Modernizing the payments industry: a review into the global

initiatives and trends that are shaping the future of payments

The traditional role of payment service providers (PSPs) is becoming

outdated. New, digitally sophisticated market entrants are offering

consumers innovative, value-adding services that complement payments

execution and fundamentally shift consumer expectations.

Similarly, payments infrastructure is not agile enough or not developed

enough to fully capitalize on the benets of new technology. In countries

with highly developed nancial systems, payments structures have

become complex, inefcient and inexible as a result of decades of

incremental development. Conversely, countries with less sophisticated

nancial systems do not have architecture that is advanced enough to

meet consumer demand. These countries often also boast large populations

of nonbanked and newly banked consumers who may be excluded or

limited in the way they can use payment systems.

Continued on page 3

#payments

insights. opinions.

Volume 19

»

The global payments

landscape is undergoing

radical transformation.

We explore the effect that

regulators and industry

participants across the globe

are having on the payments

industry and analyze future

trends.

Modernizing the payments industry

A review into the global initiatives

and trends that are shaping the future

of payments.

Editorial

Dear readers,

As we have often discussed in this newsletter, the payments

industry is going through its most signicant transformation in

decades. In 2018, this is set to continue and indeed intensify.

When we look at global themes, we see the ongoing rollout of

immediate payment systems across countries and regions and

other major national infrastructure projects intended to make

payment systems t for the 21st century. We also see the era of

open banking unfolding, driven by regulators in some countries

and regions, and emerging through market appetite in others, as

we have discussed in previous newsletters.

The complexity increases when we consider other, adjacent

regulatory initiatives that need to be delivered, for example,

those related to security and privacy, such as the General Data

Protection Regulation (GDPR), which we cover in this edition.

This is, of course, all amplied by ongoing innovation, competition

and the deployment of emerging technologies such as articial

intelligence (AI) and blockchain.

In short, it is clear that 2018 is set to be a dynamic, exciting

and challenging year for the payments industry globally. We

believe it will continue to thrive thanks to collaboration between

those who deliver, those who use and those who govern payment

systems and that this will benet individuals and businesses that

depend on them.

Best,

Hamish Thomas

Partner, Ernst & Young LLP, EY EMEIA Payments Leader

3

9

How to achieve readiness

for GDPR compliance

Advice for non-EU nancial services

rms on how to comply with the EU’s

stringent privacy and data protection

regulations.

VC roundup

Continuation of the trend toward greater

payment segment diversication in

Q4 2017.

Transaction overview

M&A and VC

14

16

18

M&A roundup

Increase in deal activity in the fourth

quarter of 2017 with fewer large-scale

transactions.

#payments

3

Volume 19

Modernizing the payments

industry

Continued from page 1

In response to this evolving landscape,

we have seen signicant efforts from both

regulators and the payments industry

to modernize payments and close the gap

between capability and consumer needs.

Strategic change is being driven in several

ways:

• Industry-driven change: We have seen

unprecedented collaboration in the

payments industry in recent years. Banks

and other PSPs have recognized that

they need to drive change in order to stay

relevant to today’s consumers.

• Regulatory-driven change: Regulators

have taken a pivotal role in fostering

modernization in some jurisdictions by

creating new regulatory requirements

or acting as leaders and coordinators of

industry-driven initiatives.

• Individual innovation: Fintechs and other

disrupters have found ways to set a new

benchmark for payments.

1 “A Payments Strategy for the 21st Century: putting

the needs of users rst,” November 2016, Payments

Strategy Forum.

Throughout this article, we will explore

the effect that regulators and industry

participants are having on the payments

industry and analyze the trends that are

shaping the future.

Global initiatives: what activities

are being undertaken to transition the

payments industry to the future?

In this section, we will explore national

payment initiatives driven by regulators

and the payments industry.

UK

The Payments Strategy Forum (the

Forum) was established in October 2015

by the Payment Systems Regulator (PSR).

The Forum represented the rst time that

the payments entities in the UK worked

together to plan for a future that meets the

needs of its users. Specic objectives

include closing the needs gap, addressing

end-user detriments, and unlocking

competition and innovation opportunities.

The Forum identied ve challenges that

needed to be addressed (gure 1).

In November 2016, the Forum published

A Payments Strategy for the 21st Century

1

,

which put the needs of users rst, and sets

out a vision for the future of UK payments

to meet the needs of current and future

generations of payment service users. This

includes:

