© 2019, Association of International Certified Professional Accountants. All rights reserved.

Report of Independent Auditors

and Financial Statements for

Big National Charity, Inc.

December 31, 20XX and 20XX

ASU 2016-14 Financial Statement Example

The AICPA's Not-for-Profit Expert Panel created this set of illustrative financial statements that

shows the implementation of ASU 2016-14. This document provides a non-authoritative example

of a possible presentation of a complete set of financial statements for a nongovernmental NFP that

is not a health care provider under current GAAP. The example is fictitious.

© 2019, Association of International Certified Professional Accountants. All rights reserved.

CONTENTS

PAGE

FINANCIAL STATEMENTS

Statements of Financial Position 1

Statements of Activities 2–3

Statements of Functional Expenses 4

Statements of Cash Flows – Indirect Method 5

Statements of Cash Flows – Direct Method 6

Notes to Financial Statements 7–14

See accompanying notes. 1

© 2019, Association of International Certified Professional Accountants. All rights reserved.

BIG NATIONAL CHARITY, INC.

STATEMENTS OF FINANCIAL POSITION

AS OF DECEMBER 31, 20XX AND 20XX

20XX 20XX

ASSETS

Cash and cash equivalents 1,740,000$ 920,000$

Contributions receivable 244,000 409,000

Due from related parties

- 90,000

Prepaid expenses and other assets 170,000 169,000

Investments 1,158,000 677,000

Property and equipment, net 151,000 207,000

Total assets 3,463,000$ 2,472,000$

LIABILITIES AND NET ASSETS

LIABILITIES

Accounts payable and accrued expenses 373,000$ 219,000$

Due to related parties 303,000 -

Other liabilities 143,000 147,000

Total liabilities 819,000 366,000

NET ASSETS

Without donor restrictions 1,599,000 914,000

With donor restrictions 1,045,000 1,192,000

Total net assets 2,644,000 2,106,000

Total liabilities and net assets 3,463,000$ 2,472,000$

2 See accompanying notes.

© 2019, Association of International Certified Professional Accountants. All rights reserved.

BIG NATIONAL CHARITY, INC.

STATEMENTS OF ACTIVITIES

FOR THE YEAR ENDED DECEMBER 31, 20XX

Without Donor With Donor

Restrictions Restrictions Total

Operating activities

REVENUES AND OTHER SUPPORT

Contributions 4,976,000$ 515,000$ 5,491,000$

Contributions - from related parties 755,000 - 755,000

Contributions - donation in-kind 13,000 - 13,000

Interest and dividends 20,000 9,000 29,000

Net assets released from restrictions 662,000 (662,000) -

Total revenues and other support 6,426,000 (138,000) 6,288,000

EXPENSES

Animal services 4,286,000 - 4,286,000

Supporting services:

Management and general 283,000 - 283,000

Fundraising 1,139,000 - 1,139,000

Total support services 1,422,000 - 1,422,000

Total expenses 5,708,000 - 5,708,000

Change in net assets from operations 718,000 (138,000) 580,000

Nonoperating activities

Investment return, net (33,000) (9,000) (42,000)

Total nonoperating activities (33,000) (9,000) (42,000)

Change in net assets 685,000 (147,000) 538,000

Net assets, beginning of year 914,000 1,192,000 2,106,000

Net assets, end of year 1,599,000$ 1,045,000$ 2,644,000$

See accompanying notes. 3

© 2019, Association of International Certified Professional Accountants. All rights reserved.

BIG NATIONAL CHARITY, INC.

