[Type text]

Plant Health Care PLC

(AIM: PHC)

September 19, 2018

Prominent Plant Biologicals Provider

Plant Health Care PLC (the “Company”, “Plant Health Care”, “PHC”) is a US-based

company, providing proprietary agricultural technology solutions and biological

products to enhance plant health and yields. The Company has two business

segments, Commercial and New Technology. The Commercial business sells

patented biological products across geographic areas such as the Americas,

Europe and South Africa, and is generating revenues of over $7 million per year.

The New Technology business focuses on the development of proprietary

biological solutions that can be both complementary to or substitutes for

conventional agrochemicals (pesticides). The Company has successfully created

three proprietary biological platforms (Innatus

™

3G, Y-Max 3G and T-Rex 3G),

which are under various stages of evaluation by its agricultural partners.

Investment Rationale

Commercial Business grew 21% Year-Over-Year in 2017

The Company’s Commercial business, which sells patented biological products for

enriched crop performance, is growing rapidly. The Commercial business

generated $7.7 million revenue for FY 2017 (ending December 31, 2017,

representing a 21% Y-o-Y increase from FY 2016. Specifically, the sale of Harpin

αβ products, which represented 63% of the Company’s total sales in 2017, has

grown at a 23% CAGR between FY2013 and FY2017. At present, the Company’s

products are sold in more than 14 countries and is poised for expansion into more

countries in 2018. The Company’s Harpin αβ products have increased the yield of

US corn and soybeans by 3-5%. Further, demonstration field trials of Harpin αβ in

sugarcane fields have resulted in average yield increases of over 20%. Harpin αβ

is also sold in fruit and vegetable crops such as citrus, tomatoes, peppers and

potatoes, resulting in significant yield increases. The effectiveness of the

Company’s products in yield improvement and disease resistance in crop plants is

helping drive its sales globally. In February 2018, the Company launched its Harpin

αβ product in the promising Brazilian sugarcane market and generated $400,000 in

revenue from February 2018 to June 2018. Brazil has 10 million hectares of

sugarcane crop and is the world’s largest producer of sugarcane. The Company

has potential to gain 2.5 - 5% market share in the Brazilian sugarcane market over

the next four years. The Company was awarded a contract in the US and also

expects to launch Harpin αβ for US corn seed treatment and anticipates initial

sales in H2-2018. Further, the Company also expects to launch its Harpin product

for coffee in Brazil during the 2019/2020 growing season. With these recent

favorable events, the Company expects 30% Y-o-Y revenue growth in FY2018.

Successful Partnerships should help New Technology Business growth

The Company has signed agreements with nine agricultural/seed companies,

including all the major, global industry leaders, for evaluation of its PREtec

platforms. These evaluations include assessing the Innatus 3G platform for usage

along with their agrochemical products (pesticides) for improved disease

resistance and yield enhancements in soybean and corn. Past field trials

conducted by and on behalf of the Company between 2013 and 2016 have shown

that the application of Innatus 3G to crops, after treatment with a conventional

agrochemical, resulted in superior pest protection and crop yields. The field trials in

soybean and corn crops conducted by the Company in 2013-2016 resulted in an

average yield increase of approximately 7.6 Bu/ac (Bushels/acre) in corn and 1.8

Bu/ac in soybean. Such successful field trials strengthen the commercialization

prospects of the Company’s Innatus 3G platform.

Price (Sept 18, 2018): £0.184

Beta: -0.46

Price/Sales: 4.14x

Debt/Equity Ratio: 0.08

Listed Exchange: AIM

Source: Yahoo Finance

Recent News

30-Jul-2018: Usage of PHC’s Harpin αβ in sugarcane

crop in Brazil, sold under the brand name H2Copla,

generated revenues of $400,000 since its launch in

February 2018. PHC now plans to launch Harpin αβ in

coffee during the 2019/2020 growing season.

16-Jul-2018: In February 2018, PHC launched Harpin αβ

in sugarcane in Brazil, supported by demonstration plot

yield increase of 20% or more. Awarded contract for a

Harpin αβ product to be used on corn in the US, with

significant first sales expected in H2 2018.

30-May-2018: Granted a total of 1,860,104 options to Dr.

Christopher Richards and 467,538 options to Dr. Richard

Webb.

10-Apr-2018: Revenues increased by 21% YOY to $7.7

million for the year ended December 31, 2017, due to

strong sales growth in South Africa and Spain, 104% and

60%, respectively. The Company’s gross margin was

healthy at 62%.

27-Feb-2018: Raised £5.0 million (USD $6.7 million)

through the issuance of an aggregate 25 million new

ordinary shares.

12-Dec-2017: Signed an agreement with a fifth major

agricultural/seed company for evaluation of its Innatus 3G

platform.

Fully Diluted Shares Outstanding: 184.85 million

Common shares Outstanding: 172.82 million

Market Cap: £31.79 million

52 Week High: £0.28

52 Week Low: £0.135

Note: All $ symbols represent US dollars (USD), unless

otherwise specified. Share price & market cap are in GBp.

www.RBMILESTONE.com

2

Plant Health Care PLC

Experienced Management Team

Plant Health Care’s board of Directors and management team has strong knowledge and expertise in the plant biologicals and

agrochemical industry. Dr. Christopher Richards, the Executive Chairman and Interim Chief Executive Officer of the Company, has

more than 30 years of experience in various life science and agrochemical companies. He has held senior-level positions in

companies such as Syngenta, Arysta LifeScience and Dechra Pharmaceuticals. Prior to joining Plant Health Care, Dr. Richards was

CEO of Arysta LifeScience. Mr. Michael J. Higgins, a Senior Independent Director of the Company, has more than ten years of

experience in advising small and mid-sized publicly traded companies. Prior to joining Plant Health Care, he served as a senior

advisor at KPMG. Further, Dr. Richard H. Webb, an Executive Director of the Company, has significant experience in handling

laboratory discovery and field development of pesticides. He has held various senior level positions at companies including ICI and

Zeneca Agrochemicals. Finally, Mr. William M. Lewis, a Non-executive Director of the Company, has significant experience in the

agrochemical business. He has held senior roles at companies such as Syngenta Crop Protection, Arysta LifeScience and

Zeneca/ICI.

Biologicals industry growth augments future revenue prospects

Plant Health Care's operations are well supported by favorable growth trends in the plant biologicals industry. According to Dunham

Trimmer, a market research firm, the global biologicals market is projected to grow from $5.7 billion in 2016 to $9.1 billion by 2020,

representing an attractive 12% CAGR. Factors such as increasing global population, declining arable land per person, falling yields

and increasing pest resistance to conventional agrochemicals (pesticides) are driving demand of plant biologicals. Further,

biologicals are now well positioned to gain market share from conventional agrochemicals. Biologicals provide more benefits than

conventional agrochemical solutions because they are non-toxic and are more environmentally friendly. Biologicals can also provide

a superior pest control in plants than agrochemicals. Such advantages may drive significant adoption for biologicals among crop

growers.

Company Overview

Business

Plant Health Care PLC provides patented biological products and solutions to global agricultural markets. The Company’s biological

products are offered to improve the yield and vigor of various field and specialty crops. PHC’s biological products are

environmentally friendly and hence are well-positioned to take advantage of the long-term growth trends for natural agricultural

solutions. The Company’s products have been in use or undergoing trials at numerous locations across the world as seen in Exhibit

1. PHC also has a dedicated research and development program that continues to develop innovative agricultural solutions in crop

health, disease resistance and establish potential synergies with various agrochemical companies. Exhibit 2 shows an overview of

the company’s business segments and product offerings. As discussed earlier, the Company operates in two strategic business

segments namely, Commercial and New Technology.