• Enabling simpler access

• Ensuring ongoing stability and resilience

• Encouraging greater innovation and

competition

• Enhancing adaptability and security

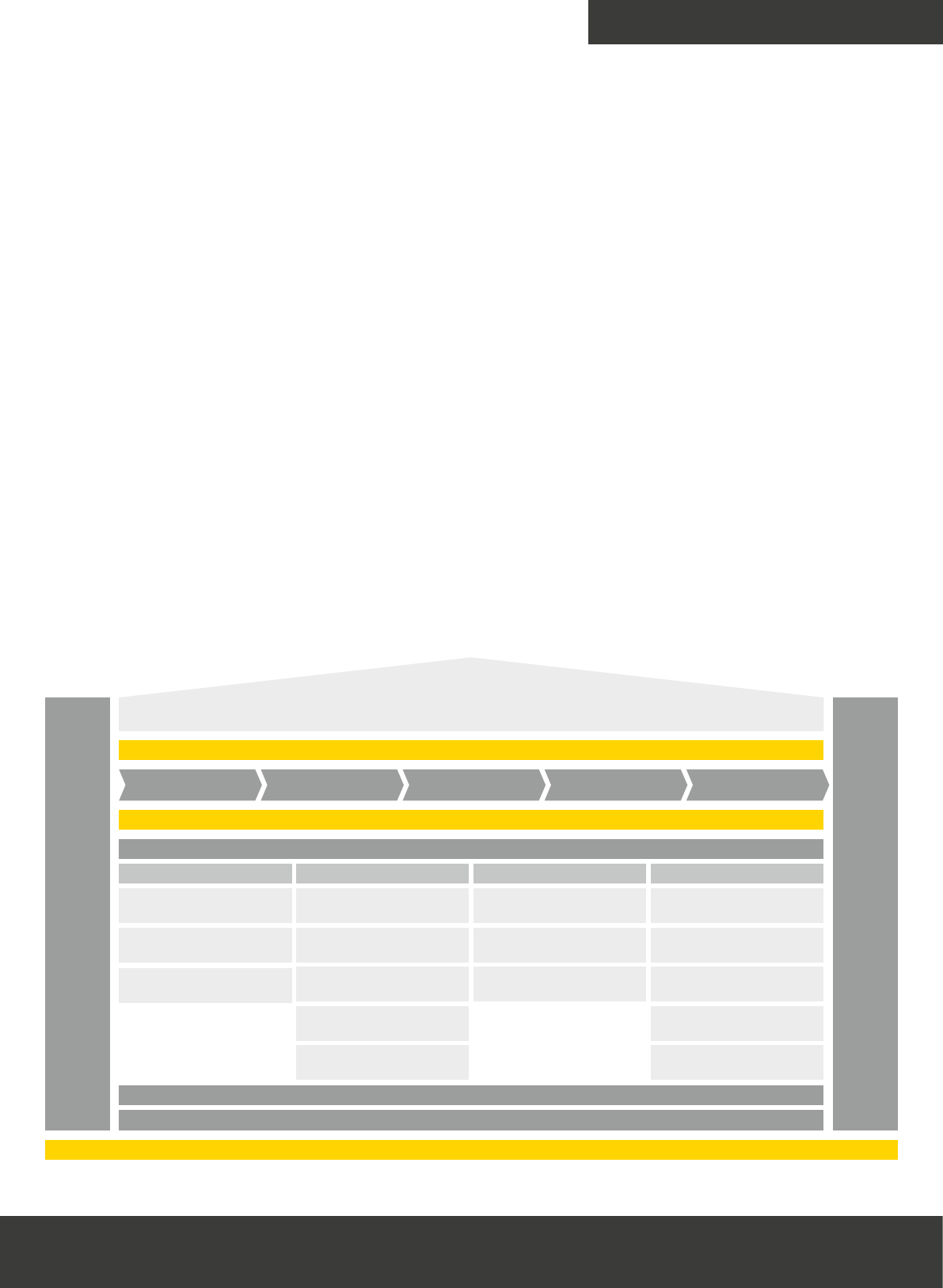

Figure 1: Key challenges in the UK payments landscape

1

Current UK

payments

landscape

• Meets majority of

our needs

• Secure

• Unnecessarily

complex

• Attractive for

innovators, but

access is inhibited

• Difficult to change

• Detriments to be

addressed

Future UK

payments

landscape

• Adaptable to user

needs

• Secure and resilient

against new threats

• Efficient, simple

and stable

• Encourages

innovation and

competition

• Easy to change

• Current detriments

addressed,

responsive to

emerging detriments

Challenge 1

Changing needs

of consumer,

business and

government end

users

Challenge 2

Growing

complexity across

multiple schemes

resulting from

evolving

technology and

regulation

Challenge 3

Increasing

sophistication

of financial

crime and fraud

Challenge 4

Increasing

demands to foster

innovation

Challenge 5

Requirement to

meet as-yet-

unknown future

needs

Modernizing payments

#payments

4

Volume 19

The UK‘s strategy compared with other initiatives is that

it isn‘t focused solely on new payments infrastructure

but also includes parallel initiatives to improve trust in

the payments system by collaboratively working to

prevent nancial crime.

Global initiatives and trends

A notable difference in the UK’s strategy

compared with other initiatives is that

it isn’t focused solely on new payments

infrastructure. Instead, it also includes

parallel initiatives to improve trust in the

payments system by collaboratively

working to prevent nancial crime.

As the work continued into 2017, a

draft consultation was published in July

proposing a blueprint for the future of

UK payments. Feedback was invited from

the payments community to nalize the

design and implementation approach for

a new payment system in the UK.

The blueprint recommended a design

based on a layered architecture with

a thin collaborative infrastructure to enable

competition and innovation. Adoption

of common, international standards

(ISO 20022) to enable access, innovation

and interoperability, and exibility was

built into the design to support a range of

new end-user services.

By the end of September 2017,

59 organizations had responded to the

66 questions in the consultation. The

responses were used to provide insights

and inform the development of the nal

blueprint.

At the end of 2017, the initiatives proposed

by the Forum were handed over to the

New Payments System Operator (NPSO)

and UK Finance, which are now carrying

forward the work started by the Forum.

Australia

Australia’s pursuit of payments

modernization was sparked by a strategic

review of the payment system, conducted

by the Payments System Board (the Board).

The Board identied a consumer need

for several developments in the payments

industry, with a particular focus on real-time

payments settlement and clearing. As a

result, the payments industry collaborated

with the Australian Payments Network to

create the Real-Time Payments Committee

(RTPC), eventually launching its New

Payments Platform (NPP) program in

June 2013.

The NPP program brings together

13 nancial institutions, with the objective

of delivering a leading payments

infrastructure that meets the needs of

modern consumers.

The NPP will introduce real-time payments

capability, a more exible payments

architecture, enriched payments data and

PayID — a feature that will allow users to

identify the recipient using memorable

information, such as a mobile phone

number.

At the time of writing, implementation of

the NPP is expected to be incremental, with

real-time payments becoming available at

the end of January 2018. End-user access

to the platform will be wide and will

continue to increase as bank and PSP

adoption increases.

Figure 2: Features of Australia’s NPP

2

1

New infrastructure separate from products

2

Open access platform

3

Data-rich payments

4

Conrmation of payee before payment

5

Real-time central bank settlement

6

PayID

7

Request-to-pay function

2 Katrina Stuart, “Introduction to the New Payments

Platform.” NPPA Webinar, © NPP Australia Limited

(accessed via www.nppa.com.au/wp-content/

uploads/2016/12/NPP-Webinar_July-2017-

Publishing.pdf, 10 January 2018).

Modernizing payments

#payments

5

Volume 19

Singapore’s Smart Nation payments strategy

is part of a wider government initiative to

foster innovation across all sectors and improve

standards of living in Singapore.

Global initiatives and trends

Canada

Canada is often recognized as a leader in

payment services. However, like many other

developed payments infrastructures, it

uses legacy systems that have become

outdated. In recognition of this, and in the

context of the evolving digital environment,

the Canadian Payments Association (CPA)

has published plans to modernize Canada’s

payments industry. It began by reviewing

the global payments landscape and assessing

its own stakeholders’ needs.

The CPA’s modernization strategy outlines

ve major pillars of development (see

gure 3), which will be delivered through

a series of infrastructure developments,

rules and guidelines and the introduction of

shared services and proprietary products

and services.

3

The pillars address consumer

needs, including the need for more

efciency, transparency, convenience, and

a platform for innovation.

The modernization plans will be implemented

over several years, with completion planned

for 2020.

Figure 3: Canadian payments industry initiatives

4

Figure 4: A New Era of Smart Banking: key initiatives

7

3 “Developing a Vision for the Canadian Payment Ecosystem,” 20 April 2016, The Canadian Payments Association.

4 “Industry Roadmap & High Level Plan,” 8 December 2016, The Canadian Payments Association.

5 “Digital Payments: Thinking Beyond Transactions,” PayPal website (www.paypalobjects.com/digitalassets/c/website/marketing/global/shared/global/media-resources/

documents/PayPal_Asia_Research_Report_Digital_Payments.pdf, accessed 16 December 2017).

6 “Singapore Payments Roadmap,” August 2016, KPMG.

7 “A New Era of Smart Banking,” Press Release, Hong Kong Monetary Authority website (www.hkma.gov.hk/eng/key-information/press-releases/2017/20170929-3.shtml,

accessed 18 December 2017).

Singapore

Singapore’s consumer trends are

considerably different from those of the

UK, Australia and Canada. In Singapore,

cash is the most popular way for individuals

to pay.

4

Recognizing this, the Monetary

Authority of Singapore (MAS) has focused

on encouraging adoption of its real-

time payments platform Fast and Secure

Transfers (FAST) at the heart of its Smart

Nation vision.

5

Singapore’s Smart Nation payments

strategy is part of a wider government

initiative to foster innovation across all

sectors and improve standards of living in

Singapore.

In addition to wide adoption of electronic,

real-time payments, the payments vision also

fosters competition and interoperability

and encourages efciency and security

and an enhanced, standardized consumer

experience.

6

Hong Kong

In September 2017, the Hong Kong

Monetary Authority (HKMA) announced

A New Era of Smart Banking, a vision of an

efcient, exible and safe payments

industry, founded on a convergence of

banking and technology. The initiative will

be led by the HKMA and will be achieved

through seven key initiatives.

7

The rst initiative focuses on the ability to

execute real-time payments, which will be

delivered in September 2018 through the

Faster Payment System. The subsequent

six initiatives focus on fostering innovation

and competition, developing technological

capability, and reducing friction between

regulation and digital offerings.

The New Era of Smart Banking is an

interesting shift in the context of

national strategies; while innovation

and competition are often key, they

are usually balanced with a fundamental

change in payments architecture.

Europe

The EU’s regulatory agenda is transforming

in the European payments industry. There

are a number of overlapping and sometimes

parallel regulations that PSPs are now

being asked to comply with, such as the

GDPR and the Competition and Markets

Authority (CMA).

In January 2016, the most substantial

payments legislation of recent years —

the second Payment Services Directive

(PSD2) — was published by the EU. The

directive expands the rules outlined

in the rst Payment Services Directive

(PSD1), which aimed to ease cross-border

payments, widen the choice of payment

services for customers, increase the speed

of payments and improve consumer

protection. For example, the directive set

out the legal framework for the Single

Euro Payments Area (SEPA). SEPA was

launched in November 2017 and introduced

a single euro payments market, offering

real-time payments execution.

