Consumer Sentiment

Banking Survey

August 2023

August 2021

i | P a g e

Contents

1. Summary of Main Findings ...................................................................................................... 1

1.1 The Banking Landscape, Experience & Switching ........................................................................... 1

1.2 Channel Usage & Preferences ................................................................................................................... 4

1.3 Fintech Providers ........................................................................................................................................... 7

2. Introduction .............................................................................................................................. 9

2.1 The Retail Banking Sector ...................................................................................................................... 9

2.2 Study Scope .................................................................................................................................................... 10

3. Methodology .......................................................................................................................... 11

3.1 Sample Selection .......................................................................................................................................... 11

3.2 Sample Accuracy .......................................................................................................................................... 12

3.3 Collection of Data ......................................................................................................................................... 12

3.4 Sample Size ..................................................................................................................................................... 12

3.5 Questionnaire ................................................................................................................................................ 12

3.6 Limitations ...................................................................................................................................................... 13

3.7 Privacy of the Respondent ....................................................................................................................... 13

4. Profile of Respondents........................................................................................................... 14

5. Banks & Financial Providers .................................................................................................. 15

5.1 Banks & Financial Providers Used ........................................................................................................ 15

5.2 Overall Satisfaction with Banks ............................................................................................................. 17

5.3 Complaints over Financial Service Providers .................................................................................. 19

5.4 Awareness of Relevant State Agencies/Bodies ............................................................................... 22

6. Financial Products/Services .................................................................................................. 24

6.1 Financial Products/Services Held......................................................................................................... 24

6.2 Provider for Financial Products ............................................................................................................ 26

7. Fintech Providers ................................................................................................................... 27

7.1 Fintech Usage ................................................................................................................................................. 27

7.2 Fintech Appeal .............................................................................................................................................. 28

7.3 Importance of Fintech Features ............................................................................................................ 29

7.4 Fintech as a Substitute for Traditional Banks.................................................................................. 30

8. Channel Availability & Usage ..................................................................................................... 31

8.1 Bank Branch ................................................................................................................................................... 31

8.2 Online Banking .............................................................................................................................................. 35

8.3 Main Form of Contact ...................................................................................................................................... 39

9. Channel Preference & Satisfaction ............................................................................................ 40

ii | P a g e

9.1 Preferred Form of Contact ....................................................................................................................... 40

9.2 Level of Confidence in Automated Branch Services...................................................................... 41

9.3 Level of Confidence in Ability to Use Online Banking Services ............................................... 44

9.4 Satisfaction with Branch Service and Remote Services .............................................................. 47

10. Switching Behaviour & Experience .......................................................................................... 53

10.1 Switching Consideration/Incidence .................................................................................................... 53

10.2 The Switching Process ............................................................................................................................... 55

10.3 Main Reasons for Switching/Not Switching ..................................................................................... 57

10.4 Usage of Comparison Tools ..................................................................................................................... 59

10.5 Level of Choice in Market ......................................................................................................................... 61

11. Cash vs Card Payment ............................................................................................................. 64

11.1 Preferred Payment Method In-Store ................................................................................................... 64

11.2 Most Common Method for Cash Withdrawals................................................................................. 68

Appendix 1 – The Questionnaire .................................................................................................... 70

Appendix 2 – Social Class Definition ............................................................................................. 85

1 | P a g e

1. Summary of Main Findings

This report contains the results of the Department of Finance Consumer Banking Sentiment Survey 2023,

covering consumer experience and perceptions of the banking sector in Ireland. All interviews were

conducted between 12

th

June and 26

th

July 2023 amongst a nationally representative sample of 1,501

adults aged 18+ years. The first wave of this survey was conducted February-April 2022, as part of the

Department of Finance Retail Banking Review and comparisons between 2022 and 2023 are shown, when

relevant.

Interviewing was completed by Behaviour & Attitudes face-to-face interviewers using CAPI (Computer Aided

Personal Interviewing). Sampling points were randomly selected, ensuring overall geographical

representativeness. Quota controls were also implemented on gender, age and socio-economic status to

ensure a nationally representative sample.

1.1 The Banking Landscape, Experience & Switching

According to the results of this survey wave, the two pillar banks, AIB and Bank of Ireland, continue to

dominate in terms of main current account held, and have 41% and 33% market share respectively. This

represents an increase of 5% for AIB and 1% for Bank of Ireland. Permanent TSB now stands at 13%, also

up 1%. However, this should be considered in the context of both Ulster Bank and KBC exiting the market

this year.

The survey results port that the use of ‘fintech’ which includes a growing use of apps on smartphones and

contactless payments by customers of traditional banks has increased as has a rise in the market share of

“digital only”

1

banking providers.

Revolut has made significant inroads over the past 12 months – 4% consider this provider as their main

provider (up from 1% last year). However, the financial services provider is becoming more prominent as

part of consumers’ repertoire; 1 in 3 (33%) now have some relationship with Revolut, compared to 18% in

2022.

Just over 2 in five (41%) of Irish adults have just one financial provider (down three points since 2022),

with 57% being multi-banked.

Nearly 7 in 10 (69%) possess a savings account, down 6%, with 1 in 3 owning a credit card. Just over one

fifth (21%) have a mortgage, down 4%.

1

https://www.centralbank.ie/consumer-hub/explainers/what-do-i-need-to-know-about-digital-only-banking-providers

2 | P a g e

In terms of satisfaction with their main financial provider, over 1 in 3 (34%) state that they are very satisfied,

an increase of 3%. Overall satisfaction remains steady at 82%, with dissatisfaction being expressed by 6%;

similar to 2022.

3 | P a g e

Switching consideration for banking products is somewhat limited, with 11% having ever considered

switching their current account. Propensity to switch is higher among mortgage account holders; 17% have

considered switching. Switching intentions for other financial products are in single digits.

There is a perception that there is a decreasing lack of competitiveness across most products, with current

accounts and mortgage options in particular seen to be lacking in choice for a sizeable minority of

respondents.

However, reflecting the structural changes in the banking landscape (Ulster Bank and KBC’s exits), there

has been a noticeable increase in those who have already switched, with 9% having changed their current

account (up 5% since 2022) and 10% having switched mortgages (also up 5%).

Among those who have switched current accounts, 37% found the process to be very easy. However, 1 in

5 or 20 % experienced some difficulties.

The main barrier to switching in general is a perception that the process may not be seamless, with many

citing reasons such as ‘it is difficult in general’, ‘lack of time’, ‘difficulty in researching the switching

process’.

Inertia is also a prominent reason for not switching banking products. The actual cost of switching is not

seen to be a particularly influential barrier.

4 | P a g e

1.2 Channel Usage & Preferences

Nearly 3 in 5 (59%) report living within five kilometres of a branch of their main bank. 1 in 5 (19%) state

that they to live at least 10 kilometres from their main branch.

Unsurprisingly, those living in Dublin are most likely to be living in closer proximity to a branch of their main

bank, with 3 in 4 (76%) located within a five-kilometre radius. This is also reflected in the Urban/Rural

divide – 75% of Urbanites are within a shorter range.

In contrast, over 2 in 5 rural dwellers (41%) have to travel at least 10 kilometres. Those living in

Connaught/Ulster have the furthest distances to travel.

89% of those with a current account have ever visited their branch in person, with males, older customers

and those living in rural areas more likely to have done so.

The main reasons for customers to visit their branch is to lodge/withdraw cash (63%), followed by

endeavoring to speak to staff about specific products (such as mortgages, loans or overdrafts {32%}).

Cards, and especially debit cards, are the preferred payment method when in a physical location,

particularly among those aged under 45. However, both have slipped back this year, with Smartphone

payments displaying modest growth.

Contactless by Smartphone is the preferred method of payment in a physical location among 18-24 year

olds (52%) and 25-34 year olds (36%), and also among Dubliners (30%).

