I:Vol3/Burs/Admin/Training/DeptGuide Page 1

Departmental

Guide

to

Banner,

TouchNet, and

Argos

PREPARED BY: SUSAN FORMAN

Bursar

BURSAR’S OFFICE

Updated March 2013

I:Vol3/Burs/Admin/Training/DeptGuide Page 2

TABLE OF CONTENTS

Section 1……..……Introduction to Banner/TouchNet/Iris………….Page 3

Income/Expenses/FERPA/Waivers

Section 2.…………..Processing Contracts in Banner………..………Page 28

Section 3……………Processing Exemptions in Banner..…..……….Page 51

Section 4……………Graduate Student Waiver Rules…………….…Page 59

Section 5……………General Ledger Reconciliation Reports in

ARGOS…………………………………………Page 68

Section 6……………Overview of Fee Exemptions and……………..Page 80

Reductions

Section 7……………Explanation of Terms………………………..…Page 133

Section 8……………Reviewing Student Accounts in TouchNet……Page 138

Section 9……………Course Fees…………..…………………………Page 151

Section 10…………..Hold Processing in Banner…………………….Page 161

Section 11…………..One Stop Services………………………………Page 181

Section 12…………..Bursar’s Office Services……………………….Page 183

Section 13…………..Directory of Staff………………………………Page 185

Section 14…………..Screen Shots……………………………………Page 187

I:Vol3/Burs/Admin/Training/DeptGuide Page 3

Introduction to Banner/TouchNet/IRIS

Income/Expense

Waivers/FERPA

I:Vol3/Burs/Admin/Training/DeptGuide Page 4

SECTION 1

GENERATION OF STUDENT CHARGES/PAYMENTS

When a student registers, charges are created in the student’s VolXpress account for In-state

Maintenance fee, Technology fee, Programs and Services-Primary, Programs and Services-

Health, Library fee, Facility fee and Transportation fee. If the student is classified as an out-of-

state student, a charge is also calculated for Out-of-State Tuition. Undergraduate students are

also assessed a Study Abroad fee. The charges are based on the number of hours for which the

student registers. Some courses carry special course fees. Examples are Golf, Bowling, Art,

Chemistry, Biology, Music, Business, Nursing, Architecture and Engineering courses. The

charge for these fees is generated when the student registers for one of these courses. Room and

Board charges are added to the student’s account prior to e-mailing the first VolXpress statement

for the term provided the student has a signed contract. Room and Board charges are based on

the student’s contract with Residence Halls and Aramark Food Services. A student can begin the

registration process months before the term actually begins. The Bursar’s Office e-mails a

VolXpress statement approximately two weeks before payment is due for the term. Payment is

due two days before the first day of class. This allows the Bursar’s Office to process all

payments before cancellation of schedules from Priority Registration. Schedules are cancelled

due to non-payment of fees, payment of less than 50% of fees due, etc. After Priority schedules

are cancelled, the registration system is opened for Final Registration. Students who register

during this period who were registered in the previous term or in Priority Registration will be

assessed a Final Registration fee of $20 to $100.

Student’s fees can be paid from various sources. A student may receive financial aid awarded

through the Financial Aid Office in the form of grants, scholarships, fellowships and loans. This

aid will show as pending aid on the student’s VolXpress statement until financial aid is released

to students approximately one week into the term. A student may also pay by check, e-check or

credit card. Credit card payments are only accepted on the web at MyUTK.EDU. A student may

be sponsored by an outside agency such as Tennessee Vocational Rehabilitation or by an on-

campus sponsor such as the Athletic Department. These students are authorized in Banner as

Contracts. These authorizations show on the student’s VolXpress statement as a Contract

Payment. A graduate student can also be on a departmental assistantship. There are four types of

assistantships: graduate assistant, graduate teaching assistant, graduate teaching associate and

graduate research assistant. Effective with Fall Semester, 2004, the process for charging graduate

fee waivers changed. Many are now charged back to the student’s department. A student must

have at least one 25% FTE position to be eligible for a fee waiver. Out-of-state tuition for

graduate waiver positions is charged to the Central Waiver Account E019005 using Banner

detail codes EXGO or EXGN. In-state tuition is charged to the student’s distribution Cost

Centers or WBS Element listed on PA20 in IRIS or the Central Pool account depending on

waiver rules defined in the Graduate Waiver section. The department may move the charge to

another account after the charge has posted. Charges to the Central Pool account must be

I:Vol3/Burs/Admin/Training/DeptGuide Page 5

approved by the Budget Director in the Office of the Chancellor and Provost. In-state

maintenance is charged with detail codes EXGA and EXGI.

DISTRIBUTION OF INCOME

All charges associated with student accounts are identified in Banner by a Detail Code

maintained by The Bursar’s Office. This table (TWADETC) list each charge (such as in-state

maintenance) and the associated income/expense Funds, Cost Centers or WBS elements. It also

includes other information necessary for the creation of financial transactions through Banner.

O/S Graduate Tuition is a Term-Based detail code. This means that the income can go to a

different account number and GL code based on the Term of the charge.

FA = Fall Semester SP = Spring Semester

SU = Summer Semester MT = Summer Mini-Term

This allows for easier reporting of semester income.

I:Vol3/Burs/Admin/Training/DeptGuide Page 6

Allowance for Doubtful Accounts (ADA) is calculated before the income is posted to the income

account. ADA is an account set up to protect the University against Bad Debts. The uncollectible

accounts are written off against the ADA account. Any department for which the Bursar’s Office

charges and collects payment will be assessed an ADA Charge.

Financial Aid accounts are separated into regular payments and Aid-Year based payments. Aid-

Year based payments are federal financial aid payments. They cannot be automatically applied to

prior year charges. The student has the option to take any excess funds and apply them to prior

balances. $200 can be automatically applied to prior year balances if a student has a Prior Year

PY authorization on TVAAUTH.

A TIV authorization allows Title IV financial aid to pay non-institutional charges such as

VolCard transfers, Parking hang-tags, etc.

I:Vol3/Burs/Admin/Training/DeptGuide Page 7

CY = Current Year PY = Prior Year

FY = Future Year

The account number normally differs by aid year. The account numbers are sent to the Bursar’s

Office by Sponsored Projects accounting each year. This is how the IRIS ledger postings are

established. A charge or a payment must have a detail code with current IRIS account and GL

numbers in order to be processed from Banner to IRIS.

Payment Detail Codes can also be set up to apply to any term or year by not designating Term-

Based, Aid Year Based or Title IV. See the detail code below set up for a web e-check.

I:Vol3/Burs/Admin/Training/DeptGuide Page 8

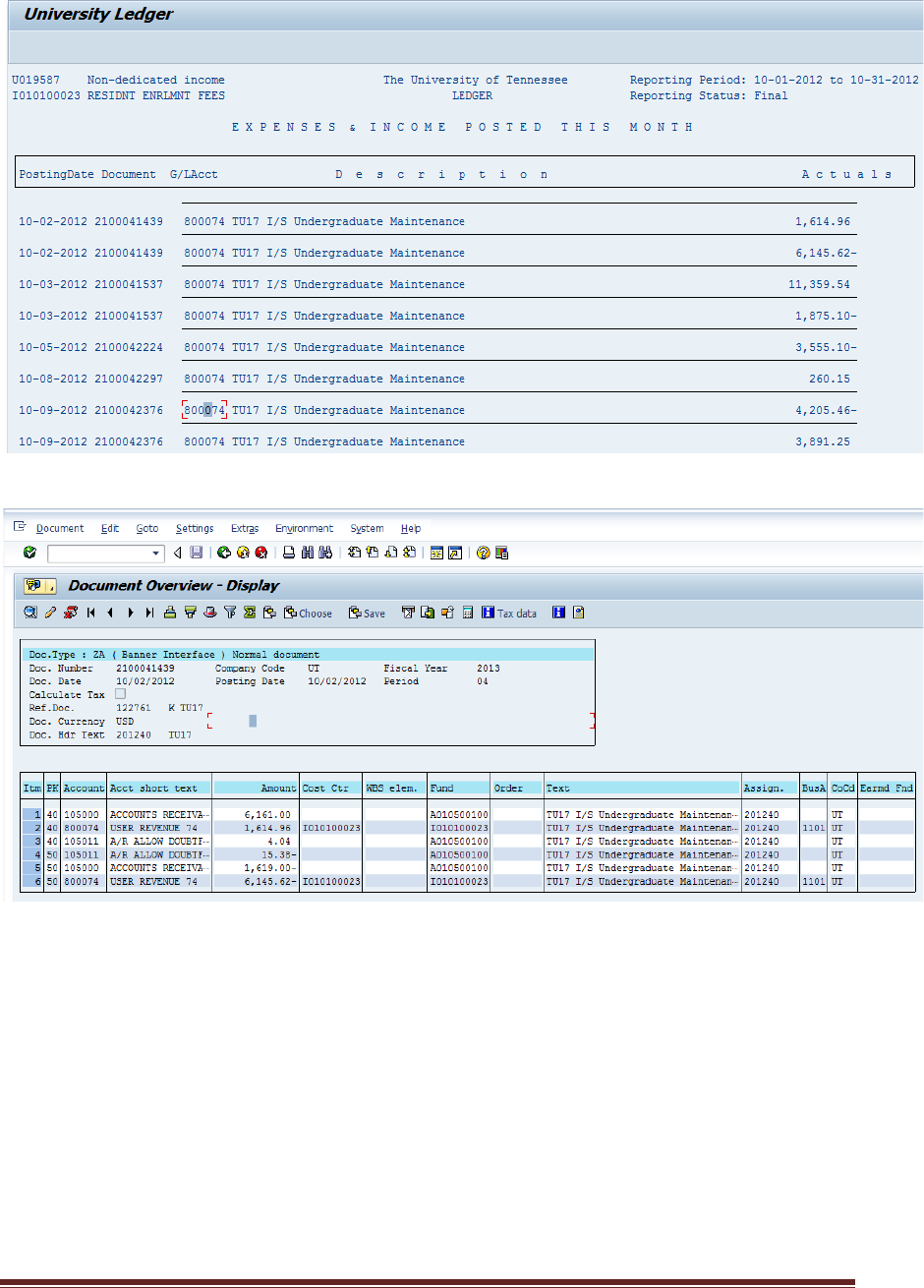

The income hits the department’s ledger the same day the charge hits the student’s account. Fall

charges are released to student’s account around August 1, Spring charges December 1, Summer

Mini-Term April 1 and Summer Term approximately May 15. Income is posted to IRIS daily

with a detail code specific to the income account. For example, Undergraduate tuition’s detail

code is TU17. Below is an example of the ledger posting from IRIS.

You can look up each individual entry by the Document number. The daily transactions are

posted as a ZA transaction.

I:Vol3/Burs/Admin/Training/DeptGuide Page 9

Individual document:

EXPENSE TRANSACTIONS

Expense transactions processed in Banner are generated by payments to student accounts. They

include financial aid awards, fee exemption payments and contract payments. Financial aid

awards are posted to a student’s account as a payment on the 3

rd

day of class each term. After

that date, transactions are posted to the student’s account daily as new or additional awards are

made by the Financial Aid Office. Assistantships are posted to the student’s account from IRIS.

If a student is on IRIS with at least one 25% FTE position as a GA, GTA, TA or GRA, a

exemption payment will be posted to the student’s account when the student incurs a charge for

I:Vol3/Burs/Admin/Training/DeptGuide Page 10

in-state maintenance and/or out-of-state tuition. If the student HAS NOT yet been added to IRIS

payroll, he/she must be included in an email to the Bursar’s Office requesting a deferment until

the paperwork can be processed in Iris.