1

A new core clearing and settlement system

to support new technology, such as

distributed ledger technology, and meet

regulatory requirements

2

Real-time payments capability, which will

execute transactions within 60 seconds

3

Enhanced automated funds transfer (AFT)

to operate along with the real-time

payments service

4

Alignment of the Automated Clearing

Settlement System (ACSS) with global

regulatory standards

5

Modernization of the rules framework in

relation to high value and retail standards

1

Introduction of real-time payments

2

Enhanced Fintech supervisory sandbox

3

Promotion of virtual banking

4

Banking made easy initiative

5

Open application programming

interfaces (APIs)

6

Closer cross-border collaboration

7

Enhanced research and talent development

Modernizing payments

#payments

6

Volume 19

Unrestricted, real-time payments processing

is undoubtedly one of the leading global

trends in the payments industry, with signicant

end-user benets.

Global initiatives and trends

PSD2 has a greater focus on promoting

the development of innovative electronic

payments solutions by creating a “level

playing eld” for new entrants into the

market. PSD2 will require banks to share

customer data with third-party providers,

rebalancing the power between new entrants

to the industry and bank incumbents. The

competitive landscape will be transformed;

consumers will be offered more choice and

convenience, and innovation will be key to

competitive success.

The deadline for European Economic Area

(EEA) countries to transpose PSD2 into

domestic law was January 2018. At the

time of writing, the majority of EEA nations

were targeting this deadline; however,

Belgium and the Netherlands have explicitly

stated that they will delay implementation

until April and June 2018, respectively.

Thus, while these EU directives aim to

promote a single, innovative payments

market across Europe, the reality of the

EU and EEA as an alliance of autonomous

nations remains a challenge.

Global trends: what does the future

payments industry look like?

In pursuit of a modern payments industry,

each jurisdiction has a different starting

point and will undertake a different journey.

However, many payments industry objectives

transcend jurisdictions and create a vivid

vision of what tomorrow’s payments

landscape could look like. In this section,

we review some of the prominent trends

that we are seeing in modernization

initiatives.

Real-time payments

There has been a huge emphasis on real-

time payments processing in recent

years. This is driven by consumer demand,

coupled with the availability of high-

speed data connections. The rst real-time

payments processing system, Zengin,

was adopted by Japan in 1973. Since then,

a number of other countries, including

the UK, South Africa, India, Singapore

and the US, have followed suit. Real-time

payments capability varies between

countries:

• The UK is one of the leading countries in

real-time payments capability. Such

payments are not only widely available,

they are also virtually unrestricted. For

example, the UK’s Faster Payments

Service is widely accessible, 24 hours a

day, 365 days a year, for values of up

to £250,000.

• Japan and Canada also have real-time

capability, but their services are subject

to cutoff times. Both countries have

outlined plans to move to an unrestricted

real-time payments model.

• Hong Kong does not currently have the

ability to process real-time payments.

Unrestricted, real-time payments processing

is undoubtedly one of the leading global

trends in the payments industry, with

signicant end-user benets. Individual

consumers benet from the exibility

of an immediate service. Whether they are

paying a friend or the deposit on their

rst home, immediacy is critical to their

experience. Similarly, businesses benet

from rapid services that improve their

ability to manage their liquidity position.

Promoting competition and innovation

It is widely acknowledged that competition

is critical to driving innovation. However,

there are signicant barriers to entry within

the payments industry that prevent new,

innovative entrants from accessing the

market. These barriers vary depending on

the jurisdiction, but include access to data,

access to settlement and clearing systems,

and the cost and complexity required to

navigate through different standards and

systems. Reducing these barriers to entry

and promoting competition is at the heart

of each initiative that we have explored in

this article.

While the end goal of enhancing competition

is shared across the globe, the strategy for

achieving this vision depends on the nature

of regulation, market barriers and payment

systems in each jurisdiction.

Modernizing payments

#payments

7

Volume 19

The global payments market is fragmented,

which makes it difcult to create value-adding

services that can be accessed across multiple

geographies.

Global initiatives and trends

For example:

• The UK has developed initiatives aimed

at providing both direct and indirect

accessibility to nonbank PSPs.

• Japan and Switzerland have recently

allowed a selection of nonbank

institutions — including PSPs — to access

payment clearing directly.

• Canada’s CPA plans to focus more heavily

on improving indirect access options and

interfaces via existing participants.

Interoperability

The global payments market is fragmented,

which makes it difcult to create value-

adding services that can be accessed across

multiple geographies. Historically, countries

have built their own payments infrastructure,

independent of one another. This creates

inefciency that hinders interoperability.

As a result, international payments lack

speed, efciency and transparency, and

their cost is too high. In addition,

international payments cause concern

for B2B payments, as they limit intraday

reporting and liquidity management due

to the lack of transparency in the cross-

border payments process.

In recent years, acceptance has grown

that some global commonality is needed

in order to further drive collaboration and

competition. As a result, ISO 20022 is

becoming the common real-time payment

messaging standard. There is already wide

uptake of the standard, with many more

countries planning to adopt ISO 20022.

Inefciencies arising from cross-border

fragmentation are also driving innovation in

Sources:

Japan and Singapore: “The ISO 20022 Adoption Initiatives Report,” ISO 20022 Registration Authority website (www.iso20022.org, accessed 18 September 2017).

New Zealand: “Payments Direction.” Payments NZ website (www.paymentsnz.co.nz/about-us/payments-direction/, accessed 18 September 2017).

Canada: In February, 2016, Payments Canada completed the multi-year development of new ISO 20022 payments messages, related rules and standards, and an adoption

strategy for its participant nancial institutions. Payments Canada website (www.payments.ca/resources/iso-20022-resource-centre/faqs, accessed 6 February 2018).

US: “Industry Perspective,” April 2017, The Federal Reserve Financial Services website.

(frbservices.org/assets/news/fedfocus-fedash/fedfocus-archive-april-latest-iso-20022.pdf, accessed 5 December 2017).

Brazil, Denmark, Switzerland: “Flavours of Fast,” May 2015, FIS. © 2015 FIS and/or its subsidiaries.

Poland: “Poland, an Eastern European country at the cutting-edge of payment technologies,” December 2016, The European Payments Council website,

(www.europeanpaymentscouncil.eu/news-insights/insight/poland-eastern-european-country-cutting-edge-payment-technologies, accessed 5 December 2017).

China: “CIPS Accelerates the Internationalization of the RMB,” SWIFT MI Forum October 2016, SWIFT website

(www.swift.com/sites/default/les/resources/swift_news_mi_cips_accelerates_internationalisation_rmb.pdf, accessed 6 December 2017).

Australia: Katrina Stuart, “Introduction to the New Payments Platform,” NPPA Webinar, © NPP Australia Limited .

(www.nppa.com.au/wp-content/uploads/2016/12/NPP-Webinar_July-2017-Publishing.pdf, accessed 10 January 2018).

UK: “A Payments Strategy for the 21st Century: putting the needs of users rst,” November 2016, Payments Strategy Forum.

India: “Adoption of ISO 20022 messaging standard in new RTGS System,” 20 December 2013, Reserve Bank of India Press Release.

(rbidocs.rbi.org.in/rdocs/notication/PDFs/AMSI201213SC.pdf, accessed 6 December 2017).

Canada

✔ ISO 20022 capable

Figure 5: The diagram below shows ISO capabilities across the world, highlights some of the key payments hubs and outlines whether they have ISO 20022

capability for commercial transactions.