5 | P a g e

Online banking has seen an increase year on year; 86% have ever done so (up 5%), with 2 in 3 avail of

online banking at least weekly.

6 | P a g e

While weekly online banking is driven by younger customers, there has been significant increases in

frequent usage among older customers (weekly usage among those aged 55-64 has risen by 9% to 55%,

and among those aged 65+ there has been an 8% growth to 36%).

Similarly, the approach to digital banking has evolved – mobile apps are now cited as the main form of

contact with their provider; up 14% to 55% since 2022.

7 | P a g e

1.3 Fintech Providers

The use of some fintech apps provided by firms outside the traditional banking sector on mobile devices

for payments and other consumer transactions has nearly doubled in the past year, with 1 in 3 now using

such providers, almost exclusively driven by Revolut.

While Revolut sees growth across all demographic cohorts, it remains most popular among under 35s. It

is also more widely used among the middle classes and those living in Dublin.

Among fintech users, there is strong endorsement for the proposition that the services provided are a good

substitute for traditional banks; 82% agree.

The main appeal of fintech providers versus the more traditional retail banks is that they offer instant money

transfers (75% agree), free banking (55%), and a user-friendly app (37%).

8 | P a g e

Overall, there has been a marked shift in how the Irish public interact with various ways of interacting with

their financial provider, with mobile apps being the main form of contact among 55% of all respondents,

and fintech usage up significantly compared to 2022.

However, the branch remains the main form of contact among those aged 55 years or older, this is

particularly the case amongst those aged 65 years or older, with more than half (52%) of this age cohort

having the branch as their main form of contact with their main financial provider. The older age cohorts

are also significantly less likely to use online banking every week and are less satisfied with remote

services. They are also significantly less likely to use fintech providers.

9 | P a g e

2. Introduction

On 23

rd

November 2021, the Minister for Finance published the Terms of Reference

2

for a broad-ranging

review of the retail banking sector in Ireland following a number of announcements which will result in

significant changes in the structure of the sector.

This report presents the results from the second wave of the survey of consumers commissioned by the

Department of Finance to provide an understanding of consumers’ experience and perceptions of the

operation of the banking sector in Ireland. The survey was conducted by Behaviour & Attitudes Ltd (B&A),

the independent market research and polling organisation.

All interviews for the survey were conducted face-to-face between 12

th

June and 26

th

July 2023 using B&A’s

Computer Aided Personal Interviewing. In total, a nationally representative sample of 1,501 adults was

obtained.

2.1 The Retail Banking Sector

Banks play a key role in Ireland’s economic activity by safeguarding people’s savings, providing credit to

consumers and businesses, maintaining the flow of cash and ensuring appropriate access to retail banking

services to all in society. Traditionally retail banking services in Ireland have been provided by banks, with

additional choice provided by credit unions and An Post. More recently digital banks and non-banks have

entered retail banking market providing some retail banking services to consumers and SMEs. Their

number, and the number of customers they serve have been growing in recent years.

Irish consumers and SMEs are currently served by three traditional retail banks: AIB, Bank of Ireland and

Permanent TSB. In 2021, NatWest made an announcement that it intends to make a phased withdrawal

of Ulster Bank from the Irish market. Shortly after NatWest’s announcement, KBC made a similar

announcement. These two banks have now largely left the retail banking market in Ireland. In April,

following the transfer of 25 Ulster Bank branches to PTSB, Ulster Bank’s 63 remaining branches were

closed. In August, KBC closed the last of its 12 hub locations.

These closures follow moves made in 2021, when Bank of Ireland closed 88 branches which equated to

around one third of all its branches in Ireland, and AIB closed a further 15 branches in 2021.

In addition, to the consolidation in the retail banking market, Ireland continues to experience historically

low levels of switching, which may act as a barrier to entry for new firms seeking to offer retail banking

services in Ireland. The low rates of switching in mortgages and current/payment accounts persist despite

efforts by the Central Bank of Ireland, the Competition and Consumer Protection Commission (CCPC) and

the Department of Finance to address this issue.

A number of additional themes have emerged in the retail banking sector which will influence how it

operates into the future. These include the following:

Changing demographics

Advances in financial technology (“fintech”)

The expansion of non-banks in the retail banking sector

Digitalisation; and,

Changes to the regulatory framework.

2

The Terms of Reference for the Retail Banking Review is available at:https://www.gov.ie/en/publication/ea57f-banking-review-terms-of-

reference/

10 | P a g e

The importance of the retail banking sector in supporting Irish consumers will remain unchanged as

consumers will need a safe place to hold their savings, access credit and cash given the economic context.

2.2 Study Scope

The purpose of the survey is to provide data on the general public’s experiences and perceptions of the

banking sector in Ireland:

Banks and financial providers used, including fintech

Overall satisfaction with main provider, including complaints

Financial products/services held

Drivers of fintech growth

Channel usage – branch, digital & phone

Channel satisfaction & preference – branch, digital & phone

Confidence in automated branch services and ability to use online services

Switching consideration and behaviour, by banking products, and including usage of comparison

tools

Perception of competition/choice in the market

Cash vs. card usage and preference in retail

The results are reviewed by sub-groups such as:

Gender

Age

Social Economic Class

Region

Urbanisation

A number of other variables were used to report on the financial context:

Household income

Frequency of using online banking

Main current account held with

The following banking products were included in the study:

Current accounts

Savings/deposit accounts

Credit cards

Mortgage accounts

Car loans/financing

Overdraft

High-cost credit products

Other personal loans

Time Period of Study

In reviewing results, it should be noted that the study took place over the period 12

th

June to 26

th

July 2023.

11 | P a g e

3. Methodology

This survey represents a Behaviour & Attitudes study of consumer experience and perceptions of the

banking sector in Ireland. Fieldwork and analysis for the survey was carried out by Behaviour & Attitudes

(B&A), an independent market research company. This report covers the second wave of this study

conducted in 2023, with comparisons shown between initial survey in 2022 and 2023, when relevant.

3.1 Sample Selection

The study sample was selected at random through face-to-face interviewing and following a multi-stage

sampling approach:

Sampling Stage I: Geographical stratification of sample proportionate to the profile of adults 18+

The sample was first stratified by a total of 17 broad regions within the four standard areas of Dublin, Rest

of Leinster, Munster and Connaught/Ulster. This ensures a representative territorial spread of Primary

Sampling Units across the country.

Within each cell of this matrix, the appropriate number of primary sampling units i.e. Electoral Divisions

(EDs) was chosen using probability sampling procedures (proportionate to size of population).

A total of 188 sampling points were chosen, yielding 1.501 completed interviews.

Sampling Stage II: Selection of randomly generated addresses

In order to remove as much of the sampling process from the hands of the interviewer as possible a

randomly selected starting address is drawn from the Geo Directory within each sampling point (the official

Register of Irish household addresses). Each interviewer began his/her assignment of interviews starting

at this address.

Within each sampling point, the interviewer was assigned a number of interviews to complete, in

accordance with demographic controls for that region drawn from the Census/AIMRO data.

Rather than allowing the interviewers to decide which specific households are called to in pursuit of these

quotas, he/she was issued with a single randomly generated private residence address, along with its GPS

co-ordinates, so as to ensure unambiguous identification of that household (particularly important in rural

areas where house numbering is less common).

From each chosen address, interviewers were instructed to follow a simplified random route procedure

(e.g. first left, next right etc.) calling at every nth house to complete an interview, until the quotas had been

filled. The nth house was defined differently for urban vs. rural areas where population density is less. Only

one interview was harnessed per household.

Sampling Stage III: Quota controls & Filling of Quotas

Quota controls were applied on age, gender and social class to further ensure representativeness. Socio-

economic class and occupation of respondents was coded according to the latest AIMRO agreed

stratifications.

