Prepared by DCMA CIG – Draft posted as a resource, not official policy, guidance or direction

Introduction

Purpose: Section 801 of the FY20 National Defense Authorization Act (NDAA) establishes the

requirements for a pilot program on the subject of intellectual property (IP) to “assess mechanisms

to evaluate intellectual property (such as technical data deliverables and associated license rights),

including commercially available intellectual property valuation analysis and techniques”. More

specifically, Section 801(b)(1)(b) calls for an activity to “recommend criteria for the consideration

of types of commercial products, commercial services, or nondevelopmental items that can [sic]

used as an alternative to a product or service to be specifically developed for a selected acquisition

program”. In order to provide a reasonable recommendation, a baseline value estimate for the

potential IP being developed must be determined for comparative purposes. This requires the

procuring office and acquisition workforce analysts to understand and properly apply currently

available IP valuation estimating techniques and best practices that are utilized in the commercial

world.

With the substantial emphasis recently placed by the NDAA on this subject matter, it is imperative

to prepare and educate the acquisition workforce on how to properly value and price IP. It is also

reasonable to anticipate that acquisition programs could benefit significantly from the potential

cost savings and efficiencies to be gained from leveraging IP valuation data in conjunction with

analysis of alternatives. This paper outlines some IP considerations and challenges within the

context of government contracting and examines the most commonly used valuation analysis

techniques, best practices, and emerging trends.

Disclaimer: This document does not constitute Agency, Department, or U.S. government policy,

instruction or regulation. This document will not bind a Contracting Officer or Agreement

Officer (KO/AO) into a price determination.

What is Intellectual Property? Four Categories of Intellectual Property Rights

IP Overview: The World Intellectual Property Organization (WIPO) defines IP as, “creations of

the mind, such as inventions; literary and artistic works; designs; and symbols, names and images

used in commerce.” IP can be further subdivided into several broad categories: patents, copyrights,

trademarks, trade secrets, and registered industrial design. To encourage creativity and innovation

and facilitate technological progress, IP has certain legal protections in place to incentivize its

owner and/or creator with financial benefits and prestige. Due to its intangible nature, there are

additional complications and nuances with regards to legal protection of IP versus tangible goods

and property.

Prepared by DCMA CIG – Draft posted as a resource, not official policy, guidance or direction

