GRT - Filer's Kit 1 www.tax.newmexico.gov

NEW MEXICO

Taxation and Revenue Department

P.O. Box 25128 l Santa Fe, New Mexico 87504-5128 l 1-866-285-2996

Taxation and Revenue Division web site: http://www.tax.newmexico.gov/

Taxpayer Access Point (TAP): https://tap.state.nm.us/Tap/_/

MAIL TO:

July to December 2023

GRT FILER'S KIT

For Reporting Gross Receipts Tax

Contents

In This Kit:

in order of appearance

Announcements

Gross Receipts and Compensating

Tax Rate Schedule

Form TRD-41413 Instructions.

Includes:

(1) Contacting the Department;

(2)General Information;

(3) What to Know and Do Before You

Begin;

(4) Filing methods;

(5) Required Forms and Attachments;

(6) When and Where to File and Pay;

(7) Line Instructions;

(8) Refunds;

(9) Interest and penalties;

(10) Your Rights Under the Tax Law;

(11) Deduction codes; and

(12) New Mexico Taxpayer Bill of

Rights.

6 - Form TRD-41413 Gross Receipts

Tax Return and Schedule A

1 - Form 41413 Gross Receipts Tax

Business-Related Tax Credit Schedule

CR and Supplemental Schedule CR

GRT payment voucher instructions

and 7-GRT-PV

ACD-31015 - Business Tax Registration

Application and Update Form

RPD-41071 - Application for Tax Refund

ACD-31050 - Application for Nontaxable

Transaction Certicates

ACD-31102 - Tax Information

Authorization Tax Disclosure

Please note, gross receipts rate changes and the legislative changes

can be located on page 2. Other important changes and reminders

are listed below:

EFFECTIVE July 1, 2023

• The state portion of the gross receipts tax rate has been lowered from 5.000%

to 4.875%, due to HB-163 from the 2022 legislative session. This change

impacts all location codes across the state. Make sure to review the Gross

Receipts and Compensating Tax Rate Schedule included in this packet.

• The New Mexico Taxation and Revenue Department has removed the

reporting of the optional deduction codes. For any deduction that is

not required to be separately reported leave Column E blank and enter the

dollar amount for a specic location code in Column F. For those deductions

that are required to be separately reported, either using a special rate code

or a deduction code starting with D0. Continue separately reporting those

required deductions. See the instructions for further information.

ELECTRONIC FILING AND PAYMENT REQUIREMENT REMINDER

Gross receipts tax returns shall be led electronically if the taxpayer’s average

monthly tax liability for gross tax during the preceding calendar year equaled

or exceeded $1,000.

For taxpayers with an average monthly tax liability for gross receipts tax during

the preceding calendar of $1,000 or more, shall be remitted by electronic means.

The following electronic methods of remitting tax payments will be accepted:

credit card, ACH debit, and ACH credit. See the instructions for more information.

ELECTRONIC FILING AND PAYMENT CAN BE

MADE ONLINE USING THE TAXPAYER ACCESS

POINT (TAP).

You can use the URL below or the QR Code to the left to

locate TAP. To use the QR code open your smart phone

camera and scan the image to the left.

https://tap.state.nm.us/Tap

The Taxation and Revenue Department oers

publications on our website that includes information

on certain topics. You can locate brochures, bulletins,

FYI's and forms on our website at:

https://www.tax.newmexico.gov/forms-publications/

GRT - Filer's Kit 2 www.tax.newmexico.gov

***GROSS RECEIPTS TAX RATE CHANGES*** EFFECTIVE July 1, 2023

The state portion of the gross receipts tax rate has been lowered from 5.000% to 4.875%, due to HB-163 from the 2022

legislative session. This change impacts all location codes across the state.

Additional locations with further changes include:

The following tax rate location is NEW:

• South Campus TID District (02-430 in Bernalillo Co.)

The gross receipts tax rates will increase for the following locations:

• Sandia Pueblo (02-901 & 02-902 in Bernalillo Co.) (29-911 & 29-912 in Sandoval Co.)

• Village of Tijeras (02-318 in Bernalillo Co.)

• Pueblo of Acoma (28-923 & 28-924 in Catron Co.) (33-909 & 33-910 in Cibola Co.) (25-933 & 25-934 in Socorro Co.)

• Carrizozo (26-307 in Lincoln Co.)

• Columbus (19-212 in Luna Co.)

• Cloudcroft (15-213 in Otero Co.)

• Pueblo de San Ildefanso (17-975 & 17-976 in Rio Arriba Co.) (29-975 & 29-976 in Sandoval Co.)

• Santa Ana Pueblo (29-951 & 29-952 in Sandoval Co.)

• Pueblo of Tesuque (01-953 & 01-957 in Santa Fe Co.)

• All of Taos County

• Peralta (14-412 in Valencia Co.)

• Rio Communities (14-037 in Valencia Co.)

The gross receipts tax rates will decrease for the following locations:

• Taos Pueblo (20-913 & 20-914 in Taos Co.)

• Taos/Taos Pueblo (20-915 & 20-916 in Taos Co.)

Legislative Changes

You can nd a summary of all of legislative changes in the Legislative Summaries: LS - 2023 Legislative Summary. You can

locate all brochures, bulletins, Legislative Summaries and FYI's at https://www.tax.newmexico.gov/forms-publications/ in the

"Publications" folder. In relation to this ler's kit, the following changes will go into eect July 1, 2023:

• HB-547, amended Section 7-9-93 NMSA 1978, see the "M" special rate code.

• SB-146, made changes to the Tax Administration Act, which included protest and tax fraud changes.

• SB-147, includes the following changes:

• Section 7-9-3 NMSA 1978, changes the denition of a disclosed agency.

• Section 7-9-3.5 NMSA 1978, the denition of gross receipts now excludes cannabis excise tax when calculating the

amount of gross receipts due.

• Section 7-9-88.1 NMSA 1978, changes allow tribes in New Mexico to determine their own tax rates for gross re-

ceipts tax if the have a Tribal Cooperative Agreement with the Department.

• The following exemptions and deductions were amended:

• Section 7-9-14 NMSA 1978, allows the United States, State of New Mexico, or any governmental unit or subdivi-

sion, agency, department or instrumentality thereof to exempt also the use of service from compensating tax.

• Section 7-9-26 NMSA 1978, updates statutory references for the exemption of receipts of gasoline, special fuel

or alternative fuel in which another New Mexico tax is already charged.

• Section 7-9-41.6 NMSA 1978, is amended to add receipts from payments for the Federal American Rescue

Plan Act of 2021 from the Human Services Department to the exemption.

• Section 7-9-46 NMSA 1978, was amended to clarify when a NTTC is needed for the deduction and where the

use of alternative evidence can be used.

• Section 7-9-54 NMSA 1978, allows for the sale of licenses to use digital goods for the purpose of loaning those

digital goods to the public to items when sold to a governmental agency and Indian tribe, nation, or pueblo to

be deductible.

• The following exemption, deductions, and credits were repealed and can no longer be used going forward:

• Section 7-9-16 NMSA 1978, exemption from gross receipts tax for certain nonprot facilities.

• Section 7-9-86 NMSA 1978, deduction from gross receipts tax for sales to qualied lm production companies.

• Section 7-9-105 NMSA 1978, credit for penalty pursuant to Section 7-1-71.2 NMSA 1978.

• Section 7-9-106 NMSA 1978, deduction for construction services and equipment.

• Section 7-9-114 NMSA 1978, deduction from gross receipts and compensating tax for advanced energy.

• Section 7-9G-2 NMSA 1978, the credit against gross receipts, compensating, and withholding taxes for ad-

vanced energy.

More detail on these changes can be located in the legislative summary LS - 2023 Legislative Summary.

GRT - Filer's Kit 3 www.tax.newmexico.gov

Call Center: 1-866-285-2996

Call Center Fax: 1-505-841-6327

LOCAL TAXATION AND REVENUE DEPART-

MENT OFFICES: Tax District Field Oces and the

Department’s call center can provide full service and

general information about the Department's taxes,

taxpayer access point (TAP), programs, classes, and

forms. Information specic to your ling situation,

payment plans and delinquent accounts.

