Financial Aid Terms and Conditions

2023-2024

Introduction________________________________________________________

The purpose of this guide is to provide an overview of financial aid policies and procedures that must be followed to receive financial

aid at Longwood University. Financial aid includes grants, loans, work-study, and scholarship programs funded by federal and state

governments, educational institutions, and private organizations. The purpose of financial aid is to assist individuals in obtaining an

education that otherwise does not have the resources to do so. Additional financial aid information is available on the Office of

Financial Aid website at www.longwood.edu/financialaid/.

Financial Aid Disclaimer

The Office of Financial Aid (OFA) at Longwood University is committed to helping students obtain the maximum financial assistance

possible. However, students must assume responsibility for complying with all requirements necessary to process their financial aid.

Additionally, the Office of Financial Aid is not responsible for any student’s financial obligations to Longwood. You must ensure that

your financial obligations to the university are properly met.

Financial Aid packages are based on current funding. If the availability of funds causes an increase or a decrease in your financial aid

package, you will be emailed a revised package notification. Aid packages are based on full-time enrollment per semester for

undergraduates and six credits per semester for graduates. If you retake courses that you previously passed, your enrollment for

financial aid eligibility may be affected (please see section on Retaking Coursework for more details). Enrollment in fewer credits

than the number of credits used in establishing award eligibility may result in a reduction in one or more financial aid awards. You

must be at least half-time to receive most types of federal aid (with the exception of the Pell grant). To be considered half-time,

undergraduates must be enrolled in at least six credit hours, and graduates must be enrolled in at least three credit hours.

Applying for Financial Aid_________________________________________________________

To be considered for financial aid, you must complete the Free Application for Federal Student Aid (FAFSA). You can file the

FAFSA at www.studentaid.gov. On the FAFSA, you should list Longwood University, code 003719, to receive your application.

Longwood will receive your data electronically from the United States Department of Education and will be able to calculate your aid

eligibility.

The Virginia Alternative State Aid Application (VASA) is an alternative option to the Free Application for Federal Student Aid

(FAFSA) for Virginia students who are nonimmigrants, undocumented, have Deferred Action for Childhood Arrivals (DACA) status,

or are otherwise ineligible to file the FAFSA and would like to be considered for financial aid. The VASA application provides

access to state grant eligibility, and if available, need-based institutional funds.

Longwood’s priority filing date is March 1. Remember, grant funds are limited and are expended quickly. File on time to ensure full

consideration.

Also, you must be accepted for admission to a Longwood degree or an initial teaching licensure program before a financial aid

package will be offered.

Once the Office of Financial Aid receives your FAFSA or VASA results, your financial aid package information will be posted to

your myLongwood account. Notifications will be emailed to new students in early spring. Returning students will receive a

notification via Longwood email. In addition, other documents may be requested from you during the process. You generally have 30

days to respond to these requests before any aid is canceled.

Renewal of Financial Aid _____________________________________________________________

Financial aid offers from Longwood University are not automatically renewed yearly. A FAFSA or VASA must be submitted each

academic year. Longwood University’s priority filing date is March 1 to be considered for State funds. See Financial Aid Programs

for renewal eligibility for each aid program.

How Financial Aid is Awarded _______________________________________________________

The following calculation determines your overall eligibility for financial aid:

2

Cost of Attendance (COA)

- Expected Family Contribution (EFC)

= Financial Need

The Expected Family Contribution (EFC) is calculated by the U.S. Department of Education as prescribed by the United States

Congress. The data submitted on the FAFSA is used to determine your EFC. You will see the result on the Student Aid Report (SAR)

that you will receive after your FAFSA is processed.

Once your need is determined, a financial aid offer is prepared from the aid programs that are available. Based on eligibility,

applicants will be considered for all forms of financial aid from programs with available funds. The criteria for selection will vary

with the level of funding for each program, the program guidelines, and your level of financial need.

Full-time status (enrollment level) all initial financial aid awards are based on the assumption that students will be enrolled full-

time in the fall and spring semesters. If you are not full-time, then aid will be recalculated based on the lesser enrollment. It is possible

for aid delivery to less than full-time students to be delayed. Early notification to our office of a change in this assumption can help

eliminate some of this delay. With the exception of the Federal Pell Grant and Private loans, you cannot receive financial aid for less

than half-time enrollment. The following represents the number of semester credit hours for each financial aid enrollment level:

Undergraduate Students

Full-time = 12 credit hours or more

Three-quarter time = 9-11 credit hours

Half-time = 6-8 credit hours

Graduate Students

Full-time = 6 credit hours

Three-quarter time = 4-5 credit hours

Half-time = 3 credit hours

These enrollment levels apply for financial aid eligibility in all semesters (i.e., fall, spring, and summer).

Class Level

This is a factor when determining Federal Direct Loan limits. Limits on these loans are partially determined by your class level. If you

progress or regress a class level, then financial aid eligibility may change. For example, in fall 2023 a dependent freshman is eligible

for no more than $5,500 in a Direct Loan for the award year, while a dependent sophomore is eligible for no more than $6,500 for the

same period. Students progressing a grade level after being awarded and who would like to be reviewed for a Direct Loan based on

the higher grade level must contact The Office of Financial Aid to make this request. Direct Loans are not automatically increased

based on a grade level progression within an academic year. You can view your residency status and class level on your myLongwood

account.

Living Plans

You may receive different award amounts based on your living situation. Your award will be the same if you live in the residence

halls or off-campus without parents or relatives. However, eligibility is different if you live at home with your parents or relatives.

Outside Aid

Federal and state regulations require us to consider outside sources of financial assistance when awarding aid. Outside aid can

be scholarships (Longwood or private), tuition waivers, veteran benefits, etc. If your Financial Aid award does not list any outside aid,

then we were unaware of any when your award was made. The addition of later outside aid may cause a reduction to an existing

financial aid award if it creates an over-award.

Over-award

An over-award can be created in two ways. The first is when a student has more “need-based” financial aid than calculated need.

Need-based aid includes grants, many scholarships, Subsidized Direct Loans, Work-Study, and potentially some forms of third-party

aid. Financial aid not considered “need-based” can include Unsubsidized Direct Loans, Parent PLUS Direct Loans, Grad PLUS Direct

Loans, merit-based scholarships, and potentially some forms of third-party aid. The second type of over-award is when a student

receives assistance from all sources that exceed the cost of attendance.

Financial Aid Need Example:

$12,000 Cost of Attendance (COA) developed by the school

- $3,000 Expected Family Contribution (EFC) from the FAFSA

= $9,000 Demonstrated Financial Need

3

This student can receive up to $9,000 in “need-based” financial aid. Any amount over $9,000 is considered an over-award situation.

Applicable federal, state, institutional, and/or third-party rules may require a reduction to the student’s financial aid package to keep

the student within the $9,000 need level. Additionally, this student cannot receive more than $12,000 in financial aid from all sources.

Any amount over $12,000 is considered an over-award situation and may require a reduction to the student’s financial aid package to

ensure the total does not exceed $12,000.

If any of the above information is incorrect or changes, students are urged to contact the Financial Aid Office as soon as possible. The

sooner the aid office learns of any changes, the sooner your financial aid eligibility can be reviewed. It is preferable to do this before

financial aid or outside aid is credited to your student account. If it is done later, you may be asked to repay federal or state funds you

have already received.