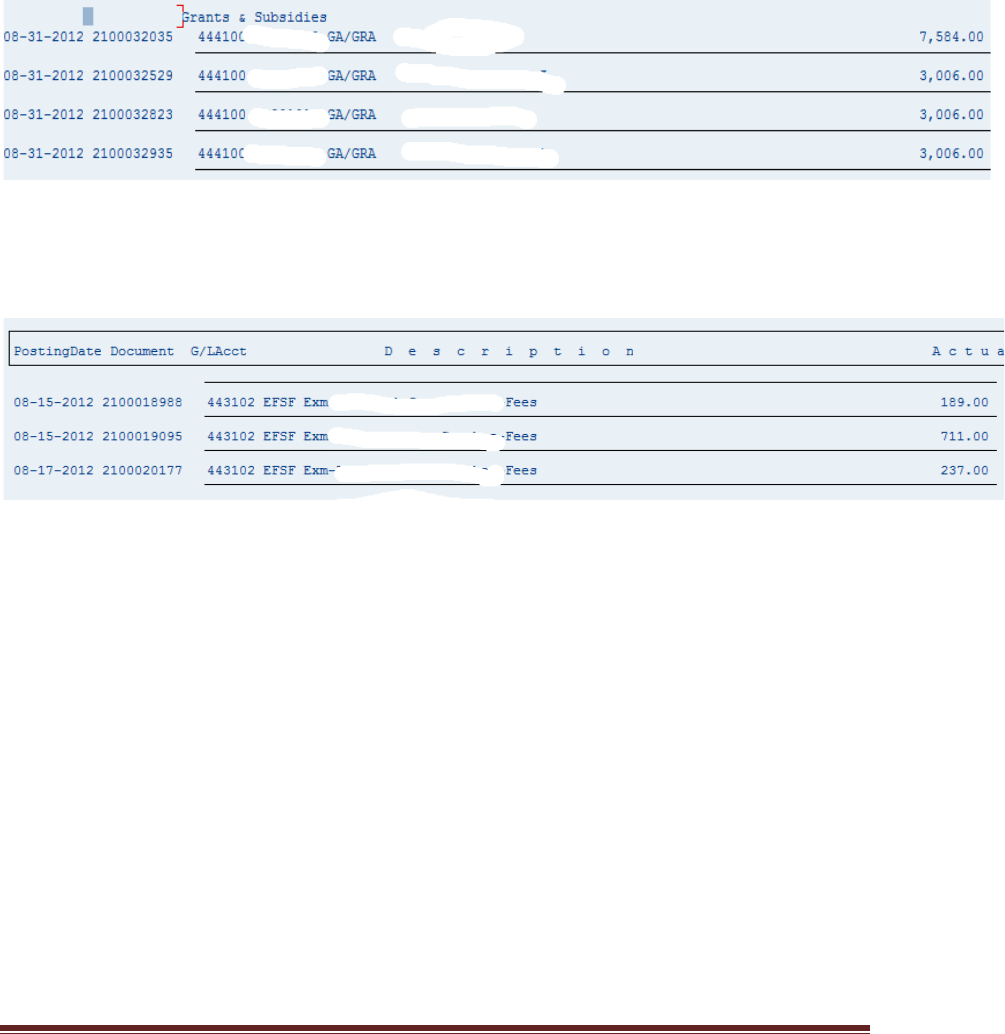

Graduate waiver/exemptions are posted to their respective E/R accounts with the detail codes of

EXGI for GTA’s, TA and GRA’s in-state maintenance; EXGA for Graduate Assistant instate

maintenance; EXGO for O/S Tuition for GTA’s TA’s and GRA’s and EXGN for O/S Tuition for

GA’s. You can review on your ledger in IRIS by student. They are posted to ledgers on a

monthly basis on a ZF transaction type.

Contract payments are posted to the ledgers daily beginning with the first day income is released.

They will post on your ledger by detail code. You will need to go to Banner or ARGOS to obtain

the list of students.

You can go to Banner TGIACCD to list the students by using the assigned detail code such as

EFSF for Football and the term. The term is based on year with 20 for Spring; 25 for Mini term;

30 for Summer and 40 for Fall.

Spring 2013 = 201320.

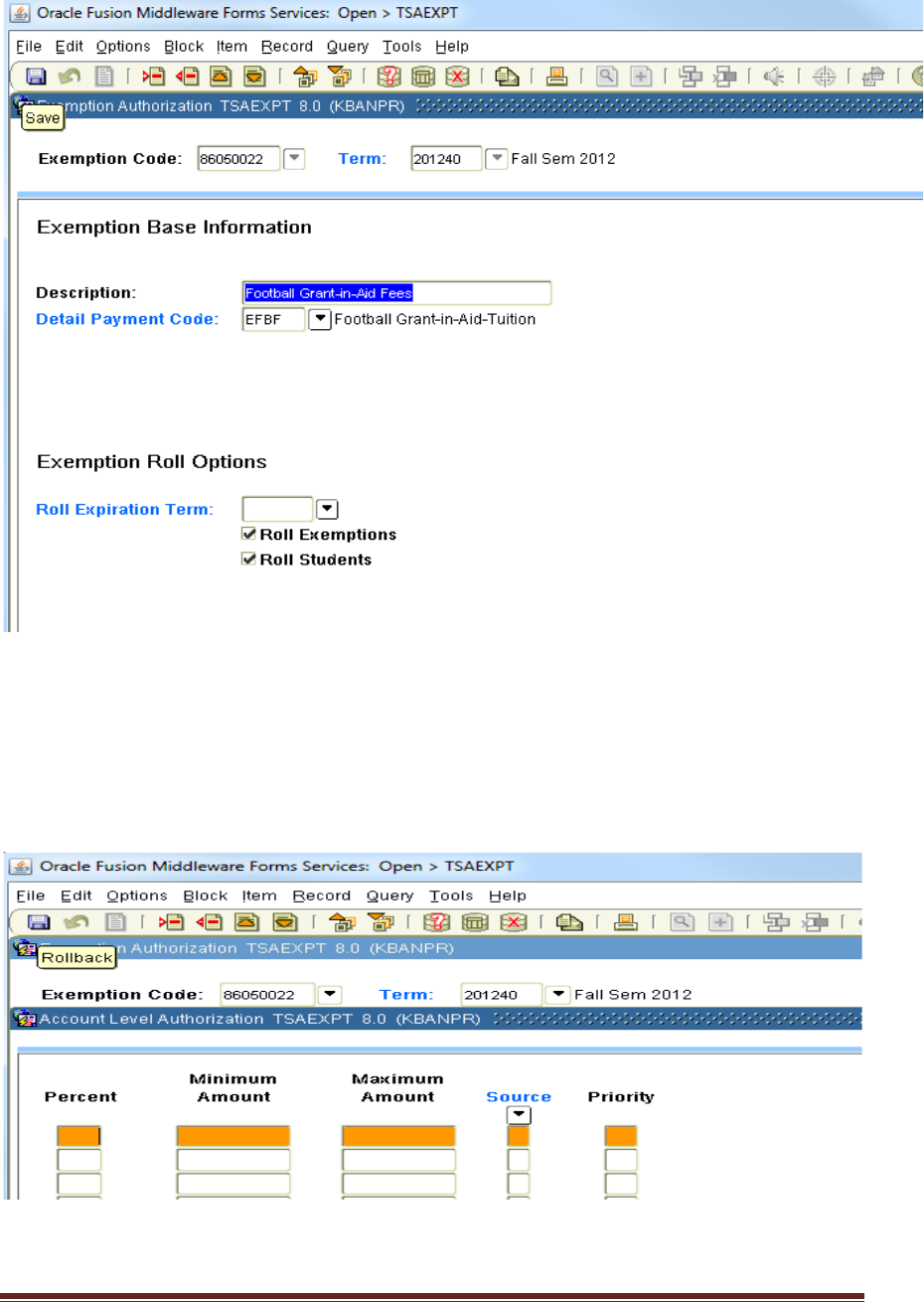

You would enter EFSF (Football Grant-in-aid) in the box under Detail Code in the ledger

example above:

I:Vol3/Burs/Admin/Training/DeptGuide Page 11

Enter the Term code under Term:

You can also narrow it down to Effective date. Banner dates are entered with day-month-year.

For example November 26, 2012 would be 26-Nov-2012. After entering your selections, press

“F8” to execute your query or press the barrel icon.

Payroll based fee waivers are not posted to the accounts until the end of August for Fall term,

end of January for Spring, end of May for Mini term and end of June for Summer term. After the

initial release, charges/credits are posted monthly. If you use ZDEPT_Ledger in IRIS and go to

GL Code 422500 for Dependents or 422200 for Staff, you can view both the amount and the

name of the individual for which your account has been charged. Please verify that these

individuals should be charged to your account.

I:Vol3/Burs/Admin/Training/DeptGuide Page 12

You can also identify the type of waiver by the detail code.

EXDE is Dependent of UT Staff

EXSP is Spouse of UT Staff

EXST is UT staff

There are also codes for retired staff and their dependents and dependents of deceased staff.

ACCESS TO BANNER

Go to the Registrar’s website for Forms:

http://registrar.tennessee.edu/forms/index.shtml

. Click on Banner System Account

Request Form.

You must complete the form below, mark the sections for which your job requires

access, have it signed by your supervisor and submit it to Enrollment Services. The

form will then be reviewed by each of the departments to which you have

requested access. They will approve the needed access. You will then be notified

of your user name and password. You will be required to change the initial

password the first time you log into Banner.

BANNER System Account Request

I:Vol3/Burs/Admin/Training/DeptGuide Page 13

Complete and send to:

Enrollment Services

219 Student Services Building

FAX 974-

0727

1. Name: ____________________________________________________________________________ Request Date: _____________________

(last first middle Jr. Sr.) (mm/dd/yy)

2. Net ID: _______________________________ Email_________________________________ Phone___________________________________

3. UT Position/Job Title: _____________________________________________________________

4. College: ________________________ Dept:____________________________________

5. Check only the system(s) to which you need access.

ADMISSIONS

_____ Admission Query _____ Admission Update ( Admissions Staff Only)

FINANCIAL AID

_____Fin Aid Query _____ Financial Aid Update (Financial Aid Staff Only)

REGISTRATION /ACADEMIC HISTORY/TIMETABLE

_____ Registration Query _____ Registration Update (Registrar Staff Only)

_____ Demo-Bio Query _____Registration Departmental Update _____ Registration Advising Update

_____ Academic History/DARS Query _____ Registration Student Groups Update _____Registration Max Hours Override

Update

_____ Advising Query _____Registration Permission Update _____Timetable\

Room Scheduling Update

_____Catalog Query _____Program/Major/Minor/Concentration Advisor Update

_____Print Class Rolls

_____Print Class Rolls (Argos)

BURSAR

_____Bursar Inquiry _____ Department User Update _____Bursar Update(Bursar Staff Only)

HOLDS

_____Holds Inquiry _____Holds Update

Please list the hold codes that you maintain:

_____________________________________________________________________________________________________________________

FERPA

_____FERPA Query _____FERPA Academic Record _____FERPA Finance _____FERPA Discipline ___

__ FERPA Athlete

(Query) (Maintenance) (Maintenance) (Maintenance) (Maintenance)

6 . Provide an explanation of how you intend to use the system(s) you have checked on this form. Access will not be granted without an

explanation.

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

I:Vol3/Burs/Admin/Training/DeptGuide Page 14

If you are in a department that issues holds on a student account, you will need to include

the Hold code for which you will be responsible. The Bursar’s Office will then approve

you access to the proper Hold Originator category.

Each department involved must approve your access.

Proper use of FERPA protected data

By signing the Banner access request form, you are certifying that you will properly use

the data you have access to. You will have access to student financial information,

academic information, etc. You have restrictions on sharing that data.

You are responsible for how you share the data and you are subject to the Federal

regulations surrounding FERPA.

