District of columbia

e

lectronic taxpayer service center

FP-31 (REV. 03/17)

2018

District of Columbia (DC)

Personal Property Tax

Forms and Instructions

FP-31

The following forms are provided in this booklet:

• FP-31 Personal Property Tax Return

• FP-31P Payment Voucher

• FP-129A Extension of time to le a DC Personal Property Tax Return

-1-

General Instructions for FP-31

________________________________________

Who must le a FP-31?

Generally, every individual, corporation, partnership, executor,

administrator, guardian, receiver, trustee (every entity) that

owns or holds personal property in trust must file a District of

Columbia (DC) personal property tax return, Form FP-31. This

includes entities located in the District and those that, by legal

definition, are located in the District. This includes property:

• used or available for use in DC in a trade or business,

whether or not operated for profit; and

• kept in storage, held for rent or lease or similar

business arrangement with third parties, government

agencies or non-profit entities.

NOTE: By definition, you are engaged in a trade or business if

you are carrying on the affairs of a trade, business, profession,

vocation, rental of property, or any other activity, whether or not

operated for profit or livelihood. Construction companies doing

business in DC at any time during the tax year must apportion

the remaining cost (current value) of tangible personal property

as of July 1, 2017, by the number of days their tangible personal

property was physically located in the District.

Who is exempt from paying Personal

Property Tax?

You are exempt from paying if:

• Your remaining cost (current value) is $225,000 or

less;

• You are a non-profit organization. If the tangible

personal property of an Internal Revenue Code (IRC)

§501(c)(3) organization has received a certificate of

exemption from the DC Office of Tax and Revenue

(OTR), it is exempt from the personal property tax.

Note: Any personal property used for activities that

generate unrelated business income subject to tax under

IRC §511 is not exempt from the personal property tax.

If you are an IRC §501(c) (3) organization and would like

a DC application for exemption (form FR-164), please

visit our website at www.taxpayerservicecenter.com or

call (202) 442-6546.

• You pay DC Gross Receipts Tax, Distribution Tax, Toll

Telecommunication Service Tax or Commercial Mobile

Service Tax.

• You are a Qualified High Technology (QHTC).

If you are a QHTC within the meaning of DC

Code §47-1817.01(5A), qualified tangible personal

property within the meaning of DC Code §47-1521(4)

purchased and used or held for use by you after

December 31, 2000, is exempt from DC personal

property tax for 10 years beginning with the year

of purchase. After the 10th year the property

must be reported at 25% of the original cost or

exchange value, unless it is qualified as technological

equipment. In that case it must be reported

at 10% of the original cost or exchange value.

See DC Code §§ 47-1523(b) and 47-1523(d)(2).

A QHTC claiming exemption from personal property

tax must attach Form QHTC-CERT to Form FP-31.

For additional information, see Publication FR-399,

Qualified High Technology Companies. The FR-399

includes information on filing QHTC claims for a refund

of personal property tax and the schedules to use for

exempt QHTC property. (For additional information,

visit our web site: www.taxpayerservicecenter.com).

• You are a qualified supermarket under DC Official

Code §47-3801(2), have otherwise been subject to

personal property tax for less than 10 years, and have

applied for and received a certificate of eligibility for

the exemption from the Office of the Mayor. See DC

Code §§ 47-3802(c)(1) and 47-1508(a)(9).

Simplied ling for those with remaining

cost of $225,000 or less

To determine if your personal property remaining cost

(current value) is $225,000 or less, do the following:

• Complete page 1 of the Form FP-31, except for “Fill in

if remaining cost is $225,000 or less” oval;

• Complete page 2 of Form FP-31, Lines 1-8;

• Complete Schedule A on page 3 even if remaining cost

is $225,000 or less;

• Complete page 1 of the Form FP-31, shading the oval

for “Fill in if remaining cost is $225,000 or less” oval

if applicable;

• Sign the return; and

• Send the return to the OTR.

________________________________________

Which other DC personal property tax

forms may be led?

• Railroad Tangible Personal Property Return, Form FP-32;

• Railroad Company Report, Form FP-33; and

• Rolling Stock Tax Return, Form FP-34

When are your taxes due?

You must file your return (FP-31, FP-32, FP-33, FP-34, FP-31P or

FP-129A) by July 31, 2017.

Please file the original signed

return(s). Do not send a photocopy.

How to le your return

Send the FP-31 or PF-31P:

By mail with a payment to: Office of Tax and Revenue

PO Box 96183

Washington, DC 20090-6183

By mail without a payment to: Office of Tax and Revenue

PO Box 96144

Washington, DC 20090-6144

Send your FP-129A to: Office of Tax and Revenue

PO Box 96196

Washington, DC 20090-6196

-2-

________________________________________

Payment Options

If the amount of the payment due for a period exceeds $5,000,

you must pay electronically.

Refer to the Electronic Funds Transfer (EFT) Payment Guide

available on the DC website at www.taxpayerservicecenter.com

for instructions for electronic payments.

Payment options are as follows:

• Electronic check (e-check). E-check is similar to ACH debit,

but it is a one-time transaction where the taxpayer provides the

banking information at the time of payment instead of storing

the information. There is no fee for business e-check payments.

eTSC does not allow the use of foreign bank accounts for

business e-check.

• ACH Credit. ACH credit is for business taxpayers only. There

is no fee charged by OTR, but the taxpayer’s bank may charge

a fee. The taxpayer directly credits OTR’s bank account. The

taxpayer does not need to be eTSC registered to use this

payment type, and does not need access to the website.

Note: When making ACH Credit payments through your bank,

please use the correct tax type code (00400) and tax period

ending date (YYMMDD).

• ACH Debit. ACH debit is for registered eTSC business

taxpayers only. There is no fee. The taxpayer’s bank routing

and account numbers are stored within their online eTSC

account. This account can be used to pay any existing liability.

The taxpayer gives OTR the right to debit the money from their

bank account. eTSC does not allow the use of foreign bank

accounts for business ACH Debit.

• Credit/Debit Card. The taxpayer may pay the amount owed

using Visa®, MasterCard®, Discover® or American Express®.

You will be charged a fee that is paid directly to the District’s

credit/debit card service provider. Payment is effective on the

day it is charged.

• Check or money order. Include a check or money order

(US dollars), payable to the DC Treasurer, with your completed

return. Write your Taxpayer Identification Number (TIN), either

FEIN/SSN, daytime telephone number, ‘2018’, and FP-31 on

the check or money order. Attach your payment to the Form

FP-31P Payment Voucher provided in this booklet. Mail the FP-

31P with, but not attached to the FP-31 tax return to:

Office of Tax and Revenue

PO Box 96183

Washington, DC 20090-6183

Note: International ACH Transaction (IAT). Your payment

cannot be drawn on a foreign account. Pay by money

order (US dollars) or credit card instead. If you request

your refund to be direct deposited into an account outside

of the United States, you will receive a paper check.