Beginning Enrollment

Students must begin attendance or participate in an academically related activity in the classes for which they are awarded aid to

establish eligibility for financial aid funds. For example, if a student is awarded financial aid based on 12 credit hours of enrollment

but only begins attendance in nine hours, the financial aid awarded for that enrollment period may be adjusted from a full-time level to

a three-quarter time level. This means it is possible for students to receive a financial aid disbursement only to have later all or part of

it canceled after the process of verifying attendance takes place. It should be noted that regulations prohibit a student from self-

certifying attendance. Verification of attendance can only be secured from official Longwood University sources, such as a faculty

member.

Summer Financial Aid

Financial aid for the summer term will be based on the current year’s FAFSA.

The Office of Financial Aid will email students regarding their summer aid eligibility. We begin posting summer aid at the end of

April and continue throughout the summer.

Generally, students must be enrolled at least half-time to receive summer aid:

• Six credit hours for undergraduate students (students may receive a Federal Pell Grant if registered for three credits if

remaining eligibility)

• three credit hours for graduate students

• Courses taken for audit are not eligible for financial aid.

Cost of Attendance (COA) 2023-24

The estimated cost of attendance (COA) for the period covered by the financial aid package provides allowances for tuition and fees,

housing and meals, books and supplies, transportation expenses, and miscellaneous expenses. Total allowances depend on the

student’s lifestyle choices, housing plans, and credit hours that are taken during the academic year.

Undergraduate/Full-time/On-campus

VIRGINIA RESIDENTS

Tuition & Fees

$15,048

Housing & Meals

$15,887

Books & Supplies

$1,240

Transportation

$1,166

Miscellaneous / Personal

$1,570

Loan Fees

$68

Total Estimated Cost of Attendance

$34,979

NON-VIRGINIA RESIDENTS

Tuition & Fees

$27,594

Housing & Meals

$15,887

Books & Supplies

$1,240

Transportation

$1,166

Miscellaneous / Personal

$1,570

Loan Fees

$68

Total Estimated Cost of Attendance

$47,525

4

Graduate/Full-time/Off-campus

VIRGINIA RESIDENTS

Tuition & Fees

$5,544

Housing & Meals

$15,887

Books & Supplies

$492

Transportation

$1,736

Miscellaneous / Personal

$1,570

Loan Fees

$152

Total Estimated Cost of Attendance

$25,381

NON-VIRGINIA RESIDENTS

Tuition & Fees

$13,284

Housing & Meals

$15,887

Books & Supplies

$492

Transportation

$1,736

Miscellaneous / Personal

$1,570

Loan Fees

$152

Total Estimated Cost of Attendance

$33,121

Graduate MBA/ HPE Full-time/Off-campus based on full-time

VIRGINIA RESIDENTS

Tuition & Fees

$5,112

Housing & Meals

$15,887

Books & Supplies

$492

Transportation

$1,736

Miscellaneous / Personal

$1,570

Loan Fees

$152

Total Estimated Cost of Attendance

$24,949

NON-VIRGINIA RESIDENTS

Tuition & Fees

$5,232

Housing & Meals

$15,887

Books & Supplies

$492

Transportation

$1,736

Miscellaneous / Personal

$1,570

Loan Fees

$152

Total Estimated Cost of Attendance

$25,069

SLP On-Line Prerequisites Program/Full-time/Off-campus

VIRGINIA RESIDENTS

Tuition & Fees

$7,104

Housing & Meal Plans

$15,887

Books & Supplies

$1,240

Transportation

$1,166

Miscellaneous / Personal

$1,570

Loan Fees

$68

Total Estimated Cost of Attendance

$27,035

NON-VIRGINIA RESIDENTS

Tuition & Fees

$9,024

Housing & Meals

$15,887

Books & Supplies

$1,240

Transportation

$1,166

Miscellaneous / Personal

$1,570

Loan Fees

$68

Total Estimated Cost of Attendance

$28,955

5

Estimated Awards and Verification of Application Information___________________

Your application for federal student aid may be selected for a process known as verification. This means that OFA must verify the

accuracy of the information you submitted on the FAFSA. If selected, you must submit a verification worksheet, a signed copy of a

tax return or transcript(s), and or an account transcript or signed 1040X (for an amended return) for both student and parents or use the

IRS data retrieval tool. Non-filers must submit alternative supporting documentation such as verification of non-filing letter from the

IRS and/or W-2’s etc. Occasionally, a student may be selected for verification after a package is made. Financial aid will not be

final/disburse to your student account until verification is completed.

Returning students will be notified by email if they have been selected for verification. You will normally have 30 days to submit the

required verification documents. If any of the data reported on the FAFSA is found to be incorrect, your financial aid eligibility will

be recalculated. You will be sent a financial aid award notification once verification is complete.

Before verification is conducted, freshman and incoming transfer students receive an estimated financial aid offer. Estimated aid offers

are typically canceled at least one week before the admitted term's billing date. Upon verification completion, a revised award notice

will be emailed to the student's Longwood University email address. If a freshman or incoming transfer students are selected for

verification after May 1

st

. an official award notice will not be generated until verification is complete.

Eligible Programs of Study___________________________________________________________

To be eligible for federal aid, a student must be a regular student as defined in 34 CFR 668.32. A regular student is defined as “A

person who is enrolled or accepted for enrollment at an institution for the purpose of obtaining a degree, certificate, or other

recognized education credential offered by the institution.” Therefore, students are ineligible to receive Title IV assistance for credit

hours/course work which will not count towards the completion of their degree program requirements.

While the federal rule may allow for financial aid to be awarded to students in certificate programs, Longwood University does not

have any certificate programs that fall under this provision. Students enrolled in the Initial Teaching Licensure program are eligible

for federal aid consideration, as technically, this is not a certificate program at Longwood University.

Audited courses cannot be counted towards a student’s enrollment level for financial aid purposes.

Financial Aid Programs_______________________________________________________________

Federal Pell Grant

A federal grant provided by the federal government to

undergraduate students who demonstrate exceptional financial

need and have an Expected Family Contribution (EFC) below

a certain threshold established by the federal government. The

Pell Grant award amount is prorated based on enrollment

status. Federal Pell Grants do not need to be repaid or

accepted. This award may be renewed, but not automatically,

each year based on your FAFSA eligibility. Students working

on their first bachelor’s degree with a qualifying Expected

Family Contribution (EFC) and who are meeting the general

eligibility requirements for Title IV financial aid may be

considered for this grant.

Federal Supplemental Educational Opportunity Grant

(FSEOG)

A federal grant awarded by the institution to qualified

undergraduate students who demonstrate exceptional financial

need. Priority is given to Federal Pell Grant

recipients. FSEOG does not have to be repaid or accepted.

Awards will be made to undergraduate students pursuing their

first bachelor’s degree with a $0 Expected Family

Contribution (EFC) prior to any other student group. Funds are

limited in this account, so awards will be made as long as

funds remain available.

Commonwealth of Virginia Program

The VA Commonwealth Award is a need-based grant offered

to Virginia residents. Eligibility is determined each year based

on the information from your FAFSA or VASA. In addition to

demonstrated financial need, students must maintain at least

half-time enrollment (minimum six credits per semester).

Awards will be reduced for students taking fewer than 12

credits.

VA Guaranteed Assistance Program (VGAP)

VGAP is a need-based grant awarded to Virginia residents.