Exhibit 1: PHC’s worldwide presence

Source: Company Investor Presentation

3

Plant Health Care PLC

Exhibit 2: PHC Business

Source: Company Investor Presentation

Commercial Business - Recent growth shows plenty of promise

The Company’s Commercial business sells patented biological products, including biofertilizers and biostimulants. The Company

also distributes third party complementary products for improved crop performance in Mexico. The Company’s biological products

are known to enhance the plant’s natural physiological process, resulting in superior yield and plant health. PHC’s proprietary

biological products fall under two major technologies, Harpin technology and Myconate technology. The Company sells N-Hibit

®

,

ProAct

®

and Employ

®

products under the Harpin technology and Myconate

®

product under the Myconate technology. The

Company’s products are currently sold across three primary geographical areas, namely the Americas, Mexico and EMEA.

For the year ended December 2017, the Company’s Commercial business generated $7.7 million in revenue, an increase of 21%,

compared to $6.3 million in 2016. The Company’s proprietary biological products accounted for 69% of the sales in 2017, compared

to 59% in 2016. The Company is currently on track to achieve full year revenue expectations, which would represent a 30% Y-O-Y

revenue growth in FY2018.

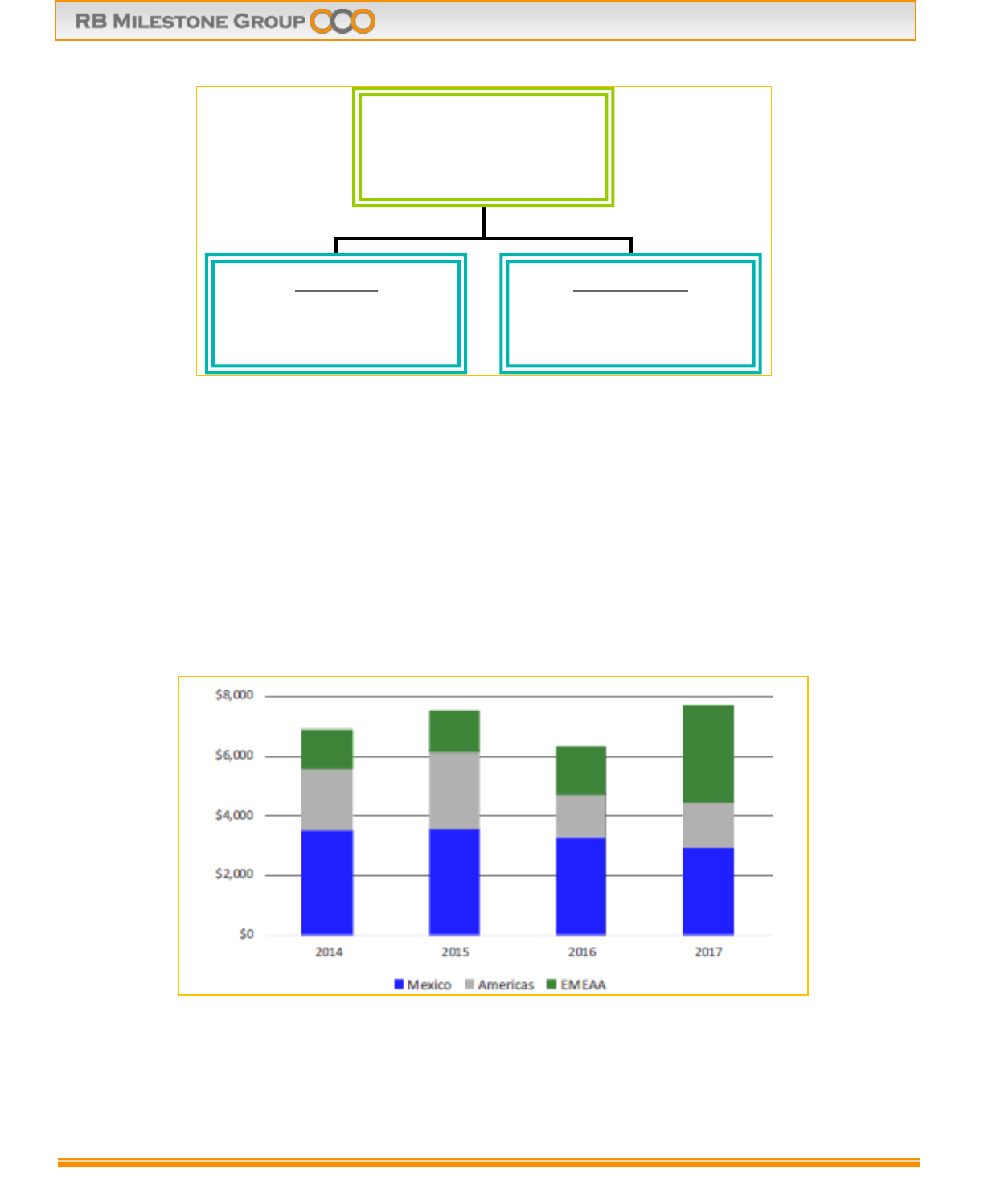

Exhibit 3 shows sales growth from 2014 to 2017 across its geographical areas.

Exhibit 3: Commercial business sales across its geographical areas

Source: Company Investor Presentation

Plant Health Care

Business

Commercial

Harpin technology

Myconate technology

New Technology

Innatus 3G

T-Rex 3G

Y-Max 3G

4

Plant Health Care PLC

Harpin technology - an effective biological solution for crop vigor using Harpin αβ

Harpin proteins are produced naturally by certain bacterial plant pathogens. Harpin αβ is a recombinant protein developed by the

Company. On contact with a crop plant, Harpin αβ elicits the plant's natural growth and immune responses such as Hypersensitivity

Response (HR) and System Acquired Response (SAR). HR prevents the spread of pathogen infection in plants, while SAR creates

a plant-wide resistance to pathogen attack.

The Company’s Harpin αβ protein activates the self-defense mechanisms in plants for improved crop performance. Through a

Harpin αβ product application, the plant’s growth and immune responses (HR and SAR) are activated artificially. The plant responds

by increasing its photosynthesis and generates extra energy to resist the mimicked pathogen attack. This extra energy is further

utilized in reducing stress levels and improving crop yields. Harpin αβ application therefore results in improved yield, crop quality

and extended shelf life. Further, since Harpin αβ does not interact directly with pathogens, the pathogens are not expected to

develop resistance to the Harpin αβ application, unlike conventional pesticides. Harpin αβ can be used in crop plants either as a

seed treatment or as a foliar application. Exhibit 4 describes the Harpin technology and plant response to the application of Harpin

technology.

Exhibit 4: Plant’s response to Harpin application

Source: Company Investor Presentation

Harpin αβ products

PHC sells three Harpin αβ products namely N-Hibit (seed treatment), ProAct and Employ (foliar application).

• N-Hibit HX-209 - N-Hibit HX-209 is a seed treatment product that can be applied before planting. N-Hibit works by activating the

plant’s internal defense mechanisms. N-Hibit usage in row crops such as corn, soybeans and cotton has resulted in improved

plant health, fewer nematodes and strong yield.

• ProAct - ProAct is a foliar treatment product for row crops. ProAct activates the SAR response and improves self-defense

mechanisms in plants. Numerous studies and trials have shown that ProAct usage in plants reduced nematode problems and

improved crop yield.