12 | P a g e

3.2 Sample Accuracy

The sample error for a survey of this nature is very good. The total sample of 1,501 respondents has a

possible sample error of just +/-2.5% (at a 95% confidence level), while also providing robust measurement

when analysing by sub-groups, e.g. demographics.

3.3 Collection of Data

Face to face interviews were conducted with 1,501 respondents aged 18 years or older. The interviews

were conducted using CAPI (Computer Aided Personal Interviewing).

All interviews were conducted between 12

th

June to 26

th

July 2023. The typical face to face interview lasted

15 minutes.

Data from completed questionnaires was reviewed and analysed, and the results are presented in this

report. Comparison with the initial wave of this survey from 2022 is also shown, when relevant.

The full study questionnaire is attached as an appendix to the report, and detailed results are presented in

Sections 4-10.

3.4 Sample Size

Some 1,501 adults aged 18+ years participated in the face-to-face interviews. All interviewing was

conducted by fully trained and experienced members of the Behaviour & Attitudes field-force, who work

under direct supervision and are subject to rigorous quality controls.

All aspects of our CAPI survey operate to the guideline standards established by the company’s membership

of the MRS and ESOMAR (the international industry representative body).

All data was anonymised in line with Data Protection regulations and B&A ISO 27001 Information Security

Management system.

3.5 Questionnaire

To ensure comparability between the 2022 and 2023 survey, a similar questionnaire to 2022 was utilised

for the 2023 survey, with key questions being unchanged.

However, additional questions were included to cover:

High-cost credit products

Complaints made to bank and/or the Financial Services and Pensions Ombudsman

Awareness/knowledge of agencies/bodies supporting consumers in the Irish retail banking market

Usage of comparison tools for switching

13 | P a g e

3.6 Limitations

The results set out in this document should be considered in the context of the following limitations:

1. The study provides the consolidated opinions of members of the general public in relation to their

banking behaviour and attitudes to and perceptions of banking in general, but it is not a census of

the entire population of Ireland.

2. Whilst every effort has been made to ensure that the study sample is as fully representative of the

population as a whole as possible, it is possible that certain sub-groups are under-represented, e.g.

people who are reluctant to take part in market research or people with limited ability to take part in

a survey.

3. The study is based on recall of behaviour and attitudes towards banks/the banking sector. As such,

customer expectations also play a role in the evaluation of the banking sector, not just the

performance of the banks and the sector as a whole.

4. Please note that the figures in the report are based on rounded percentages, rather than to multiple

decimal places, for ease of review. This is a standard occurrence in market research statistics and

does not negate the accuracy of findings.

3.7 Privacy of the Respondent

Throughout the study process all interviews conducted with the general public were carried out on a

confidential basis and the respondents’ rights under the Data Protection Act(s) were fully observed,

including the rights of respondents to choose not to answer or to end the interview at any stage.

The Department of Finance had no specific interest in the individual financial affairs of any of member of

the general public who participated in this study. Rather, the key objective was to better inform Government

of the experience and perceptions of the general public in relation to the banking sector of Ireland.

We would like to express our sincere thanks to all those who have participated in this study.

14 | P a g e

4. Profile of Respondents

Quotas on gender, age, region and social class were implemented to ensure a nationally representative

sample of the population 18+ years. Corrective weighting was also applied at the analysis stage.

Throughout report, we show data broken down by relevant demographic groups. For the social class

definition, please see appendix 2.

15 | P a g e

5. Banks & Financial Providers

5.1 Banks & Financial Providers Used

The pillar banks dominate in terms of main current account held by those surveyed, with 41% having their

main current account with AIB (up from 36%, with Ulster Bank and KBC having left the Irish market), 33%

with Bank of Ireland and 13% with Permanent TSB.

4% have their main current account with Revolut, while 33% use Revolut at least occasionally. Revolut

has grown in importance since the 2022 survey where 1% had their main current account with Revolut,

and 18% used Revolut at least occasionally.

16 | P a g e

41% of Irish adults rely on just one financial provider (down from 44% in 2022), with 57% having more than

one financial provider.

The average number of financial providers used by consumers in 2023 is 1.78, up from 1.72 in 2022. This

is despite of Ulster Bank and KBC leaving the Irish market.

17 | P a g e

5.2 Overall Satisfaction with Banks

More than 1 in 3 (34%) are very satisfied with their main provider overall, with an additional half (48%)

being relatively satisfied. 6% are dissatisfied overall, with 11% being neither satisfied nor dissatisfied.

Compared to 2022, the proportion of very satisfied customers has increased from 31% to 34%.

18 | P a g e

Satisfaction is similar across demographics but peaks amongst the 18-24 year olds, lower social classes,

women and those living in Connaught/Ulster.

19 | P a g e

5.3 Complaints over Financial Service Providers

3% have made a formal complaint to a financial service provider in the past 12 months. The primary reason

for complaining is customer service issues (42%), followed by issues with current/savings accounts (27%).

8% of reported complaints are related to mortgage products.

Among those who made a formal complaint, 44% submitted their complaint by phone, with 32% submitting

their complaint through a branch. 19% submitted the complaint by letter, 11% through a mobile app, and

11% online, but not through an app.