Albuquerque

10500 Copper Pointe Avenue NE

Albuquerque, NM 87123

Farmington

3501 E. Main Street, Suite N.

Farmington, NM 87499-0479

Las Cruces

2540 S. El Paseo, Bldg.#2

Las Cruces, NM 88001-0607

Roswell

400 Pennsylvania Ave., Suite 200

Roswell, NM 88201-1557

Santa Fe

1200 South St. Francis Drive

Santa Fe, NM 87502-5374

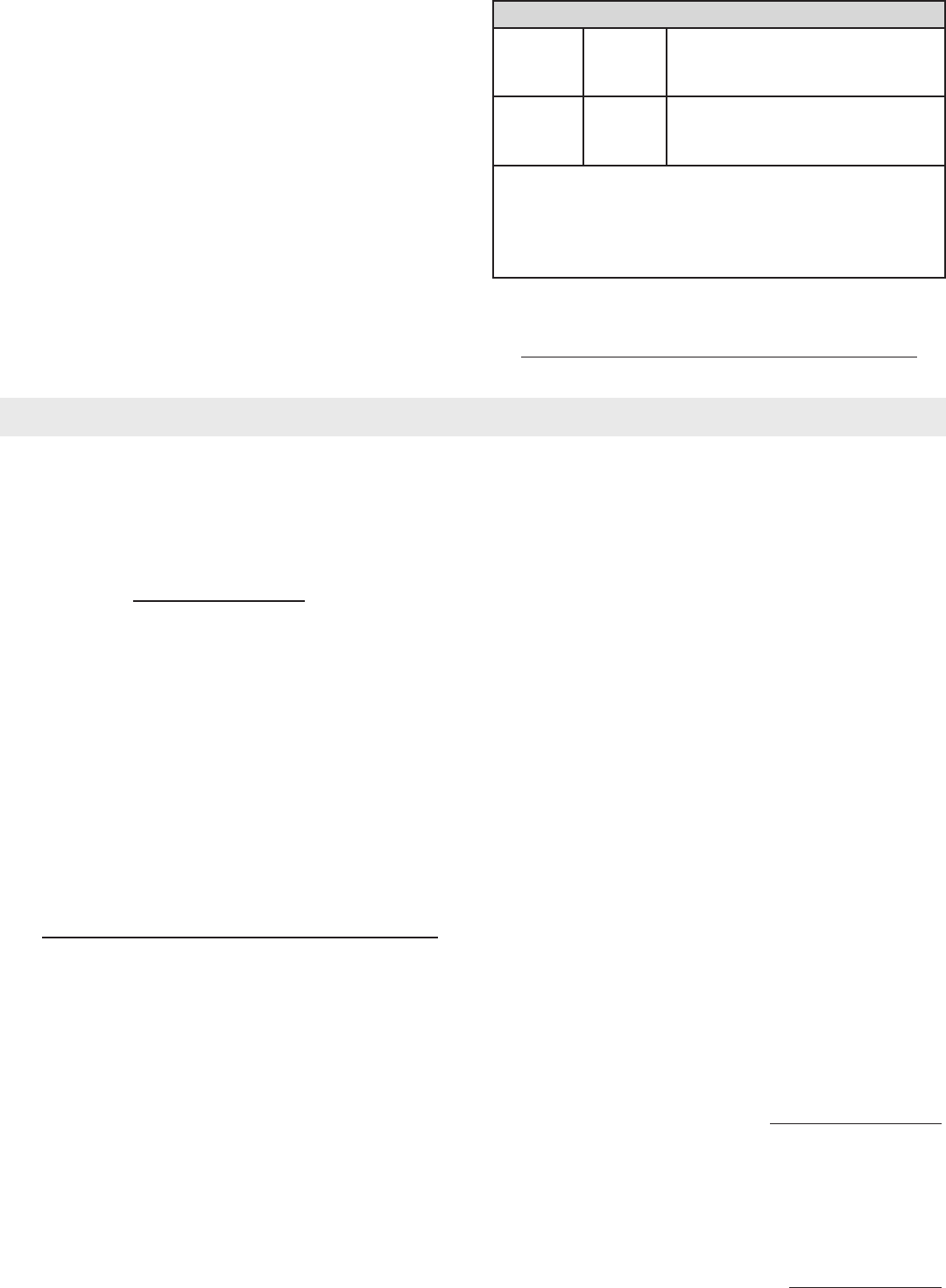

MONTHLY FILING STATUS

NOTES:

1. Your ling status can be located on your

Registration Certicate received from

the Department. The ling frequency

will be monthly, quarterly or semiannu-

ally.

2. Each Form TRD-41413 is due on or

before the 25th of the month following

the end of the tax period that is being

reported.

3. If your due date falls on a weekend, a le-

gal, state or national holiday, your Form

TRD-41413 and payment due date will

be extended to the next business day.

4. No Penalty will be imposed for report-

ing and paying early. However, you can-

not le online until after the period you

are ling for has ended. Example: For

the ling period that begins on January

1st and ends January 31st your Form

TRD-41413 can not be led online until

February 1st.

5. TRD-41413 is due even if there is no tax

due for the ling period. For a late led

return there is a minimum penalty of $5.

January 1

st

February 1

st

March 1

st

April 1

st

May 1

st

June 1

st

July 1

st

August 1

st

September 1

st

October 1

st

November 1

st

December 1

st

January 31

st

February 28

th

or 29

th

March 31

st

April 30

th

May 31

st

June 30

th

July 31

st

August 31

st

September 30

th

October 31

st

November 30

th

December 31

st

February 25

th

March 25

th

April 25

th

May 25

th

June 25

th

July 25

th

August 25

th

September 25

th

October 25

th

November 25

th

December 25

th

January 25

th

PERIOD BEGINS PERIOD ENDS DUE DATE

QUARTERLY FILING STATUS

PERIOD BEGINS PERIOD ENDS DUE DATE

January 1

st

April 1

st

July 1

st

October 1

st

March 31

st

June 30

th

September 30

th

December 31

st

April 25

th

July 25

th

October 25

th

January 25

th

SEMI-ANNUAL FILING STATUS

January 1

st

July 1

st

June 30

th

December 31

st

July 25

th

January 25

th

PERIOD BEGINS PERIOD ENDS DUE DATE

Filing status: Below are the ling statuses outlined in the ACD-31015,

Business Tax Registration Application and Update Form.

Monthly - due by the 25th of the following month if combined taxes

due average more than $200 per month, or if you wish to le monthly

regardless of the amount due.

Quarterly - due by the 25th of the month following the end of the quarter

if combined taxes due for the quarter are less than $600 or an average

of less than $200 per month in the quarter.

Semiannually - due by the 25th of the month following the end of the

6-month period if combined taxes due are less than $1,200 for the

semiannual period or an average less than $200 per month for the

6-month period.

The following ling statuses all follow the due dates for the monthly

ling status.

Seasonal - you will need to specify what month(s) you will be ling. This

is most common for business that only operate seasonally in New Mexico.

Temporary - the month in which the business les must be a period in

which the registration is active.

Special event - the month in which the business les must be a period

in which the registration is active. You can locate more information on

this ling frequency here: https://www.tax.newmexico.gov/businesses/

special-events-and-vendors/.

Casual- due by the 25th of the following month if relevant business

activity has occurred and the taxpayer has an obligation to report it to

the Department.

Note: Filing status is for non-prots and Compensating Tax only.

GRT - Filer's Kit 4 www.tax.newmexico.gov

Municipality or County

Locatio

n Code

Rate Municipality or County

Locatio

n Code

Rate

Remainder of County 02-002 6.1875% Springer 09-301 7.5208%

Albuquerque 02-100 7.6250% Springer (Water & Sanitation Facility) 09-321 5.8333%

19 Pueblos District (AISD Property) (1)

a c *

02-905 7.7500% Surgarite Canyon - Raton 09-172 5.8333%

19 Pueblos District (AISD Property) (2)

a c *

02-906 7.7500%

Edgewood (Bernalillo) 02-334 7.6250% Remainder of County 05-005 5.8750%

Isleta Pueblo (1) 02-221 0.0000% Clovis 05-103 7.9375%

Isleta Pueblo (2)^ use location code 02-002 6.1875% Clovis Airport 05-154 5.8750%

Laguna Pueblo (1) 02-950 6.1875% Grady 05-203 6.6875%

Laguna Pueblo (2) 02-952 6.1875% Melrose 05-402 7.5000%

Los Ranchos de Albuquerque 02-200 7.1875% Texico 05-302 7.3125%

Lower Petroglyphs TID District 02-420 7.6250%

Mesa Del Sol TID District 1 02-606 7.6250% Remainder of County 27-027 6.5000%

Rio Rancho (Bernalillo) 02-647 7.8750% Fort Sumner 27-104 7.8125%

Sandia Pueblo (1)* 02-901 6.4375%

Sandia Pueblo (2)* 02-902 6.4375% Remainder of County 07-007 6.5000%

Santolina TID District 01 02-621 6.1875% Anthony ^ use location code 07-517 07-507

0.0000%

Santolina TID District 02 02-622 6.1875% Anthony (Water & Sanitation District) Municipality b 07-517 8.3750%

Santolina TID District 03 02-623 6.1875% Co Remainder (Water & Sanitation District) 07-527 6.7500%

Santolina TID District 04 02-624 6.1875% Downtown TIDD - Las Cruces 07-132 8.0625%

Santolina TID District 05 02-625 6.1875% Hatch 07-204 7.5625%

Santolina TID District 06 02-626 6.1875% Las Cruces 07-105 8.0625%

Santolina TID District 07 02-627 6.1875% Mesilla 07-303 7.9375%

Santolina TID District 08 02-628 6.1875% Sunland Park 07-416 8.1875%

Santolina TID District 09 02-629 6.1875%

Santolina TID District 10 02-630 6.1875% Remainder of County 03-003 5.7083%

Santolina TID District 11 02-631 6.1875% Artesia 03-205 7.6458%

Santolina TID District 12 02-632 6.1875% Carlsbad 03-106 7.3958%

Santolina TID District 13 02-633 6.1875% Hope 03-304 6.5833%

Santolina TID District 14 02-634 6.1875% Loving 03-403 7.3833%

Santolina TID District 15 02-635 6.1875%

Santolina TID District 16 02-636 6.1875% Remainder of County 08-008 6.3125%

Santolina TID District 17 02-637 6.1875% Bayard

08-206

7.6250%

Santolina TID District 18 02-638 6.1875% Hurley 08-404 7.3750%

Santolina TID District 19 02-639 6.1875% Santa Clara 08-305 7.3750%

Santolina TID District 20 02-640 6.1875% Silver City 08-107 8.1125%

South Campus TID District * 02-430 7.6250%

State Fairgrounds 02-555 6.1875% Remainder of County 24-024 6.1875%

Upper Petroglyphs TID District 1 02-607 6.1875% Santa Rosa 24-108 8.2500%

Upper Petroglyphs TID District 2 02-608 6.1875% Vaughn 24-207 8.3625%

Upper Petroglyphs TID District 3 02-609 6.1875%

Upper Petroglyphs TID District 4 02-610 6.1875% Remainder of County 31-031 5.8750%