Eligibility is determined each year based on the information

from your FAFSA or VASA. In addition to demonstrated

financial need, students must maintain continuous full-time

enrollment (minimum 12 credits per semester), maintain a 2.0

cumulative GPA, and advance a grade level each year.

Students may receive VGAP for one year per grade level.

6

Merit Scholarship

Scholarships offered through the admissions acceptance

letter are renewable. Students may receive the scholarship

for up to four years (eight semesters) if they successfully

earned at least 30 credits in the first year, 60 cumulative

credits in the second year, and 90 cumulative credits in the

third year (inclusive of transfer credits), and maintain a

3.0 cumulative GPA.

Athletic Grant

These awards are determined by the Athletics Department.

College Work-Study

Longwood provides employment opportunities for students.

This program is for those students who do not have a

demonstrated financial need, or do not receive a Federal Work

Study award, and have an interest in working. Students can

apply for positions through Canvas at:

https://canvas.longwood.edu/

International Studies Grant

A limited number of grants are available for students

participating in study abroad programs. Contact the

International Studies Office for award eligibility criteria.

Veterans Assistance

All programs available to veterans/children are administered

through the Registrar’s Office. If you are eligible for

assistance through these programs, please contact the

Registrar’s Office. Questions concerning eligibility may be

directed to the Veterans Administration by calling 1-

888GIBILL-1.

Outside Scholarship

If you are receiving an outside scholarship, you are required to

notify the Office of Financial Aid. Scholarships will be used

to reduce any unmet need and/or any need-based work/loans

before reducing need-based grants.

DC Tuition Assistance Program

The Washington DC College Access Act of 1999 created the

DC Tuition Assistance Program which provides tuition

subsidies to DC residents to attend colleges in Virginia. The

program will pay the difference between in-state and out-of-

state tuition, up to $10,000 per year (with a lifetime cap of

$50,000 per student). For additional eligibility information

and applications, contact the Office of the State

Superintendent of Education at (877) 485-6751.

Federal Direct Student Loan

Loans must be repaid with interest, and payments will not

begin until six months after a student graduates or stops

attending half time. Subsidized loans do not accrue

interest while the student is in school or during the six-

month grace period. Unsubsidized loans do accrue interest

while the student is in school.

Federal Direct PLUS Loan

PLUS loans are credit-based loans available to parents and

graduate students to help pay educational expenses.

Federal Work-Study

This program is for those students who do have a financial

need. Students can apply for positions through Canvas at:

https://canvas.longwood.edu/ Federal work-study does not pay

towards the student’s account. Student workers will be paid

bi-weekly for hours worked, and it is highly recommended to

sign up for direct deposit. Students are not required to accept

Federal work-study, it is optional. If Federal work-study is

included as part of your financial aid, the amount offered is

the maximum you may earn. Exceptions can be made if a

student would like to earn more.

Federal TEACH Grant

The Federal Teacher Education Assistance for College and

Higher Education (TEACH) Grant program is a federal grant

program available to graduate students that requires a service

agreement and converts to a loan if the terms of the service

agreement are not met. TEACH Grant funds may only be used

for a student's first graduate degree.

Longwood Foundation Scholarships

Student who are currently enrolled may be eligible for a

Longwood Foundation scholarship. Details about the process

and deadlines, visit the Longwood Foundations Scholarship

page.

Phi Theta Kappa Transfer Scholarship

Scholarships are available each fall to Phi Theta Kappa

members who transfer to Longwood University. Availability

depends on the number of renewed scholarships. The selection

criteria is based on merit and needed. To apply contact the

Office of Financial Aid.

Two-Year College Transfer Grant

The Two-Year College Transfer Grant is available to Virginia

Residents who have received an Associate Degree at a

Virginia two-year public institution. Students must be enrolled

full-time at a Virginia four-year school within the year after

completing the Associate Degree program, have an EFC of

$12,000 or less, and maintain a 3.0 cumulative GPA. Awards

are limited to three years or 70 credits, and students must meet

the priority filing date of March 1.

7

Federal Teach Grant ___________________________________________________________________

The Federal Teacher Education Assistance for College and Higher Education (TEACH) Grant program is a federal grant program

available to graduate students that requires a service agreement and converts to a loan if the terms of the service agreement are not

met. TEACH Grant funds may only be used for a student's first graduate degree.

The Federal TEACH Grant allows up to $4,000 per year for full-time graduate students. Students who enroll in the summer term may

be eligible for up to and additional $2,000. Amounts are prorated according to enrollment levels per term. The total amount of

TEACH Grant a graduate student may receive is $8,000.

Service Agreement In exchange for receiving a Federal TEACH Grant, you must agree to serve as a full-time teacher in a high-need

field, in a school that serves low-income students (see below for more information on high-need fields and schools serving low-

income students). Recipients of a Federal TEACH Grant must teach for at least four years within eight years of completing the

program of study for which the Federal TEACH Grant was received.

IMPORTANT: If you fail to complete this service obligation, the U.S. Department of Education will convert all Federal TEACH

Grants funds you received to a Federal Direct Unsubsidized Loan. You must then repay this loan to the U.S. Department of

Education. You will be charged interest from the date the grant(s) disbursed.

Student Eligibility Requirements for Federal TEACH Grant

• Complete the Free Application for Federal Student Aid (FAFSA) - you do not have to demonstrate financial need

• Be a U.S. citizen or eligible non-citizen

• Be enrolled as a graduate student in a Federal TEACH Grant eligible program

• Meet certain academic requirements (generally, scoring above the 75th percentile on a college admissions test or maintaining

a cumulative GPA of at least 3.25)

• Sign a Federal TEACH Grant Agreement to Serve (ATS)

• High Needs Fields

o Mathematics

o Science

o Foreign Language

o Bilingual Education and English Language Acquisition

o Special Education

o Reading Specialist

TEACH eligible Programs at Longwood University:

Master of Science-Education

o Elementary and Middle School Mathematics

o Special Education General Curriculum Plus One

o Reading, Literacy & Learning

o Special Education General Curriculum Initial Licensure

o Special Education General Curriculum Fifth Year – Liberal Students/Special Education

What to do if you believe you qualify and are interested in the Federal TEACH Grant If you meet the requirements, you will

receive an invitation to participate in the TEACH Grant program. We will send information on the required grant counseling which

will explain the commitment you are making by accepting this grant. You will then be required to sign an "Agreement to Serve"

contract with the federal government before the funds are disbursed to your account.

Loans___________________________________________________________________________________

The U.S. Department of Education’s federal student loan program is the William D. Ford Direct Loan (Direct Loan) Programs.

Under this program, the U.S. Department of Education is your lender. There are four types of Direct Loans available:

• Direct Subsidized Loans, are loans made to eligible undergraduate students who demonstrate financial need.

o The U.S. Department of Education pays the interest on a Direct Subsidized loan, while you are in school at least

half-time, for the first six months after you leave school (referred to as a grace period) and during a period of

deferment.

• Direct Unsubsidized Loans, are loans made to eligible undergraduate and graduate students, and eligibility is not based on

financial need.

8

o You are responsible for paying the interest on a Direct Unsubsidized Loan during all periods.

• Direct PLUS Loans, are loans made to graduate students or parents of dependent students to help pay for education

expenses not covered by other financial aid. Eligibility is not based on financial need; but a credit check is required.