20 | P a g e

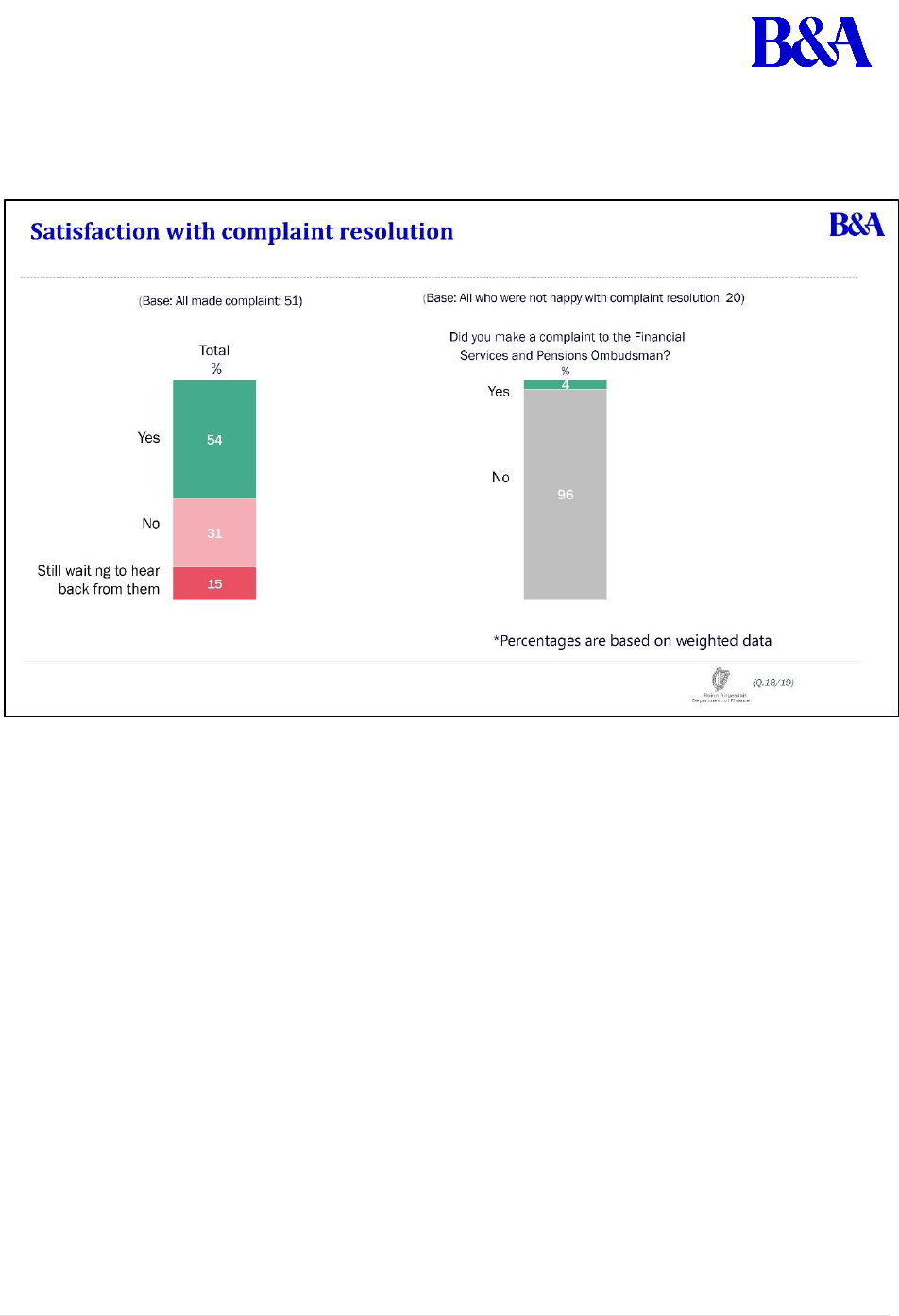

54% of those who made a formal complaint were satisfied with how the financial service provider resolved

the issue, with 31% being dissatisfied. 15% were still waiting to hear back on the complaint at the time of

the fieldwork.

Amongst those dissatisfied with the response from the financial service providers, just 4% brought the

complaint to the Financial Services and Pensions Ombudsman (note: small base size).

21 | P a g e

The main reasons given for not complaining to the Financial Services and Pensions Ombudsman were lack

of awareness/knowledge of the Ombudsman (26%), lack of time (24%), and difficulties in making a

complaint (18%).

22 | P a g e

5.4 Awareness of Relevant State Agencies/Bodies

Almost 2 in 3 (65%) are aware and know the function of the Money Advice & Budgeting Service (MABS),

with 5% just being aware without knowing its function, and 30% not aware of this service. 54% are aware

and know the function of the Competition and Consumer Protection Commission (CCPC)

3

, with a further 7%

simply aware without knowing its function. A majority of the public are aware of both entities.

48% are aware and know the function of the Financial Services and Pensions Ombudsman (FSPO), while

the corresponding number for the Insolvency Service of Ireland (ISI) is 37%.

3

It should be noted that due to a typo in the questionnaire, consumers were asked if they were aware of the Consumer Complaints and

Consumer Protection (CCPC)

23 | P a g e

Knowledge levels of the functions of the various agencies are highest among those aged 45-64 years while

lowest among those aged 18-34 years. Higher knowledge is also seen among the middle classes.

Awareness & know what they do

Total

Gender

Age

Social Class

Male

Female

18-24

25-34

35-44

45-54

55-64

65+

ABC1F

C2DE

Base

1501

720

777

112

234

293

286

259

317

844

657

%

%

%

%

%

%

%

%

%

%

%

Money Advice & Budgeting

Service (MABS)

63

61

65

40

47

64

77

75

66

66

60

Competition and Consumer

Protection Commission (CCPC)

51

51

51

39

39

52

61

60

53

59

43

Financial Services and Pension

Ombudsman (FSPO)

45

47

44

26

32

43

53

60

50

51

38

Insolvency Service of Ireland (ISI)

34

38

31

12

26

34

46

45

37

41

28

Lowest knowledge of the agencies is seen amongst those living in Dublin.

Awareness & know what they

do

Total

Region

Urban Rural

Dublin

Leinster

Munster

Conn/

Ulster

Urban

Rural

Base

1501

440

405

366

290

977

476

%

%

%

%

%

%

%

Money Advice & Budgeting

Service (MABS)

63

53

65

72

64

59

71

Competition and Consumer

Protection Commission

(CCPC)

51

43

55

57

50

48

58

Financial Services and

Pension Ombudsman

(FSPO)

45

42

46

47

45

44

46

Insolvency Service of Ireland

(ISI)

34

29

36

39

35

32

39

Key

Significantly higher than the total

Significantly lower than the total

24 | P a g e

6. Financial Products/Services

6.1 Financial Products/Services Held

Close to, but not all, of the population hold current accounts, almost 7 in 10 (69%) hold savings accounts

and a third hold credit cards. More than 1 in 5 (21%) have a mortgage while 8% have an overdraft and 6%

other personal loans. 12% have a car loan/financing, however, the actual incidence is probably higher,

with not all respondents including car hire purchase in their answer of this question. The incidence of

high-cost credit products came in below 0.5%.

25 | P a g e

Middle classes are more likely to hold the various financial products/services, while the 35-54 year olds

over-index for mortgage. Higher incidence of having car loans/financing is seen for the 25-34 year olds.

Total

Gender

Age

Social Class

Male

Female

18-24

25-34

35-44

45-54

55-64

65+

ABC1F

C2DE

Base:

1501

720

777

112

234

293

286

259

317

844

657

%

%

%

%

%

%

%

%

%

%

%

Current Account

99

98

99

99

99

98

98

99

99

99

98

Savings account

69

70

67

65

72

69

70

68

68

75

62

Credit card

33

34

32

23

27

36

35

35

36

40

24

Mortgage account

21

21

22

2

23

36

38

20

1

29

13

Car loan/car financing

12

12

11

7

20

15

15

10

3

16

8

Overdraft

8

9

7

3

7

10

12

7

8

12

4

High-cost credit products

0

0

0

-

0

-

1

0

1

0

0

Other personal loan

6

6

6

8

7

7

6

4

5

6

6

Other

5

5

5

8

2

5

6

3

6

5

5

None

18

16

20

22

17

18

15

20

18

11

26

Key

Significantly higher than the total

Significantly lower than the total

26 | P a g e

6.2 Provider for Financial Products

Those with current accounts are likely to stick with their main financial provider for saving accounts, credit

cards and overdrafts.

Other providers play a bigger role in terms of mortgages, but especially car loans/financing and personal

loans.

27 | P a g e

7. Fintech Providers

7.1 Fintech Usage

By fintech usage, we mean usage of digital-only providers, such as Revolut. 4% hold their main current

account with Revolut – up from just 1% in 2022. 1 in 3 (33%) use Revolut for banking/payments at least

occasionally – up from 18% in 2022.

Although Revolut sees growth across all demographic cohorts, it remains more used among those aged 18-

34 years. For the age group 65+ years, 8% use Revolut –up from 4% in 2022. Revolut is also more used in

the middle classes and among those living in Dublin.

28 | P a g e

7.2 Fintech Appeal

The main perceived benefits of fintech providers versus the more traditional retail banks is that they offer

instant money transfers, free banking, a great/user friendly app, and allow customers to split bills.

Free banking and foreign exchange have increased as perceived benefits since 2022.

29 | P a g e

7.3 Importance of Fintech Features

The top features provided by fintech providers in terms of perceived importance are instant money transfer,

free banking and a great/user-friendly mobile app. This is followed by splitting bills, spend information,

foreign exchange and saving vault, while investment opportunities are the least important.

Compared to 2022, foreign exchange, saving vault and investment opportunities have become more

important, while great/user-friendly app and splitting bills have become less important.

30 | P a g e

7.4 Fintech as a Substitute for Traditional Banks

Respondents using fintech providers were asked how much they agree with the following statement: “The

services offered by fintech providers is a very good substitute for the services offered by the more

traditional banks”.

3 in 5 (58%) fintech customers strongly believe that the services offered by fintech providers are a very

good substitute for the services offered by more traditional banks – unchanged from 2022.

Among those using fintech, agreement is generally consistent across the demographic spectrum.

31 | P a g e

8. Channel Availability & Usage

8.1 Bank Branch

Nearly 3 in 5 (59%) report living within five kilometres of a branch of their main bank. 1 in 5 (19%) stated

that they live at least 10 kilometres from their main branch.

