CHAPTER 10: COMPENSATION OF EMPLOYEES

(Updated: November 2019)

Definitions and Concepts

Recording in the NIPAs

Overview of Source Data and Estimating Methods

Annual estimates

Current quarterly estimates

Table 10.A—Summary of Methodology for Wages and Salaries

Table 10.B—Summary of Methodology for Employer Contributions for Pension and Insurance

Funds

Table 10.C—Summary of Methodology for Employer Contributions for Social Insurance

Appendix A: NIPA Measures of Employment and Hours

Compensation measures the total income—both wages and salaries and supplements to

wages and salaries—earned by employees in return for contributing to production during an

accounting period. It is the largest component of gross domestic income (GDI), of national

income, and of personal income in the U.S. national income and product accounts (NIPAs).

Compensation estimates are an integral part of the NIPAs, a set of accounts that provides a

logical and consistent framework for presenting statistics on U.S. economic activity (see

“Chapter 2: Fundamental Concepts”).

BEA’s measures of compensation provide comprehensive and consistent economic

measures of the income earned by all U.S. workers. In contrast to other available measures of

compensation, the NIPA measures include not just wages and salaries but also noncash

benefits—such as employer contributions to pension plans, to health insurance, and to social

insurance programs. Thus, the NIPA measures of compensation are particularly useful in

analyses of labor’s share in the functional distribution of income. Additionally, unit labor costs—

the ratio of compensation to real output—is an important indicator of potential inflation.

Moreover, analyses of the components and supporting detail underlying the compensation

measures are useful for considering the differences between the individual experiences of

households and the picture of the economy captured in broader aggregates such as GDP and

personal income. The estimates of wages and salaries—the largest component of

compensation—are critical for projecting federal budgets and Social Security trust fund

balances.

1

Additionally, BEA prepares associated measures of employment and hours. While the

Bureau of Labor Statistics (BLS) is the principal provider of information on the labor market in

the United States (including detailed data on employment, hours, and earnings), BEA’s

1

See J. Steven Landefeld, Brent R. Moulton, Joel D. Platt, and Shaunda M. Villones, “GDP and Beyond: Measuring

Economic Progress and Sustainability,” Survey of Current Business 90 (April 2010): 12-25.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-2

supplemental measures are consistent with the NIPA compensation measures and therefore

facilitate analyses of NIPA-based compensation and productivity by employee. These measures

are described in appendix A to this chapter; they include full-time equivalent employees and

hours worked.

Definitions and Concepts

Compensation measures the total remuneration, in cash or in kind, that accrues to

employees in return for their work during the accounting period, regardless of when they are

paid. As such, the NIPA treatment of compensation is consistent with the treatment

recommended by the System of National Accounts 2008 (SNA), in which compensation reflects

total remuneration and is measured on an accrual basis.

2

Compensation consists of the earnings

of employees, but it does not include the earnings of the self-employed, which the NIPAs treat as

proprietors’ income (and the SNA treats as mixed income).

Compensation is equal to the sum of wages and salaries and of supplements to wages

and salaries. Wages and salaries, which generally accounts for over 80 percent of compensation,

consists of cash remuneration of labor (including sick or vacation pay, severance pay,

commissions, tips, and bonuses), and in-kind remuneration of labor such as transit subsidies and

meals. Supplements to wages and salaries consists of employer payments that are made on behalf

of employees but are not included in the regular wage payments provided directly to

employees—specifically, employer contributions for employee pension and insurance funds and

employer contributions for government social insurance. Because these payments are made for

the benefit of employees and because the value of the contributions is typically determined, in

some fashion, by their labor, they are treated as compensation. Table 10.1 shows the kinds of

transactions that are included in, and excluded from, compensation of employees.

Table 10.1—Content of Compensation of Employees

Category of transaction

Comments

Wages and salaries in cash

Includes monetary wages and salaries payable by employers

to employees and to corporate officers at regular intervals,

including piecework payments; overtime or unusual-hour

payments; payments for periods away from work due to

temporary discontinuation of production, such as holidays or

absences for illness; allowances for unusual location or

conditions; early retirement (buyout) payments; severance

pay; jury, witness, and other compensatory fees; and regular

2

See Commission of the European Communities, International Monetary Fund, Organisation for Economic Co-

operation and Development, United Nations, and the World Bank, System of National Accounts 2008

: paragraph 7.5.

For a discussion of the accrual and cash methods of accounting, see “Accounting principles” in chapter 2 of this

handbook.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-3

supplementary allowances, such as housing allowances.

3

Includes incentive payments, commissions, tips, and bonuses

payable to employees and to corporate officers.

Includes employee gains from exercising nonqualified stock

options (NSOs).

4

Includes wages and salaries paid to employees of

unincorporated enterprises.

Excludes the income received by the owners or associated

household members of unincorporated enterprises, which is

treated as proprietors’ income.

Excludes the income received by tax-exempt cooperatives,

which is treated as proprietors’ income.

Excludes reimbursement by employers of expenditures made

by employees in order to carry out their work (such as

purchases of tools and equipment), which are treated as

intermediate ex

penditures by the employer.

Wages and salaries in kind

Includes employer-provided in-kind earnings, such as transit

subsidies, meals, and lodging.

Excludes goods or services that employers must provide in

order for employees to perform their work, which are treated

as intermediate expenditures by the employer.

Supplements to wages and salaries

Includes employer contributions for employee pension and

insurance funds: private pension plans, government

employee pension plans, private insurance funds such as

group health and life insurance, workers’ compensation,

supplemental unemployment insurance, and publicly

administered government employee insurance plans.

Includes employer contributions for government social

insurance: old age, survivors, and disability insurance (social

security); hospital insurance; unemployment insurance;

railroad retirement; pension benefit guaranty; veterans life

insurance; workers’ compensation; military medical

insurance; and temporary disability insurance.

Employers provide employees with pension benefits largely through two mechanisms:

• Defined contribution plans provide benefits during retirement based on the

amount of money that has accumulated in an employee’s account as a result of

employer and employee contributions to the plans and the income earned from

investment of the plans’ assets.

• Defined benefit plans provide benefits during retirement based on a formula that

typically depends on an employee’s length of service and average pay, among

3

The source data underlying the estimates of wages and salaries do not provide the separate estimates of severance

payments or of payments for time away due to illness or injury that are required for excluding them from

compensation (as the SNA recommends), so they are included in the NIPA measures of compensation.

4

NSOs are regarded as additional, taxable, income at the time they are exercised; in contrast, incentive stock options

do not require the reporting of additional income and are taxed as long-term capital gains when sold. The detailed

data required for treating NSOs as compensation of employees when the options are granted (as the SNA

recommends) are not currently available. Instead, NSOs are valued at the time that they are exercised, and the

difference between the market price at the time of the exercise and the price paid by the employee at the time of the

exercise is recorded as wages and salaries. For a discussion of the SNA recommendations and BEA’s research on

NSOs, see Carol E. Moylan, “Employee Stock Options and the National Economic Accounts

,” Survey 88 (February

2008): 7-13.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-4

other factors. To fund promised benefits to retirees, defined benefit plans

primarily rely on contributions from employers and employees and on the income

earned on the financial assets that the plans hold.

The contributions made by employers to both types of plans are included in supplements

to wages and salaries; the interest and dividend income earned on the plans’ financial

assets are included in personal interest income.

The NIPAs provide two measures of compensation in order to distinguish the

compensation earned by all of the employees of resident U.S. employers from the compensation

earned by resident U.S. employees from all employers. “Compensation of employees, paid” is

the NIPA measure of the compensation paid by U.S. resident employers to their resident and

nonresident employees. That is, it excludes compensation received from the rest of the world,

and it includes compensation paid to the rest of the world.

5

“Compensation of employees” is the

NIPA measure of the compensation paid by resident and nonresident employers to U.S. resident

employees. That is, it excludes compensation paid to the rest of the world, and it includes

compensation received from the rest of the world.