Borrowers who have an adverse credit history must meet additional requirements to qualify.

o The borrower is responsible for paying the interest on a Direct PLUS Loan during all periods. The maximum PLUS

loan amount you can received is the cost of attendance (determined by the school) minus any other financial aid

received.

• Direct Consolidation Loans (after graduation)

Direct Loan Interest Rates

Direct Subsidized and Direct Unsubsidized

Loan (Undergraduate)

First disbursement on or after July 1, 2023 and

before July 1, 2024

Interest Rate 5.50%

Direct Unsubsidized Loan (Graduate)

First disbursement on or after July 1, 2023 and

before July 1, 2024

Interest Rate 7.05%

Direct PLUS Loan

First disbursement on or after July 1, 2023 and

before July 1, 2024

Interest Rate 8.05%

Direct Loan Origination Fees

Loan fees are charged to originate a student loan and are calculated as a percentage of the total loan amount. The loan fees are

deducted proportionately from each loan disbursement. The loan fee is subtracted directly from the loan before it is disbursed to you.

Direct Subsidized and Direct Unsubsidized

Loan (Undergraduate)

First disbursement on or after October 1, 2023

and before October 1, 2024

Origination Fee 1.057%

Direct Unsubsidized Loan (Graduate)

First disbursement on or after October 1, 2023

and before October 1, 2024

Origination Fee 1.057%

Direct PLUS Loan

First disbursement on or after October 1, 2023

and before October 1, 2024

Origination Fee 4.228%

Direct Loan Annual (yearly) Limits

The U.S. Department of Education sets a maximum annual amount a student can borrow. An award at Longwood University consists

of fall, spring, and summer, in that order. The amounts below are the federal mandated maximum amounts. It is important to note that

not all students within the prescribed grade levels will be eligible for the maximum amount, as there are many other factors that

determine a student’s eligibility.

Dependent (defined by the FAFSA) undergraduate student annual limits for the school year are:

• $5,500 for freshmen (no more than $3,500 subsidized)

• $6,500 for sophomores (no more than $4,500 subsidized)

• $7,500 for juniors and seniors (no more than $5,500 subsidized)

Independent (as defined by the FAFSA) undergraduate student annual limits for the school year are:

• $5,500 for freshmen (no more than $3,500 subsidized), and $4,000 additional unsubsidized

• $6,500 for sophomores (no more than $4,500 subsidized) and $4,000 additional unsubsidized

• $7,500 for juniors and seniors (no more than $5,500 subsidized) and $5,000 additional unsubsidized

Graduate (as defined by the FAFSA) student annual limits for a school year are:

• $20,500 Direct Unsubsidized Loan

Direct Loan Aggregate Limits

The U.S. Department of Education has established aggregate loan limits for students borrowing from the Direct Loan programs. A

dependent undergraduate student can borrow no more than $31,000 in Direct Loans, with no more than $23,000 being subsidized. An

independent undergraduate student can borrow no more than $57,500 in Direct Loans, with no more than $23,000 being subsidized. A

dependent undergraduate with parents who are not eligible to borrow a Direct Parent PLUS loan holds the same limits as an

independent undergraduate. A graduate student can borrow no more than $138,500 in Unsubsidized Federal Direct Loans.

9

Prorating Annual Loan Limits

Federal regulations require that when an undergraduate student is enrolled in a program that is one academic year or more in length

but is in a remaining period of study that is shorter than a full academic year, their Federal Direct Loan amount must be prorated.

Students who graduate in fall term (or who enroll in spring term only during the academic year and graduate) will have their Federal

Direct Loans prorated during their final semester. The loan limit proration determines the maximum loan amount that a student may

borrow for the final term of study based on the degree they are earning.

Loan Proration Formula:

Loan Requirements and How to Apply____________________________________________________________

Annual Student Loan Acknowledgement

All Direct Loan borrowers (subsidized, unsubsidized, graduate PLUS, and parent PLUS) are recommended to complete the Annual

Student Loan Acknowledgement (ASLA). ASLA is available at https://studentaid.gov/

Entrance Counseling

First time Federal Subsidized Direct and Unsubsidized Direct (student) Loan borrowers must complete entrance counseling prior to a

loan disbursement. The counseling session will educate the student on borrower rights and responsibilities. Entrance Counseling can

be completed online at https://studentaid.gov/entrance-counseling/

Special PLUS Loan Counseling

Special loan counseling is required for any PLUS Loan applicant, student or parent, who has an adverse credit history but who

qualifies for a PLUS Loan either by getting a loan endorser or by documenting to the satisfaction of the Department that there are

extenuating circumstances related to the adverse credit. While the special PLUS counseling is mandatory only for these borrowers,

any PLUS borrower can voluntarily complete this counseling. Special PLUS loan counseling can be completed at

https://studentaid.gov/app/counselingInstructions.action?counselingType=plus

Exit Counseling

You will be asked to complete Exit Counseling upon graduation, enrollment less than half time, or leave school from Longwood

University. Information regarding Exit Counseling will be sent electronically via email at the appropriate time from the Office of

Financial Aid with instructions to complete at https://studentaid.gov/exit-counseling/

Master Promissory Note (MPN)

First time borrowers, for both the Direct (student) and the Parent (PLUS) loans, will need to sign the Master Promissory Note (MPN).

The MPN is a promissory note that can be used to take out one or more Direct or Parent loans for one or more academic years (up to

10 years). The MPN can be signed electronically online at the following website at https://studentaid.gov

Steps to apply for a Direct Subsidized or Unsubsidized Student Loan

1. File the Free Application for Federal Student Aid (FAFSA)

2. Check your Longwood e-mail daily

3. Respond to all information requested by the OFA on your myLongwood under Student Requirements

4. Take action on offer of direct loan on myLongwood, Financial Aid

5. If you are a first-time borrower, you will sign a MPN at https://studentaid.gov

a. If required, complete Entrance Counseling

6. The OFA will certify/originate the loan with the Department of Education.

7. Loan funds, less origination fees, will be disbursed to the university on designated disbursement dates once all requirements

have been met.

10

8. Any excess funds will be refunded to the student.

Steps to apply for the Direct Parent (PLUS) Loan

1. File the Free Application for Federal Student Aid (FAFSA)

2. Check with student for the PLUS loan amount offered by OFA on the student’s myLongwood and have student accept

amount needed.

9. After the student has accepted the PLUS loan, apply for the loan at https://studentaid.gov.

a Credit checks are good for 180 days.

b Follow on-line instructions at the website for pre-approval of loan and signature of MPN. Note: You only have to

sign one MPN for each student.

3. The Department of Education will notify Longwood of the pre-approval.

4. The OFA will certify/originate the pre-approved loan with the U.S. Department of Education.

5. Loan funds will be disbursed, less origination fees, to the school, on the school’s designated date and placed on the student’s

account.

6. Any excess funds will be refunded to the parent/student.

Direct Loan Repayment Schedule

The U.S. Department of Education provides students with a loan simulator https://studentaid.gov/loan-simulator/ to help make

decisions about student loan borrowing and repayment.