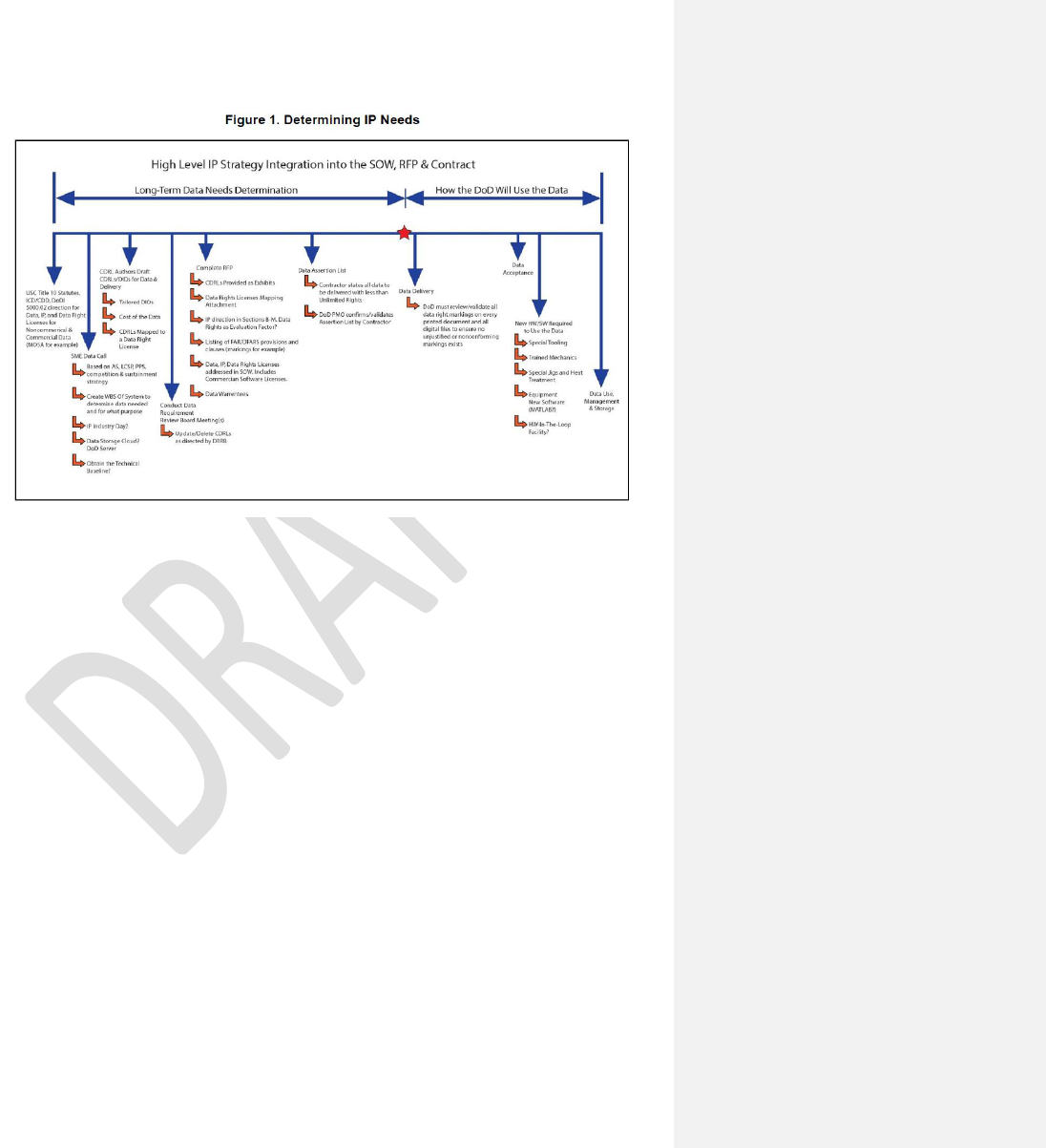

Figure 1 Source: www.business2community.com

Government procurement is primarily concerned with patents, trade secrets, registered design and

copyrights. A patent is a property right granted by the United States Patent and Trademark Office

(USPTO) for an invention that excludes others from making, using, or selling it. Copyright

protection concerns “original works of authorship” and includes computer software and technical

data. Under 17 USC Section 105, “Copyright protection under this title is not available for any

work of the United States Government, but the United States Government is not precluded from

receiving and holding copyrights transferred to it by assignment, bequest, or otherwise.”

Therefore, contractors generally retains ownership of the rights to any technical data or computer

software that is developed under a government contract. The government then negotiates a

licensing agreement that defines the “data rights” to access and use the technical data and/or

computer software.

Intellectual Property and Government Contracting

Within the context of government acquisition, the considerations around IP typically revolves

around usage rights for patentable subject matter, technical data (data rights), and computer

software. The FAR and DFARS contain very specific clauses regarding allocation of these

noncommercial data rights for example, FAR 52.227-11 and FAR 52.227-13, which distinguishes

the patent right ownership by the contractor and by the government, respectively. This stands in

contrast with private sector practices, in which these rights are highly negotiable and can results

in very specifically tailored agreements depending on the circumstances.

Prepared by DCMA CIG – Draft posted as a resource, not official policy, guidance or direction

The definitions for technical data and associated usage rights are defined in FAR 52.227-14 and

DFARS 252.227-7013/7014. FAR 52.227-14 defines technical data as “recorded information

(regardless of the form or method of the recording) of a scientific or technical nature (including

computer databases and computer software documentation). This term does not include computer

software or financial, administrative, cost or pricing, or management data or other information

incidental to contract administration.” It includes information about processes, procedures, items,

and other potentially valuable data that could be subject to patent or copyright protections. When

developed or used during execution of a federal contract, it is essential to define how the contractor

will maintain ownership and licensing rights over this data and how it will be transferred to the

government. Considerations include how and when the data is developed, the source of funding,

and many other factors.

