SUPREME COURT OF THE STATE OF NEW YORK

COUNTY OF NEW YORK

PEOPLE OF THE STATE OF NEW YORK, by

LETITIA JAMES, Attorney General of the

State of New York,

Petitioner,

-against-

YELLOWSTONE CAPITAL LLC, FUNDRY

LLC, DELT

A BRIDGE FUNDING LLC,

CLOUDFUND

LLC, ABC MERCHANT

SOLUTIONS

, LLC, ADVANCE MERCHANT

SERVICES LLC, BUSINESS ADVANCE

TEAM LLC, CAP

ITAL ADVANCE SERVICES

LLC, CAPITAL MERCHANT SERVICES

, LLC,

CASH VILLAGE FUNDING LLC, FAST CASH

ADVANCE LLC, FUNDZIO LLC, GREEN

CA

PITAL FUNDING LLC, HFH MERCHANT

SERVICES LLC, HIGH SPEED CAPITAL

LLC,

MERCHANT CAPITAL PAY LLC,

MERCHANT FUNDING SERVICES

LLC,

MIDNIGHT ADVA

NCE CAPITAL LLC, MR.

ADVANCE CAPITAL LLC, OCEAN 1213 LLC,

SIMPLY EQUITIES LLC,

TVT CAP FUND

LLC,

TVT CAPITAL HR, LLC, THRYVE

CAPITAL FUNDING LLC, WCM FUNDING

LLC, WEST COAST BUSINESS CAPITAL

,

LLC

(f.k.a. YELLOWSTONE CAPITAL WEST

LLC

), WORLD GLOBAL CAPITAL LLC

(including each entity

captioned herein doing

business

under any other name), DAVID

GLASS,

YITZHAK (“Isaac”) STERN, JEFFREY

REECE,

BARTOSZ (“Bart”) MACZUGA,

VADIM SEREBRO,

TSVI (“Steve”) DAVIS,

AARON DAVIS,

MATTHEW MELNIKOFF,

MARK SANDERS,

and DAVID SINGFER,

Respondents.

VERIFIED PETITION

Index No. ______/2024

IAS Part ___

Assigned to Justice __________

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

1 of 289

LETITIA JAMES

Attorney General of the State of New York

Attorney for Petitioner

28 Liberty Street, New York, New York 10005

Of Counsel:

JANE M. AZIA, Bureau Chief, Bureau of Consumer Frauds and Protection

LAURA J. LEVINE, Deputy Bureau Chief

JOHN P. FIGURA, Assistant Attorney General

ADAM J. RIFF, Assistant Attorney General

OLUWADAMILOLA E. OBARO, Assistant Attorney General

EMILY E. SMITH, Attorney General Fellow

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

2 of 289

i

TABLE OF CONTENTS

PRELIMINARY STATEMENT ...................................................................................... 1

PARTIES AND JURISDICTION ................................................................................... 8

I. CORPORATE RESPONDENTS .............................................................................. 9

A. Yellowstone Capital and Fundry ........................................................................ 9

B. Yellowstone Subsidiaries .................................................................................. 10

C. Yellowstone, Its Subsidiaries, and Fundry Form a Common Enterprise ....... 17

D. Delta Bridge Entities ........................................................................................ 20

II. INDIVIDUAL RESPONDENTS ............................................................................ 22

A. Officer Respondents .......................................................................................... 23

B. Funder Respondents ......................................................................................... 25

THE ATTORNEY GENERAL’S INVESTIGATION .................................................... 29

STATUTE OF LIMITATIONS AND TIME PERIOD AT ISSUE ............................... 33

FACTS ........................................................................................................................... 34

I. RESPONDENTS’ ILLEGAL PRACTICE OF USURY .......................................... 34

A. New York Law Prohibits Usurious Loans When Cloaked as Purchases of

Revenue ............................................................................................................. 39

B. Respondents’ MCAs Have Fixed Durations and Payment Amounts that Do

Not Approximate a Specified Percentage of Revenue ..................................... 40

1. The Daily Amounts Are Fixed and Do Not Approximate a Specified

Percentage of Revenue ............................................................................... 40

2. The Lengths of the Transactions Are Fixed and Do Not Vary Based on a

Specified Percentage of Revenue ............................................................... 49

3. Respondents Ignored the Specified Percentage Altogether When

Underwriting MCA Transactions .............................................................. 56

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

3 of 289

ii

C. During the Repayment Period, Respondents Do Not Change the Fixed

Durations and Payment Amounts Based on a Specified Percentage of

Revenue ............................................................................................................. 60

1. Respondents Virtually Never Issued Reconciliation Refunds .................. 62

2. Respondents Made Reconciliation Expressly Discretionary Until 2018 .. 64

3. Starting Around 2018, Respondents Used Fixed Specified Percentages

that Were Grossly Inflated to Ensure that Merchants Would Still Be

Unable to Adjust Payments Retroactively Through Reconciliation ......... 67

4. Delta Bridge’s New Practice of Suggesting a Specified Percentage ......... 87

5. Additional Barriers to Reconciliation ........................................................ 91

a. Respondents Use the Effects of Declining Revenues to Disqualify

Merchants from Reconciliation .......................................................... 91

b. Respondents Manipulate How Merchants’ Revenue Is Calculated

When Performing Reconciliations ..................................................... 92

c. Respondents Do Not Provide Relief to Merchants When They

Experience Sudden Drops in Revenue .............................................. 98

d. Yellowstone and Delta Bridge Disincentivized Reconciliation, and

Their Funders Disfavored It ............................................................ 101

6. Prospective Payment Modifications—Which Are Discretionary and Do

Not Align Payments With the Specified Percentage—Are Not a

Substitute for Reconciliation ................................................................... 106

D. Respondents Treat the Specified Percentage—Purportedly the Share of

Revenue That Respondents Are Purchasing—As Irrelevant Except as a

Barrier to Reconciliation ................................................................................. 110

1. Respondents Did Not Negotiate the Specified Percentage With Merchants

113

2. Respondents Purported to Purchase Shares of Merchants’ Revenue that

Were Improbably (or Impossibly) Large .................................................. 120

3. Yellowstone and Delta Bridge Left It up to Individual Funders to

Determine What Counted as “Revenue” ................................................. 130

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

4 of 289

iii

4. The Specified Percentage Was Only Relevant to Reconciliation—Where it

Has Served Chiefly as an Impediment .................................................... 132

E. Respondents Claim Rights to Repayment in the Event of Bankruptcy or Lack

of Revenue ....................................................................................................... 133

1. Respondents Claim Extensive Recourse in the Event of Merchant

Bankruptcy ............................................................................................... 135

2. When Merchants Are Unable to Make Just a Few Payments,

Respondents Take Court Action to Obtain Full Repayment of Pending

Balances from Merchants and Their Guarantors ................................... 138

