January 2019

MSCI GLOBAL DATA

STANDARDS

FOR REAL

ESTATE INVESTMENT

2 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

Introduction ...............................................................................................................................................3

Purpose of the Data Standards ...............................................................................................................4

Benefits of Adopting the Data Standards ...............................................................................................5

Characteristics of the Data Standards ...................................................................................................7

Structure of the Data Standards .............................................................................................................9

Appendix 1: Format of the Data Standards ..........................................................................................10

Appendix 2: General Principles for Data Recording under the Data Standards ..............................11

Appendix 3: MSCI Global Data Standards for Real Estate Investment – Schema ...........................14

Appendix 4: MSCI Global Data Standards for Real Estate Investment – Enumerations .................47

Appendix 5: Versioning Table ................................................................................................................78

CONTENTS

3 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

This document describes the first edition

of the MSCI Global Data Standards for Real

Estate Investment (the Data Standards).

The Data Standards are based on more than

two years of careful deliberation and extensive

consultation with clients and other interested

industry participants globally. This initiative

stems from the transformation, currently

taking place, in the way real estate is viewed

and invested in by a rapidly broadening class

of asset owners and managers who share

global mandates. Real estate is no longer

just the focus of domestic investors whose

mandates are defined by national boundaries.

For this reason, a new approach is required

to define the data inputs that underpin

performance measurement and investment

reporting in an era of ambitious cross-border

strategy formation and implementation. The

new Data Standards are designed to deliver

this infrastructure.

There are already a number of real estate

specific standards in existence or currently

under development, but most of these

center on areas such as best practices in

valuation and governance. The Data Standards

complement these by focusing on the data

inputs needed for investment performance

measurement at fund, asset and tenant level.

These Data Standards will be updated and

revised in future editions to meet the evolving

requirements of the various stakeholders. MSCI

welcomes ongoing discussion and feedback on

the contents of the Data Standards.

The main benefits to investors in commercial

real estate from the adoption of the Data

Standards are as follows:

• Better informed decision-making through

enhanced cross border and cross asset

class comparability;

• Improved data quality and quicker

availability of performance results, due to

process rationalization.

The Data Standards have been designed and

constructed to parallel and support MSCI’s

Global Methodology Standards for Real

Estate Investment and the MSCI Methodology

for Property Fund Indexes. Together these

documents provide comprehensive definitions

of the data inputs and calculations that

support the measurement and reporting of

performance and risk for private commercial

real estate investments.

This document provides some background to

the Data Standards, explaining its purpose,

benefits and structure. The outline of the

Data Standards is followed by appendices

listing all fields, enumerations, definitions

and data formats.

INTRODUCTION

4 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

The development and implementation of

performance measurement and reporting

standards is a significant step in the

evolution of industries. The evolution of

these standards typically follows a common

pattern, progressing from local or national, to

regional and then global standards. At each

stage of this evolution, gains in transparency

and efficiencies in reporting are achieved that

enable the industry to mature and grow.

Commercial real estate investment, like

many other areas of finance, needs globally

consistent performance measurement

standards to encourage cross border

investment and the development of more

efficient markets. However, today most of the

existing standards applied to commercial real

estate remain highly localized and focused on

the physical product due to the immobile nature

of real estate assets.

Progression from localized physical

standards to global investment standards

has been slow, but with increasing levels

of cross-border investment, the need for

consistent comparisons of performance

metrics across countries and regions of the

world has moved to the forefront for owners

and managers of real estate.

Institutions at the forefront of the globalization

process are discovering that the potential

benefits of commercial real estate are

being limited by information inconsistencies

(across both markets and asset classes) and

hampered by slow, costly, and error prone

data collection and transfer processes. This

handicap is especially evident when comparing

real estate to core financial asset classes like

equities or bonds, where there are much higher

levels of global consistency and automation

of data exchange. A global standard will help

to rationalize the way that data are held in

source systems, making it possible to automate

standard data exchange and limit the amount of

time spent on data input and validation.

PURPOSE OF THE DATA STANDARDS

5 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

Today, performance information about

private real estate investments often remains

relatively opaque, and the timely measurement

requires multiple layers of private data to be

passed between owners, managing agents,

accountants, valuers, and analysts, on an

increasingly frequent basis. The impetus for

this interchange is being driven by increasing

regulatory demands from bodies such as

the International Organization of Securities

Commissions (IOSCO), and more specific

regulations including the European Parliament’s

Alternative Investment Fund Managers Directive

(AIFMD). The current lack of consistent global

data standards for real estate investment

performance means that, even at the country

level, parties involved do not always use the

same language and often store data in their

own bespoke systems, with little transferability.

The end result is often inconsistent comparative

measurement and substantial investments

in time, money and effort spent on data

calculation, collection, and management tasks

at every stage of the investment process.

The Data Standards have been developed to

provide the real estate industry with improved

comparability across markets and asset

classes, and overcome information exchange

challenges. The potential benefits to investors

include better informed decision-making

through enhanced cross border and cross

asset class comparability and improved data

quality and quicker availability of performance

results, due to process rationalization

BETTER INFORMED DECISION MAKING

Enhanced consistency, across real estate

markets and other asset classes, will

contribute to improved decision making.

Below are some examples:

• Consistent within- and cross-asset class

strategy development and portfolio

construction. Better informed allocations

will be possible owing to an improved

alignment of return calculations,

standardized market and sector reweighting

procedures, and globally consistent

currency conversion processes. At the same

time, like-for-like assessment of real estate

market cycles will be possible as a result of

more comparable yield and rent measures.

Globally consistent geographic and property

type classifications will improve the

comparability of market segments between

countries. Operational metrics like vacancy

rates and net operating costs will be

compared and projected more consistently

across markets.

• Consistent within- and cross-asset

class benchmarking: The availability

of robust cross border indexes that are

appropriate for benchmarking private real

estate investments independently, or in

combination with indexes from other asset

classes, will grow.

IMPROVED DATA QUALITY AND QUICKER

AVAILABILITY OF PERFORMANCE RESULTS

Through broad agreement on performance

measures and definitions, the quality of real

estate data is also expected to improve.

By removing some of the ambiguity and

heterogeneity in local or national market

practices, the Data Standards will potentially help

to reduce discrepancies in the way measures are

calculated across markets, and result in greater

confidence in the underlying data.

BENEFITS OF ADOPTING THE DATA STANDARDS

6 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

This should in turn help to reduce the reliance

on manual calculation, encouraging automation

and improved data quality. The resulting

benefits will likely include:

• More precise comparisons across countries

and sectors.

• Fewer error-prone processes.

• Greater levels of consistency, promoting

comparison with other asset classes.

With increased global consistency and

automation, the speed of data verification

should also improve, resulting in faster and

more efficient data collection as well as more

timely reporting and analysis.

The results of this improvement in speed are

likely to include:

• Faster delivery of indexes and

portfolio analytics.

• Reduced reporting lags.

• Increased reporting frequencies.

• More timely risk analyses.

• Enhanced regulatory reporting.

Ultimately, improvements in consistency,

quality, and speed of delivery in performance

reporting will help to improve transparency

and comparability across real estate markets

as well as between real estate and other asset

classes. The result will be more informed and

better investment decision making, and an

improvement in the integration of real estate

within the multi-asset class portfolio.