STATEMENTS OF ACTIVITIES

FOR THE YEAR ENDED DECEMBER 31, 20XX

Without Donor With Donor

Restrictions Restrictions Total

Operating activities

REVENUES AND OTHER SUPPORT

Contributions 3,485,000$ 106,000$ 3,591,000$

Contributions - from related parties 324,000 324,000

Interest and dividends 13,000 13,000

Net assets released from restrictions 325,000 (325,000) -

Total revenues and other support 4,147,000 (219,000) 3,928,000

EXPENSES

Animal services 3,269,000 - 3,269,000

Supporting services:

Management and general 353,000 - 353,000

Fundraising 1,039,000 - 1,039,000

Total support services 1,392,000 - 1,392,000

Total expenses 4,661,000 - 4,661,000

Change in net assets from operations (514,000) (219,000) (733,000)

Nonoperating activities

Investment return, net 6,000 3,000 9,000

Total nonoperating activities 6,000 3,000 9,000

Change in net assets (508,000) (216,000) (724,000)

Net assets, beginning of year 1,422,000 1,408,000 2,830,000

Net assets, end of year 914,000$ 1,192,000$ 2,106,000$

4 See accompanying notes.

© 2019, Association of International Certified Professional Accountants. All rights reserved.

BIG NATIONAL CHARITY, INC.

STATEMENTS OF FUNCTIONAL EXPENSES

FOR THE YEARS ENDED DECEMBER 31, 20XX AND 20XX

Animal Management

Services and General Fundraising Total

Grants 1,617,000$ 105,000$ -$ 1,722,000$

Salaries and benefits 1,285,000 16,000 531,000 1,832,000

Education and awareness 706,000 54,000 245,000 1,005,000

Occupancy 203,000 30,000 72,000 305,000

Professional services 120,000 48,000 45,000 213,000

Printing 137,000 1,000 74,000 212,000

Information technologies 15,000 4,000 35,000 54,000

Travel 79,000 1,000 11,000 91,000

Depreciation 44,000 6,000 13,000 63,000

Other 80,000 18,000 113,000 211,000

4,286,000$ 283,000$ 1,139,000$ 5,708,000$

Animal Management

Services and General Fundraising Total

Grants 229,000$ 12,000$ -$ 241,000$

Salaries and benefits 1,471,000 171,000 451,000 2,093,000

Education and awareness 265,000 1,000 113,000 379,000

Occupancy 185,000 25,000 75,000 285,000

Professional services 664,000 108,000 232,000 1,004,000

Printing 111,000 3,000 22,000 136,000

Information technologies 83,000 6,000 19,000 108,000

Travel 126,000 4,000 8,000 138,000

Depreciation 44,000 6,000 18,000 68,000

Other 91,000 17,000 101,000 209,000

3,269,000$ 353,000$ 1,039,000$ 4,661,000$

20XX

20XX

See accompanying notes. 5

© 2019, Association of International Certified Professional Accountants. All rights reserved.

BIG NATIONAL CHARITY, INC.

STATEMENTS OF CASH FLOWS – INDIRECT METHOD

FOR THE YEARS ENDED DECEMBER 31, 20XX AND 20XX

INDIRECT METHOD

20XX 20XX

CASH FLOWS FROM OPERATING ACTIVITIES

Change in net assets 538,000$ (724,000)$

Adjustments to reconcile change in net assets to net

cash provided by (used in) operating activities:

Depreciation 63,000 68,000

Donated securities (70,000) (37,000)

Net depreciation (appreciation) on investments 42,000 (9,000)

Decrease (increase) in contributions receivable 165,000 (99,000)

Decrease in due to/from related parties 393,000 303,000

(Increase) decrease in prepaid expenses and other assets (1,000) 7,000

Increase (decrease) in accounts payable and accrued expenses 154,000 (73,000)

(Decrease) increase in other liabilities (4,000) 1,000

Net cash provided by (used in) operating activities 1,280,000 (563,000)

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of fixed assets (7,000) -

Purchase of investments (1,290,000) (546,000)

Proceeds from sales and maturities of investments 837,000 79,000

Net cash used in investing activities (460,000) (467,000)

Net increase (decrease) in cash and cash equivalents 820,000 (1,030,000)

Cash and cash equivalents, beginning of year 920,000 1,950,000

Cash and cash equivalents, end of year 1,740,000$ 920,000$

[NOTE – Both the indirect and direct methods are presented. NFP may choose either method of reporting

cash flows from operating activities. If the direct method is used, a reconciliation to the indirect method

(as illustrated in paragraph 230-10-55-10) may be reported but is not required.