Please read the last page carefully before you sign.

Family Education Rights & Privacy Act (FERPA)

Designed to protect the privacy of educational records; establish rights of students to inspect their

records; and provide guidelines for correcting inaccurate data.

Does FERPA apply to all students?

• Yes. All students, (regardless of age), who attend or have previously attended

postsecondary institutions have FERPA rights.

• ‘Attending students’ includes admitted students, students in residence, continuing

education students, students auditing only, and distance education students. FERPA

does not apply to applicants who have not been admitted to the institution.

Who is responsible for seeing that FERPA is enforced?

All members of the university community, (faculty, staff and students), who have access to

student records are responsible for guarding their confidentiality.

What does FERPA guarantee students?

FERPA gives students the right to:

• inspect and review their own records;

• request amendments to their record;

• have some control over the release of personally identifiable information from their

records; and

• file a complaint with the Department of Education concerning an alleged failure to comply

with FERPA regulations.

I:Vol3/Burs/Admin/Training/DeptGuide Page 15

How students are made aware of FERPA?

Notification at the University of Tennessee is furnished at freshmen orientation; through Hilltopics,

Graduate and Undergraduate Catalogs; and on the FERPA and Student Privacy website:

http://ferpa.utk.edu/

.

What is directory information?

Directory information is student data that is not generally considered harmful if disclosed.

Directory information may be disclosed UNLESS the student has invoked the FERPA

right to limit disclosure. Directory information includes:

Name Graduate or Undergraduate level

Semester (local) address Full‐time or Part‐time status

Permanent address College

NetID Major

Email address (university‐supplied) Dates of Attendance

Telephone number Degrees and Awards

Classification Participation in school activities and sports

Weight and height

Most recent previous educational institution attended

What is not directory Information?

Social Security Number Student ID Number

Grades GPA (Term or Cumulative)

Student Schedule Academic History

Academic Standing

What is meant by “disclosure of information?”

The University is not allowed to share information, other than “Directory Information”, without a

student’s written consent.

Can a student limit release of directory information?

Yes. Students can be excluded from directory creation or have more stringent privacy measures

instituted. Students can learn more at: FERPA and Student Privacy website: http://ferpa.utk.edu/

or through Student Data Resources, 218 Student Services Building, (865) 974‐2108.

How do I know if a student has asked that no information be released?

Look for the words “Privacy Requested” printed at the top of the academic history and on Banner

forms accessible by departmental personnel in colleges and administrative offices.

Special note to classroom instructors:

University faculty and staff with a legitimate educational interest do have the right to access

information about the student’s academic status and progress (for example, academic advisors or

counselors in the Early Alert Program).

DO NOT:

• Use student IDs or social security numbers in a public posting of grades

• Link the names of students with their IDs in any public manner

• Leave tests or papers for others to review (including collecting or distributing assignments

in open mailboxes or other public places)

• Circulate a printed class roll listing student ID numbers or grades as an attendance roster

• Post individual student record information on a public website

• Discuss the progress/grades of any student with anyone outside of the University without

written consent of the student (including parents/guardians)

• Provide anyone with lists of students enrolled in your classes for any commercial purpose

• Provide anyone with a student schedule or academic history or assist anyone other than

UT employees in finding a student on campus

• Leave computers on with student information accessible

I:Vol3/Burs/Admin/Training/DeptGuide Page 16

Which requests should be forwarded to the Office of the University Registrar?

• Requests for transcripts ‐ only the Office of the University Registrar can generate an

official transcript

• Certification requests ‐ verification of enrollment for lenders, health insurance, good

student car insurance discount forms

• Questions regarding the academic record of any student

Where can I find more information about FERPA?

American Assn of Collegiate Registrars & Admissions Officers:

http://www.aacrao.org/compliance/ferpa/

FERPA and Student Privacy website: http://ferpa.utk.edu/.

I:Vol3/Burs/Admin/Training/DeptGuide Page 17

Banner System Account Request

SECURITY OF USER IDS AND PASSWORDS

Your user ID and password may not be shared with anyone. This account is set up for only your use. You may not log anyone else

on with your user ID or password. You may not leave your Banner account up and running while you are out of your office. To

secure your account, you must either log off the system or protect your PC with a password (e.g. screensaver password).

Violation of this policy could result in revocation of access to Banner and disciplinary action up to and including termination of

employment.

CONFIDENTIALITY OF EDUCATION RECORDS

The confidentiality of education records is governed by The Family Educational Rights and Privacy Act (FERPA), 20 U.S.C. & 1232g,

as amended, and its implementing regulations, and the confidentiality provisions of the Tennessee Public Records Act, Tenn. Code

Ann. & 10-7-504 (a)(4). Absent the student's written consent, review and approval by the Chancellor, the Dean of Students, the

Asst. Provost of Enrollment Services, or the University Registrar (or their designees) is required for the exercise of the statutory

exceptions to the confidentiality of education records, including any lawful disclosure to non-University persons or agencies and

disclosure under emergency circumstances.

7. CONFIDENTIALITY: I understand that under mandate of federal and state laws identified on this form, University policy

protects the confidentiality of education records (including student academic histories) and information contained in education

records. Without the student's written consent, I will not disclose education records or information contained in education

records to any person or organization outside the University or (2) to any office or individual within the University

community unless that University office or individual has been determined by the University to have a legitimate educational

interest. I will keep the records and information I retrieve in such a way that they cannot be accessed by unauthorized

persons, and when no longer needed for the purpose(s) described below, I will destroy all copies so that they are no

longer recognizable. I will use the education records and information in those records solely for the following legitimate

educational purpose(s) related to my University employment.

By signing below, I certify that I understand and will comply with the above-stated limitations on disclosure and use of all

education records I access through my Banner account. I understand that failure to comply with these limitations is a violation

of University policy subject to disciplinary action up to and including termination of employment. I further understand that

failure to comply with the restrictions outlined on this form concerning security of my user ID and password is a violation

of University policy subject to revocation of access and disciplinary action up to and including termination of employment.

_____________________________________________________________________________________ _______________________________

(Signature) (Date)

8. Approved by: _________________________________________________________________________ _______________________________

(Dean, Director, Department Head) (Date)

Revised 9-14-2010

Signing into Banner:

I:Vol3/Burs/Admin/Training/DeptGuide Page 18

You can sign in to Banner from a couple of locations. You can go to the Banner

website at: https://bannerinb.utk.edu/

to log to either Banner INB (Internet Native

Banner) or Banner SSB (Self-Service Banner).

You can also use this link to view the Banner Bookshelf documentation if you are trying to find a

procedure or explanation.

I:Vol3/Burs/Admin/Training/DeptGuide Page 20

Here you can choose to go to Banner INB – Administrative Interface, Banner SSB or TouchNet

Administration if you have been given access to TouchNet by the Bursar’s Office.

When you click on Banner INB – Administrative Interface, you will be taken to the Banner log-

on screen. If you had used the first URL and selected Banner INB, you would arrive at this same

sign-on screen.

I:Vol3/Burs/Admin/Training/DeptGuide Page 21

TouchNet Access for Bill+Payment

To receive access to Banner Bill+Payment to review Financial FERPA access view, Customer

Service view of Student’s VolXpress account and official billing statements, your supervisor or

department head should send an email request to either the Bursar or Assistant Bursar. They

should include your name, netid, department and need for access.

If approved, you will be emailed a TouchNet user id and password. The URL to access

TouchNet is

https://secure.touchnet.com/cas/login?service=https%3A%2F%2Fsecure.touchnet.com%2Fucom

mercecentral%2F. We have found it works better with Fire Fox than it does with Internet

Explorer. We have not tested with Google Chrome.

You will arrive at this log-in page:

I:Vol3/Burs/Admin/Training/DeptGuide Page 22

Once you log in the first time, you will go to Edit My Profile and change your

password.

You will see this screen when you first log into TouchNet:

I:Vol3/Burs/Admin/Training/DeptGuide Page 23

You will click on Applications and choose Bill+Payment.

You will then be presented with this screen:

Authorized Users is where you will go to find if a parent or third party has

FERPA Financial Access. In this case, you can see that Susan Forman has

FERPA access for this student.

I:Vol3/Burs/Admin/Training/DeptGuide Page 24

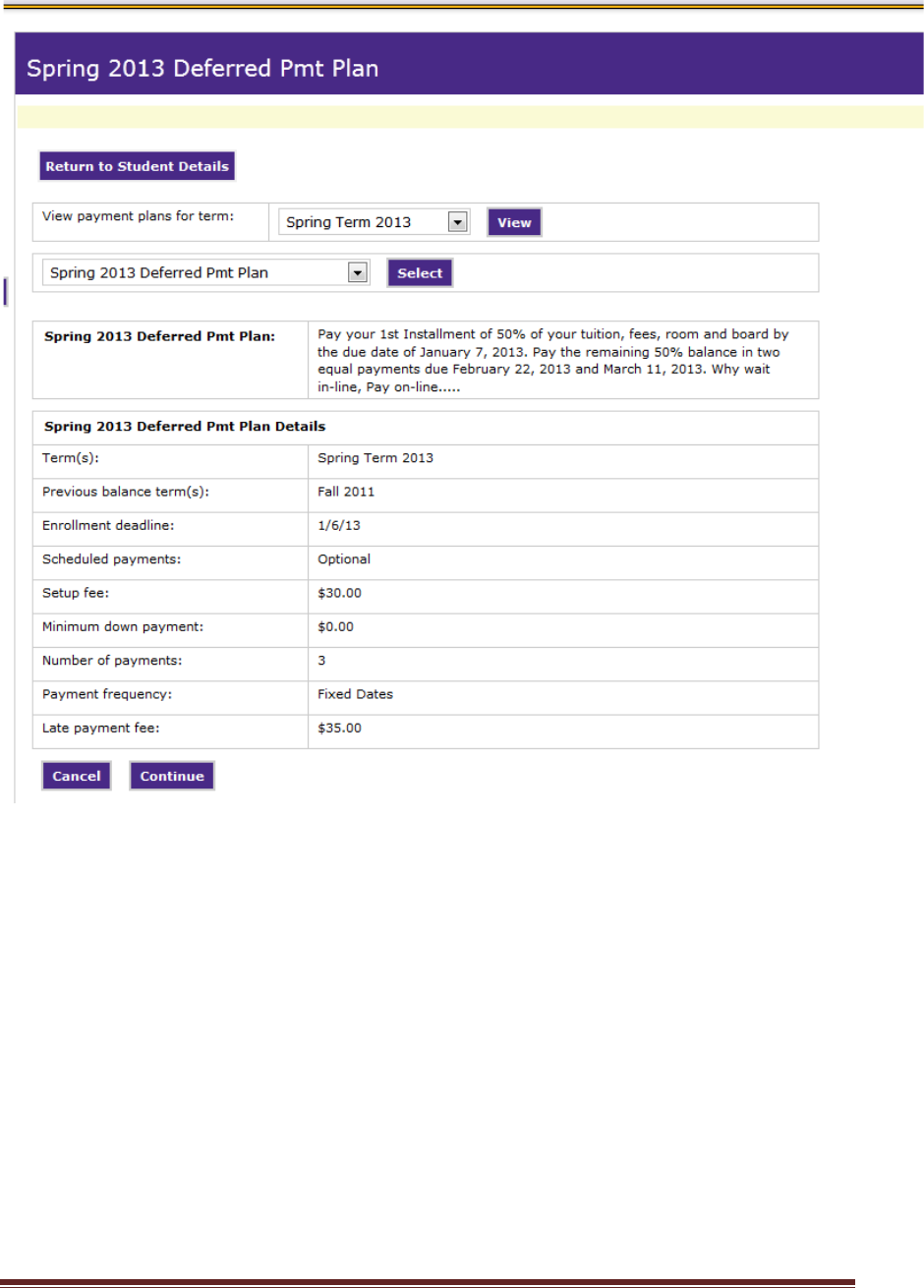

The Bursar’s Office, Financial Aid Office and One Stop Counselors also have the

ability to add a student to a deferred payment plan if dictated by circumstances. If

the student can pay the 50% down payment, they can be added to the regular

deferred payment plan. They will need to make their 50% down payment by the

due date at the beginning of the term.

