2010. This federal infusion creates and sustains economic activity in the

healthcare sector which then impacts all other sectors of the state’s economy.

The economic impact as summarized by the Kaiser Family Foundation is as follows:

Illustration 1. Flow of Medicaid Dollars through Louisiana Economy

State Medicaid Expansion: Policy Decision of State

Leads to

Federal Medicaid Dollars: Net New Dollars to Louisiana Economy (dollars that would not be

present in Louisiana economy if not for Medicaid Expansion)

Providing net new direct

spending for

Healthcare Providers

leads to spending by Healthcare Providers for

Healthcare Vendors and

Healthcare Services

Income Earned by

Employees of Healthcare

Providers

Other Products

and Services

With this spending fostering additional spending in local economy

Consumer Purchases

Business Purchases

Business Investment

All of this activity leads to economic impact on local economy

Business

Transactions

Personal Earnings

Jobs

State and Local Tax

Receipts

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 3

The economic model above has been used by multiple states to evaluate the impact of the

injection of federal dollars for Medicaid programs, including Medicaid expansion:

• The University of Michigan’s Institute for Healthcare Policy & Innovation noted that

Michigan’s expansion of Medicaid health insurance had boosted the state’s economy and

budget and would continue to do so for at least five years.

• Regional Economic Analysis prepared a study for the state of Arkansas and found that

Medicaid expansion in Arkansas had contributed a 0.41% increase in gross domestic

product as of 2014 and would have a continuing positive impact on the growth of GDP

and on state employment through 2020

• The Colorado Health Foundation prepared a report title “Assessing the Economic and

Budgetary Impact of Medicaid Expansion in Colorado: FY 2015-16 through FY 2034-35” in

which they concluded that Medicaid expansion is and will continue to have a significant

positive impact on the state’s economy

• The Commonwealth of Kentucky retained Deloitte Development, LLC to prepare a study

outlining the impact of Medicaid expansion on the state’s economy, with the following

result: the net difference between expanding Medicaid and not expanding Medicaid was

estimated to be a positive $919.1 million from FY 2014 through FY 2021

• “The Real Impact of Medicaid Expansion in Maine,” estimated that expanding Medicaid

coverage in Maine would create 6,000 net new jobs, 4,000 in the healthcare sector and

2,000 in other sectors of the economy.

• A study by the Pennsylvania Department of Human Services (January 27, 2017) found that

the expansion of Medicaid led to an increase of employment by 15,500 jobs and an

increase in state tax revenues of $53.4 million.

• Study by Bureau of Business and Economic Research at the University of Montana

estimated Medicaid expansion created and supported about 5,000 jobs with increases in

personal income of $280 million with about 2,000 jobs being in the healthcare industry

and the other 3,000 jobs scattered in retail, personal services, construction, and the

hospitality industry.

The direct economic impact of Louisiana’s decision to expand Medicaid , based on the type of

healthcare treatment being provided, is illustrated in Table ES.1 for FY 2017. In State Fiscal Year

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 4

2017, the federal government had an average FMAP of 97.5% for the Medicaid expansion

program, meaning for every dollar the state spent on Medicaid expansion, the federal

government paid 97.50 cents. Louisiana’s choice to participate in the Medicaid expansion

represents an injection of federal dollars into the Louisiana economy that otherwise would not

be present. This means that Medicaid expansion, in addition to providing healthcare for non-

elderly adults with income being less than 138% of the federal poverty level, also creates an

economic stimulus to the state’s economy. In SFY 2017 the net new federal infusion of dollars

amounted to $1.85 billion after adjusting for non-elderly adults being transferred from other

Medicaid programs with lower FMAP rates. This economic impact means sustaining and creating

employment impacts, personal earnings, and state and local tax receipts.

The federal injection of just $1.85 billion created and supported almost 19,200 jobs, state tax

receipts of just over $103 million, and local tax receipts of $74.6 million.

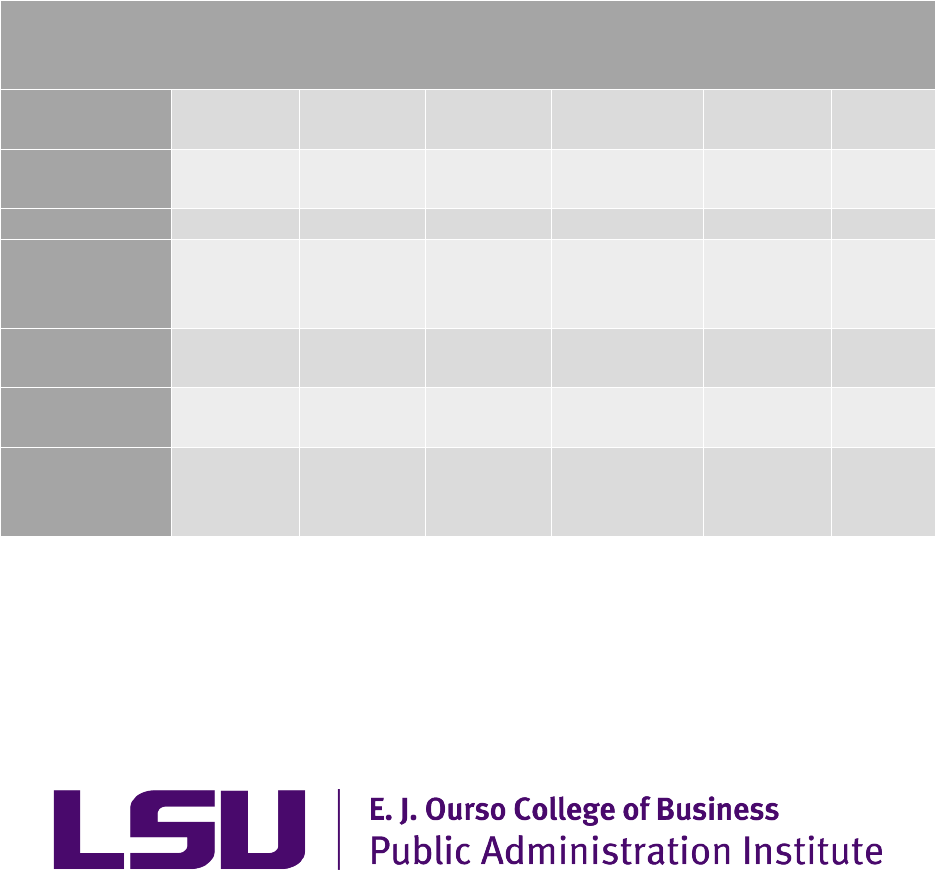

Table ES 1. Economic Impact of Medicaid Expansion Program on Louisiana Economy Based on

Payments to Managed Care Organizations, State Fiscal Year 2017 (in millions)

Type of

Activity

Federal

Payment

Business

Activity

Personal

Earnings

Employment

State Tax

Receipts

Local

Tax

Receipts

Hospitals:

Inpatient Care

$495.5

$939.9

$350.4

5,311

$29.1

$21.0

Outpatient

Care

$297.8

$564.8

$210.2

2,593

$17.5

$12.6

Pharmacy

$284.5

$539.7

$201.2

3,825

$16.7

$12.1

Physicians and

other

Professions

$441.1

$836.5

$311.9

4,420

$25.9

$18.7

Other Medical

Services

$64.6

$122.4

$41.6

1,150

$3.4

$2.5

Administration

of Program

$266.5

$476.8

$124.8

1,818

$10.4

$7.5

Total Activity

of Medicaid

Expansion

$1,850.0

$3,480.1

$1,118.2

19,195

$103.2

$74.6

The infusion of Medicaid expansion federal dollars enhances economic activity and employment

throughout the state as illustrated in Table ES.2. Healthcare activity is a statewide activity so any

increase in a federal infusion of healthcare dollars will be spent throughout the state and will

affect employment and economic activity throughout the state in addition to providing

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 5

healthcare for the state’s citizens. The impact on the various regions of the state as defined by

Health Districts in Map ES.1 is included in Figure ES.1 for FY 2017.

