Last Updated: 11/1/23

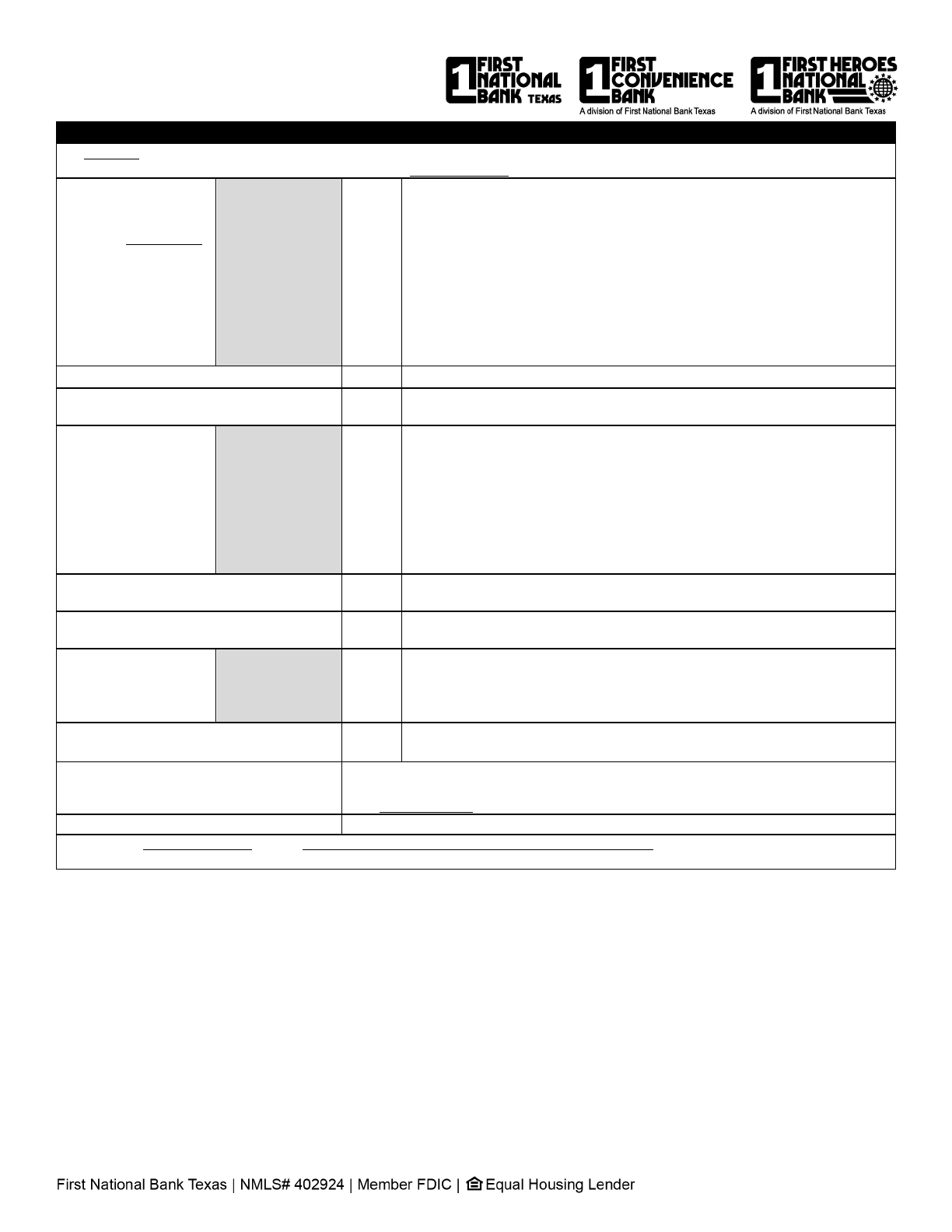

A Clear and Concise Guide to the

POWER CHECKING ACCOUNT

This Clear and Concise Guide serves as the Truth-in-Savings disclosure for the Power Checking Account. The Clear and Concise Guide as well as

the Deposit Agreement are the governing terms of the Power Checking Account we offer.

BASIC TERMS AND CONDITIONS

“Bank”, “we”, “us” and “our” means First National Bank Texas (FNBT), or First Convenience Bank (FCB), a division of First National Bank Texas or

First Heroes National Bank (FHNB), a division of First National Bank Texas.