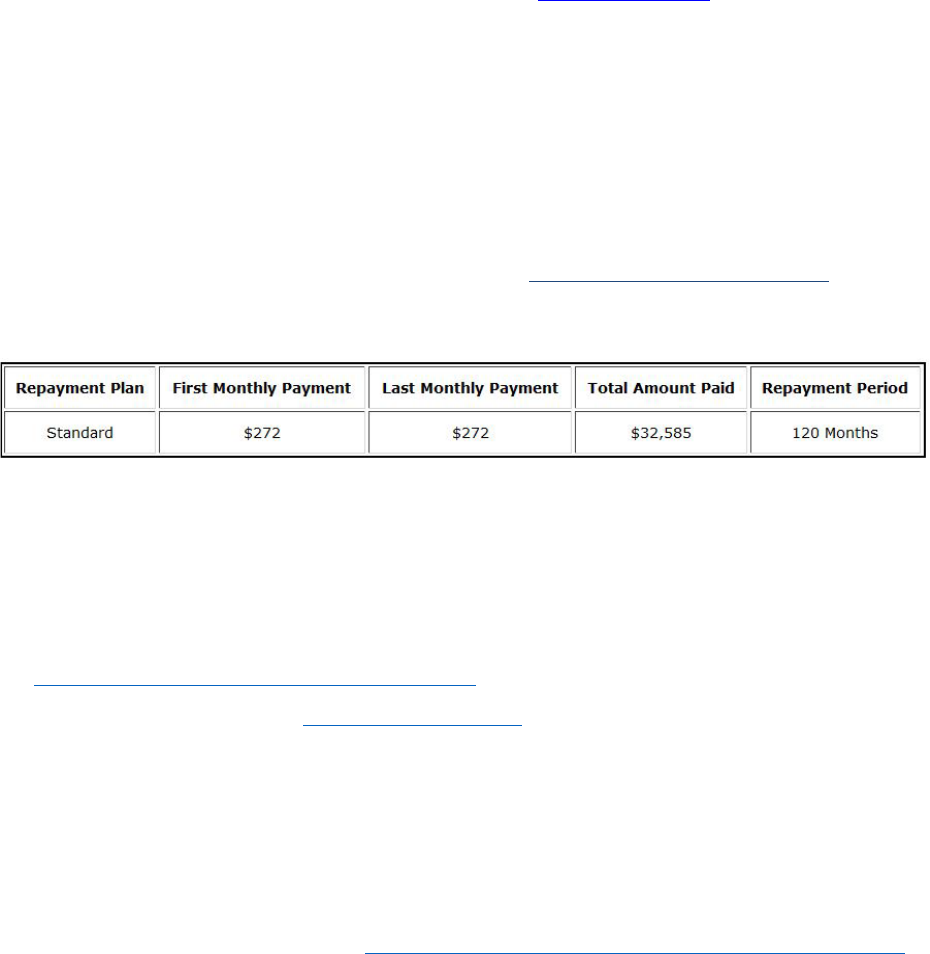

The following is a sample loan repayment schedule based on Direct Subsidized and Direct Unsubsidized loan debt totaling $26,946 at

3.90% interest rate. This example uses the standard 10-year repayment plan.

Direct Loan Disclosures

Students and Parents who borrow Direct Loans under a Master Promissory Note (MPN) will get a disclosure statement from the U.S.

Department of Education that provides specific information about that loan, including the loan amount, loan fees, and the expected

disbursement dates and amounts. Other disclosures will be provided to you throughout the loan process. Students and Parents are

encouraged to keep all loan paperwork in a safe place, including your MPN, disclosure notices, and billing statements.

Terms and Conditions for Federal Student Loans

o

https://studentaid.gov/mpn/subunsub/demo/agreements

o

Master Promissory Note (MPN)- https://studentaid.gov/mpn/

National Student Loan Data System

Students or parents of a student who borrow a Title IV HEA loan will be submitted to the National Student Loan Data System

(NSLDS). They will be accessible by guaranty agencies, lenders, and schools determined to be authorized data system users.

Private Education Loans

If you need additional funds to help offset the cost of your education, then perhaps a private loan is an option for you. The U.S.

Department of Education provides a comparison chart https://studentaid.gov/understand-aid/types/loans/federal-vs-private to help

understand the differences between federal and private loans.

Staff members at Longwood University Office of Financial Aid will discuss with students and prospective students, and their parents,

the financial aid options available to them. Students and Parents may qualify for loans or other assistance under Title IV of the Higher

Education Act programs. The terms and conditions of the Title IV HEA program loans may be more favorable than the provisions of

private loans.

Private Education Loan Self-Certification

The Higher Education Opportunity Act of 2008 added a section 128(e)(3) to the Truth in Lending Act (TILA) to require that before a

private education lender may consummate a private education loan for a student in attendance at an institution of higher education, the

private education lender must obtain the completed and signed Self-Certification Form from the applicant. Lenders of private loans

11

will provide the Self-Certification form to the student borrower. The form is also available at:

https://choice.fastproducts.org/faststatic/fastchoice/forms/PrivateEducationLoanApplicantSelf-CertificationForm.pdf

Private lender selection is an important decision and should be carefully researched. You may borrow with any lender offering a

private education loan regardless of whether or not they are listed on the Longwood University historical list. Longwood University

does not discriminate against lenders and will certify loans from any lender provided the student meets the lender’s eligibility

requirements.

Visit https://choice.fastproducts.org/FastChoice/home/371900 for information about Private Loan Lenders that Longwood University

students have used in the past three years.

Receiving Financial Aid Disbursements____________________________________________

Financial Aid Disbursements

A student is eligible to receive the first disbursement of federal financial aid when Longwood University confirms the student is

enrolled in courses for the payment period and is eligible to receive the funds.

Pending Credit

If you have been awarded financial aid before bills are generated, your aid should show on the bill as pending credit, and you need

only pay the amount due by the deadline date. Pending credit will only show on the bill if you have been awarded financial aid when

the bills are generated. You will be responsible for satisfying the account by the due date.

Loan Disbursements

You must be enrolled at least half-time (six credit hours undergraduate, three credit hours graduate) for any loan disbursements. All

loan funds are disbursed directly from the Department of Education to the school. Direct (subsidized and unsubsidized) student loans

and parent and graduate (PLUS) loans will be automatically credited to the student’s account after the MPN has been signed and

Entrance Counseling have been completed. Parent and Graduate PLUS borrowers must also complete an application for credit

approval each year.

Cancellation of Federal Direct Loans

The student (or parent in the case of a Parent PLUS loan) must inform the Office of Financial Aid if all or a portion of a Federal Direct

Loans are to be canceled. Once the loan is disbursed, the University sends the student/parent a right to cancel email, which includes

the time given to respond should the student and or parent borrower wish to cancel their loan requests. This email is sent after the loan

disbursement has been credited to the student’s account. Borrowers who wish to cancel all or a portion of their loan must inform the

University within 14 days from the date the University sends the disbursement notification. Any request received after 14 days but

prior to 110 days from the disbursement date will be honored as a partial cancellation based on Title IV funds that are currently

unapplied.

Grants and Scholarships

Federal, state, institutional grants and scholarships will automatically pay to your account at the end of the add/drop period for each

term as long as the students financial aid eligibility requirements have been met.

Outside Financial Assistance

Regulations require that adjustments may need to be made to your financial aid package if you receive additional financial assistance

not reflected on your initial aid offer. You are required to notify the OFA if you receive any such additional resources (e.g., outside

scholarships, employer reimbursement, vocational rehabilitation benefits, etc.).