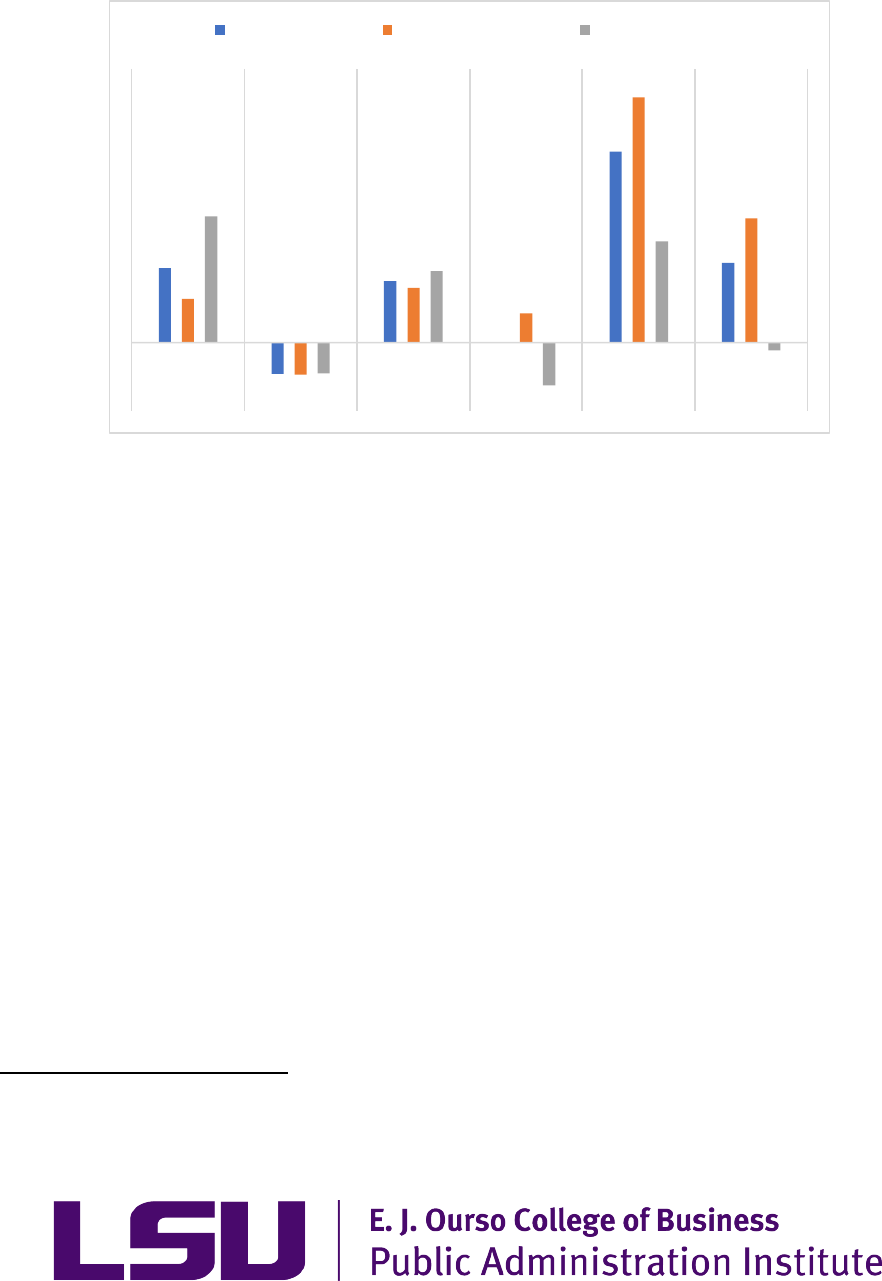

Figure ES.1 Employment Related to Medicaid Expansion

Spending in Health Districts and % of Total Employment, SFY 2017

Map ES.1, Louisiana Health Districts

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

1.2%

1.4%

-

500

1,000

1,500

2,000

2,500

3,000

District

1

District

2

District

3

District

4

District

5

District

6

District

7

District

8

District

9

District

10

Employment Related to Medicaid Expansion Program

% of Total Employment in Region

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 6

This economic stimulus will continue as long as the state allows for expanded Medicaid access

under the Affordable Care Act. In addition, there are several important comparisons to note:

(1) The estimated state tax receipts that were generated by the infusion of federal dollars

exceeded the dollars budgeted for the Medicaid expansion program by close to $50

million. This does not include any net budgetary savings from moving participants

from one Medicaid program to Medicaid expansion under a higher FMAP,

(2) The employment support is very important to the state since other sectors of the

state’s economy, such as the oil and gas sector, have been downsizing in Louisiana

since 2014 due to global market conditions

(3) The economic impact associated with the Medicaid expansion program is spread

across the state, and

(4) Any resurgence in the Louisiana economy because of global and national markets or

because of efforts by the state will not be deterred by expansion in the healthcare

industry given the variation in employment training and background.

Last, these economic gains are in addition to the broader gains from people having appropriate

healthcare throughout their adult life. Improved healthcare access can also have a positive effect

the labor force participation rate, defined as the number of persons in the work force who are

16 years of age and older. Improved labor force participation rates should be one long-term

result of the Medicaid expansion program, and rising labor force participation rates will allow for

further employment growth in the state.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 7

Medicaid Expansion and Louisiana Fiscal Outcomes

Introduction: Medicaid and Medicaid Expansion

Medicaid provides, as of 2018, health and long-term care to approximately 1.7 million low-

income children, pregnant women, adults, seniors, and people with disabilities in Louisiana.

Hospitals and nursing homes receive a large share of their funding from Medicaid

reimbursements. Medicaid is a means-tested entitlement program that finances the delivery of

primary and acute medical services as well as long-term services that is jointly funded by the

federal government, through the Federal Medical Assistance Percentage (FMAP), and state

governments.

1

The federal government provides at least 50% of Medicaid funding for every state

and provides more funding for a state according to the state’s FMAP, a formula based on the

average per capita income for each state relative to the national average.

2

In Louisiana, for FY 2018, the FMAP for the long-standing Medicaid program that covers poor,

elderly, and disabled citizens is projected to be 63.90% and 97.58% for the enhanced FMAP or

the Medicaid program for children.

3

In 2012, these FMAPs were 61.09% and 72.76% respectively.

In 2018 the state of Louisiana receives from the federal government 63.90 cents for every dollar

the state spends on healthcare for those individuals covered by Medicaid prior to the expansion

of coverage to poor non-elderly adults under the Affordable Care Act. In FY 2018, Louisiana will

receive 97.58 cents for every dollar it puts into the children’s insurance program so the state pays

on net 2.42 cents per healthcare expenditure for each dollar spent on eligible children. In both

cases of Medicaid coverage, the federal government makes a major contribution to the state’s

overall system of healthcare and related healthcare spending. In 2015, the FMAP for Louisiana’s

LAChip program was 73.44 cents. It was increased to 96.55 cents per dollar in 2016; 96.60 cents

per dollar in 2017; and, now in 2018 it is 97.58 cents per dollar. This higher rate will continue

through 2019 for the enhanced Medicaid program for children.

4

In 2015, prior to Medicaid expansion in Louisiana, almost one half of the population of Louisiana

was insured through employer-supported-insurance plans. Thirteen percent of the population

was insured through Medicare and 21% through Medicaid, two programs initiated and supported

by the federal government with the federal government bearing all of the cost for Medicare and

1

Section 1095 (b) of the Social Security Act specifies the basic formula for calculating the FMAP but with adjustments

as specified by law such as section 614 of the Children’s Health Insurance Program Reauthorization Act of 2009. U.S.

Department of Health & Human Services, Office of the Assistant Secretary for Planning and Evaluation.

2

Medicaid’s Federal Medical Assistance Percentage (FMAP), Alison Mitchell, Congressional Research Service,

February 9, 2016.

3

The enhanced FMAP is the Medicaid program for children.

4

The Affordable Care Act (P.L. 111-148)

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 8

the state and federal government sharing the cost for Medicaid. Seven percent of state residents

were insured privately but not through an employer and 11% of the population, or over 500,000

persons, were uninsured (see Figure 1).

Louisiana’s healthcare distribution is not substantially different from national distribution

averages. For the entire country, 49% of the population had employer-supported-insurance; 14%

had Medicare; 20% had Medicaid; 7% had a non-group insurance plan; and 9% had no insurance.

Figure 1. Source of Healthcare for Louisiana Citizens, Pre Medicaid-Expansion

Source: Medicaid in Louisiana, The Henry J. Kaiser Family Foundation, June 2017.

In 2016, 40% of Louisiana’s population had income less than 200% of the federal poverty level,

the definition of low income, as compared to 30% of the U.S. population.

5

Only two states had a

higher percentage of its population with income less than 200% of the federal poverty level,

Mississippi (42%) and New Mexico (41%). Louisiana’s poverty rate is an important factor in

determining eligibility for Medicaid as well as the federal assistance in paying for the Medicaid

program.

As of 2018, Medicaid plays a major role in both the U.S. healthcare system and in the Louisiana

healthcare system. According to the Henry J. Kaiser Family Foundation,

6

Medicaid accounts for

one-sixth of the dollars spent on healthcare in Louisiana; one-third of dollars distributed to

safety-net hospitals; and half of dollars spent on long-term care. Total healthcare spending in the

state is significant since, according to the Louisiana Workforce Commission, the Healthcare and

5

Distribution of the Total Population by Federal Poverty Level, www.KFF.org. the Henry J. Kaiser Family Foundation.