6 See accompanying notes.

© 2019, Association of International Certified Professional Accountants. All rights reserved.

BIG NATIONAL CHARITY, INC.

STATEMENTS OF CASH FLOWS – DIRECT METHOD

FOR THE YEARS ENDED DECEMBER 31, 20XX AND 20XX

DIRECT METHOD

20XX 20XX

CASH FLOWS FROM OPERATING ACTIVITIES

Cash received from contributions 5,986,000$ 3,741,000$

Cash payments to employees and vendors (5,128,000) (4,620,000)

Cash payments from related parties, net 393,000 303,000

Interest and dividends received 29,000 13,000

Net cash provided by (used in) operating activities 1,280,000 (563,000)

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of fixed assets (7,000) -

Purchase of investments (1,290,000) (546,000)

Proceeds from sales and maturities of investments 837,000 79,000

Net cash used in investing activities (460,000) (467,000)

Net increase (decrease) in cash

820,000 (1,030,000)

Cash and cash equivalents, beginning of year 920,000 1,950,000

Cash and cash equivalents, end of year 1,740,000$ 920,000$

BIG NATIONAL CHARITY, INC.

NOTES TO FINANCIAL STATEMENTS

7

© 2019, Association of International Certified Professional Accountants. All rights reserved.

Note 1 – Description of the Organization

Big National Charity, Inc. seeks to prevent animal suffering around the globe by helping injured animals

and reintroducing them into the wild.

Note 2 – Summary of Significant Accounting Policies

Basis of presentation –The financial statements of Big National Charity, Inc. have been prepared in

accordance with U.S. generally accepted accounting principles ("US GAAP"), which require Big National

Charity, Inc. to report information regarding its financial position and activities according to the following

net asset classifications:

Net assets without donor restrictions: Net assets that are not subject to donor-imposed

restrictions and may be expended for any purpose in performing the primary objectives of the

organization. These net assets may be used at the discretion of Big National Charity, Inc.'s

management and the board of directors.

Net assets with donor restrictions: Net assets subject to stipulations imposed by donors, and

grantors. Some donor restrictions are temporary in nature; those restrictions will be met by

actions of Big National Charity, Inc. or by the passage of time. Other donor restrictions are

perpetual in nature, where by the donor has stipulated the funds be maintained in perpetuity.

Donor restricted contributions are reported as increases in net assets with donor restrictions.

When a restriction expires, net assets are reclassified from net assets with donor restrictions to

net assets without donor restrictions in the statements of activities.

Measure of operations – The statements of activities reports all changes in net assets, including changes

in net assets from operating and nonoperating activities. Operating activities consist of those items

attributable to Big National Charity, Inc.'s ongoing animal services and interest and dividends earned on

investments. Nonoperating activities are limited to resources that generate return from investments and

other activities considered to be of a more unusual or nonrecurring nature.

Cash and cash equivalents – Big National Charity, Inc.'s cash consists of cash on deposit with banks. Cash

equivalents represent money market funds or short-term investments with original maturities of three

months or less from the date of purchase, except for those amounts that are held in the investment

portfolio which are invested for long-term purposes.

EXAMPLE CHARITY

NOTES TO FINANCIAL STATEMENTS

8

© 2019, Association of International Certified Professional Accountants. All rights reserved.

Note 2 – Summary of Significant Accounting Policies (continued)

Concentrations of credit risk – Financial instruments that potentially subject Big National Charity, Inc.

to concentrations of credit risk consist principally of cash and cash equivalents and investments. Big

National Charity, Inc. maintains its cash and cash equivalents in various bank accounts that, at times, may

exceed federally insured limits. Big National Charity, Inc.'s cash and cash equivalent accounts have been

placed with high credit quality financial institutions. Big National Charity, Inc. has not experienced, nor

does it anticipate, any losses with respect to such accounts.