________________________________________

Penalties and Interest

OTR will charge:

• A penalty of 5% per month if you fail to file a return or pay

any tax due on time. It is computed on the unpaid tax for each

month or fraction of a month, that the return is not filed or the

tax is not paid. It may not exceed an additional amount equal

to 25% of the tax due;

• A 20% penalty on the portion of an underpayment of taxes

if attributable to negligence. Negligence is failure to make

a reasonable attempt to comply with the law or to exercise

ordinary and reasonable care in preparing tax returns without

the intent to defraud.

One indication of negligence is failure to keep adequate books

and records;

• Interest of 10% per year, compounded daily, on a late

payment;

• A one-time fee to cover internal collection efforts on any

unpaid balance. The collection fee assessed is 10% of the

tax balance due 90 days after the issuance of a notice of

enforcement.

• A civil fraud penalty of 75% of the underpayment which is

attributable to fraud (see DC Code §47-4212).

Special Circumstances

Amended Returns

Use Form FP-31 to file an amended personal property tax return.

Please shade the “Fill in if amended return” oval located below

the address area. If amending a prior year form, check our web

site at www.taxpayerservicecenter.com for the correct form. You

must file a separate amended return for each year you are

amending.

The personal property tax return is considered a standalone

return for a single year. Any overpayment of tax for that year

cannot be used as a credit carry forward to the next year.

Credits created by the amended return will be refunded upon

written request to the Customer Service Administration (CSA)

within OTR.

Final Return

If you are not required to continue filing a return due to the

ending of business operations, shade the “Fill in if final return”

oval on the return. We will then cancel your filing requirement.

Do not use this oval to indicate the return is the final for the

period being reported.

Electronic ling instructions

The instructions in this booklet are designed specifically for

filers of paper returns. If you are filing electronically and

these instructions differ from the instructions for the electronic

method being used, you should comply with the instructions

appropriate for that method.

-3-

Substitute forms

You may file your DC tax return using a computer-prepared

or computer-generated substitute form provided the form is

approved in advance by OTR. The fact that a software package

is available for retail purchase does not mean that the substitute

form has been approved for use. Please contact your vendor

for further information.

_______________________________________

Getting Started

Not all items will apply. Fill in only those that do apply. If an

amount is zero, make no entry, leave the line blank.

All entries on the return and attachments are whole dollars

only. Do not enter cents. Round cents to the nearest dollar.

Examples:

$10,500.50 rounds to $10,501

$10,500.49 rounds to $10,500

Taxpayer Identication Number (TIN)

You must have a TIN, whether it is a Social Security

Number (SSN), or Federal Employer Identication

Number (FEIN)

• An SSN is a valid number issued by the Social

Security Administration (SSA). To apply for an

SSN, get Form SS-5, Application for a Social

Security Card, from your local SSA office or online

at www.ssa.gov. You may also get this form by

calling 1-800-772-1213;

• An FEIN is a valid number issued by the Internal

Revenue Service (IRS). To apply for an FEIN, get

Form SS-4, Application for Employer Identification

Number (EIN), or get this form online at

www.irs.gov/businesses and clicking on ‘Employer

Identification Number’ (EIN) under ‘Starting a

Business’. You may also get this form by calling

1-800-TAX-FORM (1-800-829-3676).

Incomplete forms will delay processing

Complete all items on the FP-31, otherwise OTR may send the

return back to you for completion and resubmission.

Help us identify your forms and attachments

Write your FEIN or SSN, tax period, business name and address

on any statements submitted with the return or filed separately.

The FEIN or SSN is used for tax administration purposes only.

Note: The District allows submission of the FP-31 return using

a CD. FP-31 filers must print and submit pages 1-2. All other

attachments must be on the CD. The CD should include a

copy of the entire return and indicate on the CD the FEIN/SSN,

tax year and tax type. Images on the CD should be submitted

in PDF format.

Filling out the form

To aid us in processing your return, please follow these rules:

Personal Information

Complete the personal information as instructed using CAPITAL

letters and black ink. Use one block per character, including

using a space between address fields. Please write clearly;

otherwise this can delay processing your return.

Assembling your FP-31 return

• Do not staple or otherwise damage the Bar Code located

in the upper right hand corner of this form or schedule(s)

being attached;

• Do not cross out the tax year on the 2018 return. If you

are not filing a 2018 FP-31, Personal Property Tax Return,

do not use this booklet. Request a booklet for the specific

year you are filing by calling our Forms Center at (202)

442-6546, or visit the Customer Service Center at 1101

4

th

Street, SW, 2

nd

Floor, Washington, DC 20024. You may

also visit our website, www.taxpayerservicecenter.com for

prior year personal property tax returns.

Signature

Sign and date your return. If the return was prepared by a

tax preparer, the tax preparer must also sign the return and

provide his or her preparer tax identification number (PTIN)

and telephone number. Taxpayer(s) are responsible for the

information prepared and submitted by a paid preparer. Please

keep a copy for your records.

Preparer Tax Identification Number (PTIN). If you are a paid

preparer, you are required to have a PTIN issued by the IRS.

A PTIN is a number issued and authorized by the IRS to file a

return on the taxpayers’ behalf.

$

.00

•

Fill in ovals completely.

Do not “3“ or “x” ovals.

3 x

3 7

Write 3s with a rounded

top, not a flat top.

Write 7s without a

middle bar.

3 7

•

Leave a space between

words and between

words and numbers.

•

8 E L M

R O B E R T S

Use black ink.

Print in CAPITAL letters.

•

•

Do not enter cents. Round

cents to the nearest dollar.

Note: Your social security number is used for tax purposes only.

•

5 7 2 0 4

Do not print outside the boxes.

00

Specic instructions

Number of DC locations

A business owner of tangible personal property having multiple

locations in the District must report that property on one personal

property tax return. Attach a separate schedule identifying tan-

gible property for each location. Do not file separate returns for

each location.

Value of Tangible Personal Property — You must report the re-

maining cost (current value) of all your tangible personal property

as of July 1, 2017.

Depreciation — Depreciation is allowed only for the period

of ownership from the month and year of acquisition. The

straight-line method of depreciation is the only method allowed

in calculating the remaining cost (current value). Do not use

accelerated depreciation methods and property lives, including

the Accelerated Cost Recovery System.

Tangible personal property (excluding qualified technological equip-

ment) reported on the return must not be depreciated in excess of

75% of its original cost. Consequently, the remaining cost (current

value) of all tangible personal property (excluding qualified tech-

nological equipment) must be at least 25% of the original cost.

Qualified technological equipment must be depreciated at the rate

of 30% per year. It must not be depreciated in excess of 90% of

its original cost. Consequently, the remaining cost (current value)

of qualified technological equipment must be at least 10% of the

original cost.