Poland

✔ ISO 20022 capable

Denmark

✔ ISO 20022 capable

India

✔ ISO 20022 capable

Singapore

✔ ISO 20022 capable

Australia

✔ ISO 20022 capable

New Zealand

✔ ISO 20022 capable

China (mainland)

✔ ISO 20022 capable

US

No, but its real-

time payments will

use ISO 20022

messaging once

implemented

Brazil

No, but an intention to

move to ISO 20022

announced in 2010

UK

No, but plans in

place to adopt

ISO 20022 across

payment systems

Switzerland

No, but plans

in place to enable

capability by

mid-2018

Japan

No, but intends to

implement capability

in 2018

Modernizing payments

#payments

8

Volume 19

By 2020, the competitive environment will

have been redened; new services, providers

and systems will create a very different

industry from the one we know today.

Global initiatives and trends

Heather Clarke

Olivia Jeavons

Hamish Thomas

payments. Distributed ledger or blockchain

is one emerging technology that is

increasingly being seen as a potential

alternative in this space.

Enriched data and user control

Today, electronic payments include a very

limited amount of information. In the new

world of payments, consumers will be able to

attach enhanced data to their transactions.

This data could be a string of characters, a

link to a page or document or, in the most

ambitious plans, a document attached to the

payment.

This enriched data will enable agents to

get more information and payment

information to become a real data asset,

opening up scope for innovation to create a

marketplace of propositions. For example,

users will be able to request payments from

others, and payers can be given control over

how and when they would like to respond.

In addition, enriched data will support

improved reconciliation capability.

Simplied payments addresses

Payments initiatives ubiquitously put users

at the heart of their plans. Users commonly

express a preference for being able to make

payments with nonbank details to improve

ease and accessibility. It is, therefore,

unsurprising that countries such as Canada,

Australia and India have committed to

substituting traditional identication details,

such as sort codes and account numbers,

with more user-friendly identiers.

A common substitution for these traditional

identication details is a mobile phone

number.

India’s central payment authority, the

National Payments Corporation of India,

has addressed this barrier by removing

the need for users to hold a bank account. It

has introduced a payments ecosystem to

support the use of various virtual addresses

via a central Unied Payments Interface

(UPI). This allows users to send and receive

payments using national ID numbers,

mobile phone numbers, and unique numbers

provided by PSPs or other addresses.

Importantly, it enables users to send and

receive money without the transaction

touching a bank. Since its launch in 2010,

mobile payments have grown in popularity,

with over 76 participating banks now

offering the service.

8

Flexible architecture

The strategies outlined in this article

largely depend upon a scalable, exible

architecture that not only meets today’s

needs, but is agile enough to adapt to

tomorrow’s evolving demands. The way

that this is being achieved in Australia and

the UK is by creating a layered architecture,

with payment system built in layered stacks.

Each stack can be isolated from the others,

making it possible to make discrete changes

without compromising other components

of the system. The actual transfer of funds

is carried out in a separate layer as an

overlay service. These overlay services

allow PSPs to develop distinct propositions

without changing the underlying message.

Conclusion

The transformation that is taking place

in the payments industry is remarkable.

By 2020, the competitive environment will

have been redened; new services,

providers and systems will create a very

different industry to the one we know today.

Current market incumbents can remain

central to the industry, but only if they pay

attention to what is happening and develop

a meaningful understanding of what it

means to them and their consumers. The

coming years will require PSPs to become

more adaptable, innovative and

technologically astute in order to thrive in

tomorrow’s competitive landscape.

8 “Flavours of Fast,” May 2015, FIS. © 2015 FIS and/or its subsidiaries.

#payments

9

Volume 19

How to achieve readiness

for GDPR compliance

Starting on 25 May 2018, any rm with

ties to EU residents will have to comply

with the requirements of the EU’s GDPR.

Despite the imminent deadline, there are

still several common misconceptions about

the GDPR’s impending requirements. To

dispel these misconceptions, here are the

rst things you’ll need to know:

• It’s not a simple change. For affected

rms, GDPR will cause signicant

changes to operations, including data

management, third-party relationships,

outsourcing contracts and even entire

business models.

• It’s not just a problem for EU

operations. For non-EU rms, GDPR

compliance will require signicant

cooperation and collaboration between US

and European operations, as well

as with relevant third parties.

• It doesn’t just cover European

addresses. GDPR also covers EU

residents, and so at a minimum, you

will have to identify the EU residents

in your customer base.

• It’s not just for retail, consumer-facing

businesses. Small and medium-sized

business as well as large business-

to-business (B2B) rms that control or

process personal addresses, tax IDs

or national security numbers of EU

residents will also need to comply with

the GDPR, regardless of whether they

serve B2B or business-to-consumer

(B2C) marketplaces.

• It’s not a one-and-done exercise. Firms

need to be able to demonstrate GDPR

compliance on an ongoing basis or risk

regulatory penalties or class action suits.

Much more than an extension of existing

EU data protection requirements, the

GDPR covers several new aspects of privacy,

any of which would be challenging to

implement on its own. Given the broad scope

of requirements for GDPR compliance,

even EU-focused organizations are having

difculty meeting the May 2018 deadline.

For non-EU organizations, the challenge is

compounded by having rst to identify

EU customers for whom the GDPR applies.

Moreover, the GDPR differs signicantly

from the privacy rules of the Gramm-Leach-

Bliley Act (GLBA) in the US. Under the

GLBA, by default, rms can share

information unless consumers specically

“opt out.” By contrast, the EU’s consumer-

focused GDPR starts from the premise

that consumers own their information and

are therefore, by default, protected from

sharing or disclosure unless they “opt in”

and provide their consent. Data processing

activities that would be permissible under

the GLBA may not be acceptable under the

GDPR without signicant process changes

and additional privacy protections.

Consequently, many non-EU organizations

covered by the GDPR have not yet made

sufcient progress toward compliance.

Provisions of the GDPR include:

• Data protection impact assessment

(DPIA): Organizations are to conduct

impact assessments for all process

operations, identifying the most effective

way to comply with their data protection

and privacy obligations.

• Data privacy governance and account-

ability: Firms must establish proactive moni-

toring of privacy standards, ensure internal

adherence to GDPR privacy principles and

demonstrate compliance to examiners.

#payments

10

Volume 19

• Condition for processing: For any given

data processing activity, rms must

demonstrate a legitimate reason, which

can include the individual’s consent,

contractual necessity, legal obligation,

regulatory requirements or public

interests.

• Data protection ofcer: Firms

that conduct large-scale systematic

monitoring of EU residents’ data, or

that process large amounts of sensitive

personal information, must appoint

a data protection ofcer (DPO) who

reports to the highest level of

management.

• Privacy by design: Organizations will

be required to design policies, procedures

and systems that follow “privacy by

design” principles at the outset of product

or process development, as opposed to

privacy controls layered on after

deployment.

• Right to erasure: Individuals may

request the deletion or removal of

personal data where there is no

compelling reason for its continued

processing.

• Consent and notication: Individuals

must freely give their specic, informed

and unambiguous consent to an

organization processing their personal

data. Furthermore, breach notications

must be made within 72 hours of

the organization becoming aware of the

breach.

• Data portability: Individuals may obtain

and reuse their personal data for their

own purposes, and organizations must

provide methods to move, copy or

transfer their personal data easily from

one IT environment to another in a

safe and secure way, without hindrance

to usability.

The GDPR represents the most

comprehensive privacy regulation

in the marketplace today.

The GDPR applies to any organization,

regardless of geographic location, that

controls or processes the personal data of

an EU resident in a prescribed way. The

relevant terminology is dened as follows:

Controller: A body (alone or jointly with

others) that determines the purposes and

means of processing personal data

Processor: A body that, on behalf of the

controller, processes personal data, which

can include collecting, organizing, storing,

disclosing, using, etc.

Personal data: Any information (single

or multiple data points) relating to an

identied or identiable natural person

such as name, employee identication

number or location data

Noncompliance can attract a ne of up to

€20 million, or 4% of the organization’s

total global revenue, whichever is greater.

Ready for the GDPR?