In general, the contractor will retain ownership over any technical data and software created under

a government contract and the government will negotiate a usage license level defined by DFARS

252.227-7013. The most common types of rights seen in practice are: unlimited rights,

government purpose rights, and limited rights. Unlimited rights are the least restrictive of these

and allows the government to do what it wants with the data including giving it to third parties.

This right is often the result of data or software that was developed under the part of the contract

that is fully government funded. Government purpose rights is more restrictive than unlimited

rights and allows internal government use of the data and/or authorize others to use it under a

governmental purpose. This can include international and multi-national defense organizations

and foreign governments. A government purpose rights license expires in 5 years (unless

negotiated differently) and can be exercised to increase competitive procurement but NOT for

commercial purposes. Upon expiration, the government then retains an unlimited rights license

for the noncommercial software and technical data. Limited rights is the most restrictive and only

allows for usage within the government. Under a limited rights license, the government may not

release or disclose the data to a party outside of the government unless it has obtained written

permission of the contractor. The term “restricted rights” refers to a set of rules on how the

government can use noncommercial software. There is also a definition under DFARS 252.227-

7013 called “specifically negotiated license rights” that allows for negotiation between the

government and contractor regarding the appropriate data rights (which should be documented in

a license agreement), but shall not be more limiting than limited rights.

Prepared by DCMA CIG – Draft posted as a resource, not official policy, guidance or direction

Figure 2: Rights

The level of license rights maintained by the government typically depends on factors such as

source of funding (government, private, or mixed), the nature of the data (commercial or

noncommercial), and other negotiated contract terms. If the government exclusively funded the

project, then it will generally have unlimited rights to the noncommercial technical data, computer

software, and related documentations. It will also have unlimited rights to the data related to the

item, component or process that was developed exclusively with government funding,

configuration data (form, fit, and function), and any relevant updates or changes to the data (such

as engineering change proposals). For mixed fund contracts, the Government typically has

Government purpose rights. If the data was developed on a fully contractor developed project, the

Government usually acquires restricted rights for the computer software and limited rights for the

technical data. For COTS (commercial off the shelf) software, the government’s licensing rights

are defined in the Terms & Conditions, End User Agreement, or other standard commercial

licensing agreements. A thorough and mutual understanding of these rights from both the

government and contractor at the onset of the contract will prevent or reduce any

misunderstandings and legal issues later on in the future, and may prevent potential misuse of the

technical data.

Prepared by DCMA CIG – Draft posted as a resource, not official policy, guidance or direction

Considerations for Your Own Procurement

As early as possible, (optimistically even before the solicitation) determine what is needed

from the intellectual property acquisition.

An intellectual property (IP) plan is an option for preparation:

Determine your needs, when you need them, and assess any risks

o Is there already a commercial market solution that we can utilize?

o Will new intellectual property be developed as part of the transaction?

If so, is there a commercial market for the new innovation?

o Is there a danger of vendor lock-in based on maintenance/service of the IP?

o Are there any risks associated with the vendor retaining the IP rights, and

what threats are there if the vendor does not maintain those same IP rights?

Decide on the type of rights to explore regarding the IP

o Think about, characteristically:

Pricing can inform what types of rights we can afford – consider the

requirements and lifecycle costs.

Competition depends on how much rights the Government would like

to maintain.

The more opportunities for commercial use of the IP by the market,

the more rights should be left with the market.

The more improvements after sales and development that are expected,

the more reason to leave the IP rights with the marketplace.

If the risk of vendor lock-in is high, the greater the need to retain IP

rights.

The greater the uncertainty regarding the future, the bigger the

obligation to retain IP.

Formulate the terms of the agreement, depending upon what rights to the IP will be

explored.