3. Respondents Exercise Their Secured, Guaranteed Rights to Repayment

Despite Merchants’ Lack of Revenue or Closing of Their Businesses ... 141

F. Other Indicia that Respondents’ MCAs Are Loans ....................................... 147

1. Everyone Knew They Were Loans ........................................................... 147

2. Yellowstone Also Did Deals That Were Explicitly Loans, Which Were No

Different from Yellowstone and Delta Bridge’s So-Called MCAs .......... 152

3. Respondents Pushed Merchants Experiencing Financial Trouble to Take

on More Debt to Keep Up with the Daily Debits .................................... 154

4. Yellowstone Used Contracts that Purported to Purchase a Share of All

Monies the Merchant Received from Any Source ................................... 158

5. Yellowstone Marketed Its MCAs to Merchants as Loans ....................... 159

6. Yellowstone Specifically Pursued Merchants Who Were High Credit

Risks and Desperate for Funding ............................................................ 161

G. Respondents’ Loans Used Interest Rates that Vastly Exceeded the Legal

Limit ................................................................................................................ 162

II. RESPONDENTS MISREPRESENT THEIR USURIOUS TRANSACTIONS TO

THE NEW YORK COURTS ....................................................................................... 163

A. Respondents Have Misrepresented Their Transactions in False Affidavits 166

B. Respondents Misrepresent Their Transactions in Verified Complaints ...... 171

C. Respondents Misrepresent the Facts of Merchants’ Payment Histories in

Claiming that the Merchants Have Defaulted on Their MCAs .................... 175

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

5 of 289

iv

III. RESPONDENTS ENGAGE IN REPEATED AND PERSISTENT FRAUD IN

THEIR DEALINGS WITH MERCHANTS ................................................................ 178

A. Respondents Misrepresent that Their Transactions Are Not Loans and that

They Will Provide Flexible Payment Structures and Terms ........................ 178

B. Respondents Falsely Promise No Collateral and No Personal Guarantees . 182

C. Respondents Falsely Promise Merchants that They Will Provide More

Desirable Financing Terms or Nonexistent Forms of Financing .................. 183

D. Yellowstone Concealed the Fees It Charged to Merchants ........................... 186

E. Respondents Fraudulently Continued to Debit Merchants’ Bank Accounts

After the Transactions Were Complete .......................................................... 189

IV. DELTA BRIDGE IS THE SAME BUSINESS AS YELLOWSTONE,

CONTINUED BY RESPONDENTS UNDER A DIFFERENT NAME ..................... 197

A. The Same People Are Doing the Same Jobs In the Same Offices ................. 199

1. The Same People Are In Charge .............................................................. 199

2. The Same People Sell, Underwrite, Service, and Collect on Delta Bridge

MCAs ........................................................................................................ 201

3. Respondents and their Personnel Continued to Work From the Same

Locations ................................................................................................... 204

B. Delta Bridge Succeeded to Virtually All of Yellowstone’s Assets In the So-

Called “Purchase of Software” ........................................................................ 206

1. The Transition to Delta Bridge Was Fraudulently Disguised as a Sale of

Software .................................................................................................... 206

2. Delta Bridge in Fact Succeeded to Virtually All of Yellowstone’s Assets

208

C. Delta Bridge Is Yellowstone—Minus the “Baggage” of the Investigations .. 213

1. Delta Bridge’s Business Is the Same as Yellowstone’s ........................... 215

2. Delta Bridge Employees and Funders Are Also Handling the So-Called

“Wind-Down” of Yellowstone’s Business ................................................. 220

D. Yellowstone Transferred Its Assets to Shield Them from Potential Liability

Resulting from the Government Investigations ............................................ 225

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

6 of 289

v

1. Yellowstone Recognized at the Time of the Asset Transfer that the

Investigations Presented Grave Liabilities ............................................. 225

2. The Asset Transfer Was Motivated by Yellowstone’s Liabilities ........... 227

3. Yellowstone Engineered the Sale to an Insider and Maintained

Significant Control ................................................................................... 230

4. Delta Bridge Significantly Underpaid for the Assets It Acquired from

Yellowstone ............................................................................................... 234

V. SCALE AND EFFECTS OF RESPONDENTS’ FRAUD AND ILLEGALITY ... 236

VI. LIABILITY OF INDIVIDUAL RESPONDENTS ................................................ 241

A. Officer Respondents ........................................................................................ 241

1. David Glass ............................................................................................... 241

a. Glass Actively Managed, Directed, and Participated in Yellowstone’s

Operations Throughout Its Entire Existence .................................. 241

b. Glass Is a De Facto Officer and Shareholder of Yellowstone ......... 244

2. Isaac Stern ................................................................................................ 252

3. Jeffrey Reece ............................................................................................. 255

4. Bart Maczuga ........................................................................................... 258

5. Vadim Serebro .......................................................................................... 261

B. Funder Respondents ....................................................................................... 264

FIRST CAUSE OF ACTION AGAINST ALL RESPONDENTS PURSUANT TO

EXECUTIVE LAW § 63(12): ILLEGAL ACTS IN THE FORM OF USURY ............ 265

SECOND CAUSE OF ACTION AGAINST ALL RESPONDENTS PURSUANT TO

EXECUTIVE LAW § 63(12): ILLEGAL ACTS IN THE FORM OF CRIMINAL

USURY ........................................................................................................................ 266

THIRD CAUSE OF ACTION AGAINST ALL RESPONDENTS PURSUANT TO

EXECUTIVE LAW § 63(12): ILLEGAL ACTS IN THE FORM OF ENGAGING IN

THE BUSINESS OF MAKING HIGH-INTEREST LOANS WITHOUT A LICENSE

IN VIOLATION OF BANKING LAW §§ 340 AND 356 ............................................ 266

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

7 of 289

vi

FOURTH CAUSE OF ACTION AGAINST ALL RESPONDENTS PURSUANT TO

EXECUTIVE LAW § 63(12): FRAUD......................................................................... 268

FIFTH CAUSE OF ACTION AGAINST ALL RESPONDENTS PURSUANT TO

EXECUTIVE LAW § 63(12): DECEPTIVE ACTS AND PRACTICES IN VIOLATION

OF GENERAL BUSINESS LAW § 349 ...................................................................... 271

SIXTH CAUSE OF ACTION AGAINST DELTA BRIDGE FUNDING LLC:

VOIDABLE TRANSFER PURSUANT TO THE UNIFORM VOIDABLE

TRANSACTIONS ACT ............................................................................................... 273

REQUEST FOR RELIEF ............................................................................................ 275

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

8 of 289

1

Petitioner the People of the State of New York (“Petitioner”), by their

attorney, Letitia James, Attorney General of the State of New York (“NYAG”),

brings this special proceeding pursuant to Executive Law § 63(12) against

Yellowstone Capital LLC, Fundry LLC, Delta Bridge Funding LLC, Cloudfund LLC,

David Glass, Bartosz (“Bart”) Maczuga, Jeffrey Reece, Vadim Serebro, Yitzhak

(“Isaac”) Stern, Tsvi (“Steve”) Davis, Aaron Davis, Matthew Melnikoff, Mark

Sanders, David Singfer, and all other Respondent entities listed above (collectively,

“Respondents”).