Recording in the NIPAs

As described in chapter 2, the NIPAs can be viewed as aggregations of accounts

belonging to individual transactors in the economy. In the seven summary accounts of the

NIPAs, “compensation of employees, paid” appears as a component of GDI in the Domestic

Income and Product Account (account 1) and “compensation of employees” appears in the

Personal Income and Outlay Account (account 3) as a component of personal income.

6

Additionally, as “compensation of employees” reflects the compensation liabilities of both

resident and nonresident employers, it appears as a component of national income.

7

5

Compensation paid to the rest of the world consists of compensation paid to foreign residents temporarily working

in the United States (including undocumented migratory workers) and to Canadian and Mexican workers who

commute to work in the United States. Compensation received from the rest of the world consists of compensation

received by U.S. residents temporarily working abroad, working in foreign diplomatic installations, or working for

international organizations in the United States, and by workers from the United States who commute to Mexico or

Canada.

6

In addition, compensation of general government employees is a product-side component of government

consumption expenditures and gross investment in account 1; see “Chapter 9: Government Consumption

Expenditures and Gross Investment” of this handbook for more information on the NIPA presentation of

government as both a consumer/investor and a producer and on the measurement of government output as the sum

of the cost of its inputs.

7

For a discussion of the relationship between GDP, gross national product, national income, and other important

NIPA aggregates, see “Major NIPA aggregates” in chapter 2

of this handbook. For a discussion of domestic and

national measures of production, see “Geographic coverage” in chapter 2.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-5

The NIPAs present current-dollar annual estimates of GDI by type of income, national

income by type of income, and national income by sector and legal form of organization.

• The presentation of GDI by type of income includes “compensation of employees, paid”

and selected aggregate components—wages and salaries to persons, wages and salaries to

the rest of the world, and supplements to wages and salaries.

• The presentation of national income by type of income includes “compensation of

employees” and selected aggregate components—wages and salaries for government and

for the aggregate of all other sectors and supplements to wages and salaries from

employer contributions for employee pension and insurance funds and from employer

contributions for government social insurance.

• The presentation of national income by sector and legal form of organization also

includes “compensation of employees” and selected aggregate components—wages and

salaries and supplements to wages and salaries.

Additionally, annual estimates of “compensation of employees,” wages and salaries, and the

major components of supplements to wages and salaries are presented by industry.

The sector-specific estimates follow the NIPA sectors—business (including government

enterprises), households and institutions, general government, and the rest of the world; within

the business sector, the estimates by legal form are classified according to the Internal Revenue

Service (IRS) filing requirements for corporate and noncorporate business.

8

The industry-

specific estimates for 1998 forward are classified according to the North American Industry

Classification System (NAICS) at the three-digit industry level, and the estimates prior to 1998

are classified according to the Standard Industrial Classification (SIC); the estimates for 1998-

2000 are also available on an SIC basis.

9

The industry-specific estimates include estimates for

federal general government (which includes both civilian employees and military personnel), for

federal government enterprises, for state and local general government, and for state and local

government enterprises.

Estimates of “compensation of employees, paid” and “compensation of employees” and

certain aggregate components are also available quarterly. The following is a list of the principal

NIPA tables that present current-dollar estimates of compensation as a component of GDI and of

8

For descriptions of NIPA sectors and of legal forms of organization, see the section “Classification” in chapter 2 of

this handbook.

9

Time-series breaks caused by the conversion to NAICS and by previous revisions to the SIC are reflected in the

separation of es timates into dis tinct tables for each range of estimates based on a different classification. For

instance, table 6.2, Compensation of Employees by Industry, comprises four separate tables: table 6.2A, based on

the 1942 SIC; table 6.2B, bas ed on the 1972 SIC; table 6.2C, bas ed on the 1987 SIC; and table 6.2D, bas ed on the

2012 NAICS. For more information on the conversion from the SIC to NAICS, see John R. Kort, “

The North

American Industry Classification System in BEA’s Economic Accounts,” Survey 81 (May 2001): 7–13.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-6

national income.

10

1.10 Gross Domestic Income by Type of Income

1.11 Percentage Shares of Gross Domestic Income

1.12 National Income by Type of Income

11

1.13 National Income by Sector, Legal Form of Organization, and Type of Income

6.2 Compensation of Employees by Industry

6.3 Wages and Salaries by Industry

Annual estimates of supplements to wages and salaries are also presented by industry and

by detailed type of supplement in the following NIPA tables:

3.6 Contributions for Government Social Insurance

12

6.10 Employer Contributions for Government Social Insurance by Industry

6.11 Employer Contributions for Employee Pension and Insurance Funds by Industry and by

Type

7.8 Supplements to Wages and Salaries by Type

Separate receipts and expenditures accounts for defined benefit and defined contribution

pension plans are presented annually in tables 7.20-7.25 for all plans, for all private defined

benefit plans, for federal government defined benefit plans, for state and local defined benefit

plans, and for all defined contribution plans, respectively.

Annual and quarterly estimates of wages and salaries paid to the rest of the world and

wages and salaries received from the rest of the world are presented in “Table 4.1. Foreign

Transactions in the National Income and Product Accounts.”

10

As a component of the product-side measure of government consumption expenditures and gross investment,

BEA prepares real (inflation-adjusted) measures of the compensation of general government employees. For more

information on the derivation of inflation-adjusted measures, see “Price and Quantity Estimates” in “Chapter 4:

Estimating Methods.” For more information on the derivation of real compensation of general government

employees, see the section “Quantity and price estimates” in chapter 9, and see Bruce E. Baker and Pamela A.

Kelly, “A Primer on BEA’s Government Accounts,” Survey 88 (March 2008): 29-38.

11

The NIPAs also present annual and quarterly estimates of “compensation of employees” in NIPA table group 2 as

a component of personal income. Annual and quarterly estimates of “compensation of employees” are available in

NIPA table 2.1. Annual and quarterly estimates of wages and salaries are available by aggregate industry groupings

in NIPA table 2.2. Monthly estimates of wages and salaries for total private industries and for total government and

monthly estimates of total supplements are available in NIPA table 2.6. Monthly estimates of wages and salaries by

aggregate industry groupings are available in table 2.7. BEA also prepares state and local area estimates of

compensation and its components by industry and by type. For more information, see the “Regional” page at

www.bea.gov.

12

The NIPAs also present estimates of the benefits paid by government social insurance programs in table 3.12.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-7

BEA also prepares nominal, or “current-dollar” estimates of compensation of employees

that are not seasonally adjusted; these are available in Section 8 of the NIPA Interactive Data

Tables.

Additional information on compensation is available in “Underlying Detail tables.”

13

Compensation paid to general government employees—that is, both civilian and military

employees of federal and state and local agencies excluding government enterprises—is

available in several tables, but table 3.25U provides detail not found elsewhere. And while

annual estimates of employer contributions for government social insurance are available in table

3.6, quarterly estimates are available as underlying detail in table 3.6U.

In addition, BEA prepares by-industry estimates of full- and part-time employees, full-

time equivalent (FTE) employees, wages and salaries per FTE, hours worked by FTE, self-

employed persons, and persons engaged in production (see NIPA tables 6.5-6.9). For a

discussion of the derivation of the employment estimates, see appendix A to this chapter.

Other measures of compensation—or more specifically, measures of wages and

employment—are prepared by the Census Bureau’s County Business Patterns series and by

BLS’ Quarterly Census of Employment and Wages (QCEW) program.

14

The Census Bureau’s

estimates are derived from Federal administrative records and survey information from business

establishments. BEA’s statistics and BLS’ statistics on compensation are both based primarily on

BLS tabulations of employment and wage data from the unemployment insurance program; BEA

presents the relationship between them annually in “Table 7.18. Relation of Wages and Salaries

in the National Income and Product Accounts to Wages and Salaries as Published by the Bureau

of Labor Statistics.” A reproduction of table 7.18 appears below in the section “Adjustments to

the QCEW data.”