For personal property tax years beginning July 1, 2000, and

thereafter, the remaining cost (current value) of qualified techno-

logical equipment acquired on or before June 30, 2000, must

be calculated as if depreciation at the rate of 30% per year was

used beginning with the acquisition date. However, there will be

no credit granted nor refund of tax paid in earlier tax years under

the prior depreciation rate for qualified technological equipment.

Depreciation rates for tangible personal property not listed in

the Depreciation Guidelines in this booklet may be obtained by

calling (202) 727-4TAX(4829).

Use Schedule A of the Personal Property Tax Return to report all

depreciable property that you own which is subject to the personal

property tax.

Denition of Qualied Technological Equipment

As used here, computer means a programmable electroni-

cally activated device capable of accepting information, apply-

ing prescribed processes to the information, and supplying the

results with or without human intervention, that consists of a

central unit containing extensive storage, logic, arithmetic and

control capabilities.

Related peripheral equipment means any auxiliary machine

(whether online or offline) designed to be placed under the control

of a computer and operated in conjunction with the computer.

Qualified technological equipment means any computer or related

peripheral equipment except:

• Equipment that is an integral part of other property that is

not a computer;

• Typewriters, calculators, adding and accounting machines,

copiers, duplicating equipment and similar devices;

• Equipment of a kind used primarily for the amusement or

entertainment of the user;

• Mainframe computers capable of simultaneously support-

ing multiple transactions and multiple users, and having an

original cost in excess of $500,000, including any additional

memory units, tape drives, disk drives, power supplies, cool-

ing units and communication controllers that are peripheral

equipment to such computers; or

• Computers used in operating industrial processing equip-

ment, equipment used in a computer-assisted manufactur-

ing system, equipment used in a computer-assisted design

or engineering system integral to an industrial process, or a

subunit or an electronic assembly comprising a component in

a computer-integrated industry processing system.

Leased Property — Any tangible personal property owned by

the lessor must be reported by the lessor in Schedule A. Any

tangible personal property under a “Lease-Purchase Agreement”

or a “Security Purchase Agreement”, under which the lessee is

obligated to become the owner, must be reported by the lessee

in Schedule A.

Schedules — When attaching separate schedules to the FP-31,

include your name, address, tax year, and the FEIN (or SSN) on

each schedule.

All items of tangible personal property owned by the business and

located or having a taxable situs in DC, whether or not currently

in use, must be reported at their remaining cost (current value)

as of July 1, 2017.

Schedule A: Books, DVDs and other reference material

Report in this schedule all books and other reference material

such as DVDs, tapes, etc., used in the business or profession.

Enter the totals on page 2 of Form FP-31, Line 1 of columns

A and B. Qualifying tangible personal property leased by a non

QHTC under an operating lease (no ownership implication for the

lessee) to either a certified QHTC or a non QHTC is subject to

the personal property tax. The property must be reported on

Schedule A of Form FP-31.

Furniture, fixtures, machinery and equipment

Report furniture, fixtures, machinery, equipment, and other fixed

assets used in the business or profession. Report the furniture,

furnishings and equipment of hotels, apartments, schools, hospi-

tals, sanitariums, rooming and boarding houses, estate property,

property in storage and private dwellings that are rented furnished

as a complete unit or as individual rooms or apartments. Enter

the totals on page 2 of Form FP-31, Line 2 of columns A and B.

Hotels and motels must also report their total number of rooms

on page 1 of Form FP-31, Line C.

Unregistered motor vehicles and trailers

Report on Schedule A the totals for all unregistered (not registered

in DC) motor vehicles and trailers. Include the totals along with

the totals for other tangible personal property on page 2 of Form

FP-31, Line 3 of columns A and B.

Other tangible personal property

Report on Schedule A the following tangible personal property:

trailers, construction equipment, special equipment mounted on

-4-

a vehicle or trailer (not used primarily for the transportation of

persons or property), boats, barges, dredges, aircraft, and other

tangible personal property. Enter the total original cost on page

2 of Form FP-31, Line 3, of column A and the total remaining

cost (current valu

e) on page 2, Line 3, of column B. Owners (les-

sors) of leased property located in DC in addition to completing

Schedule A must also complete Schedule D-2, if the property is

not included in Schedule A.

Schedule B: Supplies

Report the cost of any consumable items not held for sale, such

as office and other supplies.

• Office supplies include, but are not limited to, items such as

stationery and envelopes used in the business or profession.

• Other supplies include, but are not limited to, wrapping and

packing materials, advertising items, sales books, fuel oil,

china, glass and silverware. Enter the totals on page 2 of

Form FP-31, Line 4 of columns A and B.

Schedule C: Dispositions of tangible personal property

Report all fixed assets that were traded in, sold, donated, dis-

carded or transferred out of a DC location during the preceding

tax year. This includes items reported on last year’s return that

are not reported in either Schedules A or D-2 of the current

year’s return.

Schedule D-1: Possession of leased property

Complete this schedule only if you are a non QHTC and had

in your possession tangible personal property under either a

rental or lease agreement or under some other arrangement

with another business or individual and the tangible personal

property is not owned by you. Any tangible personal property

in your possession under a “Lease-Purchase Agreement” or a

“Security-Purchase Agreement” which obligates you to become

the owner, must be reported in Schedule A.

Schedule D-2: Leased property in DC

Complete this schedule only if you are a non QHTC and, as lessor,

rented or leased to any business or individual, tangible personal

property under a “Lease-Purchase Agreement” or a “Security-

Purchase Agreement” under which the lessee is required to

become the owner. Any other tangible personal property owned

by you and subject to a rental or lease agreement or any other

similar arrangement is reported in Schedule A.

Complete and file the following schedules, as applicable, if you

are a QHTC amending your originally filed FP-31 return.

Schedule D-3: Purchased property and QHTCs

This schedule is used to report qualifying tangible personal

property purchased after December 31, 2000, by a certified

QHTC and used or held for use by the QHTC, or leased under

a capital lease to a certified QHTC. (This schedule is also in

Publication FR-399, Qualified High Technology Companies.) A

certified DC QHTC claiming exemption for qualifying tangible

personal property which it purchased after December 31, 2000,

or which is in its possession pursuant to a lease - purchase or

security-purchase agreement (a capital lease - under which it is

required to become the owner of the property) must report the

property in a Schedule D-3 filed with Form FP-31.

All such property acquired or leased under a lease-purchase or

security-purchase agreement prior to January 1, 2001, is not

tax exempt. The property must be reported in Schedule A of

Form FP-31.

Schedule D-4: Leased property and QHTCs

This schedule is used to report qualifying tangible personal

property purchased after December 31, 2000, by a non QHTC

and leased to a certified QHTC under a capital lease. This sched-

ule is to be completed by the lessor of the property. (This schedule

is in Publication FR-399, Qualified High Technology Companies.)