Also, individuals represented by not-

for-prot organizations have new rights

to bring class-action lawsuits for privacy

violations against data controllers or

processors. In sum, the GDPR’s broad

provisions, broad-based applicability rules

and the high potential for nes place

an enormous responsibility on nancial

institutions based beyond EU borders.

How to implement the GDPR

First, determine the extent to which

the GDPR applies to you

The GDPR applies to any organization

or service provider, either located

in the EU, offering goods or services in

the EU or operating as a processor or

controller in the EU. It may also apply to

organizations that process data of EU

citizens who reside in the US. In addition,

knowledge of the regulations is relevant

for entities with plans or aspirations to

do business in the EU in the future.

Figure 6: Three key questions to assessment applicability

* Note: The responses to these questions should be evaluated based on the facts and circumstances in your

organization and discussed with legal counsel.

Source: EY analysis of the General Data Protection Regulation, EU regulation 2016/679, adopted 27 April 2016,

effective from 25 May 2018.

Are you or your service provider a

processor or controller that offers

goods or services in the EU (e.g., do

I offer payment services in the UK)?*

Are you or your service provider

a processor or controller that

monitors behavior in the EU

(e.g., am I a third party that monitors

credit card balances in France)?*

The GDPR applies The GDPR may apply

No, I do not have any entities,

subsidiaries or affiliate organizations

residing within the EU.

No, I do not have any business activities

in the EU, including those of third

parties.

No, I do not monitor behavior or process

data of anyone residing within the EU.

Questions to consider include

(but are not limited to):

• Do I have any plans or aspirations to

do business in the EU in the future?

• Do I process data of EU citizens who

reside in the US?

2

3

Are you or your service provider

a processor or controller located in

the EU (e.g., do I have an affiliate

organization in the EU)?*

1

No

No

No

YesYesYes

#payments

11

Volume 19

Second, conduct a risk-based assessment

Beyond just a legal assessment of the bare

requirements, we recommend that you

conduct a fact-based, documented review

of operations, including contracts with

third-party providers, to ascertain whether

you access, store or monitor data related

to EU residents. Your review should also

consider your rm’s strategy, growth plans,

risk tolerance, existing controls and

capabilities, and other contextual factors.

The resulting assessment can guide your

organization as you take steps to comply

with the regulations.

Third, dene your target state using

a lines of defense model

The “three lines of defense” model is being

widely adopted across risk management,

and this model should be put into practice

for GDPR compliance as well. At each line

of defense, your organization should be

prepared to demonstrate readiness for

GDPR-compliant operations.

The rst line of defense includes business

lines, technology and operations. Business

lines will have to own the risks they

create and implement effective controls

throughout their operations and IT

solutions. Relevant areas to investigate

include customer relationship management,

marketing, product development,

procurement, human resources, training

and communications.

The second line of defense includes risk

management as well as compliance,

privacy and security functions working

with the designated DPO to validate the

organization’s privacy and data security

strategy. The compliance team will also

need to work with technology and

operations specialists (i.e., the rst line of

It’s not a one-and-done exercise. Firms need

to be able to demonstrate GDPR compliance

on an ongoing basis or risk regulatory penalties

or class action suits.

Ready for the GDPR?

defense) to evaluate third-party compliance

with GDPR requirements and obligations.

The third line of defense consists of

internal auditors, who will be responsible

for compliance monitoring, access review

and overall privacy framework validation.

Fourth, perform gap analysis and

remediation

Assemble a cross-functional remediation

team to traverse across a wide range

of people, processes and technologies to

embed GDPR-compliant practices for

privacy risk management into existing

business and IT contexts.

Given the interactions between the

numerous provisions of the GDPR, an

efcient approach to compliance must

address multiple gaps at the same time.

EY’s privacy risk management framework

provides a useful starting point for dividing

and organizing the workload.

Figure 7: EY’s privacy risk management framework

Source: EY analysis and framework

Privacy culture

Privacy process, risk and control framework

Privacy risk management

Risk appetite Risk identification Risk profiling Risk assessment Issue management

Program reporting, metrics and monitoring (e.g., ROPA)

Technology enablement

Privacy governance

• Policies and standards

• Roles and responsibilities (e.g., CPO, DPO)

• Organizational structure

• Board and stakeholder expectations

Business strategy

IT strategy

Focus areas

Assess

Data mapping and inventory

Appropriate data collection

and classification

Privacy impact assessment

Advice

Privacy and security by design

Data rights management

Use of data

Consent and privacy

notification

Cross-border

Govern

Accountability and compliance

Internal and external

assurance

Training and awareness

Integrate

Incident and breach

management

Records management

Third-party risk management

Data protection and security

Contract management

#payments

12

Volume 19

Data use case management or framework,

cloud discovery, high-value asset identification,

use of risk rating criteria, evaluation of data

processing on a large scale

Program design based on business model,

incorporating privacy and security into

systems development life cycle and new

product development

Third-party risk assessment, compliance

monitoring and data controls

Jurisdiction approval, enforceability

of legal remedies for data subjects,

documentation of transfers

Training to raise employees’ awareness

of privacy policies and standards

(responsibility of all employees)

Lawful and proportionate

collection of data;

classification into

categories for taxonomy

(e.g., financial, personal)

Internal and external data subject’s right to

access, correction, erasure, portability and

objection

Identify and access management,

technology selection, encryption strategy

Attachment of requirements to physical

files, electronic documents and emails

Freely given and explicit consent, right

to withdraw consent, privacy notices

Internal audit

assessment, third-

party attestation,

certification against

industry standard

Process risk and control,

data discovery (structured

and unstructured data),

system and repository

identification and risk

prioritization

Data collection for specific, explicit and

legitimate purpose; limits collection to

what is necessary

Assessment of service-level agreements and

internal or third-party contracts to identify

gaps or opportunities to strengthen language

Data incident response plan, 72-hour

operational effectiveness process

Privacy operating

model, tone

at the top, policy

development

The GDPR starts from the premise that

consumers own their information and are

therefore protected unless they “opt in” and

provide their consent to sharing or disclosure.

Ready for the GDPR?

Figure 8: GDPR requirements organized into focus areas

Source: EY analysis

General Data Protection

Regulation

Advice

Integrate

Govern

Training and

awareness

Assess

Privacy

impact

assessment

Cross-border

Records

management

Internal

and external

assurance

Privacy and

security

by design

Data

protection

and security

Appropriate

data collection and

classification

Use of data

Third-party

risk

management

Consent and

privacy

notification

Incident and

breach

management

Accountability

and compliance

Data rights

management

Contract

management

Data mapping

and inventory

#payments

13

Volume 19

It is critical to educate key

stakeholders, including the board

of directors, on GDPR.

Ready for the GDPR?

The EY privacy risk framework separates

desired outcomes into four distinct focus

areas: assess, advice, govern and

integrate. Within each focus area, specic

areas for remediation can be addressed

using similar concepts, toolsets and

methodologies.

A divide-and-conquer strategy based

on the EY privacy risk management

framework can help an empowered cross-

functional team to make rapid adaptations

leading to faster GDPR readiness and

compliance.

While it may be challenging for some

organizations to complete the entire range

of tasks required to be in full compliance

with the GDPR, it should be entirely feasible

to prioritize the most important and

achievable actions to take prior to the

May 2018 deadline.

In addition, forming a remediation team

should enable clear communication and

reporting of organizational responsibilities.

Documenting your GDPR risk decisions

and responsibilities will allow you to

demonstrate your risk-based approach

while reducing the risk of potential legal

exposure following an alleged privacy

violation. Further activities involving

organizational change and technological

change can be added to the road map for

future development.

The GDPR represents the most

comprehensive privacy framework in

the marketplace today. By efciently

complying with the GDPR, nancial

institutions can continue to serve not

only EU residents, but also residents

of other countries and regions that will

eventually follow the EU’s approach

to privacy and data protection.