Overview of Source Data and Estimating Methods

As described earlier in the handbook, the NIPA estimates, including those for

compensation of employees, are prepared using a wide variety of source data (see “Chapter 3:

Principal Source Data”) and using estimating methods that adjust the source data to the required

NIPA concepts and that fill in gaps in coverage and timing (see “Chapter 4: Estimating

Methods”). Specifically, the compensation estimates are based on statistical reports from federal

13

BEA does not include these detailed estimates in the published tables because their quality is s ignificantly less

than that of the higher level aggregates in which they are included. Compared with these aggregates, the more

detailed estimates are more likely to be based on judgmental trends, on trends in higher level aggregates, or on less

reliable source data.

14

See “What is the difference between BEA employment and wages and BLS and Census employment and wages?”

on BEA’s Website at www.bea.gov; select “Help” and then “FAQs.”

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-8

agencies including BLS and the Department of the Treasury, on federal budget publications and

other administrative and regulatory agency reports, and on reports from private organizations

(such as trade associations).

Tables 10.A (wages and salaries), 10.B (employer contributions for pension and

insurance funds), and 10.C (employer contributions for government social insurance) at the end

of this chapter summarize the source data and estimating methods that are used to prepare the

annual estimates and the current quarterly estimates of compensation and its components. The

tables follow the categories shown in NIPA tables 6.3 (for wages and salaries), 6.11 (for

employer contributions for pension and insurance funds), and 3.6 (for employer contributions for

government social insurance).

15

The source data and methods for the current quarterly estimates

reflect both seasonally adjusted and not seasonally adjusted estimates unless otherwise noted.

Annual estimates

“Compensation of employees, paid” is measured as the sum of wages and salaries and of

supplements to wages and salaries. The primary source of information on annual wages and

salaries is the QCEW; the sources of information on supplements to wages and salaries are as

varied as the programs themselves.

Wages and salaries. The benchmark and annual estimates are derived using the same source data

and methodologies. For private industry employees and for civilian employees of federal

government, of state and local general government, and of the U. S. Postal Service, the estimates

are primarily based on the QCEW. Estimates for the military and for other government

enterprises are discussed below in the section “Adjustments to the QCEW data.” QCEW data on

wages and salaries are generally available for all four quarters of the previous year at the time of

the annual update of the NIPAs, which typically occurs in July.

The QCEW is a federal-state cooperative program in which state employment agencies

compile and report to BLS the monthly data on employment and the quarterly data on total and

15

In NIPA table 6.3, total wages and salaries on a national income basis—which includes wages and salaries

received from the rest of the world and excludes wages and salaries paid to the rest of the world—is shown on line

1. The industry-specific estimates, beginning with “Domestic industries” on line 2, include payments to the rest of

the world (and exclude receipts from the rest of the world) in order to accurately reflect each industry’s total wage

and salary liability. The offsetting entry, total wages and salaries paid to the rest of the world netted against wages

and salaries received from the rest of the world, is shown on line 97.

In NIPA table 3.6, the entry “Rest-of-the-world contributions” on line 32 recognizes the employer and employee

contributions for government social insurance from residents of the U.S. territories of Guam, American Samoa, and

the U.S. Virgin Islands and of the U.S. commonwealths of Puerto Rico and the Northern Mariana Islands. In the

NIPAs, these are treated as contributions from “nonresidents” (see the section “Geographic coverage” in chapter 2

of this handbook) and as a consequence, they are not included in the NIPA estimates of total supplements to wages

and salaries and are not shown in table 10.C.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-9

taxable wages that are reported to the states each quarter by private industries on quarterly tax

returns and by federal agencies and state and local governments on similar reports for employees

covered by state unemployment insurance (UI) laws or by the Unemployment Compensation for

Federal Employees (UCFE) program. These data cover about 97 percent of employees on

nonfarm payrolls. BLS tabulates the data by geographical categories (county, metropolitan

statistical area, combined statistical area, state, and the nation), by six-digit NAICS industry

level, and by ownership sectors (private industry, federal government, state government, or local

government).

The composition of wages reported to state employment agencies is generally consistent

with the NIPA definition of wages and salaries. The data are on a disbursement basis; they

reflect the total wages and salaries paid during a calendar quarter, regardless of when the services

were performed (although a few state laws specify that wages be reported on an accrual basis).

Conversely, the NIPAs record compensation and its components on an accrual basis; they reflect

the total wages and salaries earned during the period, regardless of when they were paid. In most

years, the pattern of wage and salary accruals and disbursements is relatively stable, with no

difference between the measures of accruals and disbursements.

16

However, when there is

evidence of a substantial departure from the usual pattern, BEA may incorporate a timing

adjustment to better reflect the earnings accrued in each period. When these adjustments are

made, they are recorded in the annual wage reconciliation table (NIPA table 7.18) discussed

below in the section “Adjustments to the QCEW data.”

17

BEA sums the quarterly QCEW data for each industry to derive annual estimates and

makes additional adjustments to account for misreporting of wages on employment tax returns

and for differences in coverage and in definitions (see the section “Adjustments to the QCEW

data”); these adjustments account for about 5 percent of the NIPA estimate of wages and salaries.

BEA uses industry payroll data from the Census Bureau’s Economic Census to aggregate the

16

As a simple example, if wages and salaries accrued annually include bonuses that typically equal $100, with one-

half of the bonuses paid in the current year and one-half paid in the following year, then each year’s disbursed wages

will include a $50 bonus payment accrued in the current year and a $50 bonus payment accrued in the previous year;

the total bonuses paid in each year—$100—equals the bonuses accrued.

17

Prior to the 2013 comprehensive update of the NIPAs, the NIPAs presented a third compensation measure,

“compensation of employees, received” that reflected estimates of wages and salaries on a disbursement basis. An

entry for “wage and salary accruals less disbursements” (WALD) in the national income tables reconciled the two

accrual-based measures with this disbursement-based measure. In practice, there was often little information on the

timing differences between accruals and disbursements, and the measure of WALD was typically zero. The new

treatment, introduced during the 2013 comprehensive update of the NIPAs , discontinued the disbursement-based

measure of “compensation of employees, received” and the measures of WALD in order to better align transactions

of the personal income and outlays account with those of the private enterprise income account, to simplify the

presentation of wages and salaries within the accounts, and to help bring the NIPAs in line with recommendations of

the SNA. See “

Preview of the 2013 Comprehensive Revision of the National Income and Product Accounts:

Changes in Definitions and Presentations,” Survey 93 (March 2013): 13-39.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-10

estimates across industries and levels of government to prepare estimates of total wages and

salaries by legal form and sector.

Supplements to wages and salaries. The benchmark and annual estimates are derived using the

same source data and methodologies. Employer contributions for employee pension and

insurance funds consists of the contributions made by private or government employers to

privately administered retirement and insurance programs and by government employers to

government employee pension plans and to publicly administered government employee

insurance programs. Employer contributions for government social insurance consists of the

contributions made by private and public employers to other publicly administered programs that

provide certain social benefits, such as social security and Medicare.

18

For employer contributions for pension funds, supplements are estimated by type of

fund—defined contribution and defined benefit pension plans—and by employer—private plans

and government employee plans. For defined contributions plans, future benefits are determined

by the contributions made by employers and employees into the plan and by the income earned

on the financial assets that the plans hold; therefore, actual contributions reflect the accrual

accounting method. For defined benefit plans, future benefit entitlements are determined

independently of actual contributions and may differ from them.

19

Thus, in order to reflect the

accrual accounting basis, the NIPA measures of employer contributions to defined benefit plans

reflect actual contributions and—when actual contributions differ from the entitlements earned in

the period—imputed contributions to reflect the value of the employers’ liability for entitlements

and for the administrative expenses of the plan that are not fulfilled by actual contributions.

20

The measurement of employer contributions for both types of plans are described below and in

table 10.B.

21

18

For descriptions of the government social insurance programs included in the NIPA measure of employer

contributions for government social insurance, see U.S. Bureau of Economic Analysis,

MP-5: Government

Transactions (Methodology Papers: U.S. National Income and Product Accounts, September 2005).