A non QHTC which after December 31, 2000, rents or leases

qualifying tangible personal property to a certified DC QHTC

under a lease- purchase or security-purchase agreement must

report the property in a Schedule D-4 filed with Form FP-31.

Note: A non QHTC lessor of such property acquired prior to

January 1, 2001, under a similar lease arrangement must report

the property in Schedule D-2 of Form FP-31.

-5-

-6-

DEPRECIATION GUIDELINES

Assets (excluding qualified technological equipment) may not be depreciated in excess of 75% of the original cost.

Qualified technological equipment may not be depreciated in excess of 90% of the original cost.

Each category includes, but is not limited to, the items listed below.

Category A: 6.67% depreciation per year ( 15 year life )

(1) Antennas, transmitting towers, ber optic cables, shelters,

satellite dishes and repeaters

(2) Cement gravel and sand bins

(3) Pianos and organs

(4) Plating equipment

(5) Safes

(6) Watercraft, docks, slips, wharves, piers and oating equipment

(boats, ships, barges)

Category B: 10% depreciation per year ( 10 year life )

1(1) Air conditioning equipment (compressors, ducts, package

units and window units)

1(2) Asphalt, cement and slurry plants and equipment

1(3) Automobile repair shop and gasoline service station equip-

ment

1(4) Automobile sales agency furniture, xtures and equipment

1(5) Bakery equipment

1(6) Banking furniture, xtures and equipment (automatic teller

machines)

1(7) Barber shop, beauty salon and cosmetic salon furniture, x-

tures and equipment

1(8) Bottling equipment

1(9) Bowling alley equipment

(10) Burglar alarm, security alarm and monitoring systems

(11) Catering equipment

(12) Clay products manufacturing equipment

(13) Cold storage, ice making and refrigeration equipment

(14) Conveyors

(15) Dentists and physicians oce furniture and equipment

(16) Department store furniture, xtures and equipment

(17) Drug store furniture, xtures and equipment

(18) Emergency power generators

(19) Fire extinguishing systems

(20) Garbage disposals, trash compactors and trash containers

(21) Hotel and motel furniture, xtures and equipment (restaurant,

bar, meeting rooms, oce rooms, lobby and other public

rooms)

(22) Intercom systems

(23) Kitchen equipment

(24) Laundry and dry cleaning equipment

(25) Libraries

(26) Mail chutes and mail boxes

(27) Musical instruments (portable)

(28) Oce furniture, xtures and equipment (any kind whether

modular or system furniture, desks, chairs, cabinets, shelving,

awnings, typewriters, calculators, adding machines, les, parti-

tions, carrels, cash registers, paper cutters, etc.)

(29) Paper products industry machinery and equipment

(30) Printing industry machinery and equipment

(31) Pulp industry machinery and equipment

(32) Restaurant, carry out, supermarket and delicatessen furniture,

xtures and equipment

(33) Shoe repairing furniture, xtures and equipment

(34) Signs (neon and others)

(35) Solar panels

(36) Special tools (dies, jigs, gauges, molds)

(37) Surveying and drafting equipment

(38) Theater furniture and equipment

(39) X-ray and diagnostic equipment

(40) Wax museum (wax gures, displays, sets, barriers, rails)

Category C: 12.5% depreciation per year ( 8 year life )

(1) Building and lawn maintenance equipment

(2) Car wash equipment

(3) Construction, road paving and road maintenance equipment

(4) Fabricated metal products machinery and equipment (ma-

chine shop)

(5) Hospital and nursing home furniture, xtures and equipment

(6) Junk yard machinery and equipment

(7) Meat, fruit, and vegetable packing equipment

(8) Meters, tickometers and automatic mailer equipment

(9) Music boxes

(10) Non-registered motor vehicles (forklifts and golf carts)

(11) Pipe contractor machinery and equipment

(12) Radio, television, telecommunications, microwave and satel-

lite transmitting systems (multiplexers, switches, transmitters,

receivers, telephones, ber optic equipment, terminal equip-

ment)

(13) Recreation, health tness, health club, golf course and sport-

ing equipment

(14) Special equipment mounted on any motor vehicle (welders,

compressors)

(15) Trailers

(16) Vending machines (cigarettes, slot, change, soft drink, food)

Category D: 20% depreciation per year ( 5 year life )

(1) Blinds, drapes and shades (used as secondary window cov-

ering)

(2) Brain scanners, CAT scanners, MRI scanners and dialysis

equipment

(3) Canvas

(4) Carpets over nished oor, loose carpet and rugs

(5) Coee makers and soda fountain equipment

(6) Computers and related peripheral equipment (excluding

qualied technological equipment)

(7) Duplicating machines, photocopiers and photographic equip-

ment

(8) Hot air balloons

(9) Outdoor Christmas decorations

(10) Portable toilets

(11) Self-service laundries (washers, dryers)

(12) Swimming pool furniture, xtures and equipment

(13) Telephone answering equipment (beepers)

(14) Television, stereo, radio and recorder equipment

(15) Test equipment and electronic manufacturing equipment

(16) Wood pallets (used in warehouses)

Category E: 30% depreciation per year

(1) Qualied technological equipment

Category F: 50% depreciation per year ( 2 year life )

(1) Amusement arcade machines, pinball machines and video

games

(2) Cable T.V. decoders

(3) China, glassware, pots, pans, serving dishes, utensils and

silverware (in service)

(4) Linens (in service)

(5) Microlms, movie lms and video movie tapes

(6) Small hand tools

(7) Tuxedos and uniforms (in service)

Category G: No depreciation — report at 100% of cost

(1) Antiques, tapestries and oriental rugs (items appreciating in

value)

(2) Chemicals

(3) Cleaning, oce and other supplies

(4) China, glassware, pots, pans, serving dishes, utensils and

silverware (new in reserve)

(5) Linens (new in reserve)

(6) Oil paintings and sculptures (items appreciating in value)

(7) Paper products

(8) Tuxedos and uniforms (new in reserve)

-7-

Tax Year beginning July 1, 2017

and ending June 30, 2018

Due Date: July 31, 2017

Business mailing address line 2

2018 FP-31 Personal

Property Tax Return

Fill in if FEIN

Fill in if SSN

Government of the

District of Columbia

Business mailing address line 1

Taxpayer Identication Number (FEIN)

A. Kind of business or profession:

D. Are you a lessee or lessor of personal property not reported in Schedule A of this return?

If “Yes”, complete Schedule D-1 or D-2 as appropriate. If you are a certied QHTC

complete FR-399 Schedule D-3 or D-4 as appropriate.

E. Are there other companies doing business from your address under a lease, sublease or

concession? If “Yes”, attach a separate schedule listing the name of each company

Oce building owners must attach a list of tenants as of July 1, 2017.

Include the building address, taxpayer ID and room number.