Direct Deposit

Direct Deposit is the quickest and most efficient way to receive a refund from your student loan. Longwood University suggests

student loan/private loan refunds be processed via direct deposit. To set up banking information to be used for the direct deposit of

student loan refunds, students must log into their student account through myLongwood. Once logged in, select the Student Tab, then

My Student Account. Select My Profiles, Payment Profiles, enter your banking information and check the refund option. Please verify

the routing number and account number are entered correctly. If your bank account information changes, please remember to update

your student loan payment profile immediately. Inaccurate banking information will delay your refund. There is no direct deposit

process available for parent refunds.

12

Refunds

Refunds of financial aid overpayments will be processed as soon as possible, but no later than 14 days after the balance occurred your

account. Refunds to parents are mailed by check to the parent borrower’s address. For students that have refunds not generated from

loan funds, a check will be mailed from the state of Virginia to the student’s local mailing address at Longwood University, if no local

address is provided a secondary address will be used.

On an exception basis, Longwood University may, at its own discretion, provide a student access to his or her anticipated federal aid

credit balance. Students who may need to request this exception should speak with someone in the Office of Financial Aid.

Buying Books with Financial Aid___________________________________________________

You may purchase books and supplies with financial aid that remains after tuition and fees are deducted.

Students can visit the Longwood University bookstore during timeframes below using their Longwood student ID.

Semester

You may charge books beginning

No Book Charges after

Fall 2023

July 17, 2023

August 31, 2023

Spring 2024

December 4, 2023 January 19, 2024

Summer 2024

April 29, 2024

May 24, 2024

Students should plan to purchase all books and supplies during these times. There will be no book charges after the date listed above.

If the books you need are on back-order, you should speak with bookstore management for special arrangements.

Retaking Coursework________________________________________________________________

According to federal regulations that became effective on July 1, 2011, classes that a student is repeating may be included when

determining the student’s enrollment status for federal financial aid purposes. However, this is limited to one repeat of a previously

passed course (a course is considered passed when the student received a grade of at least a D-). As a result, students who are

repeating courses and are enrolled as full-time students may only be eligible for part-time financial aid. Students will be notified by

email if they are not considered full-time for financial aid.

Below is an example of when a student is eligible to receive aid for a course and when they are not:

Term

Course

Result

Eligible?

Fall 2022

ENGL 100

Fail

Yes

Spring 2023

ENGL 100

Pass

Yes

Fall 2023

ENGL 100

Pass (1

st

repeat of previously passed course)

Yes

Spring 2024

ENGL 100

2

nd

repeat of previously passed course

No

Revising Your Financial Aid______________________________________________

Initial financial aid offers are based on full-time enrollment for undergraduates and six credits for graduates during both semesters of

the academic year.

Change in enrollment hours

If you will not be enrolled full-time, you should contact the Office of Financial Aid. Enrollment in fewer credits than the number of

credit hours used in establishing award eligibility may result in a reduction in one or more financial aid awards.

Change in grade level

If you change grade levels between semesters of an academic year, you may be eligible for additional loan funds. Contact the OFA to

inquire about this eligibility and procedures for receiving additional loan funds.

13

Financial Aid Appeals___________________________________________________________

Special Circumstances/FAFSA Information Appeals

Longwood uses the FAFSA – Free Application for Federal Student Aid – to determine your eligibility for financial aid. We

understand that circumstances can change, and in some cases the information on the FAFSA no longer represents your current

financial situation. Below are examples of situations that may be eligible for an appeal, and those that are not.

Reasons to appeal include, but are not limited to:

• Death of a parent or spouse.

• Divorce or separation of parents or student since the FAFSA was filed.

• Loss of parent or student income due to unemployment, change in employment, medical leave, recent disability, or loss of

recurring income such as child support, alimony, or other sources of income.

• One-time, non-recurring income was received in the tax year reported on the FAFSA.

• Unusual or high medical and/or dental expenses were recently incurred.

Situations we cannot recognize in an appeal:

• Credit card debt, typical living expenses (i.e., mortgage, car payment, student loan payments) or other consumer debt.

• Your financial situation has not changed since filing the FAFSA, but you did not receive enough financial aid to cover

educational expenses.

• You would like Longwood to match a financial aid offer from another school.

Unusual Circumstances/Dependency Appeals

There are a series of questions on the FAFSA that determine whether a student is considered Dependent or Independent for financial

aid purposes. Dependent students are required to provide parent information on the FAFSA, Independent students are not. If you are

unable to provide parent information, or feel your situation warrants an appeal based on the information below, please contact our

office so we may talk with you about it.

Reasons a Dependency Appeal may be submitted include, but are not limited to:

• Unsafe domestic environment

• Neglect or abuse by parent or other family members

• Abandonment by parents

• Unknown whereabouts of parents

• Homelessness

Examples of reasons a Dependency Appeal would not be considered:

• Parent’s unwillingness or inability to provide financial information*

• Parent’s unwillingness to provide financial support

• Parent no longer claims the student on their tax return

• A student’s ability to be self-sufficient

* If a student has contact with their parent(s), but the parent is unwilling to provide their information and sign the FAFSA, there

are minimal loan options available to the student. Please contact our office before submitting any documentation for an appeal.

We want to discuss your situation first to ensure an appeal is appropriate and determine what documentation we will need from

you. Every case is different, so the documentation we request may vary from one student to another.

Cost of Attendance Appeals

Longwood University establishes a cost of attendance (COA) each academic year. The COA may sometimes differ from the

customary amount based on variables such as campus housing location, meal plans, and course load. The COA also serves as the

maximum cap on financial aid. Under certain circumstances, students whose awards reach that COA limit may appeal for additional

aid eligibility.

14

Dropping a class

Before dropping any courses, a financial aid staff member should be consulted to discuss how an enrollment change will affect

eligibility, financial aid package and/or your financial aid satisfactory academic progress rate. See Satisfactory Academic Progress

Policy.

Withdrawing

Withdrawing from school during the term can cause financial aid to be adjusted in accordance with the Return of Title IV Funds

Policy. The policy states that students who withdraw before the 60 percent point of the term (as calculated by the number of days in

the term) must have their financial aid package reduced. If you are considering withdrawing, please contact the OFA.

Study Abroad/Consortium Programs______________________________________________

Federal and state financial aid funds are available to students enrolled in qualifying Longwood University study abroad and

consortium programs. Financial aid eligibility is generally determined the same way it would be for a student studying on campus at

Longwood University. The difference in most cases it that your cost of attendance will be based on the anticipated expenses

applicable to your study abroad or consortium program, which will be provided by the Center for Global Engagement or the host

school.

Satisfactory Academic Progress Policy (SAP)________________________________________

Federal student aid regulations require all educational institutions administering funds to ensure that financial aid recipients are

making satisfactory academic progress toward their educational objectives. The regulations apply to all students receiving Federal,

State, and Institutional financial aid funds. Questions regarding this policy should be directed to the Office of Financial Aid.

Satisfactory Academic Progress has been defined as follows:

Satisfactory Progress Requirements

Undergraduate Pace

You must earn credit for at least 67% of the hours you attempt. This calculation is performed by dividing the number of credits hours

earned by the number of credit hours attempted.

• Grades of F, W, I, and repeated courses count as hours attempted but not earned.

• Transfer hours are included in the calculation both as attempted and earned.