ACCOUNT

OPENING

AND

USAGE

Minimum Deposit Needed to Open Account

$0

In person or Online

Monthly Maintenance Fee

$12

(no Fee if you are 60 or older)

Requirements to Waive Monthly

Maintenance Fee

(No Monthly Maintenance Fee if you do one

of the following each statement cycle)

• Maintain a balance of $250 or more each day, or

• Have a total of $250 in monthly deposits reflect on your monthly statement

(Internal transfers from other FNBT / FCB or FHNB accounts, Internet Banking

transfers, and refunds from the Bank do not qualify as deposits for waiving

the Monthly Maintenance Fee), or

• Complete at least 12 debit card purchases that reflect on your monthly

statement. (ATM transactions do not count towards the 12 debit card

purchases)

• No Monthly Maintenance Fee if you are age 60 or older

ATM Transactions on any Gold Key® ATM

FREE

Withdrawals, inquiries, and transfers

ATM Transactions on any Non-Gold Key® ATM

$2.50

Each withdrawal, inquiry or transfer

Additional fees may be charged by the ATM’s owner/operator

Non-Sufficient Funds (NSF) Fee

$17

See OVERDRAFT RELATED FEES for when this Fee may be charged

Overdraft Fee

$34

See OVERDRAFT RELATED FEES for when this Fee may be charged

Negative Balance Fee

$34

See OVERDRAFT RELATED FEES for when this Fee may be charged

AccountTRANSFER Overdraft Protection

Transfer Fee

FREE

E-Statement Fee

FREE

Paper Statement Fee

$2

Enroll in E-Statements to avoid the Paper Statement Fee

Other Service and Fees

For more information, see the separate Banking Services/Fee Schedule

Funds Availability

For more information on the availability of funds for withdrawal and deposit

hold policy, refer to the Bank’s Funds Availability Policy

AccountTRANSFER OVERDRAFT PROTECTION PLAN

POSTING ORDER

We offer a contractual agreement for Overdraft protection

through our AccountTRANSFER Overdraft Protection Plan. This

service must be requested and is not automatically available

with your account.

AccountTRANSFER Overdraft Protection allows you to use the

money you put aside in a separate designated “transfer from”

account as protection against Overdrafts in other accounts.

AccountTRANSFER Overdraft Protection transfers are made for

the exact amount required to cover the Overdraft. If your

designated “transfer from” account does not have enough

available funds to cover the necessary amount, we will not

make a transfer and our normal $34 per Item Overdraft, $17 per

Item NSF and $34 Negative Balance Fees apply. We will make

one (1) transfer per day.

AccountTRANSFER Overdraft Protection transfers are allowed

for FNBT/FCB transfers to FNBT/FCB accounts or FHNB transfers

to FHNB accounts. You cannot make an AccountTRANSFER

Overdraft Protection transfer from a FNBT/FCB account to a

FHNB account or from a FHNB account to a FNBT/FCB account.

We start with the account balance in your account at the beginning of the

banking day, subtract holds from your account balance and make any

adjustments from prior days. Next, we add credits and then subtract debits

from your account balance. The following is a summary of how we generally

post Items and examples of some of our categories and the more common

transactions we assign to each category.

• First, your deposits and credits are added to your account balance.

• Then, withdrawals made at our teller windows, transfers made with our

24-Hour Personal Account Line, online and mobile banking systems,

online and mobile banking bill payments and outgoing wire transfers are

subtracted from your account balance in lowest to highest dollar

amount.

• Then, card transactions and ATM transactions are subtracted from your

account balance in date and time order.

• Then, ACH debits without a check number are subtracted from your

account balance before other checks you wrote with a check number, in

lowest to highest dollar amount. When we receive a check number,

checks will be subtracted from your account balance in sequential check

number order.

• Finally, most Fees and service charges in lowest to highest dollar

amount.

Keep in mind that we may process transactions in a different order than you

made them. This may impact the total amount of Fees you incur per banking

day. For more information on the Bank’s posting order, refer to the Deposit

Agreement section, “Processing Transactions and Posting Orders.”