B. Number of DC locations

Consolidate reporting for all business locations in the District on one personal property tax return. Do not le

separate returns for each location. (See instructions)

C. If a hotel or motel, enter the number of rooms

Statement of personal property and computation of personal property tax

Rev. 03/17

Business name

2018 FP-31 P1

Yes No

l

ll

Fill in if Amended Return Fill in if certied QHTC (Attach QHTC-Cert)

Fill in if Final Return Fill in if remaining cost is $225,000 or less

City State Zip Code + 4

*180310010000*

Yes No

Print in CAPITAL letters using black ink

OFFICIAL USE ONLY

Vendor ID# 0000

l

$

Taxpayer name :

Column A - Original Cost

Column B - Remaining Cost (Current Value)

2. Furniture, fixtures, machinery

and equipment (from

Schedule A)

3. Unregistered motor vehicles,

unregistered trailers and other

tangible personal property

(from Schedule A)

5. Total original cost of tangible

personal property (Add Lines

1 through 4, Column A)

1. Books, DVDs and other

reference material (from

Schedule A)

9. TAX (Line 8 amount multiplied by .0340 tax rate)

8. Taxable remaining cost (current value) of personal property (Line 6 minus Line 7). If Line

7 is equal to or greater than Line 6, make no more entries, sign below and mail.

6. Remaining cost (Current Value) of personal property

(Add Lines 1 through 4, Column B)

FEIN (or SSN):

*180310020000*

4. Supplies (from Schedule B)

7. Deduct: Exclusion

TAX RATE ($3.40 per hundred) X .0340

2018 FP-31 P2

225000

Dollars (Round cents to the nearest dollar)

Dollars (Round cents to the nearest dollar)

l

ll

- -

PAID

PREPARER

ONLY

Firm name

Preparer’s signature (If other than taxpayer)

Date

PLEASE

SIGN

HERE

Ocer’s or owner’s signature Date

Make check or money order (US dollars) payable to the DC Treasurer. Include your FEIN/SSN, “FP-31” and tax year 2018 on your payment.

See mailing instructions. Use the return envelope in this booklet.

Preparer’s Telephone Number

Firm address

Preparer’s FEIN, SSN or PTIN

Title

Telephone Number of Person to Contact

Under penalties of law, I declare that I have examined this return and, to the best of my knowledge, it is correct. Declaration of paid

preparer is based on the information available to the preparer.

- -

Rev. 03/17

$

$

$

$

$

$

$

$

$

$

$

$

.00

.00

.00

.00

.00

.00

.00

.00

10. Tax paid (if any) with FP-129A, request for extension of time to file

$

.00

11. If this is an amended 2018 return, payments made with original 2018 FP-31

$

.00

13. Penalties (See instructions)

$

.00

12. Balance due (Line 9 minus Line 10 and Line 11)

$

.00

14. Interest (See instructions)

$

.00

15. Total - balance due, penalties and interest (Add Lines 12, 13 and 14)

$

.00

16. Amount paid with this return

$

.00

17. Unpaid balance (If any)

$

.00

18. Overpayment (If any)

Will this refund go to an account outside of the U.S.? Yes No See instructions.

$

.00

.00

.00

.00

.00

.00

Third party designee To authorize another person to discuss this return with OTR, fill in here and enter the name and phone number of that person. See instructions.

Designee’s name Phone number

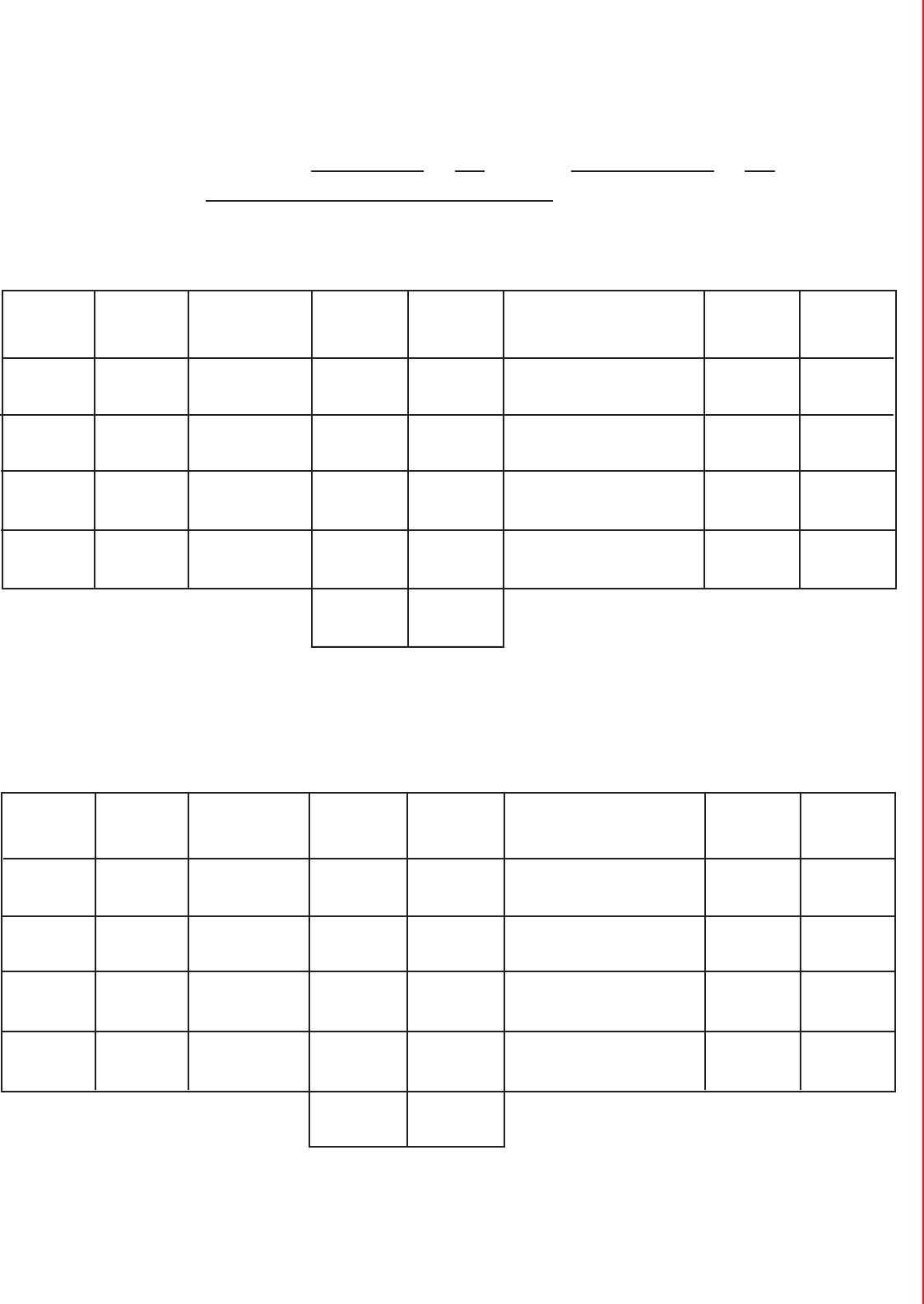

Schedule A

(1) (2) (3) (4) (5) (6)

Date Accumulated Remaining Cost

Type of Acquired Depreciation Original Depreciation as of (Current Value)

Property Month/Year Rate Used Cost June 30, 2017 July 1, 2017

$ $

Schedule B

Cost of oce and other supplies on hand as of July 1, 2017.