As is to be expected, those living in Dublin are most likely to be living in closer proximity to a branch of their

main bank, with 3 in 4 (76%) located within a five-kilometre radius. This is also reflected in the Urban/Rural

divide – 75% of Urbanites are within a shorter range.

In contrast, over 2 in 5 Rural dwellers (41%) have to travel at least 10 kilometres. Those living in

Connaught/Ulster have the furthest distances to travel.

32 | P a g e

The primary motivator for visiting a branch is to lodge or withdraw cash. Nearly 2 in 3 (63%) of those with

a current account with a traditional retail bank cite this as a reason. This is followed by 32% who visit

branches to speak to an advisor about specific products, e.g. mortgage, loans, overdraft, etc.

Other reasons for visiting a bank branch are for financial advice, foreign exchange and to pay bills.

33 | P a g e

Those located outside Dublin are significantly more likely to visit a branch in general, and specifically for

lodging or withdrawing cash. We also see a higher incidence of visiting branches for various reasons in

Munster.

In-branch dealings to lodge /withdraw cash, pay bills, conduct savings transactions and to transfer money

are driven by those aged over 65.

Rural customers are also more likely to avail of in-branch facilities to lodge/withdraw cash, whereas

ABC1s have a higher propensity to attend to discuss specific products.

Filter: Q2 Have traditional

account

Total

Age

Social Class

Urban/Rural

18-24

25-34

35-44

45-54

55-64

65+

ABC1F

C2DE

Urban

Rural

Base

1415

94

209

279

278

249

306

799

616

937

478

%

%

%

%

%

%

%

%

%

%

%

Lodge/withdraw cash

63

52

58

64

63

63

69

60

66

59

71

Speak to someone

regarding a specific

product, e.g. mortgage/

loan/overdraft, etc.

32

38

39

34

36

28

23

38

26

31

34

Financial advice

15

11

18

17

18

10

14

17

14

13

18

Foreign exchange

14

16

14

12

14

15

17

15

14

14

14

Pay bills

13

7

9

7

15

15

21

10

15

11

16

Savings

11

11

10

4

14

10

19

10

13

10

13

Transfer money

10

6

9

8

11

7

16

10

10

9

12

Other

4

2

2

3

4

5

5

3

4

4

3

Never visit a branch

11

19

14

12

10

10

4

11

11

14

5

Key

Significantly higher than the total

Significantly lower than the total

34 | P a g e

11% of those with a current account with a traditional retail bank claim to never visit a branch. Of those

visiting, there are distinct age, gender and regional differences.

35 | P a g e

8.2 Online Banking

86% of those with a current account have used online banking – up from 81% in 2022. Almost 2 in 3 (65%)

use online banking at least weekly, with 4 in 5 using online banking at least monthly.

36 | P a g e

Online banking usage is most prevalent among younger cohorts (those from 18-24 up to those aged 45-54

{90% plus in all instances}), but then tapers off among those aged 55-64 (80%), and particularly among

those aged 65+ (60%).

There are also significant differences in terms of social class – ABC1s (90%) are more likely to have availed

of online banking compared to 80% of C2DEs.

Similarly, there are regional factors evident; Dubliners (91%) are most likely to use these services, while

there is also a noticeable delta between Urbanites and Rural dwellers. 88% of those living in urban areas

have used online banking at some stage, versus 80% of the latter.

37 | P a g e

Two in three (65%) use online banking at least weekly; again, driven by younger cohorts.

While weekly usage of online banking is considerably lower among the older age groups, there has been

noticeable increases in such activity since last year. Over half (55%) of those aged 55-64 years now use

online banking weekly and over 1 in 3 (36%) of those aged 65 years or older also do so; an increase on 9%

and 8% respectively.

Weekly usage continues to be higher among the middle classes and Dubliners.

38 | P a g e

Among the three larger retail banks, AIB customers are most likely to participate in frequent (weekly plus)

online banking. All three, however, have a sizeable proportion of their customer bases availing of such

services.

39 | P a g e

8.3 Main Form of Contact

Digital channels continue to dominate in terms of being the main form of contact with customers’ main

bank although over 1 in 5 (21%) still opt for in-person branch visits. This is significantly higher among those

aged over 65 (55%).

The way that customers use digital channels has changed over the past year – contact through mobile

apps have increased significantly, with a corresponding decrease in other online touchpoints.

Over half (55%) now use mobile apps as their main conduit, driven by younger cohorts (especially those

under the age of 35).

Telephone banking remains relatively steady but is used by a small minority of customers.

40 | P a g e

9. Channel Preference & Satisfaction

9.1 Preferred Form of Contact

Preferred form of contact with provider varies by type of interaction. In-person/branch visits are the

preferred option for cash lodgement/withdrawals and financial advice. Mobile apps are more popular with

more day-to-day transactions such as transferring money, paying bills, savings, direct debits and standing

orders.

41 | P a g e

9.2 Level of Confidence in Automated Branch Services

Confidence is particularly high in automated branch services for cash lodgments/withdrawals, with more

than half (52%) expressing themselves to be very confident. This is up from 48% in 2022.

In general, confidence is high for paying bills, transferring money and to a lesser extent, savings

transactions.

Opinions are more muted for foreign exchange and especially for receiving financial advice, with financial

advice having slipped noticeably this year.

42 | P a g e

Those aged below 45 years and middle classes are more confident in nearly all aspects of automated

branch services. Conversely, confidence is lower among those aged 55 years or higher (particularly those

aged 65 years or older). Similarly, those lower down the socio-economic ladder tend to be more

circumspect.

Top 2 Box Confidence

Rating

Total

Gender

Age

Social Class

Male

Female

18-24

25-34

35-44

45-54

55-64

65+

ABC1F

C2DE

Base

1501

720

777

112

234

293

286

259

317

844

657

%

%

%

%

%

%

%

%

%

%

%

Lodge/withdraw cash

70

70

69

83

79

77

70

61

53

76

63

Transfer money

63

64

62

80

78

69

65

53

40

70

55

Pay bills

63

63

62

71

76

72

68

54

38

70

55

Financial advice

37

37

38

48

51

42

37

29

22

40

35

Savings

56

57

56

71

68

62

61

43

37

62

50

Foreign exchange

46

47

45

60

60

54

48

35

23

52

38

None

22

23

22

12

14

13

19

30

41

17

27

Key

Significantly higher than the total

Significantly lower than the total

43 | P a g e

Dubliners tend to have greater confidence in automated branch services compared to other regions, and

in general Rural dwellers are more guarded.

Top 2 Box Confidence Rating

Total

Region

Urban Rural

Dublin

Leinster

Munster

Connaught/

Ulster

Urban

Rural

Base

1501

440

405

366

290

977

476

%

%

%

%

%

%

%

Lodge/withdraw cash

70

77

65

64

75

71

66

Transfer money

63

69

59

60

63

66

57

Pay bills

63

68

60

59

63

65

58

Financial advice

37

35

39

37

38

40

32

Savings

56

59

55

52

60

59

51

Foreign exchange

46

52

44

38

47

49

41

None

22

17

26

23

24

20

27

Mirroring social class, those on higher incomes tend to have more assurance in automated branch services,

and unsurprisingly, those who use online banking most frequently are also more confident.