7 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

Historically, MSCI has maintained slightly

different data specifications in each country, to

reflect local differences in legal frameworks,

real estate management practices and

geographies. Although the core principles of

return calculation and data point specification

have been synchronized for many years,

national and other service-specific variations

have persisted to accommodate local

requirements. While additional data items may

still be necessary for some specific reporting

services, the increasing number of global

investors needing accurate cross border

comparisons, and the general adherence

to higher level international standards for

valuation and accounting, now make it both

desirable and possible to integrate MSCI’s

local data specifications within a single Data

Standards framework.

The Data Standards cover a broad range

of real estate performance measurement

data inputs at the vehicle, asset, and tenancy

levels that support performance and risk

analytics. The scope of the Data Standards

extends from the data inputs necessary for

performance measures (returns, yields, and

costs) and segmentations (asset type and

geographic classification), to methods of

data transformation (such as interpolation

and currency conversion). It covers not only

financial metrics, but also non-financial

typologies and descriptors.

The Data Standards have been designed to

complement existing standards. Wherever

possible, MSCI principles and definitions are

consistent with other external international

data standards.

In particular, MSCI draws on existing

reporting, accounting, valuation and

measurement standards:

• The overarching principles governing MSCI

portfolio level performance measurement

are those contained in the GIPS Global

Investment Performance Standard, prepared

by the Chartered Financial Analyst (CFA)

Institute, which cover the measurement

and disclosure of investment returns for all

asset classes.

• International Financial Reporting Standards

(IFRS), developed by the International

Accounting Standards Board (IASB), are

also fundamental to MSCI’s Data Standards.

IFRS accounting standards now cover the

majority of countries contributing to MSCI

global indexes, and although these have not

yet been made mandatory, it is generally

acknowledged that local standards will

converge towards IFRS. MSCI has, therefore,

aligned its data recording principles with

IFRS wherever possible.

• MSCI has always aimed to utilize only those

valuations which are predicated upon open

market principles, in order to produce

like-for-like international comparisons

of investment performance. However,

there have historically been a number of

different area-specific valuation or appraisal

standards, adopted within national markets

and prepared by local valuation bodies. The

International Valuation Standards Council

(IVSC) was formed in 1981 to develop

international technical and ethical standards

for valuations to support the regulation of

financial markets.

CHARACTERISTICS OF THE DATA STANDARDS

8 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

In 2014 the IVSC and IFRS Foundation

agreed a statement of protocols for co-

operation on International Financial

Reporting Standards and International

Valuation Standards, acknowledging their

common interest in ensuring consistent

measurement of Fair Value. MSCI has,

therefore, adopted the IVSC valuation

standards as the preferred basis for

reporting capital and rental values for

performance measurement purposes.

• The European Association for Investors in

Non-Listed Real Estate Vehicles (INREV)

publishes an integrated set of principles

and guidelines for reporting for non-listed

vehicles. Wherever possible, MSCI Global

Data Standards for Real Estate Investment

for vehicle level reporting have been

aligned with INREV definitions, albeit with

terminology adjusted to fit a wider range of

global markets.

• EPRA, the European Public Real Estate

Association, is the industry body for

European REITs and other listed property

companies. It provides industry standard

definitions of performance measures such

as yields, which have been adopted here as

the basis for definitions of some data inputs.

• The NCREIF PREA Reporting Standards

(Reporting Standards) are a U.S. industry

initiative, co-sponsored by the National

Council of Real Estate Investment

Fiduciaries (NCREIF) and the Pension Real

Estate Association (PREA), with a mission

to establish and implement information

standards for the real estate industry which

will facilitate transparency, consistency and

informed decision making.

Established standard-setting organizations

such as the Financial Accounting Standards

Board (FASB) and the CFA Institute do not

specifically address certain institutional real

estate investment and investor reporting

issues. The Reporting Standards initiative

was created to fill this gap and increase

transparency within the industry. Wherever

possible, the Data Standards are consistent

with NCREIF PREA Reporting Standards,

albeit with terminology adjusted to fit a

wider range of global markets.

MSCI’s Data Standards complements the MSCI

Global Methodology Standards for Real Estate

Investment , MSCI Methodology for Property

Fund Indexes and the MSCI Real Estate Data

Provider Code of Conduct. The Methodology

Standards detail all MSCI’s definitions of

real estate performance measures and core

analysis procedures. These measures and

calculations rely either directly or indirectly

on the data conventions set out in the Data

Standards. The Code of Conduct defines the

broad organizational and quality control

principles to which any contributor must

adhere when contributing real estate data to

MSCI.

9 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

A full representation of the Data Standards is

appended to this paper. It has been structured to

provide a robust and comprehensive data model.

At the highest level, the Data Standards can be

broken down into four sections relating to the

type of data being classified:

• The vehicle section classifies fund-level data,

including descriptive, financial, allocation,

capital and revenue-flow information.

• The direct Real Estate section classifies real

estate asset-level data including descriptive,

transaction, valuation, capital and revenue-

flow information.

• The other assets and liabilities section

classifies indirect real estate asset-level

data, financial assets and liabilities.

• The tenancy section classifies tenancy-

level data.