The NYAG, on behalf of Petitioner, alleges as follows:

PRELIMINARY STATEMENT

1. Yellowstone Capital, Fundry, Delta Bridge, Cloudfund, and the other

Respondents named herein have engaged for years in a fraudulent, illegal scheme—

under the leadership of David Glass, Isaac Stern, Jeffrey Reece, Bart Maczuga, and

Vadim Serebro—to fleece money from small businesses by issuing them illegal,

short-term loans at sky-high interest rates through so-called “merchant cash

advances,” or “MCAs.”

2. Through their illegal transactions, which Respondents have enforced

using judgments that they have fraudulently obtained from the New York courts,

Respondents have illegally collected billions of dollars from struggling small

businesses in New York and across the United States. By doing so, they have

driven merchants even further into debt or financial ruin—or worse—causing

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

9 of 289

2

immense harm not only to the small businesses themselves, but also to the lives of

their owners, employees, and others who depend on them.

3. Respondents purport to help struggling small businesses by providing

them with rapid access to funding with flexible repayment options, with no lengthy

application process and despite past credit problems.

4. In reality, Respondents’ transactions are illegal, usurious, fraudulent

loans, set to fixed payment amounts that Respondents debit from merchants’ bank

accounts each business day (“Daily Amounts”). Respondents set their transactions

to finite terms, such as 60 days or 90 days.

5. Respondents memorialize each funding transaction in an agreement in

which they fraudulently describe the deal as a “Purchase and Sale of Future

Receivables,” or similar language. Respondents falsely state in their agreements

that they are buying a portion, which they call a “Specified Percentage,” of the

merchants’ future receipts of revenue, sometimes called “receivables.” Respondents

set each merchants’ payments to a fixed, recurring amount that they fraudulently

state reflects a Specified Percentage of the merchant’s future revenue.

6. Respondents misrepresent that if merchants’ revenue declines in the

future, the merchants can “reconcile” their past payment amounts accordingly,

obtaining refunds for past payments—and, in the case of Delta Bridge, adjustment

for future payments as well—so the merchants are never paying more than a set

percentage of their revenue. And Respondents falsely state in the agreements that

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

10 of 289

3

the transactions are open-ended, such that the advances may be paid off over a long

term if the merchants’ receipt of revenue slows down.

7. All these representations are a sham, created by Respondents to lure

merchants to sign their loan agreements and to evade New York usury law by

disguising the loans as something they are not. But Respondents’ transactions are

usurious loans, not purchases of revenue.

8. Respondents collect on the transactions according to fixed Daily

Amounts that have no connection to the Specified Percentages stated in the

agreements, and Respondents debit them from merchants’ bank accounts each

business day, regardless of declines in the merchants’ revenue.

9. Respondents’ promises of payment reconciliation are a fraud.

Respondents deliberately increase their Specified Percentages while planning their

transactions in order to put the remedy of reconciliation far out of reach for

merchants, making it impossible for merchants to qualify for fair refunds of excess

payments collected by Respondents when merchants’ intake of revenue declines.

10. Despite their promises of open-ended payment terms, Respondents set

their transactions to finite terms, such as 60 or 90 business days, which

Respondents regularly negotiate and manipulate, largely based on the perceived

risk of repayment and without regard to the percentages of merchants’ revenue

purportedly purchased. These finite repayment terms are not affected by

reconciliations or adjustments based on Specified Percentages of merchants’

revenue, which Respondents virtually never provide.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

11 of 289

4

11. Through their fixed payments and finite terms, Respondents charge

the merchants sky-high annual interest rates that are regularly in the triple

digits—reaching at least as high as 820%—far beyond both the maximum civil

usury interest rate of 16% and the maximum criminal usury interest rate of 25%.

12. Respondents require the transactions to be personally guaranteed and

extensively secured against a vast array of merchants’ assets, far beyond the

revenue Respondents purport to be purchasing.

13. Respondents claim for themselves priority status as secured creditors

under UCC Article 9, enabling them to ensure full repayment in the event of

merchant bankruptcy, long after merchants’ revenue has dwindled to zero, while

unsecured and lower-priority creditors may recover little to nothing.

14. Respondents declare merchants in default when they merely have

insufficient funds in their bank account to cover Respondents’ debits of Daily

Amounts, and in the event of such “default” Respondents file legal actions against

merchants and their guarantors to immediately recover not only the missed

payments but also the merchant’s entire remaining balance.

15. And on top of their usury scheme, Respondents, through their

Yellowstone operation, have defrauded merchants in other ways by repeatedly

charging the merchants hidden, undisclosed fees and by debiting from the

merchants’ bank accounts excess payments that the merchants never agreed to.

16. Respondents have also directed their fraudulent scheme at the New

York judiciary. This was an essential part of Respondents illegal usury scheme, as

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

12 of 289

5

Respondents counted on being able to enforce their agreements with merchants,

who were located all over the country, in the courts of this state.

17. When Respondents sought to enforce their agreements, they did so by

fraudulently obtaining judgments from the New York courts. Respondents file court

papers falsely stating that they collect “Specified Percentages” of merchants’

revenue and that merchants have defaulted on the transactions by failing to pay

such percentages to Respondents. By fraudulently filing such papers in court,

Respondents have created before the courts the illusion that their transactions are

lawful investments in merchants’ future receipts of revenue—when in reality they

are nothing more than fixed-payment, short-term, ultra-high-interest loans.

Respondents have then used these fraudulently obtained judgments as a tool to

seize even more money from the bank accounts of merchants and their guarantors,

in addition to the money Respondents wrongly collected as Daily Amounts.

18. Respondents have conducted their fraudulent, illegal scheme under

numerous corporate names and purported corporate forms. From 2009 to 2021,

Respondents managed their operation under the names of Yellowstone Capital,

Fundry, and numerous subsidiary companies (“Yellowstone Subsidiaries”), such as

Green Capital Funding LLC, Capital Advance Services LLC, and World Global

Capital LLC. Each of these was merely an interchangeable brand name, an alias,

for Yellowstone Capital, and all such entities provided the same usurious,

fraudulent MCA product put forth by Yellowstone Capital.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

13 of 289

6

19. Respondents have for years concealed their association with David

Glass, a notorious white-collar criminal who was previously convicted of securities

fraud, even as Glass has been actively engaged with Respondents for years in

shaping and managing their fraudulent, illegal MCA business.

