(A Government of India Undertaking)

Credit Card and Merchant Acquiring Business Department

CREDIT CARD POLICY

[FY 2022-23]

Credit Card Policy – 2022-23

Page 2 of 52

CREDIT CARD POLICY

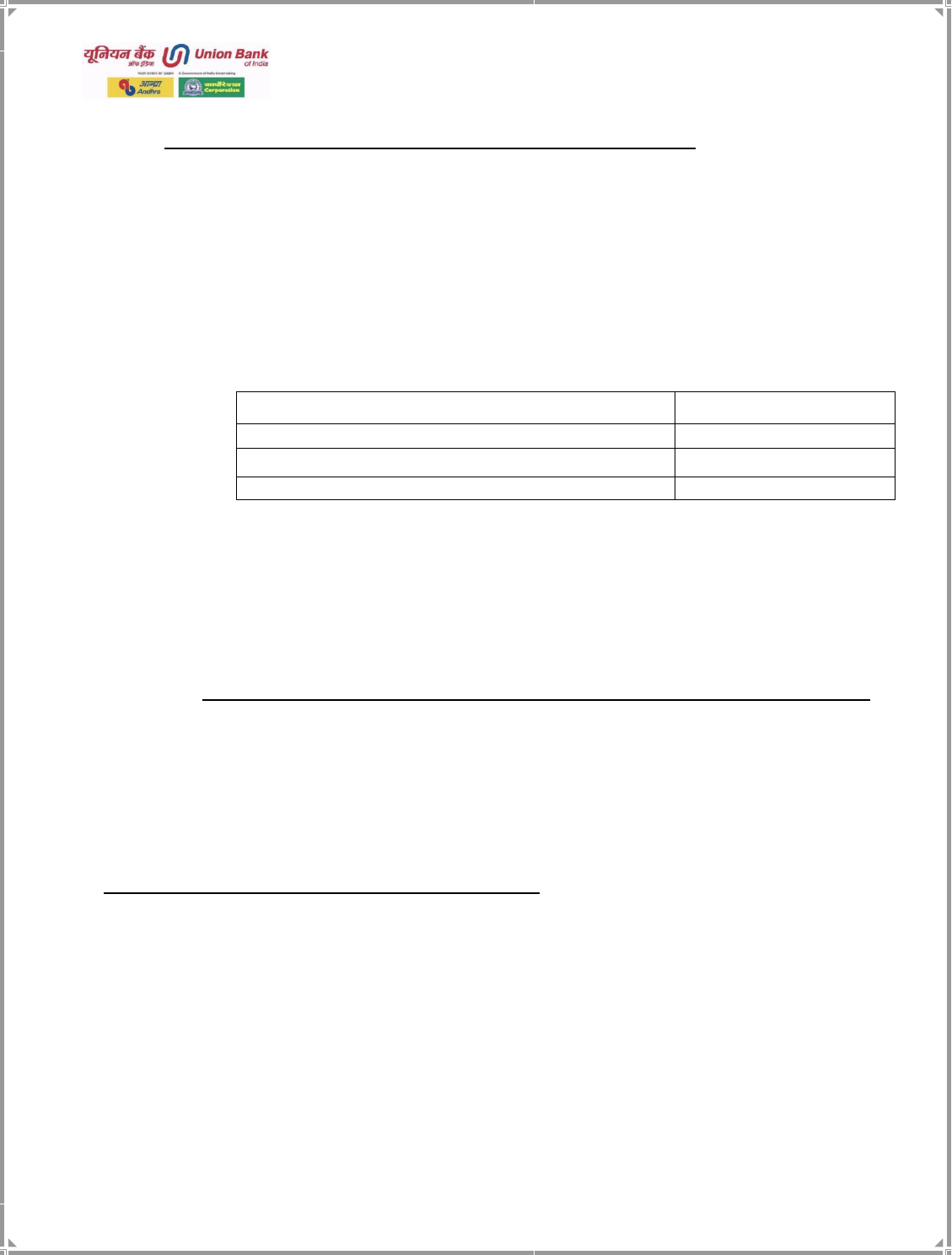

INDEX OF CONTENTS:

No.

Chapters

Page No

1

Credit Card Variants

3

2

Guidelines for issuance of Cards

5

3

Customers against proof of income

5

4

U- Secure Credit Cards against Lien on Term Deposits

6

5

Credit Cards to our Customers availing loans

7

6

Credit Cards to MSME Borrowers

7

7

Cards to NRI Customers – On Lien on Deposits

7

8

Credit Cards to Employees of PSU/State Government/Other

Government Institutions

8

9

Credit Cards to Saving Bank Account holders who maintain

required average balances

9

10

Pre-Approved Credit Cards

9

11

Credit Cards to New To Bank (NTB) Customers

9

12

General Provisions for sanction of Credit Cards

10

13

Customer Acquisition

12

14

Personal Accident Insurance

15

15

Purchase Protection to Customers

16

16

Credit Shield & Lost Card Insurance

17

17

Issuance of Corporate Credit Cards

19

18

Renewal of Corporate Credit Cards

20

19

Co-branded/Co-batching/Affinity Cards

21

20

Credit Card Mobile Application

22

21

Billing, Account Maintenance, Interest rates & other charges

23

22

EMI Facility

25

23

Cardholder Services & Grievance Redressal

27

24

Annexure – I - Credit Cards at a glance

33

25

Annexure – V - Most Important Terms and Conditions

42

26

Annexure – VI – Issuance of Corporate Cards

49

27

Annexure – VIII - Definitions

51

Credit Card Policy – 2022-23

Page 3 of 52

CREDIT CARDS

I. VARIANTS OF CARDS:

Bank shall issue different variants of Credit Cards including Co-Branding, Co-Batching and

Corporate Cards, to both its ETB (Existing To Bank) and NTB (New To Bank) Customers.

Add-on cards wherever eligible shall also be issued. Accordingly, at present, we are issuing

the following variants of Credit Cards:

Card Variant

Aimed for

1. Visa Gold

Low Variant – Mass Segment

2. VISA/Rupay Platinum

Mid Variant – Mid Segment

3. Rupay Select

Higher Variant – Upper Mid Segment

4. VISA Signature

Next Higher Variant - HNI Segment

5. VISA Business Platinum

For Corporates

Any new variant of card introduced by any of our existing associates VISA, Master Card and

NPCI shall be introduced in the Bank with the prior approval of ORMC/CRMC. Any new

agreement with a new agency shall only be with the prior approval of the Board.

The liability of the corporate/business entity on account of business cards shall form part

of their total assessed credits for compliance to instructions issued by the RBI on Exposure

norms as well as Prudential norms on Income Recognition, Asset Classification and

Provisioning pertaining to Advances.

The add-on cards shall be issued only to the persons specifically identified by the principal

cardholder under both personal and business credit card categories. Add-on cards shall be

issued with the clear understanding that the liability will be that of the principal

cardholder.

Similarly, while issuing corporate credit cards, the responsibilities and liabilities of the

corporate and its employees shall be clearly specified. The liability of the

corporate/business entity shall form part of its assessed.

Salient features Our Credit Card products:

1. Credit Cards with VISA affiliation:

a. Visa Gold cards are designed for low income group, they are globally valid with

offers and benefits provided as per VISA Gold standard guidelines, accidental

insurance coverage to the card holder, etc.

b. Visa Platinum card are designed for middle income group, they are globally valid

with offers and benefits provided as per VISA Platinum standard guidelines,

accidental insurance coverage to the card holder, etc.

Credit Card Policy – 2022-23

Page 4 of 52

c. Visa Signature cards are designed for HNI customers, they are globally valid offers

and benefits provided as per VISA Signature standard guidelines, accidental

insurance coverage to the card holder, etc.

2. Credit Cards with Master Card affiliation

Master Cards are designed for middle income group/ HNI Customers. They are globally

valid with offers and benefits provided by Master Card, accidental insurance etc.

3. Rupay Credit Cards in association with NPCI:

a. The RuPay Platinum cards are also globally valid Credit Cards with limited feature

as compared to the Select variant with Complementary accidental insurance

coverage by M/s NPCI.

b. The RuPay Select cards are designed for HNI customers, globally valid and with a

host of value-added benefits like lounge access at airports, complementary

accidental insurance coverage provided by NPCI etc.

4. Common features for all variants:

a. Free credit period ranging from 21-50 days is allowed based on the date of purchase

made.

b. Cash withdrawals through ATMs are allowed, which attract a convenience charge on

the amount withdrawn, along with finance charges at the applicable rate from the

date of withdrawal to the billing date.

c. Cash advance Limit is 40% of card limit for VISA Signature and Rupay Select variants,

30% of card limit sanctioned for VISA Platinum and RuPay Platinum Variants, 20% of

card limit for VISA Gold Variant.

d. No finance charges will be levied on POS/ E-commerce merchandise transactions

even when the roll over facility opted. However, roll over charges are applicable at

the time of billing, if full due amount is not paid.

Detailed features of each of the above card variants along with eligibility criteria for

sanction of each variant are furnished in the Annexure I. These features are subject to

change from time to time based on the guidelines of the card sponsoring company viz. VISA,

Master Card and RuPay.

Credit Card Policy – 2022-23

Page 5 of 52

II. GUIDELINES FOR ISSUANCE OF CREDIT CARDS:

Our Credit Cards are issued to:

1. Individuals [A. Customers, B. Non-Customers]

2. Corporates

1. INDIVIDUALS

A. Customers:

PAN is mandatory for issuance of Credit Cards. Multiple cards can be issued within overall eligible

limit against same PAN.