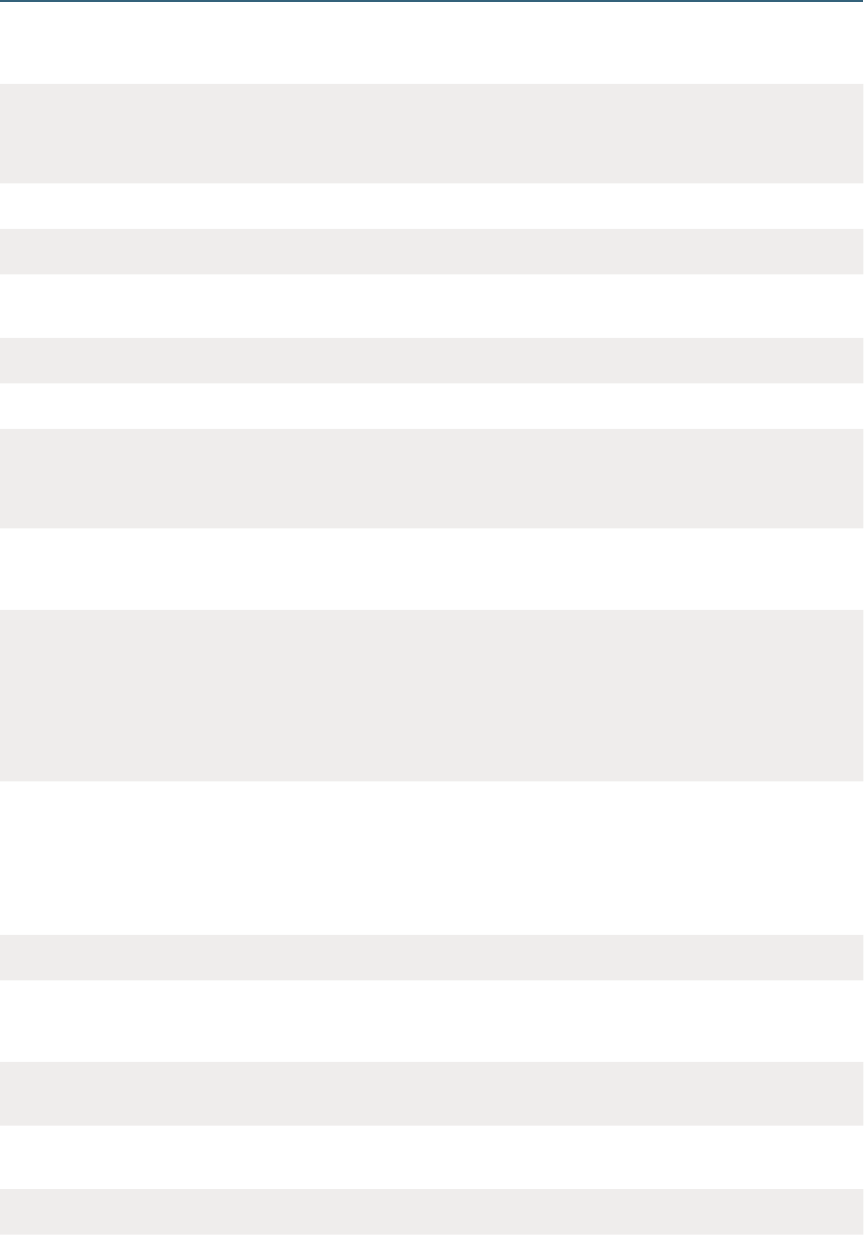

The broad structure of the Data Standards is

summarized in the diagram below.

STRUCTURE OF THE DATA STANDARDS

Entity Type of Data Sub-types

VEHICLE

Vehicle level info

Descriptive Location Profile

Fund

Reporting

Structural

Classification

Source of

Funds

Objectives &

Restrictions

Financial

Valuation

Description

Fund

valuation

Calculated

Fund Return

Market

Specific

Asset

Allocation

Country

Allocation

Sector

Allocation

Capital and

Revenue

Flows

Payable Date Capital Flow Revenue Flow

DIRECT REAL ESTATE (DRE)

DRE- Descriptive valuation,

cash flow and transaction

data

Descriptive

DRE

Description

Direct RE

Type

Location Size

Property

Management

Property Type

Specific

Market

Specific

Property Type

& Market

Specifc

Transactions Purchase Part Purchase Sale Part Sake

Market

Specific

Valuation

Valuation

Description

Asset

Ownership

Capital

Valuation

Rents Asset Status

Development

Assets

Market

Specific

Property Type

& Market

Specifc

Capital and

Revenue

Flows

DRE Capital

Flows

DRE Income

Revenue

Flows

DRE Net

Income

DRE

Irrecoverable

Op Exp

Market

Specific Cap

Flows

Market

Specific Rev

Flows

OTHER ASSETS & LIABILITIES

Assets -

Descriptive &

Valuation

Valuation

Assets

Indirect Real

Estate

Debt

Investments

Cash Derivatives

Forward

Agreements

Other Assets

Liabilities -

Descriptive &

Valuation

Valuation

Liabilities

Liabilities

Valuation

Cash

Flows

Capital and

Revenue

Flow

Indirect RE

Transns, Cap+

Rev Flows

Debt Inv.

Transms,

Cap+ Rev

Flows

Cash Revenue

Flows

RE Derivative

Transactions

and Revenue

Flows

Forward

Agreement

Costs

Liability

Transms,

Cap+ Rev

Flows

TENANCY

Tenancy

Info

Tenancy

Tenant

Description

Unit

Information

Lease

Conditions

Rental

Information

Vacant Unit

Market

Specific

Future Rent

Schedules

Future Rent

Schedule

10 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

The Data Standards are presented as a

series of complete schedules of all the

data items required for performance

measurement and risk analysis at a global

level. Other data required by MSCI for

specific local or asset type products can be

supplied to MSCI clients on request.

The data fields are set out in a readily

searchable tabular format, showing:

• Field code

• Entity level

• Data category

• Field name

• Field definition

• Data format

• Whether or not enumerations are defined.

All data definitions must be interpreted in

the context of the general principles set out

at the end of this section.

Following the logic of the data model, fields

have been sorted initially by entity level:

• Submission

• Assets

• Liabilities

• Tenancy

• Vehicle

Within each of the entities, the fields are

grouped by data category. Fields that

require enumerations are listed separately

in alphabetical order of field name. The

listing shows enumeration code values and

names against each field, including non-

response codes. Where enumeration values

are derived directly from publicly available

standard codes (e.g. ISO country or currency

codes), the individual values have not been

printed here. The source is referenced

against the field name, and the full list of

enumerations will be available from drop-

down menus in the data collection template.

APPENDIX 1: FORMAT OF THE

DATA STANDARDS

11 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

The data definitions must all be applied in

accordance with the following principles,

which underpin all the data items, bringing

them together into a consistent and

coherent data structure that is appropriate

for investment performance and risk

measurement. These principles are set out in

more detail in the instructions section of the

data collection template.

Frequency of data records: The minimum

frequency for external valuations is annual.

Actual valuations (whether full or desktop,

external or internal) should be provided for

the month to which they pertain.

Cash flows are recorded by MSCI as monthly

amounts. Wherever possible, all capital and

revenue flows should be provided month

by month, unless otherwise requested.

Transactions should be day-dated.

Completeness: All assets and liabilities that form

part of the vehicle or portfolio must be included.

• All direct properties including, but not

restricted to: developments, joint ventures

and shared ownership, owner occupied and

non-domestic holdings in commercial and

residential assets.

• All indirect investments in private and public

real estate vehicles including: Listed and

unlisted vehicles, property company shares,

mortgage loans and other derivatives.

• Cash, debt and other liabilities.

For further details, see investment types in the

data collection template in the right column.

Only trading properties should be

excluded (in accordance with EPRA Best

Practice Recommendations).

All financial data for shared ownership

properties must be submitted pro rata for

the appropriate share. Floor space data must

however be submitted as full 100% amounts.

Direct real estate assets: Asset should be

recorded at individual building or group

of buildings. For a group of buildings they

should ideally share the same location, same

building quality and same property sector. In

the case of a building or group of buildings

has a mixture of types (i.e. office and retail)

those should recorded as two separate assets

if the valuation and revenues and costs could

be provided for the individual assets. In

certain cases assets are aggregated even at

different locations, because it isn’t feasible

to split them into individual assets because

there is one agreement with the tenant and

that agreement can’t be attributed to single

assets including separate valuations for the

individual buildings.

Valuations: Valuations requirements are

documented in the MSCI Requirements for

Real Estate Valuations document.

Accruals principle: All income and costs must

be submitted on an accruals basis, assuming

that income is received when due, and costs

are paid when invoiced, excluding interest on

payment arrears and provisions for bad debts.

Income: Other (non-rental) income includes any

income from wayleaves, income guarantees,

subsidies and grants. Key money and surrender

premiums must be recorded separately.

APPENDIX 2: GENERAL PRINCIPLES

FOR DATA RECORDING UNDER THE

DATA STANDARDS

12 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

Costs: Recovered costs should be excluded

to avoid double counting. Gross costs and

recoveries are only recorded for specific

MSCI services. Under the Data Standards, all

operating costs should be recorded net of

recoverable amounts.

All capital and revenue expenditure data

(including transaction costs) should include:

• Estimated internal costs.

• Accruals and reversals of accruals.

• Costs associated with aborted

purchases, which should be included under

fund-level costs.