6

Medicaid in Louisiana, Henry J. Kaiser Family Foundation, June 2017.

48%

13%

21%

7%

11%

Employer Supported

Insurance

Medicare

Medicaid/LAChip

Non-Group

Uninsured

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 9

Social Assistance business sector makes up 16% of total employment and just over 15% of total

payroll in the state.

7

Certain segments of the healthcare industry, the ambulatory healthcare

services and hospitals, each make up 5.5% of total employment in the state and over 6% of the

state’s total payroll.

To provide a context for the state impact of Medicaid expansion under the ACA, the percentage

of uninsured non-elderly adults in the state for 2013 is illustrated in Map 1.

8

As can be seen, rates

varied across the state with northeastern Louisiana having a large number of parishes with the

uninsured rate among non-elderly adults being greater than 25.1%. Large population zones such

as Orleans Parish, East Baton Rouge Parish, Calcasieu Parish, Rapides Parish, Caddo Parish, and

Ouachita Parish had uninsured rates between 19.1% to 25.0%. A quarter of the parishes had

uninsured rates below 19.0%. The uninsured rate for non-elderly adults is much higher than the

uninsured rate among other categories of the population. Overall, Louisiana’s uninsured non-

elderly adults amounted to 22% of non-elderly adults. Prior to Medicaid expansion, uninsured

non-elderly adults lacked access to healthcare apart from emergency services.

7

Louisiana Workforce Commission, Employment and Wages, 2

nd

Quarter 2017.

8

Louisiana Health Insurance Survey, 2013, Division of Economic Development, E. J. Ourso College of Business,

LSU, published in August, 2014.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 10

Map 1. Range of Uninsured Rates in Louisiana by Parish for 19 to 64 years of age

The percent and number of uninsured persons in various categories of non-elderly adults for

2013 is illustrated in Table 1, along with their corresponding income categories. In 2013, there

were 291,000 non-elderly adults that had incomes less than 138% of the FPL. There were 555,285

non-elderly adults without insurance that had incomes up to 400% of the FPL. These estimates

were derived from a survey research project conducted by the LSU Economic Policy Research

Group on behalf of the Louisiana Department of Health. While based upon a sample of state

residents, the data provide a reasonable estimate of the number of people who had no insurance

and would likely be eligible for coverage under Medicaid expansion. This report also noted that,

based on its survey, there were an estimated 404,143 non-elderly adults with income being less

than 200% of the FPL without healthcare insurance or about two-thirds of the uninsured non-

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 11

elderly adults.

9

Some of these individuals included in these estimates were covered by Medicaid

through other mechanisms, and under Medicaid expansion, could be provided coverage under a

more favorable FMAP rate.

Table 1. Uninsured Non-elderly Adults in Relation to Federal Poverty Level

Federal Poverty Level (FPL)

Percent of Uninsured Non-

elderly Adults in Each

Income Category

Number of Uninsured Non-

elderly Adults in Each

Income Category

0 to 13% FPL

35.1%

82,249

13% to 100% FPL

39.3%

126,793

100% to 138% FPL

37.2%

81,958

138% to 150% FPL

37.3%

23,628

150% to 200% FPL

30.9%

89,515

200% to 250% FPL

23.5%

56,641

250% to 300% FPL

20.1%

43,566

300% to 400% FPL

13.8%

50,935

Source: Louisiana Health Insurance Survey, 2013, Division of Economic Development, E. J. Ourso College of

Business, LSU, published in 2014.

A further comparison of Medicaid in the U.S. and Medicaid in Louisiana is provided in Table 2

based on 2015 characteristics. Louisiana had fewer adults receiving Medicaid assistance and

fewer low-income individuals receiving Medicaid assistance than the national average despite

the fact that the share of the population in Louisiana that is low-income exceeds the national

rate. In 2015 Louisiana had not expanded Medicaid coverage to all non-elderly adults with

income below 138% of the federal poverty level (FPL). Instead, Louisiana had utilized a safety-net

healthcare system for its low income non-elderly adults who could not afford healthcare

insurance or who did not fit into another category that was covered by Medicaid.

10

Medicaid

expansion has switched the state from a safety-net model to an insurance model for most of its

lower income citizens. The insurance model could also create substantial health benefits over

time and lower healthcare costs over time given the ability of these non-elderly adults to receive

healthcare prior to emergencies.

9

Louisiana’s Uninsured Population: A Report from the 2013 Louisiana Health Insurance Survey, sponsored by the

Louisiana Department of Health & Hospitals and conducted by the LSU Division of Economic Development and the

LSU Public Policy Research Lab.

10

Louisiana has supported a state-wide charity hospital system since the initiation of the Charity Hospital in New

Orleans in 1732. The charity hospitals were state facilities. The Jindal Administration changed almost all of the

charity hospitals from state facilities to private facilities through contracts between the state and private hospitals.

The state still has a charity hospital system with private hospitals working in the role as charity hospitals for the

state.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 12

Louisiana had a larger number of persons receiving nursing home assistance than the national

average and Medicaid-provided nursing home assistance is covered in Louisiana. Louisiana had

the same number of children and the same number of persons with disabilities using Medicaid

as the national average, again Medicaid programs that have been fully adopted by Louisiana. The

insurance model had applied to all segments of the population except for non-elderly adults.

Table 2. U.S. and LA Comparison with respect to Individuals Using Medicaid, 2015(?)

U.S.

LA

Adults

1 in 7

1 in 8

low-income individuals

1 in 2

2 in 5

Children

2 in 5

2 in 5

Nursing Home Residents

3 in 5

3 in 4

People with Disabilities

2 in 5

2 in 5

* Medicaid in Louisiana, Henry J. Kaiser Family Foundation, June 2017.

The Patient Protection and Affordable Care Act (ACA), signed into law on March 23, 2010, was

intended to broadened access to health insurance. As of 2010 almost 50 million persons in the

United States, or about 15% of the population, did not have any form of health insurance. In

2015, an estimated 500,000 Louisiana residents, about 11% of the total population, lacked access

to insurance. This also amounted to 28% of the population between the ages of 18 and 65, given

that elderly adults are covered by Medicare and Medicaid, as needed, and children and parents

are covered by Medicaid, as needed.

11

The uninsured rate for all children in Louisiana is around

4% and the uninsured rate for Medicaid-eligible children is around 5%.

12

This estimate of

uninsured citizens is consistent with the fact that about 20% of non-elderly adults in Louisiana

live in poverty and with the information provided in the 2013 survey by the LSU Division of

Economic Development.

The method of extending coverage to non-elderly adults via the ACA was through graduated tax

credits for people with incomes between 100% and 400% of the federal poverty level (FPL) and

through an expansion of the Medicaid program to include non-elderly adults whose income is

less than 138% of the FPL.

13

The U.S. Supreme Court in a 2012 decision

14

declared that the federal

government could not force states to expand their Medicaid programs to include this group of

11

“The Louisiana Health Care Landscape,” Kaiser Family Foundation, published June 8, 2016. This number is reduced

by the creation of the Greater New Orleans Community Health Connection, a Medicaid pilot program whose mission

is to provide access to primary care for uninsured adults up to 200% of the FPL with this program servicing close to

40,000 persons.

12

Louisiana Department of Health.

13

The FPL for 2018 is $12,140 for family of 1; $16,460 for family of 2; $20,780 for family of 3; $25,100 for family of

4; $29,420 for family of 5; $33,740 for family of 6; $38,060 for family of 7; and, $42,380 for family of 8.

14

National Federation of Independent Business v. Sebelius, 567 U.S. 519 (2012). This decision upheld the power of

the U.S. Congress to enact most provisions of the Patient Protection and Affordable Care Act, but it did limit the

power of Congress to expand the Medicaid program to include non-elderly adults without the consent of the state.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 13

non-elderly adults, which in effect gave states the choice to expand their Medicaid programs. As

of 2018, 33 states, including the District of Columbia, have expanded their Medicaid programs.

In 2016, Louisiana made a decision to join the Medicaid expansion program.

Impact of Medicaid Expansion on the Budget and the Economy

Much of the debate in all states about whether to adopt or not to adopt Medicaid expansion has

focused on budgetary issues, namely, the cost of the program to the state and the ability of the

state to support the program as the Federal Medical Assistance Percentage (FMAP) for non-

elderly adults is gradually reduced from 100% for 2014, 2015, and 2016 to 90% in 2020.

From a purely budgetary perspective, Medicaid expansion can reduce the cost of the state’s

healthcare program through the following mechanisms:

• Movement of eligible non-elderly adult Medicaid recipients

15

from the lower

federal-match rate for the long-established Medicaid programs to the higher

federal-match rate of the Medicaid expansion program. The transfer came from

four programs including Take Charge Plus with a 90% FMAP for SFY 2016, GNOCHC

with a 62.21% FMAP for SFY 2016, Pregnant Women with a FMAP of 62.21 in SFY

2016 and Persons with Disabilities with a 62.21% FMAP for SFY 2016.