I. TO CUSTOMERS AGAINST PROOF OF INCOME:

Credit Cards to general public shall be issued only to individuals whose gross annual

income is Rs.1.80 lakhs and above. Generally, up to 20% of the declared annual income

(as per the rating obtained), duly verified is sanctioned as limit for the Credit Card.

While issuing the Cards against Income, the financials of the individual shall be

ascertained through latest salary slips for the last 2 months, Form-16 or income tax

returns for the last 2 years along with computation of income. The income estimation

may also be derived from external data sources (CICs).

If a Customer wants to avail multiple cards either in one variant or other variants, the

same can be sanctioned subject to maximum ceiling as per the overall eligibility

arrived.

Details of limits and eligibility are as per Annexure I.

For issuance of cards in respect of agriculturists and those who are not having tax

returns, the eligibility criteria shall be arrived based on the income certificate issued

by revenue authorities not below the rank of MRO/Tahsildar.

As a part of welcome kit in respect of SB accounts with full KYC compliance, branches

shall sanction Credit Card on the date of account opening itself, on the basis of CIBIL

score and income criteria provided, Income as per IT returns, salary slip and Form-16

are verified.

Request for add-on Credit Cards may be considered and sanctioned within the overall

eligible limit of the primary card i.e., limits of all Credit Cards of a customer should be

within the primary Credit Card limit. Maximum 3 (three) add-on cards for spouse,

children and parents can be availed by the primary cardholder.

Credit Card Policy – 2022-23

Page 6 of 52

II. U-SECURE CREDIT CARDS AGAINST LIEN ON TERM DEPOSITS:

a. Target Group and Purpose:

Bank issues Credit Card based on the security provided in the form of fixed

deposits of our Bank to Individuals. Such card variant is issued based on lien

against Term Deposits. These cards are termed as U-Secure Credit Card. U-

Secure Credit Cards can be of any variant depending on the credit limit. However,

ensuring that the expiry date of the Credit Card is before the maturity date of

the deposit and at any point of time outstanding amount of the Credit Card should

not exceed the outstanding amount of the fixed deposit. Branch/field

functionaries should strictly monitor and follow up repayment of such cards.

These cards, based on lien against Term Deposits, are targeted to fulfill the need

of customers who do not file IT returns/ have lower CIBIL score/ NRI Customers.

No income proof or rating sheet shall be insisted for sanction of U-Secure

Credit Cards against deposits.

b. Eligibility:

Entry Age

Minimum - 18 years;

Credit Card limit

Minimum: Rs. 15,000/- Maximum: No

Upper Limit.

Minimum annual salary / income

Not applicable

i. Limit will be 75% of the Term Deposit or present outstanding balance at the

time of issuance of card whichever is higher, with minimum deposit of

Rs.20,000/- and above.

ii. Minimum left over period of the deposit shall be One year with auto renewal

facility. No loan on the deposit is allowed and cancellation shall be done only

after surrender of the card along with payment of total dues.

iii. U-Secure card will be issued only to the primary account holder of the Term

Deposit. In case the deposit is jointly owned, Credit Card can be issued,

after taking signatures of all the joint holders on the Credit Card

application. Add-on cards can be issued to any of the joint deposit holders

as per their request made in the Credit Card application.

Credit Card Policy – 2022-23

Page 7 of 52

III. CREDIT CARDS TO OUR CUSTOMERS AVAILING LOAN FACILITIES:

a. Target Group and Purpose:

Bank issues Credit Card with limit of Rs. 0.50 Lakh to existing Home/ Mortgage

Loan borrowers with a minimum sanctioned loan amount of Rs.10.00 Lakh with

asset classification of SMA “0” and having adequate security after meeting the

loan component.

b. Eligibility:

Entry Age

Minimum - 18 years; Maximum - 70 years

Credit Card limit

Minimum : Rs. 50,000/- Maximum: Rs. 3,00,000/-

Minimum annual

salary / income

Not applicable

i. After factoring 125% of the security value (as per the latest Engineers

valuation certificate) towards the loan, the value of the balance security

available should cover the card liability and accordingly the card limit

should be assessed.

ii. Issued to existing Home/Mortgage loan borrowers, including NRIs. No limit

enhancement will be considered for these cards.

iii. However, borrowers under the Govt. sponsored schemes are NOT eligible

under this category.

IV. CREDIT CARD TO MSME BORROWERS:

A portion of assessed fund based working capital limit (not exceeding 20%) shall

be issued in the form of a Credit Card to the MSME customer as per the

guidelines issued by MSME Department of the Bank from time to time.

V. CREDIT CARDS TO NRI CUSTOMERS:

a. Target Group and Purpose: Bank issues Credit Card to NRI's against security of

fixed deposit receipts (Domestic deposits and NRE deposits), duly marking lien

on the said deposits with 25% margin on the deposit amount.

b. Eligibility:

Entry Age

Minimum - 18 years; Maximum - 70 years

Credit Card limit

Minimum: Rs. 15,000/-Maximum: No Upper limit

i. In case of Card against Term Deposit, Limit will be 75% of the Term Deposit

or present outstanding balance including accrued interest at the time of

issuance of the card. Minimum left over period of the Term Deposit shall be

One year.

Credit Card Policy – 2022-23

Page 8 of 52

ii. Credit Card to NRI’s will be issued only to the primary account holder of the

Term Deposit. In case the deposit is jointly held, Credit Card can be issued,

after taking signatures of all the joint holders on the Credit Card application.

Add-on cards also can be issued to the joint Term Deposit holders as per their

request on the Credit Card application.

iii. No Loan on the deposit and cancellation of the Term Deposit only after

surrendering the Credit Card, along with payment of total dues.

iv. These Credit Cards can be of any variant as per Bank discretion.

v. The amounts due from such cards shall be settled by inward remittance or

out of the balances held in the cardholder’s FCNR (B)/NRE/NRO Accounts as

directed under RBI Master Circulars from time to time on remittance facilities

for NRI/PIO.

vi. Any changes in the guidelines as and when received from FEMA, RBI,

specifically applicable to NRI/NRO/FCNR etc., shall be incorporated in the

policy.

vii. For sanction of Credit Cards to NRI customers, with deviations and for

ratification of deviation, powers of delegation vests with CAC II.

VI. CREDIT CARDS TO EMPLOYEES OF PSU/STATE GOVERNMENT/OTHER GOVT. INSTITUTIONS:

a. Target Group and Purpose:

Bank issues Credit Card to employees of PSU/State Government/other Govt.

Institutions as per the following criteria:

i. Salary of the employee should be credited in the salary account maintained

with our Bank. Cards to be issued to those employees where salary is being

credited in the branches for more than 3 months and above.

ii. The CIBIL score should not be less than 650.

iii. Auto debit to salary account is mandatory.

iv. Card issued will be preferably RuPay Credit Cards.

b. Eligibility:

Age (Salaried)

Minimum - 18 years; Maximum - 65 years

CIBIL Score

650 & above.

Credit Card limit

Maximum: up to 20% of Gross annual income

( based on the rating obtained)

Minimum annual

salary / income

Rs. 1.80 Lakhs per annum

Credit Card Policy – 2022-23

Page 9 of 52

VII. CREDIT CARDS BASED ON AVERAGE BALANCE IN SB ACCOUNTS:

a. Target Group and Purpose:

Savings Bank account holders of our Bank who are maintaining an average

minimum balance of Rs.50,000/- and above for the last 12 months are eligible

for availing Credit Cards.SB Accounts under Govt. Schemes like PMJDY, etc.

are not eligible.

b. Eligibility:

Credit Card Limit is sanctioned as per average balance as mentioned in the

following table.

Daily Minimum Balance

Limit to be sanctioned

Rs. 50,000 and above but less than Rs. 1,00,000

Rs. 25,000/-

Rs. 1,00,000 and above but less than Rs. 2,00,000

Rs. 50,000/-

Rs.2,00,000 and above

Rs. 1,00,000/-

Minimum annual income/ salary is not applicable. VISA Gold or VISA/ RuPay

Platinum card is issued depending on the card limit.

Branches shall issue Credit Cards for full KYC Compliant SB accounts with

relationship of more than 12 months through system, adhering to above

guidelines only.

VIII. PRE-APPROVED CREDIT CARDS (PACC) TO ETB( EXISTING TO BANK) CUSTOMERS

Bank shall issue PACC Cards to the Asset and Liability customer categories

basing on a predefined Business Rule Engine (BRE) under the respective

categories with a specified limit, as decided by the Bank from time to time.

These customers shall be on-boarded through Digital mode duly scrubbing the

details with CICs.

B. CREDIT CARDS TO NTB (NEW TO BANK) CUSTOMERS:

a. Target Group and Purpose:

To expand our Credit Card base, Bank shall issue Credit Card (including PACCs) to

New To Bank (NTB) Customers also. The basic criteria mentioned hereunder are to

be precisely complied with:

➢ Income Proof along with KYC Documents.

➢ CIBIL Score of 700 and above.

Credit Card Policy – 2022-23

Page 10 of 52

➢ Point of verification report from the Branch/ recovery agents has to be

obtained at the place of applicant’s residence/business address, for easy

recovery and follow-up of Credit Card dues.

➢ One year account statement where the prospective card holder is

maintaining the account.