Upper Petroglyphs TID District 5 02-611 6.1875% Mosquero (Harding) 31-208 6.6875%

Upper Petroglyphs TID District 6 02-612 6.1875% Roy 31-109 7.0625%

Upper Petroglyphs TID District 7 02-613 6.1875%

Upper Petroglyphs TID District 8 02-614 6.1875% Remainder of County 23-023 5.9375%

Upper Petroglyphs TID District 9 02-615 6.1875% Lordsburg 23-110 7.5000%

Village of Tijeras* 02-318 8.0750% Virden 23-209 6.4375%

Winrock Town Center TID District 1 02-035 7.6250%

Winrock Town Center TID District 2 02-036 7.6250% Remainder of County 06-006 5.2500%

Eunice 06-210 7.0625%

Remainder of County 28-028 6.0625% Hobbs 06-111 6.5625%

Pueblo of Acoma (1)* 28-923 8.0000% Jal 06-306 7.1875%

Pueblo of Acoma (2)* 28-924 8.0000% Lovington 06-405 7.0000%

Reserve 28-130 7.7500% Lovington Industrial Park 06-158 5.2500%

Tatum 06-500 6.5625%

Remainder of County 04-004 6.2708%

Dexter 04-201 7.1458%

Hagerman 04-300 7.3333%

Lake Arthur 04-400 7.3333%

Roswell 04-101 7.5833%

Location

Remainder of County 33-033 6.5625%

Code

Grants 33-227 7.8750%

Out-of-State Business (R&D Services) - 4.875% 77-777

Laguna Pueblo (1) 33-900 6.5625% Out-of-State Business (All Other) - 4.875% 88-888

Laguna Pueblo (2) 33-902 6.5625%

NOTE KEY

Milan 33-131 7.7500% (1) Sales to tribal entities or members

Pueblo of Acoma (1)* 33-909 8.0000% (2) Sales to tribal non-members by tribal non-members

Pueblo of Acoma (2)* 33-910 8.0000%

a

Businesses located on Pueblo land within the city limits.

Pueblo of Zuni (1) 33-911 6.5625%

b

Businesses located within the water district and the city limits.

Pueblo of Zuni (2) 33-912 6.5625%

c

Property owned by the 19 Pueblos of NM.

d

Land owned by Alamogordo outside Alamogordo boundaries.

Remainder of County 09-009 5.8333%

^ Indicates overlapping location code

Angel Fire 09-600 7.5208%

Cimarron 09-401 7.8958%

Eagle Nest 09-509 7.6333%

Maxwell 09-202 6.5833%

Raton 09-102 8.2583%

Raton Municipal Airport 09-152 5.8333%

HIDALGO

GROSSRECEIPTSANDCOMPENSATINGTAXRATESCHEDULE EffectiveJuly1,2023throughDecember31,2023

BERNALILLO COLFAX - Continued

CURRY

DE BACA

DONA ANA

EDDY

GRANT

GUADALUPE

HARDING

LEA

CATRON

CHAVES

STATE GROSS RECEIPTS TAX RATE = 4.875%

CIBOLA

SPECIAL TAX RATES & REPORTING LOCATIONS

COLFAX

* Indicates rate change due to enactment/expiration of local option taxes and/or change

in the state gross receipts tax rate.

NOTE: See the listing of Special Location Codes used to report certain gross receipts tax

deductions in the GRT Form Instructions located in the current

GRT Filer's Kit at www.taxnewmexico.gov/forms-publications.aspx.

GRT - Filer's Kit 5 www.tax.newmexico.gov

Municipality or County

Locatio

n Code

Rate Municipality or County

Locatio

n Code

Rate

Remainder of County 26-026 5.2500% Santa Ana Pueblo (1)* 29-951 6.1250%

Bonito Lake - Alamogordo

d

26-508 5.2500% Santa Ana Pueblo (2)* 29-952 6.1250%

Capitan 26-211 6.5625% Stonegate Communities TIDD 29-038 7.4375%

Carrizozo* 26-307 7.2000% Kewa Pueblo (1) 29-973 6.1250%

Corona 26-406 6.6875% Kewa Pueblo (2) 29-974 6.1250%

Ruidoso 26-112 8.1875% Village at Rio Rancho TIDD 29-525 7.4375%

Ruidoso Downs 26-501 7.1875% Zia Pueblo (1) 29-981 6.1250%

Zia Pueblo (2) 29-982 6.1250%

City and County 32-032 7.0625%

Remainder of County 16-016 6.5000%

Remainder of County 19-019 6.6250% Aztec 16-218 8.1875%

Columbus* 19-212 8.2500% Bloomfield 16-312 8.1250%

Deming 19-113 8.2500% Farmington 16-121 8.1875%

Kirtland 16-323 6.8125%

Remainder of County 13-013 6.5000%

Gallup 13-114 8.0625% Remainder of County 12-012 6.5833%

Pueblo of Zuni (1) 13-901 6.5000% Las Vegas 12-122 8.1458%

Pueblo of Zuni (2) 13-902 6.5000% Mosquero (San Miguel) 12-418 7.1458%

Pecos 12-313 7.5208%

Remainder of County 30-030 6.5208%

Wagon Mound 30-115 7.5208% Remainder of County 01-001 6.8750%

Edgewood (Santa Fe) 01-320 7.9375%

Remainder of County 15-015 6.0625% Espanola (Santa Fe) 01-226 8.8125%

Alamogordo 15-116 7.8750%

Espanola/Santa Clara Grant (1)

a

01-903 8.8125%

Alamogordo Land

d

15-322 6.0625%

Espanola/Santa Clara Grant (2)

a

01-904 8.8125%

Cloudcroft* 15-213 7.6250% Kewa Pueblo (1) 01-973 6.8750%

Tularosa 15-308 7.5000% Kewa Pueblo (2) 01-974 6.8750%

Nambe Pueblo (1) 01-951 6.8750%

Remainder of County 10-010 6.4375% Nambe Pueblo (2) 01-952 6.8750%

House 10-407 7.7500% Pojoaque Pueblo (1) 01-960 6.8750%

Logan 10-309 8.1250% Pojoaque Pueblo (2) 01-962 6.8750%

San Jon 10-214 8.1250% Pueblo de Cochiti (1) 01-971 6.8750%

Tucumcari 10-117 8.1250% Pueblo de Cochiti (2) 01-972 6.8750%

Pueblo de San Ildefonso (1)* 01-975 7.0000%

Remainder of County 17-017 6.6250% Pueblo de San Ildefonso (2)* 01-976 7.0000%

Chama 17-118 8.3125% Santa Clara Pueblo (1) 01-901 6.8750%

Espanola (Rio Arriba) 17-215 8.6875% Santa Clara Pueblo (2) 01-902 6.8750%

Espanola/Ohkay Owingeh Pueblo (1)

a

17-943 8.6875% Santa Fe (city) 01-123 8.1875%

Espanola/Ohkay Owingeh Pueblo (2)

a

17-944 8.6875%

Santa Fe Indian School/Nineteen Pueblos of NM (1)

a c

01-907 8.1875%

Espanola/Santa Clara Grant (1)

a

17-903 8.6875%

Santa Fe Indian School/Nineteen Pueblos of NM (2)

a c

01-908 8.1875%

Espanola/Santa Clara Grant (2)

a

17-904 8.6875% Pueblo of Tesuque (1)* 01-953 7.1250%

Jicarilla Apache Nation (1) 17-931 6.6250% Pueblo of Tesuque (2)* 01-954 7.1250%

Jicarilla Apache Nation (2) 17-932 6.6250%

Ohkay Owingeh Pueblo (1) 17-941 6.6250% Remainder of County 21-021 6.6875%

Ohkay Owingeh Pueblo (2) 17-942 6.6250% Elephant Butte 21-319 7.9375%

Pueblo de San Ildefonso (1)* 17-975 7.0000% Truth or Consequences 21-124 8.3750%

Pueblo de San Ildefonso (2)* 17-976 7.0000% Truth or Consequences Airport 21-164 6.6875%

Santa Clara Pueblo (1) 17-901 6.6250% Williamsburg 21-220 7.9375%

Santa Clara Pueblo (2) 17-902 6.6250%

Remainder of County 25-025 6.2500%

Remainder of County 11-011 6.3750% Magdalena 25-221 7.1875%

Causey 11-408 6.8750% Isleta Pueblo (1) 25-321 0.0000%

Dora 11-310 7.1250% Isleta Pueblo (2)^ use location code 25-025 6.2500%

Elida 11-216 7.7500% Pueblo of Acoma (1) * 25-933 8.0000%

Floyd 11-502 6.8750% Pueblo of Acoma (2) * 25-934 8.0000%

Portales 11-119 7.9375% Socorro (city) 25-125 7.5625%

Socorro Industrial Park 25-162 6.2500%

Remainder of County 29-029 6.1250%

Bernalillo (City) 29-120 6.9375%

Corrales 29-504 7.5625%

Cuba 29-311 8.0625%

Location

Edgewood (Sandoval) 29-335 6.9375%

Code

Jemez Springs 29-217 7.1875%

Out-of-State Business (R&D Services) - 4.875% 77-777

Jemez Pueblo (1) 29-941 6.2500% Out-of-State Business (All Other) - 4.875% 88-888

Jemez Pueblo (2) 29-942 6.2500%

Jicarilla Apache Nation (1) 29-931 6.1250% (1) Sales to tribal entities or members

Jicarilla Apache Nation (2) 29-932 6.1250% (2) Sales to tribal non-members by tribal non-members

Laguna Pueblo (1) 29-921 6.1250%

a

Businesses located on Pueblo land within the city limits.