• Employ - Employ is a foliar treatment product for specialty crops. The usage of Employ also results in increased yield, extended

shelf life, reduced nematode production and better plant recovery.

Harpin αβ sales grew at an attractive 23% CAGR between 2013 and 2017

In 2017, the sale of PHC’s Harpin αβ products generated $4.8 million in revenue and accounted for approximately 63% of the total

revenue. Harpin αβ product sales have grown at an attractive 23% CAGR between 2013 and 2017. Exhibit 5 shows Harpin product

sales between 2013 and 2017. PHC’s Harpin αβ products are sold in more than 14 countries and have treated vast acres of row and

specialty crop fields to date (in excess of 12 million acres). Harpin αβ usage has demonstrated yield increases of approximately 3-

5% in US corn and soybeans. Further, use of Harpin αβ has increased on table grapes, rice, potatoes and citrus fruits. These

improved yield results and disease protection are driving Harpin αβ adoption globally. PHC is also developing Harpin αβ for the

treatment of various other crops. The Company aims to expand its market share by developing Harpin-based products for new crops

and by entering into new markets.

5

Plant Health Care PLC

Recently, in 2018, after three years of extensive trials, Harpin αβ was launched in Brazil for sugarcane treatment. Field trials

conducted in both ratoon cane (cane that grows back after harvest) and newly planted cane demonstrated positive yield increases.

For instance, single applications of a low dose (100 g per Ha) Harpin αβ at six to eight weeks post-harvest in ratoon cane resulted in

significant yield increase of 10-29%. The Company views the Brazilian sugarcane market as a high revenue potential segment.

Further, the Company has been awarded a contract to supply Harpin αβ for corn seed treatment in the US. The Company now

expects first sales in the second half of 2018. In addition, the Company also plans to launch Harpin αβ in coffee during the

2019/2020 growing season in Brazil. The Company is currently working on testing the product for use in coffee in Brazil. The

Company owns and licenses patent rights covering a variety of claims. Patents covering the Harpin αβ products will continue in

force through 2027.

Exhibit 5: Harpin αβ (sales in ‘000s)

Source: Company Investor Presentation

Brazil Sugarcane Market - High revenue potential for Harpin αβ application

To quantify the business opportunity, we now discuss the Brazilian sugarcane market. Brazil is the world’s largest producer of

sugarcane and has 10 million hectares (ha) of sugarcane fields. Further, estimates reveal that approximately 60% of the country’s

sugarcane production is in Sao Paulo as shown in Exhibit 6. In February 2018, PHC launched Harpin αβ (H2Copla) for sugarcane

treatment in Brazil, through its distributor Coplacana. Coplacana is a leading sugarcane co-operative in Sao Paulo, with more than

50% of the state’s agrochemical market share. This presents a lucrative distribution opportunity for PHC to gain market share in the

Sao Paulo sugarcane market. H2Copla sales generated revenue of $400,000 since the launch of the product in February 2018 to

June 2018. The initial customer feedback has been strong, and the Company expects significant demand growth in H2 2018 and the

following years. Based on these promising initial sales, there is potential for PHC to gain a 2.5% market share (or $5 million in

revenue) over a four-year period.

Exhibit 6: Sugarcane production in Brazil

Source: Company Investor Presentation

6

Plant Health Care PLC

Myconate technology – ensures well developed Mycorrhiza

Mycorrhiza is a naturally occurring symbiotic association between a plant and a set of soil organisms termed as mycorrhizal fungi (or

Mycorrhizae). Mycorrhizae colonize the plant’s root system and transport essential soil nutrients and water needed for the plant’s

growth. A well-developed mycorrhizal system increases the surface area of roots available for plant growth. This could extract more

soil nutrients and water from the soil, which the plant could not access normally, resulting in superior plant health and yield. PHC's

Myconate technology is a proven yield enriching technology, which uses stimulants to strengthen the plant’s mycorrhizal system.

Myconate

PHC sells Myconate (Mycorrhizal stimulant) product under its Myconate technology. PHC’s Myconate is a soil enrichment product

that produces enhanced mycorrhizal network in plants. Myconate contains isoflavone formononetin, a naturally occurring compound,

which stimulates colonization of Vesicular-Arbuscular Mycorrhizal (VAM) fungi (a root symbiont) in the plant’s root system. The

application of Myconate produces healthier, high-yielding plants even in dry/poor soil conditions. Myconate product sales were

$455,000 for FY2017, representing 28% Y-o-Y increase compared to the same period in 2016. Exhibit 7 shows Myconate product

sales between 2013 and 2017. Patents covering Myconate will continue to expire through 2031. The Myconate product can be used

in a wide variety of agricultural (cereals, cotton, corn, peanut, rice, sorghum, soybean, sunflower) and vegetable crops (carrots,

tomato, lettuce, beans, cucurbits, peas, onion, pepper) either as a seed treatment or a soil treatment.

Exhibit 7: Myconate Sales (in $US & ‘000s)

397

459

421

356

455

200

250

300

350

400

450

500

2013 2014 2015 2016 2017

Source: Company Investor Presentation

New Technology

PHC’s New Technology is focused on the development and licensing of its proprietary Plant Response Elicitor technology (PREtec)

platforms. The Company’s PREtec platforms increase crop plant yield and aid in disease resistance. The Company has successfully

delivered three proprietary 3G (third generation-small peptides) PREtec platforms, namely Innatus 3G, T-Rex 3G and Y-Max 3G, for

evaluation by its partners. The Company intends to convert these platforms into products by collaborating with major agricultural

companies for further development and commercialization. As of April 2018, evaluation agreements have been signed with nine

companies (including five major agricultural/seed companies) for field trials. The Company has recently focused its resources on

Brazil, evaluating its products in field trials and advanced technical evaluation. Outside of the Brazilian field trials, in July 2018, the

Company reported that three of its partners have reported positive results in a range of more than 10 crops, uses and regions.

These partners and the Company are now discussing trials of PREtec across a variety of specialty and broad-acre crops. The

Company’s peptide platforms can be used for a wide range of crops such as arable crops (corn and soybean) and specialty crops

(fruits and vegetables). Further, the Company’s 4G (fourth generation) peptide platforms are in early stages of development today.

These platforms are applications of DNA or RNA forms of PREtec in agriculture and plant breeding.

7

Plant Health Care PLC

PREtec - A Promising Agricultural Technology

Plant Response Elicitor technology (PREtec) is a bio-rational (non-toxic) agricultural technology that selectively activates the growth

and self-defense mechanisms in crop plants. PREtec protects crop plants from abiotic stresses such as drought and diseases during

their growing season. A PREtec peptide platform consists of a combination of related peptides (short proteins or chains of amino

acids linked by a peptide bond) that mimic the naturally occurring larger proteins to which plants respond defensively. These

peptides, on contact with the plant’s cell membrane, function as a signal molecule and elicit a specific defensive response

determined by its molecular structure. The Company has identified and developed selective lead peptides with wide agronomic

benefits such as yield enhancements, pest resistance and crop quality. The Company’s PREtec peptides are less toxic and rapidly

bio-degradable than conventional agrochemicals. In addition, the Company has also gained significant expertise in modifying the

peptide sequences for improved biological performance.

Exhibit 8 displays the PREtec technology mechanism and Exhibit 9 shows some key competitive advantages of PREtec platforms.