Capital and revenue expenditure data

should exclude:

• Taxes, tax losses, tax depreciation, and

capital allowances.

• Recoverable Value-Added Tax.

• Interest payments on arrears.

• Interest received on arrears.

• Bank charges.

• Provisions for bad debts where tenants are

in default on rent.

• Accounting provisions for future expenditure.

• Straight-line adjustments for rent-free periods.

Development costs should be submitted net of

any rolled-up interest owed by the developer

to the investor.

Bad debts should be recorded as non-

recoverable costs when they are written off.

Unallocated cash flows: All other unallocated

cash flows should be submitted under capital

expenditure, capital receipts, other income or

‘net operating costs - other’, as appropriate.

Cash flows associated with sold assets

should be submitted under their former

reference numbers.

Transaction costs: Costs associated with the

purchase or sale of whole properties must be

recorded as at the date of the transaction in the

specific fields provided for these costs. These

costs must be excluded from on-going capital

expenditure or receipts to avoid double counting.

Transaction dates: Purchases and sales of

buildings, sites or direct developments should

be timed to the day of legal completion, from

which the new owner is entitled to receive

income. For pre-funded developments, the

purchase date is taken to be that of the payment

of the first installment to the developer.

For other assets and liabilities, the transaction

date should be the contract/trade date, not the

settlement date.

Currency: For direct holdings, all data are

recorded in the local currency of the property,

except for several Eastern European Countries

(e.g. Bulgaria, Czech Republic, Hungary,

Poland, Romania, and Slovakia) for which the

data are recorded in Euros. Data recorded

at vehicle level and for other assets and

liabilities must be recorded in the operating

currency of the vehicle.

Language: Local languages and scripts should

be used for asset, fund and other names and

addresses. Otherwise English is the default

language for the Data Standards.

13 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

Rounding: All financial amounts and floor

spaces are recorded as whole integers,

unrounded. Decimal values for percentages or

other rates should be recorded to at least two

decimal places. Percentages should be provided

as percentage points, not decimals (e.g., 75%

should be provided as ’75.00’ not ‘0.75’).

Null responses: A zero should be recorded for

all financial fields if there has been no income,

receipt or expenditure under a category.

A field left blank will be treated as a non-

response.

All enumerated fields include three standard

default responses: (1) Not applicable – as

indicated by field definitions, which state the

types of record requiring a response. (2) Not

known – only to be used where the field is

applicable and the response is genuinely not

known. (3) Applicable, not categorized – only

to be used where the field is applicable but the

response cannot be categorized under any of

the possible responses listed.

Negative values: Data points for liabilities,

expenditures and receipts should all be

submitted as positive amounts. Corrections

and reversals of accruals should be recorded

as negative amounts.

14 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

This appendix details the full Global Data

Standards, with item by item definitions, and

all relevant data field enumerations.

APPENDIX 3: MSCI GLOBAL DATA STANDARDS

FOR REAL ESTATE INVESTMENT – SCHEMA

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

SDE001 Submission Submission Data Supply

Company

Name of organization supplying

the data

alphanumeric N

SDE002 Submission Submission Extract Date Date for which data submission

document was created

dd/mm/yyyy N

SDE003 Submission Submission Months In Period No of months in latest reporting integer N

SDE004 Submission Submission Source System

Name

Name of software system from

which was data extracted. May

include a sub-module name(s).

alphanumeric N

SDE005 Submission Submission Source System

Version

Version number or name of source

software system

alphanumeric N

SDE006 Submission Submission Submission

Period End Date

End date of submission reporting

period. This usually corresponds

to the valuation or appraisal date.

dd/mm/yyyy N

SDE007 Submission Submission Supplier Data

Set ID

Unique ID assigned at source to

the submitted data set.

alphanumeric N

ADE014 Asset Multiple tabs Client Asset ID Unique client business reference

for an investment type (asset or

liability). The reference should be

supplied consistently between

periods. New purchases and split or

merged assets should be given new

unique identifiers. Use of previously

used identifiers not permitted.

alphanumeric N

ADE016 Asset Multiple tabs Client System

Asset GUID

Global unique identifier (GUID) for an

investment type (asset or liability)

maintained by the clients source IT

system, not business users.

alphanumeric N

ADE039 Asset Multiple tabs MSCI Asset ID Unique reference for an

investment type (asset or liability)

as allocated by MSCI

alphanumeric N

ADE005 Asset Multiple tabs Asset Currency

Code

The three-letter currency code

(based on ISO 4217) in which the

valuation, financial and tenancy

information for the asset must be

collected on a consistent basis

alphanumeric Y

ADE015 Asset Multiple tabs Client Group

Name

Name for the Internal portfolio or

group that this asset is assigned

to for reporting, if different from

vehicle name.

alphanumeric N

ADE096 Asset Multiple tabs Investment type Classification of type of

investment as defined by MSCI.

Includes all direct and indirect

property investments, cash, debt

and other financial assets.

integer Y

15 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

AVA048 Asset Multiple tabs Investment Name Full name of indirect real estate

holding or investment asset.

Field is applicable to individual

holdings in indirect real estate,

debt investments, derivatives and

forward agreements.

alphanumeric N

AVA047 Asset Multiple tabs Investment ISIN International Securities

Identification Number for each

investment asset in the portfolio.

Uniquely identifies specific

securities issues.

alphanumeric N

AVA006 Asset Multiple tabs Valuation Period

End Date

Period end date of

valuation record.

dd/mm/yyyy N

ARF002 Asset Multiple tabs Account Period

End Date

Date when the current account

period ends. (Required for both

direct and indirect assets)

dd/mm/yyyy N

ARF005 Asset Multiple tabs Account Period

Start Date

Date from which the current

account period started. (Required

for both direct and indirect assets)

dd/mm/yyyy N

ADE011 Asset Multiple tabs Asset or

Building Name

Primary name of building. alphanumeric N

ADE002 Asset Direct RE

Location

Address Detail 1 Building number and street name. alphanumeric N

ADE003 Asset Direct RE

Location

Address Detail 2 Direct properties additional address

detail if any e.g. suburb name.

alphanumeric N

ADE082 Asset Direct RE

Location

Town or City

Name

Name of the city or town where the

property is located. If applicable

use diacritics (e.g. umlauts, accents

etc.) Field must start with the name

of the town so assets can be sorted

alphabetically by town. If there are

two towns of the same name and

you think it is necessary to give

a region as well, add the region

abbreviation separated by a comma

e.g. Richmond, Yorks. Each line can

be a maximum of 40 characters.

alphanumeric N

ADE053 Asset Direct RE

Location

Post Code Full postal or zip code. If postal

code is unknown enter the nearest

possible postal code. When a

property covers multiple postal

codes, indicate the post code of the

main tenant by Market Rental Value.