19

This is especially true in cases where the actual contributions made by employers are sporadic. For example,

employers sometimes skip contributions when the plans have enjoyed unusually good investment returns;

conversely, employers sometimes make large “catch up” contributions to pay down unfunded benefit obligations.

20

In periods where actual contributions exceed the total liability of employers , imputed employer contributions will

be negative.

21

The measurement of defined benefit pension plans on an accrual basis was introduced as part of the 2013

comprehensive update of the NIPAs to better align pension-related compensation with the timing of when

employees earned the benefit entitlements and to be consistent with the recommendations of the 2008 SNA. The

accrual-based estimates also avoid the volatility that arises when sporadic cash payments made by employers into

defined benefit pension plans are used to measure compensation. For detailed information on accrual-based

measures of benefit entitlements and contributions, see “

Preview of the 2013 Comprehensive Revision of the

National Income and Product Accounts: Changes in Definitions and Presentations,” Survey 93 (March 2013): 13-39

and Marshall B. Reinsdorf and David G. Lenze, “Defined Benefit Pensions and Household Income and Wealth,”

Survey 89 (August 2009): 50-62. With the 2014 annual update of the NIPAs, defined contribution pension plans

were also treated as part of the same subsector. With the 2018 comprehensive update, the valuation of state and local

defined benefit pensions was changed from an accumulated benefit obligation basis to a projected benefit obligation

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-11

For employer contributions to defined contribution pension plans, the estimates are

primarily based on survey and administrative data from government agencies—including the

Department of Labor, the Department of the Treasury, the Census Bureau, the Office of

Personnel Management (OPM), the Federal Retirement Thrift Investment Board, the Pension

Benefit Guaranty Corporation (PBGC), the Employment Benefits and Security Administration

(EBSA), and the Department of Health and Human Services (HHS). For employer contributions

to defined benefit pension plans, the NIPA estimates are based on actuarial estimates of the

present value of claims to benefits accrued through service in the current period—commonly

called normal costs—primarily from PBGC, EBSA, OPM, the Department of Treasury, the

Department of Defense, and reports from state and local pension plans. The employers’ portion

of the liability for these claims—referred to as employers’ normal costs—reflects actual and

imputed employer contributions.

For privately sponsored defined benefit plans, estimates of employers’ normal costs are

based on actuarial estimates of employers’ normal costs provided by the PBGC from data

collected on IRS form 5500. The PBGC adjusts the estimates to include administrative expenses,

and BEA adjusts the PBGC estimates to reflect a common discount rate based on the average

AAA corporate bond rate published by Moody’s Investors Service.

For federal government civilian employee defined benefit pension plans, estimates of

employers’ normal costs are based on OPM data published in the annual actuarial reports of the

major civilian retirement plans, supplemented by data from the Department of Treasury. The

estimates of employers’ normal costs are scaled up slightly to account for smaller retirement

plans such as those for employees of the Foreign Service and the Coast Guard that are not

included in the source data. For the military defined benefit plans, estimates of employers’

normal costs are based on Department of Defense data on normal cost rates and payroll.

For state and local employee defined benefit pension plans, the estimates of employers’

normal costs are based on the service costs and employee contribution data reported in state and

local government financial reports. BEA adjusts the estimates to reflect the same discount rate

that is used for measures of privately sponsored defined benefit plans. Separate measures of

administrative expenses are based on Census Bureau data.

For private insurance funds and publicly administered government employee insurance

plans, estimates of employer contributions are primarily based on administrative and survey data

basis.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-12

from HHS, OPM, the Department of Veterans’ Affairs, and A.M. Best’s Aggregates and

Averages.

For employer contributions for government social insurance, estimates are derived by

program. They are primarily based on administrative data from the Social Security

Administration, the Department of Labor, and the Veterans’ Administration; on survey data from

the Census Bureau; and on financial data from the Budget of the United States Government

(Budget) as published by the Office of Management and Budget.

The industry-specific estimates are prepared by allocating the estimates to three-digit

NAICS industries using industry-specific information from the source data or from other

industry-specific data that is related to the program or fund. For instance, the source data

underlying the estimates of workers’ compensation do not include industry information, so

industry ratios are derived from industry-specific data on occupational injuries and illnesses from

BLS.

Current quarterly estimates

Current quarterly estimates of wages and salaries and of supplements to wages and

salaries are published only at aggregate levels and not by detailed industries or by program. For

wages and salaries, seasonally adjusted current quarterly estimates are prepared by averaging the

monthly estimates of wages and salaries that are released as part of BEA’s monthly personal

income estimates. For the published aggregates of supplements to wages and salaries—that is,

employer contributions for employee pension and insurance funds and employer contributions

for government social insurance—seasonally adjusted current quarterly estimates are derived as

the sum of the components (or some aggregate level of the components) that are, in most cases,

prepared by extrapolation, either judgmentally or by using an indicator series (for an explanation

of this method, see “Interpolation and extrapolation using an indicator series” in chapter 4).

22

Wages and salaries. As noted above, the primary source for the annual estimates of private

wages and salaries is QCEW data. Because these quarterly data are generally available 5 months

after the end of a quarter, the estimates of private wages and salaries for the quarters for which

the QCEW data are not yet available are derived by averaging the current monthly estimates.

23

The current monthly estimates are extrapolated for each industry from the historical monthly

22

Most of the source data that are used for extrapolation are seasonally adjusted; when this is not the case, BEA

seasonally adjusts data that display seasonality (see the section “Seasonal adjustment” in chapter 4

of this

handbook). In cases where estimates are extrapolated without the use of indicator series, there is no monthly or

quarterly seasonality.

23

The monthly estimates of personal income, including compensation, are expressed at annual rates; consequently,

the current quarterly estimates, also expressed at annual rates, may be derived by averaging the monthly estimates.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-13

estimates, which are in turn based on the most recent quarterly QCEW data that are available; the

industry estimates are then summed to derive the monthly estimates for total wages and salaries.

The extrapolation is based on the most recent monthly data from the BLS current employment

statistics (CES) program and is calculated as the growth rate for employment times average

weekly hours times and average hourly earnings. Similarly, once the QCEW data are

incorporated into the quarterly estimates, the monthly estimates are interpolated based on the

same CES indicator series. For example, the end-of-November release of Personal Income and

Outlays for October contains monthly estimates of wages and salaries for July through October

that are CES extrapolations of revised monthly estimates for the second quarter that are based on

newly available QCEW data. In turn, the end-of-November release of GDP for the third quarter

(second estimate) contains third-quarter estimates of wages and salaries that are derived by

averaging the monthly Personal Income and Outlay estimates.

In general, the release of the “third” current quarterly estimate of GDP marks the last

opportunity to revise most NIPA estimates until the next annual update. However, because of the

importance of the QCEW as a data source and because of the 5-month lag in its availability, an

exception is made for private wages and salaries and for private employer contributions for

government social insurance (for which the estimates are generally based on estimates of private

wages and salaries). As part of the “second” current quarterly release of GDP, the preceding

quarter’s estimates for these series and for affected income-side aggregates are revised in order

to incorporate the newly available QCEW data.

24

Thus, continuing with the example above, the

end-of-November release of GDP for the third quarter (second estimate) also contains revised

estimates of wages and salaries for the second quarter that are based on newly available QCEW

data. The months of the second quarter are interpolated based on the QCEW-derived quarterly

control.

For federal and for state and local government employees, the current quarterly estimates

are derived by summing monthly extrapolations from the most recent annual estimates. Federal

civilian estimates for both general government and government enterprises are extrapolated

using an indicator series that is based primarily on CES employment data. Federal military

estimates are extrapolated using Department of Defense employment data. State and local

government estimates for both general government and government enterprises are extrapolated

using an indicator series that is based on CES employment data and on information on the

24

This procedure was introduced as part of the 2002 annual update in order to reduce the magnitude of revisions to

the estimates of wages and salaries. (See the box “Revisions to Wages and Salaries and to Profits” in Eugene P.