Exhibit 8: Plant Response Elicitor Technology

Source: Company Investor Presentation

Exhibit 9: PREtec - Key Competitive Advantages

Source: Company Investor Presentation

8

Plant Health Care PLC

PHC proprietary PREtec platforms

Exhibit 10 and 11 shows the company’s three proprietary PREtec platforms (Innatus 3G, T-Rex 3G and Y-Max 3G), the lead

peptides in each platform and their performance focus. The Company has identified eight lead peptides for various disease

resistance and crop yield benefits. The Company is now also working on multiple peptide variants for enhanced crop performance.

Exhibit 10: PREtec Technology Platforms

Source: Company Investor Presentation

Exhibit 11: New Technology Platforms

3G platform

Performance focus

Lead peptides

(synthetic → fermented product)

Partner trials started

Innatus 3G

Disease resistance, vigor, quality, yield

(Combat fungicide resistance in row

crops and enhance yield and quality)

PHC398 ~>PHC279

PHC296 ~>PHC863

PHC958 ~>PHC404

PHC180 ~>PHC148

2015

T-Rex 3G

Nematode, yield

PHC176 ~>PHC032

PHC097 ~>PHC949

2016

Y-Max 3G

Growth, roots, yield

PHC353 ~>PHC414

PHC326 ~>PHC535

2016

Source: Company Investor Presentation

Innatus 3G

Innatus 3G is a bio pesticide platform, which provides a range of crop protection and yield improvement benefits in plants. Innatus

3G peptides (PHC279, PHC863, PHC404, and PHC148) work by eliciting the Hypersensitive Response in treated plants. These

peptides are compatible with conventional agrochemicals (fungicides, nematicides and pesticides) and can be applied as either

foliar or seed treatment.

Initial field trials of Innatus 3G showed attractive crop yield increases

The initial field trials of Innatus 3G conducted by PHC and by university groups on corn and soybean seeds showed significant

agronomic benefits of improved disease resistance and strong yield increases in corn and soy. The field trials were conducted

between 2013 and 2016 across several locations in the US Midwest. 3G peptide treatments resulted in an average yield increase of

approximately 7.6 Bu/ac (Bushels/acre) in corn and 1.8 Bu/ac in soybean respectively. The corn and soybean seeds were first

treated with a conventional treatment (fungicides, nematicides, biologicals and insecticides) and then over treated with Innatus 3G

peptides. The results also demonstrated that the Innatus 3G peptides enhance the efficacy of the applied agrochemical in disease

control and yield protection. Exhibit 12 and Exhibit 13 show the summary of field trial results of corn seed treatment and soybean

seed treatments (each bar represents one trial location) respectively.

9

Plant Health Care PLC

Exhibit 12: Corn Seed Treatment (Summary of results by location)

Source: Company Investor Presentation

Exhibit 13: Soybean Seed Treatment (Summary of results by location)

Source: Company Investor Presentation

10

Plant Health Care PLC

The Asian Soybean Rust (ASR) Control opportunity- a $1.7 billion fungicide market

Asian Soybean Rust (an endemic disease) has been a major problem for Brazilian soybean growers. Conventionally, fungicides are

applied to control ASR. In 2016, Brazilian farmers spent $1.7 billion on soybean fungicides. The application of conventional

fungicides often does not provide complete control due to ASR now developing resistance to such fungicides. The Company’s lead

peptide PHC279, on the other hand, also works on ASR that is resistant to conventional fungicides, and aids in improved disease

control and yield. Field trials of the PHC279 lead peptide, in combination with conventional fungicides for ASR, have shown to

increase disease control than conventional fungicide application alone. Exhibit 14 details the severity of ASR disease level for

various biologicals mixtures. Further, PHC279 peptide application also resulted in increased crop yield in laboratory tests.

Exhibit 14: PHC application for ASR resulted in improved disease control

Source: Company Investor Presentation

Field trials of Innatus 3G during the Brazilian 2017/2018 soybean crop season revealed average soybean yield increases of

6-7%

During the 2017/2018 soybean crop season, the Innatus 3G platform (lead peptide PHC279) was under advanced technical

evaluation and field testing by the top four Brazilian fungicide market leaders, which control more than 80% of the Brazilian market

share. Further, the Company has also teamed up with EMPRAPA, an esteemed Brazilian Government agricultural research

institution, to evaluate its Innatus 3G platform. The field testing during the 2017/18 season showed conventional fungicides worked

well in disease control, in contrast to previous years. Therefore, the Company’s Innatus 3G added only limited additional value to

disease control. However, the results revealed average yield increases of approximately 6-7% in Innatus 3G treated soybeans, even

at low application rates. The Company is in discussion with its partners to further undertake field trials during the next soybean crop

season. The Company also expects to test Innatus 3G platforms for both disease management and yield control benefits. Exhibits

15 and 16 detail the licensing timeline of PHC and the development timeline of the Innatus 3G PHC279 lead peptide respectively.

Exhibit 15: Licensing Timeline

Source: Company Investor Presentation

11

Plant Health Care PLC

Exhibit 16: PHC lead peptide PHC279 development milestones

2016

2017

2018

Before 2021

Efficacy

Lab/Greenhouse

Evaluation field trials

Development field trials

Commercial sales

Ability to make

Synthesis

Bench-top fermentation

Pilot production

Commercial production

Regulatory

Fast track strategy

Submit package

Approval

Technology license

Competitive arena

In discussion with partners on plans for further trials in

South American soybeans

Completed

In Progress

Planned

Source: Company Investor Presentation and Press release on July 16, 2018

T-Rex 3G

T-Rex 3G is a nematode defense platform. Nematodes are parasitic organisms that feed on the plant’s root cells. Nematodes cause

damage to the plant’s root system and affect the plant’s overall health and vigor. T-Rex 3G controls the nematode occurrence by

stimulating the plant’s self-defense mechanisms. Trials of T-Rex 3G on soybean plants conducted in 2016 showed reduced

nematode problems.

Y-Max 3G

Y-Max 3G is a bio-stimulant platform (yield and growth platform). Field trials of the Y-Max 3G platform on corn and soybeans

showed that Y-Max 3G peptides improve the biomass and yield of the crop plants.

2018-2019 Milestones

PHC expects to generate significant cash flow from its Commercial business by expanding its market share in its existing markets

and entering new markets. In its New Technology business, the Company continues to have high confidence in the value of PREtec

and is actively pursuing opportunities to monetise it..

Exhibit 17: Milestones 2018-2019

Commercial

• Deliver market expectations for revenue and cash

• Generate cash from commercial operations and reduce cash burn

New Technology

• Actively pursuing opportunities to monetise PREtec platforms

The Company

• Generate cash from commercial operations and reduce cash burn. Cash positive in 2020.

Source: Company Investor Presentation

12

Plant Health Care PLC

Company Timeline & Key Events

Exhibit 18 below shows the reverse chronological timeline of the evolution of Plant Health Care PLC, summarizing some key annual

events for the Company since 2015.

Exhibit 18: Timeline summarizing significant annual events since 2015

Dates

Events

30-July-18

PHC’s Harpin αβ in sugarcane sales in Brazil generated revenue of $400,000 since its launch in February 2018. Plans to launch

Harpin αβ in coffee during the 2019/2020 growing season.

16-July-18

In February 2018, PHC launched Harpin αβ in sugarcane in Brazil, supported by average demonstration plot yield increase of 20% or

more. Awarded contract for a Harpin αβ product to be used on corn in the USA, with significant first sales expected in H2 2018.

Results of field trials of Innatus 3G, added to chemical sprays for the control of Asian Soybean Rust (ASR) in Brazil indicated that

Innatus 3G increased soybean yield by 6-7%, even at low application rates.