Immediate next steps

• Educate key stakeholders, including

the board of directors

• Risk assess (including legal applicability)

whether the GDPR applies to your

organization

• Establish cross-function and cross-

business governance structures for

assessing the GDPR’s applicability

to business operations and evaluating

the readiness and management of

your overall GDPR remediation efforts

• Conduct a privacy impact assessment

with a strong focus on high-risk data ows

of business processes

• Analyze GDPR gaps, with a particular

focus on governance, policies, technology,

external dependencies (e.g., vendors),

existing data ows (high risk) and

processing operations

• Design and execute a prioritized

implementation plan to address gaps

based on risk tolerance, risk priorities,

resources and investment

A modied version of this article appeared

in Compliance Week magazine.

John Doherty

Mark Watson

To learn more visit:

ey.com/fsGDPR

#payments

14

Volume 18

M&A roundup

M&A activity and deal characteristics

A total of 42 M&A transactions were

announced in the fourth quarter of 2017.

This level of activity is slightly above the

38 deals recorded in Q3 2017. The nancial

terms of 20 transactions were disclosed

in the nal quarter of the year, amounting

to a total volume of US$9.7 billion. This

represents a threefold increase over the

deal volume in the last quarter of 2016,

11, 12

but a strong decline on the US$26.0 billion

worth of deals in Q3 2017.

The deal volume in Q4 2017 was driven

primarily by one large transaction within

the payments security market. Trade

buyers drove the deal activity in the nal

quarter as they acquired new targets,

while some private equity funds sold off

companies in their portfolios but were

less active on acquisitions. The largest

The fourth quarter of 2017 saw an increase in deal activity related to payments as the

number of transactions increased from 38 in Q3 2017 to 42 deals in the last quarter

of the year (Q4 2017). However, based on a transaction value of US$9.7 billion, the

last quarter of the year fell short of the US$26.0 billion worth of deals in Q3 2017 as

there were fewer large-scale transactions. The acquisition of Gemalto, a Netherlands-

headquartered provider of digital security solutions, by French defense giant Thales

stands out. It is by far the largest acquisition in the fourth quarter at US$6.5 billion,

demonstrating the importance of digital security in relation to payments.

9

The largest deal of a merchant acquirer was the acquisition of Cayan, a US-based

payment processing business, by TSYS. This deal conrms the importance of small

and medium-sized enterprises (SMEs) as a way to drive the protability and growth

of merchant acquirers.

10

The transaction will add to TSYS’ merchant sector scale

and improve distribution capabilities and reach in the SMEs segment, which is a core

growth area for TSYS.

deal of the quarter, which amounted to

65% of the total transaction volume, saw

major French defense rm Thales acquire

Gemalto, a leading European digital

payments security provider. This acquisition

values Gemalto at an implied enterprise

value of US$6.5 billion, a last-12-month

(LTM) revenue multiple of 1.8x and an

LTM earnings before interest, taxes,

depreciation and amortization (EBITDA)

multiple of 11.9x. This transaction is

expected to help transform Thales into a

global leader in digital security covering the

payments sectors among others. Thales

paid €51 per share for Gemalto, which

represents a 57% premium per the closing

price on 8 December.

13

The second largest deal of the quarter was

the acquisition of Cayan by TSYS at an

implied enterprise value of US$1.05 billion.

9 Source: Reuters (www.reuters.com,

accessed 10 January 2018).

10 Source: TSYS (www.tsys.com,

accessed 10 January 2018).

11 Sources: EY analysis, Bloomberg, Capital IQ,

company websites, Mergermarket.

12 Deal volume is based on the implied enterprise

value as recorded by Capital IQ or other publicly

available sources.

13 Sources: EY analysis, Bloomberg, Capital IQ,

company websites, Mergermarket.

Figure 9: Targets by segment (in percentage)

Payment acceptance

devices plus software

Processing

Issuing

Alternative payment

systems

Money transfer

Acquiring

Data analytics

Couponing and loyalty

Other includes security,

ATM and commerce

2017

Q4

12

5

26

2017

Q3

29

12

14

7

Sources: EY Innovalue, Capital IQ, Mergerstat M&A

Database, company websites.

Figure 11: Median enterprise value multiples

EBITDA multiple

Revenue multiple

16x

14x

12x

10x

8x

6x

4x

2x

0

2013 2014 2015 2016 2017

3.7

14.5

2.8

14.7

3.5

13.1

2.3

10.6

3.2

14.4

Figure 12: Targets by region (in percentage)

North America

Europe

Asia

Middle East and Africa

Oceania

South America

2017

Q4

7

36

17

36

2017

Q3

2

2

Figure 10: M&A market development

Number of transactions

Disclosed value (in US$ billion)

30

25

20

15

10

5

0

50

40

30

20

10

0

2016

Q4

2017

Q1

2017

Q2

2017

Q3

2017

Q4

3.4

19

5.5

45

4.0 26.0 9.7

46

38

42

#payments

15

Volume 18

Cayan was owned by Parthenon Capital

Partners, a US-based private equity fund,

14

and has a large network (70,000) of

small to medium-sized enterprises to which

it provides technology-led acquiring

services in the US. The business provides

acquiring and acceptance solutions as

well as processing for ofine merchants.

15

For TSYS, the transaction is another

strategic step toward an increased focus on

SME merchants’ needs and strengthening

its market position in the US. According to

TSYS, Cayan will enhance the group’s

commerce solutions to jointly offer value-

add products and services to their partners

and merchants in the US.

Q4 transactions were heavily geared

toward trade buyers since none of the

top 10 largest transactions was a private

equity buy-side deal. Beyond Parthenon

Capital Partners’ sale of Cayan, the second

largest private equity sell-side deal was

TA Associates’ sale of BluePay, a US-based

payment processer operating in the US

and Canada, to First Data.

16

TA Associates

acquired BluePay in 2013 and completed

ve complementary add-on acquisitions.

Beyond the acquisitions, TA Associates

supported BluePay in reorganizing its

sales and marketing organization and

strengthening its partnership model, which

resulted in robust organic growth.

17

The deal values BluePay at an implied

enterprise value of US$760 million.

According to First Data, BluePay brings

best-in-class integrated card-not-present

solutions and a cutting-edge independent

software vendor product suite.

18

The median EBITDA multiple for all deals

year-to-date increased from 10.6x in

2016

19

to 14.4x in 2017. The median

revenue multiple for the same period

increased from 2.3x to 3.2x.

20

Investors

are expected to continue to look at new

disruptive and growth opportunities in the

evolving payments sector. In particular,

the impact of open banking regulation

in the UK and neighboring European

The deal volume in Q4 was distributed

across a variety of business segments

with a fair share of processing, active

portfolio management and acceptance

acquisitions.

countries is expected to result in a rise

in the establishment and in acquisitions of

new payments companies such as account

information service providers and payment

initiation service providers.

21

In Q4 2017, 17% of the targets were based

in Europe, with 36% in North America and

36% in Asia. The four largest deals of the

quarter involved North American targets,

while the third quarter was dominated by

transactions in Europe. We expect a further

consolidation trend in Europe, which will

support the M&A agenda of trade players

and private equity funds over the next

quarters.

Andreas Habersetzer

Markus Massem

M&A roundup

Erik Mostenicky

14 Source: TSYS (www.tsys.com, accessed 10 January 2018).

15 Source: Cayan (www.cayan.com, accessed 10 January 2018).

16 The Nilson Report, issue 1105, March 2017. According to the report, First Data processed US$19.8 billion in transactions in 2016.

17 Source: TA website (www.ta.com, accessed 10 January 2018).

18 Source: First Data (www.rstdata.com, accessed 10 January 2018).

19 Includes all deals in 2017.

20 Transaction multiples are based on implied enterprise value, EBITDA and revenue data sourced primarily from Capital IQ.