Prepared by DCMA CIG – Draft posted as a resource, not official policy, guidance or direction

Outside the Box Thinking

Below are a few commercial non-traditional possibilities to consider when developing your IP

plan:

Cost Sharing Agreements

A Cost Sharing Agreement (CSA) is an agreement pursuant to which parties agree to

share the costs of developing IP in exchange for obtaining the right to exploit the

developed IP in their respective territories.

The parties to a typical CSA could be a U.S. parent company of a multinational

group, where the CSA grants the right to utilize the developed IP in the U.S., and an

offshore or foreign subsidiary, where the CSA grants them the right to exploit the

developed IP in the rest of the world.

Escrow Arrangements

Intellectual property escrow is the use of an escrow service company that assists in

gaining an additional layer of security for the IP. The escrow companies help protect

the treasured IP, which also reassures potential licensees that an investment made in

the technology is safe.

The escrow service acts as a security guard. Information technology is one of the

most common arenas for escrow in tech transfer. This is because typically because

the software and source code may reside on the inventor’s server and cloud, there is a

risk of it being wiped out in a catastrophe. If something happens to the protected

technology, or something happens to the developer, the licensee would still have

access to that technology.

Escrow is held by a third party, known as the escrow agent, on behalf of involved

parties to the transaction. The contents in the account will only be released after an

event or nonevent based on predetermined criteria.

Possible example with U.S. Government: data that you would need to avoid

obsolescence is put in an escrow account. The 3

rd

party holds the escrow (is the

guardian). Events are predetermined that would cause the data in escrow to be

released – examples: company stops producing, or the company enters bankruptcy, or

if the company stops supporting the product.

Common Approaches for IP Valuation

In the commercial realm, proper valuation of IP is vital for finance and accounting purposes and

is a key consideration in mergers and acquisitions. In government contracting and procurements,

proper valuation of IP serves an important role in analysis of alternatives and determining the true

acquisition and lifecycle cost of a program. There are several feasible approaches when it comes

to IP valuation with the most common being the cost, market, and income approach. Each

methodology has its advantages and drawbacks and should be applied as appropriate within the

Prepared by DCMA CIG – Draft posted as a resource, not official policy, guidance or direction

context of the acquisition. There are other less common approach for IP valuation and emerging

trends which will be discussed subsequently.

Source: https://medium.com/@patnaik632/valuation-of-intellectual-property-57318717906e

Cost Approach

Amongst the different IP valuation methodologies, the cost approach is perhaps the simplest and

most straight forward. It works based on the principle of substitution, meaning the value of the IP

should not be greater than what it would cost to acquire it somewhere else, either from purchasing

or having it developed by a different source or replacing it with a similar product of equal

functionality and utility. There are several different practical approaches to the cost valuation

method, including analysis of reproduction cost and replacement cost. Reproduction cost accounts

for the effort that would be required to create an identical version of the IP, whereas replacement

cost considers how much would be required to create or purchase a similar piece of IP.

When applying the cost approach to estimate the value of IP, whether from a historical or future

cost perspective, one needs to assess the total required expenditures needed to reproduce or replace

the asset. This includes developmental expenses such as engineering, programming, and design

time and associated overhead and administrative expenses such as indirect labor, attorney fees,

patent application fees, etc. adjusted for inflation. The challenge with using a historical cost basis

is that previous projects might not be directly comparable and using future costs relies on the

accuracy of the projections.

A major drawback to the cost approach is that it fails to account for potential economic benefits

that might result from ownership and application of the IP. Since these methodologies only

considers the cost elements in IP development, they don’t account for the actual usefulness or

Commented [WD1]: Should discuss this chart – in the

market and income sections we don’t detail all these

methods. Also broke out relief from royalty as an “other

approach” since it was a combo of market and income.

Maybe consider removing or finding a different chart…

Prepared by DCMA CIG – Draft posted as a resource, not official policy, guidance or direction

practicality of the IP and could result in overvaluation of IP that is essentially useless or

undervaluation of IP that might have unanticipated applications and revenue stream.