Seskin and Stephanie H. McCulla, “Annual Revision of the National Income and Product Accounts

,” Survey 82

(August 2002): 24-25.) Affected aggregates include gross domestic income, the statistical discrepancy, gross

national income, national income, personal income, disposable personal income, personal taxes, personal saving,

gross (national) saving, compensation, and gross product of corporate business. Other components that are closely

linked to wages and salaries, such as personal current taxes and employer contributions for government social

insurance, are also revised. Product-side series, including government compensation, which is a component of GDP,

are not revised.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-14

change in the cost of labor from the BLS employment cost index.

Supplements to wages and salaries. Current quarterly estimates of employer contributions for

employee pension and insurance funds are released only for the aggregate, which is prepared as

the sum of the components or aggregate levels of the components. In most cases, the component

estimates are prepared by judgmentally projecting annual estimates into the next year and then

interpolating those projected annual estimates into quarterly (and monthly) estimates.

Current quarterly estimates of employer contributions for government social insurance

funds are also prepared as the sum of its components. These components are generally

extrapolated from the annual estimates to quarterly (and monthly) estimates using indicator

series, so they are made available as part of the NIPA underlying detail (see the section

“Recording in the NIPAs”). In most cases, the indicator series are based on NIPA wage and

salary estimates or the component estimates are extrapolated without an indicator but with

information from Budget projections of relevant outlays. As mentioned earlier, the estimates of

employer contributions for government social insurance funds for the preceding quarter are

revised to incorporate newly available QCEW data as part of the “second” current quarterly

release of GDP.

The not seasonally adjusted (NSA) estimates of compensation of employees are derived

using the same methods as the seasonally adjusted estimates, using not seasonally adjusted

versions of the same indicators.

Adjustments to the QCEW data

The QCEW data on wages and salaries are largely consistent with the concepts and

definitions underlying the NIPA estimates of wages and salaries. However, in deriving the

annual estimates of wages and salaries for the NIPAs, BEA adjusts the QCEW data to account

for misreporting of wages (including tips) on employment tax returns and for differences in

coverage and in definitions. A reconciliation of the BLS and the NIPA estimates of wages and

salaries is presented annually in NIPA table 7.18, a reproduction of which is shown for a single

year in table 10.2 below.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-15

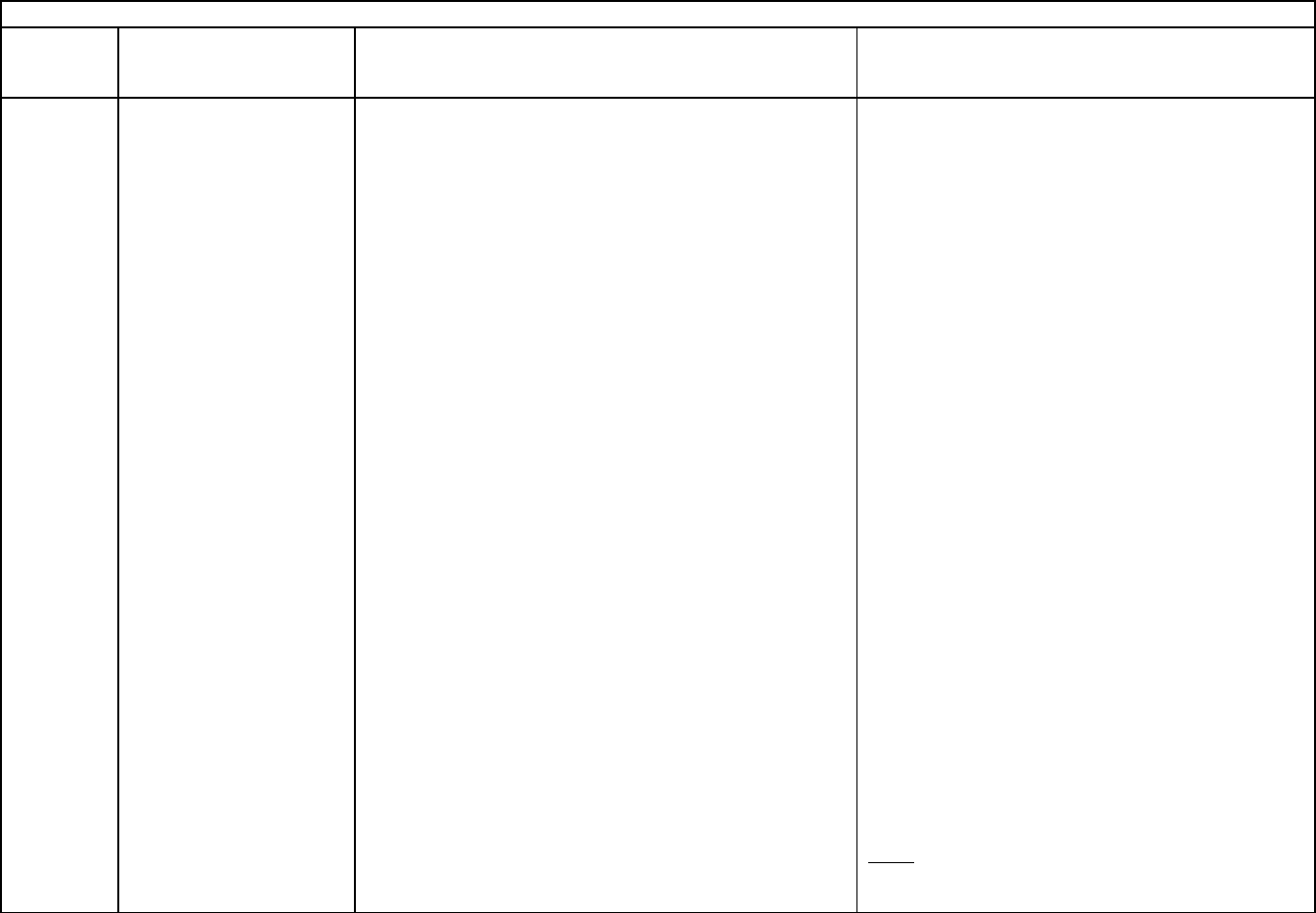

Table 10.2: Relation of BLS Wages and Salaries and NIPA Wages and Salaries

(Billions of dollars)

Line

in

NIPA

table

7.18

NIPA line item

2017

1

Total wages and salaries, BLS

1

Plus:

7,966.3

2

Adjustment for misreporting on employment tax returns

2

94.1

3

Adjustment for wages and salaries not covered or not fully covered by unemployment insurance

393.4

4

Government

151.4

5

Other

242.0

6

Timing adjustment for accrual basis

0.0

7

Equals: Wages and salaries, NIPAs

8,453.8

1

Total annual w ages of w orkers covered by state unemployment insurance (UI) law s and by the Unemployment

Compensation for Federal Employees program. Data for the most recent year are preliminary.

2

Consists of unreported w ages and salaries paid by employers and of unreported tips.

Adjustment for misreporting on employment tax returns (line 2). Adjustments are made to the

QCEW data to account for wages and salaries that are underreported on employment tax returns,

for tips that are underreported, and for wages and salaries that are not reported at all because the

employers fail to file an employment tax return.

• The estimates of underreported income are based on audits of individual employment tax

returns undertaken as part of the IRS National Research Program (NRP) for the 2008-

2010 span.

25

• The adjustment for underreported tips or gratuities is derived in the preparation of BEA’s

input-output accounts for industries—primarily accommodations, food services, taxis,

barber shops, and beauty salons—where tips are a significant factor in compensation. The

adjustment is based on the assumption that not all tips are included in the wages and

salaries reported on the employment tax returns, and it is derived using information on

industry sales and information on “tip rates” from the IRS.

• The estimates of nonreported income are based on “exact-match” studies that the Census

Bureau provides to BEA. These studies match records from the Current Population

Survey (CPS), conducted by the Census Bureau for BLS, with individual IRS tax returns

in order to estimate nonfiler income for individuals.