Undergraduate Maximum Time

You may not receive financial aid for more than 180 attempted hours or 150% of program requirements. If your program requires

more than 180 hours and you have reached the maximum time limit, please submit an appeal for review

Undergraduate Grade Point Average

The minimum GPA requirement is based on the number of credit hours attempted; transfer grades are not included. Only grades

earned at Longwood University are used in the cumulative GPA calculation. (See table below)

Credit hours attempted

(includes transferred hours)

Minimum GPA requirement

(cumulative LU GPA for financial aid)

1-24

1.60

25-55

1.70

56-88

1.90

89+

2.0

15

Graduate Pace

You must earn credit for at least 75% of the hours you attempt. This calculation is performed by dividing the number of credit hours

earned by the number of credit hours attempted.

• Grades of F, W, I, and repeated courses count as hours attempted but not earned.

• Transfer hours are included in the calculation both as attempted and earned.

Graduate Maximum Time

You may not receive financial aid for more than 150% of program requirements.

Graduate Grade Point Average

The minimum GPA requirement is based on the number of credit hours attempted. (See table below)

Satisfactory Academic Progress Evaluation

Evaluation is done annually at the conclusion of each academic year (May) for all enrolled students. Students must be making the

Satisfactory Progress requirements listed above.

Financial Aid Suspension

Students failing to maintain satisfactory academic progress (SAP) at the end of spring semester will be placed on financial aid

suspension beginning with the following semester. Such status will make students ineligible for financial aid until such time as the

satisfactory academic progress requirements are met or the student is granted an appeal.

SAP is evaluated at the end of the spring semester; a student who has been awarded summer financial aid but is found to be failing

SAP standards after the evaluation is complete will no longer be eligible for summer aid until the requirements are met, or the student

is granted an appeal.

Attendance during Financial Aid Suspension

During the period of financial aid suspension, students may (unless placed on academic suspension) attend Longwood University

without financial aid. It will be the student’s responsibility to secure other financial resources during this period.

Satisfactory Progress Appeal Process

A student who is placed on Financial Aid Suspension may appeal the denial of financial aid. Only on appeal per semester will be

accepted. Submission of the appeal does not guarantee approval, and students are responsible for dropping all classes by the add/drop

deadline if they are unable to secure funds for their classes on their own. Only completed forms will be forwarded to the Appeals

Committee for review. If an appeal is approved financial aid will not be retroactive for any semester the student was not making SAP

standards.

The appeal must include:

• Submitting a Satisfactory Academic Progress Appeal Form

• Submitting supporting documentation

o Written explanation for the appeal from the student (not parent or 3

rd

party), must include three key points.

o Statement from your academic advisor

Readmitted students, how time was spent during your time of non-enrollment at Longwood University.

If applicable, transcripts of grades you received during your non-enrollment at Longwood University.

A timeline for submission of appeal forms is established each academic year and posted on the financial aid website and the SAP

form.

Minimum GPA Requirement

(cumulative LU GPA for financial aid)

3.0

16

Return of Title IV Policy, Dropping or Withdrawing_______________________________

Return of Title IV Funds Policy (R2T4) (Withdrawing from Longwood University)

It is the responsibility of any student wishing to withdraw from Longwood to initiate the official withdrawal process with the

University. Students wishing to withdraw from Longwood should contact the Registrar’s Office to initiate this process. The complete

Withdrawal Policy may be found in the Longwood University Catalog.

Treatment of Title IV Aid When a Student Withdraws

The law specifies how Longwood must determine the amount of Title IV program assistance that students earn if they withdraw from

school. The Title IV programs that are covered by this law are: Federal Pell Grants, Iraq Afghanistan Service Grants, TEACH Grants,

Direct Student Loans, Direct PLUS loans, Federal Supplemental Educational Opportunity Grants (FSEOGs), and Federal Perkins

Loans. Longwood University uses the same return policy for state and institutional grants as is required for federal funds. Whether or

not outside scholarships are returned after a student withdraws depends upon the policies and/or wishes of the scholarship donor.

When a student withdraws during a semester the amount of Title IV program assistance that they have earned up to that point is

determined by a specific formula. If a student received (or Longwood or a parent received on a student’s behalf) less assistance then

the amount they earned, the student may be able to receive those additional funds. If a student received more assistance than they

earned, the excess funds must be returned by Longwood and/or the student (this is usually the case).

The amount of assistance a student earned is determined on a prorated basis. For example, if a student completes 30% of a semester,

they earn 30% of the assistance they were originally scheduled to receive. Once a student has completed more than 60% of the

semester, they earn all the assistance that they were scheduled to receive for that semester. The percentage of the semester completed

is determined by the last date the student attended classes or otherwise participated in an academically related activity.

If a student does not receive all of the funds that they earned, the student may be due a post-withdrawal disbursement. If a post-

withdrawal disbursement includes loan funds, Longwood must get permission from the student (and/or parent for parent PLUS loans)

before we can disburse them. The student may choose to decline some or all of the loan funds so that they do not incur additional debt.

Longwood will automatically use all or a portion of a student’s post-withdrawal disbursement of grant funds for tuition, fees, and

housing and meal charges. Longwood needs a student’s permission to use the post-withdrawal disbursement for all other school

charges. If a student does not give their permission, the student will not be offered the funds. However, it may be in the student’s best

interest to allow Longwood to keep the funds to reduce their debt to Longwood.

There are some Title IV funds that students were scheduled to receive that cannot be disbursed after withdrawal because of other

eligibility requirements.

If a student (or Longwood or a parent received on a student’s behalf) excess Title IV program funds that must be returned, Longwood

must return a portion of the excess equal to the lesser of:

1. Longwood’s charges multiplied by the unearned percentage of the student’s funds, or

2. The entire amount of excess funds.

Longwood must return this amount even if it did not keep this amount of a student’s Title IV program funds.

If Longwood is not required to return all of the excess funds, the student must return the remaining amount. Any loan funds that a

student must return, the student (or parent for a PLUS Loan) repays in accordance with the terms of the promissory note. That is, the

borrower makes scheduled payments to the loan holder over a period of time. Funds are returned in the following order: Unsubsidized

Direct Loan, Subsidized Direct Loan, Grad PLUS, Parent PLUS, Pell Grant, SEOG (grant), and TEACH Grant.

Longwood must complete the Return of Funds process no later than 45 days from the determination of a student’s withdrawal.

Longwood determines that a student is withdrawn once official notification is received from the Office of Registration.

The following is an example of what can happen when a student receives Federal Title IV Aid and withdraws from a semester. This

example is based on a student, whom we will call James, in the fall 2023 semester, which contains 105 calendar days (8/22/23-

12/09/23

excluding the days of Thanksgiving Break). The same rules apply to all award years:

Longwood Charges:

Tuition $5,265.00 (in-state, undergraduate taking 15 credits)

Housing/Meal $0 (student did not live on campus)

Total Charges $5,265.00

17

Financial Aid

Amount

Date Disbursed

Federal Pell Grant

$2,775.00

08/28/2023

Federal Direct Subsidized Loan

$5,500.00

08/28/2023

Federal Direct Unsubsidized Loan

$2,375.00

08/28/2023

Total Financial Aid Disbursed:

$10,650.00

The financial aid was disbursed to James’ account, which paid all his charges, leaving him with a $5,385.00 refund. This refund was

deposited in his checking account via direct deposit on 08/28/2023. As a result, James’ fall account is now at a $0 balance. James

decided to withdraw from Longwood early in the semester, and on 08/30/2023, he contacted the Registrar’s Office to begin the

official withdrawal process. According to the Federal Return of Title IV Funds regulations, 08/30/2023, is considered James’

withdrawal date. Therefore James only completed 8.6% of the fall semester.