Laguna Pueblo (2) 29-922 6.1250%

b

Businesses located within the water district and the city limits.

Los Diamantes TIDD 29-530 7.4375%

c

Property owned by the 19 Pueblos of NM.

Pueblo de Cochiti (1) 29-971 6.1250%

d

Land owned by Alamogordo outside Alamogordo boundaries.

Pueblo de Cochiti (2) 29-972 6.1250%

^ Indicates overlapping location code

Rio Rancho (Sandoval) 29-524 7.4375%

Pueblo de San Ildefonso (1)* 29-975 7.0000%

Pueblo de San Ildefonso (2)* 29-976 7.0000%

San Ysidro 29-409 6.6250%

Sandia Pueblo (1)* 29-911 6.4375%

Sandia Pueblo (2)* 29-912 6.4375%

LINCOLN SANDOVAL - Continued

GROSSRECEIPTSANDCOMPENSATINGTAXRATESCHEDULE EffectiveJuly1,2023throughDecember31,2023

ROOSEVELT

LOS ALAMOS

SAN JUAN

LUNA

McKINLEY

SAN MIGUEL

MORA

SANTA FE

OTERO

QUAY

RIO ARRIBA

SIERRA

SOCORRO

SANDOVAL

STATE GROSS RECEIPTS TAX RATE = 4.875%

SPECIAL TAX RATES & REPORTING LOCATIONS

NOTE KEY

* Indicates rate change due to enactment/expiration of local option taxes and/or change

in the state gross receipts tax rate.

NOTE: See the listing of Special Location Codes used to report certain gross receipts tax

deductions in the GRT Form Instructions located in the current

GRT Filer's Kit at www.taxnewmexico.gov/forms-publications.aspx.

GRT - Filer's Kit 6 www.tax.newmexico.gov

Municipality or County

Locatio

n Code

Rate

Remainder of County* 20-020 7.0000%

El Prado Water and Sanitation District* 20-415 7.2500%

El Prado Water and Sanitation District

b*

20-425 8.9250%

El Valle de Los Ranchos Water & Sanitation District* 20-419 7.2500%

El Valle de Los Ranchos Water & Sanitation District

b*

20-429 8.9250%

Picuris Pueblo (1)* 20-917 7.0000%

Picuris Pueblo (2)* 20-918 7.0000%

Questa* 20-222 8.0625%

Questa Airport* 20-160 7.0000%

Red River* 20-317 8.9250%

Taos (city)* 20-126 8.6750%

Taos Airport* 20-163 7.0000%

Taos Pueblo (1)* 20-913 7.5000%

Taos Pueblo (2)* 20-914 7.5000%

Taos/Taos Pueblo (1)

a*

20-915 7.5000%

Taos/Taos Pueblo (2)

a*

20-916 7.5000%

Taos Ski Valley (all GRT activity in location code 20-430)* 20-414 8.9375%

Taos Ski Valley TIDD* 20-430 8.9375%

Remainder of County 22-022 6.5000%

Encino 22-410 7.0625%

Estancia 22-503 7.9375%

Isleta Pueblo (1) 22-221 0.0000%

Isleta Pueblo (2)^ use location code 22-022 6.5000%

Moriarty 22-223 7.9375%

Mountainair 22-127 7.6875%

Willard 22-314 7.3125%

Remainder of County 18-018 5.8125%

Clayton 18-128 7.8750%

Des Moines 18-224 7.5000%

Folsom 18-411 7.2500%

Grenville 18-315 7.2500%

Remainder of County 14-014 6.6250%

Belen 14-129 8.0625%

Bosque Farms 14-505 8.3000%

Isleta Pueblo (1) 14-221 0.0000%

Isleta Pueblo (2)^ use location code 14-014 6.6250%

Laguna Pueblo (1) 14-900 6.6250%

Laguna Pueblo (2) 14-902 6.6250%

Los Lunas 14-316 8.4250%

Peralta* 14-412 8.3000%

Rio Communities * 14-037 8.3000%

Location

Code

Out-of-State Business (R&D Services) - 4.875% 77-777

Out-of-State Business (All Other) - 4.875% 88-888

NOTE KEY

(1) Sales to tribal entities or members

(2) Sales to tribal non-members by tribal non-members

a

Businesses located on Pueblo land within the city limits.

b

Businesses located within the water district and the city limits.

c

Property owned by the 19 Pueblos of NM.

d

Land owned by Alamogordo outside Alamogordo boundaries.

^ Indicates overlapping location code

UNION

GROSSRECEIPTSANDCOMPENSATINGTAXRATESCHEDULE EffectiveJuly1,2023throughDecember31,2023

TAOS*

TORRANCE

VALENCIA

STATE GROSS RECEIPTS TAX RATE = 4.875%

SPECIAL TAX RATES & REPORTING LOCATIONS

* Indicates rate change due to enactment/expiration of local option taxes and/or change

in the state gross receipts tax rate.

NOTE: See the listing of Special Location Codes used to report certain gross receipts tax

deductions in the GRT Form Instructions located in the current

GRT Filer's Kit at www.taxnewmexico.gov/forms-publications.aspx.

TRD-41413 Instructions Inst.pg.1 www.tax.newmexico.gov

CONTACTING THE DEPARTMENT

Local Taxation and Revenue Oces

If you need to visit the Department in person you can visit

one of our tax district oces at one of the following locations:

Albuquerque

10500 Copper Pointe Avenue NE

Albuquerque, NM 87123

Farmington

3501 E. Main Street, Suite N.

Farmington, NM 87499-0479

Las Cruces

2540 S. El Paseo, Bldg.#2

Las Cruces, NM 88001-0607

Roswell

400 Pennsylvania Ave., Suite 200

Roswell, NM 88201-1557

Santa Fe

1200 South St. Francis Drive

Santa Fe, NM 87502-5374

Phone Contact

You can contact the Department’s call center and they can

provide full service and general information about the De-

partment’s taxes, Taxpayer Access Point (TAP), programs,

classes, and forms. They can also provide assistance with

information specic to your account including your ling sit-

uation, payment plans, and delinquent account information.

Call Center: (866) 285-2996.

You may also locate your account information through the

Taxpayer Access Point (TAP), https://tap.state.nm.us.

What You Need

When you call or visit us on the web, make sure to have

your New Mexico Business Tax Identication Number

(NMBTIN)(previously known as your CRS number), a copy

of your tax return, or letter in question.

Note: If you are inquiring about a letter please locate the

Letter ID in the top right hand corner to provide to the De-

partment’s agent.

Mailing Address

If you want to write us about your return, please address

your letter to:

Gross Receipts Tax Correspondence

Taxation and Revenue Department

P.O. BOX 25128

Santa Fe, NM 87504-5128

If you are writing in response to a letter, please include the

Letter ID in your response.

Email Contacts

The Taxation and Revenue Department provides several

email contacts for you.

If you have questions about your in-progress Gross Receipts

Tax (GRT) return, the instructions, a return you already sub-

mitted, or your refund, email: GRT[email protected].

If you have questions about New Mexico tax law and need

additional clarication on statutes and regulations, email:

Policy.Oce@tax.nm.gov.

Forms and Instructions

You can nd forms and instructions on

our website at

www.

tax.newmexico.gov.

At the top of the page, click FORMS

& PUBLICATIONS.

Online Services

The TAP website at https://tap.state.nm.us is a secure online

resource that lets you electronically le your return for free:

• See information about your return, payment, and refund

• Pay existing tax liabilities online

• Check the status of a refund

• Change your contact information

• Register a business

NEW MEXICO TAXATION AND REVENUE DEPARTMENT

GROSS RECEIPTS TAX RETURN

GENERAL INFORMATION

This document provides instructions for the New Mexico

Form TRD-41413, Gross Receipts Tax Return. Each Form

TRD-41413 is due on or before the 25th of the month following

the end of the tax period being reported. Certain taxpayers

are required to le the Form TRD-41413 electronically. For

more information on whether electronic ling is required for

your business, please see FYI-108, Electronic Filing Mandate

which is available through your local district oce or online

at https://www.tax.newmexico.gov/forms-publications/.

Please Note: When completing your form, all pertinent col-

umns must be clearly lled out and completed or your Form

TRD-41413 may be rejected and returned for correction and

will need to be resubmitted.

Important: If you will be having another party outside of the

taxpayer wanting access to your account, you will need to

complete Form ACD-31102, Tax Information Authorization

Disclosure, which can be located on our website in the "Tax

Authorization folder here: https://www.tax.newmexico.gov/

forms-publications/.

GENERAL INSTRUCTIONS

TRD-41413 Instructions Inst.pg.2 www.tax.newmexico.gov

WHAT TO KNOW AND DO BEFORE YOU BEGIN

Who Must File A Gross Receipts Tax Return

The gross receipts tax is a tax imposed on persons engaged

in business in New Mexico for the privilege of doing busi-

ness in New Mexico.

“Engaging in business” means carrying on or causing to be

carried on any activity with the purpose of direct or indirect

benet. For those that lack physical presence in New

Mexico, including a marketplace provider, it means having

at least $100,000 of taxable gross receipts sourced to New

Mexico in the previous calendar year. See What is Gross

Receipts Tax below for more information. For more information

on physical presence or nexus, see our website here: https://

www.tax.newmexico.gov/businesses/determining-nexus/.

What is Gross Receipts Tax

“Gross receipts” means the total amount of money or the

value of other consideration received from selling property in

New Mexico, leasing or licensing property employed in New

Mexico, from granting a right to use a franchise employed in

New Mexico, performing services in New Mexico or selling

research and development services performed outside New

Mexico the product of which is initially used in New Mexico.