Basis of Valuation If Other

Type of Supplies Than Physical Inventory

Total original cost of supplies on hand (Enter on Line 4 in both Col. A. and Col. B, page 2 of FP-31.) $

Schedule C

Tangible personal property reported on last year’s return and disposed of subsequently.

(1) (2) (3) (4) (5) (6) (7)

Type of Date Original Date of Method of Name and Address of Sales

Property Acquired Cost Disposition Disposition Purchaser Price

Schedule D-1

Leased tangible personal property in DC in your possession. To be completed by lessee (other than a QHTC) only. (See the specific instructions for Schedule D-1.)

(1) (2) (3) (4) (5)

Type of Original Date Lease Annual

Property Owner’s Name and Complete Address Cost Started Rent

Schedule D-2

Leased tangible personal property in DC (other than leased to a QHTC). To be completed by lessor only. (See the specific instructions for Schedule D-2.)

(1) (2) (3) (4) (5)

Type of Original Date Lease Annual

Property Owner’s Name and Complete Address Cost Started Rent

Books, DVDs and other reference material, furniture, xtures, machinery and equipment, unregistered motor vehicles, unregistered

trailers and other tangible personal property. (If the total cost is over $225,000, attach a copy of your latest balance sheet.)

Total Remaining Cost (Current Value)

(Also enter on appropriate Line(s) 1, 2

and/or 3 of Col. B. page 2 of FP-31.)

IF SOLD

Rev. 03/17

$ $

$

2018 FP-31 P3

$ $

$

$

$

$

Total Original Cost (Also enter on appropriate Line(s) 1, 2 and/or 3 of Col. A,

page 2 of FP-31)

Use only the straight-line depreciation method

Name FEIN/SSN 2018

Remaining Cost

(Current Value)

July 1, 2017

SCHEDULE D-3—QUALIFYING TANGIBLE PERSONAL PROPERTY PURCHASED BY A CERTIFIED QHTC AND USED

OR HELD FOR USE BY THE QHTC (OR LEASED UNDER A CAPITAL LEASE) TO A CERTIFIED QHTC.

SCHEDULE D-4—QUALIFYING TANGIBLE PERSONAL PROPERTY PURCHASED BY A NON QHTC AND LEASED

TO A CERTIFIED QHTC UNDER A CAPITAL LEASE.

PROPERTY PURCHASE QHTC ORIGINAL REMAINING LESSOR’S NAME MONTHLY DATE

TYPE DATE CERTIFICATION COST COST AND ADDRESS RENT LEASE

DATE BEGAN

$ $ $

TOTAL: TOTAL:

$ $

TOTAL: TOTAL:

$ $

PROPERTY PURCHASE LESSEE’S ORIGINAL REMAINING LESSOR’S NAME MONTHLY DATE

TYPE DATE CERTIFICATION COST COST AND ADDRESS RENT LEASE

DATE BEGAN

$ $ $

Form FP-31 Personal Property

Schedules D-3 and D-4

Tax Return Year Beginning , 20 and ending , 20

FEIN/SSN:

2018 FP-31 P4

Tax Year beginning July 1, 2017

and ending June 30, 2018

Due Date: July 31, 2017

Business mailing address line 2

2018 FP-31 Personal

Property Tax Return

Fill in if FEIN

Fill in if SSN

Government of the

District of Columbia

Business mailing address line 1

Taxpayer Identication Number (FEIN)

A. Kind of business or profession:

D. Are you a lessee or lessor of personal property not reported in Schedule A of this return?

If “Yes”, complete Schedule D-1 or D-2 as appropriate. If you are a certied QHTC

complete FR-399 Schedule D-3 or D-4 as appropriate.

E. Are there other companies doing business from your address under a lease, sublease or

concession? If “Yes”, attach a separate schedule listing the name of each company

Oce building owners must attach a list of tenants as of July 1, 2017.

Include the building address, taxpayer ID and room number.

B. Number of DC locations

Consolidate reporting for all business locations in the District on one personal property tax return. Do not le

separate returns for each location. (See instructions)

C. If a hotel or motel, enter the number of rooms

Statement of personal property and computation of personal property tax

Rev. 03/17

Business name

2018 FP-31 P1

Yes No

l

ll

Fill in if Amended Return Fill in if certied QHTC (Attach QHTC-Cert)

Fill in if Final Return Fill in if remaining cost is $225,000 or less

City State Zip Code + 4

*180310010000*

Yes No

Print in CAPITAL letters using black ink

OFFICIAL USE ONLY

Vendor ID# 0000

l

$

Taxpayer name :

Column A - Original Cost

Column B - Remaining Cost (Current Value)

2. Furniture, fixtures, machinery

and equipment (from

Schedule A)

3. Unregistered motor vehicles,

unregistered trailers and other

tangible personal property

(from Schedule A)

5. Total original cost of tangible

personal property (Add Lines

1 through 4, Column A)

1. Books, DVDs and other

reference material (from

Schedule A)

9. TAX (Line 8 amount multiplied by .0340 tax rate)

8. Taxable remaining cost (current value) of personal property (Line 6 minus Line 7). If Line

7 is equal to or greater than Line 6, make no more entries, sign below and mail.

6. Remaining cost (Current Value) of personal property

(Add Lines 1 through 4, Column B)

FEIN (or SSN):

*180310020000*

4. Supplies (from Schedule B)

7. Deduct: Exclusion

TAX RATE ($3.40 per hundred) X .0340

2018 FP-31 P2

225000

Dollars (Round cents to the nearest dollar)

Dollars (Round cents to the nearest dollar)

l

ll

- -

PAID

PREPARER

ONLY

Firm name

Preparer’s signature (If other than taxpayer)

Date

PLEASE

SIGN

HERE

Ocer’s or owner’s signature Date

Make check or money order (US dollars) payable to the DC Treasurer. Include your FEIN/SSN, “FP-31” and tax year 2018 on your payment.

See mailing instructions. Use the return envelope in this booklet.

Preparer’s Telephone Number

Firm address

Preparer’s FEIN, SSN or PTIN

Title

Telephone Number of Person to Contact

Under penalties of law, I declare that I have examined this return and, to the best of my knowledge, it is correct. Declaration of paid

preparer is based on the information available to the preparer.