Pull the student up on the Customer Service screen as illustrated above.

I:Vol3/Burs/Admin/Training/DeptGuide Page 25

These are the payment plans you can select from each term:

The Spring 2013 Deferred Pmt Plan is the one you would select if they are

making the 50% down payment.

After clicking Select, this is the next form that comes up:

I:Vol3/Burs/Admin/Training/DeptGuide Page 26

Click Continue.

This will show you the charges to be included in the plan, contracts, exemptions,

financial aid and any payments to be applied to the charges:

I:Vol3/Burs/Admin/Training/DeptGuide Page 27

Click Display Payment Schedule:

I:Vol3/Burs/Admin/Training/DeptGuide Page 28

This will give you the dates and the amounts to be paid on each date. These

amounts will appear on the students account as memo items and will not show in

current amount due until the due date. Click Process Enrollment. The student will

then receive an email telling them they have been enrolled in the payment plan.

They can then go into MyUTK or the parent can sign into the Parent Portal and

schedule payments for the due dates.

You go through the same steps to enroll students in the other available payment

plans. The 50% down payment plan is the only one available online through

MyUTK.

Bursar Exemption Deferred Payment Plan:

When the department initiates a new PIF (Personnel Information Form) to appoint, change

a GA, GTA, TA or GRA at the beginning of the term, they should also email the Bursar’s

Office. This enables us to put the student on a Bursar Exemption deferred payment plan so

that they do not have to pay their account in full by the payment due date for the term.

Otherwise, the student is responsible for payment of fees to maintain their schedule. Entry of a

deferment gives the student the waiver benefit and reduces the amount the student has to pay to

hold their semester schedule.

If the student has paid his fees and then receives a fee waiver, a refund is not issued until the

appointment appears on payroll. The Bursar’s Office validates all payroll based fee waivers. In

order for the student to be eligible for the fee waiver for each term, they must be on payroll for

minimum appointment periods.

MINIMUM APPOINTMENT PERIODS

FALL SEMESTER SEPTEMBER 1 TO NOVEMBER 30 91 DAYS

SPRING SEMESTER FEBRUARY 1 TO APRIL 30 89 DAYS

SUMMER SEMESTER – FULL TERM JUNE 15 TO JULY 31 47 DAYS

FIRST SESSION ONLY JUNE 15 TO JUNE 30 16 DAYS

SECOND SESSION ONLY JULY 1 TO JULY 31 31 DAYS

I:Vol3/Burs/Admin/Training/DeptGuide Page 29

PROCESSING CONTRACTS

IN BANNER

SECTION 2

I:Vol3/Burs/Admin/Training/DeptGuide Page 30

BANNER CONTRACTS

Banner processes two types of Contracts. We have outside agencies who authorize the University

to bill their agency/department for a student’s fees. External Contracts examples are Tennessee

Vocational Rehabilitation, foreign embassies and trust funds. Any university department

wishing to award aid to students should contact the Scholarship Section of the Financial Aid

Office.

Contracts are authorized in Banner on TSACONT and must be processed by the Bursar’s Office.

For external contracts, an authorization must be submitted to the Bursar’s Office, 211 Student

Services Bldg., Knoxville, TN 37996-0225. The authorization must contain the student’s name,

UT ID number, charges to be covered and the maximum dollar amount to be charged. The

Bursar’s Office will send an official UT invoice to the sponsor after the drop/add period for the

semester has passed.

When you log into Banner, you will be presented with a menu screen:

Unless you work in the Bursar’s Office you would not be able to go directly to the form

TSACONT. However you can review any Contracts and Exemptions the student may have by

going to TSIAUTH. You can either type this directly in the Go To box or by clicking through the

menu. To follow the menu path, you go through Student/Accounts Receivable/Student Accounts

Receivable/Student Inquiry/ Contract/Exemption History Query.

You will enter the student’s UT id number or netid in the ID block. Then process a Next Block.

I:Vol3/Burs/Admin/Training/DeptGuide Page 31

You will use Next Block to move forward in different parts of the form. You will also use the

next set of commands to begin a query, execute a query or clear a query. There are also shortcut

function keys.

I:Vol3/Burs/Admin/Training/DeptGuide Page 32

You can use whichever method you are comfortable with.

Contracts can be authorized in several different ways. If the authorization covers broad

categories of fees, we can use a category authorization. However, if the contract will only pay for

Undergraduate Tuition, we have to narrow the authorization to specific detail codes.

Our contract with Dependents of Board of Regents Institutions is an example of a contract that

must be authorized at the detail code level.

If a Contract ID is not already set up, you would need to go to SPAIDEN to set up a Non-Person

Entity ID #. We begin these numbers with a “T” for Third Parties. Once you have an id#, go to

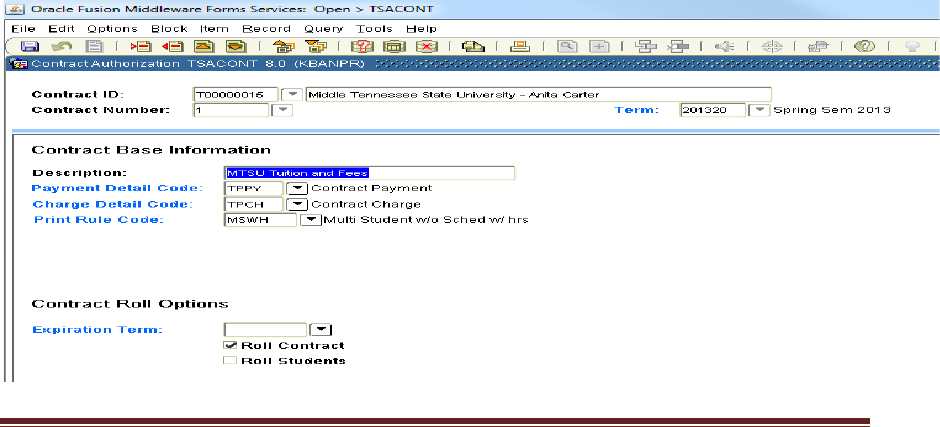

TSACONT.

You will enter the Contract ID, the Contract Number is 1 in most instances, and the term. You

will then do a “Next Block”.

You can then “Next Block” through each form. Please note the Payment Detail Code that will be

posted to the student’s account. The balance is shifted from the student’s account and posted as a

charge to the contract with the Charge Detail Code. The Print Rule tells Banner which Third

Party Invoice to print for this contract.

The Contract Roll options allow you to roll just the contract details from term to term or to roll

both the contract and all of the student assigned to the contract. If a new authorization is required

from the student each semester, you would roll only the contract detail.

I:Vol3/Burs/Admin/Training/DeptGuide Page 33

If the contract paid a flat dollar amount that could be applied to any charges, you could do an

account level authorization for the contract.

We will cover the category code authorization on another account. This particular type of

contract pays specific charges. That means you have to authorize at the detail code level. It will

only pay 50% of Undergrad tuition and fees. Each detail code is listed and marked with 50% to

be paid by the contract. The system automatically assigns a payment priority for each detail

code. This can be changed if the student has multiple contracts and/or exemptions. You usually

want to pay charges from all sources. It can be limited if necessary.

I:Vol3/Burs/Admin/Training/DeptGuide Page 34

Next you will add the students to the contract. You will need to add their student id#. The name,

priority and activity date will be auto-populated. Here again you can change the priority if the

student has multiple payment sources. You can also put a maximum amount to be charged to the

grant on each student.

I:Vol3/Burs/Admin/Training/DeptGuide Page 35

If a contract pays all tuition and fees, you can authorize by category code.

On the contract above, we have used category codes. This contract will pay whether the student

is UG or Grad. Notice that the maximum amount the contract will pay for the tuition category

code is $4500. There is not a limit on the Fee and Other Category codes.

You can also put limits on the amount charged at the student level.

If you have checked to roll student at the contract level, you can uncheck specific students at this

level and that student will not roll with the others.

I:Vol3/Burs/Admin/Training/DeptGuide Page 36

Example of an authorization:

I:Vol3/Burs/Admin/Training/DeptGuide Page 37

The Contract would be set up with the individual student maximum listed on the authorization:

Contract Payment Detail Codes

Detail Code

Desc

Type

Category

Active

FP05

Naval Surface Warfare Center

P

CNT

Y

FP19

Air Force ROTC

P

CNT

N

TP02

43MSS/DPE

P

CNT

Y

TP05

Naval Surface Warfare Center

P

CNT

Y

TP06

Navy

P

CNT

Y

TP09

AMEDD C&S LT‐Keith Wilson

P

CNT

Y

TP19

Air Force ROTC

P

CNT

Y

TP20

Department of Defense

P

CNT

Y

TP21

AFIT

P

CNT

Y

TP22

Naval Surface Warfare Center

P

CNT

Y

TP24

90 FSS/FSDE Ruth Brooks

P

CNT

Y

TP26

Dantes‐Nashville

P

CNT

Y

TP27

Navesea 08‐Angela West

P

CNT

Y

TP29

Army ROTC

P

CNT

Y

TP32

Defense Military HPSP

P

CNT

Y

TP33

Dept of Veterans Affairs

P

CNT

Y

TP34

Dept of Veteran's Aff.‐VA Voc

P

CNT

Y

TP35

Army Civil Engineering

P

CNT

Y

I:Vol3/Burs/Admin/Training/DeptGuide Page 38

TP37

Go Army Education

P

CNT

Y

TP43

Dept. of Defense

P

CNT

Y

TP44

Air Force Tuition Assistance

P

CNT

Y

TP50

VA Vocational Rehab

P

CNT

Y

TP51

Dept of Veteran's Aff.‐VA Voc

P

CNT

Y

TP52

Dept of Veteran's Aff.‐VA Voc

P

CNT

Y

TP53

Dept of Veteran Affairs

P

CNT

Y

TP54

Dept Of Veterans Affairs

P

CNT

Y

TP58

Air Force Tuition Assistance

P

CNT

Y

TPCH

Contract Charge

C

CNT

Y

TPPY

Contract Payment

P

CNT

Y

Third Party Contracts as of March 1, 2013

ID

Name

Activity

T00000181

Knoxville Catholic High School ‐ Steve R Walker

25‐Oct‐10

T00000252

Marshall Space Flight Center ‐ Chrissa Hall

28‐Oct‐10

T00000310

Workforce Investment ‐ Doris Sparks

28‐Oct‐10

T00000245

341 MSS/DPHE _ Gail Duerre

28‐Oct‐10

T00000538

344 Tuskegee Airmen Blvd.

9‐Aug‐12

T00000214

43 MSS/DPE

26‐Oct‐10

T00000215

78 MSS/DPE

26‐Oct‐10

T00000248

90 FSS/FSDE ‐ Ruth Brooks

17‐Nov‐10

T00000216

95 MSS/DPE

27‐Oct‐10

T00000359

AEDC/DPE ‐ Dee Wolfe

28‐Oct‐10

T00000180

AFIT‐RPB

25‐Oct‐10

T00000212

AFIT/FMA‐ Mr. Lynn Weed

26‐Oct‐10

T00000268

AGESO/Dantes

28‐Oct‐10

T00000290

AMEDD C&S LT HET‐ Delia Cook

17‐Dec‐10

T00000290

AMEDD C&S LT HET‐ Jody Cheap

1‐May‐12

T00000290

AMEDD C&S LT HET‐ Keith Wilson

1‐May‐12

T00000197

AMIDEAST

26‐Oct‐10

T00000197

AMIDEAST ‐ Leigh Peele

26‐Oct‐10

T00000540

AMRCC, Inc.