20. In 2021, Respondents purported to wind down the Yellowstone/Fundry

operation and sell its software assets to a brand-new MCA company, Delta Bridge—

a transaction arranged by Glass—but the asset sale was a sham. Delta Bridge and

its affiliated company Cloudfund were nothing more than new names for the same

Yellowstone/Fundry operation, run by former Yellowstone officers, staffed by the

same Yellowstone personnel, and selling the same fraudulent, illegal, usurious

MCA product that was long sold by Yellowstone.

21. Since 2013, Respondents under their various names have illegally,

fraudulently collected an estimated $4.5 billion from merchants and their

guarantors, including an estimated $1.38 billion in interest. Businesses throughout

the country have been ruined as a result. Many, such as the popular New York

City-based City Bakery, have been forced to lay off their employees and go out of

business after being pushed by Respondents into deepening spirals of debt. When

one merchant, Jerry Bush, a plumber based in Virginia, was told by Respondent

Steve Davis that death was the only escape from his ballooning debts to

Yellowstone (or winning the lottery), the merchant attempted suicide in a desperate

attempt to save himself and his family from a bottomless pit of debt.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

14 of 289

7

22. Petitioner now seeks relief for the merchants that have been harmed

by Respondents’ repeated and persistent fraud and illegality and an injunction

prohibiting Respondents from engaging in similar conduct in the future.

23. Pursuant to New York Executive Law § 63(12), Petitioner seeks an

order:

a. Permanently enjoining Respondents from engaging in the fraudulent

and illegal practices alleged herein;

b. Permanently enjoining Respondent Glass from engaging in or profiting

from MCAs, loans, or business funding in the future, and enjoining all

other Respondents from involvement in the Merchant Cash Advance

business for no less than ten years;

c. Ordering Respondents to cease all collection of payments on MCAs

pending the hearing of this Petition;

d. Declaring void and ordering rescission of each of Respondents’

usurious, fraudulent, and illegal agreements;

e. Ordering Respondents to file papers sufficient to obtain vacatur of all

judgments obtained by them pursuant to such agreements;

f. Staying all marshals, sheriffs, and collection agents from executing or

collecting upon such judgments;

g. Ordering Respondents to apply for dismissal of all pending court

proceedings concerning such agreements;

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

15 of 289

8

h. Ordering Respondents to file papers sufficient to terminate all liens or

security interests related to their cash advances;

i. Ordering Respondents to provide a detailed accounting of all moneys

collected;

j. Ordering Respondents to pay full restitution and damages to

merchants in the amount of every dollar of interest Respondents have

illegally collected from merchants, every dollar Respondents have

fraudulently overcollected from merchants beyond the total collection

amounts represented, every dollar of their fraudulent fees, and every

dollar they have collected through execution of their fraudulently

obtained court judgments;

k. Ordering Respondents to disgorge all profits;

l. Awarding civil penalties and costs to the NYAG;

m. Setting aside the asset transfer between Yellowstone and Delta Bridge;

and

n. Granting such other and further relief as the Court deems just and

proper.

PARTIES AND JURISDICTION

24. Petitioner is the People of the State of New York.

25. The NYAG brings this special proceeding on behalf of the People

pursuant to, inter alia, Executive Law § 63(12), which authorizes the NYAG to seek

injunctive relief, restitution, damages, and costs when any person or entity has

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

16 of 289

9

engaged in repeated fraudulent or illegal acts or has otherwise demonstrated

persistent fraud or illegality in conducting its business.

I. CORPORATE RESPONDENTS

A. Yellowstone Capital and Fundry

26. Respondent Yellowstone Capital LLC is a limited liability company

organized under New York law in 2009. Ex. 436 (Articles of Organization).

1

From

2009 until 2016, Yellowstone Capital LLC was headquartered at 160 Pearl Street in

Manhattan. See Kern Tr. at 29:14-25; Melnikoff Tr. at 41:14-18.

2

27. After 2016, Yellowstone and its subsidiaries maintained offices in

Manhattan at 30 Broad Street, 14

th

Floor, and 116 Nassau Street, Suite 804, and in

New Jersey at One Evertrust Plaza, Jersey City. In all of their MCA transactions

with merchants, Yellowstone and its subsidiaries prominently listed one of their

Manhattan addresses, locating themselves in the Financial District of the financial

capital of the world. E.g., Ex. 1 (hereinafter “Yellowstone 2018 Exemplar”) at 2; Ex.

2 (hereinafter “Yellowstone 2020 Exemplar”) at 1.

28. The MCA agreements that Yellowstone and its subsidiaries entered

into with merchants were all negotiated and carried out in New York, and each of

the payments collected from merchants was delivered to Yellowstone in New York,

as expressly stated in the agreements. See, e.g., Yellowstone 2020 Exemplar at 11-

1

Exhibits cited herein are exhibits to the Affirmation of Adam J. Riff, filed

herewith.

2

Transcripts are identified by exhibit number in paragraphs 83 and 112, infra.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

17 of 289

10

12 § 43; Ex. 87 at 11 § 43 (Nov. 2018 Green Capital contract); see also infra ¶¶ 466-

472 (discussing Respondents’ targeting of New York as an essential part of their

fraudulent and illegal usury scheme).

29. Respondent Fundry LLC is a limited liability company organized

under New York law in 2015. See Ex. 437 at 28 (Fundry Articles of Organization).

Fundry is an alias for Yellowstone Capital LLC, and its employees and

representatives have used the two names “interchangeably.” Stern Tr. at 31:19-20;

see also Reece Tr. at 24:24-25:2.

30. Yellowstone Capital LLC and Fundry currently have no offices of their

own, but instead do business from the offices of Delta Bridge, as set forth infra

¶¶ 637-651, and from the homes of their officers, Respondents Stern, Reece, and

Glass.

31. Yellowstone purportedly ceased issuing new MCAs in May 2021. In

reality, Yellowstone has continued to operate under the Delta Bridge name, as set

forth below. See infra Part IV. Yellowstone also continues to collect on certain

outstanding MCAs that were issued prior to May 2021. See, e.g., Stern Tr. at

150:11-151:17.

B. Yellowstone Subsidiaries

32. Yellowstone Capital LLC issued and collected on its MCAs through

numerous subordinate limited liability corporations (“Yellowstone Subsidiaries”).

See Ex. 47 (Yellowstone Organization Charts) (defining such entities as “Funding

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

18 of 289

11

Platforms”); see also infra ¶¶ 59-69 (explaining that Yellowstone and the

Subsidiaries form a common enterprise).

33. As used in this Petition, the name “Yellowstone” refers collectively to

Yellowstone Capital LLC, Fundry, and all Yellowstone Subsidiaries.