Where no postcode exists e.g. land -

the code for nearest building should

be used if possible.

alphanumeric N

ADE098 Asset Direct RE

Location

Geographic

Classification

County

Area in which property is located

above Municipality but below large

administrative areas, for example

NUTS 3 in Europe, County in USA,

similar statistical areas

alphanumeric N

ADE099 Asset Direct RE

Location

Geographic

Classification

Neighborhood

Neighborhood/postcode in which

property is located. Please provide

postcodes only in countries where

they exist; elsewhere provide

name of neighborhood.

alphanumeric N

ADE018 Asset Direct RE

Location

Country Name International assets must also

include name of the country. This

is a text field.

alphanumeric N

16 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ADE032 Asset Direct RE

Location

Latitude Geographic 6-digit latitude

co-ordinate Positive latitudes are

north of the Equator, negative

latitudes are south of the Equator.

integer N

ADE035 Asset Direct RE

Location

Longitude Geographic 6-digit longitude

co-ordinate. Positive longitudes

are east of the Prime Meridian,

negative longitudes are west of

the Prime Meridian.

integer N

ADE069 Asset Direct RE

Location

Retail Location

(Global)

Geographical location of

retail properties

integer Y

ADE043 Asset Direct RE

Location

Office Location

(Global)

Geographical location of

office properties

integer Y

ADE030 Asset Direct RE

Location

Industrial

Property

Situation

Location of industrial property

with reference to whether it is

situated on a park or not

integer Y

ADE028 Asset Direct RE

Location

Industrial

Location (Global)

Geographical location of

industrial properties

integer Y

ADE095 Asset Direct RE Type Valuation

Frequency

Frequency of valuation of an asset integer Y

ADE036 Asset Direct RE Type Managing Agent

Name

Name of organization responsible

for managing the property, or if

management is by investor's own

staff record 'In House', NOT the

company name.

alphanumeric N

ADE077 Asset Direct RE Type Tenure Legal conditions under which

the land, on which the property

is situated, is owned. Includes

freehold; leasehold; shared interest.

integer Y

ADE056 Asset Direct RE Type Property Type Classification of property types used

in MSCI Global Intel products. Codes

derived from other descriptive

fields listed below. Predominant use

of the property in terms of Market

Rental Value, at the end of the

period. Predominant use of property

should account for more than 50%

of Market Rental Value.

integer Y

ADE057 Asset Direct RE Type Property Type -

Secondary Use

Secondary use of the property in

terms of Market Rental Value, at

the end of the period. Secondary

use of property should account for

25-50% of total Market Rental Value.

Secondary use is not recorded if use

accounts for less than 25% of total

Market Rental Value.

integer Y

ADE017 Asset Direct RE Type Construction

Date

Year in which construction of the

property was completed.

YYYY N

ADE060 Asset Direct RE Type Refurbishment

Date

The date at which the last major

refurbishment of the building was

completed or the planned year of

completion of the refurbishment.

dd/mm/yyyy N

ADE101 Asset Direct RE Type With or

Without Air

Conditioning?

Do the principal buildings in the

property have full, integrated air

conditioning systems?

Integer Y

ADE040 Asset Direct RE Type Number of

Storeys in the

Principal Building

Number of whole storeys above

ground in the largest building of

the property.

integer N

ADE073 Asset Direct RE Type Shopping Center

Configuration

Type of shopping center in terms

of whether or not it is covered.

integer Y

17 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ADE074 Asset Direct RE Type Shopping

Center Main

Classification

Type of shopping center in terms

of whether it is traditional (mixed

use) or specialized.

integer Y

ADE067 Asset Direct RE Type Residential

Sub-Building

Type

Physical form of residential building. integer Y

ADE063 Asset Direct RE Type Residential

Letting

Characteristics

Indication of whether tenants benefit

from housing aid or not; when not,

whether it is market rent or not

integer Y

ADE086 Asset Direct RE Type Type of

Residential

Occupancy

Type of residential occupant e.g.

student, supported, retirement

home, standard residential.

integer Y

ADE064 Asset Direct RE Type Residential

Location (Global)

Geographical location of

residential properties

integer Y

ADE080 Asset Direct RE Type Total Number of

Lettable Units

Total number of lettable units in

the property (excluding parking)

at the end of the period. Includes

both vacant and let units.

integer N

ADE041 Asset Direct RE Type Number of

bedrooms

Number of bedrooms included

in the property. Excludes studio

apartments. Only required where

the predominant property use, in

terms of market rental value, is

residential or hotel.

integer N

ATR001 Asset Direct RE

Transactions

Purchase

Date - Whole

Properties

Investment purchase: Date of

completion of transfer of title on

initial acquisition of building, or

site without development plans.

Pre-funded development: Date of

payment of first tranche. Direct

development: Date of completion

of transfer of title on initial

acquisition of building/site. Indirect

purchase: Date of initial investment

into indirect investment.

dd/mm/yyyy N

ATR002 Asset Direct RE

Transactions

Method of

Acquisition

Method of acquisition of the asset, by

direct purchase or other agreement

integer Y

ATR003 Asset Direct RE

Transactions

Type of

Purchase

Whether property was

acquired as a completed

investment, or development

integer Y

ATR004 Asset Direct RE

Transactions

Asset Strategy Intended investment strategy at time

of purchase, for example to hold , to

renovate, to convert or to redevelop.

integer Y

ATR005 Asset Direct RE

Transactions

Net Purchase

Price

Direct purchase: Contract price,

including advance deposits and

indicate if retentions are outstanding.

Direct development: Contract price,

including advance deposits and

indicate if retentions are outstanding.

Pre-funded development: Cost of

first payment to developer, including

any expenditure prior to acquisition

Excludes indirect and financial

assets recorded elsewhere.

decimal N

ATR006 Asset Direct RE

Transactions

Gross Purchase

Price

Gross amount paid for acquisition of

title including all associated costs.

(Gross purchase price = net purchase

price + total purchase costs).

Excludes indirect and financial

assets recorded elsewhere

decimal N

18 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ATR007 Asset Direct RE

Transactions

Total Purchase

Costs

Gross amount paid for acquisition

of title. (Gross purchase price = net

purchase price + total purchase

costs).

decimal N

ATR008 Asset Direct RE

Transactions

Purchase Costs

Tax

Transfer tax costs incurred in

acquisition, for example Stamp

Duty. These should be reported in

line with the accruals principle, i.e.

in the period of the purchase date

rather than when paid.

decimal N

ATR009 Asset Direct RE

Transactions

Purchase Costs

Legal

Legal costs (internal & external)

incurred in the acquisition. These

should be reported in line with

the accruals principle, i.e. in the

period of the purchase date rather

than when paid. Where not known

standard rates are applied by MSCI.

decimal N

ATR010 Asset Direct RE

Transactions

Purchase Costs:

Agents' Fees

Agent fees incurred in the

acquisition. These should be

reported in line with the accruals

principle, i.e. in the period of the

purchase date rather than when

paid. Where not known standard

rates are applied by MSCI.

decimal N

ATR011 Asset Direct RE

Transactions

Purchase Costs:

Other

All other costs incurred in the course

of the acquisition. E.g. surveyor's or

planning advisory fees, These should

be reported in line with the accruals

principle, i.e. in the period of the

purchase rather than when paid.

decimal N

ATR012 Asset Direct RE

Transactions

Part Purchase

Date

Date of legal completion of purchase/

transfer of title of additional land or

parts of direct properties, further

shares or units in indirect vehicles,

additional investment into financial

products, cash etc.

dd/mm/yyyy N

ATR013 Asset Direct RE

Transactions

Part Purchase

Expenditure

Total capital expenditure

incurred during the period of

acquisition of additional title to

(parts of, or interests in) properties

already owned.

Includes costs from purchasing

parcels of land; further units in an

existing property; acquisition of

head lease interests; increase in

ownership share.