17‐Aug‐12

T00000196

Air Force Rotc ‐ Sgt Lisa Mitchell

26‐Oct‐10

T00000538

Air Force Tuition Assistance

9‐Aug‐12

T00000545

Air Force Tuition Assistance

21‐Aug‐12

T00000341

Al Al‐Bayt University ‐ Hashem Al‐Masaied

29‐Oct‐10

T00000239

Alabama Department of Rehabilitation ‐ Keith Dear

28‐Oct‐10

T00000298

Alabama Prepaid College Tuition‐ Kelly Renner

17‐Apr‐12

T00000298

Alabama Prepaid College Tuition‐Alicia Gethers

28‐Mar‐

12

T00000298

Alabama Prepaid College Tuition‐Liz Harrell

17‐Apr‐12

T00000238

Alabama Vocational Rehab Services ‐ Don Stephens

28‐Oct‐10

I:Vol3/Burs/Admin/Training/DeptGuide Page 39

T00000257

Alcoa Tuition Assistance Program

28‐Oct‐10

T00000289

Ambassade De La Rebulique Gabonaise‐Laurent Ndong

28‐Oct‐10

T00005010

American InterContinental University Online

17‐Mar‐

11

T00000387

American Legion Department of Tennessee ‐ Darlene Burgess

28‐Oct‐10

T00000357

American Military Retirees Association ‐ Catherine L Lavalle

28‐Oct‐10

T00000231

Americorp/ National Service Trust

27‐Oct‐10

T00000369

Anderson COunty Schools ‐ Lisa Champion

28‐Oct‐10

T00000370

Anderson County Schools ‐ Becky Stewart

28‐Oct‐10

T00000371

Anderson County Schools ‐ Denise Wilburn

28‐Oct‐10

T00000273

Ankara Universitesi Rektorlugu

28‐Oct‐10

T00000353

Army Advanced Civil Schooling programs ‐ Michelle Carr

28‐Oct‐10

T00000286

Army Education Center

28‐Oct‐10

T00000291

Army Rotc‐ Ms. Hinton

28‐Oct‐10

T00005016

Ashford University

27‐Apr‐12

T00000336

Atlanta Next Step ‐ Jo Anne Pascall

29‐Oct‐10

T00000009

Austin Peay State University ‐ Amy Jackson‐Hayes

26‐Oct‐10

T00000003

BEST

11‐May‐

11

T00000003

BEST ‐ LaKesha Page

11‐May‐

11

T00000502

BNGC‐Melissa Mattingly‐Overby

11‐Jan‐11

T00000003

Baccalaureate Education System Trust

11‐May‐

11

T00000548

Bangkok University

11‐Oct‐12

T00005014

Bank of America

7‐Feb‐12

T00000200

Barnes Educationla Trust/44‐2465‐001 ‐ Molly Schroader

26‐Oct‐10

T00005017

Bethel University

6‐Sep‐12

T00000004

Board of Regents Central Office

26‐Oct‐10

T00000229

Boeing/Washington

27‐Oct‐10

T00000300

CAEL/Colgate‐Palmolive College Program ‐ Marisol Martinez

28‐Oct‐10

T00000210

CBIE‐ Candian Bureau for International Educ. Mitch Miller

29‐Mar‐

11

T00000210

CBIE‐ Candian Bureau for International Education

29‐Mar‐

11

T00000905

CNPQ Conselho Nacional De Desenvoliment

6‐Jan‐11

T00000512

Caldwell Trust Company

27‐May‐

11

T00005001

Catholic Health Initiatives

21‐Dec‐10

T00000355

Central Bank of Jordan

28‐Oct‐10

T00000356

Central High School Alumni Assn ‐ Patsy Ferguson, Treasurer

28‐Oct‐10

T00000287

Central High School Alumni Association, Inc.‐ Walter Seifert

28‐Oct‐10

T00000018

Chattanooga State Tech Comm College ‐ Lynn Shook

27‐Oct‐10

T00000368

Civitan International ‐ Rosematy Franklin

28‐Oct‐10

T00000019

Cleveland State Community College ‐ Wilma Ownby

27‐Oct‐10

I:Vol3/Burs/Admin/Training/DeptGuide Page 40

T00000271

Coast Guard Foundation

28‐Oct‐10

T00000020

Columbia State Community College ‐ Lauren Hall

27‐Oct‐10

T00000363

Commonwealth of Pennsylvania ‐ Office of Vocational Rehab

28‐Oct‐10

T00000388

Commonwealth of Virginia ‐ Gary Roberts

28‐Oct‐10

T00000234

Cumberland Good Samaritans ‐ Carol Price

28‐Oct‐10

T00000260

Dantes‐ Nashville

28‐Oct‐10

T00000259

Dantes‐ Pensacola

28‐Oct‐10

T00000264

Dantes/ Salt Lake City ‐ Danny Sanchez

28‐Oct‐10

T00000266

Dantes/Birmingham‐ Kathy King

28‐Oct‐10

T00000262

Dantes/Fort Bragg ‐ Patsy Stewart

28‐Oct‐10

T00000263

Dantes/Fort McCoy ‐ Mary Miller

28‐Oct‐10

T00000265

Dantes/Snelling

28‐Oct‐10

T00000261

Dantes/St. Augustine‐ Paule Mueller

28‐Oct‐10

T00005013

Dave Schmidt Memorial Scholarship Fund

25‐Oct‐11

T00000326

Defense Military Pay Office/HPSP

17‐Nov‐10

T00000329

Defense Nuclear Facilities Safety Board ‐ Nadine Loften

7‐Nov‐11

T00000325

Denfense MiltiaryPay Office HPSP‐ Tamica Williams

28‐Oct‐10

T00000329

Denfense Nuclear Facilities Safety Board ‐ Nadine Loften

7‐Nov‐11

T00000321

Department of Army ‐ Wallis Berrios

28‐Oct‐10

T00000295

Department of Children's Services ‐ Dave Shonts

28‐Oct‐10

T00000543

Department of Defense

18‐Aug‐12

T00000206

Department of Defense ‐ Karen Freeman

26‐Oct‐10

T00000284

Department of The Interior‐ Eileen D Schultz

28‐Oct‐10

T00000537

Department of Veteran Affairs

8‐Aug‐12

T00000533

Department of Veteran's Affairs

15‐Mar‐

12

T00000513

Department of Veterans Affairs

22‐Jul‐11

T00000542

Department of Veterans Affairs

18‐Aug‐12

T00006911

Department of Veterans Affairs

4‐Aug‐11

T00000373

Department of the Army ‐ Dawn Bilodeau, Budget Officer

28‐Oct‐10

T00000342

Dept Of Veteran's Affairs

19‐Dec‐12

T00000342

Dept Of Veteran's Affairs‐ Ashlee Buck

19‐Dec‐12

T00006005

Dept of Treasury

25‐Oct‐11

T00000524

Dept of Veteran Affairs

18‐Aug‐11

T00006911

Dept. of Veterans Affairs

4‐Aug‐11

T00005000

Dickson County Bar Association Scholarship Fund

21‐Dec‐10

T00000233

Dupoint High School Alumni Association, Inc.‐Wilson Stewart

23‐Aug‐11

T00000233

Dupont High School Alumni Association, Inc.‐Wilson Stewart

23‐Aug‐11

T00000021

Dyersburg State Community College ‐ Angela W Hooper

10‐May‐

11

T00000021

Dyersburg State Community College ‐ Debbie Roberson

10‐May‐

11

T00006001

ELM Resources

26‐Jan‐11

T00000228

East Tennessee Historical Society

27‐Oct‐10

I:Vol3/Burs/Admin/Training/DeptGuide Page 41

T00000228

East Tennessee Historical Society‐ Lisa Oakley

27‐Oct‐10

T00000010

East Tennessee State University

26‐Oct‐10

T00000318

Eastern Band of Cherokee Indians ‐ LeAnn Reed

10‐Mar‐

11

T00000318

Eastern Band of the Cherokee Indians ‐ LeAnn Reed

14‐Mar‐

11

T00000318

Eastern Band of the Cherokee Indians ‐ Leeann Reid

14‐Mar‐

11

T00005005

Educational Services of America, Inc.