These characteristics means the cost model generally produces the lowest valuation out of all the

available methodologies in the real world. One would not reasonable expect companies whose

business model heavily (or solely) relies on leveraging their IP assets for competitive advantage

to favor this method of value estimation. This is especially true for IP and technology with

potential industry disrupting implications. Therefore, it is most appropriate to apply the cost

methods for estimating non-proprietary or relatively simple IP and IP that have no foreseeable

market applications and no identifiable potential income streams. In general, this approach

provides a means for estimating the lowest possible value for the subject IP and should be

supplemented by other methodologies whenever possible.

Market Approach

The market approach for IP valuation is based on the principle of economic equilibrium, where

the market forces of supply and demand is used to determine the price of the asset. This approach

leverages publically available market data involving the sales, transfer, licensing, and transaction

of similar IP assets in order to estimate the price of the subject IP. Whenever possible, this should

be the first approach used for estimation because the commercial market is often the best indicator

of value whether for IP or any other goods and services. In order to properly apply this method,

there needs to be an active IP market, similar enough IP assets that have been exchanged,

transparent pricing data, and techniques to quantify the differences between the IP assets. Because

of these properties, this approach is most effective for estimating valuation of IP assets that is

marginally different than existing IPs and not suitable for estimating the value of newer developing

or disruptive technology.

In practice, there are several challenges that prevents the market approach from being optimal.

First, the marketplace for IP is sparse compared to traditional goods and services so it is often

difficult to identify previous transaction involving IP that is similar enough to use as an equitable

comparison. Many of the transactions are also conducted privately and under non-disclosure and

other confidentially agreements so the negotiated value will be non-public or lack transparency.

For government procurements and military weapons platforms, these challenges are amplified as

there is often not many comparable IP to be used for comparison.

If an acceptable analogous is identified, analysts needs to consider and account for all of the

differences between the IP packages and any relevant associated procurement conditions. Because

each IP asset is unique by nature, and market activity for these assets is relatively infrequent, these

adjustments are almost always required.

The market approach does not take into consideration any future income premiums that the subject

IP might offer over the analogous IP so it could result in a lower valuation than the income

approach. It is reliant on general market information and does not take into consideration any

unique non-market driven factors that might have influenced previous transaction data. On the

Prepared by DCMA CIG – Draft posted as a resource, not official policy, guidance or direction

same note, it is also susceptible to market sentiments and moods at the time of the transaction so

IP that was exchanged in a thriving market might have been overvalued and those that were

exchanged in during downturns could be undervalued. Because this method estimates value based

on data from actual sales of similar assets, it is becoming a more preferred approach, especially as

the marketplace for IP matures and additional transaction data becomes available.

Income Approach

The income method values the IP asset on the basis of the amount of economic income that the

IP is expected to generate, adjusted to its present day value. This method is the most commonly

used method of IP valuation.

The basic parameters of the income approach are:

- Project the future income stream or cost savings generated by the IP asset

- Determine the duration of the income stream or cost savings

- Calculate a present day value taking into consider the risk or discount rate associated with

the income stream generation

Complexities regarding the income approach come in identifying the various measures of

economic income that can be used in this sort of analysis. These can include: net revenues, gross

income, gross profit, operating income, income before tax, operating cash flow, EBITDA

(earnings before interest, taxes, depreciation, and amortization), net cash flow, expected

incremental income, etc.

One of the most common errors in applying this approach is the lack of differentiation between

the income generated by the total business enterprise, and the value of the income generated by

the IP within that business. When valuing IP, in order to use the income approach, it is critical to

be able to separate the stream of income that the IP is generating from the value of the business

as a whole and then apply an appropriate discount rate and life span.

A key benefit of the income approach is that it provides the analyst the ability to perform

sensitivity analyses by adjusting the various parameters, such as income levels or discount rate.

This allows the expert to better understand the performance of the various factors driving value,

and enables estimates of upper and lower limits to a range of value.

Advantages of Income Approach over the other approaches:

- No need for market transactions – captures expected future returns to owner without the

need for comparable market transactions.