Date of Withdrawal:

• Calendar Days in fall 2023 Term = 105 days (8/22/23-12/09/23

excluding the days of Thanksgiving Break)

• Calendar Days Attended = 9 days (8/22/23-8/30/23)

• Percentage of Term Attended: 9 days/105 days =8.6% Earned Aid:

• Percentage of Title IV Aid Earned Based on Date of Withdrawal = 8.6%

• Amount of Title IV Aid Earned = $10,650.00 x 8.6% = $915.90

• 91.4% of term not attended

Unearned Aid:

• Amount of Title IV Aid Unearned = $10,650.00 (total aid) - $915.90 (earned aid) = $9,734.10

Amount of Unearned Charges:

• $5,265.00 (charges) x 91.4 % (percent term not attended) = $4,812.21

Office of Financial Aid enters the relevant withdrawal and aid information into the R2T4 software provided by the Department of

Education to calculate the return of funds for federal aid. The formula determines how much of the $10,650.00 James has “earned”

based on his attendance and how much must be returned to the aid programs immediately. In James’ case, the results of the calculation

are as follows:

Aid Summary Based on 08/30/2023 Date of Withdrawal:

• Earned Aid = $915.90 ($10,650.00 total aid x 8.6% of term attended)

• Total Aid to be Returned = $9,734.10 ($10,650 total aid - $915.90 student’s earned aid)

• Amount for Longwood to return = $471 of his Federal Pell Grant, $2,375.00 of his Federal Direct Unsubsidized Loan and

$2,437 of his Federal Direct Subsidized Loan ($5,265.00 institutional charges x 91.4% of term not attended)

• Amount of Aid for James to Return = $5,283.00

• Longwood will return the unearned portion of the Pell Grant to the Department of Education on James’ behalf. James will

owe any resulting account balance directly to Longwood.

• Longwood will return these funds to the Department of Education within 45 days of receiving the notice of James’

withdrawal. Depending on whether any of his original charges are adjusted by the Office of Student Accounts, James could

receive a bill to reimburse Longwood for returning these funds. This is because James’ bill was paid to $0 prior to the

withdrawal. So, if his charges are not reduced, then returning loan funds will remove those funds from his account and create

a balance due.

The requirements for Title IV program funds when students withdraw are separate from the Office of Student Accounts refund policy.

Therefore, students may still owe funds to Longwood to cover unpaid institutional charges. Longwood may also charge you for any

Title IV program funds that Longwood was required to return. Longwood’s refund/charge policy is available in the undergraduate

catalog. https://catalog.longwood.edu/content.php?catoid=11&navoid=575#refunds-and-charge-adjustments

For questions about Title IV program funds, call the Federal Student Aid Information Center at 1-800-4-FEDAID (1-800-730-8913)

or The Office of Financial Aid at Longwood University at 1-434-395-2077 or 1-800-281-4677. Information is also available at

https://studentaid.gov.

When a Student Fails to Earn a Passing Grade in Any of Their Classes

Students receiving all, or a combination of grades, F, W, or I at the end of an enrollment period will be assumed to have unofficially

withdrawn from the University unless Longwood can document that the student completed the semester. The student will be obligated

to pay any resulting unpaid charges.

18

Other Information___________________________________________________________________

Borrowers with concerns about their Federal Direct Loan may contact the Student Loan Ombudsman at:

https://studentaid.gov/feedback-ombudsman/disputes/prepare

Veterans Benefits

Longwood is here to assist students who plan to use veterans’ benefits to assist with educational expenses. While the Office of

Financial Aid plays a role in processing your benefits, the certification process begins with our Registrar’s Office. Information on

types of benefits and the process to receive them is available on the Registrar’s website. You may also call 434.395.2580 or email

veterans@longwood.edu.

Taxable Financial Aid

Changes in federal tax laws have made some forms of financial aid taxable income. Financial aid received (other than loans) above the

cost of tuition, fees, and books, is considered taxable income. You should contact the IRS for additional information.

Financial Aid Appeal Procedures

Students wishing to appeal financial aid eligibility determination, or the amount or type of financial aid awarded, must send a written

appeal to the Office of Financial Aid. Appeals should include an explanation of the reason for appeal and documentation supporting

the appeal. The appeal will be reviewed by the Appeals Committee and the decision of the committee is final. Students will be

informed in writing of the committee’s decision.

Financial Aid Questions_______________________________________________________________

The Office of Financial Aid has an open-door policy. Our office is open from 8:15 a.m. to 5:00 p.m. Monday - Friday.

Physical Address: 107 Brock Hall http://www.longwood.edu/media/top-tier/campus-map.pdf

Mailing Address: Longwood University, Office of Financial Aid, 201 High Street

,

Farmville, VA 23909-1899

Phone: 434-395-2077

Fax: 434-395-2829

Cashiering and Student Accounts Information____________________________________

Students having specific questions related to their charges, payments, and refunds should contact the Office of Student Accounts.

Below is a directory of staff to help direct your questions most appropriately:

LeAnn Ferguson

Bursar

434-395-2270

Eason 205F

fergusonal@longwood.edu

Kirsten Bowen

Associate Bursar for Auxiliary Services

434-395-2329

Eason 205A

bowenks2@longwood.edu

Jenise Ragland

Refunds Manager/Student Account Analyst

434-395-2269

Eason 206

raglandsj@longwood.edu

19

Karin Warner

Manager- Third Party Programs/Receivables

434-395-2068

Eason 205C

warnerkj@longwood.edu

Lisa Flippen

Payment Plan & Pre-Collections Manager

Eason 205B

434-395-2955

flippenlj@longwood.edu

Billing Schedule

Longwood will bill you twice each year: beginning in July for the fall semester and December for the spring semester. Half of your

financial aid will be applied to each bill, not including summer enrollment.

Monthly Payment Plan

Longwood University offers a monthly payment option to divide tuition and fees into four or five equal installments per semester. The

plan is available regardless of need. This plan can be used in conjunction with other financial aid or in place of financial aid. For

further details, please visit http://www.longwood.edu/studentaccounts/billing-payments/monthly-payment-plan/

Late Fees

Student bills may be assessed a late payment fee of 10% of the unsecured past-due account balance as prescribed in 2.2-4805 of the

Code of Virginia. Financial aid must be awarded, accepted, and processed before credit will be given towards the bill. A late fee is

still assessed if financial aid is pending. Note, financial aid cannot pay late fees, the student will be responsible to pay late fees with

another form of payment.

Student Work-Study Programs

Credit is not given towards the tuition and fee bill for work-study awards. Students will receive pay for hours worked via direct

deposit once a month.

Financial Aid Credits

Although tuition due dates are set before financial aid actually pays to a student’s account, students who have satisfied all financial aid

requirements will have credit for expected financial aid payments included in any balanced owed.

529 Plans

If you will be paying any portion of the bill with a 529 plan, contact your plan administrator to arrange payment to Longwood. For

further details, please visit http://www.longwood.edu/studentaccounts/billing--payments/billing-process/.