Contributions receivable – Unconditional promises to give that are expected to be collected within one

year are recorded at net realizable value. Unconditional promises to give that are expected to be collected

in future years are recorded at the present value of their estimated future cash flows. The discounts on

those amounts are computed using risk-adjusted interest rates applicable to the years in which the

promises are received. Discount amortization is included in contribution revenue. Conditional promises

to give are not included as support until the conditions are met.

As of December 31, 20XX, Big National Charity, Inc.'s contributions receivable consisted of unconditional

promises to give in the amount of $150,000 and receivables from third party processors in the amount of

$94,000, all of which are expected to be collected within one year. As of December 31, 20XX, contributions

receivable consisted of unconditional promises to give in the amount of $301,000 and receivables from

third party processors in the amount of $108,000.

Due to/from related parties – Amounts reported as due to/from related parties, included in the

accompanying statements of financial position, arise principally from the collaborative activities between

Big National Charity, Inc., Big National Charity, Inc. International, and Big National Charity, Inc. Canada to

further the mission of the organization.

Property and equipment, net – Property and equipment are stated at cost at the date of purchase or, for

donated assets, at fair value at the date of donation, less accumulated depreciation. Depreciation is

calculated using the straight-line method over the lesser of the estimated useful lives of the assets or the

lease term. The useful lives range from three to seven years. Big National Charity, Inc.'s policy is to

capitalize renewals and betterments acquired for greater than $5,000 and expense normal repairs and

maintenance as incurred. Big National Charity, Inc.'s management periodically evaluates whether events

or circumstances have occurred indicating that the carrying amount of long-lived assets may not be

recovered.

Investments – Investments are reported at cost, if purchased, or at fair value, if donated. Thereafter,

investments are reported at their fair values in the statements of financial position, and changes in fair

value are reported as investment return in the statements of activities.

Purchases and sales of securities are reflected on a trade-date basis. Gains and losses on sales of securities

are based on average cost and are recorded in the statements of activities in the period in which the

securities are sold. Interest is recorded when earned. Dividends are accrued as of the ex-dividend date.

BIG NATIONAL CHARITY, INC.

NOTES TO FINANCIAL STATEMENTS

9

© 2019, Association of International Certified Professional Accountants. All rights reserved.

Note 2 – Summary of Significant Accounting Policies (continued)

Fair value measurements – Fair value is defined as the price that would be received to sell an asset in

the principal or most advantageous market for the asset in an orderly transaction between market

participants on the measurement date. Fair value should be based on the assumptions market participants

would use when pricing an asset. US GAAP establishes a fair value hierarchy that prioritizes investments

based on those assumptions. The fair value hierarchy gives the highest priority to quoted prices in active

markets (observable inputs) and the lowest priority to an entity's assumptions (unobservable inputs). Big

National Charity, Inc. groups assets at fair value in three levels, based on the markets in which the assets

and liabilities are traded and the reliability of the assumptions used to determine fair value. These levels

are:

Level 1 Unadjusted quoted market prices for identical assets or liabilities in active markets as of

the measurement date.

Level 2 Other observable inputs, either directly or indirectly, including:

• Quoted prices for similar assets/liabilities in active markets;

• Quoted prices for identical or similar assets in non-active markets;

• Inputs other than quoted prices that are observable for the asset/liability; and,

• Inputs that are derived principally from or corroborated by other observable market

data.

Level 3 Unobservable inputs that cannot be corroborated by observable market data.

Contributions – Contributions received are recorded as net assets without donor restrictions or net

assets with donor restrictions, depending on the existence and/or nature of any donor-imposed

restrictions. Contributions that are restricted by the donor are reported as an increase in net assets

without donor restrictions if the restriction expires in the reporting period in which the contribution is

recognized. All other donor restricted contributions are reported as an increase in net assets with donor

restrictions, depending on the nature of restriction. When a restriction expires (that is, when a stipulated

time restriction ends or purpose restriction is accomplished), net assets with donor restrictions are

reclassified to net assets without donor restrictions and reported in the statements of activities as net

assets released from restrictions.