- Forecasted cash flows required – based on cash flows or earnings generated by the

technology; or based on the costs saved by the technology.

- The income approach calculates the present value of cash flows from an IP asset, on the

basis of discount rate which takes into account the systematic risk.

- It shows the relationship between returns on investment on a security and the returns on

overall market portfolio.

Prepared by DCMA CIG – Draft posted as a resource, not official policy, guidance or direction

Disadvantages of Income Approach:

- Requires subjective cash flow allocation

- Translation of theory into practice requires assumptions which are limiting

- Relevant information is not always readily accessible from internal reporting systems.

Other Approaches

Value Approach

View the IP from a variety of different angles (360 degree view) and ask questions:

- Will this save lives? How do you value a life?

- The multiplier effect: will gains in total output or sales be greater than the spending that

caused it?

- Do not forget to consider qualitative characteristics (describes information)

- Are there maintenance costs? If so at what amount, and how long will those costs apply?

- Will this equate to a product that impacts size and weight? This will make life for the

warfighter easier, how do we value that?

The Relief from Royalty Approach

This method is a combination of the income approach and the market approach, where

comparable market royalty rates can be found. This tactic is the calculation of the present value

of a stream of royalties that the IP owner would have received (or that an infringer has been

relieved from paying).

This approach provides a measure of value by determining the avoided cost of an infringer not

having to pay the appropriate royalties. It is calculated by assuming that the infringer does not

own the patent, trademark, or copyright and thus has avoided a royalty that the infringer should

be paying for its use. Royalty rates are utilized that are based on market place transactions, in

combination with a forecast of the infringer’s actual or projected revenue as the income stream to

which the royalties apply.

Conclusion/ Wrap Up

References

NDAA: https://www.congress.gov/116/bills/s1790/BILLS-116s1790enr.pdf

IP definition: https://www.wipo.int/about-ip/en/

https://www.heerlaw.com/determining-value-intellectual-property

Prepared by DCMA CIG – Draft posted as a resource, not official policy, guidance or direction

https://nevium.com/ip-valuation/

https://www.uspto.gov/ip-policy/economic-research

https://www.pilieromazza.com/what-is-technical-data-and-how-do-you-protect-

it/#:~:text=Technical%20data%2C%20as%20defined%20by,14%3B%20DFARS%20252.227%2

D7013.

https://www.law.cornell.edu/cfr/text/48/252.227-7015

https://www.dau.edu/guidebooks/Shared%20Documents/Air%20Force%20Data%20Rights%20

Guidebook.pdf

https://disa.mil/About/Legal-and-Regulatory/DataRights-IP

https://www.consor.com/articles/value-of-intellectual-property-and-intangible-assets/

http://www.consor.com/ip-valuation-what-methods-are-used-to-value-intellectual-property-and-

intangible-assets-the-cost-approach/

http://www.willamette.com/insights_journal/18/winter_2018_7.pdf

https://faculty.darden.virginia.edu/chaplinskys/PEPortal/Documents/IP%20Valuation%20F-

1401%20_watermark_.pdf

https://www.intracomgroup.com/single-post/2017/10/04/the-pros-and-cons-of-4-patent-

valuation-approaches

https://www.pianoo.nl/sites/default/files/documents/documents/introduction-intellectual-

property-rights-ppi-jan14.pdf

https://www.wipo.int/export/sites/www/sme/en/documents/pdf/ip_panorama_11_learning_points

.pdf

http://www.consor.com/ip-valuation-the-income-approach/

http://www.intelproplaw.com/Articles/files/Income%20Approach.pdf

https://www.consor.com/articles/value-of-intellectual-property-and-intangible-assets/

https://www.omm.com/resources/alerts-and-publications/alerts/client-alert-parties-to-cost-

sharing-agreements-must-share-the-costs-and-

deductions/#:~:text=A%20CSA%20is%20an%20agreement,IP%20in%20their%20respective%2

0territories.

Prepared by DCMA CIG – Draft posted as a resource, not official policy, guidance or direction

Source: 2019 Air Force Data Rights Guidebook