25

The IRS Taxpayer Compliance Measurement Program had provided estimates of misreported income for selected

years since 1963. In 2001, the IRS launched the NRP to update the research and to reflect a changing economy,

revisions to the tax code, and shifts in individual behavior.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-16

Adjustment for wages and salaries not covered or not fully covered by unemployment insurance

(line 3). The QCEW data provide almost complete coverage for most private industry

employees, federal civilian employees, and state and local government employees. However, for

military personnel and for certain private industries for which the QCEW provides little or no

coverage—railroads, farms, farm labor contractors, private elementary and secondary schools,

religious membership organizations, and private households—estimates of wages and salaries

are prepared separately using other source data.

• Government (line 4). This entry reflects the addition of the NIPA estimate for wages and

salaries of military personnel and for various other government wage and salary

payments not captured by the QCEW. The compensation paid to military personnel is

based on Budget data and includes cash wages as well as in-kind compensation such as

uniform and housing allowances and rations. The wage and salary information in the

Budget is available on a fiscal year basis; actual wage and salary expenses are provided

for one year, and projections are provided for the current year and the budget year (for

example, the FY2015 Budget provides actual expenses for FY2013 and projected

expenses for FY2014 and FY2015). BEA converts the fiscal year estimates to a calendar

year basis by allocating one quarter of the estimate for a given fiscal year to the previous

year and three quarters to the given year.

Additional government-related adjustments are made for students and their

spouses employed by public colleges or universities, for elected officials and members of

the judiciary, for intelligence agents, for interns employed by publicly administered

hospitals and by social service agencies, for judicial fees paid to jurors and witnesses, for

compensation of prison inmates, and for marriage and license fees paid to justices of the

peace. These adjustments, which comprise only a very small share of the total

government adjustment, are prepared using a variety of source data, including data from

the Census Bureau and the Department of Justice.

• Other (line 5). This entry accounts for all of the other adjustments that are made in the

estimation of NIPA wages and salaries, including estimates for employees not covered by

the QCEW and estimates for differences between the QCEW and the NIPA definitions of

wages and salaries.

Adjustments for employees not fully captured in the QCEW data are made as follows:

- for federal government enterprises excluding the U.S. Postal Service (which is

covered by the QCEW), based on Budget data.

- for farms, based on data on farm labor expenses from the U.S. Department of

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-17

Agriculture (USDA).

- for farm labor contractors, primarily based on data for contract farm labor

expenses from the Census of Agriculture.

- for private elementary and secondary schools, primarily based on annual payroll

data from the Census Bureau’s County Business Patterns; estimates of in-kind

wages are judgmentally derived.

- for religious membership organizations, primarily based on annual payroll data

from the Census Bureau’s County Business Patterns; estimates of in-kind wages

are judgmentally derived.

- for private households, primarily based on CPS data; estimates of in-kind wages

are judgmentally derived.

- for railroads, primarily based on wage and salary data from the Railroad

Retirement Board.

Adjustments for differences between the QCEW and the NIPA definitions of wages and

salaries include the following:

- An adjustment to include compensation received from foreign employers and to

exclude compensation paid to foreigners in order to make the measure consistent

with national income, derived from ITA estimates of compensation received from

foreigners. Alternatively, in gross domestic income tables, the ITA estimate of

compensation paid to the rest of the world is included and the ITA estimate of

compensation received from the rest of the world is excluded. The ITA estimates

of compensation received from, and paid to, foreigners are based mostly on data

from foreign statistical authorities and from the IRS, as well as various

demographic and labor market data from the USDA and the Department of

Labor.

26

- An adjustment to include employer contributions to “cafeteria plans” that are

excluded from the QCEW data for private industries and for state and local

governments when state laws do not count them as wages for unemployment

insurance purposes. These plans allow participating employees to use a portion of

their salaries on a pre-tax basis to pay for health insurance and for “flexible

spending accounts,” which reimburse employees for medical care and for

dependent daycare. The adjustment is based on data from the Agency for

Healthcare Research and Quality’s Medical Expenditure Panel Survey and on

trade source data.

27

This adjustment is not needed for federal employer

26

For more information on the sources and methods for estimating compensation paid to and received from the rest

of the world, see the section “Compensation of Employees” in “

U.S. International Transactions Accounts: Concepts

and Estimation Methods,” at www.bea.gov.

27

For more information, see Clinton P. McCully and Steven Payson, “Preview of the 2009 Comprehensive Revision

of the NIPAs,” Survey 89 (May 2009): 11.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-18

contributions to these plans because they are included in the QCEW data for all

states.

• Adjustment for timing for accrual basis (line 6). This adjustment accounts for differences

in the timing of wage and salary disbursements from QCEW data and the accrual basis

underlying the NIPA measure of wages and salaries. A positive adjustment reflects a net

amount of compensation that was earned, but not actually received (and therefore not

reflected in the source data) during the period, and a negative adjustment reflects a net

amount of compensation that was paid (and reflected in the source data), but not actually

earned, during the period. In practice, as reliable source data are generally lacking on

these differences, timing adjustments are infrequent.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-19

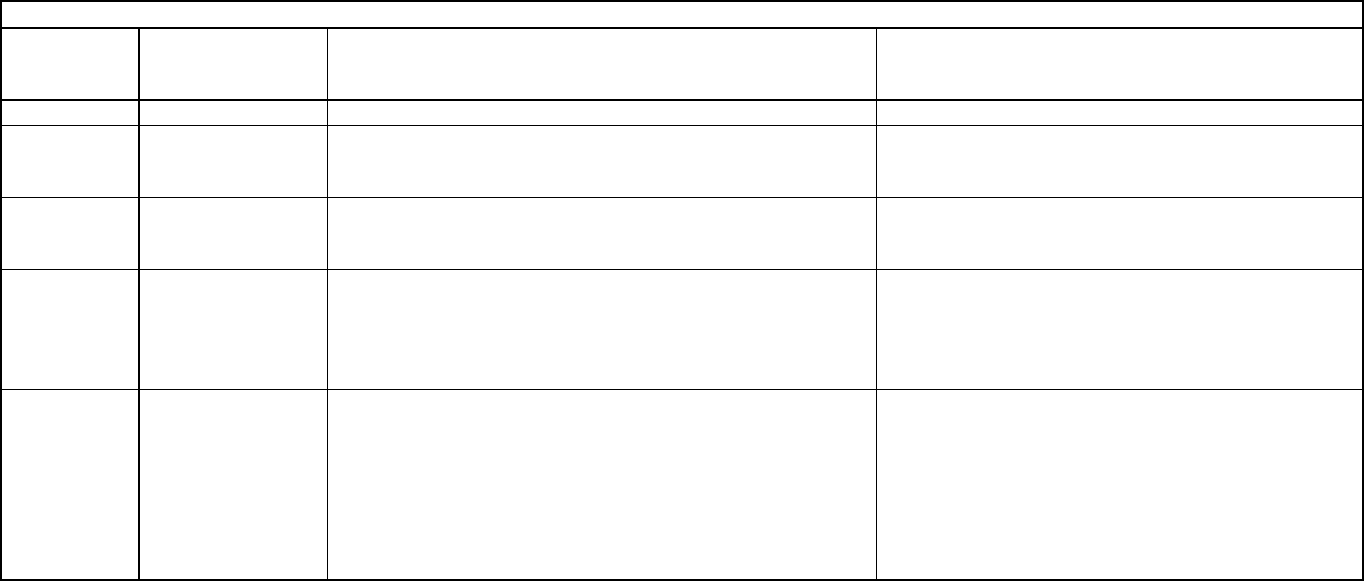

Table 10.A—Summary of Methodology Used to Prepare Estimates of Wages and Salaries

Line in NIPA

table 6.3

Component

Annual estimates

Current quarterly estimates

(Indicator series used to extrapolate)

3

Private industries

Most industries: QCEW, w ith adjustments by BEA for coverage, misreporting, and

definitions (see the section “Adjustments to the QCEW data”).

For certain other industries, or types of enterprises w ithin industries, other

sources as follow s:

Farms: USDA f arm labor expense data on cash w ages and payments-in-kind

by ow ner-operators to hired farm labor.

Farm labor contractors: For Arizona and California, QCEW. For other states,

for benchmark years, Census of Agriculture contract farm labor expenses, and

for nonbenchmark years, straight-line interpolations of benchmark-year

estimates.