21‐Dec‐10

T00000213

Embassy of Botswanna ‐ B. Bamontshonyana

26‐Oct‐10

T00000190

Embassy of the State of Kuwait

26‐Oct‐10

T00008001

Estate of Helen Stehm

3‐Aug‐11

T00008002

Estate of James Hazenfield

31‐Jan‐11

T00008001

Estate of Marian Katherine Curtner

4‐Aug‐11

T00008001

Estate of Mary Katherine Curtner

4‐Aug‐11

T00008005

Estate of Ryan B. Edwards

12‐Jul‐12

T00000354

Evans High School ‐ Beverly Bibee

28‐Oct‐10

T00000254

FSG Bank ‐ J Wayne Cox

28‐Oct‐10

T00000334

Farragut Rotary Club

29‐Oct‐10

T00000241

Farragut Rotary Club ‐Dale S Read

28‐Oct‐10

T00000385

Federal Highway Administration ‐ Debra Garrett

14‐Sep‐11

T00000385

Federal Highway Administration ‐ Kristie Revera

14‐Sep‐11

T00000532

First Presbyterian Church

5‐Mar‐12

T00000391

First Presbyterian Church ‐ Vicki Pope

19‐Nov‐10

T00000350

Florida Pre‐paid College Program ‐ Lenora Allen

29‐Oct‐10

T00000383

Follett Educational Foundation ‐ Tom Galanis

28‐Oct‐10

T00005007

Foundation of the First United Methodist Church

23‐Feb‐11

T00000517

Frank E Page Scholarship

3‐Aug‐11

T00000544

Fulbright ‐ Pakistan

20‐Aug‐12

T00000203

Fulbright Grant ‐ Jalika Saidy

26‐Oct‐10

T00000529

Fulbright Turkey

14‐Oct‐11

T00000347

Fulbright‐Kommission ‐ Thomas Mutzhe

29‐Oct‐10

T00000390

Fulbright/Amideast ‐ Kea Greene

19‐Nov‐10

T00000349

Fulbright/Conicyt ‐ Mariana Guajardo

29‐Oct‐10

T00000304

Georgia Department labor Vocational Rehab‐ Valerie Carter

28‐Oct‐10

T00000307

Georgia Department of Labor‐ Stephanie Crenshaw

28‐Oct‐10

T00000305

Georgia Voc Rehab ‐ Karen McGill

28‐Oct‐10

T00000306

Georgia Vocational Rehab‐ Laura G Ferguson

28‐Oct‐10

T00000519

Georgia Vocational Rehabilitation Services

14‐Sep‐11

T00000519

Georiga Vocational Rehabilitation Services

14‐Sep‐11

T00000531

Green Mountain Coffee Roasters

7‐Feb‐12

T00000195

HQ AFOATS/SDF ‐ Cathy Cruikshank

26‐Oct‐10

T00000221

HQ AFTC/DPIDE ‐ Joshua Miner

26‐Oct‐10

T00000292

HQ, US Army Cadet Command ‐ Lucy Sherman

28‐Oct‐10

I:Vol3/Burs/Admin/Training/DeptGuide Page 42

T00000302

HQPACAF/DPFE‐ Nguten Uribe

28‐Oct‐10

T00000547

HRSA Nursing Program

26‐Sep‐12

T00000384

Haywood County Schools Fountain, Inc. ‐ Stephen M Brown

28‐Oct‐10

T00000178

Humphreys Enterprises, Inc. ‐ Ron McCall

25‐Oct‐10

T00000308

Illinois Prepaid Program‐ Yadira Rivira

28‐Oct‐10

T00000530

Institute of International Education

11‐Jan‐12

T00000327

Intel

29‐Oct‐10

T00000012

Jackson State Community College ‐ Lynne Rouse

26‐Oct‐10

T0000508

KG‐J1‐ED ‐ Linda Hawkins

27‐Jan‐11

T00000509

KG‐J1‐ED ‐ Linda Wolverton

27‐Jan‐11

T00000274

KY Dept of Vocational Rehab ‐ Tina Prichard

28‐Oct‐10

T00000281

Kansai Gaidai Univeristy

28‐Oct‐10

T00000198

Kentucky Affordable Prepaid Tuition ‐

26‐Oct‐10

T00005011

Kfrat Foods North America Scholarship Program

17‐Mar‐

11

T00000367

Knox County Schools ‐ Donna Wright

28‐Oct‐10

T00000366

Knox County Schools Title I ‐ Judy Fortenberry

28‐Oct‐10

T00000365

Knox County Schools/No Child Left Behind ‐ Ann Tuggle

28‐Oct‐10

T00000380

Knoxville‐Knox County Head Start ‐ James Rose

28‐Oct‐10

T00000294

Krell Institute‐ Thomas Brennan

28‐Oct‐10

T00000546

LASPAU Fulbright

22‐Aug‐12

T00000316

Louisiana Rehab Services‐ Cynthia Clard

12‐May‐

11

T00000316

Louisiana Rehab Services‐ Mike Harrell

15‐Oct‐12

T00000316

Louisiana Rehab Services‐ Tehill Wright

15‐Oct‐12

T00000225

Lumbee River Electric Corp ‐ Ruby Clark

27‐Oct‐10

T00000205

MYCAA/Military Souse Career Account ‐ Jane B Burke

26‐Oct‐10

T00000338

Maine Department of Rehab Services ‐ Heather Gilmour

29‐Oct‐10

T00000185

Malaysian Rubber Board ‐ Hashimah Abu Hashim

25‐Oct‐10

T00005004

Marine Corps Scholarship Foundation

21‐Dec‐10

T20200000

Marshall County Board of Education ‐ Lisa Mason

26‐Oct‐10

T00000362

Marshall Space Flight Center ‐ Jane Thomas

28‐Oct‐10

T00000361

Marshall Space flight Center ‐ Cory McElyea

28‐Oct‐10

T00000335

Maryland State Dept of Rehab Services ‐ James Reissig

29‐Oct‐10

T00000325

Med‐Trans Corp‐ Tamica Williams

28‐Oct‐10

T00000503

Medical University of South Carolina‐ Nancy Carder

12‐Jan‐11

T00000192

Mellon Bank, NA ‐ Lori M LaMar

26‐Oct‐10

T00000352

Metropolitan Nashville Public Schools ‐ Debbie C Hirsch

28‐Oct‐10

T00000360

Michigan Education Trust ‐ Robin Lott

28‐Oct‐10

T00000015

Middle Tennessee State University

10‐May‐

11

T00000015

Middle Tennessee State University ‐ Anita Carter

10‐May‐

11

T00000511

Milwaukee Area Workforce Investment Board

23‐May‐

11

I:Vol3/Burs/Admin/Training/DeptGuide Page 43

T00000328

Minnesota Rehab Services‐ Steve Pesola

29‐Oct‐10

T00000377

Minority Empowerment Initiative Trust ‐ Dr. Willis Holloway

28‐Oct‐10

T00000320

Mississippi Prepaid College Program ‐ Kathy Barker

28‐Oct‐10

T00000013

Motlow State Community College ‐ Reada Payne

26‐Oct‐10

T00000204

Mount Currie Band Council ‐ Martin Pierre

26‐Oct‐10

T00000269

NETPDTC N8155/Navy

28‐Oct‐10

T00000026

Nashville State Community College ‐ Elaine Davis

27‐Oct‐10

T00000224

Naval Surace War Center ‐ L. Hamblin

27‐Oct‐10

T00000223

Naval Surface Center ‐ Audrey Gillian

27‐Oct‐10

T00000520

Naval Surface Warfare Center Dahlgren

13‐Aug‐11

T00000278

Navsea 08‐ Angela West

28‐Oct‐10

T00000333

Nevada Prepaid Tuition Program ‐ Cathy Vasquez

29‐Oct‐10

T00000275

New Jersey Commission for the Blind‐ Jan Mielchen

28‐Oct‐10

T00000258

Nidge Universitesi Rekrotlugu‐ Prof Tasdurmaz

28‐Oct‐10

T00005015

North Carolina Community Foundation, Inc.

29‐Feb‐12

T00000283

North Carolina Vocational Rehab‐ Eric Ward

28‐Oct‐10

T00000521

North Carolina Vocational Rehabilitation

13‐Aug‐11

T00000027

Northeast State Tech Comm College ‐ Diane Fitzgerald

22‐Mar‐

12

T00000027

Northeast State Tech Comm College ‐ Robin Byrd

22‐Mar‐

12

T00000244

ORISE ‐ Samuel Held

28‐Oct‐10

T00000237

ORISE/DHS Scholarship and Fellowship‐LeighAnn Pennington

28‐Oct‐10

T00000288

Oak Ridge Associated Universities‐ Marie Westfall

28‐Oct‐10

T00000236

Oak Ridge Institute for Science and Educ ‐ Barbara Dorsey

28‐Oct‐10

T00000235

Oak Ridge Institute for Science and Education ‐ Alicia Wells

28‐Oct‐10

T00000191

Ohio Rehab Services ‐ Elisa Ericson

26‐Oct‐10

T00000243

Orise/Global Change Education Program

7‐Apr‐11

T00000243

Orise/Global Change Education Program ‐ Pai Moua

7‐Apr‐11

T00000536

PEO Carriers

7‐Aug‐12

T00000314

Paris Rotary Club

28‐Oct‐10

T00000014

Pellissippi State Tech Comm College ‐ Carol Nicolls

22‐Mar‐

12

T00000014

Pellissippi State Tech Comm College ‐ Debra Clark

22‐Mar‐

12

T00000210

People's Libyan Arab Jamahiriya ‐ Ms. Aseel Elborno

29‐Mar‐

11

T00000497

Polk County Department of Education

10‐Jan‐13

T00000541

Presentation College

17‐Aug‐12

T00000322

Rarity Bay Women'sw Club‐ Shelia Walliser

28‐Oct‐10

T00005009

Riverdale High School

17‐Mar‐

11

T00000022

Roane State Community College ‐ Tabatha Hamby

27‐Oct‐10

T00000337

Rockingham Educational Foundation ‐ Donna Miller

29‐Oct‐10

T00000279

Ross University‐ Lou de Castro

28‐Oct‐10

I:Vol3/Burs/Admin/Training/DeptGuide Page 44

T00000220

Rotary International ‐ Ron Weatherspoon

27‐Oct‐10

T00000270

Rotary International 6730‐ Ron Weatherspoon

24‐Aug‐11

T00000270

Rotary International 6760‐ Ron Weatherspoon

24‐Aug‐11

T00000297

Royal Thai Embassy ‐ BoonPlook Chaiket

25‐Oct‐10

T00000523

SCG Chemicals Co. LTD

16‐Aug‐11

T00000246

SOACDF ‐ Educational Assistance Program

28‐Oct‐10

T00000240

Saint Thomas Hospital _ Marilyn Gentzler

28‐Oct‐10

T00000272

Sandia National Laboratories

28‐Oct‐10

T00000226

Saudi Arabian Cultural Mission

27‐May‐

11

T00000226

Saudi Arabian Cultural Mission ‐ Huda Abushar

27‐May‐

11

T00000504

Schlumberger Engineering‐ Yilmaz Luy

12‐Jan‐11

T00000386

Shelby County Board of Commissioners ‐ Sharon Smith

28‐Oct‐10

T00000232

Siemens Medical Soulutions, USA ‐ Freddie Walker

28‐Oct‐10

T00000364

Societe Tunisienne De Banque

28‐Oct‐10

T00005012

Society of Petroleum Engineers, East Ky Section

17‐May‐

11

T00000247

South Carolina Prepayment Program

28‐Oct‐10

T00000187

South Carolina Vocational Rehab Dept ‐ Lorell C Gordon

25‐Oct‐10

T00000535

Southern Adventist University

25‐Jul‐12

T00000023

Southwest Tennessee Community College ‐ Ruth Lemon

27‐Oct‐10

T00000250

Southwest Virginia Higher Education Center‐Alicia Young

28‐Oct‐10

T00000276

St. George's University Services, LTD‐ Monique Brewster

28‐Oct‐10

T00000379

St. Jude Children's Research Hospital ‐ Trini Guerrero

28‐Oct‐10

T00000313

Stanford University

14‐Dec‐12

T00000378

Stanford University ‐ Judy Ray

28‐Oct‐10

T00000313

Stanford University‐ Rubie C Paredes

14‐Dec‐12

T00005003

Station Camp High School

21‐Dec‐10

T00000301

TECTA‐Saundra Stiles

30‐Mar‐

12

T00000301

TECTA‐Whitney Deakins

30‐Mar‐

12

T00008000

THE ESTATE OF A. R. FRIZZELL

7‐Jan‐11

T00008000

THE ESTATE OF ANDREA RACHAEL FRIZZELL

7‐Jan‐11

T00000282

TN Center for Child Welfare/MTSU‐ Lauri Schultz

28‐Oct‐10

T00000534

TN Department of Children's Services (DCS)