34. Each of the Yellowstone Subsidiaries identified herein on information

and belief operated from Yellowstone Capital LLC’s offices.

35. Respondent ABC Merchant Solutions, LLC, is a Yellowstone

Subsidiary and a limited liability company organized under New York law in 2016.

See Ex. 437 at 1 (New York Department of State (“NY DOS”) Entity Information).

36. Respondent Advance Merchant Services LLC is a Yellowstone

Subsidiary and a limited liability company organized under New York law in 2015.

See id. at 4 (NY DOS Entity Information).

37. Respondent Business Advance Team LLC is a Yellowstone Subsidiary

and a limited liability company organized under New York law in 2016. See id. at 7

(NY DOS Entity Information). Business Advance Team LLC did business under its

own name and the names Accel Funding, BRC, and Everyday Capital. See Ex. 47

(Yellowstone Organization Chart).

38. Respondent Capital Advance Services LLC is a Yellowstone Subsidiary

and a limited liability company organized under New York law in 2015. See Ex. 437

at 9 (NY DOS Entity Information).

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

19 of 289

12

39. Respondent Capital Merchant Services, LLC, is a Yellowstone

Subsidiary and a limited liability company organized under New York law in 2015.

See id. at 12 (NY DOS Entity Information).

40. Respondent Cash Village Funding LLC is a Yellowstone Subsidiary

and a limited liability company organized under New York law in 2017. See id. at

15 (NY DOS Entity Information).

41. Respondent Fast Cash Advance LLC is a Yellowstone Subsidiary and a

limited liability company organized under New York law in 2018. See id. at 25 (NY

DOS Entity Information).

42. Respondent Fundzio LLC is a Yellowstone Subsidiary and a limited

liability company organized under New York law in 2017. See id. at 31 (NY DOS

Entity Information).

43. Respondent Green Capital Funding LLC is a Yellowstone Subsidiary

and a limited liability company organized under New York law in 2015. See id. at

37 (NY DOS Entity Information).

44. Respondent HFH Merchant Services LLC is a Yellowstone Subsidiary

and a limited liability company organized under New York law in 2017. See id. at

40 (NY DOS Entity Information).

45. Respondent High Speed Capital LLC is a Yellowstone Subsidiary and a

limited liability company organized under New York law in 2014. See id. at 43 (NY

DOS Entity Information).

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

20 of 289

13

46. Respondent Merchant Capital Pay LLC is a Yellowstone Subsidiary

and a limited liability company organized under New York law in 2018. See id. at

46 (NY DOS Entity Information).

47. Respondent Merchant Funding Services LLC is a Yellowstone

Subsidiary and a limited liability company organized under Florida law in 2013.

See id. at 49 (Articles of Organization).

48. Respondent Midnight Advance Capital LLC is a Yellowstone

Subsidiary and a limited liability company organized under New York law in 2016.

See id. at 53 (NY DOS Entity Information).

49. Respondent Mr. Advance Capital LLC is a Yellowstone Subsidiary and

a limited liability company organized under New York law in 2019. See id. at 56

(NY DOS Entity Information).

50. Respondent Ocean 1213 LLC is a Yellowstone Subsidiary and a limited

liability company organized under New York law in 2017. See id. at 59 (NY DOS

Entity Information).

51. Respondent Simply Equities LLC is a Yellowstone Subsidiary and a

limited liability company organized under New York law in 2018. See id. at 62

(Articles of Organization).

52. Respondent Thryve Capital Funding LLC is a Yellowstone Subsidiary

and a limited liability company organized under New York law in 2016. See id. at

65 (NY DOS Entity Information).

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

21 of 289

14

53. Respondent TVT Cap Fund LLC is a Yellowstone Subsidiary and a

limited liability company organized under New York law in 2016. See id. at 68 (NY

DOS Entity Information).

54. Respondent TVT Capital HR, LLC, is a Yellowstone Subsidiary and a

limited liability company organized under New York law in 2018. See id. at 71 (NY

DOS Entity Information).

55. Respondent WCM Funding LLC is a Yellowstone Subsidiary and a

limited liability company organized under New York law in 2017. See id. at 74 (NY

DOS Entity Information).

56. Respondent West Coast Business Capital, LLC (“West Coast Capital”),

is a Yellowstone Subsidiary and a limited liability company organized under New

York law in 2012. See id. at 77 (NY DOS Entity Information). West Coast Capital

was known as Yellowstone Capital West LLC until 2018, when it changed its name

to West Coast Business Capital, LLC. See id. at 82 (Certificate of Amendment).

57. Respondent World Global Capital LLC (“World Global”) is a

Yellowstone Subsidiary and a limited liability company organized under New York

law in 2016. See id. at 80 (NY DOS Entity Information). World Global has done

business under its own name and over forty additional entity names (“World Global

DBAs”), as identified in its MCA agreements and in Yellowstone’s Organization

Chart. See Ex. 47. The World Global DBAs include:

1) 1 West Financial

2) 24 Capital

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

22 of 289

15

3) ABC Merchant Solutions

4) Accel Capital Services

5) Blue Rock Capital

6) Cardinal Advance

7) Cardinal Funding

8) Citi Cap

9) Clara Capital

10) Crestmont Capital

11) Direct Capital Source

12) EIN Cap

13) Everlasting Capital

14) Fast Cash Advance

15) Fast Cash Funding

16) Fastline Capital

17) Flash Advance

18) Fortress Advance

19) Funderslink

20) Fundit Lending Solutions

21) Fundkite Funding

22) Fundworks

23) Grand Capital Funding

24) Ibex Funding Group

25) Ifundco

26) Karish Funding

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

23 of 289

16

27) Main Street Merchant Services

28) Mainstreet Capital Group

29) Mass Capital Funding

30) New Era Advance

31) One Funder

32) One World Funding

33) PBS Capital

34) Prosperum Funding

35) RBS Funding

36) RTR Funding

37) Richmond Funding

38) SBG Funding

39) Samson Advance

40) Simple Funding Solutions

41) Smart Business High Risk

42) Sprout Funding

43) Standard Financing

44) Three Tree Funding

45) Velocity Capital Group

46) Velocity Funding Group

47) Westwood Funding

48) Yes Funding

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

24 of 289

17

58. The Yellowstone Subsidiaries memorialized their MCAs in agreements

substantially identical to the Yellowstone agreements. See generally Exs. 462 and

463 (exemplar agreements in alphabetical order by Yellowstone Subsidiary).

C. Yellowstone, Its Subsidiaries, and Fundry Form a

Common Enterprise

59. Yellowstone Capital LLC, Fundry, and the Yellowstone Subsidiaries

form a common enterprise.