➢ Possibility of opening an account with our Bank to be explored.

b. Eligibility:

Entry Age (Salaried)

Minimum - 18 years; Maximum - 65 years

Entry Age (Others)

Minimum - 18 years; Maximum - 70 years

Credit Card limit

Up to 20% of the Gross annual income (based on

the rating obtained.

Minimum card Limit: Rs. 10,000/-

Maximum card Limit: No Upper limit.

Minimum annual

salary / income

Rs. 1.80 Lakhs per annum

NTB Customers shall be on-boarded through digital mode also duly scrubbing PAN, Aadhar,

Credit Score and income proof.

COMPLIMENTARY CREDIT CARDS:

Bank shall also issue complimentary Credit Cards to individuals having regards to their status

in the society on selective basis and the power to sanction such cards shall remain with Credit

Card & MAB Department.

Cards shall also be issued under any specific deposit / loan scheme or product launched by

the Bank as per the terms and conditions set out in the said scheme or product.

IV. GENERAL PROVISIONS FOR SANCTION OF CREDIT CARDS:

The instructions/guidelines on KYC/AML/CFT applicable to Banks, issued by RBI from time to

time, shall be adhered to in respect of all cards issued, including co-branded, corporate and

on add-on cards.

The applicant’s age, financial position, proven income, business profile, employment,

residential/social status, etc. shall also be taken into consideration while sanctioning a card

or for arriving at the limit to be sanctioned.

Credit risk shall be assessed while issuing Credit Cards, and shall be issued with a specific

card limit, commensurate with the financial standing, credit worthiness, business relation of

the applicant with the Bank and repayment capacity of the applicant.

Credit Card Policy – 2022-23

Page 11 of 52

The issuance of the cards is subject to satisfactory CIBIL score. The minimum CIBIL score

required for issuance of Credit Card is 700. However, CIBIL score of -1, which means no credit

history is available with Credit Information Companies(CIC), is also eligible for issuing Credit

Card with enhanced due diligence. Sanction of Credit Cards to the borrowers having CIBIL

score of -1 is vested with higher authorities. However, for issuance of cards to PSU/State

Government/other Govt. employees whose salary is being credited at our branches, minimum

CIBIL score required is 650.

Delegated authority can decide Credit Card limit of applicants as per eligibility norms and

scoring model in the application and calculate the Credit Card limit up to 20% of the gross

annual income based on latest ITR.

Add on card shall be issued to the spouse/ children/ parents of the primary cardholder by

obtaining add-on application from the primary cardholder with a specific clause that the

liability of add-on cards shall be on principal cardholder. Customer ID shall be created for all

add-on card holders after obtaining full KYC documents. The add-on cardholders should also

fulfill the age criteria for issuing Credit Card. Maximum of 3 add-on cards can be issued to

the primary card. However, the overall limit of all the cards shall be within the eligible card

limit.

Bank shall block a lost card immediately on being informed by the cardholder and

formalities, if any, can follow within a reasonable period of 3 days.

Bank shall immediately send a confirmation to the cardholder subsequent to the blocking

of a card.

Bank shall not dispatch a card to a customer unsolicited, except in the case where the card

is a replacement/renewal of a card already held by the customer.

In case a card is blocked at the request of the customer, replacement card in lieu of the

blocked card shall be issued with the explicit consent of the customer.

Further, bank shall obtain explicit consent of the cardholder prior to the renewal of an

existing card.

Any information regarding discounts, cashbacks, reward points, loyalty points or any other

benefits offered by the bank shall be displayed on the bank’s website issuer and a copy of

the same shall also be provided to the cardholder

In case of an insurance cover provided with a card, bank shall ensure that the relevant

nomination details are recorded by the Insurance Company and the availability of insurance

is included, along with other information, in every statement. The information shall also

include the details regarding the insurance cover, name/address and telephone number of

the Insurance Company which will handle the claims relating to the insurance

Credit Card Policy – 2022-23

Page 12 of 52

OTHER IMPORTANT PROVISIONS:

o As per RBI guidelines, by default all Credit Cards, though issued with global validity, shall be

activated for domestic usage only. However, cardholder can activate the international usage

by Logging in to Credit Card portal or through mobile application (U-mobile or Union Credit

Card). Alternately, cardholder can send request email to Credit Card & MAB Department to

enable international usage in their Credit Card.

o Cash advance Limit is 40% of card limit for VISA Signature and RuPay Select variants and 30%

of the card limit sanctioned for VISA/ RuPay Platinum, 20% of card Limit for VISA Gold

Variant.

o Card limit is subject to revision based on the track record of the cardholder.

o At any time, Bank shall NOT issue any unsolicited cards or allow any enhancement of Limit

or sanction without specific consent of the card holder.

o Whenever the card applications are rejected, the Bank shall inform with reason for such

rejection.

o Bank shall process and sanction the cards to its customers through CBS and also through

digital mode.

CUSTOMER ACQUISITION

1. Conveying reasons in-writing about Rejection of application:

i. In case of sanctions through CCARD Menu, Branches to communicate reason for

rejection in writing.

ii. In case of STP application, a page containing Rejection, MITC, copy of agreement

in PDF format [downloadable] will be made available

iii. In case of PACC, MITC & agreement will be sent over email

2. Sending of MITC & copy of agreement between bank & Cardholder to his regd. email /

postal address as per choice of customer will be provided against acknowledgement.

3. In case of applications through STP, consent of the applicant for Annual Insurance [as Y

/ N] and details of Nominee such as Name of nominee, Age, Relation shall be obtained

on-line

4. Cards shall be issued only on request of customer and any upgradation shall be with the

consent of the customer.

5. For activation of cards, customers are empowered via App, SMS to dedicated number or

from Regd. Email ID.

6. For the cards which are not activated for more than 30 days from the date of issuance

Credit Card Policy – 2022-23

Page 13 of 52

of cards, SMS link will be provided for activation of cards. Based on OTP shared by

cardholder for activation of cards, Cards will be activated. If OTP is not received within

7 working days from the date of link shared, such cards will be de-activated [To be

implemented with effect from 01-10-2022].

7. For renewal/replacement cards, on payment of applicable dues, cards will be de-

activated if no consent is received within 7 days from the OTP based consent sent via

SMS for activation of the cards.

8. In case of new cards, AMC/Insurance premium if any, will be recovered after activation

of the cards.

9. For inactivated cards, the Bank will withdraw all information shared with CIC within 30

days from the effective date of RBI directions. Charges if any levied to these inactivated

cards till date will be absorbed in P & L.

10. Bank will intimate Department of Regulation, RBI in case of obtention of consent through

any alternative digital modes.

11. Role of DSA/DMA or other Agents will be limited to soliciting / servicing the customer /

account and not the power for issuance of cards.

12. Tele-callers shall contact only between 10.00 and 19.00 hrs

Underwriting Standards

• Bank will assess credit risk taking into account independent financial means of

applicants viz., Risk scoring matrix, CIBIL site verification, ITR verification, EPFO, Bank

statement, Salary statement or any other correct means etc as necessitated from time

to time depending on the mode of on-boarding customers.

• Bank will obtain total card limits enjoyed by the applicant from Credit Information

companies [CIC] / Self-declaration as the case may be for sanctioning new card or

enhancement of existing limit which should not cross beyond 75% of total Gross income

of the last FY. Our application form should contain total card limit from industry which

will be verified with CICs.

b. Limit Enhancement:

• Normally limit will be enhanced on the basis of income as per ITR/Salary Slip, at the

request of the card holder.

• Limit can be enhanced without submission of any income documents depending upon the

card usage (minimum card usage of 75% of the present Card limit) and prompt repayment

pattern during the past 12 months period (SMA0 and SMA1 Category) and CIBIL SCORE of

the card holder up to a maximum of 25% of the card limit on yearly basis by duly taking

the consent through SMS. However, Re-KYC and obtention of income proof should be done

once in three years.

Credit Card Policy – 2022-23

Page 14 of 52

• Limit can also be enhanced on temporary basis (adhoc basis) under exceptional cases at

the request of the card holder for a period of not more than three billing cycles in a year

and with a maximum limit of Rs. 2.00 lakhs.

V. Benefits and Offers:

a. Airport Lounge:

Free airport lounge access to the cardholders at selected airports will be available, as

provided by respective card networks (VISA/Rupay/Master Card). The terms and

conditions are applicable as laid down and updated by card network from time to

time.

b. Reward Points:

Reward Points program is applicable on usage of all individual Credit Cards for all

merchant transactions from time to time with the following features:

• Reward Points are allotted only on successful merchant transactions (PoS/E-COM)

after settlement of funds.

• Cardholder will earn 1 reward point for every Rs. 100 spent using Gold variant, 2

points for every Rs.100 spent on Platinum Variants and 4 points for every Rs.100

spent using Signature/ Select card variants.

• Value of each point shall be Rs. 0.25 for redemption. Reward point facility and the

conversion price may vary from time-to-time.

• However, the following are not eligible for reward program:

➢ Cash withdrawals from ATMs/ Cash at PoS.

➢ Purchase of fuel at fuel stations.

➢ If card is NPA, reward points stands cancelled.

• Corporate cards are not eligible for the program.

• Bank may introduce new Credit Card products which offers variable reward points

on Credit Card spends based on merchant category (MCC) or cost benefit analysis

to improve the card usage and customer experience.

• Bank can decide on the reward points for spends at various merchants irrespective

of card variant based on card proposition and cost benefit analysis. However, Bank

may restrict/enhance this facility to any of the Credit Card variants based on Credit

Card features/proposition.