21‐May‐

12

T00000401

TN Voc Rehab

1‐Jun‐11

T00000407

TN Voc Rehab ‐ Allison Spencer

17‐Aug‐11

T00000408

TN Voc Rehab ‐ Darleen Strassner

24‐Aug‐11

T00000404

TN Voc Rehab ‐ Gail Evans

16‐Aug‐11

T00000417

TN Voc Rehab ‐ James Lauderdale

18‐Aug‐12

T00000406

TN Voc Rehab ‐ Leanne Pierce

17‐Aug‐11

T00000412

TN Voc Rehab ‐ Rhonda Corvette

23‐Jan‐12

I:Vol3/Burs/Admin/Training/DeptGuide Page 45

T00000411

TN Voc Rehab ‐ Sam Pearson

12‐Jan‐12

T00000508

TN Voc Rehab‐William Hess

21‐Jan‐11

T00000415

TN Voc Rehab. ‐ Jennifer Chlarson

16‐Aug‐12

T00000409

TN Voc. Rehab ‐ Claire Lange

14‐Oct‐11

T00000410

TN Voc. Rehab ‐ Amiee Wallace

10‐Jan‐12

T00000405

TN Voc. Rehab ‐ Isaac martin

17‐Aug‐11

T00000413

TN Voc. Rehab ‐ Jamie McCrary

3‐Aug‐12

T00000421

TN Voc. Rehab ‐ Kelsey Koenig

4‐Feb‐13

T00000418

TN Voc. Rehab ‐ Patrick Owen

27‐Aug‐12

T00000422

TN Voc. Rehab ‐ Patrick Owen

4‐Feb‐13

T00000414

TN Voc. Rehab. ‐ Bruce Crain

16‐Aug‐12

T00000419

TN Voc. Rehab. ‐ Diana Hague

1‐Feb‐13

T00000416

TN Voc. Rehab. ‐ Jill Rightler

16‐Aug‐12

T00000424

TN. Voc. Rehab. ‐ Deedra Glenn

6‐Feb‐13

T00000423

TN. Voc. Rehab. ‐ Melanie Hampton

5‐Feb‐13

T00000323

Teh Wapakoneta Area Community Foundation‐Larry R Tester

28‐Oct‐10

T00000035

Tenessee Technology Center at Jacksboro ‐ Bobbie J Gross

27‐Oct‐10

T00000059

Tenessee Voc Rehab ‐ Mark L Rottero

10‐Mar‐

11

T00000527

Tennessee Board of Regents

25‐Aug‐11

T00000374

Tennessee Career Center ‐ Debra J Clark

28‐Oct‐10

T00000255

Tennessee Department of Transportation ‐ Becky Higley

8‐Nov‐12

T00000255

Tennessee Department of Transportation ‐ Tim Pearsall

8‐Nov‐12

T00000199

Tennessee Division of Rehab Services ‐ Robyn O'Neal

26‐Oct‐10

T00000016

Tennessee State University ‐ Deloris Modunkwu

26‐Oct‐10

T00000002

Tennessee Tech at Athens ‐ Barbara Brakebill

26‐Oct‐10

T00000029

Tennessee Tech at Memphis ‐ Marc Davis

26‐Oct‐10

T00000402

Tennessee Tech at Newbern

14‐Jul‐11

T00000017

Tennessee Technological University

27‐Oct‐10

T00000403

Tennessee Technology Center @ Hohenwald

30‐Jul‐12

T00000002

Tennessee Technology Center at Athens ‐ Barbara Brakebill

26‐Oct‐10

T00000007

Tennessee Technology Center at Covington ‐ Linda Ray

26‐Oct‐10

T00000028

Tennessee Technology Center at Elizabethton ‐ Dean Blevins

27‐Oct‐10

T00000030

Tennessee Technology Center at Harriman ‐ Sheila Hicks

27‐Oct‐10

T00000036

Tennessee Technology Center at Hartsville ‐ Susan Celsor

17‐Jul‐12

T00000036

Tennessee Technology Center at Hartsville ‐ Susan McDonald

17‐Jul‐12

T00000032

Tennessee Technology Center at Livingston ‐ Myra West

27‐Oct‐10

T00000038

Tennessee Technology Center at McMinnville ‐ Andy Forrester

27‐Oct‐10

T00000029

Tennessee Technology Center at Memphis ‐ Marc Davis

26‐Oct‐10

T00000006

Tennessee Technology Center at Morristown

26‐Oct‐10

T00000006

Tennessee Technology Center at Morristown ‐ Lynn Elkins

26‐Oct‐10

T00000400

Tennessee Technology Center at Murfreesboro

10‐May‐

11

I:Vol3/Burs/Admin/Training/DeptGuide Page 46

T00000400

Tennessee Technology Center at Murfreesboro ‐ Jean Williams

10‐May‐

11

T00000033

Tennessee Technology Center at Nashville

27‐Oct‐10

T00000037

Tennessee Technology Center at Oneida/Huntsville

27‐Oct‐10

T00000008

Tennessee Technology Center at Paris

26‐Oct‐10

T00000031

Tennessee Technology Center at Pulaski ‐ Nancy Dunnavant

27‐Oct‐10

T00000034

Tennessee Technology Center at Whiteville ‐ Charla Cooper

27‐Oct‐10

T00000176

Tennessee VOc Rehab ‐ Gary Mott

28‐Oct‐10

T00000169

Tennessee Voc Rahab ‐ Dan K Eason

28‐Oct‐10

T00000142

Tennessee Voc Rahab ‐ Leslie Hull

28‐Oct‐10

T00000059

Tennessee Voc Rehab

19‐May‐

11

T00000088

Tennessee Voc Rehab ‐ Alicia Scruggs Mosley

28‐Oct‐10

T00000174

Tennessee Voc Rehab ‐ Amanda F Cleek

28‐Oct‐10

T00000109

Tennessee Voc Rehab ‐ Amy Rader

28‐Oct‐10

T00000058

Tennessee Voc Rehab ‐ Angie S Respess

27‐Oct‐10

T00000062

Tennessee Voc Rehab ‐ Arthur H. Klar

27‐Oct‐10

T00000510

Tennessee Voc Rehab ‐ Ashley Ramsey

18‐Mar‐

11

T00000103

Tennessee Voc Rehab ‐ Audrey Hughes

28‐Oct‐10

T00000104

Tennessee Voc Rehab ‐ Barbara Rowe

28‐Oct‐10

T00000057

Tennessee Voc Rehab ‐ Barbara W Brown

27‐Oct‐10

T00000064

Tennessee Voc Rehab ‐ Belinda Champion

27‐Oct‐10

T00000160

Tennessee Voc Rehab ‐ Bill Everett

28‐Oct‐10

T00000040

Tennessee Voc Rehab ‐ Brenda G. Evans

26‐Oct‐10

T00000120

Tennessee Voc Rehab ‐ Brenda Lawrence

28‐Oct‐10

T00000158

Tennessee Voc Rehab ‐ Brenda Ross

28‐Oct‐10

T00000121

Tennessee Voc Rehab ‐ Brian Kennedy

28‐Oct‐10

T00000147

Tennessee Voc Rehab ‐ Bridgett Blevins

28‐Oct‐10

T00000050

Tennessee Voc Rehab ‐ Bruce B Brown

26‐Oct‐10

T00000154

Tennessee Voc Rehab ‐ Candy Ruesken

28‐Oct‐10

T00000113

Tennessee Voc Rehab ‐ Carolyn Edwards

28‐Oct‐10

T00000067

Tennessee Voc Rehab ‐ Cathy Holt

27‐Oct‐10

T00000168

Tennessee Voc Rehab ‐ Charles Lankford

28‐Oct‐10

T00000148

Tennessee Voc Rehab ‐ Chris Gallaher

28‐Oct‐10

T00000085

Tennessee Voc Rehab ‐ Christy Hill

27‐Oct‐10

T00000100

Tennessee Voc Rehab ‐ Christy Starnes

28‐Oct‐10

T00000087

Tennessee Voc Rehab ‐ Cindy Groce

28‐Oct‐10

T00000099

Tennessee Voc Rehab ‐ Claire Lange

28‐Oct‐10

T00000123

Tennessee Voc Rehab ‐ Collietta Bassett

28‐Oct‐10

T00000149

Tennessee Voc Rehab ‐ Connie Baumgardner

28‐Oct‐10

T00000043

Tennessee Voc Rehab ‐ Connie Miller

26‐Oct‐10

T00000069

Tennessee Voc Rehab ‐ David Bowers

27‐Oct‐10

T00000046

Tennessee Voc Rehab ‐ David F Sweitzer

26‐Oct‐10

I:Vol3/Burs/Admin/Training/DeptGuide Page 47

T00000507

Tennessee Voc Rehab ‐ Deborah Amick

13‐Jan‐11

T00000135

Tennessee Voc Rehab ‐ Deborah Michael

28‐Oct‐10

T00000098

Tennessee Voc Rehab ‐ Denise Webb

28‐Oct‐10

T00000042

Tennessee Voc Rehab ‐ Dorris McBride

26‐Oct‐10

T00000070

Tennessee Voc Rehab ‐ Earl Watkins

27‐Oct‐10

T00000130

Tennessee Voc Rehab ‐ Elise W Young

28‐Oct‐10

T00000110

Tennessee Voc Rehab ‐ Elizabeth Stapleton

28‐Oct‐10

T00000171

Tennessee Voc Rehab ‐ Ellen Averso

28‐Oct‐10

T00000060

Tennessee Voc Rehab ‐ Ellie Parchman

27‐Oct‐10

T00000132

Tennessee Voc Rehab ‐ Erika Lacey

28‐Oct‐10

T00000096

Tennessee Voc Rehab ‐ Floria Jackson

28‐Oct‐10

T00000501

Tennessee Voc Rehab ‐ Frank Bruton

11‐Mar‐

11

T00000501

Tennessee Voc Rehab ‐ Frank Burton

11‐Mar‐

11

T00000076

Tennessee Voc Rehab ‐ George L Fugett

27‐Oct‐10

T00000136

Tennessee Voc Rehab ‐ Iran Yarbrough

28‐Oct‐10

T00000081

Tennessee Voc Rehab ‐ James Bunch

27‐Oct‐10

T00000140

Tennessee Voc Rehab ‐ James Paige

28‐Oct‐10

T00000153

Tennessee Voc Rehab ‐ Jane Mills

28‐Oct‐10

T00000097

Tennessee Voc Rehab ‐ Jeff A Marsh

28‐Oct‐10

T00000128

Tennessee Voc Rehab ‐ Jennifer R Schneider

28‐Oct‐10

T00000125

Tennessee Voc Rehab ‐ Jennifer Sawyer

28‐Oct‐10

T00000156

Tennessee Voc Rehab ‐ Jill Dyer

28‐Oct‐10

T00000071

Tennessee Voc Rehab ‐ Jo Morey

27‐Oct‐10

T00000151

Tennessee Voc Rehab ‐ John Ayers

28‐Oct‐10

T00000095

Tennessee Voc Rehab ‐ John Piver

28‐Oct‐10

T00000167

Tennessee Voc Rehab ‐ Jordan E Collins

28‐Oct‐10

T00000065

Tennessee Voc Rehab ‐ Joy G Vaughn

27‐Oct‐10

T00000051

Tennessee Voc Rehab ‐ Judy E Green

27‐Oct‐10

T00000108

Tennessee Voc Rehab ‐ Judy Hart

28‐Oct‐10

T00000127

Tennessee Voc Rehab ‐ Juliann Mathis

28‐Oct‐10

T00000115

Tennessee Voc Rehab ‐ Kamekio Lewis

28‐Oct‐10

T00000161

Tennessee Voc Rehab ‐ Karen Holloway Powell

28‐Oct‐10

T00000053

Tennessee Voc Rehab ‐ Karen K Baker

27‐Oct‐10

T00000054

Tennessee Voc Rehab ‐ Karen L Fleenor

27‐Oct‐10

T00000068

Tennessee Voc Rehab ‐ Kathleen Walker

27‐Oct‐10

T00000162

Tennessee Voc Rehab ‐ Kathleen Walker

28‐Oct‐10

T00000138

Tennessee Voc Rehab ‐ Kelly Roberts

28‐Oct‐10

T00000074

Tennessee Voc Rehab ‐ Ken Clark

27‐Oct‐10

T00000150

Tennessee Voc Rehab ‐ Kim Dance

28‐Oct‐10

T00000133

Tennessee Voc Rehab ‐ Kimberly Sappington

28‐Oct‐10

T00000116

Tennessee Voc Rehab ‐ Kimberly Washington

28‐Oct‐10

I:Vol3/Burs/Admin/Training/DeptGuide Page 48

T00000082

Tennessee Voc Rehab ‐ Kristeena Givens

27‐Oct‐10

T00000084

Tennessee Voc Rehab ‐ Lana Newton

27‐Oct‐10

T00000092

Tennessee Voc Rehab ‐ Larry Shaw

28‐Oct‐10

T00000044

Tennessee Voc Rehab ‐ Larry Vaden