Private elementary and secondary schools: For cash w ages, Census Bureau

County Business Patterns data on annual payrolls; for pay-in-kind,

judgmentally derived.

Religious membership organizations: For cash w ages, Census Bureau County

Business Patterns data on annual payrolls. For in-kind w ages, judgmentally

derived.

Private households: For cash w ages, BLS Current Population Survey data.

For pay-in-kind, judgmentally derived.

Railroads: U.S. Railroad Retirement Board data on w ages and salaries

subject to the payroll tax that supports the railroad retirement system, adjusted

to include the portion of w ages and salaries not subject to the tax, based on

the number of employees w hose w ages and salaries exceed the limit for

retirement taxation.

NSA : For historical quarters subject to revision, NSA estimates are interpolated

from the annual control value using NSA QCEW by industry as the indicator.

CES employment, hours, and earnings data.

NSA: For quarters in w hich NSA QCEW data

are available, NSA estimates are

extrapolated from the most recent estimates

not subject to revision using the quarter-to-

quarter change in NSA QCEW. For quarters

w here NSA QCEW data are unavailable,

NSA estimates are derived by industry as a

five-year moving average of the implied

seasonal factor multiplied by the CES-based

seasonally adjusted series.

86

Government:

87

Federal government:

89

Civilian general

government

For cash w ages, QCEW w ith adjustments by BEA for coverage (see the section

“Adjustments to the QCEW data”). For in-kind transit benefits, Department of

Transportation.

CES civilian employment data.

90

Military

For cash and in-kind w ages, Budget of the United States Government.

Department of Defense manpow er reports.

91

Government

enterprises

For U.S. Postal Service, QCEW data. For other enterprises, Budget data.

CES employment data for Postal Service.

92

State and local government:

93

General

QCEW data for all state and local employees allocated to general government

CES employment data and BLS employment

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-20

Table 10.A—Summary of Methodology Used to Prepare Estimates of Wages and Salaries

Line in NIPA

table 6.3

Component

Annual estimates

Current quarterly estimates

(Indicator series used to extrapolate)

government

and government enterprises using Census Bureau Public Employment payroll

data w ith adjustments by BEA for coverage (see the section “Adjustments to the

QCEW data").

cost index data.

96

Government

enterprises

QCEW data for employees allocated to government enterprises using Census

Bureau Public Employment payroll data.

CES employment data and BLS employment

cost index data.

97

Rest of the w orld:

98

Receipts from

the rest of the

w orld

ITA estimates.

ITA estimates.

99

Less: Payments

to the rest of

the w orld

ITA estimates.

ITA estimates.

BEA Bureau of Economic Analysis

BLS Bureau of Labor Statistics

CES Current Employment Statistics, BLS

ITA International Transactions Accounts , BEA

QCEW Quarterly Census of Employment and Wages, BLS

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-21

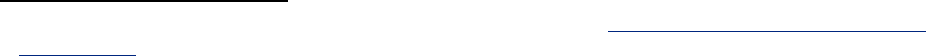

Table 10.B—Summary of Methodology Used to Prepare Estimates of Employer Contributions for Employee Pension and Insurance Funds

Line in

NIPA table

6.11

Component

Annual estimates

Current quarterly estimates*

(Indicator series used to extrapolate)

22

Employer contributions for

employee pension and

insurance funds

See method for each component.

The aggregate of unreleased measures of (1) private

employer contributions for employee pension and

insurance funds, (2) federal government employer

contributions for employee pension and insurance

funds, and (3) state and local government employer

contributions for employee pension and insurance

funds.

(1) For the aggregate of private employer contributions

for private pension and insurance funds,

judgmental trend.

(2) For the aggregate of federal employer contributions

for employee pension and insurance funds, the

sum of unreleased measures of (1) federal

government employer contributions to government

employee pension plans, (2) federal government

employer contributions to group health insurance,

(3) federal government employer contributions to

group life insurance, and (4) federal government

employer contributions to publicly administered

government employee insurance plans. See

corresponding entries below .

(3) For the aggregate of state and local employer

contributions to employee pension and insurance

funds, the sum of unreleased measures of (1) state

and local government employer contributions to

government employee pension plans, (2) state and

local government employer contributions to group

health insurance, (3) state and local government

employer contributions to group life insurance, and

(4) state and local government employer

contributions to w orkers’ compensation.

NSA : Seasonally adjusted and NSA measures of

employer contributions for employee pension and

insurance funds are presumed equal.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-22

Table 10.B—Summary of Methodology Used to Prepare Estimates of Employer Contributions for Employee Pension and Insurance Funds

Line in

NIPA table

6.11

Component

Annual estimates

Current quarterly estimates*

(Indicator series used to extrapolate)

23

Pension plans

24

Private pension plans

25

Defined benefit

For all except 2 most recent years, employers’ normal costs

based on BEA tabulations of plan-level data provided by

PBGC f rom IRS form 5500 on employer normal costs for

each plan,

adjusted to a uniform discount rate based on AAA

corporate bond rates from Moody’s Investors Service and

aggregated to the total for all industries.

28

For second most

recent year, employers’ normal costs based on BEA

tabulations of form 5500 data provided by PBGC w ith

adjustments by BEA for coverage. For most recent year,

employers’ normal costs derived as BEA’s normal cost rate

applied to total covered payroll; form 5500 data are not

available for the most recent year. Covered payroll is derived

as the product of NIPA w ages and salaries and a coverage

rate, w hich is derived as the ratio of the number of active

participants, from EBSA data, to private full-time equivalent

employees, from NIPA estimates.

Quarterly estimates are not released at this level of

detail; see line 22.

26

Defined contribution

For all except 2 most recent years, employers’ cash

contributions from EBSA tabulations of IRS form 5500 data

for three-digit NAICS industries. For second most recent

year, PBGC tabulations of IRS form 5500 data, and for most

recent year, Standard and Poor’s 500 and other corporate

financial data.

Quarterly estimates are not released at this level of

detail; see line 22.

27

Government employee

pension plans

See method for each component,

Quarterly estimates are not released at this level of

detail; see line 22.

For unreleased measures of government employee

pension plans, the sum of unreleased measures of

federal government employee pension plans and state

28

Plan-level da ta a re assigned to a 6-digit NAICS code based on the primary industry of the employer.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-23

Table 10.B—Summary of Methodology Used to Prepare Estimates of Employer Contributions for Employee Pension and Insurance Funds

Line in

NIPA table

6.11

Component

Annual estimates

Current quarterly estimates*

(Indicator series used to extrapolate)

and local employee pension plans; see lines 28 and 29.

28

Federal

Civilian: For defined contribution plans, such as Thrift

Savings Plan, actual contributions based on Federal

Retirement Thrift Investment Board data.

For defined benefit plans, for all except most recent year,

total employer contributions based on OPM estimates of

employers’ normal costs for the Federal Employees

Retirement System (FERS), and normal cost rates and

payroll data for the Civil Service Retirement System (CSRS),

adjusted to alternative discount rates. Total employer

contributions are scaled up by BEA to reflect smaller plans

not included in OPM data

. For the most recent year for both

FERS and CSRS plans, total employer contributions based

on OPM projections of normal cost rates and payroll data.

Military: For defined contribution plans, contributions to the

Thrift Savings Plan based on Federal Retirement Thrift

Investment Board data and judgmental trends.

For defined benefit plans, for all except the most recent year,

total employer contributions derived from DoD reports on

employer normal cost rates and payroll. For the most recent

year, total employers’ normal costs derived from DoD Of fice

of the Actuary projections of normal cost rates and payroll.

Quarterly estimates are not released at this level of

detail. See line 22.

For unreleased measures of federal government

employer contributions to government employee

pension plans, the sum of components:

Civilian: For defined contribution plans, CES

employment. For defined benefit plans, interpolation

w ithout indicator of annual estimates extrapolated

based on OPM projections of normal cost rates and

payroll data.