Gross receipts includes receipts from:

• Sales of tangible personal property handled on consign-

ment;

• Commissions and fees received;

• Amounts paid by members of any cooperative associa-

tion;

• Fees received by persons for serving as disclosed agents

for another;

• Amounts received by persons providing telephone or

telegraph services;

• Amounts received by a New Mexico orist from the sale

of owers, plants, etc., that are lled and delivered out-

side New Mexico by an out-of-state orist;

• Providing intrastate mobile telecommunications services

(i.e., the services originate and terminate in the same

state) to customers whose place of primary use is in New

Mexico; and

• Amounts collected by a marketplace provider engaging

in business in the state from sales, leases and licenses

of tangible personal property, sales of licenses and sales

of services or license for use of real property that are

sourced to New Mexico by a marketplace provider on be-

half of a marketplace seller(s) regardless if the market-

place seller(s) are engaging in business in New Mexico.

For more detail, see FYI-105,Gross Receipts & Compensating

Taxes: An Overview available at https://www.tax.newmexico.

gov/forms-publications/ or through your local district oce.

Gross Receipts and Compensating Tax Rate Table

Gross receipts tax is based on municipality/county locations

and reported/collected based on location code. The Depart-

ment releases the Gross Receipts and Compensating Tax

Rate Schedule semiannually and has the listing of counties,

municipalities, location codes for each, and the tax rate. The

location codes are used to determine which tax rate should

be used when ling your return. The gross receipts and

compensating tax rates can change on January 1 and July

1 of each year, so it is important to check the Gross Receipts

and Compensating Tax Rate Schedule for new rates located

online at https://www.tax.newmexico.gov/governments/

gross-receipts-location-code-and-tax-rate-map/.

Location Code and Tax Rate

Gross receipts tax is required to be reported by municipality,

county, and location code as described in Section 7-1-14

NMSA as follows:

B. Reporting location for receipts from the sale, lease, or

granting of a license to use real property located in New

Mexico and any related deductions shall be the location

of the property.

C. Reporting location for receipts from the sale or license

of property, other than real property, and any related de-

ductions, shall be at the following locations:

(1) if the property is received by the purchaser at the

New Mexico location of the seller, the location of the

seller;

(2) if the property is not received by the purchaser at a

business location of the seller, the location indicated

by instructions for delivery to the purchaser, or the

purchaser's donee, when known to the seller;

(3) if Paragraphs (1) and (2) of this subsection do not

apply, the location indicated by an address for the

purchaser available from the business records of the

seller that are maintained in the ordinary course of

business; provided that use of the address does not

constitute bad faith;

(4) if Paragraphs (1) through (3) of this subsection do not

apply, the location for the purchaser obtained during

consummation of the sale, including the address of a

purchaser's payment instrument, if no other address

is available; provided that use of this address does

not constitute bad faith; or

(5) if Paragraphs (1) through (4) of this subsection do

not apply, including a circumstance in which the

seller is without sucient information to apply those

standards, the location from which the property was

shipped or transmitted.

D. The reporting location for gross receipts from the lease

of tangible personal property, including vehicles, other

transportation equipment and other mobile tangible per-

sonal property, and any related deductions, shall be the

location of primary use of the property, as indicated by

the address for the property provided by the lessee that

is available to the lessor from the lessor's records main-

tained in the ordinary course of business; provided that

use of this address does not constitute bad faith. The

location of primary use shall not be altered by intermit-

tent use at dierent locations, such as use of business

property that accompanies employees on business trips

and service calls.

E. The reporting location for gross receipts from the sale,

lease or license of franchises, and any related deduc-

tions, shall be where the franchise is used.

F. The reporting location for gross receipts from the perfor-

TRD-41413 Instructions Inst.pg.3 www.tax.newmexico.gov

FILING METHODS

Dierent Filing Methods

You can le your Gross Receipts Tax Return (TRD-41413) on

paper or electronically. Both options are described here to

help you choose the most convenient method. The Depart-

ment asks that the Gross Receipts Tax return be led online

using the Taxpayer Access Point (TAP) whenever possible.

TAP is a free online ling option that can be located by going

to our website at https://tap.state.nm.us.

Important: After completing your paper or electronic return,

make a copy for your records and keep it in a safe place.

Electronic Filing and Payment Mandate

Gross receipts tax returns shall be led electronically if the

taxpayer’s average monthly tax liability for this tax during

the preceding calendar year equaled or exceeded $1,000.

For taxpayers with an average monthly tax liability for gross

receipts tax during the preceding calendar of $1,000 or more,

shall be remitted by electronic means. The following electronic

methods of remitting tax payments will be accepted: credit

card, ACH debit, and ACH credit. For more information see

FYI-401, Special Payment Methods located on our website

here: https://www.tax.newmexico.gov/forms-publications/ in

the "Publications" folder.

For more information about ling electronically see the next

section Filing Methods.

Getting Ready to File

Follow these steps before you start lling out your TRD-41413,

Gross Receipts Tax Return:

1. Collect all forms and schedules you are required to le,

publications you need to reference, and all your tax

records.

For a description of dierent forms and schedules, see

Required Forms and Attachments starting on page 4 of

these instructions. To nd out where to get the forms and

schedules you need, see Contacting the Department on

page 1.

2. Read the next section, Valid Identication Number Re-

quired, to learn about New Mexico Business Tax Identi-

cation Number (NMBTIN), Federal Employer Identica-

tion Number (FEIN), Social Security Numbers (SSN) and

Individual Taxpayer Identication Numbers (ITIN).

Benets of Filing Electronically

The Department encourages you to le electronically when-

ever possible. Electronic ling is fast, safe, secure, and it

provides these benets:

• Filing is free on the Department website.

• File return, pay, and request a refund.

• View all letters sent by the Department.

• View your account and see if there are any missing

returns or payments.

• You can speak with an agent while viewing your account

and they can walk you through using TAP or any noti-

cations you may be seeing on your account.

• You can also provide third-party access to your accoun-

tant to be able to complete returns, le, and pay your tax

due.

• The state saves tax dollars in processing costs and re-

sults in faster processing times for returns and payments

submitted to the Department.

Using The Department Website, Taxpayer Access Point

(TAP)

To le your return on the Department website, follow these

steps:

1. Logon or create a TAP account at https://tap.state.nm.us.

2. Select Gross Receipts Tax (GRT).

3. Within the Return Panel Select File Now.

4. After you complete all your entries, check the Signature

box, then click Submit to le.

5. Select OK in the Conrmation box to continue.

mance or sale of the following services, and any related

deductions, shall be at the following locations:

(1) for professional services performed in New Mexico,

other than construction-related services, or per-

formed outside New Mexico when the product of the

service is initially used in New Mexico, the location of

the performer of the service or seller of the product of

the service, as appropriate;

(2) for construction services and construction-related

services performed for a construction project in New

Mexico, the location of the construction site;

(3) for services with respect to the selling of real estate

located in New Mexico, the location of the real estate;

(4) for transportation of persons or property in, into or

from New Mexico, the location where the person or

property enters the vehicle; and

(5) for services other than those described in Paragraphs

(1) through (4) of this subsection, the location where

the product of the service is delivered.

Using the Out-of-State Location Codes

88-888 4.875 % If you are reporting for an out-of-

state location for a professional ser-

vice or shipping goods out-of-state.

77-777 4.875 % If you are performing research and

development services outside NM

as a professional service.

If you transact business with tribal non-members on tribal

territory, use the tribal location of the sale or delivery. If

a tribe, pueblo, or nation has entered into a cooperative

agreement with New Mexico they will have a separate

location code listed.

For more detail, see FYI-200, Gross Receipts Reporting

Location and the Appropriate Tax Rate available online

at https://www.tax.newmexico.gov/forms-publications/ or

through your local district oce.

TRD-41413 Instructions Inst.pg.4 www.tax.newmexico.gov

TRD-41413 Followed by Forms and Attachments Sub-

mit in This Order

• TRD-41413, Gross Receipts Tax Return.

• Schedule A, if required.

• Schedule CR, if required.

• Supplemental Schedule CR, if required.

• GRT-PV, if required.

• RPD-41071, Application for Refund, if required.

• Other required schedules or attachments.

TRD-41413 Required

Every person required to le a New Mexico gross receipts

tax return must complete and le a TRD-41413 New Mexico

Gross Receipts Tax Return.

Schedule A

Use the Schedule A, New Mexico Gross Receipts Tax

Schedule A if additional space is needed to report gross

receipts from multiple locations. Include this page with the

TRD-41413 Form.

Schedule CR

Use the Schedule CR, New Mexico Business-Related Tax

Credit Schedule. Attachments for each credit are required.

The attachments are specied next to each credit on this

form.

If you will be claiming a refundable credit you will also need

to submit RPD-41071, Application for Refund.

Important: If you believe you may qualify for business tax

credits please see the FYI-106, Claiming Business-Related

Tax Credits for Individuals and Business

Supplemental Schedule CR

If you are claiming more than 20 credits, also le Supple-

mental Schedule CR, Gross Receipts Tax Business-Related

Tax Credit Supplemental Schedule CR. Attachments for each

credit are required. The attachments are specied next to

each credit type on this form See credits table, Attachments

Required to Claim Schedule CR Business-Related Tax

Credits on page 5.

Payment Voucher

If making a payment, place the payment and voucher at the

front of the return, in this order.

• Payment (check or money order)

• GRT-PV Payment Voucher

When paying by check or money order, make sure to indicate

the correct ling period of the return to which you want the

payment to apply. The Department supports the fast and

REQUIRED FORMS AND ATTACHMENTS

6. Select Print Conrmation Page showing your conrma-

tion number as proof and verication that you led online.

7. Select Print Return to print a copy of your return for

your records.