21 Sources: EY analysis, Bloomberg, Capital IQ, company websites, Mergermarket.

#payments

16

Volume 19

Funding activity

The fourth quarter of 2017 saw 56

companies raise a total of US$1.2 billion

in funding, all of which was equity

funding. There were an additional

12 deals announced in the last quarter,

up from 44 in Q3 2017, while total

investment value increased by 16% in

Q4 2017, reecting stronger investment

activity in early-stage companies.

22

Q3 2017 was characterized by an

increasing number of initial coin offerings

and a strong focus on alternative payment

systems and security solutions. Activity in

Q4 2017 continued the trend from earlier

in 2017, where overall investment activity

was more diversied as investors looked to

extract value across the entire payments

value chain.

In geographic terms, investment activities

picked up in Asia compared to the

previous quarter (based on the number

of transactions), while the number of deals

in North America and Europe remained

relatively at compared to Q3 2017.

23

Investment trends

Across the board, Q4 2017 saw more

diversied investor interest in terms of

payments segments, although payment

acceptance, alternative payment systems

and money transfer solutions attracted

the most interest.

24

Two key investment themes we observed

over the quarter were mobile-based

payment solutions driven by nontraditional

payments players entering the market and

frictionless instant cross-border payment

solutions driven by the continuous strong

growth of cross-border e-commerce.

The interest in mobile payments prevailed

in 2017, and it is likely to continue into 2018

where large players both inside and outside

of the traditional payments ecosystems are

implementing new services, such as money

transfers and bill payments (e.g., Facebook,

Nordea and Nets have formed a partnership

to implement a bill payment service

25

). This

trend is creating additional opportunities

for providers of innovative solutions,

particularly in data analytics and payments

VC roundup

22 Sources: EY analysis, Crunchbase.

23 Sources: EY analysis, Crunchbase.

24 Sources: EY analysis, Crunchbase.

25 Sources: EY analysis, Crunchbase, The Paypers.

Figure 14: Investment by region (in percentage)

North and Central America

Asia

Europe

Middle East

and Africa

Oceania

2017

Q4

18

23

43

2017

Q3

Figure 15: Deals by funding stage (in percentage)

5

2

4

2017

Q1

2017

Q2

2017

Q3

2017

Q4

7

9

23

14

11

7

9

7

29

14

27

25

12

23

16

16

26

22 36 23 34

Funding stages

Other C A

D/E B Venture seed

Figure 13: VC deal

Number of investments

Disclosed value (US$billion)

2,000

1,750

1,500

1,250

1,000

750

500

250

0

60

50

40

30

20

10

0

2017

Q1

2017

Q2

2017

Q3

2017

Q4

753 1,938 1,006 1,168

40

44 44

56

#payments

17

Volume 19

security, to help provide more engaging

and secure services. In this quarter, we

saw Accel Partners lead the series B

funding round with a total investment of

US$25 million in Simility,

26

a fraud

prevention provider with big data analytics

and visualization capability that enables

more efcient and secure mobile payments.

Looking forward, investors are likely to

continue to be active in this space, but

as funded businesses develop and industry

standards start to be dened, investors

are likely to be more stringent with their

investment requirements; therefore, we

expect the majority of investment activity

to shift toward later-stage funding rounds.

Partially driven by increased mobile

penetration, global e-commerce activity

had another strong year in terms of

growth, and the current momentum does

not look like it is slowing down any time

soon. Within e-commerce, cross-border

e-commerce continuously drove demand

for more innovative and efcient payment

solutions and future cross-border growth

will likely outpace domestic transactions.

In Q4 2017, China Broadband Capital

spent US$270 million on an investment in

Payoneer, a cross-border multi-currency

payments platform that connects

businesses and individuals from different

countries. On the smaller end of the scale

was Square Peg Capital’s US$22 million

investment in Airwallex, which aims to

simplify B2B cross-border transactions

through machine learning. As the nature of

e-commerce is becoming ever more global

and dynamic, the need for fast settlement,

seamless and secure payments has

become more important for merchants

and consumers alike. Interestingly, many

solutions tend to focus on one side of the

e-commerce relationship, i.e., either the

merchant or the consumer, and it is rare

that both are given equal consideration.

In Q4 2017, one of the biggest investments

was led by La Caisse de dépôt et placement

du Québec, with a total investment of

US$292 million in Lightspeed POS,

25

an

online and ofine commerce payments

acceptance provider. This combined with

the other funding deals closed in the

last quarter of the year demonstrates that

investors still have ample appetite for

e-commerce-themed investments.

Looking ahead to 2018, we expect the

broader themes of mobile and e-commerce-

driven investments to continue and some

of the efforts made in the past few years to

start to make a real impact on the industry,

in particular, in the Internet of Things (IoT)

and mobile segments. In terms of new

trends, we expect more cross-regional

partnership types of investments to come

to market, driven by increased cross-

regional payments activity both in the B2C

and B2B space.

Cross-border transaction volume growth is likely

to outpace domestic transactions in the future,

providing ample investment opportunities in

cross-border payments solutions.

26 Sources: EY analysis, Crunchbase, The Paypers.

VC roundup

Andreas Habersetzer

Markus Massem

Dawei Wang

Figure 16: Investment sectors

2017

Q1

2017

Q2

2017

Q3

2017

Q4

12

27

36

20

7

24

11

14

20

9

7

7

11

13

17

16

14 14

33 30 18 23

Money transfer

Security

Alternative payment systems

Payment acceptance

Other

Processing

Issuing

5

2

5

5

2

#payments

18

Volume 19

M&A

Transaction overview

Q4 2017

Date

announced

Target company Market Target company industry Buyer(s) Market Transaction

value (US$m)

1

6 Oct. 2017 Anypay Service Thailand Offers electronic payment processing services V.I. Capital Thailand 0.2

2

10 Oct. 2017 TBE for Payment

Solutions and

Services

Egypt Operates as an electronic payment solution provider BPE Partners, M.M.

Group for Industry

and International

Trade

Egypt 8.8

3

10 Oct. 2017 AnchorOps US Develops electronic payment solutions for media buyers FastPay US Not disclosed

4

10 Oct. 2017 bKash Bangladesh Provides a mobile money platform for the low-income

mass in Bangladesh

Undisclosed buyer Not

disclosed

Not disclosed

5

17 Oct. 2017 Wepay US Provides online payment gateways and payment

solutions

JPMorgan Chase US Not disclosed

6

20 Oct. 2017 BluePay US Provides payment processing for merchants and

suppliers in North America

First Data US 760

7

26 Oct. 2017 Planet Payment US Provides international payment and transaction

processing

Fintrax Group Ireland 260.2

8

27 Oct. 2017 InPlat Russia Owns and operates a mobile payment processing

platform

Mail.Ru Group Russia 9.6

9

30 Oct. 2017 QUO CARD Japan Provides issuing, maintenance, encoding and sale of

prepaid cards in Japan

T-Gaia Corporation Japan 199.0

10

31 Oct. 2017 Stone

Pagamentos

Brazil Operates as a merchant acquirer for point of sale (POS)

and online businesses in Brazil

DLP Pagamentos

Brasil

Brazil 69.9

11

31 Oct. 2017 SmartCentric

Technologies

International

Ireland Provides a secure payments and transactions system The ai Corporation UK Not disclosed

12

1 Nov. 2017 MC Payment Singapore Operates as a merchant acquirer for POS and online

businesses in Southeast Asia and Australia

Artivision

Technologies

Singapore 44.4

13

3 Nov. 2017 Wall Street

Finance

India Engages in foreign exchange and money transfer

businesses in India

Spice Mobility India 7.5

14

7 Nov. 2017 Phoenix Group US Distributes POS equipment to merchants in North

America

Ingram Micro US Not disclosed

15

7 Nov. 2017 Cantaloupe

Systems

US Provides a cloud-based cashless vending solution for

accepting card and mobile payments, such as Apple Pay

and Android Pay

USAA Technologies US 86.6

16

7 Nov. 2017 MPOS Global Vietnam Provides nonbank mobile payment acceptance terminals

and nancial solutions for individuals and businesses

GHL Systems Bhd Malaysia 3.3

17

8 Nov. 2017 ABC Financial

Services

US Provides health club software and billing services to the

tness industry

Thoma Bravo US Not disclosed

18

8 Nov. 2017 Evokio India India Provides digital payments for ofine retail merchants Cashless

Technologies India

India Not disclosed

19

15 Nov. 2017 Kartuku Indonesia Provides electronic payment processing solutions Go-Jek Indonesia 50

20

16 Nov. 2017 Westcliff

Technologies

US Operates bitcoin automated teller machines Northsight Capital,

Inc.