Last Updated: 11/1/23

OVERDRAFTS AND OVERDRAFT RELATED FEES

An Overdraft occurs when you do not have enough money in your account to cover a transaction(s), but the Bank pays it anyway.

The Bank pays overdrafts at our discretion, which means we do not guarantee we will always authorize and pay any type of Item.

If the Bank does not pay

an Overdraft, your Item

will be returned and

subject to the following

fee

Non-Sufficient

Funds (NSF) Fee

$17

Per Item we return unpaid because you do not have enough money in your

account to cover the Item.

If an Item is presented more than once for payment, we will charge you an NSF

Fee each time we return the Item.

We will not charge an NSF Fee:

• If an Item is presented more than once for payment, and the Item is a paper

check or the merchant identifies a re-presented ACH Item with a description

of “RETRY PYMT” or “REDEPCHECK,” or;

• If the Item(s) we return is $5 or less.

Additional merchant Fees may apply

Maximum Number of NSF Fees per Day

2

We will not charge more than two (2) NSF Fees in a single Banking Day.

Maximum Number of NSF Fees per

Calendar Month

10

We will limit the number of per Item NSF Fees we charge to ten (10) per calendar

month.

If the Bank pays your

Overdraft, your account

will be subject to the

following fee

Overdraft Fee

$34

Per Item we pay even though you do not have enough money in your account.

If an Item was previously returned as insufficient, we will charge an Overdraft Fee

if we pay the Item into the Overdraft upon re-presentment, unless the Item is a

paper check, or the merchant Identifies the re-presented ACH Item with a

description of “RETRY PYMT” or “REDEPCHECK.”

We will not charge an Overdraft Fee:

• on individual Overdraft Items of $5 or less or;

• if the account is not overdrawn by more than $25, including Fees.

Maximum Number of Overdraft Fees per

Day

2

We will not charge more than two (2) Overdraft Fees in a single Banking Day.

Maximum Number of Overdraft Fees per

Calendar Month

10

We will limit the number of per Item Overdraft Fees we charge to ten (10) per

calendar month.

Negative

Balance Fee

$34

If your account is negative for seven (7) consecutive Banking Days, we will charge

you a Negative Balance Fee.

We will waive this Fee if on the seventh (7th) day your account is overdrawn $100

or less.

Maximum Number of Negative Balance

Fees per Calendar Month

2

We will not charge you more than two (2) Negative Balance Fees in a calendar

month.

One Day Rewind

This service provides you the opportunity to have Overdraft Fees assessed, on the prior

Banking Day, refunded if you resolve your overdrawn balance the next Banking Day. Refer to

your One Day Rewind disclosure for full details on this service.

Banking Day

A “Banking Day” is every day except Easter Sunday, Thanksgiving Day and Christmas Day.

Refer to your Deposit Agreement and the What You Need to Know About Overdrafts and Overdraft Fees, disclosure for an explanation of the

Bank’s standard Overdraft practices.

Last Updated: 11/1/23

Payment of Certain Items: Because the Bank is legally obligated to pay certain Items, your account may become overdrawn even if you do not

authorize us to pay Items into the Overdraft. If the Bank pays this type of Item, and it causes your account to become overdrawn, your account

will be subject to the Overdraft Related Fees in the section above.

The Bank does not authorize and pay Overdrafts for the following types of transactions unless you ask us to:

• ATM transactions

• Everyday debit card transactions

OVERDRAFT ELECTIONS

AVAILABLE

You must

request this

Items you want the Bank to authorize and

pay into the Overdraft

1

Overdraft Related Fees that may be charged on

your account

1

The Bank pays overdrafts at our discretion, which means we do not guarantee we will always authorize and pay any type of Item

Standard

NO

Check(s)

ACH Items

Bill Payment(s)

NSF Fee

Overdraft Fee*

Negative Balance Fee

Opt-Out Election

(No Overdraft)

YES

NONE

NSF Fee

Overdraft Fee*

Negative Balance Fee

Opt-In Election

YES

ATM

Everyday Debit Card Transactions

Check(s)

ACH Items

Bill Payment(s)

NSF Fee

Overdraft Fee

Negative Balance Fee

*Subject to Payment of Certain Items. Please be advised that different or more favorable deposit and lending products may be available at

FHNB-branded branches or at www.fhnb.com.