The amount should include

acquisition price and all purchase

costs (transfer tax; legal; agent

fees and other acquisition costs).

decimal N

ATR014 Asset Direct RE

Transactions

Sale Date

- Whole

Properties

Day, month and year of date of

legal completion of transfer of title

on final disposal. The day on which

money is received by the vendor.

dd/mm/yyyy N

ATR015 Asset Direct RE

Transactions

Gross Sale Price Contract sale price of direct

real estate assets (before costs

deducted), as at completion of

contract. Indicate if retentions

have been withheld.

decimal N

19 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ATR016 Asset Direct RE

Transactions

Net Sale Receipt Net amount received from purchaser

in consideration of sale of direct real

estate assets. This should exclude

any gain or loss attributable to

financing conditions and should be

net of all costs, (net sale receipt =

gross sale receipt - total sale costs)

decimal N

ATR017 Asset Direct RE

Transactions

Method of Sale Method of disposal of the asset.

Includes direct sale; transfer of

assets between funds; group sale.

integer Y

ATR018 Asset Direct RE

Transactions

Total Sale Costs Total sale costs incurred on final

disposal. These should be reported

in line with accruals principle, i.e. in

the period of the date of sale rather

than when paid. If in house and no

sale fees charged, MSCI will apply

standard scale fees. (Total sales

costs = sale costs: tax + sales costs:

legal + sale costs: agent’s fees + sale

costs: other). Retrospective invoices

and adjustments to accruals must be

entered under a dummy record.

decimal N

ATR019 Asset Direct RE

Transactions

Sale Costs: Tax Transfer tax costs incurred (if any)

on final disposal, or purchase tax

paid occasionally by the vendor. This

should be reported in line with the

accruals principle, i.e. in the period

incurred rather than when paid.

decimal N

ATR020 Asset Direct RE

Transactions

Sales Costs:

Legal

Legal costs (internal & external)

incurred on final disposal. This

should be reported in line with the

accruals principle, i.e. in the period

of the sale rather than when paid. If

in-house and no fee is charged, MSCI

will apply a standard scale fee.

decimal N

ATR021 Asset Direct RE

Transactions

Sale Costs:

Agents' Fees

Agent fees incurred on final

disposal. This should be reported

in line with the accruals principle,

i.e. in the period of the sale rather

than when paid. If in-house and no

fee is charged, MSCI will apply a

standard scale fee.

decimal N

ATR022 Asset Direct RE

Transactions

Sale Costs:

Other

All other sale costs excluding

tax, legal and agent fees. This

should be reported in line with

the accruals principle, i.e. in the

period of the sale rather than

when paid.

decimal N

ATR023 Asset Direct RE

Transactions

Part Sale Date Date of legal completion of sale /

transfer of title on disposal of land

or parts of direct properties, sale of

shares or units in indirect vehicles.

dd/mm/yyyy N

20 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ATR024 Asset Direct RE

Transactions

Part Sale

Receipt

Net receipts from the disposal

during the period of physical

parts, or interests in properties

that are retained.

Includes proceeds from selling

parcels of land; existing units

from a property; single buildings

on an estate, intermediate

leasehold interests, decrease in

ownership share.

This amount is the sale price less

any sale costs (legal and agents’

fees and other sale costs). Record

as positive amounts.

decimal N

ADE020 Asset Direct RE

Valuations

Actual Valuation

Date

Date at which the valuation was

carried out

dd/mm/yyyy N

ADE021 Asset Direct RE

Valuations

Appraiser

Internal/

External

Name of organization responsible

for property appraisal/ valuation,

or if valuations are prepared by

own staff, record 'In House', NOT

the name of the company.

alphanumeric N

ADE078 Asset Direct RE

Valuations

Appraisal

Method

Appraisal/valuation technique

employed to calculate this

valuation. If more than one method

is used, supply the predominant

method.

integer Y

ADE079 Asset Direct RE

Valuations

Basis of Value Statement of the fundamental

measurement assumptions of

the valuation. (RICS Valuation -

professional standards Jan 2014 p52)

integer Y

AVA001 Asset Direct RE

Valuations

Owner

Occupied/

Non-Market

Value Indicator

Property that is not valued on

the basis of Market or Fair Value

or Verkehrswert. This may be

because it is owner occupied or

otherwise not available for sale or

letting on the open market.

integer Y

AVA002 Asset Direct RE

Valuations

Ownership Share

Percentage

The percentage ownership share

of direct property holdings must be

recorded on every monthly record to

2 decimal places, including 100.00%

if the asset is wholly owned.

Percentage N

AVA005 Asset Direct RE

Valuations

Market Capital

Value

The Fair or Market Value, which is

the estimated price that would be

received to sell an asset or paid

to transfer a liability in an orderly

transaction between market

participants at the measurement

date, net of assumed purchasers'

costs. In the context of Financial

Reporting the IFRS13 definition of

Fair Value and IVSC definitions of

Market Value are interchangeable.

Include valuations prepared on the

Verkehrswert basis. ("The German

Verkehrswert definition corresponds

to the Market Value definition of

the RICS Red Book". RICS Guidance

Note for Germany 2014. ) Market

Valuations are required for all

assets, including developments.

decimal N

21 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

AVA009 Asset Direct RE

Valuations

Valuer's

Assumed

Purchasers'

Costs

Percentage rate used by the valuer

to adjust between Market Value

net of assumed purchasers’ costs

and gross capital value. Assumed

purchasers’ costs to include the

rate of transfer tax rate pertaining

at the property location on the

date of the valuation, plus notional

legal and agents' fees.

Percentage N

AVA010 Asset Direct RE

Valuations

Market Rental

Value

Total annual Market Rental Value

for the whole property at the end

of the period, gross of recoveries

(including vacant units). Defined

as the estimated amount for which

an interest in real property should

be leased on the date of valuation

between a willing lessor and a

willing lessee on appropriate lease

terms in an arm's-length transaction

after proper marketing wherein

the parties acted knowledgeably,

prudently and without compulsion.

If the lease states that the rent paid is

to be linked (geared) to a proportion

of the full Market Rental Value, then

the MRV should be provided pro rated

to reflect the terms of the lease.

For developments, unimproved

MRV to be provided until

development commenced, at

which point improved rental value

to be provided.

decimal N

AVA004 Asset Direct RE

Valuations

Total Market

Rental Value

(MRV) in Vacant

Units

The Market Rental Value of all

vacant units.

decimal N

AVA028 Asset Direct RE

Valuations

Rent Passing Total annual rent derived from all

leases in the property, at the end

of the period, taking into account

the impact of lease incentives

(i.e. if there is a rent free period,

amount reported equals zero).

Excluding: turnover rents and other

operating income (e.g. charges

for property tax, heating, air

conditioning, water) , which should

be recorded separately.

Exclude also: Effects of straight

lining for lease incentives such

as rent free periods or step rents

that are required under IFRS,

VAT, arrears, interest on arrears,

cost recoveries, key money, and

surrender premiums.

decimal N

22 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

AVA031 Asset Direct RE

Valuations

Topped-Up Rent Total annual rent passing from all

leases in the property at the valuation

date plus the additional rent after

expiration of rent-free periods or

other lease incentives. For rent-free

period, it should reflect the headline

cash rent as stipulated in the lease

contract. Exclude: - straight line

adjustments for rent free periods.