30-May-18

Granted a total of 1,860,104 options to Dr. Christopher Richards and 467,538 options to Dr. Richard Webb.

10-April-18

Revenues increased by 21% YOY to $7.7 million for the year ended December 31, 2017, due to strong sales growth in South Africa

and Spain (up 104% and 60% respectively). Gross margin was stable at 62%.

27-Feb-18

Raised £5.0 million through issuance of an aggregate 25 million new ordinary shares.

12-Dec-17

Signed an agreement with a fifth major agricultural/seed company for evaluation of its Innatus 3G platform.

18-Sep-17

Revenues increased by 8% to $3.1 million for the six months ended June 30, 2017 compared to $2.9 million for the same period in

2016, due to strong sales growth in EMEAA. Sales for this region increased by 202% (231% respectively in constant currency).

Gross margin was stable at 58%.

12-Jul-17

Granted options for a total of 925,789 ordinary shares to Dr. Richard Webb, Executive Director.

10-Apr-17

Revenues decreased by 16% YOY to $6.3 million for the year ended December 31, 2016, due to lower sales in the US. Sales in the

US were down by $1.1 million. Gross margin was stable at 62%.

18-Jan-17

Extended the terms of evaluation contracts with its four Innatus 3G evaluation partners to 2018.

14-Dec-16

Established four new distribution arrangements for its commercial plant health products.

14-Sep-16

Revenues decreased by 9% to $2.9 million for the six months ended June 30, 2016, compared to $3.2 million for the same period in

2015. Gross margin decreased to 59% from 63% due to lower sales.

16-Aug-16

Raised $7.6 million through issuance of an aggregate 75,967,796 new ordinary shares.

8-Apr-16

Revenues increased by 9% YOY to $7.5 million for the year ended December 31, 2015, due to a $1.5 million increase in Harpin αβ

product sales. Gross margin increased to 62% in 2015 from 51% in 2014 due to lower manufacturing costs of Harpin αβ products.

02-Dec-15

Signed a new agreement with Sym-Agro Inc, (a leading biologicals company based in California) for the distribution of its Employ

®

and Myconate products in the western US agricultural markets.

25-Sep-15

Signed its third and fourth agreements with major agricultural industry companies for evaluation of its Innatus 3G platform.

14-Sep-15

Revenues marginally decreased by 3% to $3.2 million for the six months ended June 30, 2015 compared to $3.3 million for the same

period in 2014. Gross margin increased to 63% from 53% primarily due to higher pricing as well as lower cost of goods.

Source: Company filings

13

Plant Health Care PLC

Industry Overview

The global agricultural industry is experiencing a major technological shift. Factors such as rapid population growth, declining arable

land per person, falling crop yields and climate change have created the need for innovative products and solutions to increase crop

yield and crop vitality. Besides the presence of conventional agricultural solutions, such as the usage of agrochemicals, genetic

modification of seeds and plant breeding, Biologicals are growingly seen as effective agricultural solutions for improved crop

performance. Biological solutions, in some cases, have even surpassed the benefits provided by conventional agricultural solutions.

Hence, the adoption of plant biologicals is growing significantly.

Biologicals – A natural agricultural solution for improved crop performance

Biologicals for agriculture are naturally occurring or synthetically derived compounds extracted from microorganisms, beneficial

insects, organic matter and others. Biologicals are known to positively influence the plant’s growth and self-defense mechanisms for

efficient pest management and higher productivity. Further, biologicals have a non-toxic mode of action, and hence are environment

friendly compared to conventional agrochemicals (pesticides such as fungicides, insecticides etc.). Since the concerns due to

pesticide residue in food produce are growing globally, biologicals are well positioned to gain market share from conventional

agrochemicals in the global agricultural market. Bio stimulants (plant growth biologicals) and Bio pesticides (pest resistant

biologicals) are the major categories of agricultural biologicals. Currently, biologicals are used in the production of a wide variety of

agricultural crops, including horticulture crops (fruits and vegetables) and row crops (corn, soybeans, wheat and others).

Growing population and declining arable land per person

According to “World Population Prospects: The 2017 Revision by UN Department of Economic and Social Affairs”, the world

population is estimated to grow to 9.8 billion in 2050 and 11.2 billion in 2100, from 7.6 billion, as of 21 June 2017. Further, the arable

land per person has been falling over the years and is projected to reach approximately 0.17 hectare per person in 2050. Exhibit 19

and 20 show the global population annual growth rates and declining arable land per person over the years.

Exhibit 19: Declining arable land per person

0.00

0.05

0.10

0.15

0.20

0.25

0.30

0.35

0.40

1961

1963

1965

1967

1969

1971

1973

1975

1977

1979

1981

1983

1985

1987

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

2013

2015

2030 E

Source: UN Department of Economic and Social Affairs

14

Plant Health Care PLC

Exhibit 20: Population growing at a steady rate

0.00

0.50

1.00

1.50

2.00

2.50

1961

1963

1965

1967

1969

1971

1973

1975

1977

1979

1981

1983

1985

1987

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

2013

2015

Global population growth (%)

Source: UN Department of Economic and Social Affairs

Increasing Pest Resistance to Conventional Agrochemicals should drive demand for Biologicals

Increasing pesticide resistance by plant pathogens has been a major problem in crop management. Pesticides have played a major

role in increasing crop yields over the years. Much of the average yield increases over the last four decades are predominantly due

to active pest control through the use of pesticides, rather than the increase in yield potentials; according to research papers Oerke,

E. C. 2006. Crop losses to pests and Cassman, K. G. 1999. Ecological intensification of cereal production systems: yield potential,

soil quality, and precision agriculture. However the yield growth is slowing, and in some cases (for certain crops or region), yields

have started to decline. Such fluctuations in crop yields could be related to cases where the pesticides are now deemed less

effective or ineffective. Increasing pesticide resistance by plant pathogens is one of the major factors leading to such inefficiencies in

agrochemicals usage. Biologicals are widely seen as innovative solutions to such agricultural problems. The usage of biologicals,

along with agrochemicals, could also improve the efficacy of the conventional agrochemical application. Further, the pests are also

not expected to develop resistance to biologicals applications due to their differing mode of action compared to conventional

agrochemicals.

Exhibit 21 shows the trends in sugarcane and soybean yields in Brazil. Fluctuations due to plant pathogens and weather are notable

issues.

Exhibit 21: Sugarcane and Soybean yield (Brazil) growth (1961-2016)

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

-

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

900,000

hectogramme per hectare (hg/ha)

hectogramme per hectare (hg/ha)

Sugarcane (primary axis) Soybeans (secondary axis)

Source: Food and Agricultural Organization (FAO)

15

Plant Health Care PLC

Exhibit 22 shows that the average yields of sweet potatoes during the 2001-2010 and 2011-2016 period has declined, compared to

average yields during the period 1991-2000, perhaps due to new agrochemical resistant varieties of plant pathogens.

Exhibit 22: Global yields (Soybeans, Sweet potatoes and Wheat) (1961-2016)

13

93

13

16

116

17

18

136

22

21

143

26

23

135

29

26

124

33

0

20

40

60

80

100

120

140

160

Soybeans Sweet potatoes Wheat

hectogramme per hectare ('1000 hg/ha)

1961-1970 1971-1980 1981-1990 1991-2000 2001-2010 2011-2016

Source: Food and Agricultural Organization (FAO)

Biologicals for agriculture- estimated to grow at an attractive 12% CAGR between 2016 and 2020

According to Dunham Trimmer, a biological market intelligence company, the global demand for biologicals is estimated to grow to

$9.1 billion by 2020, from $5.7 billion in 2016, representing an attractive 12% CAGR. In 2016, horticulture crops accounted for

approximately 80% of the biologicals sales, while, biologicals in row crops are also expected to grow significantly in the years to

come, specifically with applications in corn and soybeans.