Contributed property and equipment are recorded at fair value at the date of donation. Contributions with

donor-imposed stipulations regarding how long the contributed assets must be used are recorded as net

assets with donor restrictions; otherwise, the contributions are recorded as net assets without donor

restrictions.

EXAMPLE CHARITY

NOTES TO FINANCIAL STATEMENTS

10

© 2019, Association of International Certified Professional Accountants. All rights reserved.

Note 2 – Summary of Significant Accounting Policies (continued)

In-kind donations – Big National Charity, Inc. received donated professional services and other

advertising services of $13,000 for the year ended December 31, 20XX. Such amounts, which are based

upon information provided by third-party service providers, are recorded at their estimated fair value

determined on the date of contribution and are reported as contributions in-kind and supporting services

on the accompanying statements of activities and statements of functional expenses.

Several volunteers have made significant contributions of their time in furtherance of Big National Charity,

Inc.'s mission. These services were not reflected in the accompanying statements of activities because

they do not meet the necessary criteria for recognition under US GAAP.

Functional expenses – The costs of providing program and other activities have been summarized on a

functional basis in the statements of activities. Accordingly, certain costs have been allocated among

animal services and supporting services benefited. Such allocations are determined by management on

an equitable basis.

The expenses that are allocated include the following:

Expense Method of Allocation

Grants Time and effort

Salaries and benefits Time and effort

Education and awareness Time and effort

Occupancy Square Footage

Professional services Full Time Equivalent

Printing Full Time Equivalent

Information technologies Full Time Equivalent

Travel Time and effort

Depreciation Square Footage

Other Time and effort

Use of estimates – The preparation of financial statements in conformity with US GAAP requires

management to make estimates and assumptions that affect certain reported amounts and disclosures.

Actual results could differ from those estimates.

BIG NATIONAL CHARITY, INC.

NOTES TO FINANCIAL STATEMENTS

11

© 2019, Association of International Certified Professional Accountants. All rights reserved.

Note 2 – Summary of Significant Accounting Policies (continued)

Income taxes –Big National Charity, Inc. is exempt from income tax under IRC section 501(c)(3), though

it is subject to tax on income unrelated to its exempt purpose, unless that income is otherwise excluded

by the Code. Big National Charity, Inc. has processes presently in place to ensure the maintenance of its

tax-exempt status; to identify and report unrelated income; to determine its filing and tax obligations in

jurisdictions for which it has nexus; and to identify and evaluate other matters that may be considered tax

positions. Big National Charity, Inc. has determined that there are no material uncertain tax positions that

require recognition or disclosure in the financial statements.

Reclassifications – Certain prior year amounts have been reclassified to conform to the current year

presentation.

New Accounting Pronouncement – On August 18, 2016, FASB issued ASU 2016-14, Not-for-Profit

Entities (Topic 958) – Presentation of Financial Statements of Not-for-Profit Entities. The update addresses

the complexity and understandability of net asset classification, deficiencies in information about liquidity

and availability of resources, and the lack of consistency in the type of information provided about

expenses and investment return. Big National Charity, Inc. has adjusted the presentation of these

statements accordingly. The ASU has been applied retrospectively to all periods presented.

Note 3 – Availability and Liquidity

The following represents Big National Charity’s financial assets at December 31, 20XX and 20XX:

Big National Charity’s goal is generally to maintain financial assets to meet 90 days of operating expenses

(approximately $1.4 million). As part of its liquidity plan, excess cash is invested in short-term

investments, including money market accounts and certificates of deposit. Big National Charity has a

$250,000 line of credit available to meet cash flow needs.