• The GNOCHC transfers, as well as the transfer of Pregnant Women and Persons

with Disabilities, saved Louisiana 35.29 cents for every dollar of Medicaid

expenditures in 2017 for former participants

16

and will save the state 31.29 cents

for every dollar of Medicaid expenditures in SFY 2018 and in SFY 2019, 29.29 cents

in SFY 2020, and 29.79 cents in each year beyond FSY 2020.

• The Take Charge Plus program saved Louisiana 3.5 cents for every dollar of

Medicaid expenditures in SFY 2017 and will save the state 3 cents in SFY 2018 and

SFY2019, and 1.5 cents in SFY 2020. After FSY 2020 the Take Charge FMAP will be

the same as the Medicaid expansion FMAP in 2020 at least as it is currently

established.

• Certain hospital supplemental payments have been funded at the lower federal-

match rate but can now be funded at a higher expansion match rate saving the

state approximately from 30 cents per dollar of eligible Medicaid expenditures in

2017 to 26 cents for every dollar of eligible Medicaid expenditures once the

Medicaid expansion federal/state ratio reaches 90/10

15

Louisiana Department of Health

16

And this comment does not include any benefits from better healthcare service since the GNOCHC program

supported relatively limited healthcare services.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 14

• Newly released state prisoners are now eligible for Medicaid insurance under the

Medicaid expansion program

• Collection of additional premium taxes from the managed care organizations

thereby increasing state revenues, and

• Disproportionate share payments to hospitals will decrease as the number of

uninsured decreases.

Some of these budgetary changes are long-term and will continue to contribute to budgetary

savings for the duration of the program. The state’s share of the Medicaid expansion program

will gradually increase to 10%, so the budgetary savings will be reduced over time. If additional

persons are added to the Medicaid rolls, then this will affect the state’s spending on Medicaid. A

more robust federal match rate for Medicaid expansion allows for the budgetary savings. During

the first three years of Medicaid expansion (2014, 2015, and 2016) the federal government

agreed to fund 100% of the cost for non-elderly adults. Gradually, this federal obligation will fall

to 90% by 2020.

In addition to the budgetary implications of the program for the state, the Medicaid expansion

program also serves as an ongoing economic input given the very favorable FMAP. Medicaid

expansion represents an injection of net new federal dollars that would not be forthcoming

unless the Medicaid expansion program were implemented. The Kaiser Family Foundation

summarized the economic impact of Medicaid spending in a state as shown in Illustration 1, with

this model working for both the Medicaid expansion program and the long-established Medicaid

programs.

17

This model is also outlined in a study by the Urban Institute in June 2013.

18

17

The Role of Medicaid in State Economies: A Look at the Research, Executive Summary, Kaiser Family Foundation,

January 2009.

18

Medicaid Expansion Under the ACA: How States Analyze the Fiscal and Economic Trade-offs, Urban Institute,

June 2013,

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 15

Illustration 1. Flow of Medicaid Dollars through Louisiana Economy

State Medicaid Expansion: Policy Decision of State

Leads to

Federal Medicaid Dollars: Net New Dollars to Louisiana Economy (dollars that would not be

present in Louisiana economy if not for Medicaid Expansion)

Providing net new direct

spending for

Healthcare Providers

leads to spending by Healthcare Providers for

Healthcare Vendors and

Healthcare Services

Income Earned by

Employees of Healthcare

Providers

Other Products

and Services Purchased by

Healthcare Providers

With this net new direct spending fostering additional spending in local economy by

Consumer Purchases

Business Purchases

Business Investment

All of this activity leads to economic impact on local economy

Business

Transactions

Personal Earnings

Jobs

State and Local Tax

Receipts

This economic model has been used by multiple states to evaluate the impact of Medicaid

programs on a state’s economy and on the “real” cost of expanding Medicaid coverage. These

studies focus on the economic impact from a state’s perspective, not from a national perspective

with examples of these studies including the following:

• The University of Michigan’s Institute for Healthcare Policy & Innovation published an

article in the New England Journal of Medicine stating that Michigan’s expansion of

Medicaid health insurance had boosted the state’s economy and budget and would

continue to do so for at least five years.

• Regional Economic Analysis prepared a study for the state of Arkansas and found that

Medicaid expansion in Arkansas had contributed a 0.41% increase in gross domestic

product as of 2014 and would have a continuing positive impact on the growth of GDP

and on state employment through 2020 (“Economic Impacts of the Arkansas Private

Option,” August 2015).

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 16

• The Colorado Health Foundation prepared a report title “Assessing the Economic and

Budgetary Impact of Medicaid Expansion in Colorado: FY 2015-16 through FY 2034-35” in

which they concluded that (1) Medicaid expansion is and will continue to have a

significant positive impact on the state’s economy and (2) the combination of federal

funding, the use of a health provider fee paid by hospitals as the source of revenue for

the state’s share of Medicaid expansion, modest savings in other programs, and increased

state tax revenues due to expansion would result in no net cost to Colorado’s General

Fund.

• The Commonwealth of Kentucky retained Deloitte Development, LLC to prepare a study

outlining the impact of Medicaid expansion on the state’s economy, with the following

result: the net difference between expanding Medicaid and not expanding Medicaid was

estimated to be a positive $919.1 million from FY 2014 through FY 2021, with 90% of this

estimate being related to the positive fiscal impact of Medicaid expansion and the other

10% being related to a negative impact on the state’s budget if Medicaid had not been

expanded.

• A study by Dr. Elizabeth Kilbreth, “The Real Impact of Medicaid Expansion in Maine,”

estimated that expanding Medicaid coverage in Maine would create 6,000 net new jobs,

4,000 in the healthcare sector and 2,000 in other sectors of the economy. This study

preceded a vote by the residents of Maine in 2017 to expand Medicaid. This study also

noted that studies in some states had concluded that Medicaid expansion had reduced

state spending or prior state-only programs and increased revenues from the infusion of

net new federal dollars, thereby offsetting the state revenues required to expand

Medicaid.

• A study by the Pennsylvania Department of Human Services (January 27, 2017) found

that the expansion of Medicaid led to an increase of employment by 15,500 jobs and an

increase in state tax revenues of $53.4 million. The methodology used in this analysis of

the impact of an infusion of federal dollars on the state’s economy is based on the model

used by the Kaiser Family Foundation.

• Study by Bureau of Business and Economic Research at the University of Montana for

Montana estimated Medicaid expansion created and supported about 5,000 jobs with

increases in personal income of $280 million with about 2,000 jobs being in the healthcare

industry and the other 3,000 jobs scattered in retail, personal services, construction, and

the hospitality industry and a previous study in 2015 comparing the results of states that

had expanded Medicaid to Montana which, at that time, had not expanded its Medicaid

Program conducted by the Chief Administrative Officer for the Native American Programs

and Population Management Research in Montana.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 17

This analysis of Medicaid expansion in Louisiana focuses on the economic impact from a state’s

perspective, not from a national perspective. This diagram of the flow of federal Medicaid dollars

through the local economies illustrates the fact that the federal dollars are net new dollars

coming to the state that, otherwise, would not. These dollars initiate payments to the healthcare

sector which in turn initiate payments to vendors providing commodities and services to the

healthcare providers and payments to employees of the healthcare providers and payments to

employees of the vendors. This spending by the healthcare providers lead to a second and third

round of spending by its employees and the healthcare vendors and providers of healthcare

services. The impact of the net new dollars from the federal government has a large impact on

the healthcare community and its vendors and employees but also has an impact on grocery

stores, service stations, personal and business services, and state and local governments. These

jobs, wages and earnings, and state and local tax receipts would not exist if the federal dollars

had not been introduced into the state’s economy. And, the federal dollars would not be

forthcoming if the state had not adopted the Medicaid expansion program.

The state must put up dollars to receive the federal dollars, but, in the case of Medicaid

expansion, Louisiana in calendar 2016 did not have to put up any money so the federal

government paid 100% of the Medicaid expansion program; the state in calendar 2017 had to

put up 5 cents to get 95 cents from the federal government; as of calendar 2018 the state has to

put up 6 cents to get 94 cents, as of calendar 2019 the state will have to put up 7 cents to get 93

cents of federal assistance, and as of calendar 2020 Louisiana will have to put up 10 cents in order

to get 90 cents of federal dollars. For state fiscal year 2017 Louisiana had to pay 2.5 cents of each

dollar put into the Medicaid expansion program and the federal government paid 97.5 cents of

each dollar. For state fiscal year 2018 Louisiana will pay approximately 5.5 cents of each dollar

for the Medicaid Expansion program and the federal government will pay 94.5 cents of each

dollar. The FMAP declines to 90% as of calendar 2020 which means that Louisiana will have to

pay its 10% share starting in state fiscal year 2021. In state fiscal year 2020 the state will have six

months of a FMAP of 93% and then six months of a FMAP of 90%.