Exhibit 23: Plant biologicals set to grow at a 12% CAGR between 2016 and 2020 ($ billions)

$5.70

$9.10

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

$8.00

$9.00

$10.00

2016 2020

Source: Company Investor Presentation

16

Plant Health Care PLC

Plant Health Care – Comparables

We now discuss Plant Health Care’s major comparables. We have selected the following companies: Eden Research PLC, Isagro

S.p.A and Tessenderlo Group as Plant Health Care PLC’s comparables based on their products. We begin with a brief description of

the companies, followed by some key financial/valuation metrics (seen in Exhibit 24). GBP denotes the British pound while GBp

denotes the British pence.

Based on the EV/Revenue metric, PHC looks attractive compared to its closest competitor Eden Research PLC (based on market

capitalization). PHC currently trades at 3.65x EV/Revenue compared to Eden Research PLC at 11.61x EV/Revenue. Further, PHC

trades at a slight premium compared to its large market cap competitors (Isagro S.p.A and Tessenderlo Group), perhaps primarily

due to their conventional agrochemical offerings. PHC’s future growth and expansion opportunities in the form of New Technology

commercialization may imply its slightly higher valuation to its more mature competitors (Isagro S.p.A and Tessenderlo Group).

• Eden Research PLC (LON: EDEN) (“Eden”) – Eden is an AIM-listed agricultural company involved in the production

and sale of natural bioactive products for higher crop yield and crop protection. Eden has expertise in terpenes,

encapsulation and formulation technologies. Eden Research manufactures products for foliar disease control, soil pests

and post-harvest applications. The Company has a market capitalization of GBP22.65 million.

• Isagro S.p.A (LON: OESX) (“Isagro”) – Isagro is an Italian-based manufacturer of biological products for crop

protection (agropharmaceuticals). Isagro is involved in the research, production and distribution of agropharmaceuticals,

and also in the development of new molecules with low environmental impact. Isagro is listed on the London Stock

Exchange. Isagro has a presence in countries such as Australia, South Africa, Mexico and Chile. Isagro has a market

capitalization of GBP48.56 million.

• Tessenderlo Group (EBR: TESB) (“Tessenderlo”) – Tessenderlo is a Belgium based diversified industrial group

operating three business segments namely the Agro segment, Bio-valorization segment and Industrialization segment.

Tessenderlo manufactures markets and sells crop nutrients and crop protection products through its Agro segment.

Tessenderlo’s plant nutrient products are primarily focused on ensuring crop vitality. Tessenderlo is headquartered in

Belgium and sells its products worldwide. Tessenderlo has a market capitalization of GBP1.27 billion

17

Plant Health Care PLC

Exhibit 24 shows some key financial/valuation metrics of Eden Research PLC, Isagro S.p.A, Tessenderlo Group and Plant Health

Care PLC.

Exhibit 24: Financial/Valuation metrics of comparables (as of Aug 14, 2018)

Companies

Market Cap

(million)

Price

EV

(million)

EV/Revenue

1-year price chart

Eden Research PLC

(LON: EDEN)

£22.65

£0.109

£21.79

11.61x

Isagro S.p.A

(LON: 0ESX)

£48.56

£1.46

£101.93

0.77x

Tessenderlo Group

(EBR: TESB)

£1,270

£29.43

£1,350

0.91x

Plant Health Care PLC

(AIM: PHC)

£25.84

£0.149

£28.04

3.65x

Source: Yahoo! Finance and Financial Times

18

Plant Health Care PLC

Company SWOT Analysis

Strengths

Growing Commercial business

The Company’s Commercial business is generating revenues through the sale of its Harpin and Myconate products. Harpin sales

grew 42% YOY and Myconate sales grew 28% YOY in 2017.

Partnership with leading agricultural/seed companies

PHC has established partnership agreements with five top agricultural/seed companies, including the top four market leaders of the

Brazilian fungicide market. Partnership with such top agricultural companies and potential licensing of its 3G peptide platforms

potential should help PHC gain market share in the growing biologicals market space.

Patented product lines

The Company’s products are patent protected. Patents covering Harpin αβ products will continue to expire through 2027. Patents

covering Myconate will continue to expire through 2031.

Qualified and Experienced Board of Directors and Management Team

The Company’s management team has significant expertise in plant science technology and agrochemicals. The Company’s

Executive Chairman and Interim Chief Executive Officer, Dr. Christopher Richards has more than 30 years of experience in plant

technology and life science companies. This experienced management team should successfully help the Company achieve its

future goals.

Weakness

Generating loss since inception

Plant Health Care has a history of operating losses since inception. The Company raises funds from the capital markets from time to

time to meet its working capital expenditures. The Company’s loss for the year attributable to the equity holders of the parent

company was ($5.4) million during the year ended December 31, 2017. This is mainly due to the fact the Company is still growing

the scale of its business and expects to commercialize its products in the near future.

Opportunities

Brazil Sugarcane market – Harpin application

Brazil has 10 million hectares (ha) of sugarcane crop, with a 60% concentration in the state of Sao Paulo. Demonstration field trials

of the Company’s Harpin αβ product revealed average yield increases of over 20%. There is a potential for PHC to gain a 2.5%

market share in the Brazil Sugarcane agrochemical market over the next four years.

Soybean ASR control

Soybean production in Brazil was estimated at $30 billion in 2016. ASR has been devastating for soybean growers. ASR also has

developed resistance against conventional fungicide application, making it ineffective for complete ASR control. Brazilian farmers

spent $1.7 billion on fungicides in 2016. PHC’s Innatus 3G platform demonstrated significant fungus resistance in soybeans during

the initial field trials by the Company. ASR is also not expected to develop resistance to Innatus 3G due to the latter’s mode of

action. PHC, through its Innatus 3G platform, is in discussion with partners on plans for further trials in South American soybeans in

the 2018/19 season.

Threats

Competition

Currently, numerous plant biological companies operate across the world. According to Forbes, the shorter development timeline

and development costs of biological technologies over synthetic chemicals are pushing more companies into the plant biologicals

market. Forbes estimates reveal that over 500 companies operate in the Plant Biologicals segment, which constitute only 5% of the

global market for products used in crop cultivation.

19

Plant Health Care PLC

Financial Performance

The Company follows January to December as its financial year. We begin by analyzing the Company’s cash burn followed by the

financial statements. All financial amounts are in US dollars unless specified.

Exhibit 25 shows the cash burn analysis of Plant Health Care PLC. We have considered operating cash flows for cash burn analysis

as other activities are not part of its core business. The Company’s average cash burn per month stood at $598,000 with an average

survival period of 3.74 months. The Company’s investments, cash and cash equivalents stood at $3.9 million as of December 31,

2017. Further, on February 27, 2018, the Company successfully raised $6.7 million through equity issuance. Based on the current

cash and cash equivalents in hand, the Company is confident that it has sufficient liquidity to fund its working capital needs through

the fiscal year 2018 (based upon its 2018 revenue and operating expense projections). As of June 30, 2018, the Company reported

that it had cash reserves of $6.1 million.