- developments, lots, unused

buildings rights & properties. - future

indexation uplifts, rent reviews or

rental uplifts which are intended to

compensate for future inflation.

decimal N

AVA032 Asset Direct RE

Valuations

Annual Ground

Rent as per

Lease

Regular payment required under a

lease from the owner of leasehold

interest, payable to the freeholder.

decimal N

ADE105 Asset Direct RE

Valuations

Unit of

Measurement

for Area

The unit of measurement used

to state the floor area. Includes

square meters; square feet;

tsubos; hectares; acres.

integer Y

ADE106 Asset Direct RE

Valuations

Total Net

Lettable Area

For buildings record total usable

floor space. Square meters

assumed unless specified in Unit of

Measurement for Area. Area should

be reported at 100%, not ownership

share percentage. The total building

area must be in line with prevailing

local standards for measurement

and match with values that will

be stated in lease contracts. The

area must not include "unlettable"

areas like common areas although

tenant may participate to the

costs. For general guidelines of

measurements for oces please

consult IPMS (International Property

Measurement Standards) latest

release (ISBN 978-1-78321-062-6).

For retail, please use Gross Leasing

Area. For residential, comply with

any ocial regulation that is likely

to apply. For land, record total area

in acres, not hectares or square

meters. (1 hectare = 2.471 acres,

10,000 sq. m and 1 acre =

0.405 hectares).

integer N

ADE107 Asset Direct RE

Valuations

Total Let Area Total floor area that it is under

lease to tenants at the reporting

date. Include leases subject to

rent-free periods, but exclude

pre-lets where the lease has start

date in the future.

Area must be reported at 100%,

not ownership share percentage.

integer N

ADE104 Asset Direct RE

Valuations

Retail Floor

Space

Gross lettable area for retail

use (including marketing halls,

permanent kiosks, food courts and

shop units). Only required where the

predominant property use, in terms

of Market Rental Value, is Shopping

Center or Factory Outlet.

integer N

ADE042 Asset Direct RE

Valuations

Number of

Parking Spaces

Total Number of Parking Spaces integer N

23 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ADE108 Asset Direct RE

Valuations

Detailed

Management

Status

Stage of development at time

of valuation.

integer Y

ADE109 Asset Direct RE

Valuations

Development

status

Is asset under development at

the end of the period? A property

is treated as a development if

expenditure over the course of the

project will be more than 25% of the

start value. If it is less than 25% it is

treated as a refurbishment.

Integer Y

ADE110 Asset Direct RE

Valuations

Number of

Months in

Development

Number of months under

development at any time within

the period.

Integer N

ADE111 Asset Direct RE

Valuations

Date of Practical

Completion of

Development:

Day/ Month/

Year

Year of practical completion of

development. A development should

only be coded as complete when it

is actually completed. MSCI define

this as the earlier of i) 6 months

after practical completion (the date

on which the architect's certificate

of completion is made) or ii) 75%

letting to actual tenants (not a

developer's guarantee).

dd/mm/yyyy N

ADE102 Asset Direct RE

Valuations

Hotel Occupancy

Rate

Occupied rooms as a proportion of

total available rooms in a hotel.

Percentage N

24 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ACF026 Asset Direct RE

Capital Flows

Total Capital

Expenditure

Capital expenditure incurred during

the period, net of recoverable VAT.

Excludes:

• costs associated with full or part

purchases (recorded elsewhere)

• accounting Provisions for

future liabilities

• capitalized interest

• taxes, except for non-recoverable

VAT and transfer taxes recorded

under Purchase costs.

Includes:

• all expenditure that has been

capitalized (rather than expensed)

• expenditure incurred on

developments (including

associated fees)

• landlord’s improvements

• refurbishment costs

• capital inducements

• restructuring tenant leases

• contributions to new tenants’

fitting-out costs

• retentions of purchase

amounts (when released)

• change in ownership share

• non-recoverable VAT.

• accrued costs

• reversals of accruals (as

negative amounts) .

Costs paid on pre-funded

developments should be provided

net of rolled up interest paid by

the developer.

Also includes all expenditure that

cannot be allocated to a live asset

or an individual asset.

decimal N

ACF027 Asset Direct RE

Capital Flows

Total Capital

Receipts

Capital receipts incurred during

the period.

Exclude:

• Part or full sales

• tax rebates

Includes:

• Surrender premiums if capitalized

• developer compensation

• subsidies or grants if capitalized

• redemptions

• compulsory purchase orders.

Capital receipts should be recorded

as positive amounts. Reversals of

accrued capital Receipts should be

recorded as negative values under

Capital Receipts.

If Surrender Premiums are treated

as Revenue receipts they should

be recorded under Key Money &

Surrender Premiums

Also includes all capital receipts

that cannot be allocated to a live

asset or an individual asset.

decimal N

25 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ARF076 Asset Direct RE

Capital Flows

Unallocated

Cash flow

Identifier

Yes' if record relates to a cash

flow that cannot be allocated to an

existing real estate asset

integer Y

ARF065 Asset Direct RE

Revenue Flows

Rent as Invoiced

for the period

including

Turnover rents

Rent as invoiced for the period

from all leases net of any rent

discounts but gross of ground rent,

and including Turnover Rents. MSCI

will pro rata to monthly amounts.

The sum of unit level rents

invoiced including Turnover rent.

Excludes:

• Rent Lost due to vacancies

• VAT

• Arrears

• Prepayments

• Repayments

• Service charges

• Buy-off of rental contracts.

decimal N

ARF075 Asset Direct RE

Revenue Flows

Turnover Rent Turnover rent: The variable

portion of the total income from

a single or a group of tenants in

a property. The variable portion

or the turnover element is based

on the trading accounts of the

occupational tenant(s). If the

current period figures are not

available, the actual figure reported

as at prior period is considered as

a best available estimate.

decimal N

ARF038 Asset Direct RE

Revenue Flows

Key Money

& Surrender

Premiums

Key Money: Payments occasionally

made by potential tenants to

secure a new lease. (Exclude

deposits paid by tenants and held

by landlords against potential

damages.) Include Surrender

Premiums treated as Revenue

receipts under local accounting

regulations: Payments made by

tenants to release them from

lease contracts prior to the expiry

date. Surrender Premiums classed

as Capital Receipts under local

accounting regulations should be

recorded under Capital Receipts.

decimal N

26 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ARF051 Asset Direct RE

Revenue Flows

Other Income

for the period

Income other than rental income

attributable to the property for the

period, collated to a property level.

May include: hoardings, wayleaves,

rights of way, Income guarantees,

subsidies, and car parking income

(where not included in the total

Rent Passing above). Exclude:

• Key money

• Surrender premiums

• Income derived from expenditure

recoveries (service charges)

• Interest paid on Rent arrears

• Tax credits

• Income from activities outside

the landlord’s obligation under

tenant leases e.g. income from

supply of secretarial or other

services to tenants.

• insurance commission.

Includes historic Tax Subsidies

available historically in Nordic

countries, and other revenue

grants. Also includes all income

that cannot be allocated to a live

asset or an individual asset. MSCI

will pro rata to monthly amounts.

decimal N

ARF077 Asset Direct RE

Revenue Flows

Unallocated

Recovered Costs

Any recovery (income) that a

landlord may have received, but for

which it is not possible to identify

the cost it should be attached to.