Total

Household Income

Frequency of Using online banking

€25,000

or less

€25,001

€50,000

€50,001 -

€100,000

€100,001

€150,000

Over

€150,001

Ever

At

least

once a

week

Once

every

2 to 3

weeks

Once a

month

Once

every

2-3

mths

<Once

every

3 mths

Never

Base

1501

252

380

220

63

26

1275

955

168

69

35

48

207

%

%

%

%

%

%

%

%

%

%

%

%

%

Lodge/withdraw cash

70

61

65

81

71

76

75

77

71

64

73

74

40

Transfer money

63

50

58

73

67

74

70

73

64

53

65

64

24

Pay bills

63

50

58

72

70

81

70

73

60

59

66

63

23

Financial advice

37

33

37

43

32

46

42

44

34

34

41

37

16

Savings

56

44

53

65

66

56

62

65

54

50

56

59

25

Foreign exchange

46

34

44

54

66

70

51

55

39

31

37

50

15

None

22

31

26

13

17

8

16

15

21

26

15

17

55

Key

Significantly higher than the total

Significantly lower than the total

44 | P a g e

9.3 Level of Confidence in Ability to Use Online Banking Services

Confidence in the ability to use online banking services remains high for paying bills, transferring money

and savings (with the proportion expressing themselves to be very confident increasing in each case since

last year). In terms of when a personal interaction is required, such as enquiring about a specific product

or for financial advice, the public tend to be less self-assured.

45 | P a g e

As with other digital transactions, older cohorts (those aged over 55 and especially the eldest cohort

{65+}) are significantly less poised in terms of using online banking services. Likewise, working class

respondents also under-index.

Rating 4-5

Total

Gender

Age

Social Class

Male

Female

18-24

25-34

35-44

45-54

55-64

65+

ABC1F

C2DE

Base

1501

720

777

112

234

293

286

259

317

844

657

%

%

%

%

%

%

%

%

%

%

%

Pay bills

69

69

69

78

81

77

74

62

46

78

59

Transfer money

67

67

68

81

79

75

71

62

42

77

57

Savings

60

60

61

77

75

69

62

51

35

68

51

Speak to someone

regarding a specific

product

45

45

46

58

53

52

47

34

30

51

38

Financial advice

43

43

43

59

56

48

46

32

24

49

37

None

23

23

22

13

11

16

19

29

45

14

32

Dubliners tend to be most confident with online transactions, which is reflected in urbanites in general

tending to be more comfortable with these services.

Rating 4-5

Total

Region

Urban Rural

Dublin

Leinster

Munster

Conn/

Ulster

Urban

Rural

Base

1501

440

405

366

290

977

476

%

%

%

%

%

%

%

Pay bills

69

78

65

62

71

72

64

Transfer money

67

74

63

64

68

69

64

Savings

60

64

57

56

65

62

58

Speak to someone regarding a

specific product

45

49

47

40

42

47

41

Financial advice

43

47

42

42

40

46

38

None

23

15

28

26

23

20

28

Key

Significantly higher than the total

Significantly lower than the total

46 | P a g e

Again, reflecting socio economic differences, lower income respondents and those who have never used

online banking services are also less at ease with online banking services.

Rating 4 - 5

Total

Household Income

€25,000

or less

€25,001 -

€50,000

€50,001 -

€100,000

€100,001 -

€150,000

Over €150,001

Base (WTD)

1501

252

380

220

63

26

UNWTD

%

%

%

%

%

%

Pay bills

69

48

70

83

79

88

Transfer money

67

48

67

81

77

83

Savings

60

43

62

68

72

49

Speak to someone

regarding a specific

product

45

32

47

56

51

44

Financial advice

43

30

44

52

38

43

Rating 4 - 5

Total

Frequency of Using online banking

Ever

At least

once a

week

Once

every 2 to

3 weeks

Once a

month

Once

every 2-3

months

< once

every 3

months

Never

Base

1501

1275

955

168

69

35

48

207

%

%

%

%

%

%

%

%

Pay bills

69

78

81

71

64

73

60

21

Transfer money

67

76

79

65

69

68

68

18

Savings

60

67

70

60

55

58

66

22

Speak to someone regarding a

specific product

45

50

53

45

34

23

40

18

Financial advice

43

48

51

42

36

31

42

16

Key

Significantly higher than the total

Significantly lower than the total

47 | P a g e

9.4 Satisfaction with Branch Service and Remote Services

Almost 3 in 4 (72%) are satisfied with the branch services from their main financial provider – a slight

decline from 75% in 2022. 2 in 5 are very satisfied, while 7% are dissatisfied – up from 4% in 2022.

48 | P a g e

Those over the age of 45 are more likely to express dissatisfaction with branch services from their main

financial provider (particularly those aged 55-64), along with those living in Leinster (excluding Dublin).

49 | P a g e

Over 2 in 5 (41%) are very satisfied with remote services from their main financial provider, with a further

1 in 3 (32%) being somewhat satisfied.

6% are dissatisfied with remote services, which is more or less on par with 2022 results, and also similar

to the in-branch rating of dissatisfaction (7%).

50 | P a g e

There is a correlation between the age of respondents and their levels of satisfaction with remote

services. Younger customers tend to be most vocal in expressing satisfaction (82% among 18-24 year

olds, and 80% among 25-34 year olds) while older respondents (those aged 65+) are less surefooted;

they are more likely not to have an opinion (reflecting to a certain extent their lack of experiencing such

touchpoints). Just 65% of them express satisfaction, but tellingly 14% do not know.

51 | P a g e

Among the minority who are dissatisfied with branch service from their main financial provider, the main

reasons provided are poor customer service (35%) and lack of staff (31%). There is a sizeable minority

who voice concerns about automation/forcing you online. The length of queues is also cited by 1 in 6

(16%). Local branch closures are mentioned by a small minority.

For remote services, poor customer service/can’t get an answer is the primary reason for dissatisfaction,

whilst technical issues and phone waiting times are also prominent.

52 | P a g e

There is still a sizeable minority who cite dissatisfaction with the ease of contacting staff when calling by

phone. Over 1 in 5 (21%) are unhappy (although this has dropped ten percentage points since last year).

Ease of contacting staff in-branch remains relatively steady – just over 1 in 10 (11%) are disgruntled, but

2 in 3 (66%) express at least relative ease in doing so.

53 | P a g e

10. Switching Behaviour & Experience

10.1 Switching Consideration/Incidence

Switching consideration for banking products is limited, with just over 1 in 10 ever having considered

switching provider for current account (down from 14% in 2022), and 9% ever having considered

switching a savings account or credit card. Given that Ulster Bank and KBC have now largely exited the

market, many may already have switched over the past year, and are thus reluctant to do so again.

Just 6% have ever considered switching provider for a personal loan, down slightly from last year, while

mortgages are the one product where customers are potentially more mobile – 15% of them have

considered a move, albeit down two percentage points since 2022.

54 | P a g e

Reflecting the changing dynamics of the Irish financial landscape (Ulster Bank and KBC exiting the market,

and increasing mortgage interest rates), the incidence of having already switched provider has increased

for both mortgages and current accounts – approximately 1 in 10 claim to have done so over the past 5

years: a notable increase since 2022.

Other products (savings, credit card and personal loans) remain steady, with the levels of switching

continuing to be relatively low.

55 | P a g e

10.2 The Switching Process

Among those who have switched current account provider in the past five years, nearly 2 in 5 (37%) found

it very easy to switch. But 1 in 5 found it difficult to switch current account provider.

44% of those who have switched saving account found it very easy to switch, with 11% expressing

reservations.

56 | P a g e

Among those who have switched current account provider in the past five years, over 1 in 4 (27%) were

very satisfied with the process, with 7 in 10 satisfied overall. However, 1 in 5 were unhappy with the

process.

36% were very satisfied with the process of switching saving account, rising to a net satisfaction score of

73%.

57 | P a g e

10.3 Main Reasons for Switching/Not Switching

Among those that have switched in the past 5 years, the key driver in 2023 was structural – the exit of

two banks from the market.

Aside from this development over the past year, the other main drivers of switching were dissatisfaction

with the previous provider and better rates.

58 | P a g e

Among those who have not switched in the past 5 years, a common theme emerges. The perception of

the general difficulty in switching is a constant thread across all products (be it difficult in general, lack of

time, difficulty in researching the switching process).

Inertia is also a prominent reason for not switching. The cost of switching is not seen to be a particularly

obvious barrier.