• Validity of reward points shall be for 1 year.

Credit Card Policy – 2022-23

Page 15 of 52

• Redemption of reward points through cash back is available to customers. At the

option of the Credit Card holder, Reward points will be redeemed and credited to

Card Account at monthly intervals at the time of billing.

• Bank may also facilitate reward point redemption through Nth rewards of NPCI.

Redemption through other modes can be facilitated by the Bank based on the card

proposition/features.

• Minimum points required for redemption are as follows:

Card Variant

Minimum Reward

Points

Gold

500

Platinum

750

Signature/ Select

1000

The remaining points after redemption will be carried forward. Reward points on

spends per variant will be reviewed on every year.

c. Fuel surcharge reimbursement:

Fuel surcharge shall be reimbursed @ 1% with maximum of ₹100/- per card per billing

cycle. However, Bank may restrict/enhance this facility to any of the Credit Card

variants based on Credit Card features/proposition.

d. Personal Accidental Insurance:

Cardholders are covered under Personal accidental insurance package in case of

death by accident. The premium payable for the insurance cover is borne by the

card holder. Bank takes insurance policy which is valid for one year from January

to December, on the lowest premium per card as such insurance agencies may be

changed from time to time. The insurance coverage and premium rates will be as

decided by the Bank. Exercising of option for opting of insurance coverage shall

be given to the card holders.

Sum Insured for the different card variants.

S.

No.

Variant

Rs. (Sum

insured)

Insurance Company

1

VISA Gold

5,00,000

New India Assurance Company Ltd,

Regd & Head Office: New India

Assurance Bldg,. 87 MG Road, Fort,

Mumbai-400001

Toll Free No: 18002091415

2

VISA Platinum/Rupay Platinum

10,00,000

3

VISA Signature/RuPay Select

30,00,000

*The same benefit would be available for Add-on card holders if the Primary Card holder

exercises the option for add-on card holders also.

Credit Card Policy – 2022-23

Page 16 of 52

For the RuPay Card variants, NPCI is offering following free accidental death

coverage as follows:

Card Type

*Accidental death coverage

Rs. in lakhs

Insurance Company details

Rupay

Platinum

Card

Rs. 2.00 (Premium Borne by

NPCI for primary and add on

cards)

TATA-AIG General

Insurance Co. Ltd,

A-501, 5

th

floor, Bldg No-4,

Infinity Part, Dindoshi, Malad

[East] Mumbai-400097

Email:

[email protected]rg.in

Rupay

Select Card

Rs. 10.00 (Premium Borne by

NPCI for primary and add on

cards )

Additional Rs. 30.00 ( Premium

Borne by Card Holder)

UNI

CARBON

Rs. 10.00 (Premium Borne by

NPCI)

Additional Rs. 10.00 Lakhs

(Premium Borne by Card

Holder)

INSURANCE YEAR:

The common insurance year is January to December at present.

In addition to the above, as a good gesture, Bank will be bearing the cost of the

insurance premium as mentioned below.

ii. PURCHASE PROTECTION FOR VISA/RUPAY CREDIT CARDS:

Any durable goods of value of Rs.1,000/- or more purchased through Credit Cards

would be insured against damage or loss due to fire or theft. The cover shall be

valid for 60 days from the date of purchase, subject to production of invoice in

favor of the cardholder and the maximum value of cover shall be Rs.50,000/-. If

sellers of the goods offers warranty/extended warranty, this Purchase protection

is not applicable.

In case of non-availability of such warranty or in case of theft, the Purchase

protection is made available subject to maximum value of cover of Rs.50,000/-

or price of the product whichever is lower and the cover will be valid for sixty

days from the date of purchase. It is offered by Bank as an additional facility to

Credit Card holders.

How to use purchase protection.

i) Cardholder has to submit the necessary invoice duly showcasing the purchase

through Bank’s Credit Card along with Credit Card statement.

Credit Card Policy – 2022-23

Page 17 of 52

ii) If Cardholder has a primary insurance policy covering the item, he must file

a claim before approaching the Bank for purchase protection and produce copy

of such claim.

iii) FIR copy (for theft).

iv) A copy of the claim settlement/rejection from the Customer’s primary

insurance company, if applicable.

v) A copy of primary insurance declaration page, if applicable.

vi) Any other documentation needed to substantiate claim.

vii) The cover is valid for 60 days from the date of purchase of the goods.

i. Credit Shield for VISA/RUPAY Credit Cards:

Credit shield enables the cardholder to cover the outstanding balance in the card

against accidental death and disability. The enrollment process is simple, and no

medical checkup is required.

The insurance cover would be restricted to a maximum of Rs.50,000/- in the

event of death, accident leading to loss of employment arising out of permanent

total disability.

ii. Lost Card Insurance:

Lost card insurance for liability outstanding up to Rs.1,50,000/-.

Insurance premium:

Bank, from time to time, will be deciding the Insurance premium duly following

the laid down procedures.

Eligibility Criteria for lodging Insurance Claim for accidental death of the card

holder:

• The accidental death is to be reported within 60 days from the date of

death.

• Insurance is covered for accidental death only.

• The last transaction of the Rupay Credit Card should have been done at

least once within 45 days before the date of death.

• The last transaction of the VISA Credit Card should have been done at least

one in 180 days before the date of death.

e. Offers:

Any offers presented by the card networks (VISA/ Master Card/RuPay) will be

passed on to the cardholders.

Credit Card Policy – 2022-23

Page 18 of 52

F. OTHER VALUE ADDED SERVICES:

Bank shall continuously strive for value addition to our existing and prospective

cardholders. As of now, following facilities /benefits have been provided to the

card holders for a carrying out hassle free transactions in a safe and secured

environment.

a. SMS/IVRS based services viz., balance enquiry, card activation, OTP for

generation of pin through ATMs, Lost card marking in case of card lost, and

request for replacement of lost card, enabling/ disabling international

transactions, etc.

b. EMI facility.

c. Virtual card facility for online transactions.

d. Credit Card portal for card holder’s convenience.

e. Credit Card mobile app (Android and IOS version) with card control and second

factor authentication facility.

f. E-mandate facility as per guidelines in force.

Bank shall endeavor to introduce utility payment options, card to card (C2C) balance

transfer, arrange special discounts or freebies from agencies with reputed market brands

or any other value additions to the cardholders. It shall endeavor to provide technically

advanced products, facilities and related services to the cardholders, in tune with the

card industry and in association with Card Networks.

VI. Closure of Credit Card:

• For closure of credit cards, Bank will endeavor to provide access to various channels

such as IVR, App, dedicated email to Cardholder for closure of card including link in

website.

• Credit cards not used for more than a year; an e-mail/SMS will be sent to close the card.

Before closing such cards, dues if any shall be recovered.

• Card closure details will be updated with CIC within a period of 30 days from date of

closure

• After closure of card, any credit balance will be transferred to CH’s bank account for

which account details will be obtained.

• In case of card issuance to NTB customers, account number & IFSC details will be

captured in Application form or while on-boarding through digital process.

VII. Issue of Unsolicited facilities

• Unsolicited loans or other credit facilities shall not be offered to the credit cardholders

without seeking explicit consent.

• Bank shall not unilaterally upgrade credit cards and enhance credit limits. Explicit

consent of the cardholder shall invariably be taken whenever there is/are any change/s

in terms and conditions (To be implemented with effect from 01-10-2022).

• In case of reduction in the credit limit, the card-issuer shall intimate the same to the

cardholder.

Credit Card Policy – 2022-23

Page 19 of 52

CORPORATE CREDIT CARDS:

i. Customer - Corporates:

a. Target Group and Purpose:

Bank issues “corporate Credit Card” to companies having excellent track record. The

primary corporate card will be in the name of the company and it will NOT be a physical

card but will be for the purpose of account creation only. These cards are issued to the

company executives as add-on cards only to the primary corporate card and in the

name of company executives.

b. Eligibility:

• . Companies having excellent track record with tangible net worth of minimum Rs.

1.00 Crore and consistent profits for the last 3 years.

• Credit Card Limit: Rs. 1.00 Lakh and above

• Overall spending limit will be 2% of the tangible net worth, with a minimum of Rs.

1.00 Lakh

• Board Resolution: Bank will obtain Board Resolution (Wherever applicable)

mentioning the name and details of the executives whom cards will be issued.

• KYC details of these executives will be obtained.

• No cash withdrawals are permitted.

• Bill will be raised on the company and debited to company's account.

• Auto-debit for bill payment is mandatory.

• The Corporate Credit Card limit will be sanctioned by respective delegated

authority.

• Multiple individual cards can be issued in the names of different officials/Executives

of the corporate with different sub-limits as per their requirements. However, within

the total (overall) corporate Credit Card limit sanctioned. The aggregate limit for all

cards issued on behalf of the corporate shall not exceed 25% of the company's net

worth or Rs. 5.00 Crores whichever is lower.

• VISA Business Platinum card variant will be issued for corporate cards where no

reward points/ no insurance coverage is available.

ii. Eligibility Criteria for New to Bank (NTB)Corporates:

Companies availing credit facilities with Banks or Development Finance Institutions are

only eligible for corporate Credit Cards duly following the guidelines:

a) When 100% liquid security is offered as guarantee by way of lien on deposits/

Government securities for issue of Corporate Credit Cards. The limits sanctioned

are to the extent of 75% of security notwithstanding the norms as to the net worth.