This includes any recovered costs

that have not been netted off in

any of the net cost categories (i.e.

not covered by normal Common

Areas Management or Service

Charge recoveries). Examples are

the occasional recovery of Ground

Rents or Letting Fees, and other

uncommon arrangements. This

is a Mandatory Field. It must be

subtracted from the Total Net

Cost to provide the true total net

cost figure.

decimal N

ARF044 Asset Direct RE

Revenue Flows

Net Income for

the period

Total Income Receivable (Rent as

Invoiced + Key Money & Surrender

Premiums + Other Income

(excluding cost recoveries), less

Total of Net Operating Costs.

MSCI will pro rata to

monthly amounts.

decimal N

ARF072 Asset Direct RE

Revenue Flows

Total of Net

Operating Costs

Total of Net Operating costs for the

preceding 12 months.

Total of Net Cost = Sum of all

Net costs (Utilities, Maintenance,

Property Taxes, Management Costs

and Other Net Costs) + (Cost of

Vacancies, Letting & Rent Review

fees, Ground Rents, Bad Debt

Write-offs) minus Unallocated

Recovered Costs.

decimal N

27 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ARF048 Asset Direct RE

Revenue Flows

Net Property

Management

Costs

Property management costs for

the period, either in-house or

outsourced net of any amounts

recovered from tenants.

Includes collection of rents and

Service charge / CAM recoveries,

as well as Facilities Management

(workplace, design & layout, space

planning), project on the property as

well as environmental, information,

and quality management.

Excludes Rent Review fees & Costs

associated with new lettings to be

recorded under Letting Costs.

Excludes Fund-level Costs such as

fund and asset management costs,

professional indemnity insurance,

valuation fees, research,

custodian, and auditors fees.

If properties are managed in-

house without internal charges, a

total cost should be estimated and

allocated to individual assets pro

rata to Market Rent.

Unlet vacant units which are

standing assets or investment

properties undergoing development/

refurbishment should be recorded

under Costs of Vacancies.

decimal N

28 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ARF046 Asset Direct RE

Revenue Flows

Net Maintenance

& Care Costs

Maintenance and care costs net

of any recoveries from tenants.

Include all materials and labor

costs attached to both occasional

preventive and corrective

maintenance, and regular property

care (either contracted or in house).

• Preventive is maintenance

performed before an equipment

performance becomes

unsatisfactory or to prevent

consequential damage. It

includes statutory inspections

and work carried out at regular

intervals to prevent attrition or

minimize the risk of breakdown

or accidents.

• Corrective maintenance covers

total restoration or replacement

of building components

(e.g. roof, facade, windows,

installation systems) to bring

them back to their initial state.

• Care including : surveillance &

alarms, salaries for janitors/

caretakers, cleaning of

common areas (interior and

exterior), clearing of roads,

garden upkeep and decoration.

Typical internal equipment subject

to maintenance are lifts, escalators,

water and plumbing, waterproofing,

heaters, air conditioning, sprinkler

systems, fire services, electrical

installations, IT installations, security

installations, External equipment

are roofs, external walls, cladding,

fenestration, foundations, drainage,

external redecoration or finishes.

Unlet vacant units which are

standing assets or investment

properties undergoing development/

refurbishment should be recorded

under Costs of Vacancies.

Note: Care and Maintenance

costs also can be recorded

separately under the German and

Nordic services.

decimal N

ARF050 Asset Direct RE

Revenue Flows

Net Utility Costs Cost of utilities supplied for the

period net of any recoveries

from tenants

Include all forms of energy

(electricity, fuel oils, heating or

cooling networks), as well as

water consumption, sewers and

refuse collection.

Exclude Telecommunication costs

which should be recorded as

“Other costs” below.

Unlet vacant units which are

standing assets or investment

properties undergoing development/

refurbishment should be recorded

under Costs of Vacancies.

decimal N

29 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ARF045 Asset Direct RE

Revenue Flows

Net Insurance

Costs

All costs of premiums for insuring

the property for the period paid by

the landlord net of any recoveries

from tenants. Typically covering fire,

storm, fungus and insect attack,

pipe damage, and public liability

insurance. Include the costs of all

building related insurance, liability

for excess and any premiums for

loss of rent, subsidence, terrorism,

fires, floods, burst pipes, explosions

and earthquakes. Excludes

insurance for loss of trade.

Note: Damages covered by

Insurance should neither be

counted as a Capital Cost when they

occur, nor as a Capital Receipts

when payments are received from

the insurers. This will prevent value

distortions.

Unlet vacant units which are

standing assets or investment

properties undergoing development/

refurbishment should be recorded

under Costs of Vacancies.

decimal N

ARF049 Asset Direct RE

Revenue Flows

Net Property

Taxes

Cost of taxes for the period,

arising directly from occupation

and/or ownership of a property

under national and local laws and

regulations net of any recoveries

from tenants. Typical taxes

are property tax, land tax and

municipal taxes (rates). Any taxes

relating to Utilities should be

recorded here, not with Utilities.

Excludes property transfer tax

(Stamp duty), which must be

recorded under Purchase costs,

Corporation tax, Capital Gains tax,

and all business and sales taxes

levied on business profits and sales

of either the landlord or the occupier.

Unlet vacant units which are

standing assets or investment

properties undergoing development/

refurbishment should be recorded

under Costs of Vacancies.

decimal N

30 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ARF047 Asset Direct RE

Revenue Flows

Net Operating

Costs - Other

Other Costs including some service-

specific costs, Irrecoverable VAT

/ GST, and some Occupier’s costs

which are sometimes provided

by landlords. Include costs

related to tenant activities (e.g.

telecommunication, business

support, catering etc.), and any

costs of litigation with tenants.

Also includes all revenue costs that

cannot be allocated to a live asset or

an individual asset.

Exclude legal costs associated

with Lettings and rent reviews

which should be recorded under

Letting & Lease Renewal Costs.

Unlet vacant units which are

standing assets or investment

properties undergoing development/

refurbishment should be recorded

under Costs of Vacancies.

decimal N

ARF021 Asset Direct RE

Revenue Flows

Gross Letting

Costs & Rent

Review fees

All costs that are associated with

administering changes to the

lease structure of a property. This

includes costs of advertising and

marketing (brochures, hoardings,

events etc.), agent’s or broker’s

letting fees, lease renewal, rent

review fees and associated legal

costs. Exclude fitting out costs,

building and tenant improvements.

Note: Under some accounting

principles Lease Commissions are

capitalized, typically over the length

of the lease. Where this applies

they should be excluded here and

recorded under capital expenditure.

decimal N

ARF032 Asset Direct RE

Revenue Flows

Ground Rent

payable

The total cost of ground rents

payable against the property for

the period. Rents due on leasehold

properties to a superior landlords/

owners of the freehold.

Where ground rents include a

turnover element based on tenant

trading figures, provide the last

available figure as a best estimate

and adjust for the accrual in the

following period. These amounts

should include any movement in

accrued costs and may include

negative amounts where costs

have been reversed.

decimal N

31 MSCI GLOBAL DATA STANDARDS FOR REAL ESTATE INVESTMENT

GDS

FIELD CODE

ENTITY

LEVEL

DATA

CATEGORIES

DATA FIELD DATA DEFINITION DATA FORMAT ENUMERATION

ARF008 Asset Direct RE

Revenue Flows

Bad debt write-