US Not disclosed

21

16 Nov. 2017 SunGard Kingstar

Data System

China Provides processing solutions for nancial services,

higher education and the public sector in China

Shanghai Zhongping

Capital Co., Ltd.

China Not disclosed

22

16 Nov. 2017 1Linx Blockchain

Technologies

Corp

US Operates a blockchain authentication platform and

provides a suite of blockchain security services

that caters to meeting the regulatory requirements of

blockchain money services companies

Global Remote

Technologies

Canada 1.5

23

17 Nov. 2017 EML Payments

Limited

Australia Operates as a cards issuer in Australia, Europe and

North America

Undisclosed buyer Not

disclosed

Not disclosed

#payments

19

Volume 19

Date

announced

Target company Market Target company industry Buyer(s) Market Transaction

value (US$m)

24

20 Nov. 2017 MatchMove

Indonesia

Singapore Provides end-to-end enterprise mobile wallet and payment

card solutions to help businesses increase revenue

M Cash Integrasi Indonesia Not disclosed

25

20 Nov. 2017 Ariett US Offers online payments and invoice services AvidXchange US Not disclosed

26

28 Nov. 2017 Ensenta US Provides innovative enterprise-wide SaaS solutions for

mobile and online deposits and payments

Jack Henry and

Associates

US Not disclosed

27

28 Nov. 2017 Money Forward Japan Provides mobile payment solutions in Japan Undisclosed buyer Not

disclosed

Not disclosed

28

30 Nov. 2017 Blockimpact UK Provides full end-to-end cryptocurrency blockchain

solution including wallets

Glance Technologies Canada 1.1

29

30 Nov. 2017 Best Pay

Software

UK Provides technology and payment solutions Jeton Venture UK Not disclosed

30

5 Dec. 2017 Swift Prepaid

Solutions

US Operates as a cards issuer in North America Bain Capital

Ventures and

Silversmith

Capital Partners

US Not disclosed

31

7 Dec. 2017 Airlink Taiwan Provides value-add services to payment companies

in Northeast Asia

Ingenico France Not disclosed

32

7 Dec. 2017 Novo Mundo

Corretora

de Câmbio

Brazil Offers foreign exchange services TTT Moneycorp UK Not disclosed

33

14 Dec. 2017 Plastc US Designs and develops a digital wallet and mobile

payment device

EDGE Mobile

Payments

US Not disclosed

34

15 Dec. 2017 Kartuku, Mid-

trans and Mapan

Indonesia Provides payment processing services PT Go-Jek Indonesia Indonesia Not disclosed

35

17 Dec. 2017 Gemalto Netherlands Provides digital security services worldwide Thales France 6,521.4

36

18 Dec. 2017 Cayan US Provides payment processing services in the US Total System

Services

US 1,050

37

19 Dec. 2017 Intermex Wire

Transfer

US Provides remittance services in the US and

Latin America

FinTech Acquisition

Corp. II

US 350

38

19 Dec. 2017 PCS PayCard

Service

and Simplepay

Germany Provides solutions for cashless payments at retail

points of sale

ConCardis Germany Not disclosed

39

19 Dec. 2017 Walmart Chile

Servicios

Financieros

Chile Issues credit cards for making payments in Walmart

stores and afliate stores

Banco de Crédito e

Inversiones

Chile 148

40

21 Dec. 2017 Paynova Sweden Provides online payment solutions in Sweden David Larsson Not

disclosed

Not disclosed

41

21 Dec. 2017 POS business of

Banco BPI

Portugal Operates as cards issuer in Portugal Comercia Global

Payments Entidad

de Pago

Spain 71.3

42

22 Dec. 2017 Comviva

Technologies

India Offers products to banked and unbanked consumers to

save, borrow, transfer and spend money using their mobile

Tech Mahindra India 51.3

M&A

Transaction overview

Q4 2017

#payments

20

Volume 19

VC

Date

an nounced

Market Market Round Financial

volume

(US$m)

Total

funding

(US$m)

Lead investor Market

segment

Description

1

3 Oct. 2017 Fawry Banking &

Payment

Technology

Services

Egypt N/D 20.4 ResponsAbility

Social Investment

Services, Private

Equity Arm

Other Operates an electronic bill presentment and

payment platform in Egypt

2

4 Oct. 2017 Taulia US N/D 20.0 75.0 Other Provides businesses with payment, e-invoice and

invoice discounting solutions

3

4 Oct. 2017 These Basic

Transfer

South

Africa

Venture Newton Partners Alternative

payment

systems

Provides e-wallet services

4

5 Oct. 2017 Anypay Service Thailand N/D 0.1 0.1 V.I. Capital Co.,

Ltd.

Processing Offers electronic payment processing services

5

6 Oct. 2017 Pundi X Indonesia N/D 84.0 Payment

acceptance

devices and

software

Provides POS to accept, sell and buy

cryptocurrencies

6

10 Oct. 2017 Payment Rails Canada Seed 1.1 1.1 Money

transfer

Designs and develops an application programming

interface payouts platform that allows companies

to send fast and low-cost payouts to on-demand

workers, suppliers and employees globally

7

12 Oct. 2017 Omniway US A 12.8 14.3 Nyca Partners Payment

acceptance

devices and

software

Offers branded mobile payment and currency

systems that reduce payment costs

8

13 Oct. 2017 Epesos Mexico Venture 6.0 6.0 Santander

Innoventures

Alternative

payment

systems

Operates as an online payment system to

pay bills to any person or institution through

Facebook, a mobile phone or email

9

16 Oct. 2017 Finnovation

Tech Solutions

India A 8.0 10.0 Shunwei Fund Other Provides nance solutions that help college

students to purchase products online via exible

monthly payment plans

10

16 Oct. 2017 Midpoint

Holdings

Canada N/D 1.0 5.1 Alternative

payment

systems

Operates a peer-to-peer international currency

matching and payments platform that offers

mid-market foreign exchange rates through its

patented matching technology

11

17 Oct. 2017 Feedzai US C 50.0 76.1 Sapphire

Ventures

Data

analytics

Provides business intelligence applications for small

and large organizations in telecommunications,

banking and utility markets

12

17 Oct. 2017 Lightspeed

POS

Canada D 166.0 292.0 La Caisse de

dépôt et

placement du

Québec

Payment

acceptance

devices and

software

Provides point-of-sale and e-commerce solutions

for retailers and restaurateurs to manage their

businesses

13

17 Oct. 2017 Paygevity US Debt 1.5 Processing Provides technology-driven payment processing

and vendor management

14

17 Oct. 2017 Dejamobile France Venture 2.9 2.9 Payment

acceptance

devices and

software

Provides HCE and NFC mobile payment platforms

15

18 Oct. 2017 Finja Pakistan A 1.5 2.5 Vostok Emerging

Finance

Alternative

payment

systems

Provides payment solutions in Pakistan

16

18 Oct. 2017 Tpaga Colombia Seed 2.2 2.3 Green Visor

Capital

Management

Alternative

payment

systems

Operates a digital wallet that allows users to

make payments through mobile phones

Transaction overview

Q4 2017

#payments

21

Volume 19

Date

an nounced

Market Market Round Financial

volume

(US$m)

Total

funding