Credit Card Policy – 2022-23

Page 20 of 52

b) New To Bank (NTB) Corporates are required to produce status report on their

account dealings with their financing Banks/Development Finance Institution,

etc., along with the application.

c) Net worth of the company applying for corporate Credit Cards shall be minimum

of Rs.1.00 Crore. The net worth is to be arrived at on the same basis adopted by

our Bank in credit appraisals.

d) The aggregate limit under various cards issued to a company should not exceed

25% of its net worth subjective to a maximum of Rs.5.00 Crores.

iii. Renewal of Corporate Credit Cards:

Bank will review the financials of the company and communicate their sanction once in

a year. The review shall be based on the latest available financial statements. Bank

will communicate latest net worth of the company and the card limit sanctioned to

the company. Credit Card & MAB Department shall consider renewal of cards based on

the past performance of each card and within the renewed limit recommended and

sanctioned by Branch/RO/FGMO.

iv. Others:

• Payment of company’s aggregate corporate card dues should be made by debit to

the operating account of the company by the branch, irrespective of the status of

the account.

Roll over facility is not available to the corporate cards.

• All charges as applicable for other Card Variants are applicable to Corporate cards

also, except admission/joining fees shall be Rs. 1,500/- and annual charges shall be

Rs. 2,000/- per card.

• All facilities available for other card variants are also applicable to corporate cards.

• Hot listing of cards and NPA classification is done based on the performance of

individual card but not as a group.

• Declaration cum undertaking by the company and employees as per the format

provided in the application is to be signed by authorized signatory of the company

and employee in whose name the card is applied and also whenever additional cards

are applied for. This undertaking is obtained with the joint signatures of the

company and the employees.

• Company’s Board Resolution is required, wherever applicable as per format

provided in the application.

• Regional Offices shall send process and sanction note along with application and

other documents to Credit Card department for onward processing and for issuance

of cards.

Credit Card Policy – 2022-23

Page 21 of 52

• Regional Offices/Branches to note that this is also a credit facility and to be treated

on par with other credit facilities sanctioned to the corporate and assessed the

eligibility accordingly. Further, irrespective of the status of the borrower account,

the card dues, in case of slippage to NPA, to be debited to the borrower account.

CO-BRANDED/CO-BATCHING/ AFFINITY CARDS:

Credit Card & MAB Department shall explore the opportunities for identifying suitable public

sector, private sector, co-operative Banks, and reputed institutions/ organizations or

Government or Government bodies, associations as partners for joint venture to issue co-

branded Credit Cards, as per RBI guidelines.

Credit Card & MAB Department shall also expand the card base through specific groups

having general Banking and credit relationship with the Bank by issuing customized affinity

cards and also by sponsoring BIN to FinTechs, duly adhering to extant guidelines.

The co-branded credit card shall explicitly indicate that the card has been issued under a

co-branding arrangement.

The co-branding partner shall not advertise/market the co-branded card as its own product.

In all marketing/advertising material, the name of bank shall be clearly shown

The co-branded card shall prominently bear the branding of the bank.

The information relating to revenue sharing between the card-issuer and the co- branding

partner entity shall be indicated to the cardholder and also displayed on the website of the

card-issuer.

Bank shall ensure that in cases where the proposed co-branding partner is a financial entity,

it has obtained necessary approvals from its regulator for entering into the co-branding

arrangement.

The co-branding partner shall not have access to information relating to transactions

undertaken through the co-branded card. Post issuance of the card, the co-branding partner

shall not be involved in any of the processes or the controls relating to the co- branded card

except for being the initial point of contact in case of grievances.

Credit Card Policy – 2022-23

Page 22 of 52

CREDIT CARD MOBILE APPLICATION (ANDROID & IOS):

It is a Value-added service that offers the card holders to have a complete control of their

Credit Card. Card holders can manage the usage of all their Credit Cards from mobile

application. Card holders need to install the application in their smart phone and enter the

card details on the mobile app which will enable them to manage the card. The basic

facilities provided to the Credit Card holders through the App are as under:

➢ Account Summary

➢ Statement Summary (view and download for last 12 months)

➢ Transaction details (Billed and unbilled)

➢ Card control facility with the option to enable the channels like ATM, PoS, E-

commerce, Temporary card blocking, set spending limits, etc.

➢ PIN generation

➢ Virtual Card

➢ Scan and Pay (Bharat QR Payments)

➢ Service request for card blocking, duplicate statement through mail, EMI creation,

Card Replacement, Application for Add on Card, Application for new card through

Pre-login page, Enabling/Disabling accidental Insurance Coverage etc.

➢ Enable/ disable international transactions.

➢ SMS notification alert.

➢ Second Factor Authentication channel setting through online or SMS.

The above features allow cardholder to make these changes instantly using their

registered mobile on real time basis.

BILLING & ACCOUNT MAINTENANCE INCLUDING INTEREST RATES AND OTHER CHARGES:

The following procedure for billing and maintenance of card transactions shall be followed

and any changes in the process shall be done with the approval of General Manager- Credit

Card & MAB Department.

Monthly bills shall be prepared by the Service Provider on 25

th

of every month after the

billing date showing the summary of the transactions in the card account as on the 25

th

of

previous month to 24

th

of present month

• E-statement will be sent to all the cardholders on their registered email ID, in a

password protected mode, using the details known only to the card holder.

• Physical copy of the bill will be sent to those card holders whose email ID is not available

in the Bank record.

• SMS alert will also be sent to the card holder on their registered mobile number informing

the billing amount and due date. Reminder SMS will also be sent before due date.

• To minimize the complaints of non-receipt of statements, branches are being provided

with access to CCMS Portal where Branch can download the Card Statements at Branch

Credit Card Policy – 2022-23

Page 23 of 52

level. This facility empowers the branches to download and print at branch level or email

the statements to customer in their registered email ID or any alternate email ID as

requested by the card holders.

• The bills shall be dispatched to card holders in the last week of every month, through

Mass Mailing System of Department of Posts / Speed Post or any other approved courier

service.

• Any changes in the billing date or due date, providing for more than one cycle of billing

for the convenience of the customers or easing the workload at department shall be

considered after due approvals from the General Manager - Credit Card & MAB

Department duly informing card holders well in advance.

Interest rates and other charges

i. Bank shall publicize through website the interest rates charged to various categories of

customers as part of MITC

ii. Bank shall indicate upfront to the card holder [as part of MITC], the methodology of

calculation of finance charges with illustrative examples, particularly in situations

where only a part of the amount outstanding is paid by the customer

iii. Bank shall quote APR for all types of payments with clear example on partial payment

cases i.e. Cash, Late payment etc in Welcome Kit.

iv. MPD i.e. 5% of total outstanding amount will be shown separately. MPD cannot be paid

through EMI.

v. For the unpaid amounts of previous billings, interest free credit period shall not be

available.

vi. These will be captured in billing statements, with clear example will also be captured

in Welcome kit & placed in bank’s website.

Billing / Account Maintenance and Interest and other charges

i. Bank shall ensure that there is no delay in sending/dispatching/ emailing

bills/statements and the customer has sufficient number of days [at least one fortnight]

for making payment before the interest starts getting charged.

ii. Bank shall send a link by mail/SMS. By clicking on the link Bill statement can be

downloaded by cardholder.

iii. Bank shall ensure that wrong bills are not raised and issued to cardholders. In case, a

cardholder protests any bill, the card-issuer shall provide explanation and, wherever

applicable, documentary evidence shall be provided to the cardholder within a

maximum period of 30 days from the date of complaint

iv. No charges shall be levied on transactions disputed as ‘fraud’ by the cardholder until

the dispute is resolved.

v. Card-issuers do not follow a standard billing cycle for all credit cards issued. In order to

provide flexibility in this regard, cardholders shall be provided a one-time option to

modify the billing cycle of the credit card as per their convenience

vi. Any credit amount arising out of refund/failed/reversed transactions or similar

transactions before the due date of payment for which payment has not been made by

the cardholder, shall be immediately adjusted against the ‘payment due’ and notified to

the cardholder.

Credit Card Policy – 2022-23

Page 24 of 52

vii. Bank shall seek explicit consent of the cardholder to adjust credit amount beyond a cut-

off, one percent of the credit limit or ₹5000, whichever is lower, arising out of

refund/failed/reversed transactions or similar transactions against the credit limit for

which payment has already been made by the cardholder. The consent shall be obtained

through e-mail or SMS within seven days of the credit transaction. The card-issuers shall

reverse the credit transaction to the cardholder’s bank account, if no consent/response

is received from the cardholder.

viii. Notwithstanding the cut-off, if a cardholder makes a request to bank for reversal of the

credit amount outstanding in the card account into his/her bank account, the card-issuer

shall do it within three working days from the receipt of such request.

ix. Bank shall report a credit card account as ‘past due’ to CIC or levy penal charges, viz.

late payment charges and other related charges, if any, only when a credit card account

remains 'past due' for more than 3 days.

x. Changes in charges shall be communicated with 30 days notice period, in case customer

does not agree on payment of all dues, cardholder will be permitted to close without

levying any extra charge.

xi. No Capitalization unpaid charges / levies/taxes for charging/ compounding of interest

(To be implemented with effect from 01-10-2022).