59 | P a g e

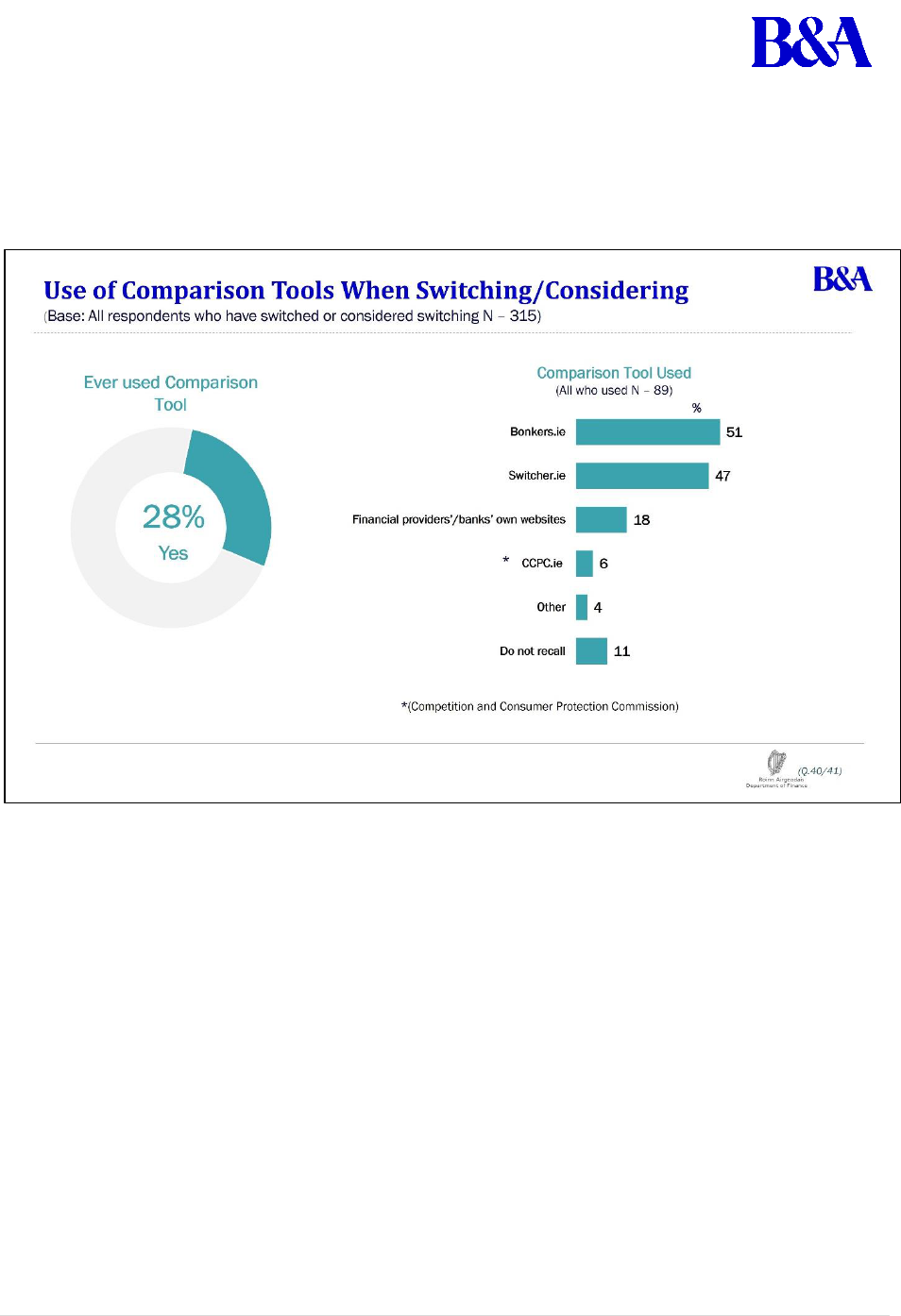

10.4 Usage of Comparison Tools

Among those who have ever switched, or are considering doing so, nearly 3 in 10 (28%) availed of

comparison websites. Of those, Bonker.ie and Switcher.ie are by far the most popular sites to visit. Less

than 1 in 5 (18%) went directly to the banks’ own website.

60 | P a g e

Among those who used such websites, 35-44 year olds were significantly more likely to have done so, along

with high income earners.

Have switched/Considered switching x Demographics

% Yes

TOTAL

28

Gender

Male

26

Female

30

Age

18-24

11

25-34

18

35-44

43

45-54

32

55-64

27

65+

17

Social Class

ABC1F

33

C2DE

19

Region

Dublin

33

Leinster

37

Munster

19

Connaught/Ulster

14

Urban Rural

Urban

26

Rural

29

Have switched/Considered x Financial Context

% Yes

Household Income

€25,000 or less

7

€25,001 - €50,000

23

€50,001 - €100,000

34

€100,001 - €150,000

46

Over €150,001

34

Main current account provider

AIB

30

Bank of Ireland

26

Permanent TSB

26

Credit union

16

Revolut

25

Any Digital Bank

25

Other

80

Banking Products Held

Savings account

30

Mortgage account

43

Credit card

37

Overdraft

42

Net Loans

36

Car loan/car financing

33

Other personal loan

42

Other

16

Key

Significantly higher than the total

Significantly lower than the total

61 | P a g e

10.5 Level of Choice in Market

There is a belief amongst respondents in the survey that the levels of choice in the market is highest for

savings accounts and lowest for mortgages (just 1 in 4 believe there is choice for the latter).

However, there is a perception that there is a decreasing lack of competitiveness across most products,

with current accounts and mortgage options in particular seen to be lacking in choice for a sizeable

minority of respondents.

62 | P a g e

Those aged 25-34 are more likely to feel there is a lot of choice in the market. Older respondents

(particularly those aged 55-64) are most likely to feel there is a lack of options available.

Those rating 4-5 – a

lot of Choice

Total

Gender

Age

Social Class

Male

Female

18-24

25-34

35-44

45-54

55-64

65+

ABC1F

C2DE

Base

1501

720

777

112

234

293

286

259

317

844

657

%

%

%

%

%

%

%

%

%

%

%

Current account

34

34

34

43

40

34

33

27

30

35

34

Mortgage account

25

24

26

25

28

27

26

22

21

25

25

Savings account

39

40

39

54

47

37

40

28

34

42

36

Credit card

36

38

33

43

45

34

35

31

31

38

33

Other personal loans

34

35

33

34

41

35

35

31

29

36

32

None

47

47

48

38

40

49

44

58

52

45

50

Dubliners are more likely to cite the lack of choice in terms of product offerings available, and to a lesser

extent, those living in Leinster. Those living along the western seaboard are more complimentary.

Those rating 4-5 – a lot of Choice

Total

Region

Urban Rural

Dublin

Leinster

Munster

Conn/

Ulster

Urban

Rural

Base

1501

440

405

366

290

977

476

%

%

%

%

%

%

%

Current account

34

30

29

43

34

36

32

Mortgage account

25

19

22

30

33

26

25

Savings account

39

34

33

44

50

39

42

Credit card

36

28

31

45

42

35

38

Other personal loans

34

26

30

40

44

33

37

None

47

55

52

39

42

48

44

Key

Significantly higher than the total

Significantly lower than the total

63 | P a g e

Among holders of specific financial products, mortgage holders are more likely to say there is less choice

(37%) than to say that there is choice (27%). Products that are perceived to be more competitive are

credit cards and other personal loans.

Current accounts have also diminished in perceived competitivenss over the past 12 months.

64 | P a g e

11. Cash vs Card Payment

11.1 Preferred Payment Method In-Store

Debit Cards are the preferred payment method for adults when in a physical location, especially among

18-44 year olds. However, debit cards have slipped back this year, with Smartphone payments having

modest growth.