60. Respondent Stern, Yellowstone’s co-founder and CEO, explained that

“Yellowstone issued merchant cash advances through various LLCs.” Stern Tr. at

54:8-11. He testified that the LLCs were simply “Yellowstone entities” that “were

owned and controlled by Yellowstone” and used simply as “different Yellowstone

brands,” id. at 54:25-55:9, and treated as “just the [contractual] paper that the

merchant cash advances were funded on,” id. at 56:17-19; accord Maczuga Tr. at

112:22-113:11; S. Davis Tr. at 214:9-24.

61. Stern testified that “there were no differences among [the] merchant

cash advances that the [subordinate] entities offered,” and Yellowstone’s personnel

“use[d] the entities interchangeably.” Stern Tr. at 56:3-5, 62:24-63:2; accord S.

Davis Tr. at 24:18-25:13; Ehrlich Tr. at 66:22-67:4; Kern Tr. at 165:16-166:7; McNeil

Tr. at 103:1-104:16; Melnikoff Tr. at 86:18-25; Saffer Tr. at 35:12-24, 104:7-20,

155:25-156:4; Schwartz Tr. at 72:14-73:7, 79:8-15; Worch Tr. at 42:21-44:25, 144:24-

145:5; Yagecic I Tr. at 127:22-128:6.

62. Respondents occasionally referred to such Yellowstone brands as

“white labels.”

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

25 of 289

18

63. The Yellowstone Subsidiaries were “identical in terms of their

operations, personnel, [and] location.” Stern Tr. at 70:6-11; accord Reece Tr. at

58:12-59:25. They had no separate officers, employees, boards of directors, legal

counsel, office addresses, Stern Tr. at 58:6-20, or phone numbers aside from those

of Yellowstone Capital LLC, see, e.g., Ex. 117 at 9, 15 (Mar. 8, 2018 Yellowstone

Capital LLC agreement); Ex. 106 at 9-10 (Green Capital Funding LLC agreement of

the same date); Ex. 89 at 7 (May 29, 2015 Merchant Funding Services LLC

agreement); Ex. 119 at 1 (May 28, 2015 Yellowstone Capital LLC agreement); Ex.

98 at 1, 10 (Jan. 19, 2017 Yellowstone Capital West LLC agreement).

64. The Yellowstone Subsidiaries were operationally identical, with no

differences in underwriting, servicing, or collections. See Stern Tr. at 61:18-63:5.

The Yellowstone Subsidiaries were financially identical, including in their

distribution of revenues and profits. Stern Tr. at 61:14-17. The Yellowstone

Subsidiaries differed only in their names and in their use of different bank accounts

to collect payments. Stern Tr. at 70:6-11; McNeil Tr. at 113:6-10.

65. Yellowstone issued its MCAs through subsidiary names such as Green

Capital Funding and High Speed Capital largely to conceal from merchants

Yellowstone’s involvement in its MCA transactions. See Ex. 325 at 5 (email to all

Yellowstone personnel, stating: “We are treating Green Capital with the same level

of discretion as HighSpeed; looking to avoid a direct Yellowstone connection”).

Yellowstone had a “particularly bad” relationship in the MCA industry, Ehrlich Tr.

at 70:22-71:3, so it “tr[ied] to obscure its involvement in deals through the use of . . .

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

26 of 289

19

different entities,” Williams Tr. at 60:12-18; accord id. at 58:14-19, 61:24-62:5;

Yagecic I Tr. at 131:20-22; Vasquez Tr. at 37:11-13, 38:6-12.

66. Around 2015, for example, Yellowstone began selling MCAs through

Green Capital, a Yellowstone Subsidiary, “the whole purpose” of which “was to try

to separate from the extremely negative reputation that Yellowstone had.” Ehrlich

Tr. at 69:9-70:5; see Ex. 325 at 5. Merchants “knew to stay away from Yellowstone,

but then they would come to Green Capital, thinking they were speaking with a

new company, but it’s the same paper.” Ehrlich Tr. at 70:14-19; see, e.g. Alabudi

Aff. ¶¶ 65-66, 70, 73.

67. For example, the merchant Austin’s Habibi entered into an MCA

agreement with High Speed Capital in March 2018 in part because its owner had

previously had a bad experience with a different Yellowstone Subsidiary and

believed that High Speed was not Yellowstone-affiliated—an understanding that

was fraudulently confirmed by a broker working with High Speed Capital, who

falsely “confirmed that they were ‘different’ companies.” Alabudi Aff. ¶ 70.

68. Also in 2015, Respondents created the company Fundry LLC, and they

began using Fundry as a “brand name” for Yellowstone’s overall operation. See

Stern Tr. at 51:16-52:18; accord Reece Tr. at 24:24-25:2 (“Fundry is the rebranding

of Yellowstone.”).

69. For “operational and financial purposes,” there was no difference

between Fundry and Yellowstone Capital LLC. Stern Tr. at 51:18-22; accord Glass

Tr. at 44:24:45:4. Fundry had no personnel, office address, or phone lines separate

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

27 of 289

20

from those of Yellowstone Capital LLC. Stern Tr. at 52:13-18. Respondents used

the Yellowstone and Fundry names “interchangeably.” Stern Tr. at 31:19-20.

D. Delta Bridge Entities

70. Respondent Delta Bridge Funding LLC is a limited liability company

organized under Delaware law in 2021. See Ex. 437 at 21 (Certificate of

Formation). Delta Bridge Funding LLC maintains offices in Suffern, New York,

and in Fort Lauderdale and Aventura, Florida. See Ex. 53.

71. In its MCA transactions with merchants, Delta Bridge prominently

lists its Suffern address, continuing Yellowstone’s practice of outwardly identifying

itself as a New York-based company. E.g., Ex. 3 (hereinafter “Delta Bridge

Exemplar”) at 1; see also infra ¶¶ 466-472.

72. The MCA agreements that Delta Bridge has entered into with

merchants were all negotiated and carried out in New York, and each of the

payments collected from merchants was delivered to Delta Bridge in New York, as

expressly stated in the agreements. See, e.g., Delta Bridge Exemplar at 10 § 38; see

also infra ¶¶ 466-472 (discussing Respondents’ targeting of New York as an

essential part of their fraudulent and illegal usury scheme).

73. Respondent Cloudfund LLC is a limited liability company organized

under New York law in 2021. See Ex. 437 at 18 (Articles of Organization).

Cloudfund is an affiliate of Delta Bridge Funding LLC and is operated from the

same offices. Maczuga Tr. at 114:8-25. Cloudfund does business both under its own

name and under other names, including: Samson Group, Unique Capital,

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

28 of 289

21

Alternative Fast Source, Red Hawk Funding, and WWF Funding Group. E.g., Exs.

63, 69, 99, 91, 56.

74. Since May 2021, Respondents’ MCA agreements have identified

Cloudfund as party to its agreements and Delta Bridge Funding LLC as

Cloudfund’s “servicing agent,” responsible for servicing the transactions. Serebro

Tr. at 97:17-25; e.g., Delta Bridge Exemplar at 1, 3 § 8.