Payment of Bill:

Due date for payment of Bill shall be 14

th

or 15

th

of the succeeding month of bill generation

or any other date as approved by General Manager - Credit Card & MAB Department

adhering up to 50 days interest free credit period. However as per RBI Circular No RBI/2015-

16/126 DBR No.BP.BC.30/241.04.048/2015-16 dated 16.7.2015, Bank shall report Credit

Card account as “Demand Past Due” to Credit Information Companies (CIC) or levy penal

charges Viz. late payment charges, if any, only when a Credit Card account remains past

due for more than three days.

The number of days past due and late payment charges shall however be computed from

the payment due date mentioned in the Credit Card statement. The cardholders shall be

given the options to pay either the entire amount of card dues or Minimum Payment Due

(MPD) or any amount between MPD and the total dues.

Minimum payment due will be 5% of the outstanding if the card holder does not have any

previous unpaid dues. The minimum due calculation will be as under:

Minimum due = All previous unpaid minimum dues + 5% of the current outstanding + Over

limit amount (if any) + EMI amount (if opted)

When Minimum Payment Dues or any amount between MPD and total dues are paid, service

charges (interest) at the specified rates are levied.

To encourage cardholders for better utilization of their card limits by opting Roll over

facility and for revenue generation to the Department, the monthly service charges shall

be kept at competitive rates.

1. Presently the service charges as approved at the rate of 2.50% per month, if Minimum

Payment Dues (MPD) is paid before due date.

Credit Card Policy – 2022-23

Page 25 of 52

2. If MPD is not paid by the cardholder before the due date, a service charge at 2.95% per

month shall be charged on the total outstanding and a late payment fee at specified rate

shall also be levied.

Goods and Service Tax (GST) will be applicable on the Banking services availed.

The monthly bill statement shall have a notice of “Making only minimum payment every

month would result in the repayment stretching over long periods with consequent

interest payment on your outstanding balance”, so as to caution the customers about the

implication in paying only minimum amount due.

The card holder will have the following options to make Payment:

➢ Pay by cash/ by transfer from Union Bank of India account at any of the branches

through CBS.

➢ Deposit cheque favouring card number in any of the Union Bank branches.

➢ Issue standing instruction or Auto debit* of the account on due date.

➢ Through Mobile Banking and Internet Banking.

➢ Make online payment from any Bank account by NEFT/IMPS/ UPI modules etc.

➢ Payment through PG services from other Bank accounts.

Auto Debit: Standing Instruction is mandatory for all the cardholders who hold Bank

account with the Union Bank of India. However, cardholder can opt for either MPD or

total amount outstanding.

EMI Facility:

In order to facilitate card holders, to conveniently repay the card dues and to provide a

competitive edge to our Credit Card product, for its increasing usage for high value

merchant transactions, an option to make payments in Equated Monthly Installments

(EMIs) shall be made available to the Cardholders.

Accordingly, an EMI facility with the following salient features, as approved is in vogue.

1. Merchant transactions of Rs.5,000/- and above, except the under mentioned are

eligible for EMI facility. Transactions less than Rs.5,000/-cannot be combined.

a. Cash withdrawal through ATM and Cash @ PoS

b. Transactions done at Bars.

c. Transaction made for Jewellery Purchases.

d. Amount spent through card on purchase of fuel at petrol pumps.

2. The EMI repayment period shall be 3/6/9/12 months as per convenience of the

cardholder with Rate of Interest at 16% per annum under reducing balances.

3. One-time processing charges of 2% of transaction amount subject to a Minimum of

Rs.200/- and a maximum of Rs.1,000/- shall be levied on the card, for each EMI request

registered.

4. Interest shall be charged at the prescribed rate presently 16% per annum on reduced

balances.

Credit Card Policy – 2022-23

Page 26 of 52

5. Pre-closure charges shall be levied at 2% of the outstanding amount under EMI still not

due.

6. The monthly billing will include the amount spent during the month and the installment

under EMI, falling due in the month.

Conversion of total outstanding balance of the card to 3/6/9/12 EMIs may be considered

as one-time facility on selective basis, where there is no default in the card till date and

card is been used for more than one year. However, for NPA cards, on case-to-case basis,

restructuring guidelines of the Bank to be followed.

Procedure for availing EMI facility and maintenance:

On a successful completion of an eligible transaction, an automated SMS will be sent on

the registered mobile number of the card holder, informing the EMI facility being

available for the transaction. Upon receipt of SMS, cardholder can convert the transaction

into 3/6/9/12 EMI, either through Credit Card mobile app or can call Toll free number

and register EMI Request for eligible transactions.

Customers can avail the EMI facilities if provided by the Bank both Online/Offline at the

time of transaction.

Once registered, the EMI schedule will commence from subsequent Billing cycle,

depending on number of EMIs opted by card holder. General Manager - Credit Card & MAB

Department shall have the delegated powers to make any changes in the procedure and

operative guidelines of the EMI scheme.

Post Billing Monitoring:

If current month bill is not paid by a cardholder by due date, soft tele-follow up shall be

made and the cardholder shall be reminded to make the payment.

In addition to the random check on the genuineness of merchant transactions, all high

volume transactions or exceptional transactions in higher limit card accounts may be

monitored on daily basis during the first month of operations or for unusual transactions

and any suspicious transactions shall be verified and cross checked with the cardholder. In

the event of any transaction, which was not authorized by the cardholder and any

fraudulent usage is observed; further usage of the card shall be blocked immediately. A

replacement card with a new card number shall be sent to the cardholder on receipt of

confirmation from the cardholder.

Fair Practices in Debt Collection:

A model code of conduct for recovery agencies with the following provisions shall be put in

place.

Credit Card Policy – 2022-23

Page 27 of 52

• The Recovery agents are advised to adhere to the extant guidelines on fair practices

code while dealing with the cardholders for collection of card dues and also ensure the

BCSBI code of Bank’s commitment to customers.

• Recovery agencies are advised to adhere to the code of conduct and are strictly

instructed not to indulge in any unfair practices and shall not resort to intimidation or

harassment of any cardholder, while dealing with cardholders for collection of card

dues.

• The Recovery agents are advised to refrain from action that could damage the integrity

and reputation of the Bank and that they observe strict customer confidentiality.

• Recovery agents carry the identification card issued by Bank and shall not adopt

uncivilized, unlawful and questionable behavior on recovery process causing reputation

loss to the Bank.

• Any complaints from the cardholders against Bank or recovery agents, related with

Recovery of dues shall be dealt appropriately.

• All communications issued by Recovery agents must contain the Name, email-id,

telephone number and address of the concerned Senior officer of the bank whom the

customer can contact.

• Further, bank shall provide the name and contact details of the recovery agent to the

cardholder immediately upon assigning the agent to the cardholder.

• Bank shall ensure that the DSAs/DMAs/Recovery Agents do not transfer or misuse any

customer information during marketing of credit card products.

• Bank shall have a system of random checks and mystery shopping to ensure that their

agents have been properly briefed and trained as to how to handle customers and are

also aware of their responsibilities, particularly with regard to soliciting customers,

hours for calling, privacy of customer information, conveying the correct terms and

conditions of the product on offer.

• A dedicated helpline and email-id shall be made available to the cardholders to raise

complaints against any act of mis-selling or harassment by the representative/Recovery

Agents of the bank

Cardholder Services and Grievance Redressal:

Bank shall put in place a Grievance Redressal Mechanism within the card issuing entity and

give wide publicity about it through electronic and print media as required. The name, direct

contact number, email-id and postal address of the designated grievance redressal officer of

the bank is being mentioned on the credit card bills and account statements.

The designated officer shall ensure that grievances of cardholders are redressed promptly

without any delay.

The grievance redressal procedure and the Board approved policy shall be displayed on the

website of the card-issuer with a clearly visible link on the homepage.

Credit Card Policy – 2022-23

Page 28 of 52

Bank shall ensure that their call centre staff are trained adequately to competently handle

and escalate, a complaint, if necessary.

The Grievance Redressal process shall have a provision for automatic escalation of

unresolved complaints from a call center/base level to higher authorities. There shall be a

system of acknowledging customers' complaints for follow up, such as complaint

number/docket number, even if the complaints are received over phone

Bank has established a process for handling customer grievances and providing needed

assistance, as part of better customer service. Bank has setup Call Centre/IVRS/ Help Line

for inquires, requests and for recording any grievances. Bank has extended some of these

services through the web module and Union Credit Card/U-Mobile app also.

Call center is connected 24x7 with adequate number of telephone lines for easy reach of

cardholder. Also, help desk at Department during Banking hours i.e. 10.00 AM to 5.00 PM to

be made available.

Services offered by call center/help line/Union Credit Card app includes:

a. Hot listing of Credit Card due to card loss.

b. PIN Change

c. Balance enquiry

d. Transaction / payment details.

e. Queries on payment discrepancy.

f. Register for statements through e-Mail.

g. Request for re-issue/replacement of cards.

h. Status of card sent for reissue/renewal/replacement.

❖ All the branches will help the customer to activate their cards and recommend for

enhancement of card limit for customers from time to time by sending a communication to

Credit Card & MAB Department.

❖ Branches/ Department shall make efforts to examine and resolve the complaints and

grievances at the earliest.

❖ Bank shall display the grievance redressal procedure and the details of chief Grievance

Redressal Officer on Bank's website.

❖ Bank shall put in place a system of grievance redressal where customer complaints are first

acknowledged, a complaint number is given for reference and necessary steps are taken

to ensure closure within turnaround time.

❖ All complaints received from cardholder over phone / e-mail / post shall be acknowledged

and redressed within a reasonable time depending upon the nature of complaint. However,

in matters involving inter-Bank disputes, the timelines set by respective networks will be

followed.