8. Click Print to print a copy of your return for your records.

Important: Do not mail the conrmation page or the return

you led online to the Department. Mailing in the return can

cause processing issues.

If you need assistance ling your return on TAP, you can

email, GRT.TRDHelp@tax.nm.gov or you can call the Call

Center at: (866) 285-2996.

For help with TAP, email: TAP.TechnicalHelp@tax.nm.gov.

Where To Get Paper Tax Forms

Gross Receipts Tax forms and schedules can be lled out

by hand and mailed to the Department. You can get these

tax forms from any district oce, request they be mailed to

you or by downloading them from the Department website.

In Person

Ask for forms at the Department’s local district oces. Use

CONTACTING THE DEPARTMENT information listed on

page 1 of these instructions.

Downloading Forms and Instructions

To download tax forms

, follow these steps:

1. Go to www.tax.newmexico.gov

.

2. At the top of the webpage, click FORMS & PUBLICA-

TIONS.

3. Locate the folders toward the bottom of the page, click

the Business Taxes folder.

4. Click on the Gross Receipts Tax folder.

Check the Print Quality

Make sure the printer can clearly print a logo. If it can, it will

print a quality tax form. It is important to use an original. Never

submit a return with a form that has been photocopied or

photo shopped as it will not be accepted by our process-

ing machines.

Valid Identication Number Required

Enter your business name and New Mexico Business Tax

Identication Number (NMBTIN) on all forms, schedules, and

correspondence you send to the Department. The Department

cannot accept a return without a valid identication number.

***Important Guidelines***

Review the following items before making your entries:

• Complete all required information on your form. Failure

to do this delays processing your return and may cause

errors when the Taxation and Revenue Department per-

forms calculations during processing.

• Leave blank all spaces and boxes that do not apply to

you. Do not draw lines through or across areas you leave

blank.

• Write numbers clearly and legibly to reduce processing

errors and increase eciently. Use the boxes on the form

as a guide for your handwritten entries.

• Do not use dollar signs ($) or any punctuation marks or

symbols other than a comma (,).

TRD-41413 Instructions Inst.pg.5 www.tax.newmexico.gov

secure ling of electronic payments.

To print copies of vouchers, go to http://www.tax.newmexico.

gov. At the top of the page, click FORMS & PUBLICATIONS

then select the following items in this order:

• Business Taxes

• Gross Receipts Tax and then click Payment Voucher

GRT-PV, Gross Receipts Tax Payment Voucher

If your return shows a balance due and you choose to pay by

mail or delivery to one of our local oces, you must complete

the GRT-PV payment voucher and include it with your check

or money order. Also include GRT-PV when submitting your

payment with your paper return. Important: On all checks

and money orders, write your New Mexico Business Tax

Identication Number (NMBTIN) (previously known as your

CRS number), GRT-PV, and the ling period.

Amended Return

Any change to New Mexico gross receipts, exemptions, de-

ductions, or credits require an amended TRD-41413. When

ling an amended return mark the amended box on your

return clearly. You will le this return as if it is an original

return and must submit all required forms that apply to your

TRD - 41413. Note: Do not enter only supplemental amounts

on the return.

If you will be requesting a refund of taxes previously paid or

you have a refundable credit you will need to submit RPD-

41071, Application for Refund with supporting documentation.

RPD-41071, Application for Tax Refund

This form will need to be submitted with your return if you

determine that a refund is due on your account. You can also

submit an application for a Tax Refund for gross receipts tax

online through your taxpayer access point (TAP) account.

For the information required on an application for refund and

what needs to be submitted please see Refunds on page 13.

Other Forms That May Be Needed

This section describes forms that are related to TRD-41413

that you may need.

Notify the Department of a change to your business:

• ACD-31015, Business Tax Registration Application

and Update Form

If you need anyone to have access to your account infor-

mation the following form will need to be submitted to the

Department:

• ACD- 31102, Tax Information Authorization Tax Disclo-

sure

If you are required to le an electronic return but you are

unable to le electronically complete and submit the appli-

cable form below:

• RPD-41350, E-le and E-Pay Exception Request

• RPD-41351, E-File and E-Pay Waiver Request

If you are eligible for the food deduction under Section 7-9-

92 NMSA 1978 and you are a new ler in New Mexico or

you are unable to see the deduction in TAP please submit

the following form:

• RPD-41295, Application for NM Retail Food Store

Certication

If you are a marketplace provider please see the form

below:

• TRD-31117, Marketplace Provider Data Sharing

Agreement

Attachments Required to Claim Schedule CR Business-Related Tax Credits

To Claim These Gross Receipts

Tax Schedule CR Credits

Attach Gross Receipts Tax Business Related Tax Credit Schedule CR

and these items

Aordable Housing Tax Credit RPD-41301, Aordable Housing Tax Credit Claim Form, and a copy of

voucher(s) issued by Mortgage Finance Authority (MFA).

Advanced Energy Tax Credit RPD-41334, Advanced Energy Tax Credit Claim Form. Repealed July 1, 2023.

Alternative Energy Tax Credit RPD-41331, Alternative Energy Product Manufacturers Tax Credit Claim Form

Biodiesel Blending Facility Tax Credit RPD-41321, Biodiesel Blending Facility Tax Credit Claim Form

High-wage Jobs Tax Credit RPD-41290, High-Wage Jobs Tax Credit Claim Form

Investment Tax Credit RPD-41212, Investment Credit Claim Form

Laboratory Partnership with Small

Business Tax Credit

RPD-41325, Application For Laboratory Partnership With Small Business Tax

Credit

Rural Job Tax Credit RPD-41243, Rural Job Tax Credit Claim Form.

Technology Readiness Gross

Receipts Tax Credit

RPD-41407, Technology Readiness Gross Receipts Tax Credit Application

Technology Jobs And Research And

Development Tax Credit

RPD-41386, Technology Jobs And Research and Development Tax Credit

Claim Form.

Unpaid Doctor Services Credit RPD-41323, Gross Receipts Tax Credit for Certain Unpaid Doctor Services

TRD-41413 Instructions Inst.pg.6 www.tax.newmexico.gov

WHEN AND WHERE TO FILE AND PAY

When and Where to File

File your return as soon as you have all the necessary in-

formation. Each Form TRD-41413 is due on or before the

25th of the month following the end of the tax period being

reported. If you le or pay late, you may need to pay interest

and penalties. See Interest and Penalties on page 13. If the

date falls on a weekend, a legal, state or national holiday, your

Form TRD-41413 and payment due date will be extended to

the next business day.

Important: If you le your return electronically either through

TAP or a third-party do not submit a paper return. The du-

plicate return will slow down processing.

Filing Periods and Due Dates

These dates should be selected based on your ling status.

Your ling status can be located on your Registration Cer-

ticate received from the Department. The ling frequency

will be monthly, quarterly or semiannually.