75. In fact, Delta Bridge Funding LLC and Cloudfund operate as a

common enterprise. The two entities are referred to collectively as “Delta Bridge” in

this Petition.

76. As Respondent Bart Maczuga—CEO of both entities—testified, “[I]t’s

all one . . . it’s one company.” Maczuga Tr. at 114:8-15; see also Saffer Tr. at 37:12-

18 (“Cloud Fund and Delta Bridge are the same”).

77. Cloudfund is simply a “brand name,” or “platform,” for Delta Bridge’s

MCAs, created for the “sole purpose of being . . . [named] on the contract” for Delta

Bridge’s MCAs. Maczuga Tr. at 113:12-114:12.

78. Cloudfund has no employees of its own apart from those who work for

Delta Bridge Funding LLC. See id. at 114:8-9; Serebro Tr. at 89:14-90:6, 91:25-92:8.

79. Cloudfund has no offices separate from those of Delta Bridge Funding

LLC. See Maczuga Tr. at 114:8-25.

80. Cloudfund has no directors or officers separate from those of Delta

Bridge Funding LLC. See id. at 114:4-15; Serebro Tr. at 89:14-90:6, 91:25-92:8.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

29 of 289

22

81. On information and belief, Cloudfund has no telephone lines separate

from those of Delta Bridge Funding LLC.

82. Delta Bridge is also Yellowstone’s legal successor, as set forth below.

Infra Part IV.

II. INDIVIDUAL RESPONDENTS

83. The individual Respondents, who are detailed in this Part, are

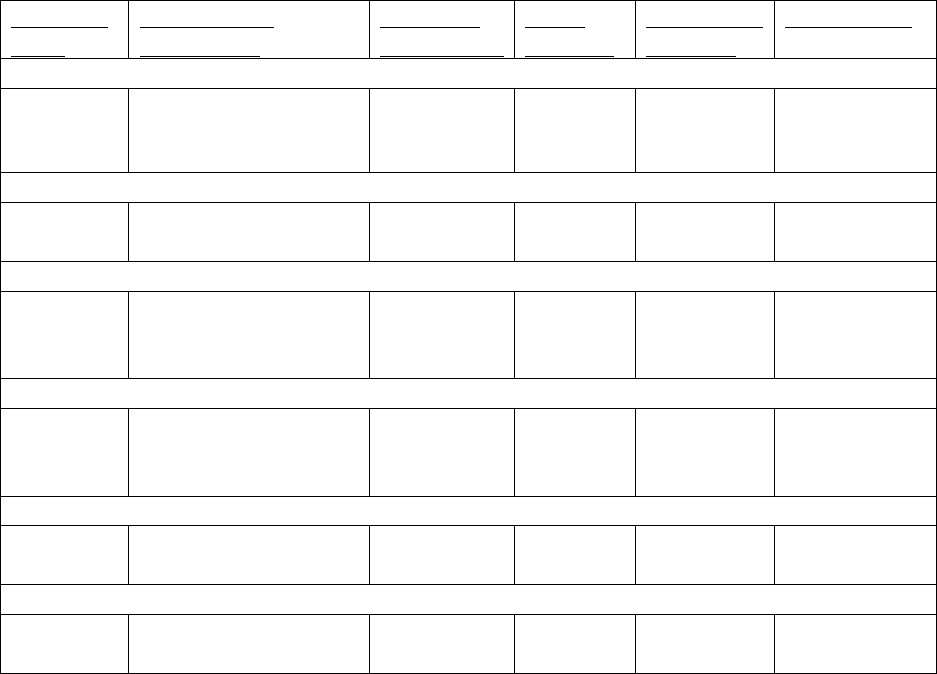

summarized in this chart:

RESPONDENT

ROLE

TESTIMONY

David Glass

Yellowstone de facto officer, part owner,

and co-founder (2015-present)

Yellowstone CFO, part owner

(2009-2014)

Ex. 9 (“Glass Tr.”)

Ex. 10 (“Glass Strike

Tr.”) (see infra

¶ 600 & n.13)

Yitzhak (“Isaac”)

Stern

Yellowstone CEO, part owner, and co-

founder (2009-present)

Ex. 20 (“Stern Tr.”)

Jeffrey Reece

Yellowstone president and part owner

(2015-present)

Ex. 15 (“Reece Tr.”)

Bartosz (“Bart”)

Maczuga

Delta Bridge CEO, majority owner, and

co-founder (2021-present)

Yellowstone Co-CEO and part owner

(2019-2021)

Yellowstone Funder (2012-2019)

Ex. 12 (“Maczuga

Tr.”)

Vadim Serebro

Delta Bridge general counsel, part

owner, and co-founder (2021-present)

Yellowstone general counsel

(2018-present)

Ex. 18 (“Serebro

Tr.”)

Aaron Davis

Yellowstone & Delta Bridge Funder

(to present)

Ex. 6 (“A. Davis

Tr.”)

Tsvi (“Steve”)

Davis

Yellowstone Funder (to 2018) and part

owner (to present)

Ex. 7 (“S. Davis Tr.”)

Matthew

Melnikoff

Yellowstone & Delta Bridge Funder

(to present)

Ex. 14 (“Melnikoff

Tr.”)

Mark Sanders

Yellowstone & Delta Bridge Funder

(to present)

N/A (see infra ¶ 107)

David Singfer

Yellowstone & Delta Bridge Funder

(to present)

Ex. 19 (“Singfer

Tr.”)

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

30 of 289

23

A. Officer Respondents

84. Respondents Glass, Stern, Reece, Maczuga, and Serebro, each of whom

has served as an officer of Yellowstone and/or Delta Bridge, are collectively referred

to herein as Officer Respondents.

85. Respondent David Glass currently resides in Fort Lauderdale, Florida.

Glass Tr. at 13:11-13. Glass co-founded Yellowstone with Isaac Stern in 2009, id. at

39:5-6, served as its managing member and chief financial officer through 2014, id.

at 29:25-30:5; Ex. 409 at 1 (identifying Glass as Yellowstone’s Managing Member);

Ex. 414 at 2 (same), and has since January 2015 remained active in planning

Respondents’ operations and transactions as an undisclosed, de facto officer and

shareholder, as set forth below.

86. Glass was Yellowstone Capital LLC’s registered agent when the entity

was organized in 2009, listing his Manhattan residence as the place of service. Ex.

436 (Articles of Organization). Glass managed Yellowstone working out of

Yellowstone’s Manhattan office at 160 Pearl Street through at least 2014. Glass Tr.

at 35:23-25, 59:2-5, 63:21-64:10.