To have a concerted approach in dealing with card holders the queries of cardholders shall

be categorized into separate categories.

Credit Card Policy – 2022-23

Page 29 of 52

Bank shall display important sections of the Credit Card policy relating to Customer

related matters in the Website

Requests & Enquiries, Grievances & Complaints:

i) Requests and Enquiries:

Normally, the request & enquiries from the card holders will be as below:

➢ Request for change of address.

➢ Enquiries about details of bill.

➢ Balance enquiries

➢ Request for statement of account.

➢ Report loss of Credit Card.

➢ Request for issue of duplicate card/ PIN.

➢ Request for up gradation of card or enhancement of credit limit.

➢ Request for Add-on cards.

➢ Request for activation of blocked card.

➢ Request for activation of blocked PIN.

➢ Enquiries on status of application.

➢ Enquiries about non-receipt of card or PIN.

➢ Request for waiver of Annual Subscription / Late payment fees / Service charges.

➢ Request for cancellation of card.

➢ Enquiry about non-acceptance of Card / Transaction.

➢ Request on Registering for Second Factor Authentication for One Time Password

(OTP) for online transactions.

It shall be the endeavor of the Department to ensure that all requests and enquiries

received over phone at Help Desk are answered immediately. All requests and enquiries

received through emails / post shall be redressed at the earliest.

ii) Grievances:

Grievances arising on account of non-compliance of cardholders’ requests within

reasonable time.

➢ Looking after grievances on wrong billing such as double debits, non-acceptance

of transaction etc.

➢ Grievance about non-receipt of cash through ATM

➢ Grievance about credit not posted.

➢ Grievances on non- receipt of bills/PINs/cards

An option to lodge complaint has also been provided at all branches through CBS Menu.

It will be our endeavor to redress all the grievances received within 7 to 10 days of the

receipt as far as possible. If a grievance is not resolved within 30 days from the date of

lodging the complaint, the cardholder will have the option to approach Ombudsman for

redressal of grievances.

Credit Card Policy – 2022-23

Page 30 of 52

Protection of Customer Rights:

As mandated by RBI, Bank shall frame and circulate to all its cardholders, the Most

Important Terms and Conditions (MITC) of Card activation and utilization.

1. All cardholders shall be clearly informed about the Most Important Terms and

Conditions (MITC) covering the following details:

a. Fees and Charges

b. Cash Withdrawal limits,

c. Billing,

d. Default and circumstances,

e. Termination/ revocation of card membership,

f. Loss/Theft/Misuse of card and

g. Disclosure.

2. The Particulars mentioned under aforesaid items ‘a’ to ‘g’ are disclosed in the

application form.

3. In the welcome kit of Credit Cards, MITC on the aforesaid items ‘a’ to ‘g’ are

provided with explanation.

4. MITC are available in Bank’s Website and updated from time-to-time.

5. Monthly Bill sent to the cardholder will have the items from a, b and c.

The details of the Most Important Term & Conditions and charges presently levied on the

card are furnished in Annexure V.

Any changes in the Terms and Conditions shall be with the approval of ORMC and such

changes shall be intimated with prospective effect, giving one-month notice to the

cardholders through monthly bills, SMS, brochures enclosed with the monthly bills and

published in our Bank’s website.

Cardholders shall also be kept informed, as per guidelines on any new/ modifications of

Terms and conditions, charges, value additions, facilities, etc.

Other Provisions:

Cardholder’s rights in relation to personal privacy, clarity related to rights and

obligations, preservation of records, maintaining confidentiality of customer information

and fair practices in debt collection shall be maintained.

Bank neither issues unsolicited cards nor extends any unsolicited loans, credit facilities,

upgrading the Credit Cards and enhancing limits without prior consent of the cardholders.

Bank may initiate outbound calls through call center for marketing Credit Cards. However,

Customers who inform the Bank that they do not wish to receive unsolicited calls/ SMS

for marketing of our Credit Card products, as per statutory guidelines, will have the option

to register at "Do Not Call Register" (DNCR) maintained by telecom companies. The Do

Credit Card Policy – 2022-23

Page 31 of 52

Not Call Registry numbers are not passed on to any unauthorized person/s and Bank is not

engaging any Tele-Marketers for marketing of card products.

Customer confidentiality:

Bank shall obtain specific consent from the applicant with explicit option for sharing the

information with other agencies. The purpose and implications of sharing the information

are explained and provided in the application.

The cardholder shall be intimated with prior notice that the information relating to Credit

history/ repayment record of the cardholder shall be informed to a Credit Information

Company and shall be intimated in terms of the Credit Information Companies

(Regulation) Act, 2005.

In the event the cardholder settles the dues to the full satisfaction of the Bank, the

negative report shall be withdrawn within 30 days from the date of full settlement of

dues.

Bank to report default status of a credit cardholder to CIC with 7 days notice period. In

the event of settling the dues after having been reported as defaulter to CIC, the bank

shall update the status within 30 days from the date of settlement.

The disclosure/release of information to CIC, particularly about the default, shall be

made only after the dispute is settled. Further, MITC furnished as an annexure is modified

covering above points

Compensation with respect to Frauds:

Since Bank issues EMV Credit Cards, frauds due to card cloning/ counterfeiting has been

reduced to a great extent. Bank sends One Time Password (OTP) for all domestic online

transactions as second factor authentication as SMS to Registered Mobile Number. Bank also

sends SMS alerts on successful completion of transactions to the cardholder.

Whenever a cardholder has informed about fraudulent use of his/her card, Bank shall

examine such complaint and do the necessary initial investigation. On confirming that prima

facie there is fraud and it happened without connivance or negligence of the customer,

Bank shall initiate the chargeback to get back the amount from the acquiring

Bank/merchant. Wherever the disputes could not be resolved through chargeback, Bank

shall raise Pre-arbitration/ Arbitration claim against the acquiring Bank/ merchant.

However, since such procedures would take long time to settle, Bank, in the meantime,

will consider releasing the money to the customer by debit of a separate suspense account,

pending such settlement, to gain the customer confidence and avoiding reputational loss.

Whenever the charge back claim is settled, such amount is adjusted against the

compensation paid through suspense account.

Meantime, Credit Card Department will place the matter before the competent authority

as per IC 1714 dated 30/09/2019, if department is convinced that on prime facie fraud has

Credit Card Policy – 2022-23

Page 32 of 52

happened without the negligence of the customer and customer has taken all the

preventive measures like replacing the card on foreign visit etc.

On the basis of conclusion given by the committee, if element of fraud

Observed/concluded, Credit Card department will report the matter to Fraud Risk

Management Department, Central Office for further investigation and reporting purposes.

Liability of Customer:

Liability of Customer against unauthorized transaction will be governed by Banks

Compensation Policy issued from time to time.

*****

Credit Card Policy – 2022-23

Page 33 of 52

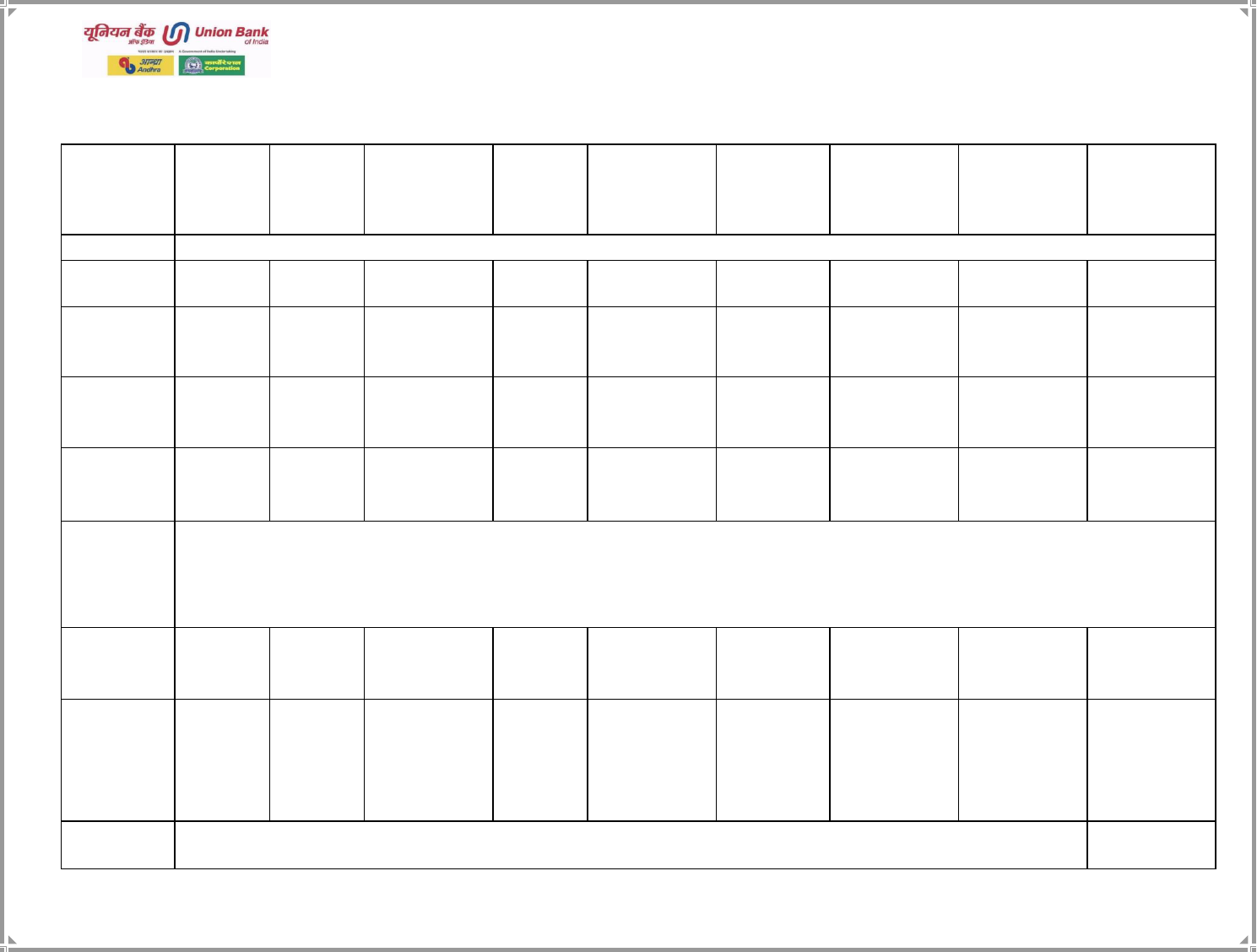

Annexure I

Credit Cards at a glance

Type of Fee

VISA Gold

Visa

Platinum

VISA Signature

RUPAY

Platinum

Rupay Select

UNICARBON

(HPCL)