There is a cost to the state, but there is also the economic feedback of the net new dollars flowing

to the state to support the Medicaid program that will offset partially or possibly fully the state’s

expenses. The state’s contribution to the Medicaid expansion is a direct cost to be incurred by

the state due to the Medicaid expansion program, but the economic impact of the net new

federal dollars, including any increased employment, earnings, and state and local tax receipts,

is also the result of the Medicaid expansion program. An economic impact coincides with any

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 18

program that brings in net new dollars, but in the case of Medicaid expansion, because of the

size of the federal contribution to the federal/state mix, the impact is notable.

19

This ripple effect is associated with all Medicaid programs since the federal government provides

dollars for healthcare for lower income individuals. These federal Medicaid contributions vary

among programs. In Louisiana in 2018 the FMAP for the long-standing Medicaid program is

projected to be 63.90 and 97.58 for the enhanced FMAP for children.

20

The FMAP for the

Medicaid expansion is projected to be 90.0 starting in calendar 2020, but in calendar 2018 it will

be 94.0 and in calendar 2019 it will be 93.0. In calendar 2018 the state of Louisiana will receive

from the federal government 63.90 cents of every dollar it puts into its long-standing Medicaid

program so the state pays on net 34.10 cents; 97.58 cents for every dollar the state puts into the

children’s insurance program so the state pays on net 2.42 cents; and, 94 cents for every dollar

in the Medicaid expansion program for newly eligible non-elderly adults so the state pays on net

6 cents and 90.6 cents for every dollar the state uses for childless adults in the pre-ACA expansion

so the state pays on net 9.4 cents. In all of these cases, the federal government makes a

contribution to the state’s healthcare plan, but a very significant federal contribution comes

under the Medicaid expansion program as provided in the ACA. And, in all of these cases, there

is an economic ripple effect that creates jobs, earnings, and state and local tax receipts that,

otherwise, would not have occurred.

Louisiana Department of Health Budget: State and Federal Expenditures

The Louisiana Department of Health’s budget and its budget for Medical Vendor Payments are

illustrated in Table 2 highlighting expenditures from the state and the federal government.

Medical vendor payments are the expenditures paid by the state to medical vendors for services

rendered or to managed care organizations The first thing to notice is that Medical Vendor

Payments make up close to 90% of the total state expenditures as of FY 2017. The second thing

to notice is that federal allocations make up close to 70% of all DH spending as of FY 2018.

19

The Medicaid Expansion dollars will come to the state regardless of what dollars Louisiana citizens may be paying

to the federal government.

20

The enhanced FMAP is the Medicaid program for children.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 19

Table 2. Louisiana Budget for Department of Health and Medical Vendor Payments (MVP) (billions $s)

Fiscal

Year

State Funds*

Federal Funds

All Funds

Fed.

as %

of all

Funds

MVP

as %

of

Total

DH

MVP

DH

MVP

DH

MVP

DH

MVP

FY 2012

$2.82

$1.93

$5.138

$4.703

$7.955

$6.633

64.6%

83.4%

FY 2013

$3.01

$2.18

$5.290

$4.928

$8.303

$7.113

63.7%

85.7%

FY 2014

$3.46

$2.70

$5.261

$4.873

$8.726

$7.577

60.3%

86.8%

FY 2015

$3.66

$2.90

$5.374

$4.960

$9.031

$7.862

59.5%

87.1%

FY 2016

$3.59

$2.85

$5.929

$5.471

$9.517

$8.317

62.3%

87.4%

FY 2017

$3.96

$3.20

$7.929

$7.433

$11.894

$10.636

66.7%

89.4%

FY 2018

$4.07

$9.499

$13.568

70.0%

Source: Executive Budgets for Louisiana, Louisiana Division of Administration and Louisiana Department of Health

*includes State General Funds, Statutory Dedications, Fees and Self-Generated, and Interagency Transfers

**Enacted, FY 2018

Total spending in the Louisiana Department of Health, according to the Executive Budget for the

state, increased in nominal dollars from $8.247 billion in FY 2012 to $13.594 billion in FY 2018.

This increase includes both state and federal revenues. The DH budget increased from FY 2012

to FY 2016 by about $1.3 billion or about $320 million per year. The growth in federal revenues

in DH’s budget from 2012 through 2016 or before Medicaid expansion was 15.4% and the growth

in state spending was 27.4%. This growth corresponded to rising healthcare prices relative to the

overall inflation rate, to a rising population with additional pressure on the state support for

uninsured individuals, and with a slightly improving FMAP for the state so Louisiana picked up

slightly more federal dollars for each Medicaid claim.

In 2016 Louisiana made a decision to become part of the Medicaid expansion program as created

by the ACA in 2010. From 2016 to 2018 the growth in federal spending was 60.2% and the growth

in state spending was 13.4%. This represents a major change in the source of funds for the

support of the Medicaid program and a major expansion of persons now covered by an insurance

network.

This decision expanded the number of persons who could qualify for Medicaid to include non-

elderly adults with an income equal to or below 138% of the federal poverty level. Many of these

people were already being serviced by the state in an emergency management system. That is,

if they became seriously ill, they could go to one of the state’s private hospitals that had been

contracted to provide healthcare service to persons who did not have healthcare insurance. And,

even more significantly, the uninsured who became ill, but not in what would typically be called

an emergency, would also seek service through emergency rooms. Under the pre-2016 system,

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 20

the federal government put up about 64% of the cost of taking care of persons under the

emergency management system. The state still incurred and will continue to incur a cost for

uninsured non-elderly adults even if the state had not accepted Medicaid expansion, but with a

lower degree of federal support.

The federal share of DH’s budget rose from 62.3% in FY 2016 to 66.7% in FY 2017 and is projected

to be 70.0% in FY 2018. This is due to the fact that the federal government subsidizes the

healthcare program for non-elderly adults more generously than for the long-standing Medicaid

programs. This estimate of 70% federal assistance for the state of Louisiana may diminish

modestly since the FMAP for Medicaid expansion will decline from the 94% federal share in 2018

to the 90% federal share in 2020. This estimate of the federal/state ratio also depends on the

proportion of persons on the long-established Medicaid programs and those who are eligible for

the Medicaid expansion program.

The share of federal spending on the Medicaid program is important since these are dollars that,

otherwise, would not come to the Louisiana economy. From FY 2016 to FY 2017 the increase in

federal spending made up 80% of the overall increase in the DH budget, while from FY 2017 to

FY 2018 the federal spending for DH is projected to make up over 100% of the increase in DH

spending so state outlays are projected to decrease.

The source of payments for healthcare is a very important metric given the economic impact of

federal spending as noted in Illustration 1. The increasing role of federal spending in the

healthcare budget is illustrated in Figure 2. Federal support for healthcare spending in Louisiana

grew more rapidly than state spending in FY 2016 and FY 2017 and, as currently projected, in FY

2018. Just over 70% of LDH’s budget comes from the federal government. Based on information

from the House Fiscal Division approximately 24% of the remainder of the state’s budget is

financed by federal funds.

21

21

FY17-18 Executive Budget Review, Louisiana Department of Health, House Committee on Appropriations,

prepared by House Fiscal Division, April 5, 2017.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 21