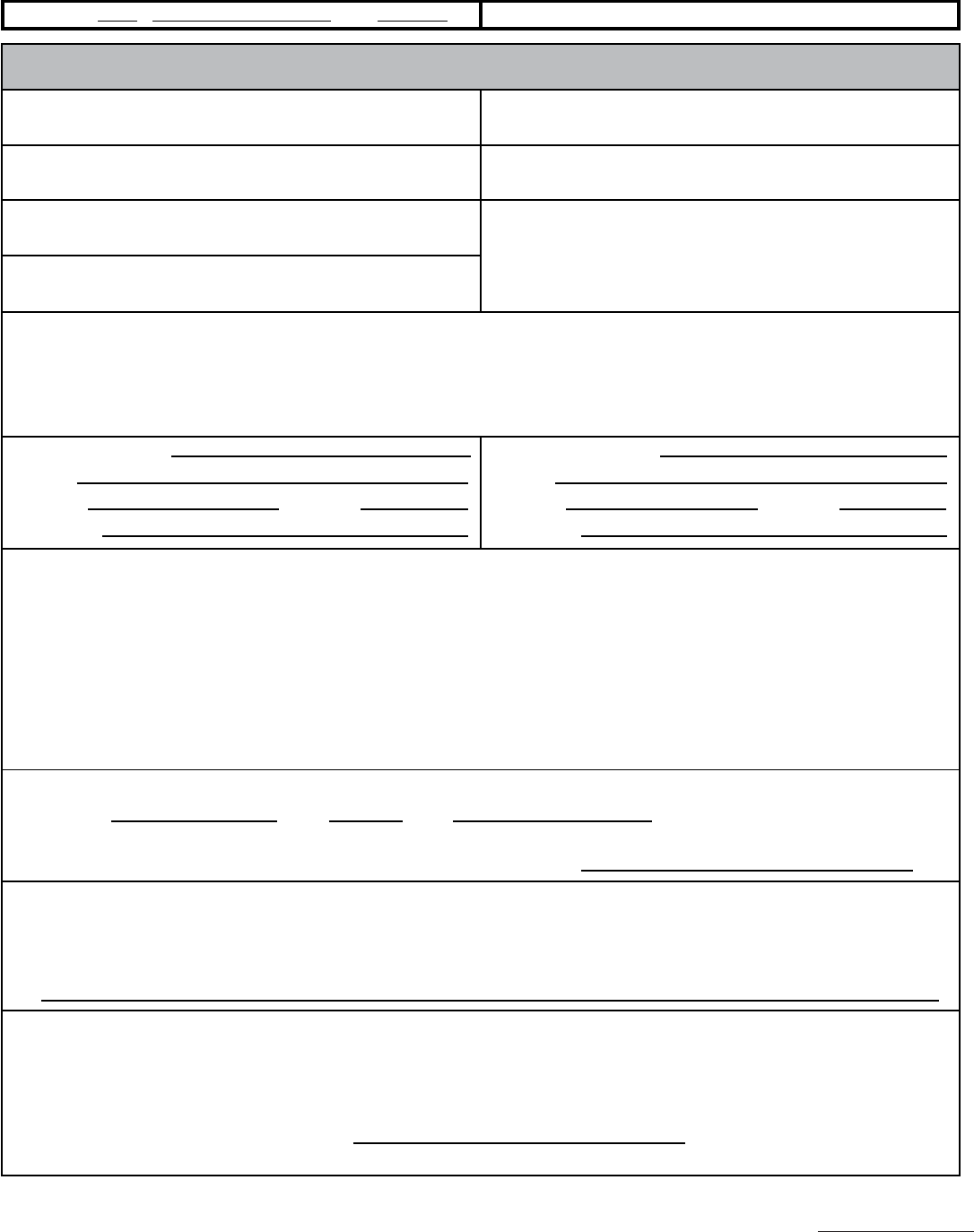

MONTHLY FILING STATUS**

BEGINNING ENDING DUE DATE*

January 1 January 31 February 25

February 1 February 28 or

29

March 25

March 1 March 31 April 25

April 1 April 30 May 25

May 1 May 31 June 25

June 1 June 30 July 25

July 1 July 31 August 25

August 1 August 31 September 25

September 1 September 30 October 25

October 1 October 31 November 25

November 1 November 30 December 25

December 1 December 31 January 25

QUARTERLY FILING STATUS

BEGINNING ENDING DUE DATE*

January 1 March 31 April 25

April 1 June 30 July 25

July 1 September 30 October 25

October 1 December 31 January 25

SEMI-ANNUAL FILING STATUS

BEGINNING ENDING DUE DATE*

January 1 June 30 July 25

July 1 December 31 January 25

**Monthly Filing Status If you are a seasonal, temporary,

or special event ler use the monthly ling status. These l-

ing frequencies allow for businesses that do not do regular

business in New Mexico to le a singular return for the time

period that business was conducted in New Mexico.

Electronic Returns and Payments

If you have an electronic ling requirement, you must le

electronically. See FYI-108, Electronic Filing Mandate for

more information. You can le the return and pay at dier-

ent times but dierent penalty and interest may apply if you

miss the due date of the return. No Penalty will be imposed

for reporting and paying early.

ØTAP TIP: TAP will allow you to le online as of the rst

day of the ling period. You must acknowledge that you

are aware you are ling a return for a period that has not

ended yet.

Paper Returns To Mail

File paper returns no later than the deadline of 25th of the

month following the end of the tax period being reported.

No Penalty will be imposed for reporting and paying early.

Determining a Timely Mailing Date for Paper Returns

If the U.S. Postal Service postmark on the envelope bears a

date on or before the due date, a

mailed New Mexico gross

receipts tax re

turn and tax payment are timely. If the due

date falls on a Saturday, Sunday, or a state or national legal

holiday, the tax return is timely when the postmark bears the

date of the next business day.

If the date recorded or marked by a private delivery service is

on or before the due date, delivery through a private delivery

service is timely.

Where To Mail Paper Returns and Payments

Mail refund requests and returns to:

Gross Receipts Tax Correspondence

Taxation and Revenue Department

P.O. BOX 25128

Santa Fe, NM 87504-5128

How To Pay

Select the most convenient way to pay your taxes. You can

pay with an electronic check, a credit card, a paper check,

or a money order. See Paying Your Taxes on page 12.

Mailing a Payment and Voucher

Do the following when mailing any payment by check or

money order:

• Make it payable to New Mexico Taxation and Revenue

Department.

• Write your New Mexico Business Tax Identication Num-

ber (NMBTIN), GRT-PV, and the ling period on it.

• Mail the voucher with your payment.

Payment Vouchers for TRD-41413

Whether you submit your payment with or without your tax

return, complete GRT-PV, Gross Receipts Tax Payment

Voucher and submit it with your payment.

TRD-41413 Instructions Inst.pg.7 www.tax.newmexico.gov

What To Do Next

Fill in your return using the line instructions that start on this

page. When you nish lling in your TRD-41413, see Before

Filing Your Return on page 13.

Top of Page 1

The top section of TRD-41413, page 1 gathers all your busi-

ness information. Please be sure to ll out all applicable elds.

Incomplete elds may result in processing delays.

New Mexico Business Tax Identication Number

(NMBTIN)

This number was issued to you by the New Mexico Taxation

and Revenue Department and can be located on your Regis-

tration Certicate. Note: This number was previously referred

to as the combined reporting system number or CRS ID.

No New Mexico Business Tax Identication Number?

If you do not have NMBTIN, apply for one using the ACD-

31015, Business Tax Registration Application and Update

Form. DO NOT le a return unless you have a NMBTIN is-

sued by the Department. Filing a return without this number

could result in a lost return or misapplied payment.

Federal Employer Identication Number (FEIN)

This number is issued by the Internal Revenue Service. If

you have a FEIN associated to your business please add

your FEIN here. If you do not have a FEIN leave this eld

blank. One reason you may not have a FEIN number is that

your business is a sole proprietorship.

Social Security Number (SSN)

Clearly enter your name and social security number (SSN)

if your NMBTIN is associated with your SSN.

Business Name

Clearly print the name of the business associated with the

New Mexico Business Tax Identication Number (NMBTIN).

New or Changed Address Check Box

If the mailing address has changed or is a new address

please mark X in this box. This will allow for your address

to be updated in the Department’s system. If you need

to change your address for all of your business accounts

please complete and submit the ACD-31015, Business Tax

Registration Application and Update Form.

Mailing address, City, State, Postal/ Zip Code

Enter your mailing address here. If you have a new or

changed mailing address please select the check box above.

See above for more information.

If you have a foreign address, enter the street address, city

name and postal code in the appropriate line. Also complete

the spaces for the foreign province and/or state and country.

Follow the country’s practice for entering the foreign postal

code, the province or state, and country. Do not abbreviate

the country name. If your address is located within the United

States of America leave these boxes blank.

E-mail address

Enter the e-mail address you would like the Department to

use to contact you if there are any questions about the return

you are submitting.

Phone Number

Enter the phone number you would like the Department to

use to contact you if there are any questions about the return

you are submitting.

Tax Period

These dates should be selected based on your ling status.

Your ling status can be located on your Registration Cer-

ticate received from the Department. The ling frequency

will be monthly, quarterly or semiannually. Use the format

MM/DD/CCYY. The dates should match your ling status.

See table on page 6.

Amended Return

Check the box above only if you are amending over your

original return. Be sure to ll out this return as it should

have been originally led for the specied Tax Period. The

amended return will override all information reported on your

original return. Do not enter only supplemental amounts on

the amended return.

If you fail to check the amended box this will cause process-

ing errors. If your Amended Return does not have the box

checked it will delay posting of the return or it may cause

the return to be rejected.

Important: If your amended return will result in an overpay-

ment on your account, you must submit a RPD-41071, Ap-

plication for Refund. In order for the Department to validate

the overpayment and issue a refund all required documents

must be provided.

COLUMNS A THROUGH H

Column A. Municipality/County Name

On separate lines, enter the name of each municipality

or county where you have a gross receipts tax to report.

Refer to the Gross Receipts and Compensating Tax Rate

Schedule, https://www.tax.newmexico.gov/governments/

gross-receipts-location-code-and-tax-rate-map/.

Eective July 1, 2021, gross receipts are reported using

destination-based sourcing. This means that gross receipts,

with some exceptions, will generally be reported under the

location code where the customer is located. Prior to July

1, 2021, New Mexico gross receipts were reported using

origin-based sourcing rules. This meant that gross receipts

were reported at the location of the business address, with

the exception of construction, real estate sales, utilities, or

tribal agreements. More information can be located under

Location Code and Tax Rate on page 2.

Certain situations or types of receipts require a special nota-

tion in Column A that has no relation to a county, municipality

or other physical location, refer to table T1.

LINE INSTRUCTION

TRD-41413 Instructions Inst.pg.8 www.tax.newmexico.gov

T1. Special Notations

Out-of-State Use when an in state rate does not ap-

ply. See below and table T2 Out-Of-State

Codes for more information.

Column B. Location Code

Enter the Location Code from the current Gross Receipts

and Compensating Tax Rate Schedule, https://www.tax.new-

mexico.gov/governments/gross-receipts-location-code-and-

tax-rate-map/. Make sure that the location code corresponds

with the municipality or county you listed in Column A.

When applicable, use one of the out-of-state special locations

and/or deduction codes listed in table T2.

T2. Out-of-State Codes

88-888 4.875 % If you are reporting for an out-of-

state location for a professional ser-

vice or shipping goods out-of-state.

77-777 4.875 % If you are performing research and

development services outside NM

as a professional service.

Column C. Special Rate Code

Enter the alpha Special Rate Code from table T3. These

codes are account specic. Do not use these codes unless

they apply to your tax situation. These codes alert the De-

partment’s computer system to a special rate, distribution,

or reporting requirement that may apply to your industry or

to the type of deduction being reported.

ØTAP TIP: These special rates codes are granted based

on the information provided to the Department on your

ACD-31015, Business Tax Registration Application and

Updates Form. If you can not see these in TAP and need

them, please submit an updated ACD-31015.

Note: Manufacturers who have entered into a Form RPD-

41377, Manufacturers Agreement to Pay Gross Receipts

Tax on Behalf of a Utility Company for Certain Utility Sales

with a utility company must use the special rate codes listed

in table T4.

Important: A separate row is needed for gross receipts as-

sociated with Special Rate Codes (not the rate listed for the

Municipality/County). Do not combine receipts calculated

under the regular rates from the Gross Receipts and Com-

pensating Tax Rate Schedule.