- -

Rev. 03/17

$

$

$

$

$

$

$

$

$

$

$

$

.00

.00

.00

.00

.00

.00

.00

.00

10. Tax paid (if any) with FP-129A, request for extension of time to file

$

.00

11. If this is an amended 2018 return, payments made with original 2018 FP-31

$

.00

13. Penalties (See instructions)

$

.00

12. Balance due (Line 9 minus Line 10 and Line 11)

$

.00

14. Interest (See instructions)

$

.00

15. Total - balance due, penalties and interest (Add Lines 12, 13 and 14)

$

.00

16. Amount paid with this return

$

.00

17. Unpaid balance (If any)

$

.00

18. Overpayment (If any)

Will this refund go to an account outside of the U.S.? Yes No See instructions.

$

.00

.00

.00

.00

.00

.00

Third party designee To authorize another person to discuss this return with OTR, fill in here and enter the name and phone number of that person. See instructions.

Designee’s name Phone number

Schedule A

(1) (2) (3) (4) (5) (6)

Date Accumulated Remaining Cost

Type of Acquired Depreciation Original Depreciation as of (Current Value)

Property Month/Year Rate Used Cost June 30, 2017 July 1, 2017

$ $

Schedule B

Cost of oce and other supplies on hand as of July 1, 2017.

Basis of Valuation If Other

Type of Supplies Than Physical Inventory

Total original cost of supplies on hand (Enter on Line 4 in both Col. A. and Col. B, page 2 of FP-31.) $

Schedule C

Tangible personal property reported on last year’s return and disposed of subsequently.

(1) (2) (3) (4) (5) (6) (7)

Type of Date Original Date of Method of Name and Address of Sales

Property Acquired Cost Disposition Disposition Purchaser Price

Schedule D-1

Leased tangible personal property in DC in your possession. To be completed by lessee (other than a QHTC) only. (See the specific instructions for Schedule D-1.)

(1) (2) (3) (4) (5)

Type of Original Date Lease Annual

Property Owner’s Name and Complete Address Cost Started Rent

Schedule D-2

Leased tangible personal property in DC (other than leased to a QHTC). To be completed by lessor only. (See the specific instructions for Schedule D-2.)

(1) (2) (3) (4) (5)

Type of Original Date Lease Annual

Property Owner’s Name and Complete Address Cost Started Rent

Books, DVDs and other reference material, furniture, xtures, machinery and equipment, unregistered motor vehicles, unregistered

trailers and other tangible personal property. (If the total cost is over $225,000, attach a copy of your latest balance sheet.)

Total Remaining Cost (Current Value)

(Also enter on appropriate Line(s) 1, 2

and/or 3 of Col. B. page 2 of FP-31.)

IF SOLD

Rev. 03/17

$ $

$

2018 FP-31 P3

$ $

$

$

$

$

Total Original Cost (Also enter on appropriate Line(s) 1, 2 and/or 3 of Col. A,

page 2 of FP-31)

Use only the straight-line depreciation method

Name FEIN/SSN 2018

Remaining Cost

(Current Value)

July 1, 2017

SCHEDULE D-3—QUALIFYING TANGIBLE PERSONAL PROPERTY PURCHASED BY A CERTIFIED QHTC AND USED

OR HELD FOR USE BY THE QHTC (OR LEASED UNDER A CAPITAL LEASE) TO A CERTIFIED QHTC.

SCHEDULE D-4—QUALIFYING TANGIBLE PERSONAL PROPERTY PURCHASED BY A NON QHTC AND LEASED

TO A CERTIFIED QHTC UNDER A CAPITAL LEASE.

PROPERTY PURCHASE QHTC ORIGINAL REMAINING LESSOR’S NAME MONTHLY DATE

TYPE DATE CERTIFICATION COST COST AND ADDRESS RENT LEASE

DATE BEGAN

$ $ $

TOTAL: TOTAL:

$ $

TOTAL: TOTAL:

$ $

PROPERTY PURCHASE LESSEE’S ORIGINAL REMAINING LESSOR’S NAME MONTHLY DATE

TYPE DATE CERTIFICATION COST COST AND ADDRESS RENT LEASE

DATE BEGAN

$ $ $

Form FP-31 Personal Property

Schedules D-3 and D-4

Tax Return Year Beginning , 20 and ending , 20

FEIN/SSN:

2018 FP-31 P4

Revised 03/17

Revised 03/17

2018 FP-31P P1

Payment Voucher

2018 FP-31P P1

Payment Voucher

2018 FP-31P Payment Voucher

Government of the

District of Columbia

Important: Print in CAPITAL letters using black ink.

STAPLE CHECK OR MONEY ORDER HERE

Business name

Business mailing address line 2

City State Zip Code + 4

Taxpayer Identication Number

l l

l

*18031p110000*

Tax Year beginning July 1, 2017

and ending June 30, 2018

Due Date: July 31, 2017

Fill in if FEIN

Fill in if SSN

USE

2018 FP-31P Payment Voucher

Business mailing address line 1

$

Amount of payment

To avoid penalties and interest, your payment

must be postmarked no later than the due date of your return.

.00

OFFICIAL USE ONLY

Vendor ID# 0000

Government of the

District of Columbia

Important: Print in CAPITAL letters using black ink.

KEEP FOR YOUR RECORDS

Business name

Business mailing address line 2

City State Zip Code + 4

Taxpayer Identication Number

l l

l

*18031p110000*

Tax Year beginning July 1, 2017

and ending June 30, 2018

Due Date: July 31, 2017

Detach at perforation before mailing

Fill in if FEIN

Fill in if SSN

USE

Business mailing address line 1

$

Amount of payment

(dollars only)

(dollars only)

To avoid penalties and interest, your payment

must be postmarked no later than the due date of your return.

.00

OFFICIAL USE ONLY

Vendor ID# 0000

Form FP-31P

Payment Voucher for DC Personal Property

Tax

Instructions for FP-31P - Please print clearly

The FP-31P Payment Voucher is used when making any payment due on your FP-31 return.

• Enter your federal employer identication number (FEIN) or your social security number (SSN).

• Fill in the oval for the identication number you entered.

• Enter your business name and mailing address.

• Enter the amount you are paying by check or money order (do not send cash).

• Make your check or money order (US dollars) payable to the DC Treasurer.

• Write your FEIN/SSN, FP-31 and the tax year on your check or money order.

• Enter your name and address on your payment.

• Staple your payment to the FP-31P.

• Mail the FP-31P with the FP-31 return to the Oce of Tax and Revenue, PO Box 96183, Washington, DC

20090-6183. Do not attach this voucher to your return.

By using the FP-31P Payment Voucher, you are helping us process your return.

Notes:

• If the amount of the payment due for a period exceeds $5,000, you must pay electronically.

Visit www.taxpayerservicecenter.com

• For electronic lers, in order to comply with new banking rules, you will be asked the question

“Will the funds for this payment come from an account outside of the United States?”.

If the answer is yes, you will be required to pay by money order (US dollars) or credit card. Please notify this

agency if your response changes in the future.