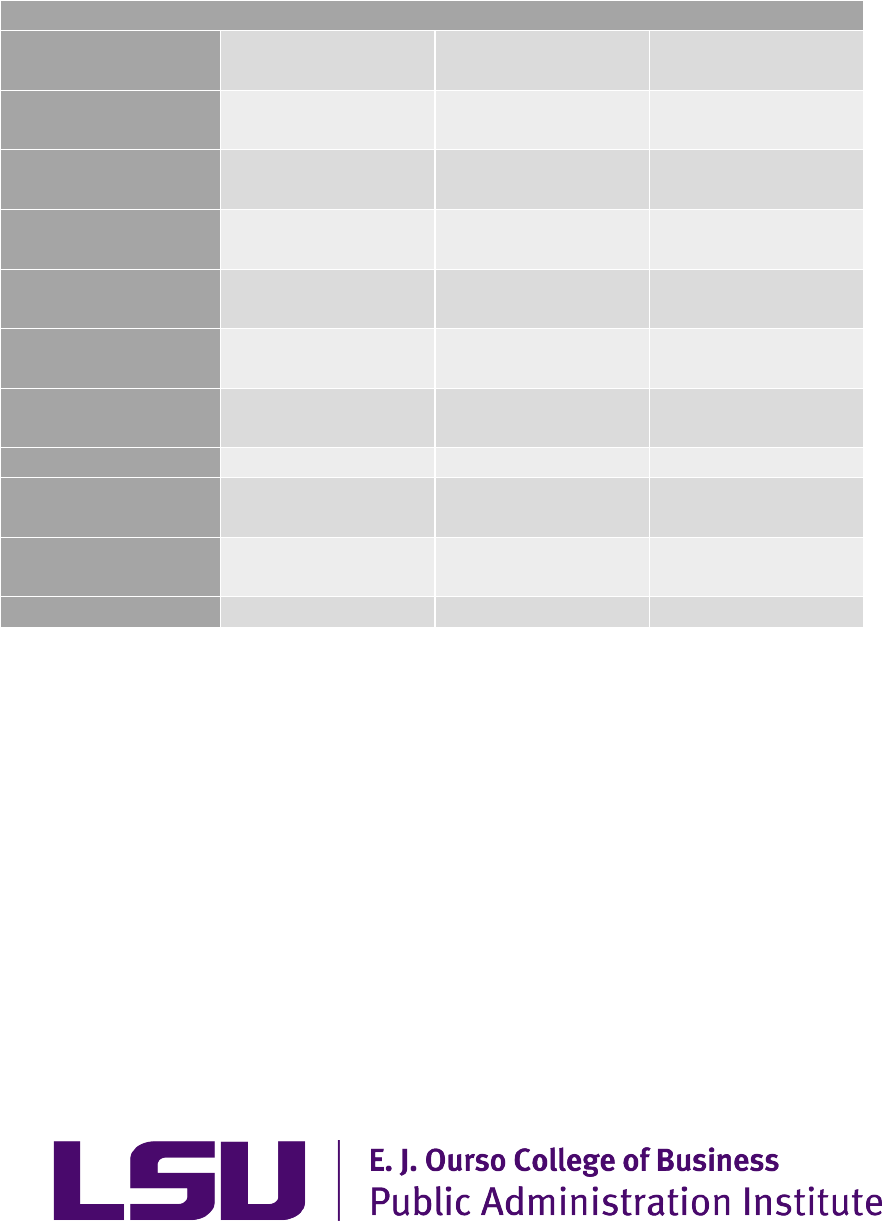

Figure 2. Growth in DH Budget for FY 2013 through FY 2018.

Increases in federal support for the Louisiana Medicaid project will not eliminate the need for

the state to use some of its dollars to support the state’s healthcare program. The state still has

to make decisions regarding how much of its budget to focus on healthcare for lower income

non-elderly adults, but the federal dollars provide another factor in bringing net new dollars to

the state that would not be spent in the state without the state’s investment in healthcare for its

non-elderly citizens.

LDH spending on healthcare is illustrated in Figures 3 and 4 in terms of nominal and real

expenditures from FY 2012 through FY 2018. The purpose of these figures is to give perspective

to the increases in healthcare spending over the last six years. In Figure 3 both nominal and real

expenditures on healthcare have increased from just over $8 billion in 2012 to about $13.8 billion

in nominal terms by FY 2018 and about $11.6 billion in real terms.

22

In Figure 4 real healthcare

expenditures per capita are illustrated with real per capita spending rising from $1,792 in 2012

to $2,447 in 2018. This increase is consistent with the Medicaid expansion program initiated in

2016. Real state healthcare spending per capita increased from $665 in 2012 to $733 in 2018, an

increase of just over 10%. Real federal healthcare spending per capita increased from $1,127 in

2012 to $1,714 in 2018 or an increase of over 52%. Healthcare spending has grown from 2012

through 2018, but this increase has been dominated by federal outlays.

22

Real expenditures are derived by dividing the nominal expenditures by the consumer price index for healthcare

with this index including healthcare commodities and services. The CPI for healthcare has averaged about 70% above

the CPI for all goods and services over the last 20 years based on information from the U.S. Bureau of Labor Statistics.

10.9%

-4.6%

9.0%

0.1%

27.9%

11.7%

6.4%

-4.7%

8.0%

4.3%

35.8%

18.2%

18.5%

-4.4%

10.5%

-6.3%

14.8%

-1.1%

FY13 FY14 FY15 FY16 FY17 FY18

DH Budget, Total Federal Funds for DH State Funds for DH

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 22

Figure 3. Nominal and Real Expenditures in Healthcare in Louisiana, including

Federal and State

Table 2, Figure 2, Figure 3, and Figure 4 highlight the expanding role of the federal government

in the Medicaid program with respect to the source of funding for the program. This increasing

federal role with respect to financing the Medicaid program permits the state to improve its

budgetary status as opposed to not having the Medicaid expansion program and also allows the

state’s economy to be stimulated by a new and larger source of federal dollars that, otherwise,

would not be have been spent in Louisiana. The increasing federal role in supporting healthcare

for non-elderly adults who makes less than 138% of the federal poverty level also enhances

healthcare for a group of people who have had a very high rate of being uninsured.

$6,000,000,000

$7,000,000,000

$8,000,000,000

$9,000,000,000

$10,000,000,000

$11,000,000,000

$12,000,000,000

$13,000,000,000

$14,000,000,000

SFY12 SFY13 SFY14 SFY15 SFY16 SFY17 SFY18

Nominal Real

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 23

Figure 4. Real Healthcare Expenditures per capita (state and federal)

Medicaid and Medicaid Expansion in Louisiana

Medicaid recipients includes the aged, disabled, families and children, and others, all meeting

certain income requirements. The Medicaid enrollees and payments, pre-Medicaid expansion,

are noted in Figure 5 for Louisiana and the United States representing a division of Medicaid

resources among the different eligible categories. Louisiana has relatively more children in its

Medicaid program than the national average and spends slightly more on the children as part of

its total Medicaid expenditures than the national average. But 58% of the Medicaid enrollees in

Louisiana account for only 29% of Medicaid payments. Similarly, 15% of the enrollees in Louisiana

are classified as parents and this group accounts for only 9% of the Medicaid payments. Disabled

Medicaid enrollees in Louisiana make up 18% of the total enrollees but account for 45% of the

Medicaid payments. Louisiana also has a slightly larger number of disabled persons and spends

slightly more on their treatment. Louisiana has 18% of its Medicaid enrollees as disabled

compared to the national average of 15%. Disabilities account for 45% of the Louisiana Medicaid

expenditures compared to the national average of 42%. Louisiana spends less on its parents than

the national average and parents represent a smaller percentage of enrollees in Louisiana than

the national average. In Louisiana a larger share of the expenditures is on children than the

national average. We do not have information presently to say how the Medicaid expansion

enrollment and expenditures will compare. Figure 5 certainly conveys the message that there

can be and there is a significant difference between the enrollees in Medicaid and the percentage

of resources used in the treatment of these enrollees. This is not surprising since it is very

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018

Real Federal Spending per Capita Real State Spending per Capita

Real Healthcare Spending per Capita

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 24

reasonable to expect a disabled patient to cost much more than a young child for medical

treatment or, for that matter, an adult without any disability as compared to a disabled patient.

Figure 5. Medicaid Enrollees and Payments for U.S. and LA,

not including Medicaid Expansion

Enrollment in the Medicaid program after Medicaid expansion is illustrated in Figure 6. Children

and parents make up just over 50% of the total Medicaid enrollees and the non-elderly adults

covered by the Medicaid expansion program now make up just under 29% of the total enrollees.

The aged and disabled make up a small percentage of the enrollees, less than 15%, but will

continue to make up a much larger share of the Medicaid expenditures.

15%

18%

42%

45%

9%

9%

22%

17%

27%

15%

15%

9%

49%

58%

21%

29%

U.S. LOUISIANA U.S. LOUISIANA

ENROLLEES PAYMENTS

Disabled Elderly Parents Children

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 25

Figure 6. Enrollment in Medicaid by Category

Medicaid expansion payments for hospitals, outpatient care, pharmacy payments, physicians and

other professionals, and all other categories of healthcare spending are illustrated in Table 5.

The Medicaid payments include managed care organization fees and fees for services provided

as paid directly by the state. Almost all of the expenditures will be for managed care

organizations. We have divided the Medicaid payments into various types of expenditures since

each of these healthcare expenditures has different impacts on the local economies.

Table 5. Total Payments by Type of Healthcare Expenditure for Medicaid Expansion Program,

FY 2017 (in millions of dollars)

Expenditures

Federal

Contribution

State Share

Total

Expenditures

% of Total

Hospitals

$495.6

$12.7

$508.3

26.8%

Outpatients

$297.8

$7.6

$305.4

16.1%

Pharmacy

$284.5

$7.3

$291.8

15.4%

Physicians and

Professionals

$441.1

$11.3

$452.3

23.8%

All Other

Healthcare

Spending

$64.6

$1.7

$66.3

3.5%

Administration

$266.4

$6.8

$273.2

14.4%

Total

$1,850.0

$47.4

$1,897.4

3.6%

10.7%

50.8%

6.1%

28.9%

aged disabled children and parents Other medicaid expansion

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 26

We can also note that there was a noticeable increase in claim accounts of 51,000,000 in FY 2016

to 66,000,000 in FY 2017.