Contactless by Smartphone is more prevalent among 18-24 year olds (52%) and 25-34 year olds (36%),

and also among Dubliners (30%).

Nearly 1 in 4 prefer to pay by cash, up four percentage points since 2022, and driven by those over the

age of 65 (43%).

65 | P a g e

Demographics x Gender, Age & Class

Total

Gender

Age

Social Class

Male

Female

18-24

25-34

35-44

45-54

55-64

65+

ABC1F

C2DE

Base

1501

720

777

112

234

293

286

259

317

844

657

%

%

%

%

%

%

%

%

%

%

%

Debit card (Pin

/Contactless)

50

47

54

30

46

57

55

56

50

55

46

Cash

24

26

22

16

14

15

24

27

43

15

33

Contactless by

smartphone

22

23

22

52

36

26

17

11

3

26

19

Credit card (Pin /

Contactless)

3

3

3

2

4

2

3

6

3

4

2

Demographics x Region & Area

Total

Region

Area

Dublin

Leinster

Munster

Conn/

Ulster

Urban

Rural

Base

1501

440

405

366

290

1001

500

%

%

%

%

%

%

%

Debit card (Pin /Contactless)

50

42

54

50

60

50

52

Cash

24

22

22

29

21

23

26

Contactless by smartphone

22

30

21

19

17

24

20

Credit card (Pin / Contactless)

3

6

3

2

3

4

2

Key

Significantly higher than the total

Significantly lower than the total

66 | P a g e

The average claimed proportion of cash spending in-store relative to total spend is 36% (up 5 percentage

points since 2022), with the most mentioned interval ranging from 10% to 30% of spending.

67 | P a g e

Those aged 65 and older and C2DEs are more likely to spend a higher proportion each week using cash.

Those under the age of 45 are more likely to have lower proportions of their spend in cash, and thereafter

the switch to cash becomes more pronounced.

Total

Gender

Age

Social Class

Male

Female

18-24

25-34

35-44

45-54

55-64

65+

ABC1F

C2DE

Base

1414

681

730

103

210

268

272

249

312

786

628

%

%

%

%

%

%

%

%

%

%

%

Less than 5

14

13

14

17

21

17

12

13

5

16

11

From 5 to 10

14

15

13

13

16

19

13

11

10

16

11

From 10 to 30

29

27

30

32

31

33

30

26

21

33

24

From 30 to 70

20

19

20

24

18

15

24

22

18

19

21

70 or more

24

26

23

15

15

16

21

28

45

16

34

Mean

36.18

37.48

34.81

29.34

26.58

27.92

35.53

40.00

52.97

27.96

44.91

Those living in Munster and Connaught/Ulster and those in rural areas in general are more likely to spend

a higher proportion of their weekly outgoings in cash.

Total

Region

Area

Dublin

Leinster

Munster

Conn/

Ulster

Urban

Rural

Base)

1414

385

387

355

287

907

459

%

%

%

%

%

%

%

Less than 5

14

16

14

13

10

16

9

From 5 to 10

14

16

17

10

12

16

10

From 10 to 30

29

28

29

25

34

28

30

From 30 to 70

20

19

15

23

22

18

23

70 or more

24

21

24

30

22

22

29

Mean

36.18

32.46

34.22

42.19

35.42

33.11

41.57

Key

Significantly higher than the total

Significantly lower than the total

68 | P a g e

11.2 Most Common Method for Cash Withdrawals

ATMs still dominate in terms of cash withdrawals and have increased in popularity this year – they are

now used by 78% of adults (up five percentage points). Cashback from retailers has slipped back slightly.

69 | P a g e

Total

Gender

Age

Social Class

Male

Female

18-24

25-34

35-44

45-54

55-64

65+

ABC1F

C2DE

Base

1501

720

777

112

234

293

286

259

317

844

657

%

%

%

%

%

%

%

%

%

%

%

Any

94

94

94

91

89

92

95

97

98

93

95

ATMs

78

78

79

80

78

82

87

77

66

83

73

Cashback from a retailer

18

17

18

22

20

20

18

15

11

17

19

Withdrawal from counter

at a bank branch

17

18

16

18

10

13

16

19

26

13

21

Withdrawal from counter

at Post Office

9

8

10

10

7

6

6

8

16

7

11

Paid in cash by your

employer/government

transfer

2

2

2

3

3

2

2

1

2

1

3

Other

2

1

2

3

-

1

1

1

4

1

2

I never use cash

6

6

6

9

11

8

5

3

2

7

5

Total

Region

Area

Dublin

Leinster

Munster

Connaught/Ulster

Urban

Rural

Base

1501

440

405

366

290

1001

500

%

%

%

%

%

%

%

Any

94

87

95

97

99

93

96

ATMs

78

76

77

78

84

81

73

Cashback from a retailer

18

9

20

23

20

14

24

Withdrawal from counter at a

bank branch

17

11

15

30

10

16

19

Withdrawal from counter at

Post Office

9

5

10

16

4

6

14

Paid in cash by your

employer/government transfer

2

2

2

2

1

2

2

Other, please specify:

2

2

2

1

1

1

2

I never use cash

6

13

5

3

1

7

4

Key

Significantly higher than the total

Significantly lower than the total

70 | P a g e

Appendix 1 – The Questionnaire

Department of Finance Consumer Sentiment Survey

Questionnaire 08.06.23

Good morning, afternoon, I am …….. from Behaviour & Attitudes, the independent Irish market research

agency. We are conducting a survey on behalf of the Department of Finance about people’s attitudes to

banking and financial services.

The survey itself will take about 15 minutes to complete. It will be conducted in accordance with Market

Research Society guidelines.

All information that we collect will be kept in the strictest confidence and results will be reported at a merged

level only. It will not be possible to identify any particular individual in the results and no information will be

provided to anyone that could identify you personally.

Department of Finance Consumer Sentiment Survey

Questionnaire 08.06.23

Good morning, afternoon, I am …….. from Behaviour & Attitudes, the independent Irish market research

agency. We are conducting a survey on behalf of the Department of Finance about people’s attitudes to

banking and financial services.

The survey itself will take about 15 minutes to complete. It will be conducted in accordance with Market

Research Society guidelines.

All information that we collect will be kept in the strictest confidence and results will be reported at a merged

level only. It will not be possible to identify any particular individual in the results and no information will be

provided to anyone that could identify you personally.

CONSENT

Q.A Are you happy to proceed with the interview?

Yes

1

No

2

Firstly, I would like to ask you a few questions to make sure that we talk to a wide cross section of people.

SCREENING SECTION

S.1 Interviewer record gender

1: Male

2: Female

3: Other

S.2 Interviewer record date of birth - ALL TO BE AGED 18+

71 | P a g e

S.3 Are you yourself the chief wage earner in your household or not? That is the person who contributes most

money to the household income?

Yes

1

No

2

OCCUPATION OF CHIEF WAGE EARNER

(If farmer, state acreage. If proprietor/manager/supervisor, state number of employees. If unemployed for over

a year or widow on State Pension, ask about Chief Wage Earner).

S.4 Socio Economic Grade

A

1

B

2

C1

3

C2

4

DE

5

F50+

6

F50-

7

NOW CODE

72 | P a g e

Banking Products & Provider (incl. Fintech)

ASK ALL

1. Do you use any online/mobile apps to conduct your day-to-day banking?

a. Yes

b. No

ASK ALL

2. Who do you hold your main current account with? By main current account, we mean the account you

get your salary/social welfare payments/other payments paid into. If you don’t receive any regular

payments, your main current account is the account that you use the most for your day-to-day

transactions. This could be with a traditional bank, a credit union, the post office or an online bank.

SINGLE CODE, DO NOT READ OUT

a. AIB

b. Bank of Ireland

c. Permanent TSB

d. Ulster Bank

e. KBC

f. Credit union

g. An Post/An Post money

h. Revolut

i. N26