87. Glass has maintained his ownership share in Yellowstone through

New York entities including Grace Capital LLC. See Ex. 417. According to the New

York Department of State, Glass is the registered agent for Grace Capital, at

residential addresses in Brooklyn and Southhampton, New York. See Ex. 437 at 34

(NY DOS entity information for Grace Capital); see also Ex. 368 at 1 (reference to a

gathering at “glass’s hamptons place” in 2019); Saffer Tr. at 224:18-25.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

31 of 289

24

88. Respondent Yitzhak (“Isaac”) Stern resides in Hillside, New Jersey.

Stern co-founded Yellowstone with Glass in 2009 and since that time has led the

company as its chief executive officer (“CEO”). Stern Tr. at 14:6-7, 82:4.

89. Stern managed Yellowstone working out of Yellowstone’s Manhattan

office at 160 Pearl Street until 2016. Glass Tr. at 35:23-25, 59:2-5, 63:21-64:10.

90. Respondent Jeffrey Reece currently resides in Providence, Utah. Reece

joined Yellowstone’s management team in 2015, serves as its president, and is a

part owner of Yellowstone. Reece Tr. at 13:9-10, 21:7-8; Stern Tr. at 28:23-29:3.

91. Reece managed Yellowstone working out of Yellowstone’s Manhattan

office at 160 Pearl Street until 2016. Reece Tr. at 39:13-17.

92. Respondent Bartosz (“Bart”) Maczuga currently resides in Sunny Isles

Beach, Florida. Maczuga Tr. at 19:19-24. Maczuga started at Yellowstone in 2011

in a behind-the-scenes role working for David Glass, who recruited him for the role,

and then became a Funder the next year. Id. at 38:2-39:25, 43:19-45:8; see infra

¶ 97 (defining “Funder”). During the years 2016 through 2018, Maczuga was

ranked as one of Yellowstone’s top Funders. See Ex. 54. Maczuga was a Funder on

Yellowstone transactions, working out of Yellowstone’s Manhattan office at 160

Pearl Street until 2016.

93. In February 2019 Maczuga was promoted to co-CEO of Yellowstone,

serving alongside Stern. Maczuga Tr. at 34:7-8; 374:24-25. From May 2021 until

the present Maczuga has served as CEO of Delta Bridge, which company he co-owns

with Respondent Vadim Serebro. Maczuga Tr. at 28:15-19; Serebro Tr. at 68:3-12.

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

32 of 289

25

94. Respondent Vadim Serebro resides in Yonkers, New York. Serebro Tr.

at 12:19-24. Together with Maczuga, Serebro is co-founder and co-owner of Delta

Bridge. See Ex. 52. Serebro is also the sole owner of an affiliated collections firm

dedicated to collecting on defaulted Delta Bridge MCAs, called Max Recovery, which

previously performed the same function at Yellowstone. See infra ¶¶ 587-590;

Serebro Tr. at 68:20-69:17, 74:11-21.

95. Serebro is Delta Bridge’s general counsel (2021 to present) as well as

Yellowstone’s general counsel (2018 to present), where he worked beginning in

2013. See Exs. 50, 51; Serebro Tr. at 19:16-20:14; Stern Tr. at 135:8-11. Serebro

also uses the title of general counsel at Max Recovery, the collections firm he solely

owns and manages. Serebro Tr. at 20:23-24, 69:9-17. In addition, Serebro holds the

title of Chief Strategy Officer at Delta Bridge. Id. at 51:25-52:17.

96. Serebro has personally invested in hundreds of Respondents’

individual MCA transactions as a “participant” (defined infra ¶ 98), through an

entity he owns called VS Ventures. Serebro Tr. at 58:14-59:7, 62:7-63:3, 103:13-

107:7; 130:24-133:18.

B. Funder Respondents

97. Both Yellowstone and Delta Bridge operate through individuals they

refer to as “funders” (“Funders”), who purportedly serve as independent contractors

and are responsible for negotiating, underwriting, issuing, servicing, and collecting

upon the companies’ MCAs, as set forth herein. E.g., Melnikoff Tr. at 28:16-29:7;

Maczuga Tr. at 76:14-80:19; A. Davis Tr. at 31:25-32:13; S. Davis Tr. at 47:25-15,

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

33 of 289

26

50:14-51:13; Singfer Tr. at 21:8-20; Saffer Tr. at 39:4-41:11; see also infra ¶¶ 327-

331 (discussing Funders’ negotiations with merchants).

98. Yellowstone’s and Delta Bridge’s Funders participate financially in

each of the MCAs they manage by investing money into the transactions and

sharing in the profits and losses that result. See Glass Tr. at 133:9-15; Kern Tr. at

38:12-19; S. Davis Tr. at 41:6-13; Ehrlich Tr. at 20:4-15, 59:6-25, 83:7-84:14; see also

infra ¶ 630 (Funder compensation same at Yellowstone and Delta Bridge).

Yellowstone and Delta Bridge’s Funders also regularly invest in individual

Yellowstone and Delta Bridge MCA deals managed by other Funders through so-

called “participation” or “syndication” arrangements. Maczuga Tr. at 55:4-10; Reece

Tr. at 45:11-20; Saffer Tr. at 63:15-20; Yagecic II Tr. at 93:2-6; McNeil Tr. at 142:6-

24 (testifying about Ex. 288).

99. The Funder respondents identified herein include Maczuga, who

served as a Funder at Yellowstone prior to being named Yellowstone’s co-CEO, and

five of Respondents’ top ten additional Funders from 2016 through 2022, as

determined by total dollars advanced to merchants in Yellowstone’s and Delta

Bridge’s MCAs (“Funder Respondents”). See Ex. 54 (list of top Yellowstone/Delta

Bridge Funders by year by dollars advanced). Each Funder Respondent remains

active in the MCA industry as of at least 2023.

100. The Funder Respondents include the following individuals.

101. Respondent Aaron Davis resides in Pomona, New York. A. Davis Tr.

at 12:17-21. Aaron Davis worked as a Funder at Yellowstone from around 2009

CAUTION: THIS DOCUMENT HAS NOT YET BEEN REVIEWED BY THE COUNTY CLERK. (See below.) INDEX NO. UNASSIGNED

NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 03/05/2024

This is a copy of a pleading filed electronically pursuant to New York State court rules (22 NYCRR §202.5-b(d)(3)(i))

which, at the time of its printout from the court system's electronic website, had not yet been reviewed and

approved by the County Clerk. Because court rules (22 NYCRR §202.5[d]) authorize the County Clerk to reject

filings for various reasons, readers should be aware that documents bearing this legend may not have been

accepted for filing by the County Clerk.

34 of 289

27

until at least May 2021 and at Delta Bridge from May 2021 to the present. See id.

at 20:15-18, 41:7-17. Respondents Aaron Davis and Steve Davis are brothers.

102. Respondent Tsvi (“Steve”) Davis currently resides in Miami Beach,