Exhibit 25: Cash burn analysis (in $’000s)

Period/ Amount

(in '000)

Six months

ended June

2015

Six months

ended Dec 2015

Six months

ended June

2016

Six months

ended Dec 2016

Six months

ended June

2017

Six months

ended Dec 2017

AVG

Net operating cash flow

(3,828)

(3,684)

(5,054)

(4,092)

(3,155)

(1,722)

(3,589)

Net investing cash flow

2,798

1,518

4,462

(2,666)

1,211

1,385

1,451

Net financing cash flow

(6)

141

(5)

9,741

(5)

(5)

1,644

Cash position (Six

months end)

2,768

948

1,169

4,727

2,179

1,175

2,161

Burn Rate per month

(638)

(614)

(842)

(682)

(526)

(287)

(598)

Survival period (in

months)

4.34

1.54

1.39

6.93

4.14

4.09

3.74

Source: RBMG Research

Exhibit 26 shows the Company’s income statements for the year ended December 31, 2017 and 2016. The Company generated

$7.7 million revenue in 2017, a 21% increase compared to $6.3 million in 2016. This increase was driven by a strong sales growth in

the Rest of World segment, up 100% to $3.2 million from $1.6 million in 2016, partially offset by a 11% decrease in revenue from the

Mexican segment ($2.9 million in 2017 from $3.2 million in 2016). Gross profits increased by 22% to $4.7 million for the year ended

December 2017, compared to $3.9 million for the same period in 2016. Gross margins were steady at 61.6% in 2017, a marginal

0.1% increase. Operating loss narrowed to $5.8 million in 2017, a 49% decrease compared to 2016. This was due to lower

administrative expenses in 2017, which fell by approximately 75% compared to 2016. Excluding the exceptional costs incurred in

2016 relating to a potential US listing ($1.2 million) and a non-cash decrease in the value of loans (loss of $1.5 million in 2016

compared to a gain of $1.3 million in 2017), cash operating expenses fell by approximately 5% in 2017, compared to 2016. Further,

net loss for the year attributable to the equity holders of the Company in 2017 narrowed to $5.4 million, a 51% decrease compared

to $11.2 million in 2016.

Exhibit 26: Income Statements for year ended December 31, 2017 and 2016 (in $’000s)

Particulars

For the year ended December

31, 2017

For the year ended December

31, 2016

Y-o-Y

(%)

Revenue

$7,685

$6,329

21%

Cost of sales

($2,953)

($2,436)

21%

Gross profit

$4,732

$3,893

22%

Research and development expenses

($5,127)

($4,485)

14%

Business development expenses

($623)

($954)

-35%

Sales and marketing expenses

($2,995)

($2,518)

19%

Administrative expenses

($1,788)

($7,286)

-75%

Operating loss

($5,801)

($11,350)

-49%

Finance income

$87

$52

67%

Finance expense

($2)

($2)

0%

Loss before tax

($5,716)

($11,300)

-49%

Income tax credit

$262

$83

216%

Loss for the year attributable to the equity holders of the parent

company

($5,454)

($11,217)

-51%

Other comprehensive income

Items which will or may be reclassified to profit or loss:

Exchange difference on translation of foreign operations

($1,282)

$1,393

-192%

Total comprehensive loss for the year attributable to the equity

holders of the parent company

($6,736)

($9,824)

-31%

Basic and diluted loss per share

($0.04)

($0.11)

-64%

Source: Company filings

20

Plant Health Care PLC

Exhibit 27 displays the balance sheets, as of December 31, 2017 and December 31, 2016. As of December 31, 2017, the

Company’s cash and cash equivalents stood at $1.2 million compared to $4.7 million on December 31, 2016. The decrease was

primarily due to no issuance of shares in the year ended December 31, 2017, compared to a $9.7 million equity issuance in the year

ended December 31, 2016. Working capital decreased $5.3 million as of December 31, 2017 compared to December 31, 2016.

Exhibit 27: Balance Sheets as of December 31, 2017, and December 31, 2016 (in $’000s)

As at December 31, 2017

As at December 31, 2016

Y-o-Y (%)

Assets

Non-current assets

Intangible assets

$1,898

$2,162

-12%

Property, plant and equipment

$968

$1,236

-22%

Trade and other receivables

$134

$131

2%

Total non-current assets

$3,000

$3,529

-15%

Current assets

Inventories

$1,536

$1,245

23%

Trade and other receivables

$4,668

$3,284

42%

Investments

$2,719

$5,349

-49%

Cash and cash equivalents

$1,175

$4,727

-75%

Total current assets

$10,118

$14,605

-31%

Total assets

$13,118

$18,134

-28%

Liabilities

Current liabilities

Trade and other payables

$2,879

$2,088

38%

Finance leases

$8

$8

0%

Total current liabilities

$2,887

$2,096

38%

Non-current liabilities

Finance leases

-

$7

NM

Total non-current liabilities

-

$7

NM

Total liabilities

$2,887

$2,103

37%

Total net assets

$10,231

$16,031

-36%

Share capital

$2,237

$2,237

Share premium

$79,786

$79,786

Foreign exchange reserve

($389)

$893

-144%

Accumulated deficit

($71,403)

($66,885)

7%

Total equity

$10,231

$16,031

-36%

Source: Company filings

21

Plant Health Care PLC

Exhibit 28 shows Plant Health Care’s cash flow statements for the year ended December 31, 2017 and 2016. The Company’s

operating cash outflow flow decreased to $4.9 million in the year ended December 31, 2017, compared to $9.1 million in the year

ended December 31, 2016. This was primarily due to the decrease in net loss in the year ended December 31, 2017 compared to

the same period a year ago. Net cash provided by investing activities was $2.6 million in the year ended December 31, 2017, due to

the sale of money market and fund investments. Net cash provided by financing activities was zero in the year ended December 31,

2017, compared to $9.7 million in the year ended December 31, 2016.

Exhibit 28: Cash Flow Statement for the year ended December 31, 2017 and December 30, 2016 (in $’000s)

Particulars

For the year ended December 31,

2017

For the year ended December 31,

2016

Y-o-Y (%)

Cash flows from operating activities

Loss for the year

($5,454)

($11,217)

-51%

Adjustments for:

Depreciation

$393

$359

9%

Amortization of intangibles

$264

$273

-3%

Share-based payment expense

$936

$1,063

-12%

Finance income

($87)

($52)

67%

Finance expense

$2

$2

0%

Income taxes credit

($262)

($83)

216%

(Increase)/decrease in trade and

other receivables

($1,024)

$1,145

-189%

Gain on disposal of fixed assets

($4)

($14)

-71%

(Increase)/decrease in inventories

($291)

$146

-299%

Increase/(decrease) in trade and

other payables

$771

($973)

-179%

Income taxes paid

($121)

$205

-159%

Net cash used in operating

activities

($4,877)

($9,146)

-47%

Investing activities

Purchase of property, plant and

equipment

($125)

($469)

-73%

Sale of property, plant and

equipment

$4

$71

-94%

Finance income

$87

$52

67%

Purchase of investments

($2,258)

($7,918)

-71%

Sale of investments

$4,888

$10,060

-51%

Net cash provided by investing

activities

$2,596

$1,796

45%

Financing activities

Finance expense

($2)

($2)

0%

Issue of ordinary share capital

-

$9,747

Repayment of finance lease

principal

($8)

($9)

-11%

Net cash (used)/provided by

financing activities

($10)

$9,736

-100%

Net (decrease)/increase in cash

and cash equivalents

($2,291)

$2,386

-196%

Effects of exchange rate changes

on cash and cash equivalents

($1,261)

$1,393

-191%

Cash and cash equivalents at the

beginning of period

$4,727

$948

399%

Cash and cash equivalents at the

end of period

$1,175

$4,727

-75%

Source: Company filings

22

Plant Health Care PLC

Key Risk Factors

Financial risk

Since inception, the Company has a history of generating losses. Plant Health Care raises funds periodically to fund its working

capital and development activities. If the Company were unsuccessful in raising capital in a timely manner, it would severely impede

its commercial operations as well as research and development activities.