Military: For defined contribution plans, contributions to

the Thrift Savings Plan based on Federal Retirement

Thrift Investment Board data and judgmental trends.

For contributions for defined benefit plans, interpolation

w ithout indicator of annual estimates extrapolated

based on DoD projections of normal cost rates and

payroll data.

29

State and local

For defined contributions plans, ratio of employer

contributions as a percent of compensation to w ages as a

percent of compensation from BLS Employer Costs for

Employee Compensation survey data applied to NIPA w ages

and salaries.

For defined benefit plans for all except 2 most recent years,

employers’ normal cost based on financial and actuarial

reports of a sample (covering 90 percent of universe) of S&L

Quarterly estimates are not released at this level of

detail. See line 22.

For unreleased measures of state and local employer

contributions to employee pension plans, the sum of

components:

For defined contribution plans, same as annual.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-24

Table 10.B—Summary of Methodology Used to Prepare Estimates of Employer Contributions for Employee Pension and Insurance Funds

Line in

NIPA table

6.11

Component

Annual estimates

Current quarterly estimates*

(Indicator series used to extrapolate)

retirement systems scaled up to represent the universe of

systems and adjusted to reflect common actuarial cost

method and discount rate, plus administrative expenses

based on Census data. For second most recent year,

employers’ normal cost extrapolated using incomplete

sample data and administrative data based on judgmental

trend. For most recent year, judgmental trend.

For defined benefit plans, extrapolated using NIPA

w ages and salaries.

30

Private insurance funds

31

Group insurance

32

Group health insurance

For private employer contributions, Health and Human

Services’ Agency for Health Care Research and Quality’s

Medical Expenditure Panel Survey data on insurance

purchased by employers for employees and on health

insurance provided by employers w ho insure themselves

(self-insurance).

For state and local government contributions, for all except

most recent year, same as for private employers. For most

recent year, judgmental trend.

For federal government contributions, OPM internal

accounting report for the Federal Employee Health Benefits

Program.

Quarterly estimates are not released at this level of

detail. See line 22.

For unreleased aggregate of private employer

contributions for private pension and insurance funds,

judgmental trend.

For unreleased measures of state and local government

employer contributions to group health insurance,

judgmental trend.

For unreleased measures of federal government

employer contributions to group health insurance, CES

employment data.

33

Group life insurance

For private and for state and local government, for all except

the most recent year, A.M. Best’s Aggregate and Averages

Life/Health data on premiums paid. For most recent year,

extrapolated based on the percent change in net premiums

from A.M. Best data.

For federal government contributions for civilian employees,

OPM internal accounting report for the Federal Employee

Group Life Insurance Program.

For federal government contributions for active duty military

personnel and their families, Veterans’ Affairs Administration

data on premiums paid for Servicemen’s Group Life

Quarterly estimates are not released at this level of

detail. See line 22.

For unreleased aggregate of private employer

contributions for private pension and insurance funds,

judgmental trend.

For unreleased measures of federal government

employer contributions for group life insurance, CES

employment data.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-25

Table 10.B—Summary of Methodology Used to Prepare Estimates of Employer Contributions for Employee Pension and Insurance Funds

Line in

NIPA table

6.11

Component

Annual estimates

Current quarterly estimates*

(Indicator series used to extrapolate)

Insurance.

For unreleased measures of state and local government

employer contributions to group life insurance, CES

employment data.

34

Workers’ compensation

A.M. Best’s Aggregates and Averages Property/Casualty

data on premiums paid, supplemented by data from the

National Academy of Social Insurance (NA SI) for self-insured

and for large deductible policies, and by data on the

contributions made to privatized funds that are not covered

by A.M. Best or by NASI from the National Council on

Compensation Insurance, the National Association of

Insurance Commissioners, and the American Association of

State Compensation Insurance Funds.

Quarterly estimates are not released at this level of

detail. See line 22.

For unreleased aggregate of private employer

contributions for private pension and insurance funds,

judgmental trend.

For unreleased measures of state and local government

employer contributions to w orkers’ compensation, CES

employment data.

35

Supplemental

unemployment benefit

funds

EBSA tabulations of IRS form 5500 data.

Quarterly estimates are not released at this level of

detail. See line 22.

For unreleased aggregate of private employer

contributions for private pension and insurance funds,

judgmental trend.

36

Publicly administered

government employee

insurance plans

Monthly Treasury Statement data on employer contributions

to the “Medicare-Eligible Retiree Health Care Fund”

Quarterly estimates are not released at this level of

detail. See line 22.

For unreleased measures of military employment from

DoD manpow er reports.

*Quarterly estimates are provided only for the aggregate of employer contributions for pension and insurance funds.

BEA Bureau of Economic Analysis

BLS Bureau of Labor Statistics

CES Current Employment Statistics, BLS

DoD Department of Defense

EBSA Employment Benefits and Security Administration

IRS Internal Revenue Service

MTS Monthly Treasury Statement

NAICS North American Industry Classification System

NIPA National Income and Product Accounts

OPM Office of Personnel Management

PBGC Pension Benefit Guaranty Corporation

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-26

Table 10.C—Summary of Methodology Used to Prepare Estimates of Employer Contributions to Government Social Insurance

Line in NIPA

table 3.6

Component

Annual estimates

Current quarterly estimates*

(Indicator series used to extrapolate)

5

Old-age, survivors,

and disability

insurance

SSA Social Security Bulletin: Annual Statistical Supplement data

on w ages and salaries subject to OASDI taxes multiplied by

OASDI tax rate.

NIPA w ages and salaries for appropriate industries.

6

Hospital insurance

For all employees except those in the railroad industry, SSA

w ages and salaries multiplied by the hospital-insurance tax rate.

For railroad employees, U.S. Railroad Retirement Board calendar

year data on railroad w ages and salaries multiplied by the hospital

insurance tax rate.

For w orkers covered by OASDI, same as for OASDI. For

w orkers not covered by OASDI, judgmental trend.

8

State unemployment

insurance

QCEW data on total unemployment insurance taxes.

For contributions by private employers, NIPA private

w ages and salaries less those of railroad, farm, and

private household w orkers. For state and local

reimbursements, unemployment insurance rate.

9

Federal

unemployment tax

Sum of (1) Office of Workforce Security, Department of Labor

tabulations of taxable w ages and salaries by state from annual tax

returns filed by employers multiplied by the effective federal tax

rate and (2) for states that have borrow ed funds to finance

unemployment benefits, either the taxable w ages and salaries

multiplied by the surtax rate or state-provided data on the amount

of surtax.

NIPA private w ages and salaries less those of railroad,

farm, and private household w orkers.

10

Railroad employees

unemployment

insurance

Monthly Treasury Statement data on railroad unemployment tax

receipts.

NIPA railroad w ages and salaries.

11

Federal employees

unemployment

insurance

Imputation based on Office of Workforce Security data on

unemployment benefits paid to unemployed former federal

employees.

Same as for annual estimates.

12

Railroad retirement

U.S. Railroad Retirement Board Annual Report data on w ages

and salaries subject to railroad retirement multiplied by railroad

retirement tax rates.

NIPA railroad w ages and salaries.

13

Pension benefit

guaranty

Pension Benefit Guaranty Corporation monthly data on premiums

paid by employers, aligned to the calendar years in w hich the

premiums w ere accrued.

Extrapolated using information from fiscal year projections

of premium collections from the Budget of the United

States Government.

14

Veterans life

Veterans Affairs Annual Report data on premiums paid by the

Judgmental trend.

CHAPTER 10: COMPENSATION OF EMPLOYEES

10-27

Table 10.C—Summary of Methodology Used to Prepare Estimates of Employer Contributions to Government Social Insurance

Line in NIPA

table 3.6

Component

Annual estimates

Current quarterly estimates*

(Indicator series used to extrapolate)

insurance

federal government to life insurance programs for veterans.

15

Workers’

compensation

Imputation equal to benefits paid based on unpublished data on

benefits from the Department of Labor’s Employment Standards

Administration.

Extrapolated using information from fiscal year projections

of premium collections from the Budget.

16

Military medical