2018 FP-31P P2

Payment Voucher

2018 FP-129A P1

Extension of Time to le DC Personal Property Tax Return

l

Government of the

District of Columbia

2018

FP-129A Extension of Time

to File DC Personal Property

Tax Return

l

*181290010000*

l

STAPLE CHECK OR MONEY ORDER

Important: Print in CAPITAL letters

using black ink

Business name

City State Zip Code + 4

Taxpayer Identication Number

Tax Year beginning July 1, 2017

and ending June 30, 2018

Due Date: July 31, 2017

Fill in if FEIN

Fill in if SSN

Business mailing address line 1

Business mailing address line 2

Request for a 3-month extension until October 31, 2017.

2018 FP-129A P1

Extension of Time to le DC Personal Property Tax Return

l

Rev 03/17

$

Amount of payment

.00

OFFICIAL USE ONLY

Vendor ID# 0000

Government of the

District of Columbia

2018

FP-129A Extension of Time

to File DC Personal Property

Tax Return

l

*181290010000*

l

KEEP FOR YOUR RECORDS

Important: Print in CAPITAL letters

using black ink

Business name

City State Zip Code + 4

Taxpayer Identication Number

Tax Year beginning July 1, 2017

and ending June 30, 2018

Due Date: July 31, 2017

Fill in if FEIN

Fill in if SSN

Business mailing address line 1

Business mailing address line 2

Request for a 3-month extension until October 31, 2017.

Form FP-129A

Extension of Time to File DC Personal Property Tax Return Woksheet

Detach at perforation before mailing

Rev 03/17

$

Amount of payment

.00

1. Estimated taxable remaining cost (current value) of tangible

personal property as of July 1, 2017

3. Balance due (Multiply Line 1 amount by Line 2 rate) Payment of the total balance due

must be submitted with this form, otherwise your extension request will be denied.

(Note: If you fail to pay any penalty and interest due, it will be added to any tax due

and not paid with this extension request)

4. Enter the amount from Line 3 onto the FP-129A form

2. Tax rate ($3.40 per hundred)

X .0340

Detach and submit the FP-129A form with your payment in full of any tax due shown on Line 3.

Dollars

$

$

.00

.00

OFFICIAL USE ONLY

Vendor ID# 0000

(dollars only)

(dollars only)

Extension of time to le

A 3-month extension of time to file will be granted if you

properly complete and timely file Form FP-129A together

with full payment of any tax due. If you are granted an ex-

tension of time to file you must attach a copy of your Form

FP-129A when you actually file your personal property tax

return or report.

A taxpayer must use Form FP-129A to request a 3-month

extension of time to file Forms FP-31, FP-32, FP-33 or

FP-34. A separate Form FP-129A must be submitted for

each return or report for which an extension of time to file

is requested. No extension of time to file will be granted

beyond the 3-month extension.

When to le

The request for an extension of time to file must be submitted

no later than the due date of the return or report.

Where to le

Mail the completed Form FP-129A together with the pay-

ment of any tax due to the Office of Tax and Revenue,

PO Box 96196, Washington DC 20090-6196. Be sure to

sign and date the form. Make the check or money order

(US dollars) payable to the DC Treasurer. Include on the

payment your FEIN/SSN, “FP-129A” and tax year 2018.

Interest and penalty

If any tax due is not paid by the due date of the return or re-

port, without regard to any extension of time to file, interest of

10% per year, compounded daily, will be assessed on any tax

remaining unpaid after the due date of the return. Interest on a

late payment is computed from the due date of the return to the

date the tax is paid.

A penalty of 5% per month, or portion of a month (limited to a

25% maximum), will be assessed on unpaid taxes.

Signature

The request for an extension to file must be signed by the taxpayer

or the taxpayer’s authorized agent.

Notes:

• If the amount of the payment due for a period exceeds

$5,000, you must pay electronically.

Visit www.taxpayerservicecenter.com for instructions.

• For electronic filers, in order to comply with the banking

rules, you will be asked the question “Will the funds for this

payment come from an account outside of the United States?”

If the answer is yes, you will be required to pay by money

order (US dollars) or credit card. Please notify this agency if

your response changes in the future.

Instructions

Form FP-129A

Extension of Time to File DC Personal Property Tax Return

Make check or money order (US dollars) payable to the DC Treasurer. Include your FEIN / SSN, “FP-129A” and tax year 2018 on your payment.

Mail this form and payment to: Office of Tax and Revenue, PO Box 96196, Washington DC 20090-6196.

PAID

PREPARER

ONLY

Firm name

Preparer’s signature (if other than taxpayer)

Date

PLEASE

SIGN

HERE

Taxpayer’s signature

Preparer’s Telephone Number

Firm address

Preparer’s FEIN, SSN or PTIN

Telephone Number of Person to Contact

Print name Date

Under penalties of law, I declare that I have examined this return and, to the best of my knowledge, it is correct.

Declaration of paid preparer is based on all the information available to the preparer.

Fill in if you are granting the preparer power of attorney authority

- -

- -

Detach at perforation before mailing

Government of the District of Columbia

Office of the Chief Financial Officer

Office of Tax and Revenue

Need assistance?

Pay online: www.taxpayerservicecenter.com

Get tax forms Download forms at www.taxpayerservicecenter.com Request forms by mail: 202-442-6546

Pick up forms:

Ofce of Tax and Revenue

1101 4th St SW 2nd Floor

8:15 am–5:30 pm

Ask tax questions; get tax forms preparation help free

Visit our Walk-In Center, 1101 4th St SW 2nd Floor; or

Contact our Customer Service Center: 202-727-4TAX(4829)

Regular hours

8:15 am–5:30 pm

Monday–Friday

Do you need help

with this form?

Visit our Walk-In

Center, at 1101 4th St

SW 2nd Floor.

Are you unable to hear

or speak?

Call the DC Relay Service,

202-727-3363.

[Spanish] Si necesita ayuda en Español, por favor llame al (202) 727-4829 para

proporcionarle un intérprete de manera gratuita.

[Vietnamese] Nếu qu ý vị cần giúp đỡ về tiếng Việt, xin gọi (202) 727-4829 để chúng tôi

thu xếp có thông dịch viên đến giúp qu ý vị miễn phí.

[French] Si vous avez besoin d’aide en Français appelez-le (202) 727-4829 et l’assistance

d’un interprète vous sera fournie gratuitement.

[Amharic] በአማርኛ እርዳታ ከፈለጉ በ (202) 727-4829 ይደውሉ። የነፃ አስተርጓሚ ይመደብልዎታል።

[Korean] 한국어로 언어 지원이 필요하신 경우 (202) 727-4829 로 연락을 주시면 무료로 통역이

제공됩니다.

[Chinese] 如果您需要用(中文)接受幫助,請電洽 (202) 727-4829 將免費向您提供口譯員服務。