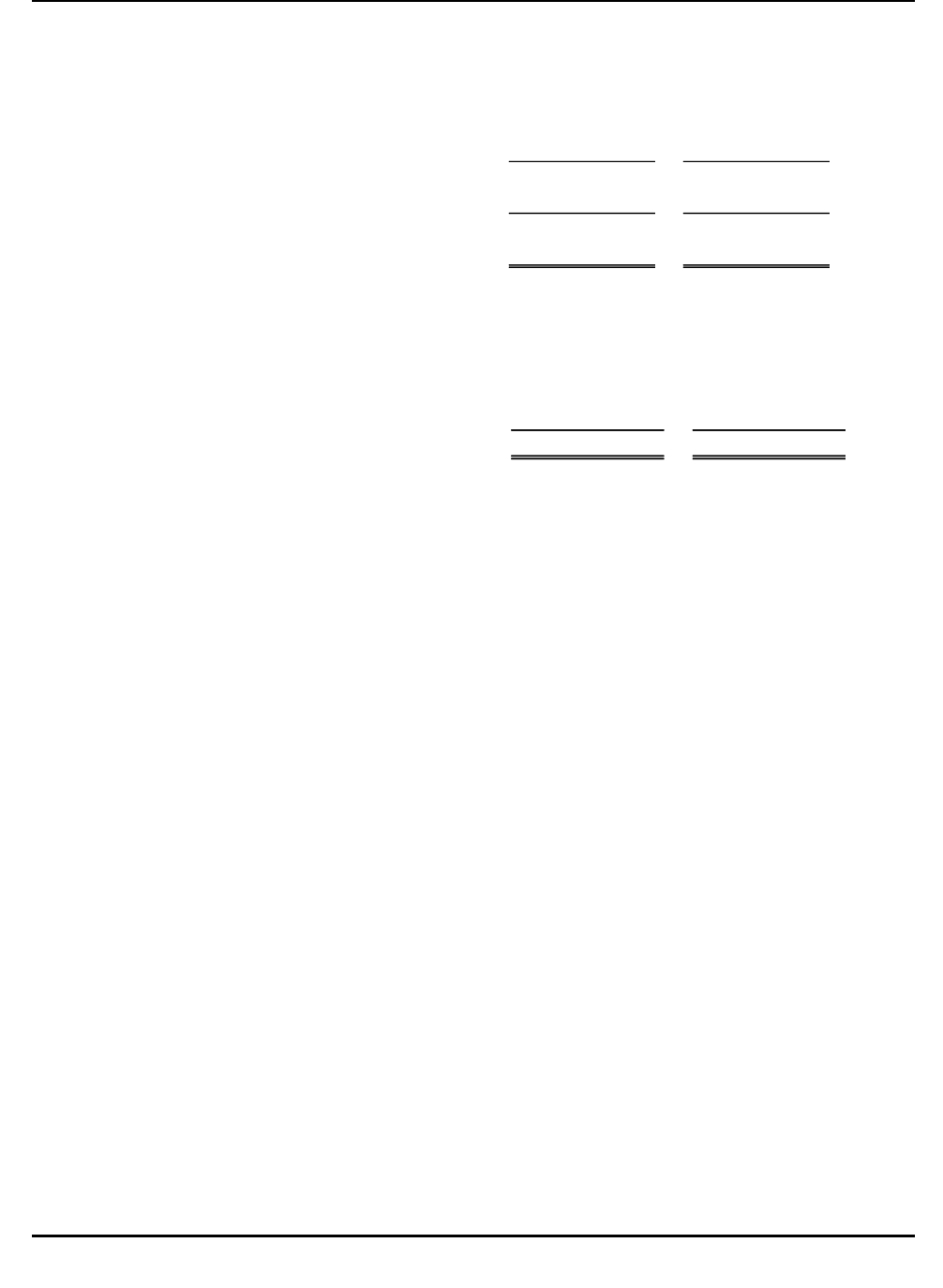

Financial assets at year end: 20XX 20XX

Cash and cash equivalents 1,740,000$ 920,000$

Contributions receivable 244,000 409,000

Investments 1,158,000 677,000

Total financial assets 3,142,000 2,006,000

Less amounts not available to be used within one year:

Net assets with donor restrictions

1,045,000 1,192,000

Less net assets with purpose restrictions to be met in

less than a year - (7,000)

Board-designated funds for future use 205,000 130,000

1,250,000 1,315,000

Financial assets available to meet general expenditures

over the next twelve months 1,892,000$ 691,000$

EXAMPLE CHARITY

NOTES TO FINANCIAL STATEMENTS

12

© 2019, Association of International Certified Professional Accountants. All rights reserved.

Note 4 – Investments

The following is a summary of investments at December 31, 20XX and 20XX:

20XX 20XX

Cash and equivalents -$ 2,000$

Equity funds 91,000 122,000

Stock index funds 598,000 310,000

Bond funds 58,000 34,000

Bond index funds 411,000 209,000

1,158,000$ 677,000$

As of December 31, 20XX and 20XX, all investments were considered level 1 investments.

Note 5 – Property and Equipment, Net

Property and equipment, net consisted of the following at December 31, 20XX and 20XX:

20XX 20XX

Property and equipment 364,000$ 357,000$

Less: accumulated depreciation (213,000) (150,000)

Property and equipment, net 151,000$ 207,000$

For the years ended December 31, 20XX and 20XX, depreciation expense totaled $63,000 and $68,000,

respectively.

BIG NATIONAL CHARITY, INC.

NOTES TO FINANCIAL STATEMENTS

13

© 2019, Association of International Certified Professional Accountants. All rights reserved.

Note 6 – Lease Commitments

Total rent expense incurred under operating leases totaled $231,000 and $229,000 for the years ended

December 31, 20XX and 20XX respectively.

For years subsequent to 20XX, minimum annual future rental commitments under the lease agreements,

are as follows:

Fiscal Year End Rental Expense

20XX 302,000$

20XX 310,000

20XX 318,000

20XX 215,000

1,145,000$

Deferred rent consists of the excess of the rental expenses on a straight-line basis over the payments

required by the lease and is included in other liabilities in the statements of financial position. As of

December 31, 20XX and 20XX, the deferred rent liability balance was $95,000 and $96,000, respectively.

Note 7 –Net Assets

Net assets with donor restrictions were as follows for the years ended December 31, 20XX and 20XX:

20XX 20XX

Specific Purpose

Animal services 1,045,000$ 1,185,000$

Passage of Time

Contributions receivable - 7,000

Total 1,045,000$ 1,192,000$

EXAMPLE CHARITY

NOTES TO FINANCIAL STATEMENTS

14

© 2019, Association of International Certified Professional Accountants. All rights reserved.

Note 7 –Net Assets (continued)

Net assets without donor restrictions for the years ended December 31, 20XX and 20XX are as follows:

The Board has designated funds to be set aside for future capital purchases.

Net assets released from net assets with donor restrictions are as follows:

Satisfaction of Purpose Restrictions 20XX 20XX

Animal services 662,000$ 325,000$

Note 8 – Employee Benefit Plan

The Big National Charity, Inc. has a tax-deferred 403(b) plan covering all employees. The assets are held

for each employee in an individual account maintained by an investment firm. Big National Charity, Inc.'s

match is 3% of each qualified employee's basic contribution. Plan contribution before non-vesting

forfeiture incurred by Big National Charity, Inc. during the years ended December 31, 20XX and 20XX

totaled $22,000 and $29,000, respectively.

Note 9 – Subsequent Events

Big National Charity, Inc. has evaluated subsequent events through April 20, 20XX, which is the date the

financial statements were available to be issued. Big National Charity, Inc. is not aware of any material

subsequent events.

20XX 20XX

Undesignated 1,394,000$ 784,000$

Board-designated net assets 205,000 130,000

1,599,000$ 914,000$