Example 1 (Column C): Taxpayer has gross receipts in

the Albuquerque to report under the Medical Special Rate

Code "M". The taxpayer will review the Gross Receipts and

Compensating Tax Rate Schedule to locate the Municipal-

ity/County (Albuquerque) and the Location Code (02-100),

these are entered in Column A and Column B of the return.

The taxpayer would enter the "M" code under Column C.

Special Rate. The taxpayer would continue to Column D,

then Column F. In Column F the taxpayer would put the

same amount listed in Column D. In Column G and Column

I that taxpayer would enter Zero as instructed in table T3.

T3. Special Rate Codes

A Local

Economic

Develop-

ment Act

(LEDA)

Only qualifying entities under Sec-

tion 5-10-14 NMSA 1978 use this

special rate code. For more informa-

tion on who qualies for the special

rate code please refer to the Local

Economic Development Act Fund

Section 5-10-14 NMSA 1978.

F Food Retail-

ers

Only food retailers reporting deduct-

ible receipts under Section 7-9-92

NMSA 1978 need to use this special

code. For more information on who

qualies, please see FYI-201. When

using this special code, be sure to

indicate zero in Columns G and I for

the respective line. Note: Do NOT

claim this deduction for federal food

stamp sales paid for with food cards.

Not all food retailers qualify for the

special code “F” deduction.

M Certain

Health Care

Practitioners

Only licensed health care practitio-

ners or an association of health care

practitioners reporting deductions

under Section 7-9-93 NMSA 1978

use this special code. For more

information on who qualies for the

special code “M” deduction, see FYI-

202. When using this special code,

be sure to indicate zero in Columns

G and I for the respective line. Note:

Do not use the special code in Col-

umn B for other receipts reported by

licensed health care practitioners.

Use a separate line for other types

of medical-related deductions. Co-

payment or deductible (7-9-93(B)).

Starting July 1, 2023, and prior to July

1, 2028, receipts from a co-payment

or deductible paid by an insured or

enrollee to a health care practitio-

ner or an association of health care

practitioners for commercial contract

services pursuant to the terms of the

insured's health insurance plan or

enrollee's managed care health plan

may be deducted from gross receipts.

NH Sales by a

Nonprot

hospital

“Nonprot hospital” means a hospital

that has been granted exemption

from federal income tax by the United

States commissioner of internal rev-

enue as an organization described

in Section 501(c)(3) of the Internal

Revenue Code. Rate of 4.875%.

(7-9-41.5)

TRD-41413 Instructions Inst.pg.9 www.tax.newmexico.gov

T4. Manufactures Agreement Special Rate Codes

E Certain Sales of

Electricity to a

Manufacturer

Please refer to FYI-275 for

detailed special reporting re-

quirements for qualied trans-

actions that require the use of

this special code. When using

this special code, be sure to

indicate zero in Columns G

and I for the respective line.

G Certain Sales of

Natural Gas to a

Manufacturer

Please refer to FYI-275 for

detailed special reporting re-

quirements for qualied trans-

actions that require the use of

this special code. When using

this special code, be sure to

indicate zero in Columns G

and I for the respective line.

W Certain Sales of

Water to a Manufac-

turer

Please refer to FYI-275 for

detailed special reporting re-

quirements for qualied trans-

actions that require the use of

this special code. When using

this special code, be sure to

indicate zero in Columns G

and I for the respective line.

O Certain Sales of

Other Utilities to a

Manufacturer

Please refer to FYI-275 for

detailed special reporting re-

quirements for qualied trans-

actions that require the use of

this special code. When using

this special code, be sure to in-

dicate zero in Columns G and

I for the respective line.

Column D. Gross Receipts (excluding Tax)

The amounts in Column D should be the gross receipts

amount excluding the tax associated with those receipts.

This includes taxable gross receipts and deductible gross

receipts. Note: In order to report this correctly you may need

to back the tax out. See Example 2 on this page.

Gross Receipts Including Tax ÷

1.0(insert tax rate without the decimal)

Example 2 (Column D): Taxpayer’s gross receipts including

tax is $342.50 and the tax rate is 8.1875%. The taxpayer

would back out the tax by dividing 342.50 by 1.081875, the

answer is 316.580001... (round this number to the nearest

cent). The gross receipts excluding tax would be $316.58.

This is the amount the taxpayer would put in Column D.

Important: A separate row is needed for gross receipts as-

sociated with special rates or separately reported deductions

(required or optional).

Column E. Deduction Code

When using deduction codes, the gross receipts and deduc-

tion associated with amounts that have deduction codes that

are *required* to be reported will have to be reported on a

separate line. All other deductions can be claimed together

on one line by leaving column E blank and lling in Column

F with the deduction dollar amount, see the fourth line on

Example 3 below. See Example 3 at the bottom of this page.

Required to be reported separately by statute: Deductions

that have a separate reporting requirement (D0) can be lo-

cated on page 10, see on table T5. Deductions Requiring

Separate Reporting.

All other deductions that are available for New Mexico

gross receipts tax that are not required to be separately

reported are reported only in column F as a dollar amount.

For a list of these deductions see T6. Other New Mexi-

co GRT Deductions starting on page 14 or the FYI-105,

Gross Receipts & Compensating Taxes - An Overview.

COLUMN F. Deduction Amount

All deductions are to be reported in this column. Deductions

must be supported by Nontaxable Transaction Certicate

(NTTC), alternative evidence, statute, or regulation.

If you complete this column, Column E must have a deduction

code for special rate codes and deductions required to be

separately reported, see instructions for Column E above.

If you are reporting a special rate code please refer to the

instructions for Column C.

Note: If you are claiming multiple deductions that require

separate reporting (Column E) the associated location

code, gross receipts, and deduction for each will have to be

reported on a separate line. See example 3.

Example 3 (Column E): Taxpayer A has gross receipts tax (GRT) for Santa Fe City and Santa Fe County - Remainder of

County. They have 1 required D0- deduction code and 2 deductions that fall under deductions that are not required to be

separately reported and 1 special rate code applicable to their monthly gross receipts. Taxpayer A will report as follows:

Col. A Col. B Col. C Col. D Col. E Col. F Col. G Col. H Col. I

Muni/County Location

Code

Special

Rate Code

GR (ex-

clude Tax)

Deduction

Code

Deduction

Amount

Taxable

GR

Tax Rate GRT Due

Santa Fe 01-123 M 12,500 12,500 0 0

Santa Fe 01-123 16,000 D0-010 16,000 0 8.1875% 0

Santa Fe 01-123 10,500 10,500 0 8.1875% 0

SF R. of Co. 01-001 31,500 10,000 21,500 6.8750% 1,478.13

TRD-41413 Instructions Inst.pg.10 www.tax.newmexico.gov

Important: Deductions are not the same as business ex-

penses. Do not include business expenses on your Gross

Receipts Tax Return as business expenses are not deduct-

ible or exempt from gross receipts tax.

A taxpayer must maintain in their possession a nontaxable

transaction certicate (NTTC), other acceptable alternative

evidence or documentation for each deduction claimed in

this column. Deductions cannot exceed the gross receipts

reported in Column D for that same location.

For a listing of available deductions, please see FYI-105:

Gross Receipts & Compensating Taxes - An Overview,

available at your local district oce or online at

https://www.tax.newmexico.gov/forms-publications/

REQUIRED DEDUCTION CODES

T5. Deductions Requiring Separate Reporting

D0-001 Uranium Hexauoride (7-9-90) If you sell uranium hexauoride and your receipts are deductible under Section

7-9-90.

D0-002 Manufacturing - Ingredient

(7-9-46(A))

If you sell tangible personal property to a manufacturer who incorporates the

property as an ingredient or component part of a manufactured product and your

receipts are deductible under Section 7-9-46(A).

D0-003 Manufacturing - Consumed

(7-9-46(B))

If you sell tangible personal property that is a manufacturing consumable and

your receipts are deductible under Section 7-9-46(B).

D0-004 Converting Electricity

(7-9-103.1)

If you transmit electricity and provide ancillary services and your receipts are

deductible under Section 7-9-103.1.

D0-005 Electricity Exchange

(7-9-103.2)

If you operate a market or exchange for the sale or trade of electricity and your

receipts are deductible under Section 7-9-103.2.

D0-006 Sale of Ag Implement or Aircraft

50% (7-9-62(A))

If you sell agricultural implements, vehicles or aircraft and your receipts 50% of

can be deducted under Section 7-9-62(A).

D0-007 Sale of Aircraft or Flight Sup-

port (7-9-62(B))

If you sell aircraft, provide ight support and training and your receipts are de-

ductible under Section 7-9-62(B).

D0-008 Aircraft Parts and Maintenance

(7-9-62 (C))

If you sell aircraft parts, provide maintenance services for aircraft and aircraft

parts and your receipts are deductible under Section 7-9-62(C).

D0-009 Commercial/Military Aircraft

(7-9-62.1)

If you sell or provide services for commercial and military aircraft and your receipts

are deductible under Section 7-9-62.1.

D0-010 Medicare

(7-9-77.1(A))

If you provide medical and health care services to Medicare beneciaries and

your receipts are deductible under Section 7-9-77.1(A).

D0-011 TRICARE Program

(7-9-77.1(C))

If you provide medical and health care services as a third-party administrator

for the TRICARE program and your receipts are deductible under Section 7-9-

77.1(C).

D0-012 Indian Health Service

(7-9-77.1 (D))

If you provide medical and health care services to Indian Health Service of the

United States Department of Health and Human Services to covered beneciaries

and your receipts are deductible under Section 7-9-77.1(D).

D0-013 Medicare - Clinical Laboratory

(7-9-77.1(E))