23

This increase in the claim accounts certainly illustrates the increased

usage of Medicaid and indicates the movement from an emergency service program to a health

insurance program.

The increase in overall Medicaid enrollees from FY 2016 to FY 2017 represented only about one-

third of the total number of Medicaid expansion enrollees which suggest a number of Medicaid

enrollees moved from one enrollment option to the Medicaid expansion enrollment option and

a number of non-elderly adults who had not been on any Medicaid program but are eligible under

the Medicaid expansion guidelines chose to enroll. Non-elderly adults switching from other

Medicaid programs included 222,367 from the Take Charge Plus program, a program for family

planning services; 65,495 from the Greater New Orleans Community Health Connection; and, a

number of persons from the program for pregnant women and for those with disabilities that

would qualify for Medicaid expansion.

The information about Medicaid in Louisiana as of 2018 can be summarized as follows:

• A large number of people have taken advantage of the Medicaid Expansion

program—over 545,000 persons, but this number is much larger than the increase

in total Medicaid enrollees so non-elderly adults who had been on other Medicaid

programs were able to switch to the Medicaid expansion program with a much

more favorable FMAP.

• The increase usage of the Medicaid program is also documented by the increase

in claim accounts from almost 51,000,000 to just over 66,000,000 from FY 2016 to

FY 2017

• The Medicaid expansion program has been successful in terms of soliciting eligible

citizens to sign up for the health insurance program.

• Public programs such as the Medicaid expansion are not free; rather, there is a

financial cost to the state as well as benefits from improving the health of citizens

of the state. In the case of Medicaid expansion, this cost to the state is reduced

by

o The very high FMAP associated with this program so the federal

government has decided to accept a larger share of the cost of the

Medicaid expansion program

23

Louisiana Department of Health.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 27

o Certain non-elderly adults other Medicaid programs have switched to

Medicaid expansion thereby benefiting the state due to the higher FMAP

associated with the Medicaid expansion program

o And the infusion of net new federal dollars into the economy creates an

economic dynamic that leads to net new jobs and earnings and state and

local tax receipts. This is a dynamic factor that should not be overlooked

as the Medicaid expansion program is evaluated.

Hence, appreciating the true cost of the Medicaid expansion program to the state is not as simple

as examining the budget of the program. It must be accompanied by an analysis of the overall

impact including both the budgetary impact and the overall impact of the net new federal dollars

on the state and regional economies.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 28

Economic Impact of Medicaid Expansion Program on Louisiana Economy and on State

Revenues

The process of estimating the economic impact of the Medicaid expansion program includes the

following steps.

1. Keep in mind the economic ripples being generated by the net new dollars being put into

the Louisiana economy as illustrated in Illustration 1. These economic ripples are being

magnified by the FMAP on Medicaid expansion as opposed to other Medicaid programs.

The model is based on the Regional Input-Output Modeling System as developed by the

U.S. Department of Commerce, Bureau of Economic Analysis.

Illustration 1. Flow of Medicaid Dollars through Louisiana Economy

State Medicaid Expansion: Policy Decision of State

Leads to

Federal Medicaid Dollars: Net New Dollars to Louisiana Economy (dollars that would not be

present in Louisiana economy if not for Medicaid Expansion)

Providing net new direct

spending for

Healthcare Providers

leads to spending by Healthcare Providers for

Healthcare Vendors and

Healthcare Services

Income Earned by

Employees of Healthcare

Providers

Other Products

and Services Purchased by

Healthcare Providers

With this net new direct spending fostering additional spending in local economy by

Consumer Purchases

Business Purchases

Business Investment

All of this activity leads to economic impact on local economy

Business

Transactions

Personal Earnings

Jobs

State and Local Tax

Receipts

2. Identify the number of Medicaid enrollees in the Medicaid Expansion program on

statewide basis and by the ten health districts as illustrated in Map 2. These health

districts have as few as 1 parish in District 10 (Jefferson) and 3 parishes in District 1

(Orleans, Plaquemines, and St. Bernard) to 12 parishes in District 8 (Caldwell, East Carroll,

Franklin, Jackson, Lincoln, Madison, Morehouse, Ouachita, Richland, Tensas, Union, and

West Carroll).

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 29

Map 2. Health Districts in Louisiana, Louisiana Department of Health

3. Medicaid enrollees for FY 2017 are noted in Table 5. The total enrollees will include some

double-counting due to a person having changed classifications during the year.

Table 5. Medicaid Enrollees by Type of Eligibility, FY 2017

Aged

Disability

Parents &

Children

Medicaid

Expansion

Others

Total

Enrollees*

%

Medicaid

Expansion

District 1

11,026

27,923

89,734

74,727

26,618

230,028

32.5%

District 2

12,049

28,519

126,424

66,845

28,162

261,999

25.5%

District 3

8,155

20,173

80,071

44,657

21,097

174,153

25.6%

District 4

14,748

29,846

130,158

70,071

29,909

274,732

25.5%

District 5

5,908

12,913

62,120

31,830

14,451

127,222

25.0%

District 6

8,512

18,827

64,732

33,346

16,180

141,597

23.5%

District 7

13,565

32,277

111,843

60,283

26,754

244,722

24.6%

District 8

10,102

21,285

81,914

48,078

20,565

181,944

26.4%

District 9

10,403

22,860

105,870

56,261

26,201

221,595

25.4%

District

10

8,625

18,089

87,270

56,731

20,167

190,882

29.7%

Others

3,117

3,117

100.0%

Louisiana

103,093

232,712

940,136

545,946

230,104

2,064,219

26.4%

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 30

Medicaid enrollees without any double-counting came to 1,791,69 in 2017 as opposed to

the 2,064,219 as noted in Table 5. The enrollees in Table 5 reflect the persons who, at

one time during FY 2017, were classified in a particular program.

4. Approximately 26.4% of Medicaid enrollees are entered in Medicaid expansion in FY 2017

with the largest percentage being in District 1, including Orleans, Plaquemines, and St.

Bernard parishes, with 32.5% of this District’s Medicaid enrollees be in the Medicaid

expansion program and District 10, which is Jefferson Parish, having almost 30% of their

Medicaid enrollees being in Medicaid expansion. Districts 2 through 9 hovers around 25%

of their Medicaid enrollees being in Medicaid expansion.

5. Medicaid expansion enrollees and spending are compared to population of each district

in Figure 6. The percentage of Medicaid expansion enrollment and spending exceeds the

population percentage in Districts 1 (New Orleans) , 4 (Lafayette), 7 (Shreveport), 8

(Monroe) and 10 (Jefferson). In Districts 2 (Baton Rouge), 3 (Houma-Thibodaux), and 9

(Northshore) the percentage of Medicaid expansion enrollment and spending is lower

than the percentage of population. In Districts 5 and 6 the percentage of population and

Medicaid expansion enrollment and spending are approximately the same.

Figure 6. Comparison of Population and Medicaid Expansion Enrollment

6. The Medicaid expansion activities of these enrollees in terms of payments for services

received in FY 2017 are illustrated in Table 6 by Districts with these medical activities

being Inpatient Hospital Care, Outpatient services, Pharmacy, Professional Visits

(including visits to Doctors and other medical professions), other medical activities, and

administration. Medicaid expansion expenditures total close to $1.9 billion with $452

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

District

1

District

2

District

3

District

4

District

5

District

6

District

7

District

8

District

9

District

10

% of Medicaid Expansion Enrollment % of Medicaid Expansion Spending

% of Population

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 31

million going to Physicians and professional visits and medical assistance, $291.8 million

being for pharmacy and prescriptions, $508.3 million for inpatient hospitals, $305.4

million for outpatient services, $66.2 million for other healthcare services, and $273.2

million for administration. Districts 1, 2, and 8 tend to spend relatively more Medicaid

expansion expenditures than the percentage of Medicaid expansion enrollees. For

example, Health District 1 has 11.2% of the Medicaid enrollees but spend about 11.5% of

Medicaid expansion expenditures and in District 2 Medicaid enrollees make up about

12.8% of the total Medicaid expansion enrollees but about 13.6% of the Medicaid

expansion estimated expenditures.