(Rupay

Platinum)

JCB

Wellness

(Rupay Select)

JCB Health

(Rupay

Platinum)

Union MSME

(Rupay Select)

Eligibility

Major Resident Indian Nationals

Age criteria

(For Salaried)

18-65 Yrs.

18-65 Yrs.

18-65 Yrs.

18-65 Yrs.

18-65 Yrs.

18-65 Yrs.

18-65 Yrs.

18-65 Yrs.

--

Age criteria

(For

Professionals)

18-70 Yrs.

18-70 Yrs.

18-70 Yrs.

18-70 Yrs.

18-70 Yrs.

18-70 Yrs.

18-70 Yrs.

18-70 Yrs.

--

Age criteria

(against Term

Deposits)

Min :

18 Years

Min :

18 Years

Min :

18 Years

Min :

18 Years

Min :

18 Years

Min :

18 Years

Min :

18 Years

Min :

18 Years

--

Minimum

Income

Rs.1.80

lakhs per

annum

Rs.2.50

Lakhs per

annum

Rs.10.00 Lakhs

per annum

Rs. 2.50

lakhs per

annum

Rs.7.50 lakhs

per annum

Rs.2.50

lakhs

per annum

Rs.7.50 lakhs

per annum

Rs. 2.50 lakhs

per annum

--

CIBIL SCORE

Other than PSU/Central Government /State Government employees >=700 or -1; for Government Servants >=650 or -1.

(Sanction of Credit Cards to the borrowers having CIBIL score of -1 is vested with RO/FGMO even if it comes under the branch

delegation to sanction the Credit Card.

In case of branches which are reporting directly to CO Verticals, it should be referred to the respective verticals for placing the same to

CACs. )

Base Card

Limit

Rs.10,000/-

Rs.50,000/-

Rs.2.00 lakhs

Rs.50,000/-

Rs.1.50

lacs

Rs.50,000/-

Rs.1.50

lacs

Rs.50,000/-

Rs.20,000/-

Against

Deposit

(without

Income Proof

& scoring)

Min

Deposit

Rs.

20,000/-

Min

Deposit

Rs.67,000/-

Min Deposit

Rs.2.67 lakhs

Rs.67,000

Rs.2,00,000

Rs.67,000

Rs.2,00,000

Rs.67,000

--

Margin

with 25% margin

--

Credit Card Policy – 2022-23

Page 34 of 52

Against

Deposit

Card base

Limit

Rs.15,000/-

Rs.50,000/-

Rs.2.00 lakhs

Rs.50,000

Rs.1.50 lakhs

Rs.50,000

Rs.1.50 lakhs

Rs.50,000

--

Validity of

Card

Globally Valid across VISA/ PULSE/ Diners Club network

Validity

period

4 Years from the date of issue of Card

Compatibility

of Card

All cards are Compatible for PoS, ATM, Internet & IVR transactions

Welcome

Benefits

-

-

-

-

-

Up to Rs.300/-

by way of

credit to the

Bill. The

Customer has

to purchase

fuel worth

Rs.300 and

above at HPCL

authorized fuel

outlet within

60 days from

activation of

card

Rs 22,000/-

worth

Spa Services ,

Health Checkup ,

Gym Access ,

Golf Program ,

Merchant Offers

Rs.31,750/-

worth medical as

well as lifestyle

services on the

activation of the

card.

-

Admission/

Joining Fee

NIL

NIL

NIL

NIL

NIL

Rs.499/-

Rs.999/-

Rs.499/–

NIL

Annual Fees -

Main card

Rs.299/-

Rs.399/-

Rs.1,999/-

Rs.299/-

Rs.499/-

Rs.499/-

Rs.999/-

Rs.499/-

NIL

Annual Fees -

Add on card

Rs.199/-

Rs.299/-

Rs.999/-

Rs.199/-

Rs.399/-

Rs.199/-

--

--

No add on card

Annual Fees

waived in the

first year and

not levied if

Rs.30,000/-

Rs.50,000/-

Rs.2,70,000

Rs.30,000/-

Rs.50,000/-

Rs.1,00,000/-

Rs.1,00,000/-

Rs.50,000/-

NA

Credit Card Policy – 2022-23

Page 35 of 52

usage in the

previous year

is

Free Credit

Period

21 to 50 days depending up on the date of purchase

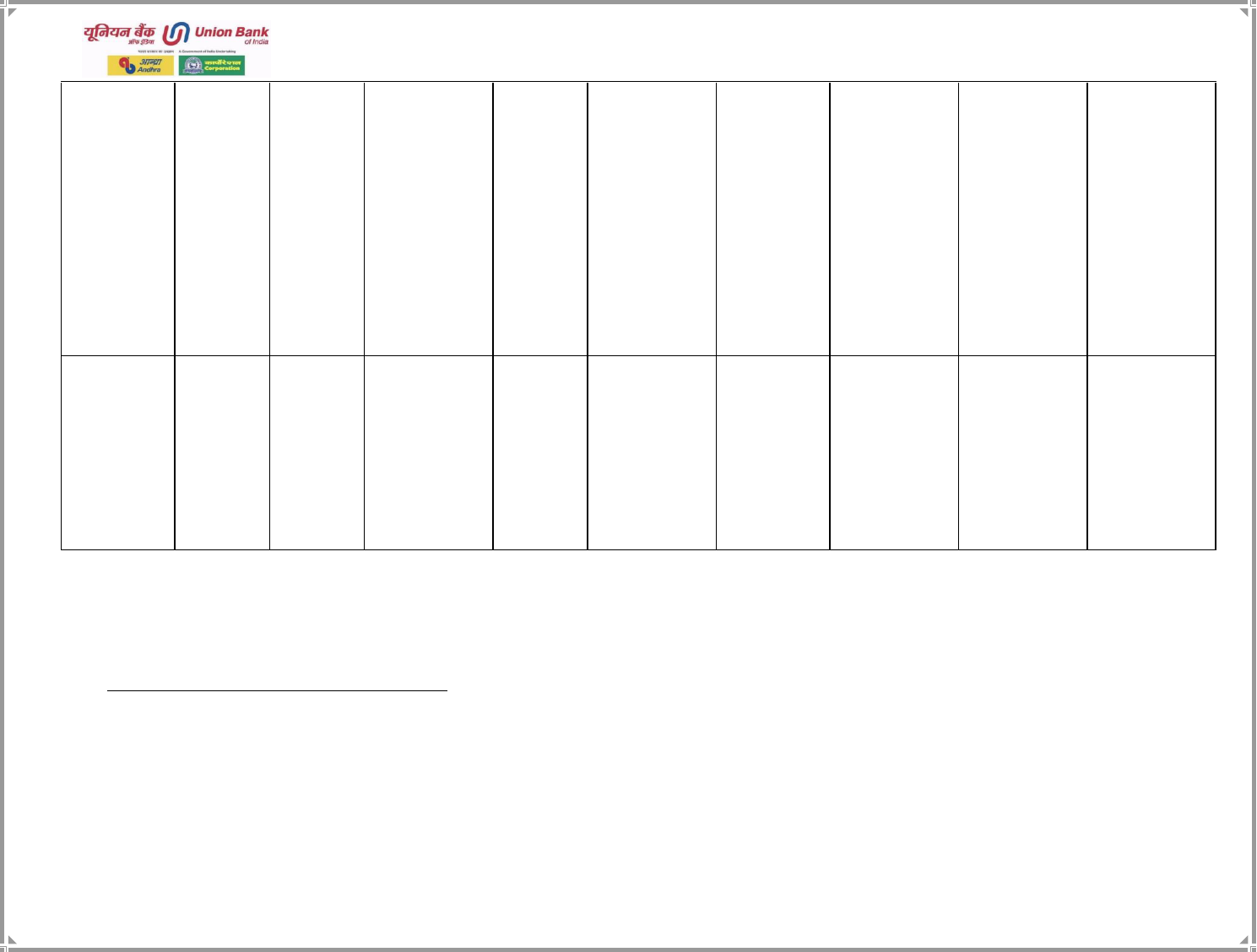

Roll Over