Credit risk

Plant Health Care sells majority of its products through credit sales. The ability of the customers to repay PHC on time is partly

dependent on several macroeconomic factors such as economic strength of the industry and the geographic area in which it

operates. Failure to successfully collect money from credit sales could potentially affect the Company’s financial condition.

Dependence on employees and officers

Plant Health Care’s ability to compete and potential success is highly dependent on retaining its key qualified personnel. Inability to

retain such key personnel and attract new talents could hinder the Company’s business activities.

Commercialization risk

The licensing of PHC’s PREtec technology depends on the evaluation partner’s interest in conversion to a formal commercial offer.

Any uncertainties in partner evaluation could potentially lead to a slowdown in PREtec commercialization.

Regulatory risk

The Company has to obtain regulatory approvals and abide by the current rules and regulations governing them. Inability to follow

such regulations could delay the sales of its products, and even hinder the development of its potential products.

Shareholding Pattern

As of May 30, 2018, the Company has 184.8 million fully diluted shares including stock options. Exhibit 29 and 30 show the capital

structure and details of the major shareholders respectively.

Exhibit 29: Share capitalization, as of May 30, 2018

Particulars

Millions

Total Shares outstanding

172,822,881

Stock Options

12,037,060

Total fully diluted shares

184,859,941

Source: Plant Health Care PLC Investor Presentation

Exhibit 30: Major shareholder summary, as of March 2, 2018

Shareholder

% of holding

Mr. Richard I Griffiths

36.71%

1798 Volantis

20.64%

Boulder River Capital Corp

7.32%

Polar Capital

6.97%

Source: Plant Health Care PLC Investor Presentation

23

Plant Health Care PLC

Profile of Directors and Management

Dr. Christopher Richards, Executive Chairman and Interim Chief Executive Officer

Dr. Christopher Richards is the Executive Chairman and Interim Chief Executive Officer of Plant Health Care. He has more than 30

years of experience in technology and life sciences. He has held several senior level positions at various companies located in

South America, Europe and Asia. From 2003 to 2015, he held various leadership positions at Arysta LifeScience, a global

agrochemical company. He has worked at companies namely Dechra Pharmaceuticals PLC, Cibus Global, Ltd. and Bio Products

Laboratory Ltd. Dr. Richards completed his Masters in Zoology in 1975 and Ph.D. in Ecology in 1980 from St. John’s College,

Oxford University.

Michael J. Higgins, Senior Independent Director

Mr. Michael J. Higgins is a Senior Independent Director of the Company. He has over 25 years of expertise in advising companies to

achieve high growth in the marketing service and technology sectors. From 1996 to 2006, he was a partner of KPMG LLP. From

2006 to 2011, he worked as a Senior Adviser at KPMG. He worked at Saudi International Bank and was an accountant with PwC.

From November 2013 to October 2016, Mr. Higgins worked as a Non-Executive Director at Arria NLG PLC. He holds a Masters in

Economics and Politics from Cambridge University.

Dr. Richard H. Webb, Executive Director

Dr. Richard H. Webb is an Executive Director of Plant Health Care. In 1995, he founded StepOut Ltd, a consultancy business firm.

From 2012 to 2014, he played an important role in developing the Company’s new business strategy and New Technology program.

He holds a doctorate in pest biology from the London School of Hygiene & Tropical Medicine.

William M. Lewis, Non-executive Director

Mr. William M. Lewis is a Non-executive Director of the Company. He has held several senior positions at various companies

namely Syngenta Crop Protection, Arysta LifeScience and Zeneca/ICI. He is the Chair of the Remuneration Committee and a

member of the Audit Committee.

24

Plant Health Care PLC

Sources

• Company Website

• Company Press Release & Presentations

• UN Department of Economic and Social Affairs

• Food and Agricultural Organization (FAO)

• Dunham Trimmer

• Yahoo! Finance

• Financial Times

• Forbes

• E. C. 2006. Crop losses to pests and Cassman, K. G. 1999. Ecological intensification of cereal production systems: yield

potential, soil quality, and precision agriculture.

Disclaimer

The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to

meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or

solicitation of an offer to buy or sell any security. To the fullest extent of the law, RB Milestone Group LLC (“RBMG”), its staff, specialists, advisors,

principals and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of any information

provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to

any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or

incompleteness of such information). Investors are expected to take full responsibility for any and all of their investment decisions based on their

own independent research and evaluation of their own investment goals, risk tolerance, and financial condition. Investors are further cautioned that

small-cap and microcap stocks have additional risks that may result in trading at a discount to their peers. Liquidity risk, caused by small trading

floats and very low trading volume can lead to large spreads and high volatility in stock price. Small-cap and microcap stocks may also have

significant company-specific risks that contribute to lower valuations. Investors need to be aware of the higher probability of financial default and

higher degree of financial distress inherent in the small-cap and microcap segments of the market. The information, opinions, data, quantitative and

qualitative statements contained herein have been obtained from sources believed to be reliable but have not been independently verified and are

not guaranteed as to accuracy, nor does it purport to be a complete analysis of every material fact regarding RBMG client companies, industries, or

securities. The information or opinions are solely for informational purposes and are only valid as of the date appearing on the report and are subject

to change without notice. Statements that are not historical facts are "forward-looking statements" that involve risks and uncertainties. "Forward

looking statements" as defined under Section 27A of the Securities Act of 1933, Section 21B of the Securities Exchange Act of 1934 and the Private

Securities Litigation Act of 1995 include words such as "opportunities," "trends," "potential," "estimates," "may," "will," "could," "should," "anticipates,"

"expects" or comparable terminology or by discussions of strategy. These forward-looking statements are subject to a number of known and

unknown risks and uncertainties outside of the company's or our control that could cause actual operations or results to differ materially from those

anticipated. Factors that could affect performance include, but are not limited to those factors that are discussed in each profiled company's most

recent reports or company filings or registration statements filed with the SEC or other actual government regulatory agency. Investors should

consider these factors in evaluating the forward-looking statements contained herein and not place undue reliance upon such statements. Investors

are encouraged to read investment information available at the websites of Plant Health Care PLC (“PHC”) at www.planthealthcare.com and the

SEC at http://www.sec.gov and/or FINRA at http://www.finra.org and/or other actual government regulatory agency. RBMG is a US-based consulting

firm and is hired by client companies globally to carry out consulting services that include: corporate strategy formation, business development,

market intelligence and research. RBMG is not a FINRA member or registered broker/dealer. RBMG research reports and other proprietary

documents or information belonging to RBMG are not to be copied, transmitted, displayed, distributed (for compensation or otherwise), or altered in

any way without RBMG's prior written consent. Over time, RBMG has received cash fees equal to sixty five thousand USD from Plant in exchange

for RBMG consulting services. In this case, consulting services consist of corporate strategy formation, business development, market intelligence

and research. These services include the preparation of this report and RBMG helping Plant communicate its corporate characteristics to applicable

investment and media communities. In addition, RBMG and/or its respective affiliates, contractors, principals or employees may buy, sell, hold or

exercise shares, options, rights, or warrants to purchase shares of Plant at their lawful discretion and this can happen at any time.