Table 6. Medicaid Expenditures by Type of Healthcare Activity for Medicaid Expansion Program

Including both Federal and State Contributions, FY 2017 (in millions)

Medical

Services:

Hospitals

Inpatient

Medical

Services:

Outpatient

and Other

Services

Medical

Services:

Pharmacy

Medical

Services:

Physicians

and Other

Professionals

Other

Medical

Services

Total

District 1

$61.8

$37.7

$45.1

$53.3

$6.7

$204.6

District 2

$78.9

$41.3

$42.0

$53.6

$8.3

$224.2

District 3

$40.6

$28.2

$25.4

$40.0

$6.0

$140.2

District 4

$59.5

$39.6

$36.3

$57.4

$10.2

$202.9

District 5

$33.1

$17.6

$14.4

$24.9

$5.0

$95.1

District 6

$36.6

$20.3

$16.2

$30.7

$5.1

$108.9

District 7

$55.2

$31.1

$25.6

$49.9

$5.9

$167.7

District 8

$43.1

$29.2

$24.7

$47.8

$7.0

$151.7

District 9

$53.1

$35.1

$31.4

$51.1

$7.9

$178.6

District 10

$46.3

$25.3

$30.8

$43.6

$4.2

$150.1

Administration

$0.0

$0.0

$0.0

$0.0

$273.2

$273.2

Total

$508.3

$305.4

$291.8

$452.3

$66.2

$1,897.2

7. The expenditures in Table 6 are state dollars coupled with federal dollars and, in the case

of Medicaid expansion, the federal government in state fiscal year 2017 put up 97.5% of

the total expenditures so for every 2.5 cents the state spent on healthcare for non-elderly

adults with incomes less than 138% of the FPL, the federal government injected 97.5

cents. In FY 2017 the federal government put up $1.85 billion for the state to spend

$1.897 billion so the state’s contribution was less than $50 million. This $1.85 billion

represents new Medicaid expansion enrollees as well as switching non-elderly adults from

other Medicaid programs to the Medicaid expansion program.

24

24

This model accounts for all Medicaid Expansion enrollees regardless of his or her previous enrollment in a Medicaid

program. The model, however, does not allow for any budgetary savings by the state due to the fact that the FMAPs

will be different for Medicaid Expansion as opposed to the previous program in which he or she were enrolled.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 32

The economic impact of the federal input to Medicaid expansion expenditures for state

fiscal year 2017 is illustrated in Table 7 with this economic impact to include overall

business transactions, earnings, employment, and state and local tax collections related

to the federal contribution to the Medicaid expansion program.

Table 7. Economic Impact of Federal Contribution to Medicaid Expansion Program in 2017 (all dollars

in millions)

Type of

Healthcare

Activity

Federal

Payment

Business

Activity

Personal

Earnings

Employment

State Tax

Receipts

Local Tax

Receipts

Hospitals:

Inpatient Care

$495.5

$939.9

$350.4

5,311

$29.1

$21.0

Outpatient

Care

$297.8

$564.8

$210.2

2,593

$17.5

$12.6

Pharmacy

$284.5

$539.7

$201.2

3,825

$16.7

$12.1

Physicians and

other

Professions

$441.1

$836.5

$311.9

4,420

$25.9

$18.7

Other Medical

Services

$64.6

$122.4

$41.6

1,150

$3.4

$2.5

Administration

of Program

$266.5

$476.8

$124.8

1,818

$10.4

$7.5

Total Activity

of Medicaid

Expansion

$1,850.0

$3,480.1

$1,118.2

19,195

$103.2

$74.6

Source: U.S. Department of Commerce, Regional Input-Output Multipliers, based on 2015 Regional Data

The key takeaway from Table 7 is that the economic ripples from the infusion of federal

dollars into the Medicaid expansion program leads to net new state tax receipts being

generated that offsets the state’s expenditures and leaves a net revenue improvement of

$55.7 million of state tax receipts after allowing for the state spending its share of the

Medicaid expansion obligation. In addition, the infusion of federal dollars generates

$74.6 million for local governments.

8. The total economic impact and budgetary affect includes the following parts:

a. Additional Costs to State in state fiscal year 2017: $47.431 million

b. Additional spending by Federal Government in Louisiana: $1.850 billion

c. Gains from the Economic Impact of Federal Spending

i. creating and supporting 19,195 jobs in sectors throughout the economy

and across the state

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 33

ii. creating and supporting personal earnings of $1.118 billion throughout the

economy and across the state

iii. enhancing state revenues by an estimated $103.2 million

iv. enhancing local revenues by an estimated $74.6 million across the state

and political sub-divisions

9. In calendar 2018 the federal government will put up 94% so for state fiscal year the FMAP

will average 94.5%; in calendar 2019 the federal government will put up 93% so the FMAP

for state fiscal year 2019 will average 93.5%; and in 2020 the federal government will put

up 90% so for fiscal year 2020, the FMAP will average 91.5%.

10. The above estimates take into account the transfer of Medicaid enrollees from other

Medicaid programs in which the federal match was less than the 95% match in calendar

2017.

11. The earnings and jobs will not just be in the healthcare sector. About 50% of the jobs will

be in the healthcare sector and the other jobs will be in trade, personal services, food

services, arts and entertainment, and other such sectors that cater to individuals living in

a community.

12. These earnings and jobs are also spread throughout the state as noted in Table 8 which

provides the breakdown of earnings and jobs by district.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 34

Table 8. Economic Impact of Medicaid Expansion in Various Regions of the State

(Dollars in millions)

District

Personal Earnings

Employment

Local Tax Receipts

District 1 (New

Orleans)

$141.0

2,202

$8.46

District 2 (Baton

Rouge)

$154.4

2,405

$9.27

District 3 (Houma-

Thibodaux)

$96.5

1,498

$5.79

District 4

(Lafayette)

$139.7

2,183

$8.38

District 5 (Lake

Charles)

$65.4

1,021

$3.93

District 6

(Alexandria)

$75.0

1,162

$4.50

District 7

(Shreveport)

$115.5

1,774

$6.93

District 8 (Monroe)

$104.5

1,618

$6.27

District 9

(Northshore)

$123.0

1,910

$7.38

District 10

(Jefferson)

$103.4

1,605

$6.21

Louisiana

$1,118.6

19,195

$74.60

13. This economic impact will be felt around the state since healthcare is a state-wide activity

as illustrated in Figure 7. Medicaid expansion employment ranges above 2,000 in three

districts (New Orleans, Baton Rouge, and Lafayette); between 1,500 to 2,000 in four

districts (Shreveport, Monroe, Northshore, and Jefferson); and, between 1,000 and 1,500

in three districts (Houma-Thibodaux, Lake Charles, and Alexandria). This employment

related to the Medicaid expansion program represents about 1% of total employment

throughout the state but represents slightly more in Alexandria and Monroe.

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 35

Figure 7. Employment Related to Medicaid Expansion

Spending in Health Districts and % of Total Employment

14. The economic impact of the Medicaid expansion will continue as long as the state

maintains the program and as long as no major changes are instituted by the federal

government, either through acts of the U.S. Congress or regulatory decisions made by the

Center for Medicare & Medicaid Services.

15. This economic and fiscal are already built into the employment and fiscal numbers for

Louisiana.

Summary and Conclusions

Medicaid expansion provides health insurance for non-elderly adults with income less than 138%

of the Federal Poverty Level with a 97.5% federal contribution for state fiscal year 2017, a 94%

federal contribution in calendar year 2018, a 93% federal contribution in calendar year 2019, and

a 90% federal contribution starting in calendar year 2020 and beyond assuming no further

changes in Medicaid at the federal level. This large federal contribution represents an infusion

of federal spending in Louisiana that would not have occurred if the state had not accepted

Medicaid expansion as created in the Patient Responsibility and Affordable Care Act passed by

the U.S. Congress in 2010. This federal infusion creates and sustains economic activity in the

healthcare sector which then spreads over to all other sectors of the state’s economy.

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

1.2%

1.4%

-

500

1,000

1,500

2,000

2,500

3,000

District

1

District

2

District

3

District

4

District

5

District

6

District

7

District

8

District

9

District

10

Employment Related to Medicaid Expansion Program

% of Total Employment in Region

Medicaid Expansion and Louisiana Fiscal Outcomes

March 2018

Page 36

This economic stimulus will continue as long as the state continues to provide expanded Medicaid

access and assuming there are no major changes made by the U.S. Congress. There are several

important impacts that the state policy makers should be aware of:

(5) The estimated state tax receipts generated by the infusion of federal dollars exceeded

the state dollars budgeted for the Medicaid expansion program by over $50 million

and this does not include any net budgetary savings from moving participants from

one Medicaid program to Medicaid expansion with the higher FMAP,

(6) The employment support is very important to the state since other sectors of the

state’s economy such as the oil and gas sector has been downsizing in Louisiana since

2014 due to global market conditions

(7) The economic impact associated with the Medicaid expansion program is spread

across the state and will be sustained as long as Medicaid expansion is sustained, and