26‐Oct‐10

T00000137

Tennessee Voc Rehab ‐ Laura Mills

28‐Oct‐10

T00000157

Tennessee Voc Rehab ‐ LeeAnne Tucsnak

28‐Oct‐10

T00000172

Tennessee Voc Rehab ‐ Leora Jackson

28‐Oct‐10

T00000164

Tennessee Voc Rehab ‐ Lige Johnson

28‐Oct‐10

T00000073

Tennessee Voc Rehab ‐ Linda Baharloo

27‐Oct‐10

T00000075

Tennessee Voc Rehab ‐ Linda Cranford

27‐Oct‐10

T00000139

Tennessee Voc Rehab ‐ Linda Owens

28‐Oct‐10

T00000143

Tennessee Voc Rehab ‐ Linda Peterman

28‐Oct‐10

T00000177

Tennessee Voc Rehab ‐ Lori Crawford

28‐Oct‐10

T00000112

Tennessee Voc Rehab ‐ Lucy Mercer

28‐Oct‐10

T00000118

Tennessee Voc Rehab ‐ Lynn Pentecost

28‐Oct‐10

T00000080

Tennessee Voc Rehab ‐ Lynn Willis

27‐Oct‐10

T00000129

Tennessee Voc Rehab ‐ Madge C Davis

28‐Oct‐10

T00000089

Tennessee Voc Rehab ‐ Margaretann Walters

28‐Oct‐10

T00000039

Tennessee Voc Rehab ‐ Marilyn C Murphy

26‐Oct‐10

T00000047

Tennessee Voc Rehab ‐ Marjorie E Boyd

26‐Oct‐10

T00000059

Tennessee Voc Rehab ‐ Mark L Rottero

19‐May‐

11

T00000144

Tennessee Voc Rehab ‐ Marvin Arbertha

28‐Oct‐10

T00000045

Tennessee Voc Rehab ‐ Melanie Myers

26‐Oct‐10

T00000052

Tennessee Voc Rehab ‐ Michael B Mayo

27‐Oct‐10

T00000049

Tennessee Voc Rehab ‐ Midge M Terry

26‐Oct‐10

T00000066

Tennessee Voc Rehab ‐ Mike Satterfield

27‐Oct‐10

T00000105

Tennessee Voc Rehab ‐ Nichole Garrett

28‐Oct‐10

T00000155

Tennessee Voc Rehab ‐ Opheca Jordan

28‐Oct‐10

T00000152

Tennessee Voc Rehab ‐ Patti C Bell

28‐Oct‐10

T00000072

Tennessee Voc Rehab ‐ Paula Knisley

27‐Oct‐10

T00000117

Tennessee Voc Rehab ‐ Phil McPeak

28‐Oct‐10

T00000079

Tennessee Voc Rehab ‐ Priscilla L Finnell

27‐Oct‐10

T00000124

Tennessee Voc Rehab ‐ Randall Boothe

28‐Oct‐10

T00000159

Tennessee Voc Rehab ‐ Reecie Teague

28‐Oct‐10

T00000126

Tennessee Voc Rehab ‐ Robyn O'Neal

28‐Oct‐10

T00000122

Tennessee Voc Rehab ‐ Rodney Case

28‐Oct‐10

T00000094

Tennessee Voc Rehab ‐ Roy G Harlan

28‐Oct‐10

T00000091

Tennessee Voc Rehab ‐ Samuel Smith

28‐Oct‐10

T00000078

Tennessee Voc Rehab ‐ Scott Corey

27‐Oct‐10

T00000163

Tennessee Voc Rehab ‐ Sharon Driver

28‐Oct‐10

T00000063

Tennessee Voc Rehab ‐ Sheila M Dorris

27‐Oct‐10

T00000106

Tennessee Voc Rehab ‐ Sherry Callahan

28‐Oct‐10

I:Vol3/Burs/Admin/Training/DeptGuide Page 49

T00000166

Tennessee Voc Rehab ‐ Sherry Hill

28‐Oct‐10

T00000041

Tennessee Voc Rehab ‐ Shirley A Jarnigan

26‐Oct‐10

T00000119

Tennessee Voc Rehab ‐ Sonya Hood

28‐Oct‐10

T00000111

Tennessee Voc Rehab ‐ Stacey Hoffman

28‐Oct‐10

T00000102

Tennessee Voc Rehab ‐ Stracee Robinson

28‐Oct‐10

T00000114

Tennessee Voc Rehab ‐ Susan Armour

28‐Oct‐10

T00000173

Tennessee Voc Rehab ‐ Susan Garrett

28‐Oct‐10

T00000055

Tennessee Voc Rehab ‐ Suzette S Amos

27‐Oct‐10

T00000101

Tennessee Voc Rehab ‐ Tamara Oglesby

28‐Oct‐10

T00000107

Tennessee Voc Rehab ‐ Tammie Buckles

28‐Oct‐10

T00000170

Tennessee Voc Rehab ‐ Tammie Green

28‐Oct‐10

T00000165

Tennessee Voc Rehab ‐ Tammie Winningham

28‐Oct‐10

T00000146

Tennessee Voc Rehab ‐ Teresa Kirk

28‐Oct‐10

T00000141

Tennessee Voc Rehab ‐ Teri Feigelson

28‐Oct‐10

T00000131

Tennessee Voc Rehab ‐ Terry Wilkey

28‐Oct‐10

T00000093

Tennessee Voc Rehab ‐ Thomas Harris

28‐Oct‐10

T00000077

Tennessee Voc Rehab ‐ Thomas N Lloyd

27‐Oct‐10

T00000134

Tennessee Voc Rehab ‐ Thungvanh Phrachak

28‐Oct‐10

T00000086

Tennessee Voc Rehab ‐ Tina Jones

27‐Oct‐10

T00000090

Tennessee Voc Rehab ‐ Tracy Berrong

28‐Oct‐10

T00000061

Tennessee Voc Rehab ‐ Valerie I Jennings

27‐Oct‐10

T00000048

Tennessee Voc Rehab ‐ Vernon L Hooks

26‐Oct‐10

T00000145

Tennessee Voc Rehab ‐ Vicky Reeves

28‐Oct‐10

T00000056

Tennessee Voc Rehab ‐ Will Wright

27‐Oct‐10

T00000175

Tennessee Voc Rehab ‐ Yolanda Flowers

28‐Oct‐10

T00000139

Tennessee Voc rehab ‐ Linda Owens

28‐Oct‐10

T00000177

Tennessee Voc rehab ‐ Lori Crawford

28‐Oct‐10

T00006111

Tennessee Vocational Rehab Svcs

15‐Nov‐11

T00000277

Texas Guaranteed Tuition Plan

28‐Oct‐10

T00000515

The American Legion, Department of Maryland

1‐Aug‐11

T00000376

The Catawba Indian Nation ‐ Evie Stewaart

19‐Sep‐11

T00000376

The Catawba Indian Nation‐ Evie Stewart

19‐Sep‐11

T00008003

The Estate of Kevin Paul Davis

25‐Apr‐12

T00008004

The Estate of Scott J. Gianopoulos

25‐Apr‐12

T00000526

The Government of Trinidad and Tobago

29‐Sep‐11

T00000351

The Hashemite University ‐ Prof A Barrikhi

29‐Oct‐10

T00000381

The Jackson Laboratory ‐ Suzanne Serreze

28‐Oct‐10

T00000375

The Mohegan Tribe ‐ Kurt Eichelberg

28‐Oct‐10

T00000312

The Negro Spiritual Scholarship Foundation‐ Sherina Johnson

28‐Oct‐10

T00000182

The Tribal Scholarship Program, MS Choctaw ‐ Melanie Carson

25‐Oct‐10

T00000219

The University of the Thai of Commerce

27‐Oct‐10

T00000323

The Wapakoneta Area Community Foundation‐Larry R Tester

28‐Oct‐10

T00000420

Tn Voc Rehab ‐ Steve Harrison

1‐Feb‐13

I:Vol3/Burs/Admin/Training/DeptGuide Page 50

T11111111

Transcript/Duplicate Dipolma

28‐Feb‐12

T00006007

Treasurer, State of TN

10‐Aug‐12

T00000499

Tri‐State Educational Foundation

14‐Dec‐12

T00000285

Turkish Consulate General

28‐Oct‐10

T00000183

Turkish Embassy

25‐Oct‐10

T00000253

U.S. Coast Guard Headquaters‐E. Lutkendhouse

28‐Oct‐10

T00000001

UHS

3‐Jun‐11

T00000001

UHS ‐ Tami McClain

3‐Jun‐11

T00000324

UPA/United Physicians Association ‐ Debbie Lash

28‐Oct‐10

T00000505

US Department of Justice ‐ William L Bennett

13‐Jan‐11

T00000280

US Dept of Energy‐ Bettty Warrick

28‐Oct‐10

T00000319

US Geological Survey Office ‐ Debbie Colley

28‐Oct‐10

T00006000

US Treasury

21‐Dec‐10

T00000525

USDA

29‐Sep‐11

T00000330

USDA Forest Service ‐ Elaine Kiefer

29‐Oct‐10

T00000331

USDA Forest Service ‐ John Coulston

23‐Feb‐12

T00000331

USDA Forest Service ‐ Tony Johnson

23‐Feb‐12

T00000340

USDA MRPBS FMD ‐ Ashley Dihn

29‐Oct‐10

T00000217

UTAH Army National Guard

27‐Oct‐10

T00000311

UTC L &D Carrier Corp‐ Pam Coppinger

28‐Oct‐10

T00000296

United Arab Emirates/Embassy Cultural‐ Gudrun Kendon

28‐Oct‐10

T00000218

United States Army Health Professions ‐ Marisa M Bacungan

27‐Oct‐10

T00000372

United Technologies Corporation ‐ UTC L&D

28‐Oct‐10

T00000011

University of Memphis ‐ Jennifer McNeil

26‐Oct‐10

T00000303

University of Norte Dame ‐ Gina Wiedemann

28‐Oct‐10

T10000000

University of Tennessee

26‐Jul‐11

T00000539

University of Thai Chamber of Commerce

17‐Aug‐12

T00006911

VA Agent Cashier

4‐Aug‐11

T00000506

VA Vocational Rehab ‐ Ashlee Buck

13‐Jan‐11

T00000342

VA Vocational Rehab ‐ Jodie Arebalo

19‐Jul‐11

T00000343

VA Vocational Rehab ‐ Keith Tackett

29‐Oct‐10

T00000005

Vanderbilt University ‐ Judy Arntz

26‐Oct‐10

T00000242

Verizon‐Wireless/IL

28‐Oct‐10

T00000309

Veterans Administration‐ Douglas Murdock

28‐Oct‐10

T00000317

Virginia College Savings Plan ‐ Mary G Morris

28‐Oct‐10

T00000528

Virginia Tech

31‐Aug‐11

T00000024

Volunteer State Community College ‐ Sheila Jessup

19‐Feb‐13

T00000024

Volunteer State Community College ‐ Tandy Hamm

19‐Feb‐13

T00000211

WR_ALC/FTAC ‐ Lee McNees

26‐Oct‐10

T00000025

Walters State Community College ‐ Pamela Hughett

27‐Oct‐10

T00000207

Washington University in St. Louis ‐ Christine Leonard

26‐Oct‐10

T00000193

West Virginia Rehab Services ‐ Becky Hall

12‐Feb‐13

T00000193

West Virginia Rehab Services ‐ Betty Parsons

12‐Feb‐13

I:Vol3/Burs/Admin/Training/DeptGuide Page 51

T00000514

West Virginia Rehabilitation Services

28‐Jul‐11

T00000518

West Virginia Rehabilitation Services

11‐Aug‐11

T00000522

West Virginia Rehabilitation Services

15‐Aug‐11

T00000516

Westchester Golf Association Scholarship

21‐Sep‐11

T00000516

Westerchester Golf Association Scholarship

21‐Sep‐11

T00000382

William and Barchhelder ‐ Jeffrey L Bramley

28‐Oct‐10

T00000332

Wisconsin Dept of Children's Services ‐ Christine Lenske

29‐Oct‐10

T00000315

Work Force Essentials, Inc.‐ Robert A Reed

18‐Feb‐11

T00000315

Work Force Essentials, Inc.‐ Robert A Reeed

18‐Feb‐11

T00000189

Workforce Connections ‐ David Mency

25‐Oct‐10

T00000358

Wyoming Workforce ‐ Kymbrlye Freeman

28‐Oct‐10

T00000389

Yarmouk University ‐ Marwan R Kamal

28‐Oct‐10

I:Vol3/Burs/Admin/Training/DeptGuide Page 52

PROCESSING

EXEMPTIONS

IN

BANNER

SECTION 3